Table of Contents

As filed with the U.S. Securities and Exchange Commission on December 17th, 2020

Registration Nos. 333-147508

811-06025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-6

| Registration Statement | ||||

| Under | ||||

| the Securities Act of 1933 | ☐ | |||

| Pre-Effective Amendment No. | ☐ | |||

| Post-Effective Amendment No. 13 | X | |||

| Registration Statement | ||||

| Under | ||||

| the Investment Company Act of 1940 | ☐ | |||

| Amendment No. 101 | X |

Metropolitan Life Separate Account UL

(Exact Name of Registrant)

Metropolitan Life Insurance Company

(Name of Depositor)

200 Park Avenue

New York, NY 10166

(Address of depositor’s principal executive offices)

Depositor’s Telephone Number, including Area Code: (212) 578-9500

Stephen Gauster, Esq.

Executive Vice President and General Counsel

Metropolitan Life Insurance Company

200 Park Avenue

New York, NY 10166

(Name and Address of Agent for Service)

Copy to:

W. Thomas Conner, Esquire

Vedder Price P.C.

1401 I Street, N.W.

Suite 1100

Washington, D.C. 20005

It is proposed that this filing will become effective (check appropriate box)

| ☐ | immediately upon filing pursuant to paragraph (b) |

| ☐ | on (date) pursuant to paragraph (b) |

| ☒ | 60 days after filing pursuant to paragraph (a)(1) |

| ☐ | on (date) pursuant to paragraph (a)(1) of Rule 485 |

| ☐ | this post-effective amendment designates a new effective date for a previously filed post-effective amendment |

Title of Securities Being Registered: Flexible Premium Variable Universal Life Insurance Policies.

Table of Contents

EQUITY ADVANTAGE VUL

Flexible Premium

Variable Life Insurance Policies

Issued by Metropolitan Life Separate Account UL of Metropolitan Life Insurance Company

April/May __, 2021

This prospectus describes individual flexible premium variable life insurance policies (the “Policies”) issued by Metropolitan Life Insurance Company (“MetLife” ,” the “Company,” “we,” “us” or “our). The Policies are no longer offered for sale.

You allocate net premiums among the Divisions of Metropolitan Life Separate Account UL (the “Separate Account”). Each Division of the Separate Account invests in shares of one of the following “Portfolios” (Divisions may be referred to as “Investment Divisions” in your Policy):

| American Funds Insurance Series® — Class 2 American Funds Bond Fund American Funds Global Small Capitalization Fund American Funds Growth Fund American Funds Growth-Income Fund

|

Schroders Global Multi-Asset Portfolio — Class B SSGA Growth and Income ETF Portfolio — Class A SSGA Growth ETF Portfolio — Class A T. Rowe Price Mid Cap Growth Portfolio — Class A Victory Sycamore Mid Cap Value Portfolio — Class A

| |

| Brighthouse Funds Trust I AB Global Dynamic Allocation Portfolio — Class B American Funds® Balanced Allocation Portfolio — Class B American Funds® Growth Allocation Portfolio — Class B American Funds® Moderate Allocation Portfolio — Class B AQR Global Risk Balanced Portfolio — Class B BlackRock Global Tactical Strategies Portfolio — Class B Brighthouse Asset Allocation 100 Portfolio — Class A Brighthouse Balanced Plus Portfolio — Class B Brighthouse/Aberdeen Emerging Markets Equity Portfolio — Class A Brighthouse/Templeton International Bond Portfolio — Class A Brighthouse/Wellington Large Cap Research Portfolio — Class A Clarion Global Real Estate Portfolio — Class A Harris Oakmark International Portfolio — Class A Invesco Balanced-Risk Allocation Portfolio — Class B Invesco Global Equity Portfolio — Class A (formerly Oppenheimer Global Equity Portfolio) Invesco Small Cap Growth Portfolio — Class A JPMorgan Global Active Allocation Portfolio — Class B JPMorgan Small Cap Value Portfolio — Class A Loomis Sayles Global Allocation Portfolio — Class A Loomis Sayles Growth Portfolio — Class A (formerly ClearBridge Aggressive Growth Portfolio) MetLife Multi-Index Targeted Risk Portfolio — Class B MFS® Research International Portfolio — Class A Morgan Stanley Discovery Portfolio — Class A PanAgora Global Diversified Risk Portfolio — Class B PIMCO Inflation Protected Bond Portfolio — Class A PIMCO Total Return Portfolio — Class A |

Brighthouse Funds Trust II — Class A Baillie Gifford International Stock Portfolio BlackRock Bond Income Portfolio BlackRock Capital Appreciation Portfolio Brighthouse Asset Allocation 20 Portfolio Brighthouse Asset Allocation 40 Portfolio Brighthouse Asset Allocation 60 Portfolio Brighthouse Asset Allocation 80 Portfolio Brighthouse/Artisan Mid Cap Value Portfolio Brighthouse/Wellington Balanced Portfolio Brighthouse/Wellington Core Equity Opportunities Portfolio Frontier Mid Cap Growth Portfolio Jennison Growth Portfolio Loomis Sayles Small Cap Core Portfolio Loomis Sayles Small Cap Growth Portfolio MetLife Aggregate Bond Index Portfolio MetLife Mid Cap Stock Index Portfolio MetLife MSCI EAFE® Index Portfolio MetLife Russell 2000® Index Portfolio MetLife Stock Index Portfolio MFS® Total Return Portfolio MFS® Value Portfolio Neuberger Berman Genesis Portfolio T. Rowe Price Large Cap Growth Portfolio T. Rowe Price Small Cap Growth Portfolio VanEck Global Natural Resources Portfolio Western Asset Management Strategic Bond Opportunities Portfolio Western Asset Management U.S. Government Portfolio

|

Table of Contents

The prospectuses for the Portfolios describe in greater detail an investment in the Portfolios. You can obtain prospectuses for the Portfolios by calling 800-638-5000, by going online at www.metlife.com. or by sending an email request to RCG@metlife.com.

