0000861459DEF 14AFALSE00008614592023-01-012023-12-31000086145912023-01-012023-12-31000086145922023-01-012023-12-31000086145932023-01-012023-12-31000086145942023-01-012023-12-310000861459gva:LarkinMember2023-01-012023-12-31iso4217:USD0000861459gva:LarkinMember2022-01-012022-12-3100008614592022-01-012022-12-310000861459gva:LarkinMember2021-01-012021-12-3100008614592021-01-012021-12-310000861459gva:LarkinMember2020-01-012020-12-310000861459gva:RobertsMember2020-01-012020-12-3100008614592020-01-012020-12-310000861459ecd:PeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2023-01-012023-12-310000861459ecd:PeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2023-01-012023-12-310000861459ecd:PeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2023-01-012023-12-310000861459ecd:PeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2023-01-012023-12-310000861459ecd:PeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2023-01-012023-12-310000861459ecd:PeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2023-01-012023-12-310000861459ecd:PeoMemberecd:EqtyAwrdsAdjsMember2023-01-012023-12-310000861459ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2023-01-012023-12-310000861459ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2023-01-012023-12-310000861459ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2023-01-012023-12-310000861459ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000861459ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2023-01-012023-12-310000861459ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2023-01-012023-12-310000861459ecd:EqtyAwrdsAdjsMemberecd:NonPeoNeoMember2023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

GRANITE CONSTRUCTION INCORPORATED

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

GRANITE CONSTRUCTION INCORPORATED

585 West Beach Street

Watsonville, California 95076

Notice of Annual Meeting of Shareholders

April 25, 2024

| | | | | |

| Date: | Wednesday, June 5, 2024 |

| | | | | |

| Time: | 10:30 a.m., Pacific Time |

| | | | | |

| Place: | Virtual Meeting http://www.virtualshareholdermeeting.com/GVA2024 |

Purposes of the Meeting:

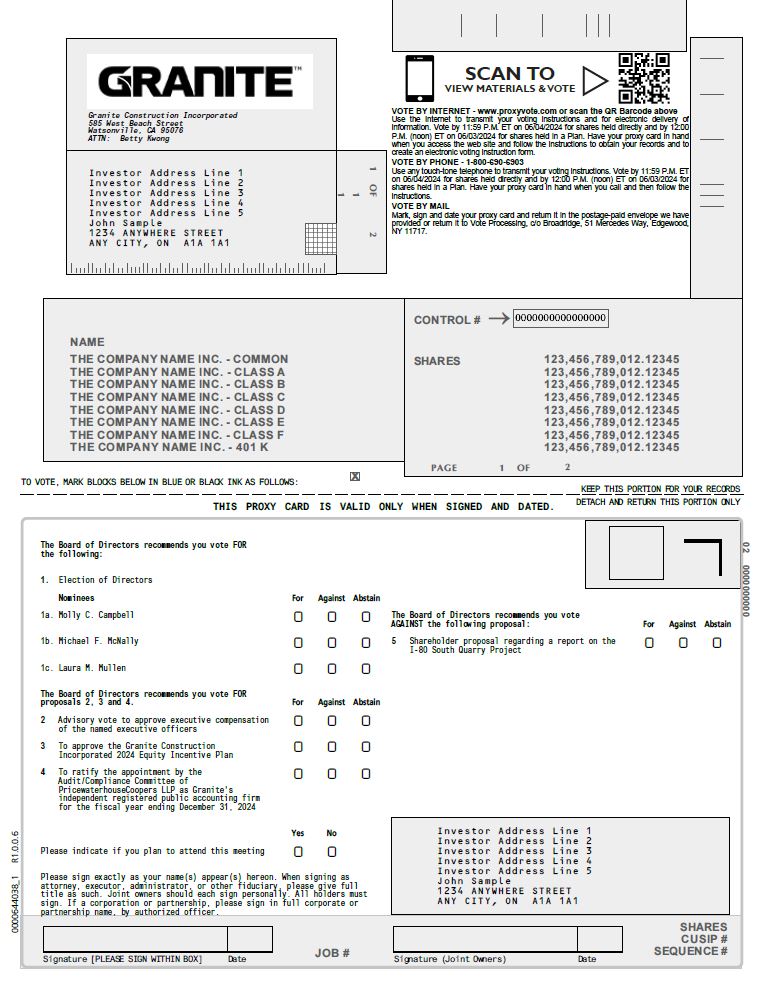

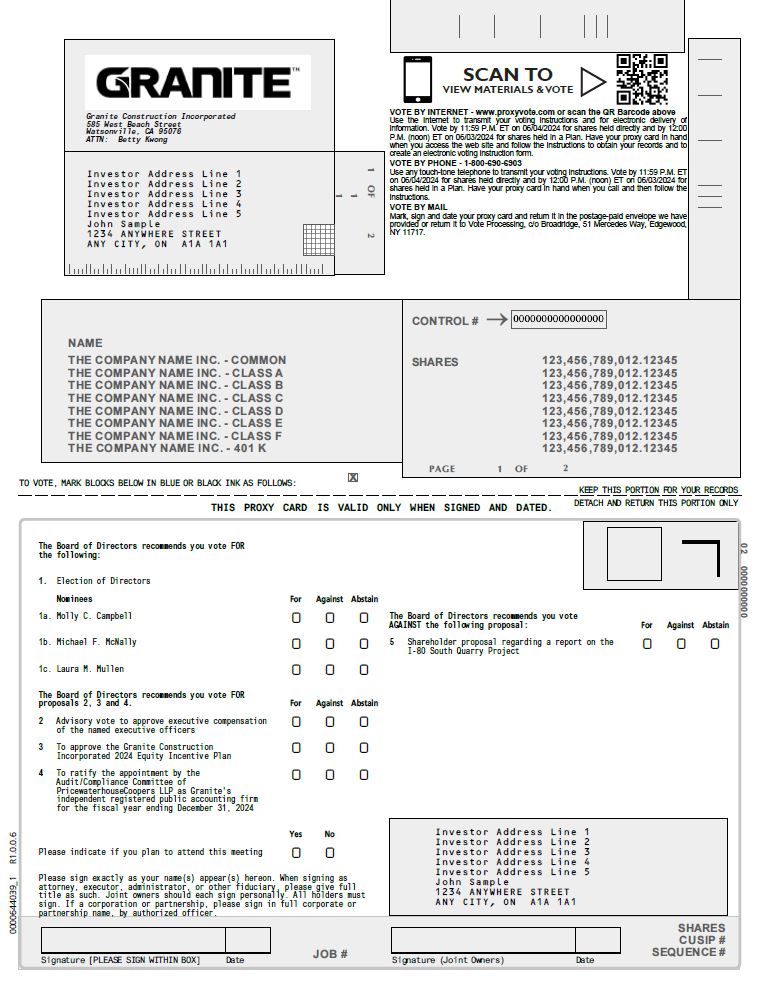

•To elect three directors of Granite Construction Incorporated (the “Company”) for a term set to expire at the 2027 annual meeting;

•To hold an advisory vote on executive compensation for the Named Executive Officers;

•To approve the Granite Construction Incorporated 2024 Equity Incentive Plan;

•To ratify the appointment by the Audit/Compliance Committee of PricewaterhouseCoopers LLP as Granite's independent registered public accounting firm for the fiscal year ending December 31, 2024;

•To vote on a shareholder proposal, if properly presented at the Annual Meeting, regarding a report on the I-80 South Quarry Project; and

•To consider any other matters properly brought before the meeting.

Who May Attend the Meeting:

Only shareholders and/or their representatives, persons holding proxies from shareholders, and invited representatives of the media and financial community may attend the meeting.

How to Participate:

To participate in the Annual Meeting, you must visit http://www.virtualshareholdermeeting.com/GVA2024 and enter the 16-digit control number included in the Notice of Internet Availability of Proxy Materials, on your proxy card, or in the instructions that accompanied your proxy materials. During the Annual Meeting, shareholders may vote their shares virtually and submit questions by following the instructions available on the meeting website. If you are a beneficial shareholder, you may contact the bank, broker or other institution where you hold your shares if you have questions about obtaining your control number.

