December

17, 2009

VIA

EDGAR AND FACSIMILE

Mr.

Terence O’Brien

Accounting

Branch Chief

Division

of Corporation Finance

Securities

and Exchange Commission

Washington,

D.C. 20549-7010

|

|

Re:

|

Granite

Construction Incorporated

|

|

|

Form

10-K for the Fiscal Year Ended December 31,

2008

|

|

|

Filed

February 27, 2009

|

|

|

Form

10-Q for the Fiscal Quarter Ended September 30,

2009

|

|

|

Filed

October 29, 2009

|

|

|

Definitive

Proxy Statement

|

|

|

Filed

April 3, 2009

|

|

|

File

No. 001-12911

|

Dear Mr.

O’Brien:

This

letter will respond to your letter dated November 9, 2009 conveying additional

comments from the Staff of the Securities and Exchange Commission with respect

to our annual report on Form 10-K for the fiscal year ended

December 31, 2008, our quarterly report on Form 10-Q for the fiscal quarter

ended September 30, 2009 and our definitive proxy statement filed on

April 3, 2009, following our response dated September 4, 2009 to the

Staff’s initial letter of comment dated August 13, 2009. Based on our November

12, 2009 communication with the Staff this response should be considered

timely. Portions of this response reflect our telephone conversation of

December 1, 2009 with Tracey McKoy, Melissa Rocha, Sherry Haywood and a

subsequent telephone conversation with George Schuler of the Staff.

For

convenience, the Staff’s comments are set forth below in italics, followed by

our response.

1

Form 10-K for the Fiscal

Year Ended December 31, 2008

Valuation of Real Estate

Held for Development and Sale and other Long Lived Assets, page

21

|

1.

|

We note your response to

comment 1 in our letter dated August 13, 2009, implying that 15% of your

annual revenues are derived from sales of aggregate products to third

parties. While sales to third parties are not the major portion

of your business or considered a significant part of your construction

business, aggregate product sales are material and Industry Guide 7

disclosure is necessary. In addition, your partial disclosure

of aggregate reserves sufficient for several years also requires further

clarification. The materiality review does not address the

potential vertical integration issue, which includes that portion of the

raw materials provided to Granite West’s construction projects by your

captive facilities. In future filings please include the

appropriate Industry Guide 7 disclosure for your mining

properties. Please segregate these facilities by salable

product or source material such as sand & gravel, hard rock,

limestone, etc and with the large number of facilities, you may wish to

aggregate them based on business unit, geographic location, region or

state. Please show us in your supplemental response what the

revisions will look like.

|

Response:

We

acknowledge the Staff’s comment and will revise future annual filings to contain

disclosures consistent with the following:

Item 2.

Properties

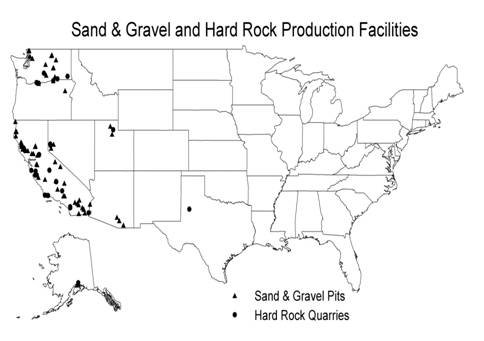

We have

46 active and 40 inactive quarry properties available for the extraction of sand

& gravel and hard rock, all of which are located in the western United

States. All of our quarries are open-pit and are primarily accessible by road.

We process aggregates into construction materials for internal use and for sale

to third parties. The following map shows the approximate locations of our

permitted quarry properties as of December 31, 2008.

We

estimate our permitted proven1 and

probable2

aggregate reserves to be 753 million tons with an average permitted life of

approximately 41 years at present operating levels. Present operating levels are

determined based on annual aggregate production rates of 18.8 million tons per

year. These reserve estimates were made by our geologists and engineers based

primarily on drilling studies. Our plant equipment is powered mostly by

electricity provided by local utility companies.

