royaleenergy10k123114.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Fiscal Year Ended December 31, 2014

|

|

Commission File No. 0-22750

|

ROYALE ENERGY, INC.

(Name of registrant in its charter)

|

California

|

|

33-0224120

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

3777 Willow Glen Drive

El Cajon, CA 92019

(Address of principal executive offices)

Issuer's telephone number: 619-383-6600

Securities registered pursuant to Section 12(b) of the Act:

None

Securities to be registered pursuant to Section 12(g) of the Act:

Common Stock, no par value per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-B is not contained herein, and will not be contained, to the best or registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer o Accelerated filer o

Non-accelerated filer o Smaller Reporting Company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

At June 30, 2014, the end of the registrant’s most recently completed second fiscal quarter; the aggregate market value of common equity held by non-affiliates was $42,785,383.

At March 6, 2015, 14,945,789 shares of registrant's Common Stock were outstanding.

|

PART I

|

|

|

| |

Item 1

|

|

1

|

| |

|

|

1

|

| |

|

|

2

|

| |

Item 1A

|

|

3

|

| |

Item 1B

|

|

6

|

| |

Item 2

|

|

6

|

| |

|

|

7

|

| |

|

|

7

|

| |

|

|

7

|

| |

|

|

7

|

| |

|

|

8

|

| |

|

|

8

|

| |

Item 3

|

|

8

|

| |

Item 4

|

|

8

|

|

PART II

|

|

|

| |

Item 5

|

|

9

|

| |

|

|

9

|

| |

|

|

9

|

| |

|

|

9

|

| |

Item 6

|

|

10

|

| |

|

|

10

|

| |

|

|

12

|

| |

|

|

13

|

| |

|

|

15

|

| |

Item 7

|

|

15

|

| |

Item 8

|

|

15

|

| |

Item 9

|

|

15

|

| |

Item 9A

|

|

15

|

| |

|

|

15

|

| |

|

|

16

|

| |

|

|

16

|

| |

|

|

16

|

|

PART III

|

|

|

| |

Item 10

|

|

17

|

| |

Item 11

|

|

19

|

| |

Item 12

|

|

22

|

| |

Item 13

|

|

23

|

| |

Item 14

|

|

24

|

|

PART IV

|

|

|

| |

Item 15

|

|

25

|

|

|

|

26

|

|

|

F-1

|

ROYALE ENERGY, INC.

PART I

Item 1 Description of Business

Royale Energy, Inc. ("Royale Energy") is an independent oil and natural gas producer. Royale Energy's principal lines of business are the production and sale of natural gas, acquisition of oil and gas lease interests and proved reserves, drilling of both exploratory and development wells, and sales of fractional working interests in wells to be drilled by Royale Energy. Royale Energy was incorporated in California in 1986 and began operations in 1988. Royale Energy's common stock is traded on the NASDAQ Capital Market System (symbol ROYL). On December 31, 2014, Royale Energy had 20 full time employees.

Royale Energy owns wells and leases located mainly in the Sacramento Basin and San Joaquin Basin in California as well as in Utah, Texas, Oklahoma, Louisiana, and Alaska. Royale Energy usually sells a portion of the working interest in each well it drills or participates in to third party investors and retains a portion of the prospect for its own account. Selling part of the working interest to others allows Royale Energy to reduce its drilling risk by owning a diversified inventory of properties with less of its own funds invested in each drilling prospect, than if Royale Energy owned all the working interest and paid all drilling and development costs of each prospect itself. Royale Energy generally sells working interests in its prospects to accredited investors in exempt securities offerings. The prospects are bundled into multi-well investments, which permit the third party investors to diversify their investments by investing in several wells at once instead of investing in single well prospects.

During its fiscal year ended December 31, 2014, Royale Energy continued to explore and develop natural gas properties with a concentration in California. Additionally, we own proved developed producing and non-producing reserves of oil and natural gas in Utah, Texas, Oklahoma and Louisiana, as well as prospective shale oil property in Alaska. In 2014, Royale Energy drilled four wells in northern California; three were commercially productive and one was a dry hole. We also participated in the drilling of an additional well with an industry partner which turned out to be a dry hole. Royale Energy's estimated total reserves remained constant at approximately 4.1 BCFE (billion cubic feet equivalent) at December 31, 2014 and December 31, 2013, respectively. According to the reserve reports furnished to Royale Energy by Netherland, Sewell & Associates, Inc., and Source Energy, LLC, Royale Energy's independent petroleum engineers, the undiscounted net reserve value of its proved developed and undeveloped reserves was approximately $12.4 million at December 31, 2014, based on natural gas prices ranging from $4.33 per MCF to $4.89 per MCF. Source Energy, LLC, supplied reserve value estimates for Royale Energy’s Utah properties, and Netherland, Sewell & Associates, Inc. provided reserve information for the Company’s California, Texas, Oklahoma and Louisiana properties.

Of course, net reserve value does not represent the fair market value of our reserves on that date, and we cannot be sure what return we will eventually receive on our reserves. Net reserve value of proved developed and undeveloped reserves was calculated by subtracting estimated future development costs, future production costs and other operating expenses from estimated net future cash flows from our developed and undeveloped reserves.

Our standardized measure of discounted future net cash flows at December 31, 2014, was estimated to be $6,615,039. This figure was calculated by subtracting our estimated future income tax expense from the net reserve value of proved developed and undeveloped reserves, and by further applying a 10% annual discount for estimated timing of cash flows. A detailed calculation of our standardized measure of discounted future net cash flow is contained in Supplemental Information about Oil and Gas Producing Activities – Changes in Standardized Measure of Discounted Future Net Cash Flow from Proved Reserve Quantities, page F-24.

Royale Energy reported a gain on turnkey drilling in connection with the drilling of wells on a "turnkey contract" basis in the amount of $1,640,731 and $2,008,734 for the years ended December 31, 2014 and 2013, respectively.

In addition to Royale Energy's own geological, land, and engineering staff, Royale Energy hires independent contractors to drill, test, complete and equip the wells that it drills. Approximately 80.7% of Royale Energy's total revenue for the year ended December 31, 2014, came from sales of oil and natural gas from production of its wells in the amount of $2,598,297. In 2013, this amount was $1,913,364, which represented 74.4% of Royale Energy's total revenues.

Royale Energy acquires interests in oil and natural gas reserves and sponsors private joint ventures. Royale Energy believes that its stockholders are better served by diversification of its investments among individual drilling prospects. Through its sale of joint ventures, Royale Energy can acquire interests and develop oil and natural gas properties with greater diversification of risk and still receive an interest in the revenues and reserves produced from these properties. By selling some of its working interest in most projects, Royale Energy decreases the amount of its investment in the projects and diversifies its oil and gas property holdings, to reduce the risk of concentrating a large amount of its capital in a few projects that may not be successful.

After acquiring the leases or lease participation, Royale Energy drills or participates in the drilling of development and exploratory oil and natural gas wells on its property. Royale Energy pays its proportionate share of the actual cost of drilling, testing, and completing the project to the extent that it retains all or any portion of the working interest.

Royale Energy also may sell fractional working interests in undeveloped wells to finance part of the drilling cost. A drilling contract that calls for a company to drill a well, for a fixed price, to a specified depth or geological formation is called a "turnkey contract." When Royale Energy sells fractional working interests in unproved property to raise capital to drill oil and natural gas wells, generally it agrees to drill these wells on a turnkey contract basis, so that the holders of the fractional interests prepay a fixed amount for the drilling and completion of a specified number of wells. Under a turnkey contract, Royale Energy may record a gain if total funds received to drill a well were more than the actual cost to drill those wells including costs incurred on behalf of the participants and costs incurred for its own account.

