UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the fiscal year ended

or

For the transition period from _____________________ to ___________________________

Commission file number

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of Incorporation or organization) | (I.R.S. Employer Identification No.) |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including

area code:

Securities registered under Section 12(b) of the Exchange Act:

None

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, 0.001 per share

(Title of Class)

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant

(1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes ☐

Indicate by check mark whether the registrant

has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted pursuant

to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☐

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☐ | Smaller reporting company | ||

| Emerging growth company | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

State the aggregate market value of the voting and non-voting common

equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price

of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter approximately

$

As of May 20, 2022, the registrant had

TABLE OF CONTENTS

i

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements,” within the meaning of the Private Securities Litigation Reform Act of 1995, all of which are subject to risks and uncertainties. Forward-looking statements can be identified by the use of words such as “expects,” “plans,” “will,” “forecasts,” “projects,” “intends,” “estimates,” and other words of similar meaning. One can identify them by the fact that they do not relate strictly to historical or current facts. These statements are likely to address our growth strategy, financial results and product and development programs. One must carefully consider any such statement and should understand that many factors could cause actual results to differ from our forward looking statements. These factors may include inaccurate assumptions and a broad variety of other risks and uncertainties, including some that are known and some that are not. No forward looking statement can be guaranteed and actual future results may vary materially.

These risks and uncertainties, many of which are beyond our control, include, and are not limited to:

| ● | our growth strategies in digital assets and commercial real estate industries; |

| ● | our anticipated future operation and profitability; |

| ● | our future financing capabilities and anticipated need for working capital; |

| ● | the anticipated trends in our industries and industries that we intend to enter into; |

| ● | acquisitions of other companies or assets that we might undertake in the future; and |

| ● | current and future competition. |

In addition, factors that could cause or contribute to such differences include, but are not limited to, those discussed in this Annual Report on Form 10-K, and in particular, the risks discussed under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as those discussed in other documents we file with the SEC. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. In this report, “we,” “us,” “our,” the “Company” and “Wave.” refer to Wave Sync Corp.

ii

PART I

Item 1. Business

History of the Company

Wave Sync Corp., formerly known as China Bio-Energy Corp., formerly known as China INSOnline Corp., was initially incorporated on December 23, 1988 under the name Lifequest Medical, Inc. (“DEXT”), a Delaware corporation.

On December 6, 2010, the Company entered into an Amendment (the “Amendment”) to a certain share exchange agreement dated November 12, 2010 with Ding Neng Holdings, a British Virgin Islands company (“Ding Neng Holdings”). This share exchange agreement and the Amendment provided for an acquisition transaction in which the Company, through the issuance of shares of its common stock, representing 90% of the issued and outstanding common stock immediately following the closing of this acquisition, acquired 100% of Ding Neng Holdings.

The closing of this acquisition took place on February 10, 2011, on which date, pursuant to the terms of the share exchange agreement as amended, the Company acquired all of the outstanding equity securities of Ding Neng Holdings from the shareholders of Ding Neng Holdings. Accordingly, on the closing of the acquisition, the Company, via Ding Neng Holdings, held 100% of Ding Neng Bio-technology Co., Limited, a Hong Kong Company, which held 100% of Zhangzhou Fuhua Biomass Energy Technology Co., Ltd., a wholly-foreign owned enterprise in China (“Fuhua Biomass”), which, via a series of variable interest entity (or VIE) arrangements, controlled the operating company Fujian Zhangzhou Ding Neng Bio-technology Co., Ltd. (“Ding Neng Bio-tech”). In connection of this share exchange, the Company changed its fiscal year end from June 30 to December 31.

The Company and the previous management believed that from late 2011 to 2014, due to change in law, unfavorable market conditions, and lack of effective management, the business of Ding Neng Bio-tech deteriorated significantly and eventually the Company defaulted on various loan obligations. Eventually, Ding Neng Bio-tech completely ceased its operations.

On June 4, 2015, Fuhua Biomass filed a civil action in Haicang District People’s Court of Xiamen, Fujian, PRC against Ding Neng Bio-tech, alleging that the purposes of those certain Consulting Service Agreement, Operating Agreement, Pledge and Security Agreement, Option Agreement, and Voting Rights Proxy Agreement (the “VIE Agreements”) entered into by Fuhua Biomass and Ding Neng Bio-tech on October 28, 2010 had been frustrated, and that these VIE Agreements should be terminated. On July 14, 2015, this case was settled via in-court mediation directed by the Court. As a result, Fuhua Biomass and Ding Neng Bio-tech entered into binding settlement to, among other things, terminate the VIE Agreements.

Given that the Company was unable to exercise effective control over Ding Neng Bio-tech or gain access to Ding Neng Bio-tech’s financial information since 2011, and that the VIE Agreements were terminated, the Company deconsolidated Ding Neng Bio-tech’s financial results. The Company has written off all investments made in Ding Neng Holdings as loss on investment in subsidiary.

Effective November 1, 2021, we completed a 1 for 5 reverse split of our common stock by filing an amended and restated Certificate of Incorporation with the State of Delaware, reducing the issued and outstanding shares of common stock from 59,327,713 to 11,865,542 (the “Reverse Stock Split”). The number of shares of common stock authorized for issuance remained as previously established at 100,000,000 shares. On February 1, 2022, the Company filed a certificate of amendment to the Company’s Amended and Restated Certificate of Incorporation (the “Certificate of Amendment”) to change its corporate name from “Wave Sync Corp.” to “New York Holding Corp,” and the corporate action of such name change is pending with the Financial Industry Regulatory Authority.

1

Recent Development

| ● | Acquisition of Center Florence |

With an intent to the business of operating and managing commercial and industrial real estates, on November 18, 2021, the Company entered into a Share Purchase/Exchange Agreement (the “Share Exchange Agreement”) with Center Florence Holding LLC (the “Parent”) and Center Florence, Inc. (the “Target”), a wholly-owned subsidiary of the Parent. Pursuant to the Share Exchange Agreement, on December 1, 2021 the Company issued the Parent four million six hundred thousand (4,600,000) shares (the “Exchange Shares”) of the Company’s common stock, at an agreed price of $4.00 per share of the common stock for a total valuation of $18,400,000 of the Target, and thereby acquiring 100% equity interest in Target.

In connection with the acquisition, the Company has entered into commercial and industrial real estate business through the Target, which owns three operating entities: (i) Florence Development LLC (in the business of purchasing, holding, salvaging, renovating, leasing and/or mortgaging real property and related improvements located in Florence, South Carolina) (“Florence Development”); (ii) Royal Park LLC (dba The Country Club of South Carolina, operating as a golf club in Florence, South Carolina) (the “Country Club”), and (iii) St. Louis Center, LLC (operating a recreational sports facility located in Affton, Missouri) (“Center St. Louis”). Pursuant to the Share Exchange Agreement, the Parent shall not offer, sell, pledge or otherwise dispose of any of the Exchange Shares until one-year anniversary from November 18, 2021.

| ● | Securities Purchase Agreement with PX Global Advisors, LLC. |

On December 12, 2021, the Company entered into a securities purchase agreement (the “Purchase Agreement”) with PX Global Advisors, LLC (the “Investor”), pursuant to which the Investor purchased a convertible promissory note (the “Note”) from the Company in the principal amount of $2,000,000, which was closed on December 13, 2021 with the Company issuing the note to the Investor. The Note bears an interest rate of 10% per annum, with the principal amount and accrued but unpaid interest of the Note shall be due and payable on December 12, 2022 (the “Maturity Date”) and such principal amount and the interest accrued thereon shall be convertible into shares of the Company’s common stock at the selection of the Investor on the Maturity Date at a fixed conversion price of $3.20 per share. The Company has the right to prepay the outstanding balance of and interest on this Note at any time prior to the Maturity Date. The Company intends to use the net proceeds from the Note for general working capital purposes.

| ● | Disposal of EGOOS Mobile Technology Co. Ltd. |

On December 30, 2021, the Company entered into a stock sale and purchase agreement (the “EGOOS SPA”) with Terry Chu (the “Buyer”), pursuant to which the Company sold to Buyer (the “Disposal Transaction”) EGOOS Mobile Technology Company Limited, a British Virgin Islands corporation (“EGOOS”) and wholly-owned subsidiary of the Company, for an aggregate purchase price of $1.00 via selling all of EGOOS’ issued and outstanding share capital. On December 30, 2021, the Company and Buyer consummated the Disposal Transaction set forth in the EGOOS SPA and as a result the Company completely disposed its legacy audio bank card business in the People’s Republic of China, which has ceased its meaningful operations since 2019.

| ● | Hosting and Colocation Services Agreement with PLANBTC, LLC, d/b/a Gigacrypto, Inc. |

On October 26, 2021, New York Tech Capital Inc. (“New York Tech”), a wholly-owned subsidiary of the Company, entered into a Hosting and Colocation Services Agreement (the “Hosting Agreement”) with PLANBTC, LLC, d/b/a Gigacrypto, Inc., a Wyoming limited liability company (“Gigacrypto”). Pursuant to the Hosting Agreement Gigacrypto is to deploy, operate and maintain certain cryptocurrency mining equipment to mine Bitcoins (the “Equipment”) that New York Tech has provided thereto for a service fee equal to twelve percent (12%) of the total Bitcoin mining revenue payable in Bitcoin, irrespective of their dollar value, unless indicated otherwise by Gigacrypto. In accordance with the Hosting Agreement, New York Tech shall reimburse certain fees and expenses, including the energy costs of operating the Equipment, actually incurred as a result of operating any of the Equipment. Pursuant to the Hosting Agreement, on October 26, 2021, New York Tech and Gigacrypto signed the initial statement of work (the “Statement of Work”) as Exhibit A to the Agreement, which provided the initial service term of three (3) years from the date of the Statement of Work. The Agreement shall expire upon the end of the term of the latest Statement of Work unless terminated earlier.

| ● | Sales Agreement between New York Tech Capital, Inc. and Fortune Gear Ltd. |

On January 12, 2022, New York Tech, entered into an international sales agreement (the “Sales Agreement”) with Fortune Gear Limited (“Fortune”), pursuant to which the Company, through New York Tech, for a total purchase price of $1,918,350 purchased 350 units of A1246 cryptocurrency mining machines (the “Products”) with mixed Hash performance of 83T, 85T and 87T.

| ● | Engagement Agreement with Joseph Stone Capital, LLC |

2

On January 13, 2022, the Company entered into an engagement agreement (the “Engagement Agreement”) with Joseph Stone Capital, LLC (the “FA”), pursuant to which the FA is providing the Company an exclusive financial advisor to assist with certain matters, including up-listing, mergers and acquisitions, licensing or a joint venture or partnership, and global capital raising transactions by the Company (the “Services”) for a period of twelve (12) months, with an automatic extension for additional twelve (12) months with the mutual approval of the Company and FA. For the Services provided and to be provided by the FA, the Company has issued the FA 1,000,000 shares of the Company’s common stock (the “Upfront Shares”) as upfront fees. Pursuant to the Engagement Agreement, the Company has granted the FA an anti-dilution right to maintain the FA’s equity ownership percentage of the Company of at least five percentage (5%) on a fully diluted basis for a period of eighteen (18) months from the date of the issuance of the Upfront Shares. The Company shall pay a certain percentage of the Aggregate Consideration as compensation to the FA for any sale, merger, acquisition, joint venture, strategic alliance, technology partnership, licensing agreement or other similar agreements undertaken by the Company due to the FA’s advice and facilitation. In addition, the FA shall receive a mutually agreed compensation for any form of debt financing raised with the assistance of the FA for the Company. Furthermore, for any successful equity raise by the Company as a result of the FA’s efforts, the FA shall receive (i) a Success Fee, payable in cash, equal to ten percent (10%) of the gross proceeds of the equity offering, plus (ii) warrants to purchase shares of Company’s commons stock (the “FA Warrants”), with the cashless exercise option, in the amount equal to ten percent (10%) of the gross proceeds of the equity offering, exercisable, in whole or in part, at any time within five (5) years from a public offering of the Company at a strike price equal to hundred-twenty percent (120%) of the public offering price of the Company’s common stock, or, if a public offering price is not available, then the market price of the common stock on the date when such offering is commenced. In accordance with the Engagement Agreement, the Company has granted the piggyback registration right to the shares underlying the FA Warrants and the Upfront Shares. The Company paid the FA $25,000 as advanced payment for any accountable expenses pursuant to the Engagement Agreement. The Company has granted the FA a right to first refusal to act as the sole placement agent, sole book runner, manager, agent, or advisor for the Company’s next placement of debt or equity securities for a period of 18 months, subject to the terms of the Engagement Agreement. Additionally, the FA is entitled to compensation for any transaction undertaken by the Company with parties identified by the FA within eighteen (18) months from the termination or expiration of the Engagement Agreement. Any capitalized term used but not defined herein shall have the meaning given thereto in the Engagement Agreement. Before their entry into the Engagement Agreement, no material relationship existed between the Company and the FA.

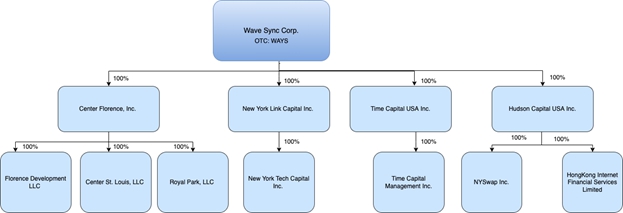

Corporate Structure

3

The following flow chart illustrates our Company’s organizational structure as of March 24, 2021:

Competition

Country Club of South Carolina:

The golf industry is an ever-evolving industry where it takes extensive knowledge and experiences to run a fully operational country club. Our Country Club is located one (1) hour from Myrtle Beach, which is the golf capital of America. As a hidden gem only an hour from Myrtle Beach, the Country Club allows for quick rounds of golf at affordable prices without the over-crowded environment. However, our Golf Club faces intense competition because Myrtle Beach offers a diverse array of golf courses like The Dunes Club, which is highly regarded and TPC Myrtle Beach, another competing public course known for its water obstacles.

Center St. Louis:

Center St. Louis boasts one of the largest indoor sports venues in the Midwest. Having some of the larger tenants in the industry allows for Center St. Louis’ continual growth through many avenues. However, to Target’s knowledge, in the next few years, there will be a few new facilities built that will mirror Center St. Louis’ operations, including Bud Dome and PowerPlex in St. Louis, and 417 Athletics in Springfield, Missouri.

