UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number: |

811-06024 |

|

|

|

|

Exact name of registrant as specified in charter: |

Aberdeen Indonesia Fund, Inc. |

|

|

|

|

Address of principal executive offices: |

1735 Market Street, 32nd Floor |

|

|

|

|

|

Philadelphia, PA 19103 |

|

|

|

|

|

|

|

Name and address of agent for service: |

Ms. Andrea Melia |

|

|

|

|

|

Aberdeen Asset Management Inc. |

|

|

|

|

|

1735 Market Street, 32nd Floor |

|

|

|

|

|

Philadelphia, PA 19103 |

|

|

|

|

|

|

|

Registrant’s telephone number, including area code: |

866-839-5205 |

|

|

|

|

Date of fiscal year end: |

December 31 |

|

|

|

|

Date of reporting period: |

December 31, 2010 |

Item 1. Reports to Stockholders.

Closed-end funds have a one-time initial public offering and then are subsequently traded on the secondary market through one of the stock exchanges. The investment return and principal value will fluctuate so that an investor’s shares may be worth more or less than the original cost. Shares of closed-end funds may trade above (a premium) or below (a discount) the net asset value (NAV) of the fund’s portfolio. Past performance does not guarantee future results. Foreign securities are more volatile, harder to price and less liquid than U.S. securities. These risks may be enhanced in emerging market countries. Concentrating investments in a single country, region or industry may subject a fund to greater price volatility and risk of loss than more diverse funds. Aberdeen Asset Management Inc., 1735 Market Street, 32nd Floor, Philadelphia, PA 19103.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

Letter to Shareholders

February 10, 2011

Dear Shareholder,

We present this Annual Report which covers the activities of Aberdeen Indonesia Fund, Inc. (the “Fund”) for the twelve-month period ended December 31, 2010. The Fund seeks long-term capital appreciation as a primary objective and income as a secondary objective by investing primarily in Indonesian securities.

For the year ended December 31, 2010, the total return to shareholders of the Fund based on the net asset value (NAV) of the Fund was 52.8% versus a return of 34.6% for the Fund’s benchmark, the MSCI Indonesia Index. Based on market price, the Fund’s shares gained 51.3% during the period, assuming reinvestment of dividends and distributions.

Share Price Performance

The Fund’s share price increased 40.1% over the twelve months, from $9.50 on December 31, 2009 to $13.31 on December 31, 2010. The Fund’s share price on December 31, 2010 represented a discount of 7.5% to the NAV per share of $14.39 on that date, compared with a discount of 6.6% to the NAV per share of $10.17 on December 31, 2009. As of February 10, 2011, the share price was $11.83, representing a discount of 9.0% to the NAV per share of $13.00.

Market Review

Indonesia was one of the best performing equities markets in Asia in 2010, rising 49.5% last year to hit an all-time high in December. In particular, the Indonesian consumer sector performed strongly, while telecom stocks lagged the market. More generally, domestic sectors outperformed the resource sectors and cyclicals outperformed defensive plays.

Promising corporate profits, underpinned by robust economic expansion, led to ratings upgrades. This far outweighed earlier worries over the possibility of a withdrawal of stimulus measures, Dubai’s debt problems, and a surprise discount rate hike by the United States Federal Reserve.

On the economic front, GDP growth accelerated to the highest level in two years in the second quarter. A mild slow down followed in the third quarter, but for the year as a whole, the Indonesia economy was still expected to expand by around 6%. Inflation advanced steadily, as unusually wet weather interrupted food supplies. While the central bank resisted hiking interest rates, it did raise lenders’ cash reserves to quell concerns.

Outlook

Indonesia is widely expected to enjoy healthy GDP growth through 2011 as a result of the solid macroeconomic foundations, robust domestic demand and supportive commodity prices underpinned by Chinese demand. Agriculture, plantation and mining businesses are all expected to recover in 2011 after the unusually poor weather of 2010.

However, the domestic stock market is expected to face increased volatility in the near term, as equity prices have risen to record levels and appear fully priced. Inflation also remains a concern with rising global food prices posing a threat and the possibility of capacity constraints amongst domestic businesses. The central bank remains wary of strong capital inflows into the country and the impact this may have on the economy.

In the longer term, however, the country’s attractive fundamentals remain undiminished: its small but expanding middle class, coupled with low penetration rates for consumer goods and services, are likely to cushion the economy from external shocks.

Dividend Reinvestment and Direct Stock Purchase Plan

As part of a broad effort to enhance available services to Shareholders, we are pleased to announce the availability of a Dividend Reinvestment and Direct Stock Purchase Plan (the “Plan”) that is sponsored and administered by Computershare Trust Company, N.A. (“Computershare”), the Fund’s transfer agent. For both purchases and reinvestment purposes, shares will be purchased in the open market at the current share price and cannot be issued directly by the Fund.

The new Plan has similar features to the previous Dividend Reinvestment Plan that was administered by Computershare, but it also offers some enhancements that enable new investors to purchase initial shares through the Plan, authorize recurring monthly purchases through the automatic investment feature and purchase shares over the Internet at www.computershare.com/aberdeen or by check.

For more information about the Plan and a brochure that includes the terms and conditions of the Plan, please contact Computershare at 1-800-647-0584 or visit www.computershare.com/buyaberdeen.

Investor Relations Information

For information about the Fund, daily updates of share price, NAV and details of recent distributions, please contact Aberdeen by:

· Calling toll free at 1-866-839-5205 in the United States,

· Emailing InvestorRelations@aberdeen-asset.com, or

· Visiting the website at www.aberdeenif.com.

For additional information on the Aberdeen Closed-End Funds, Aberdeen invites you to visit our recently redesigned website and Closed-End Investor Center at: www.aberdeen-asset.us/cef.

From the site you will also be able to review performance, download literature and sign up for email services. The site houses most topical

Letter to Shareholders (concluded)

February 10, 2011

information about the Aberdeen Closed-End Funds, including fact sheets from Morningstar that are updated daily and monthly manager reports. If you sign up for our email service online, we can ensure that you are among the first to know about Aberdeen’s latest closed-end fund news.

Included within this report is a reply card with postage paid envelope. Please complete and mail the card if you would like to be added to our enhanced email service and receive future communications from Aberdeen.

Yours sincerely,

Christian Pittard

President

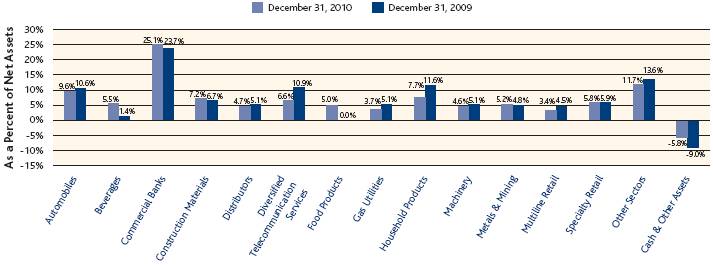

Portfolio Summary

December 31, 2010 (unaudited)

