As filed with the U.S. Securities and Exchange Commission on March 2, 2021

Registration No. 333-252591

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

To

FORM

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

1389 | ||||||

(State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

Telephone: (

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

President & Chief Executive Officer

ION Geophysical Corporation

Telephone: (

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

J. Eric Johnson |

| Matthew Powers |

| Gerald Spedale |

Approximate date of commencement of proposed sale to the public: The exchange will occur as soon as practicable after the effective date of this registration statement.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ | |||||

☒ | Smaller reporting company | |||||||

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

Exchange Act Rule 14d-l(d) (Cross-Border Third-Party Tender Offer)

CALCULATION OF REGISTRATION FEE

Title of Each Class of |

| Amount |

| Proposed |

| Proposed |

| Amount of |

| |||

8.00% Senior Secured Second Priority Notes due 2025 | $ | 106,703,565 | 100 | % | $ | 106,703,565(1) | $ | 11,641.36 | ||||

Common stock, $0.01 par value | (2) | (2) | (2) | (2) | ||||||||

Guarantees | (3) | (3) | (3) | (3) | ||||||||

Total | $ | 106,703,565 | N/A | $ | 106,703,565 | $ | 11,641.36(4) | |||||

(1) | Estimated pursuant to Rule 457(f) under the Securities Act of 1933, as amended, solely for the purposes of calculating the registration fee. The fee is based on the exchange in the exchange offer of 100% of the $120.6 million aggregate principal amount outstanding of our 9.125% Senior Secured Second Priority Notes due 2021 (“Old Notes”) for the exchange consideration, including, for each $1,000 principal amount of Old Notes tendered, $150 in cash, $850 of our new 8.00% Senior Secured Second Priority Notes due 2025 (“New Notes”) and $35, at our option, either in cash, our common stock, $0.01 par value (our “Common Stock”) based on $2.57 per share, or New Notes if you tender prior to the early tender time. |

(2) | There is being registered hereunder the offer and sale of the maximum number of shares of Common Stock that may be issued as a part of the exchange consideration and an indeterminate number of shares of Common Stock that may be issued upon conversion of the New Notes covered by this registration statement. No additional consideration shall be received for the Common Stock upon conversion of the securities and therefore no additional registration fee is required pursuant to Rule 457(i) under the Securities Act. Pursuant to Rule 416 under the Securities Act, the number of shares of Common Stock registered hereby shall include an indeterminate number of shares of Common Stock that may be issued in connection with a stock split, stock dividend, recapitalization or other similar event. No more than $106,703,565 of securities will be issued in the exchange offer, and therefore, no further registration fee is reflected for the Common Stock that may be issued in the exchange offer as such total amount is reflected in connection with the New Notes. |

(3) | No separate consideration will be received for the guarantees, and no separate fee is payable pursuant to Rule 457(n) under the Securities Act. |

(4) | Previously paid. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

TABLE OF ADDITIONAL REGISTRANTS

Exact Name of Additional Registrant as Specified in its Charter(1) |

| State or Other Jurisdiction of |

| I.R.S. Employee |

GX Technology Corporation | Texas | 76-0450115 | ||

ION Exploration Products (U.S.A.), Inc. | Delaware | 76-0491394 | ||

I/O Marine Systems, Inc. | Louisiana | 72-0733230 | ||

GX Geoscience Corporation, S. de R.L. de C.V. | Mexico | GGC150303UDA |

| (1) | The address for each Additional Registrant is 2105 CityWest Blvd., Suite 100, Houston, Texas 77042-2839, and the telephone number for each Additional Registrant is (281) 933-3339. The Primary Standard Industrial Classification Code Number for each Additional Registrant is 1382. |

March , 2021

Dear ION Noteholder:

ION Geophysical Corporation (“ION,” “we,” or the “Company”) has developed a restructuring plan to address the pending maturity of the outstanding 9.125% Senior Secured Second Priority Notes (the “Old Notes”) that you own, and to provide a mechanism to reduce our financial leverage in the future, that we believe offers the best path for the future of our company. As a key component of this plan, we are making an offer (the “Exchange Offer”) to you to exchange the Old Notes you own for our newly issued 8.00% Senior Secured Second Priority Notes due 2025 (the “New Notes”) and the other consideration described below and in the enclosed prospectus.

We are soliciting your support for our Exchange Offer, which will allow ION to restructure its existing debt out-of-court and put the Company in a stronger financial position.

In conjunction with our Exchange Offer, we are soliciting your consent to certain proposed amendments to the indenture governing the Old Notes (the “Consent Solicitation”). The Exchange Offer and the Consent Solicitation are described in detail in the enclosed preliminary prospectus, which we encourage you to read fully.

Pursuant and subject to the terms of a Restructuring Support Agreement, as amended and restated, by and among us and certain holders (the “Supporting Parties”) of Old Notes that hold in aggregate approximately 90% of the outstanding principal amount thereof, as well as a letter agreement between us and Mr. James M. Lapeyre, Jr., pursuant to which Mr. Lapeyre has agreed to tender his Old Notes in the Exchange Offer as a part of the Restructuring Transactions, resulting in a tender rate of 92%, all Old Notes held by such parties will be tendered in the Exchange Offer. As these holders represent more than 66 2/3% of the Old Notes outstanding, we expect that the proposed amendments to the indenture governing the Old Notes will receive the required consents.

The Exchange Offer

If you tender (and do not validly withdraw) your Old Notes in the Exchange Offer on or prior to , 2021, you will be eligible to receive, per $1,000 principal amount of Old Notes tendered, (a) $150 in cash and (b) $850 of New Notes, provided, however, that up to an aggregate of $20 million of New Notes exchange consideration may instead be paid in the form of Common Stock at the Company’s option for every dollar of Rights Offering proceeds raised from the issuance of Common Stock (the “Exchange Consideration”).

Subject to conditions described herein, you will also be eligible to receive $35, per $1,000 principal amount of Old Notes, and at the Company’s option, either in (I) cash, (II) Common Stock, based on $2.57 per share, or (III) New Notes if you validly tender (and do not validly withdraw) your Old Notes at or prior to immediately after 11:59 P.M., New York City Time, on , 2021 (the “Early Tender Time”).

For the Exchange Offer to be successful, we need to satisfy several conditions, including receiving the tenders (which are not validly withdrawn) of at least 95% of the outstanding principal amount of Old Notes.

Restructuring Transactions

Concurrent with the Exchange Offer, we are granting the right to all holders of our Common Stock to participate in a rights offering (the “Rights Offering”) to subscribe for their pro rata share of up to $50 million of New Notes issued at par or shares of our common stock issued at $2.57 per share. The Rights Offering is described in more detail in the enclosed preliminary prospectus, which we encourage you to read fully.

Deadline for Participating

THE DEADLINE FOR PARTICIPATING IN THE EXCHANGE OFFER IS , 2021 unless extended or earlier terminated. Tenders of Old Notes in the Exchange Offer may be validly withdrawn at any time prior to

5:00 p.m., New York City time, on , 2021, unless extended, but will thereafter be irrevocable. In order to allow sufficient time for processing, you must contact your broker, dealer, bank, trust company or other nominee significantly in advance of that date and request them to tender your Old Notes in the Exchange Offer.

None of the Company, the Dealer Manager (defined below), the trustees and collateral agents with respect to the Old Notes and the New Notes, the information and exchange agent or any affiliate of any of them makes any recommendation as to whether you should participate in the Exchange Offer, and no one has been authorized by any of them to make such a recommendation. You must make your own decision as to whether you tender Old Notes and, if so, the principal amount of the Old Notes to tender.

We urge you to carefully read the accompanying prospectus in its entirety, including the discussion of risks, uncertainties and other issues that you should consider with respect to the exchange offer described in the section entitled “Risk Factors,” starting on page 19 of the accompanying prospectus.

THE EXCHANGE OFFER AND THE CONSENT SOLICITATION ARE CONDITIONED UPON THE VALID TENDER OF OLD NOTES (WHICH ARE NOT VALIDLY WITHDRAWN) IN AN AGGREGATE PRINCIPAL AMOUNT OF AT LEAST 95% OF THE AGGREGATE PRINCIPAL AMOUNT OUTSTANDING OF SUCH OLD NOTES. Holders of Old Notes may not tender Old Notes in the Exchange Offer without delivering the related consents to the indenture amendments, and holders of Old Notes may not deliver consents without tendering the related Old Notes. The Exchange Offer and the Consent Solicitation may be amended, extended or terminated by ION at its sole option, subject to certain consent rights thereto by the Supporting Parties.