Record Date:

The record date for the 2024 Annual Meeting of Shareholders (the “Annual Meeting”) is April 12, 2024. This means that if you own Granite stock at the close of business on that date, you are entitled to receive notice of the meeting and vote at the meeting and any adjournments or postponements of the meeting.

Annual Report:

Our Annual Report to Shareholders for 2023 will be made available to shareholders at the same time as the proxy materials.

Shareholder List:

For 10 days prior to the meeting, a complete list of shareholders entitled to vote at the meeting will be available for examination by any shareholder for any purpose related to the meeting during regular business hours at Granite's headquarters located at 585 West Beach Street, Watsonville, CA 95076.

Information about the Notice of Internet Availability of Proxy Materials:

Instead of mailing a printed copy of our proxy materials, including our Annual Report, to each shareholder of record, we will provide access to these materials online. This reduces the amount of paper necessary to produce these materials, as well as the costs associated with mailing these materials to all shareholders. Accordingly, on or about April 25, 2024, we will begin mailing a Notice of Internet Availability of Proxy Materials to all shareholders of record as of April 12, 2024, other than persons who hold shares in the Granite Construction Profit Sharing and 401(k) Plan (such persons, the “401(k) Participants” and such plan, the “401(k) Plan”). We will also post our proxy materials on the website referenced in the Notice (https://www.proxyvote.com). All 401(k) Participants will receive a package in the mail that includes all proxy materials. The proxy materials will be mailed to all 401(k) Participants on or about April 25, 2024.

All shareholders may choose to access our proxy materials online or may request to receive a printed set of our proxy materials. In addition, the Notice and website provide information regarding how you may request to receive proxy materials in printed form by mail on an ongoing basis.

Proxy Voting:

Your vote is important. Please vote your proxy promptly so your shares can be represented at the Annual Meeting even if you plan to attend the meeting. Shareholders, including 401(k) Participants, can vote by Internet, telephone or mail. Shareholders, other than 401(k) Participants, may revoke a proxy and vote virtually if attending the Annual Meeting.

The Annual Meeting will be held exclusively online via live audio webcast on the above date and time. You or your proxyholder will be able to attend the Annual Meeting online, vote your shares virtually and submit questions during the meeting by visiting http://www.virtualshareholdermeeting.com/GVA2024 and using your 16-digit control number included in the Notice of Internet Availability of Proxy Materials, on your proxy card, or in the instructions that accompanied your proxy materials.

In the event of a technical malfunction or other situation that the meeting chair determines may affect the ability of the Annual Meeting to satisfy the requirements for a meeting of shareholders to be held by means of remote communication under the Delaware General Corporation Law, or that otherwise makes it advisable to adjourn the Annual Meeting, the chair or secretary of the meeting will convene the meeting at 10:30 a.m. Pacific Time on the date specified above and at our address specified above solely for the purpose of adjourning the meeting to reconvene at a date, time and physical or virtual location announced by the meeting chair. Under either of the foregoing circumstances, we will post information regarding the adjournment on the investors page of our website at www.graniteconstruction.com. Additionally, the Company will display during the time scheduled for the Annual Meeting at http://www.virtualshareholdermeeting.com/GVA2024 the date, time and physical or virtual location of the adjourned meeting.

| | | | | |

| | By Order of the Board of Directors, |

| | |

| | M. Craig Hall Senior Vice President, General Counsel, Corporate Compliance Officer and Secretary |

GRANITE CONSTRUCTION INCORPORATED

585 West Beach Street

Watsonville, California 95076

PROXY STATEMENT

As more fully described in the Notice of Internet Availability of Proxy Materials, Granite Construction Incorporated, a Delaware corporation (referred to herein as “we,” “us,” “our,” “Granite” or the “Company”), on behalf of its Board of Directors (referred to herein as “Board of Directors” or “Board”), has made its proxy materials available to you on the Internet in connection with Granite's 2024 Annual Meeting of Shareholders (the "Annual Meeting"), which will take place virtually at http://www.virtualshareholdermeeting.com/GVA2024 on June 5, 2024. The Notice of Internet Availability of Proxy Materials was mailed to all Granite shareholders of record, except 401(k) Participants, on or about April 25, 2024, and our proxy materials were posted on the website referenced in the Notice of Internet Availability of Proxy Materials and made available to shareholders on April 25, 2024. If you received a Notice of Internet Availability of Proxy Materials by mail and would like to receive a printed copy of our proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials. The proxy materials were mailed to all 401(k) Participants on or about April 25, 2024.

After carefully considering the format of our Annual Meeting, our Board elected to hold the Annual Meeting exclusively online. Our aim is to offer shareholders rights and participation opportunities during our virtual Annual Meeting that are comparable to those that have been provided at our past in-person Annual Meetings. To participate in the Annual Meeting, you must go to http://www.virtualshareholdermeeting.com/GVA2024 and enter the 16-digit control number included in the Notice of Internet Availability of Proxy Materials, on your proxy card, or in the instructions that accompanied your proxy materials. During the Annual Meeting, shareholders may vote their shares virtually and submit questions by following the instructions available on the meeting website. Please refer to the “Participating in the Annual Meeting” section of this Proxy Statement for more details about attending the Annual Meeting online.

Granite, on behalf of its Board of Directors, is soliciting your proxy to vote your shares at the Annual Meeting or any subsequent adjournment or postponement. We solicit proxies to give all shareholders of record an opportunity to vote on the matters listed in the accompanying notice and/or any other matters that may be presented at the Annual Meeting. In this proxy statement you will find information on these matters, which is provided to assist you in voting your shares.

Granite was incorporated in Delaware in January 1990 as the holding company for Granite Construction Company, which was incorporated in California in 1922.

PROPOSAL 1: ELECTION OF DIRECTORS

The Board of Directors is divided into three classes. We keep the classes as equal in number as reasonably possible; however, the number of directors in a class depends on the total number of directors at any given time. Each director serves for a term of three years. The classes are arranged so that the terms of the directors in each class expire at successive annual meetings. Typically, this means that shareholders annually elect approximately one-third of the members of the Board. The Board currently consists of nine directors.

The terms of Molly C. Campbell, Michael F. McNally and Laura M. Mullen will expire at the Annual Meeting. The Board, upon recommendation of the Nominating and Corporate Governance Committee, has nominated Molly C. Campbell, Michael F. McNally and Laura M. Mullen for new terms. All nominees serve as directors. If elected, each of the nominees will serve as a director until the 2027 annual meeting and until his or her successor is elected and qualified or he or she resigns or until his or her death, retirement or removal.

Management knows of no reason why any of these nominees would be unable or unwilling to serve. All nominees have accepted the nomination and agreed to serve as a director if elected by the shareholders.

BOARD OF DIRECTORS’ RECOMMENDATION

The Board of Directors unanimously recommends a vote “FOR” each of the above-named nominees.

Director Qualifications

The tables below highlight the qualifications, competency, experience and other information of each director, including each nominee for election to our Board, that contributed to the Board’s determination that each individual is qualified to serve on the Board. This high-level summary is not intended to be an exhaustive list of each director’s skills or contributions.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Competency / Experience |

| Name of Director | Financial Expertise & Literacy | Capital Structuring/ Project Finance/M&A | Strategic Planning Experience | Human Capital/Executive Compensation | Enterprise Risk Management | Project Execution Risk Management | Legal/Claims Management | Public Sector Contracting | Industry Experience | Operating Experience | Environmental and Social Factors | Cyber-Security | Politics/Public Policy |

| Darnell | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ¡ | ¡ | ¡ | ⬤ | ⬤ | ¡ | ⬤ |

| Krusi | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ¡ |

| McNally | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ |

| Caldera | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ¡ | ¡ | ⬤ | ⬤ | ⬤ |

| Galloway | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ |

| Mullen | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ¡ | ¡ | ¡ | ¡ | ⬤ | ⬤ | ¡ |

| Campbell | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ |

| Mastin | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ¡ | ¡ | ¡ | ¡ | ⬤ | ⬤ | ¡ | ¡ |

| Larkin | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ⬤ | ¡ | ¡ |

| ⬤ | Highly Experienced | ⬤ | General Experience | ¡ | Limited Experience or Expertise |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Location | Gender | Age Range | Tenure on Board | Race & Ethnicity |

| Name of Director | Location | Gender | 59 and under | 60-64 | 65-69 | 70 + | 0-5 | 6-10 | 11 + | Race & Ethnicity |

