UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended |

OR

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from _____ to _____ |

Commission file number

Granite Construction Incorporated

(Exact name of registrant as specified in its charter)

| | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

|

|

|

| |

|

| | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant was $

At February 18, 2022,

DOCUMENTS INCORPORATED BY REFERENCE

Certain information called for by Part III is incorporated by reference to the definitive Proxy Statement for the 2022 Annual Meeting of Shareholders of Granite Construction Incorporated, which will be filed with the Securities and Exchange Commission not later than 120 days after December 31, 2021.

| DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS | ||

| PART I | ||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

||

| CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

||

|

|

EXHIBIT 21 |

|

|

|

EXHIBIT 23.1 |

|

|

|

EXHIBIT 31.1 |

|

|

|

EXHIBIT 31.2 |

|

|

|

EXHIBIT 32 |

|

|

|

EXHIBIT 95 |

|

|

|

EXHIBIT 101.INS |

|

|

|

EXHIBIT 101.SCH |

|

|

|

EXHIBIT 101.CAL |

|

|

|

EXHIBIT 101.DEF |

|

|

|

EXHIBIT 101.LAB |

|

|

|

EXHIBIT 101.PRE |

|

| EXHIBIT 104 |

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

From time to time, Granite makes certain comments and disclosures in reports and statements, including in this Annual Report on Form 10-K, or statements made by its officers or directors, that are not based on historical facts, including statements regarding future events, occurrences, circumstances, strategy, activities, performance, outlook, outcomes, guidance, capital expenditures, committed and awarded projects, and results, that may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are identified by words such as “future,” “outlook,” “assumes,” “believes,” “expects,” “estimates,” “anticipates,” “intends,” “plans,” “appears,” “may,” “will,” “should,” “could,” “would,” “continue,” and the negatives thereof or other comparable terminology or by the context in which they are made. In addition, other written or oral statements that constitute forward-looking statements have been made and may in the future be made by or on behalf of Granite. These forward-looking statements are estimates reflecting the best judgment of senior management and reflect our current expectations regarding future events, occurrences, circumstances, strategy, activities, performance, outlook, outcomes, guidance, capital expenditures, committed and awarded projects, and results. These expectations may or may not be realized. Some of these expectations may be based on beliefs, assumptions or estimates that may prove to be incorrect. In addition, our business and operations involve numerous risks and uncertainties, many of which are beyond our control, which could result in our expectations not being realized or otherwise materially affect our business, financial condition, results of operations, cash flows and liquidity. Such risks and uncertainties include, but are not limited to, those more specifically described in this report under “Item 1A. Risk Factors.” Due to the inherent risks and uncertainties associated with our forward-looking statements, the reader is cautioned not to place undue reliance on them. The reader is also cautioned that the forward-looking statements contained herein speak only as of the date of this Annual Report on Form 10-K, and, except as required by law, we undertake no obligation to revise or update any forward-looking statements for any reason.

Introduction

Granite Construction Company was incorporated in 1922. In 1990, Granite Construction Incorporated was formed as the holding company for Granite Construction Company and its wholly-owned and consolidated subsidiaries and was incorporated in Delaware. Unless otherwise indicated, the terms “we,” “us,” “our,” “Company” and “Granite” refer to Granite Construction Incorporated and its wholly-owned and consolidated subsidiaries.

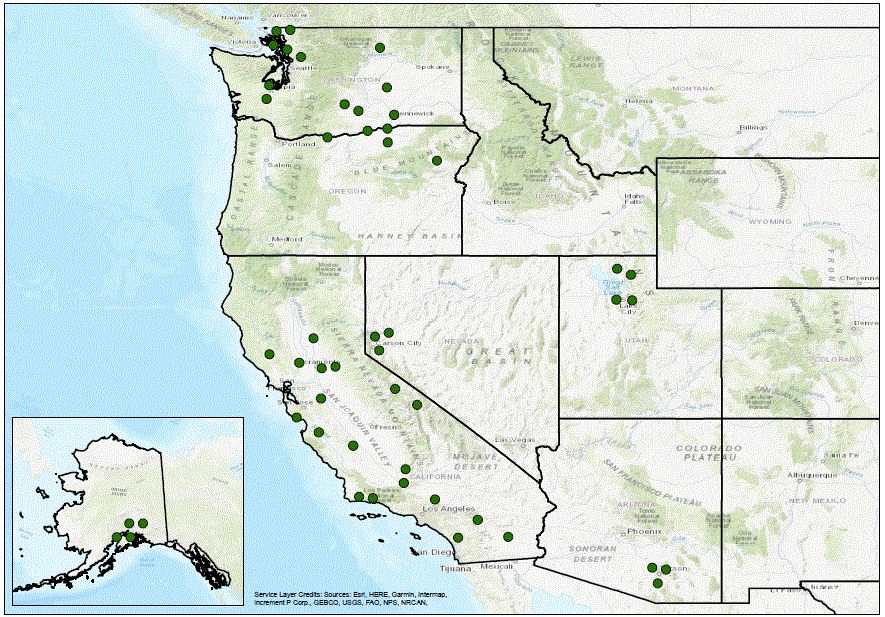

We deliver infrastructure solutions for public and private clients primarily in the United States. We are one of the largest diversified infrastructure companies in the United States. Within the public sector, we primarily concentrate on infrastructure projects, including the construction of streets, roads, highways, mass transit facilities, airport infrastructure, bridges, dams, power-related facilities, utilities, tunnels and other infrastructure-related projects. Within the private sector, we perform site preparation, mining services, and infrastructure services for residential development, energy development, commercial and industrial sites, and other facilities, as well as provide construction management professional services.

New Strategic Plan

During the fourth quarter of 2021, the Company updated its strategy to focus on its core business capabilities, to leverage its current geographic based home markets in the civil construction and materials business and to target expansion based upon that combined strategy. Through our strategic analysis, we determined that the end markets and geographic structure of the former Water and Mineral Services operating group (“WMS”) did not align with the Company’s new strategy and the Board of Directors approved a plan to sell these businesses within the next twelve months. As a result of these actions, we classified WMS as held-for-sale in the consolidated balance sheets and as discontinued operations in the consolidated statements of operations as of and for the year ended December 31, 2021 and applied these changes retrospectively for all other periods presented. See Note 2 of “Notes to the Consolidated Financial Statements” for WMS financial information, which has been excluded from all other disclosures unless explicitly stated otherwise.

On February 2, 2022, we entered into a purchase agreement with Inland Pipe Rehabilitation LLC (“IPR”) and 1000097155 Ontario Inc. (“Ontario” and together with IPR, the “Purchasers”), investment affiliates of J.F. Lehman & Company. Per the terms of that agreement, the Company agreed to sell our trenchless and pipe rehabilitation services business (“Inliner”), a portion of WMS, to the Purchasers, for a purchase price of $159.7 million. The sale has been unanimously approved by the Company’s Board of Directors and is subject to customary covenants and closing conditions. The transaction is expected to close in the first half of 2022. The water supply, treatment, delivery and maintenance business (“Water Resources”) and mineral exploration drilling business (“Mineral Services”), which represent the remainder of WMS, are expected to be sold within the next twelve months.