Sector Allocation

Top 10 Holdings, by Issuer

December 31, 2010 (unaudited)

|

|

|

Holding |

|

Sector |

|

Percent of Net Assets |

|

|

1. |

|

PT Bank OCBC NISP Tbk |

|

Commercial Banks |

|

11.3% |

|

|

2. |

|

PT Astra International Tbk |

|

Automobiles |

|

9.6% |

|

|

3. |

|

PT Bank Permata Tbk |

|

Commercial Banks |

|

7.9% |

|

|

4. |

|

PT Unilever Indonesia Tbk |

|

Household Products |

|

7.7% |

|

|

5. |

|

PT Holcim Indonesia Tbk |

|

Construction Materials |

|

7.2% |

|

|

6. |

|

PT Telekomunikasi Indonesia Tbk |

|

Diversified Telecommunication Services |

|

6.6% |

|

|

7. |

|

PT ACE Hardware Indonesia Tbk |

|

Specialty Retail |

|

5.8% |

|

|

8. |

|

PT Multi Bintang Indonesia Tbk |

|

Beverages |

|

5.5% |

|

|

9. |

|

PT International Nickel Indonesia Tbk |

|

Metals & Mining |

|

5.2% |

|

|

10. |

|

MP Evans Group PLC |

|

Food Products |

|

5.0% |

|

Average Annual Returns

December 31, 2010 (unaudited)

|

|

|

1 Year |

|

3 Years |

|

5 Years |

|

10 Years |

|

|

Net Asset Value (NAV) |

|

52.85% |

|

10.90% |

|

24.16% |

|

26.53% |

|

|

Market Value |

|

51.35% |

|

10.63% |

|

23.24% |

|

26.78% |

|

Aberdeen Asset Management Asia Limited may waive fees and/or reimburse expenses but has made no determination to do so. Returns represent past performance. Total investment return at NAV is based on changes in the NAV of Fund shares and assumes reinvestment of dividends and distributions, if any. Total investment return at market value is based on changes in the market price at which the Fund’s shares traded on the stock exchange during the period and assumes reinvestment of dividends and distributions, if any, at actual prices pursuant to the Fund’s dividend reinvestment program. Because the Fund’s shares trade in the stock market based on investor demand, the Fund may trade at a price higher or lower than its NAV. Therefore, returns are calculated based on share price and NAV. Past performance is no guarantee of future results. The current performance of the Fund may be lower or higher than the figures shown. The Fund’s yield, return and market price and NAV will fluctuate. Performance information current to the most recent month-end is available by calling 866-839-5205.

The annualized gross and net expense ratios are 1.52%.

|

|

Aberdeen Indonesia Fund, Inc. |

|

Portfolio of Investments

December 31, 2010

|

No. of |

|

Description |

|

Value |

| |

|

EQUITY SECURITIES—105.8% |

|

|

| |||

|

INDONESIA—99.9% |

|

|

| |||

|

AUTOMOBILES—9.6% |

|

|

| |||

|

1,882,461 |

|

PT Astra International Tbk(a) |

|

$ |

11,376,511 |

|

|

BEVERAGES—5.5% |

|

|

| |||

|

215,000 |

|

PT Multi Bintang Indonesia Tbk |

|

6,560,960 |

| |

|

COMMERCIAL BANKS—19.2% |

|

|

| |||

|

72,918,960 |

|

PT Bank OCBC NISP Tbk(a)(b) |

|

13,443,115 |

| |

|

47,208,614 |

|

PT Bank Permata Tbk(a)(b) |

|

9,384,995 |

| |

|

|

|

|

|

22,828,110 |

| |

|

CONSTRUCTION MATERIALS—7.2% |

|

|

| |||

|

34,219,000 |

|

PT Holcim Indonesia Tbk(a)(b) |

|

8,526,139 |

| |

|

DISTRIBUTORS—4.7% |

|

|

| |||

|

195,000 |

|

Jardine Cycle & Carriage Limited(a) |

|

5,560,545 |

| |

|

DIVERSIFIED TELECOMMUNICATION SERVICES—6.6% |

|

|

| |||

|

8,868,560 |

|

PT Telekomunikasi Indonesia Tbk |

|

7,825,200 |

| |

|

FOOD PRODUCTS—5.0% |

|

|

| |||

|

780,000 |

|

MP Evans Group PLC(a) |

|

6,007,867 |

| |

|

GAS UTILITIES—3.7% |

|

|

| |||

|

9,000,000 |

|

PT Perusahaan Gas Negara(a) |

|

4,415,509 |

| |

|

HOUSEHOLD PRODUCTS—7.7% |

|

|

| |||

|

4,990,000 |

|

PT Unilever Indonesia Tbk(a) |

|

9,128,094 |

| |

|

MACHINERY—4.6% |

|

|

| |||

|

2,087,700 |

|

PT United Tractors Tbk(a) |

|

5,506,099 |

| |

|

METALS & MINING—5.2% |

|

|

| |||

|

11,420,000 |

|

PT International Nickel Indonesia Tbk(a) |

|

6,165,876 |

| |

|

MULTILINE RETAIL—3.4% |

|

|

| |||

|

43,318,000 |

|

PT Ramayana Lestari Sentosa Tbk(a) |

|

4,075,797 |

| |

|

OIL, GAS & CONSUMABLE FUELS—3.4% |

|

|

| |||

|

723,000 |

|

PT Indo Tambangraya Megah(a) |

|

4,066,595 |

| |

|

PERSONAL PRODUCTS—2.7% |

|

|

| |||

|

4,186,000 |

|

PT Mandom Indonesia Tbk(a) |

|

3,273,241 |

| |

|

PHARMACEUTICALS—0.4% |

|

|

| |||

|

42,000 |

|

PT Merck Tbk(c) |

|

433,518 |

| |

|

SPECIALTY RETAIL—5.8% |

|

|

| |||

|

21,186,500 |

|

PT ACE Hardware Indonesia Tbk(a) |

|

6,929,251 |

| |

|

TEXTILES, APPAREL & LUXURY GOODS—2.6% |

|

|

| |||

|

419,500 |

|

PT Sepatu Bata Tbk(c) |

|

3,147,414 |

| |

|

WIRELESS TELECOMMUNICATION SERVICES—2.6% |

|

|

| |||

|

5,150,000 |

|

PT Indosat Tbk(a) |

|

3,074,066 |

| |

|

|

|

Total Indonesia (cost $51,978,544) |

|

118,900,792 |

| |

|

|

Aberdeen Indonesia Fund, Inc. |

|

Portfolio of Investments (concluded)

December 31, 2010

|

No. of |

|

Description |

|

Value |

|

|

EQUITY SECURITIES (continued) |

|

|

| ||

|

SINGAPORE—5.9% |

|

|

| ||

|

COMMERCIAL BANKS—5.9% |

|

|

| ||

|

487,774 |

|

Overseas-Chinese Banking Corp. Limited(a) |

|

$ 3,755,643 |

|

|

227,692 |

|

United Overseas Bank Limited(a) |

|

3,231,422 |

|

|

|

|

Total Singapore (cost $4,802,147) |

|

6,987,065 |

|

|

|

|

Total Equity Securities (cost $56,780,691) |

|

125,887,857 |

|

|

SHORT-TERM INVESTMENT—1.2% |

|

|

| ||

|

Principal |

|

|

|

|

|

|

BAHAMAS—1.2% |

|

|

| ||

|

$1,490 |

|

Citibank Nassau, overnight deposit, 0.03%, 01/03/11 (cost $1,490,000) |

|

1,490,000 |

|

|

|

|

Total Investments—107.0% (cost $58,270,691) |

|

127,377,857 |

|

|

|

|

Liabilities in excess of cash and other assets—(7.0)% |

|

(8,342,414 |

) |

|

|

|

Net Assets—100.0% |

|

$119,035,443 |

|

(a) Security was fair valued as of December 31, 2010. Security is valued at fair value as determined in good faith by, or under the direction of, the Board of Directors under procedures established by the Board of Directors. (See Note 1).