Although Royale Energy’s operating agreements do not usually address whether investors have a right to participate in subsequent wells in the same area of interest as a proposed well, it is the Company’s policy to offer to investors in a successful well the right to participate in subsequent wells at the same percentage level as their working interest investment in the prior successful well.

Our policy for turnkey drilling agreements is to recognize a gain on turnkey drilling programs after our obligations have been fulfilled, and a gain is only recorded when funds received from participants are in excess of all costs Royale incurs during the drilling programs (e.g., lease acquisition, exploration and development costs), including costs incurred on behalf of participants and costs incurred for its own account. See Note 1 to our Financial Statements, at page F-9.

Once drilling has commenced, it is generally completed within 10-30 days. See Note 1 to Royale Energy's Financial Statements, at page F-9. Royale Energy maintains internal records of the expenditure of each investor's funds for drilling projects.

Royale Energy generally operates the wells it completes. As operator, it receives fees set by industry standards from the owners of fractional interests in the wells and from expense reimbursements. For the year ended December 31, 2014, Royale Energy earned gross revenues from operation of the wells in the amount of $464,429 representing 14.4% of its total revenues for the year. In 2013, the amount was $414,850, which represented about 16.1% of total revenues. At December 31, 2014, Royale Energy operated 54 natural gas wells in California. Royale also has non-operating interests in four natural gas wells in Utah, eleven oil and gas wells in Texas, two in Oklahoma, one in California, and one in Louisiana.

Royale Energy currently sells most of its California natural gas production through PG&E pipelines to independent customers on a monthly contract basis, while some gas is delivered through privately owned pipelines to independent customers. Since many users are willing to make such purchase arrangements, the loss of any one customer would not affect our overall sales operations.

All oil and natural gas properties are depleting assets in which production naturally decreases over time as the finite amount of existing reserves are produced and sold. It is Royale Energy’s business as an oil and natural gas exploration and production company to continually search for new development properties. The company’s success will ultimately depend on its ability to continue locating and developing new oil and natural gas resources. Natural gas demand and the prices paid for gas are seasonal. In recent years, natural gas demand and prices in Northern California have fluctuated unpredictably throughout the year.

Royale Energy had no subsidiaries in 2014 or 2013.

Competition

The exploration and production of oil and natural gas is an intensely competitive industry. The sale of interests in oil and gas projects, like those Royale Energy sells, is also very competitive. Royale Energy encounters competition from other oil and natural gas producers, as well as from other entities which invest in oil and gas for their own account or for others, and many of these companies are substantially larger than Royale Energy.

Markets

Market factors affect the quantities of oil and natural gas production and the price Royale Energy can obtain for the production from its oil and natural gas properties. Such factors include: the extent of domestic production; the level of imports of foreign oil and natural gas; the general level of market demand on a regional, national and worldwide basis; domestic and foreign economic conditions that determine levels of industrial production; political events in foreign oil-producing regions; and variations in governmental regulations including environmental, energy conservation, and tax laws or the imposition of new regulatory requirements upon the oil and natural gas industry.

Regulation

Federal and state laws and regulations affect, to some degree, the production, transportation, and sale of oil and natural gas from Royale Energy’s operations. States in which Royale Energy operates have statutory provisions regulating the production and sale of oil and natural gas, including provisions regarding deliverability. These statutes, along with the regulations interpreting the statutes, generally are intended to prevent waste of oil and natural gas, and to protect correlative rights to produce oil and natural gas by assigning allowable rates of production to each well or proration unit.

The exploration, development, production and processing of oil and natural gas are subject to various federal and state laws and regulations to protect the environment. Various federal and state agencies are considering, and some have adopted, other laws and regulations regarding environmental controls that could increase the cost of doing business. These laws and regulations may require: the acquisition of permits by operators before drilling commences; the prohibition of drilling activities on certain lands lying within wilderness areas or where pollution arises; and the imposition of substantial liabilities for pollution resulting from drilling operations, particularly operations in offshore waters or on submerged lands. The cost of oil and natural gas development and production also may increase because of the cost of compliance with such legislation and regulations, together with any penalties resulting from failing to comply with the legislation and regulations. Ultimately, Royale Energy may bear some of these costs.

Presently, Royale Energy does not anticipate that compliance with federal, state and local environmental regulations will have a material adverse effect on capital expenditures, earnings, or its competitive position in the oil and natural gas industry; however, changes in the laws, rules or regulations, or the interpretation thereof, could have a materially adverse effect on Royale Energy’s financial condition or results of operation.

Royale Energy files quarterly, yearly and other reports with the Securities Exchange Commission. You may obtain a copy of any materials filed by Royale Energy with the SEC at 450 Fifth Street, N.W., Washington, D.C. 20549, by calling 1-800-SEC-0300. The SEC also maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov. Royale Energy also provides access to its SEC reports and other public announcements on its website, http://www.royl.com.

In addition to the other information contained in this report, the following risk factors should be considered in evaluating our business.

We Depend on Market Conditions and Prices in the Oil and Gas Industry.

Our success depends heavily upon our ability to market oil and gas production at favorable prices. In recent decades, there have been both periods of worldwide overproduction and underproduction of hydrocarbons and periods of increased and relaxed energy conservation efforts. As a result the world has experienced periods of excess supply of, and reduced demand for, crude oil on a worldwide basis and for natural gas on a domestic basis; these periods have been followed by periods of short supply of, and increased demand for, crude oil and, to a lesser extent, natural gas. The excess or short supply of oil and gas has placed pressures on prices and has resulted in dramatic price fluctuations.

Natural gas demand and the prices paid for gas are seasonal. The fluctuations in gas prices and possible new regulations create uncertainty about whether we can continue to produce gas for a profit.

Prices for oil and natural gas affect the amount of cash flow available for capital expenditures and our ability to borrow and raise additional capital. Lower prices may also reduce the amount of oil and natural gas that we can economically produce. Any substantial and extended decline in the price of oil or natural gas would decrease our cash flows, as well as the carrying value of our proved reserves, our borrowing capacity and our ability to obtain additional capital.

The Price of Natural Gas

Large parts of our established production and reserves in California consist of natural gas. The price of natural gas has been volatile recently, and for 2014 the average sales price we received for natural gas was $4.64 per MCF, compared to $3.64 in 2013. The increase in our natural gas production and the higher gas prices resulted in a 35.8% increase in natural gas revenues in 2014 when compared to 2013. See Management’s Discussion and Analysis of Financial Condition and Results of Operations – Results of Operations for the Twelve Months Ended December 31, 2014, as Compared to the Twelve Months Ended December 31, 2013.

Variance in Estimates of Oil and Gas Reserves could be Material.

The process of estimating oil and gas reserves is complex, requiring significant decisions and assumptions in the evaluation of available geological, geophysical, engineering and economic data for each reservoir. As a result, such estimates are inherently imprecise. Actual future production, oil and gas prices, revenues, taxes, development expenditures, operating expenses and quantities of recoverable oil and gas reserves may vary substantially from those estimated in reserve reports that we periodically obtain from independent reserve engineers.

You should not construe the standardized measure of proved reserves contained in our annual report as the current market value of the estimated proved reserves of oil and gas attributable to our properties. In accordance with Securities and Exchange Commission requirements, we have based the standardized measure of future net cash flows from the standardized measure of proved reserves on the average price during the 12-month period before the ending date of the period covered by the report, whereas actual future prices and costs may vary significantly. The following factors may also affect actual future net cash flows:

|

·

|

the timing of both production and related expenses;

|

|

·

|

changes in consumption levels; and

|

|

·

|

governmental regulations or taxation.

|

In addition, the calculation of the standardized measure of the future net cash flows using a 10% discount as required by the Securities and Exchange Commission is not necessarily the most appropriate discount rate based on interest rates in effect from time to time and risks associated with our reserves or the oil and gas industry in general. Furthermore, we may need to revise our reserves downward or upward based upon actual production, results of future development, supply and demand for oil and gas, prevailing oil and gas prices and other factors.

