10-K

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 0-21229

Stericycle, Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 36-3640402 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification Number) |

28161 North Keith Drive

Lake Forest, Illinois 60045

(Address of principal executive offices, including zip code)

(847) 367-5910

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Common stock, par value $.01 per share | | NASDAQ Global Select Market |

Depositary Shares, each representing a 1/10th ownership interest in a share of 5.25% Mandatory Convertible Preferred Stock, Series A, par value $0.01 per share | | NASDAQ Global Select Market |

(Title of each class) | | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES x NO ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Act of 1934. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K, or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of "accelerated filer", "large accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one)

|

| | |

Large accelerated filer x | | Accelerated filer ¨ |

Non-accelerated filer ¨ | | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2 of the Exchange Act). YES ¨ NO x

State the aggregate market value of voting and non-voting common equity held by non-affiliates computed by reference to the price at which common equity was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2015): $11,358,678,595.

On February 19, 2016, there were 84,647,029 shares of the Registrant’s Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Information required by Items 10, 11, 12 and 13 of Part III of this Report is incorporated by reference from the Registrant’s definitive Proxy Statement for the 2016 Annual Meeting of Stockholders to be held on May 25, 2016.

Stericycle, Inc.

Table of Contents

PART I

Item 1. Business

Unless the context requires otherwise, "we," "us" or "our" refers to Stericycle, Inc. and its subsidiaries on a consolidated basis.

Overview

Services

Stericycle is a business-to-business services provider with a focus on regulated and compliance solutions for healthcare, retail, and commercial businesses. This includes the collection and processing of regulated and specialized waste for disposal and the collection of personal and confidential information for secure destruction, plus a variety of training, consulting, recall/return, communication, and compliance services. We operate integrated operations and customer service networks in the United States and 21 other countries. Our worldwide networks include a total of 253 processing facilities, 358 transfer sites, and 137 other service facilities. Our solutions for regulated or specialty waste streams include: medical waste disposal, pharmaceutical waste disposal, hazardous waste management, sustainability solutions for expired or unused inventory, and secure information destruction of documents and e-media. Our compliance solutions include: training and consulting through our Steri-Safe® and Clinical Services programs, inbound/outbound communications, data reporting, and other regulatory compliance services. Our regulated recall and returns management solutions consist of communication, logistics, and data management services to support the recall, withdrawal, or return of expired or recalled products.

More specifically, our services and products include:

•Medical waste management services

•Reusable sharps disposal management services

•Pharmaceutical waste services

•Integrated Waste Stream Solutions ("IWSS") program

•Hazardous waste management services

•Sustainability and recycling services for expired or unused inventory

•Shred-it secure information destruction services

•Steri-Safe® and Clinical Services compliances programs

•Regulated recall and returns management services for expired or recalled products

•Communication services including afterhours answering, appointment scheduling, appointment reminders, secure messaging, and event registration

•Mailback solutions for regulated medical waste, universal wastes, pharmaceutical wastes, and other specialty wastes

Customers

Our broad offering of services appeals to a wide range of business customers. While healthcare businesses (hospitals, physician and dental practices, outpatient clinics, long-term care facilities, etc.) make the largest portion of customers, we also provide services to retailers, manufacturers, financial services providers, professional services providers, governmental entities, and other businesses. The majority of our customers are small businesses generating low volumes of regulated wastes or materials for disposal or destruction and having compliance needs consistent

with a small staff or facility. However, we also provide services to large customers, which include hospitals, manufacturers, and laboratories.

In total, we serve more than 1,000,000 customers worldwide. No single customer accounts for more than 1.5% of our total revenues, and our top ten customers collectively account for approximately 8.0% of total revenues. We provide service to the majority of these customers through multi-year contracts. Although we have several standard forms of contract, terms vary depending upon the customer’s service requirements, the volume of regulated waste or material generated, or other factors including statutory and regulatory requirements.

Business Strategy

Focus on Regulated Business-to-Business Operations

We have a focus on business-to-business services in areas of operations that are highly regulated. By helping our customers maintain compliance with complex regulations, we protect people and brands, promote health, and safeguard the environment. Governmental legislation and regulation increasingly requires the proper handling and disposal of items such as medical waste, hazardous waste, pharmaceutical waste, and personal and confidential information. Regulated waste can be defined as any material with government-imposed guidelines for handling the material for transportation or disposal. Medical waste, such as needles, syringes, gloves, cultures and stocks of infectious agents, blood and blood products, can potentially cause an infectious disease. Hazardous waste is designated and governed by federal and local environmental protection agencies but generally includes waste that is considered dangerous or potentially harmful to our health or the environment. Hazardous wastes can be liquids, solids, gases, or sludges. Pharmaceutical waste may be hazardous or nonhazardous and consists of expired, recalled, or otherwise unused pharmaceuticals. Personal and confidential information includes documents and e-media containing protected healthcare information, financial information, or other confidential information. Additionally, the regulatory environment related to promoting overall health and protecting consumers from unsafe products continues to increase, especially in the United States.

Focus on the Small Customer with Recurring Service Need

Our business strategy recognizes that smaller businesses have an even greater need for support with compliance matters since they tend to lack the specialization of staff resources that is found among larger businesses. With a small business, regulatory and compliance matters are often managed by a business owner, office manager, or facility supervisor who manage multiple functions for the organization and often lack the time and resources to properly investigate and comply with a wide range of regulations that may impact their operation. In response to this unmet need of small businesses, we developed comprehensive, no-hassle compliance programs which feature scheduled service at low, flat monthly fees. This business fundamental has guided us as we have expanded into additional service offerings including hazardous or pharmaceutical waste management, communication services, and secure information destruction.

Organic Growth

As a leading provider in regulated and compliance solutions, we continue to focus on enhancing our service offerings and platforms to exceed customer expectations. We have developed a strong and loyal customer base, with a revenue retention rate exceeding 90%, and have been able to leverage these customer relationships to provide additional services. Allocation of our sales resources has and will continue to focus on driving incremental organic growth from cross selling and upselling various services in our portfolio.

Growth through Acquisition

The various regulated waste and compliance services that we provide tend to be in highly fragmented industries. We have proved that acquisitions are a rapid and efficient way to scale operations, build critical customer density for transportation and treatment operations, and enter new markets or geographies, as well as an opportunity to introduce our additional services to the acquired customers. In our early history, acquisitions were a key strategy to building our customer base and route density in the United States. Beginning in 1998, we were able to expand internationally through acquisition and now operate in 21 different markets outside the U.S. Over our history, Stericycle has completed 435 acquisitions, with 230 in the United States and 205 internationally. During 2015, we completed 43 acquisitions. In addition to the Shred-it acquisition, which increased our international footprint by adding 8 countries we were not currently operating in, our acquisitions consisted of 19 domestic businesses and 24 international businesses.

The acquisition of Shred-it International ULC, the largest acquisition in Stericycle’s history, was completed on October 1, 2015. The acquisition expands our portfolio of services by adding secure information destruction, a highly complementary service to our regulated waste and compliance services. Shred-it adds substantially to Stericycle’s operational infrastructure bringing approximately 2,400 trucks and 5,400 team members based out of more than 200 facilities in 13 countries, including the United States. The acquisition provides operational synergies stemming from our core competencies in route logistics and lean management systems and a focus on small and loyal customers providing opportunities for growth from the cross sale of additional services.

