UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________

FORM 10-Q

_______________

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended December 31, 2011

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______to______.

CHINA GRAND RESORTS, INC.

(Exact name of registrant as specified in Charter)

| NEVADA | 0-27246 | 62-1407521 | ||

| (State or other jurisdiction of incorporation or organization) | (Commission File No.) | (IRS Employee Identification No.) |

RM 905, Reignwood Center

No.8 Yong’an Dongli Jianguomen Outer Street,

Chaoyang District Beijing, 100022,

People’s Republic of China

(Address of Principal Executive Offices)

_______________

(86-10) 8528 8755

(Issuer Telephone number)

_______________

(Former Name or Former Address if Changed Since Last Report)

Indicate by check whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2)has been subject to such filing requirements for the past 90 days. [X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [ ] Yes [X] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

Large Accelerated Filer [ ] Accelerated Filer [ ]

Non-Accelerated Filer [ ] Smaller Reporting Company [X]

Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act [ ]Yes [X] No

State the number of shares outstanding of each of the issuer’s classes of common equity, as of February 6,2012: 3,272,311 shares of common stock

| 1 |

TABLE OF CONTENTS

| PART I - FINANCIAL INFORMATION | Page | |

| Item 1. | Financial Statements | 3 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operation | 15 |

| Item 3. | Controls and Procedures | 22 |

| PART II -OTHER INFORMATION | ||

| Item 4. | Exhibits. | 23 |

| SIGNATURES | 24 | |

| 2 |

| CHINA GRAND RESORTS, INC. | |||

| CONSOLIDATED BALANCE SHEETS | |||

| (IN U.S. DOLLARS) | |||

| As of | |||

| December 31, 2011 | September 30, 2011 | ||

| (Unaudited) | (Audited) | ||

| ASSETS | |||

| Current Assets | |||

| Cash and cash equivalents | 26,599 | 6,367 | |

| Other receivables | 10,485 | 9,712 | |

| Total Current Assets | 37,084 | 16,079 | |

| Property and equipment, net | 22,661 | 24,714 | |

| Security deposit | 17,367 | 17,193 | |

| 40,028 | 41,907 | ||

| Total Assets | 77,112 | 57,986 | |

| LIABILITIES AND STOCKHOLDERS’ DEFICIENCY | |||

| Current Liabilities | |||

| Other payables | 33,976 | 33,162 | |

| Loan from related parties | 893,538 | 803,744 | |

| Total Current Liabilities | 927,514 | 836,906 | |

| Total Liabilities | 927,514 | 836,906 | |

| Commitment and Contingencies | |||

| Stockholders' Deficiency | |||

| Common stock, $0.001 par value, authorized 1,750,000,000 shares, 3,272,311 shares issued and outstanding as of December 31,2011 and September 30, 2011 | 3,272 | 3,272 | |

| Additional paid-in capital | 10,099,040 | 10,099,040 | |

| Accumulated deficit | (10,978,948) | (10,913,514) | |

| Accumulated other comprehensive income | 26,234 | 32,282 | |

| Total Stockholders' Deficiency | (850,402) | (778,920) | |

| Total Liabilities and Stockholders’ Deficiency | 77,112 | 57,986 | |

See accompanying notes to the consolidated financial statements

| 3 |

CHINA GRAND RESORTS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(IN U.S. DOLLARS)

| CHINA GRAND RESORTS, INC. | |||

| CONSOLIDATED STATEMENTS OF OPERATIONS | |||

| (IN U.S. DOLLARS) | |||

| For the three months ended | |||

| December 31, | |||

| 2011 | 2010 | ||

| (Unaudited) | (Unaudited) | ||

| Operating expenses | |||

| General and administrative expenses | 53,949 | 58,986 | |

| Depreciation and amortization | 2,256 | 2,143 | |

| Operating loss | (56,205) | (61,129) | |

| Other (expenses) income | |||

| Interest income | 19 | 51 | |

| Interest expenses | (9,127) | (5,899) | |

| Other expenses | (121) | (209) | |

| Total other expenses, net | (9,229) | (6,057) | |

| Loss before income taxes | (65,434) | (67,186) | |

| Income tax expense | - | - | |

| Net loss | $ (65,434) | $ (67,186) | |

| Effects of foreign currency conversion | (6,048) | (4,939) | |

| comprehensive income/(loss) | (71,482) | (72,125) | |

| Loss per common share - basic and diluted | $(0.02) | $(0.02) | |

|

Weighted average number of common shares outstanding - basic and diluted |

3,272,311 | 3,272,311 | |

See accompanying notes to the consolidated financial statements

| 4 |

| CHINA GRAND RESORTS. INC. | ||||

| CONSOLIDATED STATEMENTS OF CASH FLOWS | ||||

| (IN U.S. DOLLARS) | ||||

|

For the three months ended December 31, | ||||

| 2011 | 2010 | |||

| (Unaudited) | (Unaudited) | |||

| Cash flows from operating activities : | ||||

| Net loss | (65,434) | (67,186) | ||

| Adjustments to reconcile net loss to net cash used in | ||||

| operating activities : | ||||

| Finance cost | 9,127 | |||

| Depreciation and amortization | 2,256 | 2,143 | ||

| Change in operating assets and liabilities: | ||||

| Other receivables | (947) | (322) | ||

| Other payables | 814 | (3,172) | ||

| Net cash used in operating activities | (54,184) | (68,537) | ||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||

| (Purchase of ) proceeds from sale of property and equipment | - | - | ||

| Purchase of intangible assets | - | - | ||

| Net cash provided by (used in) investing activities | - | - | ||

| Cash flows from financing activities : | ||||

| Repayment to related parties for loans | - | - | ||

| Advances from shareholders | 74,593 | 11,820 | ||

| Net cash provided by financing activities | 74,593 | 11,820 | ||

| Effect of exchange rate fluctuations on cash | (177) | (5,499) | ||

| Net (decrease)/ increase in cash and cash equivalents | 20,232 | (62,216) | ||

| Cash and cash equivalents at beginning of year | 6,367 | 78,373 | ||

| Cash and cash equivalents at end of year | 26,599 | 16,157 | ||

See accompanying notes to consolidated financial statements.

| 5 |

CHINA GRAND RESORTS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(stated in US dollars)

(1) BUSINESS AND SIGNIFICANT ACCOUNTING POLICIES

The accompanying unaudited consolidated financial statements of China Grand Resorts, Inc. (“CGND”) and its wholly owned subsidiaries including Sun New Media Transaction Service Ltd. (“SNMTS”), China Focus Channel Development Co., Ltd (“CFCD”) and Key Proper Holdings Limited (“KPH”), defined herein below, collectively referred to as the “Company” or “we" have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission and in accordance with accounting principles generally accepted in the United States of America (“US GAAP”). Certain information and footnote disclosures normally included in the consolidated financial statements prepared in accordance with US GAAP have been condensed or omitted in accordance with such rules and regulations. The information furnished in the interim consolidated financial statements includes normal recurring adjustments and reflects all adjustments that, in the opinion of management, are necessary for a fair presentation of such consolidated financial statements. Although management believes the disclosures and information presented are adequate to make the information not misleading, it is suggested that these interim consolidated financial statements be read in conjunction with the Company's most recent audited consolidated financial statements and notes included in its annual report on Form 10-K for the fiscal year ended September 30, 2011 filed on January 13, 2012. Operating results for the three months ended December 31,2011, are not necessarily indicative of the results that may be expected for longer periods or the entire year.