Any significant variance in these assumptions could materially affect the estimated quantities and present value of our reserves. In addition, our standardized measure of proved reserves may be revised downward or upward, based upon production history, results of future exploration and development, prevailing oil and gas prices and other factors, many of which are beyond our control. Actual production, revenues, taxes, development expenditures and operating expenses with respect to our reserves will likely vary from the estimates used, and such variances may be material.

Future Acquisitions and Development Activities May Not Result in Additional Proved Reserves, and We May Not be Able to Drill Productive Wells at Acceptable Costs.

In general, the volume of production from oil and gas properties declines as reserves are depleted. Except to the extent that we acquire properties containing proved reserves or conduct successful development and exploration activities, or both, our proved reserves will decline as reserves are produced. Our future oil and gas production is, therefore, highly dependent upon our ability to find or acquire additional reserves.

The business of acquiring, enhancing or developing reserves is capital intensive. We require cash flow from operations as well as outside investments to fund our acquisition and development activities. If our cash flow from operations is reduced and external sources of capital become limited or unavailable, our ability to make the necessary capital investment to maintain or expand our asset base of oil and gas reserves would be impaired.

The Oil and Gas Industry has Mechanical and Environmental Risks.

Oil and gas drilling and production activities are subject to numerous risks. These risks include the risk that no commercially productive oil or gas reservoirs will be encountered, that operations may be curtailed, delayed or canceled, and that title problems, weather conditions, compliance with governmental requirements, mechanical difficulties or shortages or delays in the delivery of drilling rigs and other equipment may limit our ability to develop, produce or market our reserves. New wells we drill may not be productive and we may not recover all or any portion of our investment in the well. Drilling for oil and gas may involve unprofitable efforts, not only from dry wells but also from wells that are productive but do not produce sufficient net revenues to return a profit after drilling, operating and other costs. In addition, our properties may be susceptible to hydrocarbon drainage from production by other operators on adjacent properties.

Industry operating risks include the risks of fire, explosions, blow outs, pipe failure, abnormally pressured formations and environmental hazards, such as oil spills, natural gas leaks, ruptures or discharges of toxic gases, the occurrence of any of which could result in substantial losses due to injury or loss of life, severe damage to or destruction of property, natural resources and equipment, pollution or other environmental damage, clean up responsibilities, regulatory investigation and penalties and suspension of operations. In accordance with customary industry practice, we maintain insurance for these kinds of risks, but we cannot be sure that our level of insurance will cover all losses in the event of a drilling or production catastrophe. Insurance is not available for all operational risks, such as risks that we will drill a dry hole, fail in an attempt to complete a well or have problems maintaining production from existing wells.

Drilling is a Speculative Activity Even with Newer Technology.

Assessing drilling prospects is uncertain and risky for many reasons. We have grown in the past several years by using 3-D seismic technology to acquire and develop exploratory projects in northern California, as well as by acquiring producing properties for further development. The successful acquisition of such properties depends on our ability to assess recoverable reserves, future oil and gas prices, operating costs, potential environmental and other liabilities and other factors.

Nevertheless, exploratory drilling remains a speculative activity. Even when fully utilized and properly interpreted, 3-D seismic data and other advanced technologies assist geoscientists in identifying subsurface structures but do not enable the interpreter to know whether hydrocarbons are in fact present. In addition, 3-D seismic and other advanced technologies require greater pre-drilling expenditures than traditional drilling strategies, and we could incur losses as a result of these costs.

Therefore, our assessment of drilling prospects are necessarily inexact and their accuracy inherently uncertain. In connection with such an assessment, we perform a review of the subject properties that we believe to be generally consistent with industry practices. Such a review, however, will not reveal all existing or potential problems, nor will it permit us to become sufficiently familiar with the properties to fully assess their deficiencies and capabilities.

Breaches of Contract by Sellers of Properties Could Adversely Affect Operations.

In most cases, we are not entitled to contractual indemnification for pre closing liabilities, including environmental liabilities, and we generally acquire interests in the properties on an "as is" basis with limited remedies for breaches of representations and warranties. In those circumstances in which we have contractual indemnification rights for pre-closing liabilities, the seller may not fulfill those obligations and leave us with the costs.

We May Not be Able to Acquire Producing Oil and Gas Properties Which Contain Economically Recoverable Reserves.

Competition for producing oil and gas properties is intense and many of our competitors have substantially greater financial and other resources than we do. Acquisitions of producing oil and gas properties may be at prices that are too high to be acceptable.

We Require Substantial Capital for Exploration and Development.

We make substantial capital expenditures for our exploration and development projects. We will finance these capital expenditures with cash flow from operations and sales of direct working interests to third party investors. We will need additional financing in the future to fund our developmental and exploration activities. Additional financing that may be required may not be available or continue to be available to us. If additional capital resources are not available to us, our developmental and other activities may be curtailed, which would harm our business, financial condition and results of operations.

Profit Depends on the Marketability of Production.

The marketability of our natural gas production depends in part upon the availability, proximity and capacity of natural gas gathering systems, pipelines and processing facilities. Most of our natural gas is delivered through natural gas gathering systems and natural gas pipelines that we do not own. Federal, state and local regulation of oil and gas production and transportation, tax and energy policies, and/or changes in supply and demand and general economic conditions could adversely affect our ability to produce and market its oil and gas. Any dramatic change in market factors could have a material adverse effect on our financial condition and results of operations.

We Depend on Key Personnel.

Our business will depend on the continued services of our co-presidents and co-chief executive officers, Donald H. Hosmer and Stephen M. Hosmer. Stephen Hosmer is also the chief financial officer. We do not have employment agreements with either Donald or Stephen Hosmer. The loss of the services of either of these individuals would be particularly detrimental to us because of their background and experience in the oil and gas industry.

The Oil and Gas Industry is Highly Competitive.

The oil and gas industry is highly competitive in all its phases. Competition is particularly intense with respect to the acquisition of desirable producing properties, the acquisition of oil and gas prospects suitable for enhanced production efforts, and the hiring of experienced personnel. Our competitors in oil and gas acquisition, development, and

production include the major oil companies in addition to numerous independent oil and gas companies, individual proprietors and drilling programs.

Many of our competitors possess and employ financial and personnel resources far greater than those which are available to us. They may be able to pay more for desirable producing properties and prospects and to define, evaluate, bid for, and purchase a greater number of producing properties and prospects than we can. We must compete against these larger companies for suitable producing properties and prospects, to generate future oil and gas reserves.

Governmental Regulations Can Hinder Production.

Domestic oil and gas exploration, production and sales are extensively regulated at both the federal and state levels. Legislation affecting the oil and gas industry is under constant review for amendment or expansion, frequently increasing the regulatory burden. Also, numerous departments and agencies, both federal and state, have legal authority to issue, and have issued, rules and regulations affecting the oil and gas industry which often are difficult and costly to comply with and which carry substantial penalties for noncompliance. State statutes and regulations require permits for drilling operations, drilling bonds, and reports concerning operations. Most states where we operate also have statutes and regulations governing conservation matters, including the unitization or pooling of properties. Our operations are also subject to numerous laws and regulations governing plugging and abandonment, discharging materials into the environment or otherwise relating to environmental protection. The heavy regulatory burden on the oil and gas industry increases its costs of doing business and consequently affects its profitability. Changes in the laws, rules or regulations, or the interpretation thereof, could have a materially adverse effect on our financial condition or results of operation.

Minority or Royalty Interest Purchases Do Not Allow Us to Control Production Completely.

We sometimes acquire less than the controlling working interest in oil and gas properties. In such cases, it is likely that these properties would not be operated by us. When we do not have controlling interest, the operator or the other co-owners might take actions we do not agree with and possibly increase costs or reduce production income in ways we do not agree with.