Questions

If you have any questions or need any assistance in connection with the exchange offer, please contact D.F. King & Co., Inc., the Information and Exchange Agent, at 1 (877) 478-5045.

We are respectfully requesting your consideration and thank you in advance for your support of this important transaction.

Sincerely, | |

| |

Christopher T. Usher |

The information in this prospectus is not complete and may be changed. We may not complete the exchange offer and issue these securities

until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these

securities nor a solicitation of an offer to buy these securities in any jurisdiction where the offer and sale is not permitted.

Subject to Completion, Dated March 2, 2021

PROSPECTUS

ION Geophysical Corporation

Offer to Exchange any and all of its 9.125% Senior Secured Second Priority Notes due 2021 and

Solicitation of Consents in respect of the Indenture governing the 9.125% Senior Secured Second Priority Notes due 2021

THE EXCHANGE OFFER (AS DEFINED BELOW) AND THE CONSENT SOLICITATION (AS DEFINED BELOW) WILL EXPIRE IMMEDIATELY AFTER 11:59 P.M., NEW YORK CITY TIME, ON , 2021 UNLESS EXTENDED OR EARLIER TERMINATED (SUCH DATE AND TIME, AS THE SAME MAY BE EXTENDED, THE “EXPIRATION TIME”). TO BE ELIGIBLE TO RECEIVE THE EXCHANGE CONSIDERATION (AS DEFINED BELOW), HOLDERS MUST TENDER AND NOT VALIDLY WITHDRAW THEIR OLD NOTES (AS DEFINED BELOW) PRIOR TO THE EXPIRATION TIME. TO BE ELIGIBLE TO RECEIVE THE EARLY PARTICIPATION PAYMENT (AS DEFINED BELOW), HOLDERS MUST TENDER AND NOT VALIDLY WITHDRAW THEIR OLD NOTES AT OR PRIOR TO IMMEDIATLEY AFTER 11:59 P.M., NEW YORK CITY TIME, ON , 2021 (SUCH DATE AND TIME, AS THE SAME MAY BE EXTENDED, THE “EARLY TENDER TIME”). TENDERED OLD NOTES MAY BE VALIDLY WITHDRAWN PRIOR TO 5:00 P.M., NEW YORK CITY TIME, ON , 2021 (SUCH DATE AND TIME, AS THE SAME MAY BE EXTENDED, THE “WITHDRAWAL DEADLINE”) BUT NOT THEREAFTER, SUBJECT TO LIMITED EXCEPTIONS, UNLESS SUCH TIME IS EXTENDED BY US AT OUR SOLE DISCRETION.

IF WE ARE UNABLE TO COMPLETE THE EXCHANGE OFFER AND THE CONSENT SOLICITATION, AND TO EXTEND THE UPCOMING MATURITIES OF OUR DEBT OBLIGATIONS, WE WILL CONSIDER OTHER RESTRUCTURING ALTERNATIVES AVAILABLE TO US AT THAT TIME. THOSE ALTERNATIVES MAY INCLUDE SEEKING ASSET DISPOSITIONS, ENTERING INTO JOINT VENTURES, ISSUING ADDITIONAL DEBT, AND OBTAINING RELIEF UNDER THE U.S. CODE TITLE 11 (THE “U.S. BANKRUPTCY CODE’’), ALL OF WHICH INVOLVE UNCERTAINTIES, POTENTIAL DELAYS, SIGNIFICANT COSTS, AND OTHER RISKS. EVEN IF WE ARE SUCCESSFUL WITH THE EXCHANGE OFFER, AVOIDANCE OF AN IN-COURT RESTRUCTURING UNDER THE U.S. BANKRUPTCY CODE IN THE FUTURE IS NOT GUARANTEED.

IF YOU ELECT NOT TO PARTICIPATE IN THE EXCHANGE OFFER AND ION SUBSEQUENTLY FILES FOR BANKRUPTCY, YOUR RECOVERY WITH RESPECT TO ANY OLD NOTES THAT REMAIN OUTSTANDING MAY BE DIMINISHED SIGNIFICANTLY, AS THE OLD NOTES WILL RANK JUNIOR TO ALL OF THE NEW NOTES AND OUR OTHER SECURED DEBT TO THE EXTENT OF THE VALUE OF THE COLLATERAL SECURING SUCH DEBT.

ION Geophysical Corporation (“ION,” “we,” “our,” “us,” the “Issuer” or the “Company”) is offering to all holders (each a “Holder” and together, the “Holders”) of its 9.125% Senior Secured Second Priority Notes due 2021 (the “Old Notes”), upon the terms and subject to the conditions set forth in this Prospectus, to exchange (the “Exchange Offer”) their Old Notes for newly issued 8.00% Senior Secured Second Priority Notes due 2025 (the “New Notes”) and the other consideration described below.

Old Notes |

| CUSIP Number or ISIN |

| Principal Amount Outstanding |

| Exchange Consideration(1)(2) |

| Early Participation Payment(1)(3) |

9.125% Senior Secured Second Priority Notes due 2021 | $120,569,000 | (a) $150 in cash; and (b) $850 in New Notes, subject to certain rights to instead deliver or receive shares of our Common Stock as described in more detail herein. | $35, at our option, either in (I) cash, (II) Common Stock based on $2.57 per share, or (III) New Notes. |

| (1) | Per $1,000 principal amount of Old Notes. |

| (2) | Excludes accrued and unpaid interest, which will be paid in addition to the Exchange Consideration. |

| (3) | For the benefit of Holders of Old Notes validly tendered (and not validly withdrawn) at or prior to the Early Tender Time. |

The New Notes will have the terms as described in “Description of the New Notes.” The New Notes and the related guarantees will be secured on a second-priority basis by Liens (as defined in the New Notes Indenture) on all of the assets of ION other than the Excluded Assets (as defined below), subject to the Liens securing ION’s obligations under the Credit Agreement (as defined below) and any other Priority Lien Debt and other Permitted Prior Liens, as described in “Description of the New Notes.” All Old Notes remaining outstanding following the completion of the Exchange Offer will be effectively subordinated to all New Notes issued in the Exchange Offer to the extent of the value of the assets securing the New Notes.

On the Settlement Date (as defined below), the New Notes will be guaranteed, jointly and severally, by each subsidiary of the Company that is a guarantor under the Old Notes Indenture (as defined below) and our Revolving Credit and Security Agreement, dated August 22, 2014, by and among ION, the subsidiaries signatory thereto, PNC Bank, National Association (“PNC”), as agent for the lenders party thereto, and the lenders party thereto (as amended, the “Credit Agreement”).

The New Notes will mature on December 15, 2025. Interest on the New Notes will be payable semi-annually in arrears on each June 15 and December 15, beginning on June 15, 2021. Interest on the New Notes will accrue from (and including) the Settlement Date.

Holders who validly tender (and do not validly withdraw) their Old Notes at or prior to the Expiration Time will be eligible to receive, for each $1,000 principal amount of such notes tendered, (a) $150 in cash and (b) $850 of New Notes, provided, however, that up to an aggregate of $20 million of New Notes exchange consideration may instead be paid in the form of Common Stock at the Company’s option for every dollar of Rights Offering proceeds raised from the issuance of Common Stock (the “Exchange Consideration”). Subject to the conditions described herein, the Company will pay $35, at the Company’s option, either in (I) cash, (II) Common Stock, based on $2.57 per share, or (III) New Notes, per $1,000 of principal amount of Old Notes to Holders who validly tender (and do not validly withdraw) their Old Notes at or prior to the Early Tender Time (the “Early Participation Payment”). Holders who tender their Old Notes at or prior to the Early Tender Time will be eligible to receive the Early Participation Payment in addition to the Exchange Consideration. Holders must tender their Old Notes at or prior to the Early Tender Time in order to be eligible to receive the Early Participation Payment.

In addition, payment of accrued and unpaid interest on the Old Notes accepted for exchange will be made in cash promptly after the Expiration Time (such date, the “Settlement Date”). We currently expect the Settlement Date to be , 2021.

