Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-201463

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each class of securities to be registered |

Amount to be registered |

Proposed maximum offering price per security |

Proposed maximum aggregate offering price |

Amount of fee(1) | ||||

| 5.875% Senior Notes due 2026 |

$500,000,000 | 100.25% | $501,250,000 | $50,475.88 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Calculated in accordance with Rule 457(r) under the Securities Act of 1933, as amended. |

Table of Contents

PROSPECTUS SUPPLEMENT

(To Prospectus dated January 13, 2015)

$500,000,000

HCA Inc.

5.875% Senior Notes due 2026

HCA Inc. is offering $500,000,000 aggregate principal amount of 5.875% senior notes due 2026, which we refer to as the “notes offered hereby”. The notes offered hereby will be issued under the indenture dated August 1, 2011, as supplemented by the thirteenth supplemental indenture dated November 13, 2015 pursuant to which the $1.0 billion aggregate principal amount of 5.875% Senior Notes due 2026 were issued on November 13, 2015 (the “existing notes” and, together with the notes offered hereby, the “notes”). The notes offered hereby and the existing notes will be treated as a single series for all purposes under the indenture, including notices, consents, waivers, amendments, redemptions and any other action permitted under the indenture, and the notes offered hereby will have identical terms with the existing notes, other than their issue date and public offering price. The notes offered hereby will have the same CUSIP and ISIN numbers as, and will vote together and will be fungible with, the existing notes immediately upon issuance. The notes will bear interest at a rate of 5.875% per annum. HCA Inc. will pay interest on the notes semi-annually, in cash in arrears, on February 15 and August 15 of each year, beginning on August 15, 2016. The notes offered hereby are offered at the public offering price plus accrued interest from November 13, 2015, the original issue date of the existing notes. Interest on the notes offered hereby will accrue from November 13, 2015. Accrued interest on the notes offered hereby must be paid by the purchasers through the day before the closing date. The notes will mature on February 15, 2026.

We may redeem the notes, at any time in whole or from time to time in part, at the redemption prices described in this prospectus supplement. In addition, if we experience certain kinds of changes in control, we may be required to repurchase the notes on the terms described in this prospectus supplement.

The notes will be HCA Inc.’s senior obligations and will rank equally and ratably with all of its existing and future senior indebtedness and senior to any of its future subordinated indebtedness. The obligations under the notes will be fully and unconditionally guaranteed by HCA Holdings, Inc., the direct parent company of HCA Inc., on a senior unsecured basis and will rank equally and ratably with HCA Inc.’s existing and future senior indebtedness and senior to any of its existing and future subordinated indebtedness and will be structurally subordinated in right of payment to all obligations of HCA Inc.’s subsidiaries and will be subordinated to any of HCA Inc.’s secured indebtedness to the extent of the value of the collateral securing such indebtedness.

HCA Inc. intends to use the net proceeds of this offering for general corporate purposes.

Investing in the notes involves risks. See “Risk Factors ” beginning on page S-15.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission or other regulatory body has approved or disapproved of these securities or determined if this prospectus supplement or the attached prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Public offering price(1) | Underwriting discount | Proceeds to HCA Inc.(1) (before expenses) |

||||||||||||||||||||||

| Per note | Total | Per note | Total | Per note | Total | |||||||||||||||||||

| 5.875% Senior Notes due 2026 |

100.25 | % | $ | 501,250,000 | 1.00 | % | $ | 5,000,000 | 99.25 | % | $ | 496,250,000 | ||||||||||||

| (1) | Plus accrued interest from November 13, 2015. |

We expect to deliver the notes to investors on or about December 8, 2015 in book-entry form only through the facilities of The Depository Trust Company (“DTC”).

Joint Book-Running Managers

| Barclays | BofA Merrill Lynch | Citigroup | Credit Suisse | |||

| Deutsche Bank Securities | Goldman, Sachs & Co. |

J.P. Morgan | Morgan Stanley | |||

| RBC Capital Markets | SunTrust Robinson Humphrey | UBS Investment Bank | Wells Fargo Securities | |||

Co-Managers

| Credit Agricole CIB | Mizuho Securities | Fifth Third Securities | SMBC Nikko |

Prospectus Supplement dated December 3, 2015

Table of Contents

You should rely only on the information contained and incorporated by reference in this prospectus supplement and the accompanying prospectus. Neither HCA Inc. nor the underwriters have authorized anyone to provide you with any information or represent anything about HCA Inc., its financial results or this offering that is not contained or incorporated by reference in this prospectus supplement or the accompanying prospectus. If given or made, any such other information or representation should not be relied upon as having been authorized by HCA Inc. or the underwriters. Neither HCA Inc. nor the underwriters are making an offer to sell these notes in any jurisdiction where the offer or sale is not permitted. The information contained and incorporated by reference in this prospectus supplement and the accompanying prospectus may only be accurate on the date of this document.

| Prospectus Supplement |

Page | |||

| S-1 | ||||

| S-15 | ||||

| S-21 | ||||

| S-22 | ||||

| S-24 | ||||

| S-32 | ||||

| S-49 | ||||

| S-54 | ||||

| S-56 | ||||

| S-61 | ||||

| S-61 | ||||

| S-61 | ||||

| S-62 | ||||

| Prospectus |

Page | |||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 6 | ||||

| 11 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

S-i

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the terms of the offering of the notes and adds to and supplements information contained in the accompanying prospectus and the documents incorporated by reference therein. The second part is the accompanying prospectus, which we refer to as the “accompanying prospectus.” The accompanying prospectus contains a description of our debt securities and gives more general information, some of which may not apply to the notes. The accompanying prospectus also incorporates by reference documents that are described under “Incorporation by Reference” in that prospectus.

You should rely only on the information contained or incorporated by reference in this prospectus supplement, in the accompanying prospectus or in any free writing prospectus filed by us with the SEC. If information in this prospectus supplement is inconsistent with the accompanying prospectus, you should rely on this prospectus supplement. We have not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. You should not assume that the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus or in any such free writing prospectus is accurate as of any date other than the respective dates thereof. Our business, financial condition, results of operations and prospects may have changed since those dates.

We are not, and the underwriters are not, making an offer of the notes in any jurisdiction where the offer or sale is not permitted.

MARKET, RANKING AND OTHER INDUSTRY DATA

The data included or incorporated by reference in this prospectus supplement and the accompanying prospectus regarding markets and ranking, including the size of certain markets and our position and the position of our competitors within these markets, are based on reports of government agencies or published industry sources and estimates based on management’s knowledge and experience in the markets in which we operate. These estimates have been based on information obtained from our trade and business organizations and other contacts in the markets in which we operate. We believe these estimates to be accurate as of the date of this prospectus supplement. However, this information may prove to be inaccurate because of the method by which we obtained some of the data for the estimates or because this information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. As a result, you should be aware that market, ranking and other similar industry data included or incorporated by reference in this prospectus supplement and the accompanying prospectus, and estimates and beliefs based on that data, may not be reliable. Neither we nor the underwriters can guarantee the accuracy or completeness of any such information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus.