We expect to continue our acquisition strategy in North America and internationally, remaining focused on small, highly accretive, tuck in acquisitions that broaden our various service capabilities while creating value for our shareholders.

Market Size and Growth Potential

We provide a wide range of services across multiple market segments and industries. We believe that in 2016, the size of the global market for the services we provide, in the geographies we currently operate in, is approximately $33 billion. Industry growth is driven by a number of factors. These factors include:

•Aging of Population: The average age of the population in the countries where we operate is rising. As people age, they typically require more medical attention and a wider variety of tests, procedures and medications, leading to an increase in the quantity of regulated medical waste, hazardous waste, and pharmaceutical waste, as well as an increase in confidential healthcare records requiring secure destruction.

•Pressure to Reduce Healthcare Costs: The healthcare industry is under pressure to reduce costs. We believe that our services can help healthcare providers to reduce their handling and compliance costs and to reduce their potential liability for employee exposure to bloodborne pathogens and other infectious agents. In addition, hospital institutions and smaller healthcare practices continue to outsource compliance, communication, and secure information destruction services which we can provide.

•Enforcement of Regulations: Enforcement of regulations relating to the management of regulated waste and protected information is increasing. Penalties for violations can be costly as well as high profile thereby impacting a business’ overall reputation. Greater enforcement combined with higher penalties results in more compliance by waste generators and a corresponding increase in potential customers.

•Safety and Security Regulation: We believe that many businesses that are not currently using third party regulated waste management or secure information destruction services are unaware either of the need for proper training of employees or of the regulatory requirements regarding the handling of such materials. Similarly, the proper handling of expired or recalled products requires an expertise that many businesses lack or find inefficient to provide.

•Increased Business Focus on Sustainability: Businesses large and small continue to realize that focus on sustainability is now a business essential in order to operate efficiently and meet the increasing demands of customers for environmental responsibility. Such pressures are driving proper disposal of pharmaceuticals, recycling efforts, creative disposal efforts for unused inventory, shred-all policies for paper, and other initiates supported by our services.

•Shift to Off-Site Healthcare Treatment: We believe that patient care in the U.S. is continuing to shift from institutional higher-cost acute-care settings to less expensive, smaller, off-site treatment alternatives, with a resulting increase in the number of healthcare providers generating regulated medical waste, pharmaceutical waste, and protected health information requiring secure destruction.

•Regulation of Privacy and Information Security and Concerns over Data Breaches: Continued development and growth of the secure information destruction industry have been driven, in part, by compliance with government regulations in respect of privacy and information security. These regulations take different forms, with some requiring organizations to establish reasonable measures to protect against loss, theft and unauthorized access, use and disclosure, and others imposing data retention requirements that require businesses to destroy or render anonymous personal information when no longer required for a legal or legitimate business purpose. Secure information destruction services are increasingly a standard measure that organizations take to meet their legal safeguarding and retention requirements.

•International Market Development: The development of regulated medical waste regulations, hazardous waste regulations, and secure information destruction regulations in certain international markets are at an early stage of development relative to North American and certain European Markets. As emerging markets continue to advance their healthcare practices, environmental controls, and their data privacy regulations, we expect to see further demand for our services on a global scale.

Competitive Strengths

We believe that we benefit from the following competitive strengths, among others:

•Broad Range of Services: We offer our customers a broad range of services. We work with businesses across a number of industries such as healthcare, manufacturing, and retail to safely and efficiently dispose of regulated materials, ensure regulatory compliance, improve employee and customer safety, protect their brands, improve communications with patients, and manage corporate and personal risk.

•Strong Service Relationships with Customers: We offer our customers necessary services which require access to our customers’ facilities and operating information. This relationship, supported by a history of service, provides us with access to decision makers to offer additional opportunities.

•Long-term Contracts: The majority of services we provide involve long-term contracts.

•Established Network of Processing and Transportation Locations in Each Country: We believe that our infrastructure network results in a very efficient operation. The network also

provides redundancy so that we can quickly redirect services or operations to another location should such needs exist due to severe weather, power outages, or other such situations.

•Industry Leadership and Expertise: We maintain a global leadership position across our various services lines, including regulated medical waste, retail and healthcare hazardous waste, secure information destruction, and product recalls and returns. We believe that we maintain the most experienced teams, the deepest understanding of regulatory climate, and the thought leadership that drives progress in each of these industries.

•Experienced Senior Management Team: We have experienced leadership. Our seven most senior executives collectively have over 155 years of management experience in the health care and waste management industries.

•Ability to Integrate Acquisitions: Since 1993 we have completed 435 acquisitions in the United States and internationally and have demonstrated a consistent ability to integrate our acquisitions into our operations successfully.

•Volume-based Leverage for Disposal, Treatment or Recycling: As the leading service provider for regulated medical waste, hazardous waste, and secure information destruction, we can leverage large volumes of wastes, recyclables, and paper to obtain better pricing on final treatment, disposal and/or recycling.

•Secure Management of Information for Destruction: With the acquisition of Shred-it, Stericycle is now the global leader in secure information destruction. Our process for managing information for destruction meet or exceed the NAID AAA Certification and support our customers’ requirements in complying with GLBA, FACTA, and HIPAA in the U.S. and other data security regulations abroad.

Regulated Waste and Secure Information Destruction Operations

Collection and Transportation

Logistics is a key element of our business, especially in regard to managing regulated waste and secure information destruction. Efficiency of collection and transportation is a critical element of our operations because it represents the largest component of our operating costs.

For medical waste, hazardous waste, pharmaceutical waste, or secure information for destruction, the collection process begins at the customer location with segregation. To assure regulatory compliance, we will not accept regulated waste from customers unless it complies with our waste acceptance protocols and is properly stored or packaged in containers that we have either supplied or approved.

Our fleet of transportation vehicles then collects containers at the customer location. The majority of collected waste is then transported directly to one of our processing facilities or to one of our transfer stations for further transport to a processing facility. Our use of transfer stations in a "hub and spoke" configuration improves the efficiency of our collection and transportation operations by expanding the geographic area that a particular processing facility can serve thereby increasing utilization of the facility by increasing the volume of waste that it processes.

Processing and Disposal of Regulated Medical Waste

Stericycle was founded on the belief that there was a need for safe, secure and environmentally responsible management of regulated medical waste. From our beginning, we have encouraged the use of non-incineration treatment technologies. While we recognize that some state regulations currently mandate that some types of regulated waste must be incinerated, we also know from years of experience working with our customers that there are ways to reduce the amount of

regulated waste that is ultimately incinerated. The most effective strategy that we have seen involves comprehensive education of our customers in waste minimization and segregation.

Upon arrival at a processing facility, containers or boxes of regulated waste undergo a quality control process to verify that they do not contain any unacceptable substances. Any container or box that is discovered to contain unacceptable waste goes through a corrective action process which could include redirecting the waste, returning the waste to the customer, and/or notifying the appropriate regulatory authorities. From there, regulated medical waste is processed using one of several treatments or processing technologies, predominantly at one of our wholly-owned facilities.