In conjunction with the Exchange Offer, we are soliciting consents (the “Consent Solicitation”) from Holders of Old Notes (“Consents”) to certain proposed amendments to the indenture governing the Old Notes, dated as of April 28, 2016 (the “Old Notes Indenture”), by and among the Issuer, the guarantors party thereto and Wilmington Savings Fund Society, FSB, as trustee (the “Old Notes Trustee”) and as collateral agent (the “Old Notes Collateral Agent”), to eliminate substantially all of the restrictive covenants and certain of the default provisions contained in the Old Notes Indenture and to release all collateral securing the Old Notes (the “Proposed Amendments”). We must receive Consents by Holders representing at least 66 2/3% of the outstanding principal amount of the Old Notes to adopt the Proposed Amendments (the “Requisite Consents”). Any Old Notes owned by the Issuer or any of its affiliates will be disregarded in determining whether Holders of the required principal amount of Old Notes have consented to the Proposed Amendments. If the Requisite Consents are delivered, we, the guarantors, the Old Notes Collateral Agent and the Old Notes Trustee will enter into a supplemental indenture (the “Supplemental Indenture”) to give effect to the Proposed Amendments; provided, however, that the Proposed Amendments will not become operative until the Settlement Date. Holders of Old Notes may not tender Old Notes in the Exchange Offer without delivering the related Consents, and Holders of Old Notes may not deliver Consents without tendering the related Old Notes. See “Proposed Amendments.”

Pursuant to the terms of an Amended and Restated Restructuring Support Agreement, dated as February 11, 2021 (the “Restructuring Support Agreement”), by and among the Issuer and certain Holders that hold in aggregate approximately 90% of the outstanding principal amount of such notes (collectively, the “Supporting Parties,” and such agreement, the “Restructuring Support Agreement”), as well as a letter agreement between us and Mr. James M. Lapeyre, Jr., pursuant to which Mr. Lapeyre has agreed to tender his Old Notes in the Exchange Offer as a part of the Restructuring Transactions, resulting in a tender rate of 92%, the Supporting Parties and Mr. Lapeyre have agreed, subject to the terms and conditions set forth therein, to tender (and not withdraw) at or prior to the Expiration Time all Old Notes held by the Supporting Parties and Mr. Lapeyre in the Exchange Offer and to deliver Consents in respect of all such Old Notes. Pursuant to the Restructuring Support Agreement, subject to certain exceptions, we have agreed to not waive any conditions to the Exchange Offer and the Consent Solicitation without the consent of the Supporting Parties. As the Supporting Parties represent at least 66 2/3% of the Old Notes, we expect to receive the Requisite Consents in the Consent Solicitation.

Concurrent with the Exchange Offer, we are granting the right to all holders of our Common Stock to participate in a rights offering (the “Rights Offering” and together with the Exchange Offer, the “Restructuring Transactions”) to subscribe for their pro rata share of up to $50 million of New Notes issued at par or shares of our Common Stock issued at $2.57 per share. The Rights Offering is described in more detail in the enclosed preliminary prospectus, which we encourage you to read fully.

The Exchange Offer and the Consent Solicitation are conditioned upon the valid tender of Old Notes (which are not validly withdrawn) in an aggregate principal amount constituting at least 95% of the aggregate principal amount outstanding of such Old Notes (the “Minimum Tender Condition”).

Validly tendered Old Notes may not be withdrawn subsequent to the Withdrawal Deadline, subject to limited exceptions. If, after the Withdrawal Deadline, we (i) reduce the principal amount of Old Notes subject to the Exchange Offer, (ii) reduce the Exchange Consideration for the Old Notes, or (iii) are otherwise required by law to permit withdrawals, then previously tendered Old Notes may be validly withdrawn within a reasonable period under the circumstances after the date that notice of such reduction or permitted withdrawal is first published or given or sent to Holders by us. We may extend the Expiration Time without extending the Withdrawal Deadline, unless otherwise required by law.

We will issue up to $106,703,565 in aggregate principal amount of New Notes and shares of Common Stock in the Exchange Offer and the Consent Solicitation. We will issue the New Notes in denominations of integral multiples of $1,000. We will not issue any fractional shares of Common Stock. Holders who tender less than all of their Old Notes must continue to hold Old Notes in the minimum authorized denomination of $2,000 principal amount.

See “The Exchange Offer and the Consent Solicitation” and “Acceptance of Old Notes; Accrual of Interest.”

We reserve the right, subject to applicable law, to amend or extend the Exchange Offer and the Consent Solicitation at any time or to amend or modify the Minimum Tender Condition or the Exchange Consideration or any other terms

applicable to the Old Notes. The Exchange Offer and the Consent Solicitation are subject to the satisfaction or waiver of certain conditions set forth in this Prospectus. Subject to applicable law, we may terminate the Exchange Offer and the Consent Solicitation if any of the conditions described under “Conditions of the Exchange Offer and the Consent Solicitation” are not satisfied or waived by the Expiration Time.

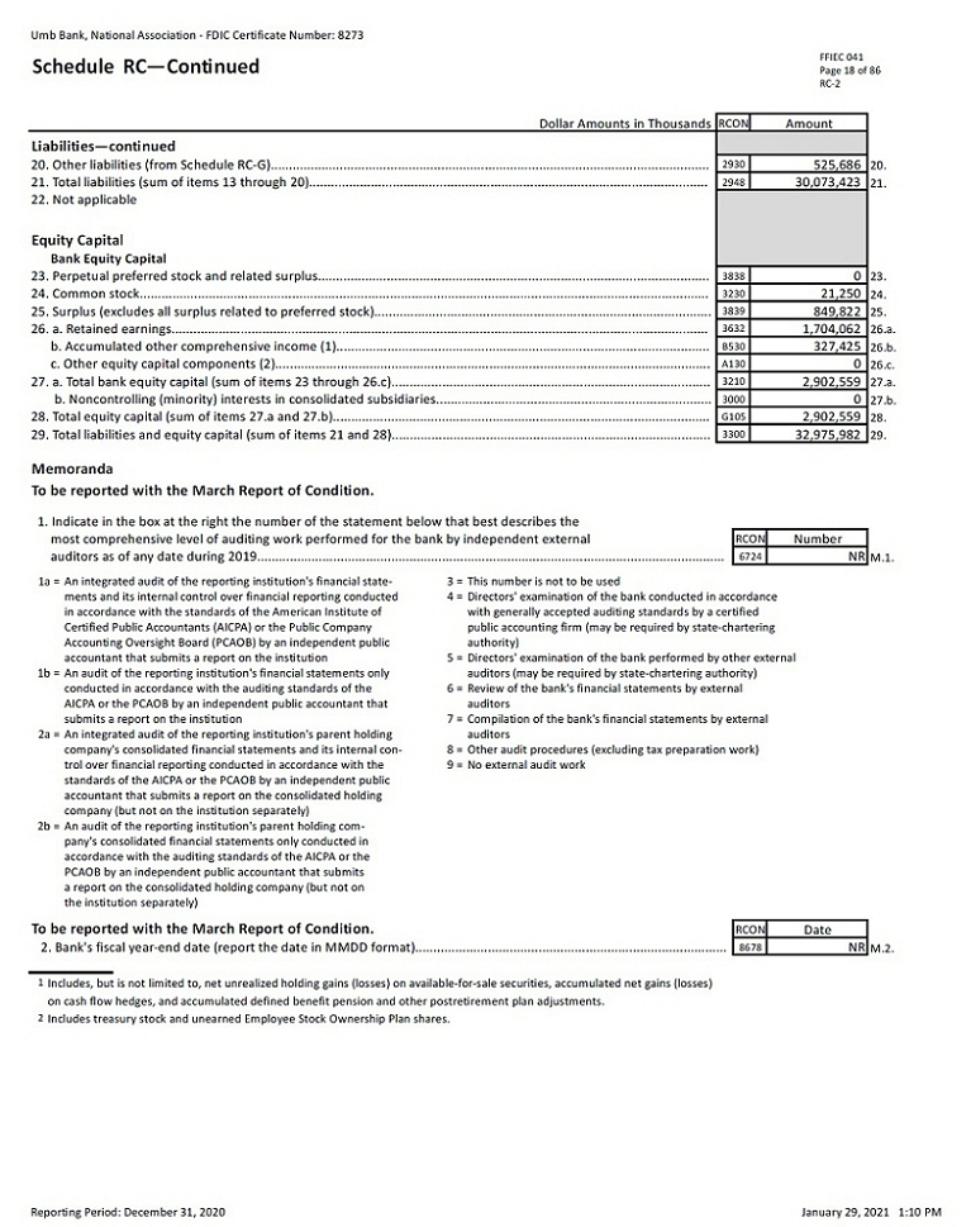

None of the Issuer, the Dealer Manager (as defined below), the Information and Exchange Agent (as defined below), the Old Notes Trustee, the Old Notes Collateral Agent, UMB Bank, National Association, as trustee for the New Notes (the “New Notes Trustee”) or UMB Bank, National Association, as the collateral agent for the New Notes (the “New Notes Collateral Agent”) or any affiliate of any of them makes any recommendation as to whether any holder of Old Notes should tender or refrain from tendering all or any portion of the principal amount of such holder’s Old Notes for New Notes in the Exchange Offer. No one has been authorized by any of them to make such a recommendation. You must make your own decision whether to tender Old Notes in the Exchange Offer and, if so, the amount of Old Notes as to which such action is to be taken.