1Proven

reserves are determined through the testing of samples obtained from closely

spaced subsurface drilling and/or exposed pit faces. Proven reserves are

sufficiently understood so that quantity, quality, and engineering conditions

are known with sufficient accuracy to be mined without the need for any further

subsurface work. Actual required spacing is based on geologic judgment about the

predictability and continuity of each deposit.

2Probable

reserves are determined through the testing of samples obtained from subsurface

drilling but the sample points are too widely spaced to allow detailed

prediction of quantity, quality, and engineering conditions. Additional

subsurface work may be needed prior to mining the

reserve.

2

The

following tables present information about our quarry properties as of December

31, 2008:

|

Type

|

||||||||||||

|

Quarry

Properties

|

Sand

& Gravel

|

Hard

Rock

|

Permitted

Aggregate Reserves (tons)

|

Unpermitted

Aggregate Reserves (tons)

|

Average

Annual Production Rate (tons)

|

Average

Reserve Life

|

||||||

|

Owned

quarry properties

|

31 | 8 |

414.2

million

|

539.1

million

|

10.2

million

|

42

years

|

||||||

|

Leased

quarry properties (1)

|

29 | 18 |

339.2

million

|

565.4

million

|

8.6

million

|

39

years

|

||||||

|

(1)

Generally our leases have expiration dates which range from 5 to 50 years

with the majority having the option to renew.

|

||||||||||||

|

Tonnage

of Permitted Reserves for each product type (in 000s)

|

Percentage

of Permitted Reserves owned and leased

|

|||||||||||||||||||

|

State

|

Number of Properties |

Sand

& Gravel

|

Hard

Rock

|

Owned

|

Leased

|

|||||||||||||||

|

California

|

48 | 210,393 | 265,117 | 50 | % | 50 | % | |||||||||||||

|

Non-California

|

38 | 171,831 | 106,074 | 57 | % | 43 | % | |||||||||||||

| 86 | 382,224 | 371,191 | 53 | % | 47 | % | ||||||||||||||

|

2.

|

We have read your response to

comment 5 from our letter dated August 13, 2009 and proposed future

disclosure. You discuss the need to provide additional funding to your

real estate investments in the future if upon renewal of mortgage debt,

your banks require you to do so. You further discuss the

possibility of having to consolidate additional real estate investments if

your partners are unable to make their required

contribution. Please tell us and disclose in future filings,

any current discussions with banks to renew or refinance any current

mortgage debt. To the extent providing additional funding is

probable, please quantify the impact that consolidating these investments

would have on your operations and liquidity. You disclose in

your Form 10-Q for the quarter ending September 30, 2009 that you have had

to provide additional funding of $4.3 million to your real estate

investments. Please tell us and disclose in the future filings

the impact this additional funding had on the accounting for these

investments and the impact on your operations and

liquidity.

|

Response:

|

|

We

acknowledge the Staff’s comment and note that Granite Land

Company’s (“GLC”) real estate entities routinely utilize short term debt

financing for their development activities. Our real estate entities

typically replace certain types of loans with new debt under terms which

reflect the evolving nature of the real estate projects as they progress

through acquisition, entitlement and development. Accordingly, our real

estate entities are typically involved in the negotiation of several loans

and loan modifications at any given time. Modification of loan terms

may include changes in loan-to-value ratios resulting in GLC’s real estate

entities repaying portions of the debt. Such repayments do not constitute

a reconsideration event as defined by FIN

46(R).

|

As noted

in our Form 10-Q for the quarter ended September 30, 2009 page 40, we

contributed $4.3 million to our real estate entities during the nine months

ended September 30, 2009 to facilitate debt refinancing. If our partner(s) in an

unconsolidated entity are unable to make their proportional investment, GLC may

negotiate to invest additional amounts in that entity. Such an additional

investment may constitute a reconsideration event under FIN 46(R) and could

result in consolidation of the entity. When such events occur, they are

disclosed such as in Form 10-K for 2008 page F-20 and Form 10-Q for the

quarter ended June 30, 2009 page 14. Information regarding our unconsolidated

real estate entities is shown in our Form 10-Q for the quarter ended September

30, 2009 page 17. As of September 30, 2009 we did not expect to consolidate any

additional real estate entities, nor did we expect future contributions to GLC’s

real estate entities to have a material impact on our operations or liquidity.

