UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06093

|

Name of Registrant: |

Vanguard Institutional Index Funds |

|

Address of Registrant: |

P.O. Box 2600 |

|

|

Valley Forge, PA 19482 |

|

|

|

|

Name and address of agent for service: |

Anne E. Robinson, Esquire |

|

|

P.O. Box 876 |

|

|

Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2018—December 31, 2018

Item 1: Reports to Shareholders

|

Annual Report | December 31, 2018

Vanguard Institutional Index Fund

|

|

See the inside front cover for important information about access to your fund's annual and semiannual shareholder reports. |

Important information about access to shareholder reports

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com.

You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard.

Contents

| A Note From Our CEO | 1 |

| Your Fund’s Performance at a Glance | 2 |

| About Your Fund’s Expenses | 3 |

| Performance Summary | 5 |

| Financial Statements | 7 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

A Note From Our CEO

Tim Buckley

Chairman and Chief Executive Officer

Dear Shareholder,

Over the years, I've found that prudent investors exhibit a common trait: discipline. No matter how the markets move or what new investing fad hits the headlines, those who stay focused on their goals and tune out the noise are set up for long-term success.

The prime gateway to investing is saving, and you don't usually become a saver without a healthy dose of discipline. Savers make the decision to sock away part of their income, which means spending less and delaying gratification, no matter how difficult that may be.

Of course, disciplined investing extends beyond diligent saving. The financial markets, in the short term especially, are unpredictable; I have yet to meet the investor who can time them perfectly. It takes discipline to resist the urge to go all-in when markets are frothy or to retreat when things look bleak.

Staying put with your investments is one strategy for handling volatility. Another, rebalancing, requires even more discipline because it means steering your money away from strong performers and toward poorer performers.

Patience—a form of discipline—is also the friend of long-term investors. Higher returns are the potential reward for weathering the market's turbulence and uncertainty.

It's important to be prepared for that turbulence, whenever it appears. Don't panic. Don't chase returns or look for answers outside the asset classes you trust. And be sure to rebalance periodically, even when there's turmoil.

Whether you're a master of self-control, get a boost from technology, or work with a professional advisor, know that discipline is necessary to get the most out of your investment portfolio. And know that Vanguard is with you for the entire ride.

Thank you for your continued loyalty.

Sincerely,

Mortimer J. Buckley

Chairman and Chief Executive Officer

January 17, 2019

| 1 |

Your Fund's Performance at a Glance

· For the 12 months ended December 31, 2018, Vanguard Institutional Index Fund returned –4.42% for Institutional Shares and –4.41% for Institutional Plus Shares, closely tracking its target index, the Standard & Poor's 500 Index, which returned –4.38%.

· The broad U.S. stock market returned about –5%, its first negative calendar-year result since 2008. Stocks declined sharply in the fourth quarter. Growth stocks outperformed value; large-capitalization stocks bested small- and mid-caps.

· Seven of the fund's 11 industry sectors recorded negative returns. Financials and industrials were the biggest detractors. Health care and information technology contributed most.

· For the ten years ended December 31, 2018, the fund posted an average annual return of about 13%, in line with its target index.

Market Barometer

| Average Annual Total Returns | |||

| Periods Ended December 31, 2018 | |||

| One Year | Three Years | Five Years | |

| Stocks | |||

| Russell 1000 Index (Large-caps) | -4.78% | 9.09% | 8.21% |

| Russell 2000 Index (Small-caps) | -11.01 | 7.36 | 4.41 |

| Russell 3000 Index (Broad U.S. market) | -5.24 | 8.97 | 7.91 |

| FTSE All-World ex US Index (International) | -14.13 | 4.58 | 1.05 |

| Bonds | |||

| Bloomberg Barclays U.S. Aggregate Bond Index | |||

| (Broad taxable market) | 0.01% | 2.06% | 2.52% |

| Bloomberg Barclays Municipal Bond Index | |||

| (Broad tax-exempt market) | 1.28 | 2.30 | 3.82 |

| FTSE Three-Month U.S. Treasury Bill Index | 1.86 | 0.98 | 0.59 |

| CPI | |||

| Consumer Price Index | 1.91% | 2.03% | 1.51% |

| 2 |

About Your Fund's Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund's gross income, directly reduce the investment return of the fund.

A fund's expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund's costs in two ways:

· Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The "Ending Account Value" shown is derived from the fund's actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading "Expenses Paid During Period."

· Based on hypothetical 5% yearly return. This section is intended to help you compare your fund's costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund's actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund's costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a "sales load."

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund's expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund's current prospectus.

| 3 |

Six Months Ended December 31, 2018

| Institutional Index Fund | Beginning Account Value 6/30/2018 |

Ending Account Value 12/31/2018 |

Expenses Paid During Period | |||

| Based on Actual Fund Return | ||||||

| Institutional Shares | $1,000.00 | $931.29 | $0.15 | |||

| Institutional Plus Shares | 1,000.00 | 931.37 | 0.10 | |||

| Based on Hypothetical 5% Yearly Return | ||||||

| Institutional Shares | $1,000.00 | $1,025.05 | $0.15 | |||

| Institutional Plus Shares | 1,000.00 | 1,025.10 | 0.10 |

The calculations are based on expenses incurred in the most recent six-month period. The fund's annualized six-month expense ratios for that period are 0.03% for Institutional Shares and 0.02% for Institutional Plus Shares. The dollar amounts shown as "Expenses Paid" are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period (184/365).

| 4 |

Institutional Index Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor's shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

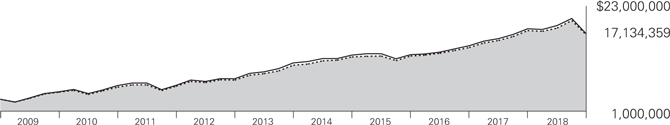

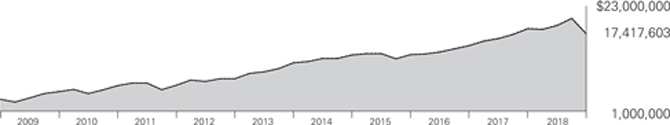

Cumulative Performance: December 31, 2008, Through December 31, 2018

Initial Investment of $5,000,000

| Average Annual Total Returns Periods Ended December 31, 2018 |

Final Value of a $5,000,000 Investment |

|||||||

| One Year |

Five Years |

Ten Years |

||||||

|

Institutional Index Fund Institutional Shares | -4.42% | 8.46% | 13.11% | $17,134,359 | |||

|

S&P 500 Index | -4.38 | 8.49 | 13.12 | 17,151,753 | |||

|

Dow Jones U.S. Total Stock Market Float Adjusted Index | -5.30 | 7.86 | 13.22 | 17,312,429 | |||

| One Year |

Five Years |

Ten Years |

Final Value of a $100,000,000 Investment |

||||

| Institutional Index Fund Institutional Plus Shares | -4.41% | 8.48% | 13.13% | $343,406,164 | |||

| S&P 500 Index | -4.38 | 8.49 | 13.12 | 343,035,069 | |||

| Dow Jones U.S. Total Stock Market Float Adjusted Index | -5.30 | 7.86 | 13.22 | 346,248,570 |

See Financial Highlights for dividend and capital gains information.

| 5 |

Institutional Index Fund

Sector Diversification

As of December 31, 2018

| Communication Services | 10.1 | % | |

| Consumer Discretionary | 9.9 | ||

| Consumer Staples | 7.4 | ||

| Energy | 5.3 | ||

| Financials | 13.4 | ||

| Health Care | 15.6 | ||

| Industrials | 9.2 | ||

| Information Technology | 20.1 | ||

| Materials | 2.7 | ||

| Real Estate | 3.0 | ||

| Utilities | 3.3 |

The table reflects the fund's equity exposure, based on its investments in stocks and stock index futures. Any holdings in short-term reserves are excluded. Sector categories are based on the Global Industry Classification Standard ("GICS”), except for the "Other” category (if applicable), which includes securities that have not been provided a GICS classification as of the effective reporting period.

