United States

Securities and Exchange Commission

Washington, DC 20549

FORM 10-K

ý Annual Report Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934, as amended (the "Exchange Act")

For the fiscal year ended December 31, 2011

or

o Transition Report Pursuant to Section 13 or 15(d) of the Exchange Act

For

the transition period from to

Commission File Number 001-08029

THE RYLAND GROUP, INC.

(Exact name of registrant as specified in its charter)

| Maryland | 52-0849948 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. employer identification no.) |

3011 Townsgate Road, Suite 200, Westlake Village, California 91361-3027

(Address of principal executive offices)

Registrant's telephone number, including area code: (805) 367-3800

Securities registered pursuant to Section 12(b) of the Exchange Act:

Title of each class |

Name of each exchange on which registered |

|

| Common stock, par value $1.00 per share | New York Stock Exchange | |

| Preferred stock purchase rights | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such

files).

Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes o No ý

The aggregate market value of the common stock of The Ryland Group, Inc. held by nonaffiliates of the registrant (43,690,809 shares) at June 30, 2011, was $722,209,073. The number of shares of common stock of The Ryland Group, Inc. outstanding on February 24, 2012, was 44,434,020.

DOCUMENT INCORPORATED BY REFERENCE

Name of Document

|

Location in Report

|

|

Proxy Statement for the 2012 Annual Meeting of Stockholders |

Part III |

2

THE RYLAND GROUP, INC.

FORM 10-K

INDEX

3

PART I

With headquarters in Southern California, The Ryland Group, Inc., a Maryland corporation (the "Company"), is one of the nation's largest homebuilders and a mortgage-finance company. The Company is traded on the New York Stock Exchange ("NYSE") under the symbol "RYL." Founded in 1967, the Company has built more than 295,000 homes. In addition, Ryland Mortgage Company and its subsidiaries and RMC Mortgage Corporation (collectively referred to as "RMC") have provided mortgage financing and related services for more than 245,000 homebuyers.

The Company consists of six operating business segments: four geographically-determined homebuilding regions; financial services; and corporate. All of the Company's business is conducted and located in the United States. The Company's operations span all significant aspects of the homebuying process—from design, construction and sale to mortgage origination, title insurance, escrow and insurance services. The homebuilding operations are, by far, the most substantial part of its business, comprising approximately 97 percent of consolidated revenues in 2011. The homebuilding segments generate nearly all of their revenues from sales of completed homes, with a lesser amount from sales of land and lots. In addition to building single-family detached homes, the homebuilding segments also build attached homes, such as townhomes, condominiums and some mid-rise buildings, that share common walls and roofs. The Company builds homes for entry-level buyers, as well as for first- and second-time move-up buyers. Its prices generally range from $150,000 to more than $450,000, with the average price of a home closed during 2011 being $251,000. The financial services segment provides mortgage-related products and services, as well as title, escrow and insurance services, to its homebuyers.

The Company has traditionally concentrated on expanding its operations by investing its available capital in both existing and new markets. New and existing communities are evaluated based on return, profitability and cash flow, and both senior and local management are incentivized based on the achievement of such returns. Management monitors the land acquisition process, sales revenues, margins and returns achieved in each of the Company's markets as part of its capital allocation process. (See discussion in Part I, Item 1A, "Risk Factors.")

The Company, which is diversified throughout the United States, believes diversification not only reduces its exposure to economic and market fluctuations, but also enhances its growth potential. Capital is strategically allocated to avoid concentration in any given geographic area and to reduce the risk associated with excessive dependence on local market anomalies. Subject to macroeconomic and local market conditions, the Company generally tries to either manage its exposure or expand its presence in its existing markets in an effort to be among the largest builders in each of those markets. In managing its exposure, the Company may decide to exit a market or reduce its inventory position because of current factors or conditions, or it may determine that a market is no longer viable for the achievement of its strategic goals. In 2011, the Company exited its homebuilding operations in Jacksonville and Dallas. It may seek diversification or expansion by selectively entering new markets, primarily through establishing start-up or satellite operations in markets near its existing divisions.

The Company's national scale has provided opportunities for the negotiation of volume discounts and rebates from material suppliers. Additionally, it has access to a lower cost of capital due to the strength and transparency of its balance sheet, as well as to its relationships within the banking industry and capital markets. The Company believes that economies of scale and diversification may contribute to improvements in its operating margins during periods of growth and mitigate its overall risk.

Committed to product innovation, the Company conducts ongoing research into consumer preferences and trends. It is constantly adapting and improving its floor plans, design features and customized options. The Company strives to offer value, selection, location and quality to all homebuyers.

The Company is dedicated to building quality homes and customer relationships. With customer satisfaction as a major priority, it continues to make innovative enhancements designed to attract homebuyers. The Company continues to develop its ability to collect customer feedback, which includes

4

online systems for tracking requests, processing issues and improving customer interaction. In addition, it uses a third party to analyze customer feedback in order to better serve its homebuyers' needs.

The Company enters into land development joint ventures, from time to time, as a means to building lot positions, reducing its risk profile and enhancing its return on capital. It periodically partners with developers, other homebuilders or financial investors to develop finished lots for sale to the joint ventures' members or other third parties.

Recent Trends

Housing markets in the United States have experienced a prolonged downturn since 2006 due to weak consumer demand for housing and an oversupply of homes available-for-sale. A challenging economic and employment environment, mortgage losses, and related uncertainty within financial and credit markets have led the Company to downsize its operations in response. From mid-2006 through 2011, the Company decreased its overhead, exited or reduced its investments in certain markets, restructured its debt, focused on improving its operating efficiencies, and redesigned its products to be more affordable and less costly to build, all in an effort to better align its operations with current home sale trends.

As a result of improving affordability statistics, demographics and household creation trends, and based upon its experience during prior cycles in the homebuilding industry, the Company believes that attractive land acquisition opportunities exist and may arise for those builders that have the financial strength to take advantage of them. During 2011, the Company judiciously increased its community count to prepare for a slow recovery and to attain volume levels to support a return to profitability. With its strong balance sheet, liquidity, broad geographic presence and experienced personnel, the Company believes that it is well positioned to make selective investments in markets with perceived growth prospects.

Homebuilding

General

The Company's homes are built on-site and marketed in four major geographic regions, or segments: North, Southeast, Texas and West.

Within each of those segments, the Company operated in the following metropolitan areas at December 31, 2011:

| North | Baltimore, Chicago, Indianapolis, Minneapolis, Northern Virginia and Washington, D.C. | |

| Southeast | Atlanta, Charleston, Charlotte, Orlando and Tampa | |

| Texas | Austin, Houston and San Antonio | |

| West | Denver, Las Vegas and Southern California |

The Company has decentralized operations to provide more flexibility to its local division presidents and management teams. Each of its homebuilding divisions across the country generally consists of a division president; a controller; management personnel focused on land entitlement, acquisition and development, sales, construction, customer service and purchasing; and accounting and administrative personnel. The Company's operations in each of its homebuilding markets may differ due to a number of market-specific factors, including regional economic conditions and job growth; land availability and local land development; consumer preferences; competition from other homebuilders; and home resale activity. The Company not only considers each of these factors upon entering into new markets, but also in determining the extent of its operations and the allocation of its capital in existing markets. The market experience and expertise of local management teams are critical in making decisions regarding operations.