In

future filings we will continue to disclose events related to the financing of

GLC’s real estate entities that have a significant impact on our operations or

liquidity.

3

Additionally,

your response to comment 5 and proposed disclosures acknowledges the current

real estate market and how it continues to show weakness and illiquidity,

however you state that you regularly review the recoverability of your real

estate assets and no further impairment has been necessary since December 31,

2008. Tell us and revise future filings to discuss what consideration

was given to performing an interim impairment analysis at June 30, 2009 under

SFAS 144. In light of your recent impairment charges and the

continued economic slowdown and tightening of capital markets relative to real

estate investments, tell us how you determined that these assets are

recoverable.

Response:

We

acknowledge the Staff’s comment and clarify for the Staff that our proposed

disclosure does not imply that we have had no additional impairment charges

since December 2008, but what the proposed revisions to our critical accounting

estimates would look like in future filings using the December 31, 2008 Form

10-K as an example.

In

accordance with SFAS 144, an asset is tested for recoverability during interim

periods when events and circumstances warrant such testing. As noted in our

critical accounting estimates, circumstances that could trigger an interim

impairment review include, but are not limited to, significant decreases in the

market price of an asset, significant adverse legal or business

climate changes, current period cash flow or operating losses combined with a

history of losses or a forecast of continuing losses associated with the use of

the asset. Each quarter, GLC updates its real estate entities’ business plans

and forecasts. Changes to these business plans or forecasts could indicate a

triggering event, in which case, an impairment analysis would be performed.

During 2009, circumstances warranted impairment charges of $1.0 million for the

quarter ended June 30, 2009 and $0.7 million for the quarter ended September 30,

2009.

Revenue, page

22

|

3.

|

We have read your response to

comment 6 from our letter dated August 13, 2009. As noted in

our previous comment, you state that decreases in private sector and

materials revenues for your Granite West segment were driven by ongoing

contraction of credit markets and residential construction in all

geographic areas in which Granite West operates. To clarify,

our comment was asking how the significant downturn in residential markets

impacted both Granite West and Granite East, specifically quantifying the

impact on sales, operations and liquidity for each of these

segments. You clarified in your response that residential

development is not an element of your public sector work as it only

relates to private sector work. Since you have private sector

work in both of your reporting segments, please address how any decreases

in private sector work (e.g. residential construction) has impacted your

segment operations.

|

Response:

We

acknowledge the Staff’s comment and would like to clarify the

following:

While our

management information systems capture work type, they do not capture industry

specific data. Hence we are unable to quantify the specific impact on our

private sector revenues related to the downturn in residential construction

activity. A noticeable impact that the downturn is having on Granite West

is increased bidding competition in the public sector markets due to the lack of

available private sector work. As a result, both revenue and backlog are

down.

Our

private sector work in Granite East was primarily related to one contract

associated with the construction of a mass transit facility which is nearly

complete.

