| PROSPECTUS

SUPPLEMENT |

Filed

Pursuant to Rule 424(b)(5) |

| (To

Prospectus dated December 29, 2020) |

Registration

No. 333-251645 |

JanOne

Inc.

571,428

shares of Common Stock

We

are offering 571,428 shares of our common stock pursuant to this prospectus supplement and the accompanying prospectus.

Our

common stock is listed on the Nasdaq Capital Market under the symbol “JAN.” On January 28, 2021, the last reported

sale price of our common stock as reported on the Nasdaq Capital Market was $12.99 per share.

Investing

in our securities involves a high degree of risk. See the section entitled “Risk Factors” appearing on page S-6 of

this prospectus supplement and elsewhere in this prospectus supplement and the accompanying base prospectus for a discussion of

information that should be considered in connection with an investment in our securities.

We

have engaged A.G.P./Alliance Global Partners (“AGP”) to act as our sole placement agent in connection with this offering.

The placement agent has agreed to use its reasonable best efforts to place the securities offered by this prospectus supplement.

We have agreed to pay the placement agent the fees set forth in the table below.

| | |

Per Share | | |

Total | |

| | |

| | |

| |

| Public offering price | |

$ | 10.50 | | |

$ | 5,999,994.00 | |

| Placement agents’ fees(1) | |

$ | 0.735 | | |

$ | 419,999.58 | |

| Proceeds, before expenses, to us | |

$ | 9.765 | | |

$ | 5,579,994.42 | |

| (1) |

In

addition, we have agreed to reimburse the placement agent for certain offering-related expenses. See “Plan of Distribution.”

|

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus supplement. Any representation to the contrary is a criminal offense.

Delivery

of the shares of common stock is expected to be made on or about February 2, 2021, subject to customary closing conditions.

Sole

Placement Agent

A.G.P.

The

date of this prospectus supplement is January 29, 2021

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document is in two parts, this prospectus supplement and the accompanying base prospectus, both of which are part of a registration

statement on Form S-3 that we filed with the U.S. Securities and Exchange Commission (the “SEC”) using a “shelf”

registration process. The first part is the prospectus supplement, including the documents incorporated by reference, which describes

the specific terms of this offering. The second part, the accompanying base prospectus, including the documents incorporated by

reference, provides more general information. Before you invest, you should carefully read this prospectus supplement, the accompanying

base prospectus, all information incorporated by reference herein and therein, as well as the additional information described

under “Where You Can Find More Information” on page S-9 of this prospectus supplement. These documents contain

information you should consider when making your investment decision. This prospectus supplement may add, update, or change information

contained in the accompanying base prospectus. To the extent there is a conflict between the information contained in this prospectus

supplement, on the one hand, and the information contained in the accompanying base prospectus or any document incorporated by

reference therein filed prior to the date of this prospectus supplement, on the other hand, you should rely on the information

in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document

having a later date — for example, a document filed after the date of this prospectus supplement and incorporated by reference

in this prospectus supplement and the accompanying base prospectus — the statement in the document having the later date

modifies or supersedes the earlier statement.

You

should rely only on the information contained or incorporated by reference in this prospectus supplement, the accompanying base

prospectus and in any free writing prospectuses we may provide to you in connection with this offering. We have not authorized

any other person to provide you with any information that is different. If anyone provides you with different or inconsistent

information, you should not rely on it. We are offering to sell, and seeking offers to buy, shares of our common stock only in

jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the offering of the common

stock in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus

supplement must inform themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution

of this prospectus supplement outside the United States. This prospectus supplement does not constitute, and may not be used in

connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement

by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

We

further note that the representations, warranties, and covenants made by us in any agreement that is filed as an exhibit to any

document that is incorporated by reference in the accompanying base prospectus were made solely for the benefit of the parties

to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should

not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were

accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as

accurately representing the current state of our affairs.

When

used herein, “Company,” “we,” “us,” or “our” refers to JanOne Inc., a Nevada corporation,

and our subsidiaries.

CAUTIONARY

STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

The

information included or incorporated by reference into the base prospectus and this prospectus supplement contains forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and

Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements

that relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other

factors that may cause our actual results, levels of activity, performance, or achievements to differ materially from any future

results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Words such

as, but not limited to, “believe,” “expect,” “anticipate,” “estimate,” “intend,”

“plan,” “targets,” “likely,” “aim,” “will,” “would,” “could,”

“should,” “predict,” “potential,” “continue,” and similar expressions or phrases

identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and future

events and financial trends that we believe may affect our financial condition, results of operation, business strategy and financial

needs. Actual results may differ materially from those expressed or implied in such forward-looking statements as a result of

various factors. We do not undertake, and we disclaim, any obligation to update any forward-looking statements or to announce

any revisions to any of the forward-looking statements, except as required by law. Certain factors that could cause results to

be materially different from those projected in the forward-looking statements include, but are not limited to, statements about:

| |

● |

our

history of losses and working capital deficit; |

| |

|

|

| |

● |

our

ability to continue as a going concern; |

| |

|

|

| |

● |

the

known and unknown impact of the Covid-19 pandemic on our Company; |

| |

|

|

| |

● |

dependence

on our key personnel; |

| |

|

|

| |

● |

need

for additional financing to complete our Phase IIb/IIIa studies for JAN101, which is a potential treatment for Periphery Artery

Disease; |

| |

|

|

| |

● |

regulatory

and legal uncertainties; |

| |

|

|

| |

● |

the

impact of quarterly results on our common stock price; and |

| |

|

|

| |

● |

dilution

to our stockholders upon the exercise of outstanding common stock options and restricted stock unit grants. |

We

urge you to consider these factors before investing in our common stock. The forward-looking statements included in this prospectus

supplement, the accompanying base prospectus, and any other offering material, or in the documents incorporated by reference into

this prospectus supplement, the accompanying base prospectus, and any other offering material, are made only as of the date of

the prospectus supplement, the accompanying base prospectus, any other offering material, or the documents incorporated by reference.

For more detail on these and other risks, please see “Risk Factors” in this prospectus supplement, our Annual Report

on Form 10-K for our fiscal year ended December 28, 2019, filed with the SEC on April 6, 2020, and our other filings with the

SEC.

PROSPECTUS

SUPPLEMENT SUMMARY

The

following information below is only a summary of more detailed information included elsewhere in, or incorporated by reference

in, this prospectus supplement and the accompanying base prospectus, and should be read together with the information contained

or incorporated by reference in other parts of this prospectus supplement and the accompanying base prospectus. This summary highlights

selected information about us and this offering. This summary may not contain all of the information that may be important to

you. Before making a decision to invest in our common stock, you should read carefully all of the information contained in or

incorporated by reference into this prospectus supplement and the accompanying base prospectus, including the information set

forth under the caption “Risk Factors” in this prospectus supplement and the accompanying base prospectus, as well

as the documents incorporated herein by reference, which are described under “Where You Can Find More Information”

and “Information Incorporated by Reference” in this prospectus supplement.