Florence Development:

Florence Development has the potential, through development, to become an industry leader in warehouse space and trade. However, there are many industrial parks surrounding the Florence and South Carolina areas, including Port Dillon and Florence Industrial Park off I-95, which we deem as competitors of Florence Development.

Competitive Strength

The Target believes it possesses the following competitive advantages:

| ● | Country Club: Our long-term members serve as a solid foundation for our customer base. At the Country Club, each hole's greens and tees stand out among the best in the region, and the course layout is no exception. |

| ● | Center St. Louis: It has a dominating market position in the St. Louis area's indoor recreational sports complexes. In addition to hosting some of the major volleyball and basketball events in the region, Center St. Louis has established ties with some of the most prominent companies in the industry. |

| ● | Florence Development: It is one of the largest industrial parks in the North and South Carolina built on the almost 1,000 acres of developed and undeveloped land. In addition, the CSX rail line that passes through the site of Florence Development provides an advantage that no other property in the Florence area can offer. |

Employees

As of March 31, 2022, we had 49 employees, including 13 full-time and 36 part-time employees. There are no collective bargaining contracts covering any of our employees. We believe our relationship with our employees is satisfactory.

4

ITEM 1A. RISK FACTORS

Not required for smaller reporting companies.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not required for smaller reporting companies.

ITEM 2. PROPERTIES

Wave Sync Corp. is located at 19 West 44th Street, Suite 1001, New York, NY 10036. Our office space is approximately 3,258 square feet. The space is leased by a related party, PX SPAC Capital Inc., and we currently do not pay rent.

In addition to our executive office, we operate the Bitcoin mining machines from Piedmont, Missouri, and through the subsidiaries, own a golf course, 81.45 acres of excess land and 62 developed lots in Florence, South Carolina, a recreational sports facility located at 6727 Langley Avenue in Affton, Missouri, and three warehouse buildings in Florence, South Carolina.

ITEM 3. LEGAL PROCEEDINGS

We are currently not aware of any such legal proceedings or claims that we believe will have a material adverse effect on our business, financial condition or operating results. From time to time, we may become involved in various lawsuits and legal proceedings, which arise, in the ordinary course of business. Litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business.

ITEM 4. MINE SAFETY DISCLOSURES.

Not Applicable.

5

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market Information

Our common stock is quoted under the symbol “WAYS” on the OTC Pink tier of the OTC Markets. There is minimal trading activity in our common stock.

Stockholders of Record

As of May 20, 2022, we had approximately 131 record holders of our common stock.

Dividends

Holders of our common stock are entitled to receive dividends if, as and when declared by the Board of Directors out of funds legally available therefore. We have never declared or paid any dividends on our common stock. We intend to retain any future earnings for use in the operation and expansion of our business. Consequently, we do not anticipate paying any cash dividends on our common stock to our stockholders for the foreseeable future.

Equity Compensation Plan Information

We do not have in effect any compensation plans under which our equity securities are authorized for issuance.

ITEM 6. [Reserved].

As a smaller reporting company, we are not required to make such disclosure under Item 6.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our results of operations and financial condition since the Company’s inception should be read in conjunction with our financial statements and the notes to those financial statements that are included elsewhere in this report. All statements, other than statements of historical facts, included in this report are forward-looking statements. When used in this report, the words “may,” “will,” “should,” “would,” “anticipate,” “estimate,” “possible,” “expect,” “plan,” “project,” “continuing,” “ongoing,” “could,” “believe,” “predict,” “potential,” “intend,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, but are not limited to, availability of additional equity or debt financing, changes in sales or industry trends, competition, retention of senior management and other key personnel, availability of materials or components, ability to make continued product innovations, casualty or work stoppages at our facilities, adverse results of lawsuits against us and currency exchange rates. Forward-looking statements are based on assumptions and assessments made by our management in light of their experience and their perception of historical trends, current conditions, expected future developments and other factors they believe to be appropriate. Readers of this report are cautioned not to place undue reliance on these forward-looking statements, as there can be no assurance that these forward-looking statements will prove to be accurate and speak only as of the date hereof. Management undertakes no obligation to publicly release any revisions to these forward-looking statements that may reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. This cautionary statement is applicable to all forward-looking statements contained in this report. In this report, “we,” “us,” “our,” the “Company” and “Wave.” refer to Wave Sync Corp.

6

Overview

Wave Sync Corp., formerly known as China Bio-Energy Corp., was initially incorporated on December 23, 1988 under the name Lifequest Medical, Inc. (“DEXT”), a Delaware corporation.

On December 6, 2010, the Company entered into an Amendment (the “Amendment”) to a certain share exchange agreement dated November 12, 2010 with Ding Neng Holdings, a British Virgin Islands company (“Ding Neng Holdings”). This share exchange agreement and the Amendment provided for an acquisition transaction in which the Company, through the issuance of shares of its common stock, representing 90% of the issued and outstanding common stock immediately following the closing of this acquisition, acquired 100% of Ding Neng Holdings.

The closing of this acquisition took place on February 10, 2011, on which date, pursuant to the terms of the share exchange agreement as amended, the Company acquired all of the outstanding equity securities of Ding Neng Holdings from the shareholders of Ding Neng Holdings. Accordingly, on the closing of the acquisition, the Company, via Ding Neng Holdings, held 100% of Ding Neng Bio-technology Co., Limited, a Hong Kong Company, which held 100% of Zhangzhou Fuhua Biomass Energy Technology Co., Ltd., a wholly-foreign owned enterprise in China (“Fuhua Biomass”), which, via a series of variable interest entity (or VIE) arrangements, controlled the operating company Fujian Zhangzhou Ding Neng Bio-technology Co., Ltd. (“Ding Neng Bio-tech”). In connection of this share exchange, the Company changed its fiscal year end from June 30 to December 31.

The Company and the previous management believed that from late 2011 to 2014, due to change in law, unfavorable market conditions, and lack of effective management, the business of Ding Neng Bio-tech deteriorated significantly and eventually the Company defaulted on various loan obligations. Eventually, Ding Neng Bio-tech completely ceased its operations.

On June 4, 2015, Fuhua Biomass filed a civil action in Haicang District People’s Court of Xiamen, Fujian, PRC against Ding Neng Bio-tech, alleging that the purposes of those certain Consulting Service Agreement, Operating Agreement, Pledge and Security Agreement, Option Agreement, and Voting Rights Proxy Agreement (the “VIE Agreements”) entered into by Fuhua Biomass and Ding Neng Bio-tech on October 28, 2010 had been frustrated, and that these VIE Agreements should be terminated. On July 14, 2015, this case was settled via in-court mediation directed by the Court. As a result, Fuhua Biomass and Ding Neng Bio-tech entered into binding settlement to, among other things, terminate the VIE Agreements.

Given that the Company was unable to exercise effective control over Ding Neng Bio-tech or gain access to Ding Neng Bio-tech’s financial information since 2011, and that the VIE Agreements were terminated, the Company deconsolidated Ding Neng Bio-tech’s financial results. The Company has written off all investments made in Ding Neng Holdings as loss on investment in subsidiary.

