Table of Contents

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 0-21229

Stericycle, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 36-3640402 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification Number) |

28161 North Keith Drive

Lake Forest, Illinois 60045

(Address of principal executive offices including zip code)

(847) 367-5910

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Common stock, par value $.01 per share |

NASDAQ Global Select Market | |

| (Title of each class) | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES x NO ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Act of 1934. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K, or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “accelerated filer”, “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one)

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2 of the Exchange Act). YES ¨ NO x

State the aggregate market value of voting and non-voting common equity held by non-affiliates computed by reference to the price at which common equity was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2012): $7,835,858,830.

On February 14, 2013, there were 86,089,532 shares of the Registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Information required by Items 10, 11, 12 and 13 of Part III of this Report is incorporated by reference from the Registrant’s definitive Proxy Statement for the 2013 Annual Meeting of Stockholders to be held on May 21, 2013.

Table of Contents

Stericycle, Inc.

2012 ANNUAL REPORT ON FORM 10-K

| Page No. | ||||||

| PART I. |

||||||

| Item 1. |

1 | |||||

| Item 1A. |

11 | |||||

| Item 1B. |

14 | |||||

| Item 2. |

14 | |||||

| Item 3. |

14 | |||||

| Item 4. |

14 | |||||

| PART II. |

||||||

| Item 5. |

15 | |||||

| Item 6. |

18 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

19 | ||||

| Item 7A. |

30 | |||||

| Item 8. |

31 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

63 | ||||

| Item 9A. |

63 | |||||

| Item 9B. |

63 | |||||

| PART III. |

||||||

| Item 10. |

64 | |||||

| Item 11. |

64 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

64 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

64 | ||||

| Item 14. |

65 | |||||

| PART IV. |

||||||

| Item 15. |

66 | |||||

| 70 | ||||||

Table of Contents

PART I.

Unless the context requires otherwise, “we,” “us” or “our” refers to Stericycle, Inc. and its subsidiaries on a consolidated basis.

Overview

Services

We are in the business of managing regulated waste and providing an array of related and complementary services. We operate in the United States, Argentina, Brazil, Canada, Chile, Ireland, Japan, Mexico, Portugal, Romania, Spain, and the United Kingdom.

The regulated waste services we provide include medical waste disposal, our Steri-Safe® medical waste and compliance program, our Clinical Services program, our Bio Systems® reusable sharps disposal management services, pharmaceutical waste disposal, and hazardous waste disposal. In addition to our regulated waste services, we offer regulated recall and returns management services, patient communication services, and medical safety products. Our regulated recall and returns management services encompass a number of solutions for a variety of businesses but consist primarily of managing the recall, withdrawal or return of expired or recalled products and pharmaceuticals. We also provide communication services to healthcare providers to improve office productivity and communications with patients.

We operate integrated regulated waste management networks in the United States, Argentina, Brazil, Canada, Chile, Ireland, Japan, Mexico, Portugal, Romania, Spain, and the United Kingdom. Our worldwide networks include a total of 153 processing facilities, 141 transfer sites, and 64 recall and returns or communication services facilities. Our regulated waste processing technologies are primarily autoclaving as well as incineration and our proprietary electro-thermal-deactivation system (“ETD”).

Customers

We serve approximately 541,000 customers worldwide, of which approximately 16,500 are large-quantity generators, such as hospitals, blood banks and pharmaceutical manufacturers, and approximately 524,500 are small-quantity generators, such as outpatient clinics, medical and dental offices, long-term and sub-acute care facilities, veterinary offices, municipalities and retail pharmacies.

For large-quantity generators of regulated waste such as hospitals and for pharmaceutical companies and distributors, we offer:

| • | our regulated waste management services; |

| • | our Bio Systems® reusable sharps disposal management services; |

| • | our pharmaceutical waste services; |

| • | our Integrated Waste Stream Solutions (IWSS) program; |

| • | a variety of products and services for infection control; |

| • | our regulated recall and returns management services for expired or recalled products and pharmaceuticals; and |

| • | a variety of patient communication services. |

For small-quantity generators of regulated waste such as doctors’ offices or retail pharmacies, we offer:

| • | our regulated waste management services; |

| • | our Steri-Safe® OSHA, HIPAA compliance, and clinical services programs; |

1

Table of Contents

| • | a variety of products and services for infection control; |

| • | our regulated recall and returns management services for expired or recalled products and pharmaceuticals; and |

| • | a variety of patient communication services. |

We benefit from significant customer diversification. No one customer accounts for more than 1.1% of our total revenues, and our top ten customers account for approximately 7.2% of total revenues.

Industry Overview

Governmental legislation and regulation increasingly requires the proper handling and disposal of regulated waste which includes such items as medical waste, hazardous waste, and pharmaceutical waste. Regulated waste is generally any medical waste that can cause an infectious disease and includes: single-use disposable items, such as needles, syringes, gloves and other medical supplies; cultures and stocks of infectious agents; blood and blood products; hazardous waste; and regulated pharmaceutical waste, which consists of expired or recalled pharmaceuticals.

We believe that in 2012 the size of the global market for the regulated waste and other services we provide was approximately $15.0 billion. Industry growth is driven by a number of factors. These factors include:

| • | Aging of Population: The average age of the population in the countries we operate in is rising. As people age, they typically require more medical attention and a wider variety of tests, procedures and medications, leading to an increase in the quantity of regulated waste generated. |

| • | Pressure to Reduce Healthcare Costs: The healthcare industry is under pressure to reduce costs. We believe that our services can help healthcare providers to reduce their handling and compliance costs and to reduce their potential liability for employee exposure to bloodborne pathogens and other infectious agents. In addition, hospital institutions continue to outsource services which we can provide. |

| • | Environmental and Safety Regulation: We believe that many businesses that are not currently using third party regulated waste management services are unaware either of the need for proper training of employees or of the requirements of OSHA and other regulations regarding the handling of regulated waste. These businesses include manufacturing facilities, schools, restaurants, hotels and other businesses where employees may come into contact with bloodborne pathogens or handle hazardous materials. Similarly, the proper handling of expired or recalled products requires an expertise that many businesses lack or find inefficient to provide. |

| • | Shift to Off-Site Treatment: We believe that patient care is continuing to shift from institutional higher-cost acute-care settings to less expensive, smaller, off-site treatment alternatives, with a resulting increase in the number of regulated waste generators that cannot treat their own regulated waste. |

| • | Control of Drug Diversion: The U.S. Drug Enforcement Administration (“DEA”) has recently emphasized improved control of the handling and shipment of controlled substances to prevent diversion and counterfeiting, thus increasing the utility to pharmaceutical manufacturers and distributors of a returns service for expired or recalled pharmaceuticals. |

Competitive Strengths

We believe that we benefit from the following competitive strengths, among others:

| • | Broad Range of Services: We offer our customers a broad range of services. We work with businesses across a number of industries such as healthcare, manufacturing, and retail to safely and efficiently dispose of regulated materials, ensure regulatory compliance, improve employee and customer safety, protect their brands, improve communications with patients, and manage corporate and personal risk. |