Our

Company

General

As

of September 10, 2019, JanOne Inc. (formerly known as Appliance Recycling Centers of America, Inc.) and subsidiaries (collectively,

“we,” the “Company,” or “JanOne”) broadened its business perspectives to being a pharmaceutical

company focused on finding treatments for conditions that cause severe pain and bringing to market drugs with non-addictive pain-relieving

properties. The Company aims to reduce prescriptions for dangerous opioid drugs by treating underlying diseases that cause severe

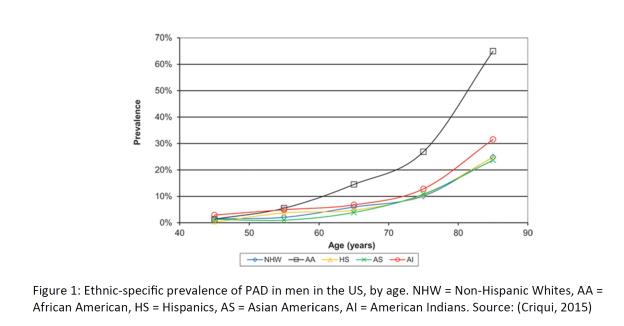

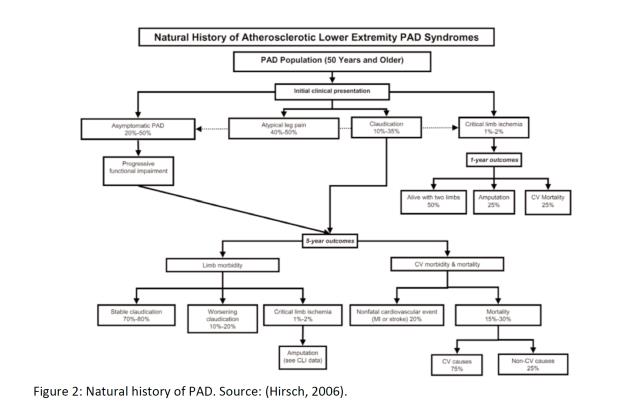

pain. Our first drug candidate is a treatment for Peripheral Arterial Disease (“PAD”), a condition that can cause

severe pain and affects over 8.5 million people in the U.S. alone. In addition, we continue to operate our legacy businesses,

ARCA Recycling, Inc. (“ARCA Recycling”), in our Recycling segment, and GeoTraq Inc. (“GeoTraq”), in our

Technology segment. ARCA Recycling recycles major household appliances in North America by providing turnkey appliance recycling

and replacement services for utilities and other sponsors of energy efficiency programs. GeoTraq is engaged in the development,

design, and, ultimately, we expect, the sale of cellular transceiver modules and associated wireless services.

Biotechnology

Overview

We

are a clinical-stage biopharmaceutical company focused on becoming the leader in identifying, acquiring, licensing, developing,

partnering, and commercializing novel, non-opioid and non-addictive therapies to address the large unmet medical need for the

treatment of pain. Our initial product candidate, JAN101 (formerly known as TV1001SR) is a potential treatment for Periphery Artery

Disease (“PAD”), a vascular disease that affects more than 60 million people worldwide. We are also researching the

potential impact our compound JAN101 could have in patients with COVID-19, as many doctors around the world and our Company believe

COVID-19 is a respiratory disease that directly affects the vascular system. We expect to commence Phase 2b clinical trials for

the treatment of PAD in early 2021. It is expected that the Investigational New Drug application (referred to in the industry

as “IND”) for JAN101 as a COVID-19 vascular complication treatment will be submitted to the U.S. Food and Drug Administration

in the coming weeks.

JAN101

JAN101,

formerly known as TV1001SR and/or TV1001, our advanced product candidate, is a patented oral, sustained release pharmaceutical

composition of sodium nitrite and targets poor blood flow to the extremities, such as those with vascular complications of diabetes

or PAD and treats pain. A conclusion from a round of human studies found JAN101 sustained release sodium nitrite prevents the

prevalent reports of headaches by patients treated with an immediate release formulation of sodium nitrite. In a previous study

of patients with PAD, 40 mg BID treatment with immediate release sodium nitrite led to a statistically significant reduction in

reported pain, while an 80 mg BID treatment had the more pronounced effect on bioactivity and Flow Mediated Dilation, a measure

of vascular function. However, a number of subjects on both treatment groups reported headaches and dizziness following treatment.

Although this did not result in subjects discontinuing treatment, JAN101 was developed to overcome this side effect. JAN101 was

tested in a bridging study of diabetic neuropathy subjects and, during that bridging study, the subjects did not report headaches

or dizziness. Subjects in this bridge study also reported less pain following treatment and improvements in bioactivity (quantitative

sensory testing, a measure of nerve function) were similar to the PAD study, where the 80 mg dose group had the greatest improvement

in Flow Mediated Dilation. The ability to alleviate pain with BID treatment of JAN101 offers promise for a new, non-addictive,

non-sedating treatment of chronic pain.

Recycling

We

started our business in 1976 as a used appliance retailer that reconditioned old appliances to sell in our stores. Under contracts

with national and regional retailers of new appliances, such as Sears Roebuck and Co. and Montgomery Ward Inc., we collected the

replaced appliance from the retailer’s customer’s residence when one of their stores delivered a new appliance in

the Minneapolis/St. Paul, Miami, or Atlanta market. Any old appliances that we could not sell in our stores were sold to scrap

metal processors. In the late 1980s, stricter environmental regulations began to affect the disposal of unwanted appliances and

we were no longer able to take appliances that contained hazardous components to a scrap metal processor. At that time, we began

to develop systems and equipment to remove the harmful materials so that metal processors would accept the appliance shells for

processing. We then offered our services for disposing of appliances in an environmentally sound manner to appliance manufacturers

and retailers, waste hauling companies, rental property managers, local governments, and the public.

We

operate 13 recycling centers in the U.S. and Canada to process and recycle old appliances according to all federal, state, provincial,

and local rules and regulations. ARCA Recycling uses U.S. EPA RAD-compliant methods to remove and properly manage hazardous components

and materials, including CFC refrigerants, mercury, polyurethane foam insulation, and recyclable materials, such as ferrous and

nonferrous metals, plastics, and glass. All of our facilities comply with licensing and permitting requirements, and employees

who process appliances receive extensive safety and hazardous materials training.

Technology

On

August 18, 2017, in a move to diversify our offering beyond our then-current appliance recycling capabilities, we acquired GeoTraq,

Inc., a Mobile Internet of Things (“IoT”) technology company that designs innovative wireless modules that provide

Location Based Services (“LBS”) and connect external sensors to the IoT. GeoTraq is planning to manufacture and sell

wireless transceiver modules and subscription services that will allow connectivity using publicly available global Mobile IoT

networks. GeoTraq addresses the large LBS market segment that is currently under-served with existing solutions due to high deployment

costs (hardware, service, logistics), limited battery life, and large form factors. We believe that there is a large under-served

portion of the LBS market that is not addressed by existing solutions. RFID and Wi-Fi require close proximity for asset tracking,

while GPS is too bulky and power hungry for many needs. GeoTraq addresses the white space in-between by designing wireless transceiver

modules with technology that provides LBS directly from global Mobile IoT networks. GeoTraq’s technology allows for a substantially

lower cost solution, extended service life, a small form factor, and even disposable devices, which we believe can significantly

reduce return logistics costs. Additionally, GeoTraq applied for and was granted Patent No. 10,182,402, which covers various aspects

of operation of its Mobile IoT wireless modules.

Please

see our Annual Report on Form 10-K for the fiscal year ended December 28, 2019 as filed with the SEC on April 6, 2020, and our

other subsequent filings with the SEC for additional information about our business, operations, and financial condition.

Risk

Factors

Investing

in our securities involves a high degree of risk. You should carefully consider all of the information in this prospectus and

in the documents incorporated by reference prior to investing in our securities. These risks are discussed more fully in the section

titled “Risk Factors” herein and in our Annual Report on Form 10-K for the year ended December 28, 2019 and

our Quarterly Reports on Form 10-Q for the periods ended March 28, 2020, June 27, 2020, and September 26, 2020, each of

which is incorporated by reference in this prospectus. These risks and uncertainties include, but are not limited to, the

following:

| ● |

We

have a history of losses and a working capital deficit; |

| |

|

| ● |

Our

ability to continue as a going concern will require us to obtain additional financing to fund our current operations, which

may be unavailable on acceptable terms, or at all; |

| |

|

| ● |

Our

business and operations have been adversely impacted by the Covid-19 pandemic and we are unable to predict the ultimate overall

impact on our company; |

| |

|

| ● |

We

are dependent on a limited number of key personnel; |

| |

|

| ● |

We

need additional financing to initiate and complete our Phase IIb/IIIa studies for JAN101, which is a potential treatment for

Periphery Artery Disease; |

| |

|

| ● |

Our

business is subject to regulatory and legal uncertainties; |

| |

|

| ● |

Our

quarterly results will have a material impact on our common stock price; and |

| |

|

| ● |

Our

stockholders will suffer dilution upon the exercise of outstanding common stock options and restricted stock unit grants. |

Corporate

information

We

are incorporated in Nevada. Our principal executive offices are located at 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada

89119, and our telephone number is (702) 997-5968. We report on a 52-or 53-week fiscal year. Our 2020 fiscal year ended on

January 2, 2021. Our 2019 fiscal year ended on December 28, 2019. Our 2018 fiscal year ended on December 29, 2018. We maintain

a corporate website at www.janone.com. Except as specifically set forth herein, the information which appears on our website is

not part of the prospectus or this prospectus supplement.