The Company markets attached and detached single-family homes, which are generally targeted to entry-level and first- and second-time move-up buyers. Its diverse product line is tailored to the local styles and preferences found in each of its geographic markets. The product line offered in a particular community is determined in conjunction with the land acquisition process and is dependent upon a number of factors, including consumer preferences, competitive product offerings and development costs.

In most of the Company's single-family detached home communities, it offers at least four different floor plans, each with several substantially unique architectural styles. In addition, the exterior of each home

5

may be varied further by the use of stone, stucco, brick or siding. The Company's traditional attached home communities generally offer several different floor plans with two, three or four bedrooms.

Although some of the same basic home designs are found in similar communities within the Company, it is continuously developing new designs to replace or augment existing ones to ensure that its homes reflect current consumer preferences. The Company relies on its own architectural staff and also engages unaffiliated architectural firms to develop new designs. During the past year, the Company introduced 105 new models.

Homebuyers are able to customize certain features of their homes by selecting from numerous options and upgrades displayed in the Company's model homes and design centers. These design centers, which are conveniently located in most of the Company's markets, showcase upgrades that represent increasing sources of additional revenue and profit for the Company. In all of the Company's communities, a wide selection of options is available to homebuyers for additional charges. The number and complexity of options typically increase with the size and base selling price of the home. Custom options contributed 17.2 percent of homebuilding revenues in 2011 and resulted in significantly higher margins in comparison to base homes.

Land Acquisition and Development

The Company's long-term objective is to control a portfolio of building lots sufficient to meet its anticipated homebuilding requirements for a period of approximately three to four years. The Company acquires land only after completing due diligence and feasibility studies. The land acquisition process is controlled by a corporate land approval committee to help ensure that transactions meet the Company's standards for financial performance and risk. In the ordinary course of its homebuilding business, the Company utilizes both direct acquisition and lot option purchase contracts to control building lots for use in the sale and construction of homes. The Company's direct land acquisition activities include the purchase of finished lots from developers and the purchase of undeveloped entitled land from third parties. The Company generally does not purchase unentitled or unzoned land.

Although control of lot inventory through the use of option contracts minimizes the Company's investment, such a strategy is not viable in certain markets due to the absence of third-party land developers. In other markets, competitive conditions may prevent the Company from controlling quality lots solely through the use of option contracts. In such situations, the Company may acquire undeveloped entitled land and/or finished lots on a bulk basis. The Company utilizes the selective development of land to gain access to prime locations, increase margins and position itself as a leader in the area through its influence over a community's character, layout and amenities. After determining the size, style, price range, density, layout and overall design of a community, the Company obtains governmental and other approvals necessary to begin the development process. Land is then graded; roads, utilities, amenities and other infrastructures are installed; and individual homesites are created.

Materials Costs

Substantially all materials used in construction are available from a number of sources, but they may fluctuate in price due to various factors. To increase purchasing efficiencies, the Company not only standardizes certain building materials and products, but also acquires such products through national supply contracts. The Company has, on occasion, experienced shortages of certain materials. If shortages were to occur in the future, such shortages could result in longer construction times and higher costs than those experienced in the past.

Construction

Substantially all on-site construction is performed for a fixed price by independent subcontractors selected on a competitive-bid basis. The Company generally requires a minimum of three competitive bids for each phase of construction. Construction activities are supervised by the Company's production team, which schedules and coordinates subcontractor work; monitors quality; and ensures compliance with local zoning and building codes. The Company requires substantially all of its subcontractors to have workers' compensation insurance and general liability insurance, including construction defect coverage. Construction time for homes depends on weather, availability of labor or subcontractors, materials, home size, geological conditions and other factors. The duration of the home construction process is generally

6

between three and six months. The Company has an integrated financial and homebuilding management system that assists in scheduling production and controlling costs. Through this system, the Company monitors construction status and job costs incurred for each home during each phase of construction. The system provides for detailed budgeting and allows the Company to track and control actual costs, versus construction bids, for each community and subcontractor. The Company has, on occasion, experienced shortages of skilled labor in certain markets. If shortages were to occur in the future, such shortages could result in longer construction times and higher costs than those experienced in the past.

The Company, its subcontractors and its suppliers maintain insurance, subject to deductibles and self-insured amounts, to protect against various risks associated with homebuilding activities, including, among others, general liability, "all-risk" property, workers' compensation, automobile and employee fidelity. The Company accrues for expected costs associated with the deductibles and self-insured amounts, when appropriate.

Marketing

The Company generally markets its homes to entry-level and first- and second-time move-up buyers through targeted product offerings in each of the communities in which it operates. The Company's marketing strategy is determined during the land acquisition and feasibility stages of a community's development. Employees and independent real estate brokers sell the Company's homes, generally by showing furnished models. A new order is reported when a customer's sales contract has been signed by the homebuyer, approved by the Company and secured by a deposit, subject to cancellation. The Company normally starts construction of a home when a customer has selected a lot, chosen a floor plan and received preliminary mortgage approval. However, construction may begin prior to this in order to satisfy market demand for completed homes and to facilitate construction scheduling and/or cost savings. Homebuilding revenues are recognized when home sales are closed, title and possession are transferred to the buyer, and there is no significant continuing involvement from the homebuilder.

The Company advertises directly to potential homebuyers through the Internet and in newspapers and trade publications, as well as with marketing brochures and newsletters. It also uses billboards; radio and television advertising; and its Web site to market the location, price range and availability of its homes. The Company also attempts to operate in conspicuously located communities that permit it to take advantage of local traffic patterns. Model homes play a significant role in the Company's marketing efforts not only by creating an attractive atmosphere, but also by displaying options and upgrades.

The Company's sales contracts typically require an earnest money deposit. The amount of earnest money required varies between markets and communities. Buyers are generally required to pay additional deposits when they select options or upgrades for their homes. Most of the Company's sales contracts stipulate that when homebuyers cancel their contracts with the Company, it has the right to retain their earnest money and option deposits; however, its operating divisions may refund a portion of such deposits. The Company's sales contracts may also include contingencies that permit homebuyers to cancel and receive a refund of their deposits if they cannot obtain mortgage financing at prevailing or specified interest rates within a specified time period, or if they cannot sell an existing home. The length of time between the signing of a sales contract for a home and delivery of the home to the buyer may vary, depending on customer preferences, permit approval and construction cycles.

Customer Service and Warranties

The Company's operating divisions are responsible for conducting pre-closing quality control inspections and responding to homebuyers' post-closing needs. The Company believes that prompt and courteous acknowledgment of its homebuyers' needs during and after construction reduces post-closing repair costs; enhances its reputation for quality and service; and ultimately leads to repeat and referral business.

The Company provides each homeowner with product warranties covering workmanship and materials for one year, certain mechanical systems for two years and structural systems for ten years from the time of closing. The Company believes its warranty program meets or exceeds terms customarily offered in the homebuilding industry. The subcontractors who perform most of the actual construction also provide warranties on workmanship.

7

Seasonality

The Company experiences seasonal variations in its quarterly operating results and capital requirements. Historically, new order activity is higher during the spring and summer months. As a result, the Company typically has more homes under construction, closes more homes, and has greater revenues and operating income in the third and fourth quarters of its fiscal year. Given recent market conditions, historical results are not necessarily indicative of current or future homebuilding activities.

