Exhibit 3.1

CERTIFICATE OF DESIGNATIONS, PREFERENCES AND RIGHTS

OF

SERIES E PREFERRED STOCK

OF

IDERA PHARMACEUTICALS, INC.

(Pursuant to Section 151 of

the Delaware General Corporation Law)

Idera Pharmaceuticals, Inc. (the “Corporation”), a corporation organized and existing under the laws of the State of Delaware, hereby certifies that, pursuant to authority conferred on its Board of Directors (the “Board”) by the Restated Certificate of Incorporation of the Corporation, as amended (the “Certificate of Incorporation”), the following resolution was adopted by the Board at a meeting duly called and held on November 9, 2012, which resolution remains in full force and effect on the date hereof:

RESOLVED, that there is hereby created and established a series of the Corporation’s authorized Preferred Stock (the “Preferred Stock”) having a par value of $0.01 per share, which series shall be designated as “Series E Convertible Preferred Stock” (the “Series E Preferred Stock”) and shall consist of 424,242 shares. The shares of Series E Preferred Stock shall have the voting powers, designations, preferences and other special rights, and qualifications, limitations and restrictions thereof set forth below:

1. Dividends.

1.1 Each holder of Series E Preferred Stock shall be entitled to receive with respect to each share of Series E Preferred Stock then outstanding and held by such holder of Series E Preferred Stock, dividends, commencing from the date of issuance of such share of Series E Preferred Stock, at the Initial Dividend Rate (as defined below) per annum (on the basis of a 360 day year) of the Series E Original Issue Price (as defined below) (the “Series E Preferred Dividends”); provided, however, that subject to and effective upon the filing with the Delaware Secretary of State of the amendment to the Certificate of Designations, Preferences and Rights of Series D Preferred Stock (the “Series D Certificate of Designations,” with the amendment thereto being referred to as the “Amendment to Series D Certificate of Designations”) as described in Section 5.11(B) of that certain Convertible Preferred Stock and Warrant Purchase Agreement, dated November 9, 2012, between the Corporation and the purchasers of the Series E Preferred Stock therein (the “Series E Purchase Agreement”), the dividend rate provided for in this Section 1.1 shall be increased from the Initial Dividend Rate to the rate of eight percent (8%) per annum (on the basis of a 360 day year) of the Series E Original Issue Price. The Series E Preferred Dividends shall be cumulative, whether or not earned or declared, shall be paid quarterly in arrears on the last day of March, June, September and December (a “Quarterly Dividend Payment Date”) in each year that Series E Preferred Stock is outstanding, with the first Quarterly Dividend Payment Date being March 31, 2013, and shall be prorated for periods shorter than one

quarter. Notwithstanding the foregoing, if, as of any Quarterly Dividend Payment Date at which the dividend rate is the Initial Dividend Rate, there are no shares of the Corporation’s Series D Convertible Preferred Stock outstanding, then the dividend payable on such Quarterly Dividend Payment Date shall be calculated and paid at a rate of eight percent (8%) per annum (on the basis of a 360 day year) of the Series E Original Issue Price. In the event that the Amendment to Series D Certificate of Designations is filed with the Delaware Secretary of State and the dividend rate with respect to the Series E Preferred Dividends is increased pursuant to this Section 1.1, the Series E Preferred Dividends paid on the first Quarterly Dividend Payment Date after such filing and increase shall be paid at the increased rate. In the event that the Amendment to Series D Certificate of Designations is submitted to the stockholders of the Corporation as contemplated by Section 5.11 of the Series E Purchase Agreement and the Amendment to Series D Certificate of Designations is not approved, then the holders of the Series E Preferred Stock shall no longer be entitled to any Series E Preferred Dividends under this Section 1.1 and the Corporation shall have no further obligation to pay the Series E Preferred Dividends under this Section 1.1; provided, however, the Corporation shall not submit the Amendment to the Series D Certificate of Designations to the stockholders if there are no shares of Series D Preferred Stock then outstanding. The rights of a holder of Series E Preferred Stock to Series E Preferred Dividends shall rank senior to the rights of the Corporation’s Series A Convertible Preferred Stock and Series D Convertible Preferred Stock as to dividends. The Series E Preferred Dividends shall be paid to each holder of Series E Preferred Stock in cash out of legally available funds. The term “Initial Dividend Rate” shall mean four and six tenths percent (4.6%) or such other percentage approved by the Corporation and by the holders of at least a majority of then outstanding shares of Series E Preferred Stock, with such approval given in writing or by vote at a meeting, consenting or voting (as the case may be) as a separate class.

1.2 Notwithstanding the foregoing, if any Series E Preferred Dividend is not paid by the Corporation within five trading days following a Quarterly Dividend Payment Date, such Series E Preferred Dividend shall continue to accrue and the Corporation shall be obligated to pay the holders a late fee with respect to such Series E Preferred Dividend, which shall be paid by the Corporation in cash, at the rate of sixteen percent (16%) per annum (or such lesser rate permitted by applicable law) (the “Dividend Late Fee”), and shall accrue daily from the applicable Quarterly Dividend Payment Date through and including the date the Corporation pays such Series E Preferred Dividend plus the Dividend Late Fee in full (which amount shall be paid as liquidated damages and not as a penalty); provided however, that no Dividend Late Fee shall accrue or be owed with respect to any Series E Preferred Dividend that the Corporation is not permitted to pay under Delaware law.