The Global Industry Classification Standard ("GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. ("MSCI”) and Standard and Poor's, a division of McGraw-Hill Companies, Inc. ("S&P”), and is licensed for use by Vanguard. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classification makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of its affiliates or any third party involved in making or compiling the GICS or any GICS classification have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

| 6 |

Institutional Index Fund

Financial Statements

Statement of Net Assets

As of December 31, 2018

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund's semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund's Forms N-Q on the SEC's website at sec.gov.

| Shares | Market Value· ($000) | |||||||||

| Common Stocks (99.7%)1 | ||||||||||

| Communication Services (10.1%) | ||||||||||

| * | Alphabet Inc. Class C | 2,915,916 | 3,019,752 | |||||||

| * | Facebook Inc. Class A | 22,769,867 | 2,984,902 | |||||||

| * | Alphabet Inc. Class A | 2,833,559 | 2,960,956 | |||||||

| Verizon Communications Inc. | 39,161,714 | 2,201,672 | ||||||||

| AT&T Inc. | 68,978,592 | 1,968,649 | ||||||||

| Walt Disney Co. | 14,109,552 | 1,547,112 | ||||||||

| Comcast Corp. Class A | 43,029,974 | 1,465,171 | ||||||||

| * | Netflix Inc. | 4,133,063 | 1,106,256 | |||||||

| Twenty-First Century Fox Inc. Class A | 10,026,503 | 482,475 | ||||||||

| * | Charter Communications Inc. Class A | 1,670,673 | 476,092 | |||||||

| Activision Blizzard Inc. | 7,232,103 | 336,799 | ||||||||

| * | Electronic Arts Inc. | 2,863,563 | 225,964 | |||||||

| Twenty-First Century Fox Inc. | 4,608,027 | 220,171 | ||||||||

| * | Twitter Inc. | 6,854,297 | 196,992 | |||||||

| Omnicom Group Inc. | 2,124,400 | 155,591 | ||||||||

| CBS Corp. Class B | 3,191,653 | 139,539 | ||||||||

| CenturyLink Inc. | 9,013,949 | 136,561 | ||||||||

| * | Take-Two Interactive Software Inc. | 1,079,168 | 111,089 | |||||||

| Viacom Inc. Class B | 3,346,946 | 86,016 | ||||||||

| * | Discovery Communications Inc. | 3,420,569 | 78,947 | |||||||

| Interpublic Group of Cos. Inc. | 3,637,510 | 75,042 | ||||||||

| News Corp. Class A | 4,852,418 | 55,075 | ||||||||

| * | DISH Network Corp. Class A | 2,167,274 | 54,117 | |||||||

| * | TripAdvisor Inc. | 972,873 | 52,477 | |||||||

| *,^ | Discovery Communications Inc. Class A | 1,479,673 | 36,607 | |||||||

| 20,174,024 | ||||||||||

| Consumer Discretionary (9.9%) | ||||||||||

| * | Amazon.com Inc. | 3,892,803 | 5,846,873 | |||||||

| Home Depot Inc. | 10,705,355 | 1,839,394 | ||||||||

| McDonald's Corp. | 7,306,502 | 1,297,416 | ||||||||

| NIKE Inc. Class B | 12,066,335 | 894,598 | ||||||||

| Starbucks Corp. | 11,758,147 | 757,225 | ||||||||

| * | Booking Holdings Inc. | 439,121 | 756,351 | |||||||

| Lowe's Cos. Inc. | 7,610,257 | 702,883 | ||||||||

| TJX Cos. Inc. | 11,729,067 | 524,758 | ||||||||

| General Motors Co. | 12,439,762 | 416,110 | ||||||||

| Target Corp. | 4,946,019 | 326,882 | ||||||||

| Ross Stores Inc. | 3,538,788 | 294,427 | ||||||||

| Marriott International Inc. Class A | 2,683,681 | 291,340 | ||||||||

| Ford Motor Co. | 37,026,640 | 283,254 | ||||||||

| Yum! Brands Inc. | 2,960,232 | 272,105 | ||||||||

| Dollar General Corp. | 2,491,660 | 269,299 | ||||||||

| * | O'Reilly Automotive Inc. | 759,193 | 261,413 | |||||||

| * | eBay Inc. | 8,577,758 | 240,778 | |||||||

| VF Corp. | 3,084,550 | 220,052 | ||||||||

| * | Dollar Tree Inc. | 2,255,451 | 203,712 | |||||||

| Hilton Worldwide Holdings Inc. | 2,811,046 | 201,833 | ||||||||

| * | AutoZone Inc. | 239,025 | 200,384 | |||||||

| Carnival Corp. | 3,795,273 | 187,107 | ||||||||

| Royal Caribbean Cruises Ltd. | 1,624,486 | 158,859 | ||||||||

| Aptiv plc | 2,496,856 | 153,731 | ||||||||

| Genuine Parts Co. | 1,391,030 | 133,567 | ||||||||

| * | Ulta Beauty Inc. | 534,031 | 130,752 | |||||||

| Expedia Group Inc. | 1,122,765 | 126,479 | ||||||||

| Best Buy Co. Inc. | 2,218,779 | 117,507 | ||||||||

| Darden Restaurants Inc. | 1,176,304 | 117,466 | ||||||||

| MGM Resorts International | 4,746,827 | 115,158 | ||||||||

| DR Horton Inc. | 3,247,204 | 112,548 | ||||||||

| Advance Auto Parts Inc. | 690,768 | 108,768 | ||||||||

| Lennar Corp. Class A | 2,736,688 | 107,141 | ||||||||

| Kohl's Corp. | 1,564,551 | 103,792 | ||||||||

| * | CarMax Inc. | 1,654,448 | 103,784 | |||||||

| 7 |

Institutional Index Fund

| Shares | Market Value· ($000) | |||||||||

| * | Chipotle Mexican Grill Inc. Class A | 231,713 | 100,051 | |||||||

| Tractor Supply Co. | 1,156,299 | 96,482 | ||||||||

| Tapestry Inc. | 2,744,617 | 92,631 | ||||||||

| Wynn Resorts Ltd. | 926,865 | 91,676 | ||||||||

| Hasbro Inc. | 1,102,959 | 89,615 | ||||||||

| * | Norwegian Cruise Line Holdings Ltd. | 2,083,351 | 88,313 | |||||||

| Macy's Inc. | 2,911,737 | 86,712 | ||||||||

| Tiffany & Co. | 1,027,719 | 82,742 | ||||||||

| Newell Brands Inc. | 4,064,366 | 75,557 | ||||||||

| Garmin Ltd. | 1,144,525 | 72,471 | ||||||||

| * | LKQ Corp. | 3,011,112 | 71,454 | |||||||

| * | Mohawk Industries Inc. | 598,810 | 70,037 | |||||||

| BorgWarner Inc. | 1,970,953 | 68,471 | ||||||||

| PVH Corp. | 716,437 | 66,593 | ||||||||

| Whirlpool Corp. | 603,409 | 64,486 | ||||||||

| PulteGroup Inc. | 2,453,537 | 63,767 | ||||||||

| Foot Locker Inc. | 1,091,705 | 58,079 | ||||||||

| L Brands Inc. | 2,161,129 | 55,476 | ||||||||

| * | Michael Kors Holdings Ltd. | 1,427,538 | 54,132 | |||||||

| Ralph Lauren Corp. Class A | 518,356 | 53,629 | ||||||||

| Harley-Davidson Inc. | 1,547,094 | 52,787 | ||||||||

| Gap Inc. | 2,029,492 | 52,280 | ||||||||

| Nordstrom Inc. | 1,079,581 | 50,319 | ||||||||

| H&R Block Inc. | 1,943,356 | 49,303 | ||||||||

| Goodyear Tire & Rubber Co. | 2,213,563 | 45,179 | ||||||||

| Leggett & Platt Inc. | 1,233,875 | 44,222 | ||||||||

| Hanesbrands Inc. | 3,410,142 | 42,729 | ||||||||

| *,^ | Mattel Inc. | 3,285,124 | 32,818 | |||||||

| *,^ | Under Armour Inc. Class A | 1,766,613 | 31,216 | |||||||

| *,^ | Under Armour Inc. | 1,826,747 | 29,539 | |||||||

| Lennar Corp. Class B | 46,974 | 1,472 | ||||||||

| 19,811,984 | ||||||||||

| Consumer Staples (7.4%) | ||||||||||

| Procter & Gamble Co. | 23,612,400 | 2,170,452 | ||||||||

| Coca-Cola Co. | 36,307,658 | 1,719,168 | ||||||||

| PepsiCo Inc. | 13,378,480 | 1,478,055 | ||||||||

| Walmart Inc. | 13,492,153 | 1,256,794 | ||||||||

| Philip Morris International Inc. | 14,733,238 | 983,591 | ||||||||

| Altria Group Inc. | 17,808,854 | 879,579 | ||||||||

| Costco Wholesale Corp. | 4,153,207 | 846,050 | ||||||||

| Mondelez International Inc. Class A | 13,778,743 | 551,563 | ||||||||

| Walgreens Boots Alliance Inc. | 7,619,437 | 520,636 | ||||||||

| Colgate-Palmolive Co. | 8,220,013 | 489,255 | ||||||||

| Kimberly-Clark Corp. | 3,282,098 | 373,962 | ||||||||

| Sysco Corp. | 4,532,339 | 283,996 | ||||||||

| Estee Lauder Cos. Inc. Class A | 2,084,099 | 271,141 | ||||||||

| Kraft Heinz Co. | 5,894,388 | 253,694 | ||||||||

| Constellation Brands Inc. Class A | 1,574,723 | 253,247 | ||||||||

| General Mills Inc. | 5,650,980 | 220,049 | ||||||||

