UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____ to _____

Commission file number 1-12911

Granite Construction Incorporated

(Exact name of registrant as specified in its charter)

Delaware | 77-0239383 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

585 West Beach Street | |

Watsonville, California | 95076 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (831) 724-1011

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

Common Stock, $0.01 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. Large accelerated filer x Accelerated filer o Non-accelerated filer o Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant was $1.4 billion as of June 30, 2014, based upon the price at which the registrant’s Common Stock was last sold as reported on the New York Stock Exchange on such date.

At February 18, 2015, 39,187,087 shares of Common Stock, par value $0.01, of the registrant were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information called for by Part III is incorporated by reference to the definitive Proxy Statement for the Annual Meeting of Shareholders of Granite Construction Incorporated to be held on June 4, 2015, which will be filed with the Securities and Exchange Commission not later than 120 days after December 31, 2014.

Index

PART IV

EXHIBIT 101.INS | |

EXHIBIT 101.SCH | |

EXHIBIT 101.CAL | |

EXHIBIT 101.DEF | |

EXHIBIT 101.LAB | |

EXHIBIT 101.PRE | |

1

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

From time to time, Granite makes certain comments and disclosures in reports and statements, including in this Annual Report on Form 10-K, or statements made by its officers or directors, that are not based on historical facts, including statements regarding future events, occurrences, circumstances, activities, performance, outcomes and results that may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are identified by words such as “future,” “outlook,” “assumes,” “believes,” “expects,” “estimates,” “anticipates,” “intends,” “plans,” “appears,” “may,” “will,” “should,” “could,” “would,” “continue,” and the negatives thereof or other comparable terminology or by the context in which they are made. In addition, other written or oral statements which constitute forward-looking statements have been made and may in the future be made by or on behalf of Granite. These forward-looking statements are estimates reflecting the best judgment of senior management and reflect our current expectations regarding future events, occurrences, circumstances, activities, performance, outcomes and results. These expectations may or may not be realized. Some of these expectations may be based on beliefs, assumptions or estimates that may prove to be incorrect. In addition, our business and operations involve numerous risks and uncertainties, many of which are beyond our control, which could result in our expectations not being realized or otherwise materially affect our business, financial condition, results of operations, cash flows and liquidity. Such risks and uncertainties include, but are not limited to, those more specifically described in this report under “Item 1A. Risk Factors.” Due to the inherent risks and uncertainties associated with our forward-looking statements, the reader is cautioned not to place undue reliance on them. The reader is also cautioned that the forward-looking statements contained herein speak only as of the date of this Annual Report on Form 10-K, and, except as required by law, we undertake no obligation to revise or update any forward-looking statements for any reason.

PART I

Item 1. BUSINESS

Introduction

Granite Construction Company was originally incorporated in 1922. In 1990, Granite Construction Incorporated was formed as the holding company for Granite Construction Company and its wholly-owned subsidiaries and was incorporated in Delaware. Unless otherwise indicated, the terms “we,” “us,” “our,” “Company” and “Granite” refer to Granite Construction Incorporated and its consolidated subsidiaries.

We are one of the largest diversified heavy civil contractors and construction materials producers in the United States. We operate nationwide, serving both public and private sector clients. Within the public sector, we primarily concentrate on heavy-civil infrastructure projects, including the construction of streets, roads, highways, mass transit facilities, airport infrastructure, bridges, trenchless and underground utilities, power-related facilities, utilities, tunnels, dams and other infrastructure-related projects. Within the private sector, we perform site preparation and infrastructure services for residential development, energy development, commercial and industrial sites, and other facilities, as well as provide construction management professional services.

We own and lease substantial aggregate reserves and own a number of plant facilities to produce construction materials for use in our construction business and for sale to third parties. We also have one of the largest contractor-owned heavy construction equipment fleets in the United States. We believe that the ownership of these assets enables us to compete more effectively by ensuring availability of these resources at a favorable cost.

In December 2012, we purchased 100% of the outstanding stock of Kenny Construction Company (“Kenny”), a Northbrook, Illinois-based national contractor and construction manager. Amounts associated with Kenny are included in our consolidated statements of operations and of cash flows for the years ended December 31, 2014 and 2013 and on the consolidated balance sheets as of December 31, 2014 and 2013.

Operating Structure

During 2014, our business was organized into four reportable business segments. These business segments were: Construction, Large Project Construction, Construction Materials and Real Estate. In the fourth quarter of 2014, we determined that the Real Estate segment no longer met the requirements of a reportable business segment under Accounting Standard Codification (“ASC”) 280 and have eliminated it as a segment for all periods presented. See Note 20 of “Notes to the Consolidated Financial Statements” for additional information about our reportable business segments.

2

In addition to business segments, we review our business by operating groups and by public and private market sectors. Our operating groups are defined as follows: 1) California; 2) Northwest, which primarily includes offices in Alaska, Arizona, Nevada, Utah and Washington; 3) Heavy Civil, which primarily includes offices in California, Florida, New York and Texas; and 4) Kenny, which primarily includes offices in Colorado and Illinois. Each of these operating groups may include financial results from our Construction and Large Project Construction segments. A project’s results are reported in the operating group that is responsible for the project, not necessarily the geographic area where the work is located. In some cases, the operations of an operating group include the results of work performed outside of that geographic region. Our California and Northwest operating groups include financial results from our Construction Materials segment.

Construction: Revenue from our Construction segment was $1.2 billion and $1.3 billion (52.1% and 55.2% of our total revenue) in 2014 and 2013, respectively. Revenue from our Construction segment is derived from both public and private sector clients. The Construction segment performs construction management, as well as various civil construction projects with a large portion of the work focused on new construction and improvement of streets, roads, highways, bridges, site work, underground, power-related facilities, utilities and other infrastructure projects. These projects are typically bid-build and construction management projects completed within two years with a contract value of less than $75 million.

Large Project Construction: Revenue from our Large Project Construction segment was $825.0 million and $777.8 million (36.3% and 34.3% of our total revenue) in 2014 and 2013, respectively. The Large Project Construction segment focuses on large, complex infrastructure projects which typically have a longer duration than our Construction segment work. These projects include major highways, mass transit facilities, bridges, tunnels, waterway locks and dams, pipelines, canals, power-related facilities, utilities and airport infrastructure. This segment primarily includes bid-build, design-build and construction management/general contractor contracts, together with various contract methods relating to Public Private Partnerships, generally with contract values in excess of $75 million.

We utilize the design-build construction management/general contract, construction management at-risk, and other alternative procurement methods of project delivery. Unlike traditional projects where owners first hire a design firm or design a project themselves and then put the project out to bid for construction, design-build projects provide the owner with a single point of responsibility and a single contact for both final design and construction. Although design-build projects carry additional risk as compared to traditional bid/build projects, the profit potential can also be higher. Under the construction management/general contract method of delivery, we contract with owners to manage the design phase of the contract with the understanding that we will negotiate a contract on the construction phase when the design nears completion. Revenue from alternative procurement method projects jointly represented 72.1% and 63.6% of Large Project Construction revenue in 2014 and 2013, respectively.

We participate in joint ventures with other construction companies mainly on projects in our Large Project Construction segment. Joint ventures are typically used for large, technically complex projects, including design-build projects, where it is necessary or desirable to share risk and resources. Joint venture partners typically provide independently prepared estimates, shared financing and equipment, and often bring local knowledge and expertise (see “Joint Ventures” section below).