Operating Structure

Also related to our new strategic plan, during the fourth quarter of 2021, we reorganized our operating groups to improve operating efficiencies and better position the Company for long-term growth. In alphabetical order, our continuing business operating groups are defined as follows:

| • |

California; | |

| • |

Central (formerly Heavy Civil, Federal and Midwest operating groups), which primarily includes offices in Arizona (formerly in the Northwest operating group), Colorado, Florida, Illinois, Texas and Guam; and |

|

| • | Mountain (formerly Northwest), which primarily includes offices in Alaska, Nevada, Utah and Washington. |

In addition, we revised the financial information our chief operating decision maker, or decision-making group (our “CODM”), regularly reviews to allocate resources and assess our performance. This change is consistent with our strategic plan update and better aligns with our continuing civil construction and materials business. Our CODM now regularly reviews financial information regarding our two primary product lines, construction and materials, as well as our operating groups. We identified our CODM as our Chief Executive Officer and our Chief Operating Officer.

As a result of these changes, in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 280, Segment Reporting, our reportable segments, which are the same as our operating segments, were changed to: Construction and Materials. The Construction segment replaces the previous Transportation, Water and Specialty reportable segments, with the composition of our Materials segment for our continuing operations remaining unchanged. These changes have been applied retrospectively for all periods presented. Our Construction segment focuses on construction and rehabilitation of roads, pavement preservation, bridges, rail lines, airports, marine ports, dams, reservoirs, aqueducts, infrastructure and site development for use by the general public and water-related construction for municipal agencies, commercial water suppliers, industrial facilities and energy companies. It also provides construction of various complex projects including infrastructure / site development, mining, public safety, tunnel, solar and other power-related projects. The Materials segment focuses on production of aggregates and asphalt production for internal use and for sale to third parties. See Note 21 of “Notes to the Consolidated Financial Statements” for additional information about our reportable segments.

Customers

Customers in our Construction segment are predominantly in the public sector and include certain federal agencies, state departments of transportation, local transit authorities, county and city public works departments, school districts and developers, utilities and private owners of industrial, commercial and residential sites. Customers of our Materials segment include internal usage by our own construction projects, as well as third-party customers. Our third-party Materials segment customers include, but are not limited to, contractors, landscapers, manufacturers of products requiring aggregate materials, retailers, homeowners, farmers and brokers. The majority of both our public and private customers are located in the United States.

During the years ended December 31, 2021, 2020 and 2019, our largest volume customer, including both prime and subcontractor arrangements, was the California Department of Transportation (“Caltrans”). Revenue recognized from contracts with Caltrans during the years ended December 31, 2021, 2020 and 2019 represented $337.1 million (11.2% of total revenue from continuing operations), $316.9 million (10.1% of total revenue from continuing operations) and $226.2 million (7.8% of total revenue from continuing operations), respectively, which was primarily in the Construction segment. Other than Caltrans, none of our customers, including both prime and subcontractor arrangements, had revenue that individually exceeded 10% of total revenue during the years ended December 31, 2021 and 2020 and none of our customers had revenue that individually exceeded 10% of total revenue during the year ended December 31, 2019.

Business Strategy

Granite exists to satisfy society’s needs for mobility, power, water and essential services that sustain living conditions and improve quality of life. Across our footprint of regional offices, Granite teams provide horizontal civil infrastructure construction services and construction materials products to a diverse base of public, industrial and commercial clients. These clients benefit from our local relationships, market intelligence and the resources and expertise of one of the oldest and most respected U.S. contractors and materials producers.

Local market knowledge, relationships, and project management expertise, supported by the financial strength of a publicly traded company with a strong balance sheet provide Granite a sustainable competitive advantage. By diversifying our revenue channels across geographies and clients, and by taking measured risks within our construction capabilities, we simultaneously grow our business and mitigate risk. Supported by proven operating processes, functional support systems and financial governance processes, our growing network of regional businesses focus on local market conditions, client relationships, employee development, workforce capabilities and investment opportunities to drive growth and efficiency within their home markets.

Additionally, the following continue to be key objectives in our new strategic plan:

Selective Bidding: We focus our resources on bidding jobs that meet our bidding criteria, which include analyzing the risk of a potential job relative to: (1) available personnel to estimate and prepare the proposal as well as to effectively manage and build the project; (2) project procurement methodology; (3) the competitive environment; (4) our experience with the type of work and the owner; (5) local resources and partnerships; (6) equipment resources; and (7) the size, duration, complexity and expected profitability of the job

Risk-Balanced Growth: We intend to grow our business by strategically adding to our client base within our current geographic markets and expanding into new geographic areas both organically and through acquisitions. Growth opportunities are evaluated relative to their incremental impact to the execution risk and profitability profile of our operating portfolio.

Vertical Integration: We own and lease aggregate reserves and own processing plants that are vertically integrated into our construction operations. By ensuring availability of these resources through strategic expansion and providing quality products, we believe we have a competitive advantage in many of our markets, as well as a source of revenue and earnings from the sale of construction materials to third parties.

Diversification: To mitigate the risks inherent in the construction business as the result of general economic factors, we pursue projects: (1) in both the public and private sectors; (2) in diverse end markets such as federal, rail, power and renewable energy; (3) for a wide range of clients from the federal government to small municipalities and from large corporations to small private customers; (4) in diverse geographic markets; (5) with procurement methods that include construction management/general contractor (“CM/GC”), design-build and bid-build; (6) that are executed according to a fixed price, time and materials, cost reimbursable and fixed unit price; and (7) of various size, duration and complexity.

Performance-Based Incentives: In 2022, we revised our incentive compensation plans to align with the key objectives outlined in our new strategic plan. Managers are incentivized with cash compensation and equity awards, payable upon the attainment of pre-established annual financial and non-financial metrics, including capital efficiency and cash flow generation.

Code of Conduct and Core Values: We strive to maintain high ethical standards through an established Code of Conduct and a company-wide compliance program, while always being guided by our core values. During 2021, we refreshed our core values, with renewed emphasis on Integrity, Safety, Excellence, Sustainability and Inclusion. We also launched monthly, company-wide campaigns emphasizing the importance of the core values to Granite.

Human Capital Resources

Employees: We believe our employees are our most valuable resource and are the primary factor in the successful implementation of our business strategies, including our new strategic plan. Significant resources are employed to attract, develop and retain extraordinary and diverse talent and fully promote each employee’s capabilities. We believe our workforce possesses strong dedication and great pride in our company demonstrated by our managerial and supervisory personnel having an average tenure of 11 years with Granite. Successful execution of our new strategy is dependent on attracting, developing, and retaining key employees who represent our core values in the communities we serve. Our focus on inclusive diversity, talent development, talent acquisition, and succession planning has allowed us to build our bench throughout the Company on many levels.

On December 31, 2021, our continuing operations employed approximately 1,900 salaried employees who work in project, functional and business unit management, estimating and administrative capacities plus approximately 1,400 hourly employees. These totals do not include employees of unconsolidated joint ventures. The total number of hourly personnel is subject to the volume of construction in progress and is seasonal. During 2021, the number of hourly employees in our continuing operations ranged from approximately 1,400 to 3,300 and averaged approximately 2,800. The majority of both our salaried and hourly personnel were located in the United States during 2021. As of December 31, 2021, three of our wholly-owned subsidiaries within our continuing operations, Granite Construction Company, Granite Construction Northeast, Inc. and Granite Industrial, Inc., were parties to craft collective bargaining agreements in many areas in which they operate (see Note 16 of the “Notes to the Consolidated Financial Statements”).

