Filed by the Registrant ☒ | ||

Filed by a party other than the Registrant ☐ | ||

Check the appropriate box: | ||

☐ |

Preliminary Proxy Statement | |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ |

Definitive Proxy Statement | |

☐ |

Definitive Additional Materials | |

☐ |

Soliciting Material Under Rule 240.14a-12 | |

Payment of Filing Fee (Check the appropriate box): | ||||

☒ |

No fee required. | |||

☐ |

Fee paid previously with preliminary materials. | |||

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held April 25, 2024

Dear Stockholder:

On Thursday, April 25, 2024, HCA Healthcare, Inc. will hold its annual meeting of stockholders in a virtual meeting format only, via live webcast. The meeting will begin at 2:00 p.m. (CDT) and is being held for the following purposes:

| 1. | To elect ten nominees for director of the Company, nominated by the Board of Directors, with each director to serve until the 2025 annual meeting of the stockholders of the Company or until such director’s respective successor is duly elected and qualified; |

| 2. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2024; |

| 3. | To approve, in an advisory (non-binding) vote, the compensation of the Company’s named executive officers as described in the accompanying proxy statement (“say-on-pay”); |

| 4. | To conduct an advisory (non-binding) vote to approve the frequency of future say-on-pay votes; |

| 5. | To consider and vote upon a stockholder proposal regarding a report on risk mitigation regarding state restrictions for emergency abortions; |

| 6. | To consider and vote upon a stockholder proposal regarding a report on patient feedback regarding quality of care; |

| 7. | To consider and vote upon a stockholder proposal regarding a report on maternal health outcomes; and |

| 8. | To transact such other business as may properly come before the meeting or any postponement or adjournment of the meeting. |

Only stockholders that owned our common stock at the close of business on February 26, 2024 are entitled to notice of and may vote at this meeting.

References to “HCA,” “HCA Healthcare,” the “Company,” “we,” “us,” or “our” in this notice and the accompanying proxy statement refer to HCA Healthcare, Inc. and its applicable affiliates unless otherwise indicated.

WHETHER OR NOT YOU PLAN TO ATTEND THE VIRTUAL ANNUAL MEETING, TO ENSURE THE PRESENCE OF A QUORUM, PLEASE VOTE PRIOR TO THE VIRTUAL ANNUAL MEETING OVER THE INTERNET OR BY TELEPHONE AS INSTRUCTED IN THESE MATERIALS OR COMPLETE, DATE, AND SIGN A PROXY CARD AS PROMPTLY AS POSSIBLE. IF YOU ATTEND THE VIRTUAL ANNUAL MEETING AND WISH TO VOTE YOUR SHARES DURING THE MEETING, YOU MAY DO SO AT ANY TIME BEFORE THE PROXY IS EXERCISED.

| By Order of the Board of Directors, |

| John M. Franck II Vice President — Legal and Corporate Secretary |

Nashville, Tennessee

March 15, 2024

TABLE OF CONTENTS

| 2 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 21 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 23 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| Fostering an Engaged Workplace and Increasing Access to Health Care |

25 | |||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 34 | ||||

| 37 | ||||

| 37 | ||||

| Proposal 2 — Ratification of Appointment of Independent Registered Public Accounting Firm |

38 | |||

| 39 | ||||

| Proposal 4 — Advisory Vote on the Frequency of “Say-on-Pay” Votes |

40 | |||

| 41 | ||||

| Proposal 6 — Stockholder Proposal: Report on Patient Feedback Regarding Quality of Care |

44 | |||

| Proposal 7 — Stockholder Proposal: Report on Maternal Health Outcomes |

50 | |||

| 55 | ||||

| 55 | ||||

| 55 | ||||

| 77 | ||||

| 78 | ||||

| 78 | ||||

| 80 | ||||

| Narrative Disclosure to 2023 Summary Compensation Table and 2023 Grants of Plan-Based Awards Table |

81 | |||

| 83 | ||||

| 85 | ||||

| 86 | ||||

| 88 | ||||

| 89 | ||||

| 95 | ||||

| 96 | ||||

| 99 | ||||

| 101 | ||||

| 101 | ||||

| Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

102 | |||

| 104 | ||||

| 105 | ||||

| 105 | ||||

| A-1 | ||||

Proxy Statement for Annual Meeting of Stockholders

to be held on April 25, 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON THURSDAY, APRIL 25, 2024

The Company’s Proxy Statement and 2023 Annual Report to Stockholders are available on our website at www.hcahealthcare.com. Additionally, and in accordance with Securities and Exchange Commission Rules, you may access our proxy materials, including the Company’s Proxy Statement, form of Proxy Card and 2023 Annual Report to Stockholders, at https://materials.proxyvote.com/40412C.

Certain statements contained in this proxy statement may constitute “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act. All statements other than statements of historical or current facts, including statements regarding our environmental and other corporate responsibility and sustainability plans and objectives, made in this document are forward-looking. We use words such as “anticipates,” “believes,” “expects,” “future,” “intends,” and similar expressions or future or conditional tense verbs such as “will,” “may,” “might,” “should,” “would,” “could” and “working” to identify forward-looking statements. Forward-looking statements reflect management’s current expectations and are inherently uncertain. Actual outcomes and results may differ materially from those expressed in, or implied by, forward looking statements. You should not place undue reliance on any forward-looking statement and should consider the uncertainties and risks discussed in our 2023 Annual Report on Form 10-K and subsequent Securities and Exchange Commission filings. Website references throughout this document are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this document.

QUESTIONS AND ANSWERS

| 1. | Q: WHEN WAS THIS PROXY STATEMENT FIRST MAILED OR MADE AVAILABLE TO STOCKHOLDERS? |

A: This proxy statement was first mailed or made available to stockholders on or about March 15, 2024. Our 2023 Annual Report to Stockholders is being mailed or made available with this proxy statement. The 2023 Annual Report to Stockholders is not part of the proxy solicitation materials.

| 2. | Q: WHY DID I RECEIVE A ONE-PAGE NOTICE IN THE MAIL REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS INSTEAD OF A FULL SET OF PROXY MATERIALS? |

A: Pursuant to rules adopted by the Securities and Exchange Commission (“SEC”), the Company has elected to provide access to our proxy materials and 2023 Annual Report to Stockholders over the Internet. Accordingly, we are sending to our stockholders of record and beneficial owners a notice of Internet availability of the proxy materials (“Internet Notice”) instead of sending a paper copy of the proxy materials and 2023 Annual Report to Stockholders. All stockholders receiving the Internet Notice will have the ability to access the proxy materials and 2023 Annual Report to Stockholders on a website referenced in the Internet Notice or to request a printed set of the proxy materials and 2023 Annual Report to Stockholders. Instructions on how to access the proxy materials and 2023 Annual Report to Stockholders over the Internet or to request a printed copy may be found in the Internet Notice and in this proxy statement. In addition, the Internet Notice contains instructions on how you may request to receive our proxy materials and 2023 Annual Report to Stockholders in printed form by mail or electronically on an ongoing basis.

| 3. | Q: WHAT IS THE PURPOSE OF THE ANNUAL MEETING? |

A: At the annual meeting, stockholders will act upon the following matters outlined in the notice of meeting on the cover page of this proxy statement: (i) the election of each of the directors nominated by the Board of Directors; (ii) the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2024; (iii) an advisory resolution to approve our executive compensation as described in this proxy statement (“say-on-pay”); (iv) an advisory vote on the frequency of future say-on-pay votes; (v) the consideration and vote upon a stockholder proposal regarding a report on risk mitigation regarding state restrictions for emergency abortions, if properly presented; (vi) the consideration and vote upon

2

a stockholder proposal regarding a report on patient feedback regarding quality of care, if properly presented; and (vii) the consideration and vote upon a stockholder proposal regarding a report on maternal health outcomes, if properly presented.

