Table of Contents

PARNASSUS INCOME FUNDS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06673

Parnassus Income Funds

(Exact name of registrant as specified in charter)

One Market—Steuart Tower #1600, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Debra A. Early

Parnassus Income Funds

One Market—Steuart Tower #1600, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 778-0200

Date of fiscal year end: December 31

Date of reporting period: June 30, 2006

Table of Contents

Item 1: Report to Shareholders

THE PARNASSUS INCOME FUNDS

Semiannual Report June 30, 2006

Investing with a Conscience

Parnassus Equity Income Fund

Parnassus Fixed-Income Fund

Parnassus California Tax-Exempt Fund

Table of Contents

| Parnassus Equity Income Fund–Investor Shares | (PRBLX) | |

| Parnassus Equity Income Fund–Institutional Shares | (PRILX) | |

| Parnassus Fixed-Income Fund | (PRFIX) | |

| Parnassus California Tax-Exempt Fund | (PRCLX) |

| 1 | ||

| Fund Performance |

||

| 2 | ||

| 10 | ||

| 13 | ||

| 16 | ||

| Portfolios and Financial Statements |

||

| 18 | ||

| 27 | ||

| 34 | ||

| 41 | ||

| 47 | ||

| 51 | ||

Table of Contents

THE PARNASSUS INCOME FUNDS

August 4, 2006

DEAR SHAREHOLDER:

Enclosed is your semiannual report for the Parnassus Income Funds: the Equity Income Fund, the Fixed-Income Fund and the California Tax-Exempt Fund. Portfolio Manager Todd Ahlsten wrote the reports for the Equity Income Fund and the Fixed-Income Fund, while Portfolio Manager Ben Allen wrote the report for the California Tax-Exempt Fund. All the funds did well this quarter, but the real star was the Parnassus Fixed-Income Fund that finished first for the year-to-date among the 176 A-rated bond funds followed by Lipper, Inc.

I think you’ll find the reports to be interesting and informative. Thank you for investing with us.

| Yours truly, |

|

| Jerome L. Dodson, President |

| Parnassus Income Funds |

The Parnassus Income Funds • June 30, 2006 1

Table of Contents

As of June 30, 2006, the total return for the Equity Income Fund– Investor Shares for the second quarter was a loss of 0.92%. This compares to a loss of 1.44% for the S&P 500 and a gain of 0.23% for the average equity income fund followed by Lipper, Inc. Since the beginning of the year, the Fund is up 4.25% versus a gain of 2.71% for the S&P and return of 5.14% for the Lipper Average.

Below is a table that compares the performance of the Fund with the S&P 500 and the average equity income fund followed by Lipper.

Average Annual Total Returns

for periods ended June 30, 2006

| One Year |

Three Years |

Five Years |

Ten Years |

|||||||||

| EQUITY INCOME FUND – Investor Shares |

7.94 | % | 7.79 | % | 6.50 | % | 10.01 | % | ||||

| S&P 500 Index |

8.63 | % | 11.21 | % | 2.49 | % | 8.31 | % | ||||

| Lipper Equity Income Fund Average |

10.14 | % | 12.88 | % | 5.11 | % | 8.61 | % |

The average annual return for the Equity Income Fund – Institutional Shares from inception (April 28, 2006) was (2.43%).

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted, and current performance information is on the Parnassus website (www.parnassus.com). Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should read the prospectus which contains this information. The prospectus is on the Parnassus website or you can get one by calling (800) 999-3505. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns shown in the table do not reflect the deduction of taxes a shareholder would pay in fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. An index doesn’t take expenses into account, but mutual fund returns do.

Second Quarter Recap

The Fund held up well during a turbulent second quarter. Our objective is to beat the S&P 500 by providing upside participation in rising markets and downside protection during stock market declines. We met our goal during the second quarter as our loss of 0.92% was modest versus the 1.44% drop for the S&P 500 and declines in other markets such as the 7.0% downturn in the Nasdaq. The first six weeks of the quarter were strong as good earnings, and a hope that the Federal Reserve (Fed) was finished raising rates, helped the S&P 500 to advance 2.5% for the quarter and 6.68% for the year. We were doing fine, up 2.26% for the quarter and

2 The Parnassus Income Funds • Equity Income Fund

Table of Contents

7.45% for the year, when on May 10th, the Fed raised rates for the 16th straight time and said, “Further policy firming may yet be needed.” That Fed statement, along with inflationary economic data released during late May and early June, sparked a sharp market decline. From May 10th to June 13th, the S&P fell 7.3% while the Nasdaq plunged 10.44% as investors focused on accelerating inflation, slowing growth and increasing interest rates. While no one likes to lose money, we did meet our objective by posting a more modest 6.48% decline during that stretch.

Fortunately, the markets recovered during the last two weeks of the quarter as the Fed’s comments on June 28th seemed to imply that signs of a cooling economy could slow inflation and limit further interest rate increases. The S&P 500 climbed 3.75% from the low point of the quarter on June 13th to June 30th while our Fund gained 3.86%. As a result, the Fund finished the first half of 2006 up 4.25% versus a gain of 2.71% for the S&P 500.

Strategy

On a daily basis our research team looks at economic data such as interest rates, inflation, housing activity and consumer spending. Major trends are very important and we take them into account. Because we spend most of our time analyzing businesses and focusing on buying good companies at undervalued prices, I usually use most of the space in these reports talking about our portfolio companies rather than economic data. Sometimes, though, it is useful to talk about some key economic indicators and how they may affect the stock market.

After robust 5.6% growth during the first quarter, it appears that the economy is set for a slowdown over the next year or so. Consumer spending is finally starting to show signs of fatigue. I have written many times about my concerns regarding the housing market and the statistics show it is finally starting to soften. Inventory has been rising and homes are remaining on the market longer with a supply of 6.5 months in May, versus 4.3 months a year ago. The other concern is that 33% of all homes sold last year went to investors, and investor-owned homes are more vulnerable to pricing pressures than owner-occupied homes. Consumer spending has been strong these past few years due to low rates, the availability of home equity loans and high housing prices. While we’re not expecting a recession, we believe growth looks set to slow during the second half of 2006.

Right now, I feel positive about the portfolio because we own better than average companies that trade at lower than average prices. The numbers prove this as the average return on equity for the Fund’s companies is 21% versus 19% for the S&P 500. At the same time, our stocks trade at an average price earnings (P/E) of 13.4 versus a P/E of 14.5 for the S&P 500. Finally, we think we own some good growth businesses that have the potential to increase in value.

The Fund’s largest overweight positions are in technology, healthcare and consumer products. I am excited about the individual companies that comprise these

The Parnassus Income Funds • Equity Income Fund 3

Table of Contents

sectors, because they are positioned to grow their intrinsic values this year, despite the prospects for slower economic growth. For example, our analyst, Lori Keith, likes IBM because the company is well positioned to gain market share in the outsourcing and information technology services market. She is also impressed with the company’s recently expanded Indian consulting and development operations. It’s a great opportunity to buy this company at only 13 times 2006 earnings. If the economy remains strong, IBM should perform well and the stock could reach higher levels from its current price of $77.10. Moving to the rest of our major industry sectors, we are slightly overweight energy, as we added to our exposure during the second quarter sell-off. We remain underweight financial and housing-related stocks.

I am proud of our team for working hard and providing our investors with a good start in 2006. We are disciplined in our search to find good, undervalued companies. During the past ten years, the Fund has had only one down year (a 3.69% loss in 2002 versus a 23% decline for the S&P 500 that year.) In addition, we have generated a 6.50% return over the past five years versus a 2.50% return for the S&P 500.

Analysis

The Fund had seven stocks that cost the NAV 6¢ or more during the second quarter. Our most significant loss was eBay, which cost the Fund 15¢, as the stock dropped 24.9% from $39.00 to $29.29. The stock declined because investors focused on increasing competition from Google. While Google’s new services are not good news for eBay, we feel investors have overreacted. Let’s start with PayPal, one of eBay’s crown jewels that accounts for 25% of the company’s sales. During the quarter, Google announced its intent to launch Google Checkout to compete with PayPal. While Google will probably discount the service with lower prices and rebates, eBay has built a very strong position with over 105 million accounts and an estimated $27 billion in total payment volume. In addition, many PayPal customers are entrenched users of the company’s auction site which makes it hard to switch. Finally, PayPal has a great reputation because it offers users attractive interest rates, links to shipping services and less than 0.3% in fraud losses.

| Top 10 Holdings at June 30, 2006 (percentage of net assets) |

|||

| Apache Corp. |

4.1 | % | |

| J.P. Morgan Chase & Co. |

3.9 | % | |

| Sysco Corp. |

3.4 | % | |

| Intel Corp. |

3.4 | % | |

| Wells Fargo & Co. |

3.3 | % | |

| Canon Inc. (ADR) |

3.2 | % | |

| International Business Machines Corp. |

3.1 | % | |

| Johnson & Johnson |

2.8 | % | |

| Procter & Gamble Co. |

2.8 | % | |

| Energen Corp. |

2.7 | % |

Portfolio characteristics and holdings are subject to change periodically.