Wilmington Savings Fund Society, FSB, in each of its capacities including, but not limited to Old Notes Trustee and Old Notes Collateral Agent, has not participated in or been involved in the preparation of this Exchange Offer and assumes no responsibility and no liability for its contents.

The Exchange Offer cannot be consummated until the registration statement of which this Prospectus forms a part is declared effective.

If we are unable to complete the Exchange Offer and the Consent Solicitation and to extend the upcoming maturities of our debt obligations, we will consider other restructuring alternatives available to us at that time. Those alternatives may include seeking asset dispositions, entering into joint ventures, issuing additional debt and obtaining relief under the U.S. Bankruptcy Code, all of which involve uncertainties, potential delays, significant costs and other risks. Even if we are successful with the Exchange Offer and the Restructuring Transactions, avoidance of an in-court restructuring under the U.S. Bankruptcy Code in the future is not guaranteed and we expect to continue to restructure our remaining obligations and will likely attempt to undertake other financing and refinancing alternatives, the success of which cannot be predicted at this time.

If you elect not to participate in the Exchange Offer and ION subsequently files for bankruptcy, your recovery with respect to any Old Notes that remain outstanding may be diminished, as the Old Notes will rank junior to all of the New Notes and our other secured debt to the extent of the value of the collateral securing such debt.

Neither we nor the Dealer Manager have authorized any other person to provide you with different or additional information other than information that is contained in this Prospectus, and we take no responsibility for, and can provide no assurances as to the reliability of, any different or additional information any other person may give you. We are not making an offer to exchange these securities in any jurisdiction where the exchange, offer or sale is not permitted. You should assume that the information in this Prospectus is accurate as of the date appearing on the front cover of this Prospectus only, unless the information specifically indicates that another date applies. Our business, financial condition, results of operations and prospects may have changed since that date, including as a result of the continued impact of the Coronavirus disease 2019 (“COVID-19”).

This Prospectus is part of a registration statement that we have filed with the U.S. Securities and Exchange Commission (the “SEC”). Before making any decision on the Exchange Offer and the Consent Solicitation, you should read this Prospectus and any prospectus supplement, together with the documents incorporated by reference in this Prospectus, any prospectus supplement, the registration statement, the exhibits thereto and the additional information described in the section “Where You Can Find More Information and Incorporation by Reference.”

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

You should carefully consider the risks set forth under “Risk Factors” beginning on page 19 of this Prospectus before you decide whether to participate in the Exchange Offer.

Dealer Manager | |

Oppenheimer & Co. Inc. | |

The date of this Prospectus is , 2021. |

IMPORTANT DATES

Please take note of the following important dates and times in connection with the Exchange Offer and the Consent Solicitation. We reserve the right to extend any of these dates.

Date |

| Calendar Date |

| Event |

Launch Date | , 2021. | Commencement of the Exchange Offer and the Consent Solicitation. | ||

Early Tender Time | Immediately after 11:59 p.m., New York City time, on , 2021 | The deadline for Holders to validly tender (and not validly withdraw) their Old Notes in order to be eligible to receive the Early Participation Payment in addition to the Exchange Consideration. | ||

Withdrawal Deadline | 5:00 p.m., New York City time, on , 2021. | The deadline for Holders who validly tender their Old Notes to validly withdraw tenders of their Old Notes. A valid withdrawal of tendered Old Notes will constitute the concurrent valid revocation of such Holder’s related Consent. | ||

Expiration Time | Immediately after 11:59 p.m., New York City time, on , 2021. | The deadline for Holders to validly tender their Old Notes in order to be eligible to receive the Exchange Consideration. | ||

Settlement Date | Promptly after the Expiration Time. We currently expect the Settlement Date to be , 2021. | The date on which the Exchange Consideration and the Early Participation Payment, as applicable, will be paid to Holders in exchange for Old Notes validly tendered (and not validly withdrawn) in the Exchange Offer at or prior to the Expiration Time. |

TABLE OF CONTENTS

PAGE | |

ii | |

iii | |

1 | |

6 | |

19 | |

41 | |

46 | |

59 | |

60 | |

61 | |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 63 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 64 |

83 | |

84 | |

96 | |

97 | |

99 | |

100 | |

181 | |

184 | |

188 | |

191 | |

202 | |

204 | |

208 | |

209 | |

Where You Can Find More Information and Incorporation by Reference | 210 |

F-1 |

i

IMPORTANT INFORMATION

This Prospectus does not constitute an offer to participate in the Exchange Offer to any person in any jurisdiction where it is unlawful to make such an offer or solicitations. The Exchange Offer is being made on the basis of this Prospectus and is subject to the terms described herein and those that may be set forth in any amendment or supplement thereto or incorporated by reference herein. Any decision to participate in the Exchange Offer should be based on the information contained in this Prospectus or any amendment or supplement thereto or specifically incorporated by reference herein. In making an investment decision or decisions, prospective investors must rely on their own examination of us and the terms of the Exchange Offer and the securities being offered and the terms of the amendments being sought, including the merits and risks involved. Prospective investors should not construe anything in this Prospectus as legal, business or tax advice. Each prospective investor should consult its advisors as needed to make its investment decision and to determine whether it is legally permitted to participate in the Exchange Offer under applicable legal investment or similar laws or regulations.

Each prospective investor must comply with all applicable laws and regulations in force in any jurisdiction in which it participates in the Exchange Offer or possesses or distributes this Prospectus and must obtain any consent, approval or permission required by it for participation in the Exchange Offer under the laws and regulations in force in any jurisdiction to which it is subject, and neither we nor any of our respective representatives shall have any responsibility therefor.

For prospective investors in Canada, prior to the distribution of this Prospectus, we distributed to certain Holders of Old Notes an Eligibility Letter confirming that each such Holder is an “accredited investor,” as that term is defined in National Instrument 45-106 Prospectus Exemptions or subsection 73.3(1) of the Securities Act (Ontario), and a permitted client, as that term is defined in National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations. Only Holders who have completed and returned an Eligibility Letter, available from the Information and Exchange Agent, may receive and review this Prospectus or participate in the Exchange Offer. Prospective investors in Canada should carefully read the information set forth under “Procedures for Tendering Old Notes and Delivering Consents — Notice to Canadian Holders.”

No action with respect to the Exchange Offer has been or will be taken in any jurisdiction (except the United States) that would permit a public offering of the offered securities, or the possession, circulation or distribution of this Prospectus or any material relating to the Company or the offered securities where action for that purpose is required. Accordingly, the Old Notes and New Notes, as applicable, may not be offered, sold or exchanged, directly or indirectly, and neither this Prospectus nor any other offering material or advertisement in connection with the Exchange Offer may be distributed or published, in or from any such jurisdiction, except in compliance with any applicable rules or regulations of any such jurisdiction.

This Prospectus contains summaries believed to be accurate with respect to certain documents, but reference is made to the actual documents for complete information. All of those summaries are qualified in their entirety by this reference. Copies of documents referred to herein will be made available to prospective investors upon request to us at the address and telephone number set forth under “Where You Can Find More Information and Incorporation by Reference.”

This Prospectus incorporates important business and financial information about the Company that is not included in or delivered with this document. This information is available without charge to security holders upon written or oral request to the Company, which may be made in writing or by phone to the following address or telephone number: 2105 CityWest Blvd. Suite 100, Houston, TX 77042-2839, Tel. (281) 933-3339, Attention: Legal Department. To obtain timely delivery of such information, security holders must request such information no later than , 2021.

ii

FORWARD-LOOKING STATEMENTS

This prospectus, including any information incorporated by reference herein, contains certain “forward-looking statements” within the meaning of Section 27A of the United States Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve many risks and uncertainties. These statements relate to our expectations for future events and time periods. All statements other than statements of historical fact are statements that could be deemed to be forward-looking statements, including, but not limited to, statements regarding:

| ● | future financial performance and growth targets or expectations; |

| ● | market and industry trends and developments; and |

| ● | the potential benefits of our proposed restructuring transactions. |

You can identify these and other forward-looking statements by the use of words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,” “might,” “should,” “would,” “could,” “potential,” “future,” “continue,” “ongoing,” “forecast,” “project,” “target” or similar expressions, and variations or negatives of these words.

