false2022FY0000861878http://fasb.org/us-gaap/2022#AccountingStandardsUpdate201613Memberhttp://fasb.org/us-gaap/2022#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2022#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2022#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2022#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2022#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2022#LongTermDebtAndCapitalLeaseObligationsCurrentP3Y00008618782022-01-012022-12-3100008618782022-06-30iso4217:USD00008618782023-02-17xbrli:shares0000861878us-gaap:LineOfCreditMembersrcl:SeniorCreditFacilityDueJuneTwentyTwentyTwoMember2022-12-310000861878us-gaap:SuretyBondMember2022-12-310000861878srcl:BankGuaranteesMember2022-12-3100008618782021-01-012021-12-3100008618782020-01-012020-12-31iso4217:USDxbrli:shares0000861878country:JP2022-01-012022-12-310000861878country:JP2021-01-012021-12-310000861878country:JP2020-01-012020-12-310000861878country:AR2022-01-012022-12-310000861878country:AR2021-01-012021-12-310000861878country:AR2020-01-012020-12-3100008618782022-12-3100008618782021-12-3100008618782020-12-3100008618782019-12-310000861878us-gaap:CommonStockMember2019-12-310000861878us-gaap:AdditionalPaidInCapitalMember2019-12-310000861878us-gaap:RetainedEarningsMember2019-12-310000861878us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310000861878us-gaap:NoncontrollingInterestMember2019-12-310000861878us-gaap:RetainedEarningsMember2020-01-012020-12-310000861878us-gaap:NoncontrollingInterestMember2020-01-012020-12-310000861878us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310000861878us-gaap:CommonStockMember2020-01-012020-12-310000861878us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310000861878srcl:ArgentinaOperationsMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310000861878srcl:ArgentinaOperationsMember2020-01-012020-12-3100008618782019-01-012019-12-310000861878us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310000861878srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310000861878us-gaap:CommonStockMember2020-12-310000861878us-gaap:AdditionalPaidInCapitalMember2020-12-310000861878us-gaap:RetainedEarningsMember2020-12-310000861878us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000861878us-gaap:NoncontrollingInterestMember2020-12-310000861878us-gaap:RetainedEarningsMember2021-01-012021-12-310000861878us-gaap:NoncontrollingInterestMember2021-01-012021-12-310000861878us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310000861878us-gaap:CommonStockMember2021-01-012021-12-310000861878us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000861878us-gaap:AccumulatedOtherComprehensiveIncomeMembersrcl:JapanOperationsMember2021-01-012021-12-310000861878srcl:JapanOperationsMember2021-01-012021-12-310000861878us-gaap:CommonStockMember2021-12-310000861878us-gaap:AdditionalPaidInCapitalMember2021-12-310000861878us-gaap:RetainedEarningsMember2021-12-310000861878us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000861878us-gaap:NoncontrollingInterestMember2021-12-310000861878us-gaap:RetainedEarningsMember2022-01-012022-12-310000861878us-gaap:NoncontrollingInterestMember2022-01-012022-12-310000861878us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310000861878us-gaap:CommonStockMember2022-01-012022-12-310000861878us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000861878us-gaap:CommonStockMember2022-12-310000861878us-gaap:AdditionalPaidInCapitalMember2022-12-310000861878us-gaap:RetainedEarningsMember2022-12-310000861878us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000861878us-gaap:NoncontrollingInterestMember2022-12-310000861878us-gaap:NonUsMember2022-01-012022-12-31srcl:country0000861878srcl:ZeroCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2022-01-012022-12-31xbrli:pure0000861878us-gaap:SalesRevenueNetMembersrcl:ZeroCustomersMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310000861878us-gaap:BuildingAndBuildingImprovementsMembersrt:MinimumMember2022-01-012022-12-310000861878srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2022-01-012022-12-310000861878us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2022-01-012022-12-310000861878srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2022-01-012022-12-310000861878us-gaap:ContainersMembersrt:MinimumMember2022-01-012022-12-310000861878srt:MaximumMemberus-gaap:ContainersMember2022-01-012022-12-310000861878us-gaap:VehiclesMembersrt:MinimumMember2022-01-012022-12-310000861878srt:MaximumMemberus-gaap:VehiclesMember2022-01-012022-12-310000861878us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2022-01-012022-12-310000861878srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2022-01-012022-12-310000861878us-gaap:SoftwareDevelopmentMembersrt:MinimumMember2022-01-012022-12-310000861878srt:MaximumMemberus-gaap:SoftwareDevelopmentMember2022-01-012022-12-310000861878us-gaap:CustomerRelationshipsMembersrt:MinimumMember2022-01-012022-12-310000861878srt:MaximumMemberus-gaap:CustomerRelationshipsMember2022-01-012022-12-310000861878us-gaap:CustomerRelationshipsMember2022-01-012022-12-310000861878us-gaap:NoncompeteAgreementsMember2022-01-012022-12-310000861878srcl:OperatingPermitsMembersrt:MinimumMember2022-01-012022-12-310000861878srt:MaximumMembersrcl:OperatingPermitsMember2022-01-012022-12-310000861878srcl:OperatingPermitsMember2022-01-012022-12-310000861878us-gaap:TradeNamesMembersrt:MinimumMember2022-01-012022-12-310000861878srt:MaximumMemberus-gaap:TradeNamesMember2022-01-012022-12-310000861878us-gaap:TradeNamesMember2022-01-012022-12-310000861878srcl:LandfillAirRightsMembersrt:MinimumMember2022-01-012022-12-310000861878srt:MaximumMembersrcl:LandfillAirRightsMember2022-01-012022-12-310000861878srcl:LandfillAirRightsMember2022-01-012022-12-310000861878srcl:RegulatedWasteAndComplianceServicesMember2022-01-012022-12-310000861878srcl:RegulatedWasteAndComplianceServicesMember2021-01-012021-12-310000861878srcl:RegulatedWasteAndComplianceServicesMember2020-01-012020-12-310000861878srcl:SecureInformationDestructionServicesMember2022-01-012022-12-310000861878srcl:SecureInformationDestructionServicesMember2021-01-012021-12-310000861878srcl:SecureInformationDestructionServicesMember2020-01-012020-12-310000861878srcl:RegulatedWasteAndComplianceServicesMembersrcl:NorthAmericaSegmentMember2022-01-012022-12-310000861878srcl:RegulatedWasteAndComplianceServicesMembersrcl:NorthAmericaSegmentMember2021-01-012021-12-310000861878srcl:RegulatedWasteAndComplianceServicesMembersrcl:NorthAmericaSegmentMember2020-01-012020-12-310000861878srcl:SecureInformationDestructionServicesMembersrcl:NorthAmericaSegmentMember2022-01-012022-12-310000861878srcl:SecureInformationDestructionServicesMembersrcl:NorthAmericaSegmentMember2021-01-012021-12-310000861878srcl:SecureInformationDestructionServicesMembersrcl:NorthAmericaSegmentMember2020-01-012020-12-310000861878srcl:NorthAmericaSegmentMember2022-01-012022-12-310000861878srcl:NorthAmericaSegmentMember2021-01-012021-12-310000861878srcl:NorthAmericaSegmentMember2020-01-012020-12-310000861878srcl:InternationalSegmentsMembersrcl:RegulatedWasteAndComplianceServicesMember2022-01-012022-12-310000861878srcl:InternationalSegmentsMembersrcl:RegulatedWasteAndComplianceServicesMember2021-01-012021-12-310000861878srcl:InternationalSegmentsMembersrcl:RegulatedWasteAndComplianceServicesMember2020-01-012020-12-310000861878srcl:InternationalSegmentsMembersrcl:SecureInformationDestructionServicesMember2022-01-012022-12-310000861878srcl:InternationalSegmentsMembersrcl:SecureInformationDestructionServicesMember2021-01-012021-12-310000861878srcl:InternationalSegmentsMembersrcl:SecureInformationDestructionServicesMember2020-01-012020-12-310000861878srcl:InternationalSegmentsMember2022-01-012022-12-310000861878srcl:InternationalSegmentsMember2021-01-012021-12-310000861878srcl:InternationalSegmentsMember2020-01-012020-12-310000861878us-gaap:OtherCurrentAssetsMember2022-12-310000861878us-gaap:OtherCurrentAssetsMember2021-12-310000861878us-gaap:OtherNoncurrentAssetsMember2022-12-310000861878us-gaap:OtherNoncurrentAssetsMember2021-12-310000861878us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2021-01-012021-12-310000861878srcl:MidwestBasedRegulatedWasteBusinessMember2022-04-012022-06-300000861878srcl:MidwestBasedRegulatedWasteBusinessMember2022-06-300000861878srcl:MidwestBasedRegulatedWasteBusinessMemberus-gaap:CustomerRelationshipsMember2022-06-300000861878us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2021-12-310000861878srcl:InternationalSegmentsMembercountry:GB2020-01-012020-12-310000861878srcl:CommunicationSolutionsBusinessMembersrcl:NorthAmericaSegmentMember2022-01-012022-12-310000861878srcl:CommunicationSolutionsBusinessMembersrcl:NorthAmericaSegmentMember2021-10-012021-12-310000861878srcl:CommunicationSolutionsBusinessMembersrcl:NorthAmericaSegmentMember2020-01-012020-12-310000861878srcl:CanadaEnvironmentalSolutionsOperationsMembersrcl:NorthAmericaSegmentMember2022-01-012022-12-310000861878srcl:CanadaEnvironmentalSolutionsOperationsMembersrcl:NorthAmericaSegmentMember2021-01-012021-12-310000861878srcl:CanadaEnvironmentalSolutionsOperationsMembersrcl:NorthAmericaSegmentMember2020-01-012020-12-310000861878srcl:CommunicationRelatedServicesMembersrcl:NorthAmericaSegmentMember2022-01-012022-12-310000861878srcl:CommunicationRelatedServicesMembersrcl:NorthAmericaSegmentMember