You may also allocate net Premiums to our Fixed Account. Special limits may apply to Fixed Account transfers and withdrawals.

You received Fixed Account performance until 20 days after we apply your initial premium payment to the Policy. Thereafter, we invest the Policy’s Cash Value according to your instructions.

Additional information about certain investment products, including variable life insurance, has been prepared by the Securities and Exchange Commission’s staff and is available at Investor.gov.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these policies or determined if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

We do not guarantee how any of the Divisions or Portfolios will perform. The Policies and the Portfolios are not deposits or obligations of, or guaranteed or endorsed by, any financial institution and are not federally insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other government agency.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THE CONTRACTS AS DESCRIBED IN THIS PROSPECTUS UNTIL THE POST-EFFECTIVE AMENDMENT TO THE REGISTRATION STATEMENT RELATING TO THE CONTRACTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE CONTRACTS AND IS NOT SOLICITING AN OFFER TO BUY THESE CONTRACTS IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

IMPORTANT INFORMATION

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of a Portfolio’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from us. Instead, the shareholder reports will be made available on www.metlife.com, and you will be notified by mail each time a shareholder report is posted and provided with a website link to access the shareholder report.

If you already elected to receive your shareholder report electronically, you will not be affected by this change, and you need not take any action. You may elect to receive shareholder reports and other communications, including Portfolio prospectuses and other information we send you by contacting our Administrative Office.

If you wish to continue to receive shareholder reports in paper on and after January 1, 2021, we will continue to send you all future reports in paper, free of charge. Please contact us at our Administrative Office if you wish to continue receiving paper copies of the Portfolios’ shareholder reports. Your election to receive shareholder reports in paper will apply to all Portfolios available under your Policy.

Table of Contents

CONTENTS

| PAGE | ||||

| A-5 | ||||

| A-9 | ||||

| A-14 | ||||

| A-14 | ||||

| A-15 | ||||

| A-18 | ||||

| A-9 | ||||

| A-9 | ||||

| A-11 | ||||

| A-14 | ||||

| A-20 | ||||

| A-20 | ||||

| A-20 | ||||

| A-20 | ||||

| A-21 | ||||

| A-21 | ||||

| A-22 | ||||

| A-23 | ||||

| A-23 | ||||

| A-24 | ||||

| A-24 | ||||

| A-24 | ||||

| A-25 | ||||

| A-25 | ||||

| A-25 | ||||

| A-25 | ||||

| A-25 | ||||

| A-26 | ||||

| A-27 | ||||

| A-27 | ||||

| RECEIPT OF COMMUNICATIONS AND PAYMENTS AT METLIFE’S DESIGNATED OFFICE |

A-27 | |||

| A-28 | ||||

| A-29 | ||||

| A-30 | ||||

| A-31 | ||||

| A-32 | ||||

| A-33 | ||||

| A-33 | ||||

| A-34 | ||||

| A-34 | ||||

| A-34 | ||||

| A-35 | ||||

| A-37 | ||||

| A-37 | ||||

| A-40 | ||||

| A-41 |

A-3

Table of Contents

| PAGE | ||||

| A-42 | ||||

| A-42 | ||||

| A-43 | ||||

| A-43 | ||||

| A-45 | ||||

| A-45 | ||||

| A-45 | ||||

| A-46 | ||||

| A-46 | ||||

| A-47 | ||||

| A-47 | ||||

| A-48 | ||||

| A-48 | ||||

| A-49 | ||||

| A-49 | ||||

| A-51 | ||||

| Charges Against the Portfolios and the Divisions of the Separate Account |

A-51 | |||

| A-51 | ||||

| A-51 | ||||

| A-52 | ||||

| A-52 | ||||

| A-56 | ||||

| A-56 | ||||

| A-58 | ||||

| A-58 | ||||

| A-58 | ||||

| A-59 | ||||

| A-60 | ||||

| APPENDIX B: GUIDELINE PREMIUM TEST AND CASH VALUE ACCUMULATION TEST |

A-63 |

A-4

Table of Contents

Important Information You Should Consider About the Policy

An investment in the Policy is subject to fees, risks, and other important considerations, some of which are briefly summarized in the following table. You should review the prospectus for additional information about these topics.

| FEES AND EXPENSES |

LOCATION

IN | |||||

|

|

Charges for Early Withdrawal | A surrender charge will be deducted from the cash value if the Policy is surrendered or terminated after a grace period during the first ten (10) Policy years. A surrender charge will also be deducted upon surrender or termination of a Policy during the first (10) Policy years after an increase in the specified face amount of a Policy. A surrender charge will also be deducted if a partial withdrawal is made from the Policy within the first ten (10) Policy years (or the first ten (10 Policy years following the face amount increase) if the partial withdrawal reduces the face amount (or the face amount increase). If the Policy is surrendered within the first Policy year (or the first Policy year following a face amount increase) we will also deduct an amount equal to the remaining first year Coverage Expense Charges. In each case, the amount of the surrender charge is based on a charge per thousand dollars of specified face amount of the Policy.