These forward-looking statements are based on information available to us as of the date of this prospectus and our current expectations, forecasts and assumptions, and involve a number of risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date. Future performance cannot be ensured, and actual results may differ materially from those in the forward-looking statements. Some factors that could cause actual results to differ include:

● the impact of the COVID-19 pandemic on our business, financial condition, and results of operations;

● future levels of our capital expenditures and of our customers for seismic activities;

● future oil and gas commodity prices;

● the effects of current and future worldwide economic conditions (particularly in developing countries) and demand for oil and natural gas and seismic equipment and services;

● future implication of our negative working capital and stockholders’ deficit, including future cash needs and availability of cash, to fund our operations and pay our obligations;

● the effects of current and future unrest in the Middle East, North Africa and other regions;

● the timing of anticipated revenues and the recognition of those revenues for financial accounting purposes;

● the effects of ongoing and future industry consolidation;

● the timing of future revenue realization of anticipated orders for multi-client survey projects and data processing work in our E&P Technology & Services segment;

● future government laws or regulations pertaining to the oil and gas industry, including trade restrictions, embargoes and sanctions imposed by the U.S. government or laws curtailing the exploration for, or use of; hydrocarbons;

iii

● future government actions that may result in the deprivation of our contractual rights, including the potential for adverse decisions by judicial or administrative bodies in foreign countries with unpredictable or corrupt judicial systems;

● expected net revenues, gross margins, income from operations and net income for our services and products;

● future seismic industry fundamentals, including future demand for seismic services and equipment;

● future benefits to our customers to be derived from new services and products;

● future benefits to be derived from our investments in technologies, joint ventures and acquired companies;

● future growth rates for our services and products;

● the degree and rate of future market acceptance of our new services and products;

● expectations regarding E&P companies and seismic contractor end-users purchasing our more technologically-advanced services and products;

● anticipated timing and success of commercialization and capabilities of services and products under development and start-up costs associated with their development, including Marlin SmartPort;

● future opportunities for new products and projected research and development expenses;

● expected continued compliance with our debt financial covenants;

● expectations regarding realization of deferred tax assets;

● expectations regarding the impact of the U.S. Tax Cuts, Jobs Act and CARES Act;

● expectations regarding the approval of our request for forgiveness of the PPP loan.

● anticipated results with respect to certain estimates we make for financial accounting purposes;

● future success dependent on our continuing ability to identify, hire, develop, motivate and retain skilled personnel for all areas of our organization;

● breaches to our systems could lead to loss of intellectual property, dissemination of highly confidential information, increased costs and impairment of our ability to conduct our operations;

● evolving cybersecurity risks, such as those involving unauthorized access or control, denial-of-service attacks, malicious software, data privacy breaches by employees, insiders or others with authorized access, cyber or phishing-attacks, ransomware, malware, social engineering, physical breaches or other actions;

● compliance with the U.S. Foreign Corrupt Practices Act and other applicable U.S. and foreign laws prohibiting corrupt payments to government officials and other third parties; and

● anticipated approval of the INOVA sale by applicable regulators.

You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this prospectus. Except as required by law, we do not undertake any obligation to update or release any revisions to these forward-looking statements to reflect any events or circumstances, whether as a result of new information, future events, changes in assumptions or otherwise, after the date hereof.

iv

QUESTIONS AND ANSWERS ABOUT THE EXCHANGE OFFER

The following are some of the questions you may have as a holder of the Old Notes and the answers to those questions. You should refer to the more detailed information set forth in this Prospectus for more complete information about us and the Exchange Offer.

Q:Who is making the Exchange Offer?

A:ION Geophysical Corporation, the issuer of the Old Notes, is making the Exchange Offer.

Q:Why are we making the Exchange Offer?

A: | We are making this Exchange Offer to address the pending maturity of our Old Notes and to provide a mechanism to reduce our financial leverage in the future. We have executed the Restructuring Support Agreement, as amended and restated, with the Supporting Parties, which own approximately 90% of outstanding aggregate principal amount of such Old Notes as well as a letter agreement between us and Mr. James M. Lapeyre, Jr., pursuant to which Mr. Lapeyre has agreed to tender his Old Notes in the Exchange Offer as a part of the Restructuring Transactions, resulting in a tender rate of 92%, pursuant to which we committed to use our reasonable efforts to effect the following transactions: |

| (i) | the Exchange Offer, as described in this Prospectus; and |

| (ii) | the Rights Offering, granting the right to all holders of ION’s Common Stock to subscribe for a pro rata share of up to $50 million of New Notes issued at par, or our Common Stock issued at $2.57 per share. |

If we are not successful in our efforts to restructure our debt obligations, including because the response to the Exchange Offer is too limited, or if we are otherwise unable to extend the maturities of our debt obligations, we may consider seeking relief under the U.S. Bankruptcy Code. Even if the Exchange Offer is successful, avoidance of an in-court restructuring under the U.S. Bankruptcy Code in the future is not guaranteed.

Q: | What will happen to the Company if the Restructuring Transactions, including the Exchange Offer, are not completed? |

A: | If we are unable to complete the Restructuring Transactions, including the Exchange Offer and the Consent Solicitation and to extend the upcoming maturities of our debt obligations, we will consider other restructuring alternatives available to us at that time. Those alternatives may include seeking asset dispositions, entering into joint ventures, issuing additional debt and obtaining relief under the U.S. Bankruptcy Code, all of which involve uncertainties, potential delays, significant costs and other risks. For a more complete description of potential bankruptcy relief and the risks relating to our failure to complete the Exchange Offer, see “Risk Factors — Risks to Holders of Old Notes Not Tendered for Exchange.” |

Q:What will happen to the Old Notes if the Company files for bankruptcy?

A: | Your recovery with respect to any Old Notes that remain outstanding may be diminished in the event of a bankruptcy, as the Old Notes will be effectively junior to the New Notes and our other secured debt to the extent of the collateral securing the New Notes and such debt. |

Q: | Why are we pursuing an out-of-court restructuring rather than an in-court restructuring? |

A: | An out-of-court restructuring through the Exchange Offer and an in-court restructuring pursuant to the U.S. Bankruptcy Code provide alternative means of restructuring our liabilities and seeking to achieve the survival and long-term viability of our business. We believe that there are advantages to restructuring our indebtedness out-of- |

1

court. We believe that the successful consummation of the Restructuring Transactions, including the Exchange Offer, out-of-court would, among other things:

| ● | enable us to continue operating our business without the negative impact that a bankruptcy could have on our relationships with our customers, suppliers, employees and others: and |

| ● | allow us to complete our restructuring in less time, with potentially significantly less expenses than any in-court alternatives. |

If we have to resort to bankruptcy relief, among other things, we expect that the ability of Holders of Old Notes to recover all or a portion of their investment would likely be diminished to a greater degree than if the Exchange Offer is completed.

Q:When will the Exchange Offer expire?

A: | The Exchange Offer will expire immediately after 11:59 p.m. New York City time, on , 2021, unless extended or earlier terminated at our sole discretion. If the Exchange Offer is extended, we will announce any extensions by press release or other permitted means no later than 9:00 a.m., New York City time, on the business day after the scheduled expiration of the Exchange Offer. |

Q: | What will you receive in the Exchange Offer if you tender your Old Notes prior to the Early Tender Time and they are accepted? |

A: | Subject to the conditions set forth in this Prospectus, Holders who validly tender (and do not validly withdraw) their Old Notes prior to the Early Tender Time will be eligible to receive the Early Participation Payment in addition to the Exchange Consideration. |

Q: | What will you receive in the Exchange Offer if you tender your Old Notes at or prior to the Expiration Time and they are accepted? |

A: | Subject to the conditions set forth in this Prospectus, for each $1,000 principal amount of Old Notes that tendered for exchange, you will receive (a) $150 in cash and (b) $850 in New Notes, subject to certain rights to instead deliver or receive shares of our Common Stock, plus payment of all accrued and unpaid interest on your Old Notes to, but not including, the settlement date of the Exchange Offer. |

Q:When are the New Notes convertible into shares of Common Stock of the Company?

