UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSR

Investment Company Act file number: 811-06071

Deutsche DWS Institutional Funds

(Exact Name of Registrant as Specified in Charter)

345 Park Avenue

New York, NY 10154-0004

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 250-2500

Diane Kenneally

One International Place

Boston, MA 02110

(Name and Address of Agent for Service)

| Date of fiscal year end: | 8/31 |

| Date of reporting period: | 8/31/2019 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

Table of Contents

Table of Contents

This report must be preceded or accompanied by a prospectus. To obtain a summary prospectus, if available, or prospectus for any of our Funds, refer to the Account Management Resources information provided in the back of this booklet. We advise you to consider the Fund’s objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the Fund. Please read the prospectus carefully before you invest.

Investing involves risk, including possible loss of principal. Stocks may decline in value. Funds investing in a single industry, country or in a limited geographic region generally are more volatile than more diversified funds. Because the Fund seeks to provide exposure to stocks based on the following multifactors — value, momentum, quality, low volatility and size — it is expected exposure to such investment factors will detract from performance in some market environments, as more fully explained in the Fund’s prospectus. Performance of the Fund may diverge from that of the Underlying Index due to operating expenses, transaction costs, cash flows, use of sampling strategies or operational inefficiencies. An investment in any fund should be considered only as a supplement to a complete investment program for those investors willing to accept the risks associated with that fund. Please read the prospectus for details.

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc. which offers investment products or DWS Investment Management Americas, Inc. and RREEF America L.L.C. which offer advisory services.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

| 2 | | | DWS U.S. Multi-Factor Fund |

Table of Contents

Dear Shareholder:

The markets, both domestic and global, have been increasingly influenced by geopolitical concerns in recent months — most notably the trade conflict between China and the United States and uncertainty around the implementation of Britain’s exit from the European Union (“Brexit”). The result has been increased volatility and continued efforts by central banks to bolster economic growth through monetary policy.

Against this backdrop, our Americas Chief Investment Officer (“CIO”) remains constructive, albeit more cautious than at the beginning of the year. In our view, while tariffs raise concerns, particularly for commodity producing and manufacturing industries, including the world’s regional economies tilted toward such industries and still suffering from their own weak internal recoveries, a robust labor market and other key metrics suggest the underpinnings of the U.S. economy remain intact.

Of course, these issues and their potential implications bear close watching. Our CIO Office and global network of analysts diligently monitor these matters to determine when and what, if any, strategic or tactical adjustments may be warranted.

We invite you to access these views to better understand the changing landscape and, most important, what it may mean for you. The “Insights” section of our web site, dws.com, is home to our CIO View, which integrates the on-the-ground views of our worldwide network of economists, research analysts and investment professionals. This truly global perspective guides our strategic investment approach.

As always, we thank you for trusting DWS to help serve your investment needs.

Best regards,

|

Hepsen Uzcan

President, DWS Funds |

Assumptions, estimates and opinions contained in this document constitute our judgment as of the date of the document and are subject to change without notice. Any projections are based on a number of assumptions as to market conditions and there can be no guarantee that any projected results will be achieved. Past performance is not a guarantee of future results.

| DWS U.S. Multi-Factor Fund | | | 3 |

Table of Contents

| Portfolio Management Review | (Unaudited) |

Market Overview and Fund Performance

All performance information below is historical and does not guarantee future results. Returns shown are for Institutional Class shares, unadjusted for sales charges. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may differ from performance data shown. Please visit dws.com for the most recent month-end performance of all share classes. Fund performance includes reinvestment of all distributions. Unadjusted returns do not reflect sales charges and would have been lower if they had.

The Fund returned 1.39% in the 12-month period ended August 31, 2019. During the same interval, the Fund’s benchmark — the Russell 1000 Comprehensive Factor Index — gained 1.66%. Since our strategy is to replicate the performance of the index before the deduction of expenses, the Fund’s return is normally close to that of the index. The Russell 1000 Comprehensive Factor Index trailed the 2.49% return of the broad-based Russell 1000 Index in the 12-month period.

While domestic equities produced a narrow gain, the path to achieving the positive return was quite uneven. After displaying strength in September 2018, stocks fell sharply in the final three months of the year. The market initially turned lower in early October, when comments by U.S. Federal Reserve (Fed) Chairman Jerome Powell were taken as a sign that several more rate hikes could be on the way in the year ahead. Fed officials quickly made it clear that this was unlikely to be the case, but stocks continued to slide due to the combination of slowing global growth, uncertain U.S. trade policy, and declining corporate earnings estimates for 2019. The major indexes reached their low for the period with a dramatic downturn on December 24, 2018.

The investment picture began to change as the calendar turned to the New Year, and equities went on to post an impressive, four-month rally that brought the major indexes back into positive territory for the period. A number of developments provided fuel for the market’s advance in this time. First, the Fed communicated its intention to take a much less aggressive approach to its interest rate policy, raising hopes that several rate cuts could be in the offing by mid-2020. Investors also grew more sanguine regarding the prospects for both trade policy and economic growth. Not least, corporate earnings reports came in close to expectations, allaying fears that profits were set to turn sharply lower.

| 4 | | | DWS U.S. Multi-Factor Fund |

Table of Contents

Investment Strategy and Process

The Fund, using a “passive” or indexing investment approach, seeks investment results, before fees and expenses, that correspond generally to the performance of the Russell 1000 Comprehensive Factor Index (the “Underlying Index”), which is designed to track the equity market performance of companies in the United States selected on the investment style criteria (“factors”) of value, momentum, quality, low volatility and size. The companies eligible for the Underlying Index are derived from its starting universe, the Russell 1000 Index, which is comprised of large-cap equity securities from issuers in the United States. The index provider, Frank Russell Company (“Index Provider”), selects companies from the starting universe for the Underlying Index by applying a consistent rules-based methodology to achieve exposure to companies demonstrating the factors listed below, while considering levels of diversification and capacity:

Value

Value investing generally refers to a strategy that buys stocks whose price is lower than the fundamental value of the stock. The Index Provider’s methodology for measuring the value factor attempts to identify stocks that have low prices relative to their fundamental value and that provide the possibility of excess returns. The value score is calculated by measuring a company’s valuation based on, among other things, cash-flow yield, earnings yield and sales to price and then comparing it to the company’s valuation based on share price.

Momentum

Momentum style investing emphasizes investing in securities that have had higher recent price performance compared to other securities, with the expectation that this will continue to produce short-term excess returns in the future. The momentum score is calculated based on each company’s cumulative 11 month return. The Index Provider’s methodology for measuring the momentum factor attempts to identify stocks with stronger past performance over the short-term.

Quality

The Index Provider’s methodology for measuring the quality factor attempts to identify stocks that are characterized by low debt, stable earnings growth, and other “quality” metrics, with the expectation that these will provide the possibility of excess returns. The quality score is calculated from a company’s leverage and profitability (e.g., return on assets, asset turnover and accruals).

Low Volatility

Volatility is a statistical measurement of the magnitude of increases or decreases in a stock’s price over time. The low volatility score is calculated based on the standard deviation of five years of weekly total returns. Low volatility investing is a strategy based on the concept that stocks that exhibit low volatility tend to perform better than stocks with higher volatility. The Index Provider’s methodology for measuring the low volatility factor attempts to identify stocks with a historically lower risk (and higher return) profile relative to those with higher risk.

Size

The size factor seeks to capture excess returns of smaller companies relative to larger counterparts. The size score is calculated based on the full market capitalization of a company. The Index Provider’s methodology for measuring the size factor attempts to identify stocks of smaller companies relative to their larger counterparts, with the expectation that these will provide the possibility of excess returns.

Companies are weighted in the Underlying Index based on their relative exposure to all five factors with companies that have higher factor scores receiving larger weightings.

| DWS U.S. Multi-Factor Fund | | | 5 |

Table of Contents

Volatility rose over the final four months of the period, and stocks closed slightly off their late April high. During this interval, a further slowdown in global growth and an increasingly negative tone to the U.S.-China trade dispute created a great deal of uncertainty. These factors were largely offset by the prospect of more accommodative policies by the world’s central banks, which provided support for the markets despite the generally unfavorable news flow.

At the factor level, low-volatility stocks performed well as elevated uncertainty prompted investors to seek relative “safe havens.” The momentum factor produced modest outperformance, while size and quality finished closely in line with the index. The value factor was the largest underperformer, demonstrating investors’ ongoing preference for companies with the ability to deliver accelerating profits even in a time of slowing economic growth.

“While domestic equities produced a narrow gain, the path to achieving the positive return was quite uneven.”

Fund Performance

The outperformance of lower-volatility stocks was reflected in sector-level returns. The utilities sector was the top performer, as investors gravitated to its defensive characteristics and above-average dividend yields. Similarly, the real estate and consumer staples sectors soundly outpaced the broader index. At the same time, the period was also characterized by outperformance for traditional growth sectors such as information technology and consumer discretionary. The strong relative returns for both low-volatility stocks and faster growers reflected investors’ apparent preference for companies with below-average sensitivity to global growth trends. Financials also outperformed, with strength among insurance companies and exchange operators outweighing a weaker showing for the banking industry.

On the other end of the spectrum, sectors seen as having the highest vulnerability to the uncertainty surrounding growth and trade — including energy, industrials, and materials — underperformed. Health care, though traditionally regarded as a more defensive area of the market, lagged due in part to questions about a possible shift in government policy toward a “Medicare-for-all” model. The communications services sector also posted a narrow loss.

At the individual stock level, Starbucks Corp., AutoZone, Inc., and Ball Corp. were the leading contributors. Valero Energy Corp., Lear Corp., and Centene Corp. were the most notable detractors.

| 6 | | | DWS U.S. Multi-Factor Fund |

Table of Contents

The Fund used derivatives, primarily futures contracts on domestic stock indexes. The purpose of these holdings was to add equity exposure rather than holding cash. The use of derivatives had no material impact on the Fund’s relative performance.

Outlook and Positioning

We continued to use a passive strategy designed to provide returns that approximate those of the benchmark. The Fund’s largest sector weightings as of August 31, 2019 were industrials, consumer discretionary, information technology, and financials, and its top individual holdings were CDW Corp., Lam Research Corp., and Cummins, Inc.

