UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSR

Investment Company Act file number: 811-06071

Deutsche DWS Institutional Funds

(Exact Name of Registrant as Specified in Charter)

345 Park Avenue

New York, NY 10154-0004

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 250-2500

Diane Kenneally

One International Place

Boston, MA 02110

(Name and Address of Agent for Service)

| Date of fiscal year end: | 12/31 |

| Date of reporting period: | 12/31/2018 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

Table of Contents

Table of Contents

This report must be preceded or accompanied by a prospectus. To obtain a summary prospectus, if available, or prospectus for any of our funds, refer to the Account Management Resources information provided in the back of this booklet. We advise you to consider the Fund’s objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the Fund. Please read the prospectus carefully before you invest.

Investing in foreign securities presents certain risks, such as currency fluctuations, political and economic changes, and market risks. Various factors, including costs, cash flows and security selection, may cause the Fund’s performance to differ from that of the index. The Fund may lend securities to approved institutions. Stocks may decline in value. Please read the prospectus for details.

In June 2016, citizens of the United Kingdom approved a referendum to leave the European Union (EU) and in March 2017, the United Kingdom initiated its withdrawal from the EU, which is expected to take place by March 2019. Significant uncertainty exists regarding the United Kingdom’s anticipated withdrawal from the EU and any adverse economic and political effects such withdrawal may have on the United Kingdom, other EU countries and the global economy.

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc. which offers investment products or DWS Investment Management Americas, Inc. and RREEF America L.L.C. which offer advisory services.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

| 2 | | | DWS EAFE® Equity Index Fund |

Table of Contents

Dear Shareholder:

The picture for the economy and markets continues to be positive with corporate fundamentals continuing to be solid, a tight labor market and inflation near the Federal Reserve Bank’s target.

Nevertheless, the fourth quarter of 2018 introduced a level of volatility that investors have not seen in quite a while. That trend continues into the new year, triggered by uncertainty around trade conflicts, the withdrawal of liquidity by central banks, higher interest rates and concerns around European hot spots such as Italy and the United Kingdom.

While these issues bear close watching, our Chief investment Officer (“CIO”) and Chief Economist agree that the markets remain broadly attractive. The rate hike cycle appears to be nearing its end, inflation remains under control and recession is not on the near horizon.

The “Insight” section of our Web site, dws.com, is home to a comprehensive library of market and economic views around current developments, opportunities and emerging risks. We invite you to visit us online often to stay apprised of the market landscape and what it may mean for you.

Best regards,

|

Hepsen Uzcan

President, DWS Funds |

Assumptions, estimates and opinions contained in this document constitute our judgment as of the date of the document and are subject to change without notice. Any projections are based on a number of assumptions as to market conditions and there can be no guarantee that any projected results will be achieved. Past performance is not a guarantee of future results.

| DWS EAFE® Equity Index Fund | | | 3 |

Table of Contents

| Portfolio Management Review | (Unaudited) |

Market Overview and Fund Performance

All performance information below is historical and does not guarantee future results. Returns shown are for Institutional Class shares, unadjusted for sales charges. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may differ from performance data shown. Please visit dws.com for the most recent month-end performance of all share classes. Fund performance includes reinvestment of all distributions. Unadjusted returns do not reflect sales charges and would have been lower if they had. Please refer to pages 8 through 9 for more complete performance information.

Investment Objective

The Fund seeks to replicate, as closely as possible, before the deduction of expenses, the performance of the Morgan Stanley Capital International (“MSCI”) EAFE Index, which emphasizes stocks of companies in major markets in Europe, Australasia and the Far East.

DWS EAFE® Equity Index Fund returned –13.69% in 2018, which compares with a return of –13.79% for its benchmark, the Morgan Stanley Capital International (MSCI) Europe, Australasia and Far East (EAFE) Index.

International stocks entered January with continued momentum from their strong showing in the prior year. The MSCI EAFE Index posted a gain of 25.02% in 2017, reflecting investor optimism about the prospects for a synchronized global economic recovery. However, the outlook grew gradually less favorable as 2018 progressed due to incoming data showing that growth outside of the United States was in fact decelerating. The foreign markets moved steadily lower throughout the year as a result, causing the index to lag U.S. equities by a wide margin through the middle two calendar quarters. The downturn picked up steam in the final three months of the year, when a sharp increase in investor risk aversion fueled broad-based weakness in equities across the globe. The sell-off caused the index to post its worst return since 2008 and finish behind the U.S. market, as gauged by the –4.38% return of the S&P 500 Index.

Currency translation also had an adverse impact on the returns of international equities for U.S.-based investors, reversing another trend that was in place in the previous year. The MSCI EAFE Index returned

| 4 | | | DWS EAFE® Equity Index Fund |

Table of Contents

–10.99% in local currency terms in 2018, indicating that currency performance detracted nearly three percentage points of return for those measuring results in U.S dollars. Most foreign currencies lost ground against the dollar due to the relative strength of the U.S. economy and the fact that the U.S. Federal Reserve continued to raise rates at a faster pace than other major central banks.

European Markets Underperform

European equities performed poorly and finished behind the index, reflecting the region’s sluggish economic growth and expectations that the European Central Bank would begin to reduce monetary stimulus in 2019. A host of political developments further weighed on the markets, including Italy’s rising government debt, the ongoing Brexit negotiations, and the rise of populist movements across the Continent. Germany was a particularly notable underperformer, with a loss of more than 22% in U.S. dollar terms.

The story was somewhat more favorable in Asia, where Australia and New Zealand outpaced the MSCI EAFE Index. Singapore and Hong Kong, both of which were aided by their close ties to China, also outperformed. Japan, which is the largest index component with a weighting of approximately 25%, generated a modest performance advantage. The country gained a relative benefit from a stable political picture, slow but steady economic growth, and improving corporate results. In addition, investors remained confident that the country’s central bank would maintain an accommodative monetary policy in 2019.

Financials and Cyclical Stocks Weigh on Index Returns

Financial stocks — which have an allocation of approximately 20% in the index — produced the weakest return of the 11 major sectors. Financials lagged due to the effects of slowing growth and the gradual tightening of monetary policy by global central banks. HSBC Holdings PLC (United Kingdom), BNP Paribas SA (France), and Banco Santander SA (Spain) were among the largest detractors from the sector’s performance. (Contribution and detraction incorporate both a stock’s total return and its weighting in the benchmark.)

Uncertainty about economic growth also weighed heavily on the materials, industrials, and consumer discretionary sectors. Commodity

| DWS EAFE® Equity Index Fund | | | 5 |

Table of Contents

prices fell sharply in the fourth quarter due to concerns about the 2019 outlook for global demand, leading to sizable downturns for the majority of the stocks in the materials sector. Industrials, for their part, were hurt by both the slowing economy and questions surrounding U.S. trade policy. Industrial conglomerates such as Siemens AG (Germany), ABB Ltd. (Switzerland), and Komatsu Ltd. (Japan) lagged considerably and dragged down the return of the sector as a whole. The shortfall in the consumer discretionary sector stemmed largely from the weakness in the producers of automobiles, auto components, and tires. Investors grew concerned that global auto sales had peaked and were set to turn lower, causing sizable losses for stocks such as Daimler AG (Germany) and Continental AG (Germany). Shares of companies specializing in luxury brands, including LVMH Moet Hennessy Louis Vuitton SE (France) and Compagnie Financiere Richemont SA (Switzerland), also underperformed due to the broader worries about consumer spending.

On the positive side, utility stocks finished well ahead of the index. The sector experienced strong relative performance in the fourth-quarter market downturn, during which investors gravitated to defensive, dividend-paying equities. Other sectors seen as having defensive qualities, including health care, consumer staples, and real estate, also delivered market-beating returns. Lastly, energy outperformed despite the sharp decline in the price of oil from the beginning of October onward.

Portfolio Positioning

The Fund invested in equity index futures and currency forward contracts during the year, with the goal of keeping the portfolio’s exposures in line with those of the benchmark. This strategy had a neutral impact on results.

We continued to use a passive strategy that seeks to provide returns that approximate those of the benchmark. We made no changes in the Fund’s approach, as our objective is to replicate the return and risk characteristics of the index. To this end, all changes to the index were incorporated in the Fund in order to maintain proper tracking. The index itself provides broad-based exposure to 21 of the largest developed markets outside the United States, across all sectors of the economy.

| 6 | | | DWS EAFE® Equity Index Fund |

Table of Contents

Portfolio Manager

Thomas O’Brien, CFA

Vice President of Northern Trust Investments, Inc. Portfolio Manager of the Fund. Began managing the Fund in 2013.

| — | Portfolio Manager for the International Equity Index group in Chicago. |

| — | Prior to joining Northern Trust in November 2004, he was a Principal at State Street Global Advisors focusing on US index strategies. |

| — | BS, University of Rhode Island; MBA, Suffolk University. |

The views expressed reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team’s views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Past performance is no guarantee of future results. Current and future portfolio holdings are subject to risk.

Terms to Know

The Morgan Stanley Capital International (MSCI) Europe, Australasia and Far East (EAFE) Index is an equity index which captures large- and mid-cap representation across developed markets countries around the world, excluding the U.S. and Canada. With 928 constituents, the index covers approximately 85% of the free float adjusted market capitalization in each country. Index returns do not reflect fees or expenses and it is not possible to invest directly into an index.

The Standard & Poor’s 500 (S&P 500) Index is an unmanaged, capitalization weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Index returns do not reflect fees or expenses and it is not possible to invest directly into an index.

Futures contracts are contractual agreements to buy or sell a particular commodity or financial instrument at a pre-determined price in the future.

Currency forward contracts are agreements between two parties to exchange two designated currencies at a specific time in the future.

The consumer discretionary sector represents industries that produce goods and services that are not necessities in everyday life.

| DWS EAFE® Equity Index Fund | | | 7 |

Table of Contents

| Performance Summary | December 31, 2018 (Unaudited) |

| Institutional Class | 1-Year | 5-Year | 10-Year | |||||||||

| Average Annual Total Returns as of 12/31/18 | ||||||||||||

| No Sales Charges | –13.69% | 0.35% | 5.97% | |||||||||

| MSCI EAFE® Index† | –13.79% | 0.53% | 6.32% | |||||||||

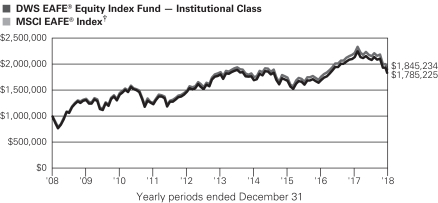

Performance in the Average Annual Total Returns table above and the Growth of an Assumed $1,000,000 Investment line graph that follows is historical and does not guarantee future results. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may differ from performance data shown. Please visit dws.com for the Fund’s most recent month-end performance. Fund performance includes reinvestment of all distributions.