| Archer-Daniels-Midland Co. | 5,313,534 | 217,696 | ||||||||

| Kroger Co. | 7,563,352 | 207,992 | ||||||||

| Clorox Co. | 1,209,856 | 186,487 | ||||||||

| * | Monster Beverage Corp. | 3,773,607 | 185,737 | |||||||

| McCormick & Co. Inc. | 1,154,132 | 160,701 | ||||||||

| Church & Dwight Co. Inc. | 2,333,801 | 153,471 | ||||||||

| Tyson Foods Inc. Class A | 2,796,901 | 149,355 | ||||||||

| Hershey Co. | 1,329,092 | 142,452 | ||||||||

| Kellogg Co. | 2,400,877 | 136,874 | ||||||||

| ^ | Hormel Foods Corp. | 2,583,628 | 110,269 | |||||||

| Lamb Weston Holdings Inc. | 1,387,600 | 102,072 | ||||||||

| JM Smucker Co. | 1,077,803 | 100,764 | ||||||||

| Molson Coors Brewing Co. Class B | 1,774,448 | 99,653 | ||||||||

| Conagra Brands Inc. | 4,600,332 | 98,263 | ||||||||

| Brown-Forman Corp. Class B | 1,573,847 | 74,884 | ||||||||

| *,^ | Campbell Soup Co. | 1,830,717 | 60,395 | |||||||

| Coty Inc. Class A | 4,286,138 | 28,117 | ||||||||

| 14,766,414 | ||||||||||

| Energy (5.3%) | ||||||||||

| Exxon Mobil Corp. | 40,126,700 | 2,736,240 | ||||||||

| Chevron Corp. | 18,109,774 | 1,970,162 | ||||||||

| ConocoPhillips | 10,911,421 | 680,327 | ||||||||

| EOG Resources Inc. | 5,496,376 | 479,339 | ||||||||

| Schlumberger Ltd. | 13,124,507 | 473,532 | ||||||||

| Occidental Petroleum Corp. | 7,156,113 | 439,242 | ||||||||

| Marathon Petroleum Corp. | 6,547,894 | 386,391 | ||||||||

| Phillips 66 | 4,020,878 | 346,399 | ||||||||

| Valero Energy Corp. | 4,021,595 | 301,499 | ||||||||

| Kinder Morgan Inc. | 17,989,877 | 276,684 | ||||||||

| Williams Cos. Inc. | 11,473,605 | 252,993 | ||||||||

| Halliburton Co. | 8,302,969 | 220,693 | ||||||||

| Pioneer Natural Resources Co. | 1,615,746 | 212,503 | ||||||||

| ONEOK Inc. | 3,899,201 | 210,362 | ||||||||

| Anadarko Petroleum Corp. | 4,779,739 | 209,544 | ||||||||

| * | Concho Resources Inc. | 1,898,069 | 195,103 | |||||||

| Diamondback Energy Inc. | 1,461,975 | 135,525 | ||||||||

| Marathon Oil Corp. | 7,878,448 | 112,977 | ||||||||

| 8 |

Institutional Index Fund

| Shares | Market Value· ($000) | |||||||||

| Baker Hughes a GE Co. Class A | 4,864,426 | 104,585 | ||||||||

| Devon Energy Corp. | 4,436,038 | 99,988 | ||||||||

| Hess Corp. | 2,357,443 | 95,476 | ||||||||

| Apache Corp. | 3,597,742 | 94,441 | ||||||||

| National Oilwell Varco Inc. | 3,631,187 | 93,322 | ||||||||

| Cabot Oil & Gas Corp. | 4,084,314 | 91,284 | ||||||||

| Noble Energy Inc. | 4,542,437 | 85,216 | ||||||||

| TechnipFMC plc | 4,028,474 | 78,878 | ||||||||

| HollyFrontier Corp. | 1,508,942 | 77,137 | ||||||||

| Cimarex Energy Co. | 908,687 | 56,021 | ||||||||

| Helmerich & Payne Inc. | 1,037,006 | 49,714 | ||||||||

| * | Newfield Exploration Co. | 1,894,671 | 27,776 | |||||||

| 10,593,353 | ||||||||||

| Financials (13.3%) | ||||||||||

| * | Berkshire Hathaway Inc. Class B | 18,125,298 | 3,700,823 | |||||||

| JPMorgan Chase & Co. | 31,517,172 | 3,076,706 | ||||||||

| Bank of America Corp. | 86,505,044 | 2,131,484 | ||||||||

| Wells Fargo & Co. | 40,152,274 | 1,850,217 | ||||||||

| Citigroup Inc. | 23,145,968 | 1,204,979 | ||||||||

| US Bancorp | 14,397,536 | 657,967 | ||||||||

| CME Group Inc. | 3,390,849 | 637,886 | ||||||||

| American Express Co. | 6,639,050 | 632,834 | ||||||||

| Chubb Ltd. | 4,367,757 | 564,227 | ||||||||

| Goldman Sachs Group Inc. | 3,278,761 | 547,717 | ||||||||

| PNC Financial Services Group Inc. | 4,373,290 | 511,281 | ||||||||

| Morgan Stanley | 12,390,810 | 491,296 | ||||||||

| Charles Schwab Corp. | 11,391,501 | 473,089 | ||||||||

| BlackRock Inc. | 1,150,960 | 452,120 | ||||||||

| Intercontinental Exchange Inc. | 5,398,331 | 406,656 | ||||||||

| Bank of New York Mellon Corp. | 8,621,685 | 405,823 | ||||||||

| S&P Global Inc. | 2,377,964 | 404,111 | ||||||||

| MetLife Inc. | 9,353,257 | 384,045 | ||||||||

| Marsh & McLennan Cos. Inc. | 4,773,931 | 380,721 | ||||||||

| Capital One Financial Corp. | 4,489,326 | 339,348 | ||||||||

| Progressive Corp. | 5,526,545 | 333,416 | ||||||||

| Aon plc | 2,282,594 | 331,798 | ||||||||

| American International Group Inc. | 8,384,493 | 330,433 | ||||||||

| Aflac Inc. | 7,215,107 | 328,720 | ||||||||

| Prudential Financial Inc. | 3,914,618 | 319,237 | ||||||||

| BB&T Corp. | 7,303,870 | 316,404 | ||||||||

| Travelers Cos. Inc. | 2,510,513 | 300,634 | ||||||||

| Allstate Corp. | 3,264,518 | 269,747 | ||||||||

| State Street Corp. | 3,597,295 | 226,881 | ||||||||

| Moody's Corp. | 1,579,947 | 221,256 | ||||||||

| SunTrust Banks Inc. | 4,258,444 | 214,796 | ||||||||

| T. Rowe Price Group Inc. | 2,280,986 | 210,581 | ||||||||

| M&T Bank Corp. | 1,330,232 | 190,396 | ||||||||

| Discover Financial Services | 3,184,388 | 187,815 | ||||||||

| Willis Towers Watson plc | 1,231,594 | 187,030 | ||||||||

| Northern Trust Corp. | 2,098,530 | 175,416 | ||||||||

| Hartford Financial Services Group Inc. | 3,400,073 | 151,133 | ||||||||

| Synchrony Financial | 6,267,292 | 147,031 | ||||||||

| Fifth Third Bancorp | 6,214,399 | 146,225 | ||||||||

| KeyCorp | 9,806,515 | 144,940 | ||||||||

| Ameriprise Financial Inc. | 1,320,950 | 137,868 | ||||||||

| Citizens Financial Group Inc. | 4,435,372 | 131,864 | ||||||||

| Regions Financial Corp. | 9,800,438 | 131,130 | ||||||||

| Arthur J Gallagher & Co. | 1,740,677 | 128,288 | ||||||||

| MSCI Inc. Class A | 834,424 | 123,019 | ||||||||

| Huntington Bancshares Inc. | 10,062,349 | 119,943 | ||||||||

| Loews Corp. | 2,620,328 | 119,277 | ||||||||

| Cincinnati Financial Corp. | 1,434,342 | 111,047 | ||||||||

| Principal Financial Group Inc. | 2,495,148 | 110,211 | ||||||||

| * | First Republic Bank | 1,248,755 | 108,517 | |||||||

| E*TRADE Financial Corp. | 2,409,082 | 105,710 | ||||||||

| Comerica Inc. | 1,532,229 | 105,249 | ||||||||

| Cboe Global Markets Inc. | 1,065,928 | 104,280 | ||||||||

| Lincoln National Corp. | 2,024,149 | 103,859 | ||||||||

| * | SVB Financial Group | 504,450 | 95,805 | |||||||

| Raymond James Financial Inc. | 1,221,358 | 90,881 | ||||||||

| Nasdaq Inc. | 1,087,882 | 88,739 | ||||||||

| Everest Re Group Ltd. | 385,241 | 83,890 | ||||||||

| Franklin Resources Inc. | 2,817,099 | 83,555 | ||||||||

| Zions Bancorp NA | 1,818,976 | 74,105 | ||||||||

| Torchmark Corp. | 970,677 | 72,345 | ||||||||

| Invesco Ltd. | 3,890,480 | 65,127 | ||||||||

| * | Berkshire Hathaway Inc. Class A | 208 | 63,648 | |||||||

| Unum Group | 2,071,908 | 60,873 | ||||||||

| People's United Financial Inc. | 3,586,208 | 51,749 | ||||||||

| Affiliated Managers Group Inc. | 500,492 | 48,768 | ||||||||

| Jefferies Financial Group Inc. | 2,670,919 | 46,367 | ||||||||

| Assurant Inc. | 495,368 | 44,306 | ||||||||

| * | Brighthouse Financial Inc. | 1,124,644 | 34,279 | |||||||

| 26,631,918 | ||||||||||

| Health Care (15.5%) | ||||||||||

| Johnson & Johnson | 25,418,713 | 3,280,285 | ||||||||

| Pfizer Inc. | 54,784,655 | 2,391,350 | ||||||||

| UnitedHealth Group Inc. | 9,117,790 | 2,271,424 | ||||||||

| 9 |

Institutional Index Fund

| Shares | Market Value· ($000) | |||||||||

| Merck & Co. Inc. | 24,645,093 | 1,883,132 | ||||||||

| AbbVie Inc. | 14,256,453 | 1,314,302 | ||||||||