•Autoclaving: Autoclaving treats regulated waste with steam at high temperature and pressure to kill pathogens.

•Incineration: Incineration burns regulated waste at elevated temperatures and reduces it to ash. Incineration reduces the volume of waste, and it is the recommended treatment and disposal option for some types of regulated waste such as anatomical waste or residues from chemotherapy procedures and non-hazardous pharmaceutical waste. Air emissions from incinerators can contain certain byproducts that are subject to federal, state, and in some cases, local regulation. In some circumstances, the ash byproduct of incineration may be regulated.

Upon completion of the particular process, the resulting waste or incinerator ash is transported for disposal in a landfill owned by unaffiliated third parties.

Processing and Disposal of Hazardous Wastes

Our technicians receive hazardous wastes either as expired goods requiring deconstruction or as defined hazardous wastes. Expired goods are deconstructed to recover metals and plastics for recycling thereby minimizing the total volume of waste disposed of as hazardous waste. Materials that are predefined as hazardous upon collection are bulked together or consolidated at treatment storage and disposal facilities for more efficient transport to final disposal or processing. Whenever possible, we seek sustainability solutions for managing materials including alternative uses, recovery processes, recycling options, fuel blending, or energy recovery. When sustainability options do not exist, these wastes are sent to third parties for incineration, landfill and water treatment.

Destruction and Recycling of Secure Information

If not sorted on site in a proprietary Shred-it information destruction truck, documents are sent to a shredding facility for secure destruction. Documents are cross-cut shredded and then baled to be sold as office paper (SOP) for recycling.

Communication Solutions and Expert Solutions Business Overview

Stericycle’s Communication Solutions provide a broad range of services to help our customers keep in touch with their patients and clients. These services include daytime and after hours answering, live voice scheduling, online self-scheduling, automated notifications, appointment follow-up, and on-hold messaging services. On a daily basis, we execute more than 350,000 automated communications and our agents conduct more than 100,000 live conversations on behalf of our customers. Providing these solutions requires sophisticated information management systems to redirect calls, store and quickly retrieve live voice protocols, or send automated communications as well as provide easily accessible reporting and activity details to our customers. To that end, we have developed a proprietary communications platform which manages call flows, messaging, and data tracking. This system is being launched during 2016 to connect our multiple call center locations onto one master information management system.

Beyond the information management system infrastructure, call center staffing and education levels are critical to business success. We leverage sophisticated workflow analysis and staffing tools to ensure redundancies are in place in order to handle call volumes quickly and consistently across our multiple call centers during peak volumes. Maintaining consistent and quality responses to our customers’ clients requires an educated staff of call center experts. We rely on a multi-level certification program that ensures our experts are appropriately suited to manage the dispatch methodology required for the specific call type. Training, retraining, and quality monitoring systems are critical to meeting the communication needs of our customers.

Stericycle Expert Solutions acts as a business partner to automotive, food/beverage, medical device, pharmaceutical, and consumer goods manufacturers as well as retailers to guide them through a critical recall, retrieval, return, or audit processes. Our comprehensive suite of highly focused services provides global and local expertise before, during, and after a recall threat. Our services include:

•Preparation and consulting

•Notification services

•Customer response

•Product retrievals

•Product processing, remedy and response

•Compliance and regulatory reporting

Stericycle entered the recall and returns business in 2006 as a service expansion that leveraged our expertise in communication, logistics, regulatory management and data tracking. Since that time, we’ve become an industry leader in outsourced recall management. Our expertise stemming from handling more than 4,000 recalls has established Stericycle as a foremost thought leader on recalls handling. This expertise includes a deep understanding of the regulatory climate surrounding consumer and healthcare products, including those established by the Food and Drug Administration, the Consumer Product Safety Commission, the National Highway Traffic Safety Administration, and others.

Competition

The industries and markets in which we operate are highly competitive, and barriers to entry are low. Our competitors consist of many different types of service providers, including national, regional and local companies. In the regulated waste and secure information destruction industries, another major source of competition is on-site treatment. For regulated medical waste, some large-quantity generators, particularly hospitals may choose an onsite autoclave or other treatment process. For secure information destruction, many businesses may choose to use small, on-site shredders for their documents. Similarly, customers could handle recalls or communication solutions internally.

In addition, we face potential competition from businesses that are attempting to commercialize a wide range of technologies that directly or indirectly reduce the need for regulated medical waste, hazardous waste or secure information destruction services.

Governmental Regulation

The regulated medical waste, hazardous waste, and secure information destruction industries are subject to numerous regulations. In many countries there are multiple regulatory agencies at the local and national level that affect our services. This statutory and regulatory framework imposes

a variety of compliance requirements, including requirements to obtain and maintain government permits. We maintain numerous governmental permits, registrations, and licenses to conduct our business in the jurisdictions in which we operate. Our permits vary by jurisdiction based upon our activities within that jurisdiction and on the applicable laws and regulations of that jurisdiction. These permits grant us the authority, among other things:

•to construct and operate collection, transfer and processing facilities;

•to transport regulated waste within and between relevant jurisdictions; and

•to handle particular regulated substances.

Our permits must be periodically renewed and are subject to modification or revocation by the issuing authority. Periodic renewals are subject to public participation and can lead to additional regulatory oversight. We are also subject to regulations that govern the definition, generation, segregation, handling, packaging, transportation, treatment, storage and disposal of regulated waste. In addition, we are subject to extensive regulations to ensure public and employee health and safety.

U.S. Federal and Foreign Regulation

We are subject to substantial regulations enacted and enforced by the U.S. government and by the governments of the foreign jurisdictions in which we conduct regulated waste and secure information destruction operations. The specific statutory and regulatory requirements we must comply with vary from jurisdiction to jurisdiction. The laws governing our domestic and international operations generally consist of statutes, legislation and regulations concerning environmental protection, employee health and welfare, transportation, the use of the mail, and proper handling and management of regulated waste streams, controlled substances and personal and confidential information.

Environmental Protection

Our business is subject to extensive and evolving environmental regulations in all of the geographies in which we operate. Generally, the environmental laws we are subject to regulate the handling, transporting, and disposing of hazardous and non-hazardous waste, the release or threatened release of hazardous substances into the environment, the discharge of pollutants into streams, rivers, groundwater and other surface waters, and the emission of pollutants into the air. The principal environmental laws that govern our operations in the U.S. are state environmental regulatory agencies as they provide the specific legislative and or regulatory frameworks which require the management and treatment of regulated medical waste. Additionally, the Resource Conservation and Recovery Act of 1976 ("RCRA"), the Comprehensive Environmental Response, Compensation and Liability Act of 1980 ("CERCLA"), and the Clean Air Act of 1970 are the federal regulations that affect management of certain aspects of regulated medical waste and all RCRA hazardous wastes. CERCLA and state laws similar to it may impose strict, joint and severe liabilities on the current and former owners and operators of facilities from which release of hazardous substances has occurred and on the generators and transporters of the hazardous substances that come to be located at these facilities. The ten incinerators at seven facilities we currently operate in the U.S. must comply with the emissions standards imposed by the applicable states permitting authorities pursuant to regulations promulgated under the Clean Air Act as well as state and/or municipal waste permit requirements.