The gross expense ratio of the Fund, as stated in the fee table of the prospectus dated May 31, 2018 is 1.10% for Institutional Class shares and may differ from the expense ratio disclosed in the Financial Highlights table in this report.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

Performance figures do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The MSCI EAFE® Index is the exclusive property of Morgan Stanley Capital International, a service of Morgan Stanley, and has been licensed for use by the Fund’s investment advisor. There is no guarantee that the Fund will be able to mirror the MSCI EAFE® Index closely to track its performance.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

| 8 | | | DWS EAFE® Equity Index Fund |

Table of Contents

| Growth of an Assumed $1,000,000 Investment |

The growth of $1,000,000 is cumulative.

The minimum initial investment for Institutional Class shares is $1,000,000.

| † | MSCI Europe, Australasia and Far East (EAFE) Index is an equity index which captures large and mid cap representation across developed markets countries around the world, excluding the U.S. and Canada. With 928 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. |

| Institutional Class |

||||

| Net Asset Value | ||||

| 12/31/18 | $ | 5.09 | ||

| 12/31/17 | $ | 6.58 | ||

| Distribution Information as of 12/31/18 | ||||

| Income Dividends, Twelve Months | $ | .18 | ||

| Cap Gain Distributions, Twelve Months | $ | .39 | ||

| DWS EAFE® Equity Index Fund | | | 9 |

Table of Contents

| 10 | | | DWS EAFE® Equity Index Fund |

Table of Contents

| Ten Largest Equity Holdings at December 31, 2018 (12.5% of Net Assets) |

Country | Percent | ||||||||

| 1 | Nestle SA | Switzerland | 1.9 | % | ||||||

| Multinational company that markets a wide range of food products | ||||||||||

| 2 | Royal Dutch Shell PLC | Netherlands | 1.9 | % | ||||||

| Explores, produces, and refines petroleum | ||||||||||

| 3 | Novartis AG | Switzerland | 1.4 | % | ||||||

| Manufacturer of pharmaceutical and nutrition products | ||||||||||

| 4 | Roche Holding AG | Switzerland | 1.4 | % | ||||||

| Developer of pharmaceutical and chemical products | ||||||||||

| 5 | HSBC Holdings PLC | United Kingdom | 1.3 | % | ||||||

| Provider of international banking and financial services | ||||||||||

| 6 | Toyota Motor Corp. | Japan | 1.0 | % | ||||||

| Manufacturer of diversified automotive products | ||||||||||

| 7 | TOTAL SA | France | 1.0 | % | ||||||

| Produces, refines, transports and markets oil and natural gas | ||||||||||

| 8 | BP PLC | United Kingdom | 1.0 | % | ||||||

| Exporter and producer of oil and natural gas | ||||||||||

| 9 | AIA Group Ltd. | Hong Kong | 0.8 | % | ||||||

| Offers insurance and financial services | ||||||||||

| 10 | SAP SE | Germany | 0.8 | % | ||||||

| Manufacturer of computer software | ||||||||||

Portfolio holdings and characteristics are subject to change.

For more complete details about the Fund’s investment portfolio, see page 12. A quarterly Fact Sheet is available on dws.com or upon request. Please see the Account Management Resources section on page 68 for contact information.

| DWS EAFE® Equity Index Fund | | | 11 |

Table of Contents

| Investment Portfolio | as of December 31, 2018 |

| Shares | Value ($) | |||||||

| Common Stocks 97.2% | ||||||||

| Australia 6.7% |

| |||||||

| AGL Energy Ltd. |

2,078 | 30,085 | ||||||

| Alumina Ltd. |

7,671 | 12,406 | ||||||

| Amcor Ltd. |

3,726 | 34,702 | ||||||

| AMP Ltd. |

9,940 | 17,117 | ||||||

| APA Group (Units) |

4,016 | 23,954 | ||||||

| Aristocrat Leisure Ltd. |

1,870 | 28,704 | ||||||

| ASX Ltd. |

642 | 27,102 | ||||||

| Aurizon Holdings Ltd. |

6,538 | 19,696 | ||||||

| AusNet Services (Units) |

5,993 | 6,550 | ||||||

| Australia & New Zealand Banking Group Ltd. |

9,331 | 160,743 | ||||||

| Bank of Queensland Ltd. |

1,515 | 10,354 | ||||||

| Bendigo & Adelaide Bank Ltd. |

1,558 | 11,820 | ||||||

| BGP Holdings PLC (a)* |

328,818 | 1,454 | ||||||

| BHP Group Ltd. |

9,580 | 230,117 | ||||||

| BlueScope Steel Ltd. |

1,750 | 13,464 | ||||||

| Boral Ltd. |

4,092 | 14,236 | ||||||

| Brambles Ltd. |

5,283 | 37,688 | ||||||

| Caltex Australia Ltd. |

826 | 14,789 | ||||||

| Challenger Ltd. |

1,814 | 12,099 | ||||||

| CIMIC Group Ltd. |

372 | 11,330 | ||||||

| Coca-Cola Amatil Ltd. |

1,476 | 8,506 | ||||||

| Cochlear Ltd. |

183 | 22,371 | ||||||

| Coles Group Ltd.* |

3,808 | 31,206 | ||||||

| Commonwealth Bank of Australia |

5,729 | 291,746 | ||||||

| Computershare Ltd. |

1,467 | 17,747 | ||||||

| Crown Resorts Ltd. |

1,323 | 11,024 | ||||||

| CSL Ltd. |

1,468 | 191,974 | ||||||

| Dexus (REIT) |

3,219 | 24,019 | ||||||

| Domino’s Pizza Enterprises Ltd. Series L |

224 | 6,385 | ||||||

| Flight Centre Travel Group Ltd. |

196 | 5,911 | ||||||

| Fortescue Metals Group Ltd. |

4,850 | 14,305 | ||||||

| Goodman Group (REIT) |

5,449 | 40,750 | ||||||

| GPT Group (REIT) |

5,745 | 21,571 | ||||||

| Harvey Norman Holdings Ltd. |

1,366 | 3,032 | ||||||

| Incitec Pivot Ltd. |

4,803 | 11,064 | ||||||

| Insurance Australia Group Ltd. |

7,630 | 37,627 | ||||||

| LendLease Group (Units) |

1,860 | 15,196 | ||||||

| Macquarie Group Ltd. |

1,040 | 79,430 | ||||||

| Medibank Private Ltd. |

9,713 | 17,571 | ||||||

| Mirvac Group (REIT) (Units) |

11,725 | 18,501 | ||||||

The accompanying notes are an integral part of the financial statements.

| 12 | | | DWS EAFE® Equity Index Fund |

Table of Contents

| Shares | Value ($) | |||||||

| National Australia Bank Ltd. |

8,911 | 151,145 | ||||||

| Newcrest Mining Ltd. |

2,479 | 38,141 | ||||||

| Oil Search Ltd. |

4,422 | 22,184 | ||||||

| Orica Ltd. |

1,156 | 14,034 | ||||||

| Origin Energy Ltd.* |

5,463 | 24,745 | ||||||

| QBE Insurance Group Ltd. |

4,422 | 31,414 | ||||||

| Ramsay Health Care Ltd. |

444 | 18,018 | ||||||

| REA Group Ltd. |

189 | 9,829 | ||||||

| Rio Tinto Ltd. |

1,192 | 65,779 | ||||||

| Santos Ltd. |

5,878 | 22,539 | ||||||

| Scentre Group (REIT) |

17,628 | 48,358 | ||||||

| SEEK Ltd. |

1,040 | 12,375 | ||||||

| Sonic Healthcare Ltd. |

1,256 | 19,525 | ||||||

| South32 Ltd. |

16,602 | 39,135 | ||||||

| Stockland (REIT) (Units) |

7,589 | 18,792 | ||||||

| Suncorp Group Ltd. |

4,225 | 37,515 | ||||||

| Sydney Airport (Units) |

3,344 | 15,839 | ||||||

| TABCORP Holdings Ltd. |

6,018 | 18,162 | ||||||

| Telstra Corp., Ltd. |

13,493 | 27,015 | ||||||

| TPG Telecom Ltd. |

1,032 | 4,667 | ||||||

| Transurban Group (Units) |

8,524 | 69,906 | ||||||

| Treasury Wine Estates Ltd. |

2,233 | 23,263 | ||||||

| Vicinity Centres (REIT) |

9,779 | 17,892 | ||||||

| Washington H Soul Pattinson & Co., Ltd. |

363 | 6,351 | ||||||

| Wesfarmers Ltd. |

3,676 | 83,337 | ||||||

| Westpac Banking Corp. |

11,179 | 197,088 | ||||||

| Woodside Petroleum Ltd. |

3,004 | 65,974 | ||||||

| Woolworths Group Ltd. |

4,265 | 88,479 | ||||||

| WorleyParsons Ltd. |

1,044 | 8,367 | ||||||

|

|

|

|||||||

| (Cost $1,274,016) |

|

2,788,214 | ||||||

| Austria 0.2% |

| |||||||

| Andritz AG |

216 | 9,942 | ||||||

| Erste Group Bank AG* |

1,012 | 33,762 | ||||||

| OMV AG |

483 | 21,180 | ||||||

| Raiffeisen Bank International AG |

459 | 11,693 | ||||||

| Verbund AG |

236 | 10,034 | ||||||

| Voestalpine AG |

360 | 10,824 | ||||||

|

|

|

|||||||

| (Cost $51,075) |

|

97,435 | ||||||

| Belgium 0.9% |

| |||||||

| Ageas |

592 | 26,660 | ||||||

| Anheuser-Busch InBev SA |

2,472 | 163,939 | ||||||

| Colruyt SA |

199 | 14,168 | ||||||

| Groupe Bruxelles Lambert SA |

259 | 22,601 | ||||||

| KBC Group NV |

816 | 53,176 | ||||||

The accompanying notes are an integral part of the financial statements.