2021-01-012021-12-310000861878srcl:CommunicationRelatedServicesMembersrcl:NorthAmericaSegmentMember2020-01-012020-12-310000861878srcl:DomesticEnvironmentalSolutionsBusinessMembersrcl:NorthAmericaSegmentMember2022-01-012022-12-310000861878srcl:DomesticEnvironmentalSolutionsBusinessMembersrcl:NorthAmericaSegmentMember2021-01-012021-12-310000861878srcl:DomesticEnvironmentalSolutionsBusinessMembersrcl:NorthAmericaSegmentMember2020-01-012020-12-310000861878srcl:InternationalSegmentsMembersrcl:JapanOperationsMember2022-01-012022-12-310000861878srcl:InternationalSegmentsMembersrcl:JapanOperationsMember2021-01-012021-12-310000861878srcl:InternationalSegmentsMembersrcl:JapanOperationsMember2020-01-012020-12-310000861878srcl:InternationalSegmentsMembersrcl:CommunicationRelatedServicesMember2022-01-012022-12-310000861878srcl:InternationalSegmentsMembersrcl:CommunicationRelatedServicesMember2021-01-012021-12-310000861878srcl:InternationalSegmentsMembersrcl:CommunicationRelatedServicesMember2020-01-012020-12-310000861878srcl:MexicoOperationsMembersrcl:InternationalSegmentsMember2022-01-012022-12-310000861878srcl:MexicoOperationsMembersrcl:InternationalSegmentsMember2021-01-012021-12-310000861878srcl:MexicoOperationsMembersrcl:InternationalSegmentsMember2020-01-012020-12-310000861878srcl:InternationalSegmentsMembersrcl:ChileOperationsMember2022-01-012022-12-310000861878srcl:InternationalSegmentsMembersrcl:ChileOperationsMember2021-01-012021-12-310000861878srcl:InternationalSegmentsMembersrcl:ChileOperationsMember2020-01-012020-12-310000861878srcl:InternationalSegmentsMembersrcl:ArgentinaOperationsMember2022-01-012022-12-310000861878srcl:InternationalSegmentsMembersrcl:ArgentinaOperationsMember2021-01-012021-12-310000861878srcl:InternationalSegmentsMembersrcl:ArgentinaOperationsMember2020-01-012020-12-310000861878us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembersrcl:CommunicationSolutionsBusinessMembersrcl:NorthAmericaSegmentMember2022-12-010000861878srcl:CommunicationSolutionsBusinessMembersrcl:NorthAmericaSegmentMember2022-10-012022-12-310000861878srcl:CommunicationSolutionsBusinessMembersrcl:NorthAmericaSegmentMember2022-12-012022-12-010000861878srcl:CommunicationSolutionsBusinessMembersrcl:NorthAmericaSegmentMember2022-12-010000861878srcl:CanadaEnvironmentalSolutionsOperationsMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembersrcl:CanadaEnvironmentalSolutionsOperationsMembersrcl:NorthAmericaSegmentMember2021-12-010000861878srcl:CanadaEnvironmentalSolutionsOperationsMembersrcl:NorthAmericaSegmentMember2021-10-012021-12-310000861878srcl:CanadaEnvironmentalSolutionsOperationsMembersrcl:NorthAmericaSegmentMember2021-12-012021-12-010000861878srcl:ExpertSolutionsMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2020-12-010000861878srcl:ExpertSolutionsMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembersrcl:NorthAmericaSegmentMember2020-12-012020-12-010000861878srcl:ExpertSolutionsMembersrcl:InternationalSegmentsMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2020-12-012020-12-010000861878srcl:ExpertSolutionsMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2020-12-012020-12-010000861878srcl:DomesticEnvironmentalSolutionsLessRetainedBusinessMember2020-02-060000861878srcl:DomesticEnvironmentalSolutionsLessRetainedBusinessMember2019-01-012019-12-310000861878srcl:NorthAmericaSegmentMembersrcl:DomesticEnvironmentalSolutionsLessRetainedBusinessMember2019-01-012019-12-310000861878srcl:HSAMember2020-02-062020-02-060000861878us-gaap:TransmissionServiceAgreementMember2020-02-062020-02-060000861878srcl:DomesticEnvironmentalSolutionsLessRetainedBusinessMember2020-01-012020-12-310000861878srcl:NorthAmericaSegmentMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:CustomerListsMember2020-01-012020-12-310000861878srcl:InternationalSegmentsMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberus-gaap:SubsequentEventMembersrcl:ContainerManufacturingOperationsMember2023-01-190000861878srcl:JapanOperatingUnitMembersrcl:InternationalSegmentsMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2021-09-010000861878srcl:JapanOperatingUnitMembersrcl:InternationalSegmentsMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2021-07-012021-09-300000861878srcl:InternationalSegmentsMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembercountry:AR2020-08-012020-08-310000861878us-gaap:SellingGeneralAndAdministrativeExpensesMembersrcl:NorthAmericaSegmentMember2022-01-012022-12-310000861878us-gaap:SellingGeneralAndAdministrativeExpensesMembersrcl:NorthAmericaSegmentMember2021-01-012021-12-310000861878us-gaap:SellingGeneralAndAdministrativeExpensesMembersrcl:NorthAmericaSegmentMember2020-01-012020-12-310000861878srcl:NorthAmericaSegmentMemberus-gaap:CostOfSalesMember2022-01-012022-12-310000861878srcl:NorthAmericaSegmentMemberus-gaap:CostOfSalesMember2021-01-012021-12-310000861878srcl:NorthAmericaSegmentMemberus-gaap:CostOfSalesMember2020-01-012020-12-310000861878srcl:InternationalSegmentsMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310000861878srcl:InternationalSegmentsMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310000861878srcl:InternationalSegmentsMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2020-01-012020-12-310000861878srcl:InternationalSegmentsMemberus-gaap:CostOfSalesMember2022-01-012022-12-310000861878srcl:InternationalSegmentsMemberus-gaap:CostOfSalesMember2021-01-012021-12-310000861878srcl:InternationalSegmentsMemberus-gaap:CostOfSalesMember2020-01-012020-12-310000861878us-gaap:LandAndLandImprovementsMember2022-12-310000861878us-gaap:LandAndLandImprovementsMember2021-12-310000861878us-gaap:BuildingAndBuildingImprovementsMember2022-12-310000861878us-gaap:BuildingAndBuildingImprovementsMember2021-12-310000861878us-gaap:MachineryAndEquipmentMember2022-12-310000861878us-gaap:MachineryAndEquipmentMember2021-12-310000861878us-gaap:VehiclesMember2022-12-310000861878us-gaap:VehiclesMember2021-12-310000861878us-gaap:ContainersMember2022-12-310000861878us-gaap:ContainersMember2021-12-310000861878us-gaap:FurnitureAndFixturesMember2022-12-310000861878us-gaap:FurnitureAndFixturesMember2021-12-310000861878srcl:SoftwareAndEnterpriseResourcePlanningSystemMember2022-12-310000861878srcl:SoftwareAndEnterpriseResourcePlanningSystemMember2021-12-310000861878us-gaap:ConstructionInProgressMember2022-12-310000861878us-gaap:ConstructionInProgressMember2021-12-310000861878srcl:NorthAmericaSegmentMember2020-12-310000861878srcl:InternationalSegmentsMember2020-12-310000861878srcl:NorthAmericaSegmentMember2021-12-310000861878srcl:InternationalSegmentsMember2021-12-310000861878srcl:NorthAmericaSegmentMember2022-12-310000861878srcl:InternationalSegmentsMember2022-12-310000861878us-gaap:CustomerRelationshipsMember2022-12-310000861878us-gaap:CustomerRelationshipsMember2021-12-310000861878us-gaap:NoncompeteAgreementsMember2022-12-310000861878us-gaap:NoncompeteAgreementsMember2021-12-310000861878srcl:OperatingPermitsMember2022-12-310000861878srcl:OperatingPermitsMember2021-12-310000861878us-gaap:TradeNamesMember2022-12-310000861878us-gaap:TradeNamesMember2021-12-310000861878us-gaap:OtherIntangibleAssetsMember2022-12-310000861878us-gaap:OtherIntangibleAssetsMember2021-12-310000861878srcl:OperatingPermitsMember2022-12-310000861878srcl:OperatingPermitsMember2021-12-310000861878us-gaap:TradeNamesMember2022-12-310000861878us-gaap:TradeNamesMember2021-12-310000861878us-gaap:LineOfCreditMembersrcl:CreditAgreementAmendedSept2021Membersrcl:SeniorCreditFacilityDueSeptemberTwentyTwentySixMember2022-12-310000861878us-gaap:LineOfCreditMembersrcl:CreditAgreementAmendedSept2021Membersrcl:SeniorCreditFacilityDueSeptemberTwentyTwentySixMember2021-12-310000861878us-gaap:LineOfCreditMembersrcl:CreditAgreementAmendedSept2021Membersrcl:TermLoanFacilityDueTwentyTwentySixMember2022-12-310000861878us-gaap:LineOfCreditMembersrcl:CreditAgreementAmendedSept2021Membersrcl:TermLoanFacilityDueTwentyTwentySixMember2021-12-310000861878us-gaap:SeniorNotesMembersrcl:SeniorNotesFacilityDueTwentyTwentyFourMember2022-12-310000861878us-gaap:SeniorNotesMembersrcl:SeniorNotesFacilityDueTwentyTwentyFourMember2021-12-310000861878srcl:SeniorNotesFacilityDueTwentyTwentyNineMemberus-gaap:SeniorNotesMember2022-12-310000861878srcl:SeniorNotesFacilityDueTwentyTwentyNineMemberus-gaap:SeniorNotesMember2021-12-310000861878srcl:NotesWeightedAverageMaturityTwoPointThreeYearsAndTwoPointFiveYearsMembersrcl:PromissoryNotesAndDeferredConsiderationMember2022-01-012022-12-310000861878srcl:NotesWeightedAverageMaturityTwoPointThreeYearsAndTwoPointFiveYearsMembersrcl:PromissoryNotesAndDeferredConsiderationMember2021-01-012021-12-310000861878srcl:NotesWeightedAverageMaturityTwoPointFourNineAndTwoPointSevenFourYearsMembersrcl:PromissoryNotesAndDeferredConsiderationMember2022-12-310000861878srcl:NotesWeightedAverageMaturityTwoPointFourNineAndTwoPointSevenFourYearsMembersrcl:PromissoryNotesAndDeferredConsiderationMember2021-12-310000861878srcl:ForeignLongTermDebtMembersrcl:DebtWeightedAverageMaturityOnePointFourYearsAndOnePointSixYearsMember2022-01-012022-12-310000861878srcl:ForeignLongTermDebtMembersrcl:DebtWeightedAverageMaturityOnePointFourYearsAndOnePointSixYearsMember2021-01-012021-12-310000861878srcl:ForeignLongTermDebtMembersrcl:DebtWeightedAverageMaturityOnePointSixAndOnePointNineYearsMember2022-12-310000861878srcl:ForeignLongTermDebtMembersrcl:DebtWeightedAverageMaturityOnePointSixAndOnePointNineYearsMember2021-12-310000861878us-gaap:LineOfCreditMembersrcl:CreditAgreementAmendedSept2021Member2021-12-310000861878us-gaap:LineOfCreditMembersrcl:CreditAgreementAmendedSept2021Member2021-01-012021-12-310000861878us-gaap:LineOfCreditMembersrcl:ExistingCreditAgreementMember2021-01-012021-12-310000861878us-gaap:LineOfCreditMembersrcl:CreditAgreementAmendedSept2021Member2022-01-012022-12-310000861878us-gaap:LineOfCreditMembersrcl:CreditAgreementAmendedSept2021Membersrcl:ConsolidatedLeverageRatioPeriodOneMember2022-01-012022-12-310000861878us-gaap:LineOfCreditMembersrcl:CreditAgreementAmendedSept2021Membersrcl:ConsolidatedLeverageRatioPeriodTwoMember2022-01-012022-12-310000861878us-gaap:LineOfCreditMembersrcl:CreditAgreementAmendedSept2021Membersrcl:ConsolidatedLeverageRatioPeriodTwoMember2022-09-300000861878us-gaap:LineOfCreditMembersrcl:ConsolidatedLeverageRatioPeriodThreeMembersrcl:CreditAgreementAmendedSept2021Member2022-01-012022-12-310000861878us-gaap:LineOfCreditMembersrcl:CreditAgreementAmendedSept2021Member2021-07-012021-09-300000861878us-gaap:LineOfCreditMembersrcl:CreditAgreementAmendedSept2021Member2021-10-012021-12-310000861878us-gaap:LineOfCreditMembersrcl:CreditAgreementAmendedSept2021Member2022-01-012022-03-310000861878us-gaap:LineOfCreditMembersrcl:CreditAgreementAmendedSept2021Member2022-10-012022-12-310000861878us-gaap:LineOfCreditMembersrcl:CreditAgreementAmendedSept2021Member2022-04-012022-04-300000861878us-gaap:LineOfCreditMembersrcl:CreditAgreementAmendedSept2021Member2022-12-310000861878us-gaap:EurodollarMemberus-gaap:LineOfCreditMembersrcl:CreditAgreementAmendedSept2021Member2022-01-012022-12-310000861878us-gaap:LineOfCreditMembersrcl:CreditAgreementAmendedSept2021Memberus-gaap:BaseRateMember2022-01-012022-12-310000861878srcl:SeniorNotesFacilityDueTwentyTwentyNineMemberus-gaap:SeniorNotesMember2020-11-240000861878us-gaap:RevolvingCreditFacilityMemberus-gaap:SeniorNotesMember2020-11-240000861878srcl:SeniorNotesFacilityDueTwentyTwentyNineMemberus-gaap:SeniorNotesMember2020-11-092020-11-090000861878srt:MaximumMembersrcl:SeniorNotesFacilityDueTwentyTwentyNineMemberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodOneMember2020-11-092020-11-090000861878srcl:SeniorNotesFacilityDueTwentyTwentyNineMemberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodOneMember2020-11-092020-11-090000861878us-gaap:RevolvingCreditFacilityMemberus-gaap:SeniorNotesMember2019-12-310000861878us-gaap:LineOfCreditMembersrcl:SeniorCreditFacilityDueJuneTwentyTwentyTwoMember2021-12-310000861878us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-12-310000861878us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-12-310000861878us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-12-310000861878us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-01-012022-12-310000861878us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-01-012021-12-310000861878us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-01-012020-12-310000861878us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-12-310000861878srt:MinimumMember2022-12-310000861878srt:MaximumMember2022-12-310000861878us-gaap:FairValueInputsLevel3Member2022-12-310000861878us-gaap:FairValueInputsLevel3Member2021-12-310000861878us-gaap:FairValueInputsLevel2Member2022-12-310000861878us-gaap:FairValueInputsLevel2Member2021-12-310000861878srcl:SeniorCreditFacilityDueJuneTwentyTwentyTwoMemberus-gaap:StandbyLettersOfCreditMember2022-12-310000861878srcl:SeniorCreditFacilityDueJuneTwentyTwentyTwoMemberus-gaap:StandbyLettersOfCreditMember2021-12-310000861878us-gaap:SuretyBondMember2021-12-310000861878srcl:BankGuaranteesMember2021-12-310000861878country:US2022-01-012022-12-310000861878country:US2021-01-012021-12-310000861878country:US2020-01-012020-12-310000861878us-gaap:ForeignPlanMember2022-01-012022-12-310000861878us-gaap:ForeignPlanMember2021-01-012021-12-310000861878us-gaap:ForeignPlanMember2020-01-012020-12-31srcl:plan0000861878srcl:PensionPlanPrivateSanitationUnitLocal813IBTMember2022-01-012022-12-310000861878srcl:PensionPlanPrivateSanitationUnitLocal813IBTMember2021-01-012021-12-310000861878srcl:NursesAndLocal813IBTRetirementPlanMember2022-01-012022-12-310000861878srcl:NursesAndLocal813IBTRetirementPlanMember2021-01-012021-12-310000861878srt:MinimumMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310000861878srt:MaximumMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310000861878srcl:EmployeeStockPurchasePlanMember2022-12-310000861878srcl:EmployeeStockPurchasePlanMember2022-01-012022-12-310000861878srcl:EmployeeStockPurchasePlanMember2021-01-012021-12-310000861878srcl:EmployeeStockPurchasePlanMember2020-01-012020-12-310000861878us-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310000861878us-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310000861878us-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:EmployeeStockOptionMember2020-01-012020-12-310000861878us-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310000861878us-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310000861878us-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310000861878us-gaap:PerformanceSharesMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310000861878us-gaap:PerformanceSharesMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310000861878us-gaap:PerformanceSharesMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2020-01-012020-12-310000861878srcl:USEmployeeStockPurchasePlanAndCanadaEmployeeStockPurchasePlanMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310000861878srcl:USEmployeeStockPurchasePlanAndCanadaEmployeeStockPurchasePlanMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310000861878srcl:USEmployeeStockPurchasePlanAndCanadaEmployeeStockPurchasePlanMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2020-01-012020-12-310000861878srcl:EmployeeStockOptionAndRestrictedStockUnitsMember2022-01-012022-12-310000861878srcl:EmployeeStockOptionAndRestrictedStockUnitsMember2021-01-012021-12-310000861878srcl:EmployeeStockOptionAndRestrictedStockUnitsMember2020-01-012020-12-310000861878srt:DirectorMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310000861878srcl:OfficersAndEmployeesMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310000861878us-gaap:EmployeeStockOptionMember2022-12-310000861878us-gaap:EmployeeStockOptionMember2022-01-012022-12-310000861878srt:MinimumMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310000861878srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310000861878srcl:TwoThousandAndTwentyOnePlanMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310000861878us-gaap:RestrictedStockUnitsRSUMember2021-12-310000861878us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310000861878us-gaap:RestrictedStockUnitsRSUMember2022-12-310000861878us-gaap:PerformanceSharesMember2022-01-012022-12-31srcl:installment0000861878srt:MinimumMember2022-01-012022-12-310000861878srt:MaximumMember2022-01-012022-12-310000861878srt:MaximumMemberus-gaap:PerformanceSharesMember2022-01-012022-12-310000861878us-gaap:PerformanceSharesMember2021-12-310000861878us-gaap:PerformanceSharesMember2022-12-310000861878us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310000861878us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310000861878us-gaap:EmployeeStockOptionMember2022-01-012022-12-310000861878us-gaap:EmployeeStockOptionMember2021-01-012021-12-310000861878us-gaap:EmployeeStockOptionMember2020-01-012020-12-310000861878us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310000861878us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310000861878us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-31srcl:segment0000861878us-gaap:AllOtherSegmentsMember2022-01-012022-12-310000861878us-gaap:AllOtherSegmentsMember2021-01-012021-12-310000861878us-gaap:AllOtherSegmentsMember2020-01-012020-12-310000861878us-gaap:AllOtherSegmentsMember2022-12-310000861878us-gaap:AllOtherSegmentsMember2021-12-310000861878us-gaap:AllOtherSegmentsMember2020-12-310000861878country:US2022-01-012022-12-310000861878country:US2021-01-012021-12-310000861878country:US2020-01-012020-12-310000861878srt:EuropeMember2022-01-012022-12-310000861878srt:EuropeMember2021-01-012021-12-310000861878srt:EuropeMember2020-01-012020-12-310000861878srcl:OtherInternationalCountriesExcludingUSAndEuropeMember2022-01-012022-12-310000861878srcl:OtherInternationalCountriesExcludingUSAndEuropeMember2021-01-012021-12-310000861878srcl:OtherInternationalCountriesExcludingUSAndEuropeMember2020-01-012020-12-310000861878country:US2022-12-310000861878country:US2021-12-310000861878country:US2020-12-310000861878srt:EuropeMember2022-12-310000861878srt:EuropeMember2021-12-310000861878srt:EuropeMember2020-12-310000861878srcl:OtherInternationalCountriesExcludingUSAndEuropeMember2022-12-310000861878srcl:OtherInternationalCountriesExcludingUSAndEuropeMember2021-12-310000861878srcl:OtherInternationalCountriesExcludingUSAndEuropeMember2020-12-310000861878srcl:GovernmentInvestigationsMembersrcl:DepartmentOfJusticeMember2022-01-012022-12-310000861878srcl:USSecuritiesAndExchangeCommissionDepartmentOfJusticeAndBrazilianAuthoritiesMembersrcl:GovernmentInvestigationsMember2022-04-012022-09-300000861878srcl:GovernmentInvestigationsMember2022-01-012022-12-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________________________