A: | The New Notes will be convertible upon certain events described under “Description of the New Notes — Conversion Rights.” |

Q: | What percentage of the ownership of the Company will Holders receive or be entitled to if the Restructuring Transactions are completed? |

A: | If the Restructuring Transactions are consummated, we could issue up to $151.7 million aggregate principal amount of New Notes, which could be converted into 50.6 million shares of Common Stock, representing approximately 73.8% of the total shares of Common Stock outstanding following the Restructuring Transactions. The actual number of shares of Common Stock that could be issued as a result of the Restructuring Transactions may be different than the amount indicated, however, due to, among other things, the participation levels in both the Exchange Offer and the Rights Offering and the ability of the Company, any noteholders participating in the Exchange Offer, and any participants in the Rights Offering to elect to deliver or receive cash in certain circumstances. |

2

Q: | If the Exchange Offer is consummated but you do not tender your Old Notes, how will your rights be affected? |

A: | Holders of Old Notes that remain outstanding following the consummation of the Exchange Offer will be effectively subordinated to the secured indebtedness represented by the New Notes and all existing secured indebtedness of ION and the Guarantors (as defined in “Description of the New Notes”), in each case, to the extent of the value of the collateral securing such obligations. |

To the extent that any Old Notes remain outstanding after completion of the Exchange Offer, any existing trading market for the remaining Old Notes may become further limited. The reduced outstanding principal amount may make the trading prices of the remaining Old Notes more volatile.

If the Requisite Consents are received and the Proposed Amendments become operative, such Old Notes that are not exchanged pursuant to the Exchange Offer will be subject to the Old Notes Indenture as modified by the Supplemental Indenture and no longer have the benefit of substantially all restrictive covenants and certain events of default currently applicable to the Old Notes and all collateral securing the Old Notes will be released.

As the Supporting Parties represent more than 66 2/3% of the Old Notes, the Issuer expects to receive the Requisite Consents in the Consent Solicitation.

For a description of the consequences of failing to tender your Old Notes pursuant to the Exchange Offer, see “Risk Factors — Risks to Holders of Old Notes Not Tendered for Exchange.”

Q:What amount of Old Notes are we seeking in the Exchange Offer?

A:We are seeking to exchange all $120.6 million principal amount of our outstanding Old Notes.

Q:Will you exchange all of the Old Notes validly tendered?

A: | Yes. We will exchange all of the Old Notes validly tendered (and not validly withdrawn) pursuant to the terms of the Exchange Offer, if the Exchange Offer is consummated. |

Q:What is the minimum amount of Old Notes required to be tendered in the Exchange Offer?

A: | The Exchange Offer is conditioned upon the satisfaction of the Minimum Tender Consideration, which consists of the valid tender of Old Notes (which are not validly withdrawn) of at least 95% of the aggregate principal amount of the Old Notes outstanding. |

Q:What are the conditions to the completion of the Exchange Offer?

A: | The Exchange Offer is subject to a limited number of conditions, which we may only be waived with the consent of the Supporting Parties, subject to applicable law. Most significantly, (i) the Company must have received valid tender of Old Notes (which are not validly withdrawn) in an aggregate principal amount of at least 95% of the aggregate principal amount outstanding of Old Notes and the corresponding consents, (ii) the Rights Offering must have generated net cash proceeds to the Company of at least $20 million (which we expect to satisfy with the Backstop Commitment), (iii) the amendment to our Credit Agreement (the “Credit Agreement Amendment”) permitting the Restructuring Transactions, including the Exchange Offer must be executed, and (iv) the registration statement of which this Prospectus forms a part must be declared effective by the Securities and Exchange Commission (which may not be waived) and we must not have terminated or withdrawn the Exchange Offer, which we may do if any of the conditions to the Exchange Offer are not satisfied. If any of these conditions are not satisfied, we will not be obligated to accept and exchange any validly tendered Old Notes. Prior to the Expiration Time of the Exchange Offer, we reserve the right, subject to applicable law, to amend or extend the Exchange Offer and the Consent Solicitation at any time or to amend or modify the Minimum Tender Condition or the Exchange Consideration or any other terms applicable to the Old Notes. We describe the conditions to the Exchange Offer in |

3

greater detail in the section titled “The Exchange Offer and the Consent Solicitation — Conditions of the Exchange Offer and the Consent Solicitation.” Pursuant to the Restructuring Support Agreement, subject to certain exceptions, the Issuer has agreed to not waive any conditions to the Exchange Offer and the Consent Solicitation without the consent of the Supporting Parties.

Q:Who may participate in the Exchange Offer?

A: | All Holders of the Old Notes may participate in the Exchange Offer. |

Q:Do you have to tender all of your Old Notes to participate in the Exchange Offer?

A: | No. You do not have to tender all of your Old Notes to participate in the Exchange Offer. |

Q:Will the New Notes be freely tradable?

A: | Yes. The New Notes are being simultaneously registered under the Securities Act on a registration statement of which this Prospectus forms a part. The consummation of the Exchange Offer is contingent on the Securities and Exchange Commission declaring this registration statement effective (which cannot be waived). |

Q:Will the New Notes be listed?

A:We have not applied and do not intend to apply for listing of the New Notes on any exchange.

Q:What risks should you consider in deciding whether to tender your Old Notes?

A: | In deciding whether to participate in the Exchange Offer, you should carefully consider the discussion of risks and uncertainties described in the section of this Prospectus titled “Risk Factors” and the documents incorporated by reference into this Prospectus. |

Q:How do you participate in the Exchange Offer?

A: | In order to exchange Old Notes, you must tender the Old Notes through The Depository Trust Company’s (“DTC”) Automated Tender Offer Program (“ATOP”). We describe the procedures for participating in the Exchange Offer in more detail in the section titled “The Exchange Offer — Procedures for Tendering Notes and Delivering Consents.” |

Q:May you withdraw your tender of Old Notes?

A: | Yes. You may withdraw any tendered Old Notes at any time prior to the withdrawal Deadline, which, unless extended, is at 5:00 p.m. New York City time, on , 2021. |

Q: | What happens if your Old Notes are not accepted in the Exchange Offer? |

A: | If we do not accept your Old Notes for exchange for any reason, Old Notes tendered by book entry transfer into the exchange agent’s account at DTC will be credited to your account at DTC. Any Old Notes, otherwise tendered, but not accepted for exchange, will be promptly returned to you. |

Q: | If you decide to tender your Old Notes, will you have to pay any fees or commissions to us or the Information and Exchange Agent? |

A: | We will pay transfer taxes, if any, applicable to the exchange of Old Notes for New Notes issued to you pursuant to the Exchange Offer. Additionally, we will pay all other expenses related to the Exchange Offer, except any commissions or concessions of any broker or dealer. |

4

Q: | How will you be taxed on the exchange of your Old Notes? |

A: | Please see the section of this Prospectus titled “Material U.S. Federal Income Tax Considerations.” You should consult your own tax advisor for a full understanding of the tax consequences of participating in the Exchange Offer. |

Q: | Has the Board of Directors adopted a position on the Exchange Offer? |

A: | Our board of directors has approved the making of the Exchange Offer. However, our board of directors does not make any recommendation as to whether you should tender Old Notes pursuant to the Exchange Offer. You must make the decision whether to tender Old Notes and, if so, how many Old Notes to tender. |

Q: | How do I vote for the Proposed Amendments? |

A: | If a Holder validly tenders Old Notes prior to the Expiration Time, such tender will be deemed to constitute the delivery of consent to the Proposed Amendments, as a holder of Old Notes, with respect to the tendered Old Notes. See “Proposed Amendments.” |

Q: | Who can you call with questions about how to tender your Old Notes? |

A: | You should direct any questions regarding procedures for tendering Old Notes to D.F. King & Co., Inc., our Information and Exchange Agent. Any requests for additional copies of this prospectus or the documents incorporated by reference in this Prospectus should be directed to us. The address and telephone number for our Information and Exchange Agent is included on the back cover of this Prospectus. |

5

PROSPECTUS SUMMARY

Except as otherwise indicated or where the context otherwise requires, in this Prospectus, “ION,” the “Issuer,” the “Company,” “we,” “us” and “our” refer to ION Geophysical Corporation and its consolidated subsidiaries. This summary highlights selected information contained elsewhere in this Prospectus or incorporated by reference into this Prospectus.

This summary does not contain all of the information that you should consider before exchanging any of your Old Notes for newly issued New Notes. You should read the entire Prospectus and the incorporated documents carefully, including the section entitled “Risk Factors” in this Prospectus, before making a decision to participate in the Exchange offer of your Old Notes for New Notes.