1.3 The Corporation shall not declare, pay or set aside any dividends on shares of any other class or series of capital stock of the Corporation (other than dividends on shares of the Corporation’s Common Stock, par value $0.001 per share (the “Common Stock”) payable in shares of Common Stock, dividends on the Series A Convertible Preferred Stock in accordance with Section 2(a) of the Certificate of Designations, Preferences and Rights of Series A Convertible Preferred Stock (the “Series A Certificate of Designations”), dividends on the Series D Convertible Preferred Stock in accordance with Section 1.1 of the Series D Certificate of

2

Designations and such dividends on other series or classes of the capital stock of the Corporation as are approved for this exclusion by the holders of at least a majority of the then outstanding shares of Series E Preferred Stock, given in writing or by vote at a meeting, consenting or voting (as the case may be) as a separate class, unless the holders of the Series E Preferred Stock then outstanding shall first receive, or simultaneously receive, a dividend on each outstanding share of Series E Preferred Stock in an amount at least equal to the sum of (i) the amount of the aggregate dividends then accrued on such share of Series E Preferred Stock and not previously paid and (ii) (A) in the case of a dividend on Common Stock or any class or series that is convertible into Common Stock, that dividend per share of Series E Preferred Stock as would equal the product of (1) the dividend payable on each share of such class or series determined, if applicable, as if all shares of such class or series had been converted into Common Stock and (2) the number of shares of Common Stock issuable upon conversion of a share of Series E Preferred Stock, in each case calculated on the record date for determination of holders entitled to receive such dividend or (B) in the case of a dividend on any class or series that is not convertible into Common Stock, at a rate per share of Series E Preferred Stock determined by (1) dividing the amount of the dividend payable on each share of such class or series of capital stock by the original issuance price of such class or series of capital stock (subject to appropriate adjustment in the event of any stock dividend, stock split, combination or other similar recapitalization with respect to such class or series) and (2) multiplying such fraction by an amount equal to the Series E Original Issue Price; provided that, if the Corporation declares, pays or sets aside, on the same date, a dividend on shares of more than one class or series of capital stock of the Corporation, the dividend payable to the holders of Series E Preferred Stock pursuant to this Section 1.3 shall be calculated based upon the dividend on the class or series of capital stock that would result in the highest Series E Preferred Stock dividend.

1.4 The “Series E Original Issue Price” shall mean $14.00 per share, subject to appropriate adjustment in the event of any stock dividend, stock split, combination or other similar recapitalization with respect to the Series E Preferred Stock.

2. Liquidation, Dissolution or Winding Up; Sale of the Corporation.

2.1 Payments to Holders of Series E Preferred Stock Upon Liquidation.

2.1.1 In the event of any voluntary or involuntary liquidation, dissolution or winding up of the Corporation, the holders of shares of Series E Preferred Stock then outstanding shall be entitled to be paid out of the assets of the Corporation available for distribution to its stockholders before any payment shall be made to the holders of Common Stock, Series A Convertible Preferred Stock, Series D Convertible Preferred Stock or any other class of capital stock of the Corporation ranking junior to the Series E Preferred Stock as to liquidation, by reason of their ownership thereof, an amount per share equal to the greater of (i) the Series E Original Issue Price, plus any dividends accrued or declared but unpaid thereon, and (ii) such amount per share as would have been payable with respect to such share had all shares of Series E Preferred Stock been converted into Common Stock pursuant to Subsection 4 immediately prior to such liquidation, dissolution or winding up disregarding for these purposes the limitations on conversion due to beneficial ownership set forth in Subsection 4.1.2.

3

2.1.2 If upon any such liquidation, dissolution or winding up of the Corporation, the assets of the Corporation available for distribution to its stockholders shall be insufficient to pay the holders of shares of Series E Preferred Stock the full amount to which they shall be entitled under this Subsection 2.1, the holders of shares of Series E Preferred Stock shall share ratably in any distribution of the assets available for distribution in proportion to the respective amounts which would otherwise be payable in respect of the shares held by them upon such distribution if all amounts payable on or with respect to such shares were paid in full.

2.2 Payments to Holders of Common Stock Upon Liquidation. In the event of any voluntary or involuntary liquidation, dissolution or winding up of the Corporation, after the payment of all preferential amounts required to be paid to the holders of shares of Series E Preferred Stock and subject to any other distribution that may be required with respect to any other series of Preferred Stock, the remaining assets of the Corporation available for distribution to its stockholders shall be distributed among the holders of shares of Common Stock and any class or series of capital stock that participates with the Common Stock in such distributions.

