Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material under §240.14a-12 |

|

| IDERA PHARMACEUTICALS, INC. | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

Payment of Filing Fee (Check the appropriate box): |

||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

IDERA PHARMACEUTICALS, INC.

167 Sidney Street

Cambridge, Massachusetts 02139

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERS

Date and Time: |

Wednesday, June 20, 2018 at 10:00 a.m., local time | |

Place: |

Idera Pharmaceuticals, Inc. |

|

Items of Business: |

At our 2018 annual meeting of stockholders we will ask our stockholders to: |

|

|

• Elect three Class II directors to our board of directors for terms to expire at the 2021 annual meeting of stockholders; |

|

|

• Approve an amendment to our Restated Certificate of Incorporation, as amended, to effect a reverse stock split of our issued and outstanding common stock by a whole number ratio of not less than 1-for-4 and not more than 1-for-8, such ratio and the implementation and timing of such reverse stock split to be determined in the discretion of our board of directors at any time prior to our 2019 annual meeting of stockholders, and, in connection therewith, to decrease the number of authorized shares of our common stock on a basis proportional to the reverse stock split ratio; |

|

|

• Approve an amendment to our Restated Certificate of Incorporation, as amended, to set the number of authorized shares of our common stock at a number determined by calculating the product of 280,000,000 multiplied by two times (2x) the reverse stock split ratio. This Proposal Three is subject to approval by our stockholders of the amendment to our Restated Certificate of Incorporation, as amended, effecting the reverse stock split as set forth in Proposal Two and, therefore, will not be implemented unless Proposal Two is approved and such reverse stock split is implemented; |

|

|

• Approve, by non-binding vote, executive compensation; |

|

|

• Ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018; and |

|

|

• Transact any other business as may properly come before the 2018 annual meeting or any postponement or adjournment of the 2018 annual meeting. |

|

|

The board of directors has no knowledge of any other business to be transacted at the 2018 annual meeting. |

|

Record Date: |

You may vote at the 2018 annual meeting if you were a stockholder of record at the close of business on May 17, 2018. |

Proxy Voting: |

It is important that your shares be represented and voted at the 2018 annual meeting. Whether or not you plan to attend the 2018 annual meeting, please mark, sign, date and promptly mail your proxy card in the enclosed postage-paid envelope or follow the instructions on the proxy card to vote by telephone or over the internet. You may revoke your proxy at any time before its exercise at the 2018 annual meeting. |

By order of the board of directors,

| /s/ LOUIS J. ARCUDI, III Louis J. Arcudi, III Senior Vice President of Operations, Chief Financial Officer, Treasurer and Assistant Secretary Cambridge, Massachusetts |

||

May 22, 2018 |

167 Sidney Street

Cambridge, Massachusetts 02139

PROXY STATEMENT

For our Annual Meeting of Stockholders to be held on June 20, 2018

Idera Pharmaceuticals, Inc., a Delaware corporation, which is referred to as "we," "us," the "Company" or "Idera" in this proxy statement, is sending you this proxy statement and the enclosed proxy card because our board of directors is soliciting your proxy to vote at our 2018 annual meeting of stockholders, or the 2018 annual meeting. The 2018 annual meeting will be held on Wednesday, June 20, 2018, at 10:00 a.m., local time, at our office located at 505 Eagleview Boulevard, Suite 212, Exton, Pennsylvania 19341. If the 2018 annual meeting is adjourned for any reason, then proxies submitted may be used at any adjournment of the 2018 annual meeting.

This proxy statement summarizes information about the proposals to be considered at the 2018 annual meeting and other information you may find useful in determining how to vote. The proxy card is one means by which you may authorize another person to vote your shares in accordance with your instructions.

We are mailing this proxy statement and the enclosed proxy card to stockholders on or about May 23, 2018.

In this mailing, we are also including copies of our annual report to stockholders for the year ended December 31, 2017, or 2017 Annual Report. Our 2017 Annual Report consists of our annual report on Form 10-K for the year ended December 31, 2017, as filed with the Securities and Exchange Commission, or the SEC, on March 7, 2018, including our audited financial statements, which annual report on Form 10-K is available free of charge on our website, www.iderapharma.com, where it can be accessed by clicking "Investors" and then "SEC Filings," or through the SEC's electronic data system at www.sec.gov. To obtain directions to be able to attend the 2018 annual meeting and vote in person, write to Investor Relations, Idera Pharmaceuticals, Inc., 167 Sidney Street, Cambridge, Massachusetts 02139, call our toll-free number 1 (877) 888-6550, or email Investor Relations at ir@iderapharma.com.

Important Notice Regarding the Availability of

Proxy Materials for the 2018 Annual Meeting

to Be Held on June 20, 2018:

The Notice of Annual Meeting, Proxy Statement and 2017 Annual Report are available at http://ir.iderapharma.com/shareholder-services/annual-meeting.

1

INFORMATION ABOUT THE 2018 ANNUAL MEETING

Holders of record of our common stock at the close of business on May 17, 2018, the record date for the 2018 annual meeting, are entitled to vote on each matter properly brought before the 2018 annual meeting. Holders of our common stock will be entitled to one vote for each share of common stock held as of the record date. As of the close of business on May 17, 2018, the record date for the 2018 annual meeting, we had 217,310,991 shares of common stock outstanding.

How do I vote my shares if I am a stockholder of record?

If you are a stockholder of record (meaning that you hold shares in your name in the records of our transfer agent, Computershare Trust Company, N.A., and that your shares are not held in "street name" by a bank or brokerage firm), you may vote your shares in any one of the following ways:

- •

- You may vote by mail. To vote by mail, you need to complete, date and sign

the proxy card that accompanies this proxy statement and promptly mail it in the enclosed postage-prepaid envelope. You do not need to put a stamp on the enclosed envelope if you mail it from within

the United States.

- •

- You may vote by telephone. To vote by telephone through services provided

by Computershare Trust Company, N.A., call 1-800-652-VOTE (8683), and follow the instructions provided on the proxy card that accompanies this proxy statement. If you vote by telephone, you do not

need to complete and mail your proxy card.

- •

- You may vote over the internet. To vote over the internet through services

provided by Computershare Trust Company, N.A., please go to the following website: http://www.investorvote.com/IDRA and follow the instructions at that site for submitting your proxy. If you vote over

the internet, you do not need to complete and mail your proxy card.

- •

- You may vote in person. If you attend the 2018 annual meeting, you may vote by delivering your completed proxy card in person or you may vote by completing a ballot at the 2018 annual meeting. Ballots will be available at the 2018 annual meeting.

Your proxy will only be valid if you complete and return the proxy card, vote by telephone or vote over the internet at or before the 2018 annual meeting. The persons named in the proxy card will vote the shares you own in accordance with your instructions on your proxy card, in your vote by telephone or in your vote over the internet. If you return the proxy card, vote by telephone or vote over the internet, but do not give any instructions on a particular matter described in this proxy statement, the persons named in the proxy card will vote the shares you own in accordance with the recommendations of our board of directors.

How do I vote my shares if I hold them in "street name?"

If the shares you own are held in "street name" by a bank or brokerage firm, your bank or brokerage firm, as the record holder of your shares, is required to vote your shares according to your instructions. In order to vote your shares, you will need to follow the directions that your bank or brokerage firm provides to you. Many banks and brokerage firms solicit voting instructions over the internet or by telephone.