(b) Non-income producing security.

(c) Illiquid security.

See Notes to Financial Statements.

|

|

Aberdeen Indonesia Fund, Inc. |

|

|

Statement of Assets and Liabilities |

|

|

| ||

|

As of December 31, 2010 |

|

|

| ||

|

|

|

|

| ||

|

Assets |

|

|

| ||

|

Investments, at value (cost $58,270,691) |

|

$ 127,377,857 |

| ||

|

Cash |

|

26 |

| ||

|

Dividends receivable |

|

94,578 |

| ||

|

Prepaid expenses |

|

13,072 |

| ||

|

Total assets |

|

127,485,533 |

| ||

|

Liabilities |

|

|

| ||

|

Dividends and distributions (Note 1) |

|

8,014,582 |

| ||

|

Investment advisory fees payable (Note 2) |

|

304,437 |

| ||

|

Administration fees payable (Note 2) |

|

10,514 |

| ||

|

Accrued expenses and other liabilities |

|

120,557 |

| ||

|

Total liabilities |

|

8,450,090 |

| ||

|

|

|

|

| ||

|

Net Assets |

|

$119,035,443 |

| ||

|

Net Assets consist of |

|

|

| ||

|

Capital stock, $0.001 par value (Note 5) |

|

$ 8,272 |

| ||

|

Paid-in capital |

|

48,216,860 |

| ||

|

Undistributed net investment income |

|

127,594 |

| ||

|

Accumulated net realized gain on investments and foreign currency related transactions |

|

1,575,303 |

| ||

|

Net unrealized appreciation on investments and foreign currency translation |

|

69,107,414 |

| ||

|

Net Assets applicable to shares outstanding |

|

$119,035,443 |

| ||

|

Net asset value per share, based on 8,271,922 shares issued and outstanding |

|

$ 14.39 |

| ||

|

|

|

|

| ||

|

|

|

|

| ||

|

See Notes to Financial Statements. |

|

|

| ||

|

|

|

|

| ||

|

|

|

|

| ||

|

|

|

|

| ||

|

|

|

|

| ||

|

|

|

|

| ||

|

|

|

|

| ||

|

|

|

|

| ||

|

|

|

|

| ||

|

|

|

|

| ||

|

|

|

|

| ||

|

|

|

|

| ||

|

|

|

|

| ||

|

|

|

|

| ||

|

|

|

|

| ||

|

|

|

|

| ||

|

|

|

|

| ||

|

|

|

|

| ||

|

|

|

|

| ||

|

|

|

|

| ||

|

|

|

|

| ||

|

|

|

|

| ||

|

|

Aberdeen Indonesia Fund, Inc. |

| |||

|

|

|

|

| ||

|

|

|

|

| ||

Statement of Operations

For the Year Ended December 31, 2010

|

|

|

|

|

|

Investment Income |

|

|

|

|

|

|

|

|

|

Income: |

|

|

|

|

Dividends and other income |

|

$ 2,527,668 |

|

|

Less: Foreign taxes withheld |

|

(359,202 |

) |

|

Total investment income |

|

2,168,466 |

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

Investment advisory fees (Note 2) |

|

1,023,335 |

|

|

Custodian’s fees and expenses |

|

170,703 |

|

|

Directors’ fees and expenses |

|

96,037 |

|

|

Legal fees and expenses |

|

62,831 |

|

|

Administration fees (Note 2) |

|

60,470 |

|

|

Investor relations fees and expenses |

|

45,384 |

|

|

Reports to shareholders and proxy solicitation |

|

45,148 |

|

|

Independent auditor’s fees and expenses |

|

36,088 |

|

|

Insurance expense |

|

23,479 |

|

|

Transfer agent’s fees and expenses |

|

22,371 |

|

|

Miscellaneous |

|

15,026 |

|

|

Total expenses |

|

1,600,872 |

|

|

|

|

|

|

|

Net investment income |

|

567,594 |

|

|

|

|

|

|

|

Net Realized and Unrealized Gain/(Loss) on Investments and |

|

|

|

|

|

|

|

|

|

Net realized gain/(loss) on: |

|

|

|

|

Investment transactions |

|

9,286,932 |

|

|

Foreign currency transactions |

|

47,769 |

|

|

Net change in unrealized appreciation of investments and foreign currency translation |

|

33,633,061 |

|

|

Net realized and unrealized gain on investments and foreign currency transactions |

|

42,967,762 |

|

|

Net Increase in Net Assets Resulting from Operations |

|

$ 43,535,356 |

|

See Notes to Financial Statements.

|

|

Aberdeen Indonesia Fund, Inc. |

Statement of Changes in Net Assets

|

|

|

For the |

|

For the |

|

|

Increase/(Decrease) in Net Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operations: |

|

|

|

|

|

|

Net investment income |

|

$ 567,594 |

|

$ 455,286 |

|

|

Net realized gain on investments and foreign currency related transactions |

|

9,334,701 |

|

15,026,067 |

|

|

Net increase from payments by affiliates on disposal of investments in violation of restrictions |

|

– |

|

131,786 |

|

|

Net change in unrealized appreciation on investments and foreign currency translation |

|

33,633,061 |

|

31,418,854 |

|

|

Net increase in net assets resulting from operations |

|

43,535,356 |

|

47,031,993 |

|

|

|

|

|

|

|

|

|

Dividends and distributions to shareholders from: |

|

|

|

|

|

|

Net investment income |

|

(594,255 |

) |

(240,713 |

) |

|

Net realized gain on investments |

|

(8,040,721 |

) |

(9,673,186 |

) |

|

Total dividends and distributions to shareholders |

|

(8,634,976 |

) |

(9,913,899 |

) |

|

|

|

|

|

|

|

|

Capital share transactions: |

|

|

|

|

|

|

Issuance of 0 and 1,551 shares through the directors compensation plan (Note 2) |

|

– |

|

14,735 |

|

|

Total increase in net assets resulting from operations |

|

34,900,380 |

|

37,132,829 |

|

|

|

|

|

|

|

|

|

Net Assets |

|

|

|

|

|

|

Beginning of year |

|

84,135,063 |

|

47,002,234 |

|

|

End of year* |

|

$119,035,443 |

|

$84,135,063 |

|

* Includes undistributed net investment income of $127,594 and $101,608, respectively.