THE

OFFERING

The

following summary contains basic information about this offering. The summary is not intended to be complete. You should read

the full text and more specific details contained elsewhere in this prospectus supplement.

| Issuer |

JanOne

Inc. |

| |

|

| Common

stock offered by us |

571,428

shares at a purchase price of $10.50 per share. |

| |

|

| Common

stock outstanding prior to the offering |

1,829,982(1) |

| |

|

| Common

stock to be outstanding after this offering |

2,401,410

shares (1) |

| |

|

| Nasdaq

Capital Market symbol |

JAN |

| |

|

| Use

of proceeds |

We

intend to use the net proceeds from this offering for working capital. See “Use of Proceeds.” |

| |

|

| Risk

factors |

This

investment involves a high degree of risk. See “Risk Factors” and other information included or incorporated by reference

in this prospectus supplement beginning on page S-6 and the accompanying base prospectus beginning on page 4 for a discussion

of certain factors you should carefully consider before deciding to invest in shares of our common stock. |

| (1) |

The

number of shares of our common stock outstanding before and after this offering is based on 1,829,982 shares of common stock

outstanding as of January 28, 2020, and excludes: |

| |

|

| |

● |

101,900

shares of our common stock issuable upon the exercise of outstanding stock options with a weighted average exercise price

of $11.10 per share; |

| |

|

|

| |

● |

346,500

additional shares of our common stock reserved for future issuance under our equity incentive plans; and |

| |

|

|

| |

● |

33,363

shares issuable upon the exercise of outstanding common stock purchase warrants. |

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should carefully consider

the risk factors we describe in this prospectus supplement and in any related free writing prospectus that we may authorize to

be provided to you or in any report incorporated by reference into this prospectus supplement, including our Annual Report on

Form 10-K for the year ended December 28, 2019, or any Quarterly Report on Form 10-Q that is incorporated by reference

into this prospectus supplement. Although we discuss key risks in those risk factor descriptions, additional risks not currently

known to us or that we currently deem immaterial also may impair our business. Our subsequent filings with the SEC may contain

amended and updated discussions of significant risks. We cannot predict future risks or estimate the extent to which they may

affect our financial performance.

Risks

Related to this Offering of Securities

You

will experience immediate and substantial dilution in the net tangible book value per share of the common stock you purchase.

Since

the price per share of our common stock being offered is substantially higher than the net tangible book value per share of our

common stock, you will suffer immediate and substantial dilution in the net tangible book value of the common stock you purchase

in this offering. As of September 26, 2020, our net tangible book value was ($9,676,000) or approximately ($5.29) per share.

After giving effect to the sale of 571,428 shares of our common stock at the offering price of $10.50 per share in this offering,

our as adjusted net tangible book value as of September 26, 2020 would have been approximately ($4,096,006),

or approximately ($1.71) per share of outstanding common stock. Based on a public offering price of $10.50 per share of

common stock, and our as adjusted net tangible book value as of September 26, 2020, if you purchase common stock in

this offering, you will suffer immediate and substantial dilution of $12.21 per share with respect to the net tangible book

value of our common stock.

We

have broad discretion in determining how to use the proceeds from this offering and we cannot assure you that we will be successful

in spending the proceeds in ways which increase our revenues, profitability, or market value, or otherwise yield favorable returns.

We

plan to utilize net proceeds of this offering for general working capital. Nevertheless, we will have broad discretion in determining

specific expenditures. You will be entrusting your funds to our management, upon whose judgment you must depend, with limited

information concerning the purposes to which the funds will ultimately be applied. We may not be successful in spending the proceeds

of this offering in ways which increase our profitability or market value, or otherwise yield favorable returns.

Fluctuations

in the price of our common stock, including as a result of actual or anticipated sales of shares by stockholders, may make our

common stock more difficult to resell.

The

market price and trading volume of our common stock have been and may continue to be subject to significant fluctuations due not

only to general stock market conditions, but also to a change in sentiment in the market regarding the industries in which we

operate, our operations, business prospects, or liquidity or this offering. In addition to the risk factors discussed in our periodic

reports, in the prospectus, and in this prospectus supplement, the price and volume volatility of our common stock may be affected

by actual or anticipated sales of common stock by existing stockholders, including of shares purchased in this offering, whether

in the market or in subsequent public offerings. Stock markets in general may experience extreme volatility that is unrelated

to the operating performance of listed companies. These broad market fluctuations may adversely affect the trading price of our

common stock, regardless of our operating results. As a result, these fluctuations in the market price and trading volume of our

common stock may make it difficult to predict the market price of our common stock in the future, cause the value of your investment

to decline and make it more difficult to resell our common stock.

We

do not anticipate paying dividends in the foreseeable future; you should not buy our stock if you expect dividends.

We

have never paid a dividend on our common stock. The determination of whether to pay dividends on our common stock in the future

will depend on several factors, including without limitation, our earnings, financial condition, and other business and economic

factors affecting us at such time as our board of directors may consider relevant. If we do not pay dividends, our common stock

may be less valuable because a return on your investment will only occur if our stock price appreciates. We currently intend to

retain our future earnings to support operations and to finance expansion and, therefore, we do not anticipate paying any cash

dividends on our common stock in the foreseeable future.

We

could issue preferred stock without stockholder approval with the effect of diluting then current stockholder interests and impairing

their voting rights; and provisions in our charter documents could discourage a takeover that stockholders may consider favorable.

Our

articles of incorporation, as amended, authorize the issuance of up to 2,000,000 shares of “blank check” preferred

stock with designations, rights and preferences as may be determined from time to time by our board of directors. 259,729 shares

of our preferred stock, designated “Series A-1 Convertible Preferred Stock,” are issued and outstanding, leaving available

for designation and issuance up to 1,740,271 authorized, but unissued, shares of “blank check” preferred stock. Our

board of directors is empowered, without stockholder approval, to issue one or more series of preferred stock with dividend, liquidation,

conversion, voting, or other rights that could dilute the interest of, or impair the voting power of, our common stockholders.

The issuance of a series of preferred stock could be used as a method of discouraging, delaying, or preventing a change in control

of us. For example, it would be possible for our board of directors to issue preferred stock with voting or other rights or preferences

that could impede the success of any attempt to change control of our company.

Sales

of a significant number of shares of our common stock in the public markets or significant short sales of our common stock, or

the perception that such sales could occur, could depress the market price of our common stock and impair our ability to raise

capital.

Sales

of a substantial number of shares of our common stock or other equity-related securities in the public markets, could depress

the market price of our common stock. If there are significant short sales of our common stock, the price decline that could result

from this activity may cause the share price to decline more so, which, in turn, may cause long holders of the common stock to

sell their shares, thereby contributing to sales of common stock in the market. Such sales also may impair our ability to raise

capital through the sale of additional equity securities in the future at a time and price that our management deems acceptable,

if at all.

We

may seek to raise additional funds, finance acquisitions, or develop strategic relationships by issuing securities that would

dilute the ownership of the common stock. Depending on the terms available to us, if these activities result in significant dilution,

they may negatively impact the trading price of our shares of common stock.

We

have financed our acquisitions and the development of strategic relationships by issuing equity and debt securities and may continue

to do so in the future, which could significantly reduce the percentage ownership of our existing stockholders. Further, any additional

financing that we secure may require the granting of rights, preferences, or privileges senior to, or pari passu with,

those of our common stock. Any issuances by us of equity securities may be at or below the prevailing market price of our common

stock and, in any event, may have a dilutive impact on your ownership interest, which could cause the market price of our common

stock to decline. We may also raise additional funds through the incurrence of debt or the issuance or sale of other securities

or instruments senior to our shares of common stock. The holders of any securities or instruments we may issue may have rights

superior to the rights of our common stockholders. If we experience dilution from issuance of additional securities and we grant

superior rights to new securities over common stockholders, it may negatively impact the trading price of our shares of common

stock.