FORWARD-LOOKING AND CAUTIONARY STATEMENTS

This prospectus supplement and the accompanying prospectus contain and incorporate by reference “forward-looking statements” within the meaning of the federal securities laws, which involve risks and uncertainties. Forward-looking statements include statements regarding estimated Electronic Health Record (“EHR”) incentive income and related EHR operating expenses, expected share-based compensation expense, expected capital expenditures and expected net claim payments and all other statements that do not relate solely to historical or current facts, and can be identified by the use of words like “may,” “believe,” “will,” “expect,” “project,” “estimate,” “anticipate,” “plan,” “initiative” or “continue.” These forward-looking statements are based on our current plans and expectations and are subject to a number of known and unknown uncertainties

S-ii

Table of Contents

and risks, many of which are beyond our control, which could significantly affect current plans and expectations and our future financial position and results of operations. These factors include, but are not limited to, (1) the impact of our substantial indebtedness and the ability to refinance such indebtedness on acceptable terms, (2) the effects related to the implementation of the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act of 2010 (collectively, the “Health Reform Law”), possible delays in or complications related to implementation of the Health Reform Law, court challenges, the possible enactment of additional federal or state health care reforms and possible changes to the Health Reform Law and other federal, state or local laws or regulations affecting the health care industry, (3) the effects related to the continued implementation of the sequestration spending reductions required under the Budget Control Act of 2011, and related legislation extending these reductions, and the potential for future deficit reduction legislation that may alter these spending reductions, which include cuts to Medicare payments, or create additional spending reductions, (4) increases in the amount and risk of collectability of uninsured accounts and deductibles and copayment amounts for insured accounts, (5) the ability to achieve operating and financial targets, and attain expected levels of patient volumes and control the costs of providing services, (6) possible changes in Medicare, Medicaid and other state programs, including Medicaid upper payment limit programs or Waiver Programs, that may impact reimbursements to health care providers and insurers, (7) the highly competitive nature of the health care business, (8) changes in service mix, revenue mix and surgical volumes, including potential declines in the population covered under managed care agreements, the ability to enter into and renew managed care provider agreements on acceptable terms and the impact of consumer-driven health plans and physician utilization trends and practices, (9) the efforts of insurers, health care providers and others to contain health care costs, (10) the outcome of our continuing efforts to monitor, maintain and comply with appropriate laws, regulations, policies and procedures, (11) increases in wages and the ability to attract and retain qualified management and personnel, including affiliated physicians, nurses and medical and technical support personnel, (12) the availability and terms of capital to fund the expansion of our business and improvements to our existing facilities, (13) changes in accounting practices, (14) changes in general economic conditions nationally and regionally in our markets, (15) the emergence and effects related to infectious diseases, including Ebola, (16) future divestitures which may result in charges and possible impairments of long-lived assets, (17) changes in business strategy or development plans, (18) delays in receiving payments for services provided, (19) the outcome of pending and any future tax audits, disputes and litigation associated with our tax positions, (20) potential adverse impact of known and unknown government investigations, litigation and other claims that may be made against us, (21) our ongoing ability to demonstrate meaningful use of certified EHR technology and recognize income for the related Medicare or Medicaid incentive payments, and (22) other risk factors disclosed under “Risk Factors” and elsewhere or incorporated by reference in this prospectus supplement and the accompanying prospectus. As a consequence, current plans, anticipated actions and future financial position and results of operations may differ from those expressed in any forward-looking statements made by us or on our behalf. You are cautioned not to unduly rely on such forward-looking statements when evaluating the information presented in this prospectus supplement and the accompanying prospectus, which forward-looking statements reflect management’s views only as of the date of this prospectus supplement and the accompanying prospectus. We undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise.

S-iii

Table of Contents

This summary highlights information appearing elsewhere in and incorporated by reference in this prospectus supplement and the accompanying prospectus. This summary is not complete and does not contain all of the information that you should consider before investing in the notes. You should carefully read the entire prospectus supplement, the accompanying prospectus and the information incorporated herein by reference, including the financial data and related notes and the sections entitled “Risk Factors.”

As used herein, unless otherwise stated or indicated by context, references to the “Issuer” refer to HCA Inc. and its affiliates, and “HCA Holdings, Inc.,” the “Company,” “HCA,” “we,” “our” or “us” refer to HCA Holdings, Inc., parent of HCA Inc., and its affiliates. The term “affiliates” means direct and indirect subsidiaries and partnerships and joint ventures in which such subsidiaries are partners. The terms “facilities” or “hospitals” refer to entities owned and operated by affiliates of HCA and the term “employees” refers to employees of affiliates of HCA.

Our Company

We are the largest non-governmental hospital operator in the United States and a leading comprehensive, integrated provider of health care and related services. We provide these services through a network of acute care hospitals, outpatient facilities, clinics and other patient care delivery settings. As of September 30, 2015, we operated a diversified portfolio of 168 hospitals (with approximately 43,700 beds) and 114 freestanding surgery centers across 20 states throughout the United States and in England. As a result of our efforts to establish significant market share in large and growing urban markets with attractive demographic and economic profiles, we currently have a substantial market presence in 17 of the top 25 fastest growing markets with populations greater than 500,000 in the United States and currently maintain the first or second position, based on inpatient admissions, in many of our key markets. We believe our ability to successfully position and grow our assets in attractive markets and execute our operating plan has contributed to the strength of our financial performance over the last several years. For the nine months ended September 30, 2015, we generated revenues of $29.429 billion, net income attributable to HCA Holdings, Inc. of $1.547 billion and Adjusted EBITDA of $5.784 billion.

Our patient-first strategy is to provide high quality health care services in a cost-efficient manner. We intend to build upon our history of profitable growth by maintaining our dedication to quality care, increasing our presence in key markets through organic expansion and strategic acquisitions and joint ventures, leveraging our scale and infrastructure, and further developing our physician and employee relationships. We believe pursuing these core elements of our strategy helps us develop a faster-growing, more stable and more profitable business and increases our relevance to patients, physicians, payers and employers.

Using our scale, significant resources and over 40 years of operating experience, we have developed a significant management and support infrastructure. Some of the key components of our support infrastructure include a revenue cycle management organization, a health care group purchasing organization (“GPO”), an information technology and services provider, a nurse staffing agency and a medical malpractice insurance underwriter. These shared services have helped us to maximize our cash collection efficiency, achieve savings in purchasing through our scale, more rapidly deploy information technology upgrades, more effectively manage our labor pool and achieve greater stability in malpractice insurance premiums. Collectively, these components have helped us to further enhance our operating effectiveness, cost efficiency and overall financial results. Our Parallon subsidiary group also offers certain of these component services to other health care organizations.

Since the founding of our business in 1968 as a single-facility hospital company, we have demonstrated an ability to consistently innovate and sustain growth during varying economic and regulatory climates. Under the

S-1

Table of Contents

leadership of an experienced senior management team, whose tenure at HCA averages approximately 20 years, we have established an extensive record of providing high quality care, profitably growing our business, making and integrating strategic acquisitions and efficiently and strategically allocating capital spending.

Our Industry

We believe well-capitalized, comprehensive and integrated health care delivery providers are well-positioned to benefit from the current industry trends, some of which include:

Aging Population and Continued Growth in the Need for Health Care Services. According to the U.S. Census Bureau, the demographic age group of persons aged 65 and over is expected to experience compounded annual growth of 2.4% over the next 20 years (2015 to 2035) compared to general population growth of 0.7% over the same period, and constitute 20.9% of the total U.S. population by 2035. The Centers for Medicare & Medicaid Services (“CMS”) projects continued increases in hospital services based on the aging of the U.S. population, advances in medical procedures, expansion of health coverage, increasing consumer demand for expanded medical services and increased prevalence of chronic conditions such as diabetes, heart disease and obesity. We believe these factors will continue to drive increased utilization of health care services and the need for comprehensive, integrated hospital networks that can provide a wide array of essential and sophisticated health care.

Continued Evolution of Quality-Based Reimbursement Favors Large-Scale, Comprehensive and Integrated Providers. We believe the U.S. health care system is continuing to evolve in ways that favor large-scale, comprehensive and integrated providers that provide high levels of quality care. Specifically, we believe there are a number of initiatives that will continue to gain importance in the foreseeable future, including use of value-based payment methodologies tied to performance, quality and coordination of care, implementation of integrated EHR and information, and an increasing ability for patients and consumers to make choices about all aspects of health care. We believe our company is well positioned to respond to these emerging trends and has the resources, expertise and flexibility necessary to adapt in a timely manner to the changing health care regulatory and reimbursement environment.