The maximum surrender charge is $38.25 per thousand dollars of specified face amount. For example, the maximum surrender charge during the first year after issue (or a specified face amount increase), assuming an initial face amount (or subsequent specified face amount increase) of $100,000, is $3,825. |

“Charges - Surrender Charge, Partial Withdrawal Charge” | |||

| Transaction Charges | In addition to surrender charges, you also may be charged for other transactions (such as when you make a premium payment or transfer cash value between investment options or make a partial withdrawal). | “Charges” | ||||

A-5

Table of Contents

| Ongoing Fees and Expenses (monthly and annual charges) | In addition to surrender charges and transaction charges, an investment in the Policy is subject to certain ongoing fees and expenses, including a monthly deduction covering the cost of insurance under the Policy and optional benefits added by rider, and such fees and expenses are set based on characteristics of the insured (e.g., age, sex and risk classification). Please refer to the specifications page of your Policy for applicable rates.

There is also a mortality and expense risk charge deducted from the Separate Account. The rate charged is determined by the Cash Value in the Separate Account and the Fixed Account. The rate is determined on each monthly anniversary and varies based on the Policy year and the Policy’s Cash Value in relation to the Policy’s Target Premium. The rate declines as the Policy’s net Cash Value and the Policy years increase. The charge is guaranteed not to exceed 0.80% in Policy years 1-10; 0.35% in Policy years 11-19; 0.20% in Policy Years 20-29 and 0.05% thereafter. |

“Charges – Monthly Deduction from Cash Value, Charges Against the Portfolios and the Divisions of the Separate Account” | ||||||||

| You will also bear expenses associated with the Portfolios available under your Policy, as shown in the following table: | ||||||||||

| ANNUAL FEE | MIN. | MAX. | ||||||||

| Investment options (Portfolio fees and charges)

|

_____% | ____%2 | ||||||||

|

|

RISKS |

LOCATION

IN | ||||||||

| Risk of Loss | You can lose money by investing in this Policy. | “Summary of Benefits and Risks-Risks of the Policies” | ||||||||

| Not a Short-Term Investment | The Policies are designed to provide lifetime insurance protection. They should not be used as a short-term investment or if you need ready access to cash, because you will be charged when you make premium payments and you may also pay surrender charges when surrendering the Policy. | “Summary of Benefits and Risks-Risks of the Policies” | ||||||||

| Risks Associated with Investment Options | An investment in this Policy is subject to the risk of poor investment performance and can vary depending on the performance of the Portfolios available under the Policy. Each investment option has its own unique risks. You should review the Portfolios before making an investment decision. | “Summary of Benefits and Risks-Risks of the Policies, Risks of the Portfolios” | ||||||||

A-6

Table of Contents

| Insurance Company Risks |

Any obligations, guarantees, and benefits of the Policy are subject to the claims paying ability of Metropolitan Life. If Metropolitan Life experiences financial distress, it may not be able to meet its obligations to you. More information about Metropolitan Life, including its financial strength ratings, is available upon request by calling 1-800-638-5000. |

“Summary of Benefits and Risks-Risks of the Policies” | ||||||||||

| Policy Lapse | Your Policy may lapse if you have paid an insufficient amount of premiums or if the investment experience of the Portfolios is poor and the cash surrender value under your Policy is insufficient to cover the monthly deduction. Lapse of a Policy on which there is an outstanding loan may have adverse tax consequences. |

“Summary of Benefits and Risks-Risks of the Policies” | ||||||||||

|

|

RESTRICTIONS |

LOCATION

IN | ||||||||||

| Investment Options | At the present time, no charge is assessed against the cash value of a Policy when amounts are transferred among the investment divisions of the Separate Account and between the investment divisions and the Fixed Account. Policy owners may transfer cash value between and among the investment divisions and the Fixed Account. The minimum amount Policy owners may transfer is $50, or if less the total amount in the Division or the Fixed Account. We reserve the right to only allow transfers and withdrawals from the Fixed Account during the 30-day period that follows the Policy anniversary. The total amount of transfers and withdrawals from the Fixed Account in a Policy year may not exceed the greater of (a) 25% of the Policy’s Cash Surrender Value in the Fixed Account at the beginning of the Policy year, (b) the previous Policy year’s maximum allowable withdrawal amount, and (c) 100% of the Cash Surrender Value in the Fixed Account if withdrawing the greater of (a) and (b) would result in a Fixed Account balance of $50 or less. Metropolitan Life also reserves the right to limit transfers to four (4) per Policy year and to impose a charge of $25 per. Metropolitan Life reserves the right to remove or substitute portfolio companies as investment options that are available under the Policy. The Company also has policies and procedures that attempt to detect and deter frequent transfers in situations where we determine there is a potential for arbitrage trading. |

“Charges-Transfer Charge” and “Transfers” | ||||||||||

A-7

Table of Contents

| Optional Benefits | You may not elect both the Waiver of Monthly Deduction Rider and the Waiver of Specified Premium Rider. With respect to the Accelerated Death Benefit rider, In exercising the benefit the Policy Owner must accelerate at least $50,000 (or 25% of the death benefit, if less), but not more than the greater of $250,000 or 10% of the death benefit. |

“Additional Benefits by Rider” | ||||||||

| TAXES |

LOCATION IN PROSPECTUS | |||||||||

| Tax Implications | Consult with a tax professional to determine the tax implications of an investment in and payments received under this Policy.