Under applicable stock exchange rules, banks or brokerage firms subject to these rules that hold shares in street name for customers have the discretion to vote those shares with respect to certain matters if they have not received instructions from the beneficial owners. Banks or brokerage firms will have this discretionary authority with respect to routine or "discretionary" matters. Among the proposals to be presented at the 2018 annual meeting, Proposal Two (approval of a reverse stock split),

2

Proposal Three (approval of an amendment setting the number of authorized shares of common stock) and Proposal Five (the ratification of the selection of our independent registered public accounting firm) are discretionary matters, and banks and brokerage firms are permitted to vote your shares even if you have not given voting instructions. Proposal One (the election of directors) and Proposal Four (the approval of a non-binding vote on executive compensation) are non-routine or "non-discretionary" matters, and banks and brokerage firms cannot vote your shares on such proposals if you have not given voting instructions. "Broker non-votes" occur when a bank or brokerage firm submits a proxy for shares but does not indicate a vote for a particular proposal because the bank or brokerage firm either does not have authority to vote on that proposal and has not received voting instructions from the beneficial owner, or has discretionary authority but chooses not to exercise it. The effect of broker non-votes is discussed below in the answer to the question "What vote is required to approve each matter and how will votes be counted?".

Even if your shares are held in street name, you are welcome to attend the 2018 annual meeting. If your shares are held in street name, you may not vote your shares in person at the 2018 annual meeting unless you obtain a proxy, executed in your favor, from the holder of record (i.e., your bank or brokerage firm). If you hold your shares in street name and wish to vote in person, please contact your bank or brokerage firm before the 2018 annual meeting to obtain the necessary proxy from the holder of record.

How may I change or revoke my vote?

If you are a stockholder of record, even if you complete and return a proxy card or vote by telephone or over the internet, you may change or revoke your vote at any time before your proxy is exercised by taking one of the following actions:

- •

- send written notice to our Assistant Secretary, Louis J. Arcudi, III, at our address above, stating that you wish to revoke your vote;

- •

- deliver to us another signed proxy card with a later date or vote by telephone or over the internet at a later date; or

- •

- attend the 2018 annual meeting, notify our Assistant Secretary that you are present and then vote by ballot.

If you own shares in street name, your bank or brokerage firm should provide you with instructions for changing or revoking your vote.

In order for business to be conducted at the 2018 annual meeting, a quorum must be present. A quorum consists of the holders of a majority of the shares of our common stock issued, outstanding and entitled to vote at the 2018 annual meeting.

Shares of common stock present in person or represented by proxy (including broker non-votes and shares that are abstained or withheld or with respect to which no voting instructions are provided for one or more of the matters to be voted upon) will be counted for the purpose of determining whether a quorum exists.

If a quorum is not present, the 2018 annual meeting will be adjourned until a quorum is obtained.

What vote is required to approve each matter and how will votes be counted?

The table below sets forth the vote required for each matter being submitted to our stockholders at the 2018 annual meeting to be approved and the effect that abstentions, withheld votes and broker

3

non-votes will have on the outcome of voting on each proposal that is being submitted to our stockholders for approval at the 2018 annual meeting.

Proposal

|

Affirmative Vote Required | Abstentions/ Withholds | Broker Non-Votes | |||

|---|---|---|---|---|---|---|

| Election of Directors (Proposal 1) |

Plurality of votes cast by holders of common stock entitled to vote | No effect(1) | No effect | |||

Approve Reverse Stock Split (Proposal 2) |

Majority of issued and outstanding common stock entitled to vote |

Has the same effect as a vote AGAINST |

Has the same effect as a vote AGAINST |

|||

Approve Setting Number of Authorized Shares of Common Stock (Proposal 3) |

Majority of issued and outstanding common stock entitled to vote |

Has the same effect as a vote AGAINST |

Has the same effect as a vote AGAINST |

|||

Advisory Vote on Executive Compensation (Proposal 4) |

Majority of common stock present or represented and voting on the matter |

No effect |

No effect |

|||

Ratification of Selection of Ernst & Young LLP (Proposal 5) |

Majority of common stock present or represented and voting on the matter |

No effect |

No effect |

- (1)

- You may vote FOR all of the director nominees, WITHHOLD your vote from all of the director nominees or WITHHOLD your vote from any of the director nominees.

Each share of common stock will be counted as one vote.

How does the board of directors recommend that I vote?

Our board of directors recommends that you vote as follows:

- •

- To elect the three nominees to our board of directors (Proposal One); and

- •

- FOR Proposal Two, Proposal Three, Proposal Four and Proposal Five.

Under the Securities Exchange Act of 1934, as amended, or the Exchange Act, and related SEC regulations, the vote on executive compensation, as described in greater detail in Proposal Four, set forth elsewhere in this proxy statement, is an advisory vote, meaning it is non-binding. The vote on the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm, as described in greater detail in Proposal Five, is also advisory. Our board will carefully consider the outcome of each of these votes.

Will any other business be conducted at the 2018 annual meeting of stockholders?

Our board of directors does not know of any other business to be conducted or matters to be voted upon at the 2018 annual meeting. If any other matter properly comes before the 2018 annual meeting, the persons named in the proxy card that accompanies this proxy statement will exercise their judgment in deciding how to vote or otherwise act with respect to that matter at the 2018 annual meeting.

4

Who is making and paying for the solicitation of proxies and how is it made?

We are making the solicitation and will bear the costs of soliciting proxies. In addition to solicitations by mail, our directors, officers and employees, without additional remuneration, may solicit proxies by telephone, facsimile, email, personal interviews and other means. We have retained MacKenzie Partners, Inc. to assist in the solicitation of proxies in connection with the 2018 annual meeting for an estimated fee of approximately $10,000, plus expenses. We have requested that brokerage houses, custodians, nominees and fiduciaries forward copies of the proxy materials to the persons for whom they hold shares and request instructions for voting the proxies. We will reimburse the brokerage houses and other persons for their reasonable out-of-pocket expenses in connection with this distribution.

How and when may I submit a proposal for the 2019 annual meeting of stockholders?

If you are interested in submitting a proposal for inclusion in the proxy statement and proxy card for our 2019 annual meeting of stockholders, or the 2019 annual meeting, you need to follow the procedures outlined in Rule 14a-8 of the Exchange Act. We must receive your proposal intended for inclusion in the proxy statement at our principal executive offices, 167 Sidney Street, Cambridge, Massachusetts 02139, Attention: Secretary, no later than January 23, 2019. SEC rules set standards for the types of stockholder proposals and the information that must be provided by the stockholder making the request.

If you wish to present a proposal at the 2019 annual meeting, but do not wish to have the proposal considered for inclusion in the proxy statement and proxy card or have not complied with the requirements for inclusion of such proposal in our proxy statement under SEC rules, you must also give written notice to us at the address noted above. Our bylaws specify the information that must be included in any such notice, including a brief description of the business to be brought before the annual meeting, the name of the stockholder proposing such business and stock ownership information for such stockholder. In accordance with our bylaws, we must receive this notice at least 60 days, but not more than 90 days, prior to the date of the 2019 annual meeting and the notice must include specified information regarding the proposal and the stockholder making the proposal.

Notwithstanding the foregoing, if we provide less than 70 days' notice or prior public disclosure of the date of the annual meeting to the stockholders, notice by the stockholders must be received by our Secretary no later than the close of business on the tenth day following the date on which the notice of the annual meeting was mailed or such public disclosure was made, whichever occurs first. If a stockholder who wished to present a proposal fails to notify us by this date, the proxies that management solicits for that meeting will have discretionary authority to vote on the stockholder's proposal if it is otherwise properly brought before that meeting. If a stockholder makes timely notification, the proxies may still exercise discretionary authority to vote on stockholder proposals under circumstances consistent with the SEC's rules.

Are annual meeting materials householded?