Portfolio Management Team

Bryan Richards, CFA, Managing Director

Portfolio Manager of the Fund. Began managing the Fund in 2017.

| – | Joined DWS in 2011 with 11 years of industry experience. Prior to his current role, he served as the primary portfolio manager for the PowerShares DB Commodity ETFs until their sale in 2015. Prior to joining DWS he served as an equity analyst for Fairhaven Capital LLC, a long/short equity fund, and at XShares Advisors, an ETF issuer based in New York. |

| – | Head of Passive Portfolio Management, Americas: New York. |

| – | BS in Finance, Boston College. |

Patrick Dwyer, Director

Portfolio Manager of the Fund. Began managing the Fund in 2017.

| – | Joined DWS in 2016 with 16 years of industry experience. Prior to joining DWS, he was the head of Northern Trust’s Equity Index, ETF, and Overlay portfolio management team in Chicago, managing portfolios for North American based clients. His time at Northern Trust included working in New York, Chicago, and in Hong Kong building a portfolio management desk. Prior to joining Northern Trust in 2003, he participated in the Deutsche Asset Management graduate training program. He rotated through the domestic fixed income and US structured equity fund management groups. |

| – | Lead Equity Portfolio Manager, US Passive Equities: New York. |

| – | BS in Finance, Rutgers University. |

Shlomo Bassous, Vice President

Portfolio Manager of the Fund. Began managing the Fund in December 2017.

| – | Joined DWS in 2017 with 13 years of industry experience. Prior to joining DWS, Mr. Bassous worked at Northern Trust where he filled a variety of operational functions supporting portfolio management. In 2010 he began managing equity portfolios on behalf of institutional clients across a variety of global benchmarks. Before joining Northern Trust in 2007, he worked at The Bank of New York Mellon and Morgan Stanley in a variety of roles supporting equity trading and portfolio management. |

| – | Equity Portfolio Manager, US Passive Equities: New York. |

| – | BS in Finance, Yeshiva University. |

The views expressed reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team’s views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Past performance is no guarantee of future results. Current and future portfolio holdings are subject to risk.

| DWS U.S. Multi-Factor Fund | | | 7 |

Table of Contents

Terms to Know

The Russell 1000 Comprehensive Factor Index is designed to track the equity market performance of companies in the United States selected on the investment style criteria (“factors”) of value, momentum, quality, low volatility and size. The companies eligible for the Underlying Index are derived from its starting universe, the Russell 1000 Index, which is comprised of large-cap equity securities from issuers in the United States.

The Russell 1000 Index is an unmanaged index that measures the performance of the 1,000 largest companies in the Russell 3000® Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index. Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

Contribution and detraction incorporate both a stock’s total return and its weighting in the Fund.

Derivatives are contracts whose values can be based on a variety of instruments, including indices, currencies or securities. They can be utilized for a variety of reasons, including for hedging purposes, for risk management; for non-hedging purposes to seek to enhance potential gains, or as a substitute for direct investment in a particular asset class or to keep cash on hand to meet shareholder redemptions. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility.

Futures contracts are contractual agreements to buy or sell a particular commodity or financial instrument at a predetermined price in the future.

| 8 | | | DWS U.S. Multi-Factor Fund |

Table of Contents

| Performance Summary | August 31, 2019 (Unaudited) |

| Class R6 | 1-Year | Life of Fund* |

||||||

| Average Annual Total Returns as of 8/31/19 | ||||||||

| No Sales Charges | 1.44% | 8.62% | ||||||

| Russell 1000® Comprehensive Factor Index† | 1.66% | 8.91% | ||||||

| Institutional Class | 1-Year | Life of Fund* |

||||||

| Average Annual Total Returns as of 8/31/19 | ||||||||

| No Sales Charges | 1.39% | 8.59% | ||||||

| Russell 1000® Comprehensive Factor Index† | 1.66% | 8.91% | ||||||

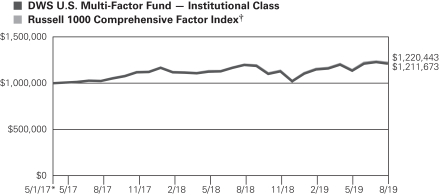

Performance in the Average Annual Total Returns table above and the Growth of an Assumed $1,000,000 Investment line graph that follows is historical and does not guarantee future results. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may differ from performance data shown. Please visit dws.com for the Fund’s most recent month-end performance. Fund performance includes reinvestment of all distributions.

The gross expense ratios of the Fund, as stated in the fee table of the prospectus dated December 21, 2018 are 0.37% and 0.46% for Class R6 and Institutional Class shares, respectively, and may differ from the expense ratio disclosed in the Financial Highlights table in this report.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

Performance figures do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

| DWS U.S. Multi-Factor Fund | | | 9 |

Table of Contents

| Growth of an Assumed $1,000,000 Investment |

The growth of $1,000,000 is cumulative.

The minimum initial investment for Institutional Class shares is $1,000,000.

| * | The Fund commenced operations on May 1, 2017. The performance shown for the index is for the time period of April 30, 2017 through August 31, 2019, which is based on the performance period of the life of the Fund. |

| † | Russell 1000® Comprehensive Factor Index (the “Underlying Index”) is an unmanaged index which is designed to provide exposure to the US large-cap equities based on five investment style factors — Value, Momentum, Quality, Low Volatility and Size. |

| Class R6 | Institutional Class |

|||||||

| Net Asset Value | ||||||||

| 8/31/19 | $ | 11.66 | $ | 11.66 | ||||

| 8/31/18 | $ | 11.77 | $ | 11.77 | ||||

| Distribution Information as of 8/31/19 | ||||||||

| Income Dividends, Twelve Months | $ | .16 | $ | .15 | ||||

| Capital Gain Distributions, Twelve Months | $ | .10 | $ | .10 | ||||

| 10 | | | DWS U.S. Multi-Factor Fund |

Table of Contents

| DWS U.S. Multi-Factor Fund | | | 11 |

Table of Contents

| Ten Largest Equity Holdings at August 31, 2019 (5.8% of Net Assets) |

Percent | |||||

| 1 | CDW Corp. | 0.7% | ||||

| Provides information technology products and services | ||||||

| 2 | Lam Research Corp. | 0.7% | ||||

| Manufactures, markets, and services semiconductor processing equipment used in the making of integrated circuits | ||||||

| 3 | Cummins, Inc. | 0.6% | ||||

| Designs and manufactures diesel engines | ||||||

| 4 | Dollar General Corp. | 0.6% | ||||

| Operator of chain of discount retail stores | ||||||

| 5 | Darden Restaurants, Inc. | 0.6% | ||||

| Operator of restaurant services | ||||||

| 6 | Medical Properties Trust, Inc. | 0.6% | ||||

| Self-advised real estate investment trust | ||||||

| 7 | Synopsys, Inc. | 0.5% | ||||

| Supplies electronic design automation solutions to the global electronics market | ||||||

| 8 | Apartment Investment & Management Co. | 0.5% | ||||

| Self-managed real estate investment trust | ||||||

| 9 | Progressive Corp. | 0.5% | ||||

| Provider of property and casualty insurance | ||||||

| 10 | Starbucks Corp. | 0.5% | ||||

| Provider of high-quality coffee | ||||||

Portfolio holdings and characteristics are subject to change.

For more complete details about the Fund’s investment portfolio, see page 13. A quarterly Fact Sheet is available on dws.com or upon request. Please see the Account Management Resources section on page 64 for contact information.

| 12 | | | DWS U.S. Multi-Factor Fund |

Table of Contents

| Investment Portfolio | as of August 31, 2019 |

| Shares | Value ($) | |||||||

| Common Stocks 99.7% | ||||||||

| Communication Services 3.0% | ||||||||

| Diversified Telecommunication Services 0.2% |

||||||||

| AT&T, Inc. |

3,456 | 121,859 | ||||||

| CenturyLink, Inc. |

3,843 | 43,733 | ||||||

| Verizon Communications, Inc. |

4,266 | 248,111 | ||||||

| Zayo Group Holdings, Inc.* |

3,123 | 105,120 | ||||||

|

|

|

|||||||

| 518,823 | ||||||||

| Entertainment 0.5% |

||||||||

| Activision Blizzard, Inc. |

502 | 25,401 | ||||||

| Cinemark Holdings, Inc. |

12,697 | 484,518 | ||||||

| Electronic Arts, Inc.* |

383 | 35,879 | ||||||

| Liberty Media Corp.-Liberty Formula One “C”* |

881 | 36,773 | ||||||

| Live Nation Entertainment, Inc.* |

4,749 | 330,103 | ||||||

| Madison Square Garden Co. “A”* |

927 | 233,910 | ||||||

| Take-Two Interactive Software, Inc.* |

1,167 | 154,009 | ||||||

| Viacom, Inc. “B” |

5,320 | 132,894 | ||||||

| Walt Disney Co. |

1,098 | 150,711 | ||||||

| Zynga, Inc. “A”* |

15,796 | 90,195 | ||||||

|

|

|

|||||||

| 1,674,393 | ||||||||

| Interactive Media & Services 0.3% |

||||||||

| Alphabet, Inc. “A”* |

51 | 60,717 | ||||||

| Alphabet, Inc. “C”* |

55 | 65,346 | ||||||

| Facebook, Inc. “A”* |

258 | 47,903 | ||||||

| IAC/InterActiveCorp.* |

2,524 | 642,711 | ||||||

| Match Group, Inc. |

457 | 38,754 | ||||||

|

|

|

|||||||

| 855,431 | ||||||||

| Media 1.8% |

||||||||

| Altice U.S.A., Inc. “A”* |

2,966 | 85,658 | ||||||

| AMC Networks, Inc. “A”* |

1,747 | 84,730 | ||||||

| Cable One, Inc. |

375 | 486,608 | ||||||

| CBS Corp. “B” |

5,748 | 241,761 | ||||||

| Charter Communications, Inc. “A”* |

499 | 204,385 | ||||||

| Comcast Corp. “A” |

3,887 | 172,039 | ||||||

| Discovery, Inc. “A”* |

464 | 12,806 | ||||||

| Discovery, Inc. “C”* |

1,522 | 39,618 | ||||||

| DISH Network Corp. “A”* |

5,286 | 177,398 | ||||||

| Fox Corp. “A” |

17,136 | 568,401 | ||||||

| Fox Corp. “B”* |

9,830 | 322,424 | ||||||

| Interpublic Group of Companies, Inc. |

16,664 | 331,280 | ||||||

| John Wiley & Sons, Inc. “A” |

1,832 | 81,524 | ||||||

| Liberty Broadband Corp. “C”* |

387 | 40,805 | ||||||

The accompanying notes are an integral part of the financial statements.