2

Table of Contents

| • | Established Network of Processing and Transportation Locations in Each Country: We believe that our network of locations results in a very efficient operation. |

| • | Diverse Customer Base and Revenue and Cost Stability: We have a diverse customer base and contractual relationships in all the markets in which we operate. We are also generally protected from the cost of regulatory changes or increases in fuel, insurance or other operating costs because our regulated waste contracts typically allow us to adjust our prices to reflect these cost changes. |

| • | Strong Sales Network and Proprietary Database: We use both telemarketing and direct sales efforts to obtain new customers for our regulated waste and other services. In addition, we have a large database of potential new small-quantity customers, which we believe gives us a competitive advantage in identifying and reaching this higher-margin sector. |

| • | Experienced Senior Management Team: We have experienced leadership. Our five most senior executives collectively have over 130 years of management experience in the health care and waste management industries. |

| • | Ability to Integrate Acquisitions: Since 1993 we have completed 299 acquisitions in the United States and internationally and have demonstrated a consistent ability to integrate our acquisitions into our operations successfully. |

Our goals are to strengthen our position as a leading provider of regulated waste and compliance services and to continue to improve our profitability. Components of our strategy to achieve these goals include:

| • | Expand Range of Services and Products: We believe that we continue to have opportunities to expand our business by increasing the range of products and services we offer our existing regulated waste customers. For example, to small-quantity customers, we also offer OSHA compliance services through our Steri-Safe® program and patient communication services; to large-quantity customers, we also offer our Bio Systems® reusable sharps management program, our pharmaceutical waste disposal services and patient communication services. |

| • | Improve Margins: We intend to continue working to improve our margins by increasing our base of small-quantity customers and focusing on service strategies that more efficiently meet the needs of our large-quantity customers. We have succeeded in raising the percentage of our domestic regulated waste revenues from small-quantity customers from 33% for the fourth quarter of 1996 to 63% for 2012. |

| • | Seek Complementary Acquisitions: We intend to continue to seek opportunities to acquire businesses that expand our networks and service capabilities in the United States and internationally that will increase our customer base. We believe that selective acquisitions can enable us to improve our operating efficiencies through increased utilization of our service infrastructure. |

Acquisitions

We have substantial experience in evaluating potential acquisitions and determining whether a particular business can be integrated into our operations with minimal disruption. Once a business is acquired, we implement programs and procedures to improve customer service, sales, marketing, routing, equipment utilization, employee productivity, operating efficiency and overall profitability.

We have completed 299 acquisitions from 1993 through 2012, with 181 in the United States and 118 internationally.

During 2012, we completed 41 acquisitions, of which 17 were domestic businesses and 24 were international businesses in Latin America, Europe, and Japan.

3

Table of Contents

International

We conduct regulated waste operations in Argentina, Brazil, Canada, Chile, Ireland, Japan, Mexico, Portugal, Romania, Spain, and the United Kingdom. We began our operations in Canada and Mexico in 1998, Argentina in 1999, the United Kingdom in 2004, Ireland in 2006, Chile in 2008, Romania and Portugal in 2009, Brazil and Japan in 2010, and Spain in 2011. Our international service offerings are primarily regulated waste disposal. We also have started an international presence for our Returns and Quality Audit program, which is managed through recall and returns management services. While our international customers are primarily large quantity generators, we are expanding our small quantity customer base through programs similar to our Steri-Safe program such as Stericycle Clinical Services in Canada and select countries in Europe.

Regulated Waste Services and Operations

Collection and Transportation: In many respects, our regulated waste business is one of logistics. Efficiency of collection and transportation of regulated waste is a critical element of our operations because it represents the largest component of our operating costs.

For regulated waste, we supply specially designed reusable leak-resistant and puncture-resistant plastic containers to most of our large-quantity customers and many of our larger small-quantity customers. To assure regulatory compliance, we will not accept regulated waste from customers unless it complies with our acceptance protocols and is properly packaged in containers that we have either supplied or approved.

We collect containers or corrugated boxes of regulated waste from our customers depending upon customer requirements, contract terms and volume of waste generated. The waste is then transported directly to one of our processing facilities or to one of our transfer stations where it is combined with other regulated waste and transported to a processing facility.

Transfer stations allow us to temporarily hold small loads of waste until they can be consolidated into full truckloads and transported to a processing facility. Our use of transfer stations in a “hub and spoke” configuration improves the efficiency of our collection and transportation operations by expanding the geographic area that a particular processing facility can serve thereby increasing utilization of the facility by increasing the volume of waste that it processes.

We collect some expired or recalled products, but more typically, customers ship them directly to our processing facilities.

Processing and Disposal: Upon arrival at a processing facility, containers or boxes of regulated waste are typically scanned to verify that they do not contain any unacceptable substances like radioactive material. Any container or box that is discovered to contain unacceptable waste is returned to the customer and the appropriate regulatory authorities are informed.

The regulated waste is then processed using one of our various treatment or processing technologies. Upon completion of the particular process, the resulting waste or incinerator ash is transported for resource recovery, recycling or disposal in a landfill owned by an unaffiliated third party. After plastic containers such as our Steri-Tub® or Bio Systems® containers have been emptied, they are washed, sanitized and returned to customers for re-use.

Upon receipt at a processing facility, expired or recalled products are counted and logged, and controlled substances are stored securely. In accordance with the manufacturer’s instructions, expired or recalled products are then returned to the manufacturer or destroyed in compliance with applicable regulations.

Documentation: We provide complete documentation to our customers for all regulated waste that we collect in accordance with applicable regulations and customer requirements.

4

Table of Contents

Processing Technologies

We currently use both non-incineration technologies (autoclaving, our proprietary ETD technology, and chemical treatment) and incineration technologies for treating regulated waste.

Stericycle was founded on the belief that there was a need for safe, secure and environmentally responsible management of regulated medical waste. From our beginning, we have encouraged the use of non-incineration treatment technologies such as autoclaving and our ETD process. While we recognize that some state regulations currently in force mandate that some types of regulated waste must be incinerated, we also know from years of experience working with our customers that there are ways to reduce the amount of regulated waste that is ultimately incinerated. The most effective strategy that we have seen involves comprehensive education of our customers in waste minimization and segregation.

Autoclaving: Autoclaving treats regulated waste with steam at high temperature and pressure to kill pathogens. Autoclaving alone does not change the appearance of waste, and some landfill operators may not accept recognizable regulated waste. In this case, autoclaving may be combined with a shredding or grinding process to render the regulated waste unrecognizable.

ETD: Our ETD treatment process includes a system for grinding regulated waste. After grinding, ETD uses an oscillating field of low-frequency radio waves to heat regulated waste to temperatures that destroy pathogens such as viruses, bacteria, fungi and yeast without melting the plastic content of the waste. ETD does not produce regulated air or water emissions.

Incineration: Incineration burns regulated waste at elevated temperatures and reduces it to ash. Incineration reduces the volume of waste, and it is the recommended treatment and disposal option for some types of regulated waste such as anatomical waste or residues from chemotherapy procedures. Air emissions from incinerators can contain certain byproducts that are subject to federal, state and, in some cases, local regulation. In some circumstances, the ash byproduct of incineration may be regulated.

Marketing and Sales

Marketing Strategy: We use both telemarketing and direct sales efforts to obtain new customers. In addition, our drivers may also participate in our regulated waste marketing efforts by actively soliciting small-quantity customers they service.