Impact of Health Reform Law. The Health Reform Law changes how health care services are covered, delivered and reimbursed through expanded coverage of uninsured individuals, reduced growth in Medicare program spending, reductions in Medicare and Medicaid Disproportionate Share Hospital (“DSH”) payments, and the establishment of programs in which reimbursement is tied to quality and integration. In addition, the Health Reform Law reforms certain aspects of health insurance, expands existing efforts to tie Medicare and Medicaid payments to performance and quality, and contains provisions intended to strengthen fraud and abuse enforcement. Based on the Congressional Budget Office’s March 2015 projection, by 2025, the Health Reform Law will expand coverage to 25 million additional individuals. This increased coverage will occur through a combination of public program expansion and private sector health insurance and other reforms. In King v. Burwell, the Supreme Court upheld subsidies for enrollees on the federally-facilitated exchanges and settled a significant challenge to the Health Reform Law’s effectiveness in reducing the number of uninsured individuals. Most of the provisions of the Health Reform Law that seek to decrease the number of uninsured became effective January 1, 2014. However, the employer mandate, which requires firms with 50 or more full-time employees to offer health insurance or pay fines, has been delayed and will not be fully implemented until January 1, 2016. In addition, a number of states have opted out of the Medicaid expansion, but these states could choose to implement the expansion at a later date. It is unclear how many states will ultimately implement the Medicaid expansion provisions of the law.

S-2

Table of Contents

Our Competitive Strengths

We believe our key competitive strengths include:

Largest Comprehensive, Integrated Health Care Delivery System. We are the largest non-governmental hospital operator in the United States, providing approximately 4% to 5% of all U.S. hospital services through our national footprint. The scope and scale of our operations, evidenced by the types of facilities we operate, the diverse medical specialties we offer and the numerous patient care access points we provide, enable us to provide a comprehensive range of health care services in a cost-effective manner. As a result, we believe the breadth of our platform is a competitive advantage in the marketplace enabling us to attract patients, physicians and clinical staff while also providing significant economies of scale and increasing our relevance with commercial payers.

Reputation for High Quality Patient-Centered Care. Since our founding, we have maintained an unwavering focus on patients and clinical outcomes. We believe clinical quality influences physician and patient choices about health care delivery. We align our quality initiatives throughout the organization by engaging corporate, local, physician and nurse leaders to share best practices and develop standards for delivering high quality care. We have invested extensively in quality of care initiatives, with an emphasis on implementing information technology and adopting industry-wide best practices and clinical protocols. As a result of these efforts, we have achieved significant progress in clinical quality. As measured by the CMS clinical core measures reported on the CMS Hospital Compare website and based on publicly available data for the twelve months ended December 31, 2014, our hospitals achieved a composite score of 99.2% of the CMS core measures versus the national average of 96.8%, making us among the top performing major health systems in the United States. Payors, including the Medicare program, are increasing efforts to tie payments to quality and clinical performance. For example, CMS has implemented a value-based purchasing system and has been adjusting hospital payment rates based on “excess” readmissions for certain conditions. We also believe our quality initiatives favorably position us in a payment environment that is increasingly performance-based.

Leading Local Market Positions in Large, Growing, Urban Markets. Over our history, we have sought to selectively expand and upgrade our asset base to create a premium portfolio of assets in attractive growing markets. As a result, we have a strong market presence in 17 of the top 25 fastest growing markets with populations greater than 500,000 in the United States. In addition, we currently operate in 18 markets with populations of one million or more, with all but one of these markets projecting growth above the national average from 2015 to 2020. Our inpatient market share places us first or second in many of our key markets. We believe the strength and stability of these market positions will create organic growth opportunities and allow us to develop long-term relationships with patients, physicians, large employers and third-party payers.

Diversified Revenue Base and Payer Mix. We believe our broad geographic footprint, varied service lines and diverse revenue base mitigate our risks in numerous ways. Our diversification limits our exposure to competitive dynamics and economic conditions in any single local market, reimbursement changes in specific service lines and disruptions with respect to payers such as state Medicaid programs or large commercial insurers. We have a diverse portfolio of assets with no single facility contributing more than 2.2% of our revenues and no single metropolitan statistical area contributing more than 6.5% of revenues for the year ended December 31, 2014. We have also developed a highly diversified payer base, with no single commercial payer representing more than 8% of revenues for the year ended December 31, 2014. In addition, we are one of the country’s largest providers of outpatient services, which accounted for approximately 38% of our revenues for the year ended December 31, 2014. We believe the geographic diversity of our markets and the scope of our inpatient and outpatient operations help reduce volatility in our operating results.

S-3

Table of Contents

Scale and Infrastructure Drive Cost Savings and Efficiencies. Our scale allows us to leverage our support infrastructure to achieve significant cost savings and operating efficiencies, thereby driving margin expansion. We strategically manage our supply chain through centralized purchasing and supply warehouses, as well as our revenue cycle through centralized billing, collections and health information management functions. We also manage the provision of information technology through a combination of centralized systems with regional service support as well as centralize many other clinical and corporate functions, creating economies of scale in managing expenses and business processes. In addition to the cost savings and operating efficiencies, this support infrastructure simultaneously generates revenue from third parties that utilize our services.

Well-Capitalized Portfolio of High Quality Assets. In order to expand the range and improve the quality of services provided at our facilities, we invested approximately $9.7 billion in our facilities and information technology systems over the five-year period ended September 30, 2015. We believe our significant capital investments in these areas will continue to attract new and returning patients, attract and retain high quality physicians, maximize cost efficiencies and address the health care needs of our local communities. Furthermore, we believe our platform, as well as EHR infrastructure, national research and physician management capabilities, provide a strategic advantage by enhancing our ability to capitalize on incentives and avoid penalties through the Health Information Technology for Economic and Clinical Health Act (“HITECH”) provisions of the American Recovery and Reinvestment Act of 2009 (“ARRA”) and position us well in an environment that increasingly emphasizes quality, transparency and coordination of care.

Strong Operating Results and Cash Flows. Our leading scale, diversification, favorable market positions, dedication to clinical quality and focus on operational efficiency have enabled us to achieve attractive historical financial performance. For the nine months ended September 30, 2015, we generated net income attributable to HCA Holdings, Inc. of $1.547 billion, Adjusted EBITDA of $5.784 billion and cash flows from operating activities of $3.176 billion. Our ability to generate strong and consistent cash flow from operations has enabled us to invest in our operations, enhance earnings per share and continue to pursue attractive growth opportunities.

Proven and Experienced Management Team. We believe the extensive experience and depth of our management team are a distinct competitive advantage in the complicated and evolving industry in which we compete. Our senior management team averages approximately 20 years of experience with our company. Members of our senior management hold significant equity interests in our company, further aligning their long-term interests with those of our stockholders.

Our Growth Strategy

We are committed to providing the communities we serve with high quality, cost-effective health care while growing our business, increasing our profitability and creating long-term value for our stockholders. To achieve these objectives, we align our efforts around the following growth agenda:

Grow Our Presence in Existing Markets. We believe we are well positioned in a number of large and growing markets that will allow us the opportunity to generate long-term, attractive growth through the expansion of our presence in these markets. We plan to continue recruiting and strategically collaborating with the physician community and adding attractive service lines such as cardiology, emergency services, oncology and women’s services. Additional components of our growth strategy include expanding our footprint through developing various outpatient access points, including surgery centers, rural outreach, freestanding emergency departments and walk-in clinics.