On November 16, 2009, the Company effected a 20 for 1 reverse split of our issued and outstanding common stock. The par value and our total number of authorized shares were unaffected by the reverse stock split. All shares and per share amounts in these consolidated financial statements and note thereto have been retrospectively adjusted to all periods presented to give effect to the reverse stock split.

(a) Organization

The Company was incorporated in the State of Nevada on September 21, 1989 under the name Fulton Ventures, Inc. On September 19, 2002, we changed our name to Asia Premium Television Group, Inc., and on November 16, 2009, we changed our name to China Grand Resorts, Inc. to more accurately reflect our business focus.

On March 30, 2009, we completed an acquisition pursuant to an Acquisition Agreement (the “Acquisition Agreement”) with the shareholders of GlobStream Technology Inc. (“GlobStream”) to acquire 100% of GlobStream, a Cayman Islands corporation for $156,000. GlobStream was founded by Dr. Wenjun Luo, one of our previous director. In May 2009, we terminated the operations related to GlobStream because the mobile phone multi-media and advertising businesses of

GlobStream were not performing well. Effective on August 1, 2009, the Company used the ownership in GlobStream to acquire from Beijing Hua Hui Hengye Investment Limited, the commercial income rights as detailed below – acquisition of commercial income rights.

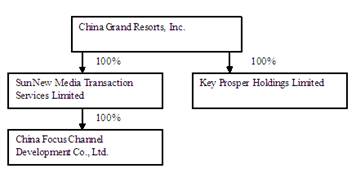

On July 1, 2007, the Company acquired 100% interest of Sun New Media Transactional Services Limited (“SNMTS”), a company incorporated in Hong Kong, and its wholly owned subsidiary China Focus Channel Development Co., Ltd (“CFCD”), a company incorporated in the People’s Republic of China, from a third party for limited consideration. In December 2009, the Company incorporated Key Prosper Holdings Limited (“KPH”), a company incorporated in the British Virgin Islands.

Below is the organizational chart of the Company of December 31, 2011:

| 6 |

CHINA GRAND RESORTS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(stated in US dollars)

(1) DESCRIPTION OF BUSINESS AND ORGANIZATION – CONTINUED

(a) Organization - Continued

Acquisition of commercial income rights

On August 1, 2009, the Company entered into a subscription and asset sale agreement (the “Agreement”) with Beijing Hua Hui Hengye Investment Ltd. (“Hua Hui”), an unaffiliated PRC company. Hua Hui is an affiliate of The Beijing Hua Hui Corporation, a PRC real estate construction and development conglomerate that specializes in constructing and developing travel, resorts, hotels, and apartment properties in popular tourist and other destinations within the PRC. Under the Agreement, we received from Hua Hui the commercial income rights to 10,000 square meters of a 17 story apartment building in the Huadun Changde International Hotel’s Apartment Complex located in the city of Changde, Hunan Province (“Project”). The Project is currently under development by Hua Hui and is expected to be completed on or near August 31, 2012.

The Apartment Complex consists of a total of 215,000 square meters located on an approximately 3.6 acre piece of land. The Project when completed, which is expected to occur in August 2012, will be comprised of a total 128 apartments, of which we will have the commercial rights to approximately 64 apartments. The commercial income rights means the exclusive right to own and/or receive any and all income and proceeds derived from these apartments pursuant to this Project in any capacity which were valued at approximately $8,777,000 by an independent valuation firm and we agreed to pay a total of $7,317,000 as consideration. In exchange, we agreed to issue to Hua Hui, 2,774,392 shares of our common stock valued at $2.4 per share (the closing price of the Company’s common stock on the transaction date, August 1, 2009 after giving effect of 20 for 1 reverse split) for a total stock value of $6,658,536 and transferred to Hua Hui certain other Company assets valued at $658,241. These assets consisted of all of our shares of the GlobStream, certain assets of both SNMTS and CFCD, and other miscellaneous assets.

On September 8, 2009, we satisfied the issuance of the 2,774,392 shares by issuing 832,318 shares to Wise Gold Investment Ltd., a British Virgin Island company acting on behalf of Hua Hui. On that same date, we also issued 1,942,074 shares of common stock to Blossom Grow Holdings Limited, a British Virgin Island company, as escrow agent under an escrow agreement by and among us the escrow agent, and Hua Hui. The escrow agent will hold the escrow shares pending completion of the Project which is expected to occur at or near the end of calendar 2010. If the escrow agent receives written instructions from the Company that the Project is completed in accordance with the terms of the Agreement, the escrow agent will release the escrow shares to Hua Hui. However, if after the projected completion date, the Project has not been completed, the escrow shares will continue to be held at escrow for one year. If after one year, the project still has not been completed, then the Company and Hua Hui will negotiate an agreement to deal with the escrow shares. On December 5, 2011, the Company entered into a Supplemental Agreement with Hua Hui and Blossom Grow Holdings Limited. The escrow agent will hold the escrow shares depending completion of the Project which is expected to occur on or near August 31 2012. If after August 31, 2012, the project still has not been completed, then the Company and Hua Hui will negotiate an agreement and reach to deal with the escrow shares. Due to certain architectural change implemented by Hua Hui to improve quality, style and appearance of the Project, Hua Hui has informed us that the Project is expected to be completed on or near August 31, 2012. All permits concerning the Project have been acquired from governmental authorities, and the construction of the Project is approximately 88% completed as of December 31, 2011. During the escrow period, Hua Hui will be able to vote such shares provided it has reached an agreement with us on such matter(s), otherwise, the escrow agent will not vote on such matter(s). As a result, Hua Hui and Mr. Menghua Liu, Hua Hui’s Chairman and sole shareholder and the Company’s Chairman and Chief Executive Office, are deemed the beneficial owner of such shares. After giving effect to the transaction, Hua Hui became the Company’s majority shareholder and beneficially owns approximately 84.8% Company’s outstanding shares.