| Abbott Laboratories | 16,646,140 | 1,204,015 | ||||||||

| Amgen Inc. | 6,039,354 | 1,175,681 | ||||||||

| Medtronic plc | 12,728,999 | 1,157,830 | ||||||||

| Eli Lilly & Co. | 8,935,428 | 1,034,008 | ||||||||

| Thermo Fisher Scientific Inc. | 3,815,537 | 853,879 | ||||||||

| Bristol-Myers Squibb Co. | 15,469,215 | 804,090 | ||||||||

| CVS Health Corp. | 12,256,649 | 803,056 | ||||||||

| Gilead Sciences Inc. | 12,260,447 | 766,891 | ||||||||

| * | Cigna Corp. | 3,608,935 | 685,409 | |||||||

| Anthem Inc. | 2,451,294 | 643,783 | ||||||||

| Danaher Corp. | 5,845,866 | 602,826 | ||||||||

| * | Biogen Inc. | 1,909,577 | 574,630 | |||||||

| Becton Dickinson and Co. | 2,542,512 | 572,879 | ||||||||

| * | Intuitive Surgical Inc. | 1,082,415 | 518,390 | |||||||

| * | Boston Scientific Corp. | 13,115,666 | 463,508 | |||||||

| Stryker Corp. | 2,943,616 | 461,412 | ||||||||

| * | Celgene Corp. | 6,627,362 | 424,748 | |||||||

| * | Illumina Inc. | 1,393,266 | 417,882 | |||||||

| Allergan plc | 3,004,846 | 401,628 | ||||||||

| * | Vertex Pharmaceuticals Inc. | 2,422,154 | 401,375 | |||||||

| Zoetis Inc. | 4,553,398 | 389,498 | ||||||||

| Humana Inc. | 1,300,174 | 372,474 | ||||||||

| HCA Healthcare Inc. | 2,544,309 | 316,639 | ||||||||

| Baxter International Inc. | 4,690,552 | 308,732 | ||||||||

| * | Edwards Lifesciences Corp. | 1,981,338 | 303,482 | |||||||

| * | Regeneron Pharmaceuticals Inc. | 735,610 | 274,750 | |||||||

| * | Centene Corp. | 1,946,343 | 224,413 | |||||||

| * | Alexion Pharmaceuticals Inc. | 2,114,497 | 205,867 | |||||||

| McKesson Corp. | 1,851,719 | 204,559 | ||||||||

| Agilent Technologies Inc. | 3,021,268 | 203,815 | ||||||||

| Zimmer Biomet Holdings Inc. | 1,933,310 | 200,523 | ||||||||

| * | IQVIA Holdings Inc. | 1,501,723 | 174,455 | |||||||

| * | Cerner Corp. | 3,122,915 | 163,766 | |||||||

| ResMed Inc. | 1,350,643 | 153,798 | ||||||||

| * | IDEXX Laboratories Inc. | 817,429 | 152,058 | |||||||

| * | Align Technology Inc. | 689,892 | 144,484 | |||||||

| * | ABIOMED Inc. | 426,881 | 138,753 | |||||||

| * | Waters Corp. | 717,865 | 135,425 | |||||||

| * | Mettler-Toledo International Inc. | 237,364 | 134,248 | |||||||

| * | Mylan NV | 4,886,981 | 133,903 | |||||||

| Cardinal Health Inc. | 2,838,182 | 126,583 | ||||||||

| * | Laboratory Corp. of America Holdings | 956,272 | 120,835 | |||||||

| Cooper Cos. Inc. | 465,821 | 118,551 | ||||||||

| * | Henry Schein Inc. | 1,444,812 | 113,447 | |||||||

| * | WellCare Health Plans Inc. | 473,807 | 111,861 | |||||||

| AmerisourceBergen Corp. Class A | 1,486,233 | 110,576 | ||||||||

| Quest Diagnostics Inc. | 1,288,971 | 107,333 | ||||||||

| * | Incyte Corp. | 1,673,633 | 106,426 | |||||||

| * | Hologic Inc. | 2,552,753 | 104,918 | |||||||

| * | Varian Medical Systems Inc. | 863,084 | 97,796 | |||||||

| Universal Health Services Inc. Class B | 807,602 | 94,134 | ||||||||

| PerkinElmer Inc. | 1,053,087 | 82,720 | ||||||||

| Dentsply Sirona Inc. | 2,106,708 | 78,391 | ||||||||

| * | DaVita Inc. | 1,197,248 | 61,610 | |||||||

| * | Nektar Therapeutics Class A | 1,644,798 | 54,064 | |||||||

| Perrigo Co. plc | 1,188,329 | 46,048 | ||||||||

| 30,979,348 | ||||||||||

| Industrials (9.2%) | ||||||||||

| Boeing Co. | 5,005,471 | 1,614,264 | ||||||||

| 3M Co. | 5,518,738 | 1,051,540 | ||||||||

| Union Pacific Corp. | 6,983,215 | 965,290 | ||||||||

| Honeywell International Inc. | 7,016,266 | 926,989 | ||||||||

| United Technologies Corp. | 7,691,973 | 819,041 | ||||||||

| Caterpillar Inc. | 5,592,980 | 710,700 | ||||||||

| United Parcel Service Inc. Class B | 6,589,132 | 642,638 | ||||||||

| General Electric Co. | 82,438,381 | 624,059 | ||||||||

| Lockheed Martin Corp. | 2,345,247 | 614,079 | ||||||||

| CSX Corp. | 7,603,434 | 472,401 | ||||||||

| Deere & Co. | 3,048,778 | 454,786 | ||||||||

| General Dynamics Corp. | 2,638,478 | 414,795 | ||||||||

| Raytheon Co. | 2,697,214 | 413,618 | ||||||||

| Northrop Grumman Corp. | 1,645,578 | 403,002 | ||||||||

| * | Norfolk Southern Corp. | 2,581,419 | 386,025 | |||||||

| FedEx Corp. | 2,297,887 | 370,718 | ||||||||

| Illinois Tool Works Inc. | 2,893,175 | 366,536 | ||||||||

| Emerson Electric Co. | 5,934,703 | 354,599 | ||||||||

| Waste Management Inc. | 3,717,313 | 330,804 | ||||||||

| Delta Air Lines Inc. | 5,913,935 | 295,105 | ||||||||

| Eaton Corp. plc | 4,107,772 | 282,040 | ||||||||

| Roper Technologies Inc. | 980,354 | 261,284 | ||||||||

| Johnson Controls International plc | 8,759,875 | 259,730 | ||||||||

| Southwest Airlines Co. | 4,796,903 | 222,960 | ||||||||

| Ingersoll-Rand plc | 2,328,389 | 212,419 | ||||||||

| PACCAR Inc. | 3,312,237 | 189,261 | ||||||||

| Fortive Corp. | 2,785,471 | 188,465 | ||||||||

| Cummins Inc. | 1,400,166 | 187,118 | ||||||||

| Parker-Hannifin Corp. | 1,254,527 | 187,100 | ||||||||

| * | United Continental Holdings Inc. | 2,169,504 | 181,653 | |||||||

| 10 |

Institutional Index Fund

| Shares | Market Value· ($000) | |||||||||

| Rockwell Automation Inc. | 1,143,895 | 172,133 | ||||||||

| Stanley Black & Decker Inc. | 1,431,827 | 171,447 | ||||||||

| * | Verisk Analytics Inc. Class A | 1,560,110 | 170,114 | |||||||

| * | IHS Markit Ltd. | 3,399,483 | 163,073 | |||||||

| * | TransDigm Group Inc. | 460,000 | 156,428 | |||||||

| Harris Corp. | 1,115,284 | 150,173 | ||||||||

| AMETEK Inc. | 2,200,147 | 148,950 | ||||||||

| Republic Services Inc. Class A | 2,060,753 | 148,560 | ||||||||

| Fastenal Co. | 2,721,257 | 142,295 | ||||||||

| Cintas Corp. | 820,713 | 137,872 | ||||||||

| L3 Technologies Inc. | 745,921 | 129,537 | ||||||||

| American Airlines Group Inc. | 3,885,685 | 124,769 | ||||||||

| WW Grainger Inc. | 432,396 | 122,091 | ||||||||

| Xylem Inc. | 1,702,954 | 113,621 | ||||||||

| Expeditors International of Washington Inc. | 1,635,566 | 111,366 | ||||||||

| CH Robinson Worldwide Inc. | 1,303,403 | 109,603 | ||||||||

| Equifax Inc. | 1,142,512 | 106,402 | ||||||||

| Textron Inc. | 2,302,218 | 105,879 | ||||||||

| Dover Corp. | 1,386,056 | 98,341 | ||||||||

| * | Copart Inc. | 1,950,466 | 93,193 | |||||||

| Kansas City Southern | 964,084 | 92,022 | ||||||||

| Masco Corp. | 2,891,464 | 84,546 | ||||||||

| * | United Rentals Inc. | 767,753 | 78,718 | |||||||

| Nielsen Holdings plc | 3,364,451 | 78,493 | ||||||||

| Huntington Ingalls Industries Inc. | 407,204 | 77,495 | ||||||||

| JB Hunt Transport Services Inc. | 826,608 | 76,908 | ||||||||

| Snap-on Inc. | 526,950 | 76,561 | ||||||||

| Allegion plc | 899,392 | 71,691 | ||||||||

| Alaska Air Group Inc. | 1,166,672 | 70,992 | ||||||||

| Arconic Inc. | 4,069,057 | 68,604 | ||||||||

| Jacobs Engineering Group Inc. | 1,135,843 | 66,401 | ||||||||

| Robert Half International Inc. | 1,154,181 | 66,019 | ||||||||

| AO Smith Corp. | 1,363,726 | 58,231 | ||||||||

| Pentair plc | 1,517,213 | 57,320 | ||||||||

| Fortune Brands Home & Security Inc. | 1,339,880 | 50,902 | ||||||||

| Rollins Inc. | 1,399,310 | 50,515 | ||||||||

| Flowserve Corp. | 1,237,715 | 47,058 | ||||||||

| Fluor Corp. | 1,330,667 | 42,848 | ||||||||

| Quanta Services Inc. | 1,387,032 | 41,750 | ||||||||