Environmental Regulations Can Hinder Production.

Oil and gas activities can result in liability under federal, state and local environmental regulations for activities involving, among other things, water pollution and hazardous waste transport, storage, and disposal. Such liability can attach not only to the operator of record of the well, but also to other parties that may be deemed to be current or prior operators or owners of the wells or the equipment involved. We have inspections performed on our properties to assure environmental law compliance, but inspections may not always be performed on every well, and structural and environmental problems are not necessarily observable even when an inspection is undertaken.

Item 1B Unresolved Staff Comments

None

Item 2 Description of Property

Since 1993, Royale Energy has concentrated on development of properties in the Sacramento Basin and the San Joaquin Basin of Northern and Central California. In 2014, Royale Energy drilled four wells in northern California, two exploratory producing wells, one developmental producing well and one developmental dry hole.

Following industry standards, Royale Energy generally acquires oil and natural gas acreage without warranty of title except as to claims made by, though, or under the transferor. In these cases, Royale Energy attempts to conduct due diligence as to title before the acquisition, but it cannot assure that there will be no losses resulting from title defects or from defects in the assignment of leasehold rights. Title to property most often carries encumbrances, such as royalties, overriding royalties, carried and other similar interests, and contractual obligations, all of which are customary within the oil and natural gas industry.

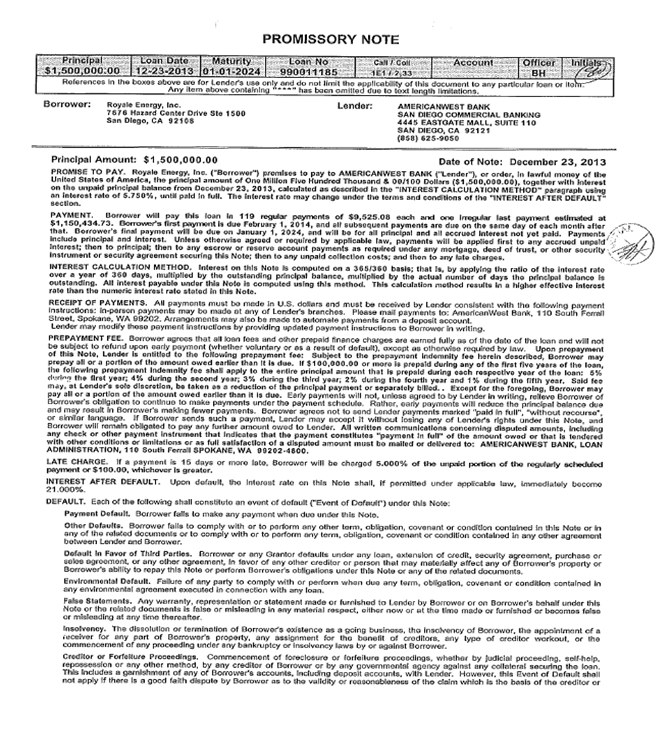

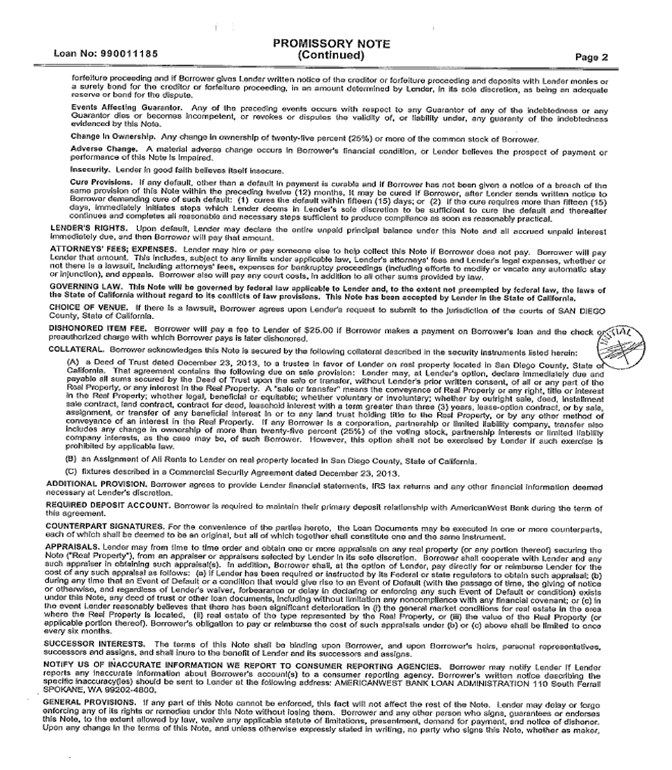

In December of 2013, Royale purchased an office building valued at $2,000,000, of which $500,000 was paid in cash on the date of purchase, and $1,500,000 was borrowed from American West Bank, with a note secured by the property being purchased. The note carries an interest rate of 5.75% until paid in full. Royale will pay this loan in 119 regular payments of $9,525 each and one balloon payment estimated at $1,150,435. Royale’s first payment was February 1, 2014, and all subsequent payments are due on the same day of each month after that. Royale’s final payment will be due on January 1, 2024, and will be for all principal and all accrued interest not yet paid. Payments include principal and interest.

Following is a discussion of Royale Energy's significant oil and natural gas properties. Reserves at December 31, 2014, for each property discussed below, have been determined by Netherland, Sewell & Associates, Inc., and Source Energy, LLC, registered professional petroleum engineers, in accordance with reports submitted to Royale Energy on February 14, 2015 and February 27, 2015, respectively.

Royale Energy owns lease interests in nine gas fields with locations ranging from Tehama County in the north to Kern County in the south, in the Sacramento and San Joaquin Basins in California. At December 31, 2014, Royale operated 54 wells in California with estimated total proven, developed, and undeveloped reserves at approximately 4.1 BCF, according to Royale’s independently prepared reserve report as of December 31, 2014.

As of December 31, 2014, Royale Energy owned leasehold interests in the following developed and undeveloped properties in both gross and net acreage.

| |

|

Developed

|

|

|

Undeveloped

|

|

| |

|

Gross Acres

|

|

|

Net Acres

|

|

|

Gross Acres

|

|

|

Net Acres

|

|

|

California

|

|

|

6,470.01

|

|

|

|

4,092.34

|

|

|

|

7,440.99

|

|

|

|

6,654.19

|

|

|

Alaska

|

|

|

0

|

|

|

|

0

|

|

|

|

96,842.59

|

|

|

|

96,842.59

|

|

|

All Other States

|

|

|

5,331.63

|

|

|

|

2,011.62

|

|

|

|

8,540.98

|

|

|

|

4,988.80

|

|

|

Total

|

|

|

11,801.64

|

|

|

|

6,103.96

|

|

|

|

112,824.56

|

|

|

|

108,485.58

|

|

Gross and Net Productive Wells

As of December 31, 2014, Royale Energy owned interests in the following oil and gas wells in both gross and net acreage:

| |

|

Gross Wells

|

|

|

Net Wells

|

|

|

Natural Gas

|

|

|

65.00

|

|

|

|

29.08

|

|

|

Oil

|

|

|

8.00

|

|

|

|

0.88

|

|

|

Total

|

|

|

73.00

|

|

|

|

29.96

|

|

The following table sets forth Royale Energy's drilling activities during the years ended December 31, 2013 and 2014. All wells are located in the Continental U.S., in California, Texas, Louisiana and Utah.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year

|

|

Type of Well(a)

|

|

|

|

|

Gross Wells(b)

|

|

|

Net Wells(e)

|

|

| |

|

|

|

Total

|

|

|

Producing(c)

|

|

|

Dry(d)

|

|

|

Producing(c)

|

|

|

Dry(d)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2013

|

|

Exploratory

|

|

|

5

|

|

|

|

3

|

|

|

|

2

|

|

|

|

1.2350

|

|

|

|

0.9805

|

|

| |

|

Developmental

|

|

|

1

|

|

|

|

1

|

|

|

|

0

|

|

|

|

0.3135

|

|

|

|

0.0000

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2014

|

|

Exploratory

|

|

|

2

|

|

|

|

2

|

|

|

|

0

|

|

|

|

0.8734

|

|

|

|

0.0000

|

|

| |

|

Developmental

|

|

|

2

|

|

|

|

1

|

|

|

|

1

|

|

|

|

0.2173

|

|

|

|

0.3612

|

|

|

a)

|

An exploratory well is one that is drilled in search of new oil and natural gas reservoirs, or to test the boundary limits of a previously discovered reservoir. A developmental well is one drilled on a previously known productive area of an oil and natural gas reservoir with the objective of completing that reservoir.