See Notes to Financial Statements.

|

8 |

Aberdeen Indonesia Fund, Inc. |

|

Financial Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Fiscal Years Ended December 31, |

| ||||||||

|

|

|

2010 |

|

2009 |

|

2008 |

|

2007 |

|

2006 |

|

|

PER SHARE OPERATING PERFORMANCE |

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, beginning of year |

|

$10.17 |

|

$5.68 |

|

$12.89 |

|

$9.66 |

|

$6.00 |

|

|

Net investment income |

|

0.07 |

(a) |

0.06 |

(a) |

0.09 |

(a) |

0.03 |

(a) |

0.05 |

|

|

Net realized and unrealized gain/(loss) on investments and foreign currency related transactions |

|

5.19 |

|

5.63 |

(b) |

(7.23 |

) |

3.22 |

|

3.66 |

|

|

Net increase/(decrease) in net assets resulting from operations |

|

5.26 |

|

5.69 |

|

(7.14 |

) |

3.25 |

|

3.71 |

|

|

Dividends and distributions to shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income |

|

(0.07 |

) |

(0.03 |

) |

(0.07 |

) |

(0.02 |

) |

(0.05 |

) |

|

Net realized gain |

|

(0.97 |

) |

(1.17 |

) |

— |

|

— |

|

— |

|

|

Total dividends and distributions to shareholders |

|

(1.04 |

) |

(1.20 |

) |

(0.07 |

) |

(0.02 |

) |

(0.05 |

) |

|

Net asset value, end of year |

|

$14.39 |

|

$10.17 |

|

$5.68 |

|

$12.89 |

|

$9.66 |

|

|

Market value, end of year |

|

$13.31 |

|

$9.50 |

|

$5.10 |

|

$12.01 |

|

$11.70 |

|

|

Total Investment Return Based on: |

|

|

|

|

|

|

|

|

|

|

|

|

Market value(c) |

|

51.35% |

|

107.82% |

|

(56.94% |

) |

2.89% |

|

104.14% |

|

|

Net asset value |

|

52.85% |

|

99.76% |

|

(55.32% |

) |

33.74% |

|

61.81% |

|

|

Ratio/Supplementary Data |

|

|

|

|

|

|

|

|

|

|

|

|

Net assets, end of year (000 omitted) |

|

$119,035 |

|

$84,135 |

|

$47,002 |

|

$106,577 |

|

$79,844 |

|

|

Average net assets (000 omitted) |

|

$105,572 |

|

$67,781 |

|

$81,652 |

|

$89,945 |

|

$65,119 |

|

|

Ratio of expenses to average net assets |

|

1.52% |

|

1.57% |

|

1.62% |

|

1.55% |

|

1.65% |

|

|

Ratio of net investment income to average net assets |

|

0.54% |

|

0.67% |

|

0.95% |

|

0.29% |

|

0.67% |

|

|

Portfolio turnover rate |

|

10.20% |

|

88.34% |

|

33.05% |

|

20.25% |

|

23.93% |

|

|

(a) |

Based on average shares outstanding. |

|

|

|

|

(b) |

The investment adviser fully reimbursed the Fund for a loss on a transaction not meeting the Fund’s investment guidelines, which otherwise would have reduced the amount by $0.02. |

|

|

|

|

(c) |

Total investment return is calculated assuming a purchase of common stock on the first day and a sale on the last day of each reporting period. Dividends and distributions, if any, are assumed, for purposes of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total investment return does not reflect brokerage commissions. |

See Notes to Financial Statements.

|

|

Aberdeen Indonesia Fund, Inc. |

Notes to Financial Statements

December 31, 2010

Aberdeen Indonesia Fund, Inc. (the “Fund”), formerly The Indonesia Fund, Inc., was incorporated in Maryland on January 8, 1990 and commenced investment operations on March 9, 1990. The Fund is registered under the Investment Company Act of 1940, as amended, as a closed-end, non-diversified management investment company.

The Fund seeks long-term capital appreciation as a primary objective and income as a secondary objective, by investing primarily in Indonesian securities.

On March 29, 2010, the Board of Directors of the Fund (the “Board”) approved a name change for the Fund in order to align the Fund more closely with the investment adviser and to differentiate the Fund in a competitive market with many known brands. The Fund’s investment objectives and NYSE Amex ticker symbol, IF, remain unchanged.

1. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The financial statements of the Fund are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The U.S. dollar is used as both the functional and reporting currency.

(a) Security Valuation:

Securities for which market quotations are readily available are valued at current market value as of “Valuation Time.” Valuation Time is as of the close of regular trading on the New York Stock Exchange (usually 4:00 p.m. Eastern Time). Equity securities are typically valued at the last quoted sale price or, if there is no sale price, the last quoted bid price provided by an independent pricing service approved by the Board. Securities traded on NASDAQ are valued at the NASDAQ official closing price. Prices are taken from the primary market or exchange in which each security trades. Investment companies are valued at net asset value as reported by such company.

Most securities listed on a foreign exchange are valued either at fair value (see description below) or at the last sale price at the close of the exchange on which the security is principally traded. Foreign securities, currencies, and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars at the exchange rate of said currencies against the U.S. dollar, as of Valuation Time, as provided by an independent pricing service approved by the Board.

Debt and other fixed-income securities (other than short-term obligations) are valued at the last quoted bid price and/or by using a combination of daily quotes and matrix evaluations provided by an independent pricing service, the use of which has been approved by the Board. In the event such quotes are not available from such pricing agents, then the security may be priced based on bid quotations from broker-dealers. Short-term debt securities of sufficient credit quality such as commercial paper and U.S. Treasury Bills having a remaining maturity of 60 days or less at the time of purchase are valued at amortized cost.

Securities for which market quotations are not readily available, or for which an independent pricing service does not provide a value or provides a value that does not represent fair value in the judgment of the Fund’s investment adviser or designee, are valued at fair value under procedures approved by the Board. In addition, fair value determinations are required for securities whose value is affected by a “significant” event that materially affects the value of a domestic or foreign security which occurs subsequent to the time of the close of the principal market on which such domestic or foreign security trades and before the Valuation Time (i.e., a “subsequent event”). Typically, this will involve events occurring after the close of a foreign market on which a security trades and before the next Valuation Time.

The Fund’s equity securities that are traded on a foreign exchange or market which closes prior to the Fund’s Valuation Time are fair valued by an independent pricing service. The fair value of each such security generally is calculated by applying a valuation factor provided by the independent pricing service to the last sales price for that security. If the pricing service is unable to provide a fair value for a security, the security will continue to be valued at the last sale price at the close of the exchange on which it is principally traded, subject to adjustment by the Fund’s Pricing Committee. When the fair value prices are utilized, the value assigned to the foreign securities may not be the quoted or published prices of the securities on their primary markets.

For the year ended December 31, 2010, there have been no significant changes to the valuation procedures approved by the Board.

Equity securities are valued at the most recent sale price or official closing price reported on the exchange (US or foreign) or over-the-counter market on which they trade and are categorized as Level 1 securities. Securities for which no sales are reported are valued at the calculated bid. For certain international equity securities, in order to adjust for events which may occur between the close of the foreign exchange they are traded on and the close of the New York Stock Exchange, a fair valuation model may be used (as described above). This fair valuation model takes into account comparisons to the valuation of American Depository

Notes to Financial Statements (continued)

December 31, 2010

Receipts (ADRs), exchange-traded funds, futures contracts and certain indices and these securities are categorized as Level 2.

The Fund is required to disclose information regarding the fair value measurement of its assets and liabilities. Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. This disclosure requirement establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classifications of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including such a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable.

Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting

entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

The three-tier hierarchy of inputs is summarized in the three broad Levels listed below.

Level 1 – quoted prices in active markets for identical securities.