In addition, following the formal business of the meeting, our management team will be available to respond to questions pertinent to company matters from our stockholders. We will endeavor to answer as many questions submitted by stockholders as time permits. We reserve the right to edit inappropriate language and to exclude questions regarding topics that are not pertinent to meeting matters or company business or are otherwise out of order or not suitable for the conduct of the virtual annual meeting. If we receive substantially similar questions, we may group questions together and provide a single response to avoid repetition.

| 4. | Q: WHO MAY ATTEND THE VIRTUAL ANNUAL MEETING? |

A: Stockholders of record as of the close of business on February 26, 2024, or their duly appointed proxies, may attend the virtual annual meeting. The annual meeting will commence at 2:00 p.m. (CDT).

| 5. | Q: WHERE WILL THE ANNUAL MEETING BE HELD? |

A: The annual meeting will be held in a virtual meeting format only, via live webcast. You will not be able to physically attend the annual meeting in person. The virtual annual meeting will be held at www.virtualshareholdermeeting.com/HCA2024. To attend and be able to vote and ask questions during the annual meeting, you must enter the 16-digit control number found on your proxy card or notice you previously received. Online access to the webcast will open approximately 15 minutes prior to the start of the annual meeting to allow time for you to log in and test your system. If you experience technical difficulties during the check-in process or during the meeting, please call 1-844-986-0822 (toll free) or 303-562-9302 (international) for assistance.

In the event of technical difficulties with the annual meeting, we expect that an announcement will be made on www.virtualshareholdermeeting.com/HCA2024. If necessary, the announcement will provide updated information regarding the date, time and location of the annual meeting. Any updated information regarding the annual meeting will also be posted on the Investor Relations section of the Company’s website.

| 6. | Q: WHO IS ENTITLED TO VOTE AT THE ANNUAL MEETING? |

A: Only stockholders of record as of the close of business on February 26, 2024 are entitled to receive notice of and participate in the annual meeting. As of the record date, there were 264,485,460 shares of our common stock outstanding. Every stockholder is entitled to one vote for each share held as of the record date. Cumulative voting is not permitted with respect to the election of directors or any other matter to be considered at the annual meeting.

| 7. | Q: WHO IS SOLICITING MY VOTE? |

A: The Company’s Board of Directors is sending you this proxy statement in connection with the solicitation of proxies for use at the 2024 annual meeting. The Company pays the cost of soliciting proxies. Proxies may be solicited in person or by telephone, facsimile, electronic mail, or other electronic medium by certain of our directors, officers, and employees, without additional compensation. In addition, we have retained Georgeson LLC to assist in the solicitation of proxies for a fee of approximately $18,000 plus associated costs and expenses. Forms of proxies and proxy materials may also be distributed through brokers, custodians, and other like parties to the beneficial owners of shares of our common stock, in which case we will reimburse these parties for their reasonable out-of-pocket expenses.

3

| 8. | Q: ON WHAT MAY I VOTE? |

A: You may vote on (i) the election of directors nominated to serve on our Board of Directors; (ii) the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2024; (iii) the advisory say-on-pay resolution to approve our executive compensation; (iv) the advisory vote on the frequency of future say-on-pay votes; (v) the stockholder proposal regarding a report on risk mitigation regarding state restrictions for emergency abortions, if properly presented; (vi) the stockholder proposal regarding a report on patient feedback regarding quality of care, if properly presented; and (vii) the stockholder proposal regarding a report on maternal health outcomes, if properly presented.

| 9. | Q: HOW DOES THE BOARD RECOMMEND I VOTE ON THE PROPOSALS? |

A: The Board unanimously recommends that you vote as follows:

| • | FOR each of the director nominees; |

| • | FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2024; |

| • | FOR the advisory say-on-pay resolution to approve our executive compensation; |

| • | ONE YEAR for the advisory vote on the frequency of future say-on-pay votes; |

| • | AGAINST the stockholder proposal regarding a report on risk mitigation regarding state restrictions for emergency abortions; |

| • | AGAINST the stockholder proposal regarding a report on patient feedback regarding quality of care; and |

| • | AGAINST the stockholder proposal regarding a report on maternal health outcomes. |

| 10. | Q: HOW WILL VOTING ON ANY OTHER BUSINESS BE CONDUCTED? |

A: It is not expected that any matter not referred to herein will be presented for action at the annual meeting. If any other matters are properly brought before the annual meeting, including, without limitation, a motion to adjourn the annual meeting to another time and/or place for the purpose of, among other matters, permitting dissemination of information regarding material developments relating to any of the proposals or soliciting additional proxies in favor of the approval of any of the proposals, the persons named on the accompanying Proxy Card will vote the shares represented by such proxy upon such matters in their discretion. Should the annual meeting be reconvened, all proxies will be voted in the same manner as such proxies would have been voted when the annual meeting was originally convened, except for the proxies effectively revoked or withdrawn prior to the time proxies are voted at such reconvened meeting.

| 11. | Q: HOW DO I VOTE IF MY SHARES ARE REGISTERED DIRECTLY IN MY NAME? |

A: You may vote during the annual meeting by following the instructions available on the meeting website during the meeting or authorize the persons named as proxies on the Proxy Card to vote your shares by returning the Proxy Card by mail, over the Internet, or by telephone. Although we offer four different voting methods, we encourage you to vote prior to the annual meeting over the Internet as we believe it is the most cost-effective method for the Company. We also recommend that you vote as soon as possible, even if you are planning to attend the virtual annual meeting, so that the vote count will not be delayed. Voting prior to the annual meeting over the Internet or by telephone both provide convenient, cost-effective alternatives to returning your Proxy Card by mail. If you choose to vote your shares prior to the annual meeting over the Internet or by telephone, there is no need for you to mail back your Proxy Card.

4

To Vote Over the Internet Prior to the Annual Meeting:

Log on to the Internet and go to the website www.proxyvote.com (24 hours a day, 7 days a week). Have your Proxy Card available when you access the website. You will need the control number from your Proxy Card to vote.

To Vote By Telephone:

On a touch-tone telephone, call 1-800-690-6903 (24 hours a day, 7 days a week). Have your Proxy Card available when you make the call. You will need the control number from your Proxy Card to vote.

To Vote By Proxy Card:

Complete and sign the Proxy Card and return it to the address indicated on the Proxy Card. If you received an Internet Notice instead of a paper copy of the proxy materials and 2023 Annual Report to Stockholders, you should follow the voting instructions set forth in the Internet Notice.

Internet and telephone voting options are available until 11:59 p.m. (ET) on April 24, 2024 for shares held directly.