If you purchase the Policy through a tax-qualified plan or individual retirement account (IRA), you do not get any additional tax deferral.

Withdrawals will be subject to ordinary income tax, and may be subject to tax penalties.

Lapse of a Policy on which there is an outstanding loan may have adverse tax consequences |

“Federal Tax Matters” | ||||||||

| CONFLICTS OF INTEREST |

LOCATION

IN | |||||||||

| Investment Professional Compensation | Your investment professional may receive compensation relating to your ownership of a Policy, both in the form of commissions and continuing payments. This conflict of interest may influence your investment professional when advising you on your Policy. |

“Distribution of the Policies” | ||||||||

| Exchanges | Some investment professionals may have a financial incentive to offer you a new policy in place of your current Policy. You should only exchange your Policy if you determine, after comparing the features, fees, and risks of both policies, that it is better for you to purchase the new policy rather than continue to own your existing policy. |

“The Policies-Replacing Existing Insurance” | ||||||||

A-8

Table of Contents

Purpose of the Policy

The Policy is designed to provide lifetime insurance coverage on the insured(s) named in the Policies, as well as maximum flexibility in connection with premium payments and death benefits. This flexibility allows you to provide for changing insurance needs within the confines of a single insurance policy.

Payment of Premiums

A Policy owner has considerable flexibility concerning the amount and frequency of premium payments. The Policy owner elected in the application when the Policy was first purchased to pay premiums annually or on a monthly “check-o-matic” (or payroll deduction plan if provided by the employer of the Policy owner) or semi-annual basis, which is the planned periodic premium schedule. The schedule will provide for a premium payment of a level amount determined by the Policy owner at fixed intervals over a specified period of time. A Policy owner need not adhere to the planned periodic premium payment schedule. Instead, a Policy owner may, subject to certain restrictions, make premium payments in any amount and at any frequency. However, the Policy owner may be required to make an unscheduled premium payment in order to keep the Policy in force.

Features of the Policy

The Policy has a number of features designed to provide lifetime insurance coverage as well as maximum flexibility is connection with premium payments and death benefits, including flexibility to change the type and amount of the death benefit; flexibility in paying premiums; loan privileges; surrender privileges; and optional insurance benefits.

The following tables describe the fees and expenses that a Policy Owner will pay when buying, owning and surrendering the Policy. The first table describes the fees and expenses that a Policy Owner will pay at the time he or she buys the Policy, surrenders the Policy or transfers Cash Value among accounts.

| Charge | When Charge is Deducted |

Current Amount Deducted |

Maximum Amount Deductible | |||

| Premium Expense charges | ||||||

| Sales Charge Imposed on Premiums | On payment of premium | 2.25% of premiums paid up to the Target Premium per Policy year1 | 2.25% of each premium paid | |||

| State Premium Tax Imposed on Premiums | On payment of premium | 2.0% in all Policy years | 2.0% in all Policy years | |||

| Federal Tax Imposed on Premiums | On payment of premium | 1.25% in all Policy years | 1.25% in all Policy years | |||

1 The target premium varies based on individual characteristics, including the insured’s issue age, risk class and (except for unisex Policies) sex.

A-9

Table of Contents

| Charge | When Charge is Deducted |

Current Amount Deducted |

Maximum Amount Deductible | |||

| Surrender Charge1 | On surrender, lapse, or face amount reduction in the first ten (10) Policy years (and, with respect to a face amount increase, in the first ten (10) Policy years after the increase) | |||||

|

Minimum and Maximum Charge |

In Policy year 1, $3.75 to $38.25 per $1,000 of base Policy face amount2 |

In Policy year 1, $3.75 to $38.25 per $1,000 of base Policy face amount2 | ||||

|

Charge in the first Policy year for a Representative Insured3 |

$14.00 per $1,000 of base Policy face amount | $14.00 per $1,000 of base Policy face amount | ||||

| Transfer Charge4 | On transfer of cash value among the Divisions and to and from the Fixed Account | Not currently charged | $25 for each transfer | |||

| Partial Withdrawal Charge | On partial withdrawal of cash value | Not currently charged | $25 for each partial withdrawal5 | |||

| Illustration of Benefits Charge | On provision of each illustration in excess of one per year | Not currently charged | $25 per illustration | |||

1 The Surrender Charge varies based on individual characteristics, including the insured’s issue age, risk class, sex (except for unisex Policies), smoker status, and the Policy’s face amount. The Surrender Charge may not be representative of the charge that a particular Policy Owner would pay. You can obtain more information about the Surrender Charge that would apply for a particular insured by contacting your registered representative.

2 No Surrender Charge will apply on up to 10% of cash surrender value withdrawn each year. The Surrender Charge will remain level for one to three Policy years, and will then begin to decline on a monthly basis until it reaches zero in the last month of the tenth Policy year. The Surrender Charge applies to requested face amount reductions as well as to face amount reductions resulting from a change in death benefit option.

3 The Representative Insured is a male, age 35, in the preferred nonsmoker risk class, under a Policy with a base Policy face amount of $375,000.