Inclusive Diversity: Our culture is driven by our core values, including an unwavering commitment to inclusive diversity. This stems from our guiding belief that diverse backgrounds, perspectives, and experiences enhance creativity and innovation. In 2021, we established Employee Resource Groups that serve employees from a variety of backgrounds. We added Inclusion as one of our refreshed core values and designated October as Inclusion month throughout our Company.

We continued to execute our inclusive diversity strategy with the following key goals:

| • |

increase the representation of women throughout the entire organization from 13% in 2021 to 18% by 2025; |

|

| • |

increase women in leadership from 15% in 2021 to 20% by 2025; |

|

| • |

increase persons of color in leadership from 17% in 2021 to 20% by 2025; and |

|

| • |

increase Inclusion Index based on Kincentric 2021 Survey Data from 70% in 2021 to 80% by 2025. |

We have been successful with our targeted talent acquisition plan that focused on diverse colleges and universities as exemplified by 56% of our 220 interns in 2021 being diverse (women and persons of color).

Granite is committed to pay equity, regardless of race, gender, ethnicity or sexual orientation, and annually conducts a pay equity analysis.

Employee Development and Training: The development of employees is critical to Granite’s success and is a key factor in our ability to attract and retain talent. Our people are the foundation of our success, and we encourage every employee to actively participate in their own career growth and development. Granite offers a wide variety of training opportunities to ensure our employees are supplementing their on-the-job learning with classroom and online courses needed to promote performance and growth. Through Granite University, these training topics range from soft skills to job-specific technical skills and from formal instructor-led programs to self-guided online learning. Our programs are targeted toward specific employee populations including new employees, new engineers, managers and current and emerging leaders.

In 2021, our employees completed over 40,000 training courses and more than 100 employees ranging from emerging leaders to senior leaders graduated from our multi-level leadership development program. The COVID-19 pandemic required Granite to convert many live programs to a virtual instructor-led format. We have successfully delivered over 100 classes in this virtual format in addition to ongoing in-person and self-paced online learning.

We have a robust talent and succession planning process and have established specialized programs to accelerate the development of our talent pipeline for critical roles in general management, engineering, project management, and operations. On an annual basis, we conduct group succession planning reviews with senior leaders focusing on our high performing and high potential talent, diverse talent and succession for critical roles.

Employee Engagement: We measure organizational culture and engagement to build on the competencies that are important for our future success. At least annually, we engage independent third parties to conduct employee engagement surveys. These include corporate culture assessments, as well as real-time feedback on employee engagement and on employee well-being which includes physical, emotional, social and financial health.

Compensation and Benefits: Granite’s compensation programs are designed to align the compensation of our employees with Granite’s performance and to provide proper incentives to attract, retain and motivate employees to achieve superior results. The structure of our compensation programs balances guaranteed base pay with incentive compensation opportunities.

Specifically:

| • |

we provide wages that are competitive and consistent with employee positions, skill levels, experience, knowledge and geographic location; |

|

| • |

we engage nationally recognized compensation and benefits consulting firms to independently evaluate the effectiveness of our executive compensation and benefit programs and to provide benchmarking against our peers. We align our executives’ long-term equity compensation with our shareholders’ interests by linking realizable pay to stock performance; |

|

| • |

annual increases and incentive compensation are based on merit, which is communicated to employees at the time of hiring and documented through our talent management process as part of our annual review procedures and upon internal transfer and/or promotion; and |

|

| • |

all employees are eligible for health and wellness insurance, paid and unpaid leave, a retirement plan, life insurance and disability/accident coverage. We also offer a variety of voluntary benefits that allow employees to select the options that meet their needs, including telemedicine, paid parental leave, prescription savings solutions, a personalized health wellness program, pet insurance and a financial wellness program. |

Environmental, Social and Governance Matters

Sustainability is one of our refreshed core values and we are committed to contributing to the development of a more sustainable future. Our sustainability objectives encompass corporate social responsibility, environmental stewardship, responsible governance and long-term financial prosperity. We envision Granite as the leading provider of sustainable infrastructure solutions, differentiated by our pursuit of social, environmental, and financial excellence.

To obtain our objectives, we have a Sustainability department that coordinates and communicates our environmental, social and governance (“ESG”) initiatives across the Company and we participate in the United Nations Global Compact. Our Board of Directors oversees our sustainability program, including how we manage sustainability and ESG-related risks in conjunction with our overall Enterprise Risk Management process.

We are committed to addressing the effects of climate change, and currently have a priority target to reduce scope 1 greenhouse gas emissions by 25% by 2030 from a 2020 baseline. We use the Global Reporting Initiative and Sustainability Accounting Standards Board standards as frameworks to support performance, tracking and reporting and responsible business behavior. Within these frameworks, we have selected industry-specific metrics that align with stakeholder expectations, are relevant to our business and will have the most significant impact.

Additional information about the sustainability program and Granite’s annual Sustainability Report can be found on our website at https://www.graniteconstruction.com/company/building-better-future-today. The information on our website and Granite’s Sustainability Report are not incorporated into, and are not part of, this report.

Committed and Awarded Projects

Effective during the three months ended June 30, 2021, on a retroactive basis, we renamed contract backlog to Committed and Awarded Projects (“CAP”) and added the general construction portion of CM/GC contracts. This is the same presentation used in our quarterly reports, earnings calls and press releases. Prior period amounts have been revised to reflect this change. In line with the revised reportable segments, all CAP is now in the Construction segment.

CAP consists of two components: (1) unearned revenue and (2) other awards. Unearned revenue includes the revenue we expect to record in the future on executed contracts, including 100% of our consolidated joint venture contracts and our proportionate share of unconsolidated joint venture contracts. We generally include a project in unearned revenue at the time a contract is awarded, the contract has been executed and to the extent we believe funding is probable. Contract options and task orders are included in unearned revenue when exercised or issued, respectively. Certain government contracts where funding is appropriated on a periodic basis are included in unearned revenue at the time of the award when it is probable the contract value will be funded and executed.

Other awards include the general construction portion of CM/GC contracts and awarded contracts with unexercised contract options or unissued task orders. The general construction portion of CM/GC contracts are included in other awards to the extent contract execution and funding is probable. Contracts with unexercised contract options or unissued task orders are included in other awards to the extent option exercise or task order issuance is probable, respectively.

Substantially all of the contracts in CAP may be canceled or modified at the election of the customer; however, we have not been materially adversely affected by contract cancellations or modifications in the past (see “Contract Provisions and Subcontracting”). Many projects are added to CAP and completed within the same fiscal year and, therefore, may not be reflected in our beginning or year-end CAP. CAP by segment is presented in “Committed and Awarded Projects” under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our CAP from continuing operations was $4.0 billion at both December 31, 2021 and 2020. Approximately $2.0 billion of the December 31, 2021 CAP from continuing operations is expected to be completed during 2022.