2.3 Sale of the Corporation.

2.3.1 In the event of a Sale of the Corporation (as defined below) after payment shall be made to the holders of Series A Convertible Preferred Stock, Series D Convertible Preferred Stock and any other class of capital stock of the Corporation ranking senior to the Series E Preferred Stock upon a Sale of the Corporation, the remaining assets of the Corporation available for distribution to its stockholders shall be distributed among the holders of the shares of Series E Preferred Stock and Common Stock pro rata based on the number of shares held by each such holder, treating for this purpose all such securities as if they had been converted to Common Stock pursuant to the terms of the Certificate of Incorporation immediately prior to such Sale of the Corporation disregarding for these purposes the limitations on conversion due to beneficial ownership set forth in Subsection 4.1.2.

2.3.2 The term “Sale of the Corporation” shall mean each of the following events: (a) a merger or consolidation in which (i) the Corporation is a constituent party or (ii) a subsidiary of the Corporation is a constituent party and the Corporation issues shares of its capital stock pursuant to such merger or consolidation (except in the case of clause (i) and (ii), any such merger or consolidation involving the Corporation or a subsidiary in which the shares of capital stock of the Corporation outstanding immediately prior to such merger or consolidation continue to represent, or are converted into or exchanged for shares of capital stock that represent, immediately following such merger or consolidation, at least a majority, by voting power, of the capital stock of (y) the surviving or resulting corporation or (z) if the surviving or resulting corporation is a wholly owned subsidiary of another corporation immediately following such merger or consolidation, the parent corporation of such surviving or resulting corporation; or (b) the sale, lease, transfer, exclusive license or other disposition, in a single transaction or series of related transactions, by the Corporation or any subsidiary of the Corporation of all or substantially all the assets of the Corporation and its subsidiaries taken as a whole, or the sale or disposition (whether by merger or otherwise) of one or more subsidiaries of the Corporation if substantially all of the assets of the

4

Corporation and its subsidiaries taken as a whole are held by such subsidiary or subsidiaries, except where such sale, lease, transfer, exclusive license or other disposition is to a wholly owned subsidiary of the Corporation. For the purposes of clarity, a Sale of the Corporation shall not be deemed to be a liquidation, dissolution or winding up of the Corporation for the purposes of this Section 2.

3. Voting.

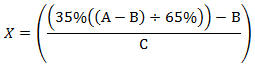

3.1 Unless and until the stockholders of the Corporation approve the Nasdaq Proposal (as defined by and in accordance with Section 5.11(B) of the Series E Purchase Agreement), the holders of the Series E Preferred Stock shall have no voting rights with respect to any matter presented to the stockholders of the Corporation for their action or consideration at any meeting of stockholders of the Corporation or otherwise, except as otherwise required by applicable law or regulation. Subject to and effective upon the date that the stockholders of the Corporation approve the Nasdaq Proposal, on any matter presented to the stockholders of the Corporation for their action or consideration at any meeting of stockholders of the Corporation, each holder of outstanding shares of Series E Preferred Stock shall be entitled to cast a number of votes equal to the lesser of (a) the number of whole shares of Common Stock into which the shares of Series E Preferred Stock held by such holder are convertible as of the record date for determining stockholders entitled to vote on such matter and (b) the product of the Voting Adjustment Percentage (as defined below) multiplied by the number of whole shares of Common Stock into which the shares of Series E Preferred Stock held by such holder are convertible as of the record date for determining stockholders entitled to vote on such matter. Except as provided by law or by the other provisions of the Certificate of Incorporation, holders of Series E Preferred Stock shall vote together, as a single class, with the holders of Common Stock, Series D Convertible Preferred Stock and any other series or class of the stock of the Corporation that votes together with the holders of Common Stock. The “Voting Adjustment Percentage” is determined in accordance with the formula below:

For purposes of the foregoing formula, the following definitions shall apply:

(a) “A” shall mean the number of shares of Common Stock then issued and outstanding plus the number of shares of Common Stock then issuable upon conversion of the Series D Preferred Stock then issued and outstanding and any other series of Preferred Stock (other than the Series E Preferred Stock) then issued and outstanding, and entitled to vote on any matter presented to the stockholders of the Corporation for their action or consideration at any meeting of stockholders of the Corporation;

5

(b) “B” shall mean the number of shares of Common Stock then issued and outstanding plus the number of shares of Common Stock then issuable upon conversion of the Series D Preferred Stock then issued and outstanding and any other series of Preferred Stock (other than the Series E Preferred Stock) then issued and outstanding, and entitled to vote on any matter presented to the stockholders of the Corporation for their action or consideration at any meeting of stockholders of the Corporation, in each case held by any holders of Series E Preferred Stock or an affiliate of any holders of Series E Preferred Stock;

(c) “C” shall mean the number of shares of Common Stock then issuable upon conversion of the Series E Preferred Stock then issued and outstanding; and

(d) “X” shall mean the Voting Adjustment Percentage.