If

securities or industry analysts do not publish or cease publishing research or reports about us, our business, or our market,

or if they change their recommendations regarding our common stock adversely, our common stock price and trading volume could

decline.

The

trading market for our shares of common stock will be influenced by many factors, including without limitation, the research reports

that industry or securities analysts may publish about us, our business, our market, or our competitors. As of the date of this

prospectus, no analysts cover us, but, if any were to cover us and then adversely change their recommendation regarding our common

stock, or provide more favorable relative recommendations about our competitors, our share price would likely decline. If any

analyst who may cover us were to cease coverage of our Company or fail to publish reports on us regularly, we could lose visibility

in the financial markets, which in turn could cause our common stock price or trading volume to decline.

Significant

dilution will occur if outstanding options or warrants are exercised, or restricted stock unit grants vest.

As

of January 28, 2021, we had 101,900 shares of our common stock underlying outstanding stock options and 33,363 shares of

our common stock underlying outstanding common stock purchase warrants. If outstanding stock options or warrants are exercised,

dilution will occur to our stockholders, which may be significant.

USE

OF PROCEEDS

Based

upon the public offering price of $10.50 per share of common stock, we estimate that the net proceeds from the sale of the securities

offered under this prospectus supplement, after deducting placement agents’ fees and commissions and estimated offering

expenses payable by us will be approximately $5.4 million.

We

currently expect to use the net proceeds from this offering for working capital and other general corporate purposes.

Pending

our use of the net proceeds from this offering, we intend to invest the net proceeds in a variety of capital preservation investments,

including short-term, investment-grade, interest-bearing instruments and U.S. government securities.

DILUTION

A

purchaser of our shares of our common stock in this offering will be diluted immediately to the extent of the difference between

the offering price per share and the as adjusted net tangible book value per share of our common stock upon the closing

of this offering. Our historical net tangible book value as of September 26, 2020, was ($9,676,000), or approximately ($5.29)

per share of outstanding common stock, based on 1,829,982 shares of common stock outstanding as of September 26, 2020. Net

tangible book value per share of our common stock is determined at any date by subtracting total liabilities from the amount of

total tangible assets, and dividing this amount by the number of shares of common stock deemed to be outstanding as of that date.

Our

net tangible book value as of September 26, 2020 was ($9,676,000), or approximately ($5.29) per share of common

stock, based upon 1,829,982 shares outstanding. After giving effect to the issuance and sale of 571,428 shares of

our common stock at the offering price of $10.50 per share in this offering, our as adjusted net tangible book value

as of September 26, 2020 would have been approximately ($4,096,006), or approximately ($1.71) per share of outstanding

common stock. This amount represents an immediate increase in net tangible book value of $3.58 per share of our common

stock to our existing stockholders and an immediate dilution of $12.21 per share of our common stock to new investors

purchasing securities in this offering, as illustrated in the following table:

| Public offering price per share | |

| | | |

$ | 10.50 | |

| Historical net tangible book value per share of common stock as of September 26, 2020 | |

$ | (5.29 | ) | |

| | |

| Increase in net tangible book value per share of common stock attributable to this offering | |

$ | 3.58 | | |

| | |

| | |

| | | |

| | |

| As adjusted net book value per share of common stock, after giving effect to this offering | |

| (4,096,006 | ) | |

$ | (1.71 | ) |

| Dilution per share of common stock to new investors | |

| | | |

$ | 12.21 | |

The

foregoing table does not take into account further dilution to new investors that could occur upon the exercise of outstanding

options having a per share exercise price less than the per share offering price to the public in this offering.

The

foregoing table excludes the following as of September 26, 2020:

| ● |

101,900

shares issuable upon the exercise of outstanding stock options; |

| |

|

| ● |

346,500

shares reserved for future issuances under our equity compensation plans; and. |

| |

|

| ● |

33,363

shares issuable upon the exercise of outstanding common stock purchase warrants. |

DIVIDEND

POLICY

We

have not declared or paid cash dividends on our common stock since our inception. Under Nevada law, we are prohibited from paying

dividends if the distribution would result in our Company not being able to pay its debts as they become due in the normal course

of business if our total assets would be less than the sum of our total liabilities plus the amount that would be needed to pay

the dividends, or if we were to be dissolved at the time of distribution to satisfy the preferential rights upon dissolution of

stockholders whose preferential rights are superior to those receiving the distribution. Our board of directors has complete discretion

on whether to pay dividends subject to compliance with applicable Nevada law. Even if our board of directors were to decide to

pay dividends, the form, the frequency, and the amount will depend upon our future operations and earnings, capital requirements

and surplus, general financial condition, contractual restrictions, and other factors that the board of directors may deem relevant.

While our board of directors will make any future decisions regarding dividends, if, when, and as circumstances surrounding us

change, it currently does not anticipate that we will pay any cash dividends in the foreseeable future.

PLAN

OF DISTRIBUTION

A.G.P./Alliance

Global Partners has agreed to act as sole placement agent in connection with this offering. The placement agent is not purchasing

or selling any of the shares of our common stock offered by this prospectus supplement, but will use its reasonable best efforts

to arrange for the sale of the securities offered by this prospectus supplement. We have entered into a securities purchase agreement

directly with investors in connection with this offering. We will make offers only to a limited number of accredited investors.

The offering is expected to close on or about February 2, 2021, subject to customary closing conditions, without further notice

to you.

Fees

and Expenses

We

have agreed to pay the placement agent a placement agent’s fee equal to 7.0% of the aggregate purchase price of the shares

of our common stock sold in this offering. The following table shows the per share and total cash placement agent’s fees

we will pay to the placement agent in connection with the sale of the shares of our common stock offered pursuant to this prospectus

supplement and the accompanying prospectus.

| | |

Per Share | | |

Total | |

| | |

| | |

| |

| Public offering price | |

$ | 10.50 | | |

$ | 5,999,994.00 | |

| Placement agents’ fees(1) | |

$ | 0.735 | | |

$ | 419,499.58 | |

| Proceeds, before expenses, to us | |

$ | 9.765 | | |

$ | 5,579,994.42 | |

| |

(1) |

We

have also agreed to reimburse the placement agent for certain expenses. See below. |

In

addition, we have agreed to reimburse the placement agent for accountable legal expenses incurred by it in connection with the

offering of up to $35,000.

Regulation

M

The

placement agent may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions

received by it and any profit realized on the resale of the shares sold by it while acting as a principal might be deemed to be

underwriting discounts or commissions under the Securities Act. As an underwriter, the placement agent would be required to comply

with the requirements of the Securities Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities

Act and Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and

sales of shares by the placement agent acting as a principal. Under these rules and regulations, the placement agent:

| ● |

may

not engage in any stabilization activity in connection with our securities; and |

| |

|

| ● |

may

not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than

as permitted under the Exchange Act, until they have completed their participation in the distribution. |

Nasdaq

Capital Market Listing

Our

common stock is listed on the Nasdaq Capital Market under the symbol “JAN.” On January 28, 2021, the last reported

sale price of our common stock as reported on the Nasdaq Capital Market was $12.99 per share.

Indemnification

We

have agreed to indemnify the placement agent and other specified persons against certain civil liabilities, including liabilities

under the Securities Act and the Exchange Act, and to contribute to payments that the placement agent may be required to make

in respect of such liabilities.

Other

Relationships

The

placement agent or its affiliates may in the future engage in transactions with, and may perform, from time to time, investment

banking and advisory services for us in the ordinary course of their business and for which it would receive customary fees and

expenses. In addition, in the ordinary course of its business activities, the placement agent and its affiliates may make or hold

a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments

(including bank loans) for its own account and for the accounts of its customers. Such investments and securities activities may

involve securities and/or instruments of ours or our affiliates.

LEGAL

MATTERS

Clark

Hill PLC, Los Angeles, California, will provide us with opinions as to certain legal matters in connection with the shares of

common stock offered hereby. The placement agent is being represented by Nelson Mullins Riley & Scarborough LLP, Washington,

D.C.