Some banks and brokerage firms may be participating in the practice of "householding" proxy statements and annual reports. This means that the banks and brokerage firms send only one copy of this proxy statement and the accompanying 2017 Annual Report to multiple stockholders in the same household. Upon request, we will promptly deliver separate copies of this proxy statement and our annual report to stockholders. To make such a request, please call Investor Relations at 1 (877) 888-6550, write to Investor Relations, 167 Sidney Street, Cambridge, Massachusetts 02139 or email Investor Relations at ir@iderapharma.com. To receive separate copies of our annual report to stockholders and proxy statement in the future, or to receive only one copy for the household, please contact us or your bank or brokerage firm.

5

PROPOSAL ONE

ELECTION OF DIRECTORS

Our board of directors is divided into three classes and currently consists of three Class I directors: Vincent J. Milano, Kelvin M. Neu, M.D. and William S. Reardon, C.P.A.; three Class II directors: Julian C. Baker, James A. Geraghty and Maxine Gowen, Ph.D.; and one Class III director: Mark Goldberg, M.D. Each member of a class is elected for a three-year term, with the terms staggered so that approximately one-third of our directors stand for election at each annual meeting of stockholders. The Class I, Class II and Class III directors were elected to serve until the annual meeting of stockholders to be held in 2020, 2018 and 2019, respectively, and until their respective successors are elected and qualified.

Our board of directors, on the recommendation of the members of our nominating and corporate governance committee, has nominated Mr. Baker, Mr. Geraghty and Dr. Gowen for election as Class II directors at the 2018 annual meeting. At the 2018 annual meeting, stockholders will be asked to consider the election of Mr. Baker, Mr. Geraghty and Dr. Gowen. Dr. Gowen has been nominated for election as a director at a meeting of our stockholders for the first time. In January 2016, Dr. Gowen was elected to our board of directors as a Class II director by action of our board of directors with a term expiring at our 2018 annual meeting. Dr. Gowen was recommended for initial election to our board of directors by our nominating and corporate governance committee.

The persons named in the enclosed proxy card will vote to elect Mr. Baker, Mr. Geraghty and Dr. Gowen to our board of directors unless you indicate that you withhold authority to vote for the election of any or all nominees. You may not vote for more than three directors. Each Class II director will be elected to hold office until our 2021 annual meeting of stockholders and until his or her successor is elected and qualified or until his or her earlier resignation, death or removal. Each of the nominees is presently a director and each has indicated a willingness to serve as a director, if elected. If a nominee becomes unable or unwilling to serve, however, the persons acting under the proxy may vote for substitute nominees selected by the board of directors.

On January 21, 2018, we entered into an Agreement and Plan of Merger, or the Merger Agreement, with BioCryst Pharmaceuticals, Inc., a Delaware corporation, or BioCryst, Nautilus Holdco, Inc., a Delaware corporation and a wholly owned subsidiary of BioCryst, or Holdco, Island Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Holdco, or Merger Sub A, and Boat Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Holdco, or Merger Sub B. Pursuant to the Merger Agreement, and subject to the satisfaction or waiver of the conditions specified therein, (a) Merger Sub A will be merged with and into us, or the Idera Merger, with us surviving as a wholly owned subsidiary of Holdco, and (b) Merger Sub B will be merged with and into BioCryst, or the BioCryst Merger, which we refer to together with the Idera Merger as the Mergers, with BioCryst surviving as a wholly owned subsidiary of Holdco. We and BioCryst are each planning to hold a special meeting of stockholders to vote on, among other things, the Merger Agreement on July 10, 2018, and, if approved by both our stockholders and BioCryst's stockholders, we expect to consummate the Mergers as soon as practicable thereafter. If the Mergers are consummated, at the effective time of the Mergers and in accordance with the terms of the Merger Agreement, each of Mr. Milano, Dr. Neu, Mr. Reardon, Mr. Baker, Mr. Geraghty, Dr. Gowen and Dr. Goldberg are expected to resign from his or her respective position as a member of our board of directors and any committee thereof. Following the effective time of the Mergers, it is anticipated that Messrs. Milano and Geraghty and Drs. Goldberg and Gowen will serve as members of Holdco's board of directors.

6

Information about our Directors

Set forth below are the names of each of the nominees for election to our board of directors, the names of each of our other continuing directors, the year in which each director first became a director, their age as of April 30, 2018, their positions and offices with our Company, their principal occupations and business experience during at least the past five years and the names of other public companies for which they currently serve, or have served within the past five years, as a director. We have also included information about each director's specific experience, qualifications, attributes or skills that led our board of directors to conclude that such individual should serve as one of our directors. We also believe that all of our directors have a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to Idera and our board of directors.

Recommendation of the Board of Directors

Our board of directors unanimously recommends that the stockholders vote FOR the election of Mr. Baker, Mr. Geraghty and Dr. Gowen as

Class II directors.

Class II Nominees—Terms to Expire in 2018

Julian C. Baker

Director since 2014

Mr. Baker, age 51, is a Managing Partner of Baker Brothers Investments, which he founded in 2000 with his brother, Dr. Felix J. Baker. The firm primarily manages long-term investment funds focused on publicly traded life sciences companies. Mr. Baker's career as a fund manager began in 1994 when he co-founded a biotechnology investing partnership with his brother and the Tisch Family. Previously, Mr. Baker was employed from 1988 to 1993 by the private equity investment arm of Credit Suisse First Boston Corporation. He also serves on the boards of directors of Acadia Pharmaceuticals, Inc., Incyte Corporation and Genomic Health, Inc. and previously served on the board of directors of Trimeris, Inc. Mr. Baker holds an A.B. from Harvard University. We believe that Mr. Baker's qualifications to sit on our board of directors include his financial expertise, affiliation with one of our significant stockholders, knowledge of our industry and significant public company board experience.

James A. Geraghty

Director since 2013

Mr. Geraghty, age 63, has served as chairman of our board of directors since July 2013. He was an Entrepreneur in Residence at Third Rock Ventures from May 2013 to October 2016. Mr. Geraghty served as a Senior Vice President of Sanofi, a global healthcare company, from April 2011 to December 2012. Prior to that, he served in various senior management roles at Genzyme Corporation, a biotechnology company, from 1992 to April 2011, including as Senior Vice President, International Development from January 2007 to April 2011. Mr. Geraghty currently serves as chairman of the board of Juniper Pharmaceuticals, Inc., a publicly traded company, and as a member of the board of Voyager Therapeutics, Inc., a publicly traded company. He also serves as a director of Fulcrum Therapeutics, Inc. He previously served as a director of bluebird bio Inc. and GTC Biotherapeutics, Inc. We believe that Mr. Geraghty's qualifications to sit on our board of directors include his public company board and management experience and his broad and deep knowledge of the industry in which we operate.

7

Maxine Gowen, Ph.D.

Director since 2016

Dr. Gowen, age 59, has served as the founding President and CEO and a member of the board of directors of Trevena, Inc., a biopharmaceutical company, since November 2007. Prior to joining Trevena, Dr. Gowen was Senior Vice President for the Center of Excellence for External Drug Discovery at GlaxoSmithKline plc, or GSK, where she held a variety of leadership positions during her tenure of 15 years. Before GSK, Dr. Gowen was Senior Lecturer and Head, Bone Cell Biology Group, Department of Bone and Joint Medicine, of the University of Bath, U.K. Dr. Gowen has served as a director of Akebia Therapeutics, Inc., a publicly traded company, since July 2014. From 2008 until 2012, Dr. Gowen served as a director of Human Genome Sciences, Inc., a publicly traded company. She received her Ph.D. from the University of Sheffield, U.K., an M.B.A. with academic honors from The Wharton School of the University of Pennsylvania, and a B.Sc. with Honors in Biochemistry from the University of Bristol, U.K. We believe that Dr. Gowen's qualifications to sit on our board of directors include her significant public company management and board experience and knowledge of our industry.