Financial Services

The Company's financial services segment provides mortgage-related products and services, as well as title, escrow and insurance services, to its homebuyers. The Company's financial services segment includes RMC, RH Insurance Company, Inc. ("RHIC"), LPS Holdings Corporation and its subsidiaries ("LPS") and Columbia National Risk Retention Group, Inc. ("CNRRG"). By aligning its operations with the Company's homebuilding segments, the financial services segment leverages this relationship to offer its lending services to homebuyers. Providing mortgage financing and other services to its customers helps the Company monitor its backlog and closing process. Substantially all of the loans the Company originates are sold within a short period of time in the secondary mortgage market on a servicing-released basis. The third-party purchaser then services and manages the loans. During 2011, the Company began to transition mortgage sales from an early purchase program with Bank of America ("BOA," successor to Countrywide Home Loans, Inc.) to other financial institutions due to the bank's decision to exit the correspondent lending business.

Loan Origination

In 2011, RMC's mortgage origination operations consisted primarily of the Company's homebuilder loans, which were originated in connection with sales of the Company's homes. During the year, mortgage operations originated 2,556 loans totaling $564.1 million, the vast majority of which was used for purchasing homes built by the Company and the remainder was used for purchasing homes built by others, purchasing existing homes or refinancing existing mortgage loans.

RMC arranges various types of mortgage financing, including conventional, Federal Housing Administration ("FHA") and Veterans Administration ("VA") mortgages, with various fixed- and adjustable-rate features. RMC is approved to originate loans that conform to the guidelines established by the Federal Home Loan Mortgage Corporation ("Freddie Mac") and the Federal National Mortgage Association ("Fannie Mae"). The Company sells the loans it originates, along with the related servicing rights, to others.

Title and Escrow Services

Cornerstone Title Company, doing business as Ryland Title Company, is a 100 percent-owned subsidiary of RMC that provides escrow and title services and acts as a title insurance agent primarily for the Company's homebuyers. At December 31, 2011, it provided title services in Arizona, Colorado, Florida, Illinois, Indiana, Maryland, Minnesota, Nevada, Texas and Virginia.

Insurance Services

Ryland Insurance Services ("RIS"), a 100 percent-owned subsidiary of RMC, provides insurance services to the Company's homebuyers. At December 31, 2011, RIS was licensed to operate in all of the states in which the Company's homebuilding segments operate. During 2011, it provided insurance services to 41.5 percent of the Company's homebuyers, compared to 46.8 percent during 2010.

RHIC, a 100 percent-owned subsidiary of the Company, provided insurance services to the homebuilding segments' subcontractors in certain markets. Effective June 1, 2008, RHIC ceased providing such services. Registered and licensed under Section 431, Article 19 of the Hawaii Revised Statutes, RHIC is required to meet certain minimum capital and surplus requirements. Additionally, no dividends may be paid without prior approval of the Hawaii Insurance Commissioner.

CNRRG, a 100 percent-owned subsidiary of the Company and some of its affiliates, was established to directly offer insurance, specifically structural warranty coverage, to protect homeowners against liability risks arising in connection with the homebuilding business of the Company and its affiliates.

8

Corporate

Corporate is a non-operating business segment whose purpose is to support operations. Its departments are responsible for establishing operational policies and internal control standards; implementing strategic initiatives; and monitoring compliance with policies and controls throughout the Company's operations. Corporate acts as an internal source of capital and provides financial, human resource, information technology, insurance, legal and tax compliance services. In addition, it performs administrative functions associated with a publicly traded entity.

Real Estate and Economic Conditions

The Company is significantly affected by fluctuations in economic activity, interest rates and levels of consumer confidence. The effects of these fluctuations differ among the various geographic markets in which the Company operates. Higher interest rates and the availability of homeowner financing may affect the ability of buyers to qualify for mortgage financing and reduce the demand for new homes. As a result, rising interest rates generally will decrease the Company's home sales and mortgage originations. In addition, continued tight credit standards negatively impacted the Company's ability to attract homebuyers during 2011. The Company's business is also affected by national and local economic conditions such as employment rates, consumer confidence and housing demand. Many of the Company's markets have experienced a significant decline in housing demand, as well as an oversupply of new and existing homes for sale.

Inventory risk can be substantial for homebuilders. The market value of land, lots and housing inventories fluctuates as a result of changing market and economic conditions. The Company must continuously locate and acquire land not only for expansion into new markets, but also for replacement and expansion of land inventory within current markets. The Company employs various measures designed to control inventory risk, including a corporate land approval process and a continuous review by senior management. It cannot, however, assure that these measures will avoid or eliminate this risk. The Company has experienced substantial losses from inventory valuation adjustments and write-offs in recent periods.

Competition

The Company competes in each of its markets with a large number of national, regional and local homebuilding companies. The strong presence of national homebuilders, plus the viability of regional and local homebuilders, impacts the level of competition in many markets. The Company also competes with other housing alternatives, including existing homes and rental properties. Principal competitive factors in the homebuilding industry include price; design; quality; reputation; relationships with developers; accessibility of subcontractors; availability and location of lots; and availability of customer financing. The Company's financial services segment competes with other mortgage bankers to arrange financing for homebuyers. Principal competitive factors include interest rates, fees and other mortgage loan product features available to the consumer.

Employees

At December 31, 2011, the Company had 922 employees. The Company considers its employee relations to be good. No employees are represented by a collective bargaining agreement.

Web Site Access to Reports

The Company files annual, quarterly and special reports; proxy statements; and other information with the U.S. Securities and Exchange Commission ("SEC") under the Exchange Act and the Securities Act of 1933, as amended (the "Securities Act"). The Company files information electronically with the SEC, and its filings are available from the SEC's Web site at www.sec.gov. The Company's Web site address is www.ryland.com. Information on the Company's Web site is not part of this report. The Company makes its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, XBRL filings, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act available on its Web site as soon as possible after it electronically files such material with or furnishes it to the SEC. To retrieve any of this information, visit www.ryland.com, select "Investor Relations" and scroll down the page to "SEC Filings." Through its Web site, the Company shares information about itself with the securities marketplace.

9

The homebuilding industry is cyclical in nature and has experienced downturns, which have in the past and may in the future cause the Company to incur losses in financial and operating results.

The Company is affected by the cyclical nature of the homebuilding industry, which is sensitive to many factors, including fluctuations in general and local economic conditions; interest rates; housing demand; employment levels; levels of new and existing homes for sale; demographic trends; availability of homeowner financing; and consumer confidence. In recent years, the markets served by the Company, and the U.S. homebuilding industry as a whole, continued to experience a prolonged decrease in demand for new homes, as well as an oversupply of new and existing homes available-for-sale. The homebuilding industry has been impacted by a lack of consumer confidence and a softening of demand for new homes, which has resulted in increased home inventories. In addition, an oversupply of alternatives to new homes, such as rental properties and existing homes, has further depressed prices and reduced margins. These trends resulted in higher inventories of unsold homes in 2011, compared to the past several years. The Company cannot predict how long these market conditions will persist and what effect they might have on the Company's financial and operating performance.