Examples of environmental laws applicable to our international operations include the Waste Framework Directive, Environmental Liabilities Directive, Integrated Pollution Prevention and

Control Directive, and Waste Incineration Directive in the European Union ("EU"), the Waste Management Act in Ireland, Ley 154 (Residuos Patogenicos) in Argentina, Lei 12.305/2010 (Lei Ordinária) Institui A Política Nacional De Resíduos Sólidos in Brazil, and the Canadian Environmental Protection Act and related regulations in Canada.

Employee Health and Welfare

We are also subject to numerous regulations promulgated to protect and promote worker health and welfare through the implementation and enforcement of standards designed to prevent illness, injury and death in the workplace. The primary federal laws relating to employee health and welfare applicable to our business in the U.S. is the Occupational Safety and Health Act of 1970 ("OSHA"), which establishes specific employer responsibilities including engineering controls, administrative controls, training, policies and programs complying with the regulations and ultimately recordkeeping and reporting, all in an effort to ensure a safe workplace. Various OSHA standards apply to almost all aspects of our operations and govern such matters as exposure to bloodborne pathogens, hazard communication, personal protective equipment, etc.

Employee health and welfare laws governing our business in foreign jurisdictions include examples such as the Workplace Health and Safety Directive and the Directive concerning ionizing radiation in the EU, and various provisions of the Canada Labour Code and related regulations in Canada.

Transportation

Various laws regulating the transportation of waste and other potentially hazardous materials also apply to the services we provide. In the U.S., the Department of Transportation ("DOT") has promulgated regulations which deal with two different aspects of transportation: hazardous materials transport and safety in transportation. First, the Pipeline Hazardous Materials Safety Administration ("PHMSA") requires specific packaging and labeling of regulated hazardous materials and wastes to ensure public safety. For regulated medical waste PHMSA incorporates the OSHA bloodborne pathogens standard and requires containers that meet certain specifications including but not limited to: proper markings (biohazard symbol, UN-ID, etc.), sufficient strength and rigidity, leak-proof and puncture resistance. Other hazardous materials such as expired pharmaceuticals, waste chemicals, damaged retail products which are hazardous wastes are also subject to DOT PHMSA regulations. We identify pharmaceutical products by their National Drug Code number and classify them according to the Environmental Protection Agency ("EPA") classification criteria and identify the proper handling, transportation and disposal requirements. Second, the Federal Motor Carrier Safety Administration ("FMCSA") regulates safety of drivers and vehicles which requires us to ensure driver and vehicle fitness through training, medical surveillance and inspection. These federal requirements plus additional state requirements are closely monitored internally and due to our fleet size we are regularly subject to road side inspections. These inspections have a cumulative effect on our compliance history and require us to remain in good standing so as not to jeopardize our permits.

Examples of transportation laws we must comply with internationally include the Directive on the Inland Transportation of Dangerous Goods in the EU and the Transport of Dangerous Goods Act and related regulations in Canada.

Document Management

Numerous laws and regulations require proper protection of confidential customer information by business parties that have access to such information. In the U.S., the most commonly cited

regulations include FACTA Final Disposal Rule, the FACTA Red Flag Rule, the HIPAA Privacy, Security, Enforcement, and Breach Notification Rules, and the Gramm-Leach-Bliley Act.

For the transportation of secure information for destruction, we are regulated by the U.S. Department of Transportation as a commercial motor carrier. The processes for the destruction of secure information destruction processes are not regulated by any government agency. However, the National Association for Information Destruction ("NAID") maintains a certification to ensure that destruction processes support the needs of organizations to meet laws and regulations relating to the protection of confidential information. We currently hold the NAID AAA Certification. Further, Payment Card Industry ("PCI") Security Standards Council has developed Data Security Standards which are imposed upon merchants utilizing credit cards and require destruction of documents and media in accordance with their standards.

Use of the Mail

United States Postal Service ("USPS") has its own set of specific regulations defined in Publication 52 which governs the use of the postal system for mailing of hazardous, restricted and perishable materials. More specifically, mailback management offerings for sharps, medical waste, and pharmaceutical wastes, require us to obtain and maintain authorization permits from the USPS. We have obtained permits from the USPS to conduct our "mail-back" programs which provide a convenient service for customers who need such a service with approved containers for "sharps" (needles, knives, broken glass and the like) or other regulated wastes to be sent directly to a treatment facility.

Controlled Substances

In the U.S. our service offerings for the recall, return and destruction of controlled substance pharmaceuticals are subject to laws and regulations under the Drug Enforcement Administration ("DEA"). These regulations apply to both the closed loop management of controlled substances from other DEA registrants as well as the return of unused controlled substances from consumers. These regulations require facilities to obtain a registration from the DEA and meet certain criteria in order to collect, process, and dispose of controlled substances. The DEA has very strict requirements for the management of employees, the type of security within facilities, recordkeeping, and the reporting of all controlled substances managed at the facility. Much like permitting, the registration must be updated regularly and subjects us to inspection and enforcement by DEA agents.

U.S. and Foreign Local Regulation

We conduct business in all 50 states and Puerto Rico. Because the federal EPA did not promulgate regulations for regulated medical waste at a national level, each state has its own regulations related to the handling, treatment and storage of regulated medical waste. Many states have followed requirements similar to the Medical Waste Tracking Act of 1988 or have placed medical waste regulations under solid waste regulations. Hazardous waste in the U.S. is regulated under the Resource Recovery and Conservation Act. In addition, certain states may have their own regulations for handling, treatment and storage of hazardous wastes. Regulated Garbage (sometimes referred to as APHIS waste) is another area of regulatory requirements we are subject to pursuant to regulations promulgated by the United States Department of Agriculture ("USDA") and Customers and Border Patrol. The USDA typically inspects our facilities receiving such APHIS waste on a quarterly basis.

In each state where we operate a processing facility or a transfer station, we are required to comply with varying state and local laws and regulations which may also require a specific operating plan. In addition, many local governments have ordinances and regulations, such as zoning or wastewater regulations that affect our operations. Similarly, our international operations are subject to regulations enacted and enforced at the provincial, municipal, and local levels of government in addition to the national regulations with which we must comply.

Patents and Proprietary Rights

With the acquisition of Shred-it, we hold patents in the U.S. for a two-staged shredder with patents pending in Canada and Europe. We also hold patents in the U.S., Canada, and Europe for Securshield, propriety locks for shredding containers.

We own federal registrations for a number of trademarks/servicemarks including Stericycle®, Steri-Safe®, Stericycle ExpertRECALL®, Sustainable Solutions®, Bio Systems®, Shred-it®, Securit®, Community Shred-it®, Making Sure it’s Secure®, and our company logo service mark consisting of a nine-circle design. We also hold international registrations for Stericycle, the nine-circle design used in our logo, and the Shred-it name and design.