4 The Parnassus Income Funds • Equity Income Fund

Table of Contents

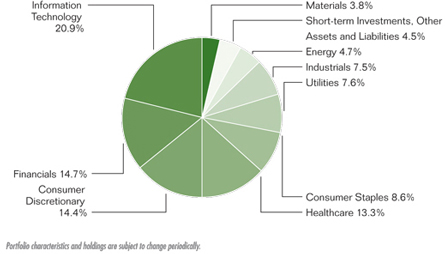

Equity Income Fund Portfolio Composition as of June 30, 2006 (percentage of net assets)

The eBay auction business is a strong franchise, and buyers and sellers remain very loyal to the site. In essence, eBay brings together the most buyers and sellers in one place and user satisfaction is high.

Clearly, eBay must work hard to stay one step ahead of its competition, but we feel management, led by CEO Meg Whitman, is doing just that. During the past month, eBay introduced eBay Express which contains fixed-price listings that can be bought right away. Buyers can now use one shopping cart to purchase merchandise from multiple sellers. Users must have a 98% positive feedback score to be eligible for the eBay Express marketplace. We feel this cements the company’s trusted reputation. Finally, eBay Express sellers are required to accept PayPal which helps protect the entire franchise. While eBay may need to respond in the long term by introducing more services and lowering prices, the business remains strong and valuable. The company owns some of the best brands on the Web: eBay, PayPal and Skype. We sold a portion of our position during the second quarter for tax purposes; however, the Fund remains overweight eBay versus the S&P 500.

ServiceMaster, the lawn-care and pest-control service provider, cost the Fund 12¢, as its stock sank 21.3% during the quarter from $13.12 to $10.33. Unfortunately, April showers didn’t bring May flowers for ServiceMaster. The stock fell after the Board of Directors on May 16th removed the company’s CEO, Jonathan Ward, who failed to satisfy their expectations for revenue growth. Our analyst, Ben Allen, and I heard about the news just after we landed at Baltimore’s BWI airport for a three-day business conference. We stayed up late that night listening to the company’s conference

The Parnassus Income Funds • Equity Income Fund 5

Table of Contents

call and discussing the situation. After careful review and sleeping on it, we agreed the management shake up was a positive. ServiceMaster should be growing faster given its strong brands. We have taken advantage of the low share price to add to our position in ServiceMaster. The stock now trades for only 12 times free cash flow and offers an attractive 4.3% dividend yield.

Tuesday Morning, the closeout retailer of quality home goods, reduced the Fund’s NAV by 11¢ as the stock fell 43.0% from $23.09 to $13.15. Our research team liked Tuesday Morning because it’s been a consistent growth business with a high dividend yield. After extensive store checks and a trip by one of our senior analysts to Dallas to meet the executive team, I felt confident the company was undervalued and a good long-term investment.

Unfortunately, my timing was off, as the stock continued to fall after we bought our shares. Competition was tough during the second quarter and Tuesday’s sales and profits were below plan. While sales trends are soft, the business is fundamentally still strong. I will maintain our position in Tuesday Morning, as I feel the market has overreacted to fixable problems affecting the business.

HCC Insurance Holdings cost the Fund 8¢ per share as the stock declined 15.4% from $34.80 to $29.44. Despite record first quarter earnings, HCC’s stock fell as investors worried about another devastating hurricane season. While the “wind season” is a risk, I feel HCC is an absolute bargain and is misunderstood by investors. During my February meeting with CEO Stephen Way in Houston, he discussed the company’s risk management strategy in great detail. In essence, the company’s policy is to limit its maximum loss exposure to one quarter of corporate earnings. As a result, HCC was still profitable and built capital during the third quarter last year when the hurricanes hit. Mr. Way has a great track record. Amazingly, he started underwriting insurance as a 15-year old child prodigy in London, England, back in 1965. He started HCC as an insurance company in 1981 with $750,000 in capital and the company now has over $1.5 billion in assets. Mr. Way is truly an “owner-operator” and I expect the company to have a strong year in 2006. We have been adding to our position.

Home Depot reduced the NAV by 7¢ as its stock fell 15.4% to $35.79 from $42.30 due to fears of a slowing housing market. Despite an attractive valuation of 11 times earnings, I sold our stock in Home Depot early in the 3rd quarter because of corporate governance concerns, including excessive executive pay and a questionable stock options grant to CEO Robert Nardelli. Collectively, these issues call into question Home Depot’s business ethics and transparency.

Invitrogen Corporation, a leading seller of biotechnology kits for research, fell 5.8% from $70.13 to $66.07 and cost the NAV 6¢. Overall, despite slightly lower than expected first quarter sales, demand remains strong for Invitrogen.

6 The Parnassus Income Funds • Equity Income Fund

Table of Contents

Electro Scientific Industries (ESI), a Portland, Oregon-based designer and manufacturer of equipment used to make memory chips and capacitors, fell 18.7% during the quarter from $22.13 to $17.99 which reduced the NAV by 6¢. The stock fell as investors feared that slowing sales of electronic components would weaken orders for ESI. In contrast, we are very bullish on ESI’s future. Our research indicates demand is strong for the company’s products as many new devices cannot be built unless customers buy next generation laser systems. Trading at $17.99, the stock is an absolute bargain as the company has $7.50 per share in cash on its books and no debt.

Winners

The Fund’s biggest winner was the Tower Group, Inc., a property and casualty insurance company that primarily serves small to mid-sized businesses. The stock soared 31.0% during the quarter from $23.10 to $30.25 for a gain of 11¢ on the NAV. The company reported strong growth in a business with high barriers to entry. In essence, the company sells insurance policies with premiums typically around $2,000 to small businesses that are underserved by the large insurance companies. In April, I had lunch with the CEO, Michael Lee, in a group meeting and felt optimistic about the company’s growth prospects. Like Stephen Way at HCC Insurance Holdings, Michael Lee is also a manager that can build capital without excessive risk.

Canon, the large Japanese company that makes digital cameras and copiers, added 8¢ to the NAV as its stock jumped 10.9% to $73.27 from $66.05. Sales are strong, especially for Canon’s digital cameras.

3M increased the NAV by 7¢ as the stock climbed 6.7% to $80.77 from $75.69. Business was strong in the company’s industrial, electronics, consumer and safety divisions. New CEO George Buckley seems to be off to a good start as first quarter sales and profits were ahead of plan.

Energen Corporation operates Alabama Natural Gas, a regulated public utility, as well as an oil and gas exploration business. Energen’s stock price climbed 9.7%, going from $35 to $38.41 for a gain of 6¢ for each Fund share. The stock price increased due to high oil prices, increased reserves and a large stock buyback.

Apache Corporation, a Houston, Texas-based company that explores, produces and develops crude oil and natural gas, increased 4.2% from $65.51 to $68.25, and added 6¢ to the NAV. I attended a meeting in Boston during March, where the CFO outlined the company’s growth strategy. We feel the company is doing a good job building reserves that position Apache for strong long-term growth.

Another major winner was old favorite WD-40 which rose 8.8% during the quarter from $30.85 to $33.57 and lifted the NAV by 6¢. The company, led by the talented Gary Ridge, reported another strong quarter of sales and profits despite high energy prices. His team has done a great job introducing popular new products

The Parnassus Income Funds • Equity Income Fund 7

Table of Contents

such as the WD-40 “Smart Straw” and WD-40 “No Mess Pen.” I also want to recognize CFO Mike Irwin as a talented financial manager. During a recent conversation, I learned that he ran and completed the Boston Marathon.

Social Notes

Northwest Natural Gas (NW Natural) began as a two-man venture to light the streets of Portland in 1859, weeks before Oregon officially became a state. If you ever get frustrated due to a flight delay and a few long lines at the airport, think of this: their machinery and equipment were delivered from New York, around the horn of South America via sailing ships at a time when settlers were still arriving in covered wagons on the Oregon Trail. Not only does NW Natural have a colorful past, but Parnassus Investments can see a bright future for the company. NW Natural has added customers, currently totaling 627,000, at a rate of more than 3% per year for the past 19 consecutive years. NW Natural also has a long history of returning profits to shareholders, one of only four U.S. companies to increase dividends every year for more than 50 consecutive years. NW Natural earns a place in our “social spotlight” for demonstrating a genuine concern for community and customers. In July, they created a Sustainability Department. The company ranked third nationally in customer satisfaction, according to J.D. Power and Associates, and is on the list of “100 Best Corporate Citizens” put out by Business Ethics magazine, for six years in a row, coming in at number 30 this year, up from 47th last year.

In the early days, the company manufactured gas from coal, then switched to manufacturing gas from oil, building its third and last plant on the Willamette River in 1913. Then in 1956, the company made an amazing transformation, converting more than 200,000 home appliances to use piped-in natural gas from New Mexico. It was the beginning of a new era. The company built 1,500 miles of pipeline, closed its manufactured gas plant and undertook an intensive educational program including letters, postcards, handbills and newspaper ads. In all, it cost the company approximately $4.3 million to convert its system to natural gas. Recently, NW Natural has taken responsibility for toxic emissions from plants built nearly a century ago, vol-untarily agreeing in the mid-1990s to study and help clean up the Portland harbor. Dredging of the tar waste along a six-mile strip of waterway began last July. NW Natural made the transition from manufactured gas to natural gas, and the company continues to adapt to concerns about climate change and nonrenewable energy resources. This June, NW Natural hired Bill Edmonds to be as director of their new Environmental Policy and Sustainability Department.