Achieve Industry-Leading Performance in Clinical and Satisfaction Measures. Achieving high levels of patient safety, patient satisfaction and clinical quality are central goals of our business model. To achieve

S-4

Table of Contents

these goals, we have implemented a number of initiatives including infection reduction initiatives, hospitalist programs, advanced health information technology and evidence-based medicine programs. We routinely analyze operational practices from our best-performing hospitals to identify ways to implement organization-wide performance improvements and reduce clinical variation. We believe these initiatives will continue to improve patient care, help us achieve cost efficiencies, grow our revenues and favorably position us in an environment where our constituents are increasingly focused on quality, efficacy and efficiency.

Recruit and Employ Physicians to Meet Need for High Quality Health Services. We depend on the quality and dedication of the health care providers and other team members who serve at our facilities. We believe a critical component of our growth strategy is our ability to successfully recruit and strategically collaborate with physicians and other professionals to provide high quality care. We attract and retain physicians by providing high quality, convenient facilities with advanced technology, by expanding our specialty services and by building our outpatient operations. We believe our continued investment in the employment, recruitment and retention of physicians will improve the quality of care at our facilities.

Continue to Leverage Our Scale and Market Positions to Enhance Profitability. We believe there is significant opportunity to continue to grow the profitability of our company by fully leveraging the scale and scope of our franchise. We are currently pursuing next generation performance improvement initiatives such as contracting for services on a multistate basis and expanding our support infrastructure for additional clinical and support functions, such as physician credentialing, medical transcription and electronic medical recordkeeping. We believe our centrally managed business processes and ability to leverage cost-saving practices across our extensive network will enable us to continue to manage costs effectively. We continue to invest in our Parallon subsidiary group to leverage key components of our support infrastructure, including revenue cycle management, health care group purchasing, supply chain management and staffing functions, by offering these services to other hospital companies.

Selectively Pursue a Disciplined Development Strategy. We continue to believe there are significant growth opportunities in our markets. We will continue to provide financial and operational resources to successfully execute on our in-market opportunities. To complement our in-market growth agenda, we intend to focus on selectively developing and acquiring new hospitals, outpatient facilities and other health care service providers. We believe the challenges faced by the hospital industry may spur consolidation and we believe our size, scale, national presence and access to capital will position us well to participate in any such consolidation. We have a strong record of successfully acquiring and integrating hospitals and entering into joint ventures and intend to continue leveraging this experience.

Recent Developments

On November 13, 2015, the Issuer completed the public offering of the existing notes (the “November 2015 offering”) and provided notice of its election to redeem all $1,000,000,000 aggregate principal amount of its outstanding existing 6.500% notes due February 15, 2016 (the “redeemed notes”) at the “make whole” redemption price specified in the redeemed notes. The redeemed notes will be redeemed on December 13, 2015, with payment for the redeemed notes to take place on December 14, 2015, the next succeeding business day.

Corporate Information

Through our predecessors, we commenced operations in 1968. The Company was incorporated in Nevada in January 1990 and reincorporated in Delaware in September 1993. Our principal executive offices are located at One Park Plaza, Nashville, Tennessee 37203, and our telephone number is (615) 344-9551.

S-5

Table of Contents

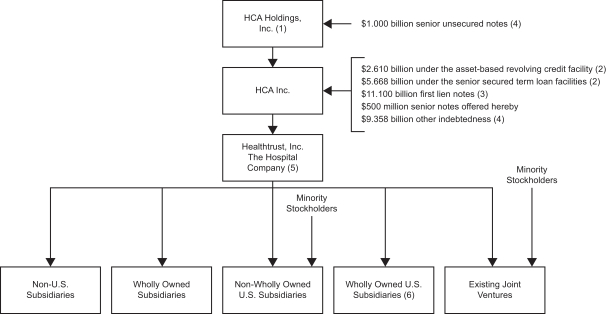

CORPORATE STRUCTURE

The indebtedness figures in the diagram below are as of September 30, 2015, and give effect to the November 2015 offering and the use of proceeds therefrom and the notes offered hereby and the use of proceeds therefrom. In this prospectus supplement, where we have presented information as adjusted to give effect to the use of the net proceeds of this offering, we have assumed that the notes will not be offered at a discount. If the notes are offered at a discount, the net proceeds to us will be less than we have assumed.

| (1) | HCA Holdings, Inc. is a guarantor of certain of HCA Inc.’s outstanding notes but is not subject to the covenants that apply to HCA Inc. or HCA Inc.’s restricted subsidiaries under those notes. |

| (2) | Consists of (i) a $3.250 billion senior secured asset-based revolving credit facility maturing on March 7, 2019 (the “asset-based revolving credit facility”) ($2.610 billion outstanding at September 30, 2015); (ii) a $2.000 billion senior secured revolving credit facility maturing on February 26, 2019 (the “senior secured revolving credit facility”) (none outstanding at September 30, 2015, without giving effect to outstanding letters of credit); (iii) a $1.383 billion senior secured term loan A-5 facility maturing on June 10, 2020; (iv) a $2.325 billion senior secured term loan B-4 facility maturing on May 1, 2018; and (v) a $1.960 billion senior secured term loan B-5 facility maturing on March 31, 2017. We refer to the facilities described under (ii) through (v) above, collectively, as the “cash flow credit facility” and, together with the asset-based revolving credit facility, the “senior secured credit facilities.” |

| (3) | Consists of (i) $3.000 billion aggregate principal amount of 6.50% first lien notes due 2020 that HCA Inc. issued in August 2011 (the “August 2011 first lien notes”); (ii) $1.350 billion aggregate principal amount of 5.875% first lien notes due 2022 that HCA Inc. issued in February 2012 (the “February 2012 first lien notes”); (iii) $1.250 billion aggregate principal amount of 4.75% first lien notes due 2023 that HCA Inc. issued in October 2012 (the “October 2012 first lien notes”); (iv) $1.500 billion aggregate principal amount of 3.75% first lien notes due 2019 that HCA Inc. issued in March 2014 (the “March 2014 3.75% first lien notes”); (v) $2.000 billion aggregate principal amount of 5.00% first lien notes due 2024 that HCA Inc. issued in March 2014 (the “March 2014 5.00% first lien notes”); (vi) $600 million aggregate principal amount of 4.25% first lien notes due 2019 that HCA Inc. issued in October 2014 (the “October 2014 4.25% first lien notes”); and (vii) $1.400 billion aggregate principal amount of 5.25% first lien notes due 2025 that HCA Inc. issued in October 2014 (the “October 2014 5.25% first lien notes” and, collectively with the |

S-6

Table of Contents

| August 2011 first lien notes, the February 2012 first lien notes, the October 2012 first lien notes, the March 2014 3.75% first lien notes, the March 2014 5.00% first lien notes and the October 2014 4.25% first lien notes, the “first lien notes”). |

| (4) | Consists of HCA Inc.’s (i) aggregate principal amount of $125 million 7.58% medium-term notes due 2025; (ii) aggregate principal amount of $886 million debentures with maturities ranging from 2015 to 2095 and a weighted average interest rate of 7.55%; (iii) aggregate principal amount of $7.891 billion senior notes with maturities ranging from 2018 to 2033 and a weighted average interest rate of 6.38%; (iv) $632 million of secured debt, which represents capital leases and other secured debt with a weighted average interest rate of 5.87%; and (v) $176 million of debt issuance costs that reduce the existing indebtedness. Existing unsecured indebtedness also includes HCA Holdings, Inc.’s $1.000 billion aggregate principal amount of 6.25% senior notes due 2021. We intend to use the net proceeds of the November 2015 offering, together with cash on hand, to redeem all of HCA Inc.’s $1,000,000,000 aggregate principal amount outstanding of existing 6.500% notes due 2016. For more information regarding our unsecured and other indebtedness, see “Description of Other Indebtedness.” |

| (5) | The cash flow credit facility and the first lien notes are secured by first-priority liens on substantially all the capital stock of Healthtrust, Inc.—The Hospital Company and the first-tier subsidiaries of the subsidiary guarantors (but limited to 65% of the voting stock of any such first-tier subsidiary that is a foreign subsidiary), subject to certain exceptions. |

| (6) | Includes subsidiaries which are designated as “restricted subsidiaries” under HCA Inc.’s indenture dated as of December 16, 1993, certain of their wholly owned subsidiaries formed in connection with the asset-based revolving credit facility and certain excluded subsidiaries (non-material subsidiaries). |