3.2 Series E Preferred Stock Protective Provisions. At any time when at least 84,849 shares of Series E Preferred Stock (subject to appropriate adjustment in the event of any stock dividend, stock split, combination or other similar recapitalization with respect to the Series E Preferred Stock) are outstanding, the Corporation shall not, either directly or indirectly by amendment, merger, consolidation or otherwise, do any of the following without (in addition to any other vote required by law or the Certificate of Incorporation) the written consent or affirmative vote of the holders of at least 51% of the then outstanding shares of Series E Preferred Stock, given in writing or by vote at a meeting, consenting or voting (as the case may be) as a separate class, and any such act or transaction entered into without such consent or vote shall be null and void ab initio, and of no force or effect:

3.2.1 amend, alter or repeal any provision of the Certificate of Incorporation or bylaws of the Corporation in a manner that adversely and uniquely affects the powers, preferences or rights of the Series E Preferred Stock;

3.2.2 purchase or redeem (or permit any subsidiary to purchase or redeem) or pay or declare any dividend or make any distribution on, any shares of capital stock of the Corporation other than (i) redemptions of or dividends or distributions on the Series A Preferred Stock and Series D Preferred Stock, (ii) dividends or other distributions payable on the Common Stock solely in the form of additional shares of Common Stock, (iii) repurchases of stock from former employees, officers, directors, consultants or other persons who performed services for the Corporation or any subsidiary in connection with the cessation of such employment or service at the lower of the original purchase price or the then-current fair market value thereof pursuant to agreements between such persons and the Corporation or (iv) redemptions under Subsection 5 below; or

3.2.3 recapitalize or reclassify any of the Common Stock.

6

4. Optional Conversion.

The holders of the Series E Preferred Stock shall have conversion rights as follows (the “Conversion Rights”):

4.1 Right to Convert.

4.1.1 Termination of Conversion Rights. In the event of a notice of redemption of any shares of Series E Preferred Stock pursuant to Subsection 5, the Conversion Rights of the shares designated for redemption shall terminate at the close of business on the last full day preceding the date fixed for redemption, unless the redemption price is not fully paid on such redemption date, in which case the Conversion Rights for such shares shall continue until such price is paid in full. In the event of a liquidation, dissolution or winding up of the Corporation or a Sale of the Corporation, the Conversion Rights shall terminate at the close of business on the last full day preceding the date fixed for the payment of any such amounts distributable on such event to the holders of Series E Preferred Stock.

4.1.2 Conversion Ratio. Each share of Series E Preferred Stock shall be convertible, at the option of the holder thereof, at any time and from time to time, and without the payment of additional consideration by the holder thereof, into such number of fully paid and nonassessable shares of Common Stock as is determined by dividing the Series E Original Issue Price by the Series E Conversion Price (as defined below) in effect at the time of conversion. The “Series E Conversion Price” shall initially be equal to $0.70. Such initial Series E Conversion Price, and the rate at which shares of Series E Preferred Stock may be converted into shares of Common Stock, shall be subject to adjustment as provided below. Notwithstanding the foregoing, the Corporation shall not effect any conversion of such holder’s Series E Preferred Stock and such holder shall not be entitled to convert its shares of Series E Preferred Stock for a number of shares of Common Stock in excess of that number of shares of Common Stock which, upon giving effect to such conversion, would cause (a) the aggregate number of shares of Common Stock beneficially owned by a holder of Series E Preferred Stock and its affiliates and any other persons whose beneficial ownership of Common Stock would be aggregated with the holder’s for purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) to exceed 19.99% of the total number of issued and outstanding shares of Common Stock of the Corporation (including for such purpose the shares of Common Stock issuable upon conversion of the Series E Preferred Stock) following such conversion, or (b) the combined voting power of the securities of the Corporation beneficially owned by a holder of Series E Preferred Stock and its affiliates and any other persons whose beneficial ownership of Common Stock would be aggregated with the holder’s for purposes of Section 13(d) of the Exchange Act to exceed 19.99% of the combined voting power of all of the securities of the Corporation then outstanding following such conversion, unless, in either case, the stockholders of the Corporation approve the Nasdaq Proposal, in which case, the 19.99% limitation under clause (a) and clause (b) of this Section 4.1.2 shall be increased, with respect to any holder of Series E Preferred Stock, to 35% for purposes of both clause (a) and clause (b) of this Section 4.1.2. For purposes of this Section 4.1.2, the aggregate number of shares of Common Stock or voting securities beneficially owned by the holder and its affiliates and any other persons whose beneficial ownership of Common Stock would be aggregated with the holder’s for purposes of Section 13(d) of the

7

Exchange Act shall include the shares of Common Stock issuable upon the conversion of the Series E Preferred Stock with respect to which such determination is being made, but shall exclude the number of shares of Common Stock which would be issuable upon exercise or conversion of the unexercised, non-converted or non-cancelled portion of any other securities of the Corporation that do not have voting power (including without limitation any securities of the Corporation which would entitle the holder thereof to acquire at any time Common Stock, including without limitation any debt, preferred stock, right, option, warrant or other instrument that is at any time convertible into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive, Common Stock), subject to a limitation on conversion or exercise analogous to the limitation contained herein beneficially owned by the holder or any of its affiliates and other persons whose beneficial ownership of Common Stock would be aggregated with the holder’s for purposes of Section 13(d) of the Exchange Act.