Competition and Market Trends

In both our Construction and Materials segments, we have competitors within the individual markets and geographic areas in which we operate, ranging from small, local companies to larger regional, national and international companies. Although the construction business is highly competitive, there are few, if any, companies which compete in all of our market areas. The degree and type of competition is influenced by the type and scope of construction projects within the individual markets. One of our significant competitive advantages is that we own and/or have long-term leases for quarries where we mine aggregates.

Factors influencing competitiveness in both of our segments include price, knowledge of local markets and conditions, financial strength, reputation for quality, aggregate materials availability and machinery and equipment. Factors that also influence competitiveness in our Construction segment are estimating abilities and project management.

Many of our Construction segment competitors have the ability to perform work in either the private or public sectors. When opportunities for work in one sector are reduced, competitors tend to look for opportunities in the other sector. This migration has the potential to reduce revenue growth and/or increase pressure on gross profit margins.

Capital requirements have not historically had a significant impact on our ability to compete in the marketplace. However, because smaller projects within our Construction segment have not historically required large amounts of capital, the entry by companies possessing acceptable qualifications into this market may be relatively easy. By contrast, larger projects typically require larger amounts of capital that may make entry into the market by future competitors more difficult.

See “Current Economic Environment and Outlook” under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” for further information on current market trends.

Government Regulations

Our business is impacted by environmental, health and safety, government procurement, anti-bribery and other government regulations and requirements. Below is a summary of some of the significant regulations that impact our business.

Environmental: Our operations are subject to various federal, state, local and foreign laws and regulations relating to the environment, including those relating to: (i) the discharge of materials into the air, such as equipment-related emissions and crystalline silica dust at our aggregate processing facilities; (ii) the discharge of materials into water and land; (iii) the handling and disposal of solid and hazardous waste; (iv) the handling of underground storage tanks; and (v) the cleanup of properties affected by hazardous substances. Certain environmental laws impose substantial penalties for non-compliance and others, such as the federal Comprehensive Environmental Response, Compensation and Liability Act, impose strict, retroactive, joint and several liability upon persons responsible for releases of hazardous substances. We continually evaluate whether we must take additional steps at our locations to ensure compliance with environmental laws and whether we can operate in a more sustainable manner. While compliance with applicable regulatory requirements has not materially adversely affected our operations in the past, there can be no assurance that these requirements will not change, and that compliance will not adversely affect our operations in the future.

Government Procurement: Approximately 75% of our construction-related revenue from continuing operations in 2021 was derived from contracts funded by federal, state and local government agencies and authorities. Government contracts are subject to specific procurement regulations, contract provisions and a variety of socioeconomic requirements relating to their formation, administration, performance and accounting and often include express or implied certifications of compliance.

Our operations are subject to various statutes and executive orders including the Davis-Bacon Act (which regulates wages and benefits), the Walsh-Healy Act (which prescribes a minimum wage and regulates overtime and working conditions), Executive Order 11246 (which establishes equal employment opportunity and affirmative action requirements), Executive Order 14063 (which requires project labor agreements on federal construction projects over $35 million), the Drug-Free Workplace Act, the Federal Acquisition Regulation and the Federal Civil False Claims Act. We are also subject to the rules and regulations promulgated by the Occupational Safety and Health Administration and the Mine Safety and Health Administration. In addition, certain contracts within our government agency projects contain minimum Disadvantaged Business Enterprise (“DBE”) participation clauses.

These laws and regulations affect how we transact business and, in some instances, impose additional costs on our business operations, which may adversely affect our business, results of operations and financial condition. As further described in “Item 1A. Risk Factors,” violation of specific laws and regulations could lead to fines, contract termination, debarment of contractors and/or suspension of future contracts. Our government customers can also terminate, renegotiate or modify any of their contracts with us at their convenience.

Anti-corruption and Bribery: We are subject to the Foreign Corrupt Practices Act (“FCPA”). The FCPA prohibits U.S. and other business entities from making improper payments to foreign government officials, political parties or political party officials. We are also subject to the applicable anti-corruption laws in the jurisdictions in which we operate, thus potentially exposing us to liability and potential penalties in multiple jurisdictions. The anti-corruption provisions of the FCPA are enforced by the Department of Justice while other state or federal agencies may seek recourse against the Company for issues related to FCPA. In addition, the Securities and Exchange Commission (“SEC”) requires strict compliance with certain accounting and internal control standards set forth under the FCPA. Failure to comply with the FCPA and other laws can expose us and/or individual employees to potentially severe criminal and civil penalties. Such penalties may have a material adverse effect on our business, results of operations and financial condition. We devote resources to the development, maintenance, communication and enforcement of our Code of Conduct, our anti-bribery compliance policies, our internal control processes and compliance related policies. We strive to conduct timely internal investigations of potential violations and take appropriate action depending upon the outcome of the investigation.

Contract Provisions and Subcontracting

Contracts with our customers are primarily “fixed unit price” or “fixed price.” Under fixed unit price contracts, we are committed to providing materials or services at fixed unit prices (for example, dollars per cubic yard of concrete placed or cubic yard of earth excavated). The percentage of fixed unit price contracts in our unearned revenue from continuing operations was 53.3% and 42.6% at December 31, 2021 and 2020, respectively. While the fixed unit price contract shifts the risk of estimating the quantity of units required for a particular project to the customer, any increase in our unit cost over the expected unit cost in the bid, whether due to inflation, inefficiency, incorrect estimates or other factors, is borne by us unless otherwise provided in the contract. Fixed price contracts are priced on a lump-sum basis under which we bear the risk that we may not be able to perform the work for the specified contract amount. The percentage of fixed price contracts in our unearned revenue from continuing operations was 44.3% and 54.8% at December 31, 2021 and 2020, respectively. All other contract types represented 2.4% and 2.6% of our unearned revenue from continuing operations at December 31, 2021 and 2020, respectively.

Within our Construction segment, we utilize several methods of project delivery including, but not limited to, bid-build, design-build, CM/GC, construction management at-risk (“CMAR”) and progressive design-build. Unlike traditional bid-build projects where owners first hire a design firm or design a project themselves and then put the project out to bid for construction, the design portion of design-build projects is typically only partially complete when going out to bid. This project delivery method expedites the bidding process for the owner and provides the owner with a single point of responsibility and a single contact for both final design and construction. Under the CM/GC and CMAR delivery methods, we contract with owners to assist the owner during the design phase of the contract with construction efficiencies and risk mitigation, with the understanding that we will negotiate a contract on the construction phase when the collective design nears completion. The progressive design-build delivery method is similar to CM/GC and CMAR; however, we are responsible for the design of the project and will subcontract with a design firm, with the understanding that we will negotiate a contract that includes both the design and construction prices when the collective design nears completion.