You have the right to revoke your proxy at any time before the meeting by: (i) notifying our Corporate Secretary in writing at One Park Plaza, Nashville, Tennessee 37203; (ii) voting during the virtual annual meeting by following the instructions available on the virtual meeting website; (iii) submitting a later-dated Proxy Card; (iv) submitting another vote by telephone or over the Internet; or (v) if applicable, submitting new voting instructions to your broker or nominee. If you have questions about how to vote or revoke your proxy, you should contact our Corporate Secretary at One Park Plaza, Nashville, Tennessee 37203. For shares held in street name, refer to Question 12.

| 12. | Q: HOW DO I VOTE MY SHARES IF THEY ARE HELD IN THE NAME OF MY BROKER (STREET NAME)? |

A: If your shares are held by your broker or other nominee, often referred to as held in street name, you will receive a form from your broker or nominee seeking instruction as to how your shares should be voted. You should contact your broker or other nominee with questions about how to provide or revoke your instructions.

| 13. | Q: WHAT IS THE VOTE REQUIRED TO ELECT DIRECTORS? |

A: Since Proposal 1 in this proxy statement is in respect of an uncontested director election, Proposal 1 requires the affirmative vote of a majority of the votes cast at the annual meeting to elect a nominee, which means that a nominee will be elected only if the number of shares voted “for” that nominee exceeds the number of shares voted “against” that nominee. Accordingly, each nominee receiving a greater number of shares voted “for” such nominee than “against” such nominee shall be elected as a director. If an incumbent director does not receive a greater number of shares voted “for” such director than “against” such director, then such director shall tender his or her resignation to the Board of Directors, which resignation shall be contingent upon acceptance thereof by the Board of Directors. If a nominee who is not an incumbent director does not receive a greater number of shares voted “for” such director than “against” such director, then such nominee will not be elected to the Board of Directors. In the event there is a contested director election, director nominees must receive affirmative votes from a plurality of the votes cast at the annual meeting to be elected. This means that the nominees receiving the greatest number of affirmative votes of the shares present in person or represented by proxy at the virtual annual meeting and entitled to vote will be elected as directors.

5

| 14. | Q: WHAT IS THE VOTE REQUIRED TO APPROVE THE OTHER PROPOSALS? |

A: Ratification of Ernst & Young LLP: The ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024 must receive affirmative votes from the holders of a majority of the shares present in person or represented by proxy at the virtual annual meeting and entitled to vote to be approved.

Advisory Say-On-Pay Resolution: The advisory say-on-pay resolution to approve our executive compensation must receive affirmative votes from the holders of a majority of the shares present in person or represented by proxy at the virtual annual meeting and entitled to vote to be approved. Because your vote is advisory, it will not be binding on the Company, the Board of Directors or our Compensation Committee. Although non-binding, our Compensation Committee will review and consider the voting results when making future decisions regarding our executive compensation program.

Frequency of Say-On-Pay Advisory Vote: With respect to the advisory vote on the frequency of future say-on-pay votes, the frequency receiving the greatest number of votes of shares present in person or represented by proxy at the virtual annual meeting and entitled to vote — every one year, every two years, or every three years — will be the frequency that stockholders approve. Because your vote is advisory, it will not be binding on the Company, the Board of Directors or our Compensation Committee. Although non-binding, the Board will review and consider the voting results when making future decisions regarding the frequency of the advisory vote on executive compensation.

Stockholder Proposal Regarding a Report on Risk Mitigation Regarding State Restrictions for Emergency Abortions: The stockholder proposal regarding a report on risk mitigation regarding state restrictions for emergency abortions, if properly presented at the annual meeting, must receive affirmative votes from the holders of a majority of the shares present in person or represented by proxy at the virtual annual meeting and entitled to vote to be approved.

Stockholder Proposal Regarding a Report on Patient Feedback Regarding Quality of Care: The stockholder proposal regarding a report on patient feedback regarding quality of care, if properly presented at the annual meeting, must receive affirmative votes from the holders of a majority of the shares present in person or represented by proxy at the virtual annual meeting and entitled to vote to be approved.

Stockholder Proposal Regarding a Report on Maternal Health Outcomes: The stockholder proposal regarding a report on maternal health outcomes, if properly presented at the annual meeting, must receive affirmative votes from the holders of a majority of the shares present in person or represented by proxy at the virtual annual meeting and entitled to vote to be approved.

| 15. | Q: WHAT CONSTITUTES A “QUORUM”? |

A: The presence at the virtual annual meeting, in person or by proxy, of the holders of a majority of the aggregate voting power of the common stock outstanding on the record date will constitute a quorum. There must be a quorum for business to be conducted at the meeting. Failure of a quorum to be represented at the annual meeting will necessitate an adjournment or postponement and will subject the Company to additional expense. Abstentions and broker non-votes are counted as present or represented for purposes of determining the presence or absence of a quorum.

6

| 16. | Q: WHAT IF I ABSTAIN FROM VOTING? |

A: If you attend the virtual annual meeting or send in your signed Proxy Card or vote by telephone or over the Internet prior to the annual meeting, but abstain from voting on any proposal, you will still be counted for purposes of determining whether a quorum exists. If you abstain from voting on Proposal 1, your abstention will have no effect on the outcome. If you abstain from voting on Proposals 2, 3, 5, 6 or 7, your abstention will have the same legal effect as a vote against these proposals. If you abstain from voting on Proposal 4, your abstention will not be counted as expressing any preference with regards to Proposal 4.

| 17. | Q: WILL MY SHARES BE VOTED IF I DO NOT SIGN AND RETURN MY PROXY CARD OR VOTE BY TELEPHONE OR OVER THE INTERNET? |

A: If you are a registered stockholder and you do not sign and return your Proxy Card or vote by telephone or over the Internet prior to the annual meeting, your shares will not be voted at the annual meeting unless you vote during the annual meeting. Questions concerning stock certificates and registered stockholders may be directed to EQ Shareowner Services at 1110 Centre Pointe Curve, Suite 101, Mendota Heights, Minnesota 55120-4100 or by telephone at 1-800-468-9716 (domestic) or 1-651-450-4064 (outside the U.S.). If your shares are held in street name and you do not issue instructions to your broker, your broker may vote your shares at its discretion on routine matters, but may not vote your shares on non-routine matters. Under New York Stock Exchange (“NYSE”) rules, Proposal 2 relating to the ratification of the appointment of the independent registered public accounting firm is deemed to be a routine matter, and brokers and nominees may exercise their voting discretion without receiving instructions from the beneficial owner of the shares. Proposals 1, 3, 4, 5, 6 and 7 are non-routine matters and, therefore, may only be voted in accordance with instructions received from the beneficial owner of the shares.

| 18. | Q: WHAT IS A “BROKER NON-VOTE”? |

A: Under NYSE rules, brokers and nominees may exercise their voting discretion without receiving instructions from the beneficial owner of the shares on proposals that are deemed to be routine matters. If a proposal is a non-routine matter, a broker or nominee may not vote the shares on the proposal without receiving instructions from the beneficial owner of the shares. If a broker turns in a Proxy Card expressly stating that the broker is not voting on a non-routine matter, such action is referred to as a “broker non-vote.”

| 19. | Q: WHAT IS THE EFFECT OF A BROKER NON-VOTE? |

A: Broker non-votes will be counted for the purpose of determining the presence of a quorum but will not be counted for purposes of determining the outcome of the vote on any proposal, other than Proposal 2.

| 20. | Q: WHO WILL COUNT THE VOTES? |

A: Broadridge Financial Solutions, Inc. has been engaged as our independent inspector of election to tabulate stockholder votes for the annual meeting.

| 21. | Q: CAN I PARTICIPATE IF I AM UNABLE TO ATTEND THE VIRTUAL ANNUAL MEETING? |

A: If you are unable to attend the virtual annual meeting, we encourage you to send in your Proxy Card or to vote by telephone or over the Internet prior to the annual meeting.