4.2 Fractional Shares. No fractional shares of Common Stock shall be issued upon conversion of the Series E Preferred Stock. In lieu of any fractional shares to which the holder would otherwise be entitled, the Corporation shall pay cash equal to such fraction multiplied by the Market Price of a share of Common Stock. Whether or not fractional shares would be issuable upon such conversion shall be determined on the basis of the total number of shares of Series E Preferred Stock the holder is at the time converting into Common Stock and the aggregate number of shares of Common Stock issuable upon such conversion. The “Market Price” of the Common Stock shall be determined as follows: if the Common Stock is listed on a national securities exchange or another nationally recognized trading system, the Market Price per share of Common Stock shall be deemed to be the greater of (a) the 20 consecutive trading day average closing price per share of the Common Stock ending on the trading day immediately prior to the date of determination and (b) the closing price of the Common Stock on the trading day immediately prior to the date of determination; and if the Common Stock is not listed on a national securities exchange or another nationally recognized trading system, the Market Price per share of Common Stock shall be deemed to be the amount most recently determined by the Board to represent the fair market value per share of the Common Stock (including without limitation a determination for purposes of granting Common Stock options or issuing Common Stock under any plan, agreement or arrangement with employees of the Corporation). Upon request of a holder of Series E Preferred Stock, the Board (or a representative thereof) shall, as promptly as reasonably practicable but in any event not later than 10 days after such request, notify the holder of the Market Price and furnish the holder with reasonable documentation of the Board’s determination of such Market Price. Notwithstanding the foregoing, if the Board has not made such a determination within the three-month period prior to the date of determination, then the Board shall make, and shall provide or cause to be provided to the holder notice of, a determination of the Market Price within 15 days of a request by the holder that it do so.

4.3 Mechanics of Conversion.

4.3.1 Notice of Conversion. In order for a holder of Series E Preferred Stock to voluntarily convert shares of Series E Preferred Stock into shares of Common Stock, such holder shall surrender the certificate or certificates for such shares of Series E Preferred Stock (or, if such registered holder alleges that such certificate has been lost, stolen or destroyed, a lost certificate affidavit and agreement reasonably acceptable to the Corporation to indemnify the Corporation against any claim that may be made against the Corporation on account of the alleged loss, theft or destruction of such certificate), at the office of the transfer agent for the Series E Preferred Stock (or at the principal office of the Corporation if the Corporation serves as its own transfer agent), together with written notice that such holder elects to convert all or any number of the shares of the Series E Preferred Stock represented by such certificate or certificates and, if applicable, any event on which such conversion is contingent. Such notice shall state such holder’s name or the names of the nominees in which such holder wishes the certificate or certificates for shares of Common Stock to be issued. If required by the Corporation, certificates surrendered for conversion shall be endorsed or accompanied by a written instrument or instruments of transfer, in form satisfactory to the Corporation, duly executed by the registered holder or his, her or its attorney duly authorized in writing. The close of business on the date of receipt by the transfer agent (or by the Corporation if the Corporation serves as its own transfer agent) of such certificates (or lost certificate affidavit and agreement) and notice shall be the time of conversion (the “Conversion Time”), and the shares of Common Stock issuable upon conversion of the shares represented by such certificate shall be deemed to be outstanding of record as of such date. The Corporation shall, as soon as practicable after the Conversion Time, (i) issue and deliver to such holder of Series E Preferred Stock, or to his, her or its nominees, a certificate or certificates for the number of full shares of Common Stock issuable upon such conversion in accordance with the provisions hereof and a certificate for the number (if any) of the shares of Series E Preferred Stock represented by the surrendered certificate that were not converted into Common Stock, (ii) pay in cash such amount as provided in Subsection 4.2 in lieu of any fraction of a share of Common Stock otherwise issuable upon such conversion and (iii) subject to applicable law, pay all accrued or declared but unpaid dividends on the shares of Series E Preferred Stock converted.

8

4.3.2 Reservation of Shares. The Corporation shall at all times when the Series E Preferred Stock shall be outstanding, reserve and keep available out of its authorized but unissued capital stock, for the purpose of effecting the conversion of the Series E Preferred Stock, such number of its duly authorized shares of Common Stock as shall from time to time be sufficient to effect the conversion of all outstanding Series E Preferred Stock; and if at any time the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all then outstanding shares of the Series E Preferred Stock, the Corporation shall take such corporate action as may be necessary to increase its authorized but unissued shares of Common Stock to such number of shares as shall be sufficient for such purposes, including, without limitation, engaging in best efforts to obtain the requisite stockholder approval of any necessary amendment to the Certificate of Incorporation. Before taking any action which would cause an adjustment reducing the Series E Conversion Price below the then par value of the shares of Common Stock issuable upon conversion of the Series E Preferred Stock, the Corporation will take any corporate action which may, in the opinion of its counsel, be necessary in order that the Corporation may validly and legally issue fully paid and nonassessable shares of Common Stock at such adjusted Series E Conversion Price.