4 The Portfolios in which the Divisions invest may impose a redemption fee on shares held for a relatively short period.

5 If imposed, the partial withdrawal charge would be in addition to any Surrender Charge that is imposed.

The next table describes the fees and expenses that a Policy Owner will pay periodically during the time that he or she owns the Policy, not including Portfolio fees and expenses.

A-10

Table of Contents

Periodic Charges other than Annual Portfolio Expenses

| Charge | When Charge is Deducted |

Current Amount Deducted |

Maximum Amount Deductible | |||

| Cost of Insurance1

Minimum and Maximum Charge

Charge in the first Policy year for a Representative Insured3 |

Monthly

Monthly |

$.01 to $83.33 per $1,000 of net amount at risk2

$.02 per $1,000 of net amount at risk |

$.02 to $83.33 per $1,000 of net amount at risk2

$.09 per $1,000 of net amount at risk | |||

| Policy Charge4

Policy face amount less than $50,000

Policy face amount between $50,000 and $249,999 |

Monthly

Monthly |

$12

$15 |

$12

$15 | |||

| Mortality and Expense Risk Charge (annual rate imposed on Cash Value in the Separate Account)5 | Monthly | .60% | .80% | |||

| Coverage Expense Charge6

Minimum and Maximum Charge

Charge for a Representative Insured3 |

Monthly

Monthly |

$.04 to $2.30 per $1,000 of base Policy face amount7

$.16 per $1,000 of base Policy face amount7 |

$.04 to $2.30 per $1,000 of base Policy face amount

$.16 per $1,000 of base Policy face amount | |||

| Loan Interest Spread8 | Annually (or on loan termination, if earlier) | 1.00% of loan collateral | 1.00% of loan collateral | |||

1 The cost of insurance charge varies based on individual characteristics, including the Policy’s face amount and the insured’s age, risk class, and (except for unisex Policies) sex. The cost of insurance charge may not be representative of the charge that a particular Policy Owner would pay. You can obtain more information about the cost of insurance charge that would apply for a particular insured by contacting your registered representative.

2 The net amount at risk is the difference between the death benefit (generally discounted at the monthly equivalent of 3% per year) and the Policy’s Cash Value.

3 The Representative Insured is a male, age 35, in the preferred nonsmoker risk class, under a Policy with a base Policy face amount of $375,000.

4 After the first Policy Year, the Policy Charge declines to $9 for a Policy with a face amount of less than $50,000, and to $8 for a Policy with a face amount between $50,000 and $249,999. No Policy Charge applies if a Policy is issued with a face amount equal to or greater than $250,000.

5 The Mortality and Expense Risk Charge declines over time in accordance with the following schedule:

| Current Charge | Maximum Charge | |||||||

| Policy years 1 - 10 |

.60 | % | .80 | % | ||||

| Policy years 11 - 19 |

.35 | % | .35 | % | ||||

| Policy years 20 – 29 |

.20 | % | .20 | % | ||||

| Policy years 30+ |

.05 | % | .05 | % | ||||

A-11

Table of Contents

The Current Charge Percentages shown above apply if the Policy’s net Cash Value is less than the equivalent of five Target Premiums. The percentages decrease as the Policy’s net Cash Value, measured as a multiple of Target Premiums, increases, as shown below:

| Less than 5 target premiums |

At least 5 but less than 10 target premiums |

At least 10 but less than 20 target premiums |

20 or more target premiums |

|||||||||||||

| Policy years 1- 10 |

.60 | % | .55 | % | .30 | % | .15 | % | ||||||||

| Policy years 11- 19 |

.35 | % | .30 | % | .15 | % | .10 | % | ||||||||

| Policy years 20- 29 |

.20 | % | .15 | % | .10 | % | .05 | % | ||||||||

| Policy years 30+ |

.05 | % | .05 | % | .05 | % | .05 | % | ||||||||

6 The Coverage Expense Charge varies based on individual characteristics, including the Policy’s face amount and the Insured’s age, risk class, and (except for unisex Policies) sex. The Coverage Expense Charge may not be representative of the charge that a particular Policy Owner would pay. You can obtain more information about the Coverage Expense Charge that would apply to a particular insured by contacting your registered representative.

7 The Coverage Expense Charge is imposed in Policy years 1-8 and, with respect to a requested face amount increase, during the first eight years following the increase. If you surrender the Policy in the first Policy year (or in the first year following a face amount increase), we will deduct from the surrender proceeds an amount equal to the Coverage Expense Charges due for the remainder of the first Policy year (or the first year following the face amount increase). If the Policy’s face amount is reduced in the first year following a face amount increase, we will deduct from the Cash Value an amount equal to the Coverage Expense Charges due for the remainder of the first year following the face amount increase.

8 The loan interest spread is the difference between the interest rates we charge on Policy loans and the interest earned on Cash Value we hold as security for the loan (“loan collateral”). We charge interest on Policy loans at an effective rate of 4.0% per year in Policy years 1-10 and 3.0% thereafter. Loan collateral earns interest at an effective rate of not less than 3.0% per year.