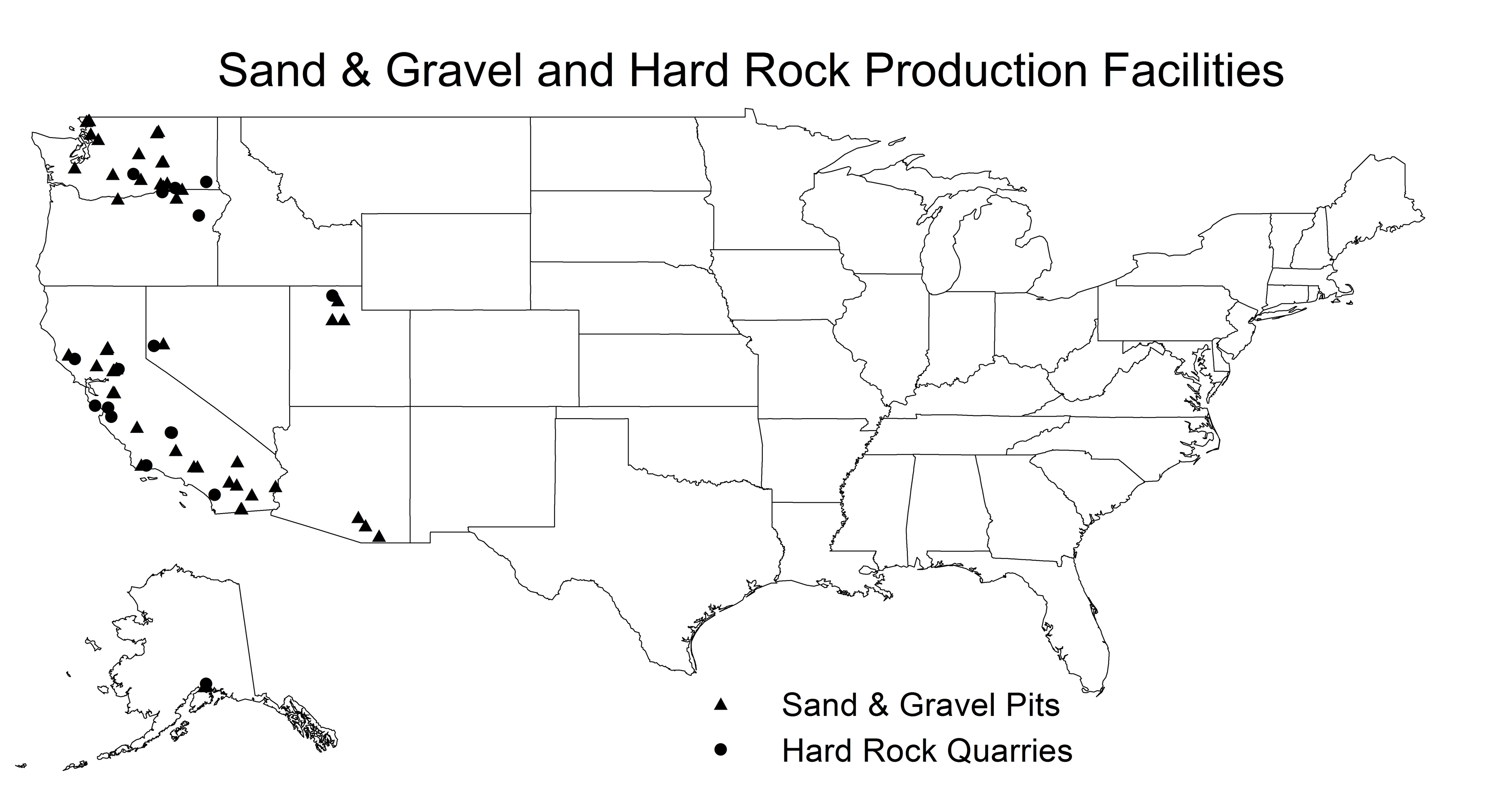

Construction Materials: Revenue from our Construction Materials segment was $263.8 million and $237.9 million (11.6% and 10.5% of our total revenue) in 2014 and 2013, respectively. The Construction Materials segment mines and processes aggregates and operates plants that produce construction materials for internal use and for sale to third parties. We have significant aggregate reserves that we own or lease through long-term leases. Sales to our construction projects represented 30.5% of our gross sales during 2014, and ranged from 30.5% to 45.6% over the last five years. The remainder is sold to third parties.

During 2013 and in connection with our 2010 Enterprise Improvement Plan (“EIP”), we recorded $14.7 million in restructuring charges related to non-performing quarry sites and incurred $3.2 million in lease termination charges, both related to the Construction Materials segment. During 2014 we recorded a $1.3 million restructuring gain resulting from our release from the lease obligations. In addition, during 2013 as part of the EIP we recorded $31.1 million of non-cash impairment charges, including amounts attributable to non-controlling interests of $3.9 million, related to all of the remaining consolidated real estate assets. Separate from the EIP, we recorded $1.3 million in non-cash impairment gains and $3.2 million in non-cash impairment charges during 2014 and 2013, respectively, related to the Construction Materials segment. See Note 11 of “Notes to the Consolidated Financial Statements” and “Restructuring and Impairment (Gains) Charges, Net” under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional information.

3

Business Strategy

Our fundamental objective is to increase long-term shareholder value as measured by the appreciation of the value of our common stock over a period of time, as well as dividend payouts. A specific measure of our financial success is the achievement of a return on net assets greater than the cost of capital. The following are key factors in our ability to achieve these objectives:

Aggregate Materials - We own and lease aggregate reserves and own processing plants that are vertically integrated into our construction operations. By ensuring availability of these resources and providing quality products, we believe we have a competitive advantage in many of our markets, as well as a source of revenue and earnings from the sale of construction materials to third parties.

Controlled Growth - We intend to grow our business by working on many types of infrastructure projects, as well as by expanding into new geographic areas organically and through acquisitions. In addition, our financial strength and project experience provide us with a competitive advantage, as we focus our efforts on larger projects.

Decentralized Profit Centers - Each of our operating groups is established as an individual profit center which encourages entrepreneurial activity while allowing the operating groups to benefit from centralized administrative and support functions.

Diversification - To mitigate the risks inherent in the construction business as the result of general economic factors, we pursue projects: (i) in both the public and private sectors; (ii) in federal, rail, power and renewable energy markets; (iii) for a wide range of customers within each sector (from the federal government to small municipalities and from large corporations to individual homeowners); (iv) in diverse geographic markets; (v) that are construction management/general contractor, design-build and bid-build; (vi) at fixed price, time and materials, cost reimbursable and fixed unit price; and (vii) of various sizes, durations and complexity. In addition to pursuing opportunities with traditional project funding, we continue to evaluate other sources of project funding (e.g., public and private partnerships).

Employee Development - We believe that our employees are key to the successful implementation of our business strategies. Significant resources are employed to attract, develop and retain extraordinary talent and fully promote each employee’s capabilities.

Core Competency Focus - A core competency is to perform the myriad tasks necessary to deliver major infrastructure projects. These projects include the building of roads, highways, bridges, dams, tunnels, mass transit facilities, airport and railroad infrastructure, underground utilities, power-related facilities, materials management, construction management, staff augmentation and site preparation. This focus allows us to most effectively utilize our specialized strengths.