| DWS U.S. Multi-Factor Fund | | | 13 |

Table of Contents

| Shares | Value ($) | |||||||

| Liberty Media Corp.-Liberty SiriusXM “A”* |

1,548 | 62,679 | ||||||

| Liberty Media Corp.-Liberty SiriusXM “C”* |

3,029 | 123,613 | ||||||

| New York Times Co. “A” |

10,430 | 304,556 | ||||||

| News Corp. “A” |

2,303 | 31,666 | ||||||

| Nexstar Media Group, Inc. “A” |

3,100 | 306,559 | ||||||

| Omnicom Group, Inc. |

14,911 | 1,134,131 | ||||||

| Sinclair Broadcast Group, Inc. “A” |

1,749 | 77,953 | ||||||

| Sirius XM Holdings, Inc. |

10,279 | 63,421 | ||||||

| Tribune Media Co. “A” |

5,481 | 255,305 | ||||||

|

|

|

|||||||

| 5,209,320 | ||||||||

| Wireless Telecommunication Services 0.2% |

||||||||

| T-Mobile U.S., Inc.* |

2,080 | 162,344 | ||||||

| Telephone & Data Systems, Inc. |

14,138 | 356,277 | ||||||

| United States Cellular Corp.* |

1,831 | 65,898 | ||||||

|

|

|

|||||||

| 584,519 | ||||||||

| Consumer Discretionary 13.7% | ||||||||

| Auto Components 0.4% |

||||||||

| Aptiv PLC |

2,293 | 190,709 | ||||||

| BorgWarner, Inc. |

5,170 | 168,697 | ||||||

| Gentex Corp. |

22,347 | 594,430 | ||||||

| Goodyear Tire & Rubber Co. |

1,869 | 21,437 | ||||||

| Lear Corp. |

1,637 | 183,770 | ||||||

|

|

|

|||||||

| 1,159,043 | ||||||||

| Automobiles 0.2% |

||||||||

| Ford Motor Co. |

37,371 | 342,692 | ||||||

| General Motors Co. |

6,390 | 237,005 | ||||||

| Harley-Davidson, Inc. |

4,338 | 138,382 | ||||||

| Thor Industries, Inc. |

496 | 22,772 | ||||||

|

|

|

|||||||

| 740,851 | ||||||||

| Distributors 0.7% |

||||||||

| Genuine Parts Co. |

14,947 | 1,349,565 | ||||||

| LKQ Corp.* |

6,517 | 171,202 | ||||||

| Pool Corp. |

2,317 | 455,012 | ||||||

|

|

|

|||||||

| 1,975,779 | ||||||||

| Diversified Consumer Services 1.0% |

||||||||

| Bright Horizons Family Solutions, Inc.* |

3,028 | 499,771 | ||||||

| Frontdoor, Inc.* |

6,318 | 324,366 | ||||||

| Graham Holdings Co. “B” |

896 | 630,838 | ||||||

| Grand Canyon Education, Inc.* |

1,850 | 232,360 | ||||||

| H&R Block, Inc. |

33,740 | 817,183 | ||||||

| Service Corp. International |

10,960 | 507,448 | ||||||

| ServiceMaster Global Holdings, Inc.* |

458 | 26,124 | ||||||

|

|

|

|||||||

| 3,038,090 | ||||||||

The accompanying notes are an integral part of the financial statements.

| 14 | | | DWS U.S. Multi-Factor Fund |

Table of Contents

| Shares | Value ($) | |||||||

| Hotels, Restaurants & Leisure 3.2% |

||||||||

| Aramark |

2,659 | 108,647 | ||||||

| Carnival Corp. |

7,379 | 325,266 | ||||||

| Chipotle Mexican Grill, Inc.* |

417 | 349,621 | ||||||

| Choice Hotels International, Inc. |

1,304 | 118,638 | ||||||

| Darden Restaurants, Inc. |

13,939 | 1,686,340 | ||||||

| Domino’s Pizza, Inc. |

1,572 | 356,592 | ||||||

| Dunkin’ Brands Group, Inc. |

4,259 | 351,112 | ||||||

| Extended Stay America, Inc. (Units) |

4,011 | 56,355 | ||||||

| Hilton Worldwide Holdings, Inc. |

3,515 | 324,681 | ||||||

| Hyatt Hotels Corp. “A” |

2,040 | 147,186 | ||||||

| Las Vegas Sands Corp. |

1,120 | 62,126 | ||||||

| Marriott International, Inc. “A” |

1,600 | 201,696 | ||||||

| McDonald’s Corp. |

937 | 204,238 | ||||||

| MGM Resorts International |

1,915 | 53,735 | ||||||

| Norwegian Cruise Line Holdings Ltd.* |

8,482 | 430,461 | ||||||

| Planet Fitness, Inc. “A”* |

2,206 | 155,766 | ||||||

| Royal Caribbean Cruises Ltd. |

3,056 | 318,680 | ||||||

| Six Flags Entertainment Corp. |

1,552 | 91,832 | ||||||

| Starbucks Corp. |

15,887 | 1,534,049 | ||||||

| The Wendy’s Co. |

17,466 | 384,252 | ||||||

| Vail Resorts, Inc. |

576 | 136,097 | ||||||

| Wyndham Destinations, Inc. |

6,141 | 272,292 | ||||||

| Wyndham Hotels & Resorts, Inc. |

691 | 35,504 | ||||||

| Yum China Holdings, Inc. |

9,570 | 434,765 | ||||||

| Yum! Brands, Inc. |

9,998 | 1,167,566 | ||||||

|

|

|

|||||||

| 9,307,497 | ||||||||

| Household Durables 2.0% |

||||||||

| D.R. Horton, Inc. |

10,738 | 531,209 | ||||||

| Garmin Ltd. |

12,427 | 1,013,670 | ||||||

| Leggett & Platt, Inc. |

10,754 | 399,941 | ||||||

| Lennar Corp. “A” |

5,258 | 268,158 | ||||||

| Mohawk Industries, Inc.* |

629 | 74,782 | ||||||

| NVR, Inc.* |

351 | 1,263,249 | ||||||

| PulteGroup, Inc. |

41,563 | 1,404,829 | ||||||

| Tempur Sealy International, Inc.* |

505 | 38,946 | ||||||

| Toll Brothers, Inc. |

14,036 | 507,963 | ||||||

| Whirlpool Corp. |

2,794 | 388,618 | ||||||

|

|

|

|||||||

| 5,891,365 | ||||||||

| Internet & Direct Marketing Retail 0.4% |

||||||||

| Amazon.com, Inc.* |

23 | 40,855 | ||||||

| Booking Holdings, Inc.* |

98 | 192,708 | ||||||

| eBay, Inc. |

13,396 | 539,725 | ||||||

The accompanying notes are an integral part of the financial statements.

| DWS U.S. Multi-Factor Fund | | | 15 |

Table of Contents

| Shares | Value ($) | |||||||

| Expedia Group, Inc. |

2,284 | 297,148 | ||||||

| Qurate Retail, Inc.* |

3,447 | 36,917 | ||||||

|

|

|

|||||||

| 1,107,353 | ||||||||

| Leisure Products 0.1% |

||||||||

| Brunswick Corp. |

785 | 36,581 | ||||||

| Hasbro, Inc. |

2,634 | 290,978 | ||||||

| Polaris, Inc. |

195 | 15,994 | ||||||

|

|

|

|||||||

| 343,553 | ||||||||

| Multiline Retail 1.2% |

||||||||

| Dollar General Corp. |

11,562 | 1,804,713 | ||||||

| Dollar Tree, Inc.* |

3,217 | 326,622 | ||||||

| Kohl’s Corp. |

4,566 | 215,789 | ||||||

| Nordstrom, Inc. (a) |

2,525 | 73,149 | ||||||

| Ollie’s Bargain Outlet Holdings, Inc.* |

1,455 | 80,680 | ||||||

| Target Corp. |

8,852 | 947,518 | ||||||

|

|

|

|||||||

| 3,448,471 | ||||||||

| Specialty Retail 3.8% |

||||||||

| Advance Auto Parts, Inc. |

4,278 | 590,150 | ||||||

| AutoNation, Inc.* |

974 | 46,226 | ||||||

| AutoZone, Inc.* |

1,332 | 1,467,451 | ||||||

| Best Buy Co., Inc. |

10,022 | 637,900 | ||||||

| Burlington Stores, Inc.* |

2,495 | 505,213 | ||||||

| CarMax, Inc.* |

3,158 | 262,998 | ||||||

| Dick’s Sporting Goods, Inc. |

5,436 | 185,042 | ||||||

| Five Below, Inc.* |

714 | 87,729 | ||||||

| Foot Locker, Inc. |

7,544 | 273,017 | ||||||

| Home Depot, Inc. |

795 | 181,189 | ||||||

| L Brands, Inc. |

781 | 12,894 | ||||||

| Lowe’s Companies, Inc. |

7,330 | 822,426 | ||||||

| O’Reilly Automotive, Inc.* |

2,718 | 1,043,060 | ||||||

| Penske Automotive Group, Inc. |

1,554 | 66,480 | ||||||

| Ross Stores, Inc. |

11,714 | 1,241,801 | ||||||

| The Gap, Inc. |

3,629 | 57,302 | ||||||

| Tiffany & Co. |

1,116 | 94,715 | ||||||

| TJX Companies, Inc. |

23,129 | 1,271,401 | ||||||

| Tractor Supply Co. |

12,706 | 1,294,487 | ||||||

| Ulta Salon, Cosmetics & Fragrance, Inc.* |

2,121 | 504,225 | ||||||

| Williams-Sonoma, Inc. |

5,822 | 383,088 | ||||||

|

|

|

|||||||

| 11,028,794 | ||||||||

| Textiles, Apparel & Luxury Goods 0.7% |

||||||||

| Carter’s, Inc. |

3,231 | 295,572 | ||||||

| Columbia Sportswear Co. |

1,456 | 136,558 | ||||||

| Hanesbrands, Inc. |

7,666 | 104,718 | ||||||

| Lululemon Athletica, Inc.* |

1,225 | 226,221 | ||||||

The accompanying notes are an integral part of the financial statements.