Charges for Insurance Benefits (Riders):

| Charge | When Charge is Deducted |

Current Amount Deducted |

Maximum Amount Deductible | |||

| Guaranteed Survivor Income Benefit Rider1

Minimum and Maximum Charge

Charge for a Representative Insured2 |

Monthly

Monthly |

$.01 to $1.08 per $1,000 of Eligible Death Benefit

$.02 per $1,000 of Eligible Death Benefit |

$.01 to $83.33 per $1,000 of Eligible Death Benefit

$.02 per $1,000 of Eligible Death Benefit | |||

| Children’s Term Insurance Rider | Monthly | $.40 per $1,000 of rider face amount | $.40 per $1,000 of rider face amount | |||

| Waiver of Monthly Deduction Rider3

Minimum and Maximum Charge

Charge in the first Policy year for a Representative insured4 |

Monthly

Monthly |

$.00 to $61.44 per $100 of Monthly Deduction

$6.30 per $100 of Monthly Deduction |

$.00 to $61.44 per $100 of Monthly Deduction

$6.30 per $100 of Monthly Deduction | |||

| Waiver of Specified Premium Rider

Minimum and Maximum Charge

Charge in the first Policy year for a Representative Insured4 |

Monthly

Monthly |

$.00 to $21.75 per $100 of Specified Premium

$3.00 per $100 of Specified Premium |

$.00 to $21.75 per $100 of Specified Premium

$3.00 per $100 of Specified Premium | |||

A-12

Table of Contents

1 The charge for the Guaranteed Survivor Income Benefit Rider varies based on individual characteristics, including the rider’s Eligible Death Benefit and the insured’s age, risk class, and (except for unisex Policies) sex. The rider change may not be representative of the charge that a particular Policy Owner would pay. You can obtain more information about the rider charge that would apply for a particular insured by contacting your registered representative.

2 The Representative Insured is a male, age 35, in the preferred nonsmoker risk class, under a Policy with an Eligible Death Benefit of $375,000.

3 The charge for this rider varies based on individual characteristics, including the insured’s age, risk class, and (except for unisex Policies) sex. The rider charge may not be representative of the charge that a particular Policy Owner would pay. You can obtain more information about the rider charge that would apply for a particular insured by contacting your registered representative.

4 The Representative Insured is a male, age 35, in the preferred nonsmoker risk class.

Charges for Optional Insurance Benefits (Riders) (Cont’d)

| Charge | When Charge is Deducted |

Current Amount Deducted |

Maximum Amount Deductible | |||

| Options to Purchase Additional Insurance Coverage Rider1

Minimum and Maximum Charge

Charge for a Representative Insured2 |

Monthly

Monthly |

$.02 to $.25 per $1,000 of Option amount

$.03 per $1,000 of Option amount |

$.02 to $.25 per $1,000 of Option amount

$.03 per $1,000 of Option amount | |||

| Accidental Death Benefit Rider1

Minimum and Maximum Charge

Charge in the first Policy year for a Representative Insured2 |

Monthly

Monthly |

$.00 to $.34 per $1,000 of rider face amount

$.05 per $1,000 of rider face amount |

$.00 to $83.33 per $1,000 of rider face amount

$.08 per $1,000 of rider face amount | |||

| Guaranteed Minimum Death Benefit Rider1,3

Minimum and Maximum Charge

Charge for a Representative Insured4 |

Monthly

Monthly |

$.03 to $.14 per $1,000 of net amount at risk

$.03 per $1,000 of net amount at risk |

$.03 to $83.33 per $1,000 of net amount at risk

$.03 per $1,000 of net amount at risk | |||

| Acceleration of Death Benefit Rider | At time of benefit payment | Not currently charged | One-time fee of $150 | |||

| Overloan Protection Rider | At time of exercise | One-time fee of 3.5% of Policy cash value | One-time fee of 3.5% of Policy cash value | |||

1 The charge for this rider varies based on individual characteristics, including the insured’s age, risk class, and (except for unisex Policies) sex. The rider charge may not be representative of the charge that a particular Policy Owner would pay. You can obtain more information about the rider charge that would apply for a particular insured by contacting your registered representative.

2 The Representative Insured is a male, age 35, in the preferred nonsmoker risk class.

3 The charge shown applicable to both the Guaranteed Minimum Death Benefit to Age 85 Rider and the Guaranteed Minimum Death Benefit to Age 121 Rider.

4 The Representative Insured is a female, age 45, in the preferred nonsmoker risk class.

A-13

Table of Contents

The next table shows the minimum and maximum total operating expenses charged by the Portfolios that you may pay periodically during the time that you own the Policy. A complete list of the Portfolios available under the Policy, including their annual expenses, may be found in Appendix A.

|

Annual Operating Expenses (as a percentage of average net assets) |

||||||||

| Minimum and Maximum Total Annual Portfolio Operating Expenses | Minimum | Maximum | ||||||

| Total Annual Portfolio Operating Expenses |

0.28 | % | 1.42 | % | ||||

This summary describes the Policy’s important benefits and risks. The sections in the prospectus following this summary discuss the Policy in more detail. The Glossary at the end of the prospectus defines certain words and phrases used in this prospectus.

Death Proceeds. The Policy is designed to provide insurance protection. Upon receipt of satisfactory proof of the death of the insured, we pay death proceeds to the beneficiary of the Policy. Death proceeds generally equal the death benefit on the date of the insured’s death plus any additional insurance provided by rider, less any outstanding loan and accrued loan interest.