|

|

b)

|

Gross wells represent the number of actual wells in which Royale Energy owns an interest. Royale Energy's interest in these wells may range from 1% to 100%.

|

|

c)

|

A producing well is one that produces oil and/or natural gas that is being purchased on the market.

|

|

d)

|

A dry well is a well that is not deemed capable of producing hydrocarbons in paying quantities.

|

|

e)

|

One "net well" is deemed to exist when the sum of fractional ownership working interests in gross wells or acres equals one. The number of net wells is the sum of the fractional working interests owned in gross wells expressed as a whole number or a fraction.

|

The following table summarizes, for the periods indicated, Royale Energy's net share of oil and natural gas production, average sales price per barrel (BBL), per thousand cubic feet (MCF) of natural gas, and the MCF equivalent (MCFE) for the barrels of oil based on a 6 to 1 ratio of the price per barrel of oil to the price per MCF of natural gas. "Net" production is production that Royale Energy owns either directly or indirectly through partnership or joint venture interests produced to its interest after deducting royalty, limited partner or other similar interests. Royale Energy generally sells its oil and natural gas at prices then prevailing on the "spot market" and does not have any material long term contracts for the sale of natural gas at a fixed price.

| |

|

2014

|

|

|

2013

|

|

|

Net volume

|

|

|

|

|

|

|

|

Oil (BBL)

|

|

|

685

|

|

|

|

1,019

|

|

|

Gas (MCF)

|

|

|

547,898

|

|

|

|

498,778

|

|

|

MCFE

|

|

|

552,008

|

|

|

|

504,892

|

|

| |

|

|

|

|

|

|

|

|

|

Average sales price

|

|

|

|

|

|

|

|

|

|

Oil (BBL)

|

|

$

|

85.20

|

|

|

$

|

93.79

|

|

|

Gas (MCF)

|

|

$

|

4.64

|

|

|

$

|

3.64

|

|

| |

|

|

|

|

|

|

|

|

|

Net production costs and taxes

|

|

$

|

1,427,673

|

|

|

$

|

936,631

|

|

| |

|

|

|

|

|

|

|

|

|

Lifting costs (per MCFE)

|

|

$

|

2.59

|

|

|

$

|

1.86

|

|

Net Proved Oil and Natural Gas Reserves

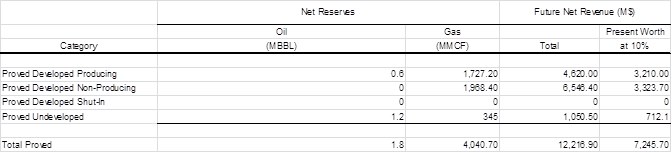

As of December 31, 2014, Royale Energy had proved developed reserves of 3,787 MMCF and total proved reserves of 4,132 MMCF of natural gas on all of the properties Royale Energy leases. For the same period, Royale Energy also had proved developed oil and natural gas liquid combined reserves of .6 MBBL and total proved oil and natural gas liquid combined reserves of 2 MBBL.

Oil and gas reserve estimates and the discounted present value estimates associated with the reserve estimates are based on numerous engineering, geological and operational assumptions that generally are derived from limited data.

Royale Energy, Inc. vs. Rampart Alaska LLC, Superior Court, Nome, Alaska. On November 14, 2014, Royale Energy, Inc. caused a complaint for lien foreclosure to be filed in the Superior Court for the State of Alaska, Second Judicial District at Nome. Royale Energy caused certain liens to be files against the working interests of Rampart Alaska LLC involving oil leases on the North Slope Alaska. The filing of the liens came about as the result of Rampart’s failure to reimburse for joint interest billings and cash calls. Royale seeks in the litigation to foreclose the liens to recover the sums secured thereby or the working interests themselves. Rampart Alaska answered the complaint and asserted a counterclaim against Royale for damages alleging breach of contract, violation of the covenant of good faith and fair dealing, unjust enrichment, defamation, violations of the Alaska Securities Act and seeking to undo the filing of the lien claims. Stephen Hosmer, as an officer of Royale, was also independently named as a third party defendant by Rampart for claims arising out of defamation and violation of the Alaska Securities Act. At this juncture, the case is in its preliminary phase and we are unable to provide a possible outcome other than to note that management vigorously will contest the allegations of the counterclaim and third-party complaint and will seek to aggressively move to realize on its lien claims to recover funds due and owing from Rampart. Because the case is only a number of months old, we are unable to provide an evaluation of the likelihood of an unfavorable outcome nor can we estimate the amount or range of potential loss.

Douglas Jones v. Royale Energy, Broward County Circuit Court, Florida. On July 1, 2010, Douglas Jones filed a lawsuit against the Company in the Circuit Court, 17th Judicial District, Broward County, Florida. Mr. Jones was an independent contractor handling certain aspects of sales for the Company prior to July 2, 2008. He asserts that he is entitled to an unspecified amount for commissions and expenses. The Company denies that any money is owed to Mr. Jones. On August 16, 2010, the Company, through Florida counsel Adam Hodkin, filed a motion to dismiss the lawsuit for lack of jurisdiction in the Florida courts. The Court ruled that it wanted to have an evidentiary hearing on the motion. The Court has finally set a date for the evidentiary hearing on whether to grant or deny the motion to dismiss. That date is May 5, 2014. On December 23, 2014 the court denied the motion to dismiss for lack of jurisdiction, meaning that the case could go forward in Florida. In February 2015, although the Company denied any liability to Mr. Jones, it agreed to settle the case for $20,000 to avoid the costs of long distance ligation.

Item 4 Mine Safety Disclosures

Not Applicable

PART II

Item 5 Market for Common Equity and Related Stockholder Matters

Since 1997 Royale Energy’s Common Stock has been traded on the Nasdaq National Market System under the symbol “ROYL”. Since July 1, 2009, Royale Energy’s stock has been listed on the NASDAQ Capital Market, and prior to that, our stock was listed on the NASDAQ Global Market. As of December 31, 2014, 14,945,789 shares of Royale Energy’s Common Stock were held by approximately 7,736 stockholders. The following table reflects the high and low quarterly closing sales prices from January 2013 through December 2014.

| |

|

1st Qtr

|

|

|

2nd Qtr

|

|

|

3rd Qtr

|

|

|

4th Qtr

|

|

| |

|

High

|

|

|

Low

|

|

|

High

|

|

|

Low

|

|

|

High

|

|

|

Low

|

|

|

High

|

|

|

Low

|

|

|

2013

|

|

2.76

|

|

|

2.08

|

|

|

3.34

|

|

|

1.98

|

|

|

2.97

|

|

|

2.58

|

|

|

2.74

|

|

|

2.51

|

|

|

2014

|

|

|

3.13

|

|

|

|

2.53

|

|

|

|

3.57

|

|

|

|

2.70

|

|

|

|

4.78

|

|

|

|

2.69

|

|

|

|

2.79

|

|

|

|

2.02

|

|

The Board of Directors did not issue cash or stock dividends in 2014 or 2013.