Effective November 1, 2021, the Company completed a 1 for 5 reverse split of our common stock by filing an amended and restated Certificate of Incorporation with the State of Delaware, reducing the issued and outstanding shares of common stock from 59,327,713 to 11,865,542 (the “Reverse Stock Split”). The number of shares of common stock authorized for issuance remained as previously established at 100,000,000 shares. On February 1, 2022, the Company filed a certificate of amendment to the Company’s Amended and Restated Certificate of Incorporation (the “Certificate of Amendment”) to change its corporate name from “Wave Sync Corp.” to “New York Holding Corp,” and the corporate action of such name change is pending with the Financial Industry Regulatory Authority.

Critical Accounting Policies

Basis of presentation

The consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Principles of Consolidation

The consolidated financial statements include the financial statements of all the subsidiaries and VIEs of the Company. All transactions and balances between the Company and its subsidiaries and VIEs have been eliminated upon consolidation

7

The consolidated financial statements include the accounts of the Company, its subsidiaries for which the Company is the primary beneficiary. All significant inter-company accounts and transactions have been eliminated. The consolidated financial statements include 100% of assets, liabilities, and net income or loss of those wholly-owned subsidiaries.

As of December 31, 2021, the detailed identities of the consolidating subsidiaries are as follows:

| Name of Company | Place of incorporation | Attributable equity interest % | Registered capital | |||||||

| New York Link Capital (“NY Link”) | New York | 100 | % | $ | 100 | |||||

| New York Tech Capital (“NY Tech”) | New York | 100 | % | 100 | ||||||

| Center Florence, Inc. | Delaware | 100 | % | 1 | ||||||

| Center St. Louis LLC (“St. Louis”) | Delaware | 100 | % | 1,000 | ||||||

| Royal Park, LLC (“Royal Park”) | South Carolina | 100 | % | 1,000 | ||||||

| Florence Development, LLC. (“Florence”) | Delaware | 100 | % | 1,000 | ||||||

As of December 31, 2020, the detailed identities of the consolidating subsidiaries are as follows:

| Name of Company | Place of incorporation | Attributable equity interest % | Registered capital | |||||||

| EGOOS Mobile Technology Company Limited (“EGOOS BVI”) | BVI | 100 | % | $ | 1 | |||||

| EGOOS Mobile Technology Company Limited (“EGOOS HK”) | Hong Kong | 100 | % | 1,290 | ||||||

| Move the Purchase Consulting Management (Shenzhen) Co., Ltd. (“WOFE”) | P.R.C | 100 | % | - | ||||||

| Guangzhou Yuzhi Information Technology Co., Ltd. (“GZYZ”) | P.R.C | 100 | % | 150,527 | ||||||

| Shenzhen Qianhai Exce-card Technology Co., Ltd. (“SQEC”) | P.R.C | 100 | % | 150,527 | ||||||

| Guangzhou Rongsheng Information Technology Co., Ltd. (“GZRS”) | P.R.C | 100 | % | 1,505,267 | ||||||

Use of estimates

The preparation of the financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Estimates are used for, but not limited to, the accounting for certain items such as allowance for doubtful accounts, depreciation and amortization, impairment, inventory allowance, taxes and contingencies.

Contingencies

Certain conditions may exist as of the date the financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company’s management assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or un-asserted claims that may result in such proceedings, the Company’s management evaluates the perceived merits of any legal proceedings or un-asserted claims as well as the perceived merits of the amount of relief sought or expected to be sought.

If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s financial statements. If the assessment indicates that a potential material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, together with an estimate of the range of possible loss if determinable and material would be disclosed.

Loss contingencies considered to be remote by management are generally not disclosed unless they involve guarantees, in which case the guarantee would be disclosed.

8

Cash and cash equivalents

The Company classifies the following instruments as cash and cash equivalents: cash on hand, unrestricted bank deposits, and all highly liquid investments purchased with original maturities of three months or less.

Accounts receivable

Trade receivables are recognized and carried at the original invoice amount less allowance for any uncollectible amounts. An estimate for doubtful accounts is made when collection of the full amount is no longer probable. Bad debts are written off as incurred.

Other receivables

Other receivables are recognized and carried at the original invoice amount less allowance for any uncollectible amounts. An allowance for doubtful accounts is made when recovery of the full amount is doubtful.

Property, plant and equipment

Lands are carried at cost and no depreciation is provided.

Plant and equipment are carried at cost less accumulated depreciation. Depreciation is provided over their estimated useful lives, using the straight-line method with a salvage value from 0% - 10%. Estimated useful lives of the plant and equipment are as follows:

| Building and improvement | 15-40 years | |||

| Furniture and equipment | 5-28 years | |||

| Digital mining machine | 5 years | |||

| Office equipment | 3 years | |||

| Office furniture | 5 years | |||

| Motor vehicle | 5 years |

The cost and related accumulated depreciation of assets sold or otherwise retired are eliminated from the accounts and any gain or loss is included in the statement of income. The cost of maintenance and repairs is charged to income as incurred, whereas significant renewals and betterments are capitalized.

Intangible Assets

Intangible assets, comprising digital assets, accounting software and big data platform, which are separable from the property and equipment, are stated at cost less accumulated amortization. Amortization is computed using the straight-line method over the estimated useful lives of the assets.

9

Digital assets

Digital assets (including Bitcoin) are included in current assets in the accompanying consolidated balance sheets. Digital assets purchased are recorded at cost and digital assets awarded to the Company through its mining activities are accounted for in connection with the Company’s revenue recognition policy disclosed below.

Digital assets held are accounted for as intangible assets with indefinite useful lives. An intangible asset with an indefinite useful life is not amortized but assessed for impairment annually, or more frequently, when events or changes in circumstances occur indicating that it is more likely than not that the indefinite-lived asset is impaired.

Impairment exists when the carrying amount exceeds its fair value, which is measured using the quoted price of the cryptocurrency at the time its fair value is being measured. In testing for impairment, the Company has the option to first perform a qualitative assessment to determine whether it is more likely than not that an impairment exists. If it is determined that it is not more likely than not that an impairment exists, a quantitative impairment test is not necessary. If the Company concludes otherwise, it is required to perform a quantitative impairment test. To the extent an impairment loss is recognized, the loss establishes the new cost basis of the asset. Subsequent reversal of impairment losses is not permitted.

For the year ended December 31, 2021, the Company has recognize impairment loss of $13,589 of its digital assets.

Purchases of digital assets by the Company, if any, will be included within investing activities in the accompanying consolidated statements of cash flows, while digital assets awarded to the Company through its mining activities are included within operating activities on the accompanying consolidated statements of cash flows. The sales of digital assets are included within investing activities in the accompanying consolidated statements of cash flows and any realized gains or losses from such sales are included in “realized gain (loss) on exchange of digital assets” in the consolidated statements of operations and comprehensive income (loss). The Company accounts for its gains or losses in accordance with the first-in first-out method of accounting.

Separable Intangible Assest - Customer-related intangible assets

Customer-related intangible assets arising from the acquistion of subsidiary which has been separated from goodwill by complying with ASC 805-20-55 which meets the contactual-legal criterion for recognition separately from goodwill even though the Company cannot sell or otherwise transfe these lease contracts.

Customer-related intangible assets are accounted for as intangible assets with useful lives of five years. It would be amortized for the useful lives on monthly basis.