FORM 10-K

________________________________________________________________________

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2022

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 1-37556

________________________________________________________________________

Stericycle, Inc.

(Exact name of registrant as specified in its charter)

________________________________________________________________________

| | | | | | | | |

| Delaware | | 36-3640402 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification Number) |

2355 Waukegan Road

Bannockburn, Illinois 60015

(Address of principal executive offices, including zip code)

(847) 367-5910

(Registrant’s telephone number, including area code)

________________________________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | SRCL | Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15-(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definition of “large accelerated filer”, “accelerated filer” “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | |

Large accelerated filer ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ |

Smaller reporting company ☐ | Emerging Growth Company ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1b.☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ☐ NO ☒

The aggregate market value of voting and non-voting common equity held by non-affiliates computed by reference to the price at which common equity was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2022): $4,011,736,033.

On February 17, 2023 there were 92,233,061 shares of the Registrant’s Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Information required by Items 10, 11, 12, 13 and 14 of Part III of this Report is incorporated by reference from the Registrant’s definitive Proxy Statement for the 2023 Annual Meeting of Stockholders.

Table of Contents

| | | | | | | | |

| | Page No. |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | 30 |

| | |

| | |

| |

| | |

| | 31 |

| | 31 |

| | 32 |

| | 45 |

| | 47 |

| | 82 |

| | 82 |

| | 85 |

| | 85 |

| | |

| | |

| |

| | |

| | 86 |

| | 86 |

| | 86 |

| | 87 |

| | 87 |

| | |

| | |

| |

| | |

| | 88 |

| | 91 |

| | |

| | |

| 92 |

Glossary of Defined Terms

Unless the context requires otherwise, the “Company”, “Stericycle”, “we”, “us”, or “our” refers to Stericycle, Inc. on a consolidated basis. The Company also uses several other terms in this Annual Report on Form 10-K, most of which are explained or defined below:

| | | | | |

| Abbreviation | Description |

| 2021 Plan | 2021 Incentive Stock Plan |

| 2022 Form 10-K | Annual report on Form 10-K for the year ended December 31, 2022 |

| Adjusted Income from Operations | Income from Operations adjusted for certain items discussed in Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations |

| APHIS | Animal and Plant Health Inspection Service |

| ASU | Accounting Standards Update |

| Buyer | Harsco Corporation and CEI Holding LLC, a Delaware limited liability company and subsidiary of Harsco Corporation |

| CARES Act | U.S. Coronavirus Aid, Relief, and Economic Security Act enacted into law on March 27, 2020 |

| CDC | U.S. Centers for Disease Control and Prevention |

| Clean Air Act | The Clean Air Act of 1970 |

| COR | Cost of Revenues |

| COSO Criteria | Internal Control Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission |

| COVID-19 | The global novel coronavirus disease 2019 outbreak, which the World Health Organization declared to be a pandemic |

| Credit Agreement | Credit Agreement dated September 30, 2021 and First Amendment dated April 26, 2022, among the Company and certain subsidiaries as borrowers. Bank of America, N.A., as administrative agent, swing line lender, a lender and a letter of credit issuer and the other lenders party thereto, as amended |

| Credit Agreement Defined Debt Leverage Ratio | As of any date of determination, the ratio of (a) (i) Consolidated Funded Indebtedness as of such date minus (ii) Unrestricted Cash as of such date to (b) Consolidated EBITDA (as defined in the Credit agreement) for the period of four fiscal quarters most recently ended on or prior to such date. |

| Credit Facility | The Company's $1.2 billion credit facility due in September of 2026 granted under the terms of the Credit Agreement |

| CRS | Communication and Related Services (Divested December 2022) |

| DCF | Discounted Cash Flows |

| DEA | U.S. Drug Enforcement Administration. The DEA is a division of the U.S. Department of Justice. It is the federal agency which regulates the manufacture, dispensing, storage, and shipment of controlled substances including medications with human abuse potential |