| 18,335,940 | ||||||||||

| Information Technology (20.0%) | ||||||||||

| Microsoft Corp. | 73,252,261 | 7,440,232 | ||||||||

| Apple Inc. | 42,726,613 | 6,739,696 | ||||||||

| Visa Inc. Class A | 16,654,529 | 2,197,399 | ||||||||

| Intel Corp. | 43,256,126 | 2,030,010 | ||||||||

| Cisco Systems Inc. | 42,611,806 | 1,846,370 | ||||||||

| Mastercard Inc. Class A | 8,611,745 | 1,624,606 | ||||||||

| Oracle Corp. | 24,155,509 | 1,090,621 | ||||||||

| * | Adobe Inc. | 4,626,426 | 1,046,683 | |||||||

| Broadcom Inc. | 3,918,497 | 996,395 | ||||||||

| * | salesforce.com Inc. | 7,250,602 | 993,115 | |||||||

| International Business Machines Corp. | 8,613,220 | 979,065 | ||||||||

| * | PayPal Holdings Inc. | 11,168,232 | 939,137 | |||||||

| Texas Instruments Inc. | 9,103,665 | 860,296 | ||||||||

| Accenture plc Class A | 6,041,389 | 851,896 | ||||||||

| NVIDIA Corp. | 5,781,444 | 771,823 | ||||||||

| QUALCOMM Inc. | 11,488,464 | 653,809 | ||||||||

| Automatic Data Processing Inc. | 4,148,589 | 543,963 | ||||||||

| Intuit Inc. | 2,459,864 | 484,224 | ||||||||

| Cognizant Technology Solutions Corp. Class A | 5,487,841 | 348,368 | ||||||||

| * | Micron Technology Inc. | 10,616,184 | 336,852 | |||||||

| Fidelity National Information Services Inc. | 3,103,721 | 318,287 | ||||||||

| HP Inc. | 14,996,953 | 306,838 | ||||||||

| Applied Materials Inc. | 9,316,761 | 305,031 | ||||||||

| Analog Devices Inc. | 3,508,386 | 301,125 | ||||||||

| * | Red Hat Inc. | 1,675,344 | 294,257 | |||||||

| * | Fiserv Inc. | 3,776,438 | 277,530 | |||||||

| * | Autodesk Inc. | 2,075,883 | 266,979 | |||||||

| TE Connectivity Ltd. | 3,250,763 | 245,855 | ||||||||

| Amphenol Corp. Class A | 2,855,484 | 231,351 | ||||||||

| Corning Inc. | 7,585,524 | 229,159 | ||||||||

| Xilinx Inc. | 2,398,396 | 204,271 | ||||||||

| Lam Research Corp. | 1,470,876 | 200,289 | ||||||||

| Paychex Inc. | 3,028,767 | 197,324 | ||||||||

| Motorola Solutions Inc. | 1,550,122 | 178,326 | ||||||||

| Hewlett Packard Enterprise Co. | 13,486,686 | 178,159 | ||||||||

| ^ | Microchip Technology Inc. | 2,241,685 | 161,222 | |||||||

| * | FleetCor Technologies Inc. | 840,446 | 156,088 | |||||||

| Global Payments Inc. | 1,499,637 | 154,658 | ||||||||

| * | Advanced Micro Devices Inc. | 8,335,730 | 153,878 | |||||||

| * | VeriSign Inc. | 1,008,378 | 149,532 | |||||||

| NetApp Inc. | 2,387,370 | 142,454 | ||||||||

| DXC Technology Co. | 2,655,049 | 141,169 | ||||||||

| Maxim Integrated Products Inc. | 2,626,035 | 133,534 | ||||||||

| KLA-Tencor Corp. | 1,450,933 | 129,844 | ||||||||

| Total System Services Inc. | 1,590,885 | 129,323 | ||||||||

| Citrix Systems Inc. | 1,213,358 | 124,321 | ||||||||

| 11 |

Institutional Index Fund

| Shares | Market Value· ($000) | |||||||||

| * | Synopsys Inc. | 1,414,642 | 119,169 | |||||||

| * | Cadence Design Systems Inc. | 2,674,205 | 116,274 | |||||||

| Symantec Corp. | 6,054,734 | 114,404 | ||||||||

| * | ANSYS Inc. | 791,829 | 113,184 | |||||||

| Skyworks Solutions Inc. | 1,682,419 | 112,756 | ||||||||

| * | Keysight Technologies Inc. | 1,775,989 | 110,253 | |||||||

| * | Gartner Inc. | 861,258 | 110,103 | |||||||

| Broadridge Financial Solutions Inc. | 1,106,254 | 106,477 | ||||||||

| * | Arista Networks Inc. | 493,008 | 103,877 | |||||||

| Western Digital Corp. | 2,743,178 | 101,415 | ||||||||

| * | Fortinet Inc. | 1,371,773 | 96,614 | |||||||

| Seagate Technology plc | 2,468,504 | 95,260 | ||||||||

| * | Akamai Technologies Inc. | 1,542,722 | 94,229 | |||||||

| * | F5 Networks Inc. | 574,239 | 93,044 | |||||||

| Jack Henry & Associates Inc. | 732,089 | 92,624 | ||||||||

| Juniper Networks Inc. | 3,268,526 | 87,956 | ||||||||

| * | Qorvo Inc. | 1,181,835 | 71,773 | |||||||

| Western Union Co. | 4,206,047 | 71,755 | ||||||||

| Alliance Data Systems Corp. | 444,026 | 66,639 | ||||||||

| FLIR Systems Inc. | 1,314,844 | 57,248 | ||||||||

| Xerox Corp. | 1,964,362 | 38,816 | ||||||||

| * | IPG Photonics Corp. | 340,106 | 38,531 | |||||||

| 40,097,765 | ||||||||||

| Materials (2.7%) | ||||||||||

| DowDuPont Inc. | 21,744,827 | 1,162,913 | ||||||||

| Linde plc | 5,222,799 | 814,966 | ||||||||

| Ecolab Inc. | 2,409,442 | 355,031 | ||||||||

| Air Products & Chemicals Inc. | 2,080,951 | 333,056 | ||||||||

| Sherwin-Williams Co. | 780,931 | 307,265 | ||||||||

| LyondellBasell Industries NV Class A | 2,981,943 | 247,978 | ||||||||

| PPG Industries Inc. | 2,273,819 | 232,453 | ||||||||

| Newmont Mining Corp. | 5,048,327 | 174,925 | ||||||||

| International Paper Co. | 3,839,382 | 154,957 | ||||||||

| Nucor Corp. | 2,975,399 | 154,155 | ||||||||

| Ball Corp. | 3,215,428 | 147,845 | ||||||||

| Freeport-McMoRan Inc. | 13,733,903 | 141,597 | ||||||||

| International Flavors & Fragrances Inc. | 960,119 | 128,915 | ||||||||

| Vulcan Materials Co. | 1,251,613 | 123,659 | ||||||||

| Celanese Corp. Class A | 1,268,000 | 114,082 | ||||||||

| Martin Marietta Materials Inc. | 594,194 | 102,124 | ||||||||

| Mosaic Co. | 3,359,458 | 98,130 | ||||||||

| Eastman Chemical Co. | 1,326,645 | 96,991 | ||||||||

| CF Industries Holdings Inc. | 2,185,969 | 95,112 | ||||||||

| FMC Corp. | 1,275,501 | 94,336 | ||||||||

| Westrock Co. | 2,401,991 | 90,699 | ||||||||

| ^ | Albemarle Corp. | 1,005,288 | 77,478 | |||||||

| Packaging Corp. of America | 894,330 | 74,641 | ||||||||

| Avery Dennison Corp. | 820,468 | 73,703 | ||||||||

| Sealed Air Corp. | 1,491,102 | 51,950 | ||||||||

| 5,448,961 | ||||||||||

| Real Estate (3.0%) | ||||||||||

| American Tower Corp. | 4,174,767 | 660,406 | ||||||||

| Simon Property Group Inc. | 2,931,410 | 492,447 | ||||||||

| Crown Castle International Corp. | 3,931,876 | 427,120 | ||||||||

| Prologis Inc. | 5,966,635 | 350,361 | ||||||||

| Public Storage | 1,421,183 | 287,662 | ||||||||

| Equinix Inc. | 761,898 | 268,615 | ||||||||

| Welltower Inc. | 3,560,302 | 247,120 | ||||||||

| Equity Residential | 3,491,874 | 230,499 | ||||||||

| AvalonBay Communities Inc. | 1,309,966 | 228,000 | ||||||||

| Digital Realty Trust Inc. | 1,955,120 | 208,318 | ||||||||

| Ventas Inc. | 3,378,517 | 197,947 | ||||||||

| Realty Income Corp. | 2,797,204 | 176,336 | ||||||||

| * | SBA Communications Corp. Class A | 1,074,043 | 173,877 | |||||||

| Boston Properties Inc. | 1,463,808 | 164,751 | ||||||||

| Weyerhaeuser Co. | 7,101,061 | 155,229 | ||||||||

| Essex Property Trust Inc. | 626,152 | 153,539 | ||||||||

| HCP Inc. | 4,525,665 | 126,402 | ||||||||

| * | CBRE Group Inc. Class A | 3,004,989 | 120,320 | |||||||

| Alexandria Real Estate Equities Inc. | 1,019,171 | 117,449 | ||||||||

| Host Hotels & Resorts Inc. | 7,033,410 | 117,247 | ||||||||

| Extra Space Storage Inc. | 1,198,858 | 108,473 | ||||||||

| UDR Inc. | 2,610,388 | 103,423 | ||||||||

| Mid-America Apartment Communities Inc. | 1,078,403 | 103,203 | ||||||||

| Vornado Realty Trust | 1,640,540 | 101,763 | ||||||||

| Regency Centers Corp. | 1,604,909 | 94,176 | ||||||||

| Duke Realty Corp. | 3,392,872 | 87,875 | ||||||||

| Iron Mountain Inc. | 2,710,280 | 87,840 | ||||||||

| Federal Realty Investment Trust | 699,354 | 82,552 | ||||||||