| Darnell | FL | M | | | | ✓ | | ✓ | | W |

| Krusi | WA | M | | | ✓ | | | ✓ | | W |

| McNally | RI | M | | | ✓ | | | ✓ | | W |

| Caldera | MD | M | | | ✓ | | ✓ | | | H |

| Galloway | WA | F | | | ✓ | | | ✓ | | W |

| Mullen | CA | F | | ✓ | | | ✓ | | | W |

| Campbell | CA | F | | ✓ | | | ✓ | | | B |

| Mastin | TX | F | ✓ | | | | | ✓ | | W |

| Larkin | CA | M | ✓ | | | | ✓ | | | W |

| A American Native or Alaskan Native | B Black or African American | H Hispanic or Latino |

| P Pacific Islander including Native Hawaiian | S Asian | W White |

In addition to the tables above, the following paragraphs provide further information as of the date of this proxy statement about each director and director nominee. The information presented includes information each director or director nominee has given us about his or her age, all positions he or she holds with Granite, his or her principal occupation and business experience for the past five years, and the names of other publicly held companies of which he or she currently serves as a director or has served as a director during the past five years. In addition to the information in the tables above and included below regarding each director's and director nominee's specific experience, qualifications, attributes, and skills that led our Board to the conclusion the he or she should serve as a director, the Board also believes that all of our directors and director nominees have a reputation for integrity, honesty and adherence to high ethical standards. The Board also believes that all of our directors have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to Granite and our Board.

NOMINEES FOR DIRECTOR TO BE ELECTED FOR TERMS EXPIRING AT THE 2027 ANNUAL MEETING

| | | | | | | | |

| Molly C. Campbell | Director since 2019 |

| | |

Ms. Campbell has served as Infrastructure Advisor with the US Treasury, Office of Technical Assistance since May 2020. She has also served as a non-executive advisor for Boston Consulting Group since March 2022. Ms. Campbell was also a 2019 Fellow at Harvard University’s Advanced Leadership Initiative Program. Prior to that, she served as the Director of the Port of New York and New Jersey from 2015 to 2018, the Director of Financial Management Systems for Los Angeles World Airport in 2015, Deputy Executive Director from 2007 to 2015 and Chief Financial Officer from 2000 to 2007 of the Harbor Department of the Port of Los Angeles and is currently a member of the board of directors of East West Bank Additionally, Ms. Campbell was a fellow of Stanford University's Distinguished Career Institute, DCI, for 2023. We believe Ms. Campbell’s executive leadership experience, expertise in finance, multi-modal logistics, the maritime industry and transportation and infrastructure project experience qualify her to serve on our Board. Ms. Campbell holds a B.A. degree in Political Science from the University of California, Los Angeles and an M.A. degree in Public Policy from Georgetown University. Age 63. |

| | | |

| Michael F. McNally | Director since 2016 |

| | |

Mr. McNally retired in 2014 as President and Chief Executive Officer of Skanska USA Inc., a subsidiary of Skanska AB, one of the world’s largest construction companies, a position he had held since 2008. During that time, he also served as one of nine members of Skanska AB’s senior executive team. Prior to his tenure at Skanska, Mr. McNally held various management positions over a 38 year career with Fluor, Marshall Contractors, Mobil Oil and J. Ray McDermott. Mr. McNally is also currently a member of the board of directors of Limbach Holdings Inc. From 2020 to 2023, he was Vice Chair of the Board of Trustees for the University of Rhode Island. Mr. McNally also served on the board of directors of Terracon from 2016 to 2022 and from 2016 to 2019, he served as the Chairman of the U.S. Green Building Council (“USGBC”) Board. In 2013 he was presented with the USGBC Leadership in the Private Sector Award. In 2014, he organized and chaired the construction industry's first Safety Week bringing together more than 30 major construction companies to advance safety in the industry. We believe that Mr. McNally’s past experience as an executive with a major multi-national construction firm and his knowledge and understanding of the construction industry and Granite’s customers qualify him to serve on our Board. Mr. McNally is also a National Association of Corporate Directors (“NACD”) Board Leadership Fellow and is NACD Directorship Certified. Mr. McNally holds a B.S. degree in Civil Engineering from the University of Notre Dame and an M.B.A. from the University of Rhode Island. Age 69. |

| | | |

| Laura M. Mullen | Director since 2021 |

| | |

Ms. Mullen currently serves as a part-time, independent consultant for KPMG International. From July 1996 to September 30, 2020, she served as an audit partner with KPMG LLP. In her 37-year tenure with KPMG, Ms. Mullen served in various roles, including Global Lead Audit Engagement Partner, SEC Reviewing Partner, West Regional Professional Practice Partner and National Office Partner. She is a certified public accountant in California and a member of the American Institute of Certified Public Accountants. We believe that Ms. Mullen’s experience as a senior audit partner of a Big Four accounting firm, as well as her in-depth knowledge and understanding of generally accepted accounting principles, experience in preparing, auditing and analyzing financial statements, understanding of internal control over financial reporting, and her understanding of audit committee functions qualify her to serve on our Board. Ms. Mullen holds a B.S. degree in Business Administration from the California State University, Long Beach. She is a certified public accountant in California and a member of the American Institute of Certified Public Accountants and California Society of Certified Public Accountants. Age 63. |

CONTINUING DIRECTORS WITH TERMS EXPIRING AT THE 2025 ANNUAL MEETING

| | | | | | | | |

| Patricia D. Galloway | Director since 2017 |

| | |

Dr. Galloway has served as Chairman of Pegasus Global Holdings, Inc., a global firm that performs risk management, management consulting and strategic consulting business services to the heavy construction and energy sectors, since February 2018. From 2008 to 2018, Dr. Galloway served as Chief Executive Officer of Pegasus Global Holdings. Dr. Galloway served in various positions at The Nielsen-Wurster Group, Inc., a global consulting firm providing expert witness, construction management and risk management services to the engineering, construction and energy sectors, including Chief Executive Officer and Principal, and President and Chief Financial Officer from 1981-2008. Dr. Galloway was the first woman President of the American Society of Civil Engineers and served from November 2003 to 2004 and in 2005 was elected to the National Academy of Construction. Dr. Galloway also serves as an arbitrator on construction and energy litigation cases. Since May 2020, Dr. Galloway has served as a director of Stantec Inc. From July 2018 to December 2018, Dr. Galloway served on the Board of SCANA Corporation as Chair of the Special Litigation Committee and her service ended with the merger of SCANA and Dominion Energy, Inc. She also served as a director on the American Arbitration Board from 2010 to May 2020 and on the National Science Board from 2006 to 2012. We believe that Dr. Galloway’s experience in corporate risk management, combined with her knowledge of the construction industry and her executive-level and dispute resolution experiences, qualify her to serve on our Board. Dr. Galloway has further demonstrated her commitment to outstanding modern leadership and ESG excellence by completing the Diligent Climate Leadership Certification and her commitment to cyber-security by completing the Diligent Cyber Risk and Strategy Certification, both presented by the Diligent Institute. Dr. Galloway is also NACD directorship certified. Dr. Galloway holds a Ph.D. in Infrastructure Systems Engineering (Civil) from Kochi University of Technology in Japan, an M.B.A. from the NY Institute of Technology and a Bachelor’s degree in Civil Engineering from Purdue University. Age 66. |

| | | |

| Alan P. Krusi | Director since 2018 |

| | |

Mr. Krusi served as President, Strategic Development of AECOM Technology Corporation, a New York Stock Exchange (“NYSE”)-listed company, from 2008 through 2015, where he led the firm’s M&A activities among other responsibilities. From 2003 until 2008, Mr. Krusi served as CEO and President of Earth Tech, Inc., a global engineering and construction firm, which primarily specialized in the design, construction, financing and operations of water treatment facilities, but also provided engineering and management services to the transportation and environmental markets. Prior to that, and over a period of twenty-six years, Mr. Krusi held a number of technical and management positions within the engineering and construction industries. From 1994 to 2003, Mr. Krusi was president of Obrien Kreitzberg, a company which specialized in providing construction management services to the transportation markets. We believe that Mr. Krusi’s extensive managerial experience attained from serving as the president and CEO of various companies in the engineering and construction services industry qualify him to serve on our Board. Mr. Krusi currently serves on the board of directors of SSR Mining Inc. (formerly Alacer Gold Corp.). He also served on the board of directors of Boxwood Merger Corp. from 2018 to 2020. Additionally, in 2022, Mr. Krusi completed the NACD Cyber-Risk Oversight Program. Mr. Krusi holds a B.A. in Geological Sciences from the University of California, Santa Barbara. Age 69. |