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments, information provided by the General Partner or investee companies such as publicly traded prices, financial statements, capital statements, recent transactions, and general market conditions).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of December 31, 2010 in valuing the Fund’s investments carried at value:

|

Investments, at value |

|

Level 1* |

|

Level 2* |

|

Level 3* |

|

Balance as of |

|

|

Automobiles |

|

$– |

|

$11,376,511 |

|

$– |

|

$11,376,511 |

|

|

Beverages |

|

6,560,960 |

|

– |

|

– |

|

6,560,960 |

|

|

Commercial Banks |

|

– |

|

29,815,175 |

|

– |

|

29,815,175 |

|

|

Construction Materials |

|

– |

|

8,526,139 |

|

– |

|

8,526,139 |

|

|

Distributors |

|

– |

|

5,560,545 |

|

– |

|

5,560,545 |

|

|

Diversified Telecommunication Services |

|

7,825,200 |

|

– |

|

– |

|

7,825,200 |

|

|

Food Products |

|

– |

|

6,007,867 |

|

– |

|

6,007,867 |

|

|

Gas Utilities |

|

– |

|

4,415,509 |

|

– |

|

4,415,509 |

|

|

Household Products |

|

– |

|

9,128,094 |

|

– |

|

9,128,094 |

|

|

Machinery |

|

– |

|

5,506,099 |

|

– |

|

5,506,099 |

|

|

Metals & Mining |

|

– |

|

6,165,876 |

|

– |

|

6,165,876 |

|

|

Multiline Retail |

|

– |

|

4,075,797 |

|

– |

|

4,075,797 |

|

|

Oil, Gas & Consumable Fuels |

|

– |

|

4,066,595 |

|

– |

|

4,066,595 |

|

|

Personal Products |

|

– |

|

3,273,241 |

|

– |

|

3,273,241 |

|

|

Pharmaceuticals |

|

433,518 |

|

– |

|

– |

|

433,518 |

|

|

Specialty Retail |

|

– |

|

6,929,251 |

|

– |

|

6,929,251 |

|

|

Textiles, Apparel & Luxury Goods |

|

3,147,414 |

|

– |

|

– |

|

3,147,414 |

|

|

Wireless Telecommunication Services |

|

– |

|

3,074,066 |

|

– |

|

3,074,066 |

|

|

Short-Term Investments |

|

– |

|

1,490,000 |

|

– |

|

1,490,000 |

|

|

Total |

|

$17,967,092 |

|

$109,410,765 |

|

$– |

|

$127,377,857 |

|

|

* |

For the year ended December 31, 2010, there have been no significant changes to the fair valuation methodologies. For the year ended December 31, 2010, there were no significant transfers in or out of Level 1, Level 2 and Level 3 fair value measurements. |

|

|

Aberdeen Indonesia Fund, Inc. |

11 |

Notes to Financial Statements (continued)

December 31, 2010

(b) Short-Term Investment:

The Fund sweeps available cash into a short-term time deposit available through Brown Brothers Harriman & Co. (“BBH & Co.”), the Fund’s custodian. The short-term time deposit is a variable rate account classified as a short-term investment.

(c) Foreign Currency Transactions:

The books and records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars on the following basis:

|

(I) |

market value of investment securities, other assets and liabilities at the valuation date rate of exchange; and |

|

|

|

|

(II) |

purchases and sales of investment securities, income and expenses at the relevant rates of exchange prevailing on the respective dates of such transactions. |

The Fund does not isolate that portion of gains and losses on investments in equity securities which is due to changes in the foreign exchange rates from that which is due to changes in market prices of equity securities. Accordingly, realized and unrealized foreign currency gains and losses with respect to such securities are included in the reported net realized and unrealized gains and losses on investment transactions balances.

The Fund reports certain foreign currency related transactions and foreign taxes withheld on security transactions as components of realized gains for financial reporting purposes, whereas such foreign currency related transactions are treated as ordinary income for U.S. federal income tax purposes.

Net unrealized currency gains or losses from valuing foreign currency denominated assets and liabilities at period end exchange rates are reflected as a component of net unrealized appreciation/depreciation in value of investments, and translation of other assets and liabilities denominated in foreign currencies.

Net realized foreign exchange gains or losses represent foreign exchange gains and losses from transactions in foreign currencies and forward foreign currency contracts, exchange gains or losses realized between the trade date and settlement date on security transactions, and the difference between the amounts of interest and dividends recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received.

Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of domestic origin, including unanticipated movements in the value of the foreign currency relative to the U.S. dollar. Generally, when the U.S. dollar rises in value against foreign currency, the Fund’s investments denominated in that currency will lose value

because its currency is worth fewer U.S. dollars; the opposite effect occurs if the U.S. dollar falls in relative value.

(d) Security Transactions and Investment Income:

Securities transactions are recorded on the trade date. Realized and unrealized gains/(losses) from security and currency transactions are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date except for certain dividends on foreign securities, which are recorded as soon as the Fund is informed after the ex-dividend date. Interest income is recorded on an accrual basis. Expenses are recorded on an accrual basis.

(e) Distributions:

On an annual basis, the Fund intends to distribute its net realized capital gains, if any, by way of a final distribution to be declared during the calendar quarter ending December 31. Dividends and distributions to shareholders are recorded by the Fund on the ex-dividend date.

Dividends and distributions to shareholders are determined in accordance with federal income tax regulations, which may differ from GAAP. These differences are primarily due to differing treatments for foreign currencies.

(f) Recent Accounting Pronouncements:

In January 2010, the Financial Accounting Standards Board issued Accounting Standards Update 2010-06 (“ASU 2010-06”) to ASC 820-10, “Fair Value Measurements and Disclosures – Overall.” This amendment requires the disclosure of input and valuation techniques used to measure fair value for both recurring and non recurring fair value measurements for Level 2 and Level 3 positions. In addition, transfers between all levels must be disclosed on a gross basis including the reason(s) for the transfer(s). Purchases, sales, issuances and settlements in the Level 3 rollforward must be disclosed on a gross basis. The amendment is effective for interim and annual reporting periods beginning after December 15, 2009, while disclosures about purchases, sales, issuances, and settlements in the Level 3 rollforward of activity is effective for interim and annual reporting periods beginning after December 15, 2010. The Fund has adopted a policy of recognizing significant transfers between Level 1 and Level 2 at the reporting period end. A significant transfer is a transfer, in aggregate, whose value is greater than 5% of the net assets of the Fund on the recognition date. As of December 31, 2010, there have been no significant transfers between Level 1, Level 2, or Level 3.

(g) Federal Income Taxes:

The Fund intends to continue to qualify as a “regulated investment company” by complying with the provisions available to certain

Notes to Financial Statements (continued)

December 31, 2010

investment companies, as defined in Subchapter M of the Internal Revenue Code, and to make distributions of net investment income and net realized capital gains sufficient to relieve the Fund from all, or substantially all, federal income taxes. Therefore, no federal income tax provision is required.

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management of the Fund has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Since tax authorities can examine previously filed tax returns, the Fund’s U.S. federal tax returns for the prior four fiscal years are subject to review by the Internal Revenue Service.

2. Agreements

Aberdeen Asset Management Asia Limited (“AAMAL”) serves as the Fund’s investment adviser with respect to all investments. The adviser is a direct wholly-owned subsidiary of Aberdeen Asset Management PLC. AAMAL receives as compensation for its advisory services from the Fund, an annual fee, calculated weekly and paid quarterly, equal to 1.00% of the first $50 million of the Fund’s average weekly net assets, 0.95% of the next $50 million and 0.90% of amounts above $100 million. For the year ended December 31, 2010, AAMAL earned $1,023,335 for advisory services to the Fund.