Ownership of Construction Equipment - We own a large fleet of well-maintained heavy construction equipment. The ownership of construction equipment enables us to compete more effectively by ensuring availability of the equipment at a favorable cost.

Profit-based Incentives - Managers are incentivized with cash compensation and restricted equity awards, payable upon the attainment of pre-established annual financial and non-financial metrics.

Selective Bidding - We focus our resources on bidding jobs that meet our selective bidding criteria, which include analyzing the risk of a potential job relative to: (i) available personnel to estimate and prepare the proposal as well as to effectively manage and build the project; (ii) the competitive environment; (iii) our experience with the type of work and with the owner; (iv) local resources and partnerships; (v) equipment resources; and (vi) the size, complexity and expected profitability of the job.

Our operating principles include:

Accident Prevention - We believe accident prevention is a moral obligation as well as good business. By identifying and concentrating resources to address jobsite hazards, we continually strive to reduce our incident rates and the costs associated with accidents.

Quality and High Ethical Standards - We believe in the importance of performing high quality work. Additionally, we believe in maintaining high ethical standards through an established code of conduct and an effective company-wide compliance program.

Sustainability - Our focus on sustainability encompasses many aspects of how we conduct ourselves and practice our core values. We believe sustainability is important to our customers, employees, shareholders, and communities, and is also a long-term business driver. By focusing on specific initiatives that address social, environmental and economic challenges, we can minimize risk and increase our competitive advantage.

4

Raw Materials

We purchase raw materials, including aggregate products, cement, diesel fuel, liquid asphalt, natural gas, propane and steel, from numerous sources. Our aggregate reserves supply a portion of the raw materials needed in our construction projects. The price and availability of raw materials may vary from year to year due to market conditions and production capacities. We do not foresee a lack of availability of any raw materials in the near term.

Seasonality

Our operations are typically affected by weather conditions during the first and fourth quarters of our fiscal year which may alter our construction schedules and can create variability in our revenues, profitability and the required number of employees.

Customers

Customers in our Construction segment include certain federal agencies, state departments of transportation, county and city public works departments, school districts and developers, utilities and owners of industrial, commercial and residential sites. Customers of our Large Project Construction segment are predominantly in the public sector and currently include various state departments of transportation, local transit authorities, utilities and federal agencies. Customers of our Construction Materials segment include internal usage by our own construction projects, as well as third-party customers. Our third party customers include, but, are not limited to, contractors, landscapers, manufacturers of products requiring aggregate materials, retailers, homeowners, farmers and brokers.

During the years ended December 31, 2014, 2013, and 2012, our largest volume customer, including both prime and subcontractor arrangements, was the California Department of Transportation (“Caltrans”). Revenue recognized from contracts with Caltrans represented $195.4 million (8.6% of our total revenue) in 2014, of which $178.7 million (15.1% of segment revenue) was in our Construction segment and $16.8 million (2.0% of segment revenue) was in our Large Project Construction segment. Revenue from Caltrans represented $265.8 million (11.7% of total revenue) in 2013, of which $239.9 million (19.2% of segment revenue) was in our Construction segment and $25.9 million (3.3% of segment revenue) was in the Large Project Construction segment. Revenue from Caltrans represented $272.9 million (13.1% of total revenue) in 2012, of which $268.9 million (27.3% of segment revenue) was in the Construction segment and $4.1 million (0.5% of segment revenue) was in the Large Project Construction segment.

Contract Backlog

Our contract backlog consists of the remaining unearned revenue on awarded contracts, including 100% of our consolidated joint venture contracts and our proportionate share of unconsolidated joint venture contracts. We generally include a project in our contract backlog at the time a contract is awarded and funding is in place. Certain federal government contracts where funding is appropriated on a periodic basis are included in contract backlog at the time of the award. Existing contracts that include unexercised contract options and unissued task orders are included in contract backlog as follows:

Contract Options: Contract options represent the monetary value of option periods under existing contracts in contract backlog, which are exercisable at the option of our customers without requiring us to go through an additional competitive bidding process and would be canceled only if a customer decided to end the project (a termination for convenience) or through a termination for default. When the options are exercised and funding is in place, the amount associated with the exercised option is recorded into contract backlog.

Task Orders: Task orders represent the expected monetary value of signed contracts under which we perform work only when the customer awards specific task orders or projects to us. When agreements for such task orders or projects are signed and funding is in place, the amount associated with the task order is recorded into contract backlog.

Substantially all of the contracts in our contract backlog, as well as unexercised contract options and unissued task orders, may be canceled or modified at the election of the customer; however, we have not been materially adversely affected by contract cancellations or modifications in the past (see “Contract Provisions and Subcontracting”). Many projects in our Construction segment are added to backlog and completed within a year and therefore may not be reflected in our beginning or year-end contract backlog. Contract backlog by segment is presented in “Contract Backlog” under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our contract backlog was $2.7 billion and $2.5 billion at December 31, 2014 and 2013, respectively. Approximately $1.4 billion of the December 31, 2014 contract backlog is expected to be completed during 2015.

5

Equipment

At December 31, 2014 and 2013, we owned the following number of construction equipment and vehicles:

December 31, | 2014 | 2013 | ||

Heavy construction equipment | 2,506 | 2,534 | ||

Trucks, truck-tractors, trailers and vehicles | 3,851 | 3,664 | ||

Our portfolio of equipment includes backhoes, barges, bulldozers, cranes, excavators, loaders, motor graders, pavers, rollers, scrapers, trucks and tunnel boring machines that are used in our Construction, Large Project Construction and Construction Materials segments. We believe that ownership of equipment is generally preferable to leasing because it ensures the equipment is available as needed and normally results in lower costs. We pool certain equipment for use by our Construction, Large Project Construction and Construction Materials segments to maximize utilization. We continually monitor and adjust our fleet size so that it is consistent with the size of our business, considering both existing backlog and expected future work. On a short-term basis, we lease or rent equipment to supplement existing equipment in response to construction activity peaks. In 2014 and 2013, we spent $32.3 million and $30.2 million, respectively, on purchases of construction equipment and vehicles.

Employees

On December 31, 2014, we employed approximately 1,700 salaried employees who work in management, estimating and clerical capacities, plus approximately 1,300 hourly employees. The total number of hourly personnel is subject to the volume of construction in progress and is seasonal. During 2014, the number of hourly employees ranged from approximately 1,300 to 3,600 and averaged approximately 2,900. Four of our wholly-owned subsidiaries, Granite Construction Company, Granite Construction Northeast, Inc., Granite Infrastructure Constructors, Inc., and Kenny Construction Company, are parties to craft collective bargaining agreements in many areas in which they work.

We believe our employees are our most valuable resource, and our workforce possesses a strong dedication to and pride in our company. Among salaried and non-union hourly employees, this dedication is reinforced by a 5.5% equity ownership at December 31, 2014 through our 401(k) Plan. Our managerial and supervisory personnel have an average of approximately 10 years of service with Granite.

Competition

Competitors in our Construction segment typically range from small, local construction companies to large, regional, national and international construction companies. We compete with numerous companies in individual markets; however, there are few, if any, companies which compete in all of our market areas. Many of our Construction segment competitors have the ability to perform work in either the private or public sectors. When opportunities for work in one sector are reduced, competitors tend to look for opportunities in the other sector. This migration has the potential to reduce revenue growth and/or increase pressure on gross profit margins.

