|

Fiscal 2023 was a year in which Hologic lived up to its commitments. Once again,

we were guided by our Purpose, Passion, and Promise; values that run deep throughout our organization and motivate our teams to not only deliver for our shareholders, but more importantly elevate women’s health around the world.

Over the last several years, despite turbulent macroeconomic trends and a more

tenuous geopolitical environment, we have remained disciplined and thoughtful with our strategy. As we have executed against our plan the outcome has become undeniable - today we are effectively a new Hologic. We are larger and

stronger, with more durable growth drivers than at any time in our Company’s history. As shareholders, you can count on Hologic to continue to live by our principles, and we expect you can count on us to deliver strong, durable

financial performance.

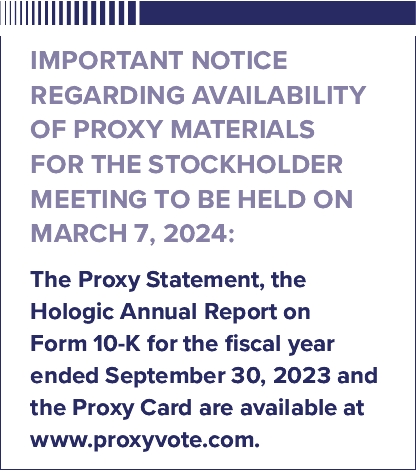

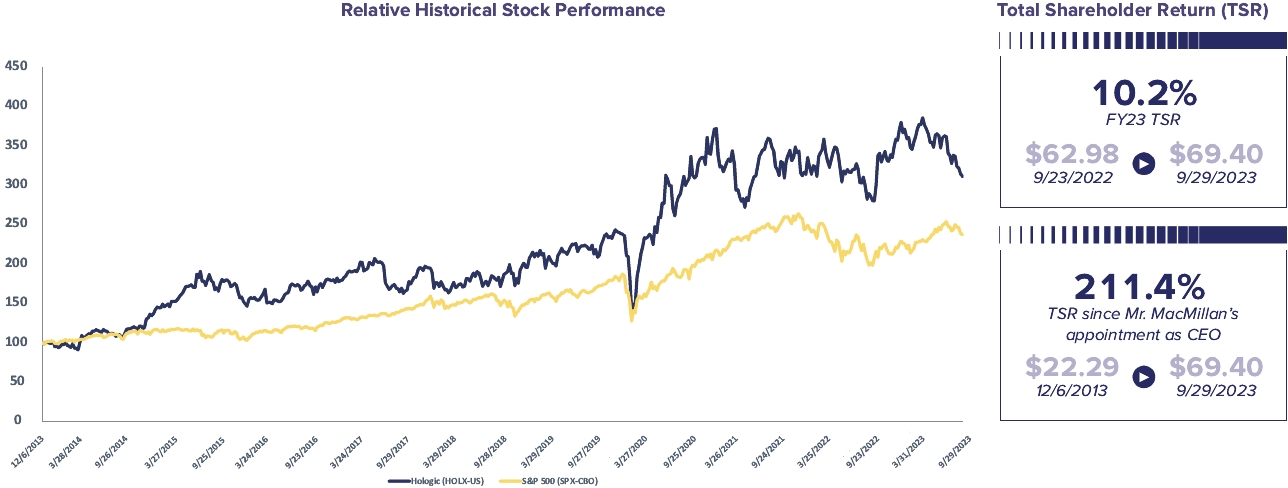

Starting with our strong financial performance in fiscal 2023. At the beginning

of our fiscal year, we committed to low double-digit organic constant currency growth excluding the impact of COVID-19. In the end we delivered more; with total Hologic annual constant currency organic revenue growth in the mid-teens at

15.6% excluding COVID-19. Our performance was broad-based, with each one of our franchises growing double digits compared to the prior year.

In Diagnostics, total organic constant currency revenue growth was just above 13%

in our fiscal 2023 excluding the impact of COVID-19. Although this is excellent growth, it is in fact more impressive when considering the challenging comparable period performance of our base Diagnostics business, which grew more than

10% in the prior year. As expected, our strong results in Diagnostics were led by our Molecular business, which continues to benefit from several tailwinds. First, since the end of our fiscal 2019 we have more than doubled the installed

base of our Panther instrumentation, allowing more customers to run our broad menu of 21 FDA approved assays. In addition, Molecular has enjoyed excellent contributions from new assays such as BV CV/TV, as well as the successful

integration of our acquired Biotheranostics business.

|

|

|

Moving next to Breast Health, the division grew constant currency revenue more

than 17% in fiscal 2023 powered by our mammography business. As a reminder, our Breast Health franchise experienced significant supply chain headwinds in fiscal 2022 related to an industry shortage of semiconductor chips. Over the last

several quarters, however, our teams worked diligently overcoming procurement hurdles to meet our customers’ demand for our mammography systems. With an elevated backlog and steady strong demand, our Breast Health business remains well

positioned for fiscal 2024.

Finally in our Surgical division, performance was also outstanding in fiscal

2023, with annual organic constant currency revenue growth of approximately 16%. Surgical continues to be powered by an increasingly diversified set of products. The division is led by an exceptionally strong core in NovaSure and

MyoSure, and also has exciting opportunities ahead with Fluent fluid management and our laparoscopic suite of products added through our acquisitions of Acessa and Bolder.

In addition to our strong operating results in fiscal 2023 and our excitement for

what lies ahead for each of our businesses, we are also extremely proud of our strong balance sheet and cash flow generation. We ended fiscal 2023 with over $2.7 billion in cash, a net leverage ratio of 0.1x, and generated more than $1

billion in operating cash flow during the fiscal year. These results demonstrate the strength and scale of our current business, while also showcasing our significant financial firepower available for organic and inorganic investments

to further strengthen our future.

To summarize our financial performance in fiscal 2023 - we did what we said we

were going to do, and more. We lived up to our financial commitments to shareholders, raising our financial guidance throughout the past year. However, for Hologic financial success alone is not enough. With our commercial success in

fiscal 2023, we made an even greater difference with our social programs, where we continued to invest to improve women’s health around the world.

|

|

|

Moving first to the Hologic Global Women’s Health Index, a partnership with

Gallup, which gathers data on the state of women’s health around the world. As an organization rooted in science, we understand that issues must be measured before they can be acted upon and ultimately resolved. We use the country-level

data from the Index to inspire policy change, seeking to break down the barriers preventing women from receiving the care they need. In fiscal 2023, we expanded the scope of the Index, growing its reach from 122 to 143 countries,

accounting for 97% of women around the world.

Turning next to our Global Access Initiative, a program promoting access to

cost-effective and quality diagnostic testing to resource constrained countries in Africa. In fiscal 2023 the program continued to make an impact, delivering our instrumentation and testing solutions to detect disease states in

virology, women’s health, and COVID-19.

Finally, Hologic’s title sponsorship with the Women’s Tennis Association (WTA)

also continues to be a winning partnership for women’s health. In fiscal 2023, Hologic and the WTA introduced a Women’s Health Taskforce, an important initiative seeking to address a broad range of health issues impacting women by

setting a standard to support healthy lifecycles for female athletes and women at large.

To conclude, I would like to thank each of our nearly 7,000 employees around the

world, our customers, our shareholders, and our outstanding Board of Directors for your support over the last twelve months. Fiscal 2023 was a remarkable year for Hologic, where we lived into our Purpose, Passion, and Promise and

delivered on our commitments. I am more excited than ever as we plan for our future as the new and stronger Hologic.

Sincerely,

Stephen P. MacMillan

Chairman, President and

Chief Executive Officer

|