| DWS EAFE® Equity Index Fund | | | 13 |

Table of Contents

| Shares | Value ($) | |||||||

| Proximus SA |

486 | 13,174 | ||||||

| Solvay SA |

244 | 24,451 | ||||||

| Telenet Group Holding NV |

151 | 7,030 | ||||||

| UCB SA |

415 | 33,918 | ||||||

| Umicore SA |

687 | 27,507 | ||||||

|

|

|

|||||||

| (Cost $152,441) |

|

386,624 | ||||||

| Bermuda 0.0% |

| |||||||

| Dairy Farm International Holdings Ltd. (Cost $9,430) |

1,100 | 9,958 | ||||||

| Chile 0.0% |

| |||||||

| Antofagasta PLC (Cost $11,696) |

1,179 | 11,798 | ||||||

| China 0.1% |

| |||||||

| BeiGene Ltd. ADR* |

100 | 14,026 | ||||||

| Minth Group Ltd. |

2,000 | 6,463 | ||||||

| Yangzijiang Shipbuilding Holdings Ltd. |

7,900 | 7,196 | ||||||

|

|

|

|||||||

| (Cost $31,755) |

|

27,685 | ||||||

| Denmark 1.7% |

| |||||||

| A P Moller-Maersk AS “A” |

12 | 14,210 | ||||||

| A P Moller-Maersk AS “B” |

22 | 27,730 | ||||||

| Carlsberg AS “B” |

362 | 38,503 | ||||||

| Chr Hansen Holding AS |

328 | 29,097 | ||||||

| Coloplast AS “B” |

372 | 34,593 | ||||||

| Danske Bank AS |

2,366 | 46,985 | ||||||

| DSV AS |

599 | 39,565 | ||||||

| Genmab AS* |

202 | 33,237 | ||||||

| H. Lundbeck AS |

211 | 9,258 | ||||||

| ISS AS |

523 | 14,660 | ||||||

| Novo Nordisk AS ‘‘B” |

5,900 | 271,042 | ||||||

| Novozymes AS “B” |

700 | 31,353 | ||||||

| Orsted AS 144A |

629 | 42,151 | ||||||

| Pandora AS |

375 | 15,280 | ||||||

| Tryg AS |

376 | 9,479 | ||||||

| Vestas Wind Systems AS |

640 | 48,487 | ||||||

| William Demant Holding AS* |

318 | 9,045 | ||||||

|

|

|

|||||||

| (Cost $234,790) |

|

714,675 | ||||||

| Finland 1.2% |

| |||||||

| Elisa Oyj |

457 | 18,910 | ||||||

| Fortum Oyj |

1,452 | 31,781 | ||||||

| Kone Oyj “B” |

1,101 | 52,643 | ||||||

| Metso Oyj |

320 | 8,419 | ||||||

| Neste Oyj |

419 | 32,396 | ||||||

| Nokia Oyj |

18,159 | 105,033 | ||||||

| Nokian Renkaat Oyj |

372 | 11,460 | ||||||

The accompanying notes are an integral part of the financial statements.

| 14 | | | DWS EAFE® Equity Index Fund |

Table of Contents

| Shares | Value ($) | |||||||

| Nordea Bank Abp |

9,992 | 84,182 | ||||||

| Orion Oyj “B” |

334 | 11,634 | ||||||

| Sampo Oyj “A” |

1,443 | 63,863 | ||||||

| Stora Enso Oyj “R” |

1,825 | 21,218 | ||||||

| UPM-Kymmene Oyj |

1,768 | 45,092 | ||||||

| Wartsila Oyj |

1,518 | 24,223 | ||||||

|

|

|

|||||||

| (Cost $180,887) |

|

510,854 | ||||||

| France 10.6% |

| |||||||

| Accor SA |

637 | 27,408 | ||||||

| Aeroports de Paris |

94 | 17,865 | ||||||

| Air Liquide SA |

1,388 | 172,745 | ||||||

| Airbus SE |

1,884 | 181,658 | ||||||

| Alstom SA |

510 | 20,639 | ||||||

| Amundi SA 144A |

172 | 9,115 | ||||||

| Arkema SA |

217 | 18,669 | ||||||

| Atos SE |

298 | 24,409 | ||||||

| AXA SA |

6,313 | 136,676 | ||||||

| BioMerieux |

153 | 10,079 | ||||||

| BNP Paribas SA |

3,626 | 164,290 | ||||||

| Bollore SA |

2,589 | 10,381 | ||||||

| Bouygues SA |

720 | 25,902 | ||||||

| Bureau Veritas SA |

848 | 17,304 | ||||||

| Capgemini SE |

515 | 51,359 | ||||||

| Carrefour SA |

1,878 | 32,089 | ||||||

| Casino Guichard-Perrachon SA |

166 | 6,923 | ||||||

| Cie de Saint-Gobain |

1,639 | 54,763 | ||||||

| Cie Generale des Etablissements Michelin |

556 | 55,287 | ||||||

| CNP Assurances |

552 | 11,725 | ||||||

| Credit Agricole SA |

3,576 | 38,739 | ||||||

| Danone SA |

2,002 | 141,157 | ||||||

| Dassault Aviation SA |

8 | 11,131 | ||||||

| Dassault Systemes SE |

416 | 49,515 | ||||||

| Edenred |

773 | 28,490 | ||||||

| Eiffage SA |

251 | 21,008 | ||||||

| Electricite de France SA |

1,880 | 29,729 | ||||||

| Engie SA |

5,872 | 84,346 | ||||||

| EssilorLuxottica SA |

930 | 117,758 | ||||||

| Eurazeo SA |

135 | 9,569 | ||||||

| Eutelsat Communications SA |

636 | 12,555 | ||||||

| Faurecia SA |

222 | 8,426 | ||||||

| Fonciere des Regions (REIT) |

128 | 12,365 | ||||||

| Gecina SA (REIT) |

152 | 19,706 | ||||||

| Getlink |

1,493 | 20,074 | ||||||

| Hermes International |

104 | 57,845 | ||||||

| Icade (REIT) |

119 | 9,082 | ||||||

The accompanying notes are an integral part of the financial statements.

| DWS EAFE® Equity Index Fund | | | 15 |

Table of Contents

| Shares | Value ($) | |||||||

| Iliad SA |

83 | 11,698 | ||||||

| Imerys SA |

135 | 6,505 | ||||||

| Ingenico Group SA |

198 | 11,252 | ||||||

| Ipsen SA |

115 | 14,875 | ||||||

| JC Decaux SA |

245 | 6,891 | ||||||

| Kering SA |

243 | 114,587 | ||||||

| Klepierre SA (REIT) |

703 | 21,747 | ||||||

| L’Oreal SA |

819 | 189,217 | ||||||

| Legrand SA |

844 | 47,757 | ||||||

| LVMH Moet Hennessy Louis Vuitton SE |

905 | 268,238 | ||||||

| Natixis SA |

3,215 | 15,185 | ||||||

| Orange SA |

6,444 | 104,782 | ||||||

| Pernod Ricard SA |

689 | 113,175 | ||||||

| Peugeot SA |

1,968 | 42,079 | ||||||

| Publicis Groupe |

681 | 39,072 | ||||||

| Remy Cointreau SA |

79 | 8,958 | ||||||

| Renault SA |

603 | 37,764 | ||||||

| Rexel SA |

859 | 9,158 | ||||||

| Safran SA |

1,082 | 130,820 | ||||||

| Sanofi |

3,663 | 317,710 | ||||||

| Sartorius Stedim Biotech |

106 | 10,622 | ||||||

| Schneider Electric SE |

1,766 | 121,338 | ||||||

| SCOR SE |

530 | 23,926 | ||||||

| SEB SA |

63 | 8,148 | ||||||

| Societe BIC SA |

82 | 8,380 | ||||||

| Societe Generale SA |

2,513 | 80,446 | ||||||

| Sodexo SA |

291 | 29,842 | ||||||

| Suez |

1,113 | 14,734 | ||||||

| Teleperformance |

193 | 30,913 | ||||||

| Thales SA |

346 | 40,488 | ||||||

| TOTAL SA |

7,794 | 412,442 | ||||||

| Ubisoft Entertainment SA* |

240 | 19,419 | ||||||

| Unibail-Rodamco-Westfield (CDI)* |

2,600 | 19,533 | ||||||

| Unibail-Rodamco-Westfield (REIT)* (b) |

216 | 33,509 | ||||||

| Unibail-Rodamco-Westfield (REIT) (b) |

108 | 16,776 | ||||||

| Valeo SA |

791 | 23,182 | ||||||

| Veolia Environnement SA |

1,734 | 35,724 | ||||||

| VINCI SA |

1,655 | 136,674 | ||||||

| Vivendi SA |

3,377 | 82,357 | ||||||

| Wendel |

81 | 9,725 | ||||||

|

|

|

|||||||

| (Cost $2,094,623) |

|

4,390,429 | ||||||

| Germany 8.0% |

| |||||||

| 1&1 Drillisch AG |

199 | 10,217 | ||||||

| adidas AG |

607 | 127,343 | ||||||

| Allianz SE (Registered) |

1,393 | 280,633 | ||||||

The accompanying notes are an integral part of the financial statements.

| 16 | | | DWS EAFE® Equity Index Fund |

Table of Contents

| Shares | Value ($) | |||||||

| Axel Springer SE |

159 | 9,030 | ||||||

| BASF SE |

2,967 | 208,250 | ||||||

| Bayer AG (Registered) |

3,027 | 211,924 | ||||||

| Bayerische Motoren Werke AG |

1,086 | 88,340 | ||||||

| Beiersdorf AG |

329 | 34,423 | ||||||

| Brenntag AG |

528 | 22,914 | ||||||

| Commerzbank AG* |

3,418 | 22,819 | ||||||

| Continental AG |

363 | 50,561 | ||||||

| Covestro AG 144A |

602 | 29,952 | ||||||

| Daimler AG (Registered) |

2,931 | 154,663 | ||||||

| Delivery Hero AG 144A* |

320 | 11,964 | ||||||

| Deutsche Bank AG (Registered) (c) |

6,397 | 51,429 | ||||||

| Deutsche Boerse AG |

636 | 76,721 | ||||||

| Deutsche Lufthansa AG (Registered) |

722 | 16,404 | ||||||

| Deutsche Post AG (Registered) |

3,258 | 89,484 | ||||||

| Deutsche Telekom AG (Registered) |

10,799 | 184,105 | ||||||

| Deutsche Wohnen SE |

1,149 | 52,833 | ||||||

| E.ON SE |

7,228 | 71,488 | ||||||

| Evonik Industries AG |

500 | 12,537 | ||||||

| Fraport AG |

122 | 8,772 | ||||||

| Fresenius Medical Care AG & Co. KGaA |

691 | 44,926 | ||||||

| Fresenius SE & Co. KGaA |

1,349 | 65,810 | ||||||

| GEA Group AG |

547 | 14,183 | ||||||

| Hannover Rueck SE |

193 | 26,116 | ||||||

| HeidelbergCement AG |

500 | 30,730 | ||||||

| Henkel AG & Co. KGaA |

334 | 32,902 | ||||||

| HOCHTIEF AG |

70 | 9,472 | ||||||

| HUGO BOSS AG |

219 | 13,515 | ||||||

| Infineon Technologies AG |

3,666 | 73,402 | ||||||

| Innogy SE* |

451 | 19,181 | ||||||

| KION Group AG |

249 | 12,692 | ||||||

| LANXESS AG |

286 | 13,229 | ||||||

| Merck KGaA |

423 | 43,767 | ||||||

| METRO AG |

560 | 8,624 | ||||||

| MTU Aero Engines AG |

168 | 30,619 | ||||||

| Muenchener Rueckversicherungs-Gesellschaft AG (Registered) |

484 | 105,923 | ||||||

| OSRAM Licht AG |

349 | 15,253 | ||||||

| ProSiebenSat.1 Media SE |

753 | 13,453 | ||||||

| Puma SE (b) |

22 | 10,763 | ||||||

| Puma SE (b) |

3 | 1,471 | ||||||

| RWE AG |

1,753 | 38,191 | ||||||

| SAP SE |

3,187 | 319,077 | ||||||

| Siemens AG (Registered) |

2,482 | 277,766 | ||||||

| Siemens Healthineers AG 144A* |

526 | 22,122 | ||||||

The accompanying notes are an integral part of the financial statements.