| 16 | | | DWS U.S. Multi-Factor Fund |

Table of Contents

| Shares | Value ($) | |||||||

| NIKE, Inc. “B” |

5,087 | 429,851 | ||||||

| PVH Corp. |

815 | 61,777 | ||||||

| Ralph Lauren Corp. |

1,226 | 108,305 | ||||||

| Tapestry, Inc. |

3,480 | 71,862 | ||||||

| VF Corp. |

6,652 | 545,131 | ||||||

|

|

|

|||||||

| 1,979,995 | ||||||||

| Consumer Staples 6.7% | ||||||||

| Beverages 0.5% |

||||||||

| Brown-Forman Corp. “A” |

764 | 43,984 | ||||||

| Brown-Forman Corp. “B” |

2,400 | 141,576 | ||||||

| Coca-Cola Co. |

1,151 | 63,351 | ||||||

| Constellation Brands, Inc. “A” |

1,266 | 258,707 | ||||||

| Molson Coors Brewing Co. “B” |

6,566 | 337,230 | ||||||

| Monster Beverage Corp.* |

3,948 | 231,629 | ||||||

| PepsiCo, Inc. |

2,380 | 325,417 | ||||||

|

|

|

|||||||

| 1,401,894 | ||||||||

| Food & Staples Retailing 1.8% |

||||||||

| Casey’s General Stores, Inc. |

6,521 | 1,094,550 | ||||||

| Costco Wholesale Corp. |

3,090 | 910,808 | ||||||

| Kroger Co. |

18,829 | 445,871 | ||||||

| Sprouts Farmers Market, Inc.* |

11,963 | 214,736 | ||||||

| Sysco Corp. |

19,879 | 1,477,606 | ||||||

| U.S. Foods Holding Corp.* |

15,399 | 622,890 | ||||||

| Walgreens Boots Alliance, Inc. |

9,202 | 471,050 | ||||||

| Walmart, Inc. |

721 | 82,381 | ||||||

|

|

|

|||||||

| 5,319,892 | ||||||||

| Food Products 2.5% |

||||||||

| Archer-Daniels-Midland Co. |

2,297 | 87,401 | ||||||

| Bunge Ltd. |

434 | 23,180 | ||||||

| Campbell Soup Co. |

2,094 | 94,230 | ||||||

| Conagra Brands, Inc. |

5,302 | 150,365 | ||||||

| Flowers Foods, Inc. |

13,292 | 303,058 | ||||||

| General Mills, Inc. |

8,028 | 431,906 | ||||||

| Hormel Foods Corp. |

14,945 | 636,806 | ||||||

| Ingredion, Inc. |

3,065 | 236,833 | ||||||

| Kellogg Co. |

5,091 | 319,715 | ||||||

| Lamb Weston Holdings, Inc. |

5,911 | 416,075 | ||||||

| McCormick & Co., Inc. |

3,981 | 648,386 | ||||||

| Mondelez International, Inc. “A” |

9,374 | 517,632 | ||||||

| Pilgrim’s Pride Corp.* |

3,586 | 111,740 | ||||||

| Post Holdings, Inc.* |

2,309 | 230,184 | ||||||

| Seaboard Corp. |

15 | 61,953 | ||||||

| The Hershey Co. |

5,030 | 797,154 | ||||||

| The JM Smucker Co. |

5,801 | 610,033 | ||||||

The accompanying notes are an integral part of the financial statements.

| DWS U.S. Multi-Factor Fund | | | 17 |

Table of Contents

| Shares | Value ($) | |||||||

| TreeHouse Foods, Inc.* |

2,033 | 102,971 | ||||||

| Tyson Foods, Inc. “A” |

15,729 | 1,463,426 | ||||||

|

|

|

|||||||

| 7,243,048 | ||||||||

| Household Products 1.4% |

||||||||

| Church & Dwight Co., Inc. |

12,468 | 994,697 | ||||||

| Clorox Co. |

4,918 | 777,831 | ||||||

| Colgate-Palmolive Co. |

10,113 | 749,879 | ||||||

| Kimberly-Clark Corp. |

9,044 | 1,276,199 | ||||||

| Procter & Gamble Co. |

1,274 | 153,173 | ||||||

| Spectrum Brands Holdings, Inc. |

2,012 | 112,410 | ||||||

|

|

|

|||||||

| 4,064,189 | ||||||||

| Personal Products 0.3% |

||||||||

| Estee Lauder Companies, Inc. “A” |

3,836 | 759,490 | ||||||

| Herbalife Nutrition Ltd.* |

1,398 | 48,133 | ||||||

|

|

|

|||||||

| 807,623 | ||||||||

| Tobacco 0.2% |

||||||||

| Altria Group, Inc. |

5,719 | 250,149 | ||||||

| Philip Morris International, Inc. |

5,076 | 365,929 | ||||||

|

|

|

|||||||

| 616,078 | ||||||||

| Energy 1.3% | ||||||||

| Energy Equipment & Services 0.1% |

||||||||

| Apergy Corp.* |

762 | 19,797 | ||||||

| Baker Hughes a GE Co. |

1,784 | 38,695 | ||||||

| Halliburton Co. |

1,246 | 23,475 | ||||||

| Helmerich & Payne, Inc. |

991 | 37,252 | ||||||

| Schlumberger Ltd. |

1,027 | 33,305 | ||||||

|

|

|

|||||||

| 152,524 | ||||||||

| Oil, Gas & Consumable Fuels 1.2% |

||||||||

| Apache Corp. |

1,715 | 36,992 | ||||||

| Cabot Oil & Gas Corp. |

18,323 | 313,690 | ||||||

| Cheniere Energy, Inc.* |

1,677 | 100,134 | ||||||

| Chevron Corp. |

1,848 | 217,546 | ||||||

| Cimarex Energy Co. |

3,469 | 148,404 | ||||||

| Concho Resources, Inc. |

699 | 51,132 | ||||||

| ConocoPhillips |

8,782 | 458,245 | ||||||

| Devon Energy Corp. |

1,985 | 43,650 | ||||||

| Diamondback Energy, Inc. |

269 | 26,383 | ||||||

| EOG Resources., Inc. |

3,730 | 276,729 | ||||||

| EQT Corp. |

2,404 | 24,449 | ||||||

| Equitrans Midstream Corp. |

10,241 | 138,151 | ||||||

| Exxon Mobil Corp. |

1,843 | 126,209 | ||||||

| Hess Corp. |

755 | 47,527 | ||||||

| HollyFrontier Corp. |

1,060 | 47,022 | ||||||

The accompanying notes are an integral part of the financial statements.

| 18 | | | DWS U.S. Multi-Factor Fund |

Table of Contents

| Shares | Value ($) | |||||||

| Kinder Morgan, Inc. |

8,835 | 179,085 | ||||||

| Murphy Oil Corp. |

685 | 12,487 | ||||||

| Noble Energy, Inc. |

621 | 14,022 | ||||||

| Occidental Petroleum Corp. |

4,107 | 178,572 | ||||||

| ONEOK, Inc. |

1,381 | 98,438 | ||||||

| Phillips 66 |

5,327 | 525,402 | ||||||

| Pioneer Natural Resources Co. |

1,473 | 181,798 | ||||||

| Valero Energy Corp. |

4,779 | 359,763 | ||||||

|

|

|

|||||||

| 3,605,830 | ||||||||

| Financials 12.3% | ||||||||

| Banks 1.4% |

||||||||

| Associated Banc-Corp. |

2,549 | 49,043 | ||||||

| Bank of America Corp. |

1,006 | 27,675 | ||||||

| Bank of Hawaii Corp. |

1,081 | 89,377 | ||||||

| BankUnited, Inc. |

1,891 | 60,058 | ||||||

| BB&T Corp. |

4,627 | 220,477 | ||||||

| CIT Group, Inc. |

3,506 | 149,321 | ||||||

| Citigroup, Inc. |

1,319 | 84,878 | ||||||

| Citizens Financial Group, Inc. |

3,651 | 123,185 | ||||||

| Comerica, Inc. |

1,469 | 90,564 | ||||||

| Commerce Bancshares, Inc. |

2,574 | 146,898 | ||||||

| Cullen/Frost Bankers, Inc. |

801 | 66,491 | ||||||

| East West Bancorp., Inc. |

888 | 36,523 | ||||||

| Fifth Third Bancorp. |

7,903 | 209,034 | ||||||

| First Citizens BancShares, Inc. “A” |

259 | 115,151 | ||||||

| First Hawaiian, Inc. |

2,319 | 59,598 | ||||||

| First Horizon National Corp. |

2,070 | 32,768 | ||||||

| First Republic Bank |

1,276 | 114,483 | ||||||

| FNB Corp. |

6,783 | 72,917 | ||||||

| Huntington Bancshares, Inc. |

12,846 | 170,209 | ||||||

| JPMorgan Chase & Co. |

181 | 19,885 | ||||||

| KeyCorp |

8,116 | 134,726 | ||||||

| M&T Bank Corp. |

1,415 | 206,887 | ||||||

| PacWest Bancorp. |

1,366 | 46,553 | ||||||

| People’s United Financial, Inc. |

6,963 | 100,058 | ||||||

| Pinnacle Financial Partners, Inc. |

1,228 | 64,679 | ||||||

| PNC Financial Services Group, Inc. |

1,312 | 169,156 | ||||||

| Popular, Inc. |

5,368 | 282,196 | ||||||

| Prosperity Bancshares, Inc. |

1,109 | 71,996 | ||||||

| Regions Financial Corp. |

6,749 | 98,670 | ||||||

| Signature Bank |

841 | 98,103 | ||||||

| Sterling Bancorp. |

3,307 | 63,064 | ||||||

| SunTrust Banks, Inc. |

2,790 | 171,613 | ||||||

| SVB Financial Group* |

67 | 13,040 | ||||||

The accompanying notes are an integral part of the financial statements.