| DOJ | U.S. Department of Justice |

| Domestic Environmental Solutions | Hazardous Waste Solutions and Manufacturing and Industrial Services (Divested April 2020) |

| DOT | U.S. Department of Transportation |

| DSO | Days Sales Outstanding, defined as the average number of days that it takes a company to collect payment after revenue has been recorded, computed as the trailing twelve months of Revenues for the period ended DSO, divided by the Accounts Receivable balance at the end of the period |

| DTSC | U.S. Department of Toxic Substances Control |

| EBITDA | Earnings Before Interest, Taxes, Depreciation & Amortization. Another common financial term utilized by Stericycle to analyze the core profitability of the business before interest, tax, depreciation and amortization |

| EHS | Environmental, Health and Safety |

| EPA | U.S. Environmental Protection Agency |

| |

| ERISA | U.S. Employee Retirement Income Security Act of 1974, as amended by the Multi-Employer Pension Amendments Act of 1980 |

| ERP | Enterprise Resource Planning |

| ESPP | Employee Stock Purchase Plan, which was approved by stockholders in May 2001 (as amended and restated in May 2017) |

| EU | European Union |

| Exchange Act | U.S. Securities Exchange Act of 1934 |

| Expert Solutions | Recall and Return Services (Divested December 2020) |

| FACTA | U.S. Fair and Accurate Credit Transaction Act |

| FASB | Financial Accounting Standards Board |

| FCPA | U.S. Foreign Corrupt Practices Act |

| FCPA Settlement | FCPA Settlement with the Securities and Exchange Commission, the Department of Justice and Brazilian authorities of approximately $90.0 million and engagement of an independent compliance monitor for 2 years and self-reporting for additional year |

| FMCSA | U.S. Federal Motor Carrier Safety Administration |

| GDPR | General Data Protection Regulation |

| GILTI | Global Intangible Low-Taxed Income |

| GPO | Group Purchasing Organization |

| HIPAA | Health Insurance Portability and Accountability Act |

| HSA | Healthcare Service Agreement with Buyer |

| IATA | International Air Transport Association |

| Indenture | Indenture, dated as of June 14, 2019 between the Company, the guarantors named therein and U.S. Bank National Association, as trustee |

| International | Operating segment including Europe, Middle East, Asia Pacific and Latin America Business operations outside of North America |

| IRS | U.S. Internal Revenue Service |

| | | | | |

| 2022 10-K Annual Report | Stericycle, Inc. • 3 |

| | | | | |

| ISO | Incentive Stock Options |

| NOL | Net Operating Losses |

| North America | Operating segment in North America, including U.S., Canada and Puerto Rico |

| NOV | Notice of Violation |

| OSHA | U.S. Occupational Safety and Health Act of 1970 |

| Other Costs | Represents corporate enabling and shared services costs, annual incentive and stock-based compensation |

| Pension Protection Act | Pension Protection Act of 2006 |

| PFA | Pre-filing agreement with the IRS |

| PHMSA | U.S. Pipeline Hazardous Materials Safety Administration |

| Plan | 401(k) defined contribution retirement savings plan |

| PPE | Personal Protective Equipment |

| PSU | Performance-based Restricted Stock Unit |

| Purchase Agreement | Stock Purchase Agreement, dated as of February 6, 2020, by and between Stericycle, Inc., and the Harsco Corporation and CEI Holding LLC, a Delaware limited liability company and subsidiary of Harsco Corporation |

| RCRA | U.S. Resource Conservation and Recovery Act of 1976 |

| Retained Business | The Company's healthcare hazardous waste services and unused consumer pharmaceuticals take-back services |

| ROU | Right-of-Use |

| RSU | Restricted Stock Unit |

| RWCS | Regulated Waste and Compliance Services, a business unit that provides regulated medical waste services |

| S&P | Standard & Poor's |

| SEC | U.S. Securities and Exchanges Commission |

| Senior Notes | 5.375% ($600.0 million) Senior Notes due July 2024 and 3.875% ($500.0 million) Senior Notes due January 2029 |

| Series A | Series A Mandatory Convertible Preferred Stock, par value $0.01 per share |

| SG&A | Selling, general and administrative expenses |

| SID | Secure Information Destruction Services, a business unit that provides confidential customer material shredding services and recycling of shredded paper |

| SOP | Sorted Office Paper |

| SQ Settlement | Small quantity medical waste customers class action settlement of $295.0 million |

| Tax Act | U.S. Tax Cuts and Jobs Act of 2017 |

| Term Facility | Aggregate amount of commitments made by any lender under the terms of the Credit Agreement |

| Term Loans | Advances made by any lender under the Term Facility |

| TSA | Transition Services Agreement |

| U.K. | United Kingdom |

| UPS | United Parcel Service, Inc. |

| U.S. | United States of America |

| USDA | U.S. Department of Agriculture |

| U.S. GAAP | U.S. Generally Accepted Accounting Principles |

| | | | | |

| 2022 10-K Annual Report | Stericycle, Inc. • 4 |

PART I

Disclosure Regarding Forward-Looking Statements

This document may contain forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. When we use words such as “believes”, “expects”, “anticipates”, “estimates”, “may”, “plan”, “will”, “goal”, or similar expressions, we are making forward-looking statements. Forward-looking statements are prospective in nature and are not based on historical facts, but rather on current expectations and projections of our management about future events and are therefore subject to risks and uncertainties, which could cause actual results to differ materially from the future results expressed or implied by the forward-looking statements. Factors that could cause such differences include, among others, inflationary cost pressure in labor, supply chain, energy, and other expenses, decreases in the volume of regulated wastes or personal and confidential information collected from customers, the ability to implement the remaining phases of our ERP system, and disruptions resulting from deployment of our ERP system, disruptions in our supply chain, disruptions in or attacks on information technology systems, labor shortages, a recession or economic disruption in the U.S. and other countries, changing market conditions in the healthcare industry, competition and demand for services in the regulated waste and secure information destruction industries, SOP pricing volatility or pricing volatility in other commodities, foreign exchange rate volatility in the jurisdictions in which we operate, changes in governmental regulation of the collection, transportation, treatment and disposal of regulated waste or the proper handling and protection of personal and confidential information, the level of government enforcement of regulations governing regulated waste collection and treatment or the proper handling and protection of personal and confidential information, charges related to portfolio optimization or the failure of acquisitions or divestitures to achieve the desired results, failure to consummate transactions with respect to non-core businesses, the obligations to service substantial indebtedness and comply with the covenants and restrictions contained in our credit agreements and notes, rising interest rates or a downgrade in our credit rating resulting in an increase in interest expense, political, economic, and other risks related to our foreign operations, pandemics and the resulting impact on the results of operations, long-term remote work arrangements which may adversely affect our business, supply chain disruptions, disruptions in transportation services, restrictions on the ability of our team members to travel, closures of our facilities or the facilities of our customers and suppliers, changes in the volume of paper processed by our secure information destruction business and the revenue generated from the sale of SOP, weather and environmental changes related to climate change, requirements of customers and investors for net carbon zero emissions strategies, and the introduction of regulations for greenhouse gases, which could negatively affect our costs to operate, the outcome of pending, future or settled litigation or investigations including with respect to the U.S. Foreign Corrupt Practices Act and foreign anti-corruption laws, failure to maintain an effective system of internal control over financial reporting, as well as other factors described in our filings with the SEC, including the 2022 Form 10-K and subsequent Quarterly Reports on Form 10-Q. As a result, past financial performance should not be considered a reliable indicator of future performance, and investors should not use historical trends to anticipate future results or trends. We disclaim any obligation to update or revise any forward-looking or other statements contained herein other than in accordance with legal and regulatory obligations.

| | | | | |

| 2022 10-K Annual Report | Stericycle, Inc. • 5 |

Item 1. Business

Overview

Company Overview

Stericycle is a global business-to-business services company. We provide an array of highly specialized solutions that protect the health and well-being of the people and places around us in a safe, responsible, and sustainable way. Since our founding in 1989, we have grown from a small start-up in medical waste management into a leader across a range of increasingly complex and highly regulated arenas, serving healthcare organizations and commercial businesses of every size through Regulated Waste and Compliance Services and Secure Information Destruction Services.

Through our family of brands, Stericycle serves customers in the U.S. and 16 other countries worldwide with solutions to safely manage materials that could otherwise spread disease, contaminate the environment, or compromise one’s identity. To our customers, team members and the communities we serve, Stericycle is a company that protects what matters.