Class I Directors—Terms to Expire in 2020

Vincent J. Milano

Director since 2014

Vincent Milano, age 54, has been our President and Chief Executive Officer, and a member of our board of directors, since December 2014. Prior to joining us, Mr. Milano served as Chairman, President and Chief Executive Officer of ViroPharma Inc., a pharmaceutical company that was acquired by Shire Plc in January 2014, from March 2008 to January 2014, as its Vice President, Chief Financial Officer and Chief Operating Officer from January 2006 to March 2008 and as its Vice President, Chief Financial Officer and Treasurer from April 1996 to December 2005. Mr. Milano also served on the board of directors of ViroPharma from March 2008 to January 2014. Prior to joining ViroPharma, Mr. Milano served in increasingly senior roles, most recently senior manager, at KPMG LLP, an independent registered public accounting firm, from July 1985 to March 1996. Mr. Milano currently serves on the board of directors of Spark Therapeutics, Inc. and Vanda Pharmaceuticals Inc., each a publicly traded company, and VenatoRx Pharmaceuticals, Inc. Mr. Milano holds a Bachelor of Science degree in Accounting from Rider College. We believe Mr. Milano's qualifications to sit on our board of directors include his knowledge of our company as our President and Chief Executive Officer, knowledge of our industry, including over 20 years of experience serving in a variety of roles of increasing responsibility in the finance department, corporate administration and operations of a multinational biopharmaceutical company, and understanding of pharmaceutical research and development, sales and marketing, strategy, and operations in both the United States and overseas. He also has corporate governance experience through service on other public company boards.

Kelvin M. Neu, M.D.

Director since 2014

Dr. Neu, age 44, is a Managing Director of Baker Bros. Advisors LP and has been with the firm since 2004. The firm primarily manages long-term investment funds focused on publicly traded life sciences companies. Dr. Neu previously served on the board of directors of XOMA Corporation, a publicly traded company. Dr. Neu also served as a director of AnorMED Inc. and diaDexus, Inc. Dr. Neu holds an A.B. in Molecular Biology from Princeton University and an M.D. from Harvard Medical School and the Harvard-MIT Division of Health Sciences and Technology. He also trained for three years in the Immunology Ph.D. program at Stanford University. We believe that Dr. Neu's qualifications to sit on our board of directors include his scientific background, affiliation with one of our significant stockholders and knowledge of our industry.

8

William S. Reardon, C.P.A.

Director since 2002

Mr. Reardon, age 71, has been a director since 2002 and served as lead independent director of our board of directors from September 2010 to July 2013. He served as an audit partner at PricewaterhouseCoopers LLP, where he led the Life Science Industry Practice for New England and the Eastern United States from 1986 until his retirement from the firm in July 2002. Mr. Reardon currently serves as a trustee of closed-end mutual funds Tekla Healthcare Investors, Tekla Life Sciences Investors and of Tekla Healthcare Opportunities Fund and Tekla World Healthcare Fund. Mr. Reardon also previously served as a director of Synta Pharmaceuticals Corp., a publicly traded company. We believe that Mr. Reardon's qualifications to sit on our board of directors include his accounting and financial experience, including as a partner at a leading accounting firm leading its life science practice, his role in keeping the board of directors and senior management team abreast of current accounting regulations and his experience as a member of several boards of directors of biotechnology companies. Additionally, we value Mr. Reardon's role in leading the board on matters of corporate governance, before, during and after his service as lead independent director.

Class III Directors—Terms to Expire in 2019

Mark Goldberg, M.D.

Director since 2014

Dr. Goldberg, age 63, served as consultant and medical and regulatory strategist for Synageva BioPharma Corp., a biopharmaceutical company, from October 2014 until June 2015. Prior to that, he served as the Executive Vice President for Medical and Regulatory Strategy of Synageva from January 2014 to October 2014 and as the Senior Vice President of Medical and Regulatory Affairs of Synageva from September 2011 to January 2014. Dr. Goldberg served in a variety of senior management positions at Genzyme Corporation from 1996 to July 2011, including most recently as Senior Vice President for Clinical Development and Therapeutic Group Head for Oncology and Personalized Genetic Health from 2009 to July 2011. Prior to working at Genzyme Corporation, he was a full-time staff physician at Brigham and Women's Hospital and Dana Farber Cancer Institute, where he still holds appointments. He has also been an Associate Professor of Medicine at Harvard Medical School since 1996. Dr. Goldberg is a board-certified medical oncologist and hematologist and has more than 50 published papers. Dr. Goldberg currently serves on the board of directors of ImmunoGen, Inc. GlycoMimetics, Inc., Blueprint Medicines Corporation and Audentes Therapeutics, Inc., all publicly traded companies. He also served on the board of directors of aTyr Pharma, Inc. from 2015 to 2017. Dr. Goldberg holds an A.B. from Harvard College and an M.D. from Harvard Medical School. We believe that Dr. Goldberg's qualifications to sit on our board of directors include his extensive scientific and medical background, public company board experience and extensive experience in the management and operations of pharmaceutical companies.

We use a combination of cash and equity-based compensation to attract and retain candidates to serve on our board of directors. We do not compensate directors who are also our employees for their service on our board of directors. As a result, Mr. Milano does not, and Dr. Sudhir Agrawal, our former director and President of Research, did not, receive any compensation for their service on our board of directors.

We generally review our director compensation program every two years with the advice of an independent compensation consultant. In November 2016, we modified our director compensation program, effective January 1, 2017.

9

Under our director compensation program, we pay our non-employee directors retainers in cash. Each director receives a cash retainer for service on the board of directors and for service on each committee on which the director is a member. The chairmen of each committee receive higher retainers for such service. These fees are paid quarterly in arrears. The fees paid to non-employee directors for service on the board of directors and for service on each committee of the board of directors on which the director was a member during 2017 were as follows:

| |

Member Annual Fee |

Chairman Annual Fee |

|||||

|---|---|---|---|---|---|---|---|

Board of Directors |

$ | 35,000 | $ | 70,000 | |||

Audit Committee |

$ | 7,500 | $ | 15,000 | |||

Compensation Committee |

$ | 6,250 | $ | 12,500 | |||

Nominating and Corporate Governance Committee |

$ | 4,000 | $ | 8,000 | |||

Our director compensation program includes a stock-for-fees policy, under which directors have the right to elect to receive common stock in lieu of cash fees. These shares of common stock are issued under our 2013 Stock Incentive Plan. The number of shares issued to participating directors is determined on a quarterly basis by dividing the cash fees to be paid through the issuance of common stock by the fair market value of our common stock, which is the closing price of our common stock, on the first business day of the quarter following the quarter in which the fees are earned. In 2017, several of our directors elected to receive shares of our common stock in lieu of cash fees as set forth in the footnotes to the Director Compensation table below. No other director elected to receive shares of our common stock in lieu of cash fees during 2017.

Under our director compensation program, we also reimburse our directors for travel and other related expenses for attendance at meetings.

Under our current director compensation program, upon their initial election to the board of directors, new non-employee directors receive an initial option grant to purchase 100,000 shares of our common stock, and all non-employee directors, other than the chairman, receive an annual option grant to purchase 50,000 shares of our common stock. The chairman receives an annual option grant for 63,000 shares of our common stock. The annual grants are made on the date of our annual meeting of stockholders and fully vest one year from that date of grant. The initial options granted to our non-employee directors vest with respect to one third of the underlying shares on the first anniversary of the date of grant and the balance of the underlying shares vest in eight equal quarterly installments following the first anniversary of the date of grant, subject to continued service as a director, and are granted under our 2013 Stock Incentive Plan. These options are granted with exercise prices equal to the fair market value of our common stock, which is the closing price of our common stock, on the date of grant and will become immediately exercisable in full if there is a change in control of our company.

Under our retirement policy for non-employee members of the board of directors, if a non-employee director is deemed to retire, then:

- •

- all outstanding options held by such director will automatically vest in full; and

- •

- the period during which such director may exercise the options will be extended to the expiration of the option under the plan.