| DWS EAFE® Equity Index Fund | | | 17 |

Table of Contents

| Shares | Value ($) | |||||||

| Symrise AG |

412 | 30,525 | ||||||

| Telefonica Deutschland Holding AG |

2,352 | 9,238 | ||||||

| ThyssenKrupp AG |

1,348 | 23,348 | ||||||

| TUI AG |

1,449 | 20,815 | ||||||

| Uniper SE |

700 | 18,137 | ||||||

| United Internet AG (Registered) |

401 | 17,649 | ||||||

| Volkswagen AG |

112 | 17,901 | ||||||

| Vonovia SE |

1,598 | 72,715 | ||||||

| Wirecard AG |

377 | 57,950 | ||||||

| Zalando SE 144A* |

349 | 9,010 | ||||||

|

|

|

|||||||

| (Cost $1,748,355) |

|

3,347,281 | ||||||

| Hong Kong 3.6% |

| |||||||

| AIA Group Ltd. |

39,081 | 324,058 | ||||||

| ASM Pacific Technology Ltd. |

1,100 | 10,478 | ||||||

| Bank of East Asia Ltd. |

4,234 | 13,415 | ||||||

| BOC Hong Kong (Holdings) Ltd. |

12,321 | 45,648 | ||||||

| CK Asset Holdings Ltd. |

8,348 | 60,486 | ||||||

| CK Hutchison Holdings Ltd. |

8,848 | 84,928 | ||||||

| CK Infrastructure Holdings Ltd. |

2,000 | 15,147 | ||||||

| CLP Holdings Ltd. |

5,274 | 59,602 | ||||||

| Galaxy Entertainment Group Ltd. |

7,497 | 47,275 | ||||||

| Hang Lung Group Ltd. |

3,000 | 7,639 | ||||||

| Hang Lung Properties Ltd. |

7,000 | 13,338 | ||||||

| Hang Seng Bank Ltd. |

2,500 | 55,775 | ||||||

| Henderson Land Development Co., Ltd. |

4,276 | 21,287 | ||||||

| HK Electric Investments & HK Electric Investments Ltd. “SS”, (Units) |

9,491 | 9,615 | ||||||

| HKT Trust & HKT Ltd. “SS”, (Units) |

11,920 | 17,174 | ||||||

| Hong Kong & China Gas Co., Ltd. |

30,434 | 62,840 | ||||||

| Hong Kong Exchanges & Clearing Ltd. |

3,779 | 109,483 | ||||||

| Hongkong Land Holdings Ltd. |

3,800 | 23,925 | ||||||

| Hysan Development Co., Ltd. |

1,773 | 8,413 | ||||||

| Jardine Matheson Holdings Ltd. |

700 | 48,651 | ||||||

| Jardine Strategic Holdings Ltd. |

700 | 25,712 | ||||||

| Kerry Properties Ltd. (b) |

2,000 | 6,832 | ||||||

| Link (REIT) |

6,653 | 67,315 | ||||||

| Melco Resorts & Entertainment Ltd. (ADR) |

783 | 13,796 | ||||||

| MGM China Holdings Ltd. |

3,897 | 6,491 | ||||||

| MTR Corp., Ltd. |

4,917 | 25,852 | ||||||

| New World Development Co., Ltd. |

20,369 | 26,834 | ||||||

| NWS Holdings Ltd. |

5,991 | 12,294 | ||||||

| PCCW Ltd. |

14,000 | 8,064 | ||||||

| Power Assets Holdings Ltd. |

4,500 | 31,278 | ||||||

| Shangri-La Asia Ltd. |

4,000 | 5,935 | ||||||

| Sino Land Co., Ltd. |

11,367 | 19,440 | ||||||

The accompanying notes are an integral part of the financial statements.

| 18 | | | DWS EAFE® Equity Index Fund |

Table of Contents

| Shares | Value ($) | |||||||

| SJM Holdings Ltd. |

8,000 | 7,463 | ||||||

| Sun Hung Kai Properties Ltd. |

5,188 | 73,955 | ||||||

| Swire Pacific Ltd. “A” |

1,500 | 15,864 | ||||||

| Swire Properties Ltd. |

3,800 | 13,337 | ||||||

| Techtronic Industries Co., Ltd. |

4,499 | 23,967 | ||||||

| WH Group Ltd. 144A |

29,259 | 22,523 | ||||||

| Wharf Holdings Ltd. |

3,750 | 9,770 | ||||||

| Wharf Real Estate Investment Co., Ltd. |

3,750 | 22,412 | ||||||

| Wheelock & Co., Ltd. |

3,000 | 17,159 | ||||||

| Yue Yuen Industrial (Holdings) Ltd. |

2,500 | 7,993 | ||||||

|

|

|

|||||||

| (Cost $660,236) |

|

1,503,463 | ||||||

| Ireland 1.1% |

| |||||||

| AIB Group PLC |

2,423 | 10,241 | ||||||

| Bank of Ireland Group PLC |

3,166 | 17,634 | ||||||

| CRH PLC |

2,659 | 70,668 | ||||||

| DCC PLC |

316 | 24,150 | ||||||

| James Hardie Industries SE (CDI) |

1,472 | 15,660 | ||||||

| Kerry Group PLC “A” (b) |

2 | 198 | ||||||

| Kerry Group PLC “A” (b) |

534 | 52,501 | ||||||

| Kingspan Group PLC |

525 | 22,561 | ||||||

| Paddy Power Betfair PLC |

288 | 23,654 | ||||||

| Shire PLC |

3,085 | 179,989 | ||||||

| Smurfit Kappa Group PLC |

784 | 20,911 | ||||||

|

|

|

|||||||

| (Cost $317,463) |

|

438,167 | ||||||

| Isle Of Man 0.1% |

| |||||||

| GVC Holdings PLC (Cost $25,618) |

1,951 | 16,781 | ||||||

| Israel 0.5% |

| |||||||

| Azrieli Group Ltd. |

144 | 6,873 | ||||||

| Bank Hapoalim BM |

3,300 | 20,847 | ||||||

| Bank Leumi Le-Israel BM |

4,781 | 28,872 | ||||||

| Bezeq Israeli Telecommunication Corp., Ltd. |

8,053 | 7,857 | ||||||

| Check Point Software Technologies Ltd.* (d) |

423 | 43,421 | ||||||

| Elbit Systems Ltd. |

66 | 7,565 | ||||||

| Israel Chemicals Ltd. |

2,347 | 13,294 | ||||||

| Mizrahi Tefahot Bank Ltd. |

378 | 6,366 | ||||||

| Nice Ltd.* |

213 | 22,938 | ||||||

| Teva Pharmaceutical Industries Ltd. (ADR) |

3,233 | 49,853 | ||||||

| Wix.com Ltd.* (d) |

100 | 9,034 | ||||||

|

|

|

|||||||

| (Cost $259,679) |

|

216,920 | ||||||

| Italy 1.9% |

| |||||||

| Assicurazioni Generali SpA |

3,812 | 63,949 | ||||||

| Atlantia SpA |

1,598 | 33,242 | ||||||

| Davide Campari-Milano SpA |

1,899 | 16,086 | ||||||

The accompanying notes are an integral part of the financial statements.

| DWS EAFE® Equity Index Fund | | | 19 |

Table of Contents

| Shares | Value ($) | |||||||

| Enel SpA |

26,590 | 154,408 | ||||||

| Eni SpA |

8,215 | 129,756 | ||||||

| Ferrari NV (b) |

82 | 8,186 | ||||||

| Ferrari NV (b) (e) |

324 | 32,219 | ||||||

| Intesa Sanpaolo SpA |

48,863 | 109,093 | ||||||

| Leonardo SpA |

1,392 | 12,292 | ||||||

| Mediobanca Banca di Credito Finanziario SpA |

1,898 | 16,121 | ||||||

| Moncler SpA |

610 | 20,381 | ||||||

| Pirelli & C SpA 144A* |

1,251 | 8,068 | ||||||

| Poste Italiane SpA 144A |

1,837 | 14,753 | ||||||

| Prysmian SpA |

722 | 14,029 | ||||||

| Recordati SpA |

311 | 10,814 | ||||||

| Snam SpA |

7,190 | 31,560 | ||||||

| Telecom Italia SpA* |

34,686 | 19,292 | ||||||

| Telecom Italia SpA (RSP) |

16,966 | 8,143 | ||||||

| Terna Rete Elettrica Nazionale SpA |

4,525 | 25,728 | ||||||

| UniCredit SpA |

6,442 | 73,098 | ||||||

|

|

|

|||||||

| (Cost $606,284) |

|

801,218 | ||||||

| Japan 23.7% |

| |||||||

| ABC-Mart, Inc. |

100 | 5,532 | ||||||

| Acom Co., Ltd. |

1,500 | 4,892 | ||||||

| Aeon Co., Ltd. |

2,000 | 39,108 | ||||||

| AEON Financial Service Co., Ltd. |

430 | 7,635 | ||||||

| AEON Mall Co., Ltd. |

400 | 6,356 | ||||||

| Air Water, Inc. |

553 | 8,369 | ||||||

| Aisin Seiki Co., Ltd. |

500 | 17,202 | ||||||

| Ajinomoto Co., Inc. |

1,600 | 28,503 | ||||||

| Alfresa Holdings Corp. |

700 | 17,883 | ||||||

| Alps Electric Co., Ltd. |

600 | 11,612 | ||||||

| Amada Holdings Co., Ltd. |

1,000 | 8,976 | ||||||

| ANA Holdings, Inc. |

400 | 14,361 | ||||||

| Aozora Bank Ltd. |

400 | 11,931 | ||||||

| Asahi Glass Co., Ltd. |

600 | 18,892 | ||||||

| Asahi Group Holdings Ltd. |

1,200 | 46,574 | ||||||

| Asahi Intecc Co., Ltd. |

300 | 12,620 | ||||||

| Asahi Kasei Corp. |

4,200 | 43,215 | ||||||

| ASICS Corp. |

600 | 7,648 | ||||||

| Astellas Pharma, Inc. |

6,100 | 78,128 | ||||||

| Bandai Namco Holdings, Inc. |

650 | 29,137 | ||||||

| Benesse Holdings, Inc. |

300 | 7,621 | ||||||

| Bridgestone Corp. |

2,000 | 76,994 | ||||||

| Brother Industries Ltd. |

700 | 10,364 | ||||||

| Calbee, Inc. |

300 | 9,389 | ||||||

| Canon, Inc. |

3,300 | 90,110 | ||||||

| Casio Computer Co., Ltd. |

700 | 8,257 | ||||||

The accompanying notes are an integral part of the financial statements.