The scale and complexity of jobs in the Large Project Construction segment preclude many smaller contractors from bidding such work. Consequently, our Large Project Construction segment competition typically is comprised of large, regional, national and international construction companies.

We own and/or have long-term leases on aggregate resources that we believe provide a competitive advantage in certain markets for both the Construction and Large Project Construction segments.

Competitors in our Construction Materials segment typically range from small local materials companies to large regional, national and international materials companies. We compete with numerous companies in individual markets; however, there are few, if any, companies which compete in all of our market areas.

Factors influencing our competitiveness include price, estimating abilities, knowledge of local markets and conditions, project management, financial strength, reputation for quality, aggregate materials availability, and machinery and equipment. Historically, the construction business has not required large amounts of capital, particularly for the smaller size construction work pursued by our Construction segment, which can result in relative ease of market entry for companies possessing acceptable qualifications. Although the construction business is highly competitive, we believe we are well positioned to compete effectively in the markets in which we operate.

6

Contract Provisions and Subcontracting

Our contracts with our customers are primarily “fixed unit price” or “fixed price.” Under fixed unit price contracts, we are committed to providing materials or services at fixed unit prices (for example, dollars per cubic yard of concrete placed or cubic yard of earth excavated). While the fixed unit price contract shifts the risk of estimating the quantity of units required for a particular project to the customer, any increase in our unit cost over the expected unit cost in the bid, whether due to inflation, inefficiency, errors in our estimates or other factors, is borne by us unless otherwise provided in the contract. Fixed price contracts are priced on a lump-sum basis under which we bear the risk of performing all the work for the specified amount. The percentage of fixed price contracts in our contract backlog increased to 71.0% at December 31, 2014 compared with 63.5% at December 31, 2013. The percentage of fixed unit price contracts in our contract backlog was 19.9% and 26.0% at December 31, 2014 and 2013, respectively. All other contract types represented 9.1% and 10.5% of our backlog at December 31, 2014 and 2013, respectively.

Our construction contracts are obtained through competitive bidding in response to solicitations by both public agencies and private parties and on a negotiated basis as a result of solicitations from private parties. Project owners use a variety of methods to make contractors aware of new projects, including posting bidding opportunities on agency websites, disclosing long-term infrastructure plans, advertising and other general solicitations. Our bidding activity is affected by such factors as the nature and volume of advertising and other solicitations, contract backlog, available personnel, current utilization of equipment and other resources, our ability to obtain necessary surety bonds and competitive considerations. Our contract review process includes identifying risks and opportunities during the bidding process and managing these risks through mitigation efforts such as contract negotiation, insurance and pricing. Contracts fitting certain criteria of size and complexity are reviewed by various levels of management and, in some cases, by the Executive Committee of our Board of Directors. Bidding activity, contract backlog and revenue resulting from the award of new contracts may vary significantly from period to period.

There are a number of factors that can create variability in contract performance as compared to the original bid. Such factors can positively or negatively impact costs and profitability, may cause higher than anticipated construction costs and can create additional liability to the contract owner. The most significant of these include:

• | the completeness and accuracy of the original bid; |

• | costs associated with scope changes; |

• | costs of labor and/or materials; |

• | extended overhead due to owner, weather and other delays; |

• | subcontractor performance issues; |

• | changes in productivity expectations; |

• | site conditions that differ from those assumed in the original bid (to the extent contract remedies are unavailable); |

• | continuing changes from original design on design-build projects; |

• | the availability and skill level of workers in the geographic location of the project; |

• | a change in the availability and proximity of equipment and materials; and |

• | our ability to fully and promptly recover on claims for additional contract costs. |

The ability to realize improvements on project profitability at times is more limited than the risk of lower profitability. For example, design-build projects typically incur additional costs such as right-of-way and permit acquisition costs. In addition, design-build contracts carry additional risks such as those associated with design errors and estimating quantities and prices before the project design is completed. We manage this additional risk by adding contingencies to our bid amounts, obtaining errors and omissions insurance and obtaining indemnifications from our design consultants where possible. However, there is no guarantee that these risk management strategies will always be successful.

Most of our contracts, including those with the government, provide for termination at the convenience of the contract owner, with provisions to pay us for work performed through the date of termination. We have not been materially adversely affected by these provisions in the past. Many of our contracts contain provisions that require us to pay liquidated damages if specified completion schedule requirements are not met, and these amounts could be significant.

We act as prime contractor on most of our construction projects. We complete the majority of our projects with our own resources and subcontract specialized activities such as electrical and mechanical work. As prime contractor, we are responsible for the performance of the entire contract, including subcontract work. Thus, we may be subject to increased costs associated with the failure of one or more subcontractors to perform as anticipated. Based on our analysis of their construction and financial capabilities, among other criteria, we determine whether to require the subcontractor to furnish a bond or other type of security to guarantee their performance. Disadvantaged business enterprise regulations require us to use our good faith efforts to subcontract a specified portion of contract work done for governmental agencies to certain types of disadvantaged contractors or suppliers. As with all of our subcontractors, some may not be able to obtain surety bonds or other types of performance security.

7

Joint Ventures

We participate in various construction joint ventures, partnerships and a limited liability company of which we are a limited member (“joint ventures”) in order to share expertise, risk and resources for certain highly complex projects. Generally, each construction joint venture is formed to accomplish a specific project and is jointly controlled by the joint venture partners. We select our joint venture partners based on our analysis of their construction and financial capabilities, expertise in the type of work to be performed and past working relationships, among other criteria. The joint venture agreements typically provide that our interests in any profits and assets, and our respective share in any losses and liabilities, that may result from the performance of the contract are limited to our stated percentage interest in the project.

Under each joint venture agreement, one partner is designated as the sponsor. The sponsoring partner typically provides all administrative, accounting and most of the project management support for the project and generally receives a fee from the joint venture for these services. We have been designated as the sponsoring partner in certain of our current joint venture projects and are a non-sponsoring partner in others.

We also participate in various “line item” joint venture agreements under which each partner is responsible for performing certain discrete items of the total scope of contracted work. The revenue for these discrete items is defined in the contract with the project owner and each venture partner bears the profitability risk associated with its own work. There is not a single set of books and records for a line item joint venture. Each partner accounts for its items of work individually as it would for any self-performed contract. We account for our portion of these contracts as project revenues and costs in our accounting system and include receivables and payables associated with our work in our consolidated financial statements.

The agreements with our joint venture partners and limited liability company members (“partner(s)”) for both construction joint ventures and line item joint ventures define each partner’s management role and financial responsibility in the project. The amount of exposure is generally limited to our stated ownership interest. Due to the joint and several nature of the performance obligations under these agreements, if one of the partners fails to perform, we and the remaining partners, if any, would be responsible for performance of the outstanding work (i.e., we provide a performance guarantee). We estimate our liability for performance guarantees and include them in accrued expenses and other current liabilities with a corresponding asset in equity in construction joint ventures on the consolidated balance sheets. We reassess our liability when and if changes in circumstances occur. The liability and corresponding asset are removed from the consolidated balance sheets upon completion and customer acceptance of the project. Circumstances that could lead to a loss under these agreements beyond our stated ownership interest include the failure of a partner to contribute additional funds to the venture in the event the project incurs a loss or additional costs that we could incur should a partner fail to provide the services and resources that it had committed to provide in the agreement. We are not able to estimate amounts that may be required beyond the remaining cost of the work to be performed. These costs could be offset by billings to the customer or by proceeds from our partners’ corporate and/or other guarantees.