Recent Sales of Unregistered Securities

None.

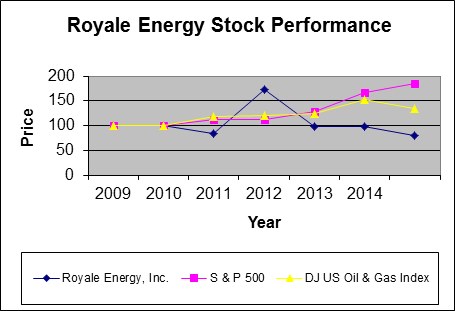

The following stock price performance graph is included in accordance with the SEC’s executive compensation disclosure rules and is intended to allow stockholders to review Royale Energy’s executive compensation policies in light of corresponding stockholder returns, expressed in terms of the appreciation of Royale Energy’s common stock relative to two broad-based stock performance indices. The information is included for historical comparative purposes only and should not be considered indicative of future stock performance. The graph compares total return on $100 value of Royale Energy’s common stock on December 31, 2009, with the cumulative total return of the Standard & Poor’s Composite 500 Stock Index and the Dow Jones U.S. Oil & Gas Index from December 31, 2009 through December 31, 2014.

| |

|

2009

|

|

|

2010

|

|

|

2011

|

|

|

2012

|

|

|

2013

|

|

|

2014

|

|

|

Royale Energy, Inc.

|

|

|

100

|

|

|

|

85

|

|

|

|

173

|

|

|

|

98

|

|

|

|

98

|

|

|

|

80

|

|

|

S&P 500 Stock Index

|

|

|

100

|

|

|

|

113

|

|

|

|

113

|

|

|

|

128

|

|

|

|

166

|

|

|

|

185

|

|

|

DJ US Oil & Gas Index

|

|

|

100

|

|

|

|

117

|

|

|

|

120

|

|

|

|

123

|

|

|

|

152

|

|

|

|

135

|

|

Item 6 Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with Royale Energy’s Financial Statements and Notes thereto and other financial information relating to Royale Energy included elsewhere in this document.

For the past twenty-two years, Royale Energy has primarily acquired and developed producing and non-producing natural gas properties in California. In 2004, Royale Energy began developing leases in Utah and in 2012 began acquiring leases in Alaska. The most significant factors affecting the results of operations are (i) changes in oil and natural gas production levels and reserves, (ii) turnkey drilling activities, and (iii) the change in commodities price of natural gas and oil reserves owned by Royale Energy.

Revenue Recognition

Royale’s primary business is oil and gas production. Natural gas flows from the wells into gathering line systems, which are equipped occasionally with compressor systems, which in turn flow into metered transportation and customer pipelines. Monthly, price data and daily production are used to invoice customers for amounts due to Royale Energy and other working interest owners. Royale Energy operates virtually all of its own wells and receives industry standard operator fees.

Royale Energy generally sells crude oil and natural gas under short-term agreements at prevailing market prices. Revenues are recognized when the products are delivered, which occurs when the customer has taken title and has assumed the risks and rewards of ownership, prices are fixed or determinable and collectability is reasonably assured.

Revenues from the production of oil and natural gas properties in which the Royale Energy has an interest with other producers are recognized on the basis of Royale Energy’s net working interest. Differences between actual production and net working interest volumes are not significant.

Royale Energy’s financial statements include its pro rata ownership of wells. Royale Energy usually sells a portion of the working interest in each well it drills or participates in to third party investors and retains a portion of the prospect for its own account. Royale Energy generally retains about a 50% working interest. All results, successful or not, are included at its pro rata ownership amounts: revenue, expenses, assets, and liabilities as defined in FASB ASC 932-323-25 and 932-360.

Oil and Gas Property and Equipment

Depreciation, depletion and amortization, based on cost less estimated salvage value of the asset, are primarily determined under either the unit-of-production method or the straight-line method, which is based on estimated asset service life taking obsolescence into consideration. Maintenance and repairs, including planned major maintenance, are expensed as incurred. Major renewals and improvements are capitalized and the assets replaced are retired.

The project construction phase commences with the development of the detailed engineering design and ends when the constructed assets are ready for their intended use. Interest costs, to the extent they are incurred to finance expenditures during the construction phase, are included in property, plant and equipment and are depreciated over the service life of the related assets.

Royale Energy uses the “successful efforts” method to account for its exploration and production activities. Under this method, Royale Energy accumulates its proportionate share of costs on a well-by-well basis with certain exploratory expenditures and exploratory dry holes being expensed as incurred, and capitalizes expenditures for productive wells. Royale Energy amortizes the costs of productive wells under the unit-of-production method.

Royale Energy carries, as an asset, exploratory well costs when the well has found a sufficient quantity of reserves to justify its completion as a producing well and where Royale Energy is making sufficient progress assessing the reserves and the economic and operating viability of the project. Exploratory well costs not meeting these criteria are charged to expense. Other exploratory expenditures, including geophysical costs and annual lease rentals, are expensed as incurred.

Acquisition costs of proved properties are amortized using a unit-of-production method, computed on the basis of total proved oil and gas reserves.

Capitalized exploratory drilling and development costs associated with productive depletable extractive properties are amortized using unit-of-production rates based on the amount of proved developed reserves of oil and gas that are estimated to be recoverable from existing facilities using current operating methods. Under the unit-of-production method, oil and gas volumes are considered produced once they have been measured through meters at custody transfer or sales transaction points at the outlet valve on the lease or field storage tank.

Production costs are expensed as incurred. Production involves lifting the oil and gas to the surface and gathering, treating, field processing and field storage of the oil and gas. The production function normally terminates at the outlet valve on the lease or field production storage tank. Production costs are those incurred to operate and maintain Royale Energy’s wells and related equipment and facilities. They become part of the cost of oil and gas produced. These costs, sometimes referred to as lifting costs, include such items as labor costs to operate the wells and related equipment; repair and maintenance costs on the wells and equipment; materials, supplies and energy costs required to operate the wells and related equipment; and administrative expenses related to the production activity.

Proved oil and gas properties held and used by Royale Energy are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amounts may not be recoverable.

Royale Energy estimates the future undiscounted cash flows of the affected properties to judge the recoverability of carrying amounts. Cash flows used in impairment evaluations are developed using annually updated evaluation assumptions for crude oil commodity prices. Annual volumes are based on field production profiles, which are also updated annually. Prices for natural gas and other products are based on assumptions developed annually for evaluation purposes.

Impairment analyses are generally based on proved reserves. An asset group would be impaired if the undiscounted cash flows were less than its carrying value. Impairments are measured by the amount the carrying value exceeds fair value. During 2014 and 2013, impairment losses of $268,093 and $70,203, respectively, were recorded on various capitalized lease and land costs where the carrying value exceeded the fair value or where the leases were no longer viable.

Significant unproved properties are assessed for impairment individually, and valuation allowances against the capitalized costs are recorded based on the estimated economic chance of success and the length of time that Royale Energy expects to hold the properties. The valuation allowances are reviewed at least annually.

Upon the sale or retirement of a complete field of a proved property, Royale Energy eliminates the cost from its books, and the resultant gain or loss is recorded to Royale Energy’s Statement of Operations. Upon the sale of an entire interest in an unproved property where the property has been assessed for impairment individually, a gain or loss is recognized in Royale Energy’s Statement of Operations. If a partial interest in an unproved property is sold, any funds received are accounted for as a recovery of the cost in the interest retained with any excess funds recognized as a gain. Should Royale Energy’s turnkey drilling agreements include unproved property, total drilling costs incurred to satisfy its obligations are recovered by the total funds received under the agreements. Any excess funds are recorded as a Gain on Turnkey Drilling Programs, and any costs not recovered are capitalized and accounted for under the “successful efforts” method.