With respect to the Project, we will not be responsible for project marketing and Hua Hui will perform the actual unit sales. We expect to pay Hua Hui a sales commission of not less than 0.5% and not more than 8% of the unit sales price and we will receive the remainder of the unit sales price. As of the date of this report, we do not have any formal agreements or arrangements with any developer or Hua Hui for fees that we will earn, or fees that we will pay Hua Hui.

| 7 |

CHINA GRAND RESORTS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(stated in US dollars)

(1) DESCRIPTION OF BUSINESS AND ORGANIZATION – CONTINUED

(b) Nature of prior businesses

During most of calendar 2008, our business focus was based on the interest acquisition in Jiangxi Hongcheng Tengyi Telecommunication Company, Ltd (“JXHC”) and the Provincial Class One Full Service Operator license for the Jiangxi Province from Union Max Enterprises Ltd. We attempted to provide ancillary services for cell-phone customers in Jiangxi Province whereby customers could buy minutes on the fly using their debit card or bank account. However, in December 2008, due to third party issues which negatively affected our ability to launch that business, we determined to terminate that business which resulted in a sale of our interests to an unaffiliated third party effective in March 2009 for $100.

(2) BASIS OF PRESENTATION

The Company’s unaudited consolidated financial statements are prepared in accordance with US GAAP and applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business.

(a) Consolidation

The consolidated financial statements include the accounts of the Company and its subsidiaries, SNMTS, CFCD and KPH. All inter-company balances and transactions between the entities have been eliminated in consolidation.

(b) Going Concern and Management Plan

As of December 31, 2011, the Company had an accumulated deficit totaling $10,978,948 and negative working capital $890,430. The Company suffered a loss of $65,434 for the three months ended December 31, 2011 and $67,186 for the three months ended December 31, 2010. In view of the matters described above, the appropriateness of the going concern basis is dependent upon continuing operations of the Company, which in turn is dependent upon the Company's ability to raise additional capital, obtain financing and succeed in its future operations. The financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

As a result of the transaction with Hua Hui as discussed in Note 1(a), we received the commercial income rights of the Project.

The Company is actively pursuing additional capital in an effort to fund its ongoing capital requirements, as well as seeking agreements with potential strategic partners to develop a new business strategy, other than its ownership of the commercial income rights to the Project.

(c) Use of estimates

The preparation of the financial statements in conformity with US GAAP requires management of the Company to make a number of estimates and assumptions relating to the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the years presented. Actual results could differ from those estimates. The Company bases its estimates on historical experience and various other factors believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Significant accounting estimates reflected in the Company's consolidated financial statements include allowance for doubtful accounts, estimated useful lives and contingent liabilities.

| 8 |

CHINA GRAND RESORTS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(stated in US DOLLARS)

(2) BASIS OF PRESENTATION – CONTINUED

(d) Recently issued accounting standards

Effective January 1, 2010, the Company adopted the provisions in ASU 2010-06, “Fair Value Measurements and Disclosures (ASC Topic 820): Improving Disclosures about Fair Value Measurements, which requires new disclosures related to transfers in and out of levels 1 and 2 and activity in level 3 fair value measurements, as well as amends existing disclosure requirements on level of disaggregation and inputs and valuation techniques. The adoption of the provisions in ASU 2010-06 did not have an impact on the Company’s consolidated financial statements.

In February 2010, the Financial Accounting Standards Board (“FASB”) issued authoritative guidance that amends the disclosure requirements related to subsequent events. This guidance includes the definition of a Securities and Exchange Commission filer, removes the definition of a public entity, redefines the reissuance disclosure requirements and allows public companies to omit the disclosure of the date through which subsequent events have been evaluated. This guidance is effective for financial statements issued for interim and annual periods ending after February 2010. This guidance did not materially impact the Company’s results of operations or financial position, but did require changes to the Company’s disclosures in its financial statements.

In April 2010, the FASB issued ASU No. 2010-13 – Compensation – Stock Compensation (Topic 718), which addresses the classification of an employee share-based payment award with an exercise price denominated in the currency of a market in which the underlying equity security trades. This Update provides amendments to Topic 718 to clarify that an employee share-based payment award with an exercise price denominated in the currency of a market in which a substantial portion of the entity’s equity securities trades should not be considered to contain a condition that is not a market, performance, or service condition. Therefore, an entity would not classify such an award as a liability if it otherwise qualifies as equity. The amendments in this Update are effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2010. The Company expects that the adoption of the amendments in this Update will not have any significant impact on its financial position and results of operations.

In April 2010, the EITF issued “Revenue Recognition – Milestone Method.” This issue provides guidance on defining a milestone and determining when it may be appropriate to apply the milestone method of revenue recognition for research or development transactions. This issue is effective on a prospective basis for milestones achieved in fiscal years beginning after June 15, 2010. Early adoption is permitted. The Company is currently evaluating the potential impact of this issue.

Other accounting standards that have been issued or proposed by the FASB or other standards-setting bodies that do not require adoption until a future date are not expected to have a material impact on the Company’s consolidated financial statements upon adoption.

| 9 |

CHINA GRAND RESORTS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(stated in US DOLLARS)

(3) PROPERTY AND EQUIPMENT, NET

The following is a summary of property and equipment, at cost, less accumulated depreciation:

| As of | ||||||||

| December 31, 2011 | September 30, 2011 | |||||||

| (Unaudited) | (Audited) | |||||||

| Computer software | $ | 1,700 | $ | 1,685 | ||||

| Office equipment | 21,463 | 21,280 | ||||||

| Leasehold improvement | 20,203 | 20,032 | ||||||

| 43,366 | 42,997 | |||||||

| Less: accumulated depreciation and amortization | (20,705 | ) | (18,283 | ) | ||||

| Property and equipment, net | $ | 22,661 | $ | 24,714 | ||||

Depreciation and amortization expenses for the three months ended December 31,2011 and 2010 were $2,256 and $2,143 respectively.