Choice of Death Benefit Option. You may choose among three death benefit options:

| — | a level death benefit that equals the Policy’s face amount; |

| — | a variable death benefit that equals the Policy’s face amount plus the Policy’s cash value; and |

| — | a combination variable and level death benefit that equals the Policy’s face amount plus the Policy’s cash value until the insured attains age 65 and equals the Policy’s face amount thereafter. |

The death benefit under any option could increase to satisfy Federal tax law requirements if the cash value reaches certain levels. After the first Policy year you may change your death benefit option, subject to our underwriting rules. A change in death benefit option may have tax consequences.

Premium Flexibility. You can make premium payments based on a schedule you determine, subject to some limits. You may change your payment schedule at any time or make a payment that does not correspond to your schedule. We can, however, limit or prohibit payments in some situations.

Right to Examine the Policy. During the first ten days following your receipt of the Policy, you have the right to return the Policy to us. If you exercise this right, we will refund the premiums you paid.

Investment Options. You can allocate your net Premiums and Cash Value among your choice of Divisions available in the Separate Account, each of which corresponds to a mutual fund portfolio, or “Portfolio.” The Portfolios available under the Policy include several common stock funds, including funds which invest primarily in foreign securities, as well as bond funds, balanced funds, asset allocation funds and funds that invest in exchange-traded funds. You may also allocate Premiums and Cash Value to our Fixed Account which provides guarantees of interest and principal. You may change your allocation of future premiums at any time.

A-14

Table of Contents

Partial Withdrawals. You may withdraw cash surrender value from your Policy at any time after the first Policy anniversary. The minimum amount you may withdraw is $500. We reserve the right to limit partial withdrawals to no more than 90% of the Policy’s cash surrender value. We may limit the number of partial withdrawals to 12 per Policy year or impose a processing charge of $25 for each partial withdrawal. Partial withdrawals may have tax consequences.

Transfers and Automated Investment Strategies. You may transfer your Policy’s Cash Value among the Divisions or between the Divisions and the Fixed Account. The minimum amount you may transfer is $50, or if less, the total amount in the Division or the Fixed Account. We may limit the number of transfers among the Divisions and the Fixed Account to no more than four per Policy year. We may impose a processing charge of $25 for each transfer. We may also impose restrictions on frequent transfers. (See “Transfers” for additional information on such restrictions.) We offer five automated investment strategies that allow you to periodically transfer or reallocate your cash value among the Divisions and the Fixed Account. (See “Automated Investment Strategies.”)

Loans. You may borrow from the Cash Value of your Policy. The minimum amount you may borrow is $500. The maximum amount you may borrow is an amount equal to the Policy’s Cash Value net of the Surrender Charge, reduced by Monthly Deductions and interest charges through the next Policy anniversary, increased by interest credits through the next Policy anniversary, less any existing Policy loans. We charge you a maximum annual interest rate of 4.0% for the first ten Policy years and 3.0% thereafter. We credit interest at an annual rate of at least 3.0% on amounts we hold as collateral to support your loan. Loans may have tax consequences. (See “Loans” for additional information.)

Surrenders. You may surrender the Policy for its cash surrender value at any time. Cash surrender value equals the Cash Value reduced by any Policy loan and accrued loan interest and by any applicable Surrender Charge. A surrender may have tax consequences.

Tax Benefits. We anticipate that the Policy should be deemed to be a life insurance contract under Federal tax law. Accordingly, undistributed increases in Cash Value should not be taxable to you. As long as your Policy is not a modified endowment contract, partial withdrawals should be non-taxable until you have withdrawn an amount equal to your total investment in the Policy. However, different rules apply in the first fifteen Policy years, as distributions accompanied by benefit reductions may be taxable prior to a complete withdrawal of your investment in the Policy. Always confirm in advance the tax consequences of a particular withdrawal with a qualified tax adviser. Death benefits paid to your beneficiary should generally be free of Federal income tax. Death benefits may be subject to estate taxes. Under current Federal income tax law, the taxable portion of distributions from variable life policies is taxed at ordinary income tax rates and does not qualify for the reduced tax rate applicable to long-term capital gains and dividends.

Conversion Right. During the first two Policy years, you may convert the Policy to fixed benefit coverage by exchanging the Policy for a fixed benefit life insurance policy that we agree to, and that is issued by us or an affiliate that we name. We will make the exchange without evidence of insurability.

Supplemental Benefits and Riders. We offer a variety of riders that provide supplemental benefits under the Policy. We generally deduct any monthly charges for these riders as part of the Monthly Deduction. Your registered representative can help you determine whether any of these riders are suitable for you.

Personalized Illustrations. You will receive personalized illustrations in connection with the purchase of this Policy that reflect your own particular circumstances. These hypothetical illustrations may help you to understand the long-term effects of different levels of investment performance, the possibility of lapse, and the charges and deductions under the Policy. They will also help you to compare this Policy to other life insurance policies. The personalized illustrations are based on hypothetical rates of return and are not a representation or guarantee of investment returns or Cash Value.

Investment Risk. If you invest your Policy’s Cash Value in one or more of the Divisions, then you will be subject to the risk that investment performance will be unfavorable and that your Cash Value will decrease. In addition, we deduct Policy fees and charges from your Policy’s Cash Value, which can significantly reduce your Policy’s Cash Value. During times of poor investment performance, this deduction will have an even greater impact on your Policy’s Cash Value. It is possible to lose your full investment and your Policy could

A-15

Table of Contents

lapse without value, unless you pay additional premium. If you allocate Cash Value to the Fixed Account, then we credit such Cash Value with a declared rate of interest. You assume the risk that the rate may decrease, although it will never be lower than the guaranteed minimum annual effective rate of 3%.