The Company tests intangible assets for impairment at the reporting unit level on an annual basis and between annual tests when an event occurs or circumstances change that could indicate that the asset might be impaired. The Company first has the option to assess qualitative factors to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount. If the Company decides, as a result of its qualitative assessment, that it is more-likely-than-not that the fair value of a reporting unit is less than its carrying amount, the quantitative impairment test is mandatory. Otherwise, no further testing is required.

Business combinations

Business combinations are recorded using the acquisition method of accounting. The assets acquired, the liabilities assumed and any non-controlling interests of the acquiree at the acquisition date, if any, are measured at their fair values as of the acquisition date. Goodwill is recognized and measured as the excess of the total consideration transferred plus the fair value of any non-controlling interests of the acquiree and fair value of previously held equity interest in the acquiree, if any, at the acquisition date over the fair values of the identifiable net assets acquired. Common forms of the consideration made in acquisitions include cash and common equity instruments. Consideration transferred in a business acquisition is measured at the fair value as of the date of acquisition.

Goodwill

Goodwill is the excess of the consideration transferred over the fair value of the acquired assets and assumed liabilities in a business combination.

10

The Company tests goodwill for impairment at the reporting unit level on an annual basis and between annual tests when an event occurs or circumstances change that could indicate that the asset might be impaired. The Company first has the option to assess qualitative factors to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount. If the company decides, as a result of its qualitative assessment, that it is more-likely-than-not that the fair value of a reporting unit is less than its carrying amount, the quantitative impairment test is mandatory. Otherwise, no further testing is required.

Impairment of Long-lived Assets

The Company reviews long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to the future net undiscounted cash flows expected to be generated by the asset. If such assets are considered to be impaired, the impairment recognized is measured by the amount by which the carrying amount of the asset exceeds its fair value. For the years ended December 31, 2021 and 2020, the Company did not recognize any impairment loss of its long-lived assets.

Long term investment

The Company’s long-term investments include equity securities without readily determinable fair values and available-for-sale investments.

Equity securities without readily determinable fair values

As of December 31, 2021, the Company’s investment in two privately held companies over which the Company neither has control nor significant influence through investment in common stock.

Equity securities not accounted for using the equity method are carried at fair value with unrealized gains and losses recorded in the consolidated income statements, according to ASC 321, Investments - Equity Securities. The Company elected to record the equity investments in privately held companies using the measurement alternative at cost, less impairment, with subsequent adjustments for observable price changes resulting from orderly transactions for identical or similar investments of the same issuer.

Equity investments in privately held companies accounted for using the measurement alternative are subject to periodic impairment reviews. The Company’s impairment analysis considers both qualitative and quantitative factors that may have a significant effect on the fair value of these equity securities, including consideration of the impact of the COVID-19 pandemic. In computing realized gains and losses on equity securities, the Company determines cost based on amounts paid using the average cost method. Dividend income is recognized when the right to receive the payment is established.

Available-for-sale investments

For investments in investees’ shares which are determined to be debt securities, the Group accounts for them as available-for-sale investments when they are not classified as either trading or held-to-maturity investments. Available-for-sale investments are reported at fair value, with unrealized gains and losses recorded in accumulated other comprehensive income as a component of shareholders’ equity. Declines in the fair value of individual available-for-sale investments below their amortized cost due to credit-related factors are recognized as an allowance for credit losses, whereas if declines in the fair value is not due to credit-related factors, the loss is recorded in other comprehensive income / (loss).

Accounting for the Impairment of Long-lived assets

The long-lived assets held by the Company are reviewed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Subtopic 360-10-35, “Accounting for the Impairment or Disposal of Long-Lived Assets,” for impairment whenever events or changes in circumstances indicate that the carrying amount of assets may not be recoverable. It is reasonably possible that these assets could become impaired as a result of technology or other industry changes. Impairment is present if carrying amount of an asset is less than its undiscounted cash flows to be generated.

If an asset is considered impaired, a loss is recognized based on the amount by which the carrying amount exceeds the fair market value of the asset. Assets to be disposed of are reported at the lower of the carrying amount or fair value less costs to sell. The Company believes no impairment has occurred to its assets during 2021 and 2020.

11

Income taxes

The Company uses the accrual method of accounting to determine income taxes for the year. The Company has implemented FASB ASC 740 Accounting for Income Taxes. Income tax liabilities computed according to the United States, People’s Republic of China (PRC), and Hong Kong tax laws provide for the tax effects of transactions reported in the financial statements and consists of taxes currently due, plus deferred taxes, related primarily to differences arising from the recognition of expenses related to the depreciation of plant and equipment, amortization of intangible assets, and provisions for doubtful accounts between financial and tax reporting. The deferred tax assets and liabilities represent the future tax return consequences of those differences, which will be either taxable or deductible when the assets and liabilities are recovered or settled. Deferred taxes also are recognized for operating losses that are available to offset future income taxes.

A valuation allowance is recognized for deferred tax assets if it is more likely than not, that the deferred tax assets will either expire before the Company is able to realize that tax benefit, or that future realization is uncertain.

Stock-based compensation

The Company has elected to use the Black-Scholes-Merton (“BSM”) pricing model to determine the fair value of stock options on the dates of grant. Also, the Company recognizes stock-based compensation using the straight-line method over the requisite service period.

The Company values stock awards using the market price on or around the date the shares were awarded and includes the amount of compensation as a period compensation expense over the requisite service period.

For the years ended December 31, 2021 and 2020, $0 and $0 stock-based compensation was recognized.

Foreign currency translation

The accompanying financial statements are presented in United States dollars (USD). The functional currency of the Company is the USD and Renminbi (RMB). The financial statements are translated into USD from RMB at year-end exchange rates as to assets and liabilities and average exchange rates as to revenues and expenses. Capital accounts are translated at their historical exchange rates when the capital transactions occurred.

| Exchange rates | December 31, 2021 | December 31, 2020 | ||||||

| Year-end/period-end RMB : US$ exchange rate | 6.4515 | 6.5249 | ||||||

| Average annual/period RMB : US$ exchange rate | 6.3757 | 6.9010 | ||||||

The RMB is not freely convertible into foreign currency and all foreign exchange transactions must take place through authorized institutions. No representation is made that the RMB amounts could have been, or could be, converted into US Dollar at the rates used in translation.

Revenue recognition

The Company recognizes services revenue when the following criteria have been met: 1.) it has agreed and entered into a contract for service with it customers which the Company identifies the contract and determines the transactions price with customers, 2.) the contract has set forth a fixed fee for the services to be rendered which the Company has determined the transactions price and the allocation of such price to performance obligations with the customers, 3.) the Company has fully rendered service to its customers, and there are no additional obligations that exist that under the terms of the contract that the Company has not fulfilled that the Company recognizes revenue when the performance obligation is satisfied, and 4.) the Company has either received payment, or reasonably expects payment from the customer in accordance to the payment terms set forth in the contract.

12

Cryptocurrency

When the cryptocurrency is sold in the exchange, which time revenue is recognized. There is no significant financing component in these transactions.

Fair value of the cryptocurrency award received is determined using the quoted price of the related cryptocurrency at the time of receipt.

There is currently no specific definitive guidance under GAAP or alternative accounting framework for the accounting for cryptocurrencies recognized as revenue or held, and management has exercised significant judgment in determining the appropriate accounting treatment. In the event authoritative guidance is enacted by the FASB, the Company may be required to change its policies, which could have an effect on the Company’s consolidated financial position and results from operations.