(4) OTHER PAYABLES

Other payables consist of the following:

| As of | ||||||

| December 31, 2011 | September 30, 2011 | |||||

| (Unaudited) | (Audited) | |||||

| Other Payables | $ | 33,976 | $33,162 | |||

| The balances of other payables mainly include audit fees and other office expense payables. |

(5) RELATED PARTY TRANSACTIONS

Loan from related parties

| As of | ||||||||

| December 31, 2011 | September 30, 2011 | |||||||

| (Unaudited) | (Audited) | |||||||

| Redrock Capital Venture Limited (a) | 100,280 | 100,280 | ||||||

| Beijing Hua Hui Hengye Investment Limited (b) | 793,258 | 703,464 | ||||||

| Total | 893,538 | 803,744 | ||||||

(a) Commencing in June 2009, we began receiving loans from time to time from Redrock Capital Venture Limited, a minority shareholder, for working capital purposes. The amount due to Redrock is due on demand and bears no interest.

| 10 |

CHINA GRAND RESORTS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(stated in US DOLLARS)

(5) RELATED PARTY TRANSACTIONS - CONTINUED

(b) Commencing in October 2009, we began receiving loans from time to time from Hua Hui, our largest shareholder, for working capital purposes. As of December 31,2011, the amount due to Hua Hui is $793,258, which is due on demand and bears interest at the prevailing rate charged by the PRC Central Bank. The interest accrued for the three months amounted to approximately $9,127 and the effective interest rate of the loans was 5.24%.

(6) CAPITAL STOCK

(a) Common stock

On September 8, 2009, pursuant to the transaction with Hua Hui on August 1, 2009, the Company issued 832,318 shares of its common stock to Wise Gold Investment Ltd., a British Virgin Island company, acting on behalf of Hua Hui. In addition, on that same date, it issued 1,942,074 shares of common stock to Blossom Grow Holdings Limited, a British Virgin Island company, as escrow agent under an escrow agreement by and among the Company, the escrow agent, and Hua Hui.

Effective on November 16, 2009, we effected a 20 for 1 reverse split of our issued and outstanding common stock. This reverse stock split already gave retroactive effect in the computation of basis and diluted EPS for all period presented accordingly.

As of December 31, 2011, the Company had 3,272,311 shares issued and outstanding.

(b) Warrants/options

On July 22, 2007, 60,000 common stock warrants were issued to Investors. Under the Warrant, the investors have the right, for a period of three years from the date of such warrant, to purchase a total of 60,000 shares of the Company’s common stock. The per share exercise price of the Warrant is $33. The warrants expired on July 21, 2010.

On July 4, 2008, pursuant to the Stock Purchase Agreement made and entered into by the Company and Her Village Limited, we issued warrants to the investor for the option to purchase 50,000 shares of Common Stock with an exercise price of $20 per share and an expiration date of 18 months from the date of issuance. The warrants expired on January 3, 2010.

| On June 28, 2009, pursuant to the Acquisition Agreement made and entered into by the Company and GlobStream, the Company issued warrants to Mr. Luo Wenjun for the option to purchase 7,782 shares of common stock with an exercise price of $3 per share and an expiration after March 23, 2019. |

These Warrants may be exercised, in whole or in part, by the Holder during the Exercise Period by (i) the presentation and surrender of this Warrant to the Company along with a duly executed Notice of Exercise specifying the number of Warrant Shares to be purchased, and (ii) delivery of payment to the Company of the Exercise Price for the number of Warrant Shares specified in the Notice of Exercise.

As of December 31,2011, the Company had 7,782 common stock warrants outstanding.

(c) 2001 stock plan

In 2001, the Board of Director adopted a Stock Plan (“Plan”). Under the terms and conditions of the Plan, the Board of Directors is empowered to grant stock options to employees, consultants, officers and directors of the Company. Additionally, the Board will determine at the time of granting the vesting provision and whether the options will be qualified as Incentive Stock Options under Section 422 of the Internal Revenue Code (Section 422 provides certain tax advantages to the employee recipients). The Plan was approved by the shareholders of the Company on September 15, 2001. The total number of shares of common stock available under the Plan may not exceed 100. As of December 31,2011, no options were granted under the Plan.

| 11 |

CHINA GRAND RESORTS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(stated in US DOLLARS)

| (7) | COMMITMENTS AND CONTINGENCIES |

Operating lease obligations

In December 2009, we relocated our office to a new space in Beijing consisting of 192.7 square feet. The term of the old lease was from September 1, 2009 to July 31, 2011; however, we terminated the old lease on December 11, 2009 as mutually agreed with the landlord and with no penalty to us. The new office lease is from December 11, 2009 to December 10, 2011 and provides for monthly lease payment of $5,333 with two months of free rent. In August 2011, we renewed this lease agreement from December 11, 2011 to December 12, 2012. Our new monthly lease payment is $6,253. As of December 31,2011, our total future commitments for minimum lease payments are as follows:

| Within one year | $ | 73,965 | ||

Rental expenses for the three months ended December 31,2011 and 2010 was $15,965 and $13,798 respectively.

(8) LOSS PER SHARE

The following data show the amounts used in computing loss per share and the weighted average number of shares for the three months ended December 31,2011 and 2010. As the Company has a loss, presenting diluted net earnings (loss) per share is considered anti-dilutive and not included in the consolidated statement of operations.

| For the Three Months Ended | ||||||||

| December 31, | ||||||||

| 2011 | 2010 | |||||||

| Net loss | $ | (65,434 | ) | $ | (67,186 | ) | ||

| Weighted average number of common shares outstanding – basic and diluted | 3,272,311 | 3,272,311 | ||||||

| Loss per share - basic and diluted | (0.02 | ) | (0.02 | ) | ||||

| 12 |

CHINA GRAND RESORTS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(stated in US DOLLARS)

(9) INCOME TAXES

The entities within the Company file separate tax returns in the respective tax jurisdictions that they operate.

British Virgin Islands

Key Prosper Holdings Limited incorporated in the British Virgin Islands as exempted company is not subject to any income tax in the British Virgin Islands.

Hong Kong

SNMTS is generally subject to Hong Kong income tax on its taxable income derived from trade or businesses carried out in Hong Kong at 16.5% for the two years ended December 31, 2011 and 2010. However, as SNMTS has not generated any revenue or income, no provision for Hong Kong income tax has been made. As SNMTS has yet commenced operations, the expenses incurred are not deductible and no loss carry forward was thus resulted.

PRC

CFCD established in the PRC was subject to the PRC Enterprise Income Tax (“EIT”) at 33% prior to January 1, 2008.

The PRC Enterprise Income Tax Law, among other things, imposes a unified income tax rate of 25% for both domestic and foreign invested enterprises registered in the PRC. The New EIT Law provides a grandfathering on tax holidays which were granted under the then effective tax laws and regulations.

The NEW EIT Law also imposes a withholding tax of 10% unless reduced by a tax treaty, for dividends distributed by a PRC-resident enterprise to its immediate holding company outside the PRC for earnings accumulated beginning on January 1, 2008 and undistributed earnings generated prior to January 1, 2008 are exempt from such withholding tax. As the PRC subsidiary is loss status, the Company has not provided for withholding taxes of its PRC subsidiary as of December 31, 2011 and 2010.