4

Liquidity and Capital

Resources, page 35

|

4.

|

We

have read your response to comment 8 from our letter dated August 13,

2009. We note your disclosure on page 29 that the $8.4 million

provision for doubtful accounts is primarily related to Granite West

private sector receivables from real estate

developers. However, your disclosure does not address why these

receivables were assessed as uncollectible and the facts and circumstances

surrounding the increase in the provision. You state that you

do not believe the increase in your provision is a current indicator of an

adverse trend that will have an impact on your

liquidity. However, without full disclosure of the underlying

reason of why the receivable was assessed as uncollectible and the factors

you considered in concluding that this was not an indicator of an adverse

trend, an investor would not be able to reach that same

conclusion. Given the economic environment we continue to urge

you to consider disclosure of the underlying reasons for material changes

in your allowance for doubtful accounts and the impact to current and

future liquidity.

|

Response:

We

acknowledge the Staff’s comment and note for the Staff that our bad debt expense

has historically been and continues to be an insignificant amount relative to

total revenues: 0.02% in YTD 2009, 0.41% in 2008, 0.14% in 2007 and 0.01% in

2006. While the change from 2007 to 2008 was relatively large in percentage

terms, this change was primarily related to one customer not paying according to

the contract terms. In accordance with our policy, we reserved $4.5 million in

the third quarter of 2008, which was immaterial to Granite’s liquidity. A

significant portion of this amount was collected in 2009 as disclosed in our

Form 10-Q for the quarter ended September 30, 2009 page 35.

In future

filings, if applicable, we will disclose any adverse trends or material changes

identified in the collectability of our accounts receivable and the related

impact on our liquidity.

5

Form

10-Q for the Fiscal Period Ended September 30, 2009

Note 3 –

Changes in Accounting Estimates, page 9

|

5.

|

We

note you have gross profit adjustments from changes in project cost

estimates of $74.5 million for the nine months ended September 30,

2009. Please revise MD&A in future filings to discuss the

impact these adjustments had on margins, net income and EPS and the impact

you anticipate these adjustments to have on future periods. We

remind you that paragraph 22 of SFAS 154 requires disclosure of the effect

of significant revisions if the effect is material. The effect

on income from continuing operations, net income (or other appropriate

captions of changes in the applicable net assets or performance indictor),

and any related per-share amounts of the current period should be

disclosed for a change in estimate that affects several future

periods. If a change in estimate does not have a material

effect in the period of change but is reasonably certain to have a

material effect in later periods, a description of that change in estimate

shall be disclosed whenever the financial statements of the period of

change are presented. Please revise future filings as

applicable. Refer to paragraph 84 of SOP 81-1 for

guidance.

|

Response:

We

acknowledge the Staff’s comment and in response, provide the following

explanation to specific excerpts from SOP 81-1 paragraph 84 (excerpts shown in

italics):

Although

estimating is a continuous and normal process for contractors, FASB Statement

No. 154, paragraph 22 requires disclosure of the effect of significant revisions

if the effect is material.

The $74.5

million is the cumulative effect of changes in estimates of project

profitability on numerous construction projects in progress. Our gross profit

related to construction contracts can vary with changes in project uncertainties

and contract modifications in the normal course of business. We have disclosed

the net effect of significant changes to estimates including the number and

range of individual construction projects impacting gross profit by $1.0 million

or more. See Note 3, page 9 Form 10-Q for the quarter ended September 30, 2009.

We believe we have provided appropriate disclosure regarding material changes as

required in FASB Statement No. 154, paragraph 22.

The

effect on income from continuing operations, net income (or other appropriate

captions of changes in the applicable net assets or performance indicator), and

any related per-share amounts of the current periods shall be disclosed for a

change in estimate that affects several future periods.

As noted

above, estimating is a continuous process for construction contracts and we

account for changes in estimates using the cumulative catch-up option from SOP

81-1 paragraph 83. Under this option, revisions to estimates are accounted for

in their entirety in the period of change so that the accounting in future

periods is as if the revised estimate had been the original estimate. At any

current period end, we have no changes in estimates that are reasonably certain

to impact future periods. Therefore, disclosures regarding the effects of

estimates affecting several future periods is not applicable.

Where

appropriate, we will enhance future MD&A disclosure to address changes in

estimates affecting gross profit comparable to our disclosure in Note

3.