Potential Liability and Insurance

The regulated waste industry involves potentially significant risks of statutory, contractual, tort and common law liability claims. Potential liability claims could involve, for example:

•cleanup costs;

•personal injury;

•damage to the environment;

•employee matters;

•property damage; or

•alleged negligence or professional errors or omissions in the planning or performance of work.

We could also be subject to fines or penalties in connection with violations of regulatory requirements.

We carry $75 million in general liability insurance (including umbrella coverage), and under separate policies, $25 million in aggregate of pollution legal liability insurance and contractor’s operations and professional services environmental insurance ($10 million per incident and $15 million excess per incident under each respective policy). We carry comprehensive policies that include: privacy liability, security liability, event management, cyber-liability and miscellaneous professional services errors and omissions coverages with the total of $15 million in coverage ($5 million primary with $10 million excess). We consider this insurance sufficient to meet regulatory and customer requirements and to protect our employees, assets and operations.

Executive Officers of the Registrant

The following table contains certain information regarding our seven current executive officers:

|

| | | |

Name | Position | Age |

|

Mark C. Miller | Executive Chairman | 60 |

|

Charles A. Alutto | President and Chief Executive Officer | 50 |

|

Brent Arnold | Executive Vice President and Chief Operating Officer | 47 |

|

Daniel V. Ginnetti | Executive Vice President and Chief Financial Officer | 47 |

|

Michael J. Collins | Executive Vice President and President, Recall and Returns Management Services | 59 |

|

John P. Schetz | Executive Vice President and General Counsel | 39 |

|

Brenda Frank | Executive Vice President and Chief People Officer | 46 |

|

Mark Miller has served as our Executive Chairman since January 2013 and director as of May 1992. He became our Chief Executive Officer in May 1992 and Chairman of the Board of Directors in August 2008. From May 1989 until joining us, Mr. Miller served as vice president for the Pacific, Asia and Africa in the international division of Abbott Laboratories, a diversified health care company, which he joined in 1976 and where he held a number of management and marketing positions. Mr. Miller serves as a director of Accelerate Diagnostics, Inc., a developer of automated diagnostics systems, and formerly served as a director of Ventana Medical Systems, Inc., a developer and supplier of automated diagnostic systems. He received a B.S. degree in computer science from Purdue University, where he graduated Phi Beta Kappa. Mr. Miller was selected by Morningstar, Inc. as its "2009 CEO of the Year."

Charlie Alutto has served as President and Chief Executive Officer since January 2013 and as a Director since November 2012. He joined us in May 1997 following our acquisition of the company where he was then employed. He became an executive officer in February 2011 and served as President, Stericycle USA. He previously held various management positions with us, including vice president and managing director of SRCL Europe and corporate vice president of our large quantity generator business unit. Mr. Alutto received a B.S. degree in finance from Providence College and a M.B.A. degree in finance from St. John’s University.

Brent Arnold was named as Chief Operating Officer effective January 1, 2015. He served as Executive Vice President and President, Stericycle USA/Canada since April 2014. He joined Stericycle in April 2005 and has worked in various leadership positions including Senior Vice President of Operations, Senior Vice President of Sales & Marketing for the US and Canada and Corporate Vice President of our large and small quantity business units. He has more than 24 years of experience primarily focused in the healthcare industry. Prior to joining Stericycle, he held various leadership roles at Baxter International Inc. and Cardinal Health, Inc. Mr. Arnold received a B.S. degree in marketing from Indiana University.

Daniel Ginnetti was named as Chief Financial Officer effective August 1, 2014. He joined Stericycle as Area Vice President of Finance in 2003. In 2004 he was promoted to Area Vice President for Stericycle’s Western, and later, Midwestern business units. Following that, he was promoted to Senior Vice President of Operations for the United States and Canada. He returned to financial management in 2013 becoming Vice President of Corporate Finance and then CFO in August 2014. Prior to joining Stericycle, Mr. Ginnetti held various finance and accounting positions with The Ralph M. Parsons Company, a worldwide engineering firm, and Ryan Herco Products

Corp., a national industrial plastics distributor. Mr. Ginnetti has a B.S. degree in Business Economics from the University of California, Santa Barbara.

Michael Collins joined Stericycle as President, Recall and Returns Management Services in June 2006. Prior to joining Stericycle, he was Medical Products Group of Abbott Laboratories. He joined Abbott in 1982 as a sales representative and later served in various management positions, including Divisional Vice President, U.S. Sales; Divisional Vice President, U.S. Marketing, Divisional Vice President and General Manager, MediSense and Corporate Vice President Abbott Diagnostics Divisions. Mr. Collins was a commissioned officer for the U.S. Marine Corps. He holds a B.S degree from the University of New Haven and a M.B.A. degree from National University, San Diego.

John Schetz has served as Executive Vice President and General Counsel since April 2015. Mr. Schetz previously served as Vice President and Senior Counsel from January 2013. He joined us in June 2009 as Senior Counsel, Mergers and Acquisitions. Prior to joining Stericycle, Mr. Schetz was a partner at McDermott Will & Emery LLP in Chicago. Mr. Schetz received a B.A. degree from the University of Michigan and a J.D. degree from the University of Michigan Law School.

Brenda Frank has served as Executive Vice President and Chief People Officer since January 2016. Brenda joined Stericycle with our acquisition of Shred-it in October 2015 where she spent six years as General Counsel and Executive Vice President of Human Resources and Franchise Relations. Brenda has spent the last 20 years focusing on people, labor and employment, holding senior human resources and legal roles at global services companies such as ITOCHU INTERNATIONAL and Pitney Bowes. Brenda started her career as a labor and employment attorney and litigator at Wilson Sonsini Goodrich & Rosati and Proskauer Rose. Brenda received her B.S. in Accounting from S.U.N.Y Albany and her J.D. from New York University Law School.

Website Access

We maintain an Internet website, www.stericycle.com, providing a variety of information about us and the services we provide. Our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K that we file with the Securities and Exchange Commission are available, as soon as practicable after filing, at the Investors page on our website, or by a direct link to our filings on the SEC’s free website, www.sec.gov.

Item 1A. Risk Factors

We are subject to extensive governmental regulation, which is frequently difficult, expensive and time-consuming to comply.

The regulated waste management and secure information destruction industries are subject to extensive federal, state and local laws and regulations relating to the collection, transportation, packaging, labeling, handling, documentation, reporting, treatment and disposal of regulated waste and the proper handling and protection of personal and confidential information. Our business requires us to obtain many permits, authorizations, approvals, certificates, and other types of governmental permission from and to comply with various regulations in every jurisdiction in which we operate. Federal, state and local regulations change often, and new regulations are frequently adopted. Changes in the regulations could require us to obtain new permits or to change the way in which we operate our business. We might be unable to obtain the new permits that we require, and the cost of compliance with new or changed regulations could be significant.

Many of the permits that we require, especially those to build and operate processing plants and transfer facilities, are difficult and time-consuming to obtain. They may also contain conditions

or restrictions that limit our ability to operate efficiently, and they may not be issued as quickly as we need them (or at all). If we cannot obtain the permits that we need when we need them, or if they contain unfavorable conditions, it could substantially impair our operations and reduce our revenues and/or profitability.