S-7

Table of Contents

THE OFFERING

The summary below describes the principal terms of the notes. Certain of the terms and conditions described below are subject to important limitations and exceptions. The “Description of the Notes” section of this prospectus supplement and the “Description of Debt Securities and Guarantees” section in the accompanying prospectus contain more detailed descriptions of the terms and conditions of the notes.

| Issuer |

HCA Inc. |

| Notes |

5.875% senior notes due 2026. |

| The notes offered hereby will be issued under the indenture pursuant to which, on November 13, 2015, we issued the existing notes. The notes offered hereby and the existing notes will be treated as a single series for all purposes under the indenture, including notices, consents, waivers, amendments, redemptions and any other action permitted under the indenture, and the notes offered hereby will have identical terms with the existing notes, other than their issue date and public offering price. The notes offered hereby will have the same CUSIP and ISIN numbers as, and will vote together and will be fungible with, the existing notes immediately upon issuance. |

| Maturity Date |

The notes will mature on February 15, 2026. |

| Interest Rate |

Interest on the notes will be payable in cash and will accrue at a rate of 5.875% per annum. |

| Interest Payment Dates |

February 15 and August 15, commencing on August 15, 2016. Interest on the notes offered hereby will accrue from November 13, 2015. Accrued interest on the notes offered hereby must be paid by the purchasers through the day before the closing date. |

| Ranking |

The notes will be the Issuer’s senior obligations and will: |

| • | rank senior in right of payment to any of its existing and future subordinated indebtedness; |

| • | rank equally in right of payment with any of its existing and future senior indebtedness; |

| • | be effectively subordinated in right of payment to any of its existing and future secured indebtedness to the extent of the value of the collateral securing such indebtedness; and |

| • | be structurally subordinated in right of payment to all existing and future indebtedness and other liabilities of its subsidiaries. |

| As of September 30, 2015, on an as adjusted basis after giving effect to the November 2015 offering and the use of proceeds therefrom and the notes offered hereby and the use of proceeds therefrom as described under “Use of Proceeds”: |

| • | the notes would have been effectively subordinated in right of payment to $20.010 billion of secured indebtedness; and |

S-8

Table of Contents

| • | we would have had $1.958 billion of unutilized capacity under the senior secured revolving credit facility and $629 million of unutilized capacity under the asset-based revolving credit facility, after giving effect to letters of credit and borrowing base limitations, all of which would be structurally senior to the notes offered hereby if borrowed. |

| Parent Guarantee |

The notes will be fully and unconditionally guaranteed on a senior unsecured basis by HCA Holdings, Inc. and will: |

| • | rank senior in right of payment to all existing and future subordinated indebtedness of HCA Holdings, Inc.; |

| • | rank equally in right of payment with all existing and future senior indebtedness of HCA Holdings, Inc.; |

| • | be effectively subordinated in right of payment to all future secured indebtedness of HCA Holdings, Inc. to the extent of the value of the collateral securing such indebtedness; and |

| • | be effectively subordinated in right of payment to all existing and future indebtedness and other liabilities of any subsidiary of HCA Holdings, Inc. (other than HCA Inc.). |

| The notes will not be guaranteed by any of HCA Inc.’s subsidiaries. |

| As of September 30, 2015, on an as adjusted basis after giving effect to the November 2015 offering and the use of proceeds therefrom and the notes offered hereby and the use of proceeds therefrom as described under “Use of Proceeds,” the notes and related guarantee would have been structurally subordinated to $20.010 billion of indebtedness of HCA Inc.’s subsidiaries, all of which would have been secured. |

| Covenants |

The indenture governing the notes contains covenants limiting the Issuer’s and certain of its subsidiaries’ ability to: |

| • | create liens on certain assets to secure debt; |

| • | engage in certain sale and lease-back transactions; and |

| • | consolidate, merge, sell or otherwise dispose of all or substantially all of its assets. |

| These covenants are subject to a number of important limitations and exceptions. See “Description of the Notes.” |

| Optional Redemption |

The Issuer may redeem the notes, at any time in whole or from time to time in part, at the redemption prices described in this prospectus supplement. See “Description of the Notes—Optional Redemption.” |

| Change of Control Offer |

Upon the occurrence of a change of control, you will have the right, as holders of the notes, to require the Issuer to repurchase some or all of your notes at 101% of their face amount, plus accrued and unpaid interest to the repurchase date. See “Description of the Notes—Repurchase at the Option of Holders—Change of Control.” |

S-9

Table of Contents

| The Issuer may not be able to pay you the required price for notes you present to it at the time of a change of control, because: |

| • | the Issuer may not have enough funds at that time; or |

| • | the terms of our indebtedness under the senior secured credit facilities may prevent it from making such payment. |

| Your right to require the Issuer to repurchase the notes upon the occurrence of a change of control will cease to apply to the notes at all times during which such notes have investment grade ratings from both Moody’s Investors Service, Inc. and Standard & Poor’s. See “Description of the Notes—Certain Covenants—Covenant Suspension.” |

| No Public Market |

The notes offered hereby will be part of an existing series of securities for which there is currently no established public market. Although the underwriters have informed the Issuer that they intend to make a market in the notes offered hereby, they are not obligated to do so, and they may discontinue market making activities at any time without notice. Accordingly, the Issuer cannot assure you that a liquid market for the notes will develop or be maintained. |

| Use of Proceeds |

We estimate that our net proceeds from this offering, after deducting underwriter discounts and commissions and estimated offering expenses, will be approximately $495 million. |

| We intend to use the net proceeds of this offering for general corporate purposes. See “Use of Proceeds” and “Capitalization.” |

| Conflicts of Interest |

Certain of the underwriters and their respective affiliates have, from time to time, performed, and may in the future perform, various financial advisory, investment banking, commercial banking and other services for us for which they received or will receive customary fees and expenses. |

RISK FACTORS

You should consider carefully all of the information set forth and incorporated by reference in this prospectus supplement and the accompanying prospectus and, in particular, should evaluate the specific factors set forth and incorporated by reference in the section entitled “Risk Factors,” including the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2014, for an explanation of certain risks of investing in the notes, including risks related to our industry and business.

S-10

Table of Contents

SUMMARY FINANCIAL DATA

The following table sets forth our summary financial and operating data as of and for the periods indicated. The financial data as of December 31, 2014 and 2013 and for the years ended December 31, 2014, 2013 and 2012 have been derived from our consolidated financial statements incorporated by reference into this prospectus supplement, which have been audited by Ernst & Young LLP, independent registered public accounting firm. The financial data as of December 31, 2012 have been derived from our consolidated financial statements audited by Ernst & Young LLP that are not included or incorporated by reference herein.