Under the policy, a non-employee director will be deemed to have retired if:

- •

- the director resigns from the board of directors or determines not to stand for re-election or is not nominated for re-election at a meeting of our stockholders and has served as a director for more than 10 years; or

10

- •

- the director does not stand for re-election or is not nominated for re-election due to the fact that he or she is or will be older than 75 at the end of such director's term.

The following table sets forth a summary of the compensation we paid to our non-employee directors who served on our board in 2017.

DIRECTOR COMPENSATION FOR 2017

Name

|

Fees Earned or Paid in Cash ($) |

Option Awards ($)(1) |

All Other Compensation ($) |

Total ($) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Julian C. Baker | 35,000 | (2) | 55,915 | — | 90,915 | ||||||||

| James A. Geraghty | 85,500 | 70,452 | — | 155,952 | |||||||||

| Mark Goldberg | 42,500 | 55,915 | — | 98,415 | |||||||||

| Maxine Gowen | 41,250 | 55,915 | — | 97,165 | |||||||||

| Kelvin M. Neu | 47,500 | (3) | 55,915 | — | 103,415 | ||||||||

| William S. Reardon | 54,000 | (4) | 55,915 | — | 109,915 | ||||||||

| Youssef El Zein(5) | 36,889 | (6) | 55,915 | — | 92,803 | ||||||||

- (1)

- These

amounts represent the aggregate grant date fair value of option awards made to each listed director in 2017 as computed in accordance with Financial Accounting

Standards Board Accounting Standards Codification Topic 718, "Stock Compensation," or ASC 718. These amounts do not represent the actual amounts paid to or realized by the directors during 2017. See

Note 10 to the financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2017 regarding assumptions we made in determining the fair value of

option awards. As of December 31, 2017, our non-employee directors, or former director in the case of Mr. El Zein, held options to purchase shares of our common stock as follows:

Mr. Baker: 225,000; Mr. Geraghty: 710,500; Dr. Goldberg: 225,000; Dr. Gowen: 155,000; Dr. Neu: 225,000; Mr. Reardon: 302,250; and Mr. El Zein: 302,250.

- (2)

- Includes

cash meeting fees of $35,000 in lieu of which Mr. Baker elected to receive 16,398 shares of our common stock.

- (3)

- Includes

cash meeting fees of $47,500 in lieu of which Dr. Neu elected to receive 22,254 shares of our common stock.

- (4)

- Includes

cash meeting fees of $13,500 in lieu of which Mr. Reardon elected to receive 7,714 shares of our common stock.

- (5)

- Mr. El

Zein resigned from our board of directors on October 24, 2017.

- (6)

- Consists of cash meeting fees in lieu of which Mr. El Zein elected to receive 16,573 shares of our common stock.

In January 2018, we formed a scientific committee of the board of directors and the annual member fee paid to non-employee directors for their service on such committee will be $4,000.

CORPORATE GOVERNANCE INFORMATION

Our board of directors is responsible for establishing our broad corporate policies and overseeing the management of our company. Our chief executive officer and our other executive officers are responsible for our day-to-day operations. Our board evaluates our corporate performance and approves, among other things, our corporate strategies and objectives, operating plans, major

11

commitments of corporate resources and significant policies. Our board also evaluates and appoints our executive officers.

Our board of directors met 12 times during 2017, including regular, special and telephonic meetings. Each director who served as a director during 2017 attended at least 75% of the total number of board meetings held during 2017 while he or she was a director and of the total number of meetings held by all board committees on which he or she served during 2017.

Directors are responsible for attending our annual meetings of stockholders. Seven of our directors attended the 2017 annual meeting of stockholders in person.

Our board of directors does not have a policy on whether the offices of chairman of the board of directors and chief executive officer should be separate and, if they are to be separate, whether the chairman of the board of directors should be selected from among the independent directors or should be an employee of our company. Our board of directors believes that it should have the flexibility to make these determinations at any given point in time in the way that it believes best to provide appropriate leadership for our company at that time. Currently, Mr. Geraghty serves as chairman of our board of directors and Mr. Milano serves as chief executive officer. Our board of directors believes that this separation allows our chief executive officer to focus on our day-to-day business, while allowing the chairman of the board of directors to lead the board of directors in its fundamental role of providing advice to and independent oversight of management.

Our board of directors recognizes that no single leadership model is right for all companies and at all times and that depending on the circumstances, other leadership models, such as a combined chairman and chief executive officer, might be appropriate. Accordingly, the board of directors periodically reviews its leadership structure. Pursuant to our corporate governance guidelines, if the chairman is not an independent director, the board of directors may elect a lead director from its independent directors. In such case, the chairman and chief executive officer would consult periodically with the lead director on board of directors matters and on issues facing our company. In addition, the lead director would serve as the principal liaison between the chairman of the board of directors and the independent directors and would preside at any executive session of independent directors.

Board of Directors' Role in Risk Oversight

Our board of directors, as a whole, has responsibility for risk oversight, with reviews of certain areas being conducted by relevant committees that report directly to the board of directors. The oversight responsibility of the board of directors and its committees is enabled by management reporting processes that are designed to provide visibility to the board of directors about the identification, assessment and management of critical risks and management's risk mitigation strategies. These areas of focus include competitive, economic, operational, financial (accounting, credit, liquidity and tax), legal, regulatory, compliance, health, safety, environmental, political and reputational risks. Our board of directors regularly reviews information regarding our strategy, operations, credit and liquidity, as well as the risks associated with each. Our compensation committee is responsible for overseeing risks relating to our executive compensation plans and arrangements. Our audit committee is responsible for overseeing financial risks and risks associated with related party transactions. Our nominating and corporate governance committee is responsible for overseeing risks associated with the independence of the board of directors. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, our entire board of directors is regularly informed through committee reports about such risks.

12

Our board of directors has established three standing committees: audit, compensation and nominating and corporate governance. Each of our audit, compensation and nominating and corporate governance committees operates under a charter that has been approved by our board of directors. Our board of directors has also adopted corporate governance guidelines to assist our board of directors in the exercise of its duties and responsibilities. Current copies of the charters for the audit, compensation and nominating and corporate governance committees and the corporate governance guidelines are posted on our website, www.iderapharma.com, and can be accessed by clicking "Investors" and "Corporate Governance."

Audit Committee

Our audit committee's responsibilities include:

- •

- appointing, approving the compensation of, and assessing the independence of our independent registered public accounting firm;

- •

- overseeing the work of our independent registered public accounting firm, including through the receipt and consideration of certain reports

from such accounting firm;

- •

- reviewing and discussing with management and our independent registered public accounting firm our annual and quarterly financial statements

and related disclosures;

- •

- monitoring our internal control over financial reporting, disclosure controls and procedures and code of business conduct and ethics;

- •

- discussing our risk management policies;

- •

- establishing procedures for the receipt and retention of accounting related complaints and concerns;

- •

- reviewing and approving related party transactions;

- •

- meeting independently with our independent registered public accounting firm and management; and

- •

- preparing the audit committee report required by SEC rules.

The current members of our audit committee are Mr. Reardon (Chairman), Mr. Geraghty and Dr. Goldberg. Our board of directors has determined that Mr. Reardon is an "audit committee financial expert" within the meaning of SEC rules and regulations. During 2017, our audit committee held seven meetings in person or by teleconference.

Compensation Committee

Our compensation committee's responsibilities include:

- •

- annually reviewing and approving corporate goals and objectives relevant to compensation for our executive officers;

- •

- determining the compensation of our senior executives;

- •

- overseeing the evaluation of our senior executives;

- •

- overseeing and administering our cash and equity incentive plans;

- •

- reviewing and making recommendations to the board of directors with respect to director compensation;

- •

- reviewing and discussing annually with management the compensation discussion and analysis required by the SEC rules and included in this proxy

statement; and

- •

- preparing the compensation committee report required by SEC rules.