7

| 22. | Q: WHERE CAN I FIND THE VOTING RESULTS OF THE ANNUAL MEETING? |

A: We intend to announce preliminary voting results at the annual meeting and publish final results in a Current Report on Form 8-K that will be filed with the SEC following the annual meeting. All reports we file with the SEC are publicly available when filed. Please refer to Question 25 for additional information.

| 23. | Q: WHEN ARE STOCKHOLDER PROPOSALS DUE IN ORDER TO BE INCLUDED IN OUR PROXY MATERIALS FOR THE NEXT ANNUAL MEETING? |

A: Any stockholder proposal must be submitted in writing to our Corporate Secretary at HCA Healthcare, Inc., One Park Plaza, Nashville, Tennessee 37203, prior to the close of business on November 15, 2024, to be considered timely for inclusion in next year’s proxy statement and form of proxy. Such proposal must also comply with SEC regulations, including Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials.

We have also adopted a proxy access right that permits a stockholder, or a group of up to 20 stockholders, owning continuously for at least three years shares of our stock representing an aggregate of at least 3% of the voting power entitled to vote in the election of directors, to nominate and include in our proxy materials director nominees, provided that the stockholder(s) and the nominee(s) satisfy the requirements in our bylaws. Under our bylaws, to be considered timely, compliant notice of proxy access director nominations for next year’s proxy statement and form of proxy must be submitted to the Corporate Secretary at the address specified above no earlier than October 16, 2024 and no later than November 15, 2024; provided, however, that if (A) the annual meeting is not within 30 days before or after the anniversary date of this year’s meeting, or (B) no annual meeting is held this year, to be timely the stockholder notice must be received no later than 90 days prior to such annual meeting or, if later, the tenth day after the day on which notice of the date of the meeting was mailed or public disclosure of the date of such meeting is first made, whichever occurs first. The foregoing is a summary of the requirements for stockholders to nominate persons for election to our Board of Directors, which requirements are set out fully in our bylaws, and the foregoing description is qualified by reference to the full text of our bylaws. You should consult our bylaws for more detailed information regarding the processes by which stockholders may nominate directors, including the specific requirements regarding the content of the written notices and other related requirements. Our bylaws are posted on the Corporate Governance portion of our website located at www.hcahealthcare.com.

| 24. | Q: WHEN ARE OTHER STOCKHOLDER PROPOSALS DUE? |

A: Our bylaws contain an advance notice provision that requires stockholders to deliver to us notice of a proposal to be considered at an annual meeting not less than 90 nor more than 120 days before the date of the first anniversary of the prior year’s annual meeting. Such proposals are also subject to informational and other requirements set forth in our bylaws, a copy of which is available under the Corporate Governance portion of our website, www.hcahealthcare.com.

In addition to satisfying the advance notice requirements in our bylaws, to comply with the universal proxy rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than January 25, 2025.

8

| 25. | Q: HOW CAN I OBTAIN ADDITIONAL INFORMATION ABOUT THE COMPANY? |

A: We will provide copies of this proxy statement and our 2023 Annual Report to Stockholders, including our Annual Report on Form 10-K for the year ended December 31, 2023, without charge to any stockholder who makes a written request to our Investor Relations Department at HCA Healthcare, Inc., One Park Plaza, Nashville, Tennessee 37203. Our Annual Report on Form 10-K and other SEC filings may also be accessed at www.sec.gov or on the Investor Relations section of the Company’s website at www.hcahealthcare.com. Our website address is provided as an inactive textual reference only. The information provided on or accessible through our website is not part of this proxy statement and is not incorporated herein by this or any other reference to our website provided in this proxy statement.

| 26. | Q: HOW MANY COPIES SHOULD I RECEIVE IF I SHARE AN ADDRESS WITH ANOTHER STOCKHOLDER? |

A: The SEC has adopted rules that permit companies and intermediaries, such as brokers, to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single Internet Notice or proxy statement addressed to those stockholders. This process, commonly referred to as “householding,” potentially provides extra convenience for stockholders and cost savings for companies. The Company and some brokers may be householding our Internet Notice or proxy materials by delivering a single Internet Notice or proxy statement and annual report to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker, or us, that they, or we, will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If at any time you no longer wish to participate in householding and would prefer to receive a separate Internet Notice or proxy statement and annual report, or if you are receiving multiple copies of the Internet Notice or proxy statement and annual report and wish to receive only one, please notify your broker if your shares are held in a brokerage account or us if you are a stockholder of record. You can notify us by sending a written request to our Corporate Secretary at HCA Healthcare, Inc., One Park Plaza, Nashville, Tennessee 37203, or by calling our Corporate Secretary at (615) 344-9551. In addition, we will promptly deliver, upon written or oral request to the address or telephone number above, a separate copy of the annual report and proxy statement to a stockholder at a shared address to which a single copy of the documents was delivered.

9

COMPANY SUMMARY

HCA Healthcare, Inc. is one of the leading health care services companies in the United States. As of December 31, 2023, we operated 186 hospitals, comprised of 178 general, acute care hospitals; six behavioral hospitals; and two rehabilitation hospitals. We also operate numerous outpatient health care facilities, which include freestanding surgery centers, freestanding emergency care facilities, urgent care facilities, walk-in clinics, diagnostic and imaging centers, radiation and oncology therapy centers, comprehensive rehabilitation and physical therapy centers, physician practices, home health, hospice, outpatient physical therapy home and community-based services providers, and various other facilities. Our facilities are located in 20 states and England.

HCA Healthcare Hospitals

Our other sites of care

Our common stock is traded on the NYSE (symbol “HCA”). Through our predecessors, we commenced operations in 1968. HCA Healthcare, Inc. was incorporated in Delaware in October 2010. Our principal executive offices are located at One Park Plaza, Nashville, Tennessee 37203, and our telephone number is (615) 344-9551.

10

CORPORATE GOVERNANCE

We are committed to employing strong corporate governance practices, which we have enhanced over time, and believe that our existing corporate governance practices empower stockholders and promote accountability.

Key Practices and Policies

Board of Directors

| · | Majority of directors are independent |

| · | All members of the Audit and Compliance Committee, Compensation Committee and Nominating and Corporate Governance Committee are independent |

| · | Annual election of all directors |

| · | Our current Board structure separates the positions of Chair of the Board and CEO |

| · | Share ownership guidelines of five times the value of the annual cash retainer within five years for each non-management director |

| · | Our directors may serve on no more than four other public company boards |

Stockholder Rights

| · | Proxy Access right for stockholders of at least 3% of stock for three years |

| · | Stockholders’ right to call a special meeting |

| · | No supermajority provisions in our certificate of incorporation or bylaws |

| · | No dual-class shareholdings (one share, one vote) |

| · | No stockholder rights plan or poison pill |

Governance

| · | Board oversight of enterprise-wide risk management processes |

| · | Board oversight of corporate social responsibility and sustainability matters |

| · | Nominating and Corporate Governance Committee: corporate governance, social responsibility and community interests, including political activities and lobbying |

| · | Audit and Compliance Committee: environmental and sustainability issues |

| · | Compensation Committee: human capital management strategies and policies, including with respect to workplace culture, employee relations, diversity and inclusion initiatives, pay equity and workplace safety |

| · | Patient Safety and Quality of Care Committee: patient safety, quality of care and equity of patient care |

| · | Audit and Compliance Committee periodically reviews the Company’s information security programs, including cybersecurity and procedures regarding disaster recovery and critical business continuity |

| · | Publicly disclose political contributions and public advocacy efforts and the contributions of our federal and state political action committees |

| · | Board supports and participates in our stockholder outreach activities and has responded to stockholder input |

11

Director Independence. Our Board of Directors currently consists of ten directors. NYSE listing standards require that a majority of our directors be independent in accordance with the independence requirements set forth in such listing standards. In addition, our Audit and Compliance Committee, Compensation Committee and Nominating and Corporate Governance Committee must be composed solely of independent directors to comply with such listing standards and, in the case of our Audit and Compliance Committee, with SEC rules.