Andrea Reichert, our social research analyst, has had a chance to speak with Mr. Edmonds several times and has been sharing our views of corporate social responsibility with him. Part of Mr. Edmond’s job is to continue pioneering policy work, like NW Natural’s innovative Conservation Tariff, approved by the utility commission in 2002 and renewed in 2005, which earned the support of both environmentalists and consumer groups. The tariff is designed to adjust revenues to compensate the

8 The Parnassus Income Funds • Equity Income Fund

Table of Contents

utility for declining usage due to customers’ conservation efforts. This way, the company no longer has a disincentive to encourage conservation. The idea is ground-breaking, and NW Natural is sharing this vision with many other utilities across the U.S. In terms of climate change, NW Natural works to squeeze every bit of energy out of the gas it delivers, and natural gas is much cleaner to burn, producing about 30% less carbon dioxide than oil and about half that of coal or wood. The company promotes two important ways to get more out of natural gas. First, “combined heat and power” makes use of heat that would otherwise be wasted as a byproduct. Second, NW Natural promotes the direct use of natural gas in homes and businesses, rather than the less efficient use of gas to make electricity.

NW Natural also encourages its employees to help the environment. While talking with Andrea, Bill Edmonds noted that 155 out of 543 people, or 30% of the Portland staff, use mass transit, carpool, bike or walk to work. The company offers free transit passes. NW Natural also owns an interest in two wind-power generation facilities in northwest California. While renewable energy currently generates less than 1% of total revenue for NW Natural, Parnassus was delighted to hear that the company is examining the possibility of natural gas generation via renewable sources, such as methane produced naturally from decomposing plant and animal wastes (biomass).

Not only is NW Natural a solid business to own and a model of innovation, it is also an excellent example of our “best in class” investment policy in the energy sector. We are practical about how fast the transition from old energy sources to cleaner technologies can happen; therefore, our investment strategy is twofold: 1) invest in best-of-class companies in traditional sectors that work especially hard at efficiency using environmentally-sound practices and 2) search out profitable companies in the renewable energy and clean technology sector.

Thank you for investing in the Parnassus Equity Income Fund.

| Yours truly, |

|

|

| Todd C. Ahlsten |

| Portfolio Manager |

The Parnassus Income Funds • Equity Income Fund 9

Table of Contents

As of June 30, 2006, the net asset value per share (NAV) of the Fixed-Income Fund was $15.98, so after taking dividends into account, the total return for the quarter was 1.05%. This compares to a loss of 0.31% for the average A-rated bond fund followed by Lipper, and a loss of 0.14% for the Lehman Government/Corporate Bond Index. Based on this strong performance, I’m pleased to report that our return for the year-ended June 30, 2006 placed us #2 out of 172 funds in our category followed by Lipper*. The Fund had an outstanding start this year. We had expected rates to rise, putting the portfolio in a defensive position with short maturities.

Since the beginning of the year, the Fund is up 3.15% versus a loss of 0.99% for the Lipper Average and a drop of 1.15% for the Lehman Government/Corporate Bond Index. Our longer-term returns are also excellent as the Fund’s one-, three-, five-and ten-year returns beat the Lipper A-rated Bond Fund Average for every period.

Below is a table that compares the performance of the Fund with the Lehman and the average A-Rated bond fund followed by Lipper. Average annual total returns are for the one-, three-, five- and ten-year periods.

Average Annual Total Returns

for periods ended June 30, 2006

| One Year |

Three Years |

Five Years |

Ten Years |

|||||||||

| FIXED-INCOME FUND |

3.79 | % | 2.12 | % | 5.69 | % | 5.82 | % | ||||

| Lipper A-rated Bond Fund Average |

(1.33 | )% | 1.83 | % | 4.58 | % | 5.64 | % | ||||

| Lehman Government/Corporate Bond Index |

(1.52 | )% | 1.60 | % | 5.13 | % | 6.25 | % |

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted, and current performance information is on the Parnassus website (www.parnassus.com). Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should read the prospectus which contains this information. The prospectus is on the Parnassus website or you can get one by calling (800) 999-3505. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns shown in the table do not reflect the deduction of taxes a shareholder would pay in fund distributions or redemption of shares. The Lehman Government/Corporate Bond Index is an unmanaged index of bonds, and it is not possible to invest directly in an index. An index doesn’t take expenses into account, but mutual fund returns do.

| * | For the one-, three-, five- and ten-year periods ended June 30, 2006 based on the Lipper A-rated Bond Fund Average the Parnassus Fixed-Income Fund placed #2 out of 172 funds, #49 out of 148 funds, #9 out of 110 funds and #27 out of 64 funds, respectively. |

10 The Parnassus Income Funds • Fixed-Income Fund

Table of Contents

First Quarter Recap

The Fund had a great quarter and a terrific first half. We expected interest rates to move higher because of inflation fears, so we played defense by owning a lot of short-term bonds. The technical term for this portfolio strategy is keeping a short duration. Duration essentially measures how much in percentage terms a bond price will move for a 1% change in interest rates. This is important because when interest rates rise, bond prices fall. As a result, we wanted to avoid owning long-duration bonds because they drop more when interest rates rise. Since the 10-year Treasury rate jumped from 4.86% to 5.15% during the quarter, many of our peers were hit with significant losses as their long-duration bond prices declined. The Fund’s “short duration” strategy not only protected us from losses but also produced a positive 1.05% return as we collected interest payments from our bond portfolio and experienced few bond price declines. In contrast, our peers lost 0.31% during the quarter.

Strategy

The Federal Reserve hinted at its June 29th meeting that it almost may be finished raising interest rates. In its statement, the Federal Open Market Committee stated that “economic growth is moderating from its quite strong pace earlier this year, partly reflecting a gradual cooling of the housing market and the lagged effects of increases in interest rates and energy prices.” While we don’t feel rates are set to decline, they could stabilize near these levels if a slowing economy begins reducing inflation. In response, we slightly increased our duration from 1.5 years to 2.9 years as a few corporate issues and a convertible bond from Intel looked attractive. However, we are still playing defense, as we feel the potential for inflationary data during the

| Portfolio Composition at June 30, 2006 (percentage of net assets) |

|||

| Long-term Securities: |

|||

| Long-term U.S. Government and Agency Securities |

7.6 | % | |

| Electronics |

7.2 | % | |

| Healthcare |

5.6 | % | |

| Information Technology |

4.7 | % | |

| Air Transport |

3.5 | % | |

| Financial Services |

3.0 | % | |

| Natural Gas |

2.0 | % | |

| Retail |

0.8 | % | |

| Short-term Securities: |

|||

| Short-term U.S. Government Agency Securities |

57.6 | % | |

| Other Short-term Investments and Assets and Liabilities |

8.0 | % | |

Portfolio characteristics and holdings are subject to change periodically.

The Parnassus Income Funds • Fixed-Income Fund 11

Table of Contents

second half of 2006 could push the 10-year Treasury to approximately 5.35% to 5.50% from its current level of 5.18%. At that level, we will be looking to extend our duration if we feel rates are set to stabilize. In addition, our team will be looking for convertible/preferred bonds to offer increased return potential.

Thank you for investing in the Parnassus Fixed-Income Fund.

| Yours truly, |

|

|

| Todd C. Ahlsten |

| Portfolio Manager |

12 The Parnassus Income Funds • Fixed-Income Fund

Table of Contents

THE CALIFORNIA TAX-EXEMPT FUND

As of June 30, 2006, the net asset value per share (NAV) of the California Tax-Exempt Fund was $16.36. Taking dividends into account, the total return for the second quarter of 2006 was a loss of 0.08%. This compares to a loss of 0.16% for the average California municipal bond fund followed by Lipper, Inc. Since the beginning of the year, the Fund is down 0.06% versus a gain of 0.15% for the Lipper average. The average duration of the California Tax-Exempt Fund was 4.2 years during the quarter, versus approximately 6.7 years for the Lehman Municipal Bond Index. Simply put, duration measures how much in percentage terms a bond price will move for a 1% change in interest rates.

Below you will find a table that compares our total average annual returns to various indices over the past one-, three-, five- and ten-year periods. The 30-day SEC yield for June 2006 was 3.49%.

Average Annual Total Returns

for periods ended June 30, 2006

| One Year |

Three Years |

Five Years |

Ten Years |

|||||||||

| CALIFORNIA TAX-EXEMPT FUND |

0.12 | % | 1.36 | % | 3.68 | % | 4.87 | % | ||||

| Lipper California Municipal Bond Fund Average |

0.84 | % | 3.21 | % | 4.61 | % | 5.21 | % | ||||

| Lehman Municipal Bond Index |

0.88 | % | 3.23 | % | 5.05 | % | 5.79 | % |

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted, and current performance information is on the Parnassus website (www.parnassus.com). Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus which contains this information. The prospectus is on the Parnassus website or you can get one by calling (800) 999-3505. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns shown in the table do not reflect the deduction of taxes a shareholder would pay on fund distributions or redemption of shares. The Lehman Municipal Bond Index is an unmanaged index of fixed-income securities and it is not possible to invest directly in an index. An index doesn’t take expenses into account, but mutual fund returns do.