Small-Quantity Customers: We target small-quantity customers as a growth area of our regulated waste business. We believe that when small-quantity regulated waste customers view the potential risks of failing to comply with applicable regulations, they appreciate the value of the services that we provide. We consider this factor to be the basis for the higher gross margins that we have achieved with our small-quantity customers relative to our large-quantity customers. We believe that the same potential exists in processing returns of hazardous and expired products for smaller customers.

Steri-Safe® and Patient Communication Services: Our domestic Steri-Safe® OSHA compliance program provides an integrated regulated waste management and compliance-assistance service for small-quantity customers who typically lack the internal personnel and systems to comply with OSHA regulations. Customers for our Steri-Safe® service pay a predetermined subscription fee in advance for regulated waste collection and processing services and can also choose from available packages of training and education services and products designed to help them to comply with OSHA regulations. We believe that the implementation of our Steri-Safe® service provides us with an enhanced opportunity to leverage our existing customer base through the program’s prepayment structure and diversified product and service offerings. In 2010 and 2011, we introduced a similar program called Clinical Services in Canada, Ireland, Portugal, and the United Kingdom. We offer a variety of services to healthcare providers designed to enhance office productivity and efficiency and to improve communications with patients. We also serve hospitals and larger facilities. We believe that our patient communication services afford us an additional opportunity to leverage our existing small-quantity customer base.

5

Table of Contents

Mail-Back Program: We also operate a domestic “mail-back” program by which we can reach small-quantity regulated waste customers located in outlying areas that would be inefficient to serve using our regular route structure. Our mail-back program has allowed us to service customers as far away as Hawaii, Alaska, Guam, and the Virgin Islands. Our mail-back program is also used in home care patient settings.

Large-Quantity Customers: Our marketing efforts to large-quantity customers are conducted by account executives, service specialists and healthcare compliance specialists focused on serving as a trusted advisor to our customers. In this role, our field resources provide advice, training and consultative services to assist our large-quantity customers reach their objectives of staying in compliance with local, state, and federal regulations, reducing their impact on the environment, and maintaining a safe work environment for their staff and patients.

We offer individual waste stream services, including regulated waste management services and Sharps Management Service featuring our Bio Systems® reusable containers. Additionally, we have the ability to manage the full spectrum of waste streams generated by a facility with our Integrated Waste Stream Solutions service. Many of Stericycle’s services for large-quantity customers deliver fully integrated, turnkey solutions which include program design, clinical staff education, implementation support, onsite service personnel and the necessary service equipment to support each program.

National Accounts: As a result of our extensive geographic coverage, we are capable of servicing national account customers (i.e., customers requiring regulated waste management services at various geographically dispersed locations).

Contracts: We have multi-year contracts with the majority of our customers. We negotiate individual contracts with each customer. Although we have several standard forms of contract, terms may vary depending upon the customer’s service requirements and the volume of regulated waste generated and, in some jurisdictions, statutory and regulatory requirements. Substantially all of our contracts with small-quantity customers contain automatic renewal provisions.

Competition

The industries and markets in which we operate are highly competitive, and barriers to entry into the regulated waste collection and disposal business, the pharmaceutical returns business, and the patient communication business are very low. Our competitors consist of many different types of service providers, including a large number of regional and local companies. In the regulated waste industry, another major source of competition is the on-site treatment of regulated waste by some large-quantity generators, particularly hospitals. Similarly, customers could handle recalls or patient communications internally.

In addition, in the regulated waste industry we face potential competition from businesses that are attempting to commercialize alternate treatment technologies or products designed to reduce or eliminate the generation of regulated waste, such as reusable or degradable medical products.

Governmental Regulation

The regulated waste industry is subject to extensive regulations. In many countries there are multiple regulatory agencies at the local and national level that affect our services. This statutory and regulatory framework imposes a variety of compliance requirements, including requirements to obtain and maintain government permits. We maintain numerous governmental permits, registrations, and licenses to conduct our business in the jurisdictions in which we operate. Our permits vary by jurisdiction based upon our activities within that jurisdiction and on the applicable laws and regulations of that jurisdiction. These permits grant us the authority, among other things:

| • | to construct and operate collection, transfer and processing facilities; |

| • | to transport regulated waste within and between relevant jurisdictions; and |

| • | to handle particular regulated substances. |

6

Table of Contents

Our permits must be periodically renewed and are subject to modification or revocation by the issuing authority.

We are also subject to regulations that govern the definition, generation, segregation, handling, packaging, transportation, treatment, storage and disposal of regulated waste. In addition, we are subject to extensive regulations to ensure public and employee health and safety.

U.S. Federal and Foreign Regulation: We are subject to substantial and dynamic regulations enacted and enforced by the U.S. government and by the governments of the foreign jurisdictions in which we conduct regulated waste operations. The specific statutory and regulatory requirements we must comply with vary from jurisdiction to jurisdiction. The laws governing our domestic and international operations generally consist of statutes, legislation and regulations concerning environmental protection, employee health and welfare, transportation, the use of the mail, and proper handling and management of controlled substances.

Environmental Protection: Our business is subject to extensive and evolving environmental regulations in all of the geographies in which we operate. Generally, the environmental laws we are subject to regulate the handling, transporting, and disposing of hazardous and non-hazardous waste, the release or threatened release of hazardous substances into the environment, the discharge of pollutants into streams, rivers, groundwater and other surface waters, and the emission of pollutants into the air. The principal environmental laws that govern our operations in the U.S. are state environmental regulatory agencies as they provide the specific legislative and or regulatory frameworks which require the management and treatment of regulated medical waste. Additionally, the Resource Conservation and Recovery Act of 1976 (“RCRA”), the Comprehensive Environmental Response, Compensation and Liability Act of 1980 (“CERCLA”), and the Clean Air Act of 1970 are the federal regulations that affect management of certain aspects of regulated medical waste and all RCRA hazardous wastes. Though regulated medical waste is currently considered non-hazardous solid waste under RCRA, some substances we collect from some of our customers, including pharmaceuticals, retail products, photographic fixer developer solutions, lead foils and dental amalgam, are considered hazardous waste. CERCLA and state laws similar to it may impose strict, joint and several liabilities on the current and former owners and operators of facilities from which release of hazardous substances has occurred and on the generators and transporters of the hazardous substances that come to be located at these facilities. The eight incinerators at six facilities we currently operate in the U.S. must comply with the emissions standards imposed by the applicable states pursuant to regulations promulgated under the Clean Air Act.

Examples of environmental laws applicable to our international operations include the Waste Framework Directive, Environmental Liabilities Directive, IPPC (Integrated Pollution Prevention and Control) Directive, and Waste Incineration Directive in the European Union (“EU”), the Waste Management Act in Ireland, Ley 154 (Residuos Patogenicos) in Argentina, Lei 12.305/2010 (Lei Ordinária) Institui A Política Nacional De Resíduos Sólidos in Brazil, and the Canadian Environmental Protection Act and related regulations in Canada.