The summary financial data as of September 30, 2015 and for the nine months ended September 30, 2015 and 2014 have been derived from our unaudited condensed consolidated financial statements incorporated by reference in this prospectus supplement. The summary financial data as of September 30, 2014 have been derived from our unaudited condensed consolidated financial statements that are not included or incorporated by reference herein. The unaudited financial data presented have been prepared on a basis consistent with our audited consolidated financial statements. In the opinion of management, such unaudited financial data reflect all adjustments, consisting only of normal and recurring adjustments, necessary for a fair presentation of the results for those periods. The results of operations for the interim periods are not necessarily indicative of the results to be expected for the full year or any future period.

The summary financial and operating data should be read in conjunction with “Selected Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” our consolidated financial statements and the related notes thereto and our unaudited condensed consolidated financial statements and the related notes thereto incorporated by reference into this prospectus supplement.

| Years ended December 31, | Nine months ended September 30, |

|||||||||||||||||||

| 2014 | 2013 | 2012 | 2015 | 2014 | ||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| (dollars in millions) | ||||||||||||||||||||

| Income Statement Data: |

||||||||||||||||||||

| Revenues before provision for doubtful accounts |

$ | 40,087 | $ | 38,040 | $ | 36,783 | $ | 32,268 | $ | 29,619 | ||||||||||

| Provision for doubtful accounts |

3,169 | 3,858 | 3,770 | 2,839 | 2,337 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Revenues |

36,918 | 34,182 | 33,013 | 29,429 | 27,282 | |||||||||||||||

| Salaries and benefits |

16,641 | 15,646 | 15,089 | 13,509 | 12,359 | |||||||||||||||

| Supplies |

6,262 | 5,970 | 5,717 | 4,952 | 4,603 | |||||||||||||||

| Other operating expenses |

6,755 | 6,237 | 6,048 | 5,268 | 4,977 | |||||||||||||||

| Electronic health record incentive income |

(125 | ) | (216 | ) | (336 | ) | (46 | ) | (97 | ) | ||||||||||

| Equity in earnings of affiliates |

(43 | ) | (29 | ) | (36 | ) | (38 | ) | (32 | ) | ||||||||||

| Depreciation and amortization |

1,820 | 1,753 | 1,679 | 1,424 | 1,361 | |||||||||||||||

| Interest expense |

1,743 | 1,848 | 1,798 | 1,255 | 1,314 | |||||||||||||||

| Losses (gains) on sales of facilities |

(29 | ) | 10 | (15 | ) | (2 | ) | (20 | ) | |||||||||||

| Losses on retirement of debt |

335 | 17 | — | 125 | 226 | |||||||||||||||

| Legal claim costs |

78 | — | 175 | 77 | 78 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 33,437 | 31,236 | 30,119 | 26,524 | 24,769 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income taxes |

3,481 | 2,946 | 2,894 | 2,905 | 2,513 | |||||||||||||||

| Provision for income taxes |

1,108 | 950 | 888 | 947 | 816 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

2,373 | 1,996 | 2,006 | 1,958 | 1,697 | |||||||||||||||

| Net income attributable to noncontrolling interests |

498 | 440 | 401 | 411 | 349 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income attributable to HCA Holdings, Inc. |

$ | 1,875 | $ | 1,556 | $ | 1,605 | $ | 1,547 | $ | 1,348 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

S-11

Table of Contents

| Years ended December 31, | Nine months ended September 30, |

|||||||||||||||||||

| 2014 | 2013 | 2012 | 2015 | 2014 | ||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| (dollars in millions) | ||||||||||||||||||||

| Statement of Cash Flows Data: |

||||||||||||||||||||

| Cash flows provided by operating activities |

$ | 4,448 | $ | 3,680 | $ | 4,175 | $ | 3,176 | $ | 2,821 | ||||||||||

| Cash flows used in investing activities |

(2,918 | ) | (2,346 | ) | (2,063 | ) | (1,631 | ) | (1,512 | ) | ||||||||||

| Cash flows used in financing activities |

(1,378 | ) | (1,625 | ) | (1,780 | ) | (1,523 | ) | (1,208 | ) | ||||||||||

| Other Financial Data: |

||||||||||||||||||||

| EBITDA(1) |

$ | 6,546 | $ | 6,107 | $ | 5,970 | $ | 5,173 | $ | 4,839 | ||||||||||

| Adjusted EBITDA(1) |

7,428 | 6,574 | 6,531 | 5,784 | 5,472 | |||||||||||||||

| Capital expenditures |

(2,176 | ) | (1,943 | ) | (1,862 | ) | (1,571 | ) | (1,482 | ) | ||||||||||

| Ratio of earnings to fixed charges |

2.76 | 2.41 | 2.44 | 3.00 | 2.69 | |||||||||||||||

| Operating Data:(2) |

||||||||||||||||||||

| Number of hospitals at end of period(3) |

166 | 165 | 162 | 168 | 165 | |||||||||||||||

| Number of freestanding outpatient surgical centers at end of period(3) |

113 | 115 | 112 | 114 | 113 | |||||||||||||||

| Number of licensed beds at end of period(4) |

43,356 | 42,896 | 41,804 | 43,731 | 43,241 | |||||||||||||||

| Weighted average licensed beds(5) |

43,132 | 42,133 | 41,795 | 43,591 | 43,069 | |||||||||||||||

| Admissions(6) |

1,795,300 | 1,744,100 | 1,740,700 | 1,401,500 | 1,337,300 | |||||||||||||||

| Equivalent admissions(7) |

2,958,700 | 2,844,700 | 2,832,100 | 2,334,900 | 2,198,500 | |||||||||||||||

| Average length of stay (days)(8) |

4.8 | 4.8 | 4.7 | 4.9 | 4.8 | |||||||||||||||

| Average daily census(9) |

23,835 | 22,853 | 22,521 | 25,172 | 23,748 | |||||||||||||||

| Occupancy(10) |

55 | % | 54 | % | 54 | % | 58 | % | 55 | % | ||||||||||

| Emergency room visits(11) |

7,450,700 | 6,968,100 | 6,912,000 | 6,012,500 | 5,501,500 | |||||||||||||||

| Outpatient surgeries(12) |

891,600 | 881,900 | 873,600 | 669,200 | 658,200 | |||||||||||||||

| Inpatient surgeries(13) |

518,900 | 508,800 | 506,500 | 395,900 | 386,300 | |||||||||||||||

| Days revenues in accounts receivable(14) |

54 | 54 | 51 | 54 | 55 | |||||||||||||||

| Outpatient revenues as a percentage of patient revenues(15) |

38 | % | 38 | % | 38 | % | 39 | % | 38 | % | ||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 566 | $ | 414 | $ | 705 | $ | 588 | $ | 515 | ||||||||||

| Working capital(16) |

3,450 | 2,342 | 1,591 | 2,908 | 2,895 | |||||||||||||||

| Property, plant and equipment, net |

14,355 | 13,619 | 13,185 | 14,704 | 13,878 | |||||||||||||||

| Total assets |

30,980 | 28,594 | 27,785 | 31,896 | 29,604 | |||||||||||||||

| Total debt |

29,426 | 28,139 | 28,640 | 29,752 | 28,249 | |||||||||||||||

| Stockholders’ deficit attributable to HCA Holdings, Inc. |

(7,894 | ) | (8,270 | ) | (9,660 | ) | (7,294 | ) | (7,384 | ) | ||||||||||

| Noncontrolling interests |

1,396 | 1,342 | 1,319 | 1,482 | 1,366 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total stockholders’ deficit |