With the exception of contract change orders and affirmative claims, which are typically sole-source, our construction contracts are primarily obtained through competitive bidding in response to solicitations by both public agencies and private parties and on a negotiated basis as a result of solicitations from private parties. Project owners use a variety of methods to make contractors aware of new projects, including posting bidding opportunities on agency websites, disclosing long-term infrastructure plans, advertising and other general solicitations. Our bidding activity is affected by such factors as the nature and volume of advertising and other solicitations, current CAP, available personnel, current utilization of equipment and other resources and competitive considerations. Our contract review process includes identifying risks and opportunities during the bidding process and managing these risks through mitigation efforts such as contract negotiation, bid/no bid decisions, insurance and pricing. Contracts fitting certain criteria of size and complexity are reviewed by various levels of management and, in some cases, by our Board of Directors or a committee thereof. Bidding activity, CAP and revenue resulting from the award of new contracts may vary significantly from period to period.

There are a number of factors that can create variability in contract performance as compared to the original bid. Such factors can positively or negatively impact costs and profitability and can create additional liability to the contractor. The most significant of these include:

| • |

changes in costs of labor and/or materials; |

|

| • | subcontractor costs, availability and/or performance issues; | |

| • |

extended overhead and other costs due to owner, weather and other delays; |

|

| • |

changes in productivity expectations; |

|

| • | changes from original design on design-build projects; | |

| • |

our ability to fully and promptly recover on affirmative claims and back charges for additional contract costs; | |

| • |

a change in the availability and proximity of equipment and materials; |

|

| • |

complexity in original design; |

|

| • |

length of time to complete the project; |

|

| • | the availability and skill level of workers in the geographic location of the project; | |

| • |

site conditions that differ from those assumed in the original bid; |

|

| • | costs associated with scope changes; and | |

| • |

the customer’s ability to properly administer the contract. |

The ability to realize improvements on project profitability at times is more limited than the risk of lower profitability. For example, design-build contracts carry additional risks such as those associated with design errors and estimating quantities and prices before the project design is completed. We manage this additional risk by including contingencies in our bid amounts, obtaining errors and omissions insurance and obtaining indemnifications from our design consultants where possible. However, there is no guarantee that these risk management strategies will always be successful.

Most of our contracts, including those with the government, provide for termination at the convenience of the contract owner, with provisions to pay us for work performed through the date of termination. We have not been materially adversely affected by these provisions in the past. Many of our contracts contain provisions that require us to pay liquidated damages if specified completion schedule requirements are not met, and these amounts could be significant.

We act as prime contractor on most of our construction projects. We complete the majority of our projects with our own resources and subcontract specialized activities such as electrical and mechanical work. As prime contractor, we are responsible for the performance of the entire contract, including subcontract work. Thus, we may be subject to increased costs associated with the failure of one or more subcontractors to perform as anticipated. Based on our analysis of their construction and financial capabilities, among other criteria, we typically require the subcontractor to furnish a bond or other type of security to guarantee their performance and/or we retain payments, or some portion thereof, in accordance with contract terms until their performance is complete. DBE regulations require us to use our good faith efforts to subcontract a specified portion of contract work done for governmental agencies to certain types of disadvantaged contractors or suppliers. As with all of our subcontractors, some may not be able to obtain surety bonds or other types of performance security.

Joint Ventures

We participate in various construction joint ventures with other construction companies of which we are a limited member (“joint ventures”) typically for large, technically complex projects, including design-build projects, where it is necessary or desirable to share expertise, risk and resources. Joint venture partners typically provide independently prepared estimates, shared financing and equipment, and often bring local knowledge and expertise. Generally, each construction joint venture is formed as a partnership or limited liability company to accomplish a specific project and is jointly controlled by the joint venture partners. We select our joint venture partners (“partner(s)”) based on our analysis of their construction and financial capabilities, expertise in the type of work to be performed and past working relationships, among other criteria. The joint venture agreements typically provide that our interests in any profits and assets, and our respective share in any losses and liabilities, that may result from the performance of the contracts are limited to our stated percentage interest in the project.

Under each joint venture agreement, one partner is designated as the sponsor. The sponsoring partner typically provides all administrative, accounting and most of the project management support for the project and generally receives a fee from the joint venture for these services. We have been designated as the sponsoring partner in certain of our current joint venture projects and are a non-sponsoring partner in others. In alignment with our new strategic plan and project bidding criteria, when entering into new joint venture agreements, we insist on being the sponsoring partner.

We consolidate joint ventures if we determine that through our participation we have a variable interest and are the primary beneficiary as defined by FASB ASC Topic 810, Consolidation, and related standards. If we have determined that we are not the primary beneficiary of a joint venture but do exercise significant influence, we account for our share of the operations of unconsolidated construction joint ventures on a pro rata basis in revenue and cost of revenue in the consolidated statements of operations. We record the corresponding investment balance in equity in construction joint ventures in the consolidated balance sheets except when a project is in a loss position, the investment balance is recorded as a deficit in unconsolidated construction joint ventures and is included in accrued expenses and other current liabilities in the consolidated balance sheets. We account for non-construction unconsolidated joint ventures under the equity method of accounting in accordance with ASC Topic 323, Investments - Equity Method and Joint Ventures and include our share of the operations in equity in income of affiliates in the consolidated statements of operations and in investment in affiliates in the consolidated balance sheets.

We also participate in “line-item” joint venture agreements under which each partner is responsible for performing certain discrete items of the total scope of contracted work. The revenue for each line-item joint venture partners’ discrete items of work is defined in the contract with the project owner and each joint venture partner bears the profitability risk associated only with its own work. There is not a single set of books and records for a line-item joint venture. Each partner accounts for its items of work individually as it would for any self-performed contract. We account for our portion of these contracts as revenue and cost of revenue in the consolidated statements of operations and in relevant balances in the consolidated balance sheets.

The agreements with our partner(s) for both construction joint ventures and line-item joint ventures define each partner’s management role and financial responsibility in the project. The amount of operational exposure is generally limited to our stated ownership interest. However, due to the joint and several nature of the performance obligations under the related owner contracts, if any of the partners fail to perform, we and the remaining partners, if any, would be responsible for performance of the outstanding work (i.e., we provide a performance guarantee). We estimate our liability for performance guarantees for our unconsolidated and line-item joint ventures using estimated partner bond rates, which are Level 2 inputs, and include them in accrued expenses and other current liabilities with a corresponding increase in equity in construction joint ventures in the consolidated balance sheets. We reassess our liability when and if changes in circumstances occur. The liability and corresponding asset are removed from the consolidated balance sheets upon completion and customer acceptance of the project. Circumstances that could lead to a loss under these agreements beyond our stated ownership interest include the failure of a partner to contribute additional funds to the venture in the event the project incurs a loss or additional costs that we could incur should a partner fail to provide the services and resources that it had committed to provide in the agreement. We are not able to estimate amounts that may be required beyond the remaining cost of the work to be performed. These costs could be offset by billings to the customer or by proceeds from our partners’ corporate and/or other guarantees.

At December 31, 2021, there was $0.7 billion of construction revenue to be recognized on unconsolidated and line item construction joint venture contracts, of which $0.3 billion represented our share and is included in our CAP and the remaining $0.4 billion represented our partners’ share. See Note 9 of “Notes to the Consolidated Financial Statements” for more information.

Insurance and Bonding

We maintain insurance coverage and limits consistent with industry practice and in alignment with our overall risk management strategy. Policies include general and excess liability, property, pollution, professional, cyber security, executive risk, workers’ compensation and employer’s liability. Further, our policies are placed with financially stable insurers, often in a layered or quota share arrangement which reduces the likelihood of an interruption or impact to operations.