The homebuilding industry has experienced a significant downturn over the last several years. A continuing decline in demand for new homes, coupled with an increase in the inventory of available existing homes and alternatives to new homes, could adversely affect the Company's sales volume and pricing even more than has occurred to date.

The homebuilding industry has experienced a significant downturn over the last several years. As a result, the Company has experienced a decline in demand for newly built homes in almost all of its markets. This decline in demand, together with an oversupply of alternatives, such as rental properties and used homes (including foreclosed homes), has depressed prices. This combination of lower demand and higher inventories affects both the number of homes the Company can sell and the prices at which it can sell them. In 2009, the Company experienced periods of significant decline in its sales results; reduced margins as a result of higher levels of sales incentives and price concessions; and higher than normal cancellation rates. In 2010 and 2011, the Company's margins approached closer to normal market levels, but demand continued to be weak due to a significant inventory for used homes, including foreclosed homes.

Demand for new homes is sensitive to economic conditions over which the Company has no control, such as the availability of mortgage financing and the level of employment.

Demand for new homes is sensitive to changes in economic conditions such as the level of employment, consumer confidence, consumer income, the availability of financing and interest rate levels. During the last few years, the mortgage lending industry has experienced significant instability. As a result of increased default rates, particularly (but not entirely) with regard to subprime and other nonconforming loans, many lenders have reduced their willingness to make residential mortgage loans and have tightened their credit requirements with regard to them. Fewer loan products, stricter loan qualification standards and higher down payments have made it more difficult for some borrowers to finance home purchases. Although the Company's financial services segment offers mortgage loans to potential buyers, the Company may no longer be able to offer financing terms that are attractive to its potential buyers. Lack of available mortgage financing at acceptable rates reduces demand for the homes the Company builds and, in some instances, causes potential buyers to cancel contracts they have signed.

There has also been a substantial loss of jobs in the United States during the last several years. People who are unemployed or concerned about job loss are unlikely to purchase new homes and may be forced to sell the homes they own. Therefore, current employment levels can adversely affect the Company both by reducing demand for the homes it builds and by increasing the supply of homes for sale.

Because most of the Company's homebuyers finance the purchase of their homes, the terms and availability of mortgage financing can affect the demand for and the ability to complete the purchase of a home, as well as the Company's future operating and financial results.

The Company's business and earnings depend on the ability of its homebuyers to obtain financing for the purchase of their homes. Many of the Company's homebuyers must sell their existing homes in order to buy a home from the Company. During 2011, 2010 and 2009, the mortgage lending industry as a whole experienced significant instability due to, among other things, defaults on subprime and other loans,

10

resulting in the declining market value of such loans. In light of these developments, lenders, investors, regulators and other third parties questioned the adequacy of lending standards and other credit requirements for several loan programs made available to borrowers in recent years. This has led to tightened credit requirements and an increase in indemnity claims for mortgages that were originated and sold by the Company. Deterioration in credit quality among subprime and other nonconforming loans has caused most lenders to eliminate subprime mortgages and most other loan products that do not conform to Fannie Mae, Freddie Mac, FHA or VA standards. Fewer loan products and tighter loan qualifications, in turn, make it more difficult for a borrower to finance the purchase of a new home or the purchase of an existing home from a potential move-up buyer who wishes to purchase one of the Company's homes. In general, these developments have resulted in reduced demand for homes sold by the Company and have delayed any general improvement in the housing market. This, in turn, has decreased demand for mortgage loans that the Company originates through RMC. If the Company's potential homebuyers or the buyers of the homebuyers' existing homes cannot obtain suitable financing, or if increased indemnity claims are made for mortgages that are originated and sold, the result will have an adverse effect on the Company's operating and financial results and performance.

Interest rate increases or changes in federal lending programs or regulation could lower demand for the Company's homes and affect the Company's profitability.

Most of the Company's customers finance the purchase of their homes. Prior to 2006, historically low interest rates and the increased availability of specialized mortgage products, including those requiring no or low down payments, and interest-only and adjustable-rate mortgages, made homebuying more affordable for a number of customers and more available to customers with lower credit scores.

Rising interest rates, decreased availability of mortgage financing or of certain mortgage programs, higher down payment requirements or increased monthly mortgage costs, as discussed above, may lead to reduced demand for the Company's homes and mortgage loans. Increased interest rates can also hinder the Company's ability to realize its backlog because its home purchase contracts provide customers with a financing contingency. Financing contingencies allow customers to cancel their home purchase contracts in the event that they cannot arrange for adequate financing. As a result, rising interest rates can decrease the Company's home sales and mortgage originations. Any of these factors could have an adverse impact on the Company's results of operations or financial position.

As a result of turbulence in the credit markets and mortgage finance industry in 2008 and 2009, the federal government has taken on a significant role in supporting mortgage lending through its conservatorship of Fannie Mae and Freddie Mac, both of which purchase home mortgages and mortgage-backed securities originated by mortgage lenders, and its insurance of mortgages originated by lenders through the FHA and VA. FHA backing of mortgages has recently been particularly important to the mortgage finance industry and to the Company's business. In 2011, 57.8 percent of the Company's homebuyers who chose to finance with RMC purchased a home using an FHA- or VA-backed loan. In addition, the Federal Reserve has purchased a sizable amount of mortgage-backed securities in an effort to stabilize mortgage interest rates and to support the market for mortgage-backed securities, a program that ended in 2010. The availability and affordability of mortgage loans, including consumer interest rates for such loans, could be adversely affected by a curtailment or ceasing of the federal government's mortgage-related programs or policies. The FHA may continue to impose stricter loan qualification standards, raise minimum down payment requirements, impose higher mortgage insurance premiums and other costs, and/or limit the number of mortgages it insures. Due to growing federal budget deficits, the U.S. Treasury may not be able to continue supporting the mortgage-related activities of Fannie Mae, Freddie Mac, the FHA and the VA at present levels, or it may revise significantly the federal government's participation in and support of the residential mortgage market.

Because the availability of Fannie Mae, Freddie Mac, FHA- and VA-backed mortgage financing is an important factor in marketing and selling many of the Company's homes, any limitations, restrictions, or changes in the availability of such government-backed financing could reduce its home sales and adversely affect the Company's results of operations, including the income from RMC.

11

Mortgage defaults by homebuyers who financed homes using nontraditional financing products are increasing the number of homes available for resale.

During the period of high demand in the homebuilding industry, many homebuyers financed their purchases using nontraditional adjustable-rate or interest-only mortgages or other mortgages, including subprime mortgages that involved, at least during initial years, monthly payments that were significantly lower than those required by conventional fixed-rate mortgages. As a result, new homes became more affordable. However, as monthly payments for these homes increased as a result of either rising adjustable interest rates or principal payments coming due, some of these homebuyers have defaulted on their payments and had their homes foreclosed, which has increased the inventory of homes available for resale. Foreclosure sales and other distress sales may result in further declines in market prices for homes. In an environment of declining home prices, many homebuyers may delay purchases of homes in anticipation of lower prices in the future. In addition, as lenders have perceived deterioration in the credit quality of homebuyers, they have been eliminating some of their available nontraditional and subprime financing products, as well as increasing qualifications needed for mortgages and adjusting terms to address increased credit risk. In general, to the extent mortgage rates increase or lenders make it harder for prospective buyers to finance home purchases, it becomes more difficult or costly for customers to purchase the Company's homes, which has an adverse effect on its sales volume.