Rental income

Rental income from letting the Company’s of investment properties is recognized on a straight-line basis over the lease term.

Clubhouse services

Clubhouse income is recognized when services are rendered.

Cost of revenue

Cryptocurrency

The cost of revenue of cryptocurrency is the corresponding amount of intangible assets.

Clubhouse services

The cost of revenue of clubhouse services is mainly the labor costs and cost of food and beverage.

Earnings per share

Basic earnings per share is computed on the basis of the weighted average number of common stock outstanding during the period. Diluted earnings per share is computed on the basis of the weighted average number of common stock and common stock equivalents outstanding. Dilutive securities having an anti-dilutive effect on diluted earnings per share are excluded from the calculation.

Dilution is computed by applying the treasury stock method for options and warrants. Under this method, options and warrants are assumed to be exercised at the beginning of the period (or at the time of issuance, if later), and as if funds obtained thereby were used to purchase common stock at the average market price during the period.

Comprehensive loss

Comprehensive income (loss) is defined to include all changes in equity except those resulting from investments by owners and distributions to owners. The Company presents components of comprehensive income with equal prominence to other financial statements. The Company’s current component of other comprehensive income is the foreign currency translation adjustment.

Subsequent events

The Company evaluates subsequent events that have occurred after the balance sheet date but before the financial statements are issued. There are two types of subsequent events: (1) recognized, or those that provide additional evidence with respect to conditions that existed at the date of the balance sheet, including the estimates inherent in the process of preparing financial statements, and (2) non recognized, or those that provide evidence with respect to conditions that did not exist at the date of the balance sheet but arose subsequent to that date.

13

Fair Value of Financial Instruments

ASC 825, Financial Instruments, requires that the Company discloses estimated fair values of financial instruments. The carrying amounts reported in the balance sheets for current assets and current liabilities qualifying as financial instruments are a reasonable estimate of fair value.

The Company applies the provisions of ASC 820-10, Fair Value Measurements and Disclosures. ASC 820-10 defines fair value, and establishes a three-level valuation hierarchy for disclosures of fair value measurement that enhances disclosure requirements for fair value measures. For certain financial instruments, including cash and cash equivalents, loan receivables and short-term bank loans, the carrying amounts approximate fair value due to their relatively short maturities. The three levels of valuation hierarchy are defined as follows:

| ● | Level 1 inputs to the valuation methodology are quoted prices for identical assets or liabilities in active markets. |

| ● | Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument. |

| ● | Level 3 inputs to the valuation methodology are unobservable and significant to the fair value measurement. |

The Company analyzes all financial instruments with features of both liabilities and equity under ASC 480, “Distinguishing Liabilities from Equity,” and ASC 815.

The following tables present the Company’s financial assets and liabilities at fair value in accordance to ASC 820-10

Quoted in Active (Level 1) | Significant (Level 3) | Significant (Level 3) | Total | |||||||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||||||||

| Financial assets: | ||||||||||||||||||||||||||||||||

| Cash | $ | 2,877,456 | $ | 3 | $ | - | $ | - | $ | - | $ | - | $ | 2,877,456 | $ | 3 | ||||||||||||||||

| Total financial assets | $ | 2,877,456 | $ | 3 | $ | - | $ | - | $ | - | $ | - | $ | 2,877,456 | $ | 3 | ||||||||||||||||

14

Results of Operations

Overview of the years ended December 31, 2021 and 2020

The following table shows the results of operations for the years ended December 31, 2021 and 2020:

| Years Ended December 31, | ||||||||||||||||

| 2021 | 2020 | Change | Percent | |||||||||||||

| Revenue | $ | 162,853 | $ | - | $ | 162,853 | 100.0 | % | ||||||||

| Cost of revenue | 19,512 | - | $ | 19,512 | 100.0 | % | ||||||||||

| Gross profit | 143,341 | - | $ | 143,341 | 100.0 | % | ||||||||||

| Operating expenses: | ||||||||||||||||

| General and administrative expenses | $ | 1,793,636 | 39,438 | $ | 1,754,197 | 4448.0 | % | |||||||||

| Impairment loss on intangible assets | $ | 13,589 | - | $ | 13,589 | 100.0 | ||||||||||

| Financial expenses | $ | 11,671 | 13 | $ | 11,658 | 89673.2 | % | |||||||||

| Total operating expenses | $ | 1,818,896 | 39,451 | $ | 1,779,444 | 4510.5 | % | |||||||||

| Income (loss) from operations | $ | (1,675,555 | ) | (39,451 | ) | $ | (1,636,104 | ) | 97.6 | % | ||||||

| Other income (expenses): | ||||||||||||||||

| Interest income | $ | 772 | - | $ | 772 | 100.0 | % | |||||||||

| Gain on disposal of fixed assets | $ | 208,012 | - | $ | 208,012 | 100.0 | % | |||||||||

| Other expenses | $ | (144 | ) | - | $ | (144 | ) | (100 | )% | |||||||

| Loss on disposal of subsidiary | $ | (2 | ) | - | $ | (2 | ) | (100 | )% | |||||||

| Total other income (expense), net | $ | 208,638 | - | $ | 208,638 | 100.0 | % | |||||||||

| Income before income tax | ||||||||||||||||

| Income tax expense | $ | - | - | $ | - | - | % | |||||||||

| Net income (loss) | $ | (1,466,917 | ) | $ | (39,451 | ) | $ | (1,427,466 | ) | 97.3 | % | |||||

Revenue

Year Ended December 31, | Year Ended December 31, | |||||||

| Revenue | $ | 162,853 | $ | - | ||||

| Cost of revenue | 19,512 | - | ||||||

| Gross profit | $ | 143,341 | $ | - | ||||

There was no revenue for the years ended December 31, 2020, as the Company ceased its active business operations during the year of 2020.

For the year ended December 31, 2021, our revenues were $162,853, representing revenue after the completion of acquisition of Center Florence at December 1, 2021, reflecting a stable revenue from rental of recreational facilities and industrial properties.

For the year ended December 31, 2021, the digital mining operation just commenced and no revenue has been generated as of December 31, 2021.

Cost of revenue

For the years ended December 31, 2021, our cost of revenue was $19,512, representing cost of revenue after the completion of acquisition of Center Florence at December 1, 2021, consisting of costs of food and beverage consumed by members and customers in the recreational facilities.

Operating Expenses

The following table sets forth the breakdown of our operating expenses for the years ended December 31, 2021 and 2020, respectively:

| For the Year Ended December 31, | Variance | |||||||||||||||||||||||

| 2021 | % | 2020 | % | Amount | % | |||||||||||||||||||

| General and administrative expenses | $ | 1,793,636 | 98.7 | % | $ | 39,438 | 99.9 | % | $ | 1,754,197 | 4448.0 | % | ||||||||||||

| Impairment loss on intangible assets | 13,589 | 0.7 | % | - | - | % | 13,589 | 100.0 | % | |||||||||||||||

| Financial expenses | 11,671 | 0.6 | % | 13 | 0.1 | % | 11,658 | 89673.2 | % | |||||||||||||||

| Total Amount | $ | 1,818,896 | 100.0 | % | $ | 39,451 | 100 | % | $ | 1,779,444 | 4510.5 | % | ||||||||||||

15

General and administrative and financial expenses were related to corporate overhead, financial and administrative contracted services, such as legal and accounting. General and administrative expenses and financial expenses for the year ended December 31, 2021 were $1,793,636 as compared to $39,451 for the comparable period ended December 31, 2020, which represented an increase of $1,754,197 or approximately 44 times. Such increase was primarily attributed to increase of consulting fee, audit fee, legal and professional fees.