(6,498 | ) | (6,928 | ) | (8,341 | ) | (5,812 | ) | (6,018 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | EBITDA, a measure used by management to evaluate operating performance, is defined as net income attributable to HCA Holdings, Inc. plus (i) provision for income taxes, (ii) interest expense and (iii) depreciation and amortization. EBITDA is not a recognized term under generally accepted accounting principles (“GAAP”) and does not purport to be an alternative to net income as a measure of operating performance or to cash flows from operating activities as a measure of liquidity. Additionally, EBITDA is not intended to be a measure of free cash flow available for management’s discretionary use, as it does not consider certain cash requirements such as interest payments, tax payments and other debt service requirements. Management believes EBITDA is helpful to investors and our management in highlighting trends because EBITDA excludes the results of decisions outside the control of operating management and that can differ significantly from company to company depending on long-term strategic decisions regarding |

S-12

Table of Contents

| capital structure, the tax jurisdictions in which companies operate and capital investments. Management compensates for the limitations of using non-GAAP financial measures by using them to supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. Because not all companies use identical calculations, our presentation of EBITDA may not be comparable to similarly titled measures of other companies. |

Adjusted EBITDA is defined as EBITDA, adjusted to exclude net income attributable to noncontrolling interests, losses (gains) on sales of facilities, losses on retirement of debt and legal claim costs. We believe Adjusted EBITDA is an important measure that supplements discussions and analysis of our results of operations. We believe it is useful to investors to provide disclosures of our results of operations on the same basis used by management. Management relies upon Adjusted EBITDA as the primary measure to review and assess operating performance of its hospital facilities and their management teams. Adjusted EBITDA target amounts are the performance measures utilized in our annual incentive compensation programs and are vesting conditions for a portion of our stock option grants. Management and investors review both the overall performance (GAAP net income attributable to HCA Holdings, Inc.) and operating performance (Adjusted EBITDA) of our health care facilities. Adjusted EBITDA and the Adjusted EBITDA margin (Adjusted EBITDA divided by revenues) are utilized by management and investors to compare our current operating results with the corresponding periods during the previous year and to compare our operating results with other companies in the health care industry. It is reasonable to expect that losses (gains) on sales of facilities, legal claim costs and losses on retirement of debt will occur in future periods, but the amounts recognized can vary significantly from period to period, do not directly relate to the ongoing operations of our health care facilities and complicate period comparisons of our results of operations and operations comparisons with other health care companies. Adjusted EBITDA is not a measure of financial performance under accounting principles generally accepted in the United States, and should not be considered an alternative to net income attributable to HCA Holdings, Inc. as a measure of operating performance or cash flows from operating, investing and financing activities as a measure of liquidity. Because Adjusted EBITDA is not a measurement determined in accordance with generally accepted accounting principles and is susceptible to varying calculations, Adjusted EBITDA, as presented, may not be comparable to other similarly titled measures presented by other companies. There may be additional adjustments to Adjusted EBITDA under our agreements governing our material debt obligations, including the notes offered hereby.

EBITDA and Adjusted EBITDA are calculated as follows:

| Years ended December 31, |

Nine months ended September 30, |

|||||||||||||||||||

| 2014 | 2013 | 2012 | 2015 | 2014 | ||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| (dollars in millions) | ||||||||||||||||||||

| Net income attributable to HCA Holdings, Inc. |

$ | 1,875 | $ | 1,556 | $ | 1,605 | $ | 1,547 | $ | 1,348 | ||||||||||

| Provision for income taxes |

1,108 | 950 | 888 | 947 | 816 | |||||||||||||||

| Interest expense |

1,743 | 1,848 | 1,798 | 1,255 | 1,314 | |||||||||||||||

| Depreciation and amortization |

1,820 | 1,753 | 1,679 | 1,424 | 1,361 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

6,546 | 6,107 | 5,970 | 5,173 | 4,839 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income attributable to noncontrolling interests(i) |

498 | 440 | 401 | 411 | 349 | |||||||||||||||

| Losses (gains) on sales of facilities(ii) |

(29 | ) | 10 | (15 | ) | (2 | ) | (20 | ) | |||||||||||

| Losses on retirement of debt(iii) |

335 | 17 | — | 125 | 226 | |||||||||||||||

| Legal claim costs(iv) |

78 | — | 175 | 77 | 78 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 7,428 | $ | 6,574 | $ | 6,531 | $ | 5,784 | $ | 5,472 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (i) | Represents the add-back of net income attributable to noncontrolling interests. |

S-13

Table of Contents

| (ii) | Represents the add-back of losses and elimination of gains on sales of facilities. |

| (iii) | Represents the add-back of losses on retirement of debt. |

| (iv) | Represents the add-back of legal claim costs. |

| (2) | The operating data set forth in this table includes only those facilities that are consolidated for financial reporting purposes. |

| (3) | Excludes facilities that are not consolidated (accounted for using the equity method) for financial reporting purposes. |

| (4) | Licensed beds are those beds for which a facility has been granted approval to operate from the applicable state licensing agency. |

| (5) | Represents the average number of licensed beds, weighted based on periods owned. |

| (6) | Represents the total number of patients admitted to our hospitals and is used by management and certain investors as a general measure of inpatient volume. |

| (7) | Equivalent admissions are used by management and certain investors as a general measure of combined inpatient and outpatient volume. Equivalent admissions are computed by multiplying admissions (inpatient volume) by the sum of gross inpatient revenues and gross outpatient revenues and then dividing the resulting amount by gross inpatient revenues. The equivalent admissions computation “equates” outpatient revenues to the volume measure (admissions) used to measure inpatient volume, resulting in a general measure of combined inpatient and outpatient volume. |

| (8) | Represents the average number of days admitted patients stay in our hospitals. |

| (9) | Represents the average number of patients in our hospital beds each day. |

| (10) | Represents the percentage of hospital licensed beds occupied by patients. Both average daily census and occupancy rate provide measures of the utilization of inpatient rooms. |

| (11) | Represents the number of patients treated in our emergency rooms. |

| (12) | Represents the number of surgeries performed on patients who were not admitted to our hospitals. Pain management and endoscopy procedures are not included in outpatient surgeries. |

| (13) | Represents the number of surgeries performed on patients who have been admitted to our hospitals. Pain management and endoscopy procedures are not included in inpatient surgeries. |

| (14) | For the years ended December 31, 2014, 2013 and 2012, revenues per day is calculated by dividing the revenues for the fourth quarter of each year by the days in the period. For the nine months ended September 30, 2015 and 2014, revenues per day is calculated by dividing the revenues for the third quarter by the days in the quarter. Days revenues in accounts receivable is then calculated as accounts receivable, net of the allowance for doubtful accounts, at the end of the period divided by revenues per day. |

| (15) | Represents the percentage of patient revenues related to patients who are not admitted to our hospitals. |

| (16) | We define working capital as current assets minus current liabilities. |

S-14

Table of Contents

You should carefully consider the Risk Factors set forth below as well as the other information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus before purchasing the notes, including the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2014. This prospectus supplement and the accompanying prospectus contain forward-looking statements that involve risk and uncertainties. Any of the following risks could materially and adversely affect our business, financial condition or results of operations. Additional risks and uncertainties not currently known to us or those we currently view to be immaterial may also materially and adversely affect our business, financial condition or results of operations. In such a case, you may lose all or part of your original investment.

The Issuer is the sole obligor of the notes and its parent, HCA Holdings, Inc., is the sole guarantor of the Issuer’s obligations under the notes; the notes are unsecured and the Issuer’s subsidiaries do not have any obligation with respect to the notes; the notes are structurally subordinated to all of the debt and liabilities of the Issuer’s subsidiaries and will be effectively subordinated to any of the Issuer’s secured debt.