| DWS U.S. Multi-Factor Fund | | | 19 |

Table of Contents

| Shares | Value ($) | |||||||

| Synovus Financial Corp. |

520 | 18,481 | ||||||

| TCF Financial Corp. |

1,279 | 49,318 | ||||||

| U.S. Bancorp. |

3,684 | 194,110 | ||||||

| Umpqua Holdings Corp. |

2,531 | 39,762 | ||||||

| Webster Financial Corp. |

860 | 38,494 | ||||||

| Wells Fargo & Co. |

316 | 14,716 | ||||||

| Western Alliance Bancorp. |

791 | 34,345 | ||||||

| Wintrust Financial Corp. |

602 | 37,824 | ||||||

| Zions Bancorp. NA |

2,363 | 97,096 | ||||||

|

|

|

|||||||

| 3,983,422 | ||||||||

| Capital Markets 3.1% |

||||||||

| Affiliated Managers Group, Inc. |

182 | 13,947 | ||||||

| Ameriprise Financial, Inc. |

2,070 | 266,989 | ||||||

| Bank of New York Mellon Corp. |

2,509 | 105,529 | ||||||

| BlackRock, Inc. |

132 | 55,778 | ||||||

| Cboe Global Markets, Inc. |

4,521 | 538,722 | ||||||

| Charles Schwab Corp. |

1,072 | 41,025 | ||||||

| CME Group, Inc. |

688 | 149,496 | ||||||

| E*TRADE Financial Corp. |

1,448 | 60,440 | ||||||

| Eaton Vance Corp. |

3,126 | 134,793 | ||||||

| Evercore, Inc. “A” |

2,594 | 206,897 | ||||||

| FactSet Research Systems, Inc. |

2,992 | 814,093 | ||||||

| Franklin Resources., Inc. (a) |

25,966 | 682,386 | ||||||

| Interactive Brokers Group, Inc. “A” |

484 | 22,845 | ||||||

| Intercontinental Exchange, Inc. |

2,579 | 241,085 | ||||||

| Invesco Ltd. |

5,467 | 85,832 | ||||||

| Janus Henderson Group PLC |

3,377 | 64,534 | ||||||

| Lazard Ltd. “A” |

3,397 | 116,653 | ||||||

| Legg Mason, Inc. |

1,309 | 48,158 | ||||||

| LPL Financial Holdings, Inc. |

5,394 | 404,280 | ||||||

| MarketAxess Holdings, Inc. |

1,586 | 630,625 | ||||||

| Moody’s Corp. |

3,075 | 662,909 | ||||||

| Morgan Stanley |

1,520 | 63,065 | ||||||

| Morningstar, Inc. |

1,436 | 232,029 | ||||||

| MSCI, Inc. |

4,000 | 938,520 | ||||||

| Nasdaq, Inc. |

3,154 | 314,895 | ||||||

| Northern Trust Corp. |

1,424 | 125,212 | ||||||

| Raymond James Financial, Inc. |

2,696 | 211,663 | ||||||

| S&P Global, Inc. |

2,266 | 589,591 | ||||||

| SEI Investments Co. |

4,409 | 253,562 | ||||||

| State Street Corp. |

635 | 32,582 | ||||||

| T. Rowe Price Group, Inc. |

5,440 | 601,773 | ||||||

| TD Ameritrade Holding Corp. |

1,600 | 71,056 | ||||||

| The Goldman Sachs Group., Inc. |

584 | 119,083 | ||||||

|

|

|

|||||||

| 8,900,047 | ||||||||

The accompanying notes are an integral part of the financial statements.

| 20 | | | DWS U.S. Multi-Factor Fund |

Table of Contents

| Shares | Value ($) | |||||||

| Consumer Finance 0.9% |

||||||||

| Ally Financial, Inc. |

14,033 | 439,934 | ||||||

| American Express Co. |

2,548 | 306,703 | ||||||

| Capital One Financial Corp. |

3,561 | 308,454 | ||||||

| Credit Acceptance Corp.* |

457 | 206,861 | ||||||

| Discover Financial Services |

9,323 | 745,560 | ||||||

| Navient Corp. |

3,151 | 40,144 | ||||||

| Santander Consumer U.S.A. Holdings, Inc. |

1,868 | 48,773 | ||||||

| SLM Corp. |

2,413 | 20,366 | ||||||

| Synchrony Financial |

15,861 | 508,345 | ||||||

|

|

|

|||||||

| 2,625,140 | ||||||||

| Diversified Financial Services 0.1% |

||||||||

| AXA Equitable Holdings, Inc. |

6,271 | 130,249 | ||||||

| Berkshire Hathaway, Inc. “B”* |

121 | 24,612 | ||||||

| Jefferies Financial Group, Inc. |

4,562 | 85,036 | ||||||

| Voya Financial, Inc. |

3,769 | 185,887 | ||||||

|

|

|

|||||||

| 425,784 | ||||||||

| Insurance 6.0% |

||||||||

| Aflac, Inc. |

12,915 | 648,075 | ||||||

| Alleghany Corp.* |

196 | 146,865 | ||||||

| Allstate Corp. |

5,940 | 608,197 | ||||||

| American Financial Group, Inc. |

2,081 | 210,119 | ||||||

| American International Group, Inc. |

1,090 | 56,724 | ||||||

| American National Insurance Co. |

301 | 34,335 | ||||||

| Aon PLC |

2,558 | 498,426 | ||||||

| Arch Capital Group Ltd.* |

17,347 | 685,206 | ||||||

| Arthur J. Gallagher & Co. |

10,131 | 918,983 | ||||||

| Assurant, Inc. |

1,768 | 217,464 | ||||||

| Assured Guaranty Ltd. |

10,036 | 427,032 | ||||||

| Athene Holding Ltd. “A”* |

4,554 | 176,968 | ||||||

| Axis Capital Holdings Ltd. |

1,073 | 65,871 | ||||||

| Brighthouse Financial, Inc.* |

633 | 22,320 | ||||||

| Brown & Brown, Inc. |

16,133 | 595,146 | ||||||

| Chubb Ltd. |

2,202 | 344,129 | ||||||

| Cincinnati Financial Corp. |

2,928 | 329,371 | ||||||

| CNA Financial Corp. |

688 | 32,425 | ||||||

| Erie Indemnity Co. “A” |

2,725 | 597,620 | ||||||

| Everest Re Group Ltd. |

627 | 147,897 | ||||||

| Fidelity National Financial, Inc. |

25,262 | 1,110,012 | ||||||

| First American Financial Corp. |

15,287 | 893,525 | ||||||

| Globe Life, Inc. |

6,716 | 599,470 | ||||||

| Hanover Insurance Group, Inc. |

3,740 | 497,981 | ||||||

| Hartford Financial Services Group, Inc. |

8,023 | 467,580 | ||||||

| Kemper Corp. |

1,889 | 132,192 | ||||||

| Lincoln National Corp. |

2,739 | 144,838 | ||||||

The accompanying notes are an integral part of the financial statements.

| DWS U.S. Multi-Factor Fund | | | 21 |

Table of Contents

| Shares | Value ($) | |||||||

| Loews Corp. |

7,185 | 345,383 | ||||||

| Markel Corp.* |

46 | 52,582 | ||||||

| Marsh & McLennan Companies, Inc. |

8,556 | 854,659 | ||||||

| Mercury General Corp. |

764 | 40,874 | ||||||

| MetLife, Inc. |

5,285 | 234,125 | ||||||

| Old Republic International Corp. |

16,275 | 380,184 | ||||||

| Primerica, Inc. |

2,273 | 270,873 | ||||||

| Principal Financial Group, Inc. |

5,690 | 302,822 | ||||||

| Progressive Corp. |

20,307 | 1,539,271 | ||||||

| Prudential Financial, Inc. |

2,996 | 239,950 | ||||||

| Reinsurance Group of America, Inc. |

2,847 | 438,353 | ||||||

| RenaissanceRe Holdings Ltd. |

2,191 | 395,585 | ||||||

| The Travelers Companies, Inc. |

4,505 | 662,055 | ||||||

| Unum Group |

4,497 | 114,269 | ||||||

| W.R. Berkley Corp. |

7,853 | 559,526 | ||||||

| Willis Towers Watson PLC |

2,560 | 506,803 | ||||||

|

|

|

|||||||

| 17,546,085 | ||||||||

| Mortgage Real Estate Investment Trusts (REITs) 0.4% |

||||||||

| AGNC Investment Corp. |

6,484 | 96,417 | ||||||

| Annaly Capital Management, Inc. |

17,298 | 143,573 | ||||||

| Chimera Investment Corp. |

13,902 | 265,111 | ||||||

| MFA Financial, Inc. |

25,580 | 183,409 | ||||||

| New Residential Investment Corp. |

12,447 | 175,129 | ||||||

| Starwood Property Trust, Inc. |

8,661 | 202,927 | ||||||

| Two Harbors Investment Corp. |

4,107 | 51,872 | ||||||

|

|

|

|||||||

| 1,118,438 | ||||||||

| Thrifts & Mortgage Finance 0.4% |

||||||||

| MGIC Investment Corp. |

75,482 | 954,847 | ||||||

| New York Community Bancorp., Inc. |

11,346 | 130,933 | ||||||

|

|

|

|||||||

| 1,085,780 | ||||||||

| Health Care 7.9% | ||||||||

| Biotechnology 0.5% |

||||||||

| AbbVie, Inc. |

1,501 | 98,676 | ||||||

| Alexion Pharmaceuticals, Inc.* |

281 | 28,314 | ||||||

| Amgen, Inc. |

2,074 | 432,678 | ||||||

| Biogen., Inc.* |

539 | 118,445 | ||||||

| Celgene Corp.* |

2,123 | 205,506 | ||||||

| Gilead Sciences, Inc. |

4,524 | 287,455 | ||||||

| Incyte Corp.* |

240 | 19,637 | ||||||

| Regeneron Pharmaceuticals, Inc.* |

526 | 152,566 | ||||||

| United Therapeutics Corp.* |

1,306 | 107,823 | ||||||

| Vertex Pharmaceuticals, Inc.* |

244 | 43,925 | ||||||

|

|

|

|||||||

| 1,495,025 | ||||||||

The accompanying notes are an integral part of the financial statements.