9

4.3.3 Effect of Conversion. All shares of Series E Preferred Stock which shall have been surrendered for conversion as herein provided shall no longer be deemed to be outstanding and all rights with respect to such shares shall immediately cease and terminate at the Conversion Time, except only the right of the holders thereof to receive shares of Common Stock in exchange therefor, to receive payment in lieu of any fraction of a share otherwise issuable upon such conversion as provided in Subsection 4.2 and to receive payment of any dividends accrued or declared but unpaid thereon. Any shares of Series E Preferred Stock so converted shall be retired and cancelled and may not be reissued as shares of such series, and the Corporation may thereafter take such appropriate action (without the need for stockholder action) as may be necessary to reduce the authorized number of shares of Series E Preferred Stock accordingly.

4.3.4 No Further Adjustment. Upon any such conversion, no adjustment to the Series E Conversion Price shall be made for any declared but unpaid dividends on the Series E Preferred Stock surrendered for conversion or on the Common Stock delivered upon conversion.

4.3.5 Taxes. The Corporation shall pay any and all issue and other similar taxes that may be payable in respect of any issuance or delivery of shares of Common Stock upon conversion of shares of Series E Preferred Stock pursuant to this Section 4. The Corporation shall not, however, be required to pay any tax which may be payable in respect of any transfer involved in the issuance and delivery of shares of Common Stock in a name other than that in which the shares of Series E Preferred Stock so converted were registered, and no such issuance or delivery shall be made unless and until the person or entity requesting such issuance has paid to the Corporation the amount of any such tax or has established, to the satisfaction of the Corporation, that such tax has been paid.

4.4 Adjustment for Stock Splits and Combinations. If the Corporation shall at any time or from time to time after the Series E Original Issue Date effect a subdivision of the outstanding Common Stock, the Series E Conversion Price in effect immediately before that subdivision shall be proportionately decreased so that the number of shares of Common Stock issuable on conversion of each share of such series shall be increased in proportion to such increase in the aggregate number of shares of Common Stock outstanding. If the Corporation shall at any time or from time to time after the Series E Original Issue Date combine the outstanding shares of Common Stock, the Series E Conversion Price in effect immediately before the combination shall be proportionately increased so that the number of shares of Common Stock issuable on conversion of each share of such series shall be decreased in proportion to such decrease in the aggregate number of shares of Common Stock outstanding. Any adjustment under this subsection shall become effective at the close of business on the date the subdivision or combination becomes effective.

4.5 Adjustment for Certain Dividends and Distributions. In the event the Corporation at any time or from time to time after the Series E Original Issue Date shall make or issue, or fix a record date for the determination of holders of Common Stock entitled to receive, a dividend or other distribution payable on the Common Stock in additional shares of Common Stock, then and in each such

10

event the Series E Conversion Price in effect immediately before such event shall be decreased as of the time of such issuance or, in the event such a record date shall have been fixed, as of the close of business on such record date, by multiplying the Series E Conversion Price then in effect by a fraction:

| (1) | the numerator of which shall be the total number of shares of Common Stock issued and outstanding immediately prior to the time of such issuance or the close of business on such record date, and |

| (2) | the denominator of which shall be the total number of shares of Common Stock issued and outstanding immediately prior to the time of such issuance or the close of business on such record date plus the number of shares of Common Stock issuable in payment of such dividend or distribution. |

Notwithstanding the foregoing, (a) if such record date shall have been fixed and such dividend is not fully paid or if such distribution is not fully made on the date fixed therefor, the Series E Conversion Price shall be recomputed accordingly as of the close of business on such record date and thereafter the Series E Conversion Price shall be adjusted pursuant to this subsection as of the time of actual payment of such dividends or distributions; and (b) no such adjustment shall be made if the holders of Series E Preferred Stock simultaneously receive a dividend or other distribution of shares of Common Stock in a number equal to the number of shares of Common Stock as they would have received if all outstanding shares of Series E Preferred Stock had been converted into Common Stock on the date of such event.

4.6 Adjustments for Other Dividends and Distributions. In the event the Corporation at any time or from time to time after the Series E Original Issue Date shall make or issue, or fix a record date for the determination of holders of Common Stock entitled to receive, a dividend or other distribution payable in securities of the Corporation (other than a distribution of shares of Common Stock in respect of outstanding shares of Common Stock) or in other property and the provisions of Subsection 1 do not apply to such dividend or distribution, then and in each such event the holders of Series E Preferred Stock shall receive, simultaneously with the distribution to the holders of Common Stock, a dividend or other distribution of such securities or other property in an amount equal to the amount of such securities or other property as they would have received if all outstanding shares of Series E Preferred Stock had been converted into Common Stock on the date of such event.