Impairment loss on intangible assets were impairment loss on digital assets, which was Bitcoin, generated from digital mining operation for the year ended December 31, 2021.

Financial expenses for the year ended December 31, 2021 were related to interests on related party loans and a convertible note from the related parties. The increase of interests is contributed by draw down of an unsecured convertible note of $2,000,000, at an annual interest rate of 10%, on December 12, 2021.

(Loss) Income from Operations and Operating Margin

Loss from operations in the year ended December 31, 2021 was $1,675,555, compared with loss from operations of $39,451 in the year ended December 31, 2020.

Operating margin, or income from operations as a percentage of total revenue was negative 10 times as for the year ended December 31, 2021, compared with no revenue for the year ended December 31, 2020, due to the previously discussed changes.

Other income (expenses)

The following table sets forth the breakdown of our other income for the year ended December 31, 2021 and the year ended December 31, 2020:

| For the Year Ended December 31, | Variance | |||||||||||||||||||||||

| 2021 | % | 2020 | % | Amount | % | |||||||||||||||||||

| Interest income | $ | 772 | 0.4 | % | $ | - | - | % | $ | 772 | 100.0 | % | ||||||||||||

| Gain on disposal of fixed assets | 208,012 | 99.7 | % | - | - | % | 208,012 | 100.0 | % | |||||||||||||||

| Other expenses | (144 | ) | (0.1 | )% | - | - | % | (144 | ) | (100 | )% | |||||||||||||

| Loss on disposal of subsidiary | (2 | ) | 0.0 | % | - | - | % | (2 | ) | (100 | )% | |||||||||||||

| Total Amount | $ | 208,638 | 100.0 | % | $ | - | - | % | $ | 208,638 | 100.0 | % | ||||||||||||

Interest income was $772 and $0 for the years ended December 31, 2021 and 2020, respectively, showing an increase of 100.0%. This increase is mainly contributed to interest expenses on convertible note acquired on November 16, 2021.

16

Gain on disposal of fixed assets for the year ended December 31, 2021 increased by $208,012 to $208,012 from $0 in the year ended December 31, 2020, due to disposal of properties from the newly acquired subsidiary at December 2021.

Other expenses was $144 and $0 for the years ended December 31, 2021 and 2020, respectively, an increase of 100.0% year over year. This increase is due to provision of penalty on franchise tax.

Loss on disposal of subsidiary for the year ended December 31, 2021 represented the disposal of a former subsidiary to a third party at December 30, 2021 for $1 and incurred loss on disposal of $2 and the operation in PRC has completely terminated.

Income tax (benefit) expense

Income tax expense was $0 and $0 for the year ended December 31, 2021 and 2020, respectively.

Foreign Currency Translation Gain (Loss)

Foreign currency translation gain was $0 and $0 in the year ended December 31, 2021 and 2020, respectively.

Net (Loss) Income

Net loss for the year ended December 31, 2021 was $1,466,917, as compared to net loss of $39,451 for the year ended December 31, 2020. The net loss is mainly due to increase of general and administrative expenses.

Liquidity and Capital Resources

Our primary liquidity and capital resource needs are to finance the costs of our operations, to make capital expenditures and to service our debt. We continue to be dependent on our ability to generate revenues, positive cash flows and additional financing.

Working Capital Summary

The following table represents a comparison of our working capital for the years ended December 31, 2021 and 2020:

|

As of December 31, 2021 |

As of December 31, 2020 |

|||||||

| Current assets | $ | 3,049,477 | $ | 3 | ||||

| Current liabilities | $ | 2,672,979 | $ | 71,844 | ||||

| Working capital | $ | 376,498 | $ | (71,841 | ) | |||

Cash Flows

The following table represents a comparison of our cash flows for the years ended December 31, 2021 and 2020:

| Years ended December 31, | ||||||||

| 2021 | 2020 | |||||||

| Cash flows used in operating activities | $ | (1,565,278 | ) | $ | (13 | ) | ||

| Cash flows from investing activities | $ | (1,870,497 | ) | $ | - | |||

| Cash flows from financing activities | $ | 6,313,228 | $ | - | ||||

17

Cash flows used in operating activities

Since the change of management in February 25, 2021, the Company has resumed its operation and incurred cash flows used in operating activities. The Company incurred cash flows used in operating activities in the amounts of $1,565,278 and $13 for the years ended December 31, 2021 and 2020, respectively.

Cash flows from investing activities

For the year ended December 31, 2021, the Company has some investing activities, including acquisition of motor vehicles of $100,000 and mining equipment of $1,300,000, investment of equity of $750,000 and convertible loan note of $106,289, and investment on intangible assets, which is digital mining costs, of $17,081.

Cash flows from financing activities

For the years ended December 31, 2021 and 2020, the Company’s cash flows from financing activities were $6,313,228 and $0, respectively. The Company’s cash flows from financing activities during the year of 2021 included $4,380,561 from certain private offerings of four investors, an advance from related party of $36,916 and issuance of convertible note to a related party of $2,000,000. The Company has also repaid the bank loan of $104,249.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Not required for a smaller reporting company.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

The full text of the Company’s audited financial statements for the fiscal years ended December 31, 2020 and 2021 begins on page F-1 of this report.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

None.

ITEM 9A. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

Our management is responsible for establishing and maintaining a system of disclosure controls and procedures (as defined in Rule 13a-15(e) and 15d-15(e) under the Exchange Act) that is designed to ensure that information required to be disclosed by the Company in the reports that the Company files or submits under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Exchange Act is accumulated and communicated to the issuer’s management, including its principal executive officer or officers and principal financial officer or officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

Our Chief Executive Officer and Chief Financial Officer (the “Certifying Officers”) conducted an evaluation of our disclosure controls and procedures. Based on this evaluation, the Certifying Officers concluded that our disclosure controls and procedures were, due to certain factors, not effective as of December 31, 2021 to ensure that material information is recorded, processed, summarized and reported by our management on a timely basis in order to comply with our disclosure obligations under the Exchange Act and the rules and regulations promulgated thereunder.

18

Management’s Report on Internal Control over Financial Reporting

Our management is also responsible for establishing and maintaining adequate internal control over financial reporting. The Company’s internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.

Our internal control over financial reporting includes those policies and procedures that:

| ● | Pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the Company; |

| ● | Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that our receipts and expenditures are being made only in accordance with authorizations of the Company’s management and directors; and |

| ● | Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the financial statements. |

We carried out an assessment of the effectiveness of our internal control over financial reporting based on the framework in in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (2013). Based on our evaluation, our management concluded that our internal control over financial reporting was not effective as of December 31, 2021. Management has specifically observed that our accounting systems and current staffing resources in our finance department are currently insufficient to support the complexity of our financial reporting requirements. We currently do not have adequate staff members in our accounting and finance department who have experience or specialized training in preparing financial statements in the form and format required by the SEC. We have also experienced difficulty in applying complex accounting and financial reporting disclosure rules as required under various aspects of GAAP and SEC reporting regulations including those relating to accounting for business combinations, intangible assets, derivatives and income taxes.