Employee Health and Welfare: We are also subject to numerous regulations promulgated to protect and promote worker health and welfare through the implementation and enforcement of standards designed to prevent illness, injury and death in the workplace. The primary law relating to employee health and welfare applicable to our business in the U.S. is the Occupational Safety and Health Act of 1970, which establishes specific employer responsibilities including engineering controls, administrative controls, training, policies and programs complying with the regulations and ultimately recordkeeping and reporting, all in an effort to ensure a safe workplace. Various OSHA standards apply to almost all aspects of our operations and govern such matters as exposure to bloodborne pathogens, hazard communication, personal protective equipment, etc.

Employee health and welfare laws governing our business in foreign jurisdictions include the Workplace Health and Safety Directive and the Directive concerning ionizing radiation in the EU, and various provisions of the Canada Labour Code and related regulations in Canada.

7

Table of Contents

Transportation: Various laws regulating the transportation of waste and other potentially dangerous materials also apply to the services we provide. In the U.S., the Department of Transportation (“DOT”) has promulgated regulations which deal with two different aspects of transportation: hazardous materials transport and safety in transportation. The Pipeline Hazardous Materials Safety Administration (“PHMSA”) requires specific packaging and labeling of regulated hazardous materials and wastes to ensure public safety. For regulated medical waste PHMSA incorporates the OSHA bloodborne pathogens standard and requires containers that meet certain specifications including but not limited to: proper markings (biohazard symbol, UN code, etc.), sufficient strength and rigidity, leakproofness and puncture resistance. Other hazardous materials such as expired pharmaceuticals, waste chemicals, damaged retail products which are hazardous wastes are also subject to DOT PHMSA regulations. We identify pharmaceutical products by their National Drug Code number and classify them by according to the EPA classification criteria and identify the proper handling, transportation and disposal requirements. Federal Motor Carrier Safety Administration (“FMCSA”) regulates safety of drivers and vehicles which requires us to ensure driver and vehicle fitness through training, medical surveillance and inspection. These requirements are closely monitored internally and due to our fleet size we are regularly subject to road side inspections. These inspections have an accumulative affect on our compliance history and require that we maintain in good standing so not to risk permits.

Examples of transportation laws we must comply with internationally include the Directive on the Inland Transportation of Dangerous Goods in the EU and the Transport of Dangerous Goods Act and related regulations in Canada.

Use of the Mails: United States Postal Service (“USPS”) has their own set of specific regulations under the Domestic Mail Manual which govern the use of the postal system for mailing of hazardous materials (of which regulated medical waste is a part). More specifically, our sharps and medical waste mailback management offering, require us to obtain and maintain authorization permits from the USPS. We have obtained permits from the USPS to conduct our “mail-back” program, to provide a convenient service for customers who need such a service with approved containers for “sharps” (needles, knives, broken glass and the like) or other regulated medical wastes directly to our treatment facilities.

Controlled Substances: In the U.S., our regulated recall and returns management services business is subject to laws and regulations under the Drug Enforcement Administration (“DEA”) regulating the closed loop management of controlled substances. Our returns service for expired and recalled pharmaceuticals accepts controlled substances as part of their service offering and is therefore subject DEA. These regulations require facilities to obtain a registration from the DEA and meet certain criteria in order to be able to collect, process and dispose of controlled substances. DEA has very strict requirements for management of employees, the type of security within facilities, recordkeeping and reporting of all controlled substances managed at the facility. Much like permitting, the registration must be updated regularly and subjects us to inspection and enforcement by DEA agents.

U.S. and Foreign Local Regulation: We conduct business in all 50 states and Puerto Rico. Because the federal EPA did not promulgate regulations for regulated medical waste at a national level, each state has its own regulations related to the handling, treatment and storage of regulated waste. Many states have followed similar requirements to the medical waste tracking act of 1989 or have placed medical waste regulations under solid waste regulations. In each state where we operate a processing facility or a transfer station, we are required to comply with varying state and local laws and regulations which may also require a specific operating plan. In addition, many local governments have ordinances and regulations, such as zoning or wastewater regulations that affect our operations. Similarly, our international operations are subject to regulations enacted and enforced at the provincial, municipal, and local levels of government in addition to the national regulations with which we must comply.

8

Table of Contents

Patents and Proprietary Rights

We hold United States patents relating to the ETD treatment process and other aspects of processing regulated waste. We have filed or have been assigned patent applications in several foreign countries. The last of our current United States patents relating to our ETD treatment process expires in January 2019.

We own federal registrations for a number of trademarks/servicemarks including Stericycle®, Steri-Safe®, Steri-Fuel®, Steri-Plastic®, Steri-Tub®, Direct Return®, Stericycle ExpertRECALL®, Sustainable Solutions®, and a service mark consisting of a nine-circle design used in our company logo.

Potential Liability and Insurance

The regulated waste industry involves potentially significant risks of statutory, contractual, tort and common law liability claims. Potential liability claims could involve, for example:

| • | cleanup costs; |

| • | personal injury; |

| • | damage to the environment; |

| • | employee matters; |

| • | property damage; or |

| • | alleged negligence or professional errors or omissions in the planning or performance of work. |

We could also be subject to fines or penalties in connection with violations of regulatory requirements.

We carry $35 million of liability insurance (including umbrella coverage), and under a separate policy, $10 million of aggregate pollution and legal liability insurance ($10 million per incident). We consider this insurance sufficient to meet regulatory and customer requirements and to protect our employees, assets and operations.

Employees

As of December 31, 2012, we had 12,598 full-time and 647 part-time employees, of which 7,933 were employed in the United States and 5,312 internationally. A total of 11 collective bargaining agreements with local unions of the International Brotherhood of Teamsters cover 437 of our U.S. drivers, transportation helpers and plant workers. These agreements expire at various dates through June 2015. We also have approximately 1,450 employees in Latin America, 110 employees in Canada, and 40 employees in Europe under collective bargaining agreements. We consider our employee relations to be satisfactory.

Executive Officers of the Registrant

The following table contains certain information regarding our five current executive officers:

| Name |

Position |

Age | ||||

| Mark C. Miller |

Executive Chairman | 57 | ||||

| Charles A. Alutto |

President and Chief Executive Officer | 47 | ||||

| Richard T. Kogler |

Executive Vice President and Chief Operating Officer | 53 | ||||

| Frank J.M. ten Brink |

Executive Vice President and Chief Financial Officer | 56 | ||||

| Michael J. Collins |

Executive Vice President and President, Recall and Returns Management Services | 56 | ||||

Mark C. Miller has served as Executive Chairman since January 2013 and Director as of May 1992. He became our Chief Executive Officer in May 1992 and Chairman of the Board of Directors in August 2008. From

9

Table of Contents

May 1989 until joining us, Mr. Miller served as vice president for the Pacific, Asia and Africa in the international division of Abbott Laboratories, a diversified health care company, which he joined in 1976 and where he held a number of management and marketing positions. Mr. Miller formerly served as a director of Ventana Medical Systems, Inc., a developer and supplier of automated diagnostic systems. He received a B.S. degree in computer science from Purdue University, where he graduated Phi Beta Kappa. Mr. Miller was selected by Morningstar, Inc. as its “2009 CEO of the Year”.