The level of governmental enforcement of environmental regulations has an uncertain effect on our business and could reduce the demand for our services.

We believe that strict enforcement of laws and regulations relating to regulated waste collection and treatment and the proper handling and protection of personal and confidential information by governmental authorities can have a positive effect on our business. These laws and regulations increase the demand for our services. Relaxation of enforcement or other changes in governmental regulation of regulated waste and personal and confidential information could increase the number of competitors we face or reduce the need for our services.

The amount of our indebtedness could adversely affect our business.

As of December 31, 2015, we had a total of $3.2 billion of outstanding indebtedness, including long-term debt and short-term debt. We also have the ability to incur a substantial amount of additional indebtedness, including up to an additional $685.8 million under our revolving credit facility.

Our annual cash obligations to service our indebtedness are approximately $375 million. In addition, the aggregate amount of dividends payable on our depositary shares is approximately $40.4 million on an annual basis. If we are unable to generate sufficient cash to repay or to refinance our debt as it comes due or to pay dividends on our depositary shares, this would have a material adverse effect on our business and the market price of our common stock and depositary shares. Our leverage could have adverse consequences on our business, including the following:

•we may be required to dedicate a substantial portion of our available cash to payments of principal of and interest on our indebtedness;

•our ability to access credit markets on terms we deem acceptable may be impaired; and

•our leverage may limit our flexibility to adjust to changing market conditions.

Servicing debt and funding other obligations requires a significant amount of cash, and our ability to generate sufficient cash depends on many factors, some of which are beyond our control.

Our ability to make payments on and refinance our indebtedness and to fund our operations and capital expenditures depends on our ability to generate cash flow and secure financing in the future. Our ability to generate future cash flow depends, among other things, upon:

•future operating performance;

•general economic conditions;

•competition; and

•legislative and regulatory factors affecting our operations and business.

Some of these factors are beyond our control. There is no assurance that our business will generate cash flow from operations or that future debt or equity financings will be available to us to enable us to pay our indebtedness or to fund other needs. As a result, we may need to refinance all or a portion of our indebtedness on or before maturity. There is no assurance that we will be able to refinance any of our indebtedness on favorable terms, or at all. Any inability to generate

sufficient cash flow or refinance our indebtedness on favorable terms could have an adverse effect on our financial condition.

Restrictions in our private placement notes, the Term Loan Credit Facility and the Revolving Credit Facility could adversely affect our business, financial condition, results of operations, ability to make distributions and value of our securities.

The terms of our private placement notes require that we comply with certain covenants and will include events of default and other terms similar to those in certain of our existing private placement notes. Each of the Term Loan Credit Facility and Revolving Credit Facility also contains customary affirmative covenants, including, among others, covenants pertaining to the delivery of financial statements; notices of default and certain other material events; payment of obligations; preservation of corporate existence, rights, privileges, permits, licenses, franchises and intellectual property; maintenance of property and insurance and compliance with laws, as well as customary negative covenants for facilities of this type, including, among others, limitations on the incurrence of liens, investments and indebtedness; mergers and certain other fundamental changes; dispositions of assets; restricted payments; changes in our line of business; transactions with affiliates and burdensome agreements. Each facility contains a financial covenant requiring maintenance of a minimum consolidated interest coverage ratio of 3.00 to 1.00 as of the end of any quarter and a financial covenant requiring maintenance of a maximum consolidated leverage ratio of between 3.75 and 4.35 to 1.00, depending on factors determined in accordance with the terms of the applicable facility. These covenants could affect our ability to operate our business and may limit our ability to take advantage of potential business opportunities as they arise.

Our ability to comply with the covenants and restrictions contained in the private placement notes, the Term Loan Credit Facility and the Revolving Credit Facility may be affected by events beyond our control, including prevailing economic, financial, and industry conditions. If market or other economic conditions deteriorate, our ability to comply with these covenants may be impaired. A failure to comply with these provisions could result in a default or an event of default. Upon an event of default, unless waived, the lenders could elect to terminate its commitments, cease making further loans, require cash collateralization of letters of credit, cause its loans to become due and payable in full and force us and our subsidiaries into bankruptcy or liquidation. If the payment of our debt is accelerated, our assets may be insufficient to repay such debt in full, and the holders of our units could experience a partial or total loss of their investment.

We will incur significant acquisition-related integration costs in connection with the Shred-it acquisition.

We have developed and are in the process of executing a plan to integrate the operations of Shred-it to achieve anticipates synergies of between $20 million to $30 million in connection with the acquisition by fiscal year 2018. We also expect to incur costs to implement such cost savings measures. We anticipate that we will incur certain non-recurring charges in connection with this integration, including costs and charges associated with integrating operations, processes and systems. We cannot identify the timing, nature and amount of all such charges. The significant acquisition-related integration costs could adversely affect our results of operations in the period in which such charges are recorded or our cash flow in the period in which any related costs are actually paid. Although we believe that the elimination of duplicative costs such as selling, general and administrative expenses, as well as the realization of other efficiencies related to the integration of the businesses such as the optimization of logistics, truck and plant utilization, cross-utilization of fleet, improvements in route density and facility optimization, will offset incremental acquisition-related costs over time, this net benefit may not be achieved in the near term, or at all. We expect it will take approximately two years from the closing of the Shred-it acquisition to implement the

cost savings measures to achieve our anticipated annual cost savings from synergies. We have identified some, but not all, of the actions necessary to achieve our anticipated cost and operational savings. Accordingly, the cost and operational savings may not be achievable in our anticipated amount or timeframe or at all.

We may not realize the synergies and growth opportunities that are anticipated from the Shred-it acquisition or other acquisitions.

The benefits we expect to achieve as a result of the Shred-it acquisition or other acquisitions that we complete will depend, in part, on our ability to realize targeted synergies and anticipated growth opportunities. Our success in realizing these synergies and growth opportunities, and the timing of this realization, depends on the successful integration of other business and operations with our pre-existing business and operations. Even if we are able to integrate these businesses and operations successfully, this integration may not result in the realization of the full benefits of the synergies and growth opportunities we currently expect within the anticipated time frame or at all. While we anticipate that certain expenses will be incurred, such expenses are difficult to estimate accurately, and may exceed current estimates. Accordingly, the benefits from the Shred-it acquisition or other acquisitions may be offset by unexpected costs incurred or delays in integrating the companies, which could cause our financial estimates to be inaccurate.

If we are unable to acquire regulated waste, secure information destruction and other businesses, our revenue and profit growth may be slowed.

Historically, our growth strategy has been based in part on our ability to acquire and integrate other businesses. We do not know whether in the future we will be able to:

•identify suitable businesses to buy;

•complete the purchase of those businesses on terms acceptable to us; and

•avoid or overcome any concerns expressed by regulators.

We compete with other potential buyers for the acquisition of regulated waste and secure information destruction companies and other businesses. This competition may result in fewer opportunities to purchase companies that are for sale. It may also result in higher purchase prices for the businesses that we want to purchase.

