UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF

REGISTERED MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number: 811-6027

KAVILCO INCORPORATED

(Exact name of registrant as specified in charter)

1000 Second Avenue, Suite 3320

Seattle, Washington

98104

(Address of principal executive offices) (Zip code)

Registrant's telephone number, including area code: (206)624-6166

Date of reporting period: March 31, 2020

| Principal Amount or Shares | Fair Value | ||||||

| INVESTMENTS IN SECURITIES | |||||||

| U.S. Common Stock - 93.8% | |||||||

| American Depository Receipts - 2.5% | |||||||

| Atlantic Power Corp. | 2,700 | 5,778 | |||||

| Eaton Corp, PLC | 1,400 | 108,766 | |||||

| Enbridge Inc. | 11,193 | 325,604 | |||||

| GW Pharmaceuticals PLC | 300 | 26,271 | |||||

| Invesco Ltd. | 6,300 | 57,204 | |||||

| Obsidian Energy Ltd. | 485 | 81 | |||||

| Royal Dutch Shell, PLC | 4,300 | 140,438 | |||||

| Schlumberger Ltd. | 1,200 | 16,188 | |||||

| Seadrill, Ltd. | 4 | 2 | |||||

| Wheaton Precious Metals Corp. | 700 | 19,271 | |||||

| Total American Depository Receipts | 699,603 | ||||||

| Consumer Staples - 1.6% | |||||||

| Coca Cola Co. | 3,500 | 154,875 | |||||

| The Kraft Heinz Company | 4,900 | 121,226 | |||||

| Walgreens Boots Alliance Inc. | 3,850 | 176,138 | |||||

| Total Consumer Staples | 452,239 | ||||||

| Consumer Discretionary - 1.0% | |||||||

| Amazon Com Inc. | 25 | 48,743 | |||||

| Genuine Parts Co. | 3,400 | 228,922 | |||||

| Ryman Hospitality Properties Inc. | 600 | 21,510 | |||||

| Total Consumer Discretionary | 299,175 | ||||||

| Energy - 2.7% | |||||||

| Chevron Corp. | 1,800 | 130,428 | |||||

| Diamond Offshore Drilling, Inc. | 1,515 | 2,772 | |||||

| Exxon Mobil Corp. | 5,000 | 189,850 | |||||

| Kinder Morgan, Inc. | 19,919 | 277,272 | |||||

| Phillips 66 | 500 | 26,825 | |||||

| Plains GP Holdings LP | 1,400 | 7,854 | |||||

| Valero Energy Corp. | 1,170 | 53,071 | |||||

| Williams Cos Inc. | 6,784 | 95,994 | |||||

| Total Energy | 784,067 | ||||||

| Financials - 24.6% | |||||||

| AvalonBay Communities, Inc. | 1,750 | 257,548 | |||||

| Blackstone Group Inc., The | 11,800 | 537,726 | |||||

| Diversified Healthcare Trust | 10,400 | 37,752 | |||||

| EPR Properties | 2,575 | 62,367 | |||||

| Equity Residential PPTYS | 3,000 | 185,130 | |||||

| HCP, Inc. | 7,000 | 151,520 | |||||

| Healthcare Realty Trust, Inc. | 5,425 | 183,645 | |||||

| Highwoods Properties, Inc. | 1,300 | 46,046 | |||||

| Iron Mountain Inc. | 8,100 | 192,780 | |||||

| Kimco Realty Corp. | 8,400 | 81,228 | |||||

| Lamar Advertising Company | 6,400 | 328,192 | |||||

| LTC Properties, Inc. | 10,330 | 319,197 | |||||

| Macerich Co. Com. | 1,500 | 8,445 | |||||

| Mack Cali Rlty Corp. | 5,600 | 85,288 | |||||

| National Retail Properties, Inc. | 1,470 | 47,319 | |||||

| Omega Healthcare Investors, Inc. | 5,831 | 154,755 | |||||

| Prologis, Inc. | 10,827 | 870,166 | |||||

| Prudential Financial Inc. | 1,260 | 65,696 | |||||

| Public Storage Inc. | 1,000 | 198,610 | |||||

| Realty Income Corp. | 12,255 | 611,034 | |||||

| Redwood Trust, Inc. | 2,600 | 13,156 | |||||

| RMR Group, Inc., The | 274 | 7,390 | |||||

| Sabra Health Care REIT, Inc. | 2,970 | 32,432 | |||||

| Hospitality Properties Trust | 13,400 | 72,360 | |||||

| Simon Property Group, Inc. | 1,240 | 68,026 | |||||

| Spirit Realty Capital, Inc. | 2,500 | 65,375 | |||||

| Stag Industrial, Inc. | 15,410 | 347,033 | |||||