Charlie Alutto has served as President and Chief Executive Officer since January 2013 and as a Director since November 2012. He joined us in May 1997 following our acquisition of the company where he was then employed. He became an executive officer in February 2011 and served as President, Stericycle USA. He previously held various management positions with us, including vice president and managing director of SRCL Europe and corporate vice president of our large quantity generator business unit. Mr. Alutto received a B.S. degree in finance from Providence College and a M.B.A. degree in finance from St. John’s University.

Richard T. Kogler has served as Executive Vice President, Chief Operating Officer since January 1999. From 1995 until he joined the Company, Mr. Kogler served as Chief Operating Officer for American Disposal. Prior to his position at American Disposal, he spent 11 years with Waste Management where he held a number of management positions prior to being promoted to Vice President of Operations. Mr. Kogler received a B.A. degree in Chemistry from St. Louis University.

Frank J.M. ten Brink has served as Executive Vice President, Chief Financial Officer and Chief Administrative Officer since joining the Company in June 1997. He has over 16 years of finance experience in high growth environments, mergers and acquisitions. Prior to joining Stericycle, he was Senior Vice President and Chief Financial Officer with Telular Corporation. Between 1991 and 1995, he was Vice President and Chief Financial Officer of Hexacomb Corporation. Mr. ten Brink studied International Business at the Netherlands School of Business and received an M.B.A. degree in Finance from the University of Oregon.

Michael J. Collins has served as President, Recall and Returns Management Services since June 2006. He was most recently Vice President, Medical Products Group of Abbott Laboratories. He joined Abbott in 1982 as a sales representative and later served in various management positions, including Divisional Vice President, U.S. Sales; Divisional Vice President, U.S. Marketing, Divisional Vice President and General Manager, MediSense and Corporate Vice President Abbott Diagnostics Divisions. Mr. Collins was a commissioned officer for the U.S. Marine Corps. He earned a bachelor’s degree from the University of New Haven and a master’s degree in business administration from National University, San Diego.

Website Access

We maintain an Internet website, www.stericycle.com, providing a variety of information about us and the services we provide. Our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K that we file with the Securities and Exchange Commission are available, as soon as practicable after filing, at the Investors page on our website, or by a direct link to our filings on the SEC’s free website, www.sec.gov.

10

Table of Contents

We are subject to extensive governmental regulation, which is frequently difficult, expensive and time-consuming to comply with.

The regulated waste management industry is subject to extensive federal, state and local laws and regulations relating to the collection, transportation, packaging, labeling, handling, documentation, reporting, treatment and disposal of regulated waste. Our business requires us to obtain many permits, authorizations, approvals, certificates, and other types of governmental permission from every jurisdiction where we operate. We believe that we currently comply in all material respects with all applicable permitting requirements. State and local regulations change often, however, and new regulations are frequently adopted. Changes in the regulations could require us to obtain new permits or to change the way in which we operate under existing permits. We might be unable to obtain the new permits that we require, and the cost of compliance with new or changed regulations could be significant.

Many of the permits that we require, especially those to build and operate processing plants and transfer facilities, are difficult and time-consuming to obtain. They may also contain conditions or restrictions that limit our ability to operate efficiently, and they may not be issued as quickly as we need them (or at all). If we cannot obtain the permits that we need when we need them, or if they contain unfavorable conditions, it could substantially impair our operations and reduce our revenues and/or profitability.

The level of governmental enforcement of environmental regulations has an uncertain effect on our business and could reduce the demand for our services.

We believe that strict enforcement of laws and regulations relating to regulated waste collection and treatment by governmental authorities has been good for our business. These laws and regulations increase the demand for our services. A relaxation of standards or other changes in governmental regulation of regulated waste could increase the number of competitors we face or reduce the need for our services.

If we are unable to acquire regulated waste and other businesses, our revenue and profit growth may be slowed.

Historically, our growth strategy has been based in part on our ability to acquire regulated waste and other businesses. We do not know whether in the future we will be able to:

| • | identify suitable businesses to buy; |

| • | complete the purchase of those businesses on terms acceptable to us; |

| • | improve the operations of the businesses that we do buy and successfully integrate their operations into our own; or |

| • | avoid or overcome any concerns expressed by regulators. |

We compete with other potential buyers for the acquisition of regulated waste companies and other businesses. This competition may result in fewer opportunities to purchase companies that are for sale. It may also result in higher purchase prices for the businesses that we want to purchase.

We also do not know whether our growth strategy will continue to be effective. Our business is significantly larger than before, and new acquisitions may not have the incremental benefits that we have obtained in the past.

The implementation of our acquisition strategy could be affected in certain instances by the concerns of federal and state regulators, which could result in our not being able to realize the full synergies or profitability of particular acquisitions.

We may become subject to inquiries and investigations by federal or state antitrust regulators from time to time in the course of completing acquisitions of other regulated waste businesses. In order to obtain regulatory

11

Table of Contents

clearance for a particular acquisition, we could be required to modify certain operating practices of the acquired business or to divest ourselves of one or more assets of the acquired business. Changes in the terms of our acquisitions required by regulators or agreed to by us in order to settle regulatory investigations could impede our acquisition strategy or reduce the anticipated synergies or profitability of our acquisitions. The likelihood and outcome of inquiries and investigations from federal or state regulators in the course of completing acquisitions cannot be predicted.

Aggressive pricing by existing competitors and the entrance of new competitors could drive down our profits and slow our growth.

The regulated waste industry is very competitive because of low barriers to entry, among other reasons. This competition has required us in the past to reduce our prices, especially to large account customers, and may require us to reduce our prices in the future. Substantial price reductions could significantly reduce our earnings.

We face direct competition from a large number of small, local competitors. Because it requires very little money or technical know-how to compete with us in the collection and transportation of regulated waste, there are many regional and local companies in the industry. We face competition from these businesses, and competition from them is likely to exist in the new locations to which we may expand in the future. In addition, large national companies with substantial resources may decide to enter the regulated waste industry. For example, in the United States, Waste Management, Inc., a major solid waste company is offering regulated waste management services to hospitals and other large and small quantity generators of regulated waste.

Our competitors could take actions that would hurt our growth strategy, including the support of regulations that could delay or prevent us from obtaining or keeping permits. They might also give financial support to citizens’ groups that oppose our plans to locate a processing or transfer facility at a particular location.

The loss of our senior executives could affect our ability to manage our business profitably.

We depend on a small number of senior executives. Our future success will depend upon, among other things, our ability to keep these executives and to hire other highly qualified employees at all levels. We compete with other potential employers for employees, and we may not be successful in hiring and keeping the executives and other employees that we need. We do not have written employment agreements with any of our executive officers, and officers and other key employees could leave us with little or no prior notice, either individually or as part of a group. Our loss of or inability to hire key employees could impair our ability to manage our business and direct its growth.

Restrictions in our senior unsecured credit facility may limit our ability to pay dividends, incur additional debt, make acquisitions and make other investments.

Our senior unsecured credit facility and the note purchase agreements for our private placement notes contain covenants that restrict our ability to make distributions to stockholders or other payments unless we satisfy certain financial tests and comply with various financial ratios.

They also contain covenants that limit our ability to incur additional indebtedness, acquire other businesses and make capital expenditures, and imposes various other restrictions. These covenants could affect our ability to operate our business and may limit our ability to take advantage of potential business opportunities as they arise.