We also do not know whether our growth strategy will continue to be effective. Our business is significantly larger than before, and new acquisitions may not have the incremental benefits that we have obtained in the past.

The implementation of our acquisition strategy could be affected in certain instances by the concerns of federal and state regulators, which could result in our not being able to realize the full synergies or profitability of particular acquisitions.

We may become subject to inquiries and investigations by federal or state antitrust regulators from time to time in the course of completing acquisitions of other regulated waste and secure information destruction businesses. In order to obtain regulatory clearance for a particular acquisition, we could be required to modify certain operating practices of the acquired business or to divest ourselves of one or more assets of the acquired business. Changes in the terms of our acquisitions required by regulators or agreed to by us in order to settle regulatory investigations could impede our acquisition strategy or reduce the anticipated synergies or profitability of our acquisitions. The likelihood and outcome of inquiries and investigations from federal or state regulators in the course of completing acquisitions cannot be predicted.

Aggressive pricing by existing competitors and the entrance of new competitors could drive down our profits and slow our growth.

The industries in which we participate are very competitive because of low barriers to entry, among other reasons. This competition has required us in the past to reduce our prices, especially to large account customers, and may require us to reduce our prices in the future. Substantial price reductions could significantly reduce our earnings.

We face direct competition from a large number of small, local competitors. Because it requires very little financial investment or technical know-how to compete in the collection and transportation of regulated wastes or the secure destruction of personal and confidential information, there are many regional and local companies in these industries. We face competition from these businesses, and competition from them is likely to exist in new locations to which we may expand in the future. In addition, large national companies with substantial resources operate in the markets we serve. For example, in the United States, Waste Management, Inc., and Clean Harbors, and Iron Mountain all offer competing services.

Our competitors could take actions that would hurt our growth strategy, including the support of regulations that could delay or prevent us from obtaining or keeping permits. They might also give financial support to citizens’ groups that oppose our plans to locate a processing or transfer facility at a particular location.

Risks from our international operations could impair our ability to expand in certain international markets and adversely affect our business, financial condition and results of operations.

We plan to continue to grow both domestically and internationally. We have established operations in the United States and 21 other countries. Foreign operations carry special risks including:

•exchange rate fluctuations;

•government controls;

•import and export license requirements;

•political or economic instability;

•trade restrictions;

•changes in tariffs and taxes;

•permitting and regulatory standards;

•differences in local laws, regulations, practices, and business customs;

•restrictions on repatriating foreign profits back to the United States or movement of funds to other countries;

•difficulties in staffing and managing international operations; and

•increases and volatility in labor costs.

Any of the foregoing or other factors associated with doing business abroad could adversely affect our business, financial condition and results of operations.

We face risks associated with project work and services that are provided on a non-recurring basis.

While the majority of our business is based on long-term contracts for regularly scheduled service, we do have a portion of revenue which is derived from short-term projects or services that

we provide on a non-recurring basis. Product recall and retrieval events, one-time purge events for secure information destruction, and certain hazardous waste services that we provide on a project or non-recurring basis are not predictable in terms of frequency, size or duration. Our customers’ need for these services could be influenced by regulatory changes, fluctuations in commodity market performance, natural disasters and acts of God, or other factors beyond our control. Variability in the demand for these services could adversely affect our business, financial condition and results of operations.

Fluctuations in the commodity market related to the demand and price for recycled paper may affect our business, financial condition and results of operations.

We sell nearly all of the shredded paper from our secure information destruction business to paper companies and recycled paper brokers. Sorted office paper is marketed as a commodity and is subject to significant demand and price fluctuations beyond our control. Historically, economic and market shifts, fluctuations in capacity and changes in foreign currency exchange rates have created cyclical changes in prices, sales volume and margins for pulp and paper products. The length and magnitude of industry cycles have varied over time and by product, but generally reflect changes in macroeconomic conditions and levels of industry capacity. The overall levels of demand for the pulp and paper products, and consequently its sales and profitability, reflect fluctuations in levels of end-user demand, which depend in part on general macroeconomic conditions in North America and worldwide, as well as the threat of digitization. As a result, the market demand for recycled paper can be volatile due to factors beyond our control. Lack of demand for our shredded paper material could adversely affect our business, financial condition and results of operations.

Our earnings could decline resulting in charges to impair intangible assets, such as goodwill.

As a result of our various acquisitions, our balance sheet at December 31, 2015 contains goodwill of $3.8 billion and other intangible assets, net of accumulated amortization of $1.8 billion. In accordance with the FASB Accounting Standards Codification Topic 350, Intangibles - Goodwill and Other, we evaluate on an ongoing basis whether facts and circumstances indicate any impairment to the value of indefinite-lived intangible assets such as goodwill. As circumstances after an acquisition can change, we may not realize the value of these intangible assets. If we were to determine that a significant impairment has occurred, we would be required to incur non-cash charges for the impaired portion of goodwill or other unamortized intangible assets, which could have a material adverse effect on our results of operations in the period in which the impairment charge occurs.

The loss of our senior executives could affect our ability to manage our business profitably.

We depend on a small number of senior executives. Our future success will depend upon, among other things, our ability to keep these executives and to hire other highly qualified employees at all levels. We compete with other potential employers for employees, and we may not be successful in hiring and keeping the executives and other employees that we need. We do not have written employment agreements with any of our executive officers, and officers and other key employees could leave us with little or no prior notice, either individually or as part of a group. Our loss of, or inability to hire, key employees could impair our ability to manage our business and direct its growth.

We face risks relating to our size and scale.

We have over 800 facilities in 22 countries and more than 25,000 employees worldwide. The sheer size of our operations exposes us to the risk that systems and practices will not be implemented uniformly throughout our Company and that information will not be shared across the locations and countries in a timely and appropriate manner. Any misalignment in strategic initiatives

and/or difficulties or delays in transmission of information could adversely affect our business, financial condition and results of operations.

The handling and treatment of regulated waste carries with it the risk of personal injury to employees and others.

Our business requires us to handle materials that may be infectious or hazardous to life and property in other ways. While we try to handle such materials with care and in accordance with accepted and safe methods, the possibility of accidents, leaks, spills, and acts of God always exists. Examples of possible exposure to such materials include:

•truck accidents;

•damaged or leaking containers;

•improper storage of regulated waste by customers;

•improper placement by customers of materials into the waste stream that we are not authorized or able to process, such as certain body parts and tissues; or

•malfunctioning treatment plant equipment.

Human beings, animals or property could be injured, sickened or damaged by exposure to regulated waste. This in turn could result in lawsuits in which we are found liable for such injuries, and substantial damages could be awarded against us.

While we carry liability insurance intended to cover these contingencies, particular instances may occur that are not insured against or that are inadequately insured against. An uninsured or underinsured loss could be substantial and could impair our profitability and reduce our liquidity.

The handling of regulated waste exposes us to the risk of environmental liabilities, which may not be covered by insurance.