EXPERTS

Our

audited consolidated balance sheets as of December 28, 2019 and December 29, 2018, and the related consolidated statements of

income, stockholders’ equity and cash flows for the years ended December 28, 2019 and December 29, 2018 incorporated by

reference in the registration statement of which this prospectus is a part have been audited by WSRP, LLC, independent registered

public accounting firm, and by SingerLewack LLP, independent registered public accounting firm, respectively, as indicated in

their reports with respect thereto, and have been so included in reliance upon the report of such firm given on their authority

as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly, and other reports, proxy statements, and other information with the SEC. The SEC maintains a website at

www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers such as our

company that file electronically with the SEC.

Our

corporate website address is www.janone.com. We make available free of charge, through the Investor section of our website,

Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K and amendments to those reports filed

or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically

file such material with, or furnish it to, the SEC.

INFORMATION

INCORPORATED BY REFERENCE

The

SEC allows us to incorporate by reference the information we file with them, which means that we can disclose important information

to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus

supplement, and later information filed with the SEC will update and supersede this information. We incorporate by reference the

documents listed below that we have previously filed with the SEC, except that information furnished under Item 2.02 or Item 7.01

of our Current Reports on Form 8-K or any other filing where we indicate that such information is being furnished and not filed

under the Exchange Act, is not deemed to be filed and not incorporated by reference herein:

| ● |

our

Annual Report on Form 10-K for the year ended December 28, 2019, as filed with the SEC on April 6, 2020; |

| |

|

| ● |

our

Quarterly Reports on Form 10-Q for the quarter ended March 28, 2020, as filed with the SEC on May 12, 2020; June 27, 2020,

as filed with the SEC on August 10, 2020; and September 26, 2020, as filed with the SEC on November 10, 2020; |

| |

|

| ● |

our

Current Reports on Form 8-K, as filed with the SEC on January 10, 2020, February 7, 2020, April 22, 2020 (as amended

on April 23, 2020), May 4, 2020, June 18, 2020, June 25, 2020, June 30, 2020, July 8, 2020, July 21, 2020, July 30, 2020,

August 6, 2020, August 12, 2020, September 3, 2020, September 16, 2020, September 24, 2020, October 2, 2020,

and January 29, 2021 (excluding any information furnished pursuant to Item 2.02 or Item 7.01 of such Current Reports on Form

8-K); and |

| |

|

| ● |

the

description of our common stock contained in Exhibit 4.1 to our Annual Report on Form 10-K for the year ended December

28, 2019, as filed with the SEC on April 6, 2020. |

We

also incorporate by reference into this prospectus supplement additional documents that we may file with the SEC under Sections

13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the completion or termination of the offering, including all such documents

we may file with the SEC after the date of the initial registration statement and prior to the effectiveness of the registration

statement, but excluding any information deemed furnished and not filed with the SEC. Any statements contained in a previously

filed document incorporated by reference into this prospectus supplement is deemed to be modified or superseded for purposes of

this prospectus supplement to the extent that a statement contained in this prospectus supplement, or in a subsequently filed

document also incorporated by reference herein, modifies or supersedes that statement.

This

prospectus supplement may contain information that updates, modifies or is contrary to information in one or more of the documents

incorporated by reference in this prospectus supplement. You should rely only on the information incorporated by reference or

provided in this prospectus supplement. We have not authorized anyone else to provide you with different information. You should

not assume that the information in this prospectus supplement is accurate as of any date other than the date of this prospectus

supplement or the date of the documents incorporated by reference in this prospectus supplement.

We

will provide to each person, including any beneficial owner, to whom this prospectus supplement is delivered, upon written or

oral request, at no cost to the requester, a copy of any and all of the information that is incorporated by reference in this

prospectus supplement. You may request a copy of these filings, at no cost to you, by telephoning us at (702) 997-5968 or by writing

us at the following address:

JanOne

Inc.

325

E. Warm Springs Road, Suite 102

Las

Vegas, Nevada 89119

Attention:

Corporate Secretary

You

may also access the documents incorporated by reference in this prospectus supplement through our website at www.janone.com. The

reference to our website is an inactive textual reference only and, except for the specific incorporated documents listed above,

no information available on or through our website shall be deemed to be incorporated in this prospectus supplement, the accompanying

prospectus, or the registration statement of which it forms a part.

PROSPECTUS

$100,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Rights

Units

We may offer and sell from time to time shares of our common stock, par value $0.001 per share (our “Common Stock”), shares of our preferred stock, par value $0.001 per share (our “Preferred Stock”), debt securities, warrants, rights, and units that include any of these securities. The Preferred Stock or warrants may be convertible into or exercisable for shares of our Common Stock or shares of our Preferred Stock or other of our securities registered hereunder. The debt securities may be convertible into or exchangeable for shares of our Common Stock or shares of our Preferred Stock. Our Common Stock is listed on The Nasdaq Capital Market and trades under the symbol “JAN.”

We may offer and sell these securities to or through one or more underwriters, dealers, and agents, or directly to purchasers, on a continuous or delayed basis.

The aggregate market value of our outstanding Common Stock held by non-affiliates was approximately $2,186,586, based on 1,829,982 shares of outstanding Common Stock as of December 15, 2020, of which approximately 410,121 shares were held by affiliates, and based on the closing sale price of our Common Stock of $4.62 on November 25, 2020. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities pursuant to this prospectus with a value of more than one-third of the aggregate market value of our Common Stock held by non-affiliates in any 12-month period, so long as the aggregate market value of our Common Stock held by non-affiliates is less than $75,000,000. In the event that, subsequent to the date of this prospectus, the aggregate market value of our outstanding Common Stock held by non-affiliates equals or exceeds $75,000,000, then the one-third limitation on sales shall not apply to additional sales made pursuant to this prospectus. During the prior 12 calendar months prior to, and including, the date of this prospectus, we have not sold any securities pursuant to General Instruction I.B.6 of Form S-3.

This prospectus describes some of the general terms that may apply to these securities and the general manner in which they may be offered. The specific terms of any securities to be offered, and the specific manner in which they may be offered, will be described in a supplement to this prospectus. You should read this prospectus and any applicable prospectus supplement carefully before you invest.

See the “Risk Factors” section of this prospectus on page 4, our filings with the SEC, and the applicable prospectus supplement for certain risks that you should consider before investing in our securities.

None of the Securities and Exchange Commission, any state securities commission, or any other regulatory body has approved or disapproved of these securities nor passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is December 29, 2020.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This document is called a prospectus and is part of a Registration Statement on Form S-3 that we have filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this shelf registration process, we may, from time to time, sell any combination of the securities described in this prospectus in one or more offerings in amounts that we will determine from time to time, up to a total dollar amount of $100,000,000.

This prospectus provides you with a general description of the securities we may offer. Each time we offer a type or series of securities described in this prospectus we will provide a prospectus supplement, incorporate information or document by reference into this prospectus or a related free writing prospectus or use other offering materials, as applicable, containing more specific information about the terms of the securities that are then being offered. We may also authorize one or more related free writing prospectuses to be provided to you that may contain material information relating to these offerings and securities. This prospectus, together with applicable prospectus supplements, any information or document incorporated by reference, and any related free writing prospectus or other offering materials, as applicable, we file with the SEC, includes all material information relating to these offerings and securities. We may also add, update, or change in the prospectus supplement any of the information contained in this prospectus or in the documents that we incorporate by reference into this prospectus, including, without limitation, a discussion of any risk factors or other special considerations that apply to these offerings or securities or the specific plan of distribution. If there is any inconsistency between the information in this prospectus and a prospectus supplement or information or document incorporated by reference having a later date, you should rely on the information in that prospectus supplement or incorporated information having a later date. We urge you to read carefully this prospectus, any applicable prospectus supplement, and any related free writing prospectus or other offering materials, as applicable, together with the information incorporated herein by reference as described under the heading “Incorporation of Certain Information by Reference,” before buying any of the securities being offered.

You should rely only on the information we have provided in, or incorporated by reference into, this prospectus, any applicable prospectus supplement, and any related free writing prospectus or other offering materials, as applicable. We have not authorized anyone to provide you with different information. No dealer, salesperson, or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus supplement, any related free writing prospectus, or other offering materials, as applicable.