4.7 Adjustment for Merger or Reorganization, etc. Subject to the provisions of Subsection 2.3, if there shall occur any reorganization, recapitalization, reclassification, consolidation or merger involving the Corporation in which the Common Stock (but not the Series E Preferred Stock) is converted into or exchanged for securities, cash or other property (other than a transaction covered by Subsections 4.5 or 4.6), then, following any such reorganization, recapitalization, reclassification, consolidation or merger, each share of Series E Preferred Stock shall thereafter be convertible in lieu of the Common Stock into which it was convertible prior to

11

such event into the kind and amount of securities, cash or other property which a holder of the number of shares of Common Stock of the Corporation issuable upon conversion of one share of Series E Preferred Stock immediately prior to such reorganization, recapitalization, reclassification, consolidation or merger would have been entitled to receive pursuant to such transaction; and, in such case, appropriate adjustment (as determined in good faith by the Board) shall be made in the application of the provisions in this Section 4 with respect to the rights and interests thereafter of the holders of the Series E Preferred Stock, to the end that the provisions set forth in this Section 4 (including provisions with respect to changes in and other adjustments of the Series E Conversion Price) shall thereafter be applicable, as nearly as reasonably may be, in relation to any securities or other property thereafter deliverable upon the conversion of the Series E Preferred Stock.

4.8 Certificate as to Adjustments. Upon the occurrence of each adjustment or readjustment of the Series E Conversion Price pursuant to this Section 4, the Corporation at its expense shall, as promptly as reasonably practicable but in any event not later than 10 days thereafter, compute such adjustment or readjustment in accordance with the terms hereof and furnish to each holder of Series E Preferred Stock a certificate setting forth such adjustment or readjustment (including the kind and amount of securities, cash or other property into which the Series E Preferred Stock is convertible) and showing in detail the facts upon which such adjustment or readjustment is based. The Corporation shall, as promptly as reasonably practicable after the written request at any time of any holder of Series E Preferred Stock (but in any event not later than 10 days thereafter), furnish or cause to be furnished to such holder a certificate setting forth (i) the Series E Conversion Price then in effect, and (ii) the number of shares of Common Stock and the amount, if any, of other securities, cash or property which then would be received upon the conversion of Series E Preferred Stock.

4.9 Notice of Record Date. In the event:

(a) the Corporation shall take a record of the holders of its Common Stock (or other capital stock or securities at the time issuable upon conversion of the Series E Preferred Stock) for the purpose of entitling or enabling them to receive any dividend or other distribution, or to receive any right to subscribe for or purchase any shares of capital stock of any class or any other securities, or to receive any other security; or

(b) of any capital reorganization of the Corporation, any reclassification of the Common Stock of the Corporation, or any consolidation or merger of the Corporation; or

(c) of the voluntary or involuntary dissolution, liquidation or winding-up of the Corporation,

then, and in each such case, the Corporation will send or cause to be sent to the holders of the Series E Preferred Stock a notice specifying, as the case may be, (i) the record date for such dividend, distribution or right, and the amount and character of such dividend, distribution or right, or (ii) the effective date on which such reorganization, reclassification, consolidation, merger, transfer, dissolution, liquidation or winding-up is proposed to take place, and the time, if any is to be fixed, as of which the holders of record of Common Stock (or such other capital stock or securities at the time issuable upon the conversion of the Series E Preferred Stock) shall be entitled to exchange their shares of Common Stock (or such other capital stock or securities) for securities or other property deliverable upon such reorganization, reclassification, consolidation, merger, transfer, dissolution, liquidation or winding-up, and the amount per share and character of such exchange applicable to the Series E Preferred Stock and the Common Stock. Such notice shall be sent at least 10 days prior to the record date or effective date for the event specified in such notice.

12

5. Redemption by Corporation.

5.1 Redemption. Shares of Series E Preferred Stock may be redeemed by the Corporation out of funds lawfully available therefor at a price equal to the Series E Original Issue Price per share, plus all accrued or declared but unpaid dividends thereon (the “5.1 Redemption Price”), at any time after the later of (i) November 9, 2014 and (ii) the date that no shares of Series D Preferred Stock remain outstanding, if the closing sales price of the Common Stock for 20 or more trading days in a period of 30 consecutive trading days is equal to or greater than 400% of the Series E Conversion Price; provided, that the Corporation provides written notice of such redemption to each holder of Series E Preferred Stock within 30 days of the end of such 30 consecutive trading day period (the “5.1 Redemption Notice”). The Corporation shall send the 5.1 Redemption Notice to each holder of record of Series E Preferred Stock not less than 30 days prior to the date fixed by the Corporation for such redemption (the “5.1 Redemption Date”). The 5.1 Redemption Notice shall state:

(a) the 5.1 Redemption Date and the 5.1 Redemption Price;

(b) the date upon which the holder’s right to convert such shares terminates (as determined in accordance with Subsection 4.1); and

(c) that the holder is to surrender to the Corporation, in the manner and at the place designated, his, her or its certificate or certificates representing the shares of Series E Preferred Stock to be redeemed pursuant to this Section 5.1.

Notwithstanding anything to the contrary set forth in this Section 5, the Corporation may not exercise its right of redemption pursuant to this Section 5.1 with respect to any shares of Series E Preferred Stock which the holder thereof may not convert into Common Stock pursuant to Subsection 4.1 as a result of the beneficial ownership limitations set forth therein (each such share, a “Nonredeemable Series E Share” and collectively, the “Nonredeemable Series E Shares”).