According to the PRC Tax Administration and Collection Law, the statute of limitations is three years if the underpayment of taxes is due to computational or other errors made by the taxpayer or the withholding agent. The statute of limitations extends five years under special circumstances. In the case of transfer pricing issues, the statute of limitations is 10 years.

There is no state of limitations in the case of tax evasions. Accordingly, the income tax returns of China Grand Resorts, Inc. for the years ended December 31, 2011 through 2011 are open to examination by the PRC state and local tax authorities.

As of December 31, 2011 and 2010, the Company did not have any significant temporary differences and carry forwards that may result in deferred tax. The Company has analyzed the tax positions taken or expected to be taken in its tax filing and has concluded it has no material liability related to uncertain tax positions or unrecognized tax benefits. The Company does not anticipate any significant increases or decreases to its liability for unrecognized tax benefits within the next 12 months.

| 13 |

CHINA GRAND RESORTS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(stated in US DOLLARS)

(10) NON-MONETARY TRANSACTION

On August 1, 2009, we entered into a subscription and asset sale agreement with Hua Hui. Under the terms of the Agreement, we received from Hua Hui the commercial income rights to 10,000 square meters to a 17 story apartment building in the Huadun Changde International Hotel’s Apartment Complex located in the city of Changde, Hunan Province (“Project”). The Project is currently under development by Hua Hui. In exchange, we agreed to issue to Hua Hui 2,774,392 shares of our common stock. As additional consideration, we transferred to Hua Hui all of our shares of the GlobStream Technology Inc., certain assets of both SNMTS and CFCD and certain assets of the Company.

According to ASC 845-10-S99, transfers of non-monetary assets to a company by its promoters or shareholders in exchange for stock prior to or at the time of the entity’s initial public offering normally should be recorded at the transferors' historical cost basis determined under GAAP. In this transaction, Hua Hui became the controlling shareholder of the Company after it transferred the commercial income rights to the Company. Therefore, the accounting principles in ASC 845-10-S99 were followed and the Company recorded the rights at its historical cost basis, which was internally developed and had zero basis.

According to ASC 845-10-30, the accounting for non-monetary transactions should be based on the fair values of the assets (or services) involved, which is the same basis as that used in monetary transactions. Thus, the cost of a non-monetary asset acquired in exchange for another non-monetary asset is the fair value of the asset surrendered to obtain it, and a gain or loss shall be recognized on the exchange. The fair value of the asset received shall be used to measure the cost if it is more clearly evident than the fair value of the asset surrendered. Similarly, a non-monetary asset received in a nonreciprocal transfer shall be recorded at the fair value of the asset received. A transfer of a non-monetary asset to a stockholder or to another entity in a nonreciprocal transfer shall be recorded at the fair value of the asset transferred and a gain or loss shall be recognized on the disposition of the asset. We recorded the disposal of the subsidiaries and assets at fair value. As the result of the transaction with Hua Hui, we experienced a loss on disposal of the above mentioned assets of $1,345,688 in fiscal year 2009.

| 14 |

CHINA GRAND RESORTS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(stated in US DOLLARS)

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward-Looking Statements

This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of Section 27A of the U. S. Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the U.S. Securities Exchange Act of 1934, as amended(the “Exchange Act”). Such statements relate to, among other things, our future plans of operations, business strategy, operating results and financial position and are often, though not always, indicated by words or phrases such as “anticipate,” “estimate,” “plan,” “project,” “outlook,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” and similar words or phrases. These forward-looking statements include statements other than historical information or statements of current condition, but instead represent only our belief regarding future events, many of which by their nature are inherently uncertain and outside of our control. Important factors that could cause actual results to differ materially from forward-looking statements include, but are not limited to, those described in the section titled “Risk Factors” previously disclosed in our Annual Report on Form 10-K/A for the year ended September 30, 2011, as well as the following:

| • | our ability to implement and execute our current business plan, including the ability to sell the apartment units of the Project; | ||

| • | the economic conditions in the Changde market, the location of the apartment units and elsewhere in the PRC for our consulting and marketing business; | ||

| • | Laws and regulations implemented by the PRC government designed to temper the real estate market in the PRC; | ||

| • | our ability to execute key strategies; | ||

| • | actions by our competitors; | ||

| • | our ability to raise additional funds, including loans from affiliates, to execute our new business plan ; | ||

| • | risks associated with assumptions we make in connection with our critical accounting estimates; | ||

| • | potential adverse accounting related developments; | ||

| • | other matters discussed in this Quarterly Report generally. |

| 15 |

CHINA GRAND RESORTS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(stated in US DOLLARS)

Forward-Looking Statements - Continued

Consequently, readers of this Quarterly Report should not rely upon these forward-looking statements as predictions of future events. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we access the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We undertake no obligation to update or revise any forward-looking statement in this Quarterly Report to reflect any new events or any change in conditions or circumstances. All of the forward-looking statements in this Quarterly Report are expressly qualified by these cautionary statements.

Overview

We were organized under the laws of the State of Nevada on September 21, 1989. We engaged in a variety of business, described in part below, and effected various name changes prior to November 2009 when the name was changed to China Grand Resorts, Inc. Our subsidiary is Sun New Media Transaction Service Ltd. (“SNMTS”), a company incorporated in Hong Kong, which has a wholly owned subsidiary China Focus Channel Development Co., Ltd (“CFCD”), a company incorporated in People’s Republic of China. In December 2009, the Company incorporated Key Prosper Holdings Limited, a company incorporated in the British Virgin Islands on December 8, 2009, with 100% shareholdings.

During the three year period prior to December 2007, our principal business was providing marketing, brand management, advertising, media planning, public relations and direct marketing services to clients in the PRC. During December 2007 through January 2008, we re-directed our business towards providing mobile phone based services in the PRC. In January 2008, we divested ourselves of our advertising and marketing business.

On December 31, 2007, we acquired a 70% equity interest in Jiangxi Hongcheng Tengyi Telecommunication Company, Ltd (“JXHC”), a local reseller of top-up mobile minutes in Jiangxi Province. Effective March 31, 2009, we acquired a Provincial Class One Full Service Operator license for the Jiangxi Province, PRC. The Class One license enabled us to sell mobile phone based products within the Jiangxi province. During this period, we also acquired other mobile phone based technologies to compliment our existing technology. We sought to market these technologies in the Jiangxi Province of China through JXHC utilizing our recently acquired Class One license. However, due to a lack of operating funds and other factors beyond our control, JXHC was unable to effectively develop its business. Consequently, effective on March 31, 2009, we sold our ownership in JXHC to an unaffiliated third party for $100.