CONTINUING DIRECTORS WITH TERMS EXPIRING AT THE 2025 ANNUAL MEETING

| | | | | | | | |

| Louis E. Caldera | Director since 2021 |

| | |

Mr. Caldera has been a Senior Lecturer at Harvard Business School teaching in the MBA program since July 2023. He has also served as a Senior Advisor to Belay Associates, LLC, a private equity firm, and its Everest Consolidator Acquisition Corp. since March 2021. Prior to that he served as Distinguished Adjunct Professor of Law and as a Senior Fellow in the Program on Law and Government at American University Washington College of Law from 2018 to 2021. He also served as a Professor of Leadership and a Senior Fellow of the George Washington University Cisneros Hispanic Leadership Institute from 2016 – 2018. From January 2009 to May 2009, he served in the Obama Administration as an Assistant to the President and Director of the White House Military Office. From August 2003 to February 2006, he served as President of The University of New Mexico, where he was also was a tenured member of the law school faculty from August 2003 to December 2010. Previously Mr. Caldera served as a California state legislator and as Secretary of the Army in the Clinton Administration. Mr. Caldera is the co-founder and co-chair of the Presidents’ Alliance on Higher Education and Immigration. He is also a member of the Board of Directors of DallasNews Corp., Meritage Homes Corporation and the Latino Corporate Directors Association. We believe that Mr. Caldera's knowledge and experience in the leadership of large public organizations, regulatory and governmental affairs, together with his legal training and business and public company board experience, qualify him to serve on our board. Mr. Caldera holds a B.S. degree from the U.S. Military Academy, a M.B.A. from Harvard Business School and a J.D. from Harvard Law School. Age 68. |

CONTINUING DIRECTORS WITH TERMS EXPIRING AT THE 2026 ANNUAL MEETING

| | | | | | | | |

| David C. Darnell | Director since 2017 |

| | |

Mr. Darnell served as Vice Chairman of Global Wealth & Investment Management at Bank of America Corporation from September 2014 to December 2015 and served as its Co-Chief Operating Officer from September 2011 to September 2014. From July 2005 to September 2011, he served as the President of Global Commercial Banking at Bank of America Corporation. Prior to that, Mr. Darnell held various leadership positions at Bank of America since joining the company in 1979, including Middle Market Banking group president; Central Banking group president; and Midwest Region president. He also served as an Executive Vice President and Commercial Division Executive for Bank of America in Florida. We believe that Mr. Darnell’s significant operational, acquisition, governmental, financial, leadership-development capabilities and technology execution skills qualify him to serve on our board. Mr. Darnell currently serves as a director of the United Services Automobile Association board and United Services Automobile Association Federal Savings Bank board. Mr. Darnell holds an undergraduate degree from Wake Forest University and an M.B.A. from the University of North Carolina at Chapel Hill. Age 71. |

| | | |

| Celeste B. Mastin | Director since 2017 |

| | |

Ms. Mastin has served as the President and Chief Executive officer of H.B. Fuller Company since December 2022, and served as Executive Vice President and Chief Operating Officer of H.B. Fuller Company from March 2022 to December 2022. H.B. Fuller Company manufactures, develops, and sells adhesives around the world and is headquartered in St Paul, Minnesota. From March 2018 to March 2022, Ms. Mastin served as Chief Executive Officer of PetroChoice Lubrication Solutions. PetroChoice is one of the largest petroleum-based lubricant distributors in the United States for passenger and commercial vehicles and industrial applications. Prior to joining PetroChoice, Ms. Mastin was the Chief Executive Officer of Distribution International, Inc., a supplier of commercial and industrial insulation from 2013 to 2017. From 2007 to 2011, she served as Chief Executive Officer and as Chief Operating Officer of MMI Products, Inc., a manufacturer and distributor of building materials. From 2004 to 2007, Ms. Mastin held the role of Vice President of color and glass performance materials and Vice President of growth and development at Ferro Corporation. Ms. Mastin started her career in sales at Shell Chemical. She held European and later global sales management positions as well as management positions at Bostik, Inc. We believe that Ms. Mastin’s global chemicals and building materials sectors experience, as well as her operating experience and proven leadership ability qualify her to serve on our Board. Ms. Mastin holds a B.S. in Chemical Engineering from Washington State University and a M.B.A. from the University of Houston. Age 55. |

| | | |

| Kyle T. Larkin | Director since 2021 |

| | |

Mr. Larkin joined Granite in 1996 and has served as President since September 2020 and as Chief Executive Officer since June 2021. He also served as Executive Vice President and Chief Operating Officer from February 2020 to September 2020, Senior Vice President and Manager of Construction and Materials Operations from 2019 to 2020, Senior Vice President and Group Manager from 2017 to 2019, Vice President and Regional Manager in Nevada from 2014 to 2017 and President of Granite’s wholly-owned subsidiary, Intermountain Slurry Seal, Inc. from 2011 to 2014. He served as Manager of Construction at the Reno area office from 2008 to 2011, Chief Estimator from 2004 to 2008 and Project Manager, Project Engineer and Estimator at Granite’s Nevada Branch between 1996 and 2003. We believe that Mr. Larkin’s knowledge of the construction industry, as well as his intimate knowledge of our business, employees, culture, and competitors, his understanding of the challenges and issues facing the Company and his insider’s perspective of the Company’s day-to-day operations and the strategic direction of the Company, qualify him to serve on our Board. Mr. Larkin holds a B.S. in Construction Management from California Polytechnic State University, San Luis Obispo and an M.B.A. from the University of Massachusetts, Amherst. Age 52. |

INFORMATION ABOUT THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Committees of the Board

The following chart shows the standing committees of the Board of Directors, the current membership of the committees and the number of meetings held by each committee in 2023.

| | | | | | | | | | | | | | |

| | Audit / Compliance | Compensation | Nominating and Corporate Governance | Risk |

Louis E. Caldera(1) | | | ✔ | ✔ |

Molly C. Campbell(1) | ✔ | ✔ | | |

David C. Darnell(1) | ✔ | Chair | | |

Patricia D. Galloway(1) | | ✔ | Chair | |

Alan P. Krusi(1) | ✔ | | | Chair |

| Kyle T. Larkin | | | | |

Celeste B. Mastin(1) | | ✔ | ✔ | |

Michael F. McNally(1)(2) | | | | |

Laura M. Mullen(1) | Chair | | | ✔ |

Number of Meetings in 2023 | 10 | 5 | 4 | 10 |

(1) Independent directors pursuant to the listing standards of the NYSE.

(2) Board Chair.

Audit/Compliance Committee

All members of the Audit/Compliance Committee are non-employee directors who are determined by the Board to be independent under the listing standards of the NYSE. Each member also satisfies the independence requirements for audit committee members of public companies established by the Securities and Exchange Commission (“SEC”). The Board has determined that Ms. Mullen meets the criteria as an audit committee financial expert as defined by SEC rules. The Board of Directors has also determined that all members of the Audit/Compliance Committee are financially literate as required by the listing standards of the NYSE. The Audit/Compliance Committee has direct responsibility for risk oversight related to accounting matters, financial reporting, enterprise, legal and compliance and cybersecurity risks. A more complete description of the risk responsibility, functions and activities of the Audit/Compliance Committee can be found under “Board Leadership Structure and its Role in Risk Oversight” and in “Report of the Audit/Compliance Committee” as well as in the Audit/Compliance Committee charter. The Audit/Compliance Committee charter is available on Granite's website. See “Granite Website” below.