At December 31, 2014, there was $5.7 billion of construction revenue to be recognized on unconsolidated and line item construction joint venture contracts, of which $1.7 billion represented our share and the remaining $4.0 billion represented our partners’ share.

Insurance and Bonding

We maintain general and excess liability, construction equipment and workers’ compensation insurance; all in amounts consistent with industry practice.

In connection with our business, we generally are required to provide various types of surety bonds that provide an additional measure of security for our performance under certain public and private sector contracts. Our ability to obtain surety bonds depends upon our capitalization, working capital, past performance, management expertise and external factors, including the capacity of the overall surety market. Surety companies consider such factors in light of the amount of our contract backlog that we have currently bonded and their current underwriting standards, which may change from time to time. The capacity of the surety market is subject to market-based fluctuations driven primarily by the level of surety industry losses and the degree of surety market consolidation. When the surety market capacity shrinks it results in higher premiums and increased difficulty obtaining bonding, in particular for larger, more complex projects throughout the market. In order to help mitigate this risk, we employ a co-surety structure involving three sureties. Although we do not believe that fluctuations in surety market capacity have significantly affected our ability to grow our business, there is no assurance that it will not significantly affect our ability to obtain new contracts in the future (see “Item 1A. Risk Factors”).

8

Environmental Regulations

Our operations are subject to various federal, state and local laws and regulations relating to the environment, including those relating to discharges to air, water and land, the handling and disposal of solid and hazardous waste, the handling of underground storage tanks and the cleanup of properties affected by hazardous substances. Certain environmental laws impose substantial penalties for non-compliance and others, such as the federal Comprehensive Environmental Response, Compensation and Liability Act, impose strict, retroactive, joint and several liability upon persons responsible for releases of hazardous substances. We continually evaluate whether we must take additional steps at our locations to ensure compliance with environmental laws. While compliance with applicable regulatory requirements has not materially adversely affected our operations in the past, there can be no assurance that these requirements will not change and that compliance will not adversely affect our operations in the future. In addition, our aggregate materials operations require operating permits granted by governmental agencies. We believe that tighter regulations for the protection of the environment and other factors will make it increasingly difficult to obtain new permits and renewal of existing permits may be subject to more restrictive conditions than currently exist.

In July 2007, the California Air Resources Board (“CARB”) approved a regulation that will require California equipment owners/operators to reduce diesel particulate and nitrogen oxide emissions from in-use off-road diesel equipment and to meet progressively more restrictive emission targets from 2010 to 2020. In December 2008, CARB approved a similar regulation for in-use on-road diesel equipment that includes more restrictive emission targets from 2010 to 2022. The emission targets will require California off-road and on-road diesel equipment owners to retrofit equipment with diesel emission control devices or replace equipment with new engine technology as it becomes available, which will result in higher equipment-related expenses. In December 2010, CARB amended both regulations to grant economic relief to affected fleets by extending initial compliance dates as well as adding additional compliance requirements. To-date, costs to prepare the Company for compliance have totaled $14.7 million and costs of compliance in 2015 are expected to be $5.6 million. We will continue to manage compliance costs; however, it is not possible to determine the total future cost of compliance.

As is the case with other companies in our industry, some of our aggregate products contain varying amounts of crystalline silica, a common mineral. Also, some of our construction and material processing operations release, as dust, crystalline silica that is in the materials being handled. Excessive, prolonged inhalation of very small-sized particles of crystalline silica has allegedly been associated with respiratory disease (including Silicosis). The Mine Safety and Health Administration and the Occupational Safety and Health Administration have established occupational thresholds for crystalline silica exposure as respirable dust. We have implemented dust control procedures to measure compliance with requisite thresholds and to verify that respiratory protective equipment is made available as necessary. We also communicate, through safety information sheets and other means, what we believe to be appropriate warnings and cautions to employees and customers about the risks associated with excessive, prolonged inhalation of mineral dust in general and crystalline silica in particular (see “Item 1A. Risk Factors”).

Website Access

Our website address is www.graniteconstruction.com. On our website we make available, free of charge, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission (“SEC”). The information on our website is not incorporated into, and is not part of, this report. These reports, and any amendments to them, are also available at the website of the SEC, www.sec.gov.

9

Executive Officers of the Registrant

Information regarding our executive officers is set forth below.

Name | Age | Position |

James H. Roberts | 58 | President and Chief Executive Officer |

Christopher S. Miller | 48 | Executive Vice President and Chief Operating Officer |

Laurel J. Krzeminski | 60 | Senior Vice President and Chief Financial Officer |

Michael F. Donnino | 60 | Senior Vice President and Group Manager |

Martin P. Matheson | 53 | Senior Vice President and Group Manager |

James D. Richards | 51 | Senior Vice President and Group Manager |

Mr. Roberts joined Granite in 1981 and has served in various capacities, including President and Chief Executive Officer since September 2010. He also served as Executive Vice President and Chief Operating Officer from September 2009 to August 2010, Senior Vice President from May 2004 to September 2009, Granite West Manager from February 2007 to September 2009, Branch Division Manager from May 2004 to February 2007, Vice President and Assistant Branch Division Manager from 1999 to 2004, and Regional Manager of Nevada and Utah Operations from 1995 to 1999. Mr. Roberts served as Chairman of The National Asphalt Pavement Association in 2006. He received a B.S.C.E. in 1979 and an M.S.C.E. in 1980 from the University of California, Berkeley, and an M.B.A. from the University of Southern California in 1981. He also completed the Stanford Executive Program in 2009.

Mr. Miller has served as Granite’s Executive Vice President and Chief Operating Officer since August 2014. From June 2006 to July 2014, he served in various executive positions with CH2M HILL, including Managing Director, Global Operations; Managing Director, United Kingdom Ministry of Defense Programs; President, Government Facilities and Infrastructure Business Group; President, CH2M HILL Constructors, Inc. and Global Business Development and Planning Director. Prior to CH2M Hill, Mr. Miller served as Director of Federal Programs for Jacobs Engineering Group. From 1989 to 1995, Mr. Miller served in the United States Air Force in the Human Systems Division, Weapons System Program Office and the Air Force Center for Environmental Excellence. He received a B.A. in Biology from the University of Louisville and an M.S. in Civil Engineering from the University of Texas at San Antonio.

Ms. Krzeminski joined Granite in 2008 and has served as Chief Financial Officer since November 2010 and Senior Vice President since January 2013. She also served as Vice President from July 2008 to December 2012, Interim Chief Financial Officer from June 2010 to October 2010 and Corporate Controller from July 2008 to May 2010. From 1993 to 2007, she served in various corporate and operational finance positions with The Gillette Company (acquired by The Procter & Gamble Company in 2005), including Finance Director for the Duracell and Braun North American business units. Ms. Krzeminski also served as the Director of Gillette’s Sarbanes-Oxley Section 404 Compliance program and as Gillette’s Director of Corporate Financial Reporting. Her experience also includes several years in public accounting with an international accounting firm. She received a Bachelor’s degree in Business Administration-Accounting from San Diego State University.

Mr. Donnino joined Granite in 1977 and has served as Senior Vice President and Group Manager since January 2010, Senior Vice President since January 2005, Manager of Granite East from February 2007 to December 2009, and Heavy Construction Division Manager from January 2005 to February 2007. He served as Vice President and Heavy Construction Division Assistant Manager during 2004, Texas Regional Manager from 2000 to 2003 and Dallas Estimating Office Area Manager from 1991 to 2000. Mr. Donnino received a B.S.C.E. in Structural, Water and Soils Engineering from the University of Minnesota in 1976.