| T Rowe Price Group Inc. | 5,300 | 517,545 | |||||

| Tanger Factory Outlet Ctr. | 10,800 | 54,000 | |||||

| Truist Financial Corp. | 1,480 | 45,643 | |||||

| Ventas, Inc. | 13,200 | 353,760 | |||||

| Vornado Realty Trust | 3,290 | 119,131 | |||||

| Washington REIT | 8,450 | 201,702 | |||||

| Wells Fargo & Co. | 9,540 | 273,798 | |||||

| Welltower, Inc. | 8,810 | 403,322 | |||||

| Weyerhaeuser Co. | 1,900 | 32,205 | |||||

| Total Financials | 7,031,322 | ||||||

| Health Care - 4.1% | |||||||

| Abbvie, Inc. | 1,680 | 127,999 | |||||

| Amgen, Inc. | 2,380 | 482,497 | |||||

| Five Star Senior Living, Inc. | 6,900 | 384,606 | |||||

| Bristol Myers Squibb | 704 | 1,957 | |||||

| Pfize,r Inc. | 5,000 | 163,200 | |||||

| Total Healthcare | 1,160,260 | ||||||

| Industrials - 2.1% | |||||||

| General Electric Co. | 24,550 | 194,927 | |||||

| Pitney Bowes, Inc. | 3,000 | 6,120 | |||||

| United Parcel Service | 3,670 | 342,851 | |||||

| Wabtec Corp. | 131 | 6,305 | |||||

| Watsco, Inc. | 300 | 47,409 | |||||

| Total Industrials | 597,612 | ||||||

| Information Technology - 3.9% | |||||||

| Apple, Inc. | 170 | 43,229 | |||||

| Cisco Systems, Inc. | 4,300 | 169,033 | |||||

| International Business Machines Corp. | 2,370 | 262,904 | |||||

| Paychex, Inc. | 9,925 | 624,481 | |||||

| Total Information Technology | 1,099,647 | ||||||

| Master Limited Partnerships - 3.1% | |||||||

| Alliancebernstein Holding LP | 1,700 | 31,603 | |||||

| CVR Partners LP | 4,760 | 4,903 | |||||

| Energy Transfer Partners LP | 15,960 | 73,416 | |||||

| Enterprise Products Partners LP | 20,400 | 291,720 | |||||

| Magellan Midstream Partners LP | 7,600 | 277,324 | |||||

| MPLX LP | 2,180 | 25,332 | |||||

| Nustar Energy LP | 4,100 | 35,219 | |||||

| Plains All American Pipeline LP | 3,914 | 20,666 | |||||

| Suburban Propane Partners LP | 3,200 | 45,248 | |||||

| Targa Resources Corp. | 1,160 | 8,016 | |||||

| TC Pipelines LP | 2,300 | 63,204 | |||||

| Total Master Limited Partnerships | 876,650 | ||||||

| Materials - 0.2% | |||||||

| International Paper Co | 1,900 | 59,147 | |||||

| Total Mutual Funds | 59,147 | ||||||

| Mutual Funds - 3.3% | |||||||

| Blackrock Floating Rate Income Trust | 3,179 | 31,186 | |||||

| John Hancock Preferred Income Fund | 3,284 | 52,774 | |||||

| iShares Investment Grade Corp. Bonds | 640 | 79,046 | |||||

| iShares US Preferred ETF | 2,516 | 80,109 | |||||

| iShares 1-3 Year Treasury Bond | 7,200 | 624,024 | |||||

| SPDR Bloomberg Barclays High Yield Bond ETF | 866 | 82,045 | |||||

| Total Mutual Funds | 949,185 | ||||||

| Telecommunication Services - 8.0% | |||||||

| AT & T, Inc. | 29,570 | 861,966 | |||||

| Centurylink, Inc. | 6,900 | 65,274 | |||||

| Consolidated Communications | 9,600 | 43,680 | |||||

| Verizon Communications | 24,540 | 1,318,534 | |||||

| Total Telecommunication Services | 2,289,454 | ||||||

| Utilities - 36.7% | |||||||

| Alliant Energy Corp. | 14,900 | 719,521 | |||||

| American Electric Power, Inc. | 8,240 | 659,035 | |||||

| Centerpoint Energy, Inc. | 19,800 | 305,910 | |||||

| Consolidated Edison | 8,100 | 631,800 | |||||

| Dominion Energy, Inc. | 10,900 | 786,871 | |||||

| Duke Energy Corp. | 9,095 | 735,604 | |||||

| Entergy Corp. | 4,170 | 391,855 | |||||

| Eversource Energy | 10,481 | 819,719 | |||||

| Exelon Corp. | 6,500 | 239,265 | |||||

| Firstenergy Corp | 7,605 | 304,732 | |||||