The Company may be subject to indemnification claims on mortgages sold to third parties.

Substantially all of the loans the Company originates are sold within a short period of time in the secondary mortgage market on a servicing-released basis. The mortgage industry has experienced substantial increases in delinquencies, foreclosures and foreclosures-in-process. All mortgages are generally sold, although under certain limited circumstances, RMC is required to indemnify loan investors for losses incurred on sold loans. Reserves are created to address repurchase and indemnity claims made by these third-party investors or purchasers. These reserves are based on pending claims received that are associated with previously sold mortgage loans, industry foreclosure data, the Company's portfolio delinquency and foreclosure rates on sold loans made available by investors, as well as on historical loss payment patterns used to develop ultimate loss projections. Estimating loss has been made more difficult by the recent processing delays related to foreclosure losses affecting agencies and financial institutions. Because of the uncertainties inherent in estimating these matters, the Company cannot provide assurance that the amounts reserved will be adequate or that any potential inadequacies will not have an adverse effect on its results of operations.

Tax law changes could make home ownership more expensive or less attractive.

Significant expenses of owning a home, including mortgage interest expense and real estate taxes, generally are deductible expenses for the purpose of calculating an individual's federal and, in some cases, state taxable income, subject to various limitations under current tax law and policy. If the federal or state governments change income tax laws, as some policymakers have discussed, by eliminating or substantially reducing these income tax benefits, the after-tax cost of owning a new home will increase significantly. This could adversely impact both demand for and/or sales prices of new homes.

The Company is subject to inventory risk for its land, options for land, building lots and housing inventory.

The market value of the Company's land, building lots and housing inventories fluctuates as a result of changing market and economic conditions. In addition, inventory carrying costs can result in losses in poorly performing projects or markets. Changes in economic and market conditions have caused the Company to dispose of land and options for land and housing inventories on a basis that has resulted in loss and required it to write down or reduce the carrying value of its inventory. During the year ended December 31, 2011, the Company decided not to pursue development and construction in certain areas where it held land or had made option deposits, which resulted in $1.7 million in recorded write-offs of option deposits and preacquisition costs. In addition, market conditions led to recorded land-related impairments on communities and land in the aggregate amount of $13.7 million during the same period. The Company can provide no assurance that it will not need to record additional write-offs in the future.

In the course of its business, the Company makes acquisitions of land. Although it employs various measures, including its land approval process and continued review by senior management, designed to

12

manage inventory risk, the Company cannot assure that these measures will enable it to avoid or eliminate its inventory risk.

Construction costs can fluctuate and impact the Company's margins.

The homebuilding industry has, from time to time, experienced significant difficulties, including shortages of qualified tradespeople; reliance on local subcontractors who may be inadequately capitalized; shortages of materials; and volatile increases in the cost of materials, particularly increases in the price of lumber, drywall and cement, which are significant components of home construction costs. The Company may not be able to recapture increased costs by raising prices because of either market conditions or because it fixes its prices at the time home sales contracts are signed.

Supply shortages and other risks related to demand for building materials and/or skilled labor could increase costs and delay deliveries.

There is a high level of competition in the homebuilding industry for skilled labor and building materials. Rising costs or shortages in building materials or skilled labor could cause increases in construction costs and construction delays. The Company is generally unable to pass on increases in construction costs to homebuyers who have already entered into purchase contracts. Purchase contracts generally fix the price of the home at the time the contract is signed, and this may occur well in advance of when construction commences. Further, the Company may not be able to pass on rising construction costs because of market conditions. Sustained increases in construction costs due to competition for materials and skilled labor and higher commodity prices (including prices for lumber, metals and other building material inputs), among other things, may decrease the Company's margins over time.

Shortages in the availability of subcontract labor may delay construction schedules and increase the Company's costs.

The Company conducts its construction operations only as a general contractor. Virtually all architectural, construction and development work is performed by unaffiliated third-party subcontractors. As a consequence, the Company depends on the continued availability of and satisfactory performance by these subcontractors for the design and construction of its homes. The Company cannot make assurances that there will be sufficient availability of and satisfactory performance by these unaffiliated third-party subcontractors. In addition, inadequate subcontractor resources could delay the Company's construction schedules and have a material adverse effect on its business.

Because the homebuilding industry is competitive, the business practices of other homebuilders can have an impact on the Company's financial results and cause these results to decline.

The residential homebuilding industry is highly competitive. The Company competes in each of its markets with a large number of national, regional and local homebuilding companies. This competition could cause the Company to adjust selling prices in response to competitive conditions in the markets in which it operates and could require it to increase the use of sales incentives. The Company cannot predict whether these measures will be successful or if additional incentives will be made in the future. It also competes with other housing alternatives, including existing homes and rental housing. The homebuilding industry's principal competitive factors are home price, availability of customer financing, design, quality, reputation, relationships with developers, accessibility of subcontractors, and availability and location of homesites. Any of the foregoing factors could have an adverse impact on the Company's financial performance and results of operations.

The Company's financial services segment competes with other mortgage bankers to arrange financing for homebuyers. The principal competitive factors for the financial services segment include interest rates, fees and other features of mortgage loan products available to the consumer.

Homebuilding is subject to warranty claims in the ordinary course of business that can be subject to uncertainty.

As a homebuilder, the Company is subject to warranty claims arising in the ordinary course of business. The Company records warranty and other reserves for the homes it sells to cover expected costs of materials and outside labor during warranty periods based on historical experience in the Company's markets and judgment of the qualitative risks associated with the types of homes built by the Company, including an analysis of historical claims. Because of the uncertainties inherent to these matters, the

13

Company cannot provide assurance that the amounts reserved for warranty claims will be adequate or that any potential inadequacies will not have an adverse effect on its results of operations.

Because the Company's business is subject to various regulatory and environmental limitations, it may not be able to conduct its business as planned.

The Company's homebuilding segments are subject to various local, state and federal laws, statutes, ordinances, rules and regulations concerning zoning, building design, construction, stormwater permitting and discharge, and similar matters, as well as open spaces, wetlands and environmentally protected areas. These include local regulations that impose restrictive zoning and density requirements in order to limit the number of homes that can be built within the boundaries of a particular area, as well as other municipal or city land planning restrictions, requirements or limitations. The Company may also experience periodic delays in homebuilding projects due to regulatory compliance, municipal appeals and other government planning processes in any of the areas in which it operates. These factors could result in delays or increased operational costs.

With respect to originating, processing, selling and servicing mortgage loans, the Company's financial services segment is subject to the rules and regulations of the FHA, Freddie Mac, Fannie Mae, VA and U.S. Department of Housing and Urban Development ("HUD"). Mortgage origination activities are further subject to the Equal Credit Opportunity Act, Federal Truth-in-Lending Act and the Real Estate Settlement Procedures Act, and their associated regulations. These and other federal and state statutes and regulations prohibit discrimination and establish underwriting guidelines that include provisions for audits, inspections and appraisals; require credit reports on prospective borrowers; fix maximum loan amounts; and require the disclosure of certain information concerning credit and settlement costs. The Company is required to submit audited financial statements annually, and each agency or other entity has its own financial requirements. The Company's affairs are also subject to examination by these entities at all times to assure compliance with applicable regulations, policies and procedures.