BBH & Co. is the Administrator for the Fund and certain other funds advised by AAMAL or its affiliates (collectively the “Funds”). The Funds pay BBH & Co. monthly for administrative and fund accounting services, at an annual rate of .06% of the Funds’ aggregate assets up to $500 million, .0525% for the next $500 million, and .0425% in excess of $1 billion. Each Fund pays its pro rata portion of the fee based on its level of assets. For the year ended December 31, 2010, BBH & Co. earned $60,470 from the Fund for administrative and fund accounting services.

Effective February 1, 2010, the Board approved an Investor Relations Services Agreement. Under the terms of the Investor Relations Services Agreement, Aberdeen Asset Management Inc. (“AAMI”), an affiliate of AAMAL, provides investor relations services to the Fund and certain other U.S. registered closed end funds advised by AAMAL or its affiliates. The Fund incurred investor relations service fees of approximately $40,864 as of December 31, 2010. Investor relations fees and expenses in the Statement of Operations include certain out-of-pocket expenses.

Fifty percent (50%) of the annual retainer of the Independent Directors is invested in Fund shares and, at the option of each Independent Director, 100% of the annual retainer can be invested in shares of the Fund. During the fiscal year ended December 31, 2009, 1,551 shares were issued and an additional 1,554 shares were

purchased pursuant to the Directors compensation plan. During the year ended December 31, 2010, there were 2,270 shares purchased pursuant to the Directors compensation plan. Directors as a group own less than 1% of the Fund’s outstanding shares.

3. Investment Transactions

For the year ended December 31, 2010, Fund purchases and sales of securities, other than short-term investments, were $10,702,638 and $20,817,473, respectively.

4. Tax Information

Income and capital gain distributions are determined in accordance with U.S. federal income tax regulations, which may differ from GAAP.

For the year ended December 31, 2010 the Fund paid $4,381,472 in distributions classified as ordinary income and $4,253,504 in distributions classified as long-term capital gains. For the year ended December 31, 2009 the Fund paid $240,713 in distributions classified as ordinary income and $9,673,186 in distributions classified as long-term capital gains.

The tax basis of components of distributable earnings differ from the amounts reflected in the Statement of Assets and Liabilities by temporary book/tax differences. These differences are primarily due to losses deferred on wash sales. At December 31, 2010, the components of distributable earnings on a tax basis for the Fund were as follows:

|

Undistributed ordinary income |

|

$127,594 |

|

|

Undistributed long-term capital gains |

|

1,756,042 |

|

|

Unrealized appreciation |

|

68,926,675 |

|

|

Total distributable earnings |

|

$70,810,311 |

|

At December 31, 2010, the identified cost for U.S. federal income tax purposes, the gross unrealized appreciation from investments for those securities having an excess of value over cost, the gross unrealized depreciation from investments for those securities having an excess of cost over value and the net unrealized appreciation from investments were $58,451,430, $69,425,469, $(499,042) and $68,926,427, respectively.

GAAP requires that certain components of net assets be adjusted to reflect permanent differences between financial and tax reporting. Accordingly, during the year ended December 31, 2010, $52,646 had been reclassified from accumulated net realized gains on investments and foreign currency related transactions and $1 had been reclassified from paid in capital to undistributed net investment income as a result of permanent differences primarily attributable to foreign currency transactions. These reclassifications had no effect on net assets or net asset values per share.

Notes to Financial Statements (concluded)

December 31, 2010

5. Capital

The authorized capital stock of the Fund is 100,000,000 shares of common stock, $0.001 par value. As of December 31, 2010 the Fund had 8,271,922 shares outstanding.

6. Credit Facility

On November 12, 2010, the Fund entered into a joint credit facility along with certain other Funds. The Funds agreed to a $10 million committed revolving credit facility with BBH & Co. for temporary or emergency purposes. Under the terms of the joint credit facility, the Funds pay an aggregate commitment fee on the average unused amount of the credit facility. In addition, the Funds pay interest on borrowings at the Overnight LIBOR rate plus a spread. For the year ended December 31, 2010, the Fund had no borrowings under the joint credit facility.

7. Contingencies

In the normal course of business, the Fund may provide general indemnifications pursuant to certain contracts and organizational documents. The Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, based on experience, the risk of loss from such claims is considered remote.

8. Portfolio Investment Risks

(a) Risks Associated with Foreign Securities and Currencies:

Investments in securities of foreign issuers carry certain risks not ordinarily associated with investments in securities of U.S. issuers. Such risks include, among others, currency risks, information risk and political risk. Currency risk results from securities denominated in currencies other than U.S. dollars that are subject to changes in value due to fluctuations in exchange rates. Information risk arises with respect to foreign securities when key information about foreign issuers may be inaccurate or unavailable. Political risk includes future political and economic developments, and the possible imposition of exchange controls or other foreign governmental laws and restrictions. In addition, with respect to certain countries, there is the possibility of expropriation of assets, confiscatory taxation, political or social instability or diplomatic developments, which could adversely affect investments in those countries. Other risks of investing in foreign securities include liquidity and valuation risks.

Certain countries also may impose substantial restrictions on investments in their capital markets by foreign entities, including restrictions on investments in issuers of industries deemed sensitive to relevant national interests. These factors may limit the investment opportunities available and result in a lack of liquidity and a high price volatility with respect to securities of issuers from developing countries.

Some countries require governmental approval for the repatriation of investment income, capital or the proceeds of sales of securities by foreign investors. In addition, if there is a deterioration in a country’s balance of payments or for other reasons, a country may impose temporary restrictions on foreign capital remittances abroad. Amounts repatriated prior to the end of specified periods may be subject to taxes as imposed by a foreign country.

(b) Risks Associated with Indonesian Markets:

The limited liquidity of the Indonesian and other foreign securities markets may also affect the Fund’s ability to acquire or dispose of securities at a price and time that it wishes to do so. Accordingly, in periods of rising market prices, the Fund may be unable to participate in such price increases fully to the extent that it is unable to acquire desired portfolio positions quickly; conversely the Fund’s inability to dispose fully and promptly of positions in declining markets will cause its net asset value to decline as the value of unsold positions is marked to lower prices.

The Indonesian securities market is an emerging market characterized by a small number of company listings, high price volatility and a relatively illiquid secondary trading environment. These factors, coupled with restrictions on investment by foreigners and other factors, limit the supply of securities available for investment by the Fund. This will affect the rate at which the Fund is able to invest in Indonesian and other foreign securities, the purchase and sale prices for such securities and the timing of purchases and sales.

9. Subsequent Events

Management has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date the financial statements were issued. Based on this evaluation, no adjustments were required to the Financial Statements as of December 31, 2010.

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders of

Aberdeen Indonesia Fund, Inc.:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Aberdeen Indonesia Fund, Inc. (the “Fund”, formerly The Indonesia Fund, Inc.) at December 31, 2010, the results of its operations for the year then ended and the changes in its net assets and financial highlights for the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audit, which included confirmation of securities at December 31, 2010 by correspondence with the custodian, provides a reasonable basis for our opinion.

![]()

Boston, Massachusetts

February 25, 2011

|

|

Aberdeen Indonesia Fund, Inc. |

Tax Information (unaudited)

For the year ended December 31, 2010, the Fund designates approximately $2,606,976, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for reduced tax rates. These lower rates range from 5% to 15% depending on an individual’s tax bracket. If the Fund pays a distribution during a calendar year, complete information will be reported in conjunction with Form 1099-DIV.