The Issuer and the guarantor of the notes, HCA Holdings, Inc., are holding companies that have no operations of their own and derive all of their revenues and cash flow from their subsidiaries. The Issuer’s subsidiaries are separate and distinct legal entities and have no obligation, contingent or otherwise, to pay amounts due under the notes or to make any funds available to pay those amounts, whether by dividend, distribution, loan or other payments. The notes are structurally subordinated to all debt and liabilities of the Issuer’s subsidiaries and the Issuer’s parent, HCA Holdings, Inc. The claims of HCA Holdings, Inc.’s creditors and the Issuer’s subsidiaries’ creditors will be required to be paid before holders of the notes have a claim (if any) against the entities and their assets. In the event of a bankruptcy, liquidation or reorganization or similar proceeding relating to the Issuer’s subsidiaries, you will participate with all other holders of the Issuer’s indebtedness in the assets remaining after the Issuer’s subsidiaries have paid all of their debt and liabilities. In any of these cases, the Issuer’s subsidiaries may not have sufficient funds to make payments to the Issuer, and you may receive less, ratably, than the holders of debt of the Issuer’s subsidiaries and other liabilities.

As of September 30, 2015, on an as adjusted basis after giving effect to the November 2015 offering and the use of proceeds therefrom and the notes offered hereby and the use of proceeds therefrom, the aggregate amount of indebtedness of the Issuer’s subsidiaries would have been $20.010 billion, all of which would have been secured and all of which would have been structurally senior to the notes. In addition, as of that date, on an adjusted basis after giving effect to the November 2015 offering and the use of proceeds therefrom and the notes offered hereby and the use of proceeds therefrom, the Issuer’s subsidiaries could have borrowed $1.958 billion under HCA Inc.’s senior secured revolving credit facility and $629 million under its asset-based revolving credit facility, after giving effect to letters of credit and borrowing base limitations. In addition, holders of the Issuer’s subsidiaries’ debt will have claims that are prior to your claims as holders of the notes. Additionally, the indenture governing the notes, the indentures governing HCA Holdings, Inc. and HCA Inc.’s outstanding notes and HCA Inc.’s senior secured credit facilities permit us and/or our subsidiaries to incur additional indebtedness, including secured indebtedness, under certain circumstances.

The Issuer and the guarantor of the notes are holding companies with no independent operations or assets. Repayment of the notes is dependent on cash flow generated by the Issuer’s subsidiaries. Restrictions in the Issuer’s subsidiaries’ debt instruments and under applicable law limit their ability to provide funds to the Issuer.

The Issuer’s and HCA Holdings, Inc.’s operations are conducted through their subsidiaries and their ability to make payment on the notes is dependent on the earnings and the distribution of funds from their subsidiaries. Their earnings are subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond their and the Issuer’s control. In addition, only HCA Holdings, Inc., as sole guarantor of the notes, is obligated to make funds available to the Issuer for payment on the notes. The Issuer’s subsidiaries are not obligated to make funds available to the Issuer for payment on the notes. The agreements governing the

S-15

Table of Contents

current and future indebtedness of the Issuer’s subsidiaries may not permit the Issuer’s subsidiaries to provide the Issuer with sufficient dividends, distributions or loans to fund scheduled interest and principal payments on these notes when due. The terms of the senior secured credit facilities significantly restrict the Issuer’s subsidiaries from paying dividends and otherwise transferring assets to the Issuer. In addition, if the Issuer’s subsidiaries do not generate sufficient cash flow from operations to satisfy their and the Issuer’s debt service obligations, including payments on the notes, we may have to undertake alternative financing plans, such as refinancing or restructuring our indebtedness, selling assets, reducing or delaying capital investments or seeking to raise additional capital. The Issuer’s ability to restructure or refinance its debt will depend on the capital markets and its financial condition at such time. Any refinancing of the Issuer’s debt could be at higher interest rates and may require the Issuer to comply with more onerous covenants, which could further restrict its business operations. In addition, the terms of existing or future debt instruments may restrict the Issuer from adopting some of these alternatives. The Issuer’s inability to generate sufficient cash flow to satisfy its debt service obligations, or to refinance its obligations on commercially reasonable terms, would have an adverse effect, which could be material, on its business, financial position, results of operations and cash flows, as well as on the Issuer’s ability to satisfy its obligations in respect of the notes.

Our substantial leverage could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry, expose us to interest rate risk to the extent of our variable rate debt and prevent us from meeting our obligations.

We are highly leveraged. As of September 30, 2015, on an as adjusted basis after giving effect to the November 2015 offering and the use of proceeds therefrom and the notes offered hereby and the use of proceeds therefrom, our total indebtedness would have been $30.236 billion. As of September 30, 2015, on an as adjusted basis after giving effect to the November 2015 offering and the use of proceeds therefrom and the notes offered hereby and the use of proceeds therefrom, the Issuer would have had availability of $1.958 billion under its senior secured revolving credit facility and $629 million under its asset-based revolving credit facility, after giving effect to letters of credit and borrowing base limitations. Our high degree of leverage could have important consequences, including:

| • | increasing our vulnerability to downturns or adverse changes in general economic, industry or competitive conditions and adverse changes in government regulations; |

| • | requiring a substantial portion of cash flow from operations to be dedicated to the payment of principal and interest on our indebtedness, therefore reducing our ability to use our cash flow to fund our operations, capital expenditures and future business opportunities; |

| • | exposing us to the risk of increased interest rates as certain of our unhedged borrowings are at variable rates of interest; |

| • | limiting our ability to make strategic acquisitions or causing us to make nonstrategic divestitures; |

| • | limiting our ability to obtain additional financing for working capital, capital expenditures, product or service line development, debt service requirements, acquisitions and general corporate or other purposes; and |

| • | limiting our ability to adjust to changing market conditions and placing us at a competitive disadvantage compared to our competitors who are less highly leveraged. |

We have the ability to incur additional indebtedness in the future, subject to the restrictions contained in our senior secured credit facilities and the indentures governing our outstanding senior secured notes and the indenture governing the notes. If new indebtedness is added to our current debt levels, the related risks that we now face could intensify. In addition, the condition of the financial markets and prevailing interest rates have fluctuated in the past and are likely to fluctuate in the future, which could have an adverse effect on the market prices of the notes.

S-16

Table of Contents

We may not be able to generate sufficient cash to service all of our indebtedness and may not be able to refinance our indebtedness on favorable terms. If we are unable to do so, we may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful.

Our ability to make scheduled payments on or to refinance our debt obligations depends on our financial condition and operating performance, which are subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond our control. We cannot assure you we will maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on our indebtedness.

In addition, we conduct our operations through our subsidiaries. Accordingly, repayment of our indebtedness is dependent on the generation of cash flow by our subsidiaries and their ability to make such cash available to us by dividend, debt repayment or otherwise. Our subsidiaries will not have any obligation to pay amounts due on the notes or our other indebtedness or to make funds available for that purpose. Our subsidiaries may not be able to, or may not be permitted to, make distributions to enable us to make payments in respect of our indebtedness. The agreements governing the current and future indebtedness of the Issuer’s subsidiaries may not permit the Issuer’s subsidiaries to provide the Issuer with sufficient dividends, distributions or loans to fund scheduled interest and principal payments on these notes when due. The terms of our senior secured credit facilities and the indentures governing our outstanding notes significantly restrict the Issuer’s and its subsidiaries from paying dividends and otherwise transferring assets to the Issuer. Each subsidiary is a distinct legal entity, and, under certain circumstances, legal and contractual restrictions may limit our ability to obtain cash from our subsidiaries.

We may find it necessary or prudent to refinance our outstanding indebtedness with longer-maturity debt at a higher interest rate. Our ability to refinance our indebtedness on favorable terms, or at all, is directly affected by the current global economic and financial conditions. In addition, our ability to incur secured indebtedness (which would generally enable us to achieve better pricing than the incurrence of unsecured indebtedness) depends in part on the value of our assets, which depends, in turn, on the strength of our cash flows and results of operations, and on economic and market conditions and other factors.