Our service offerings appeal to a wide range of business customers. Our customers are in the following industries: enterprise healthcare (i.e., hospitals, health systems, and non-affiliate hospitals; national and corporate healthcare), practices and care providers (i.e., physician offices, surgery centers, veterinary clinics, nursing and long-term care facilities, dental clinics, clinics and urgent care, dialysis centers, home health organizations), and pharmacy, lab and research centers. We also provide services to airports and seaports, education institutions, funeral homes and crematories, government and military, banks and professional services, and other businesses.

Segments

Our operating segments as of December 31, 2022, are North America and International.

Financial and other information related to our reporting segments is included in Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Part II, Item 8. Financial Statements and Supplementary Data; Note 17 - Segment Reporting.

Services

Within our operating segments, our revenues are further broken down into these service categories:

| | | | | |

| Revenue Service Category | Services Offered |

Regulated Waste and

Compliance Services | •Biohazardous Waste Disposal (including Regulated Medical Waste, Sharps Waste Management and Disposal, Pharmaceutical Waste Management and Disposal, Controlled Substance Waste Disposal, Healthcare Hazardous Waste, and COVID 19 Waste Disposal) •Compliance Solutions (including Steri-Safe® Compliance Solutions) •Specialty Services (including MedDropTM Medication Collection Kiosks, Safe Community Solutions, SafeDropTM Sharps Mailback Solutions, and Maritime Waste Services) •Medical Supply Store (including Sharps and disposable Biohazardous Waste Containers) |

Secure Information

Destruction Services | •Secure information destruction (including document and hard drive destruction services) under the Shred-it® brand name which includes regular scheduled services (and processing onsite and offsite) and one-time services (including select, priority and express) |

| | | | | |

| 2022 10-K Annual Report | Stericycle, Inc. • 6 |

Revenues by service category for each of the operating segments were as follows:

| | | | | | | | | | | |

| In millions |

| Year Ended December 31, |

| 2022 | | 2021 |

| North America | | | |

| Regulated Waste and Compliance Services | $ | 1,468.8 | | | $ | 1,457.5 | |

| Secure Information Destruction Services | 794.3 | | | 679.0 | |

| Total North America Segment | 2,263.1 | | | 2,136.5 | |

| | | |

| International | | | |

| Regulated Waste and Compliance Services | 329.4 | | | 396.5 | |

| Secure Information Destruction Services | 112.2 | | | 113.9 | |

| Total International Segment | 441.6 | | | 510.4 | |

| | | |

| Total Revenues | $ | 2,704.7 | | | $ | 2,646.9 | |

See Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations for further information on changes in revenues.

Portfolio Optimization

On December 1, 2022, we entered into an agreement and completed the sale of our Communication Solutions business for proceeds of approximately $45.0 million in cash. Communication Solutions had revenues in 2022 of approximately $54.9 million through the date of divestiture, reported in our North America segment, as part of Regulated Waste and Compliance Services.

Customers

Our service offerings appeal to a wide range of business customers. Our customers are primarily in the following industries: enterprise healthcare (i.e., hospitals, health systems, and non-affiliate hospitals; and national and corporate healthcare), practices and care providers (i.e., physician offices, surgery centers, veterinary clinics, nursing and long-term care facilities, dental clinics, clinics and urgent care, dialysis centers, and home health organizations), and pharmacy, lab and research centers. We also provide services to airports and seaports, education institutions, funeral homes and crematories, government and military, banks and professional services, and other businesses. While we manage large volumes of waste and other materials, the average volume per customer site is relatively small.

No single customer accounted for more than 1.6% of our total revenues and our top ten customers collectively accounted for approximately 8.5% of total revenues. No single customer accounted for more than 1.9% of our total accounts receivable and our top ten outstanding customer balances accounted for approximately 7.6% of total accounts receivable. We have developed a strong and loyal customer base, with an estimated revenue retention rate of approximately 90% (based on our internal customer attrition analysis) and have been able to leverage these customer relationships to provide additional services.

As of December 31, 2022, Regulated Waste and Compliance Services are provided to customers in the U.S., Brazil, Canada, Ireland, the Netherlands, Portugal, the Republic of Korea, Romania, Spain and the U.K. Secure Information Destruction Services under the Shred-it® brand are provided in the U.S., Australia, Belgium, Canada, France, Germany, Ireland, Luxembourg, the Netherlands, Portugal, Spain, Singapore and the U.K. Secure Information Destruction Services are also provided in the United Arab Emirates through a joint venture.

In the U.S. and elsewhere, the healthcare industry is evolving to meet competing demands for increased healthcare coverage of a growing and aging population and economic pressures to reduce healthcare costs. As a result of these dynamics, hospital networks are consolidating physician practices into their networks, independent practices are consolidating, while other customers are leveraging GPOs to reduce healthcare costs.

Our international RWCS operations generate most of their revenues from large account customers, such as hospitals, publicly funded healthcare organizations and National Trusts versus smaller customers which tend to be more profitable.

| | | | | |

| 2022 10-K Annual Report | Stericycle, Inc. • 7 |

Facilities and Fleet

Our worldwide network includes a global fleet of approximately 6,100 route trucks, tractors, collection vans, and small duty vehicles. We operate out of approximately 443 facilities worldwide with properties both leased and owned as described below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Autoclave or Alternative Medical Waste Treatment | | Medical Waste Incinerator Facilities | | Secure Information Destruction Processing | | Transfer Stations

(RWCS and SID) | | Other Locations and/or Administrative Facilities | | Total Facilities |

| North America | 45 | | 9 | | 93 | | 137 | | 13 | | 297 |

| International | 31 | | 16 | | 26 | | 52 | | 21 | | 146 |

| Total | 76 | | 25 | | 119 | | 189 | | 34 | | 443 |

We are headquartered in Bannockburn, Illinois.

Our Key Business Priorities

Following its founding in 1989, Stericycle grew rapidly through acquisitions as the regulated waste industry developed. Growth from regulated waste acquisitions helped us achieve scale of infrastructure, route density and a leadership position in many of the markets we serve. We also leveraged acquisitions to enter new regional and international geographies and added additional services to our portfolio, including the Secure Information Destruction business in 2015. As we grew and evolved, we operated without centralization and the efficiencies that come from an integrated, modern corporate structure and associated information systems until we shifted our focus to our five key business priorities in 2019.

•Quality of revenue – The services we offer help our customers meet complex regulations. Our expertise, infrastructure and service levels provide a differentiated and premium brand value to the customers we serve. As such, we are focused on improving the quality of revenue we deliver through a formal cross-functional deal review committee, realignment of sales incentive plans, re-organization of our commercial leadership team around our service lines, key customer channels, and implementation of global customer pipeline management processes for both RWCS and SID.

•Operational efficiency, modernization, and innovation – Our day-to-day operations are shifting toward a standardized and centralized operating model to optimize processes, drive efficiencies and improve both safety and service. Additionally, our engineering team is focused on driving cost efficiencies through work measurement, asset optimization, use of technology, enhanced operational and capital planning, expanded strategic sourcing, fleet replacement and route and long-haul network improvements, and SafeShield container rationalization and modernization.

•ERP implementation – Stericycle historically acquired more than 500 companies without fully integrating certain acquisitions onto centralized information technology platforms. The resulting disparate operating and information systems created significant operational inefficiencies and manual processes. We expect the implementation of the North America ERP and International modernization will continue to make it easier for our customers to do business with us, drive improved operating margins through daily decisions using real-time information insights, simplify and enhance financial and operational transparency for greater accountability, aid in strategic planning, and streamline operational processes.

•Debt reduction and leverage improvement – As a result of the debt accumulated from our historic acquisition strategy, debt structure and debt leverage improvement are a key focus as we aim to continue to increase the strength of our balance sheet and continue to invest in our business.

•Portfolio optimization – We continue to focus on where our core businesses can be successful. To achieve this, we remain committed to pursuing the divestitures of service lines and geographies that are not as profitable, have limited growth potential, are not vertically integrated, are not essential to our RWCS and SID Revenue categories, and/or present the opportunity to reduce debt. Additionally, we will continue to evaluate growth opportunities for our core business through smaller accretive tuck-in acquisitions.

For further details, refer to Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Item 8. Financial Statements and Supplementary Data; Note 3 – Acquisition, Note 4 – Restructuring, Divestitures, and Asset Impairments, and Note 9 – Debt.

| | | | | |

| 2022 10-K Annual Report | Stericycle, Inc. • 8 |

Regulated Waste and Compliance Services

Collection and Transportation

The collection process for regulated waste streams begins at the customer location with waste segregation. To assure regulatory compliance, we educate our customers and will not accept material from customers unless it complies with our waste acceptance protocols and is properly stored or packaged in containers that we have either supplied or approved and is appropriately labeled.