5.2 Alternative Redemption. In the event that the Corporation exercises its redemption rights under Subsection 5.1 but is unable to redeem all of the shares of Series E Preferred Stock in accordance with the last sentence of Subsection 5.1, then the Corporation may redeem all or a portion of the Nonredeemable Series E Shares at a price per Nonredeemable Series E Share equal to the greater of (a) the 20 consecutive trading day average closing price per share of the Common Stock ending on the trading day immediately prior to the 5.1 Redemption Date plus any dividends accrued or declared but unpaid thereon and (b) the Series E Conversion Price plus any dividends accrued or declared but unpaid thereon (the “5.2 Redemption Price” and, together with the 5.1 Redemption Price, the “Redemption Prices”); provided, that the Corporation provides written notice of such redemption to each holder of Series E Preferred Stock within 30 days following the 5.1 Redemption Date (the “5.2 Redemption Notice” and, together with the 5.1 Redemption Notice, the “Redemption Notices”). The Corporation shall send the 5.2 Redemption Notice to each holder of record of Series E Preferred Stock not less than 30 days prior to the date fixed by the Corporation for such redemption (the “5.2 Redemption Date” and, together with the 5.1 Redemption Date, the “Redemption Dates”).

13

The 5.2 Redemption Notice shall state:

(a) the 5.2 Redemption Date and the 5.2 Redemption Price;

(b) the number of Nonredeemable Series E Shares (as determined in accordance with Subsection 4.1); and

(c) that the holder is to surrender to the Corporation, in the manner and at the place designated, his, her or its certificate or certificates representing the Nonredeemable Series E Shares of Series E Preferred Stock to be redeemed pursuant to this Section 5.2.

5.3 Surrender of Certificates; Payment. On or before a Redemption Date, each holder of shares of Series E Preferred Stock to be redeemed on such Redemption Date, unless such holder has exercised his, her or its right to convert such shares as provided in Subsection 4, shall surrender the certificate or certificates representing such shares (or, if such registered holder alleges that such certificate has been lost, stolen or destroyed, a lost certificate affidavit and agreement reasonably acceptable to the Corporation to indemnify the Corporation against any claim that may be made against the Corporation on account of the alleged loss, theft or destruction of such certificate) to the Corporation, in the manner and at the place designated in the notice from the Corporation, and thereupon the applicable Redemption Price for such shares shall be payable to the order of the person whose name appears on such certificate or certificates as the owner thereof. In the event less than all of the shares of Series E Preferred Stock represented by a certificate are redeemed, a new certificate representing the unredeemed shares of Series E Preferred Stock shall promptly be issued to such holder.

5.4 Rights Subsequent to Redemption. If a Redemption Notice shall have been duly given, and if on the applicable Redemption Date the applicable Redemption Price payable upon redemption of the shares of Series E Preferred Stock to be redeemed on such Redemption Date is paid or tendered for payment or deposited with an independent payment agent so as to be available therefor in a timely manner, then notwithstanding that the certificates evidencing any of the shares of Series E Preferred Stock so called for redemption on such Redemption Date shall not have been surrendered, dividends with respect to such shares of Series E Preferred Stock shall cease to accrue after such Redemption Date and all rights with respect to such shares shall forthwith after such Redemption Date terminate, except only the right of the holders to receive the applicable Redemption Price without interest upon surrender of their certificate or certificates therefor.

14

5.5 Redemption Approval. Notwithstanding anything to the contrary set forth in this Section 5, no redemptions may be effected by the Corporation pursuant to Subsection 5.1 or Subsection 5.2 unless and until such redemption has been approved by a majority in number of the directors of the Corporation that are not affiliated with any holder of the Series E Preferred Stock or the Warrants (as defined in the Series E Purchase Agreement) and were not elected as a director of the Corporation as a result of being nominated or submitted for consideration by any holder of the Series E Preferred Stock or Warrants or any affiliate thereof.

6. Redeemed or Otherwise Acquired Shares. Any shares of Series E Preferred Stock that are redeemed or otherwise acquired (including pursuant to Subsection 5.4) by the Corporation or any of its subsidiaries shall be automatically and immediately cancelled and retired and shall not be reissued, sold or transferred. Neither the Corporation nor any of its subsidiaries may exercise any voting or other rights granted to the holders of Series E Preferred Stock following redemption.

7. Waiver. Any of the rights, powers, preferences and other terms of the Series E Preferred Stock set forth herein may be waived on behalf of all holders of Series E Preferred Stock by the affirmative written consent or vote of the holders of at least a majority of the then outstanding Series E Preferred Stock.

8. Notices. Any notice required or permitted to be given to a holder of shares of Series E Preferred Stock shall be mailed, postage prepaid, to the post office address last shown on the records of the Corporation, or given by electronic communication in compliance with the provisions of the General Corporation Law, and shall be deemed sent upon such mailing or electronic transmission.

IN WITNESS WHEREOF, this Certificate of Designations has been executed by a duly authorized officer of this corporation on this 9th day of November, 2012.

| By: | /s/ Sudhir Agrawal | |

| Chief Executive Officer |

15