Our expansion into foreign countries exposes us to unfamiliar regulations and may expose us to new obstacles to growth.

We plan to continue to grow both domestically and internationally. We have established operations in the United States, Argentina, Brazil, Canada, Chile, Ireland, Japan, Mexico, Portugal, Romania, Spain, and the

12

Table of Contents

United Kingdom. Foreign operations carry special risks. Although our business in foreign countries has not yet been materially affected, our business in the countries in which we currently operate and those in which we may operate in the future could be limited or disrupted by:

| • | exchange rate fluctuations; |

| • | government controls; |

| • | import and export license requirements; |

| • | political or economic instability; |

| • | trade restrictions; |

| • | changes in tariffs and taxes; |

| • | our unfamiliarity with local laws, regulations, practices and customs; |

| • | restrictions on repatriating foreign profits back to the United States or movement of funds to other countries; and |

| • | difficulties in staffing and managing international operations. |

Foreign governments and agencies often establish permit and regulatory standards different from those in the United States. If we cannot obtain foreign regulatory approvals, or if we cannot obtain them when or on terms we expect, our growth and profitability from international operations could be limited. Fluctuations in currency exchange could have similar effects.

Our earnings could decline if we write-off intangible assets, such as goodwill.

As a result of our various acquisitions, our balance sheet at December 31, 2012 contains goodwill of $2.1 billion and other intangible assets, net of accumulated amortization of $667.5 million (including indefinite lived intangibles of $112.9 million). In accordance with Accounting Standards Codification (“ASC”) Topic 350 “Intangibles—Goodwill and Other,” we evaluate on an ongoing basis whether facts and circumstances indicate any impairment of the value of indefinite-lived intangible assets such as goodwill. As circumstances after an acquisition can change, we may not realize the value of these intangible assets. If we were to determine that a significant impairment has occurred, we would be required to incur non-cash charges for the impaired portion of goodwill and other unamortized intangible assets, which could have a material adverse effect on our results of operations in the period in which the impairment charge occurs.

The handling and treatment of regulated waste carries with it the risk of personal injury to employees and others.

Our business requires us to handle materials that may be infectious or hazardous to life and property in other ways. While we try to handle such materials with care and in accordance with accepted and safe methods, the possibility of accidents, leaks, spills, and acts of God always exists. Examples of possible exposure to such materials include:

| • | truck accidents; |

| • | damaged or leaking containers; |

| • | improper storage of regulated waste by customers; |

| • | improper placement by customers of materials into the waste stream that we are not authorized or able to process, such as certain body parts and tissues; or |

| • | malfunctioning treatment plant equipment. |

13

Table of Contents

Human beings, animals or property could be injured, sickened or damaged by exposure to regulated waste. This in turn could result in lawsuits in which we are found liable for such injuries, and substantial damages could be awarded against us.

While we carry liability insurance intended to cover these contingencies, particular instances may occur that are not insured against or that are inadequately insured against. An uninsured or underinsured loss could be substantial and could impair our profitability and reduce our liquidity.

The handling of regulated waste exposes us to the risk of environmental liabilities, which may not be covered by insurance.

As a company engaged in regulated waste management, we face risks of liability for environmental contamination. The federal Comprehensive Environmental Response, Compensation and Liability Act of 1980, or CERCLA, and similar state laws impose strict liability on current or former owners and operators of facilities that release hazardous substances into the environment as well as on the businesses that generate those substances and the businesses that transport them to the facilities. Responsible parties may be liable for substantial investigation and clean-up costs even if they operated their businesses properly and complied with applicable federal and state laws and regulations. Liability under CERCLA may be joint and several, which means that if we were found to be a business with responsibility for a particular CERCLA site, we could be required to pay the entire cost of the investigation and clean-up even though we were not the party responsible for the release of the hazardous substance and even though other companies might also be liable.

Our pollution liability insurance excludes liabilities under CERCLA. Thus, if we were to incur liability under CERCLA and if we could not identify other parties responsible under the law whom we are able to compel to contribute to our expenses, the cost to us could be substantial and could impair our profitability and reduce our liquidity. Our customer service agreements make clear that the customer is responsible for making sure that only appropriate materials are disposed of. If there were a claim against us that a customer might be legally liable for, we might not be successful in recovering our damages from the customer.

Item 1B. Unresolved Staff Comments

None.

We lease office space for our corporate offices in Lake Forest, Illinois. Domestically, we own or lease 59 processing facilities, the majority of which use autoclave waste processing technology. All of our processing facilities also serve as collection sites. We own or lease 91 additional transfer sites, 12 additional sales/administrative sites, and 54 recall and returns or communication services facilities. Internationally, we own or lease 94 processing facilities, the majority of which use autoclave waste processing technology. We also own or lease 50 additional transfer sites, 41 additional sales/administrative sites, 10 recall and returns services facilities, and we lease two landfills. We believe that these processing and other facilities are adequate for our present and anticipated future needs.

We operate in a highly regulated industry and must deal with regulatory inquiries or investigations from time to time that may be instituted for a variety of reasons. We are also involved in a variety of civil litigation from time to time.

Item 4. Mine Safety Disclosures

Not Applicable.

14

Table of Contents

PART II.

Item 5. Market Price for the Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

As of February 14, 2013, we had 122 stockholders of record. The Company’s stock trades on the NASDAQ Global Select Market under the ticker symbol SRCL.

The following table provides the high and low sales prices of our Common Stock for each calendar quarter during our two most recent fiscal years:

| Quarter |

High | Low | ||||||

| First quarter 2012 |

$ | 89.27 | $ | 76.72 | ||||

| Second quarter 2012 |

91.67 | 81.37 | ||||||

| Third quarter 2012 |

94.52 | 89.06 | ||||||

| Fourth quarter 2012 |

95.76 | 89.06 | ||||||

| First quarter 2011 |

$ | 88.82 | $ | 77.00 | ||||

| Second quarter 2011 |

94.29 | 84.39 | ||||||

| Third quarter 2011 |

93.00 | 74.09 | ||||||

| Fourth quarter 2011 |

88.41 | 76.22 | ||||||

We did not pay any cash dividends during 2012 and have never paid any dividends on our common stock. We currently expect that we will retain future earnings for use in the operation and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future. See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

Under resolutions that our Board of Directors adopted, we have been authorized to purchase a cumulative total of 20,537,398 shares of our common stock on the open market. As of December 31, 2012, we had purchased a cumulative total of 16,748,921 shares.