In connection with our business, we generally are required to provide various types of surety bonds that provide an additional measure of security for our performance under certain public and private sector contracts. Our ability to obtain surety bonds depends upon our capitalization, working capital, past performance, management expertise and external factors, including the capacity of the overall surety market. Surety companies consider such factors in light of the amount of our CAP that we have currently bonded and their current underwriting standards, which may change from time to time. The capacity of the surety market is subject to market-based fluctuations driven primarily by the level of surety industry losses and the degree of surety market consolidation. When the surety market capacity shrinks it results in higher premiums and increased difficulty obtaining bonding, in particular for larger, more complex, multi-year projects throughout the market. To help mitigate this risk, we employ a co-surety structure involving three sureties. Although we do not believe that fluctuations in surety market capacity have affected our ability to grow our business, there is no assurance that it will not significantly affect our ability to obtain new contracts in the future (see “Item 1A. Risk Factors”).

Raw Materials

We purchase raw materials, including but not limited to, aggregate products, cement, diesel and gasoline fuel, liquid asphalt, natural gas, propane, resin and steel from numerous sources. Our owned and leased aggregate reserves supply a portion of the raw materials needed in our construction projects. The price and availability of raw materials may vary from year to year due to market conditions and production capacities. We do not foresee a lack of availability of any raw materials over the next twelve months from the date of this filing.

Equipment

At December 31, 2021 and 2020, we owned the following number of construction equipment and vehicles (excluding discontinued operations):

| December 31, |

2021 |

2020 |

||||||

| Heavy construction equipment |

1,633 | 1,558 | ||||||

| Trucks, truck-tractors, trailers and vehicles |

3,599 | 3,769 | ||||||

Our portfolio of equipment includes backhoes, barges, bulldozers, cranes, excavators, loaders, motor graders, pavers, rollers, scrapers, trucks and tunnel boring machines that are used in both of our segments. We pool certain equipment to maximize utilization. We continually monitor and adjust our fleet size so that it is consistent with the size of our business, considering both existing and expected future work. We lease or rent equipment to supplement our portfolio of equipment in response to construction activity cycles. In 2021 and 2020, we purchased $49.3 million and $39.7 million, respectively, of construction equipment and vehicles for continuing operations.

Seasonality

Our operations are typically affected more by weather conditions during the first and fourth quarters of our fiscal year which may alter our construction schedules and can create variability in our revenues, profitability and the required number of employees.

Website Access

Our website address is www.graniteconstruction.com. On our website we make available, free of charge, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. The information on our website is not incorporated into, and is not part of, this report. These reports, and any amendments to them, are also available on the SEC’s website, www.sec.gov.

Information About Executive Officers

Information regarding our executive officers as of February 1, 2022 is set forth below.

| Name |

Age |

Position |

||

| Kyle T. Larkin |

50 | President and Chief Executive Officer |

||

| Elizabeth L. Curtis |

55 | Executive Vice President and Chief Financial Officer |

||

| James A. Radich |

63 | Executive Vice President and Chief Operating Officer |

||

| James D. Richards |

57 | Senior Vice President and Group Manager |

||

| Michael G. Tatusko |

57 | Senior Vice President and Group Manager |

||

| Brian A. Dowd |

58 | Senior Vice President and Group Manager |

||

| Staci M. Woolsey |

45 | Chief Accounting Officer |

Mr. Larkin joined Granite in 1996, has served as President since September 2020 and as Chief Executive Officer since June 2021. He also served as Executive Vice President and Chief Operating Officer from February 2020 to September 2020, Senior Vice President and Manager of Construction and Materials Operations from 2019 to 2020, Senior Vice President and Group Manager from 2017 to 2019, Vice President and Regional Manager in Nevada from 2014 to 2017 and President of Granite’s wholly-owned subsidiary, Intermountain Slurry Seal, Inc. from 2011 to 2014. He served as Manager of Construction at the Reno area office from 2008 to 2011, Chief Estimator from 2004 to 2008 and Project Manager, Project Engineer and Estimator at Granite’s Nevada Branch between 1996 and 2003. Mr. Larkin has also served as a director of our Board of Directors since June 2021. Mr. Larkin holds a B.S. in Construction Management from California Polytechnic State University, San Luis Obispo and an M.B.A. from the University of Massachusetts, Amherst.

Ms. Curtis joined Granite in 2018 and has served as Executive Vice President and Chief Financial Officer since January 2021. She also served as Chief Accounting Officer from October 2020 to January 2021, Vice President of Investor Relations from 2019 to October 2020, and Vice President and Integration Management Officer from 2018 to 2019. Before joining Granite, Ms. Curtis served as Vice President and Chief Accounting Officer for Layne Christensen Company (“Layne”) from 2016 to 2018. Prior to joining Layne, Ms. Curtis worked for Cameron from 2009 to 2016 serving in positions of increasing responsibility and ultimately as their Controller, in charge of external reporting, accounting policies, and internal controls from 2015 to 2016. Ms. Curtis began her career in public accounting with Deloitte and graduated from Texas A&M University with B.S. degrees in Accounting and Finance and is a Certified Public Accountant.

Mr. Radich first joined Granite in 1980 and rejoined the Company in 2011. He has served as Executive Vice President and Chief Operating Officer since December 2020. He also served as Senior Vice President and Group Manager from January 2020 to December 2020, as Vice President and Coastal Region Manager from 2014 to 2019 and Vice President of the Northern California Region from 2011 to 2014. From 1993 to 2011 Mr. Radich was employed by Oldcastle Materials. Mr. Radich served Granite as Project Engineer from 1980 to 1983, Project Manager from 1985 to 1990 for the Heavy Civil and Vertical Divisions and Chief Estimator from 1990 to 1993 in the Vertical Division. He received a B.S.C.E. from Santa Clara University and is a Registered Civil Engineer.

Mr. Richards joined Granite in 1992 and has served as Senior Vice President and Group Manager since 2013, Arizona Region Manager from 2006 to 2012, Arizona Region Chief Estimator from 2000 through 2006, Estimator/Project Manager from 1996 to 2000, Regional Equipment Manager from 1993 to 1996 and Project Engineer from 1992 into 1993. Prior to joining Granite, he served as a U.S. Army Officer. Mr. Richards received a B.S. in Civil Engineering from New Mexico State University.

Mr. Tatusko joined Granite in 1991 and has served as Senior Vice President and Group Manager since January 2020. He served as Vice President and Valley Region Manager from 2014 to 2019, Northern California Area Manager from 2012 to 2014, Design Build Project Executive from 2010 to 2012, Group Construction Manager from 2007 to 2010, Arizona Operations Manager from 2005 to 2007, Arizona Construction Manager from 2001 to 2005, Plants Manager from 1999 to 2001, Estimator/Project Manager from 1995 to 1999 and Project Engineer from 1993 to 1995. Prior to joining Granite, he was employed at Oldcastle Tilcon from 1984 to 1991. Mr. Tatusko received a Construction Management degree from Southern Maine Tech.