| 22 | | | DWS U.S. Multi-Factor Fund |

Table of Contents

| Shares | Value ($) | |||||||

| Health Care Equipment & Supplies 2.5% |

||||||||

| Abbott Laboratories |

1,886 | 160,913 | ||||||

| Align Technology, Inc.* |

255 | 46,693 | ||||||

| Baxter International, Inc. |

7,941 | 698,411 | ||||||

| Becton, Dickinson & Co. |

59 | 14,981 | ||||||

| Boston Scientific Corp.* |

3,216 | 137,420 | ||||||

| Cantel Medical Corp. |

219 | 20,133 | ||||||

| Danaher Corp. |

1,590 | 225,923 | ||||||

| DENTSPLY SIRONA, Inc. |

1,612 | 84,066 | ||||||

| Edwards Lifesciences Corp.* |

1,803 | 399,977 | ||||||

| Hill-Rom Holdings, Inc. |

2,721 | 292,997 | ||||||

| Hologic, Inc.* |

3,026 | 149,394 | ||||||

| ICU Medical, Inc.* |

170 | 27,497 | ||||||

| IDEXX Laboratories, Inc.* |

1,257 | 364,203 | ||||||

| Integra LifeSciences Holdings Corp.* |

381 | 22,868 | ||||||

| Intuitive Surgical, Inc.* |

361 | 184,594 | ||||||

| Masimo Corp.* |

3,175 | 486,569 | ||||||

| Medtronic PLC |

1,651 | 178,126 | ||||||

| ResMed, Inc. |

3,862 | 537,977 | ||||||

| STERIS PLC |

5,228 | 807,203 | ||||||

| Stryker Corp. |

1,165 | 257,069 | ||||||

| Teleflex, Inc. |

677 | 246,374 | ||||||

| The Cooper Companies, Inc. |

1,388 | 429,933 | ||||||

| Varian Medical Systems, Inc.* |

5,301 | 561,535 | ||||||

| West Pharmaceutical Services, Inc. |

5,184 | 754,065 | ||||||

| Zimmer Biomet Holdings, Inc. |

1,640 | 228,288 | ||||||

|

|

|

|||||||

| 7,317,209 | ||||||||

| Health Care Providers & Services 2.6% |

||||||||

| AmerisourceBergen Corp. |

4,120 | 338,952 | ||||||

| Anthem, Inc. |

1,388 | 362,990 | ||||||

| Cardinal Health, Inc. |

9,219 | 397,616 | ||||||

| Centene Corp.* |

988 | 46,061 | ||||||

| Chemed Corp. |

1,548 | 664,758 | ||||||

| Covetrus, Inc.* |

20,349 | 270,438 | ||||||

| DaVita, Inc.* |

1,262 | 71,139 | ||||||

| Encompass Health Corp. |

3,999 | 243,099 | ||||||

| HCA Healthcare, Inc. |

5,426 | 652,205 | ||||||

| Henry Schein, Inc.* |

17,734 | 1,092,769 | ||||||

| Humana, Inc. |

1,724 | 488,254 | ||||||

| Laboratory Corp. of America Holdings* |

2,345 | 392,928 | ||||||

| McKesson Corp. |

4,190 | 579,351 | ||||||

| MEDNAX, Inc.* |

729 | 15,367 | ||||||

| Molina Healthcare, Inc.* |

829 | 108,002 | ||||||

| Premier, Inc. “A”* |

11,042 | 389,341 | ||||||

| Quest Diagnostics, Inc. |

3,524 | 360,752 | ||||||

The accompanying notes are an integral part of the financial statements.

| DWS U.S. Multi-Factor Fund | | | 23 |

Table of Contents

| Shares | Value ($) | |||||||

| UnitedHealth Group, Inc. |

398 | 93,132 | ||||||

| Universal Health Services, Inc. “B” |

6,262 | 905,360 | ||||||

| WellCare Health Plans, Inc.* |

152 | 41,153 | ||||||

|

|

|

|||||||

| 7,513,667 | ||||||||

| Health Care Technology 0.5% |

||||||||

| Cerner Corp. |

17,202 | 1,185,390 | ||||||

| Medidata Solutions, Inc.* |

867 | 79,400 | ||||||

| Veeva Systems, Inc. “A”* |

1,200 | 192,456 | ||||||

|

|

|

|||||||

| 1,457,246 | ||||||||

| Life Sciences Tools & Services 1.2% |

||||||||

| Agilent Technologies, Inc. |

7,401 | 526,285 | ||||||

| Bio-Rad Laboratories, Inc. “A”* |

495 | 167,166 | ||||||

| Bio-Techne Corp. |

1,375 | 263,409 | ||||||

| Bruker Corp. |

5,143 | 222,023 | ||||||

| Charles River Laboratories International, Inc.* |

1,755 | 230,256 | ||||||

| Illumina, Inc.* |

134 | 37,700 | ||||||

| IQVIA Holdings, Inc.* |

2,298 | 356,535 | ||||||

| Mettler-Toledo International, Inc.* |

884 | 580,602 | ||||||

| PerkinElmer, Inc. |

2,299 | 190,127 | ||||||

| PRA Health Sciences, Inc.* |

993 | 98,148 | ||||||

| QIAGEN NV* |

1,953 | 67,750 | ||||||

| Thermo Fisher Scientific, Inc. |

726 | 208,406 | ||||||

| Waters Corp.* |

2,624 | 555,999 | ||||||

|

|

|

|||||||

| 3,504,406 | ||||||||

| Pharmaceuticals 0.6% |

||||||||

| Allergan PLC |

139 | 22,201 | ||||||

| Bristol-Myers Squibb Co. |

5,949 | 285,968 | ||||||

| Catalent, Inc.* |

1,042 | 54,955 | ||||||

| Elanco Animal Health, Inc.* |

7,045 | 183,311 | ||||||

| Eli Lilly & Co. |

2,798 | 316,090 | ||||||

| Jazz Pharmaceuticals PLC* |

818 | 104,827 | ||||||

| Johnson & Johnson |

706 | 90,622 | ||||||

| Merck & Co., Inc. |

1,996 | 172,594 | ||||||

| Perrigo Co. PLC |

215 | 10,058 | ||||||

| Pfizer, Inc. |

3,018 | 107,290 | ||||||

| Zoetis, Inc. |

2,927 | 370,031 | ||||||

|

|

|

|||||||

| 1,717,947 | ||||||||

| Industrials 16.9% | ||||||||

| Aerospace & Defense 2.2% |

||||||||

| Arconic, Inc. |

3,031 | 78,321 | ||||||

| Boeing Co. |

337 | 122,698 | ||||||

| BWX Technologies, Inc. |

1,106 | 65,475 | ||||||

| Curtiss-Wright Corp. |

1,967 | 241,233 | ||||||

The accompanying notes are an integral part of the financial statements.

| 24 | | | DWS U.S. Multi-Factor Fund |

Table of Contents

| Shares | Value ($) | |||||||

| General Dynamics Corp. |

1,050 | 200,833 | ||||||

| HEICO Corp. |

1,000 | 144,670 | ||||||

| HEICO Corp. “A” |

2,223 | 245,330 | ||||||

| Hexcel Corp. |

5,193 | 436,991 | ||||||

| Huntington Ingalls Industries, Inc. |

3,927 | 820,743 | ||||||

| L3Harris Technologies, Inc. |

5,702 | 1,205,460 | ||||||

| Lockheed Martin Corp. |

698 | 268,109 | ||||||

| Northrop Grumman Corp. |

555 | 204,168 | ||||||

| Raytheon Co. |

2,269 | 420,491 | ||||||

| Spirit AeroSystems Holdings, Inc. “A” |

6,023 | 485,454 | ||||||

| Teledyne Technologies, Inc.* |

2,484 | 766,538 | ||||||

| Textron, Inc. |

4,137 | 186,165 | ||||||

| TransDigm Group, Inc. |

571 | 307,381 | ||||||

| United Technologies Corp. |

627 | 81,660 | ||||||

|

|

|

|||||||

| 6,281,720 | ||||||||

| Air Freight & Logistics 0.8% |

||||||||

| C.H. Robinson Worldwide, Inc. |

11,759 | 993,518 | ||||||

| Expeditors International of Washington, Inc. |

11,371 | 808,478 | ||||||

| FedEx Corp. |

457 | 72,485 | ||||||

| United Parcel Service, Inc. “B” |

4,301 | 510,356 | ||||||

|

|

|

|||||||

| 2,384,837 | ||||||||

| Airlines 1.2% |

||||||||

| Alaska Air Group, Inc. |

8,366 | 499,618 | ||||||

| American Airlines Group, Inc. |

1,109 | 29,178 | ||||||

| Copa Holdings SA “A” |

336 | 34,668 | ||||||

| Delta Air Lines, Inc. |

17,070 | 987,670 | ||||||

| JetBlue Airways Corp.* |

20,693 | 358,403 | ||||||

| Southwest Airlines Co. |

21,436 | 1,121,531 | ||||||

| United Airlines Holdings, Inc.* |

6,306 | 531,659 | ||||||

|

|

|

|||||||

| 3,562,727 | ||||||||

| Building Products 1.4% |

||||||||

| A.O. Smith Corp. |

3,074 | 143,002 | ||||||

| Allegion PLC |

5,325 | 512,638 | ||||||

| Armstrong World Industries, Inc. |

3,500 | 334,145 | ||||||

| Fortune Brands Home & Security, Inc. |

7,927 | 404,753 | ||||||

| Johnson Controls International PLC |

18,098 | 772,604 | ||||||

| Lennox International, Inc. |

3,322 | 843,057 | ||||||

| Masco Corp. |

18,784 | 765,072 | ||||||

| Owens Corning |

1,613 | 92,522 | ||||||

| Resideo Technologies, Inc.* |

16,608 | 228,858 | ||||||

|

|

|

|||||||

| 4,096,651 | ||||||||

| Commercial Services & Supplies 1.2% |

||||||||

| Cintas Corp. |

2,045 | 539,471 | ||||||

| Clean Harbors, Inc.* |

4,238 | 311,705 | ||||||

The accompanying notes are an integral part of the financial statements.