| Apartment Investment & Management Co. | 1,479,011 | 64,899 | ||||||||

| SL Green Realty Corp. | 810,225 | 64,073 | ||||||||

| Kimco Realty Corp. | 4,004,025 | 58,659 | ||||||||

| Macerich Co. | 1,000,898 | 43,319 | ||||||||

| 5,903,900 | ||||||||||

| Utilities (3.3%) | ||||||||||

| NextEra Energy Inc. | 4,529,785 | 787,367 | ||||||||

| Duke Energy Corp. | 6,756,457 | 583,082 | ||||||||

| Dominion Energy Inc. | 6,219,471 | 444,443 | ||||||||

| Southern Co. | 9,751,647 | 428,292 | ||||||||

| Exelon Corp. | 9,165,269 | 413,354 | ||||||||

| 12 |

Institutional Index Fund

| Shares | Market Value· ($000) | |||||||||

| American Electric Power Co. Inc. | 4,673,591 | 349,304 | ||||||||

| Sempra Energy | 2,593,693 | 280,612 | ||||||||

| Public Service Enterprise Group Inc. | 4,790,615 | 249,351 | ||||||||

| Xcel Energy Inc. | 4,872,191 | 240,053 | ||||||||

| Consolidated Edison Inc. | 2,952,249 | 225,729 | ||||||||

| WEC Energy Group Inc. | 2,990,755 | 207,140 | ||||||||

| Eversource Energy | 3,003,521 | 195,349 | ||||||||

| PPL Corp. | 6,826,255 | 193,388 | ||||||||

| DTE Energy Co. | 1,724,361 | 190,197 | ||||||||

| Edison International | 3,088,165 | 175,315 | ||||||||

| FirstEnergy Corp. | 4,605,603 | 172,940 | ||||||||

| American Water Works Co. Inc. | 1,711,882 | 155,388 | ||||||||

| Ameren Corp. | 2,315,550 | 151,043 | ||||||||

| Entergy Corp. | 1,717,106 | 147,791 | ||||||||

| Evergy Inc. | 2,496,956 | 141,752 | ||||||||

| CenterPoint Energy Inc. | 4,750,468 | 134,106 | ||||||||

| CMS Energy Corp. | 2,685,771 | 133,349 | ||||||||

| * | PG&E Corp. | 4,916,086 | 116,757 | |||||||

| NRG Energy Inc. | 2,747,311 | 108,794 | ||||||||

| * | Alliant Energy Corp. | 2,234,726 | 94,417 | |||||||

| AES Corp. | 6,272,566 | 90,701 | ||||||||

| Pinnacle West Capital Corp. | 1,061,478 | 90,438 | ||||||||

| NiSource Inc. | 3,440,198 | 87,209 | ||||||||

| SCANA Corp. | 1,355,266 | 64,755 | ||||||||

| 6,652,416 | ||||||||||

| Total Common Stocks | ||||||||||

| (Cost $121,762,367) | 199,396,023 | |||||||||

| Temporary Cash Investments (0.4%)1 | ||||||||||

| Money Market Fund (0.4%) | ||||||||||

| 2,3 | Vanguard Market Liquidity Fund, 2.530% | 7,476,627 | 747,663 | |||||||

| Face | ||||||||||

| Amount | ||||||||||

| ($000) | ||||||||||

| U.S. Government and Agency Obligations (0.0%) | ||||||||||

| 4 | United States | |||||||||

| Treasury Bill, | ||||||||||

| 2.412%, 4/11/19 | 40,000 | 39,737 | ||||||||

| 4 | United States | |||||||||

| Treasury Bill, | ||||||||||

| 2.480%, 5/9/19 | 6,000 | 5,949 | ||||||||

| 45,686 | ||||||||||

Total Temporary Cash Investments (Cost $793,316) | 793,349 | |||||||||

Total Investments (100.1%) (Cost $122,555,683) | 200,189,372 | |||||||||

| Amount ($000) | ||||

| Other Assets and Liabilities (-0.1%) | ||||

| Other Assets | ||||

| Investment in Vanguard | 11,589 | |||

| Receivables for Investment Securities Sold | 690,420 | |||

| Receivables for Accrued Income | 232,950 | |||

| Receivables for Capital Shares Issued | 474,009 | |||

| Variation Margin Receivable—Futures Contracts | 4,657 | |||

| Other Assets | 35,935 | |||

| Total Other Assets | 1,449,560 | |||

| Liabilities | ||||

| Payables for Investment | ||||

| Securities Purchased | (294,357 | ) | ||

| Collateral for Securities on Loan | (275,530 | ) | ||

| Payables for Capital Shares Redeemed | (1,062,830 | ) | ||

| Payables to Vanguard | (2,690 | ) | ||

| Total Liabilities | (1,635,407 | ) | ||

| Net Assets (100%) | 200,003,525 | |||

| At December 31, 2018, net assets consisted of: | ||||

| Amount | ||||

| ($000) | ||||

| Paid-in Capital | 121,682,852 | |||

| Total Distributable Earnings (Loss) | 78,320,673 | |||

| Net Assets | 200,003,525 | |||

| 13 |

Institutional Index Fund

| Amount ($000) | ||||

| Institutional Shares—Net Assets | ||||

| Applicable to 458,337,066 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | 104,296,447 | |||

| Net Asset Value Per Share—Institutional Shares | $227.55 | |||

| Institutional Plus Shares—Net Assets | ||||

| Applicable to 420,565,793 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | 95,707,078 | |||

| Net Asset Value Per Share—Institutional Plus Shares | $227.57 | |||

| · | See Note A in Notes to Financial Statements. |

| * | Non-income-producing security. |

| ^ | Includes partial security positions on loan to broker-dealers. The total value of securities on loan is $265,178,000. |

| 1 | The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures investments, the fund's effective common stock and temporary cash investment positions represent 100.0% and 0.1%, respectively, of net assets. |

| 2 | Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield. |

| 3 | Includes $275,530,000 of collateral received for securities on loan. |

| 4 | Securities with a value of $29,495,000 have been segregated as initial margin for open futures contracts. |

| Derivative Financial Instruments Outstanding as of Period End | ||||

| Futures Contracts |

| ($000) | ||||||||||||||

| Expiration | Number

of Long (Short) Contracts | Notional Amount | Value

and Unrealized Appreciation (Depreciation) | |||||||||||

| Long Futures Contracts | ||||||||||||||

| E-mini S&P 500 Index | March 2019 | 4,033 | 505,174 | (9,914 | ) | |||||||||

See accompanying Notes, which are an integral part of the Financial Statements.

| 14 |

Institutional Index Fund

Statement of Operations

| Year Ended December 31, 2018 | ||||

| ($000) | ||||

| Investment Income | ||||

| Income | ||||

| Dividends | 4,673,269 | |||

| Interest1 | 11,929 | |||

| Securities Lending—Net | 1,675 | |||

| Total Income | 4,686,873 | |||

| Expenses | ||||

| The Vanguard Group—Note B | ||||

| Investment Advisory Services | 9,445 | |||

| Management and Administrative—Institutional Shares | 35,387 | |||

| Management and Administrative—Institutional Plus Shares | 13,873 | |||

| Marketing and Distribution—Institutional Shares | 2,576 | |||

| Marketing and Distribution—Institutional Plus Shares | 943 | |||

| Custodian Fees | 1,231 | |||

| Auditing Fees | 36 | |||

| Shareholders' Reports—Institutional Shares | 487 | |||

| Shareholders' Reports—Institutional Plus Shares | 364 | |||

| Trustees' Fees and Expenses | 132 | |||

| Total Expenses | 64,474 | |||

| Net Investment Income | 4,622,399 | |||

| Realized Net Gain (Loss) | ||||

| Investment Securities Sold1,2 | 11,944,896 | |||

| Futures Contracts | 37 | |||

| Realized Net Gain (Loss) | 11,944,933 | |||

| Change in Unrealized Appreciation (Depreciation) | ||||

| Investment Securities1 | (24,897,707 | ) | ||

| Futures Contracts | (5,862 | ) | ||

| Change in Unrealized Appreciation (Depreciation) | (24,903,569 | ) | ||

| Net Increase (Decrease) in Net Assets Resulting from Operations | (8,336,237 | ) | ||

| 1 | Interest income, realized net gain (loss), and change in unrealized appreciation (depreciation) from an affiliated company of the fund were $11,058,000, ($240,000), and ($35,000), respectively. Purchases and sales are for temporary cash investment purposes. |

| 2 | Includes $9,888,446,000 of net gain (loss) resulting from in-kind redemptions; such gain (loss) is not taxable to the fund. |