Our team members then collect containers at the customer location via our fleet of vehicles. The majority of collected waste is then transported directly to one of our processing facilities or to one of our transfer stations until it’s transported to a processing facility. Our use of transfer stations in a “hub and spoke” configuration improves the efficiency of our collection and transportation operations by expanding the geographic area that a particular processing facility can serve, thereby increasing the utilization of the facility and the volume of waste that it processes.

Processing and Disposal of Regulated Waste

Upon arrival at a processing facility, containers or boxes of regulated waste undergo a quality control process to verify that they do not contain any unacceptable substances. Any container or box that is discovered to contain unacceptable waste goes through a corrective action process which could include redirecting the waste, returning the waste to the customer and/or notifying the appropriate regulatory authorities. From there, regulated waste is processed using one of several treatments or processing technologies, predominantly at one of our facilities:

•Autoclaving: Autoclaving is the primary method of regulated waste treatment. This process relies on steam at high temperature and pressure to kill pathogens and render materials non-infectious.

•Alternative Technologies: We use several different non-incineration alternatives to autoclaves, predominantly outside of the U.S. The processes used by these technologies are similar, as the regulated waste is heated to a specified temperature for a required time to kill the pathogens and render materials non-infectious. This is not always under pressure. Depending on local requirements, the waste may be shredded before or after treatment to render it unrecognizable.

•Incineration: While Stericycle strives to use alternative, non-incineration methods for treating medical waste, incineration remains a regulatory requirement and/or a best practice in certain geographies or for certain types of medical waste that need to be chemically destroyed. Incineration burns regulated waste at elevated temperatures and reduces it to ash. Incineration reduces the volume of waste, and it is the recommended treatment and disposal option for some types of regulated waste such as anatomical waste, residues from chemotherapy procedures and non-hazardous pharmaceutical waste. Air emissions from incinerators can contain certain byproducts that are subject to federal, state and in some cases, local regulation. In some circumstances, the ash byproduct of incineration may be regulated.

Upon completion of the treatment process, the resulting waste or incinerator ash is transported for disposal in a landfill owned by unaffiliated third parties.

In several of our incineration facilities, we use different types of waste-to-energy solutions as part of our processes. Stericycle has four incinerators with steam turbines that can generate electricity and reduce the amount of power required from utilities at each site. In the U.K., several of our incinerators export steam to hospitals, where they are co-located, to be used for facility or hot water heating, steam sterilization, and/or laundry services. Similar to exported steam, two of our U.K. incinerators export hot water to nearby hospitals. In the U.K. and Ireland, after

| | | | | |

| 2022 10-K Annual Report | Stericycle, Inc. • 9 |

medical waste has gone through the alternative treatment process, it is sent for beneficial reuse. This treated waste is sent to cement producers and used as an alternative fuel for cement kilns.

Secure Information Destruction

We leverage a combination of off-site and on-site document destruction methods for one-time and recurring paper shredding. In North America in 2022, approximately 70% of collected documents for secure destruction were sent off-site to geographic consolidating shredding facilities for secure destruction. The remainder of collected documents are shredded on-site with shredding equipment in our vehicles. For both methods, our service offerings leverage cross-cut shredding technology to enhance the security level of destruction and can provide secure chain-of-custody and Proof of Service.

Shredded paper is then baled to be sold as SOP for recycling. SOP consists of paper typically generated by offices that contains primarily white paper. It’s a higher value recyclable than mixed paper, old newspapers or magazines. In 2022, Stericycle collected and delivered approximately 523,000 tons of SOP for recycling into paper products. During 2022, the average annual SOP price was $235 per ton, as reported by Fastmarkets RISI, an increase of 67.8% over 2021.

Our Business Model and Key Business Attributes

Regulated Business-to-Business Operations

We focus on providing business-to-business services in areas of operations that are highly regulated. By helping our customers maintain compliance with complex regulations, we protect people and brands, promote health and safeguard the environment. Governmental legislation and regulation require the proper handling and disposal of items such as regulated waste and personal confidential information. Regulated waste can be defined as any material subject to government-imposed guidelines for handling the material for transportation or disposal.

•Regulated Medical Waste: Regulated medical waste generated from procedures including any items saturated with blood or other potentially infectious materials (OPIM), such as bandages, gauze, or PPE, are considered regulated medical waste or red bag waste.

•Trace Chemotherapy Waste: Chemotherapy waste includes empty chemo drug vials, syringes and needles, spill kits, IV tubing and bags, contaminated gloves and gowns, materials from spill cleanups, or bodily fluids/waste.

•Pathological Waste: Pathological waste such as human or animal body parts, organs, tissues, and surgical specimens (decanted of formaldehyde, formalin, or other preservatives) are packaged separately.

•Sharps Waste: Sharps waste such as needles, scalpels, blades, and pipettes that have come in contact with blood, body fluids, or microorganisms.

•Pharmaceutical Waste: Pharmaceutical waste that may be hazardous or nonhazardous and consists of expired, recalled, or otherwise unused pharmaceuticals.

•Controlled Substances Waste: Controlled substances waste includes unused, unwanted, or expired pharmaceutical controlled substances.

•Healthcare Hazardous Waste: Healthcare hazardous waste includes prevalent and well-known waste streams and other wastes generated in smaller quantities that require proper attention, such as flammable liquids, xylene, formalin, aerosols, and universal waste.

•Maritime Waste: Airport and seaport generated waste including gray water, black water, bilge water, sludge, solid waste, recyclable solid waste, RCRA hazardous waste, APHIS waste, and universal waste.

•COVID-19 Waste Disposal: Medical waste and PPE waste generated through the COVID-19 pandemic in healthcare and non-healthcare facilities, including vaccine disposal, testing and temporary healthcare sites, and non-healthcare PPE disposal.

•Personal Confidential Information: Documents and e-media containing protected healthcare information, financial information, or other confidential information.

Growing Markets

The services we offer, especially our core services of regulated waste and compliance and secure information destruction, are growing or have historically grown. This growth is driven by multiple factors:

| | | | | |

| 2022 10-K Annual Report | Stericycle, Inc. • 10 |

•Aging Population: The average age of the population in the countries in which we operate is rising, driving increases in healthcare demand and the quantity of regulated wastes generated.

•Enforcement of Waste Regulations: We operate in a highly regulated business where penalties for violations can be costly and high profile, thereby impacting our customers' overall reputation. We believe that many businesses are either unaware of the need for proper training of employees or of applicable regulatory requirements or understaffed or lack the expertise to comply with the regulations, and we seek to help businesses fill this gap.

•Regulation of Privacy and Information Security and Concerns over Data Breaches: The secure information destruction total addressable market has been driven, in part, by the need for compliance with increasing government regulation and increasing general concern with privacy and information security. Recent regulatory changes reflecting this increased regulatory focus include the European GDPR; California, Colorado, and Virginia’s comprehensive consumer privacy legislation; and Canada's Personal Information Protection and Electronic Documents Act. Moreover, the majority of states are working on comprehensive consumer privacy legislation.

•Increased Business Focus on Sustainability: Businesses continue to realize that a focus on sustainability is increasingly essential to operating efficiently and meeting the increasing demands and expectations of customers and stakeholders for environmental responsibility. Such pressures are driving proper disposal of pharmaceuticals, recycling efforts, shred-all policies for paper and other initiatives supported by our services.

Stable and Recurring Customer Needs Supported by Long-term Contracts

The services we provide most often require service on a routine and scheduled basis. The majority of our customer relationships include long-term contracts ranging from three to five years in length. We have developed a strong and loyal customer base, with a revenue retention rate of approximately 90% (based on our internal customer attrition analysis) in 2022.

Established Network of Processing and Transportation Locations

Our infrastructure network results in an expansive operational network with alternate transportation, treatment and destruction options for our customers. The scale of our network also provides us the ability to be the single-source provider for customers with multiple locations across the country and gives us the flexibility to quickly redirect services or operations to another location if the need arises due to severe weather, power outages, or other disruptions.

Our goal is to optimize our facilities with a strategic and standardized operating model. We are analyzing processing capabilities, plant and transportation equipment needs, team member requirements, and potential customer implications or benefits. This planning process also provides opportunities to focus on reducing our environmental impact by optimizing our transportation network to reduce miles driven and overall greenhouse gas impact. We anticipate that modernizing our plant equipment with new efficient technology will also lessen our overall energy consumption per operating cycle. Over the past two years, we opened four new greenfield autoclave facilities (New Jersey, California, Ireland, and United Kingdom) and completed over 20 upgrade projects, including improvements to autoclaves, shredders, washers and enhanced conveyance, and sharps processing. These new and improved facilities and upgrades represent the initial steps in modernizing our global facility network which we plan to expand in future periods. In 2022, we began constructing a commercial Hospital, Medical, Infectious Waste Incinerator (HMIWI) in Nevada.