The Parnassus Income Funds • California Tax-Exempt Fund 13

Table of Contents

Second Quarter Review

During the quarter, long-term interest rates continued to rise, with the 10-year Treasury rate moving from 4.86% to 5.15%. Since bond prices decline when rates increase, our portfolio recorded a modest loss of 0.08% for the quarter. While no one likes to lose money, I am pleased that we beat our peers, whose portfolios declined an average 0.16%. We outperformed because we expected interest rates to rise and positioned our portfolio with short maturity bonds.

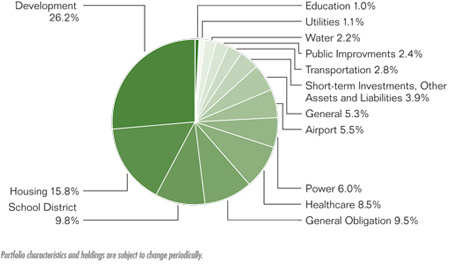

California Tax-Exempt Fund Portfolio Composition as of June 30, 2006 (percentage of net assets)

14 The Parnassus Income Funds • California Tax-Exempt Fund

Table of Contents

Outlook

Since June 2004, the Fed has increased the short-term interest rate 17 times from 1.00% to today’s 5.25% rate. After two years, we appear to be close to the end of the rate increases. The most recent statement by the Federal Open Market Committee noted that a cooling housing market, high energy prices and past rate increases have combined to slow economic growth, and, therefore, reduce the risk of inflation. We expect short- and long-term interest rates to remain close to their current levels, or slightly to increase, for the remainder of the year.

The other significant news from the quarter is that all three major credit rating agencies (Standard & Poor’s, Moody’s and Fitch) have upgraded the State of California’s debt. Explaining their upgrades, the agencies highlighted the state’s broad-based economic growth and higher than expected tax revenues. This is good news for our Fund because a healthy California economy and budget reduce the Fund’s credit risk.

I am pleased that the Fund limited shareholder losses during the quarter relative to our peers. We continue to seek opportunities to improve overall returns while limiting losses in the portfolio.

Thank you for investing in the Fund.

| Yours truly, |

|

|

| Ben Allen |

| Portfolio Manager |

The Parnassus Income Funds • California Tax-Exempt Fund 15

Table of Contents

As a shareholder of the funds, you incur ongoing costs, which include portfolio-management fees, administrative fees, shareholder reports, and other fund expenses. The funds do not charge transaction fees, so you do not incur transaction costs such as sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees. The information on this page is intended to help you understand your ongoing costs of investing in the funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The following example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the period of January 1, 2006 through June 30, 2006. For the Equity Income Fund – Institutional Shares, the example is based on the period April 28, 2006 (inception) to June 30, 2006.

Actual Expenses

In the example below, the first line for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of each fund provides information about hypothetical account values and hypothetical expenses based on the fund’s expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. You may compare the ongoing costs of investing in the fund with other mutual funds by comparing this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

16 The Parnassus Income Funds • June 30, 2006

Table of Contents

Please note that the expenses shown in the table are meant to highlight only your ongoing costs in these funds. Therefore, the second line of each fund is useful in comparing only ongoing costs and will not help you determine the relative total costs of owning other mutual funds, which may include transactional costs such as loads.

| Beginning Account Value |

Ending Account Value June 30, 2006 |

Expenses Paid During Period* | |||||||

| Equity Income Fund – Investor Shares: Actual | $ | 1,000.00 | $ | 1,042.50 | $ | 5.01 | |||

| Hypothetical (assumed 5% return) |

$ | 1,000.00 | $ | 1,019.89 | $ | 4.96 | |||

| Equity Income Fund – Institutional Shares: Actual |

$ | 1,000.00 | $ | 975.72 | $ | 1.33 | |||

| Hypothetical (assumed 5% return) |

$ | 1,000.00 | $ | 1,007.28 | $ | 1.35 | |||

| Fixed-Income Fund: Actual |

$ | 1,000.00 | $ | 1,031.50 | $ | 3.78 | |||

| Hypothetical (assumed 5% return) |

$ | 1,000.00 | $ | 1,021.08 | $ | 3.76 | |||

| California Tax-Exempt Fund: Actual |

$ | 1,000.00 | $ | 999.40 | $ | 3.37 | |||

| Hypothetical (assumed 5% return) |

$ | 1,000.00 | $ | 1,021.42 | $ | 3.41 | |||

| * | Expenses are equal to the fund’s annualized expense ratio of 0.99%, 0.75%, and 0.68% for Equity Income Fund –Investor Shares, Fixed-Income Fund and California Tax-Exempt Fund, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period from January 1, 2006 through June 30, 2006). For Equity Income Fund – Institutional Shares, expenses are equal to the fund’s annualized expense ratio of 0.78% multiplied by the average account value over the period, multiplied by 63/365 (to reflect the period April 28, 2006 (inception) to June 30, 2006). |

The Parnassus Income Funds • June 30, 2006 17

Table of Contents

Portfolio of Investments by Industry Classification

as of June 30, 2006 (unaudited)

| Shares |

Common Stocks |

Percent of Net Assets |

Market Value | |||||

| Apparel |

||||||||

| 200,000 | Cherokee Inc.2 |

$ | 8,272,000 | |||||

| 50,000 | Coach Inc.1 |

1,495,000 | ||||||

| 1.2 | % | $ | 9,767,000 | |||||

| Banks |

||||||||

| 400,000 | Wells Fargo & Co. |

3.3 | % | $ | 26,832,000 | |||

| Biotechnology |

||||||||

| 125,000 | Amgen Inc.1 |

$ | 8,153,750 | |||||

| 100,000 | Genentech Inc.1 |

8,180,000 | ||||||

| 235,000 | Invitrogen Corp.1, 2 |

15,526,450 | ||||||

| 250,000 | Sigma-Aldrich Corp.2 |

18,160,000 | ||||||

| 6.2 | % | $ | 50,020,200 | |||||

| Chemicals |

||||||||

| 250,000 | Rohm & Haas Co. |

1.6 | % | $ | 12,530,000 | |||

| Computer Peripherals |

||||||||

| 150,000 | Avocent Corp.1 |

0.5 | % | $ | 3,937,500 | |||

| Computers |

||||||||

| 325,000 | International Business Machines Corp. |

3.1 | % | $ | 24,966,500 | |||

| Cosmetics & Personal Care |

||||||||

| 400,000 | Proctor & Gamble Co. |

2.8 | % | $ | 22,240,000 | |||

| Electric Motors |

||||||||

| 125,900 | Baldor Electric Co.2 |

0.5 | % | $ | 3,939,411 | |||

| Electronics |

||||||||

| 275,000 | Plantronics Inc.2 |

0.8 | % | $ | 6,107,750 | |||

| Entertainment |

||||||||

| 379,200 | Cedar Fair, LP2 |

1.3 | % | $ | 10,063,968 | |||

| Financial Services |

||||||||

| 750,000 | J.P. Morgan Chase & Co. |

3.9 | % | $ | 31,500,000 | |||

| Food Products |

||||||||

| 50,000 | McCormick & Co., Inc.2 |

$ | 1,677,500 | |||||

| 900,000 | Sysco Corp.2 |

27,504,000 | ||||||

| 3.6 | % | $ | 29,181,500 | |||||

| Healthcare Products |

||||||||

| 550,000 | Baxter International Inc. |

$ | 20,218,000 | |||||

| 100,000 | Dentsply International Inc.2 |

6,060,000 | ||||||

| 375,000 | Johnson & Johnson |

22,470,000 | ||||||

| 375,000 | St. Jude Medical Inc.1 |

12,157,500 | ||||||

| 7.6 | % | $ | 60,905,500 | |||||

| 18 |

The accompanying notes are an integral part of these financial statements. |

Table of Contents

| Shares |

Common Stocks |

Percent of Net Assets |

Market Value | |||||

| Home Products |

||||||||

| 537,744 | WD-40 Co.2 |

2.2 | % | $ | 18,052,066 | |||

| Industrial Manufacturing |

||||||||

| 200,000 | 3M Co. |

$ | 16,154,000 | |||||

| 125,000 | PACCAR Inc. |

10,297,500 | ||||||

| 225,000 | Teleflex Inc. |

12,154,500 | ||||||

| 4.8 | % | $ | 38,606,000 | |||||

| Insurance |

||||||||

| 435,000 | AFLAC Inc. |

$ | 20,162,250 | |||||

| 700,000 | HCC Insurance Holdings Inc. |

20,608,000 | ||||||

| 525,000 | Tower Group Inc.2 |

15,881,250 | ||||||

| 7.0 | % | $ | 56,651,500 | |||||

| Internet |

||||||||

| 125,000 | eBay Inc.1 |

0.5 | % | $ | 3,661,250 | |||

| Leisure Manufacturing |

||||||||

| 100,000 | Harley-Davidson Inc.2 |

0.7 | % | $ | 5,489,000 | |||

| Machinery |

||||||||

| 50,000 | Graco Inc. |

0.3 | % | $ | 2,299,000 | |||

| Natural Gas |

||||||||

| 575,000 | Energen Corp. |

$ | 22,085,750 | |||||

| 525,000 | ONEOK Inc. |

17,871,000 | ||||||

| 500,000 | Southern Union Co.2 |

13,530,000 | ||||||

| 100,000 | XTO Energy Inc. |

4,427,000 | ||||||

| 7.2 | % | $ | 57,913,750 | |||||

| Networking Products |

||||||||

| 800,000 | Cisco Systems Inc.1 |

1.9 | % | $ | 15,624,000 | |||

| Office Equipment |

||||||||

| 350,000 | Canon Inc. (ADR)2 |

3.2 | % | $ | 25,644,500 | |||

| Oil & Gas |

||||||||

| 485,000 | Apache Corp. |

4.1 | % | $ | 33,101,250 | |||

| Pharmaceuticals |

||||||||

| 600,000 | Pfizer Inc. |

1.8 | % | $ | 14,082,000 | |||

| The accompanying notes are an integral part of these financial statements. | 19 |