The following table provides information about our purchases of shares of our common stock during the year ended December 31, 2012:

Issuer Purchases of Equity Securities

| Period |

Total Number of Shares (or Units) Purchased |

Average Price Paid per Share (or Unit) |

Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs |

Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs |

||||||||||||

| January 1 – January 31, 2012 |

38,552 | $ | 76.38 | 38,552 | 4,289,133 | |||||||||||

| February 1 – February 29, 2012 |

0 | 0 | 0 | 4,289,133 | ||||||||||||

| March 1 – March 31, 2012 |

0 | 0 | 0 | 4,289,133 | ||||||||||||

| April 1 – April 30, 2012 |

0 | 0 | 0 | 4,289,133 | ||||||||||||

| May 1 – May 31, 2012 |

0 | 0 | 0 | 4,289,133 | ||||||||||||

| June 1 – June 30, 2012 |

0 | 0 | 0 | 4,289,133 | ||||||||||||

| July 1 – July 31, 2012 |

0 | 0 | 0 | 4,289,133 | ||||||||||||

| August 1 – August 31, 2012 |

0 | 0 | 0 | 4,289,133 | ||||||||||||

| September 1 – September 30, 2012 |

43,500 | 89.97 | 43,500 | 4,245,633 | ||||||||||||

| October 1 – October 31, 2012 |

178,000 | 89.97 | 178,000 | 4,067,633 | ||||||||||||

| November 1 – November 30, 2012 |

279,156 | 90.11 | 279,156 | 3,788,477 | ||||||||||||

| December 1 – December 31, 2012 |

0 | 0 | 0 | 3,788,477 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

539,208 | $ | 89.07 | 539,208 | 3,788,477 | |||||||||||

15

Table of Contents

Equity Compensation Plans

The following table summarizes information as of December 31, 2012 relating to our equity compensation plans pursuant to which stock option grants, restricted stock awards or other rights to acquire shares of our common stock may be made or issued:

Equity Compensation Plan Information

| Plan Category |

Number of Securities to be Issued Upon Exercise of Outstanding Options (a) |

Weighted- Average Exercise Price of Outstanding Options (b) |

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) (c) |

|||||||||

| Equity compensation plans approved by our security holders (1) |

5,451,972 | $ | 63.43 | 3,385,640 | ||||||||

| Equity compensation plans not approved by our security holders (2) |

232,096 | $ | 28.27 | 0 | ||||||||

| (1) | These plans consist of our 2011 Incentive Compensation Plan, 2008 Incentive Stock Plan, 2005 Incentive Stock Plan, 1997 Stock Option Plan, 1996 Directors Stock Option Plan, and the Employee Stock Purchase Plan. |

| (2) | The only plan in this category is our 2000 Nonstatutory Stock Option Plan. |

In 2000, our Board of Directors approved the 2000 Nonstatutory Stock Option Plan (the “2000 Plan”), which authorized the granting of nonstatutory stock options for 7,000,000 shares of our common stock to employees (but not to officers or directors). See Note 6—Stock Based Compensation to the Consolidated Financial Statements for a description of this plan.

16

Table of Contents

Performance Graph

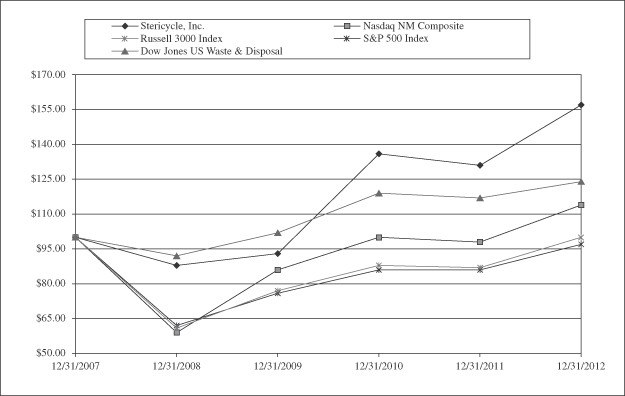

The following graph compares the cumulative total return (i.e., stock price appreciation plus dividends) on our common stock over the five-year period ending December 31, 2012 with the cumulative total return for the same period on the NASDAQ National Market Composite Index, the S&P 500 Index, the Russell 3000 Index, and the Dow Jones US Waste & Disposal index. The graph assumes that $100 was invested on December 31, 2007 in our common stock and in the stock represented by each of the four indices, and that all dividends were reinvested.

The stock price performance of our common stock reflected in the following graph is not necessarily indicative of future performance.

17

Table of Contents

Item 6. Selected Financial Data

| In thousands, except per share data |

||||||||||||||||||||||||

| Years Ended December 31, | ||||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||||||

| Statement of Income Data |

(1) | |||||||||||||||||||||||

| Revenues |

$ | 1,913,149 | $ | 1,676,048 | $ | 1,439,388 | $ | 1,177,736 | $ | 1,083,679 | ||||||||||||||

| Income from operations |

468,836 | 424,311 | 370,683 | 315,189 | 274,239 | |||||||||||||||||||

| Net income attributable to Stericycle, Inc. |

(2) | 267,996 | 234,751 | 207,879 | 175,691 | 148,708 | ||||||||||||||||||

| Earnings per share—Diluted |

(2) | 3.08 | 2.69 | 2.39 | 2.03 | 1.68 | ||||||||||||||||||

| Depreciation and amortization |

76,283 | 66,046 | 53,885 | 39,990 | 34,148 | |||||||||||||||||||

| Statements of Cash Flow Data |

||||||||||||||||||||||||

| Net cash flow provided by/(used for): |

||||||||||||||||||||||||

| Operating activities |

$ | 387,448 | $ | 306,104 | $ | 325,670 | $ | 277,246 | $ | 210,555 | ||||||||||||||

| Investing activities |

(294,245 | ) | (514,649 | ) | (245,482 | ) | (350,189 | ) | (132,930 | ) | ||||||||||||||

| Financing activities |

(86,209 | ) | 148,324 | (13,565 | ) | 81,772 | (77,882 | ) | ||||||||||||||||

| Balance Sheet Data |

(1) | |||||||||||||||||||||||

| Cash, cash equivalents and short-term investments |

$ | 31,827 | $ | 22,927 | $ | 95,524 | $ | 16,898 | $ | 10,503 | ||||||||||||||

| Total assets |

3,546,738 | 3,177,090 | 2,639,023 | 2,182,803 | 1,759,298 | |||||||||||||||||||

| Long-term debt, net of current portion |

1,268,303 | 1,284,113 | 1,014,222 | 910,825 | 753,846 | |||||||||||||||||||

| Stericycle, Inc. equity |

$ | 1,541,793 | $ | 1,198,166 | $ | 1,048,425 | $ | 845,695 | $ | 670,480 | ||||||||||||||

| (1) | See Note 3—Acquisitions and Divestitures to the Consolidated Financial Statements for information concerning our acquisitions during the three years ended December 31, 2012, 2011, and 2010. |

| (2) | See Note 8—Earnings per Common Share to the Consolidated Financial Statements for information concerning the computation of earnings per diluted common share. |

| • | In 2012, net income includes the following after-tax effects: $7.8 million of expenses related to acquisitions; $3.3 million of restructuring and plant closure costs; $3.7 million related to litigation settlement expense; $3.7 million loss related to the U.K. divestiture; and $0.7 million loss related to the change in fair value of contingent consideration. The net effect of these adjustments negatively impacted diluted earnings per share (“EPS”) by $0.22. |

| • | In 2011, net income includes the following after-tax effects: $15.6 million of expenses related to acquisitions; $3.2 million of restructuring and plant closure costs; $0.7 million related to litigation settlement expense; $0.8 million related to accelerated interest expense due to early term loan repayment; $1.3 million benefit due to a net release of prior years’ tax reserves; and $4.7 million gain related to the change in fair value of contingent consideration. The net effect of these adjustments negatively impacted diluted EPS by $0.16. |

| • | In 2010, net income includes the following after-tax effects: $8.9 million of expenses related to acquisitions; $5.2 million of restructuring and plant closure costs; litigation settlement expense of $0.5 million; $1.8 million gain in sale of assets related to the MedServe divestiture; and $1.2 million benefit due to a release of prior years’ tax reserve. The net effect of these adjustments negatively impacted diluted EPS by $0.13. |

| • | In 2009, net income includes the following after-tax effects: $6.8 million of acquisition expenses; $1.0 million of restructuring costs; and $1.8 million benefit due to a release of prior years’ tax reserve. The net effect of these adjustments negatively impacted diluted EPS by $0.06. |

| • | In 2008, net income includes the following after-tax effects: $3.5 million expense related to a business dispute settlement; and a fixed asset write-down of equipment of $0.3 million. The net effect of these adjustments negatively impacted diluted EPS by $0.05. |

18

Table of Contents

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of our financial condition and results of operations should be read in conjunction with our Consolidated Financial Statements and related notes in Item 8 of this Report.