Compensation Committee

All members of the Compensation Committee are non-employee directors who are determined by the Board to be independent under the listing standards of the NYSE. The Compensation Committee reviews and approves all aspects of compensation for our Chief Executive Officer and our other executive officers and recommends any changes to director compensation to the Board. In addition, the Compensation Committee is responsible for monitoring risk related to employment policies and our compensation and benefit systems, including consideration of whether any risks associated with such policies and systems are likely to have a material adverse effect on Granite. The Compensation Committee also reviews our overall compensation plans and strategies and, with respect to certain compensation plans, makes recommendations to the Board for their consideration and approval. The Compensation Committee also oversees and implements our clawback policy. The Compensation Committee has determined that the Company’s annual incentive compensation should partially be tied to a social responsibility metric. Granite uses two safety metrics, the OSHA Recordable Incident Rate (“ORIR”) and the Days Away, Restricted, or Transferred (“DART”) Rate, which are nationally recognized metrics, to monitor and manage safety performance and to benchmark its safety performance against the construction industry for incentive compensation purposes. For additional information regarding how safety metrics are used in Granite’s annual incentive plan, see “Compensation Discussion and Analysis—2023 AIP Performance Measures.” Our Chief Executive Officer attends Compensation Committee meetings and recommends annual salary levels, incentive compensation and payouts for other executive officers for the Compensation Committee's approval. The Compensation Committee also administers our 2021 Equity Incentive Plan and, if approved at the 2024 Annual Meeting, will administer

our 2024 Equity Incentive Plan. The Compensation Committee may delegate any of its responsibilities to a subcommittee composed of one or more members of the Committee. The Compensation Committee charter is available on Granite's website. See “Granite Website” below.

Nominating and Corporate Governance Committee

All members of the Nominating and Corporate Governance Committee are non-employee directors who are determined by the Board to be independent under the listing standards of the NYSE. The Nominating and Corporate Governance Committee develops and recommends corporate governance principles and practices to the Board and oversees the management of risks which are mitigated by these principles and practices. Upon the recommendation of the Nominating and Corporate Governance Committee, the Board recently amended its corporate governance guidelines and policies to incorporate an over boarding policy that limits the number of public company boards that the Company’s directors can serve on to no more than four and the number of public company boards that the Company’s directors who serve as executive officers of public companies can serve on to no more than two.

The Nominating and Corporate Governance Committee also recommends and nominates persons to serve on the Board. The Nominating and Corporate Governance Committee has undertaken a thoughtful approach to board refreshment through the Board nomination and evaluation process and retirement policy. Since 2016, the Board has added 10 new directors, four of whom are women and two of whom are racially/ethnically diverse. The Nominating and Corporate Governance Committee is also responsible for overseeing management succession planning and discusses management succession with the Board Chair and Chief Executive Officer and periodically reports to the Board on management succession planning. The Nominating and Corporate Governance Committee also oversees the annual evaluations of the Board and certain senior executive officers of the Company. These annual evaluations of the Board are conducted through questionnaires, which include a self-assessment, an assessment of the effectiveness of the Board and committees and a peer evaluation.

The Nominating and Corporate Governance Committee is also responsible for overseeing environmental, social and governance (“ESG”) strategy, initiatives and policies. The Nominating and Corporate Governance Committee also provides oversight of sustainability/ESG-related risks, including those posed by climate change, which are integrated into Granite’s enterprise risk management system. The Nominating and Corporate Governance Committee receives updates on sustainability/ESG performance and related risks periodically during the year. Further, the Nominating and Corporate Governance Committee oversees the preparation of, and the Board of Directors approves, the Company’s annual Sustainability Reports. Beginning with the Company’s 2020 Sustainability Report, Granite has aligned its sustainability reporting with the framework established by the Task Force on Climate-related Financial Disclosures and uses industry specific metrics, including those identified by the Sustainability Accounting Standards Board, to support performance, tracking and reporting. In the Company’s 2020 Sustainability Report, Granite announced its target to reduce total Scope 1 greenhouse gas emissions. Additionally, Granite is collecting baseline data for Scope 2 greenhouse gas emissions and plans to incorporate Scope 2 into future reduction targets. For additional information, see Granite’s Sustainability Reports.

For additional information regarding the Company’s inclusive diversity strategy, see “Inclusive Diversity” below and the Company’s Sustainability Reports. The Nominating and Corporate Governance Committee's policy for considering director candidates, including shareholder recommendations, is discussed in more detail below under the heading “Board of Directors' Nomination Policy.” This policy and the Nominating and Corporate Governance Committee charter and Granite’s Sustainability Reports are available on Granite's website. See “Granite Website” below.

Risk Committee

All members of the Risk Committee are non-employee directors who are determined by the Board of Directors to be independent under the listing standards of the NYSE. The Risk Committee is responsible for overseeing the Company’s strategic, operational and health, safety and environmental compliance risks. The Risk Committee is also responsible for, among others things, overseeing Granite’s strategic planning process, management’s adoption and implementation of enterprise risk management policies and procedures and the Company’s bid and proposal strategy for high risk contracts. The Risk Committee charter is available on Granite's website. See “Granite Website” below.

Role of the Compensation Consultant

The Compensation Committee directly retained the services of Frederic W. Cook & Co., Inc. (“FW Cook”) to provide advice and recommendations to the Compensation Committee on executive officer and Board of Director compensation programs.

FW Cook provided services to the Compensation Committee during 2023 which included, but were not limited to, the following:

•Attended meetings of the Compensation Committee as the Compensation Committee’s advisor;

•Reviewed the Company’s executive compensation benchmarking peer group and recommended changes for the Compensation Committee's consideration;

•Evaluated the competitive positioning of Granite’s executive officers' base salaries, annual incentive and long-term incentive compensation and Granite’s director compensation program relative to market data;

•Advised on target award levels within the annual and long-term incentive program and, as needed, on actual compensation actions for the Named Executive Officers;

•Provided advice on the design of Granite's annual and long-term incentive plans, including the performance measures and performance targets for the annual and long-term incentive programs;

•Advised on other executive compensation policies and practices such as the clawback policy, executive perquisites, and aggregate equity grant practices;

•Assisted with the preparation of the Company's “Compensation Discussion and Analysis”;

•Assisted with the 2024 Equity Incentive Plan features, and corresponding share reserve size, presented for shareholder approval in Proposal 3 of this proxy statement;

•Provided the Compensation Committee with an update on executive compensation trends and regulatory developments to inform the compensation planning process for 2023; and

•Assessed the potential for material risk within Granite's compensation policies and practices for all employees, including executive officers.

Based in part on the policies and procedures FW Cook and the Compensation Committee have in place, the Compensation Committee believes that the advice it receives from the executive compensation consultant, a FW Cook representative, is objective and independent. These policies and procedures include:

•FW Cook’s professional standards prohibit the executive compensation consultant from considering any other relationships FW Cook or any of its affiliates may have with Granite in rendering his or her advice and recommendations;

•FW Cook does not provide any services to Granite other than executive and non-employee director compensation advisory work conducted on behalf of the Committee;

•The Compensation Committee has the sole authority to retain and terminate the executive compensation consultant;

•The executive compensation consultant has direct access to the Compensation Committee without management intervention;

•The Compensation Committee evaluates the quality and objectivity of the services provided by the executive compensation consultant each year and determines whether to continue to retain the consultant; and

•The protocols for the engagement limit how the executive compensation consultant may interact with management.

In retaining FW Cook, the Compensation Committee considered the six factors set forth in Rule 10C-1(b)(4)(i) through (vi) of the Securities Exchange Act of 1934 (the “Exchange Act”) and its charter and concluded that no conflict of interest existed that would prevent FW Cook from serving as an independent compensation consultant to the Compensation Committee.

While it is necessary for the executive compensation consultant to interact with management to gather information, the Compensation Committee has adopted protocols governing if and when the executive compensation consultant's advice and recommendations can be shared with management. These protocols are included in the Compensation Committee’s engagement letters with FW Cook. The Compensation Committee also determines the appropriate forum for receiving the

executive compensation consultant's recommendations. Where appropriate, management invitees are present to provide context for the recommendations.

Compensation Committee Interlocks and Insider Participation

During 2023, Ms. Campbell, Mr. Darnell, Mr. Vasquez, Dr. Galloway, Ms. Mastin and Ms. Mullen served as members of the Compensation Committee. No member of the Compensation Committee (1) was, during the fiscal year ended December 31, 2023, or had previously been, an officer or employee of the Company or (2) had any material interest in a transaction of the Company or a business relationship with, or any indebtedness to, the Company. None of our executive officers have served as members of a board of directors or compensation committee of any other entity that has an executive officer serving as a member of our Board of Directors or Compensation Committee.