Routing Logistics

While we manage large volumes of waste and secure information for destruction, the average volume per customer site is relatively small and the resulting revenue per stop is low. As such, route logistics and route efficiency are a core focus. Our transportation network provides us with an advantage compared to our competition in many of the markets we serve. Additionally, we have continued to focus on route density and optimized routing at both the individual truck and geographic market level. As an example, by optimizing the location of the new greenfield autoclave facility in California and executing our transportation and long-haul plan, we are now driving 20,000 fewer miles per month, on average, in the Western United States. We expect that the North America ERP implementation will provide greater visibility to data which will continue to enable additional routing and operational efficiencies.

Industry Leadership and Expertise

Based on our infrastructure and revenues, we maintain a global leadership position across many of our services lines, including regulated waste and secure information destruction. We employ experienced team members who

| | | | | |

| 2022 10-K Annual Report | Stericycle, Inc. • 11 |

have a deep understanding of the industries they serve, the regulatory climate and the evolving needs of our customers. We collaborate regularly with a wide range of stakeholders and interest groups. Starting in 2020 and continuing throughout 2022, the Company took a leadership position related to the management of pandemic waste, supporting our customers and providing industry expertise regarding the effective management of COVID-19 waste. In 2014, we were tasked by the DOT and CDC to dispose of waste from the Ebola outbreak. Stericycle also provided essential regulated medical waste disposal during the 2003 SARs outbreak and the 2009 H1N1 outbreak. We proactively work with organizations like the CDC, DEA, EPA, OSHA and many other government and regulatory bodies, including law enforcement. Our experts are frequent speakers at hospital networks and industry trade associations and actively engage in numerous community meetings each year.

Human Capital Management

Workforce Overview

As of December 31, 2022, our workforce is over 15,000 team members, with 97% of them employed full-time. We engage approximately 1,170 global contingent workers, supplementing our staff to fill temporary positions or as a part of a temporary-to-permanent recruiting program.

Our 2022, voluntary turnover rate, excluding turnover due to divestitures, averaged approximately 28%. This represents an increase in our voluntary turnover rate of 2% year over year.

As of December 31, 2022, 12% of our total global workforce was covered by collective bargaining agreements or works councils. There are 16 collective agreements in the U.S. and Canada, covering approximately 650 team members or 6% of our North American workforce. Approximately 1,200 team members outside North America are covered by collective bargaining agreements or works councils. We engage in good faith bargaining with the works councils and unions that represent our team members.

| | | | | |

| 2022 10-K Annual Report | Stericycle, Inc. • 12 |

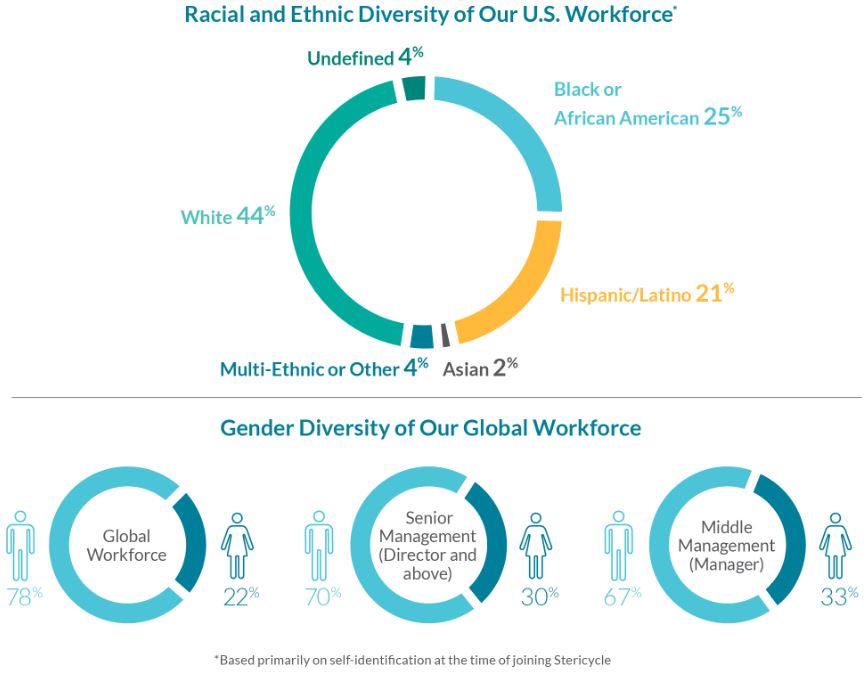

Diversity and Inclusion

At Stericycle, we are committed to driving engagement and inclusivity.

During 2022, 65% of U.S. new hires and 44% of internal promotions were from federally designated racial or ethnic minority categories. We hired approximately 200 team members during 2022 who identified as U.S. veterans.

We believe our seven employee resource groups (ERG) help drive engagement and representation and support team members who are Women, Black and African American, Latinx, Veterans, members of the LGBTQ+ (lesbian, gay, bisexual, transgender, and queer) community, young professionals, and team members and their family members who have disabilities. We routinely leverage our ERGs to address important social topics with our team members through “Let’s Talk About It” video discussion. Additionally, during 2022, our ERGs provided educational communications to our team members; hosted speaker events; led company celebrations for Black History Month, Hispanic Heritage Month, Pride Month, Asian American and Pacific Islander Month, Veterans Day, and other days of diversity awareness or celebration; and provided mentoring programs for Women, Black and African Americans, and Veterans.

We remain committed to a routine review of the competitiveness and equity of our team members’ compensation, with the next detailed analysis planned for 2023. Additionally, we continue to monitor and comply with state laws around pay transparency.

| | | | | |

| 2022 10-K Annual Report | Stericycle, Inc. • 13 |

Safety

At Stericycle, a commitment to safety is one of our core values. We focus on a comprehensive safety program to protect our team and drive our safety performance.

In 2022, our safety improvement journey included a comprehensive focus on developing centralized procedures, processes and monitoring as well as investment in new training programs to increase safety awareness. During 2022, our safety program expansion included:

•a global expansion of our comprehensive defensive driving program;

•a new, centrally coordinated Global EHS Audit Program focused on conducting comprehensive, unscheduled audits of facility operations;

•a monthly safety global coaching and communications program; and

•a weekly published Safety Exchange with themed procedures and best practices.

Our Operating Environment

Competition

The industries and markets in which we operate are highly competitive on pricing and barriers to entry are low. Our competitors consist of many different types of service providers, including national, regional and local companies. Some of these companies provide only a portion of the services of Stericycle - for example, just collection and transportation, but not treatment of regulated waste. In the regulated waste and secure information destruction industries, another source of competition is on-site management.

For regulated waste, some large-quantity waste generators, particularly hospitals, may choose an onsite autoclave or other treatment process. For secure information destruction, many businesses may choose to use small, on-site shredders for their documents. In both regulated waste and secure information destruction, there is no other competitor in North America with Stericycle’s overall scale, breadth of services, national transportation network and comprehensive treatment network.

Governmental Regulation

Stericycle’s RWCS and SID services are subject to numerous regulations, which are frequently evolving. We are subject to substantial regulations enacted and enforced by governments within the U.S. and the international jurisdictions in which we conduct operations. In many countries, there are multiple regulatory agencies at the local and national level that oversee our customers and/or our services. The regulatory requirements with which we must comply vary from jurisdiction to jurisdiction. The laws governing our domestic and international operations generally consist of statutes, legislation and regulations concerning environmental protection; employee and public health and safety; transportation; document destruction and management; data privacy; ethical business conduct; and the management of regulated waste streams, including regulations that govern the definition, generation, segregation, handling, packaging, transportation, treatment, storage and disposal of regulated waste.

This regulatory framework imposes a variety of compliance requirements, including requirements to obtain and maintain government permits or other authorizations. We maintain governmental permits, registrations and licenses to conduct our business throughout the jurisdictions in which we operate. Our permits vary by jurisdiction based upon our activities within that jurisdiction and on the applicable laws and regulations of that jurisdiction. These permits grant us the authority to, among other things, construct and operate transfer and processing facilities; transport regulated waste within and between relevant jurisdictions; and handle particular regulated substances. Our permits, registrations and licenses may be subject to modification or revocation by the issuing authority and, in some jurisdictions, are subject to periodic renewal. Permit issuance or renewal may also be subject to public participation.