6

Note 8 – Construction of

Line Item Joint Ventures, page 14

|

6.

|

We note your response to prior

comment 11 with regards to your partner’s proportionate share of

unconsolidated construction joint ventures. We note that your

partner’s proportionate share was $482.9 million at December 31, 2008,

$409.0 million at June 30, 2009 and has increased to $984.2 million at

September 30, 2009. Please tell us why your partner’s

proportionate share increased so significantly during the three months

ending September 30, 2009 and tell us whether this amount represents your

maximum exposure on the underlying arrangements and

contracts. Please provide us with a draft of your proposed

disclosure for future

filings.

|

Response:

We

acknowledge the Staff’s comment and note that for the period ended September 30,

2009 the increase in our partners’ proportionate share of unconsolidated

construction joint venture contracts was the result of recently awarded large

contracts. With respect to the Staff’s request, we are unable to accurately

quantify our maximum exposure on the underlying arrangements and contracts due

to the uncertainties associated with the nature of our work.

In future

filings, we will clarify our disclosure to contain language consistent with the

following:

At

September 30, 2009, we had approximately $1.6 billion of construction work to be

completed on unconsolidated construction joint venture contracts of which $581.9

million represented our portion and the remaining $984.2 million represented our

partners’ proportionate share. Due to the joint and several liability of our

joint venture arrangements, if one of our many joint venture partners fails to

perform, we and the remaining joint venture partners, would be responsible for

completion of the outstanding work. As of September 30, 2009, we are not aware

of situations that would require us to fulfill responsibilities of our joint

venture partners pursuant to the joint and several liability under our

contracts.

Definitive Proxy

Statement

|

7.

|

We note your response to

comment 21 in our letter dated August 13, 2009. We also note

disclosure on page 13 that the Compensation Committee considered market

median compensation levels for all elements of compensation, i.e. base

salary, short and long term incentives and total direct compensation in

setting executive compensation levels. We also note that you

have combined information on short and long term incentives with other

elements on compensation. Please revise to disclose where

actual payments of each element of compensation fell for each named

executive officer within targeted parameters. To the extent

actual compensation was outside a targeted percentile range, please

explain why.

|

Response:

We

acknowledge the Staff’s comments and provide the following additional

information:

For

purposes of setting base compensation, our Compensation Committee considers a

targeted percentile range of peer group data for named executive officers

(“NEOs”). Over the past two years, the Committee has been transitioning from a

range near the 25th

percentile to one near the 50th

percentile. For other elements of compensation such as the annual cash incentive

and restricted stock awards, the peer group median was used only as one point of

reference in setting compensation limits. Other factors considered were

retention needs, individual performance, tenure and the potential to improve

business performance.

7

The

tables below provide specific compensation information for the

NEOs:

|

Base Salary (in

thousands)

|

||||||||||||||||||||

|

Market

Data 50th Percentile

|

Approved

Limit (1)

|

Actual

|

Actual

Variance from 50th Percentile

|

Actual

Variance from Approved Limit

|

||||||||||||||||

|

William

G. Dorey

|

$ | 809 | $ | 500 | $ | 500 | -38 | % | 0 | % | ||||||||||

|

President

& Chief Executive Officer

|

||||||||||||||||||||

|

LeAnne

M. Stewart

|

$ | 394 | $ | 360 | $ | 330 | -16 | % | -8 | % | ||||||||||

|

Senior

Vice President & Chief Financial Officer

|

||||||||||||||||||||

|

Mark

E. Boitano

|

$ | 561 | $ | 400 | $ | 400 | -29 | % | 0 | % | ||||||||||

|

Executive

Vice President & Chief Operating Officer

|

||||||||||||||||||||

|

James

H. Roberts

|

$ | 340 | $ | 300 | $ | 300 | -12 | % | 0 | % | ||||||||||

|

Senior

Vice President & Granite West Manager

|

||||||||||||||||||||

|

Michael

F. Donnino

|

$ | 333 | $ | 300 | $ | 300 | -10 | % | 0 | % | ||||||||||

|

Senior

Vice President & Granite East Manager

|

||||||||||||||||||||

|

Total Cash

Compensation (2) (in

thousands)