13

The current members of our compensation committee are Dr. Neu (Chairman) and Dr. Gowen. During 2017, the compensation committee held six meetings in person or by teleconference.

The processes and procedures followed by our compensation committee in considering and determining executive compensation are described below under the heading "Executive Compensation."

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee's responsibilities include:

- •

- identifying individuals qualified to become members of our board of directors;

- •

- recommending to our board of directors the persons to be nominated for election as directors or to fill vacancies on our board of directors,

and the persons to be appointed to each of the committees of the board of directors;

- •

- reviewing and making recommendations to the board of directors with respect to management succession planning;

- •

- developing and recommending to the board of directors corporate governance principles; and

- •

- overseeing periodic evaluations of the board of directors.

The current members of our nominating and corporate governance committee are Mr. Geraghty (Chairman) and Mr. Reardon. During 2017, the nominating and corporate governance committee held six meetings in person or by teleconference.

The processes and procedures followed by our nominating and corporate governance committee in identifying and evaluating director candidates are described below under the heading "Director Nomination Process."

Under applicable rules of the Nasdaq Stock Market, or Nasdaq, a director will only qualify as an "independent director" if, in the opinion of our board of directors, that person does not have a relationship which would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Our board of directors has determined that Mr. Baker, Mr. Geraghty, Dr. Goldberg, Dr. Gowen, Dr. Neu and Mr. Reardon and all of the members of each of the audit, compensation and nominating and corporate governance committees are independent as defined under applicable rules of the Nasdaq including, in the case of all members of the audit committee, the independence requirements contemplated by Rule 10A-3 under the Exchange Act and, in the case of all members of the compensation committee, the independence requirements contemplated by Rule 10C-1 under the Exchange Act.

Our board of directors had previously made a similar determination of independence with respect to Mr. El Zein, who served as a director until October 2017.

The process followed by our nominating and corporate governance committee to identify and evaluate director candidates includes requests to members of our board of directors and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of our nominating and corporate governance committee and our board of directors. The nominating and corporate governance committee has from time to time used a third-party recruiting firm to identify and interview potential candidates.

14

In considering whether to recommend any particular candidate for inclusion in the board of director's slate of recommended director nominees, the nominating and corporate governance committee will apply the criteria set forth in our corporate governance guidelines. These criteria include the candidate's:

- •

- business acumen;

- •

- knowledge of our business and industry;

- •

- age;

- •

- experience;

- •

- diligence;

- •

- conflicts of interest;

- •

- ability to act in the interests of all stockholders; and

- •

- in the case of the renomination of existing directors, performance on our board of directors and on any committee of which the director was a member.

Our corporate governance guidelines also provide that candidates should not be discriminated against on the basis of race, religion, national origin, sex, sexual orientation, disability or any other basis proscribed by law and that our nominating and corporate governance committee should consider the value of diversity of the board of directors when evaluating particular candidates. The committee has not adopted any formal or informal diversity policy and treats diversity as one of the criteria to be considered by the committee. The committee does not assign specific weights to particular criteria that the committee reviews and no particular criterion is a prerequisite for the consideration of any prospective nominee. We believe that the backgrounds and qualifications of our directors, considered as a group, should provide a composite and diverse mix of experience, knowledge and abilities that will allow the board of directors to fulfill its responsibilities.

Stockholders may recommend individuals to the nominating and corporate governance committee for consideration as potential director candidates by submitting the individuals' name, together with appropriate biographical information and background materials and a statement as to whether the stockholder or group of stockholders making the recommendation has beneficially owned more than 5% of our common stock for at least one year as of the date such recommendation is made, to Nominating and Corporate Governance Committee, c/o Secretary, Idera Pharmaceuticals, Inc., 167 Sidney Street, Cambridge, Massachusetts 02139. Assuming that appropriate biographical and background material has been provided on a timely basis, the nominating and corporate governance committee will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others. If the board of directors determines to nominate a stockholder-recommended candidate and recommends his or her election, then his or her name will be included in our proxy card for the next annual meeting.

Stockholders also have the right under our bylaws to nominate director candidates directly, without any action or recommendation on the part of the nominating and corporate governance committee or the board of directors, by following the procedures set forth in our bylaws, including advance notice requirements. Candidates nominated by stockholders in accordance with the procedures set forth in our bylaws will not be included in our proxy card for the next annual meeting. See "Information about the 2018 annual meeting—How and when may I submit a proposal for the 2019 annual meeting of stockholders?" for more information about these procedures.

15

Communicating with our Board of Directors

Our board of directors will give appropriate attention to written communications that are submitted by stockholders and will respond if and as appropriate. The chairman of the board of directors (if an independent director) or the lead independent director, if any, is primarily responsible for monitoring communications from stockholders and for providing copies or summaries to the other directors, as he or she considers appropriate.

Communications are forwarded to all directors if they relate to important substantive matters and include suggestions or comments that the chairman of the board of directors or lead independent director, as the case may be, considers to be important for the directors to know. In general, communications relating to corporate governance and long-term corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters that involve repetitive or duplicative communications.

Stockholders who wish to send communications on any topic to the board of directors should address such communications to Board of Directors, c/o Secretary, Idera Pharmaceuticals, Inc., 167 Sidney Street, Cambridge, Massachusetts 02139.

Each communication from a stockholder should include the following information in order to permit stockholder status to be confirmed and to provide an address to forward a response if deemed appropriate:

- •

- the name, mailing address and telephone number of the stockholder sending the communication;

- •

- the number of shares held by the stockholder; and

- •

- if the stockholder is not a record owner of our securities, the name of the record owner of our securities beneficially owned by the stockholder.

Compensation Committee Interlocks and Insider Participation

Our compensation committee currently consists of Dr. Neu and Dr. Gowen, who were both members of our compensation committee throughout 2017. In 2017, Mr. El Zein was a member of our compensation committee from January until October when he resigned from our board of directors. No member of our compensation committee was at any time during 2017, or was formerly, an officer or employee of ours. No member of our compensation committee engaged in any related person transaction involving our company during 2017 other than Dr. Neu and Mr. El Zein. See "Transactions with Related Persons" for information about the terms of the transactions we engaged in with affiliates of Dr. Neu and Mr. El Zein. None of our executive officers has served as a director or member of the compensation committee (or other committee serving the same function as the compensation committee) of any other entity, while an executive officer of that other entity served as a director or member of our compensation committee.

16

Our executive officers and their respective ages and positions as of April 30, 2018 are described below. Our executive officers serve until they resign or the board of directors terminates their position.

Name

|

Age | Position | ||

|---|---|---|---|---|

Vincent J. Milano* |

54 | President and Chief Executive Officer | ||

Louis J. Arcudi, III, M.B.A. |

57 | Senior Vice President of Operations, Chief Financial Officer, Treasurer and Assistant Secretary | ||

R. Clayton Fletcher |

55 | Senior Vice President, Business Development and Strategy | ||

Joanna Horobin, M.B., Ch.B |

63 | Senior Vice President, Chief Medical Officer | ||

Jonathan Yingling, Ph.D. |

49 | Senior Vice President, Chief Scientific Officer |

- *

- Mr. Milano is a member of our board of directors. See "Information about our Directors" above for more information about Mr. Milano.