Neither the delivery of this prospectus nor any sale made under it implies that there has not been any change in our business or affairs or that the information in this prospectus is correct as of any date after the date of this prospectus. You should assume that the information in this prospectus, any applicable prospectus supplement, any related free writing prospectus, or other offering materials, as applicable, is accurate only as of the date on the front of the document and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus, any applicable prospectus supplement, any related free writing prospectus, or other offering materials, as applicable, or any sale of a security.

The Registration Statement containing this prospectus, including exhibits to the Registration Statement, provides additional information about us and the securities offered under this prospectus and any prospectus supplement. We have filed and plan to continue to file other documents with the SEC that contain information about us and our business. Also, we will file legal documents that control the terms of the securities offered by this prospectus as exhibits to the reports that we file with the SEC. The Registration Statement and other reports can be read at the SEC Internet site or at the SEC offices mentioned under the heading “Available Information.”

This prospectus contains summaries of certain provisions contained in some of the documents described herein; but, reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed, or will be incorporated by reference as exhibits to the Registration Statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Available Information.”

1

AVAILABLE INFORMATION

We have filed with the SEC a Registration Statement on Form S-3 under the Securities Act with respect to the securities covered by this prospectus. This prospectus, which is a part of that Registration Statement, does not contain all of the information set forth in the Registration Statement or the exhibits and schedules filed therewith. For further information with respect to us and the securities covered by this prospectus, please see the Registration Statement and the exhibits filed with the Registration Statement. A copy of the Registration Statement and the exhibits filed with the Registration Statement may be inspected without charge at the Public Reference Room maintained by the SEC, located at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for more information about the operation of the Public Reference Room. The SEC also maintains an Internet website that contains reports, proxy and information statements, and other information regarding registrants that file electronically with the SEC. The address of the website is http://www.sec.gov.

We are subject to the information and periodic reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, in accordance therewith, we file periodic reports, proxy statements, and other information with the SEC. Such periodic reports, proxy statements, and other information are available for inspection and copying at the Public Reference Room and website of the SEC referred to above. We maintain a website at http://www.janone.com. You may access our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed pursuant to Sections 13(a) or 15(d) of the Exchange Act with the SEC free of charge at our website as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. Our website and the information contained on that site, or connected to that site, are not incorporated into and are not a part of this prospectus.

2

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC’s rules allow us to incorporate by reference information into this prospectus. This means that we can disclose important information to you by referring you to another document. Any information referred to in this way is considered part of this prospectus from the date we file that document. Any reports filed by us with the SEC after the date of this prospectus and before the date that the offering of the securities by means of this prospectus is terminated will automatically update and, where applicable, supersede any information contained in this prospectus or incorporated by reference in this prospectus.

We incorporate by reference into this prospectus the following documents or information filed with the SEC (other than, in each case, documents or information deemed to have been furnished and not filed in accordance with SEC rules):

|

• |

Our Annual Report on Form 10-K for the year ended December 28, 2019, filed with the SEC on April 6, 2020; |

|

• |

Our Quarterly Reports on Form 10-Q for the quarters ended March 28, 2020, filed with the SEC on May 12, 2020, June 27, 2020, filed with the SEC on August 10, 2020, and September 26, 2020, filed with the SEC on November 10, 2020; |

|

• |

Our Current Reports on Form 8-K, filed with the SEC on January 10, 2020, April 22, 2020 (as amended on April 23, 2020), May 4, 2020, June 18, 2020, June 25, 2020, June 30, 2020, July 8, 2020, July 21, 2020, July 30, 2020, August 6, 2020, August 12, 2020, September 3, 2020, September 16, 2020, September 24, 2020, and October 2, 2020 (excluding any information furnished pursuant to Item 2.02 or Item 7.01 of such Current Reports on Form 8-K); and |

|

• |

The description of our Common Stock contained filed as Exhibit 4.1 to our Annual Report on Form 10-K for the year ended December 28, 2019, filed with the SEC on April 6, 2020. |

Additionally, all documents filed by us with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act, after (i) the date of the initial Registration Statement and prior to effectiveness of the Registration Statement and (ii) the date of this prospectus and before the termination or completion of this offering, shall be deemed to be incorporated by reference into this prospectus from the respective dates of filing of such documents, except that we do not incorporate any document or portion of a document that is “furnished” to the SEC, but not deemed “filed.” Any information that we subsequently file with the SEC that is incorporated by reference as described above will automatically update and supersede any previous information that is part of this prospectus.

We will provide without charge to each person, including any beneficial owner, to whom this prospectus is delivered, upon his or her written or oral request, a copy of any or all documents referred to above that have been or may be incorporated by reference into this prospectus, excluding exhibits to those documents unless they are specifically incorporated by reference into those documents. Written or telephone requests should be directed to JanOne Inc., 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119, Attention: Corporate Secretary; telephone: (702) 997-5968.

3

FORWARD-LOOKING STATEMENTS

This prospectus, including the documents we incorporate by reference into it, contains forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act, the Private Securities Litigation Reform Act of 1995 (the “PSLRA”) or in releases made by the SEC. Such statements include, without limitation, statements regarding our expectations, hopes, or intentions regarding the future. Statements that are not historical fact are forward-looking statements. These forward looking statements can often be identified by their use of words such as “expect,” “believe,” “anticipate,” “outlook,” “could,” “target,” “project,” “intend,” “plan,” “seek,” “estimate,” “should,” “will,” “may,” and “assume,” as well as variations of such words and similar expressions referring to the future. These cautionary statements are being made pursuant to the Securities Act, the Exchange Act, and the PSLRA with the intention of obtaining the benefits of the “safe harbor” provisions of such laws.

The forward-looking statements contained in or incorporated by reference into this prospectus are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve certain risks and uncertainties, many of which are beyond our control. If any of those risks and uncertainties materialize, actual results could differ materially from those discussed in any such forward-looking statement. Among the factors that could cause actual results to differ materially from those discussed in forward-looking statements are those discussed under the heading “Risk Factors” below, those discussed under the heading “Risk Factors” and in other sections of our Annual Report on Form 10-K for the year ended December 28, 2019, as well as in our other reports filed from time to time with the SEC that are incorporated by reference into this prospectus. See “Available Information” and “Incorporation of Certain Information by Reference” for information about how to obtain copies of those documents.

All readers are cautioned that the forward-looking statements contained in this prospectus and in the documents incorporated by reference into this prospectus are not guarantees of future performance, and we cannot assure any reader that such statements will be realized or that the forward-looking events and circumstances will occur. Actual results may differ materially from those anticipated or implied in the forward-looking statements. All forward-looking statements in this prospectus and the documents incorporated by reference into it are made only as of the date of the document in which they are contained, based on information available to us as of the date of that document, and we caution you not to place undue reliance on forward-looking statements in light of the risks and uncertainties associated with them. Except as required by law, we undertake no obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise.

RISK FACTORS

Investing in our securities involves significant risks. You should review carefully the risks and uncertainties described under the heading “Risk Factors” contained in, or incorporated into, the applicable prospectus supplement, any related free writing prospectus, or other offering materials, as applicable, and under similar headings in the other documents that are incorporated by reference herein or therein. Each of the referenced risks and uncertainties could adversely affect our business, operating results, and financial condition, as well as adversely affect the value of an investment in our securities. When we offer and sell any securities pursuant to a prospectus supplement, we may include additional risk factors relevant to such securities in the prospectus supplement.

4

BUSINESS

General

As of September 10, 2019, JanOne Inc. (formerly known as Appliance Recycling Centers of America, Inc.) and subsidiaries (collectively, “we,” the “Company,” or “JanOne”) broadened its business perspectives to being a pharmaceutical company focused on finding treatments for conditions that cause severe pain and bringing to market drugs with non-addictive pain-relieving properties. The Company aims to reduce prescriptions for dangerous opioid drugs by treating underlying diseases that cause severe pain. Our first drug candidate is a treatment for Peripheral Arterial Disease (“PAD”), a condition that can cause severe pain and affects over 8.5 million people in the U.S. alone. In addition, we continue to operate our legacy businesses, ARCA Recycling, Inc. (“ARCA Recycling”), in our Recycling segment, and GeoTraq Inc. (“GeoTraq”), in our Technology segment. ARCA Recycling recycles major household appliances in North America by providing turnkey appliance recycling and replacement services for utilities and other sponsors of energy efficiency programs. GeoTraq is engaged in the development, design, and, ultimately, we expect, the sale of cellular transceiver modules and associated wireless services.