Our Board of Directors affirmatively determines the independence of each director and director nominee in accordance with guidelines it has adopted, which include all elements of independence set forth in the NYSE listing standards as well as certain Board-adopted categorical independence standards. These guidelines are contained in our Corporate Governance Guidelines which are posted on the Corporate Governance portion of our website located at www.hcahealthcare.com. The Board first analyzes whether any director has a relationship covered by the NYSE listing standards that would prohibit an independence finding for Board or committee purposes. Management then provides the Board with relevant known facts and circumstances, and their analysis thereof, of any relationship of a director to HCA or to our management that does not fall within the parameters set forth in the Board’s separately adopted categorical independence standards to determine whether or not that relationship is material. The Board may determine that a director who has a relationship that falls outside of the parameters of the categorical independence standards is nonetheless independent (to the extent that the relationship would not constitute a bar to independence under the NYSE listing standards).

Our Board of Directors has affirmatively determined that Meg G. Crofton, Robert J. Dennis, Nancy-Ann DeParle, Hugh F. Johnston, Michael W. Michelson, Wayne J. Riley, M.D. and Andrea B. Smith are independent from our management under both the NYSE’s listing standards and our additional standards. The Board has also affirmatively determined that Messrs. Johnston and Michelson, Dr. Riley and Ms. Smith, the members of our Audit and Compliance Committee, meet the independence requirements of Rule 10A-3 of the Exchange Act. Any relationships between an independent director and HCA or our management fell within the Board-adopted categorical standards and, accordingly, were not specifically reviewed by our Board.

On November 17, 2006, a predecessor entity, HCA Inc., was acquired by a private investor group, including affiliates of or funds sponsored by Bain Capital Partners, LLC, Kohlberg Kravis Roberts & Co., BAML Capital Partners (formerly Merrill Lynch Global Private Equity) (each, a “Sponsor”) and affiliates of HCA founder Dr. Thomas F. Frist, Jr. (the “Frist Entities,” and together with the Sponsors, the “Investors”) and by members of management and certain other investors (the “Merger”). In connection with the Merger, we entered into a stockholders’ agreement (the “Stockholders’ Agreement”) with Hercules Holding II (f/k/a Hercules Holding II, LLC) (“Hercules Holding”) and the Investors which, among other things, currently provides for certain rights of the Frist Entities to nominate two members of our Board of Directors. See “Directors” and “Certain Relationships and Related Person Transactions.”

Executive Sessions. Our Corporate Governance Guidelines provide that non-management directors shall meet at regularly scheduled executive sessions, which will typically occur at regularly scheduled Board meetings, without any member of management present and must so meet at least annually. In addition, at least annually the independent directors shall meet in separate executive session. Mr. Thomas F. Frist III, the Chairman of our Board of Directors, presides over meetings of the non-management directors, and Mr. Michelson serves as the independent presiding director. Our Corporate Governance Guidelines also provide that the independent and/or non-management directors shall be entitled, acting as a group by vote of a majority of such independent and/or non-management directors, to retain legal counsel, accountants, health care consultants, or other experts, at the Company’s expense, to advise the independent and/or non-management directors concerning issues arising in the exercise of their functions and powers.

12

Criteria for Director Nomination. Our Nominating and Corporate Governance Committee recommends to the Board persons to be nominated to serve as directors of the Company. When determining whether to nominate a current director to stand for reelection as a director, the Nominating and Corporate Governance Committee reviews and considers the performance of such director during the prior year using performance criteria established by the Board. The Nominating and Corporate Governance Committee also considers the requirements of any stockholders’ agreement in existence which governs the composition requirements of the Company’s Board of Directors. In recruiting and evaluating new director candidates, the Nominating and Corporate Governance Committee assesses a candidate’s independence, as well as the candidate’s background and experience, current board skill needs and diversity. The Nominating and Corporate Governance Committee considers any candidates proposed by any senior executive officer, director or stockholder, consistent with applicable law, the Company’s certificate of incorporation and bylaws, the criteria set forth in our Corporate Governance Guidelines and the requirements of any stockholders’ agreement in existence.

Individual directors and any person nominated to serve as a director should demonstrate high ethical standards and integrity in their personal and professional dealings, be willing to act on and remain accountable for their boardroom decisions, and be in a position to devote an adequate amount of time to the effective performance of their director duties.

In addition, each director should contribute knowledge, experience, or skill in at least one area that is important to the Company. To provide such a contribution to the Company, a director must possess experience in one or more of the following:

| • | Business or management for complex and large consolidated companies or other complex and large institutions; |

| • | Accounting or finance for complex and large consolidated companies or other complex and large institutions; |

| • | Leadership, strategic planning, or crisis response for complex and large consolidated companies or other complex and large institutions; |

| • | The health care industry; and |

| • | Other significant and relevant areas deemed by the Nominating and Corporate Governance Committee to be valuable to the Company. |

Each director must also take reasonable steps to keep informed on the complex, rapidly evolving health care environment. The Board encourages formal continuing education, and the Company will reimburse directors for reasonable expenses incurred in connection with participation in accredited director education programs. Prior to nominating a person to serve as a director, the Nominating and Corporate Governance Committee evaluates the candidate based on the criteria described above. In addition, prior to accepting re-nomination, each director should evaluate himself or herself as to whether he or she satisfies the criteria described above.

| Our 10 Board nominees represent a robust combination of experience, perspective and expertise to enable the Board to provide effective oversight and guidance to the Company | ||

| · Healthcare and Pharmaceutical

· Corporate Finance and Accounting

· Chief Executive Officer Experience

· Human Capital Management

· Investor Experience

· Consumer and Hospitality

· Payer and Reimbursement |

· Patient Care Experience

· Operational Experience

· Legal and Regulatory

· Public Company Board Experience

· Government Experience

· Academia

· International Experience | |

13

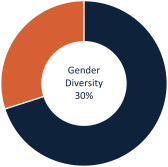

Board Diversity. We value diversity and endeavor to have a Board representing diverse experience at policy-making levels in business, education or other areas that are relevant to the Company’s business. Our Corporate Governance Guidelines provide that the initial pool of candidates from which the Nominating and Corporate Governance Committee recommends nominees should include qualified female and racially/ethnically diverse candidates, and any third-party search firm that the Nominating and Corporate Governance Committee engages to identify such candidates shall be requested to include qualified female and racially/ethnically diverse candidates in such initial pool. Four out of 10 (40%) of our Board nominees are diverse based on gender or race/ethnicity.

| Racial/Ethnic Diversity

|

Gender Diversity

| |

|

|

Board Tenure. Our Company seeks to have a well-balanced mix of tenure on our Board. Our longest tenured directors are members of the Company’s founding family, representing the third generation of Frist family members to have served on our Board and highlighting the family’s commitment to the long-term success of our Company. The average tenure of our director nominees is approximately 8.6 years, bringing a valuable mix of Company knowledge, fresh perspectives and industry insights to the Board.

We do not have term limits for our directors. All directors are elected for one-year terms without staggered terms, and each year, all directors must be nominated and stand for election for another year. However, our Corporate Governance Guidelines provide that no person shall be nominated to the Board who has attained the age of 75 or more on or before the first day of the proposed term of office. Under certain special circumstances, the Board may make an exception to this retirement policy.