On March 30, 2009, we acquired additional mobile internet software technology through our acquisition of GlobStream Technology Inc. (“Globstream”) from its shareholders for $156,000. GlobStream was founded by Dr. Wenjun Luo, one of our former directors. In May of that same year, we terminated the operations related to GlobStream. Effective on August 1, 2009, we sold our ownership in GlobStream to Hua Hui.

On August 1, 2009, as previously disclosed herein, we entered into a subscription agreement with Beijing Hua Hui Investment Ltd., an unaffiliated company organized under the laws of the PRC (“Hua Hui”). Hua Hui is part of The Beijing Hua Hui Corporation, a PRC real estate construction and development conglomerate that specializes in constructing and developing travel, resort, hotel, and apartment properties in popular tourist and other destinations within the PRC. Under the Agreement, we received from Hua Hui the commercial income rights (described herein) to 10,000 square meters of apartment space in the Huadun Changde International Hotel’s Apartment Complex located in the city of Changde in China’s Hunan Province (“Project”). The Project is currently under development by Hua Hui. The commercial income rights were valued by an independent appraiser at $8,777,000. As consideration, we agreed to pay a total of $7,317,000, to be satisfied by issuing Hua Hui subject to certain conditions, a total of 2,774,392 shares of our common stock which is valued at $2.40 per share (the closing price of our common stock on the transaction date (August 1, 2009) after giving effect of 20 for 1 reverse split) for a total stock value of $6,658,536. As additional consideration, Hua Hui received from us all of the shares of the GlobStream Technology Inc., our wholly owned subsidiary, certain assets of Sun New Media Transaction Services Limited and China Focus Channel Development Co., Ltd, and certain other miscellaneous assets of us which were valued at $658,241.

| 16 |

CHINA GRAND RESORTS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(stated in US DOLLARS)

Our Current Business Strategy

General

Hua Hui and its affiliates, including The Beijing Hua Hui Corporation, are a PRC real estate construction and development group that specializes in constructing and developing travel, resort, hotel, and apartment properties in popular tourist and other destinations within the PRC. As a result of the transaction with Hua Hui, we intended to become a leading specialty real estate consulting and marketing company for tourism projects in the PRC. Initially, our plan was to market the commercial rights to the Project that we received from Hua Hui. We further planned on expanding our business by using existing resources and knowhow of our affiliates and other parties to engage in providing consulting and marketing services for real estate developers. However, beginning in late 2009 and continuing through 2011, the PRC State Council adopted a number of initiatives designed to cool a perceived overheated real estate market. As a result, the Company has suspended its plans to engage in consulting and marketing services for real estate developers. Presently, apart from the Project (discussed below), we are evaluating other markets and business opportunities, including subject to market conditions its previously proposed real estate consulting business, however, as of the date of the report, it has not committed to any specific market or business opportunity.

With respect to the Project, Hua Hui will be responsible for all project marketing and actual unit sales. We expect to pay Hua Hui a sales commission of not less than 0.5% and not more than 8% of the unit sales price and we will receive the remainder of the unit sales price. As of the date of this report, we do not have any formal agreements or arrangements with any developer or Hua Hui for fees that we will earn, or fees that we will pay Hua Hui.

The Project

As mentioned above, the Project consists of 10,000 square meters of apartment space in the concerning Building of the Huadun Changde International Hotel’s Apartment Complex, a 17 story building, located in the city of Changde, Hunan Province (“Project”). The Project is currently under construction by Hua Hui. Changde is a popular tourist destination located in China’s central Hunan province. Upon completion, the Complex will consist of a total of 215,000 square meters located on an approximately 3.6 acre piece of land that has access roads on the North, East, and West. The city is accessible by rail and air and is in close proximity to several tourist, scenic, and commercial areas. The Project is in close proximity to several tourist, scenic, and commercial areas. Construction began on June 1, 2009 and initially was expected to be completed on December 31, 2010. However, due to change of decoration and style for improved quality and appearance, Hua Hui has informed us that the Project is expected to be completed during August 2012.

All permits concerning the Project have been acquired from governmental authorities, and the construction of the Project is approximately 85% completed as of the date hereof. We also have acquired the pre-sale permits for the sale of the apartments from the local real estate authority.

The Project when completed will be comprised of a total number of 128 apartments. The units are expected to range in size from 120 square meters to 210 square meters. Under current market conditions, we expect that the price of the apartment units to be approximately RMB4,000 ($635) per square meter, subject to market conditions. The units when sold will be unfurnished. Hua Hui began pre-completion marketing efforts in the mid-calendar 2010. In this regard, Hua Hui have initiated advertisements in the Changde airport, the Changde Evening paper and the Hunan Morning paper, Hua Hui also initiated advertisements in the Changde TV and the Changde broadcasting station. Hua Hui have initiated a text messaging program to potential buyers and posted advertisements on an outdoor billboard on the main street of Changde City. Finally, Hua Hui have printed sales brochures, hosted potential buyers and commenced website design for the Project. A sales center and several model units with respect to the Project were completed by Hua Hui in late November 2010. Potential buyers can tour these models to gain appreciation of the design, structure and appearance of the units. We have actively collaborated with Hua Hui with regard to the content of information contained in the outdoor billboard and print media, as well as the design of the sales center. In addition, we have commenced independent marketing efforts for the Project on a limited basis. We expect to play an active role in Hua Hui’s future marketing plans. In any pre-completion sale, the amount of the down payment that we will be able to obtain from a buyer is subject to the housing policy of governing real estate authorities. The current policy allows for a down payment ranging from 30% to 50% of the sales price dependent on the property size. As mentioned, Hui Hua will act as the sales agent and is expected to receive a sales commission of not less than 0.5% and not more than 8% of the unit sales price. Hua Hui has informed us that in course of selling the units, it will act in good faith in selling the units and will not act preferentially toward selling its units over the units of the Company. However, at the present time, the Company does not have a formal agreement with Hua Hui regarding sales commission or the manner of sale with respect to the units. As of the date of this filing, we have not sold any of the units.

| 17 |

CHINA GRAND RESORTS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(stated in US DOLLARS)

The Project - Continued

Our working capital budget for the next 12 months is approximately $500,000 which relate principally to costs of our executive offices. This amount is comprised of $190,000 in professional fees, $135,000 in salaries and related personnel costs, $75,000 for executive office rent, and $100,000 in miscellaneous expenses. We will not incur any costs of marketing the Project. We expect to generate revenues from the sale of the apartment units on or near August 2012. Thereafter, subject to the foregoing, we believe that revenues from the Project will be sufficient to fund our ongoing working capital needs.