On September 10, 2019, the Company changed its name from Appliance Recycling Centers of America, Inc. to JanOne Inc. and announced that it intended to broaden its business perspectives to include developing new and highly innovative solutions for ending the opioid epidemic. From digital technologies to educational advocacy to revolutionary painkilling drugs that address a multibillion dollar a year market, the Company intends to champion new initiatives to combat the opioid crisis, which claims tens of thousands of lives each year. The new name, JanOne, was strategically chosen to express the start of a “new day” in the fight against the opioid epidemic. January First is the first day of a New Year—a day of optimism, resolution, and hope. JanOne affirms the Company’s new strategic commitment to fresh thinking and innovative means to assist in ending the worst drug crisis in our nation’s history. The Company also adopted a new Nasdaq ticker symbol, NASDAQ: JAN, a new CUSIP number, 03814F403, and a new website address – www.janone.com. The information contained in or accessible from our website is not incorporated into this prospectus, and you should not consider it part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

On December 28, 2019, we had 208 employees, of which 199 were full-time employees.

We were incorporated in Minnesota in 1983, although, through our predecessors, we began operating our legacy recycling business in 1976. On March 12, 2018, we reincorporated in the State of Nevada. Our principal office is located at 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119.

Biotechnology

Overview

We are a clinical-stage biopharmaceutical company focused on becoming the leader in identifying, acquiring, licensing, developing, partnering and commercializing novel, non-opioid and non-addictive therapies to address the large unmet medical need for the treatment of pain. Our initial product candidate, JAN101 (formerly known as TV1001SR) is a potential treatment for Periphery Artery Disease (“PAD”), a vascular disease that affects more than 60 million people worldwide. We are also researching the potential impact our compound JAN101 could have in patients with COVID-19 as many doctors around the world and our company believes COVID-19 is a respiratory disease that directly affects the vascular system. We expect to commence Phase 2b clinical trials for the treatment of PAD in early 2021. It is expected that the investigational new drug application (“IND”) for JAN101 as a COVID-19 vascular complication treatment will be submitted to the U.S. Food and Drug Administration (the “FDA”) in the coming weeks.

5

JAN101

Generally

JAN101, formerly known as TV1001SR and/or TV1001, our advanced product candidate, is a patented oral, sustained release pharmaceutical composition of sodium nitrite and targets poor blood flow to the extremities, such as those with vascular complications of diabetes or PAD and treats pain. A conclusion from a round of human studies found JAN101 sustained release sodium nitrite prevents the prevalent reports of headaches by patients treated with an immediate release formulation of sodium nitrite. In a previous study of patients with PAD, 40 mg BID treatment with immediate release sodium nitrite led to a statistically significant reduction in reported pain while a 80 mg BID treatment had the more pronounced effect on bioactivity and Flow Mediated Dilation, a measure of vascular function. However, a number of subjects on both treatment groups reported headaches and dizziness following treatment. Although this did not result in subjects discontinuing treatment, JAN101 was developed to overcome this side effect. JAN101 was tested in a bridging study of diabetic neuropathy subjects and during that bridging study, the subjects did not report headaches or dizziness. Subjects in this bridge study also reported less pain following treatment and improvements in bioactivity (quantitative sensory testing, a measure of nerve function) were similar to the PAD study, where the 80 mg dose group had the greatest improvement in Flow Mediated Dilation. The ability to alleviate pain with BID treatment of JAN101 offers promise for a new non-addictive, non-sedating treatment of chronic pain.

Clinical studies in humans JAN101 Attributes

|

|

• |

Well established safety profile |

|

|

• |

Excellent bioavailability |

|

|

• |

Lack of induced tolerance |

JAN1010 does not mask pain, but instead treats the cause of pain by improving tissue and vascular dysfunction.

Benefits of Sodium Nitrite on Vascular Health

In initial research studies, sodium nitrite effectively restored ischemic tissue blood flow and was effective in a wide range of pathologies involving alterations of angiogenesis - development of new blood vessels - including diabetes, wound healing and tissue necrosis. Beneficial effects included enhancing angiogenesis, endothelial cell proliferation, and arteriogenesis. There is also a strong association between reduced circulating nitrite levels and cardiovascular diseases in humans. We describe some of the associations and beneficial effects of sodium nitrite/nitrite below.

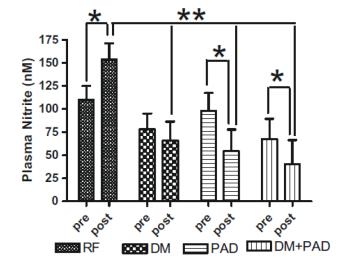

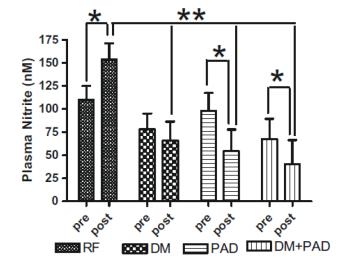

Plasma nitrite levels are negatively correlated to cardiovascular disease

6

Plasma nitrite levels were inversely related to number of cardiovascular risk factors a subject had and decreased plasma nitrite was associated with decreased flow mediated vasodilation (FMD) and increased intimal medial thickness (IMT) (both indicators of vascular pathology). -Kleinbongard, et al. (2006) Free Radic Biol and Medicine 40:295-302

Plasma nitrite levels are reduced in diabetic and PAD patients

Exercise is a well-known stimulator of endothelial nitric oxide synthase activity, NO production that leads to increased plasma nitrite. In the study by Allen et al, these authors revealed that baseline plasma levels of nitrite were less in patients with diabetes mellitus (DM) or DM + PAD. Importantly, increases in plasma nitrite levels were not observed in either DM, PAD or DM + PAD patients after supervised exercise. These data reveal that baseline nitrite availability is compromised in DM patients and that supervised exercise is unable to increase plasma nitrite levels but actually results in a decrease in nitrite highlighting a physiological efficiency of this molecule. -Allen et al Nitric Oxide 2009 20:231-237

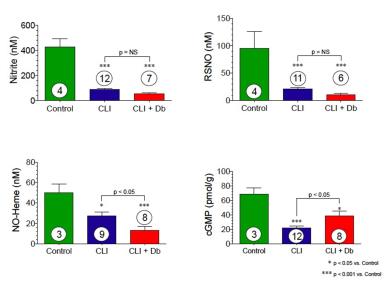

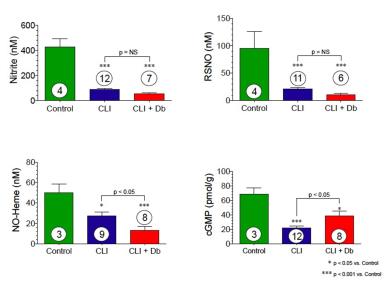

Skeletal Muscle Nitrite and Metabolite Levels are Reduced in Critical Limb Ischemia Patients

7

Skeletal muscle nitrite, nitrosothiol, nitric oxide-heme and cGMP are all significantly reduced in CLI patients. Diabetic patients with CLI show even further nitrite reductions.