The Fund has made an election under Section 853 to pass through foreign taxes paid by the Fund to its shareholders. The amount of foreign taxes that were passed through to shareholders for the year ended December 31, 2010, was $359,202. The amount of foreign source income was $2,529,397. Shareholders should refer to their Form 1099-DIV to determine the amount includable on their respective tax returns for 2010.

During the year ended December 31, 2010, the Fund declared $4,253,504 in dividends that were designated as long-term capital gains dividends.

Proxy Voting and Portfolio Holdings Information (unaudited)

Information regarding how the Fund voted proxies related to its portfolio securities during the 12-month period ended June 30 of each year, as well as the policies and procedures that the Fund uses to determine how to vote proxies relating to its portfolio securities are available:

· By calling 1-866-839-5205;

· On the website of the Securities and Exchange Commission, www.sec.gov.

The Fund files a complete schedule of its portfolio holdings for the first and third quarters of its fiscal year with the SEC on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the SEC’s Public Reference Room may be obtained by calling 1-800-SEC-0330.

The Fund makes the information on Form N-Q available to shareholders on the Fund’s website or upon request and without charge by calling Investor Relations toll-free at 1-866-839-5205.

Supplemental Information (unaudited)

Considerations in Approving Renewal of Management Agreement and Investment Advisory Agreement

The Investment Company Act of 1940 (the “Investment Company Act”) and the terms of the investment advisory agreement (the “Advisory Agreement”) between the Aberdeen Indonesia Fund, Inc. (the “Fund”) and Aberdeen Asset Management Asia Limited (the “Adviser”) require that, following its initial two-year approval period, the Advisory Agreement be approved annually at an in-person meeting by a majority of the Board of Directors (the “Board”), including a majority of the Directors who have no direct or indirect interest in the investment advisory agreement and are not “interested persons” of the Fund, as defined in the Investment Company Act (the “Independent Directors”).

At its meeting on December 7, 2010, the Board voted unanimously to renew the Advisory Agreement between the Fund and the Adviser. In connection with its evaluation of the Advisory Agreement, the Board reviewed a broad range of information requested for this purpose and considered a variety of factors, including the following:

|

(i) |

The nature, extent and quality of the services provided by the Adviser; |

|

|

|

|

(ii) |

The performance of the Fund; |

Supplemental Information (unaudited) (continued)

|

(iii) |

The management fee rate and the net total expense ratio of the Fund, both on an absolute basis and as compared both to a relevant peer group of funds and to fees charged by the Adviser to others; |

|

|

|

|

(iv) |

The extent to which economies of scale could be realized by the Adviser and shared with the shareholders; |

|

|

|

|

(v) |

The costs of services provided and profits realized by the Adviser; |

|

|

|

|

(vi) |

Other benefits realized by the Adviser from its relationship with the Fund; and |

|

|

|

|

(vii) |

Any other factors that the Board deemed relevant to its consideration. |

In its review of information presented to the Board during the contract renewal process and throughout the year, the Board also considered knowledge gained from discussions with management leading up to and since the initial approval of the Advisory Agreement. The Independent Directors were represented by independent counsel throughout the review process and convened executive sessions without management present. In its deliberations, the Board did not identify any single factor that was all-important or controlling and each Director may have attributed different weights to the various factors.

Certain of the Board considerations outlined above are discussed in more detail below.

Nature, Extent and Quality of Services. The Board received and considered various data and information regarding the nature, extent and quality of services provided under the Advisory Agreement. The Board considered, among other things, information about the background and experience of senior management and investment personnel who were responsible for managing the Fund. The Board also received presentations from and participated in information sessions with senior investment personnel of the Adviser. The Board considered the information provided regarding the portfolio managers and other resources dedicated to the Fund and the investment philosophy and process followed by those individuals responsible for managing the Fund.

The Board also evaluated the ability of the Adviser, based on its resources, reputation and other attributes, to attract and retain qualified investment professionals. In this regard, the Board considered information regarding the general nature of the compensation structure applicable to portfolio managers and other key personnel.

In addition, the Board considered and evaluated materials and information received regarding the Adviser’s investment and legal compliance program and record with respect to the U.S. registered closed-end funds managed by the Adviser. The Board met in-person with and received quarterly reports from the Fund’s Chief Compliance Officer.

Furthermore, the Board received and considered information about the financial viability of the Adviser to satisfy itself that the Adviser had adequate resources to perform the services required under the Advisory Agreement.

Based on the foregoing and other relevant information reviewed, the Board concluded that, overall, the nature, extent and quality of the services provided to the Fund supported renewal of the Advisory Agreement.

Investment Performance. In addition to reports received at its regular quarterly meetings, the Board received and considered information on the performance history of the Fund, including comparisons to a Morningstar Category average and benchmark index returns over various time periods. The Board was provided with reports, independently prepared by Strategic Insight Mutual Fund Research and Consulting, LLC (“Strategic Insight”), which included a comprehensive analysis of the Fund’s performance.

Except for year 2007, the Fund’s performance was higher than or in-line with the performance of the Morningstar Pacific Asia ex-Japan Stock Category average for the eight-year period under review. The Fund’s performance was higher than the performance of its benchmark index, the MSCI Indonesia Index, for the years 2003, 2005 and 2008 and lower than the performance of the benchmark index for the other periods under review. The Adviser discussed factors that contributed to the Fund’s performance results. The Board took into account that the Adviser had only been managing the Fund since July 2009 and that the Adviser had been gradually repositioning the portfolio as part of the transition to the Adviser’s investment approach. The Board concluded that it was generally satisfied with the Fund’s performance and that the Adviser was taking appropriate actions to improve the Fund’s performance.

Fees and Economies of Scale. The Board considered the management fee rate charged by the Adviser to the Fund. The Board received an analysis from Strategic Insight that compared the Fund’s management fee rate to the management fee rate of a peer group of funds on a gross basis and on a net basis after taking into consideration any waivers or reimbursements. The Board noted that the gross and net management fee rates for the Fund were lower than the average and median gross and net management fee rates for its peer group. Furthermore, the Board concluded that the contractual breakpoints utilized by the Fund adequately took into account potential economies of scale.

The Board also reviewed information prepared by Strategic Insight that showed that the Fund’s net total expense ratio was lower than the average and median ratios of its peer group.

Costs of Services Provided and Profitability. The Board considered, among other things, the Adviser’s estimates of its costs in providing advisory services to the Fund, and the Adviser’s resulting profitability.

Supplemental Information (unaudited) (concluded)

Based on its review of the expense and profit information provided by the Adviser, the Board concluded that the profits earned by the Adviser from the Advisory Agreement were not excessive in light of the nature, extent and quality of services provided to the Fund.

Information about Services to Other Clients. The Board considered information about the nature and extent of services and fee rates offered by the Adviser to other clients, including other registered investment companies and separate accounts. The Board considered that the Adviser was subject to a broader and more extensive regulatory regime in connection with management of the Fund compared to the Adviser’s management of unregistered or institutional accounts. The Board concluded that the fee rate under the Advisory Agreement was not excessive relative to these other fee rates, given its understanding of similarities and differences in the nature and extent of services offered and other factors.

Fall-Out Benefits and Other Factors. The Board also considered information regarding potential “fall-out” or ancillary benefits that could be realized by the Adviser as a result of its relationship with the Fund. In this regard, the Board concluded that the Adviser and its affiliates

may derive reputational benefits from their association with the Fund. The Board also noted, however, that such benefits were difficult to quantify with certainty.