Louis J. Arcudi, III, M.B.A., has been our Senior Vice President of Operations since April 2011 and our Chief Financial Officer and Treasurer since he joined us in December 2007. Mr. Arcudi served as our Secretary from December 2007 until June 2015 and has been our Assistant Secretary since June 2015. Prior to joining us, Mr. Arcudi served as Vice President of Finance and Administration and Treasurer for Peptimmune, Inc., a biotechnology company, from 2003 to 2007. From 2000 to 2003, Mr. Arcudi was Senior Director of Finance and Administration at Genzyme Molecular Oncology Corporation, a division of Genzyme Corporation. He was Director of Finance Business Planning and Operations International at Genzyme from 1998 to 2000. Prior to joining Genzyme, he held finance positions with increasing levels of responsibility at Cognex Corporation, a supplier of machine vision systems, Millipore Corporation, a provider of technologies, tools and services for bioscience, research and biopharmaceutical manufacturing, and General Motors Corporation, an automobile manufacturer. Mr. Arcudi holds an M.B.A. from Bryant College and a B.S. in accounting and information systems from the University of Southern New Hampshire.

R. Clayton Fletcher has been our Senior Vice President, Business Development and Strategic Planning since January 2015. Prior to joining us, Mr. Fletcher served in increasingly senior positions at ViroPharma Inc., which was acquired by Shire Plc in January 2014, from April 2001 until January 2014, including as Vice President, Business Development and Project Management from 2005 until January 2014. Mr. Fletcher served as Senior Project Manager at SmithKline Beecham plc, a pharmaceutical company, which was purchased by Glaxo Wellcome plc in December 2000, from 1997 until 2001. Prior to working at SmithKline Beecham, he served as Project Scientist, at Becton, Dickinson and Company, a medical devices company and as Principal Scientist at Intracel Corporation, a biopharmaceutical company. Prior to working at Intracel, he served as Senior Associate Scientist at Centocor Biotech, Inc., a biotechnology company from 1991 until 1993. Mr. Fletcher holds a B.S. and a M.S. in biology from Wake Forest University.

Joanna Horobin, M.B., Ch.B, has been our Senior Vice President and Chief Medical Officer since November 2015. Prior to joining us, Dr. Horobin served as the Chief Medical Officer of Verastem, Inc., a biopharmaceutical company, from October 2012 to June 2015. Prior to joining Verastem, she served as President of Syndax Pharmaceuticals, a biopharmaceutical company, from September 2006 to October 2012 and as Chief Executive Officer from September 2006 until April 2012. Prior to that, Dr. Horobin held several roles of increasing responsibility at global pharmaceutical corporations such as Rhône-Poulenc Rorer (now Sanofi) and Chugai-Rhône-Poulenc. Dr. Horobin received her medical degree from the University of Manchester, England.

17

Jonathan Yingling, Ph.D., joined our company as Senior Vice President, Early Development in February 2017 and since January 2018 has been serving as our Chief Scientific Officer. Prior to joining us, Dr. Yingling was Chief Scientific Officer at Bind Therapeutics Inc., a biotechnology company that filed for bankruptcy in May 2016, from December 2015 to August 2016. Prior to joining Bind Therapeutics, Dr. Yingling served as vice president, Oncology Discovery and Translational Research at Bristol-Myers Squibb Company, or BMS, a pharmaceutical company, from June 2013 to October 2015. During his tenure at BMS, he was responsible for the oncology research portfolio as well as translational capabilities in immuno-oncology. Dr. Yingling earned his Ph.D. in Cell and Molecular Biology and Pharmacology at Duke University and was a Howard Hughes Postdoctoral Fellow at Vanderbilt University.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of April 30, 2018, certain information regarding the beneficial ownership of our common stock by:

- •

- each person or entity, including any "group" as that term is used in Section 13(d)(3) of the Exchange Act, who is known to own

beneficially more than 5% of the issued and outstanding shares of our common stock;

- •

- each of our current directors;

- •

- each of our named executive officers, as defined in "Executive Compensation—Compensation Discussion and Analysis" below; and

- •

- all of our current directors and executive officers as a group.

We have determined beneficial ownership in accordance with the rules of the SEC, and the information in the table below is not necessarily indicative of beneficial ownership for any other purpose. The SEC has defined "beneficial ownership" of a security to mean the possession, directly or indirectly, of voting power and/or investment power. In computing percentage ownership of each person, shares of common stock subject to options, warrants or rights held by that person that are currently exercisable, or exercisable within 60 days of April 30, 2018, are deemed to be outstanding and beneficially owned by that person. These shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person.

To our knowledge and except as indicated in the notes to this table and pursuant to applicable community property laws, each stockholder named in the table has sole voting and investment power with respect to the shares set forth opposite such stockholder's name. Percentage of ownership is based

18

on 217,310,991 shares of our common stock issued and outstanding on April 30, 2018. All fractional common share amounts have been rounded to the nearest whole number.

Name and Address of Beneficial Owner(1)

|

Number of Shares Beneficially Owned |

Percentage of Outstanding Shares |

|||||

|---|---|---|---|---|---|---|---|

5% or more Stockholders |

|||||||

Pillar Investment Entities c/o Pillar Invest Offshore SAL Starco Ctr Bloc B, 3rd Flr Omar Daouk St. Beirut, M8 2020-3313 |

26,898,574 | (2) | 12.36 | % | |||

Affiliates of Baker Bros. Advisors LP 860 Washington Street, 3rd Floor, New York, NY 10014 |

39,081,479 | (3) | 17.95 | % | |||

Named Executive Officers and Directors |

|||||||

Vincent J. Milano |

2,259,027 | (4) | 1.03 | % | |||

Sudhir Agrawal, D. Phil. |

4,029,468 | (5) | 1.82 | % | |||

Louis J. Arcudi, III |

1,420,748 | (6) | * | ||||

Julian C. Baker |

39,081,479 | (7) | 17.95 | % | |||

R. Clayton Fletcher |

649,374 | (8) | * | ||||

James A. Geraghty |

1,128,370 | (9) | * | ||||

Mark Goldberg |

213,334 | (10) | * | ||||

Maxine Gowen |

132,834 | (11) | * | ||||

Joanna Horobin |

435,625 | (12) | * | ||||

Kelvin M. Neu |

294,966 | (13) | * | ||||

William S. Reardon |

306,307 | (14) | * | ||||

Jonathan Yingling |

187,499 | (15) | * | ||||

All current executive officers and directors as a group (11 persons) |

45,814,597 | (16) | 20.48 | % | |||

- *

- Denotes

less than 1% beneficial owner.

- (1)

- Except

as otherwise noted, the address for each person listed above is c/o Idera Pharmaceuticals, Inc., 167 Sidney Street, Cambridge, Massachusetts 02139.

- (2)

- Consists of (i) 2,090,125 shares of common stock held by Pillar Pharmaceuticals I, L.P., or Pillar I, (ii) 9,959,956 shares of common stock held by Pillar Pharmaceuticals II, L.P., or Pillar II, (iii) 2,871,839 shares of common stock held by Pillar Pharmaceuticals III, L.P., or Pillar III, (iv) 200,000 shares of common stock held by Pillar Pharmaceuticals IV, L.P., or Pillar IV, (v) 875,000 shares of common stock held by Pillar V, (vi) 10,075,973 shares of common stock held by Participations Besancon, or Besancon, and over which Pillar Invest Corporation has investment discretion, pursuant to an advisory agreement between Pillar Invest Corporation and Besancon, or the Advisory Agreement, (vii) 540,681 shares of common stock held directly by Mr. El Zein and (viii) 285,000 shares of common stock subject to issued outstanding stock options that are exercisable within 60 days after April 30, 2018 held by Mr. El Zein. Mr. El Zein, a member of our board of directors until October 31, 2017, is a director and controlling stockholder of Pillar Invest Corporation, which is the general partner of Pillar I, Pillar II, Pillar III, Pillar IV and Pillar V and is a limited partner of Pillar I, Pillar II, Pillar III, Pillar IV and Pillar V. Mr. El Zein expressly disclaims beneficial ownership over shares held directly by Pillar I, Pillar II, Pillar III, Pillar IV, Pillar V and indirectly by Pillar Invest Corporation. Besancon is an investment fund having no affiliation with Mr. El Zein, Pillar I, Pillar II, Pillar III, Pillar IV, Pillar V or Pillar Invest Corporation. The information in this footnote is based on a Schedule 13D/A filed with the SEC on October 17, 2016; Form 4s filed with the

19

SEC on May 3, 2017, October 17, 2017, December 15, 2017, January 19, 2018 and April 27, 2018; and on information provided to us by Pillar Invest Corporation and Mr. El Zein.