BUSINESS OVERVIEW

Company Overview

ION is an innovative, asset light global technology company that delivers powerful data-driven decision-making offerings to offshore energy, ports and defense industries. We are entering a fourth industrial revolution where technology is fundamentally changing how decisions are made. Decision-making is shifting from what was historically an art to a science. Data, analytics and digitalization provide a step-change opportunity to translate information into insights to enhance decisions, gain a competitive edge and deliver superior returns.

We have been a leading technology innovator for over 50 years. While the traditional focus of our cutting-edge technology has been on the E&P industry, we are now broadening and diversifying our business into relevant adjacent markets such as E&P logistics, ports and harbors and defense. Our offerings are focused on improving subsurface knowledge to enhance E&P decision-making and enhancing situational awareness to optimize offshore operations. We serve customers in most major energy producing regions of the world from strategically located offices.

The Company is publicly listed on the New York Stock Exchange (“NYSE”) under the ticker “IO”. ION is headquartered in Houston, Texas with regional offices around the world. The company has approximately 428 employees, about half of whom are in technical roles and a quarter have advanced degrees. We have approximately 450 patents and pending patent applications in various countries around the world.

We provide our services and products through two business segments — E&P Technology & Services and Operations Optimization. In addition, we have a 49% ownership interest in our INOVA Geophysical Equipment Limited (“INOVA Geophysical,” or “INOVA”), a joint venture with BGP Inc. (“BGP”), a subsidiary of China National Petroleum Corporation. BGP owns the remaining 51% equity interest in INOVA. We wrote our investment in INOVA down to zero in 2014. See further discussion below on our agreement to sell our interest in INOVA.

Our E&P Technology & Services segment creates digital data assets and delivers services to help E&P companies improve decision-making, reduce risk and maximize value. Across the E&P lifecycle, our E&P offerings focus on driving customer decisions, such as which blocks to bid on and for how much, how to maximize portfolio value, where to drill wells or how to optimize production.

Our Operations Optimization segment develops mission-critical subscription offerings and provides engineering services that enable operational control and optimization offshore. This segment is comprised of our Optimization Software & Services and Devices offerings. Our advanced hardware and software offerings control some of the largest moving objects on the planet and in some of the harshest conditions.

We historically conducted our land seismic equipment business through INOVA, which manufactures land seismic data acquisition systems, digital sensors, vibroseis vehicles (i.e., vibrator trucks), and energy source controllers. In March 2020, we announced an agreement to sell our 49% ownership interest in INOVA joint venture for $12.0 million, subject to regulatory approvals and other closing conditions. Closing of the transaction is expected in 2021.

6

Our executive offices are located at 2105 CityWest Blvd., Suite 100, Houston, Texas 77042-2839, and our telephone number is (281) 933-3339.

For a further discussion of our business, we urge you to read the information that is provided on EDGAR and incorporated by reference into this Prospectus. See “Where You Can Find More Information and Incorporation By Reference.”

Recent Developments

Restructuring Transactions and Liquidity

On December 23, 2020, to address the pending maturity of the $120.6 million aggregate principal amount of our 9.125% Senior Secured Second Priority Notes due 2021 (the “Old Notes”) and to provide a mechanism to reduce our financial leverage in the future, we executed a Restructuring Support Agreement, as amended and restated, (the “Restructuring Support Agreement”) with approximately 90% of the holders of such notes (the “Supporting Parties”) as well as a letter agreement between us and Mr. James M. Lapeyre, Jr., pursuant to which Mr. Lapeyre has agreed to tender his Old Notes in the Exchange Offer as a part of the Restructuring Transactions, resulting in a tender rate of 92%, pursuant to which we committed to use our reasonable efforts to effect the following transactions (collectively, the “Restructuring Transactions”):

| (i) | The Exchange Offer, as described in this Prospectus; and |

| (ii) | the Rights Offering, launched concurrently with the Exchange Offer, where we are granting the right to all holders of our Common Stock to subscribe for their pro rata share of up to $50 million of New Notes issued at par or shares of our Common Stock issued at $2.57 per share. |

Special Meeting of Shareholders

At a Special Meeting of Shareholders (the “Special Meeting”) on February 23, 2021, our shareholders approved the Restructuring Transactions, amendments to our Restated Certificate of Incorporation to increase the authorized number of shares of our capital stock to facilitate the Restructuring Transactions and an amendment to our Third Amended and Restated 2013 Long Term Incentive Plan (the “LTIP”) to increase the total number of shares of our Common Stock issuable thereunder.

Registered Direct Offering

On February 16, 2021, the Company entered into a securities purchase agreement providing for the sale and issuance of an aggregate of 2,990,001 shares of the Company’s Common Stock (the “RDO Shares”) at an offering price of $3.50 per share (the “Purchase Agreement”) and a placement agency agreement (the “Placement Agency Agreement”) with A.G.P./Alliance Global Partners (the “Placement Agent”) pursuant to which the Placement Agent agreed to use its reasonable best efforts to arrange for the sale of the shares of Common Stock contemplated in the Purchase Agreement.

On February 18, 2021, the Company successfully completed a registered direct offering of the RDO Shares (the “Registered Direct Offering”), which were offered pursuant to an effective shelf registration statement on Form S-3 (File No. 333-234606) previously filed with the SEC. Unless otherwise indicated, information in this Prospectus does not reflect the effect of the Registered Direct Offering.

The Company intends to use the $10.5 million in gross proceeds from the Registered Direct Offering for working capital and general corporate purposes. For more information on the offering, See Capitalization.

7

Summary of Risk Factors

There are a number of risks that you should understand before making an investment decision regarding the Exchange Offer. This summary is not intended to be complete and should only be read together with the section entitled “Risk Factors” beginning on page 19. If any of these risks occur, ION’s business, cash flows, financial condition, results of operations and/or prospects could be materially and adversely affected, and the trading price of ION’s securities and those of its subsidiaries could substantially decline. These risks include, among others, the following:

Risks to Holders of Old Notes Not Tendered for Exchange

| ● | The Proposed Amendments to the Old Notes Indenture will afford reduced protection to remaining holders of the Old Notes. |

| ● | The Exchange Offer is expected to result in reduced liquidity for the Old Notes that are not exchanged, which may limit the marketability of the Old Notes and adversely affect the market price of the Old Notes. |

| ● | If we consummate the Exchange Offer, existing ratings for the Old Notes remaining outstanding following completion of the Exchange Offer may not be maintained. |

| ● | If the Exchange Offer and Consent Solicitation are not successful, we may not have sufficient funds to pay all or a portion of the amounts due at maturity on the Old Notes. |

Risks Related to Participating in the Exchange Offer

| ● | We may be unable to repay our New Notes. |

| ● | The consummation of the Exchange Offer may not occur or may be delayed. |

| ● | Affiliates of the Company may participate in the Exchange Offer. |

| ● | Late deliveries of Old Notes or any other failure to comply with the terms and conditions of the Exchange Offer could prevent a holder of Old Notes from participating in the Exchange Offer. |

Risks Related to the New Notes

| ● | Our indebtedness could adversely affect our liquidity, financial condition and our ability to fulfill our obligations and operate our business. |

| ● | We may not be able to generate sufficient cash flow to meet our debt service obligations. |

| ● | Indebtedness under our Credit Facility and other priority debt we may incur from time to time will be effectively senior to the New Notes to the extent of the value of the collateral securing such indebtedness. |

| ● | Despite our current level of indebtedness, we may still be able to incur substantially more debt. |

| ● | There is no public market for the New Notes. |

Risk Related to the Collateral Securing the New Notes

| ● | The value of the collateral securing the New Notes may not be sufficient to satisfy our obligations under the New Notes. |

8

| ● | The right of holders of the New Notes to exercise remedies with respect to the collateral is extremely limited, even during an event of default under the Indenture governing the New Notes. |

| ● | Bankruptcy laws may significantly impair your rights to repossess and dispose of collateral securing the New Notes. |

| ● | There are circumstances other than repayment or discharge of the New Notes under which the collateral securing the New Notes will be released automatically, without your consent or the consent of the New Notes Collateral Agent or the New Notes Trustee. |

Risks Related to Our Common Stock

| ● | We have not paid cash dividends on our Common Stock and do not currently anticipate doing so in the foreseeable future. |

| ● | Our Common Stock will be diluted by the conversion of the New Notes. |

| ● | Holders of New Notes will not be entitled to any rights with respect to our Common Stock, but will be subject to all changes made with respect to our Common Stock to the extent our conversion obligation includes shares of our Common Stock. |

| ● | Future sales of our Common Stock in the public market could lower the market price for our Common Stock and adversely impact the trading price of the New Notes. |

| ● | The market price of the New Notes could be significantly affected by the market price of our Common Stock, which may fluctuate significantly. |

| ● | The conversion rate of the New Notes may not be adjusted for all dilutive events that may occur. |

| ● | Holders of the New Notes may have to pay tax with respect to distributions on our Common Stock that they do not receive. |

9

SUMMARY OF THE TERMS OF THE EXCHANGE OFFER

The summary below describes the principal terms of the Exchange Offer. Certain of the terms and conditions described below are subject to important limitations and exceptions. For a more complete understanding of the terms and conditions of the Exchange Offer and the Consent Solicitation you should read this entire Prospectus.