The Company's ability to grow its business and operations depends, to a significant degree, upon its ability to access capital on favorable terms.

The ability to access capital on favorable terms is an important factor in growing the Company's business and operations in a profitable manner. In 2007, Moody's lowered the Company's debt rating to non-investment grade, and Standard & Poor's ("S&P") also reduced the Company's investment-grade rating to non-investment grade in 2008. The Company received additional downgrades in 2008 and 2011. At December 31, 2011, Moody's and S&P reported the Company's rating outlook as stable. The loss of an investment-grade rating affects the cost, availability and terms of credit available to the Company, making it more difficult and costly to access the debt capital markets for funds that may be required to implement its business plans.

Natural disasters may have a significant impact on the Company's business.

The climates and geology of many of the states in which the Company operates present increased risks of natural disasters. To the extent that hurricanes, severe storms, tornadoes, earthquakes, droughts, floods, wildfires or other natural disasters or similar events occur, its business and financial condition may be adversely affected.

The Company's net operating loss carryforwards could be substantially limited if it experiences an ownership change as defined in the Internal Revenue Code.

The Company has experienced and continues to experience substantial operating losses, including realized losses for tax purposes from sales of inventory and land previously written down for financial statement purposes, which would produce net operating losses and unrealized losses that may reduce potential future federal income tax obligations. It may also generate net operating loss carryforwards in future years.

Section 382 of the Internal Revenue Code contains rules that limit the ability of a company that undergoes an ownership change, which is generally any change in ownership of more than 50.0 percent of its stock over a three-year period, to utilize its net operating loss carryforwards and certain built-in losses recognized in years after the ownership change. These rules generally operate by focusing on ownership changes among stockholders owning directly or indirectly 5.0 percent or more of the stock of a company and any change in ownership arising from a new issuance of stock by the company.

14

If the Company undergoes an ownership change for purposes of Section 382 as a result of future transactions involving its common stock, including purchases or sales of stock between 5.0 percent stockholders, the Company's ability to use its net operating loss carryforwards and to recognize certain built-in losses would be subject to the limitations of Section 382. Depending on the resulting limitation, a significant portion of the Company's net operating loss carryforwards could expire before it would be able to use them. The Company's inability to utilize its net operating loss carryforwards could have a negative impact on its financial position and results of operations.

In late 2008 and early 2009, the Company adopted a shareholder rights plan and amended its charter to implement certain share transfer restrictions in order to preserve stockholder value and the value of certain tax assets primarily associated with net operating loss carryforwards and built-in losses under Section 382 of the Internal Revenue Code. The shareholder rights plan and charter provisions are intended to prevent share transfers that could cause a loss of these tax assets. Both the rights plan and the charter amendment were approved by the Company's stockholders. The Company can provide no assurance that the rights plan and charter provisions will protect the Company's ability to use its net operating losses and unrealized losses to reduce potential future federal income tax obligations.

Information technology failures and data security breaches could harm the Company's business.

The Company's information technology systems are dependent upon global communications providers, web browsers, telephone systems and other aspects of the Internet infrastructure that have experienced significant systems failures and electrical outages in the past. While the Company takes measures to ensure its major systems have redundant capabilities, the Company's systems are susceptible to outages from fire, floods, power loss, telecommunications failures, break-ins, cyber-attacks and similar events. Despite the Company's implementation of network security measures, its servers are vulnerable to computer viruses, break-ins and similar disruptions from unauthorized tampering with its computer systems. The occurrence of any of these events could disrupt or damage the Company's information technology systems and hamper its internal operations, the Company's ability to provide services to its customers and the ability of its customers to access the Company's information technology systems. In addition, the Company's business requires the collection and retention of large volumes of internal and customer data. The Company also maintains personally identifiable information about its employees. The integrity and protection of customer, employee and company data is critical to the Company. A material network breach in the security of the Company's information technology systems could include the theft of customer or employee data or its intellectual property or trade secrets. To the extent that any disruptions or security breach results in a loss or damage to the Company's data, or in inappropriate disclosure of confidential information, it could cause significant damage to its reputation, affect relationships with its customers, reduce demand for the Company's services, lead to claims against the Company and ultimately harm its business. In addition, the Company may be required to incur significant costs to protect against damage caused by these disruptions or security breaches in the future.

The Company's short-term investments and marketable securities are subject to certain risks which could materially adversely affect overall financial position.

The Company invests a portion of its available cash and cash equivalent balances by purchasing marketable securities with maturities in excess of three months in a managed portfolio. The primary objectives of these investments are the preservation of capital and maintaining a high degree of liquidity, with a secondary objective of attaining higher yields than those earned on the Company's cash and cash equivalent balances. Should any of the Company's short-term investments or marketable securities lose value or have their liquidity impaired, it could materially and adversely affect the Company's overall financial position by limiting its ability to fund operations.

Item 1B. Unresolved Staff Comments

None.

15

The Company leases office space for its corporate headquarters in Westlake Village, California, and for its IT Department and RMC's operations center in Scottsdale, Arizona. In addition, the Company leases office space in the various markets in which it operates.

Contingent liabilities may arise from obligations incurred in the ordinary course of business or from the usual obligations of on-site housing producers for the completion of contracts.

On December 23, 2011, Countrywide Home Loans, Inc. filed a lawsuit against RMC in California alleging breach of contract related to representations and warranties under a loan purchase agreement dated June 26, 1995, between Countrywide and RMC, breach of contract related to repurchase obligations, and breach of contract related to indemnity obligations. The Company intends to vigorously defend itself against the asserted allegations and causes of actions contained within this lawsuit. (See Note K, "Commitments and Contingencies.")

The Company is party to various other legal proceedings generally incidental to its businesses. Based on evaluation of these matters and discussions with counsel, management believes that liabilities arising from these matters will not have a material adverse effect on the financial condition, results of operations and cash flows of the Company.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market for Common Equity, Common Stock Prices and Dividends

The Company lists its common shares on the NYSE, trading under the symbol "RYL." The latest reported sale price of the Company's common stock on February 14, 2012, was $20.48, and there were approximately 1,859 common stockholders of record on that date.

The following table presents high and low market prices, as well as dividend information, for the Company:

2011 |

HIGH |

LOW |

DIVIDENDS DECLARED PER SHARE |

2010 |

HIGH |

LOW |

DIVIDENDS DECLARED PER SHARE |

|||||||||||||

| First quarter | $ | 19.28 | $ | 15.59 | $ | 0.03 | First quarter | $ | 24.99 | $ | 19.52 | $ | 0.03 | |||||||

| Second quarter | 18.29 | 15.47 | 0.03 | Second quarter | 26.03 | 15.39 | 0.03 | |||||||||||||

| Third quarter | 17.15 | 9.39 | 0.03 | Third quarter | 18.12 | 15.25 | 0.03 | |||||||||||||

| Fourth quarter | 16.22 | 9.15 | 0.03 | Fourth quarter | 18.29 | 14.16 | 0.03 | |||||||||||||

Issuer Purchases of Equity Securities

On December 6, 2006, the Company announced that it had received authorization from its Board of Directors to purchase shares totaling $175.0 million. During 2007, 747,000 shares had been repurchased in accordance with this authorization. At December 31, 2011, there was $142.3 million, or 9.0 million additional shares, available for purchase in accordance with this authorization, based on the Company's stock price on that date. This authorization does not have an expiration date. The Company did not purchase any of its own equity securities during the years ended December 31, 2011, 2010 or 2009.