- (3)

- Consists of (i) 3,974,070 shares of our common stock owned by 667, L.P., (ii) 34,064,525 shares of our common stock owned by Baker Brothers Life Sciences, L.P., (iii) 474,141 shares of our common stock owned by 14159, L.P., (iv) (a) 60,443 shares of our common stock held directly by Mr. Baker and (b) 81,632 shares of our common stock held directly by Dr. Neu, and in which each of 667, L.P., Baker Brothers Life Sciences, L.P. and 14159, L.P. (collectively, the "Baker Brothers Funds"), has an indirect pecuniary interest and may be deemed to own a portion of these shares, and (v) (a) 213,334 shares of common stock subject to outstanding stock options that are exercisable within 60 days after April 30, 2018 held by Mr. Baker and (b) 213,334 shares of common stock subject to outstanding options that are exercisable within 60 days after April 30, 2018 held by Dr. Neu. As a result of the application of the Beneficial Ownership Cap, as described below in this footnote, the table above does not include the following as being beneficially owned by the Baker Brothers Funds: (a) 2,389,927 shares of common stock issuable upon exercise of warrants to purchase common stock owned by 667, L.P., (b) 19,280,570 shares of common stock issuable upon exercise of warrants to purchase common stock owned by Baker Brothers Life Sciences, L.P. and (c) 480,555 shares of common stock issuable upon exercise of warrants to purchase common stock owned by 14159, L.P. The information in this footnote is based on a Schedule 13D/A filed with the SEC on March 6, 2018; a Form 4 filed with the SEC on April 4, 2018; and on information provided to us by the Baker Brothers Funds and Mr. Baker. Mr. Baker, a member of our board of directors, is a managing member of Baker Bros. Advisors LP and is a principal of Baker Bros. Advisors (GP), LLC, the sole general partner of Baker Bros. Advisors LP. Baker Bros. Advisors LP serves as the investment advisor to the Baker Brothers Funds. Accordingly, Mr. Baker may be deemed to have sole power to direct the voting and disposition of the shares of common stock held directly by the Baker Brothers Funds and indirectly by Baker Bros. Advisors LP and Baker Bros. Advisors (GP), LLC. Mr. Baker expressly disclaims beneficial ownership over shares held directly by the Baker Brothers Funds and indirectly by Baker Bros. Advisors LP and Baker Bros. Advisors (GP), LLC, except to the extent of his pecuniary interest therein, if any, by virtue of his pecuniary interest therein. Dr. Neu, a member of our board of directors, is an employee of Baker Bros. Advisors LP. Under the terms of the warrants issued to the Baker Brothers Funds, the Baker Brothers Funds are not permitted to exercise such warrants to purchase common stock to the extent that such exercise would result in the Baker Brothers Funds (and their affiliates) beneficially owning more than 4.999% of the number of shares of our common stock issued and outstanding immediately after giving effect to the issuance of shares of common stock issuable upon exercise of such warrants to purchase common stock. This limitation on exercise of the warrants to purchase common stock issued to the Baker Brothers Funds is referred to in this footnote as the "Beneficial Ownership Cap." The Baker Brothers Funds have the right to increase this beneficial ownership limitation in their discretion on 61 days' prior written notice to us, provided that in no event are the Baker Brothers Funds permitted to exercise such warrants to purchase common stock to the extent that such exercise would result in the Baker Brothers Funds (and their affiliates) beneficially owning in the aggregate more than 19.99% of the number of shares of our common stock issued and outstanding or the combined voting power of our securities outstanding immediately after giving effect to the issuance of shares of common stock issuable upon exercise of such warrants to purchase common stock.

20

- (4)

- Includes

2,012,500 shares of common stock subject to outstanding stock options that are exercisable within 60 days after April 30, 2018.

- (5)

- Includes

3,903,191 shares of common stock subject to outstanding stock options that are exercisable within 60 days after April 30, 2018.

- (6)

- Includes

1,376,206 shares of common stock subject to outstanding stock options that are exercisable within 60 days after April 30, 2018.

- (7)

- Consists

of shares reported under footnote 3 to this table above. Mr. Baker is a managing member of Baker Bros. Advisors LP and is a principal of Baker

Bros. Advisors (GP), LLC, the sole general partner of Baker Bros. Advisors LP. Baker Bros. Advisors LP serves as the investment advisor to the Baker Brothers Funds. Accordingly,

Mr. Baker may be deemed to have sole power to direct the voting and disposition of the shares of common stock held directly by the Baker Brothers Funds and indirectly by Baker Bros.

Advisors LP and Baker Bros. Advisors (GP), LLC. Mr. Baker expressly disclaims beneficial ownership over shares held directly by the Baker Brothers Funds and indirectly by Baker

Bros. Advisors LP and Baker Bros. Advisors (GP), LLC, except to the extent of his pecuniary interest therein, if any, by virtue of his pecuniary interest therein.

- (8)

- Consists

of 649,374 shares of common stock subject to outstanding stock options that are exercisable within 60 days after April 30, 2018.

- (9)

- Includes

693,001 shares of common stock subject to outstanding stock options that are exercisable within 60 days after April 30, 2018.

- (10)

- Consists

of 213,334 shares of common stock subject to outstanding stock options that are exercisable within 60 days after April 30, 2018.

- (11)

- Includes

125,834 shares of common stock subject to outstanding stock options that are exercisable within 60 days after April 30, 2018, and 7,000

shares of common stock held in the name Brian Macdonald for Maxine Gowen Trust, for which Dr. Gowen is a beneficiary and trustee.

- (12)

- Includes

432,811 shares of common stock subject to outstanding stock options that are exercisable within 60 days after April 30, 2018.

- (13)

- Includes

213,334 shares of common stock subject to outstanding stock options that are exercisable within 60 days after April 30, 2018.

- (14)

- Includes

273,334 shares of common stock subject to outstanding stock options that are exercisable within 60 days after April 30, 2018.

- (15)

- Includes

187,499 shares of common stock subject to outstanding stock options that are exercisable within 60 days after April 30, 2018.

- (16)

- Includes 6,390,561 shares of common stock subject to outstanding stock options held by the directors and executive officers as a group that are exercisable within 60 days after April 30, 2018 and shares reported in clauses (i) through (iv) of the first sentence of footnote 3 to this table above.

21

Compensation Discussion and Analysis

This Compensation Discussion and Analysis, or CD&A, should be read in conjunction with the compensation tables and narratives that immediately follow this section.

Introduction

This CD&A provides an overview and analysis of the philosophy, objectives, process, components and additional aspects of our 2017 executive compensation program. This analysis focuses on the compensation paid to our named executive officers, or NEOs:

- •

- Vincent J. Milano, President and Chief Executive Officer

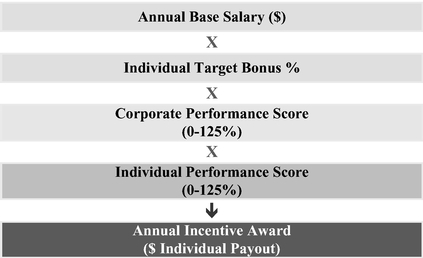

- •