Mr. Matheson joined Granite in 1989 and has served as Senior Vice President and Group Manager since August 2013. He also served as Washington Region Manager from February 2007 through July 2013, Branch Division Construction Manager from 2006 through February 2007, Utah Operations Area/Operations Manager from 1999 to 2006 and in other positions at Granite’s Nevada Branch between 1989 and 1997. Prior to joining Granite, he worked at Kenny Construction Company. Mr. Matheson received a B.S. in Animal Science from University of Illinois in 1983.

Mr. Richards joined Granite in January 1992 and has served as Senior Vice President and Group Manager since January 2013. He also served as Arizona Region Manager from February 2006 through December 2012, Arizona Region Chief Estimator from January 2000 through January 2006 and in other positions at Granite’s Arizona Branch between 1992 and 2000. Prior to joining Granite, he served as a U.S. Army Officer. Mr. Richards received a B.S. in Civil Engineering from New Mexico State University in 1987.

10

Item 1A. RISK FACTORS

Set forth below and elsewhere in this report and in other documents we file with the SEC are various risks and uncertainties that could cause our actual results to differ materially from the results contemplated by the forward-looking statements contained in this report or otherwise adversely affect our business.

• | We work in a highly competitive marketplace. We have multiple competitors in all of the areas in which we work, and some of our competitors are larger than we are and may have greater resources than we do. Government funding for public works projects is limited, thus contributing to competition for the limited number of public projects available. This increased competition may result in a decrease in new awards at acceptable profit margins. In addition, should downturns in residential and commercial construction activity occur, the competition for available public sector work would intensify, which could impact our revenue, contract backlog and profit margins. |

• | Government contracts generally have strict regulatory requirements. Approximately 75.0% of our total revenue in 2014 was derived from contracts funded by federal, state and local government agencies and authorities. Government contracts are subject to specific procurement regulations, contract provisions and a variety of socioeconomic requirements relating to their formation, administration, performance and accounting and often include express or implied certifications of compliance. Claims for civil or criminal fraud may be brought for violations of regulations, requirements or statutes. We may also be subject to qui tam (“Whistle Blower”) litigation brought by private individuals on behalf of the government under the Federal Civil False Claims Act, which could include claims for up to treble damages. Further, if we fail to comply with any of the regulations, requirements or statutes or if we have a substantial number of accumulated Occupational Safety and Health Administration, Mine Safety and Health Administration or other workplace safety violations, our existing government contracts could be terminated and we could be suspended from government contracting or subcontracting, including federally funded projects at the state level. Should one or more of these events occur, it could have a material adverse effect on our financial position, results of operations, cash flows and liquidity. |

• | Government contractors are subject to suspension or debarment from government contracting. Our substantial dependence on government contracts exposes us to a variety of risks that differ from those associated with private sector contracts. Various statutes to which our operations are subject, including the Davis-Bacon Act (which regulates wages and benefits), the Walsh-Healy Act (which prescribes a minimum wage and regulates overtime and working conditions), Executive Order 11246 (which establishes equal employment opportunity and affirmative action requirements) and the Drug-Free Workplace Act, provide for mandatory suspension and/or debarment of contractors in certain circumstances involving statutory violations. In addition, the Federal Acquisition Regulation and various state statutes provide for discretionary suspension and/or debarment in certain circumstances that might call into question a contractor’s willingness or ability to act responsibly, including as a result of being convicted of, or being found civilly liable for, fraud or a criminal offense in connection with obtaining, attempting to obtain or performing a public contract or subcontract. The scope and duration of any suspension or debarment may vary depending upon the facts and the statutory or regulatory grounds for debarment and could have a material adverse effect on our financial position, results of operations, cash flows and liquidity. |

• | Our success depends on attracting and retaining qualified personnel, joint venture partners and subcontractors in a competitive environment. The success of our business is dependent on our ability to attract, develop and retain qualified personnel, joint venture partners, advisors and subcontractors. Changes in general or local economic conditions and the resulting impact on the labor market and on our joint venture partners may make it difficult to attract or retain qualified individuals in the geographic areas where we perform our work. If we are unable to provide competitive compensation packages, high-quality training programs and attractive work environments or to establish and maintain successful partnerships, our ability to profitably execute our work could be adversely impacted. |

• | Failure to maintain safe work sites could result in significant losses. Construction and maintenance sites are potentially dangerous workplaces and often put our employees and others in close proximity with mechanized equipment, moving vehicles, chemical and manufacturing processes, and highly regulated materials. On many sites, we are responsible for safety and, accordingly, must implement safety procedures. If we fail to implement these procedures or if the procedures we implement are ineffective, we may suffer the loss of or injury to our employees, as well as expose ourselves to possible litigation. Despite having invested significant resources in safety programs and being recognized as an industry leader, a serious accident may nonetheless occur on one of our worksites. As a result, our failure to maintain adequate safety standards could result in reduced profitability or the loss of projects or clients, and could have a material adverse impact on our financial position, results of operations, cash flows and liquidity. |

11

• | An inability to obtain bonding could have a negative impact on our operations and results. As more fully described in “Insurance and Bonding” under “Item 1. Business,” we generally are required to provide surety bonds securing our performance under the majority of our public and private sector contracts. Our inability to obtain reasonably priced surety bonds in the future could significantly affect our ability to be awarded new contracts, which could have a material adverse effect on our financial position, results of operations, cash flows and liquidity. |

• | We may be unable to identify and contract with qualified Disadvantaged Business Enterprise (“DBE”) contractors to perform as subcontractors. Certain of our government agency projects contain minimum DBE participation clauses. If we subsequently fail to complete these projects with the minimum DBE participation, we may be held responsible for breach of contract, which may include restrictions on our ability to bid on future projects as well as monetary damages. To the extent we are responsible for monetary damages, the total costs of the project could exceed our original estimates, we could experience reduced profits or a loss for that project and there could be a material adverse impact to our financial position, results of operations, cash flows and liquidity. |

• | Fixed price and fixed unit price contracts subject us to the risk of increased project cost. As more fully described in “Contract Provisions and Subcontracting” under “Item 1. Business,” the profitability of our fixed price and fixed unit price contracts can be adversely affected by a number of factors that can cause our actual costs to materially exceed the costs estimated at the time of our original bid. |

• | Design-build contracts subject us to the risk of design errors and omissions. Design-build is increasingly being used as a method of project delivery as it provides the owner with a single point of responsibility for both design and construction. We generally subcontract design responsibility to architectural and engineering firms. However, in the event of a design error or omission causing damages, there is risk that the subcontractor or their errors and omissions insurance would not be able to absorb the liability. In this case we may be responsible, resulting in a potentially material adverse effect on our financial position, results of operations, cash flows and liquidity. |

• | Many of our contracts have penalties for late completion. In some instances, including many of our fixed price contracts, we guarantee that we will complete a project by a certain date. If we subsequently fail to complete the project as scheduled we may be held responsible for costs resulting from the delay, generally in the form of contractually agreed-upon liquidated damages. To the extent these events occur, the total cost of the project could exceed our original estimate and we could experience reduced profits or a loss on that project. |