Table of Contents

THE EQUITY INCOME FUND

Portfolio of Investments by Industry Classification

as of June 30, 2006 (unaudited) continued

| Shares |

Common Stocks |

Percent of Net Assets |

Market Value | |||||

| Retail |

||||||||

| 325,000 | Foot Locker Inc. |

$ | 7,959,250 | |||||

| 151,000 | Ross Stores Inc. |

4,235,550 | ||||||

| 350,000 | Target Corp. |

17,104,500 | ||||||

| 625,000 | The Gap Inc. |

10,875,000 | ||||||

| 375,000 | Home Depot Inc. |

13,421,250 | ||||||

| 575,000 | Tuesday Morning Corp.2 |

7,561,250 | ||||||

| 7.6 | % | $ | 61,156,800 | |||||

| Semiconductor Capital Equipment |

||||||||

| 225,000 | Applied Materials Inc. |

$ | 3,663,000 | |||||

| 900,000 | Electro Scientific Industries Inc.1, 2 |

16,191,000 | ||||||

| 2.5 | % | $ | 19,854,000 | |||||

| Semiconductors |

||||||||

| 1,450,000 | Intel Corp. |

$ | 27,477,500 | |||||

| 325,000 | Xilinx Inc. |

7,361,250 | ||||||

| 4.3 | % | $ | 34,838,750 | |||||

| Software |

||||||||

| 75,000 | Hyperion Solutions Corp.1 |

$ | 2,070,000 | |||||

| 125,000 | Symantec Corp.1, 2 |

1,942,500 | ||||||

| 250,000 | TIBCO Software Inc.1 |

1,762,500 | ||||||

| 0.7 | % | $ | 5,775,000 | |||||

| Services |

||||||||

| 1,950,000 | The ServiceMaster Co.2 |

2.5 | % | $ | 20,143,500 | |||

| Telecommunications |

||||||||

| 400,000 | Nokia Corp. (ADR) |

1.0 | % | $ | 8,104,000 | |||

| Transportation |

||||||||

| 125,000 | United Parcel Service Inc. |

1.3 | % | $ | 10,291,250 | |||

| Utilities |

||||||||

| 215,000 | Northwest Natural Gas Co.2 |

$ | 7,961,450 | |||||

| 200,000 | Otter Tail Corp.2 |

5,466,000 | ||||||

| 1.7 | % | $ | 13,427,450 | |||||

| Total investment in common stocks (cost $694,337,388) |

91.7 | % | $ | 736,706,395 | ||||

| 20 |

The accompanying notes are an integral part of these financial statements. |

Table of Contents

| Principal Amount $ |

Convertible Bonds |

Percent of Net Assets |

Market Value | |||||

| Air Transport |

||||||||

| 4,000,000 | ExpressJet Holdings Inc.2 |

|||||||

| 4.250%, due 08/01/2023 |

$ | 3,595,000 | ||||||

| 6,000,000 | JetBlue Airways Corp.2 |

|||||||

| 3.500%, due 07/15/2033 |

5,362,500 | |||||||

| 1.1 | % | $ | 8,957,500 | |||||

| Semiconductors |

||||||||

| 10,000,000 | Agere Systems Inc.2 |

|||||||

| 6.500%, due 12/15/2009 |

1.2 | % | $ | 9,887,500 | ||||

| Software |

||||||||

| 9,586,000 | Mentor Graphics Corp.2 |

|||||||

| 6.360%, due 08/06/2023 |

1.2 | % | $ | 9,442,210 | ||||

| Total investment in convertible bonds (cost $27,650,543) |

3.5 | % | $ | 28,287,210 | ||||

| Shares |

Preferred Stocks |

|||||||

| Banks |

||||||||

| 55,000 | Zions Capital Trust B2 |

|||||||

| Preferred 8.000%, callable 09/01/2007 |

$ | 1,423,400 | ||||||

| 55,439 | First Republic Preferred Capital Corp. |

|||||||

| Preferred 8.875%, Series B, callable 12/30/2006 |

1,391,519 | |||||||

| Total investment in preferred stock (cost $2,819,746) |

0.3 | % | $ | 2,814,919 | ||||

| Total investments in stocks and convertible bonds (cost $724,807,677) |

95.5 | % | $ | 767,808,524 | ||||

| The accompanying notes are an integral part of these financial statements. | 21 |

Table of Contents

THE EQUITY INCOME FUND

Portfolio of Investments by Industry Classification

as of June 30, 2006 (unaudited) continued

| Principal Amount $ |

Short-Term Investments |

Percent of Net Assets |

Market Value | |||||

| Certificates of Deposit 3 |

||||||||

| 100,000 | Community Bank of the Bay |

|||||||

| 3.630%, matures 08/24/2006 |

0.0 | % | $ | 99,409 | ||||

| Registered Investment Companies—Money Market Funds |

||||||||

| 1,031,844 | Evergreen U.S. Government Fund |

|||||||

| variable rate, 4.700% |

$ | 1,031,844 | ||||||

| 25,572,285 | Janus Government Fund |

|||||||

| variable rate, 5.080% |

25,572,285 | |||||||

| 10,487,954 | SSGA U.S. Government Fund |

|||||||

| variable rate, 4.690% |

10,487,954 | |||||||

| 4.7 | % | $ | 37,092,083 | |||||

| Community Development Loans3 |

||||||||

| 100,000 | Boston Community Loan Fund |

|||||||

| 2.000%, matures 06/30/2007 |

$ | 94,000 | ||||||

| 100,000 | Ecologic Finance |

|||||||

| 2.000%, matures 01/25/2007 |

96,581 | |||||||

| 100,000 | Vermont Community Loan Fund |

|||||||

| 2.000%, matures 04/16/2007 |

95,249 | |||||||

| 0.0 | % | $ | 285,830 | |||||

| 22 |

The accompanying notes are an integral part of these financial statements. |

Table of Contents

| Principal Amount $ |

Short-Term Investments |

Percent of Net Assets |

Market Value |

||||||

| Securities Purchased with Cash Collateral from Securities Lending |

|||||||||

| Registered Investment Companies |

|||||||||

| 93,447,614 | State Street Navigator Securities Lending Prime Portfolio |

||||||||

| variable rate, 5.180% |

11.6 | % | $ | 93,447,614 | |||||

| Total short-term securities (cost $130,924,936) |

16.3 | % | $ | 130,924,936 | |||||

| Total securities (cost $855,732,613) |

111.8 | % | $ | 898,733,460 | |||||

| Payable upon return of securities loaned |

–11.6 | % | $ | (93,447,614 | ) | ||||

| Other assets and liabilities – net |

– 0.2 | % | (1,620,476 | ) | |||||

| Total net assets |

100.0 | % | $ | 803,665,370 | |||||

| 1 | These securities are non-income producing. |

| 2 | This security or partial position of this security was on loan at June 30, 2006. The total value of the securities on loan at June 30, 2006 was $91,483,490. |

| 3 | Market value adjustments have been applied to these securities to reflect early withdrawal. |

| Fund holdings will vary over time. |

| Fund shares are not FDIC insured. |

| The accompanying notes are an integral part of these financial statements. | 23 |