The Lead Director and Executive Sessions

Our bylaws and Corporate Governance Guidelines provide that in the event the Board Chair does not meet the independence requirements of the listing standards of the NYSE, the independent directors shall elect an independent director to serve as Lead Director for a one-year term or until his or her successor is elected or qualified or until such time, if earlier, at which an independent Board Chair is elected. Because Michael F. McNally, the current Board Chair, is an independent director, we currently do not have a Lead Director. In his capacity as Board Chair, Mr. McNally chairs all Board meetings, sets the agenda for the Board meetings, and presides over all executive sessions of the non-employee members of the Board.

Board Leadership Structure and Its Role in Risk Oversight

The Board of Directors has determined that having an independent director serve as the Board Chair is in the best interest of Granite and its shareholders at this time. The Board believes that having a strong independent director serve as Board Chair promotes greater oversight of Granite by the independent directors and provides for greater management accountability. The structure ensures more active participation by the independent directors in setting the Board's agenda and establishing the Board's priorities. However, the Board, in accordance with its Corporate Governance Guidelines and Policies, retains the flexibility to decide, as new circumstances arise, whether or not to combine or separate the position of Board Chair and principal executive officer.

As with all companies, we face a variety of risks in our business. Our Board of Directors is responsible for oversight of our Company's risks, and effective risk management is a top priority of the Board and management. The Board believes that having a system in place for risk management and implementing strategies responsive to our risk profile and exposures will adequately identify our material risks in a timely manner. In order to more efficiently manage these risks, the Board has delegated certain risk management oversight responsibilities to relevant Board committees.

In connection with the election of a new Board Chair in 2020, the Nominating and Corporate Governance Committee evaluated the structure, composition and operations of the committees of Granite’s Board of Directors, including each committee’s respective role in risk oversight and whether a new committee dedicated to risk oversight would bolster the Board of Directors’ risk oversight function. The Board of Directors and Nominating and Corporate Governance Committee completed their review of the Board of Directors’ risk oversight function and on June 11, 2020, formed a Risk Committee. The Risk Committee is responsible for overseeing the Company’s strategic, operational and health, safety and environmental compliance risks. Since 2021, the Board of Directors and Nominating and Corporate Governance Committee have continued to focus on enhancing management succession planning efforts and on further developing Board expertise through continuing director education programs and Company sponsored membership in the NACD.

Additionally, the Board of Directors has delegated other risk management oversight responsibilities as follows:

The Audit/Compliance Committee has direct responsibility for risk oversight relating to accounting matters, financial reporting, enterprise, legal and compliance and cybersecurity risks. Our Vice President of Internal Audit and independent registered public accounting firm, PricewaterhouseCoopers LLP, report directly to, and meet with, the Audit/Compliance Committee on a regular basis. The Audit/Compliance Committee and the Board also receive regular reports from our Chief Financial Officer, Chief Accounting Officer, Treasurer, General Counsel (who is responsible for managing our risk management function and who serves as our Corporate Compliance Officer), and Chief Information Officer (who is responsible for managing cybersecurity risk). The Audit/Compliance Committee and the Board also meet periodically with management to review Granite's major financial risk exposures and the steps that management has taken to monitor and control such exposures, which include Granite's risk assessment and risk management policies.

The Compensation Committee is responsible for overseeing the management of risks which are mitigated by our employment policies and our compensation and benefits systems, and the Nominating and Corporate Governance Committee oversees the management of risks which are mitigated by our Corporate Governance Guidelines and Policies, including compliance with listing standards for independent directors and committee assignments. Additionally, the Nominating and Corporate Governance Committee oversees risk related to ESG matters. The committee chairs report on risk-related matters to the full Board from time to time as appropriate.

BOARD OF DIRECTORS' NOMINATION POLICY

Evaluation Criteria and Procedures

Members of the Board of Directors of Granite are divided into three classes and are nominated for election for staggered three-year terms. The Board, its members, its committee structure and its performance are reviewed on an annual basis. Evaluations for director nominees are conducted annually by the Nominating and Corporate Governance Committee and are generally made on the basis of observations responses to surveys, questionnaires and evaluation forms circulated to directors annually.

Also included in this review is a careful evaluation of the diversity of skills and experience of Board members weighed against Granite's current and emerging operating and strategic challenges and opportunities. The Board of Directors makes every effort to nominate individuals who bring a variety of complementary skills and, as a group, possess the appropriate skills and experience to oversee our business. The Company intends to recruit and select director candidates whose capabilities, including their educational background, their work and life experiences, their diversity of experiences and perspectives, including gender and/or racial/ethnic diversity and their demonstrated records of performance will have the balance of expertise and judgment required for the Company’s long-term performance and growth. The Nominating and Corporate Governance Committee considers diversity in its broadest sense, including diversity in professional and life experiences, education, skills, perspectives and leadership, as well as other individual qualities and attributes that contribute to Board heterogeneity, such as race, ethnicity, sexual orientation, gender and national origin. The Company believes that the inclusion of diversity as one of many factors considered in selecting director nominees is consistent with the Company's goal of creating a Board of Directors that best serves our needs and those of our shareholders. As of March 31, 2024, 44% of our directors are women, 22% are racially or ethnically diverse and two of our four committees are chaired by a woman. Further, four out of the 10 new directors who have been added to the Board since 2016 are women and two out of the 10 are racially/ethnically diverse.

Current Board members whose performance, capabilities, and experience meet Granite's expectations and needs are nominated for re-election in the year of their respective term's completion. In accordance with Granite's Corporate Governance Guidelines and Policies, Board members who became a director during or after 2021 will not be re-nominated and no proposed candidate will be nominated if the nominee’s 75th birthday occurs prior to the annual meeting of shareholders in the year of re- nomination or nomination. Moreover, Directors who became a director during or after 2021 will retire no later than the first annual meeting of shareholders immediately following their 75th birthday. Board members who became a director before 2021 will not be re-nominated if the nominee’s 72nd birthday occurs prior to the annual meeting of shareholders in the year of re-nomination. Moreover, for any individual who became a director before 2021, such individual will retire no later than the first annual meeting of shareholders immediately following their 72nd birthday. Additionally, the Board believes having a term limit of 15 years for independent directors who join the Board after January 1, 2024 is a prudent way to ensure that fresh ideas, skills and perspectives are represented on the Board. As a result, no individual who joined the Board after January 1, 2024 will be re-nominated if the nominee has served on the Board for more than 15 years in the year of re-nomination. Moreover, a director who joined the Board after January 1, 2024 will retire no later than the first annual meeting of shareholders immediately following their 15th anniversary of being on the Board. The mandatory retirement age and term limit will not apply to an employee director who continues to serve as an employee of Granite.

Each member of the Board of Directors must meet a set of core criteria, referred to as the “three C's”: Character, Capability and Commitment. Granite was founded by persons of outstanding character, and it is Granite's intention to ensure that it continues to be governed by persons of high integrity and worthy of the trust of its shareholders. Further, Granite intends to recruit and select persons whose capabilities, including their educational background, their work and life experiences, their diversity of experiences and perspectives, including gender and/or racial/ethnic diversity and their demonstrated records of performance will have the balance of expertise and judgment required for its long-term performance and growth. Finally, Granite will recruit and select only those persons who demonstrate they have the commitment to devote the time necessary to appropriately discharge their responsibilities and to prepare for and, to the extent possible, attend and participate in all meetings of the Board and Committees on which they serve.

In addition to the three C's, the Board recruitment and selection process assures that the Board composition meets all of the relevant standards for independence and specific expertise. For each new recruitment process, a set of specific criteria is determined by the Nominating and Corporate Governance Committee with the assistance of the Board Chair and in certain circumstances a search firm. These criteria may specify, for example, the type of industry or geographic experience that would be useful to maintain and improve the balance of skills and knowledge on the Board. After the search criteria are established, appropriate candidates are sought out, including through the contacts of the current directors and officers and in certain circumstances those of a search firm. The credentials of a set of qualified candidates provided by the search

process are submitted for screening by the Nominating and Corporate Governance Committee, the Board Chair and the Chief Executive Officer. Based on this review, the Nominating and Corporate Governance Committee invites the top candidates for personal interviews with the Nominating and Corporate Governance Committee and others as appropriate.