16

Performance Graph

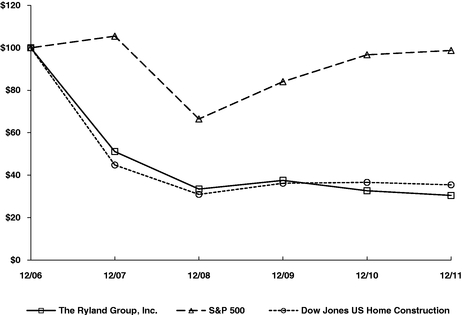

The following performance graph and related information shall not be deemed "soliciting material" or be "filed" with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act or the Exchange Act, except to the extent that the Company specifically incorporates it by reference into such filing.

The following graph compares the Company's cumulative total stockholder returns since December 31, 2006, to the Dow Jones U.S. Home Construction and S&P 500 indices for the calendar years ended December 31:

COMPARISON OF 5-YEAR CUMULATIVE TOTAL RETURN1

Among The Ryland Group, Inc., The S&P 500 Index

And The Dow Jones U.S. Home Construction Index

1 $100 invested on 12/31/06 in stock or index, including reinvestment of dividends.

Securities Authorized for Issuance Under Equity Compensation Plans

The Company's equity compensation plan information as of December 31, 2011, is summarized as follows:

| |

NUMBER OF SECURITIES TO BE ISSUED UPON EXERCISE OF OUTSTANDING OPTIONS, WARRANTS AND RIGHTS |

WEIGHTED-AVERAGE EXERCISE PRICE OF OUTSTANDING OPTIONS, WARRANTS AND RIGHTS |

NUMBER OF SECURITIES REMAINING AVAILABLE FOR FUTURE ISSUANCE UNDER EQUITY COMPENSATION PLANS (EXCLUDING SECURITIES REFLECTED IN COLUMN (a)) |

|||

|---|---|---|---|---|---|---|

| PLAN CATEGORY |

(a) |

(b) |

(c) |

|||

Equity compensation plans approved by stockholders |

4,606,699 | $ 28.91 | 3,522,508 | |||

Equity compensation plans not approved by stockholders1 |

– |

– |

– |

|||

- 1

- The Company does not have any equity compensation plans that have not been approved by stockholders.

17

Item 6. Selected Financial Data

|

YEAR ENDED DECEMBER 31, | |||||||||||||||

(in millions, except per share data) |

2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||

ANNUAL RESULTS |

||||||||||||||||

REVENUES |

||||||||||||||||

Homebuilding |

$ | 863 | $ | 970 | $ | 1,144 | $ | 1,741 | $ | 2,704 | ||||||

Financial services |

28 | 32 | 42 | 64 | 92 | |||||||||||

TOTAL REVENUES |

891 | 1,002 | 1,186 | 1,805 | 2,796 | |||||||||||

Cost of sales |

745 | 863 | 1,216 | 1,878 | 2,796 | |||||||||||

Operating expenses |

181 | 206 | 225 | 305 | 398 | |||||||||||

TOTAL EXPENSES |

926 | 1,069 | 1,441 | 2,183 | 3,194 | |||||||||||

Gain from marketable securities, net |

4 | 5 | 4 | – | – | |||||||||||

(Loss) income related to early retirement of debt, net |

(2 | ) | (19 | ) | 11 | (1 | ) | – | ||||||||

Loss from continuing operations before taxes |

(33 | ) | (81 | ) | (240 | ) | (379 | ) | (398 | ) | ||||||

Tax (benefit) expense |

(3 | ) | – | (97 | ) | (9 | ) | (86 | ) | |||||||

Net loss from continuing operations |

(30 | ) | (81 | ) | (143 | ) | (370 | ) | (312 | ) | ||||||

Loss from discontinued operations, net of taxes |

(21 | ) | (4 | ) | (19 | ) | (27 | ) | (22 | ) | ||||||

NET LOSS |

$ | (51 | ) | $ | (85 | ) | $ | (162 | ) | $ | (397 | ) | $ | (334 | ) | |

YEAR-END POSITION |

||||||||||||||||

ASSETS |

||||||||||||||||

Cash, cash equivalents and marketable securities |

$ | 563 | $ | 739 | $ | 815 | $ | 423 | $ | 243 | ||||||

Housing inventories |

795 | 752 | 612 | 994 | 1,663 | |||||||||||

Other assets |

186 | 111 | 208 | 336 | 486 | |||||||||||

Assets of discontinued operations |

35 | 51 | 59 | 109 | 158 | |||||||||||

TOTAL ASSETS |

1,579 | 1,653 | 1,694 | 1,862 | 2,550 | |||||||||||

LIABILITIES |

||||||||||||||||

Debt and financial services credit facility |

874 | 880 | 854 | 781 | 828 | |||||||||||

Other liabilities |

215 | 207 | 251 | 327 | 507 | |||||||||||

Liabilities of discontinued operations |

6 | 4 | 7 | 15 | 21 | |||||||||||

TOTAL LIABILITIES |

1,095 | 1,091 | 1,112 | 1,123 | 1,356 | |||||||||||

NONCONTROLLING INTEREST |

34 | 62 | – | 14 | 69 | |||||||||||

STOCKHOLDERS' EQUITY |

$ | 450 | $ | 500 | $ | 582 | $ | 725 | $ | 1,125 | ||||||

PER COMMON SHARE DATA |

||||||||||||||||

NET LOSS |

||||||||||||||||

Basic |

||||||||||||||||

Continuing operations |

$ | (0.67 | ) | $ | (1.83 | ) | $ | (3.30 | ) | $ | (8.69 | ) | $ | (7.40 | ) | |

Discontinued operations |

(0.47 | ) | (0.10 | ) | (0.44 | ) | (0.64 | ) | (0.52 | ) | ||||||

Total |

(1.14 | ) | (1.93 | ) | (3.74 | ) | (9.33 | ) | (7.92 | ) | ||||||

Diluted |

||||||||||||||||

Continuing operations |

(0.67 | ) | (1.83 | ) | (3.30 | ) | (8.69 | ) | (7.40 | ) | ||||||

Discontinued operations |

(0.47 | ) | (0.10 | ) | (0.44 | ) | (0.64 | ) | (0.52 | ) | ||||||

Total |

$ | (1.14 | ) | $ | (1.93 | ) | $ | (3.74 | ) | $ | (9.33 | ) | $ | (7.92 | ) | |

DIVIDENDS DECLARED |

$ | 0.12 | $ | 0.12 | $ | 0.12 | $ | 0.39 | $ | 0.48 | ||||||

STOCKHOLDERS' EQUITY |

$ | 10.12 | $ | 11.31 | $ | 13.27 | $ | 16.97 | $ | 26.68 | ||||||

18

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following management's discussion and analysis is intended to assist the reader in understanding the Company's business and is provided as a supplement to, and should be read in conjunction with, the Company's consolidated financial statements and accompanying notes. The Company's results of operations discussed below are presented in conformity with U.S. generally accepted accounting principles ("GAAP").