Royale Energy sponsors turnkey drilling agreement arrangements in unproved properties as a pooling of assets in a joint undertaking, whereby proceeds from participants are reported as Deferred Drilling Obligations, and then reduced as costs to complete its obligations are incurred with any excess booked against its property account to reduce any basis in its own interest. Gains on Turnkey Drilling Programs represent funds received from turnkey drilling participants in excess of all costs Royale incurs during the drilling programs (e.g., lease acquisition, exploration and development costs), including costs incurred on behalf of participants and costs incurred for its own account; and are recognized only upon making this determination after Royale’s obligations have been fulfilled.

The contracts require the participants pay Royale Energy the full contract price upon execution of the agreement. Royale Energy completes the drilling activities typically between 10 and 30 days after drilling begins. The participant retains an undivided or proportional beneficial interest in the property, and is also responsible for its proportionate share of operating costs. Royale Energy retains legal title to the lease. The participants purchase a working interest directly in the well bore.

In these working interest arrangements, the participants are responsible for sharing in the risk of development, but also sharing in a proportional interest in rights to revenues and proportional liability for the cost of operations after drilling is completed.

Since the participant’s interest in the prospect is limited to the well, and not the lease, the investor does not have a legal right to participate in additional wells drilled within the same lease. However, it is the Company’s policy to offer to participants in a successful well the right to participate in subsequent wells at the same percentage level as their working interest investment in the prior successful well with similar turnkey drilling agreement terms.

A certain portion of the turnkey drilling participant’s funds received are non-refundable. The company holds all funds invested as Deferred Drilling Obligations until drilling is complete. Occasionally, drilling is delayed due to the permitting process or drilling rig availability. At December 31, 2014 and 2013, Royale Energy had Deferred Drilling Obligations of $7,937,786 and $6,125,933 respectively.

If Royale Energy is unable to drill the wells, and a suitable replacement well is not found, Royale would retain the non-refundable portion of the contact and return the remaining funds to the participant. Included in cash and cash equivalents are amounts for use in completion of turnkey drilling programs in progress.

Losses on properties sold are recognized when incurred or when the properties are held for sale and the fair value of the properties is less than the carrying value.

Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The most significant estimates pertain to proved oil, plant products and gas reserve volumes and the future development costs. Actual results could differ from those estimates.

Deferred Income Taxes

Deferred income taxes reflect the net tax effects, calculated at currently enacted rates, of (a) future deductible/taxable amounts attributable to events that have been recognized on a cumulative basis in the financial statements or income tax returns, and (b) operating loss and tax credit carry forwards. All available evidence, both positive and negative, must be considered to determine whether, based on the weight of that evidence, a valuation allowance for deferred tax assets is needed. The company uses information about the company’s financial position and its results of operations for the current and preceding years.

The company must use its judgment in considering the relative impact of negative and positive evidence. The weight given to the potential effect of negative and positive evidence is commensurate with the extent to which it can be objectively verified. The more negative evidence that exists, the more positive evidence is necessary and the more difficult it is to support a conclusion that a valuation allowance is not needed for some portion or all of the deferred tax asset. A cumulative loss in recent years is a significant piece of negative evidence that is difficult to overcome.

Future realization of a tax benefit sometimes will be expected for a portion, but not all, of a deferred tax asset, and the dividing line between the two portions may be unclear. In those circumstances, application of judgment based on a careful assessment of all available evidence is required to determine the portion of a deferred tax asset for which it is more likely than not a tax benefit will not be realized.

Results of Operations for the Twelve Months Ended December 31, 2014, as Compared to the Twelve Months Ended December 31, 2013

For the year ended December 31, 2014, we recorded a net loss of $2,151,856 a $3,301,009 decline when compared to net income of $1,149,153 during 2013. Total revenues from operations in 2014 were $3,221,498, an increase of $648,437, or 25.2% from the total revenues of $2,573,061 in 2013, due to higher natural gas prices and production during 2014. Total expenses from operations in 2014 were $7,275,331, an increase of $1,326,846, or 22.3%, from the total expenses of $5,948,485 in 2013, due to increases in lease operating, bad debts and impairment costs.

In 2014, revenues from oil and gas production increased by 35.8% to $2,598,297 from $1,913,364 in 2013. This increase was due to higher natural gas commodity prices received during 2014. The net sales volume of natural gas for the year ended December 31, 2014, was approximately 547,898 MCF with an average price of $4.64 per MCF, versus 498,778 MCF with an average price of $3.64 per MCF for 2013. This represents an increase in net sales volume of 49,121 MCF or 9.9%. This increase in production volume was due to various wells coming online that were drilled in late 2013 and early 2014. The net sales volume for oil and condensate (natural gas liquids) production was approximately 685 barrels with an average price of $85.20 per barrel for the year ended December 31, 2014, compared to 1,019 barrels at an average price of $93.79 per barrel for the year in 2013. This represents a decrease in net sales volume of 335 barrels, or 32.8%. This decrease was due to the natural declines on existing wells. Northern and central California accounted for approximately 97% of the Company’s successful natural gas production in 2014.

Oil and natural gas lease operating expenses increased by $491,042, or 52.4% to $1,427,673 for the year ended December 31, 2014, from $936,631 for the year in 2013. This increase was mainly due to higher plugging and abandonment costs on several older wells in 2014. When measuring lease operating costs on a production or lifting cost basis, in 2014, the $1,427,673 equates to a $2.59 per MCFE lifting cost versus a $1.86 per MCFE lifting cost in 2013, a 39% increase, also due to higher plugging costs. Delay rental costs increased by $159,252 or 34.8%, to $616,806 for the year in 2014 from $457,554 in 2013. This increase was due to delay rental costs and our increased ownership of our Alaska leases.

At December 31, 2014, Royale Energy had a Deferred Drilling Obligation of $7,937,786. During 2014, we disposed of $4,172,296 of obligations relating to 2013, upon completing the drilling of four wells, two exploratory and two developmental, in addition to participating in the drilling of one additional well with an industry partner. There was also an adjustment of approximately $550,000 of accrued costs on a well where the additional work would no longer prove viable. These factors resulted in a gain of $1,640,731. In 2013, we disposed of $8,028,190 upon completing our obligation by drilling six wells, five exploratory and one developmental, in addition to participating in the drilling of two additional wells with an industry partner, resulting in a gain of $2,008,734. Royale expects to dispose of approximately $3 million in the first six months of 2015 with $3.2 million disposed of by the end of 2015.

During 2014, we recorded a gain of $369,977 on the sale of certain oil and natural gas leases in Utah. In 2014, we also recorded a loss of $34,601 on previously capitalized office leasehold improvements due to our office relocation. During 2013 we recorded a gain of $2,684,801 from the sale of a portion of our western block oil and gas leases in Alaska. In 2013, we also recorded a gain of $173,013 on the sale of certain California natural gas leases. During the year in 2013, we recorded a gain of $40,000 on the sale of oil and gas leases in Texas and recorded a loss of $82,184 on the sale of surface casing previously included in inventory. Additionally in 2013, we recorded a write down of $39,185 on certain oil and gas inventory that no longer appeared viable.

Impairment losses of $268,093 and $70,203 were recorded in 2014 and 2013, respectively. In 2014, $217,629 of the impairment loss was due to two Utah wells where the carrying value exceeded the fair value. For the balance of the loss in 2014 and the 2013 loss, we recorded impairments on various capitalized lease and land costs that were no longer viable.