Normally, the search, review and interview process results in a single nominee to fill a specific vacancy. However, a given search may be aimed at producing more than one nominee, or the search for a single nominee may result in multiple candidates of such capability and character that multiple candidates might be nominated and the Board may be expanded accordingly.

It is Granite's intention that this search and nomination process consider qualified candidates referred by a wide variety of sources, including all of Granite's constituents - its customers, employees and shareholders and members of the communities in which it operates. The Nominating and Corporate Governance Committee is responsible for assuring that relevant sources of potential candidates have been appropriately canvassed.

The Board used the evaluation criteria and procedures listed in this section to nominate Ms. Campbell, Mr. McNally and Ms. Mullen for election at the Annual Meeting.

Shareholder Recommendation and Direct Nomination of Board Candidates

Granite will review and consider for nomination any candidate for membership to the Board recommended by a shareholder, utilizing the same evaluation criteria and selection process described in “Evaluation Criteria and Procedures” above. Shareholders wishing to recommend a candidate for consideration in connection with an election at a specific annual meeting of shareholders should notify Granite well in advance of the meeting date to allow adequate time for the review process and preparation of the proxy statement.

In addition, Granite’s bylaws provide that any shareholder entitled to vote in the election of directors may directly nominate a candidate or candidates for election at a meeting provided that timely notice of his or her intention to make such nomination is given. To be timely, a shareholder nomination for a director to be elected at an annual meeting of shareholders must be received at Granite’s principal office, addressed to the Corporate Secretary, no less than 120 days prior to the first anniversary of the date the proxy statement for the preceding year’s annual meeting of shareholders was released to shareholders and must contain the information and comply with the requirements specified in our bylaws. If no meeting was held in the previous year, the date of the annual meeting of shareholders is changed by more than 30 calendar days from the previous year, or in the event of a special meeting, to be on time, the notice must be delivered by the close of business on the tenth day following the day on which notice of the date of the meeting was mailed or public announcement of the date of the meeting was made.

To be timely, a shareholder nomination for a director to be elected at the 2025 annual meeting of shareholders must be received at Granite’s principal office, addressed to the Corporate Secretary, on or before December 26, 2024. For further information, see “Shareholder Proposals to be Presented at the 2025 Annual Meeting of Shareholders.”

Director Independence

Under the listing standards of the NYSE, a director is considered independent if the Board determines that the director has no material relationship with Granite. In determining independence, the Board considers pertinent facts and circumstances including commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships, among others. The Board follows these guidelines, established by the NYSE, when assessing the independence of a director:

•A director who, within the last three years is, or has been, an employee of Granite or whose immediate family member is, or has been within the last three years, an executive officer of Granite, may not be deemed independent until three years after the end of such employment relationship. Employment as an interim Chair or Chief Executive Officer or other executive officer shall not disqualify a director from being considered independent following that employment.

•A director who has received, or has an immediate family member who has received, during any twelve-month period within the last three years more than $120,000 in direct compensation from Granite, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service), may not be deemed independent. Compensation received by a director for former service as an interim Chair or Chief Executive Officer or other executive officer and compensation received by an immediate family member for service as an employee of Granite (other than an executive officer) will not be considered in determining independence under this test.

•The following directors may not be deemed independent: (a) a director who is a current partner or employee of a firm that is Granite's internal or external auditor; (b) a director who has an immediate family member who is a current partner of such a firm; (c) a director who has an immediate family member who is a current employee of such a firm and who personally works on Granite's audit; or (d) a director or immediate family member who was within the last three years a partner or employee of such a firm and personally worked on Granite's audit within that time.

•A director who, or whose immediate family member, is or has been within the last three years, employed as an executive officer of another company where any of Granite's present executive officers at the same time serves or served on that company's compensation committee may not be deemed independent.

•A director who is a current employee, or whose immediate family member is a current executive officer, of a company that has made payments to, or received payments from, Granite for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other company's consolidated gross revenues for that fiscal year may not be deemed independent.

The Board reviews the independence of all non-employee directors every year. For the review, the Board relies on information from responses to questionnaires completed by directors and other sources. Directors are required to immediately inform the Nominating and Corporate Governance Committee of any material changes in their or their immediate family members' relationships or circumstances that could impact or change their independence status.

The following non-employee directors are independent under the listing standards of the NYSE: Louis E. Caldera, Molly C. Campbell, David C. Darnell, Patricia D. Galloway, Alan P. Krusi, Celeste B. Mastin, Michael F. McNally and Laura M. Mullen.

Board and Annual Shareholder Meeting Attendance

During 2023, the Board of Directors held 6 meetings. Each of the directors attended at least 75% of the aggregate of the total number of meetings of the Board and the total number of meetings of any committee(s) on which he or she served. Except for irreconcilable conflicts, directors are expected to attend the annual meeting of shareholders.

The annual meeting attendance policy is a part of Granite's Board of Directors Corporate Governance Guidelines and Policies and is posted on Granite's website. See “Granite Website” below. All twelve directors then in office attended Granite's 2023 annual meeting of shareholders.

Communications with the Board

Any shareholder or other interested party wishing to communicate with the Board of Directors, or any particular director, including the Board Chair or the Lead Director, if there is one, can do so by following the process described in the Communications with the Board of Directors Policy. The policy is posted on Granite's website. See “Granite Website” below.

Corporate Governance Guidelines and Policies

Granite's Board of Directors is subject to the Board of Directors Corporate Governance Guidelines and Policies. The Board of Directors Corporate Governance Guidelines and Policies is available on our website. See “Granite Website” below.

Our Corporate Governance Guidelines and Policies include a director resignation policy in the event a Director nominee does not receive a majority of the votes cast in an election of Directors where the number of nominees is equal to the number of Directors to be elected (an “Uncontested Election”). The policy states that promptly after receiving notice that the Director nominee has not received the requisite majority vote in an Uncontested Election, the Director nominee shall tender his or her resignation to the Board of Directors. The Nominating and Corporate Governance Committee (excluding the Director who tendered the resignation) shall then make a recommendation to the Board of Directors on whether to accept or reject the resignation, or whether other action should be taken. The Board of Directors (excluding the Director who tendered the resignation) shall evaluate such recommendation in light of the best interests of the Company and its shareholders and shall decide whether to accept or reject the resignation, or whether other action should be taken. In reaching its decision, the Board of Directors may consider any factors it deems relevant, including but not limited to the resigning Director’s qualifications, past and anticipated future contributions to the Company as well as the overall composition of the Board of Directors and whether accepting the tendered resignation would cause the Company to fail to meet any rule or regulation (inclusive of listing standards and federal securities laws). The Board of Directors shall act on

the tendered resignation and publicly disclose its decision and the rationale behind it within 90 days after the inspector’s certification of the election results. If the Board of Directors elects to reject the resignation, the then incumbent Director will continue to serve until the next annual meeting of shareholders at which time his or her term shall expire. Any vacancies in the Board of Directors resulting from a Director not receiving a majority vote and the Board accepting his or her resignation shall be filled in accordance with the Bylaws.

Insider Trading Policy and Employee, Officer and Director Hedging

The Company's Insider Trading Policy, which is reasonably designed to promote compliance with insider trading laws, rules and regulations, (1) governs the purchase, sale and/or other disposition of our securities by our directors, officers and employees and (2) prohibits our directors, officers and employees from engaging in hedging transactions with respect to Company securities. The policy prohibits transactions, other than a current sale transaction, that are designed to protect a holder of securities from a possible decline in the value of such securities, including puts, options, swaps, zero-cost collars, forward sale contracts or similar instruments or arrangements.

Code of Conduct

Granite's Code of Conduct applies to all Granite employees, including the Chief Executive Officer and the Chief Financial Officer, and to all directors. The Code of Conduct is available on Granite's website. We will also post any amendments to the Code of Conduct, or waivers of the application of provisions of the Code of Conduct to any of our directors or executive officers, on our website. See “Granite Website” below.