Exchange Offer |

| We are offering to all holders (each a “Holder” and together, the “Holders”) of Old Notes that validly tender (and do not validly withdraw) their Old Notes in the Exchange Offer the Exchange Consideration. |

Exchange Consideration | Holders who tender their Old Notes at or prior to 11:59 p.m., New York City time, on , 2021 (such date and time, as the same may be extended, the “Expiration Time”) will be eligible to receive, for each $1,000 principal amount of Old Notes tendered, (a) $150 in cash and (b) $850 of New Notes, provided, however, that up to an aggregate of $20 million of New Notes exchange consideration may instead be paid in the form of Common Stock at the Company’s option for every dollar of Rights Offering proceeds raised from the issuance of Common Stock the (“Exchange Consideration”). | |

For a description of the terms of the New Notes, see “Description of the New Notes.” | ||

Early Participation Payment | Subject to the conditions described herein, the Issuer will pay, per $1,000 principal amount of Old Notes tendered, $35, at the Issuer’s option, either in (I) cash, (II) Common Stock based on $2.57 per share, or (III) New Notes, for the benefit of Holders of Old Notes who validly tender (and do not validly withdraw) their Old Notes at or prior to the Early Tender Time. Each such payment is hereinafter referred to as the “Early Participation Payment.” Holders who tender their Old Notes at or prior to the Early Tender Time will be eligible to receive the Early Participation Payment in addition to the Exchange Consideration. Holders must tender their Old Notes at or prior to the Early Tender Time in order to be eligible to receive the Early Participation Payment. | |

Consent Solicitation | In conjunction with the Exchange Offer, we are also soliciting Consents from Holders of Old Notes to adopt the Proposed Amendments that would eliminate substantially all of the restrictive covenants and certain of the default provisions contained in the Old Notes Indenture and release all of the collateral securing the Old Notes. By tendering your Old Notes you will be deemed to have consented to the Proposed Amendments. | |

In order to adopt the Proposed Amendments, we must receive the Requisite Consents, which means the Consents by Holders representing at least 66 2/3% of the outstanding principal amount of Old Notes. Any Old Notes owned by the Issuer or any of its affiliates will be disregarded in determining whether Holders of the required principal amount of Old Notes have consented to the Proposed Amendments. | ||

If the Requisite Consents are received on or prior to the Expiration Time, we intend to execute the Supplemental Indenture promptly thereafter; provided, however, that the Proposed Amendments will not become operative until the Settlement Date (as defined below). If the Proposed Amendments become operative, Old Notes that are not tendered or are not accepted for exchange will remain outstanding but will be subject to the Old Notes Indenture as modified by the Supplemental Indenture. See “Proposed Amendments.” |

10

As the Supporting Parties represent more than 66 2/3% of the Old Notes, the Issuer expects to receive the Requisite Consents in the Consent Solicitation. | ||

Holders may not tender their Old Notes without delivering the related Consents, and Holders of Old Notes may not deliver Consents without tendering the related Old Notes. | ||

Restructuring Support Agreement | Pursuant to the terms of the Restructuring Support Agreement, as amended and restated and subject to the terms and conditions set forth therein, the Supporting Parties, which hold approximately 90% of the outstanding aggregate principal amount of the Old Notes, have agreed to tender (and not withdraw) at prior to the Expiration Time all Old Notes held by the Supporting Parties in the Exchange Offer (and, accordingly, consents in respect of all such Old Notes). Additionally, the Company entered into a letter agreement with Mr. James M. Lapeyre, Jr., pursuant to which Mr. Lapeyre has agreed to tender his Old Notes in the Exchange Offer as a part of the Restructuring Transactions, resulting in a tender rate of 92%. | |

The Supporting Parties’ obligations with respect to the Restructuring Support Agreement, as amended and restated, are conditioned upon our agreement not to waive or amend certain conditions to the consummation of the Exchange Offer set forth herein (including the execution of the Credit Agreement Amendment and the Minimum Tender Condition) without the prior written consent of the Supporting Parties in accordance with the terms of the Restructuring Support Agreement, subject to certain exceptions. |

Denominations | The Issuer will issue up to $106,703,565 in aggregate principal amount of New Notes and shares of Common Stock in this Exchange Offer and the Consent Solicitation. The Issuer will issue the New Notes in denominations of integral multiples of $1,000. We will not issue any fractional shares of Common Stock. Holders who tender less than all of their Old Notes must continue to hold Old Notes in the minimum authorized denomination of $2,000 principal amount. |

Early Tender Time | To receive the Early Participation Payment, Holders must validly tender (and not validly withdraw) their Old Notes at or prior to immediately after 11:59 p.m., New York City time, on , 2021, unless extended (such date and time, as the same may be extended, the “Early Tender Time”). We may extend the Early Tender Time or the Consent Time without extending the other. | |

Expiration Time | The Exchange Offer will expire immediately after 11:59 p.m., New York City time, on , 2021, unless extended or earlier terminated (such date and time, as the same may be extended, the “Expiration Time”). | |

Settlement Date | Subject to the terms and conditions of the Exchange Offer, the Settlement Date will occur promptly after the Expiration Time and is currently expected to occur on or about , 2021. | |

Accrued and Unpaid Interest | Holders whose Old Notes are accepted for exchange will also receive payment of accrued and unpaid interest in cash from the last interest payment date for the Old Notes to, but not including, the Settlement Date. | |

Conditions to the Exchange Offer and the Consent Solicitation | The consummation of the Exchange Offer and the Consent Solicitation is subject to the satisfaction or waiver of a number of conditions described under “Conditions of the Exchange Offer and the Consent Solicitation.” |

11

Subject to applicable law, the Issuer also has the right to waive any condition precedent to the Exchange Offer at its sole and absolute discretion. | ||

Procedure for Tenders | If a Holder wishes to participate in the Exchange Offer, and such Holder’s Old Notes are held by a custodial entity such as a bank, broker, dealer, trust company or other nominee, such Holder must instruct such custodial entity (pursuant to the procedures of the custodial entity) to tender the Old Notes on such Holder’s behalf. Custodial entities that are participants in DTC must tender Old Notes through ATOP. For further information, see “Procedures for Tendering Old Notes and Delivering Consents.” | |

Withdrawal Rights | Tenders of Old Notes may be withdrawn at any time before 5:00 p.m., New York City time, on , 2021 (such time, as the same may be extended by the Issuer from time to time at its sole discretion, the “Withdrawal Deadline”), but not thereafter, subject to limited exceptions. We may extend the Expiration Time without extending the Withdrawal Deadline, unless required by law. For information regarding withdrawal procedures, see “Withdrawal of Tenders.” | |

Consequences of Failure to Tender | Old Notes left outstanding following the consummation of the Exchange Offer will be effectively subordinated to the secured indebtedness represented by the New Notes and all existing secured indebtedness of ION and the Guarantors (as defined in “Description of the New Notes”), in each case, to the extent of the value of the collateral securing such obligations. | |

To the extent that any Old Notes remain outstanding after completion of the Exchange Offer, any existing trading market for the remaining Old Notes may become further limited. The reduced outstanding principal amount may make the trading prices of the remaining Old Notes more volatile. | ||

If the Requisite Consents are received and the Proposed Amendments become operative, any Old Notes that are not exchanged pursuant to the Exchange Offer will be subject to the Old Notes Indenture as modified by the Supplemental Indenture and will no longer have the benefit of substantially all of the restrictive covenants and certain events of default currently applicable to the Old Notes and certain other provisions currently contained in the Old Notes Indenture. | ||

For a description of the consequences of failing to tender your Old Notes pursuant to the Exchange Offer, see “Risk Factors — Risks to Holders of Old Notes Not Tendered for Exchange.” | ||