Table of Contents

THE EQUITY INCOME FUND

Statement of Assets and Liabilities

June 30, 2006 (unaudited)

| Assets |

|||

| Investments in long-term securities, at market value |

$ | 767,808,524 | |

| Investments in short-term securities |

130,924,936 | ||

| Cash |

483,374 | ||

| Receivables: |

|||

| Dividends and interest |

754,123 | ||

| Investment securities sold |

3,676,589 | ||

| Capital shares sold |

828,556 | ||

| Other assets |

28,268 | ||

| Total assets |

$ | 904,504,370 | |

| Liabilities |

|||

| Payable upon return of loaned securities |

93,447,614 | ||

| Payable for investment securities purchased |

5,445,846 | ||

| Capital shares redeemed |

1,279,351 | ||

| Fees payable to Parnassus Investments |

69,410 | ||

| Distributions payable |

78,299 | ||

| Accounts payable and accrued expenses |

518,480 | ||

| Total liabilities |

$ | 100,839,000 | |

| Net assets |

$ | 803,665,370 | |

| Net assets consist of |

|||

| Undistributed net investment income |

$ | 2,694,154 | |

| Unrealized appreciation on securities |

43,000,847 | ||

| Accumulated net realized gain |

38,152,468 | ||

| Capital paid-in |

719,817,901 | ||

| Total net assets |

$ | 803,665,370 | |

| Computation of net asset value and offering price per share |

|||

| Net asset value and redemption price per share |

|||

| Investor Shares ( $782,224,526 divided by 31,455,702 shares) |

$ | 24.87 | |

| Institutional Shares ($21,440,844 divided by 860,859 shares) |

$ | 24.91 | |

| 24 |

The accompanying notes are an integral part of these financial statements. |

Table of Contents

THE EQUITY INCOME FUND

Statement of Operations

Six Months Ended June 30, 2006 (unaudited)

| Investment income |

||||

| Dividends (net of foreign tax witholding of $ 44,604) |

$ | 7,727,287 | ||

| Interest |

2,103,151 | |||

| Securities lending |

43,315 | |||

| Other income |

5,108 | |||

| Total investment income |

$ | 9,878,861 | ||

| Expenses |

||||

| Investment advisory fees (note 5) |

2,790,095 | |||

| Transfer agent fees (note 5) |

||||

| Investor Shares |

201,335 | |||

| Institutional Shares |

375 | |||

| Fund administration (note 5) |

298,911 | |||

| Service provider fees - Investor Shares (note 5) |

908,032 | |||

| Reports to shareholders |

134,748 | |||

| Registration fees and expenses |

34,313 | |||

| Custody fees |

40,110 | |||

| Professional fees |

85,105 | |||

| Trustee fees and expenses |

26,900 | |||

| Other expenses |

83,654 | |||

| Total expenses |

$ | 4,603,578 | ||

| Fees waived by Parnassus Investments (note 5) |

(411,804 | ) | ||

| Expense offset (note 6) |

(4,238 | ) | ||

| Net expenses |

$ | 4,187,536 | ||

| Net investment income |

$ | 5,691,325 | ||

| Realized and unrealized gain (loss) on investments |

||||

| Net realized gain (loss) from security transactions |

$ | 36,294,040 | ||

| Net change in unrealized appreciation (depreciation) of securities |

(4,436,194 | ) | ||

| Net realized and unrealized gain (loss) on securities |

$ | 31,857,846 | ||

| Net decrease in net assets resulting from operations |

$ | 37,549,171 | ||

| The accompanying notes are an integral part of these financial statements. | 25 |

Table of Contents

THE EQUITY INCOME FUND

Statement of Changes in Net Assets

| Six Months Ended June 30, 2006 (unaudited) |

Year Ended December 31, 2005 |

|||||||

| Income (loss) from operations |

||||||||

| Net investment income (loss) |

$ | 5,691,325 | $ | 15,372,528 | ||||

| Net realized gain (loss) from security transactions |

36,294,040 | 54,405,759 | ||||||

| Net change in unrealized appreciation (depreciation) |

(4,436,194 | ) | (43,978,912 | ) | ||||

| Increase (decrease) in net assets resulting from operations |

$ | 37,549,171 | $ | 25,799,375 | ||||

| Distributions |

||||||||

| From net investment income |

||||||||

| Investor Shares |

(5,575,622 | ) | (31,885,584 | ) | ||||

| Institutional Shares* |

(49,867 | ) | — | |||||

| From realized capital gains |

||||||||

| Investor Shares |

— | (29,345,893 | ) | |||||

| Institutional Shares* |

— | — | ||||||

| Dividends to shareholders |

$ | (5,625,489 | ) | $ | (61,231,477 | ) | ||

| From capital share transactions |

||||||||

| Investor Shares |

(157,065,375 | ) | 47,861,166 | |||||

| Institutional Shares* |

21,963,351 | — | ||||||

| Increase (decrease) in net assets from capital share transactions |

$ | (135,102,024 | ) | $ | 47,861,166 | |||

| Increase (decrease) in net assets |

$ | (103,178,342 | ) | $ | 12,429,064 | |||

| Net assets |

||||||||

| Beginning of period |

906,843,712 | 894,414,648 | ||||||

| End of period |

$ | 803,665,370 | $ | 906,843,712 | ||||

| * | For the period April 28, 2006 (inception of Institutional Shares) through June 30, 2006. |

| 26 |

The accompanying notes are an integral part of these financial statements. |

Table of Contents

Portfolio of Investments by Industry Classification

as of June 30, 2006 (unaudited)

| Shares |

Common Stocks |

Percent of Net Assets |

Market Value | |||||

| Healthcare Products | ||||||||

| 15,000 | Baxter International Inc. | 1.1 | % | $ | 551,400 | |||

| Natural Gas | ||||||||

| 30,000 | ONEOK Inc. | 2.0 | % | $ | 1,021,200 | |||

| Total investment in common stock (cost $1,296,549) |

3.1 | % | $ | 1,572,600 | ||||

| Principal Amount $ |

Corporate Bonds |

|||||||

| Banks | ||||||||

| 500,000 | Bank One Corp. | |||||||

| Notes, 6.000%, due 02/17/2009 | $ | 503,712 | ||||||

| 500,000 | Wells Fargo Financial Inc. | |||||||

| Notes, 6.850%, due 07/15/2009 | 513,900 | |||||||

| 2.0 | % | $ | 1,017,612 | |||||

| Biotechnology | ||||||||

| 2,500,000 | Genentech Inc.1 | |||||||

| Notes, 4.750%, due 07/15/2015 | 4.5 | % | $ | 2,289,510 | ||||

| Financial Services | ||||||||

| 500,000 | Goldman Sachs Group Inc. | |||||||

| Notes, 6.650%, due 05/15/2009 | 1.0 | % | $ | 512,817 | ||||

| Networking Products | ||||||||

| 2,500,000 | Cisco Systems Inc. | |||||||

| Notes, 5.500%, due 02/22/2016 | 4.7 | % | $ | 2,400,568 | ||||

| Retail | ||||||||

| 400,000 | Target Corp.1 | |||||||

| Notes, 7.500%, due 08/15/2010 | 0.8 | % | $ | 427,418 | ||||

| Total investments in corporate bonds (cost $6,674,020) |

13.0 | % | $ | 6,647,925 | ||||

| The accompanying notes are an integral part of these financial statements. | 27 |

Table of Contents

THE FIXED-INCOME FUND

Portfolio of Investments by Industry Classification

as of June 30, 2006 (unaudited) continued

| Principal Amount $ |

Convertible Bonds |

Percent of Net Assets |

Market Value | |||||

| Air Transport | ||||||||

| 2,000,000 | JetBlue Airways Corp.1 | |||||||

| Notes, 3.500%, due 07/15/2033 | 3.5 | % | $ | 1,787,500 | ||||

| Electronics | ||||||||

| 1,000,000 | Cymer Inc. | |||||||

| Notes, 3.500%, due 02/15/2009 | 2.1 | % | $ | 1,048,750 | ||||

| Semiconductors | ||||||||

| 3,100,000 | Intel Corp.1 | |||||||

| Notes, 2.950%, due 12/15/2035 | 5.1 | % | $ | 2,607,875 | ||||

| Total investments in convertible bonds (cost $5,411,568) |

10.7 | % | $ | 5,444,125 | ||||

| U.S. Government Agency Securities | ||||||||

| 3,000,000 | Fannie Mae | |||||||

| Notes, 5.125%, due 04/22/2013 | $ | 2,896,263 | ||||||

| 1,000,000 | Federal Home Loan Bank System | |||||||

| Notes, 5.000%, due 05/28/2015 | 947,166 | |||||||

| Total investments in U.S. government agency bonds (cost $4,000,000) |

7.6 | % | $ | 3,843,429 | ||||

| Total investment in long-term securities (cost $17,382,137) |

34.4 | % | $ | 17,508,079 | ||||

| 28 |

The accompanying notes are an integral part of these financial statements. |

Table of Contents

| Principal Amount $ |

Short-Term Investments |

Percent of Net Assets |

Market Value | |||||

| U.S. Government Agency Discount Notes | ||||||||

| 5,000,000 | Federal Home Loan Mortgage Corporation | |||||||

| Zero coupon, 4.800% equivalent, matures 07/11/2006 | $ | 4,993,334 | ||||||

| 2,500,000 | Federal Home Loan Mortgage Corporation | |||||||

| Zero coupon, 4.990% equivalent, matures 07/31/2006 | 2,489,604 | |||||||

| 2,000,000 | Federal Home Loan Mortgage Corporation | |||||||

| Zero coupon, 5.180% equivalent, matures 08/04/2006 | 1,990,216 | |||||||

| 4,000,000 | Federal National Mortgage Association | |||||||

| Zero coupon, 5.150% equivalent, matures 08/09/2006 | 3,977,683 | |||||||

| 14,000,000 | Federal National Mortgage Association | |||||||

| Zero coupon, 5.250% equivalent, matures 09/13/2006 | 13,848,917 | |||||||

| 2,000,000 | Federal National Mortgage Association | |||||||

| Zero coupon, 5.070% equivalent, matures 09/06/2006 | 1,981,128 | |||||||

| 57.6 | % | $ | 29,280,882 | |||||

| Registered Investment Companies—Money Market Funds | ||||||||

| 1,031,844 | Evergreen U.S. Government Fund | |||||||

| variable rate, 4.700% | $ | 1,031,844 | ||||||

| 1,751,098 | Janus Government Fund | |||||||

| variable rate, 5.080% | 1,751,098 | |||||||

| 872,782 | SSGA U.S. Government Fund | |||||||

| variable rate, 4.690% | 872,782 | |||||||

| 7.2 | % | $ | 3,655,724 | |||||

| The accompanying notes are an integral part of these financial statements. | 29 |