We have instituted certain procedures to mitigate our internal control risks. Our Chief Executive Officer and Chief Financial Officer review and approve substantially all of our major transactions to ensure the completeness and fair presentation of our consolidated financial statements. We have, when needed, hired outside experts to assist us with implementing complex accounting principles. Management and the Board of Directors believe that the Company must allocate additional human and financial resources to address these matters.

Changes in Internal Control over Financial Reporting.

During the years ended December 31, 2021 and 2020, there was no change in our internal control over financial reporting (as such term is defined in Rule 13a-15(f) under the Exchange Act) that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

ITEM 9B. OTHER INFORMATION

None.

ITEM 9C. DISCLOSURES REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTION

Not applicable.

19

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The executive officers and directors of the Company are as follows. Directors serve until the Company’s next annual meeting of shareholders and until a successor is elected and qualified.

| Directors and Executive Officers | Age | Position / Title | ||

| Jiang Hui | 33 | Chief Executive Officer and Director | ||

| Hon Man Yun | 53 | Chief Financial Officer and Director | ||

| Hong Chen | 52 | Director | ||

| Chiang Hsien | 61 | Director | ||

| Ming Yi | 40 | Director |

Mr. Jiang Hui has been chief executive officer and director of the Company in February 2021. He has worked as the executive vice president at Move the Purchase Consulting Management (Shenzhen) Co., Ltd. since January 2020. Mr. Hui worked as the Vice President at the Industrial and Commercial Bank of China (New York Branch) from August 2018 to December 2019. Mr. Hui was the vice president of Industrial and Commercial Bank of China (London) PLC from January 2017 to August 2018, and the chief compliance officer of investment advisory at Industrial and Commercial Bank of China Financial Services LLC from January 2014 to January 2017. Mr. Hui’s executive experience qualifies him to serve on our board of directors.

Mr. Hon Man Yun has been chief financial officer and director of the Company since February 2021. He has served in several financing and accounting positions at different private and publicly traded companies. Mr. Yun has worked as the Chief Financial Officer of Kiwa Bio-tech Products Group Corporate since April 2018 and served as the CFO and a director at Hudson Capital Inc. since August 2020 until February 2022. Mr. Yun served as joint company secretary, as a group vice president, the chief accountant and compliance and internal audit officer for Kaisun Energy Group Limited, from May 2017 to August 2020. Mr. Yun was an associate at China Merchants Securities (Hong Kong) Co., Limited from December 2014 to May 2017 and financial controller at E Lighting Group Limited from March 2013 to September 2014. Mr. Yun’s financial and accounting experience qualifies him to serve on our board of directors.

Mr. Hong Chen has been a director of the Company since February 2021. Mr. Chen has worked as the Chairman of the board of directors for Grand Cartel Securities Co., Ltd. (“Grand Cartel Securities”) since 2014. Before Grand Cartel Securities, Mr. Chen served as the Chairman at China Internet Education Group (a Hong Kong listed company with the code 8055) from 2008 to 2014, as the CEO for Peking University Business Network from 2002 to 2008, and the CEO of Shenzhen Chenrun Investment Company from 1998 to 2002. Mr. Chen’s chairman experience qualifies him to serve on our board of directors.

Mr. Chiang Hsien, has over 30 years of experience in investment and asset management. Since 2020, Mr. Hsien has been working as an independent consultant for various corporations on a part-time basis. From 2016 to 2019, he was an advisor to the Chairman of the Pacific Millennium Group, a leading packaging supplier in China. From 2013 to 2016, Mr. Hsien was a Partner and Chief Representative in Asia for Lingohr & Partner Asset Management, a German asset management company. From 2008 to 2012, Mr. Hsien was Chief Representative and Director of Allianz Global Investors Hong Kong Ltd., and CEO of the Shanghai Representative Office. Allianz Global Investors is a global asset management company and a subsidiary of Allianz SE. From 2003 to 2008, Mr. Hsien was Chief Executive Officer and Director of Guotai Junan-Allianz Asset Management, which is one of the first joint-venture mutual fund management companies established in China. From 2000 to 2003, Mr. Hsien was Chief Executive Officer and Managing Director of Dresdner Securities Investment Trust Enterprise Taiwan (now Allianz Asset Management Taiwan). Mr. Hsien has a Bachelor of Arts Degree from University of International Relations Beijing (China), an MBA degree from the Christian Albrecht University of Kiel in Germany and attended Executive Programs at INSEAD and at Harvard University

20

Mr. Ming Yi has been a director of the Company since February 2021. He worked as the Chief Financial Officer at SSLJ.com Limited from 2018 to 2019. Prior to that, Mr. Yi worked as the Chief Financial Officer for this Company from 2011 to 2018. Mr. Yi’s financial experience qualifies him to serve on our board of director.

Audit Committee

We do not have a standing audit committee of the Board of Directors. Mr. Ming Yi is our financial expert serving on the Board of Directors and is independent.

Code of Ethics

We have not yet adopted a code of ethics that applies to our principal executive officers, principal financial officer, principal accounting officer or controller, or persons performing similar functions, since we have been focusing our efforts on developing our business.

Family Relationships

There is no family relationship between any director and executive officer or among any directors or executive officers.

Involvement in Certain Legal Proceedings

To our knowledge, our directors and executive officers have not been involved in any of the following events during the past ten years:

| 1. | any bankruptcy petition filed by or against such person or any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| 2. | any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| 3. | being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from or otherwise limiting his involvement in any type of business, securities or banking activities or to be associated with any person practicing in banking or securities activities; |

| 4. | being found by a court of competent jurisdiction in a civil action, the SEC or the CFTC to have violated a Federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; |

| 5. | being subject of, or a party to, any Federal or state judicial or administrative order, judgment decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of any Federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| 6. | being subject of or party to any sanction or order, not subsequently reversed, suspended, or vacated, of any self-regulatory organization, any registered entity or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

21

ITEM 11. EXECUTIVE COMPENSATION

The following table sets forth compensation information for services rendered by our named executive officers in all capacities during the last two completed fiscal years.

| Name and Position(s) | Fiscal Year |

Salary ($) |

Bonus ($) |

Stock Awards ($) |

Other ($) |

Total Compensation ($) |

||||||||||||||||

| Jiang Hui | 2021 | - | - | - | - | - | ||||||||||||||||

| Chief Executive Officer | 2020 | - | - | - | - | - | ||||||||||||||||

| Hon Man Yun | 2021 | - | - | - | - | - | ||||||||||||||||

| Chief Financial Officer | 2020 | - | - | - | - | - | ||||||||||||||||

We have not entered into any employment agreement with either our Chief Executive Officer or Chief Financial Officer as of December 31, 2021.

Outstanding Equity Awards at Fiscal Year-End

The Company did not have any outstanding unexercised options, unvested stocks and equity incentive plan awards held by each of our named executive officers for the years ended December 31, 2020 and 2021.

Director Compensation

We did not pay any compensation to directors of the Company in the years of 2020 or 2021 for services as directors.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The table below sets forth information known to us regarding the beneficial ownership of our Common Stock as of May 20, 2022 for:

| ● | each person we believe beneficially holds more than 5% of our outstanding common shares (based solely on our review of SEC filings); | |

| ● | each of our “named executive officers” and directors; and | |

| ● | all of our current directors and executive officers as a group. |