Stockholder Nominees. Our bylaws provide that stockholders seeking to nominate candidates for election as directors or to bring business before an annual or special meeting of stockholders must provide a timely notice of their proposal in writing and otherwise in proper form to the Corporate Secretary of the Company. Generally, to be timely, a stockholder’s notice must be delivered to, mailed to or received at our principal executive offices, addressed to the Corporate Secretary of the Company, and within the following time periods:

| • | in the case of an annual meeting, no earlier than 120 days and no later than 90 days prior to the first anniversary of the date of the preceding year’s annual meeting; provided, however, that if (A) the annual meeting is advanced by more than 30 days, or delayed by more than 60 days, from the first anniversary of the preceding year’s annual meeting, or (B) no annual meeting was held during the preceding year, to be timely the stockholder notice must be received no earlier than 120 days before such annual meeting and no later than the later of 90 days before such annual meeting or the tenth day after the day on which public disclosure of the date of such meeting is first made; and |

| • | in the case of a nomination of a person or persons for election to the Board of Directors at a special meeting of the stockholders called for the purpose of electing directors, no earlier than 120 days before such special meeting and no later than the later of 90 days before such |

14

| annual or special meeting or the tenth day after the day on which public disclosure of the date of such meeting is first made. |

In no event shall an adjournment, postponement or deferral, or public disclosure of an adjournment, postponement or deferral, of a meeting of the stockholders commence a new time period (or extend any time period) for the giving of the stockholder notice. Our bylaws require that stockholders comply with the procedural and disclosure requirements set forth therein in connection with nominating candidates for election as directors and soliciting proxies or votes in support therefor.

The Company has also adopted a proxy access right that permits a stockholder, or a group of up to 20 stockholders, owning continuously for at least three years shares of our stock representing an aggregate of at least 3% of the voting power entitled to vote in the election of directors, to nominate and include in our proxy materials director nominees, provided that the stockholder(s) and the nominee(s) satisfy the requirements in our bylaws. The number of potential proxy access nominees nominated by all eligible stockholders shall not exceed the greater of (A) two or (B) 20% of the directors then in office. Under our bylaws, to be considered timely, compliant notice of proxy access director nominations for next year’s proxy statement and form of proxy must be submitted to the Corporate Secretary at the address specified above no earlier than 150 days and no later than 120 days prior to the first anniversary of the date the Company mailed its proxy statement for the preceding year’s annual meeting; provided, however, that if (A) the annual meeting is not within 30 days before or after the anniversary date of the preceding year’s annual meeting, or (B) no annual meeting was held during the preceding year, to be timely the stockholder notice must be received no later than 90 days prior to such annual meeting or, if later, the tenth day after the day on which notice of the date of the meeting was mailed or public disclosure of the date of such meeting is first made, whichever occurs first.

The foregoing is a summary of the requirements for stockholders to nominate persons for election to our Board of Directors, which requirements are set out fully in our bylaws, and the foregoing description is qualified by reference to the full text of our bylaws. You should consult our bylaws for more detailed information regarding the processes by which stockholders may nominate directors, including the specific requirements regarding the content of the written notices and other related requirements. Our bylaws are posted on the Corporate Governance portion of our website located at www.hcahealthcare.com.

Board Leadership Structure. The Board of Directors regularly considers the appropriate leadership structure for the Company and has concluded that the Company and its stockholders are best served by the Board of Directors retaining discretion to determine whether the same individual should serve as both Chief Executive Officer and Chairman of the Board of Directors, or whether the roles should be separated. The Board of Directors believes that it is important to retain the flexibility to make this determination at any given point in time based on what it believes will provide the best leadership structure for the Company. Accordingly, at different points in the Company’s history, the Chief Executive Officer and Chairman of the Board of Directors roles have been held by the same person. At other times, the roles have been held by different individuals. In each instance, the decision on whether to combine or separate the roles was made in the best interests of the Company’s stockholders, based on the circumstances at the time.

The Board of Directors has appointed Thomas F. Frist III to serve as Chairman and Mr. Michelson to serve as the independent presiding director of the Board of Directors. Mr. Frist III is the son of HCA founder Dr. Thomas F. Frist, Jr. Mr. Frist III has been a member of the Board of Directors since 2006; he, along with certain other members of his family, collectively own approximately 26% of our common stock.

As Chairman, Mr. Frist III leads the activities of the Board of Directors, including calling meetings of the Board and non-management directors, as necessary, setting the agenda for Board meetings in consultation with the CEO, chairing executive sessions of the non-management directors, engaging

15

with stockholders as appropriate, and acting as an advisor to Mr. Hazen on strategic aspects of the CEO role, with regular consultations on major developments and decisions. The Board believes that this leadership structure is appropriate given Mr. Frist III’s experience, historical association with HCA and his significant ownership stake. The Board believes that this leadership structure improves the Board’s ability to focus on key policy and operational issues, including with respect to risk oversight, and helps the Company operate in the long-term interests of stockholders.

Consistent with our commitment to good governance, and as further described above, non-management directors meet at regularly scheduled executive sessions, which typically occur at regularly scheduled Board meetings, without any member of management present. In addition, at least annually the independent directors meet in separate executive session. Our Board believes its current leadership structure effectively allocates authority, responsibility, and oversight between management and the non-management and independent members of our Board. It gives primary responsibility for the operational leadership and strategic direction of the Company to our CEO, while the Chairman, coupled with strong independent director leadership in the form of an independent presiding director, facilitates our Board’s independent oversight of management, promotes communication between management and our Board, engages with stockholders and leads our Board’s consideration of key governance matters. We plan to continue to examine our corporate governance policies and leadership structure on an ongoing basis to ensure that they continue to meet the Company’s needs.

Board’s Role in Risk Oversight. Risk is inherent with every business. Management is responsible for the day-to-day management of risks the Company faces, while the Board of Directors, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the Board of Directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed. Our Board of Directors oversees an enterprise-wide approach to risk management, designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance, and enhance stockholder value. A fundamental aspect of risk management is not only understanding the risks a company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for a company. The involvement of the full Board of Directors in setting our business strategy is a key part of its assessment of management’s appetite for risk and also a determination of what constitutes an appropriate level of risk for the Company.

We conduct an annual enterprise risk management assessment, which is facilitated by our enterprise risk management team in collaboration with our internal auditors. The senior internal audit executive officer reports to the Chief Executive Officer and to the Audit and Compliance Committee in this capacity. In this process, we assess risk throughout the Company (including cybersecurity risk) by conducting surveys and interviews of our employees and directors, soliciting information regarding business risks that could significantly adversely affect the Company, including the achievement of its strategic plan. We then identify any controls or initiatives in place to mitigate any material risk and the effectiveness of any such controls or initiatives. The enterprise risk management team annually prepares a report for senior management and, ultimately, the Board of Directors regarding the key identified risks and how we manage these risks both on an annual and ongoing basis. Members of senior management attend the quarterly Board meetings, as appropriate, and are available to address any questions or concerns raised by the Board regarding risk management and any other matters. Additionally, each quarter, the Board of Directors receives presentations from senior management on strategic matters involving our operations.

While the Board of Directors has the ultimate oversight responsibility for the risk management process, various committees of the Board assist the Board in fulfilling its oversight responsibilities in certain areas of risk.

16

| Key Areas in which Committees Assist in Risk Oversight Responsibilities | ||

| Audit and Compliance Committee |

· Financial and enterprise risk exposures, including internal controls and cybersecurity risk

· Our policies with respect to risk assessment and risk

· Compliance with applicable laws and regulations

· Environmental and sustainability issues

· The Company Code of Conduct and related Company policies and procedures, including the Corporate Ethics and Compliance Program | |

| Compensation Committee |

· Management of risks arising from our human capital and compensation policies and programs | |

| Finance and Investments Committee |

· The Company’s financial structure, investment policies and objectives and other matters of a financial and investment nature | |

| Nominating and Corporate Governance Committee |

· The Company’s corporate governance, social responsibility, community interests and political activities | |

| Patient Safety and Quality of Care Committee |

· Our policies and procedures relating to patient safety, equity of care and the delivery of quality medical care to our patients | |

Board Meetings and Director Attendance. During 2023, our Board of Directors held seven meetings. All director nominees attended at least 75% of the Board meetings and meetings of the committees of the Board on which the director served, held during the period for which he or she served as a director. Our policy is to strongly encourage directors to attend the Company’s annual stockholder meetings. Our 2023 annual meeting of stockholders was attended by all directors in service at such time.