See accompanying Notes, which are an integral part of the Financial Statements.

| 15 |

Institutional Index Fund

Statement of Changes in Net Assets

| Year Ended December 31, | ||||||||

| 2018 ($000) | 2017 ($000) | |||||||

| Increase (Decrease) in Net Assets | ||||||||

| Operations | ||||||||

| Net Investment Income | 4,622,399 | 4,463,997 | ||||||

| Realized Net Gain (Loss) | 11,944,933 | 13,360,419 | ||||||

| Change in Unrealized Appreciation (Depreciation) | (24,903,569 | ) | 26,758,334 | |||||

| Net Increase (Decrease) in Net Assets Resulting from Operations | (8,336,237 | ) | 44,582,750 | |||||

| Distributions | ||||||||

| Net Investment Income | ||||||||

| Institutional Shares | (2,389,678 | ) | (2,614,732 | ) | ||||

| Institutional Plus Shares | (1,960,468 | ) | (1,853,504 | ) | ||||

| Realized Capital Gain1 | ||||||||

| Institutional Shares | (320,393 | ) | — | |||||

| Institutional Plus Shares | (290,805 | ) | — | |||||

| Total Distributions | (4,961,344 | ) | (4,468,236 | ) | ||||

| Capital Share Transactions | ||||||||

| Institutional Shares | (29,779,712 | ) | (2,887,561 | ) | ||||

| Institutional Plus Shares | 10,922,721 | (16,564,044 | ) | |||||

| Net Increase (Decrease) from Capital Share Transactions | (18,856,991 | ) | (19,451,605 | ) | ||||

| Total Increase (Decrease) | (32,154,572 | ) | 20,662,909 | |||||

| Net Assets | ||||||||

| Beginning of Period | 232,158,097 | 211,495,188 | ||||||

| End of Period | 200,003,525 | 232,158,097 | ||||||

| 1 | Includes fiscal 2018 and 2017 short-term gain distributions totaling $177,142,000 and $0, respectively. Short-term gain distributions are treated as ordinary income for tax purposes. |

See accompanying Notes, which are an integral part of the Financial Statements.

| 16 |

Institutional Index Fund

Financial Highlights

Institutional Shares

| For a Share Outstanding | Year Ended December 31, | |||||||||||||||||||

| Throughout Each Period | 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||

| Net Asset Value, Beginning of Period | $243.46 | $203.83 | $186.62 | $188.67 | $169.28 | |||||||||||||||

| Investment Operations | ||||||||||||||||||||

| Net Investment Income | 5.059 | 1 | 4.379 | 1 | 4.210 | 4.585 | 2 | 3.561 | ||||||||||||

| Net Realized and Unrealized Gain (Loss) on Investments | (15.434 | ) | 39.687 | 17.814 | (2.065 | ) | 19.380 | |||||||||||||

| Total from Investment Operations | (10.375 | ) | 44.066 | 22.024 | 2.520 | 22.941 | ||||||||||||||

| Distributions | ||||||||||||||||||||

| Dividends from Net Investment Income | (4.837 | ) | (4.436 | ) | (4.223 | ) | (4.570 | ) | (3.551 | ) | ||||||||||

| Distributions from Realized Capital Gains | (.698 | ) | — | (.591 | ) | — | — | |||||||||||||

| Total Distributions | (5.535 | ) | (4.436 | ) | (4.814 | ) | (4.570 | ) | (3.551 | ) | ||||||||||

| Net Asset Value, End of Period | $227.55 | $243.46 | $203.83 | $186.62 | $188.67 | |||||||||||||||

| Total Return | -4.42% | 21.79% | 11.93% | 1.37% | 13.65% | |||||||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||

| Net Assets, End of Period (Millions) | $104,296 | $140,591 | $120,014 | $104,705 | $102,114 | |||||||||||||||

| Ratio of Total Expenses to Average Net Assets | 0.035% | 0.04% | 0.04% | 0.04% | 0.04% | |||||||||||||||

| Ratio of Net Investment Income to Average Net Assets | 2.03% | 1.96% | 2.19% | 2.43%2 | 2.01% | |||||||||||||||

| Portfolio Turnover Rate3 | 6% | 5% | 5% | 5% | 4% | |||||||||||||||

| 1 | Calculated based on average shares outstanding. |

| 2 | Net investment income per share and the ratio of net investment income to average net assets include $0.677 and 0.36%, respectively, resulting from income received from Medtronic plc in January 2015. |

| 3 | Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund's capital shares. |

See accompanying Notes, which are an integral part of the Financial Statements.

| 17 |

Institutional Index Fund

Financial Highlights

Institutional Plus Shares

| For a Share Outstanding | Year Ended December 31, | |||||||||||||||||||

| Throughout Each Period | 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||

| Net Asset Value, Beginning of Period | $243.48 | $203.84 | $186.63 | $188.68 | $169.28 | |||||||||||||||

| Investment Operations | ||||||||||||||||||||

| Net Investment Income | 5.167 | 1 | 4.414 | 1 | 4.248 | 4.622 | 2 | 3.597 | ||||||||||||

| Net Realized and Unrealized Gain (Loss) on Investments | (15.503 | ) | 39.705 | 17.814 | (2.065 | ) | 19.388 | |||||||||||||

| Total from Investment Operations | (10.336 | ) | 44.119 | 22.062 | 2.557 | 22.985 | ||||||||||||||

| Distributions | ||||||||||||||||||||

| Dividends from Net Investment Income | (4.876 | ) | (4.479 | ) | (4.261 | ) | (4.607 | ) | (3.585 | ) | ||||||||||

| Distributions from Realized Capital Gains | (.698 | ) | — | (.591 | ) | — | — | |||||||||||||

| Total Distributions | (5.574 | ) | (4.479 | ) | (4.852 | ) | (4.607 | ) | (3.585 | ) | ||||||||||

| Net Asset Value, End of Period | $227.57 | $243.48 | $203.84 | $186.63 | $188.68 | |||||||||||||||

| Total Return | -4.41% | 21.82% | 11.95% | 1.39% | 13.68% | |||||||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||

| Net Assets, End of Period (Millions) | $95,707 | $91,567 | $91,481 | $90,042 | $85,611 | |||||||||||||||

| Ratio of Total Expenses to Average Net Assets | 0.02% | 0.02% | 0.02% | 0.02% | 0.02% | |||||||||||||||

| Ratio of Net Investment Income to | ||||||||||||||||||||

| Average Net Assets | 2.05% | 1.98% | 2.21% | 2.45%2 | 2.03% | |||||||||||||||

| Portfolio Turnover Rate3 | 6% | 5% | 5% | 5% | 4% | |||||||||||||||

| 1 | Calculated based on average shares outstanding. |

| 2 | Net investment income per share and the ratio of net investment income to average net assets include $0.677 and 0.36%, respectively, resulting from income received from Medtronic plc in January 2015. |

| 3 | Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund's capital shares. |

See accompanying Notes, which are an integral part of the Financial Statements.

| 18 |

Institutional Index Fund

Notes to Financial Statements

Vanguard Institutional Index Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund offers two classes of shares, Institutional Shares and Institutional Plus Shares, to investors who meet certain administrative, service, and account-size criteria.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been materially affected by events occurring before the fund's pricing time but after the close of the securities' primary markets, are valued by methods deemed by the board of trustees to represent fair value. Investments in Vanguard Market Liquidity Fund are valued at that fund's net asset value. Temporary cash investments are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services.

2. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objectives of maintaining full exposure to the stock market, maintaining liquidity, and minimizing transaction costs. The fund may purchase futures contracts to immediately invest incoming cash in the market, or sell futures in response to cash outflows, thereby simulating a fully invested position in the underlying index while maintaining a cash balance for liquidity. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market. Counterparty risk involving futures is mitigated because a regulated clearinghouse is the counterparty instead of the clearing broker. To further mitigate counterparty risk, the fund trades futures contracts on an exchange, monitors the financial strength of its clearing brokers and clearinghouse, and has entered into clearing agreements with its clearing brokers. The clearinghouse imposes initial margin requirements to secure the fund's performance and requires daily settlement of variation margin representing changes in the market value of each contract. Any assets pledged as initial margin for open contracts are noted in the Statement of Net Assets.

Futures contracts are valued at their quoted daily settlement prices. The notional amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

During the year ended December 31, 2018, the fund's average investments in long and short futures contracts represented less than 1% and 0% of net assets, respectively, based on the average of the notional amounts at each quarter-end during the period.