Mr. Dowd joined Granite in 1986 and has served as Senior Vice President and California Group Manager since January 2021. He also served as Vice President and Regional Manager in Nevada from October 2017 to December 2020 and Vice President and Large Projects Business Development Manager from 2013 to 2017. He served as California Group Business Development Manager from 2012 to 2013, Sacramento Valley Region Manager from 2007 to 2012, Vice President and Director of Human Resources from 2005 to 2007, Director of Employee Development from 2000 to 2005, San Diego Area Manager from 1994 to 2000, and Project Manager, Estimator and Project Engineer at Granite's Indio and Sacramento Branches between 1986 and 1994. Mr. Dowd holds a B.S. in Civil Engineering from the University of California, Berkeley and is a Registered Engineer in the states of California and Nevada.

Ms. Woolsey joined Granite in June 2021 and was appointed Chief Accounting Officer on January 1, 2022. Prior to this appointment and since joining the Company in June 2021, Ms. Woolsey served in a non-officer role with accounting responsibilities and reported directly to Ms. Curtis. Prior to joining the Company, Ms. Woolsey was the Vice President and Corporate Controller from December 2018 to August 2020 and Vice President, Corporate Controller and Chief Accounting Officer from August 2020 to June 2021 of MDC Holdings, Inc. From February 2016 to December 2018, Ms. Woolsey was the Vice President and Controller of the Energy, Infrastructure and Industrial Construction division of AECOM. Ms. Woolsey received a B.S. degree in Accounting from the University of Idaho and is a Certified Public Accountant.

Set forth below and elsewhere in this report and in other documents we file with the SEC are various risks and uncertainties that could cause our actual results to differ materially from the results contemplated by the forward-looking statements contained in this report or otherwise adversely affect our business.

RISKS RELATED TO OUR INVESTIGATION, RESTATEMENT AND MATERIAL WEAKNESSES

| • |

We restated our consolidated financial statements for several prior periods and failed to timely file our Annual and Quarterly Reports with the SEC, which has affected and may continue to affect investor confidence, our stock price and our reputation with our customers. It may also result in additional stockholder litigation and may reduce customer confidence in our ability to complete new contract opportunities. As disclosed in our Annual Report on Form 10-K for the year ended December 31, 2019, we restated our consolidated financial statements for the years ended December 31, 2018 and 2017 and unaudited quarterly financial information for the first three quarters of the year ended December 31, 2019 and for each of the quarters in the year ended December 31, 2018 to correct misstatements associated with project forecasts in our former Heavy Civil operating group, which is now part of our Central operating group, discovered in connection with the independent investigation (the “Investigation”) of the Audit/Compliance Committee (the “Audit Committee”) of our Board of Directors. As a result of the Investigation and restatement process, we failed to timely file our Annual and Quarterly Reports with the SEC. Such Investigation, restatement and failure to timely file our Annual and Quarterly Reports with the SEC: |

| • |

had and may continue to have the effect of eroding investor confidence in us and our financial reporting and accounting practices and processes; |

|

| • |

negatively impacted and may continue to negatively impact the trading price of our common stock; |

|

| • | required that we incur significant expenses related to the Investigation, restatement and remediation of the deficiencies in our internal control over financial reporting and may require that we incur significant additional expenses relating to any additional stockholder litigation; | |

| • |

may result in additional stockholder litigation; |

|

| • |

may make it more difficult, expensive and time consuming for us to raise capital, if necessary, on acceptable terms, if at all; |

|

| • | may make it more difficult to pursue transactions or implement business strategies that might otherwise be beneficial to our business; | |

| • |

may negatively impact our reputation with our customers; and |

|

| • |

may cause customers to place new orders with other companies. |

|

|

The occurrence or continued occurrence of any of the foregoing could have a material adverse effect on our business, financial condition and results of operations. |

| • |

We identified material weaknesses in our internal control over financial reporting in our Annual Reports on Form 10-K for the years ended December 31, 2019 and 2020, which have been remediated. If we identify material weaknesses in the future or otherwise fail to maintain an effective system of internal controls, we may not be able to accurately and timely report our financial results, investors may lose confidence in us and the market price of our common stock may decrease. As disclosed in our Annual Reports on Form 10-K for the years ended December 31, 2019 and 2020, we identified control deficiencies that constituted material weaknesses, either individually or in the aggregate, and since 2020, Company management, with the assistance of outside consultants, has reviewed and revised our internal control over financial reporting in response to the material weaknesses. Management has now concluded that these material weaknesses have been remediated. We may not be able to accurately and timely report our financial results and/or we may not be able to detect errors on a timely basis if in the future we: (1) identify one or more material weaknesses in our internal control over financial reporting; (2) are unable to successfully remediate any future material weaknesses; (3) are unable to comply with the requirements of Section 404 in a timely manner; or (4) are unable to assert, or our independent registered public accounting firm is unable to attest, that our internal control over financial reporting is effective. This could result in: (i) our financial statements being materially misstated; (ii) investors losing confidence in the accuracy and completeness of our financial reports; (iii) the market price of our common stock decreasing (iv) our liquidity and access to the capital markets being adversely affected; and (v) our inability to maintain compliance with applicable stock exchange listing requirements and debt covenants requirements. We could also become subject to stockholder or other third-party litigation as well as investigations by the stock exchange on which our securities are listed, the SEC or other regulatory authorities, which could require additional financial and management resources and could result in fines, penalties, trading suspensions or other remedies. Further, because of its inherent limitations, even our remediated and effective internal control over financial reporting may not prevent or detect all misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in our conditions, or that the degree of compliance with our policies or procedures may deteriorate. |

| • |

We are involved in, and may in the future be subject to, litigation and regulatory examinations, investigations, proceedings or orders as a result of or relating to our restatement and our failure to timely file our Annual and Quarterly Reports with the SEC and if any of these are resolved adversely against us, it could harm our business, financial condition and results of operations. We are currently the subject of securities class action litigation and derivative lawsuits. Additionally, in connection with our disclosure of the Audit Committee’s independent Investigation, we voluntarily contacted the San Francisco office of the SEC Division of Enforcement regarding that Investigation. Since contacting the SEC, we have produced documents to the SEC regarding the accounting issues identified during the independent Investigation and will continue to cooperate with the SEC in its investigation. The SEC’s investigation is ongoing and was not resolved when the Audit Committee completed the Investigation or when the Company’s Annual Reports on Form 10-K for the years ended December 31, 2019 and 2020 were filed. The restatement and our failure to timely file our Annual and Quarterly Reports with the SEC, as well as our previously reported material weaknesses in internal control over financial reporting, may subject us to additional litigation and regulatory examinations, investigations, proceedings or orders, the assessment of civil monetary penalties, and other equitable remedies. Our management has devoted and may continue to be required to devote significant time and attention to these matters. If any of these matters are resolved adversely against us, it could harm our business, financial condition and results of operations. Additionally, while we cannot estimate our potential exposure to these matters at this time, we have already expended significant amounts investigating the claims underlying and defending these matters and expect to continue to need to expend significant amounts to conclude these matters. |