Our business strategies are subject to certain risks and uncertainties, including our ability to raise additional funds in the future. We cannot predict whether we will be successful in any of business strategies. We do not anticipate seasonal fluctuations in our business.

Results of Operations

Unless otherwise indicated, all amounts are in U.S. Dollars.

Three Months Ended December 31,2011 Compared to Three Months Ended December 31, 2010

Total Revenues and Gross Margin

For the three month period ended December 31, 2011, we were waiting on the completion of the Project, and as a result, we had no revenues from operations or gross margin. During the comparable period in 2010, we had no revenues and related expenses from our consulting business due to the general slowdown in economic activity in the PRC during such period.

Loss from Operations

During the three months ended December 31, 2011, we incurred general and administrative expenses of $53,949 compared with $58,986 for the three months ended December 31, 2010. The reduction in general and administrative expenses is primarily due to reduced overhead at the corporate level. Commencing in 2011, we made an effort to reduce our ongoing overhead expenditures, which includes personnel reductions and office expense, due to our reduced operations. We also had $2,256 in depreciation and amortization for the three months ended December 31, 2011 compared with $2,143 for the comparable three months ended December 31, 2010. Our loss from operations for the three months ended December 31, 2011 was $56,205 compared to $61,129 for the three months ended December 31, 2010. The difference between the periods is due to the reduction of general and administrative expenses discussed above.

Other Income (Expense)

Other expense for the three months ended December 31, 2011 is $9,229, which mainly is the interest expense for the period. For the corresponding period in year 2010, other expense is $6,057 which mainly is the interest expense. The increase in interest expense is a result of higher principal loan amounts from Hua Hui during the current period.

Net loss

Our net loss $65,434 for the three months ended December 31, 2011 compared to a net loss of $67,186 for the three months ended December 31, 2010. The difference is due to the reasons discussed above.

Comprehensive Loss

During three months ended December 31, 2011, we had a foreign currency translation loss of $6,048 compared with a loss of $4,939 for the three months ended December 31, 2010. The difference is due to fluctuation of value of US dollar against RMB. As a result of all of the issues mentioned above, we had a total comprehensive loss of $71,482 for the three months ended December 31, 2011 compared with a total comprehensive loss of $72,125 for the comparable three months ended December 31, 2010.

| 18 |

CHINA GRAND RESORTS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(stated in US DOLLARS)

Liquidity and Capital Resources

We finance our operations primarily through cash generated from operating activities, a mixture of short and long-term loans (including loans from affiliates) and issuance of common stock.

The following table summarizes our cash flows for the three months ended December 31, 2011 and 2010:

|

Three Months Ended December 31, | |||||||

| 2011 | 2010 | ||||||

| Net cash used in operating activities | $ | (54,184) | $ | (68,537) | |||

| Net cash provided by (used in) investing activities | - | $ | - | ||||

| Net cash provided by financing activities | $ | 74,593 | $ | 11,820 | |||

| Effect of exchange rate fluctuations on cash and cash equivalents | $ | (177) | $ | (5,499) | |||

| Net (decrease)/ increase in cash and cash equivalents | $ | 20,232 | $ | (62,216) | |||

| Cash and cash equivalents (closing balance) | $ | 26,599 | $ | 16,157 | |||

The net cash used in operating activities for the three months ended December 31,2011 was negative $54,184, compared with net cash used in operating activities of negative $68,537 for the three months ended December 31, 2010. The difference of $14,353 is primarily due to the reduction of general and administrative expenses discussed above during the three months ended December 31,2011.

The net cash used in investing activities for the three month ended December 31, 2011 and 2010 was $0.

The net cash provided by financing activities for the three month ended December 31,2011 was $74,593, compared with net cash provided by financing activities of $11,820 for the three month ended December 31, 2010. The difference of $62,773 is mainly due to the increase of loan from shareholders during the three months ended December 31, 2011.

The effect of the exchange rate on cash was a loss of $177 for the three months ended December 31, 2011, compared with a loss of $5,499 for the three months ended December 31, 2010. The difference is due to fluctuation of value of US dollar against RMB.

The difference between the closing balance of cash and cash equivalents for the three months ended December 31, 2011 and 2010 is due to the reasons mentioned above.

| 19 |

CHINA GRAND RESORTS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(stated in US DOLLARS)

Capital Requirements for the Next 12 Months

We continue to experience significant losses from operations. We are uncertain as to when we will achieve profitable operations. We have an immediate need for capital to conduct our new business endeavors as well as our ongoing working capital needs. We anticipate raising capital through additional private placements of our equity securities, and, if available on satisfactory terms, debt financing. It is conceivable that funding of all or part of the budget required above may come from Hua Hui, our largest shareholder. However, we do not have any agreements, arrangements or commitments with or guarantees from any party, including our largest shareholder, to provide funding to us. We cannot guarantee that we will be successful in our efforts to enhance our liquidity. If we are unable to raise sufficient funds to meet our cash requirements as described above, we may be required to curtail, suspend, or discontinue our current and/or proposed operations. Our inability to raise additional funds as described above may force us to restructure, file for bankruptcy, sell assets or cease operations, any of which could adversely impact our business and business strategy, and the value of our capital stock. Due to the current price of our common stock, any common stock based financing, including transactions with affiliates which may include equity conversions of outstanding loans, will likely create significant dilution to the then existing shareholders. In addition, in order to conserve capital and to provide incentives for our employees and service providers, it is conceivable that we may issue stock for services in the future which also may create significant dilution to existing shareholders.

Our capital budget for the next 12 months is as follows:

$500,000 for our executive offices expenditures, which includes $135,000 in salaries and related costs of personnel, $190,000 in professional fees, $75,000 in executive office rent, and $100,000 in miscellaneous office expenditures.

We expect to generate revenues from the sale of the apartment units on or near August 2012. Thereafter, subject to the foregoing, we believe that revenues from the Project will be sufficient to fund our ongoing working capital needs. Our business strategies are subject to certain risks and uncertainties, including our ability to raise additional funds in the future. We cannot predict whether we will be successful in any of business strategies. We do not anticipate seasonal fluctuations in our business.