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund's tax positions taken for all open federal income tax years (December 31, 2015–2018), and has concluded that no provision for federal income tax is required in the fund's financial statements.

| 19 |

Institutional Index Fund

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes.

5. Securities Lending: To earn additional income, the fund lends its securities to qualified institutional borrowers. Security loans are subject to termination by the fund at any time, and are required to be secured at all times by collateral in an amount at least equal to the market value of securities loaned. Daily market fluctuations could cause the value of loaned securities to be more or less than the value of the collateral received. When this occurs, the collateral is adjusted and settled before the opening of the market on the next business day. The fund further mitigates its counterparty risk by entering into securities lending transactions only with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master securities lending agreements with its counterparties. The master securities lending agreements provide that, in the event of a counterparty's default (including bankruptcy), the fund may terminate any loans with that borrower, determine the net amount owed, and sell or retain the collateral up to the net amount owed to the fund; however, such actions may be subject to legal proceedings. While collateral mitigates counterparty risk, in the event of a default, the fund may experience delays and costs in recovering the securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability in the Statement of Net Assets for the return of the collateral, during the period the securities are on loan. Securities lending income represents fees charged to borrowers plus income earned on invested cash collateral, less expenses associated with the loan. During the term of the loan, the fund is entitled to all distributions made on or in respect of the loaned securities.

6. Credit Facility: The fund and certain other funds managed by The Vanguard Group ("Vanguard") participate in a $3.1 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement that may be renewed annually; each fund is individually liable for its borrowings, if any, under the credit facility. Borrowings may be utilized for temporary and emergency purposes, and are subject to the fund's regulatory and contractual borrowing restrictions. The participating funds are charged administrative fees and an annual commitment fee of 0.10% of the undrawn amount of the facility; these fees are allocated to the funds based on a method approved by the fund's board of trustees and included in Management and Administrative expenses on the fund's Statement of Operations. Any borrowings under this facility bear interest at a rate based upon the higher of the one-month London Interbank Offered Rate, federal funds effective rate, or overnight bank funding rate plus an agreed-upon spread.

The fund had no borrowings outstanding at December 31, 2018, or at any time during the period then ended.

7. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

| 20 |

Institutional Index Fund

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses) and shareholder reporting. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. Prior to November 15, 2017, in accordance with the terms of a services agreement, Vanguard provided to the fund investment advisory, corporate management, administrative, marketing, and distribution services and paid for all other operating expenses (except taxes) for a fee calculated at an annual percentage rate of the average net assets of the fund (or, with respect to shareholder services, the average net assets of each class of shares).

On November 15, 2017, shareholders of the fund approved and adopted the Funds' Service Agreement under which all other publicly offered Vanguard U.S. mutual funds operate (the "FSA"). In accordance with the terms of the FSA between Vanguard and the fund, Vanguard furnishes to the fund investment advisory, corporate management, administrative, marketing, and distribution services at Vanguard's cost of operations (as defined by the FSA). These costs of operations are allocated to the fund based on methods and guidelines approved by the board of trustees.

Upon the request of Vanguard, the fund may invest up to 0.40% of its net assets as capital in Vanguard. At December 31, 2018, the fund had contributed to Vanguard capital in the amount of $11,589,000, representing 0.01% of the fund's net assets and 4.63% of Vanguard's capitalization. The fund's trustees and officers are also directors and employees, respectively, of Vanguard.

C. Various inputs may be used to determine the value of the fund's investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund's own assumptions used to determine the fair value of investments). Any investments valued with significant unobservable inputs are noted on the Statement of Net Assets.

The following table summarizes the market value of the fund's investments as of December 31, 2018, based on the inputs used to value them:

| Investments | Level 1 ($000) | Level 2 ($000) | Level 3 ($000) | |||||||||

| Common Stocks | 199,396,023 | — | — | |||||||||

| Temporary Cash Investments | 747,663 | 45,686 | — | |||||||||

| Futures Contracts—Assets1 | 4,657 | — | — | |||||||||

| Total | 200,148,343 | 45,686 | — | |||||||||

| 1 | Represents variation margin on the last day of the reporting period. |

| 21 |

Institutional Index Fund

D. Permanent differences between book-basis and tax-basis components of net assets are reclassified among capital accounts in the financial statements to reflect their tax character. These reclassifications have no effect on net assets or net asset value per share. As of period end, permanent differences primarily attributable to the accounting for in-kind redemptions and distributions in connection with fund share redemptions were reclassified between the following accounts:

| Amount | ||||

| ($000) | ||||

| Paid-in Capital | 9,986,632 | |||

| Total Distributable Earnings (Loss) | (9,986,632 | ) | ||

Temporary differences between book-basis and tax-basis components of total distributable earnings (loss) arise when certain items of income, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. The differences are primarily related to the tax deferral of losses on wash sales and the realization of unrealized gains or losses on certain futures contracts. As of period end, the tax-basis components of total distributable earnings (loss) are detailed in the table as follows:

| Amount ($000) | ||||

| Undistributed Ordinary Income | 431,207 | |||

| Undistributed Long-Term Gains | 422,808 | |||

| Capital Loss Carryforwards (Non-expiring)* | — | |||

| Net Unrealized Gains (Loss) | 77,466,658 | |||

| * | The fund used capital loss carryforwards of $956,412,000 to offset taxable capital gains realized during the year ended December 31, 2018, reducing the amount of capital gains that would otherwise be available to distribute to shareholders. |

As of December 31, 2018, gross unrealized appreciation and depreciation for investments and derivatives based on cost for U.S. federal income tax purposes were as follows:

| Amount | ||||

| ($000) | ||||

| Tax Cost | 122,722,714 | |||

| Gross Unrealized Appreciation | 86,217,188 | |||

| Gross Unrealized Depreciation | (8,750,530 | ) | ||

| Net Unrealized Appreciation (Depreciation) | 77,466,658 | |||

| 22 |

Institutional Index Fund

E. During the year ended December 31, 2018, the fund purchased $15,091,970,000 of investment securities and sold $33,850,667,000 of investment securities, other than temporary cash investments. Purchases and sales include $2,559,650,000 and $15,393,787,000, respectively, in connection with in-kind purchases and redemptions of the fund's capital shares.

F. Capital share transactions for each class of shares were:

| Year Ended December 31, | ||||||||||||||||

| 2018 | 2017 | |||||||||||||||

| Amount ($000) | Shares (000) | Amount ($000) | Shares (000) | |||||||||||||

| Institutional Shares | ||||||||||||||||

| Issued | 15,954,616 | 64,145 | 21,584,727 | 97,781 | ||||||||||||

| Issued in Lieu of Cash Distributions | 2,515,358 | 10,165 | 2,408,508 | 10,595 | ||||||||||||

| Redeemed | (48,249,686 | ) | (193,443 | ) | (26,880,796 | ) | (119,707 | ) | ||||||||

| Net Increase (Decrease)—Institutional Shares | (29,779,712 | ) | (119,133 | ) | (2,887,561 | ) | (11,331 | ) | ||||||||

| Institutional Plus Shares | ||||||||||||||||

| Issued | 41,747,620 | 167,241 | 23,771,287 | 105,816 | ||||||||||||

| Issued in Lieu of Cash Distributions | 2,171,322 | 8,792 | 1,823,107 | 8,044 | ||||||||||||

| Redeemed | (32,996,221 | ) | (131,548 | ) | (42,158,438 | ) | (186,570 | ) | ||||||||

| Net Increase (Decrease)—Institutional Plus Shares | 10,922,721 | 44,485 | (16,564,044 | ) | (72,710 | ) | ||||||||||

G. Management has determined that no events or transactions occurred subsequent to December 31, 2018, that would require recognition or disclosure in these financial statements.

| 23 |

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Vanguard Institutional Index Funds and Shareholders of Vanguard Institutional Index Fund

Opinion on the Financial Statements

We have audited the accompanying statement of net assets of Vanguard Institutional Index Fund (one of the funds constituting Vanguard Institutional Index Funds, referred to hereafter as the "Fund") as of December 31, 2018, the related statement of operations for the year ended December 31, 2018, the statement of changes in net assets for each of the two years in the period ended December 31, 2018, including the related notes, and the financial highlights for each of the five years in the period ended December 31, 2018 (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2018, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended December 31, 2018 and the financial highlights for each of the five years in the period ended December 31, 2018 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of December 31, 2018 by correspondence with the custodian and brokers and by agreement to the underlying ownership records of the transfer agent; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

| /s/PricewaterhouseCoopers LLP | |

| Philadelphia, Pennsylvania | |

| February 13, 2019 |

We have served as the auditor of one or more investment companies in The Vanguard Group of Funds since 1975.

| 24 |

Special 2018 tax information (unaudited) for Vanguard Institutional Index Fund

This information for the fiscal year ended December 31, 2018, is included pursuant to provisions of the Internal Revenue Code.

The fund distributed $508,182,000 as capital gain dividends (20% rate gain distributions) to shareholders during the fiscal year.

For nonresident alien shareholders, 100% of short-term capital gain dividends distributed by the fund are qualified for short-term capital gains.

The fund distributed $4,350,146,000 of qualified dividend income to shareholders during the fiscal year.

For corporate shareholders, 87.4% of investment income (dividend income plus short-term gains, if any) qualifies for the dividends-received deduction.

| 25 |

This page intentionally left blank.

The People Who Govern Your Fund