Board and Committee Evaluations. Our Nominating and Corporate Governance Committee, acting on behalf of the Board, conducts an annual evaluation of the Board’s performance. This evaluation considers the Board’s contribution as a whole and specifically reviews areas in which the Board and/or senior management believes additional contributions could be made. The purpose of the evaluation is to increase the effectiveness of the Board. In addition, each Board committee, under the oversight of the Nominating and Corporate Governance Committee, conducts an annual evaluation of that committee. These evaluations include a review of the committee’s compliance with its charter and its overall contribution. The results of the annual evaluations are discussed by each committee and the Board as a whole, and the independent presiding director and/or chair of the Nominating and Corporate Governance Committee discuss the results individually with each director.

Board Committees. Our Board of Directors currently has five standing committees: the Audit and Compliance Committee, the Compensation Committee, the Finance and Investments Committee, the Nominating and Corporate Governance Committee and the Patient Safety and Quality of Care Committee. The Board of Directors receives recommendations from the Nominating and Corporate Governance Committee regarding committee composition and determines the members of each committee. The Board of Directors has determined that all members of the Audit and Compliance Committee, Compensation Committee and Nominating and Corporate Governance Committee are independent as defined in the NYSE listing standards and in our Corporate Governance Guidelines. The Board of Directors has adopted a written charter for each of these committees. All committee charters are available on the Corporate Governance portion of our website located at www.hcahealthcare.com.

17

The chart below reflects the current composition of the standing committees, with committee chairs circled.

| Name of Director | Audit and Compliance |

Compensation | Finance and Investments |

Nominating and Corporate Governance |

Patient Safety and Quality of Care | |||||

| Thomas F. Frist III |

||||||||||

| Samuel N. Hazen* |

||||||||||

| Meg G. Crofton |

|

| ||||||||

| Robert J. Dennis |

|

|

|

|||||||

| Nancy-Ann DeParle |

|

| ||||||||

| William R. Frist |

| |||||||||

| Hugh F. Johnston |

|

|

||||||||

| Michael W. Michelson |

|

|

|

|||||||

| Wayne J. Riley, M.D |

|

|

| |||||||

| Andrea B. Smith |

|

| ||||||||

| * | Indicates management director. |

Audit and Compliance Committee. Our Audit and Compliance Committee is composed of Hugh F. Johnston (Chair), Michael W. Michelson, Wayne J. Riley, M.D. and Andrea B. Smith. Our Board of Directors has affirmatively determined that each member of the Audit and Compliance Committee meets the definition of “independent director” for purposes of the NYSE rules and the independence requirements of Rule 10A-3 of the Exchange Act. Our Board of Directors has determined that each of Hugh F. Johnston, Michael W. Michelson, Wayne J. Riley, M.D. and Andrea B. Smith is an “audit committee financial expert.” The Audit and Compliance Committee is responsible for, among other things:

| • | Selecting the independent registered public accounting firm; |

18

| • | Pre-approving all audit engagement fees and terms, as well as audit and permitted non-audit services to be provided by the independent registered public accounting firm; |

| • | At least annually, obtaining and reviewing a report of the independent registered public accounting firm describing the firm’s internal quality-control procedures and any material issues raised by its most recent review of internal quality controls; |

| • | Evaluating the qualifications, performance and independence of the independent registered public accounting firm; |

| • | Reviewing with the independent registered public accounting firm any difficulties the independent registered public accounting firm encountered during the course of the audit work, including any restrictions in the scope of activities or access to requested information or any significant disagreements with management and management’s responses to such matters; |

| • | Setting policies regarding the hiring of current and former employees of the independent registered public accounting firm; |

| • | Reviewing and discussing the annual audited and quarterly unaudited financial statements with management and the independent registered public accounting firm; |

| • | Discussing earnings press releases and the financial information and earnings guidance provided to analysts and rating agencies; |

| • | Reviewing the Company’s information security programs, including cybersecurity and procedures regarding disaster recovery and critical business continuity and reviewing the Company’s programs and plans that management has established to monitor compliance with information security compliance programs and test preparedness; |

| • | Discussing policies governing the process by which risk assessment and risk management is to be undertaken; |

| • | Reviewing reports made by the CEO and CFO regarding any significant deficiencies or material weaknesses in our internal control over financial reporting; |

| • | Reviewing with the independent registered public accounting firm the internal audit responsibilities, budget and staffing, as well as procedures for implementing recommendations made by the independent registered public accounting firm and any significant matters contained in reports from the internal audit department; |

| • | Establishing procedures for receipt, retention and treatment of complaints we receive regarding accounting, auditing or internal controls and the confidential, anonymous submission of employee concerns regarding questionable accounting and auditing matters; |

| • | Conducting a reasonable prior review and oversight of certain related party transactions; |

| • | Discussing with our general counsel any legal or regulatory matters that could reasonably be expected to have a material impact on our business or financial statements; |

| • | Providing information to our Board that may assist the Board in fulfilling its responsibility to oversee the integrity of the Company’s financial statements, the Company’s compliance with legal and regulatory requirements, the independent registered public accounting firm’s performance, qualifications, and independence and the performance of the Company’s internal audit function; |

| • | Preparing the report required by the SEC to be included in our Annual Report on Form 10-K and our proxy or information statement; |

| • | Overseeing the activities of the Company’s Disclosure Committee; and |

| • | Reviewing and overseeing the Company’s policies and practices regarding environmental and sustainability issues. |

The Audit and Compliance Committee has adopted a charter which can be obtained on the Corporate Governance page of our website at www.hcahealthcare.com. In 2023, the Audit and Compliance Committee met 10 times.

19

Compensation Committee. Our Compensation Committee is composed of Meg G. Crofton, Robert J. Dennis (Chair) and Michael W. Michelson. Effective at the annual meeting, Andrea B. Smith will become a member of the Compensation Committee. Our Board of Directors has affirmatively determined that each member of the Compensation Committee meets the definition of “independent director” for purposes of the NYSE rules and the definition of “non-employee director” for purposes of Section 16 of the Exchange Act. The Compensation Committee is generally charged with the oversight of our executive compensation and rewards programs and human capital management strategies and policies. Responsibilities of the Compensation Committee include the review and/or approval of the following items:

| • | Executive compensation strategy and philosophy; |

| • | Evaluation process and compensation arrangements for executive management, including the CEO; |

| • | Design and administration of the annual Executive Officer Performance Excellence Program; |

| • | Design and administration of our equity incentive plans; |

| • | Executive benefits and perquisites (including the HCA Restoration Plan and the Supplemental Executive Retirement Plan); |

| • | Management succession planning; |

| • | Any other executive compensation or benefits related items deemed appropriate by the Compensation Committee; |

| • | Director compensation arrangements; and |

| • | Human capital management strategies and policies with respect to attracting, developing, retaining and motivating leadership and colleagues, workplace culture, employee relations, diversity and inclusion initiatives, pay equity, and workplace safety. |

In addition, the Compensation Committee considers the proper alignment of executive pay policies with Company values and strategy by overseeing employee compensation policies, corporate performance measurement and assessment, and Chief Executive Officer performance assessment.