| 20 | | | DWS EAFE® Equity Index Fund |

Table of Contents

| Shares | Value ($) | |||||||

| Central Japan Railway Co. |

500 | 105,549 | ||||||

| Chubu Electric Power Co., Inc. |

1,900 | 27,034 | ||||||

| Chugai Pharmaceutical Co., Ltd. |

700 | 40,671 | ||||||

| Chugoku Electric Power Co., Inc. |

800 | 10,410 | ||||||

| Coca-Cola Bottlers Japan Holdings, Inc. |

400 | 11,924 | ||||||

| Concordia Financial Group Ltd. |

3,100 | 11,897 | ||||||

| Credit Saison Co., Ltd. |

500 | 5,863 | ||||||

| CyberAgent Inc |

300 | 11,557 | ||||||

| Dai Nippon Printing Co., Ltd. |

800 | 16,769 | ||||||

| Dai-ichi Life Holdings, Inc. |

3,500 | 54,390 | ||||||

| Daicel Corp. |

1,000 | 10,255 | ||||||

| Daifuku Co., Ltd. |

300 | 13,654 | ||||||

| Daiichi Sankyo Co., Ltd. |

1,800 | 57,483 | ||||||

| Daikin Industries Ltd. |

800 | 84,930 | ||||||

| Daito Trust Construction Co., Ltd. |

200 | 27,291 | ||||||

| Daiwa House Industry Co., Ltd. |

1,800 | 57,176 | ||||||

| Daiwa House REIT Investment Corp. (REIT) |

5 | 11,198 | ||||||

| Daiwa Securities Group, Inc. |

5,100 | 25,826 | ||||||

| DeNA Co., Ltd. |

400 | 6,656 | ||||||

| Denso Corp. |

1,400 | 61,896 | ||||||

| Dentsu, Inc. |

700 | 31,235 | ||||||

| Disco Corp. |

100 | 11,571 | ||||||

| Don Quijote Holdings Co., Ltd. |

400 | 24,512 | ||||||

| East Japan Railway Co. |

939 | 82,922 | ||||||

| Eisai Co., Ltd. |

800 | 61,773 | ||||||

| Electric Power Development Co., Ltd. |

500 | 11,843 | ||||||

| FamilyMart UNY Holdings Co., Ltd. |

200 | 25,299 | ||||||

| FANUC Corp. |

600 | 90,803 | ||||||

| Fast Retailing Co., Ltd. |

200 | 102,084 | ||||||

| Fuji Electric Co., Ltd. |

400 | 11,767 | ||||||

| Fujifilm Holdings Corp. |

1,300 | 50,555 | ||||||

| Fujitsu Ltd. |

600 | 37,362 | ||||||

| Fukuoka Financial Group, Inc. |

500 | 10,138 | ||||||

| Hakuhodo Dy Holdings, Inc. |

700 | 10,005 | ||||||

| Hamamatsu Photonics KK |

500 | 16,742 | ||||||

| Hankyu Hanshin Holdings, Inc. |

700 | 23,254 | ||||||

| Hikari Tsushin, Inc. |

100 | 15,636 | ||||||

| Hino Motors Ltd. |

1,000 | 9,425 | ||||||

| Hirose Electric Co., Ltd. |

105 | 10,260 | ||||||

| Hisamitsu Pharmaceutical Co., Inc. |

200 | 11,052 | ||||||

| Hitachi Chemical Co., Ltd. |

400 | 5,920 | ||||||

| Hitachi Construction Machinery Co., Ltd. |

400 | 9,328 | ||||||

| Hitachi High-Technologies Corp. |

200 | 6,246 | ||||||

| Hitachi Ltd. |

3,200 | 84,893 | ||||||

| Hitachi Metals Ltd. |

700 | 7,305 | ||||||

The accompanying notes are an integral part of the financial statements.

| DWS EAFE® Equity Index Fund | | | 21 |

Table of Contents

| Shares | Value ($) | |||||||

| Honda Motor Co., Ltd. |

5,300 | 139,204 | ||||||

| Hoshizaki Corp. |

200 | 12,162 | ||||||

| Hoya Corp. |

1,200 | 72,242 | ||||||

| Hulic Co., Ltd. |

900 | 8,055 | ||||||

| Idemitsu Kosan Co., Ltd. |

400 | 13,083 | ||||||

| IHI Corp. |

500 | 13,767 | ||||||

| Iida Group Holdings Co., Ltd. |

500 | 8,647 | ||||||

| INPEX Corp. |

3,300 | 29,455 | ||||||

| Isetan Mitsukoshi Holdings Ltd. |

1,120 | 12,397 | ||||||

| Isuzu Motors Ltd. |

1,800 | 25,291 | ||||||

| Itochu Corp. |

4,600 | 78,125 | ||||||

| J. Front Retailing Co., Ltd. |

700 | 8,020 | ||||||

| Japan Airlines Co., Ltd. |

400 | 14,176 | ||||||

| Japan Airport Terminal Co., Ltd. |

200 | 6,928 | ||||||

| Japan Exchange Group, Inc. |

1,700 | 27,499 | ||||||

| Japan Post Bank Co., Ltd. |

1,400 | 15,424 | ||||||

| Japan Post Holdings Co., Ltd. |

5,000 | 57,625 | ||||||

| Japan Prime Realty Investment Corp. (REIT) |

3 | 11,407 | ||||||

| Japan Real Estate Investment Corp. (REIT) |

4 | 22,483 | ||||||

| Japan Retail Fund Investment Corp. (REIT) |

8 | 15,995 | ||||||

| Japan Tobacco, Inc. |

3,600 | 85,688 | ||||||

| JFE Holdings, Inc. |

1,625 | 25,713 | ||||||

| JGC Corp. |

600 | 8,425 | ||||||

| JSR Corp. |

600 | 8,997 | ||||||

| JTEKT Corp. |

600 | 6,650 | ||||||

| JXTG Holdings, Inc. |

10,250 | 53,608 | ||||||

| Kajima Corp. |

1,500 | 20,088 | ||||||

| Kakaku.com, Inc. |

500 | 8,815 | ||||||

| Kamigumi Co., Ltd. |

400 | 8,208 | ||||||

| Kaneka Corp. |

200 | 7,161 | ||||||

| Kansai Electric Power Co., Inc. |

2,300 | 34,540 | ||||||

| Kansai Paint Co., Ltd. |

600 | 11,513 | ||||||

| Kao Corp. |

1,600 | 118,763 | ||||||

| Kawasaki Heavy Industries Ltd. |

400 | 8,542 | ||||||

| KDDI Corp. |

5,700 | 136,224 | ||||||

| Keihan Holdings Co., Ltd. |

300 | 12,215 | ||||||

| Keikyu Corp. |

800 | 13,082 | ||||||

| Keio Corp. |

300 | 17,449 | ||||||

| Keisei Electric Railway Co., Ltd. |

500 | 15,630 | ||||||

| Keyence Corp. |

300 | 151,817 | ||||||

| Kikkoman Corp. |

500 | 26,743 | ||||||

| Kintetsu Group Holdings Co., Ltd. |

590 | 25,596 | ||||||

| Kirin Holdings Co., Ltd. |

2,600 | 54,288 | ||||||

| Kobayashi Pharmaceutical Co., Ltd. |

100 | 6,806 | ||||||

| Kobe Steel Ltd. |

1,200 | 8,306 | ||||||

The accompanying notes are an integral part of the financial statements.

| 22 | | | DWS EAFE® Equity Index Fund |

Table of Contents

| Shares | Value ($) | |||||||

| Koito Manufacturing Co., Ltd. |

358 | 18,353 | ||||||

| Komatsu Ltd. |

3,000 | 64,156 | ||||||

| Konami Holdings Corp. |

300 | 13,078 | ||||||

| Konica Minolta, Inc. |

1,500 | 13,529 | ||||||

| Kose Corp. |

100 | 15,660 | ||||||

| Kubota Corp. |

3,300 | 46,913 | ||||||

| Kuraray Co., Ltd. |

1,100 | 15,462 | ||||||

| Kurita Water Industries Ltd. |

400 | 9,648 | ||||||

| Kyocera Corp. |

1,000 | 49,915 | ||||||

| Kyowa Hakko Kirin Co., Ltd. |

910 | 17,241 | ||||||

| Kyushu Electric Power Co., Inc. |

1,300 | 15,496 | ||||||

| Kyushu Railway Co. |

500 | 16,913 | ||||||

| Lawson, Inc. |

100 | 6,335 | ||||||

| LINE Corp.* |

200 | 6,854 | ||||||

| Lion Corp. |

800 | 16,516 | ||||||

| LIXIL Group Corp. |

848 | 10,486 | ||||||

| M3, Inc. |

1,400 | 18,791 | ||||||

| Makita Corp. |

700 | 24,857 | ||||||

| Marubeni Corp. |

5,100 | 35,734 | ||||||

| Marui Group Co., Ltd. |

700 | 13,590 | ||||||

| Maruichi Steel Tube Ltd. |

200 | 6,293 | ||||||

| Mazda Motor Corp. |

1,900 | 19,542 | ||||||

| McDonald’s Holdings Co. (Japan), Ltd. |

200 | 8,494 | ||||||

| Mebuki Financial Group, Inc. |

2,700 | 7,153 | ||||||

| Medipal Holdings Corp. |

600 | 12,871 | ||||||

| MEIJI Holdings Co., Ltd. |

400 | 32,659 | ||||||

| Minebea Mitsumi, Inc. |

1,300 | 18,738 | ||||||

| MISUMI Group, Inc. |

900 | 18,880 | ||||||

| Mitsubishi Chemical Holdings Corp. |

4,000 | 30,220 | ||||||

| Mitsubishi Corp. |

4,400 | 120,852 | ||||||

| Mitsubishi Electric Corp. |

6,000 | 66,138 | ||||||

| Mitsubishi Estate Co., Ltd. |

3,800 | 59,758 | ||||||

| Mitsubishi Gas Chemical Co., Inc. |

500 | 7,512 | ||||||

| Mitsubishi Heavy Industries Ltd. |

1,000 | 35,916 | ||||||

| Mitsubishi Materials Corp. |

300 | 7,879 | ||||||

| Mitsubishi Motors Corp. |

2,000 | 10,872 | ||||||

| Mitsubishi Tanabe Pharma Corp. |

900 | 12,978 | ||||||

| Mitsubishi UFJ Financial Group, Inc. |

38,000 | 186,178 | ||||||

| Mitsubishi UFJ Lease & Finance Co., Ltd. |

1,400 | 6,716 | ||||||

| Mitsui & Co., Ltd. |

5,400 | 83,006 | ||||||

| Mitsui Chemicals, Inc. |

600 | 13,531 | ||||||

| Mitsui Fudosan Co., Ltd. |

2,900 | 63,991 | ||||||

| Mitsui O.S.K Lines Ltd. |

400 | 8,660 | ||||||

| Mizuho Financial Group, Inc. |

77,590 | 120,359 | ||||||

| MonotaRO Co., Ltd. |

400 | 9,879 | ||||||

The accompanying notes are an integral part of the financial statements.