Bad debt expense for 2014 and 2013 were $653,133 and $146,704, respectively. The expenses in 2014 and 2013 arose from identified uncollectable receivables relating to our oil and natural gas properties either plugged and abandoned or scheduled for plugging and abandonment. We periodically review our accounts receivable from working interest owners to determine whether collection of any of these charges where doubtful. By contract, the Company may not collect some charges from its Direct Working Interest owners for certain wells that ceased production or had been sold during the year, to the extent that these charges exceed production revenue.

The aggregate of supervisory fees and other income was $623,201 for the year ended December 31, 2014, a decrease of $36,496 or 5.5% from $659,697 during the year in 2013. This decrease was mainly due to lower revenues from pipeline and compressor fees due to costs to rebuild a compressor in one of our main fields. Supervisory fees are charged in accordance with the Council for Petroleum Accountants Societies (COPAS) policy for reimbursement of expenses associated with the joint accounting for billing, revenue disbursement, and payment of taxes and royalties. These charges are reevaluated each year and adjusted up or down as deemed appropriate by a published report to the industry by Ernst & Young, LLP, Certified Public Accountants. Supervisory fees increased $49,579 or 12%, to $464,429 in 2014 from $414,850 in 2013.

Depreciation, depletion and amortization expense increased to $315,574 from $309,806 an increase of $5,768 or 1.9% for the year ended December 31, 2014, as compared to 2013. The depletion rate is calculated using production as a percentage of reserves. This increase in depreciation expense was mainly due to a higher depletion rate as production volumes were higher during the period.

General and administrative expenses decreased by $117,392 or 3.6%, from $3,279,505 for the year ended December 31, 2013, to $3,162,113 for the year in 2014. This decrease was primarily due to lower office rent expense during the period in 2014, as the company relocated into its own office building which was purchased at the end of 2013. Legal and accounting expense increased to $401,160 for the year, compared to $326,270 for 2013, a $74,890 or 23% increase. The increased expense was the result of higher legal fees primarily related to the Rampart litigation.

Marketing expense for the year ended December 31, 2014, increased $98,297 or 29.6%, to $430,779, compared to $332,482 for the year in 2013. The increase was due to higher broker fees in 2014 as we used outside brokers to sell direct working interests to investors.

During 2013, we incurred $50,145 in geological and geophysical from a well which was drilled based on seismic data we gathered during our 2011 Lake Mendocino survey. This seismic data was expensed once the well was drilled. No wells drilled in 2014 were based on this survey.

During 2014, interest expense decreased to $81,605 from $304,472 in 2013, a $222,867 or 73.2% decrease. This decrease mainly resulted from a reduction of outstanding indebtedness after the 2013 repayment of a convertible note. Further details concerning Royale’s notes payable and line of credit usage can be found in Capital Resources and Liquidity, below.

In 2014 and 2013, we did not have an income tax expense due to the use of a percentage depletion carryover valuation allowance created from the current and past operations resulting in an effective tax rate less than the normal federal rate of 34% plus the relevant state rates (mostly California, 9.3%).

At December 31, 2014, Royale Energy had current assets totaling $5,473,721 and current liabilities totaling $12,469,376, a $6,995,655 working capital deficit. We had cash and cash equivalents at December 31, 2014 of $3,061,841 compared to $4,878,233 at December 31, 2013.

Ordinarily, we fund our operations and cash needs from our available credit and cash flows generated from operations. We believe that we have sufficient liquidity for the foreseeable future and do not foresee any liquidity demands that cannot be met from cash flow or financing activities, including ongoing operations as the Company continues to increase its well inventory or additional sales of equity or debt securities pursuant to a Registration Statement on Form S-3 filed with the SEC.

At the end of 2014, our other receivables, which consists of receivables from direct working interest investors and industry partners, totaled $1,760,181 compared to $1,152,473 at December 31, 2013, a $607,708 or 52.7% increase. This was primarily due to a receivable from an industry partner at year end 2014. Royale’s revenue receivable at the end of 2014 was $493,295, a decrease of $35,024 or 6.6%, compared to $528,319 at the end of 2013. At December 31, 2014, our accounts payable and accrued expenses totaled $4,502,559, a decrease of $829,764 or 15.6% over the accounts payable at the end of 2013 of $5,332,323, mainly due to lower accrued drilling costs at the end of 2014.

In April 2014, Royale entered into a sales agreement with Roth Capital, LLC (Roth) relating to the sale of shares of our common stock. See the Company’s Prospectus Supplement filed pursuant to Rule 424(b) on April 4, 2014, and the Company’s Form 8-K filed on April 4, 2014. In accordance with the terms of the sales agreement, Royale may sell up to $10,000,000 in aggregate amount of the Company’s shares from time to time through Roth, as our sales agent. Roth is not required to sell any specific number or dollar amount of shares of our common stock, but will use its commercially reasonable efforts, as our sales agent and subject to the terms of the sales agreement, to sell the shares offered by the Prospectus Supplement and the accompanying prospectus.

In December of 2013, Royale purchased an office building valued at $2,000,000, of which $500,000 was paid in cash on the date of purchase, and $1,500,000 was borrowed from AmericanWest Bank, with a note secured by the property being purchased. The note carries an interest rate of 5.75% until paid in full. Royale will pay this loan in 119 regular payments of $9,525 each and one balloon payment estimated at $1,150,435. Royale’s first payment was due February 1, 2014, and all subsequent payments are due on the same day of each month after that. Royale’s final payment will be due on January 1, 2024, and will be for all principal and all accrued interest not yet paid. Payments include principal and interest. Stephen M Hosmer, Co-CEO, CFO is named as a personal guarantor of the loan. At December 31, 2014, the outstanding balance of this note was $1,475,884. The loan agreement contains certain covenants that, among other things, Royale must maintain a ratio of EBITDA-Debt Service Coverage in excess of 1.50 to 1.00. At December 31, 2014, Royale was not in compliance with this covenant, but obtained a forbearance from the bank from terms of that covenant.

In October 2012, the Company obtained $3 million from the issuance of a convertible note. See the Company’s Prospectus Supplement filed pursuant to Rule 424(b) on October 29, 2012, and the Company’s Form 8-K filed on October 29, 2012. The Company used these proceeds for general corporate purposes, including the reduction of outstanding bank debt and for capital expenditures on oil and gas developments. The note may, at the Company’s option, be repaid by converting the interest and principal amounts due to common stock, thus reducing the Company’s cash needs to service its debt. In January 2013, the scheduled payment of $854,167 was paid in cash, which included $833,333 in principal and $20,834 in interest. In April 2013, 479,589 common shares were issued in lieu of the scheduled payment of $833,333. According to the note agreement, the note holders may elect to convert the principal balance into shares of the Company's common stock. During 2013, the note holders submitted conversion notices to the Company such that 787,055 common shares were issued for a reduction in the note principal of $1,666,666. In September 2013, this note was paid in full. In addition to the note, Royale issued a warrant for 500,000 shares of its common stock. The fair market value of this warrant was offset against the value of the warrant and amortized over the life of the loan. During the life of the loan, $100,779 was expensed to interest expense in 2012 in excess 301,415 in 2013 with the remaining 1,144,084 recorded to additional paid in capital in 2013.

In February 2009, we entered into an agreement with Texas Capital Bank, N.A. for a new revolving line of credit and letter of credit facility, also secured by our oil and gas properties, of up to $14,250,000 and separate letter of credit facility of up to $750,000, for the purposes of refinancing Royale’s existing debt and to fund development, exploration and acquisition activities as well as other general corporate purposes. The scheduled maturity date for the loan was February 13, 2013. During January 2013, the balance of $350,000 on this credit facility was paid in full. In February 2013, the revolving credit agreement matured.

We do not engage in hedging activities or use derivative instruments to manage market risks.

The following schedule summarizes our known contractual cash obligations at December 31, 2014, and the effect such obligations are expected to have on our liquidity and cash flow in future periods.

| |

|