Contractual Obligations

In December 2009, we relocated our office to a new space in Beijing. The term of the old lease was from September 1, 2009 to July 31, 2011; however, we terminated the old lease on December 11, 2009 as mutually agreed with the landlord and with no penalty to us. The new office lease is from December 11, 2009 to December 10, 2011 and provides for monthly lease payment of $5,333 with two months period of free rent. The leased premise consists of 192.7 square feet. In August 2011, we renewed this lease agreement from December 11, 2011 to December 12, 2012. Our new monthly lease payment is $6,253. The lease expenses for the three months ended December 31, 2011 amounted to $15,965 and the total lease commitment as of December 31, 2011 is $13,798

CRITICAL ACCOUNTING POLICIES

Our significant accounting policies are described in Note 2 to our consolidated financial statements included in the annual report for the year ended December 31, 2011. We prepare our financial statements in conformity with U.S. GAAP, which requires our management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities on the date of the financial statements and the reported amounts of revenues and expenses during the financial reporting period. Since the use of estimates is an integral component of the financial reporting process, actual results could differ from those estimates. Some of our accounting policies require higher degrees of judgment than others in their application. We consider the policies discussed below to be critical to an understanding of our financial statements as their application places the most significant demands on our management’s judgment.

| 20 |

CHINA GRAND RESORTS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(stated in US DOLLARS)

Recently issued Accounting Pronouncements

FASB Establishes Accounting Standards Codification

Effective January 1, 2010, the Company adopted the provisions in ASU 2010-06, “Fair Value Measurements and Disclosures (ASC Topic 820): Improving Disclosures about Fair Value Measurements, which requires new disclosures related to transfers in and out of levels 1 and 2 and activity in level 3 fair value measurements, as well as amends existing disclosure requirements on level of disaggregation and inputs and valuation techniques. The adoption of the provisions in ASU 2010-06 did not have an impact on the Company’s consolidated financial statements.

In February 2010, the Financial Accounting Standards Board (“FASB”) issued authoritative guidance that amends the disclosure requirements related to subsequent events. This guidance includes the definition of a Securities and Exchange Commission filer, removes the definition of a public entity, redefines the reissuance disclosure requirements and allows public companies to omit the disclosure of the date through which subsequent events have been evaluated. This guidance is effective for financial statements issued for interim and annual periods ending after February 2010. This guidance did not materially impact the Company’s results of operations or financial position, but did require changes to the Company’s disclosures in its financial statements.

In April 2010, the FASB issued ASU No. 2010-13 – Compensation – Stock Compensation (Topic 718), which addresses the classification of an employee share-based payment award with an exercise price denominated in the currency of a market in which the underlying equity security trades. This Update provides amendments to Topic 718 to clarify that an employee share-based payment award with an exercise price denominated in the currency of a market in which a substantial portion of the entity’s equity securities trades should not be considered to contain a condition that is not a market, performance, or service condition. Therefore, an entity would not classify such an award as a liability if it otherwise qualifies as equity. The amendments in this Update are effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2010. The Company expects that the adoption of the amendments in this Update will not have any significant impact on its financial position and results of operations.

In April 2010, the EITF issued “Revenue Recognition – Milestone Method.” This issue provides guidance on defining a milestone and determining when it may be appropriate to apply the milestone method of revenue recognition for research or development transactions. This issue is effective on a prospective basis for milestones achieved in fiscal years beginning after June 15, 2010. Early adoption is permitted. The Company is currently evaluating the potential impact of this issue.

Other accounting standards that have been issued or proposed by the FASB or other standards-setting bodies that do not require adoption until a future date are not expected to have a material impact on the Company’s consolidated financial statements upon adoption.(update)

| 21 |

OFF-BALANCE SHEET COMMITMENTS AND ARRANGEMENTS

We have not entered into any financial guarantees or other commitments to guarantee the payment obligations of any third parties. In addition, we have not entered into any derivative contracts that are indexed to our own shares and classified as shareholder’s equity, or that are not reflected in our consolidated financial statements. Furthermore, we do not have any retained or contingent interest in assets transferred to an unconsolidated entity that serves as credit, liquidity or market risk support to such entity. Moreover, we do not have any variable interest in any unconsolidated entity that provides financing, liquidity, market risk or credit support to us or engages in leasing, hedging or research and development services with us.

Revenue Recognition

We rely on SEC Staff Accounting Bulletin: No. 104 “Revenue Recognition in Financial Statements” (“SAB 104”) (ASC No.605) to recognize our revenue. SAB 104 in establishing our accounting policy states that revenue generally is realized or realizable and earned when all of the following criteria are met: (1) persuasive evidence of an arrangement exists, (2) delivery has occurred or services have been rendered, (3) the seller's price to the buyer is fixed or determinable, and (4) collectability is reasonably assured.

Income Taxes

We account for income taxes under ASC No 740, “Income Taxes”. We record a valuation allowance to reduce our deferred tax assets to the amount that we believe is more likely than not to be realized. In the event we were to determine that we would be able to realize our deferred tax assets in the future in excess of their recorded amount, an adjustment to our deferred tax assets would increase our income in the period such determination was made. Likewise, if we determine that we would not be able to realize all or part of our net deferred tax assets in the future, an adjustment to our deferred tax assets would be charged to our income in the period such determination is made. We record income tax expense on our taxable income using the balance sheet liability method at the effective rate applicable in China in our consolidated statements of operations and comprehensive loss. There is no income tax expenses in 2010 and 2011 due to net loss occurred.

Item 3 Controls and Procedures

Pursuant to Rule 13a-15(b) under the Securities Exchange Act of 1934 (“Exchange Act”), the Company carried out an evaluation, with the participation of the Company’s management, including the Company’s Chief Executive Officer (“CEO”) and Company’s Chief Financial Officer (“CFO”), of the effectiveness of the Company’s disclosure controls and procedures (as defined under Rule 13a-15(e) under the Exchange Act) as of the end of the period covered by this report. Based upon that evaluation, the Company’s CEO and CFO concluded that the Company’s disclosure controls and procedures are effective to ensure that information required to be disclosed by the Company in the reports that the Company files or submits under the Exchange Act, is recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms, and that such information is accumulated and communicated to the Company’s management, including the Company’s CEO and CFO, as appropriate, to allow timely decisions regarding required disclosure.

Changes in internal controls

There were no changes in our internal controls over financial reporting that occurred during the three months ended December 31, 2011 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

| 22 |

PART II - OTHER INFORMATION

Item 4. Exhibits.

| 31.1 | Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | |

| 31.2 | Certification of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | |

| 32.1 | Certification of Chief Executive Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | |

| 32.2 | Certification of Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| 23 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| China Grand Resorts, Inc. | ||

| Date: February 13, 2012 | By: | /s/Menghua Liu |

|

Menghua Liu Chief Executive Officer and Acting Chief Executive Officer

| ||

| 24 |