| DWS EAFE® Equity Index Fund | | | 23 |

Table of Contents

| Shares | Value ($) | |||||||

| MS&AD Insurance Group Holdings, Inc. |

1,500 | 42,780 | ||||||

| Murata Manufacturing Co., Ltd. |

600 | 81,449 | ||||||

| Nabtesco Corp. |

425 | 9,238 | ||||||

| Nagoya Railroad Co., Ltd. |

600 | 15,802 | ||||||

| NEC Corp. |

890 | 26,453 | ||||||

| Nexon Co., Ltd.* |

1,400 | 17,908 | ||||||

| NGK Insulators Ltd. |

1,000 | 13,552 | ||||||

| NGK Spark Plug Co., Ltd. |

400 | 7,918 | ||||||

| NH Foods Ltd. |

300 | 11,279 | ||||||

| Nidec Corp. |

700 | 79,291 | ||||||

| Nikon Corp. |

1,000 | 14,815 | ||||||

| Nintendo Co., Ltd. |

400 | 106,318 | ||||||

| Nippon Building Fund, Inc. (REIT) |

4 | 25,189 | ||||||

| Nippon Electric Glass Co., Ltd. |

300 | 7,349 | ||||||

| Nippon Express Co., Ltd. |

200 | 11,137 | ||||||

| Nippon Paint Holdings Co., Ltd. |

500 | 17,083 | ||||||

| Nippon Prologis REIT, Inc. (REIT) |

6 | 12,681 | ||||||

| Nippon Steel & Sumitomo Metal Corp. |

2,400 | 41,169 | ||||||

| Nippon Telegraph & Telephone Corp. |

2,276 | 92,728 | ||||||

| Nippon Yusen Kabushiki Kaisha |

600 | 9,171 | ||||||

| Nissan Chemical Industries Ltd. |

400 | 20,884 | ||||||

| Nissan Motor Co., Ltd. |

7,600 | 60,842 | ||||||

| Nisshin Seifun Group, Inc. |

700 | 14,456 | ||||||

| Nissin Foods Holdings Co., Ltd. |

200 | 12,563 | ||||||

| Nitori Holdings Co., Ltd. |

300 | 37,517 | ||||||

| Nitto Denko Corp. |

500 | 24,994 | ||||||

| Nomura Holdings, Inc. |

10,900 | 41,553 | ||||||

| Nomura Real Estate Holdings, Inc. |

500 | 9,143 | ||||||

| Nomura Real Estate Master Fund, Inc. (REIT) |

13 | 17,113 | ||||||

| Nomura Research Institute Ltd. |

400 | 14,798 | ||||||

| NSK Ltd. |

1,100 | 9,442 | ||||||

| NTT Data Corp. |

2,100 | 22,957 | ||||||

| NTT DoCoMo, Inc. |

4,300 | 96,816 | ||||||

| Obayashi Corp. |

2,100 | 18,979 | ||||||

| Obic Co., Ltd. |

200 | 15,434 | ||||||

| Odakyu Electric Railway Co., Ltd. |

900 | 19,773 | ||||||

| Oji Holdings Corp. |

3,000 | 15,377 | ||||||

| Olympus Corp. |

1,000 | 30,924 | ||||||

| Omron Corp. |

600 | 21,778 | ||||||

| Ono Pharmaceutical Co., Ltd. |

1,300 | 26,489 | ||||||

| Oracle Corp. |

100 | 6,329 | ||||||

| Oriental Land Co., Ltd. |

600 | 60,484 | ||||||

| ORIX Corp. |

4,300 | 62,626 | ||||||

| Osaka Gas Co., Ltd. |

1,300 | 23,765 | ||||||

| Otsuka Corp. |

400 | 10,959 | ||||||

The accompanying notes are an integral part of the financial statements.

| 24 | | | DWS EAFE® Equity Index Fund |

Table of Contents

| Shares | Value ($) | |||||||

| Otsuka Holdings Co., Ltd. |

1,222 | 50,025 | ||||||

| Panasonic Corp. |

7,214 | 64,618 | ||||||

| Park24 Co., Ltd. |

400 | 8,781 | ||||||

| Persol Holdings Co., Ltd. |

500 | 7,418 | ||||||

| Pigeon Corp. |

400 | 17,119 | ||||||

| Pola Orbis Holdings, Inc. |

300 | 8,075 | ||||||

| Rakuten, Inc. |

3,000 | 20,100 | ||||||

| Recruit Holdings Co., Ltd. |

3,600 | 86,911 | ||||||

| Renesas Electronics Corp.* |

2,800 | 12,648 | ||||||

| Resona Holdings, Inc. |

6,800 | 32,736 | ||||||

| Ricoh Co., Ltd. |

2,100 | 20,507 | ||||||

| Rinnai Corp. |

100 | 6,576 | ||||||

| ROHM Co., Ltd. |

300 | 19,174 | ||||||

| Ryohin Keikaku Co., Ltd. |

100 | 24,243 | ||||||

| Sankyo Co., Ltd. |

100 | 3,819 | ||||||

| Santen Pharmaceutical Co., Ltd. |

1,300 | 18,800 | ||||||

| SBI Holdings, Inc. |

744 | 14,539 | ||||||

| Secom Co., Ltd. |

700 | 57,961 | ||||||

| Sega Sammy Holdings, Inc. |

500 | 7,003 | ||||||

| Seibu Holdings, Inc. |

700 | 12,199 | ||||||

| Seiko Epson Corp. |

1,000 | 14,052 | ||||||

| Sekisui Chemical Co., Ltd. |

1,300 | 19,262 | ||||||

| Sekisui House Ltd. |

2,000 | 29,763 | ||||||

| Seven & I Holdings Co., Ltd. |

2,500 | 108,641 | ||||||

| Seven Bank Ltd. |

1,800 | 5,146 | ||||||

| SG Holdings Co., Ltd. |

300 | 7,775 | ||||||

| Sharp Corp. |

800 | 8,004 | ||||||

| Shimadzu Corp. |

800 | 15,749 | ||||||

| Shimamura Co., Ltd. |

100 | 7,643 | ||||||

| Shimano, Inc. |

200 | 28,165 | ||||||

| Shimizu Corp. |

1,700 | 13,815 | ||||||

| Shin-Etsu Chemical Co., Ltd. |

1,100 | 85,100 | ||||||

| Shinsei Bank Ltd. |

500 | 5,956 | ||||||

| Shionogi & Co., Ltd. |

900 | 51,475 | ||||||

| Shiseido Co., Ltd. |

1,200 | 75,108 | ||||||

| Showa Denko KK |

400 | 11,881 | ||||||

| Showa Shell Sekiyu KK |

600 | 8,389 | ||||||

| SMC Corp. |

200 | 60,363 | ||||||

| SoftBank Group Corp. |

2,700 | 178,925 | ||||||

| Sohgo Security Services Co., Ltd. |

200 | 9,362 | ||||||

| Sompo Holdings, Inc. |

1,100 | 37,261 | ||||||

| Sony Corp. |

4,100 | 196,893 | ||||||

| Sony Financial Holdings, Inc. |

600 | 11,208 | ||||||

| Stanley Electric Co., Ltd. |

400 | 11,203 | ||||||

| Subaru Corp. |

1,882 | 40,470 | ||||||

The accompanying notes are an integral part of the financial statements.

| DWS EAFE® Equity Index Fund | | | 25 |

Table of Contents

| Shares | Value ($) | |||||||

| SUMCO Corp. |

700 | 7,779 | ||||||

| Sumitomo Chemical Co., Ltd. |

5,000 | 24,161 | ||||||

| Sumitomo Corp. |

3,500 | 49,647 | ||||||

| Sumitomo Dainippon Pharma Co., Ltd. |

500 | 15,922 | ||||||

| Sumitomo Electric Industries Ltd. |

2,400 | 31,749 | ||||||

| Sumitomo Heavy Industries Ltd. |

400 | 11,899 | ||||||

| Sumitomo Metal Mining Co., Ltd. |

800 | 21,407 | ||||||

| Sumitomo Mitsui Financial Group, Inc. |

4,291 | 142,342 | ||||||

| Sumitomo Mitsui Trust Holdings, Inc. |

1,110 | 40,589 | ||||||

| Sumitomo Realty & Development Co., Ltd. |

1,200 | 43,885 | ||||||

| Sumitomo Rubber Industries Ltd. |

700 | 8,249 | ||||||

| Sundrug Co., Ltd. |

200 | 5,946 | ||||||

| Suntory Beverage & Food Ltd. |

400 | 18,039 | ||||||

| Suzuken Co., Ltd. |

200 | 10,180 | ||||||

| Suzuki Motor Corp. |

1,100 | 55,582 | ||||||

| Sysmex Corp. |

500 | 24,073 | ||||||

| T&D Holdings, Inc. |

1,800 | 20,814 | ||||||

| Taiheiyo Cement Corp. |

400 | 12,340 | ||||||

| Taisei Corp. |

700 | 29,923 | ||||||

| Taisho Pharmaceutical Holdings Co., Ltd. |

100 | 10,034 | ||||||

| Taiyo Nippon Sanso Corp. |

400 | 6,495 | ||||||

| Takashimaya Co., Ltd. |

500 | 6,382 | ||||||

| Takeda Pharmaceutical Co., Ltd. |

2,200 | 74,593 | ||||||

| TDK Corp. |

400 | 28,035 | ||||||

| Teijin Ltd. |

600 | 9,585 | ||||||

| Terumo Corp. |

1,000 | 56,458 | ||||||

| The Bank of Kyoto Ltd. |

200 | 8,208 | ||||||

| The Chiba Bank Ltd. |

2,000 | 11,127 | ||||||

| The Shizuoka Bank Ltd. |

1,500 | 11,755 | ||||||

| THK Co., Ltd. |

400 | 7,428 | ||||||

| Tobu Railway Co., Ltd. |

700 | 18,865 | ||||||

| Toho Co., Ltd. |

400 | 14,493 | ||||||

| Toho Gas Co., Ltd. |

200 | 8,439 | ||||||

| Tohoku Electric Power Co., Inc. |

1,300 | 17,131 | ||||||

| Tokio Marine Holdings, Inc. |

2,200 | 104,456 | ||||||

| Tokyo Century Corp. |

100 | 4,393 | ||||||

| Tokyo Electric Power Co. Holdings, Inc.* |

4,900 | 29,121 | ||||||

| Tokyo Electron Ltd. |

500 | 56,842 | ||||||

| Tokyo Gas Co., Ltd. |

1,300 | 32,955 | ||||||

| Tokyu Corp. |

1,600 | 26,151 | ||||||

| Tokyu Fudosan Holdings Corp. |

1,900 | 9,379 | ||||||

| Toppan Printing Co., Ltd. |

800 | 11,739 | ||||||

| Toray Industries, Inc. |

4,700 | 33,013 | ||||||

| Toshiba Corp. |

2,100 | 59,323 | ||||||

| Tosoh Corp. |

800 | 10,373 | ||||||

The accompanying notes are an integral part of the financial statements.