As a company engaged in regulated waste management, we face risks of liability for environmental contamination. The federal Comprehensive Environmental Response, Compensation and Liability Act of 1980 ("CERCLA") and similar state laws impose strict liability on current or former owners and operators of facilities that release hazardous substances into the environment as well as on the businesses that generate those substances and the businesses that transport them to the facilities. Responsible parties may be liable for substantial investigation and clean-up costs even if they operated their businesses properly and complied with applicable federal and state laws and regulations. Liability under CERCLA may be joint and several, which means that if we were found to be a business with responsibility for a particular CERCLA site, we could be required to pay the entire cost of the investigation and clean-up even though we were not the party responsible for the release of the hazardous substance and even though other companies might also be liable.

Our pollution liability insurance excludes liabilities under CERCLA. Thus, if we were to incur liability under CERCLA and if we could not identify other parties responsible under the law whom we are able to compel to contribute to our expenses, the cost to us could be substantial and could impair our profitability and reduce our liquidity. Our customer service agreements make clear that the customer is responsible for making sure that only appropriate materials are disposed of. If there were a claim against us that a customer might be legally liable for, we might not be successful in recovering our damages from the customer.

The handling of secure information for destruction exposes us to potential data security risks that could result in monetary damages against us and could otherwise damage our reputation, and adversely affect our business, financial condition and results of operations.

The protection of customer, employee, and company data is critical to our business. The regulatory environment in the United States and Canada surrounding information security and privacy is increasingly demanding, with the frequent imposition of new and constantly changing requirements. Certain legislation, including the Fair and Accurate Credit Transactions Act, the Health Insurance Portability and Accountability Act, and the Economic Espionage Act in the United States and the Personal Information Protection and Electronic Documents Act in Canada, require documents to be securely destroyed to avoid identity theft and inadvertent leakage of confidential and sensitive information. A significant breach of customer, employee, or company data could attract a substantial amount of media attention, damage our customer relationships and reputation and result in lost sales, fines, or lawsuits. In addition, an increasing number of countries have introduced and/or increased enforcement of comprehensive privacy laws, or are expected to do so. The continued emphasis on information security as well as increasing concerns about government surveillance may lead customers to request us to take additional measures to enhance security and/or assume higher liability under our contracts. As a result of legislative initiatives and customer demands, we may have to modify our operations to further improve data security. Any such modifications may result in increased expenses and operational complexity, and adversely affect our business, financial condition and results of operations.

Attacks on our information technology systems could damage our reputation, harm our businesses and adversely affect our results of operations.

Our reputation for the secure handling of customer and other sensitive information is critical to the success of our business. We rely heavily on various proprietary and third party information systems. Although we have implemented safeguards and taken steps to prevent potential security breaches, our information technology and network infrastructure may be vulnerable to attacks by hackers or breaches due to employee error, malfeasance, cyber-attacks, computer viruses, power outages, natural disasters, acts of terrorism or other disruptions. Because techniques used to obtain unauthorized access or to sabotage systems change frequently and generally are not recognized until launched against a target, we may be unable to prevent these techniques or to implement adequate preventative measures. A successful breach of the security of our information systems could lead to theft or misuse of our customers’ proprietary or confidential information and result in third party claims against us and reputational harm, all of which could adversely affect our businesses, financial condition or results of operations.

Our management depends on relevant and reliable information for decision making purposes, including key performance indicators and financial reporting. A lack of relevant and reliable information could preclude us from optimizing our overall performance. Any significant loss of data, failure to maintain reliable data, disruptions affecting our information systems, or delays or difficulties in transitioning to new systems could adversely affect our business, financial condition and results of operations. In addition, our ability to continue to operate our businesses without significant interruption in the event of a disaster or other disruption depends in part on the ability of our information systems to operate in accordance with our disaster recovery and business continuity plans. If our information systems fail and our redundant systems or disaster recovery plans are not adequate to address such failures, or if our business interruption insurance does not sufficiently compensate us for any losses that we may incur, our revenues and profits could be reduced and the reputation of our brands and our business could be adversely affected. In addition, remediation of such problems could result in significant, unplanned capital investments.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

We lease office space for our corporate offices in Lake Forest, Illinois. Domestically, we own or lease 114 processing facilities, which are primarily autoclaves for medical waste and shredders for secure information destruction. All of our processing facilities also serve as collection sites. We own or lease 218 additional transfer sites, 21 additional sales/administrative sites, and 83 other service facilities. Internationally, we own or lease 139 processing facilities, the majority of which use autoclave waste processing technology. We also own or lease 140 additional transfer sites, 62 additional sales/administrative sites, 54 other service facilities, and 3 landfills. We believe that these processing and other facilities are adequate for our present and anticipated future needs.

Item 3. Legal Proceedings

See Note 19 - Legal Proceedings in the Notes to the Consolidated Financial Statements (Item 8 of Part II).

Item 4. Mine Safety Disclosures

Not Applicable.

PART II

Item 5. Market Price for the Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

The Company’s common stock is listed on the NASDAQ Global Select Market under the ticker symbol "SRCL." There were 103 shareholders of record as of February 19, 2016.

We did not declare or pay any cash dividends during 2015 on our common stock. We currently expect that we will retain future earnings for use in the operation and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future.

The holders of our Series A Mandatory Convertible Preferred Stock (the "Series A Preferred Stock") are entitled to receive quarterly dividends, which accrue at an annual rate of 5.25%. Dividends of $10.1 million were paid on December 15, 2015 to holders of our Series A Preferred Stock.

See Item 7 of Part II, "Management’s Discussion and Analysis of Financial Condition and Results of Operations."

The following table provides the high and low sales prices of our Common Stock for each calendar quarter during our two most recent fiscal years:

|

| | | | | | | | |

Quarter | | High | | Low |

First quarter 2015 | | $ | 140.86 |

| | $ | 130.10 |

|

Second quarter 2015 | | 141.93 |

| | 132.76 |

|

Third quarter 2015 | | 148.26 |

| | 132.33 |

|

Fourth quarter 2015 | | 150.84 |

| | 113.64 |

|

| | | | |

First quarter 2014 | | $ | 120.09 |

| | $ | 111.96 |

|

Second quarter 2014 | | 118.90 |

| | 109.33 |

|

Third quarter 2014 | | 119.98 |

| | 115.31 |

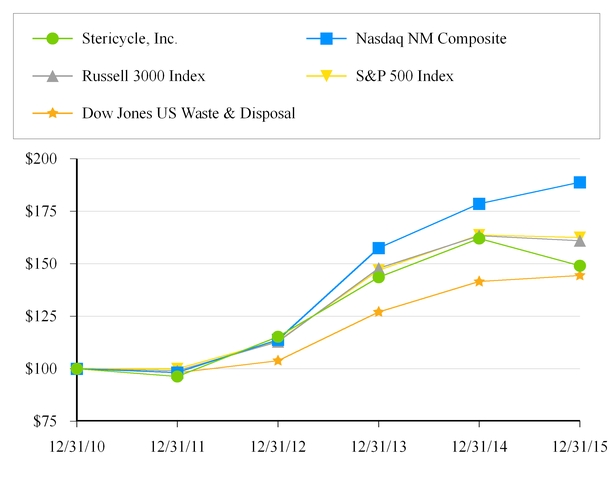

|