The Compensation Committee may retain the services of independent outside consultants, as it deems appropriate in its sole discretion, to assist in the strategic review of programs and arrangements relating to executive compensation and performance. In 2023, the Compensation Committee retained Semler Brossy Consulting Group, LLC (“Semler Brossy”) to assist in conducting an assessment of competitive executive and director compensation. Semler Brossy is retained by, and reports directly to, the Compensation Committee. As required under the NYSE listing rules, the Compensation Committee has considered and assessed all factors relevant to Semler Brossy’s independence from management, including but not limited to those set forth in Section 303A.05(c)(iv) of the NYSE Listed Company Manual, as applicable. Based on this review, the Compensation Committee is not aware of any conflict of interest that has been raised by work performed by Semler Brossy. A consultant from Semler Brossy attends most of the Compensation Committee meetings and supports the Compensation Committee’s role by providing independent expertise and advice. Semler Brossy’s main responsibilities are to:

| • | Review and advise on the Company’s executive compensation programs, including base salaries, short-term and long-term incentives, and other benefits, if any; |

| • | Review and analyze executive officer compensation data, compensation survey data, and other publicly available data; |

| • | Review and analyze management prepared market pricing analysis (i.e., review compensation surveys used, job matches, survey weightings, and year-over-year change in analysis results); |

| • | Prepare director pay assessment; and |

| • | Advise on current trends in compensation, including design and pay levels. |

The Compensation Committee may consider recommendations from our Chief Executive Officer and compensation consultants, among other factors, in making its compensation determinations. The

20

Compensation Committee has the authority to delegate any of its responsibilities to one or more subcommittees as the committee may deem appropriate. For a discussion of the processes and procedures for determining executive and director compensation and the role of executive officers and compensation consultants in determining or recommending the amount or form of compensation, see “Directors – Director Compensation” and “Executive Compensation — Compensation Discussion and Analysis.” The Compensation Committee has adopted a charter which can be obtained on the Corporate Governance page of our website at www.hcahealthcare.com. In 2023, the Compensation Committee met eight times.

Finance and Investments Committee. Our Finance and Investments Committee is composed of Robert J. Dennis, Hugh F. Johnston and Michael W. Michelson (Chair). This committee is responsible for reviewing and considering matters relating to the Company’s financial and investment structure, strategies and policies. The Finance and Investments Committee has adopted a charter which can be obtained on the Corporate Governance page of our website at www.hcahealthcare.com. In 2023, the Finance and Investments Committee met four times.

Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee is composed of Robert J. Dennis, Nancy-Ann DeParle (Chair) and Wayne J. Riley, M.D. Our Board of Directors has affirmatively determined that each member of the Nominating and Corporate Governance Committee meets the definition of “independent director” for purposes of the NYSE rules. The Nominating and Corporate Governance Committee is responsible, subject to the requirements of the Stockholders’ Agreement, as applicable, for, among other things: (1) identifying, recruiting and recommending to the Board of Directors individuals qualified to become members of our Board of Directors; (2) reviewing the qualifications of incumbent directors to determine whether to recommend them for reelection; (3) reviewing and recommending corporate governance policies, principles and procedures applicable to the Company; (4) overseeing the Company’s policies and practices regarding corporate governance, social responsibility and community interests; (5) reviewing and considering the Company’s policies and practices regarding political activities, including political contributions and lobbying and (6) handling such other matters that are specifically delegated to the Nominating and Corporate Governance Committee by the Board of Directors from time to time. The Nominating and Corporate Governance Committee has adopted a charter which can be obtained on the Corporate Governance page of our website at www.hcahealthcare.com. In 2023, the Nominating and Corporate Governance Committee met five times.

Patient Safety and Quality of Care Committee. Our Patient Safety and Quality of Care Committee is composed of Meg G. Crofton, Nancy-Ann DeParle, William R. Frist, Wayne J. Riley, M.D. (Chair) and Andrea B. Smith. This committee reviews our policies and procedures relating to the delivery of quality medical care to patients as well as matters concerning or relating to the efforts to advance the quality of health care provided and patient safety and policies and practices for promoting the Company’s commitment to equity of patient care. This committee also reviews, as appropriate, information related to the Company’s quality, clinical risk, patient safety and performance improvement. The Patient Safety and Quality of Care Committee has adopted a charter which can be obtained on the Corporate Governance page of our website at www.hcahealthcare.com. In 2023, the Patient Safety and Quality of Care Committee met four times.

Stockholder Engagement. The Company engages with stockholders throughout the year primarily through regular investor relations meetings and stockholder outreach sessions. The Company views its interactions with stockholders as a two-way dialogue and seeks to provide information and perspective concerning various subjects, such as the Company’s performance, strategy, corporate responsibility, corporate governance, environmental strategy, diversity, quality and equity of care and executive compensation-related matters. The Company also solicits and receives feedback on a regular basis with respect to a broad range of topics of interest to our stockholders.

21

Additional stockholder and investor outreach typically includes investor road shows, analyst meetings, and investor conferences. We hosted an Investor Day in November 2023 where we provided perspectives on our financial performance, operations and strategies. We also hold conference calls for our quarterly earnings releases which are available in real time and as archived webcasts on our website.

Consistent with prior years, in the first quarter of 2024, the Company extended invitations to meet with our 15 largest stockholders (excluding Hercules Holding II), collectively holding approximately 30 percent of our common stock.

Policy Regarding Communications with the Board of Directors. Stockholders and other interested parties may contact the Board of Directors, a particular director, or the non-management directors or independent directors as a group by sending a letter (signed or anonymous) to: c/o Board of Directors, HCA Healthcare, Inc., One Park Plaza, Nashville, TN 37203, Attention: Corporate Secretary.

We will forward all such communications to the applicable Board member(s) at least quarterly, except for advertisements or solicitations which will be discarded. Our legal department will review the communications received. Concerns will be addressed through our regular procedures for addressing such matters. Depending on the nature of the concern, management also may refer it to our internal audit, legal, finance, financial reporting or other appropriate department. If the volume of communication becomes such that the Board adopts a process for determining which communications will be relayed to Board members, that process will appear on the Corporate Governance page of our website at www.hcahealthcare.com.

Complaints or concerns about our accounting, internal accounting controls, auditing or other matters may be reported anonymously or otherwise to our legal department or to the Audit and Compliance Committee in any of the following ways:

| • | Call the HCA Ethics Line at 1-800-455-1996 |

| • | Write to the Audit and Compliance Committee at: Audit and Compliance Committee Chair, HCA Healthcare, Inc., c/o General Counsel, One Park Plaza, Nashville, TN 37203 |

All accounting, internal accounting controls, or auditing matters will be reported to the Audit and Compliance Committee on at least a quarterly basis. Depending on the nature of the concern, it also may be referred to our internal audit, legal, finance, financial reporting or other appropriate department. We will treat a complaint or concern about questionable accounting or auditing matters confidentially if requested, except to the extent necessary to protect the Company’s interests or to comply with an applicable law, rule or regulation or order of a judicial or governmental authority.

Our policy prohibits any employee from retaliating or taking any adverse action against anyone who, in good faith, reports or helps to resolve an ethical or legal concern.

Corporate Governance Guidelines. The Company has adopted Corporate Governance Guidelines that we believe reflect the Board’s commitment to a system of governance that enhances corporate responsibility and accountability. The Corporate Governance Guidelines contain provisions addressing the following matters, among others:

| • | Size and composition of the Board; |

| • | Director qualifications and independence; |