| NextEra Energy, Inc. | 3,170 | 762,765 | |||||

| OGE Energy Corp. Co. | 11,200 | 344,176 | |||||

| Oneok Inc. Co. | 1,600 | 34,896 | |||||

| PPL Corporation | 13,945 | 344,163 | |||||

| Public Service Enterprise Group, Inc. | 12,000 | 538,920 | |||||

| Sempra Corp | 1,740 | 196,603 | |||||

| Southern Company | 14,730 | 797,482 | |||||

| UGI Corp. New Com. | 4,611 | 122,975 | |||||

| WEC Energy Group, Inc. | 10,840 | 955,329 | |||||

| Xcel Energy, Inc. | 12,770 | 770,031 | |||||

| Total Utilities | 10,461,652 | ||||||

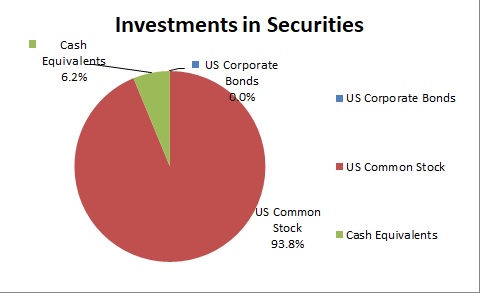

| Total U.S. Common Stock (Cost $31,861,715) | $ 26,760,012 | ||||||

| Cash Equivalents - 6.2% | |||||||

| Total Cash Equivalents (Cost $1,776,938) | $ 1,776,938 | ||||||

| TOTAL INVESTMENT IN SECURITIES (Cost $33,638,653) | $ 28,536,950 | ||||||

| FINANCIAL ACCOUNTING STANDARDS NO. 157 |

The Company adopted the provisions of the Financial Accounting Standards Board Statement of Financial Accounting Standards No. 157, Fair Value Measurements (“FAS 157”), effective January 1, 2008. In accordance with FAS 157, fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. FAS 157 also establishes a framework for measuring fair value, and a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data from sources independent of the Company. Unobservable inputs reflect the Company’s own assumption about the assumptions that market participants would use in pricing the asset or liability developed on the best information available in the circumstance.

The fair value hierarchy is categorized into three levels based on the inputs as follows

Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the ability to access.

Level 2 - Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment spreads, credit risk, yield curves, default rates and similar data.

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Company's own assumptions about the assumption a market participant would use in valuing the asset or liability, and would be based on the best information available.

The following table presents information about the Company’s assets measured at fair market value as of March 31, 2017:

| Investments in Securities | Level 1 | Level 2 | Level 3 | Balance | ||

| US Corporate Bonds | 0 | 0 | ||||

| US Common Stock | 26,760,0212 | 26,760,012 | ||||

| Cash Equivalents | 1,776,938 | 1,776,938 | ||||

| TOTALS | $28,536,950 |

| ITEM 2. | CONTROLS AND PROCEDURES. |

(a) The registrant’s President and Chief Financial Officer have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended) are effective at the reasonable assurance level based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this document.

(b) There were no changes in the registrant’s internal controls over financial reporting that occurred during the fiscal quarter of the period that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

| ITEM 3. | EXHIBITS. |

The following exhibits are attached to this Form N-Q:

| EXHIBIT NO. | DESCRIPTION OF EXHIBIT | |

| 3 (a) (1) | Certification of President | |

| 3 (a) (2) | Certification of Chief Financial Officer | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant): Kavilco Incorporated | ||

| By: | /s/ Louis L. Jones, Sr. | |

| Louis L. Jones, Sr. | ||

| President | ||

Date:April 22, 2020

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/ Scott Burns | |

| Scott Burns | ||

| Chief Financial Officer | ||

| Date: April 22, 2020 | ||