| DWS U.S. Multi-Factor Fund | | | 25 |

Table of Contents

| Shares | Value ($) | |||||||

| Copart, Inc.* |

6,815 | 513,783 | ||||||

| IAA, Inc.* |

8,712 | 425,581 | ||||||

| KAR Auction Services, Inc. |

8,565 | 227,486 | ||||||

| Republic Services, Inc. |

5,393 | 481,325 | ||||||

| Rollins, Inc. |

5,816 | 190,823 | ||||||

| Waste Management, Inc. |

6,807 | 812,416 | ||||||

|

|

|

|||||||

| 3,502,590 | ||||||||

| Construction & Engineering 0.3% |

||||||||

| AECOM* |

7,658 | 271,706 | ||||||

| Fluor Corp. |

556 | 9,824 | ||||||

| Jacobs Engineering Group, Inc. |

1,756 | 156,038 | ||||||

| Quanta Services, Inc. |

8,351 | 283,099 | ||||||

| Valmont Industries, Inc. |

482 | 65,311 | ||||||

|

|

|

|||||||

| 785,978 | ||||||||

| Electrical Equipment 1.1% |

||||||||

| Acuity Brands, Inc. |

2,467 | 309,386 | ||||||

| AMETEK, Inc. |

5,940 | 510,424 | ||||||

| Eaton Corp. PLC |

9,217 | 743,996 | ||||||

| Emerson Electric Co. |

6,883 | 410,158 | ||||||

| Hubbell, Inc. |

2,715 | 356,045 | ||||||

| nVent Electric PLC |

3,537 | 71,660 | ||||||

| Regal Beloit Corp. |

2,664 | 188,878 | ||||||

| Rockwell Automation, Inc. |

3,735 | 570,671 | ||||||

| Sensata Technologies Holding PLC* |

2,988 | 136,193 | ||||||

|

|

|

|||||||

| 3,297,411 | ||||||||

| Industrial Conglomerates 0.7% |

||||||||

| 3M Co. |

992 | 160,426 | ||||||

| Carlisle Companies, Inc. |

6,934 | 1,005,153 | ||||||

| Honeywell International, Inc. |

2,536 | 417,476 | ||||||

| Roper Technologies, Inc. |

976 | 357,958 | ||||||

|

|

|

|||||||

| 1,941,013 | ||||||||

| Machinery 5.2% |

||||||||

| AGCO Corp. |

9,497 | 656,433 | ||||||

| Allison Transmission Holdings, Inc. |

15,650 | 695,329 | ||||||

| Caterpillar, Inc. |

1,115 | 132,685 | ||||||

| Colfax Corp.* |

1,043 | 28,370 | ||||||

| Crane Co. |

3,875 | 295,430 | ||||||

| Cummins, Inc. |

12,123 | 1,809,600 | ||||||

| Deere & Co. |

1,001 | 155,065 | ||||||

| Donaldson Co., Inc. |

7,698 | 372,275 | ||||||

| Dover Corp. |

9,028 | 846,285 | ||||||

| Flowserve Corp. |

3,204 | 136,747 | ||||||

| Fortive Corp. |

6,145 | 435,680 | ||||||

| Gardner Denver Holdings, Inc.* |

820 | 23,518 | ||||||

The accompanying notes are an integral part of the financial statements.

| 26 | | | DWS U.S. Multi-Factor Fund |

Table of Contents

| Shares | Value ($) | |||||||

| Graco, Inc. |

10,721 | 488,556 | ||||||

| IDEX Corp. |

3,220 | 530,366 | ||||||

| Illinois Tool Works, Inc. |

4,314 | 646,496 | ||||||

| Ingersoll-Rand PLC |

5,826 | 705,470 | ||||||

| ITT, Inc. |

7,711 | 438,910 | ||||||

| Lincoln Electric Holdings, Inc. |

3,084 | 254,615 | ||||||

| Middleby Corp.* |

1,582 | 173,482 | ||||||

| Nordson Corp. |

2,198 | 298,840 | ||||||

| Oshkosh Corp. |

4,858 | 341,372 | ||||||

| PACCAR, Inc. |

21,372 | 1,401,148 | ||||||

| Parker-Hannifin Corp. |

3,968 | 657,775 | ||||||

| Pentair PLC |

6,828 | 245,262 | ||||||

| Snap-on, Inc. |

5,289 | 786,369 | ||||||

| Stanley Black & Decker, Inc. |

3,135 | 416,516 | ||||||

| Timken Co. |

2,867 | 115,196 | ||||||

| Toro Co. |

12,606 | 907,758 | ||||||

| WABCO Holdings, Inc.* |

5,276 | 704,399 | ||||||

| Wabtec Corp. |

230 | 15,918 | ||||||

| Woodward, Inc. |

1,396 | 150,559 | ||||||

| Xylem, Inc. |

4,750 | 363,898 | ||||||

|

|

|

|||||||

| 15,230,322 | ||||||||

| Marine 0.0% |

||||||||

| Kirby Corp.* |

1,204 | 88,602 | ||||||

| Professional Services 0.8% |

||||||||

| CoStar Group, Inc.* |

645 | 396,591 | ||||||

| Equifax, Inc. |

1,466 | 214,593 | ||||||

| IHS Markit Ltd.* |

3,711 | 243,479 | ||||||

| ManpowerGroup, Inc. |

6,684 | 546,350 | ||||||

| Nielsen Holdings PLC |

1,033 | 21,445 | ||||||

| Robert Half International, Inc. |

5,531 | 295,743 | ||||||

| TransUnion |

1,043 | 87,247 | ||||||

| Verisk Analytics, Inc. |

3,639 | 587,844 | ||||||

|

|

|

|||||||

| 2,393,292 | ||||||||

| Road & Rail 1.2% |

||||||||

| AMERCO |

529 | 186,007 | ||||||

| CSX Corp. |

4,145 | 277,798 | ||||||

| Genesee & Wyoming, Inc. “A”* |

1,591 | 176,410 | ||||||

| J.B. Hunt Transport Services, Inc. |

2,698 | 291,492 | ||||||

| Kansas City Southern |

4,053 | 509,868 | ||||||

| Knight-Swift Transportation Holdings, Inc. |

3,324 | 113,481 | ||||||

| Landstar System, Inc. |

4,996 | 557,154 | ||||||

| Norfolk Southern Corp. |

2,566 | 446,612 | ||||||

| Old Dominion Freight Line, Inc. |

2,375 | 388,930 | ||||||

| Ryder System, Inc. |

1,414 | 68,112 | ||||||

The accompanying notes are an integral part of the financial statements.

| DWS U.S. Multi-Factor Fund | | | 27 |

Table of Contents

| Shares | Value ($) | |||||||

| Schneider National, Inc. “B” |

1,399 | 27,197 | ||||||

| Union Pacific Corp. |

1,633 | 264,481 | ||||||

|

|

|

|||||||

| 3,307,542 | ||||||||

| Trading Companies & Distributors 0.7% |

||||||||

| Air Lease Corp. |

2,023 | 84,035 | ||||||

| Fastenal Co. |

25,482 | 780,259 | ||||||

| HD Supply Holdings, Inc.* |

9,327 | 362,914 | ||||||

| MSC Industrial Direct Co., Inc. “A” |

2,227 | 150,590 | ||||||

| United Rentals, Inc.* |

188 | 21,161 | ||||||

| Univar, Inc.* |

2,431 | 47,040 | ||||||

| W.W. Grainger, Inc. |

906 | 247,927 | ||||||

| Watsco, Inc. |

1,562 | 255,465 | ||||||

| WESCO International, Inc.* |

1,515 | 68,296 | ||||||

|

|

|

|||||||

| 2,017,687 | ||||||||

| Transportation Infrastructure 0.1% |

||||||||

| Macquarie Infrastructure Corp. |

4,355 | 164,706 | ||||||

| Information Technology 14.9% | ||||||||

| Communications Equipment 0.7% |

||||||||

| Arista Networks, Inc.* |

83 | 18,810 | ||||||

| Ciena Corp.* |

5,715 | 233,915 | ||||||

| Cisco Systems, Inc. |

4,694 | 219,726 | ||||||

| EchoStar Corp. “A”* |

749 | 31,645 | ||||||

| F5 Networks, Inc.* |

2,436 | 313,586 | ||||||

| Juniper Networks, Inc. |

19,496 | 451,528 | ||||||

| Motorola Solutions, Inc. |

3,941 | 712,966 | ||||||

| Ubiquiti, Inc. |

164 | 18,124 | ||||||

| ViaSat, Inc.* |

2,058 | 163,261 | ||||||

|

|

|

|||||||

| 2,163,561 | ||||||||

| Electronic Equipment, Instruments & Components 2.0% |

||||||||

| Amphenol Corp. “A” |

5,560 | 486,723 | ||||||

| Arrow Electronics, Inc.* |

2,427 | 167,948 | ||||||

| Avnet, Inc. |

8,484 | 355,395 | ||||||

| CDW Corp. |

16,778 | 1,937,859 | ||||||

| Cognex Corp. |

2,004 | 90,340 | ||||||

| Corning, Inc. |

31,006 | 863,517 | ||||||

| Dolby Laboratories, Inc. “A” |

3,741 | 230,296 | ||||||

| FLIR Systems, Inc. |

5,528 | 272,365 | ||||||

| Jabil, Inc. |

16,035 | 461,968 | ||||||

| Keysight Technologies, Inc.* |

2,972 | 287,868 | ||||||

| Littelfuse, Inc. |

203 | 31,682 | ||||||

| National Instruments Corp. |

4,935 | 207,270 | ||||||

| Trimble, Inc.* |

2,881 | 108,095 | ||||||

| Zebra Technologies Corp. “A”* |

1,092 | 223,893 | ||||||

|

|

|

|||||||

| 5,725,219 | ||||||||

The accompanying notes are an integral part of the financial statements.