• | Strikes or work stoppages could have a negative impact on our operations and results. We are party to collective bargaining agreements covering a portion of our craft workforce. Although strikes or work stoppages have not had a significant impact on our operations or results in the past, such labor actions could have a significant impact on our operations and results if they occur in the future. |

• | Failure of our subcontractors to perform as anticipated could have a negative impact on our results. As further described in “Contract Provisions and Subcontracting” under “Item 1. Business,” we subcontract portions of many of our contracts to specialty subcontractors, but we are ultimately responsible for the successful completion of their work. Although we seek to require bonding or other forms of guarantees, we are not always successful in obtaining those bonds or guarantees from our higher-risk subcontractors. In this case we may be responsible for the failures on the part of our subcontractors to perform as anticipated, resulting in a potentially adverse impact on our cash flows and liquidity. In addition, the total costs of a project could exceed our original estimates and we could experience reduced profits or a loss for that project, which could have an adverse impact on our financial position, results of operations, cash flows and liquidity. |

• | Our joint venture contracts subject us to joint and several liability. As further described in Note 1 of “Notes to the Consolidated Financial Statements” and under “Item 1. Business; Joint Ventures,” we participate in various construction joint venture partnerships in connection with complex construction projects. If our joint venture partners fail to perform under one of these contracts, we could be liable for completion of the entire contract. If the contract were unprofitable, this could have a material adverse effect on our financial position, results of operations, cash flows and liquidity. |

12

• | Our failure to adequately recover on claims brought by us against project owners or other project participants for additional contract costs could have a negative impact on our liquidity and future operations. In certain circumstances, we assert claims against project owners, engineers, consultants, subcontractors or others involved in a project for additional costs exceeding the contract price or for amounts not included in the original contract price. These types of claims occur due to matters such as delays or changes from the initial project scope, both of which may result in additional costs. Often, these claims can be the subject of lengthy arbitration or litigation proceedings, and it is difficult to accurately predict when and the terms upon which these claims will be fully resolved. When these types of events occur, we use working capital in projects to promptly and fully cover cost overruns pending the resolution of the relevant claims. A failure to recover on these types of claims promptly and fully could have a negative impact on our liquidity and results of operations. In addition, while clients and subcontractors may be obligated to indemnify us against certain liabilities, such third parties may refuse or be unable to pay us. |

• | Failure to remain in compliance with covenants under our debt and credit agreements, service our indebtedness, or fund our other liquidity needs could adversely impact our business. Our debt and credit agreements and related restrictive and financial covenants are more fully described in Note 12 of “Notes to the Consolidated Financial Statements.” Our failure to comply with any of these covenants, or to pay principal, interest or other amounts when due thereunder, would constitute an event of default under the applicable agreements. Under certain circumstances, the occurrence of an event of default under one of our debt or credit agreements (or the acceleration of the maturity of the indebtedness under one of our agreements) may constitute an event of default under one or more of our other debt or credit agreements. Default under our debt and credit agreements could result in (1) us no longer being entitled to borrow under the agreements; (2) termination of the agreements; (3) the requirement that any letters of credit under the agreements be cash collateralized; (4) acceleration of the maturity of outstanding indebtedness under the agreements; and/or (5) foreclosure on any collateral securing the obligations under the agreements. On March 3, 2014, Granite executed amendments to the Credit Agreement and 2019 NPA (the “Amendments”), which terms include, among other things, (i) revised minimum Consolidated Tangible Net Worth; and (ii) revised maximum Consolidated Leverage Ratio. For the Credit Agreement, the Amendments were effective for our quarter ending March 31, 2013 and for the 2019 NPA, the Amendments were retroactive to December 31, 2013. If we are unable to service our debt obligations or fund our other liquidity needs, we could be forced to curtail our operations, reorganize our capital structure (including through bankruptcy proceedings) or liquidate some or all of our assets in a manner that could cause holders of our securities to experience a partial or total loss of their investment in us. |

• | Unavailability of insurance coverage could have a negative effect on our operations and results. We maintain insurance coverage as part of our overall risk management strategy and pursuant to requirements to maintain specific coverage that are contained in our financing agreements and in most of our construction contracts. Although we have been able to obtain reasonably priced insurance coverage to meet our requirements in the past, there is no assurance that we will be able to do so in the future, and our inability to obtain such coverage could have an adverse impact on our ability to procure new work, which could have a material adverse effect on our financial position, results of operations, cash flows and liquidity. |

• | Accounting for our revenues and costs involves significant estimates. As further described in “Critical Accounting Policies and Estimates” under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” accounting for our contract-related revenues and costs, as well as other expenses, requires management to make a variety of significant estimates and assumptions. Although we believe we have sufficient experience and processes to enable us to formulate appropriate assumptions and produce reasonably dependable estimates, these assumptions and estimates may change significantly in the future and could result in the reversal of previously recognized revenue and profit. Such changes could have a material adverse effect on our financial position and results of operations. |

• | We use certain commodity products that are subject to significant price fluctuations. Diesel fuel, liquid asphalt and other petroleum-based products are used to fuel and lubricate our equipment and fire our asphalt concrete processing plants. In addition, they constitute a significant part of the asphalt paving materials that are used in many of our construction projects and are sold to third parties. Although we are partially protected by asphalt or fuel price escalation clauses in some of our contracts, many contracts provide no such protection. We also use steel and other commodities in our construction projects that can be subject to significant price fluctuations. We pre-purchase commodities, enter into supply agreements or enter into financial contracts to secure pricing. We have not been significantly adversely affected by price fluctuations in the past; however, there is no guarantee that we will not be in the future. |

13

• | We are subject to environmental and other regulation. As more fully described in “Environmental Regulations” under “Item 1. Business,” we are subject to a number of federal, state and local laws and regulations relating to the environment, workplace safety and a variety of socioeconomic requirements. Noncompliance with such laws and regulations can result in substantial penalties, or termination or suspension of government contracts as well as civil and criminal liability. In addition, some environmental laws and regulations impose liability and responsibility on present and former owners, operators or users of facilities and sites for contamination at such facilities and sites, without regard to causation or knowledge of contamination. We occasionally evaluate various alternatives with respect to our facilities, including possible dispositions or closures. Investigations undertaken in connection with these activities may lead to discoveries of contamination that must be remediated, and closures of facilities may trigger compliance requirements that are not applicable to operating facilities. While compliance with these laws and regulations has not materially adversely affected our operations in the past, there can be no assurance that these requirements will not change and that compliance will not adversely affect our operations in the future. Furthermore, we cannot provide assurance that existing or future circumstances or developments with respect to contamination will not require us to make significant remediation or restoration expenditures. |

• | Weather can significantly affect our revenues and profitability. Our ability to perform work is significantly affected by weather conditions such as precipitation and temperature. Changes in weather conditions can cause delays and otherwise significantly affect our project costs. The impact of weather conditions can result in variability in our quarterly revenues and profitability, particularly in the first and fourth quarters of the year. |

• | Increasing restrictions on securing aggregate reserves could negatively affect our future operations and results. Tighter regulations and the finite nature of property containing suitable aggregate reserves are making it increasingly challenging and costly to secure aggregate reserves. Although we have thus far been able to secure reserves to support our business, our financial position, results of operations, cash flows and liquidity may be adversely affected by an increasingly difficult permitting process. |