|

||||||||||||

|

Approved

Limit (1)

|

Actual

|

Actual

Variance from Approved Limit

|

||||||||||

|

William

G. Dorey

|

$ | 1,200 | $ | 1,130 | -6 | % | ||||||

|

President

& Chief Executive Officer

|

||||||||||||

|

LeAnne

M. Stewart

|

$ | 600 | $ | 528 | -12 | % | ||||||

|

Senior

Vice President & Chief Financial Officer

|

||||||||||||

|

Mark

E. Boitano

|

$ | 900 | $ | 850 | -6 | % | ||||||

|

Executive

Vice President & Chief Operating Officer

|

||||||||||||

|

James

H. Roberts

|

$ | 650 | $ | 633 | -3 | % | ||||||

|

Senior

Vice President & Granite West Manager

|

||||||||||||

|

Michael

F. Donnino

|

$ | 600 | $ | 570 | -5 | % | ||||||

|

Senior

Vice President & Granite East Manager

|

||||||||||||

8

|

Total Direct Compensation

(3) (in

thousands)

|

||||||||||||

|

Approved

Limit (1)

|

Actual

|

Actual

Variance from Approved Limit

|

||||||||||

|

William

G. Dorey

|

$ | 2,500 | $ | 2,430 | -3 | % | ||||||

|

President

& Chief Executive Officer

|

||||||||||||

|

LeAnne

M. Stewart

|

$ | 1,200 | $ | 1,078 | -10 | % | ||||||

|

Senior

Vice President & Chief Financial Officer

|

||||||||||||

|

Mark

E. Boitano

|

$ | 1,800 | $ | 1,750 | -3 | % | ||||||

|

Executive

Vice President & Chief Operating Officer

|

||||||||||||

|

James

H. Roberts

|

$ | 1,300 | $ | 1,235 | -5 | % | ||||||

|

Senior

Vice President & Granite West Manager

|

||||||||||||

|

Michael

F. Donnino

|

$ | 1,200 | $ | 1,060 | -12 | % | ||||||

|

Senior

Vice President & Granite East Manager

|

||||||||||||

|

Note:

|

||||||||||||

|

(1)

Approved limit represents the maximum amount approved by the Compensation

Committee

|

||||||||||||

|

(2)

Total cash compensation includes base salary plus annual cash

incentive

|

||||||||||||

|

(3)

Total direct compensation includes total cash compensation plus restricted

stock awards

|

||||||||||||

All NEOs

base salary levels were below the market data 50th

percentile as a result of the transition process described above. Significant

variances (10% or greater) from the approved limit for the other elements of

compensation were as follows:

· The Chief

Financial Officer’s base, total cash and total direct compensation varied from

the approved limits in that she was only employed for eleven months in

2008.

· The

Granite East Manager’s total direct compensation was below the approved limit

because he did not meet all of his performance

objectives.

9

Should

you have any further questions or comments regarding the foregoing, please

contact me at (831) 724-1011.

Very truly yours,

/s/ LeAnne M. Stewart

Senior Vice President and

Chief Financial Officer

|

cc:

|

Tracey

McKoy, Staff Accountant, Securities and Exchange

Commission

|

|

|

William

G. Dorey, Chief Executive Officer, Granite Construction

Incorporated

|

|

|

David

H. Kelsey, Chair, Audit Committee, Granite Construction

Incorporated

|

|

|

Michael

A. Jerome, PricewaterhouseCoopers

LLP

|

Michael

Futch, Vice President, General Counsel and Secretary, Granite Construction

Incorporated

Dennis C.

Sullivan, DLA Piper LLP (US)

10