Inclusive Diversity

Granite’s Board of Directors believes the Company’s culture is underpinned by its core values, including an unwavering commitment to inclusive diversity as exemplified by strategies that address our guiding belief that diverse backgrounds, perspectives, and experiences enhance creativity and innovation. We have established employee resource groups that serve employees from a variety of backgrounds, and we have designated October as Inclusion month throughout our Company. As of December 31, 2023, approximately 12.7% of Granite’s workforce were women and 45.2% were racially and ethnically diverse. We periodically conduct pay equity analyses to support our commitment to pay equity for similar job functions, regardless of race, gender, ethnicity or sexual orientation.

Granite Website

The following charters and policies are available on Granite's website at www.graniteconstruction.com at the “Investors” site, then under “Corporate Governance”: the Audit/Compliance Committee Charter, the Nominating and Corporate Governance Committee Charter, the Compensation Committee Charter, the Risk Committee Charter, the Board of Directors Corporate Governance Guidelines and Policies, the Board of Directors' Nomination Policy, and the Communication with the Board of Directors Policy. The Company’s Sustainability Reports are available on Granite’s website at www.graniteconstruction.com at the “Company” site, then under “Sustainability.” The information included in Granite’s Sustainability Reports is not incorporated into, and is not part of, this proxy statement. You can also obtain copies of these charters and policies and Granite’s Sustainability Reports, without charge, by contacting Granite's Investor Relations Department at 831.724.1011. The Code of Conduct is available on Granite's website at www.graniteconstruction.com at the “Company” site under “Code of Conduct.” You can obtain a copy of the Code of Conduct and any amendments to the Code of Conduct, without charge, by contacting Granite's Human Resources Department at 831.724.1011.

PROPOSAL 2: ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Board of Directors is asking shareholders to approve an annual advisory resolution on executive compensation. The Board of Directors is providing such vote pursuant to Section 14A of the Exchange Act. The advisory vote is a non-binding vote on the compensation of our Named Executive Officers. The vote is not intended to address any specific item of compensation, but rather the overall compensation of our Named Executive Officers and the philosophy, policies and practices described in this proxy statement. The text of the resolution to be voted on at the Annual Meeting is as follows:

Resolved, that the shareholders of Granite Construction Incorporated approve, on an advisory basis, the compensation of the Company's Named Executive Officers as disclosed in the proxy statement for the Company's 2024 Annual Meeting of Shareholders pursuant to the compensation disclosure rules of the Exchange Act (which disclosure includes the Compensation Discussion and Analysis section, the Summary Compensation Table for 2023 and the related compensation tables and narrative disclosure within the Executive and Director Compensation and Other Matters section of the proxy statement).

The Company urges you to read the disclosure under “Compensation Discussion and Analysis,” which discusses how our compensation policies and procedures implement our pay-for-performance compensation philosophy. You should also read the Summary Compensation Table and other related compensation tables and narrative disclosure which provide additional details about the compensation of our Named Executive Officers. We have designed our executive compensation structure to attract, motivate and retain executives with the skills required to formulate and implement the Company's strategic objectives and grow sustainable shareholder value. We believe that our executive compensation program is reasonable, competitive and strongly focused on pay for performance principles, and provides an appropriate balance between risk and incentives. In particular, key elements of our executive compensation program are:

•Total direct compensation generally is targeted within the range of the 50th percentile of comparable positions in the market;

•Individual executive pay levels are based on market data, experience, tenure and impact on business and financial results;

•A comprehensive benefits program which is also available to all salaried employees and includes: medical, dental, vision, life, accidental death and dismemberment insurance, short-term and long-term disability insurance, 401(k) Plan, Employee Stock Purchase Plan, health and wellness benefits, paid vacation and holiday pay; and

•Eligibility, along with other management employees, to participate in our Non-Qualified Deferred Compensation (“NQDC”) Program.

The vote regarding the compensation of the Named Executive Officers described above, referred to as a “Say on Pay advisory vote,” is advisory, and is therefore not binding on the Company, the Compensation Committee or the Board of Directors. Although non-binding, the Compensation Committee and the Board of Directors value the opinions that shareholders express in their votes and will review the voting results and take them into consideration when making future decisions regarding our executive compensation programs as they deem appropriate. We currently hold an advisory vote on the compensation of our Named Executive Officers every year. We expect to hold our next advisory vote on the compensation of our Named Executive Officers at our 2025 Annual Meeting.

BOARD OF DIRECTORS’ RECOMMENDATION

The Board of Directors unanimously recommends a vote “FOR” the approval of the compensation of the Named Executive Officers as disclosed in this proxy statement and as described pursuant to the compensation disclosure rules of the Exchange Act.

PROPOSAL 3: APPROVAL OF THE GRANITE CONSTRUCTION INCORPORATED 2024 EQUITY INCENTIVE PLAN

The Board is requesting that our shareholders vote in favor of approving the Granite Construction Incorporated 2024 Equity Incentive Plan (the "2024 Equity Plan"), which was adopted by Granite's Board of Directors (the "Board") on April 2, 2024. If approved, the 2024 Equity Plan will be effective as of the Board approval date and will serve as the successor to the Granite Construction Incorporated 2021 Equity Incentive Plan (the "2021 Equity Plan"), which is currently the only plan pursuant to which Granite can grant equity awards, and no additional equity awards will be granted under the 2021 Equity Plan after the 2024 Equity Plan is approved by shareholders. The Board believes that the 2024 Equity Plan is in the best interest of the shareholders and Granite, as it will allow Granite to continue to attract and retain talented and creative employees, directors and consultants who can assist Granite in competing in the marketplace, delivering consistent financial performance and growing shareholder value.

Status of the 2021 Equity Plan

The 2021 Equity Plan was adopted by the Board on April 1, 2021 and approved by our shareholders on June 2, 2021. The 2021 Equity Plan currently authorizes Granite to issue up to 2,915,665 shares of common stock to employees, directors and consultants, of which 167,753 shares remain available as of March 31, 2024 for the grant of new incentive awards in accordance with the following:

| | | | | |

| Shares remaining available for grant under the 2021 Equity Plan after accounting for unvested and outstanding performance awards as of March 31, 2024 | 167,753 |

Options outstanding under the 2021 Equity Plan as of March 31, 2024 | — |

Time-based full value awards (RSUs) outstanding under the 2021 Equity Plan as of March 31, 2024 | 568,664 |

Shares attributable to outstanding performance award cycles as of March 31, 2024 | 782,998 |

The complete text of the 2021 Equity Plan is incorporated by reference to Appendix A to Granite's Proxy Statement filed on April 21, 2021.

Determination of Number of Shares to Add to the 2024 Equity Plan

Awards Are an Important Part of Our Compensation Philosophy. The Board believes that Granite must offer a competitive equity incentive program if we are to continue to successfully attract and retain the best possible candidates for positions of responsibility. The Board expects that the 2024 Equity Plan will be an important factor in attracting and retaining the high caliber employees, directors and consultants essential to our success and in motivating these individuals to strive to enhance Granite's growth and profitability. The 2024 Equity Plan is intended to ensure that we will continue to have a reasonable number of shares available under our compensation plans to provide us with flexibility to meet future compensation needs. We do not view the number of shares that currently remain available for grant under the 2021 Equity Plan as sufficient to allow us to execute on our long-term business plan, and the size of the aggregate share reserve under the 2024 Equity Plan is intended to provide us with sufficient shares for approximately the next three to five years. Despite this estimate, the duration of the share reserve may be shorter or longer depending on various factors such as stock price, aggregate equity needs and equity award type mix.

Historic Use of Equity and Outstanding Awards. The following table provides certain additional information regarding our historical annual burn rate for awards and shares authorized and outstanding and available for grant:

Historic Annual Burn Rate for Awards

| | | | | | | | | | | |

| Fiscal Year | 2021 | 2022 | 2023 |

| Stock options granted | — | — | — |

Full value awards granted(1) | 254,000 | 311,000 | 315,000 |

| Weighted-average common shares outstanding | 45,788,000 | 44,485,000 | 43,879,000 |

Gross burn rate(2) | 0.55% | 0.70% | 0.72% |

(1) Includes shares subject to service-based RSUs and RSUs granted in the year indicated in settlement of performance awards upon completion of the performance cycle ending in the prior year. (2) The gross burn rate is calculated as follows: shares granted in the fiscal year divided by weighted-average common shares outstanding for the applicable fiscal year. |