Forward-Looking Statements

Certain statements in this Annual Report may be regarded as "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, and may qualify for the safe harbor provided for in Section 21E of the Exchange Act. These forward-looking statements represent the Company's expectations and beliefs concerning future events, and no assurance can be given that the results described in this Annual Report will be achieved. These forward-looking statements can generally be identified by the use of statements that include words such as "anticipate," "believe," "could," "estimate," "expect," "foresee," "goal," "intend," "likely," "may," "plan," "project," "should," "target," "will" or other similar words or phrases. All forward-looking statements contained herein are based upon information available to the Company on the date of this Annual Report. Except as may be required under applicable law, the Company does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

These forward-looking statements are subject to risks, uncertainties and other factors, many of which are outside of the Company's control that could cause actual results to differ materially from the results discussed in the forward-looking statements. The factors and assumptions upon which any forward-looking statements herein are based are subject to risks and uncertainties which include, among others:

- •

- economic changes nationally or in the Company's local markets, including volatility and increases in interest rates, the impact of, and changes in, governmental stimulus, tax and deficit reduction programs, inflation, changes in consumer demand and confidence levels and the state of the market for homes in general;

- •

- changes and developments in the mortgage lending market, including revisions to underwriting standards for borrowers and lender requirements for originating and holding mortgages, changes in government support of and participation in such market, and delays or changes in terms and conditions for the sale of mortgages originated by the Company;

- •

- the availability and cost of land and the future value of land held or under development;

- •

- increased land development costs on projects under development;

- •

- shortages of skilled labor or raw materials used in the production of homes;

- •

- increased prices for labor, land and materials used in the production of homes;

- •

- increased competition, including continued competition and price pressure from distressed home sales;

- •

- failure to anticipate or react to changing consumer preferences in home design;

- •

- increased costs and delays in land development or home construction resulting from adverse weather conditions or other factors;

- •

- potential delays or increased costs in obtaining necessary permits as a result of changes to laws, regulations or governmental policies (including those that affect zoning, density, building standards, the environment and the residential mortgage industry);

- •

- delays in obtaining approvals from applicable regulatory agencies and others in connection with the Company's communities and land activities;

- •

- changes in the Company's effective tax rate and assumptions and valuations related to its tax accounts;

- •

- the risk factors set forth in this Annual Report on Form 10-K; and

- •

- other factors over which the Company has little or no control.

19

Results of Operations

Overview

During the second half of 2011, attractive housing affordability levels; modest improvement in economic and unemployment indicators; unsustainably low permit and construction activity; and moderate changes in buyer perceptions appear to have had an impact on the Company's ability to attract qualified homebuyers. New home prices have stabilized, required sales incentives have declined, sales traffic through the Company's communities has increased and sales rates have risen slightly. The Company has recently begun to experience lower cancellation levels and valuation adjustments. On average, its ability to generate incremental sales without forfeiting margin has improved, and it reported an increase in sales volume for the year. The Company believes that these trends may be early indicators that new housing markets have begun to stabilize. These developments, combined with reductions in absolute overhead expenditures, have allowed the Company to be profitable in the fourth quarter of 2011. However, an uncertain macroeconomic environment; tight mortgage credit standards and mortgage availability; and a large inventory of lender-controlled homes acquired through foreclosure continued to impact the homebuilding industry by keeping sales absorptions per community depressed, compared to traditional levels. Despite the aforementioned signs of stabilization in selective markets, which has led to limited progress in sales and gross margins, the Company continues to pursue additional advances in profitability through cost efficiencies. It will operate its business with the view that difficult conditions may persist for the near term until more pronounced improvements in demand occur. The Company continues to believe that meaningful advances in revenue growth and financial performance will primarily come from higher demand in the form of a return to more traditional absorption rates.

The Company reported a decrease in closing volume for the year ended December 31, 2011, compared to 2010, primarily due to the effect of uncertainty regarding economic and home price trends on sales in 2010 and the first half of 2011, partially offset by a rise in the number of active communities in which it operated and by efforts designed to more effectively promote its product and increase its market share.

During the year, the Company exited the Dallas and Jacksonville markets in order to redeploy inventory investments to more profitable markets and leverage these operations to achieve lower relative overhead and higher margins, as well as to preserve liquidity. Management's Discussion and Analysis of Financial Condition and Results of Operations is based on the Company's continuing operations and excludes discontinued operations, unless otherwise indicated. (See Note M, "Discontinued Operations.")

For the year ended December 31, 2011, the Company reported a total consolidated net loss of $50.8 million, or $1.14 per diluted share, compared to a consolidated net loss of $85.1 million, or $1.93 per diluted share, for 2010 and a consolidated net loss of $162.5 million, or $3.74 per diluted share, for 2009. The Company's net loss from continuing operations totaled $29.9 million, or $0.67 per diluted share, for the year ended December 31, 2011, compared to a net loss of $80.7 million, or $1.83 per diluted share, for 2010 and a net loss of $143.3 million, or $3.30 per diluted share, for 2009. The decrease in net loss for 2011, compared to 2010, was primarily due to lower inventory and other valuation adjustments and write-offs and to a decline in interest expense, partially offset by lower closing volume and by a higher selling, general and administrative expense ratio. In spite of reporting a net loss, the Company continued its progress toward profitability by raising gross margins through continued investments in new, more profitable communities; exiting and completing less desirable markets and communities; cautiously growing overall inventory levels while reducing debt; lowering interest expense; and decreasing selling, general and administrative expense dollars through cost-saving initiatives and leverage. The decline in net loss for 2010, compared to 2009, was primarily due to lower inventory and other valuation adjustments and write-offs and to higher gross profit margins exclusive of impairments, partially offset by increased interest expense, reduced closing volume and a higher selling, general and administrative expense ratio.

In addition, the Company recorded a net valuation allowance of $16.6 million against its deferred tax assets during 2011. Its deferred tax valuation allowance of $270.5 million at December 31, 2011, was largely the result of inventory impairments taken, and the allowance against them reflects uncertainty with regard to the duration of current conditions in the housing market. Should the Company generate significant taxable income in future years, it expects that it will reverse its valuation allowance, which should, in turn, reduce its effective income tax rate.

20

Housing gross profit margin for 2011 was 14.6 percent, compared to 11.4 percent for 2010. This improvement in housing gross profit margin was primarily attributable to lower inventory and other valuation adjustments and write-offs; reduced direct construction and land costs; and the recovery of Chinese drywall warranty costs from third parties, partially offset by lower leverage of direct overhead expense due to a decrease in the number of homes delivered. Inventory and other valuation adjustments and land option abandonments impacting the housing gross profit margin declined to $8.3 million in 2011 from $33.4 million in 2010. The selling, general and administrative expense ratio was 13.4 percent of homebuilding revenues in 2011, compared to 12.9 percent in 2010. This increase was primarily due to lower leverage that resulted from a decline in revenues and to severance and feasibility abandonment charges, partially offset by cost-saving initiatives. Selling, general and administrative expense dollars decreased during 2011 to $116.0 million, compared to $125.0 million during 2010. However, the Company's current lower volume levels have made it more difficult to maintain desired overhead ratios and have required it to look at even more efficient ways of managing its business. In this regard, the Company replaced its then existing two-region operating structure with a single homebuilding management team in January 2011.