In summary, nitrite levels in various cardiovascular and vascular diseases appear to be inversely related to the severity of the disease in humans:

|

|

• |

Lower nitrite levels are associated with higher level of heart failure; |

|

|

• |

Lower nitrite levels are observed in diabetic patients with PAD and are not compensated by exercise; and |

|

|

• |

Nitrite levels are lower in the muscles of patients with critical limb ischemia and are further reduced in diabetic subjects with critical limb ischemia. |

Given the association between low levels of circulating nitrite and human diseases, supplementation with sodium nitrite has been studied preclinically in animals. Below are summaries of some of the more important findings:

|

|

• |

Stimulates wound healing |

|

|

• |

Prevents tissue necrosis |

8

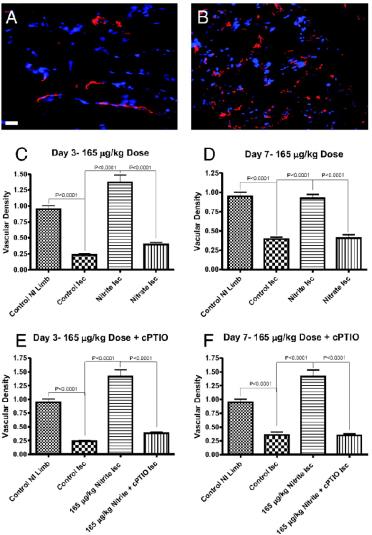

From Arya et al

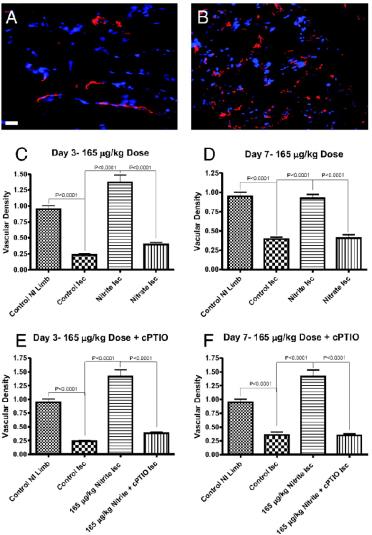

Nitrite Therapy Selectively Increases Ischemic Tissue Vascular Density in a NO-dependent Manner

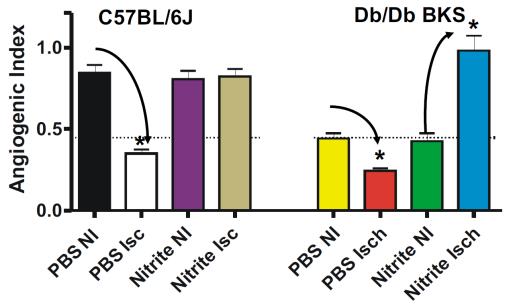

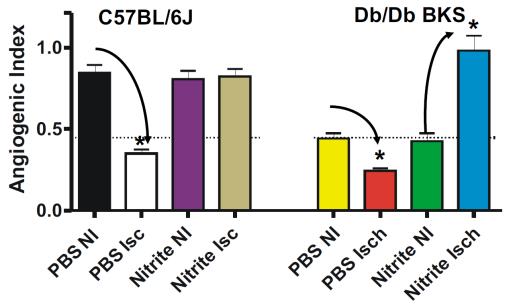

Chronic sodium nitrite therapy increases ischemic tissue vascular density in a NO-dependent manner. A and B show representative images of CD31 (red) and DAPI nuclear (blue) staining from sodium nitrite and sodium nitrate ischemic gastrocnemius muscle tissue at day 7. C and D report the vascular density of ischemic gastrocnemius muscle tissue at days 3 and 7 for 165 μg/kg sodium nitrite and nitrate treatments, respectively. E and F demonstrate the vascular density of ischemic gastrocnemius muscle tissue at days 3 and 7 from 165 μg/kg sodium nitrite plus carboxy PTIO. (Scale bar, 150 μm.) n = 10 mice per treatment group. Kumar D. et al. PNAS; 2008; 105:7540-7545.

9

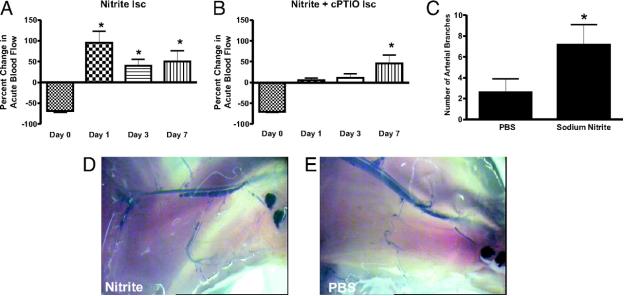

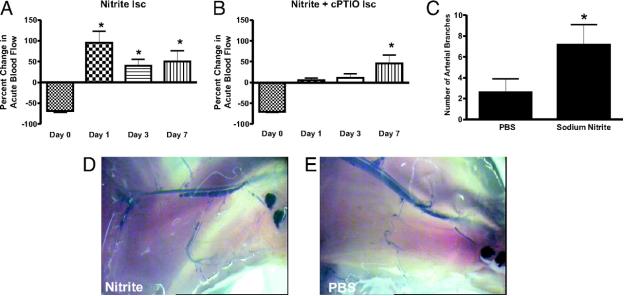

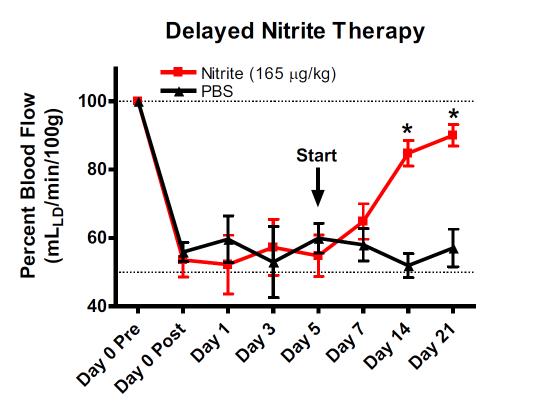

Nitrite Therapy Augments Arterial Perfusion of Ischemic Tissue

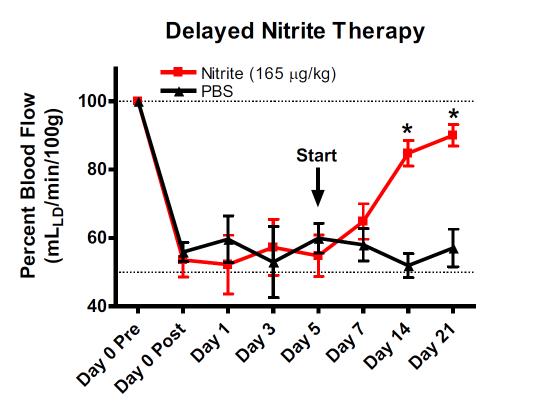

Chronic sodium nitrite therapy acutely increases ischemic tissue blood flow and stimulates arteriogenesis. A and B report 165 μg/kg sodium nitrite-induced acute changes in blood flow of chronically ischemic tissues at various time points with or without cPTIO, respectively. C reports the number of arterial branches between PBS and nitrite therapies. D and E illustrate vascular casting of the arterial vasculature in ischemic hind limbs of day 7 nitrite or PBS-treated mice, respectively. *, P < 0.01 vs. sodium nitrate. n = 10 mice per treatment group. Kumar D. et.al. PNAS;2008; 105:7540-7545

10

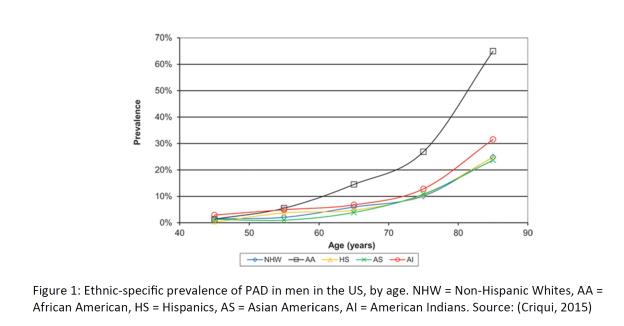

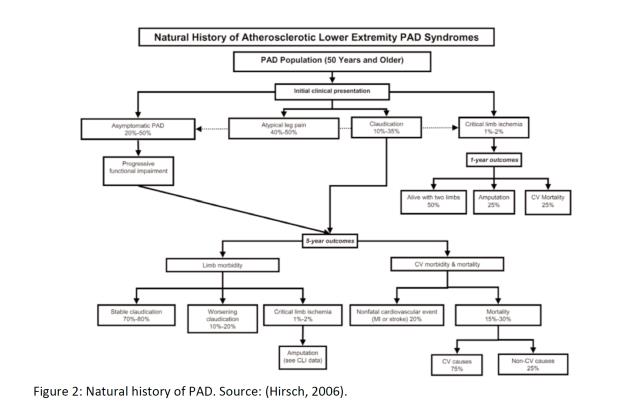

Nitrite Therapy Restores Diabetic Ischemic Hind-Limb Blood Flow and Promotes Wound Heal