Introduction

We are in the business of managing regulated waste and providing an array of related services. We operate in the United States, Argentina, Brazil, Canada, Chile, Ireland, Japan, Mexico, Portugal, Romania, Spain, and the United Kingdom.

For large-quantity generators of regulated waste such as hospitals and for pharmaceutical companies and distributors, we offer our institutional regulated waste management services; our Bio Systems® reusable sharps management services to reduce the risk of needle sticks; a variety of products and services for infection control; our regulated recall and returns management services for expired or recalled products, pharmaceutical waste disposal services; hazardous waste disposal; and our patient communication services. For small quantity generators of regulated waste such as doctors’ offices and for retail pharmacies, we offer: our medical and regulated waste management services; our Steri-Safe® OSHA and HIPAA compliance programs; a variety of products and services for infection control; our regulated recall and returns management services for expired or recalled products; and our patient communication services.

We operate integrated national regulated waste management networks domestically and internationally. Our national networks include a total of 219 processing or combined processing and collection sites and 141 additional transfer, collection or combined transfer and collection sites. Our regulated waste processing technologies include autoclaving, our proprietary ETD, chemical treatment, and incineration. We serve approximately 541,000 customers worldwide, of which approximately 16,500 are large-quantity generators and approximately 524,500 are small-quantity generators.

Critical Accounting Policies and Estimates

Our discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires that we make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and the related disclosure of contingent assets and liabilities. We believe that of our significant accounting policies (see Note 2—Summary of Significant Accounting Policies to the Consolidated Financial Statements), the following ones may involve a higher degree of judgment on our part and greater complexity of reporting.

Revenue Recognition: Revenues for our regulated waste management services, other than our Steri-Safe service, are recognized at the time of waste collection. Our Steri-Safe revenues are recognized evenly over the contractual service period. Payments received in advance are deferred and recognized as services are provided. Revenues from regulated recall and returns management services and patient communication services are recorded at the time services are performed. Revenues from product sales are recognized at the time the goods are shipped to the customer. Charges related to international value added tax (“VAT”) and other similar pass through taxes are not included as revenue.

Goodwill and Other Identifiable Intangible Assets: Goodwill associated with the excess purchase price over the fair value of assets acquired is not amortized. We have determined that our permits have indefinite lives and, accordingly, are not amortized (see Note 11—Goodwill and Other Intangible Assets to the Consolidated Financial Statements for additional information).

Our balance sheet at December 31, 2012 contains goodwill of $2.1 billion. In accordance with applicable accounting standards, we evaluate on at least an annual basis, using the fair value of reporting units, whether

19

Table of Contents

goodwill is impaired. If we were to determine that a significant impairment has occurred, we would be required to incur non-cash charges of the impaired portion of goodwill that could have a material adverse effect on our results of operations in the period in which the impairment charge occurs.

During the quarter ended June 30, 2012, we performed our annual goodwill impairment evaluation for our three reporting units, Domestic Regulated Waste Management Services, Domestic Regulated Recall and Returns Management Services, and International. We calculate the fair value of our reporting units using an income method and validate those results using a market approach. Both the income and market approaches indicated no impairment to goodwill to any of our three reporting units.

Income Approach: The income approach uses expected future cash flows of each reporting unit and discounts those cash flows to a present value. Expected future cash flows are calculated using management assumptions of internal growth, capital expenditures, and cost efficiencies. Future acquisitions are not included in the expected future cash flows. We use a discount rate based on our Company calculated Weighted Average Cost of Capital which is adjusted for each of our reporting units based on risk size premium and foreign country premium. Significant assumptions used in the income approach include realization of future cash flows and the discount rate used to present value those cash flows.

The results of our goodwill impairment test using the income approach indicated the fair value of our reporting units exceeded book value by a substantial amount; in excess of 100%.

Market Approach: Our market approach begins by calculating the market capitalization of the Company using the average stock price for the prior 30 days and the outstanding share count at June 30, 2012. We then look at the Company’s Earnings Before Interest, Tax, Depreciation, and Amortization (“EBITDA”), adjusted for stock compensation expense and other items, such as a gain or loss on the sale of divested assets, for the prior twelve months. The calculated market capitalization is divided by the modified EBITDA to arrive at a valuation multiple. The fair value of each reporting unit is then calculated by taking the product of the valuation multiple and the trailing twelve month modified EBITDA of that reporting unit. The fair value was then compared to the reporting units’ book value and determined to be in excess of the book value. We believe that starting with the fair value of the Company as a whole is a reasonable measure as that fair value is then allocated to each reporting unit based on that reporting unit’s individual earnings. A sustained drop in our stock price would have a negative impact to our fair value calculations. A temporary drop in earnings of a reporting unit would have a negative impact to our fair value calculations.

The results of our goodwill impairment test using the market approach indicated the fair value of our reporting units exceeded book value by a substantial amount, in excess of 100% of book value.

Our permits are tested for impairment annually at December 31 or more frequently if circumstances indicate that they may be impaired. We use either a discounted income or cost savings model as the current measurement of the fair value of the permits. The fair value is based upon, among other things, certain assumptions about expected future operating performance, internal and external processing costs, and an appropriate discount rate determined by management. Our estimates of discounted income may differ from actual income due to, among other things, inaccuracies in economic estimates.

In 2012, we wrote off $1.7 million for the permit intangibles of two facilities due to rationalizing our operations. Under current acquisition accounting, a fair value must be assigned to all acquired assets based on a theoretical “market participant” regardless of the acquirers’ intended use for those assets. This accounting treatment can lead to the recognition of losses if a company disposes of acquired assets.

Other identifiable intangible assets, such as customer relationships, tradenames, and covenants not-to-compete, are currently amortized using the straight-line method over their estimated useful lives. We have

20

Table of Contents

determined that our regulated waste customer relationships have between 14-year and 40-year lives based on the specific type of relationship. Although the contracted regulated waste management business is highly competitive, we have been able to maintain high customer retention through excellent customer service.

The valuation of our contractual customer relationships was derived using a discounted income approach valuation model. These assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may be more than its undiscounted estimated future cash flows. There have been no indicators of impairment of these intangibles (see Note 11—Goodwill and Other Intangible Assets to the Consolidated Financial Statements).

Share Repurchases: The purchase price over par value for share repurchases is allocated to retained earnings.