Additionally, the Board considered that the Adviser does not use “soft dollars.” The Board noted that the Adviser may enter into commission sharing arrangements with certain brokers for the receipt of goods or services that relate to the execution of trades or the provision of research. The Board considered the Adviser’s representations that it evaluates its commission sharing arrangements for compliance with US regulations, particularly, with respect to the safe harbor contained in Section 28(e) of the Securities Exchange Act of 1934 and for compliance with its best execution obligations.

* * * * *

After an evaluation of the above-described factors and based on its deliberations and analysis of the information provided and alternatives considered, the Board, including all of the Independent Directors, concluded that approval of the Advisory Agreement is in the best interest of the Fund and its shareholders. Accordingly, the Board unanimously approved the Advisory Agreement.

Management of the Fund (unaudited)

The names of the Directors and Officers of the Fund, their addresses, ages, and principal occupations during the past five years are provided in the tables below. Directors that are deemed “interested persons” (as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended) of the Fund are included in the table below under the heading “Interested Directors.” The Fund currently has not Interested Directors. Directors who are not interested persons, as described above, are referred to in the table below under the heading “Independent Directors.”

Board of Directors Information

|

Name, Address and Age |

|

Position(s) Held |

|

Term of Office |

|

Principal Occupation(s) |

|

Number of |

|

Other Directorships |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Independent Directors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enrique R. Arzac |

|

Chairman of the Board of Directors, Nominating Committee Chairman and Audit and Valuation Committee Member |

|

Since 2000; Chairman since 2005; current term ends at the 2012 annual meeting |

|

Professor of Finance and Economics, Graduate School of Business, Columbia University (1971-Present.) |

|

5 |

|

Director of Epoch Holding Corporation; Director of The Adams Express Company; Director of Petroleum and Resources Corporation; Director of Mirae Asset Management Funds (6 funds); Director of Credit Suisse Funds (13) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

James J. Cattano |

|

Director, Nominating Committee Member and Audit and Valuation Committee Chairman |

|

Since 2007; current term ends at the 2013 annual meeting |

|

President, Primary Resources Inc. (agricultural and raw materials) (October 1996-Present) |

|

5 |

|

Director of Credit Suisse Asset Management Income Fund, Inc. and Director of Credit Suisse High Yield Bond Fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lawrence J. Fox |

|

Director, Nominating and Audit and Valuation Committee Member |

|

Since 2000; current term ends at the 2011 annual meeting |

|

Partner, Drinker Biddle & Reath (law firm) (1972-Present) Lecturer at Yale Law School (2009-Present); Lecturer at Harvard Law School (2007-Present) |

|

4 |

|

Director of Credit Suisse Asset Management Income Fund, Inc. and Director of Credit Suisse High Yield Bond Fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Steven N. Rappaport |

|

Director, Nominating and Audit and Valuation Committee Member |

|

Since 2005; current term ends at the 2012 annual meeting |

|

Partner of Lehigh Court, LLC (private investment firm) and RZ Capital LLC (private investment firm) (January 2004-Present) |

|

5 |

|

Director of iCAD, Inc.; Director of Presstek, Inc.; Director of Credit Suisse Funds (13) |

|

|

* |

Aberdeen Asia-Pacific Income Fund, Inc., Aberdeen Australia Equity Fund, Inc., Aberdeen Global Income Fund, Inc., Aberdeen Chile Fund, Inc., Aberdeen Emerging Markets Telecommunications and Infrastructure Fund, Inc., Aberdeen Israel Fund, Inc., Aberdeen Latin America Equity Fund, Inc. and the Aberdeen Funds have a common Investment Manager and/or Investment Adviser with the Fund, or an investment adviser that is affiliated with the Investment Manager and Investment Adviser with the Fund, and may thus be deemed to be part of the same “Fund Complex” as the Fund. |

|

|

Aberdeen Indonesia Fund, Inc. |

Management of the Fund (unaudited) (continued)

Information Regarding Officers who are not Directors

|

Name, Address and Age |

|

Position(s) Held |

|

Term of Office*** |

|

Principal Occupation(s) During Past Five Years |

|

|

|

|

|

|

|

|

|

|

|

Officers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Christian Pittard* Age: 37 |

|

President |

|

Since July 2009 |

|

Currently, Group Head of Product Development, Collective Funds for Aberdeen Asset Management Investment Services Limited (“AAMISL”) (since 2008). Previously, Director and Vice President (from 2006 to 2008), Chief Executive Officer (from October 2005 to September 2006) and employee (since June 2005) of Aberdeen Asset Management Inc. (“AAMI”); Member of Executive Management Committee of Aberdeen Asset Management PLC (since August 2005); Managing Director of Aberdeen Asset Managers (C.I.) Limited (from 2000 to June 2005); Managing Director of Aberdeen Private Wealth Management Limited (affiliate of the Fund’s investment adviser) (from 2000 to May 2005). |

|

|

|

|

|

|

|

|

|

|

|

Jennifer Nichols* |

|

Vice President and Chief Compliance Officer |

|

Since July 2009 (Vice President); Since September 2010 (Chief Compliance Officer) |

|

Currently, Director, Vice President and Head of Legal — Americas for AAMI (since 2010). Ms. Nichols joined AAMI in October 2006. Previously was an associate attorney in the Financial Services Group of Pepper Hamilton LLP (law firm) (from 2003 to 2006). |

|

|

|

|

|

|

|

|

|

|

|

Andrea Melia* |

|

Treasurer and Chief Financial Officer |

|

Since November 2009 |

|

Currently, Vice President and Head of Fund Accounting for AAMI (since 2009). Prior to joining Aberdeen, Ms. Melia was Director of Fund Administration and accounting oversight for Princeton Administrators LLC, a division of BlackRock Inc. and had worked with Princeton Administrators since 1992. |

|

|

|

|

|

|

|

|

|

|

|

Megan Kennedy* |

|

Vice President and Secretary |

|

Since July 2009 |

|

Currently, Head of Product Management for AAMI (since 2009.) Ms. Kennedy joined AAMI in 2005 as a Senior Fund Administrator. Ms. Kennedy was promoted to Assistant Treasurer Collective Funds/North American Mutual Funds in February 2008 and promoted to Treasurer Collective Funds/North American Mutual Funds in July 2008. |

|

|

|

|

|

|

|

|

|

|

|

William Baltrus* |

|

Vice President |

|

Since July 2009 |

|

Currently, Head of Investor Services for AAMI (since 2009). Prior to joining AAMI in November 2007, he was Vice President of Administration for Nationwide Funds Group (from 2000 to 2007.) |

|

|

|

|

|

|

|

|

|

|

|

Alan Goodson* |

|

Vice President |

|

Since July 2009 |

|

Currently, Head of Product and Vice President of AAMI (since 2005.) Head of Finance (from 2000 to May 2005) and Company Secretary (from 2001 to May 2005) of Aberdeen Private Wealth Management Limited; Finance Director and Company Secretary of Aberdeen Asset Managers Jersey Limited (from 2002 to November 2005); Company Secretary of Aberdeen Asset Managers (C.I.) Limited (from 2001 to June 2005). |

|

|

|

|

|

|

|

|

|

|

|

Joanne Irvine |

|