• | We may be required to contribute cash to meet our unfunded pension obligations in certain multi-employer plans. Three of our wholly-owned subsidiaries, Granite Construction Company, Granite Construction Northeast, Inc., and Kenny Construction Company, participate in various domestic multi-employer pension plans on behalf of union employees. One of our wholly-owned subsidiaries, Granite Infrastructure Constructors, Inc., participates in a Canadian multi-employer pension plan covering union employees working on a construction project in Canada. Union employee benefits generally are based on a fixed amount for each year of service. We are required to make contributions to the plans in amounts established under collective bargaining agreements. Pension expense is recognized as contributions are made. The domestic pension plans are subject to the Employee Retirement Income Security Act of 1974 (“ERISA”). Under ERISA, a contributor to a multi-employer plan may be liable, upon termination or withdrawal from a plan, for its proportionate share of a plan’s unfunded vested liability. While we currently have no intention of withdrawing from a plan and unfunded pension obligations have not significantly affected our operations in the past, there can be no assurance that we will not be required to make material cash contributions to one or more of these plans to satisfy certain underfunded benefit obligations in the future. |

• | Recent healthcare legislation may increase our costs and reduce our future profitability. In 2012, the United States Supreme Court upheld the majority of the provisions in the Patient Protection and Affordable Care Act (the “Act”). The Act places requirements on employers to provide a minimum level of benefits to employees and assesses penalties on employers if the benefits do not meet the required minimum level or if the cost of coverage to employees exceeds affordability thresholds specified in the Act. The minimum benefits and affordability requirements took effect in 2015. The Act also imposes an excise tax beginning in 2018 on plans whose average cost exceeds specified amounts. Although our initial assessment indicates that the provisions in the Act will not have a material adverse impact to our financial position, results of operations, cash flows and liquidity, it is difficult to predict the financial and operational impacts due to the breadth and complexity of this legislation. |

• | Force majeure events, including natural disasters and terrorists’ actions, could negatively impact our business, which may affect our financial condition, results of operations or cash flows. Force majeure or extraordinary events beyond the control of the contracting parties, such as natural and man-made disasters, as well as terrorist actions, could negatively impact the economies in which we operate. We typically negotiate contract language where we are allowed certain relief from force majeure events in private client contracts and review and attempt to mitigate force majeure events in both public and private client contracts. We remain obligated to perform our services after most extraordinary events subject to relief that may be available pursuant to a force majeure clause. If we are not able to react quickly to force majeure events, our operations may be affected significantly, which would have a negative impact on our financial position, results of operations, cash flows and liquidity. |

14

• | Changes to our outsourced software or infrastructure vendors as well as any sudden loss, breach of security, disruption or unexpected data or vendor loss associated with our information technology systems could have a material adverse effect on our business. We rely on third-party software and infrastructure to run critical accounting, project management and financial information systems. If software or infrastructure vendors decide to discontinue further development, integration or long-term maintenance support for our information systems, or there is any system interruption, delay, breach of security, loss of data or loss of a vendor, we may need to migrate some or all of our accounting, project management and financial information to other systems. Despite business continuity plans, these disruptions could increase our operational expense as well as impact the management of our business operations, which could have a material adverse effect on our financial position, results of operations, cash flows and liquidity. |

• | An inability to safeguard our information technology environment could result in business interruptions, remediation costs and/or legal claims. To protect confidential customer, vendor, financial and employee information, we employ information security measures that secure our information systems from cybersecurity attacks or breaches. Even with these measures, we may be subject to unauthorized access of digital data with the intent to misappropriate information, corrupt data or cause operational disruptions. If a failure of our safeguarding measures were to occur, it could have a negative impact to our business and result in business interruptions, remediation costs and/or legal claims, which could have a material adverse effect on our financial position, results of operations, cash flow and liquidity. |

• | A change in tax laws or regulations of any federal, state or international jurisdiction in which we operate could increase our tax burden and otherwise adversely affect our financial position, results of operations, cash flows and liquidity. We continue to assess the impact of various U.S. federal, state and international legislative proposals that could result in a material increase to our U.S. federal, state and/or international taxes. We cannot predict whether any specific legislation will be enacted or the terms of any such legislation. However, if such proposals were to be enacted, or if modifications were to be made to certain existing regulations, the consequences could have a material adverse impact on us, including increasing our tax burden, increasing our cost of tax compliance or otherwise adversely affecting our financial position, results of operations, cash flows and liquidity. |

• | Our contract backlog is subject to unexpected adjustments and cancellations and could be an uncertain indicator of our future earnings. We cannot guarantee that the revenues projected in our contract backlog will be realized or, if realized, will be profitable. Projects reflected in our contract backlog may be affected by project cancellations, scope adjustments, time extensions or other changes. Such changes may adversely affect the revenue and profit we ultimately realize on these projects. |

• | Our strategic diversification plan includes growing our international operations in Canada and U.S. Territories, which are subject to a number of special risks. As part of our strategic diversification efforts, we may enter into more construction contracts in Canada or U.S. Territories, which may subject us to a number of special risks unique to foreign countries and/or operations. Due to the special risks associated with non-U.S. operations, our exposure to such risks may not be proportionate to the percentage of our revenues attributable to such operations. |

• | Our real estate investments are subject to mortgage financing and may require additional funding. Granite Land Company’s (“GLC’s”) real estate investments generally utilize short-term debt financing for their development activities. Such financing is subject to the terms of the applicable debt or credit agreement and generally is secured by mortgages on the applicable real property. GLC’s failure to comply with the covenants applicable to such financing or to pay principal, interest or other amounts when due thereunder would constitute an event of default under the applicable agreement and could have the effects described in the risk factor relating to our debt and credit agreements. Due to the tightening of the credit markets, banks have required lower loan-to-value ratios often resulting in the need to pay a portion of the debt when short-term financing is renegotiated. If our real estate investment partners are unable to make their proportional share of a required repayment, GLC may elect to provide the additional funding which could affect our financial position, cash flows and liquidity. Also, if we determine we are the primary beneficiary of real estate joint ventures, as defined by the applicable accounting guidance, we may be required to consolidate additional real estate investments in our financial statements. |

15

• | As a part of our growth strategy we have made and may make future acquisitions, and acquisitions involve many risks. These risks include: |

◦ | difficulties integrating the operations and personnel of the acquired companies; |

◦ | diversion of management’s attention from ongoing operations; |

◦ | potential difficulties and increased costs associated with completion of any assumed construction projects; |

◦ | insufficient revenues to offset increased expenses associated with acquisitions and the potential loss of key employees or customers of the acquired companies; |

◦ | assumption of liabilities of an acquired business, including liabilities that were unknown at the time the acquisition was negotiated; |

◦ | difficulties relating to assimilating the personnel, services, and systems of an acquired business and to assimilating marketing and other operational capabilities; |

◦ | Increased burdens on our staff and on our administrative, internal control and operating systems, which may hinder our legal and regulatory compliance activities; |

◦ | difficulties in applying and integrating our system of internal controls to an acquired business; |

◦ | acquisitions may cause us to increase our liabilities, record goodwill or other non-amortizable intangible assets that will be subject to subsequent impairment testing and potential impairment charges, as well as amortization expenses related to certain other intangible assets; and |

◦ | while we often obtain indemnification rights from the sellers of acquired businesses, such rights may be difficult to enforce, the losses may exceed any dedicated escrow funds, and the indemnitors may not have the ability to financially support the indemnity. |

Failure to manage and successfully integrate acquisitions could harm our financial position, results of operations, cash flows and liquidity.