| 26 | | | DWS EAFE® Equity Index Fund |

Table of Contents

| Shares | Value ($) | |||||||

| TOTO Ltd. |

500 | 17,237 | ||||||

| Toyo Seikan Kaisha Ltd. |

500 | 11,470 | ||||||

| Toyo Suisan Kaisha Ltd. |

300 | 10,460 | ||||||

| Toyoda Gosei Co., Ltd. |

300 | 5,888 | ||||||

| Toyota Industries Corp. |

500 | 22,985 | ||||||

| Toyota Motor Corp. |

7,400 | 429,581 | ||||||

| Toyota Tsusho Corp. |

700 | 20,601 | ||||||

| Trend Micro, Inc. |

400 | 21,652 | ||||||

| Tsuruha Holdings, Inc. |

100 | 8,574 | ||||||

| Unicharm Corp. |

1,300 | 42,110 | ||||||

| United Urban Investment Corp. (REIT) |

9 | 13,971 | ||||||

| USS Co., Ltd. |

600 | 10,071 | ||||||

| Welcia Holdings Co., Ltd. |

100 | 4,523 | ||||||

| West Japan Railway Co. |

500 | 35,320 | ||||||

| Yahoo! Japan Corp. |

9,500 | 23,682 | ||||||

| Yakult Honsha Co., Ltd. |

400 | 28,115 | ||||||

| Yamada Denki Co., Ltd. |

2,000 | 9,590 | ||||||

| Yamaguchi Financial Group, Inc. |

600 | 5,743 | ||||||

| Yamaha Corp. |

400 | 17,048 | ||||||

| Yamaha Motor Co., Ltd. |

800 | 15,628 | ||||||

| Yamato Holdings Co., Ltd. |

1,000 | 27,456 | ||||||

| Yamazaki Baking Co., Ltd. |

400 | 8,358 | ||||||

| Yaskawa Electric Corp. |

800 | 19,484 | ||||||

| Yokogawa Electric Corp. |

700 | 12,072 | ||||||

| Yokohama Rubber Co., Ltd. |

450 | 8,423 | ||||||

| ZOZO, Inc. |

700 | 12,811 | ||||||

|

|

|

|||||||

| (Cost $5,204,311) |

|

9,859,440 | ||||||

| Luxembourg 0.4% |

| |||||||

| ArcelorMittal |

2,155 | 45,286 | ||||||

| Aroundtown SA |

2,660 | 22,076 | ||||||

| Eurofins Scientific SE |

40 | 14,958 | ||||||

| Millicom International Cellular SA (SDR) |

197 | 12,516 | ||||||

| RTL Group SA |

147 | 7,869 | ||||||

| SES SA (FDR) |

1,127 | 21,616 | ||||||

| Tenaris SA |

1,621 | 17,537 | ||||||

|

|

|

|||||||

| (Cost $142,819) |

|

141,858 | ||||||

| Macau 0.1% |

| |||||||

| Sands China Ltd. |

7,619 | 33,371 | ||||||

| Wynn Macau Ltd. |

5,581 | 12,148 | ||||||

|

|

|

|||||||

| (Cost $18,563) |

|

45,519 | ||||||

| Mexico 0.0% |

| |||||||

| Fresnillo PLC (Cost $11,265) |

857 | 9,428 | ||||||

The accompanying notes are an integral part of the financial statements.

| DWS EAFE® Equity Index Fund | | | 27 |

Table of Contents

| Shares | Value ($) | |||||||

| Netherlands 4.7% |

| |||||||

| ABN AMRO Group NV (CVA) 144A |

1,298 | 30,571 | ||||||

| Aegon NV |

5,608 | 26,306 | ||||||

| AerCap Holdings NV* (e) |

439 | 17,384 | ||||||

| Akzo Nobel NV |

841 | 67,878 | ||||||

| ASML Holding NV |

1,328 | 209,549 | ||||||

| EXOR NV |

373 | 20,311 | ||||||

| Heineken Holding NV |

366 | 31,441 | ||||||

| Heineken NV |

863 | 76,444 | ||||||

| ING Groep NV |

12,742 | 137,707 | ||||||

| Koninklijke (Royal) KPN NV |

11,173 | 32,783 | ||||||

| Koninklijke Ahold Delhaize NV |

4,042 | 102,289 | ||||||

| Koninklijke DSM NV |

575 | 47,226 | ||||||

| Koninklijke Philips NV |

3,077 | 109,084 | ||||||

| Koninklijke Vopak NV |

219 | 9,972 | ||||||

| NN Group NV |

972 | 38,801 | ||||||

| NXP Semiconductors NV (d) |

1,130 | 82,806 | ||||||

| QIAGEN NV* |

719 | 24,618 | ||||||

| Randstad NV |

387 | 17,824 | ||||||

| Royal Dutch Shell PLC “A” |

14,894 | 438,683 | ||||||

| Royal Dutch Shell PLC “B” |

12,134 | 362,383 | ||||||

| Wolters Kluwer NV |

975 | 57,807 | ||||||

|

|

|

|||||||

| (Cost $1,177,537) |

|

1,941,867 | ||||||

| New Zealand 0.2% |

| |||||||

| a2 Milk Co., Ltd.* |

2,531 | 18,841 | ||||||

| Auckland International Airport Ltd. |

3,070 | 14,766 | ||||||

| Fisher & Paykel Healthcare Corp., Ltd. |

1,897 | 16,472 | ||||||

| Fletcher Building Ltd.* |

2,416 | 7,896 | ||||||

| Meridian Energy Ltd. |

3,728 | 8,502 | ||||||

| Ryman Healthcare Ltd. |

1,117 | 8,051 | ||||||

| Spark New Zealand Ltd. |

6,338 | 17,642 | ||||||

|

|

|

|||||||

| (Cost $61,614) |

|

92,170 | ||||||

| Norway 0.7% |

| |||||||

| Aker BP ASA |

396 | 10,052 | ||||||

| DNB ASA |

3,099 | 49,779 | ||||||

| Gjensidige Forsikring ASA |

584 | 9,156 | ||||||

| Marine Harvest ASA |

1,368 | 28,846 | ||||||

| Norsk Hydro ASA |

4,490 | 20,453 | ||||||

| Orkla ASA |

2,641 | 20,813 | ||||||

| Schibsted ASA “B” |

296 | 8,993 | ||||||

| Statoil ASA |

3,851 | 81,759 | ||||||

| Telenor ASA |

2,499 | 48,609 | ||||||

| Yara International ASA |

549 | 21,267 | ||||||

|

|

|

|||||||

| (Cost $116,319) |

|

299,727 | ||||||

The accompanying notes are an integral part of the financial statements.

| 28 | | | DWS EAFE® Equity Index Fund |

Table of Contents

| Shares | Value ($) | |||||||

| Portugal 0.2% |

| |||||||

| EDP - Energias de Portugal SA |

8,153 | 28,497 | ||||||

| Galp Energia, SGPS, SA |

1,616 | 25,589 | ||||||

| Jeronimo Martins, SGPS, SA |

729 | 8,645 | ||||||

|

|

|

|||||||

| (Cost $44,321) |

|

62,731 | ||||||

| Singapore 1.3% |

| |||||||

| Ascendas Real Estate Investment Trust (REIT) |

8,100 | 15,259 | ||||||

| CapitaLand Commercial Trust (REIT) |

9,676 | 12,410 | ||||||

| CapitaLand Ltd. |

8,125 | 18,488 | ||||||

| CapitaLand Mall Trust (REIT) |

7,870 | 13,028 | ||||||

| City Developments Ltd. |

1,500 | 8,930 | ||||||

| ComfortDelGro Corp., Ltd. |

7,500 | 11,801 | ||||||

| DBS Group Holdings Ltd. |

5,759 | 99,970 | ||||||

| Genting Singapore Ltd. |

17,995 | 12,891 | ||||||

| Golden Agri-Resources Ltd. |

14,673 | 2,623 | ||||||

| Jardine Cycle & Carriage Ltd. |

304 | 7,876 | ||||||

| Keppel Corp., Ltd. |

4,849 | 20,987 | ||||||

| Oversea-Chinese Banking Corp., Ltd. |

10,070 | 83,173 | ||||||

| SATS Ltd. |

2,500 | 8,543 | ||||||

| Sembcorp Industries Ltd. |

3,149 | 5,844 | ||||||

| Singapore Airlines Ltd. |

1,970 | 13,599 | ||||||

| Singapore Exchange Ltd. |

2,500 | 13,108 | ||||||

| Singapore Press Holdings Ltd. |

5,158 | 8,882 | ||||||

| Singapore Technologies Engineering Ltd. |

4,900 | 12,536 | ||||||

| Singapore Telecommunications Ltd. |

26,501 | 56,932 | ||||||

| Suntec Real Estate Investment Trust (REIT) |

6,100 | 7,963 | ||||||

| United Overseas Bank Ltd. |

4,422 | 79,663 | ||||||

| UOL Group Ltd. |

1,661 | 7,524 | ||||||

| Venture Corp., Ltd. |

900 | 9,203 | ||||||

| Wilmar International Ltd. |

6,600 | 15,095 | ||||||

|

|

|

|||||||

| (Cost $254,485) |

|

546,328 | ||||||

| South Africa 0.1% |

| |||||||

| Mondi PLC (Cost $23,850) |

1,161 | 24,240 | ||||||

| Spain 3.0% |

| |||||||

| ACS, Actividades de Construccion y Servicios SA |

842 | 32,681 | ||||||

| Aena SME SA 144A |

208 | 32,385 | ||||||

| Amadeus IT Group SA |

1,449 | 101,163 | ||||||

| Banco Bilbao Vizcaya Argentaria SA |

21,606 | 115,480 | ||||||

| Banco de Sabadell SA |

18,577 | 21,319 | ||||||

| Banco Santander SA |

52,737 | 241,817 | ||||||

| Bankia SA |

3,961 | 11,639 | ||||||

| Bankinter SA |

2,126 | 17,125 | ||||||

| CaixaBank SA |

11,831 | 43,017 | ||||||

The accompanying notes are an integral part of the financial statements.