| 28 | | | DWS U.S. Multi-Factor Fund |

Table of Contents

| Shares | Value ($) | |||||||

| IT Services 4.8% |

||||||||

| Accenture PLC “A” |

1,887 | 373,947 | ||||||

| Akamai Technologies, Inc.* |

3,827 | 341,101 | ||||||

| Alliance Data Systems Corp. |

224 | 27,541 | ||||||

| Amdocs Ltd. |

12,426 | 804,459 | ||||||

| Automatic Data Processing, Inc. |

2,389 | 405,748 | ||||||

| Black Knight, Inc.* |

4,758 | 296,185 | ||||||

| Booz Allen Hamilton Holding Corp. |

11,251 | 849,563 | ||||||

| Broadridge Financial Solutions, Inc. |

4,546 | 588,434 | ||||||

| CACI International, Inc. “A”* |

1,891 | 420,350 | ||||||

| Cognizant Technology Solutions Corp. “A” |

4,599 | 282,333 | ||||||

| CoreLogic, Inc.* |

1,017 | 49,223 | ||||||

| DXC Technology Co. |

1,182 | 39,266 | ||||||

| EPAM Systems, Inc.* |

4,542 | 869,021 | ||||||

| Euronet Worldwide, Inc.* |

2,594 | 397,245 | ||||||

| Fidelity National Information Services, Inc. |

2,165 | 294,916 | ||||||

| Fiserv, Inc.* |

6,009 | 642,602 | ||||||

| FleetCor Technologies, Inc.* |

1,245 | 371,508 | ||||||

| Gartner, Inc.* |

2,304 | 307,976 | ||||||

| Genpact Ltd. |

11,779 | 482,468 | ||||||

| Global Payments, Inc. |

1,130 | 187,557 | ||||||

| GoDaddy, Inc. “A”* |

1,196 | 75,755 | ||||||

| International Business Machines Corp. |

3,555 | 481,809 | ||||||

| Jack Henry & Associates, Inc. |

3,423 | 496,198 | ||||||

| Leidos Holdings, Inc. |

13,671 | 1,194,299 | ||||||

| MasterCard, Inc. “A” |

322 | 90,601 | ||||||

| Paychex, Inc. |

8,226 | 672,064 | ||||||

| PayPal Holdings, Inc.* |

1,157 | 126,171 | ||||||

| Sabre Corp. |

4,921 | 116,332 | ||||||

| Total System Services, Inc. |

1,281 | 171,936 | ||||||

| VeriSign, Inc.* |

5,450 | 1,110,982 | ||||||

| Visa, Inc. “A” |

419 | 75,764 | ||||||

| Western Union Co. |

57,732 | 1,277,032 | ||||||

| WEX, Inc.* |

538 | 110,048 | ||||||

|

|

|

|||||||

| 14,030,434 | ||||||||

| Semiconductors & Semiconductor Equipment 3.0% |

||||||||

| Analog Devices, Inc. |

4,776 | 524,548 | ||||||

| Applied Materials, Inc. |

15,851 | 761,165 | ||||||

| Broadcom, Inc. |

871 | 246,179 | ||||||

| Cypress Semiconductor Corp. |

8,017 | 184,471 | ||||||

| Entegris, Inc. |

3,781 | 161,940 | ||||||

| Intel Corp. |

3,801 | 180,205 | ||||||

| KLA Corp. |

7,307 | 1,080,705 | ||||||

| Lam Research Corp. |

9,166 | 1,929,535 | ||||||

| Maxim Integrated Products, Inc. |

7,460 | 406,868 | ||||||

The accompanying notes are an integral part of the financial statements.

| DWS U.S. Multi-Factor Fund | | | 29 |

Table of Contents

| Shares | Value ($) | |||||||

| Microchip Technology, Inc. |

213 | 18,388 | ||||||

| MKS Instruments, Inc. |

2,380 | 186,330 | ||||||

| Monolithic Power Systems, Inc. |

1,251 | 188,351 | ||||||

| ON Semiconductor Corp.* |

2,976 | 52,973 | ||||||

| Qorvo, Inc.* |

620 | 44,287 | ||||||

| QUALCOMM., Inc. |

1,019 | 79,248 | ||||||

| Skyworks Solutions, Inc. |

2,470 | 185,917 | ||||||

| Teradyne, Inc. |

20,316 | 1,076,139 | ||||||

| Texas Instruments, Inc. |

4,271 | 528,536 | ||||||

| Versum Materials, Inc. |

2,743 | 142,636 | ||||||

| Xilinx, Inc. |

7,066 | 735,288 | ||||||

|

|

|

|||||||

| 8,713,709 | ||||||||

| Software 3.3% |

||||||||

| Adobe, Inc.* |

734 | 208,830 | ||||||

| ANSYS, Inc.* |

3,728 | 770,056 | ||||||

| Aspen Technology, Inc.* |

5,467 | 728,204 | ||||||

| Atlassian Corp. PLC “A”* |

200 | 26,902 | ||||||

| Autodesk, Inc.* |

230 | 32,849 | ||||||

| Avalara, Inc.* |

359 | 30,278 | ||||||

| Cadence Design Systems, Inc.* |

17,336 | 1,187,169 | ||||||

| CDK Global, Inc. |

3,349 | 144,543 | ||||||

| Citrix Systems, Inc. |

5,437 | 505,532 | ||||||

| Fair Isaac Corp.* |

1,218 | 429,613 | ||||||

| Fortinet, Inc.* |

7,475 | 591,871 | ||||||

| Guidewire Software, Inc.* |

326 | 31,355 | ||||||

| Intuit, Inc. |

2,337 | 673,897 | ||||||

| LogMeIn, Inc. |

456 | 30,479 | ||||||

| Manhattan Associates, Inc.* |

4,218 | 348,533 | ||||||

| Microsoft Corp. |

1,757 | 242,220 | ||||||

| Nuance Communications, Inc.* |

4,631 | 77,847 | ||||||

| Oracle Corp. |

3,358 | 174,818 | ||||||

| Palo Alto Networks, Inc.* |

419 | 85,317 | ||||||

| Paycom Software, Inc.* |

237 | 59,278 | ||||||

| Pegasystems, Inc. |

340 | 23,851 | ||||||

| Proofpoint, Inc.* |

142 | 16,133 | ||||||

| PTC, Inc.* |

1,025 | 67,107 | ||||||

| RealPage, Inc.* |

457 | 29,097 | ||||||

| salesforce.com, Inc.* |

948 | 147,954 | ||||||

| ServiceNow, Inc.* |

499 | 130,658 | ||||||

| SS&C Technologies Holdings, Inc. |

697 | 32,487 | ||||||

| Symantec Corp. |

6,624 | 154,008 | ||||||

| Synopsys, Inc.* |

10,893 | 1,544,736 | ||||||

| Teradata Corp.* |

2,937 | 90,665 | ||||||

| Tyler Technologies, Inc.* |

1,051 | 269,624 | ||||||

The accompanying notes are an integral part of the financial statements.

| 30 | | | DWS U.S. Multi-Factor Fund |

Table of Contents

| Shares | Value ($) | |||||||

| VMware, Inc. “A” |

3,893 | 550,626 | ||||||

| Workday, Inc. “A”* |

202 | 35,811 | ||||||

|

|

|

|||||||

| 9,472,348 | ||||||||

| Technology Hardware, Storage & Peripherals 1.1% |

||||||||

| Apple, Inc. |

1,840 | 384,082 | ||||||

| Dell Technologies Inc. “C”* |

10,331 | 532,356 | ||||||

| Hewlett Packard Enterprise Co. |

32,932 | 455,120 | ||||||

| HP, Inc. |

42,937 | 785,318 | ||||||

| NCR Corp.* |

2,082 | 65,604 | ||||||

| NetApp, Inc. |

11,209 | 538,704 | ||||||

| Xerox Holdings Corp. |

13,321 | 386,176 | ||||||

|

|

|

|||||||

| 3,147,360 | ||||||||

| Materials 5.1% | ||||||||

| Chemicals 2.6% |

||||||||

| Air Products & Chemicals, Inc. |

4,313 | 974,393 | ||||||

| Albemarle Corp. |

1,122 | 69,261 | ||||||

| Ashland Global Holdings, Inc. |

2,318 | 169,770 | ||||||

| Axalta Coating Systems Ltd.* |

4,303 | 124,271 | ||||||

| Cabot Corp. |

1,101 | 44,040 | ||||||

| Celanese Corp. |

6,887 | 780,779 | ||||||

| CF Industries Holdings, Inc. |

2,853 | 137,486 | ||||||

| Corteva, Inc. |

974 | 28,558 | ||||||

| Dow, Inc. |

16,915 | 721,087 | ||||||

| DuPont de Nemours, Inc. |

1,608 | 109,231 | ||||||

| Eastman Chemical Co. |

1,911 | 124,922 | ||||||

| Ecolab, Inc. |

2,588 | 533,930 | ||||||

| FMC Corp. |

2,643 | 228,170 | ||||||

| LyondellBasell Industries NV “A” |

2,663 | 206,063 | ||||||

| NewMarket Corp. |

780 | 370,305 | ||||||

| Olin Corp. |

2,628 | 44,623 | ||||||

| PPG Industries, Inc. |

8,697 | 963,541 | ||||||

| RPM International, Inc. |

9,331 | 631,429 | ||||||

| Scotts Miracle-Gro Co. |

1,112 | 118,228 | ||||||

| The Mosaic Co. |

4,291 | 78,912 | ||||||

| The Sherwin-Williams Co. |

929 | 489,351 | ||||||

| Valvoline, Inc. |

16,302 | 368,425 | ||||||

| W.R. Grace & Co. |

2,171 | 146,998 | ||||||

|

|

|

|||||||

| 7,463,773 | ||||||||

| Construction Materials 0.1% |

||||||||

| Eagle Materials, Inc. |

363 | 30,561 | ||||||

| Martin Marietta Materials, Inc. |

367 | 93,133 | ||||||

| Vulcan Materials Co. |

1,375 | 194,219 | ||||||

|

|

|

|||||||

| 317,913 | ||||||||

The accompanying notes are an integral part of the financial statements.

| DWS U.S. Multi-Factor Fund | | | 31 |

Table of Contents

| Shares | Value ($) | |||||||

| Containers & Packaging 1.8% |

||||||||

| AptarGroup, Inc. |

2,357 | 288,072 | ||||||

| Ardagh Group SA |

1,489 | 24,911 | ||||||

| Avery Dennison Corp. |

5,844 | 675,391 | ||||||

| Ball Corp. |

13,754 | 1,105,959 | ||||||

| Berry Global Group, Inc.* |

8,275 | 323,883 | ||||||

| Crown Holdings, Inc.* |

6,809 | 448,305 | ||||||

| Graphic Packaging Holding Co. |

1,569 | 21,668 | ||||||

| International Paper Co. |

11,518 | 450,354 | ||||||

| Owens-Illinois, Inc. |

7,094 | 72,146 | ||||||

| Packaging Corp. of America |

3,253 | 327,187 | ||||||