Table of Contents

THE FIXED–INCOME FUND

Portfolio of Investments by Industry Classification

as of June 30, 2006 (unaudited) continued

| Principal Amount $ |

Short-Term Investments |

Percent of Net Assets |

Market Value |

||||||

| Securities Purchased with Cash Collateral from Securities Lending | |||||||||

| Registered Investment Companies | |||||||||

| 3,521,973 | State Street Navigator Securities Lending Prime Portfolio | ||||||||

| variable rate, 5.180% | 6.9 | % | $ | 3,521,973 | |||||

| Total short-term securities (cost $36,188,579) |

71.7 | % | $ | 36,458,579 | |||||

| Total securities (cost $53,570,716) |

106.1 | % | $ | 53,966,658 | |||||

| Payable upon return of securities loaned | – 6.9 | % | $ | (3,521,973 | ) | ||||

| Other assets and liabilities – net | 0.8 | % | 407,221 | ||||||

| Total net assets | 100.0 | % | $ | 50,851,906 | |||||

| 1 | This security or partial position of this security was on loan at June 30, 2006. The total value of the securities on loan at June 30, 2006 was $3,449,172. |

| Fund holdings will vary over time. |

| Fund shares are not FDIC insured. |

| 30 |

The accompanying notes are an integral part of these financial statements. |

Table of Contents

THE FIXED-INCOME FUND

Statement of Assets and Liabilities

June 30, 2006 (unaudited)

| Assets |

||||

| Investments in long-term securities, at market value |

$ | 17,508,079 | ||

| Investments in short-term securities |

36,458,579 | |||

| Cash |

241,753 | |||

| Receivables: |

||||

| Dividends and interest |

240,979 | |||

| Capital shares sold |

7,302 | |||

| Due from advisor |

3,065 | |||

| Other assets |

3,400 | |||

| Total assets |

$ | 54,463,157 | ||

| Liabilities |

||||

| Payable upon return of loaned securities |

3,521,973 | |||

| Capital shares redeemed |

30,311 | |||

| Fees payable to Parnassus Investments |

757 | |||

| Distributions payable |

21,458 | |||

| Accounts payable and accrued expenses |

36,752 | |||

| Total liabilities |

$ | 3,611,251 | ||

| Net assets |

$ | 50,851,906 | ||

| Net assets consist of |

||||

| Undistributed net investment loss |

$ | (417 | ) | |

| Unrealized appreciation on securities |

125,942 | |||

| Accumulated net realized gain |

552,107 | |||

| Capital paid-in |

50,174,274 | |||

| Total net assets |

$ | 50,851,906 | ||

| Computation of net asset value and offering price per share |

||||

| Net asset value and redemption price per share |

$ | 15.98 | ||

| The accompanying notes are an integral part of these financial statements. | 31 |

Table of Contents

THE FIXED-INCOME FUND

Statement of Operations

Six Months Ended June 30, 2006 (unaudited)

| Investment income |

||||

| Dividends |

$ | 39,378 | ||

| Interest |

1,061,988 | |||

| Securities lending |

5,012 | |||

| Total investment income |

$ | 1,106,378 | ||

| Expenses |

||||

| Investment advisory fees (note 5) |

119,571 | |||

| Transfer agent fees (note 5) |

28,507 | |||

| Fund administration (note 5) |

16,866 | |||

| Service provider fees (note 5) |

20,822 | |||

| Reports to shareholders |

16,196 | |||

| Registration fees and expenses |

13,845 | |||

| Custody fees |

3,542 | |||

| Professional fees |

7,557 | |||

| Trustee fees and expenses |

1,137 | |||

| Other expenses |

5,714 | |||

| Total expenses |

$ | 233,757 | ||

| Fees waived by Parnassus Investments (note 5) |

(52,253 | ) | ||

| Expense offset (note 6) |

(2,098 | ) | ||

| Net expenses |

$ | 179,406 | ||

| Net investment income |

$ | 926,972 | ||

| Realized and unrealized gain (loss) on investments |

||||

| Net realized gain (loss) from security transactions |

$ | 560,986 | ||

| Net change in unrealized appreciation (depreciation) of securities |

5,488 | |||

| Net realized and unrealized gain (loss) on securities |

$ | 566,474 | ||

| Net increase in net assets resulting from operations |

$ | 1,493,446 | ||

| 32 |

The accompanying notes are an integral part of these financial statements. |

Table of Contents

THE FIXED-INCOME FUND

Statement of Changes in Net Assets

| Six Months Ended June 30, 2006 (unaudited) |

Year Ended December 31, 2005 |

|||||||

| Income (loss) from operations |

||||||||

| Net investment income (loss) |

$ | 926,972 | $ | 1,251,779 | ||||

| Net realized gain (loss) from security transactions |

560,986 | (8,879 | ) | |||||

| Net change in unrealized appreciation (depreciation) |

5,488 | (239,981 | ) | |||||

| Increase (decrease) in net assets resulting from operations |

$ | 1,493,446 | $ | 1,002,919 | ||||

| Distributions |

||||||||

| From net investment income |

(927,389 | ) | (1,263,108 | ) | ||||

| From realized capital gains |

— | — | ||||||

| Dividends to shareholders |

$ | (927,389 | ) | $ | (1,263,108 | ) | ||

| From capital share transactions |

||||||||

| Increase (decrease) in net assets from capital share transactions |

4,407,235 | 7,934,016 | ||||||

| Increase (decrease) in net assets |

$ | 4,973,292 | $ | 7,673,827 | ||||

| Net assets |

||||||||

| Beginning of period |

45,878,614 | 38,204,787 | ||||||

| End of period (including undistributed net investment loss of $417 and $0 respectively) |

$ | 50,851,906 | $ | 45,878,614 | ||||

| The accompanying notes are an integral part of these financial statements. | 33 |

Table of Contents

THE CALIFORNIA TAX-EXEMPT FUND

Portfolio of Investments by Industry Classification

as of June 30, 2006 (unaudited)