| DWS EAFE® Equity Index Fund | | | 29 |

Table of Contents

| Shares | Value ($) | |||||||

| Enagas SA |

705 | 19,092 | ||||||

| Endesa SA |

1,014 | 23,413 | ||||||

| Ferrovial SA |

1,555 | 31,565 | ||||||

| Grifols SA |

989 | 25,978 | ||||||

| Iberdrola SA |

19,761 | 159,379 | ||||||

| Industria de Diseno Textil SA |

3,579 | 91,641 | ||||||

| Mapfre SA |

3,866 | 10,293 | ||||||

| Naturgy Energy Group SA |

1,160 | 29,612 | ||||||

| Red Electrica Corp. SA |

1,404 | 31,426 | ||||||

| Repsol SA |

4,472 | 72,411 | ||||||

| Siemens Gamesa Renewable Energy SA* |

709 | 8,657 | ||||||

| Telefonica SA |

15,200 | 128,105 | ||||||

|

|

|

|||||||

| (Cost $878,236) |

|

1,248,198 | ||||||

| Sweden 2.4% |

| |||||||

| Alfa Laval AB |

976 | 20,984 | ||||||

| Assa Abloy AB “B” |

3,184 | 57,101 | ||||||

| Atlas Copco AB “A” |

2,193 | 52,310 | ||||||

| Atlas Copco AB “B” |

1,247 | 27,317 | ||||||

| Boliden AB |

892 | 19,417 | ||||||

| Electrolux AB “B” |

784 | 16,607 | ||||||

| Epiroc AB “A”* |

2,048 | 19,428 | ||||||

| Epiroc AB “B”* |

1,387 | 12,379 | ||||||

| Essity AB “B” |

2,026 | 49,886 | ||||||

| Hennes & Mauritz AB “B” |

2,918 | 41,540 | ||||||

| Hexagon AB “B” |

848 | 39,228 | ||||||

| Husqvarna AB “B” |

1,211 | 9,003 | ||||||

| ICA Gruppen AB |

265 | 9,474 | ||||||

| Industrivarden AB “C” |

536 | 10,885 | ||||||

| Investor AB “B” |

1,512 | 64,340 | ||||||

| Kinnevik AB “B” |

761 | 18,389 | ||||||

| L E Lundbergforetagen AB “B” |

248 | 7,326 | ||||||

| Lundin Petroleum AB |

595 | 14,918 | ||||||

| Sandvik AB |

3,517 | 50,636 | ||||||

| Securitas AB “B” |

962 | 15,471 | ||||||

| Skandinaviska Enskilda Banken AB “A” |

5,429 | 52,900 | ||||||

| Skanska AB “B” |

1,127 | 17,997 | ||||||

| SKF AB “B” |

1,220 | 18,603 | ||||||

| Svenska Handelsbanken AB “A” |

4,967 | 55,484 | ||||||

| Swedbank AB “A” |

2,901 | 64,952 | ||||||

| Swedish Match AB |

592 | 23,368 | ||||||

| Tele2 AB “B” |

1,677 | 21,454 | ||||||

| Telefonaktiebolaget LM Ericsson “B” |

10,137 | 90,471 | ||||||

| Telia Co. AB |

8,959 | 42,543 | ||||||

| Volvo AB “B” |

5,082 | 66,776 | ||||||

|

|

|

|||||||

| (Cost $351,379) |

|

1,011,187 | ||||||

The accompanying notes are an integral part of the financial statements.

| 30 | | | DWS EAFE® Equity Index Fund |

Table of Contents

| Shares | Value ($) | |||||||

| Switzerland 9.0% |

| |||||||

| ABB Ltd. (Registered) |

5,973 | 114,157 | ||||||

| Adecco Group AG (Registered) |

501 | 23,544 | ||||||

| Baloise Holding AG (Registered) |

147 | 20,308 | ||||||

| Barry Callebaut AG (Registered) |

8 | 12,490 | ||||||

| Chocoladefabriken Lindt & Spruengli AG |

3 | 18,578 | ||||||

| Cie Financiere Richemont SA (Registered) |

1,699 | 109,920 | ||||||

| Clariant AG (Registered)* |

681 | 12,579 | ||||||

| Coca-Cola HBC AG* |

626 | 19,586 | ||||||

| Credit Suisse Group AG (Registered)* |

8,183 | 89,915 | ||||||

| Dufry AG (Registered)* |

104 | 9,866 | ||||||

| EMS-Chemie Holding AG (Registered) |

26 | 12,400 | ||||||

| Ferguson PLC |

753 | 48,251 | ||||||

| Geberit AG (Registered) |

123 | 48,007 | ||||||

| Givaudan SA (Registered) |

30 | 69,602 | ||||||

| Glencore PLC* |

36,924 | 137,353 | ||||||

| Julius Baer Group Ltd.* |

782 | 27,968 | ||||||

| Kuehne + Nagel International AG (Registered) |

170 | 21,875 | ||||||

| LafargeHolcim Ltd. (Registered)* (b) |

473 | 19,581 | ||||||

| LafargeHolcim Ltd. (Registered)* (b) |

1,125 | 46,186 | ||||||

| Lonza Group AG (Registered)* |

239 | 62,377 | ||||||

| Nestle SA (Registered) |

9,971 | 810,904 | ||||||

| Novartis AG (Registered) |

7,050 | 604,933 | ||||||

| Pargesa Holding SA (Bearer) |

110 | 7,953 | ||||||

| Partners Group Holding AG |

56 | 33,986 | ||||||

| Roche Holding AG (Genusschein) |

2,285 | 568,538 | ||||||

| Schindler Holding AG |

135 | 26,851 | ||||||

| Schindler Holding AG (Registered) |

73 | 14,252 | ||||||

| SGS SA (Registered) |

18 | 40,644 | ||||||

| Sika AG |

428 | 54,502 | ||||||

| Sonova Holding AG (Registered) |

189 | 31,115 | ||||||

| STMicroelectronics NV |

2,276 | 32,694 | ||||||

| Straumann Holding AG (Registered) |

35 | 22,158 | ||||||

| Swatch Group AG (Bearer) |

97 | 28,384 | ||||||

| Swatch Group AG (Registered) |

190 | 11,049 | ||||||

| Swiss Life Holding AG (Registered)* |

110 | 42,549 | ||||||

| Swiss Prime Site AG (Registered)* |

260 | 21,080 | ||||||

| Swiss Re AG |

994 | 91,469 | ||||||

| Swisscom AG (Registered) |

88 | 42,327 | ||||||

| Temenos AG* |

209 | 25,223 | ||||||

| UBS Group AG (Registered)* |

12,510 | 156,120 | ||||||

| Vifor Pharma AG |

158 | 17,200 | ||||||

| Zurich Insurance Group AG |

496 | 148,395 | ||||||

|

|

|

|||||||

| (Cost $1,504,052) |

|

3,756,869 | ||||||

The accompanying notes are an integral part of the financial statements.

| DWS EAFE® Equity Index Fund | | | 31 |

Table of Contents

| Shares | Value ($) | |||||||

| United Arab Emirates 0.0% |

| |||||||

| NMC Health PLC (Cost $16,533) |

347 | 12,130 | ||||||

| United Kingdom 14.8% |

| |||||||

| 3i Group PLC |

3,081 | 30,417 | ||||||

| Admiral Group PLC |

597 | 15,601 | ||||||

| Anglo American PLC |

3,467 | 77,479 | ||||||

| Ashtead Group PLC |

1,588 | 33,210 | ||||||

| Associated British Foods PLC |

1,181 | 30,784 | ||||||

| AstraZeneca PLC |

4,112 | 308,444 | ||||||

| Auto Trader Group PLC 144A |

3,320 | 19,282 | ||||||

| Aviva PLC |

12,956 | 62,126 | ||||||

| Babcock International Group PLC |

908 | 5,674 | ||||||

| BAE Systems PLC |

10,502 | 61,591 | ||||||

| Barclays PLC |

55,196 | 106,276 | ||||||

| Barratt Developments PLC |

3,351 | 19,799 | ||||||

| Berkeley Group Holdings PLC |

403 | 17,869 | ||||||

| BHP Group PLC |

6,832 | 144,882 | ||||||

| BP PLC |

64,793 | 410,251 | ||||||

| British American Tobacco PLC |

7,436 | 237,791 | ||||||

| British Land Co. PLC (REIT) |

2,865 | 19,517 | ||||||

| BT Group PLC |

27,531 | 83,824 | ||||||

| Bunzl PLC |

1,127 | 34,075 | ||||||

| Burberry Group PLC |

1,292 | 28,602 | ||||||

| Carnival PLC |

579 | 27,912 | ||||||

| Centrica PLC |

18,729 | 32,256 | ||||||

| CNH Industrial NV |

3,243 | 29,642 | ||||||

| Coca-Cola European Partners PLC |

863 | 39,823 | ||||||

| Compass Group PLC |

5,098 | 107,311 | ||||||

| ConvaTec Group PLC 144A |

4,923 | 8,733 | ||||||

| Croda International PLC |

419 | 25,075 | ||||||

| Diageo PLC |

8,000 | 285,202 | ||||||

| Direct Line Insurance Group PLC |

4,420 | 17,924 | ||||||

| easyJet PLC |

590 | 8,337 | ||||||

| Experian PLC |

3,041 | 73,884 | ||||||

| Fiat Chrysler Automobiles NV* (b) (e) |

2,999 | 43,366 | ||||||

| Fiat Chrysler Automobiles NV* (b) |

479 | 6,966 | ||||||

| G4S PLC |

4,855 | 12,201 | ||||||

| GlaxoSmithKline PLC |

16,101 | 306,578 | ||||||

| Hammerson PLC (REIT) |

2,640 | 11,093 | ||||||

| Hargreaves Lansdown PLC |

884 | 20,904 | ||||||

| HSBC Holdings PLC |

64,587 | 533,998 | ||||||

| Imperial Brands PLC |

3,118 | 94,550 | ||||||

| Informa PLC |

3,949 | 31,756 | ||||||

| InterContinental Hotels Group PLC |

568 | 30,737 | ||||||

| International Consolidated Airlines Group SA |

1,993 | 15,820 | ||||||

The accompanying notes are an integral part of the financial statements.

| 32 | | | DWS EAFE® Equity Index Fund |

Table of Contents

| Shares | Value ($) | |||||||

| Intertek Group PLC |

527 | 32,310 | ||||||

| Investec PLC |

2,352 | 13,270 | ||||||

| ITV PLC |

11,638 | 18,533 | ||||||

| J Sainsbury PLC |

5,636 | 19,054 | ||||||

| John Wood Group PLC |

2,324 | 15,029 | ||||||

| Johnson Matthey PLC |

600 | 21,434 | ||||||

| Kingfisher PLC |

7,108 | 18,811 | ||||||

| Land Securities Group PLC (REIT) |

2,455 | 25,198 | ||||||

| Legal & General Group PLC |

19,392 | 57,247 | ||||||