RISKS RELATED TO OUR BUSINESS

| • |

Public health events, including health epidemics or pandemics or other contagious outbreaks, could negatively impact our business, financial condition and results of operations. Our ability to perform work may be significantly affected by public health events. If a public health epidemic or pandemic or other contagious outbreak, including COVID-19, interferes with our ability, or that of our employees, contractors, suppliers, customers and other business partners to perform our and their respective responsibilities and obligations relative to the conduct of our business, our operations may be affected, which could have a material adverse effect on our business, financial condition and results of operations. |

| • |

Unfavorable economic conditions may have an adverse impact on our business. Volatility in the global financial system, deterioration in general economic activity, and fiscal, monetary and other policies that federal, state and local governments may enact, including infrastructure spending or deficit reduction measures, may have an adverse impact on our business, financial position, results of operations, cash flows and liquidity. In particular, low tax revenues, budget deficits, financing constraints, including timing of long-term federal, state and local funding releases, and competing priorities could negatively impact the ability of government agencies to fund existing or new infrastructure projects in the public sector. These factors could have a material adverse effect on the financial market and economic conditions in the United States as well as throughout the world, which may limit our ability and the ability of our customers to obtain financing and/or could impair our ability to execute our strategy. In addition, levels of new commercial and residential construction projects could be adversely affected by oversupply of existing inventories of commercial and residential properties, low property values and a restrictive financing environment. |

| • | We work in a highly competitive marketplace. We have multiple competitors in all of the areas in which we work, and some of our competitors are larger than we are and may have greater resources than we do. Government funding for public works projects is limited, contributing to competition. An increase in competition may result in a decrease in new awards, a decrease in profit margins, or both. In addition, should downturns in residential and commercial construction activity occur, the competition for available public sector work would intensify, which could impact our revenue, CAP and profit margins. |

| • | Our financial position could be impacted by worse than anticipated results in our former Heavy Civil operating group, which is now part of our Central operating group. We completed our previously announced strategic review of our former Heavy Civil operating group, which is now part of our Central operating group, and have taken actions that we believe will be beneficial to us and our stockholders. However, the results of our planned actions, and the timing of expected benefits, remain uncertain. In addition, it is possible that we may elect to undertake additional actions related to our Central operating group. Our results of operations, cash flows and liquidity could be materially impacted by underperformance in our Central operating group. |

| • |

Fixed price and fixed unit price contracts subject us to the risk of increased project cost. As more fully described in “Contract Provisions and Subcontracting” under “Item 1. Business,” the profitability of our fixed price and fixed unit price contracts can be adversely affected by a number of factors that can cause our actual costs to materially exceed the costs estimated at the time of our original bid. This could result in reduced profits or a loss for that project and there could be a material adverse impact to our financial position, results of operations, cash flows and liquidity. |

| • |

As part of our growth strategy, we have made and may make future acquisitions, and acquisitions involve many risks and uncertainties. These risks and uncertainties include: |

| • | our ability to complete acquisitions in accordance with our expected plans, on terms and conditions acceptable to us or our anticipated time frame, or at all; |

| • |

difficulties identifying all significant risks during our due diligence activities; |

| • |

that acquisitions involve significant costs and require the time and attention of our management, which may divert management’s attention from ongoing operations; |

| • |

potential difficulties and increased costs associated with completion of any assumed construction projects; |

| • |

our ability to successfully manage or achieve the results we expect to experience from the acquisitions and that we may lose key employees or customers of the acquired companies; |

| • |

assumption of liabilities of an acquired business, including liabilities that were unknown at the time the acquisition was negotiated; |

| • |

difficulties related to integrating the operations and internal controls, assimilating personnel, services, and systems of an acquired business and to assimilating marketing and other operational capabilities; |

| • |

increased burdens on our staff and on our administrative, internal control and operating systems, which may hinder our legal and regulatory compliance activities; |

| • | if we issue additional equity securities, such issuances could have the effect of diluting our earnings per share as well as our existing shareholders’ individual ownership percentages in the Company; | |

| • |

the recording of goodwill or other non-amortizable intangible assets that will be subject to subsequent impairment testing and potential impairment charges, as well as amortization expenses related to certain other intangible assets; and |

|

| • | while we often obtain indemnification rights from the sellers of acquired businesses, such rights may be difficult to enforce and the indemnitors may not have the ability to financially support the indemnity. |

|

|

Failure to successfully manage and integrate acquisitions could harm our business, financial condition and results of operations. |

| • |

As part of our strategy, we may make divestitures, and divestitures involve many risks and uncertainties. These risks and uncertainties include: |

| • |

our ability to locate suitable acquirors for our divestitures; |

| • |

our ability to complete the divestitures in accordance with our expected plans or anticipated time frame, or at all; |

| • |

our ability to complete the divestitures on terms and conditions acceptable to us; |

| • |

difficulties separating the assets and personnel related to businesses that we expect to divest from the businesses we expect to retain; |

| • |

that divestitures involve significant costs and require the time and attention of our management, which may divert management’s attention from ongoing operations; |

| • |

our ability to successfully cause a buyer of a divested business to assume the liabilities of that business, or even if such liabilities are assumed, we may have difficulties enforcing our rights, contractual or otherwise against the buyer; |

| • |

the need to obtain regulatory approvals and other third-party consents, which potentially could disrupt customer and vendor relationships; |

| • |

potential additional tax obligations or the loss of tax benefits; |

| • |

the divestiture could negatively impact our profitability because of losses that may result from a sale, the loss of revenue or a decrease in cash flows; and |

| • |

following the completion of a divestiture, we may have less diversity in our business and in the markets we serve as well as our client base. |

|

|

Failure to successfully manage divestitures may generate fewer benefits than expected and could harm our business, financial condition and results of operations. |

| • |

In connection with acquisitions or divestitures, we may become subject to liabilities. In connection with any acquisitions, we may acquire liabilities or defects such as legal claims, including but not limited to third party liability and other tort claims; claims for breach of contract; employment-related claims; environmental liabilities, conditions or damage; permitting, regulatory or other compliance with law issues; or tax liabilities. If we acquire any of these liabilities, and they are not adequately covered by insurance or an enforceable indemnity or similar agreement from a creditworthy counterparty, we may be responsible for significant out-of-pocket expenditures. In connection with any divestitures, we may incur liabilities for breaches of representations and warranties or failure to comply with operating covenants under any agreement for a divestiture. We may also retain exposure on financial or performance guarantees, contractual, employment, pension and severance obligations or other liabilities of the divested business and potential liabilities that may arise under law because of the disposition or the subsequent failure of an acquiror. As a result, performance by the divested businesses or other conditions outside of our control could have a material adverse effect on our business, financial condition and results of operations. In addition, we may indemnify a counterparty in a divestiture for certain liabilities of the divested business or operations subject to the divestiture transaction. These liabilities, if they materialize, could have a material adverse effect on our business, financial condition and results of operations. |

| • |

Design-build contracts subject us to the risk of design errors and omissions. Design-build is a common method of project delivery as it provides the owner with a single point of responsibility for both design and construction. We generally subcontract design responsibility to architectural and engineering firms. However, in the event of a design error or omission causing damages, there is risk that the subcontractor or their errors and omissions insurance would not be able to absorb the liability. In this case we may be responsible, resulting in a potentially material adverse effect on our financial position, results of operations, cash flows and liquidity. |

| • |