| Principal Amount $ |

Municipal Bonds |

Percent of Net Assets |

Market Value | |||||

| Airport | ||||||||

| 1,000,000 | San Francisco City & County Airport Commission | |||||||

| FGIC Insured, 5.000%, due 05/01/2010 | 5.5 | % | $ | 1,039,710 | ||||

| Development | ||||||||

| 500,000 | California Infrastructure & Economic Development Bank | |||||||

| 5.000%, due 10/01/2012 | $ | 530,155 | ||||||

| 1,000,000 | Indian Wells Redevelopment Agency | |||||||

| AMBAC Insured, 4.500%, due 09/01/2011 | 1,026,780 | |||||||

| 600,000 | La Quinta Redevelopment Agency Tax Allocation | |||||||

| MBIA Insured, 7.300%, due 09/01/2011 | 692,238 | |||||||

| 860,000 | Rialto Redevelopment Agency | |||||||

| 4.000%, due 09/01/2007 | 855,072 | |||||||

| 425,000 | Rialto Redevelopment Agency | |||||||

| 4.500%, due 09/01/2013 | 429,709 | |||||||

| 625,000 | San Mateo Redevelopment Agency | |||||||

| XLCA Insured, 4.200%, due 08/01/2023 | 599,213 | |||||||

| 800,000 | State of California | |||||||

| 5.000%, due 07/01/2016 | 827,792 | |||||||

| 26.2 | % | $ | 4,960,959 | |||||

| Education | ||||||||

| 200,000 | Sweetwater Union High School District | |||||||

| 4.250%, due 09/01/2017 | 1.0 | % | $ | 189,852 | ||||

| General | ||||||||

| 1,000,000 | ABAG Finance Authority for Nonprofit Corps | |||||||

| 4.250%, due 11/15/2012 | 5.3 | % | $ | 1,002,170 | ||||

| General Obligation | ||||||||

| 1,000,000 | State of California | |||||||

| 6.600%, due 02/01/2009 | $ | 1,063,860 | ||||||

| 700,000 | State of California | |||||||

| 6.100%, due 10/01/2009 | 745,031 | |||||||

| 9.5 | % | $ | 1,808,891 | |||||

| 34 |

The accompanying notes are an integral part of these financial statements. |

Table of Contents

| Principal Amount $ |

Municipal Bonds |

Percent of Net Assets |

Market Value | |||||

| Housing | ||||||||

| 1,000,000 | California State Public Works Board | |||||||

| FSA Insured, 5.375%, due 10/01/2013 | $ | 1,072,880 | ||||||

| 960,000 | California State Public Works Board | |||||||

| 5.500%, due 12/01/2009 | 1,007,530 | |||||||

| 910,000 | California Statewide Communities Development Authority | |||||||

| ACA Insured, 4.500%, due 08/01/2010 | 910,309 | |||||||

| 15.8 | % | $ | 2,990,719 | |||||

| Medical Healthcare | ||||||||

| 300,000 | California Health Facilities Financing Authority | |||||||

| 5.000%, due 07/01/2009 | $ | 307,260 | ||||||

| 395,000 | County of San Diego | |||||||

| 5.000%, due 09/01/2008 | 402,888 | |||||||

| 500,000 | Loma Linda Hospital | |||||||

| 4.500%, due 12/01/2018 | 478,415 | |||||||

| 415,000 | Loma Linda Hospital | |||||||

| AMBAC Insured, 4.850%, due 12/01/2010 | 430,114 | |||||||

| 8.5 | % | $ | 1,618,677 | |||||

| Public Improvements | ||||||||

| 450,000 | Linda Fire Protection District | |||||||

| 4.400%, 05/01/2014 | 2.4 | % | $ | 446,450 | ||||

| Power | ||||||||

| 1,100,000 | California State Department of Water Resources | |||||||

| 5.500%, due 05/01/2009 | 6.0 | % | $ | 1,145,298 | ||||

| The accompanying notes are an integral part of these financial statements. | 35 |

Table of Contents

THE CALIFORNIA TAX-EXEMPT FUND

Portfolio of Investments by Industry Classification

as of June 30, 2006 (unaudited) continued

| Principal Amount $ |

Municipal Bonds |

Percent of Net Assets |

Market Value | |||||

| School District | ||||||||

| 450,000 | Los Altos School District | |||||||

| 5.250%, due 08/01/2010 | $ | 474,201 | ||||||

| 440,000 | Los Angeles Unified School District | |||||||

| FGIC Insured, 5.500%, due 07/01/2013 | 467,258 | |||||||

| 450,000 | Morgan Hill Unified School District | |||||||

| FGIC Insured, 4.900%, due 08/01/2013 | 469,665 | |||||||

| 410,000 | Sacramento City Unified School District | |||||||

| 5.750%, due 07/01/2017 | 439,815 | |||||||

| 9.8 | % | $ | 1,850,939 | |||||

| Transportation | ||||||||

| 250,000 | Los Angeles County Metropolitan Transportation Authority | |||||||

| AMBAC Insured, 5.000%, due 07/01/2013 | $ | 257,813 | ||||||

| 260,000 | San Francisco Bay Area Transit Financing Authority Prerefunded | |||||||

| 5.250%, due 07/01/2013 | 269,914 | |||||||

| 2.8 | % | $ | 527,727 | |||||

| Utilities | ||||||||

| 200,000 | City of Los Angeles CA | |||||||

| FGIC Insured, 5.000%, due 06/01/2011 | 1.1 | % | $ | 206,482 | ||||

| Water | ||||||||

| 215,000 | California State Department of Water Resources | |||||||

| 5.125%, due 12/01/2016 | $ | 223,791 | ||||||

| 185,000 | California State Department of Water Resources | |||||||

| 5.125%, due 12/01/2016 | 192,174 | |||||||

| 2.2 | % | $ | 415,965 | |||||

| Total investments in municipal bonds (cost $18,298,551) |

96.1 | % | $ | 18,203,839 | ||||

| 36 |

The accompanying notes are an integral part of these financial statements. |

Table of Contents

| Principal Amount $ |

Short-Term Investments |

Percent of Net Assets |

Market Value | |||||

| Registered Investment Companies—Money Market Funds | ||||||||

| 515,245 | California Investment Trust Tax Free Fund | |||||||

| variable rate, 3.150% | $ | 515,245 | ||||||

| Total short-term securities (cost $515,245) |

2.7 | % | $ | 515,245 | ||||

| Total securities (cost $18,813,796) |

98.8 | % | $ | 18,719,084 | ||||

| Other assets and liabilities – net | 1.2 | % | $ | 223,864 | ||||

| Total net assets | 100.0 | % | $ | 18,942,948 | ||||

Fund holdings will vary over time.

Fund shares are not FDIC insured.

| Glossary of Terms | ||

| ABAG | The Association of Bay Area Governments | |

| ACA | ACA Financial Guaranty Corp. | |

| AMBAC | American Municipal Bond Assurance Corp. | |

| FGIC | Financial Guaranty Insurance Co. | |

| FSA | Financial Security Assistance | |

| MBIA | Municipal Bond Investors Assurance Corp. | |

| XLCA | XL Capital Assurance Inc. | |

| The accompanying notes are an integral part of these financial statements. | 37 |

Table of Contents

THE CALIFORNIA TAX-EXEMPT FUND

Statement of Assets and Liabilities

June 30, 2006 (unaudited)

| Assets |

||||

| Investments in municipal bonds, at market value |

$ | 18,203,839 | ||

| Investments in short-term securities |

515,245 | |||

| Receivables: |

||||

| Dividends and interest |

263,915 | |||

| Other assets |

1,506 | |||

| Total assets |

$ | 18,984,505 | ||

| Liabilities |

||||

| Capital shares redeemed |

13,934 | |||

| Fees payable to Parnassus Investments |

4,137 | |||

| Distributions payable |

7,062 | |||

| Professional fees payable |

5,925 | |||

| Service provider fees payable |

5,204 | |||

| Accounts payable and accrued expenses |

5,295 | |||

| Total liabilities |

$ | 41,557 | ||

| Net assets |

$ | 18,942,948 | ||

| Net assets consist of |

||||

| Undistributed net investment income |

$ | 534 | ||

| Unrealized depreciation on securities |

(94,712 | ) | ||

| Accumulated net realized gain |

31,230 | |||

| Capital paid-in |

19,005,896 | |||

| Total net assets |

$ | 18,942,948 | ||

| Computation of net asset value and offering price per share |

||||

| Net asset value and redemption price per share |

$ | 16.36 | ||

| 38 |

The accompanying notes are an integral part of these financial statements. |

Table of Contents

THE CALIFORNIA TAX-EXEMPT FUND

Statement of Operations

Six Months Ended June 30, 2006 (unaudited)

| Investment income |

||||

| Interest |

$ | 393,084 | ||

| Total investment income |

$ | 393,084 | ||

| Expenses |

||||

| Investment advisory fees (note 5) |

49,891 | |||

| Transfer agent fees (note 5) |

6,429 | |||

| Fund administration (note 5) |

7,033 | |||

| Service provider fees (note 5) |

14,636 | |||

| Reports to shareholders |

3,908 | |||

| Registration fees and expenses |

623 | |||

| Custody fees |

1,475 | |||

| Professional fees |

3,530 | |||

| Trustee fees and expenses |

643 | |||

| Other expenses |

5,568 | |||

| Total expenses |

$ | 93,736 | ||

| Fees waived by Parnassus Investments (note 5) |

(25,911 | ) | ||

| Net expenses |

$ | 67,825 | ||

| Net investment income |

$ | 325,259 | ||

| Realized and unrealized gain (loss) on investments |

||||

| Net realized gain (loss) from security transactions |

$ | 20,398 | ||

| Net change in unrealized appreciation (depreciation) of securities |

(349,613 | ) | ||

| Net realized and unrealized gain (loss) on securities |

$ | (329,215 | ) | |

| Net increase in net assets resulting from operations |

$ | (3,956 | ) | |

| The accompanying notes are an integral part of these financial statements. | 39 |

Table of Contents

THE CALIFORNIA TAX-EXEMPT FUND

Statement of Changes in Net Assets

| Six Months Ended June 30, 2006 (unaudited) |

Year Ended December 31, 2005 |

|||||||

| Income (loss) from operations |

||||||||

| Net investment income (loss) |

$ | 325,259 | $ | 698,676 | ||||

| Net realized gain (loss) from security transactions |

20,398 | 80,253 | ||||||

| Net change in unrealized appreciation |

(349,613 | ) | (642,709 | ) | ||||

| Increase (decrease) in net assets resulting from operations |

$ | (3,956 | ) | $ | 136,220 | |||

| Distributions |

||||||||

| From net investment income |

(325,684 | ) | (698,991 | ) | ||||

| From realized capital gains |

0 | (69,608 | ) | |||||

| Dividends to shareholders |

$ | (325,684 | ) | $ | (768,599 | ) | ||

| From capital share transactions |

||||||||

| Increase (decrease) in net assets from capital share transactions |

(2,362,123 | ) | (3,326,713 | ) | ||||

| Increase (decrease) in net assets |

$ | (2,691,763 | ) | $ | (3,959,092 | ) | ||

| Net assets |

||||||||

| Beginning of period |

21,634,711 | 25,593,803 | ||||||

| End of period |

$ | 18,942,948 | $ | 21,634,711 | ||||

| 40 |

The accompanying notes are an integral part of these financial statements. |

Table of Contents

NOTES TO FINANCIAL STATEMENTS (unaudited)

1. Significant Accounting Policies