Surrender and Withdrawal Risks. The Policies are designed to provide lifetime insurance protection. They are not offered primarily as an investment, and should not be used as a short-term savings vehicle. If you surrender the Policy within the first ten (10) Policy years (or within the first ten (10) Policy years following a face amount increase), you will be subject to a Surrender Charge as well as income tax on any gain that is distributed or deemed to be distributed from the Policy. You will also be subject to a Surrender Charge if you make a partial withdrawal from the Policy within the first ten (10) Policy years (or the first ten (10) Policy years following the face amount increase) if the partial withdrawal reduces the face amount (or the face amount increase). If you surrender the Policy in the first Policy year (or in the first year following a face amount increase) we will also deduct an amount equal to the remaining first year Coverage Expense Charges.

You should purchase the Policy only if you have the financial ability to keep it in force for a substantial period of time. You should not purchase the Policy if you intend to surrender all or part of the Policy’s Cash Value in the near future. Even if you do not ask to surrender your Policy, surrender charges may play a role in determining whether your Policy will lapse (terminate without value), because surrender charges determine the cash surrender value, which is a measure we use to determine whether your Policy will enter the grace period (and possibly lapse).

Risk of Lapse. Your Policy may lapse if you have paid an insufficient amount of Premiums or if the investment experience of the Divisions is poor. If your cash surrender value is not enough to pay the Monthly Deduction, your Policy may enter a 62-day grace period. We will notify you that the Policy will lapse unless you make a sufficient payment of additional Premium during the grace period. Your Policy generally will not lapse if you pay certain required Premium amounts and you are therefore protected by a Guaranteed Minimum Death Benefit. If your Policy does lapse, your insurance coverage will terminate, although you will be given an opportunity to reinstate it. Lapse of a Policy on which there is an outstanding loan may have adverse tax consequences.

Tax Risks. We anticipate that the Policy should be deemed to be a life insurance contract under Federal tax law. However, the rules are not entirely clear in certain circumstances, for example, if your Policy is issued on a substandard basis. The death benefit under the Policy will never be less than the minimum amount required for the Policy to be treated as life insurance under section 7702 of the Internal Revenue Code, as in effect on the date the Policy was issued. If your Policy is not treated as a life insurance contract under Federal tax law, increases in the Policy’s Cash Value will be taxed currently.

Even if your Policy is treated as a life insurance contract for Federal tax purposes, it may become a modified endowment contract due to the payment of excess Premiums or unnecessary Premiums, due to a material change or due to a reduction in your death benefit. If your Policy becomes a modified endowment contract, surrenders, partial withdrawals, loans, and use of the Policy as collateral for a loan will be treated as a distribution of the earnings in the Policy and will be taxable as ordinary income to the extent thereof. In addition, if the Policy Owner is under age 59 1⁄2 at the time of the surrender, partial withdrawal or loan, the amount that is included in income will generally be subject to a 10% penalty tax.

If the Policy is not a modified endowment contract, distributions generally will be treated first as a return of basis or investment in the Policy and then as taxable income. However, different rules apply in the first fifteen Policy years, as distributions accompanied by benefit reductions may be taxable prior to a complete withdrawal of your investment in the Policy. Moreover, loans will generally not be treated as distributions prior to termination of your Policy, whether by lapse, surrender or exchange. Finally, neither distributions nor loans from a Policy that is not a modified endowment contract are subject to the 10% penalty tax.

See “Tax Considerations.” You should consult a qualified tax adviser for assistance in all Policy-related tax matters.

A-16

Table of Contents

Loan Risks. A Policy loan, whether or not repaid, will affect the Cash Value of your Policy over time because we subtract the amount of the loan from the Divisions and/or Fixed Account as collateral, and hold it in our Loan Account. This loan collateral does not participate in the investment experience of the Divisions or receive any higher current interest rate credited to the Fixed Account.

We also reduce the amount we pay on the insured’s death by the amount of any outstanding loan and accrued loan interest. Your Policy may lapse if your outstanding loan and accrued loan interest reduce the cash surrender value to zero.

If you surrender your Policy or your Policy lapses while there is an outstanding loan, there will generally be Federal income tax payable on the amount by which loans and partial withdrawals exceed the premiums paid. Since loans and partial withdrawals reduce your Policy’s Cash Value, any remaining Cash Value may be insufficient to pay the income tax due.

Limitations on Cash Value in the Fixed Account. Transfers to and from the Fixed Account must generally be in amounts of $50 or more. Partial withdrawals from the Fixed Account must be in amounts of $500 or more. The total amount of transfers and withdrawals from the Fixed Account in a Policy year may generally not exceed the greater of 25% of the Policy’s cash surrender value in the Fixed Account at the beginning of the year, or the maximum transfer amount for the preceding Policy year. We reserve the right to only allow transfers and withdrawals from the Fixed Account during the 30-day period that follows the Policy anniversary .We may also limit the number of transfers and partial withdrawals and may impose a processing charge for transfers and partial withdrawals. We are not currently imposing the maximum limit on transfers and withdrawals from the Fixed Account, but we reserve the right to do so. It is important to note that if we impose the maximum limit on transfers and withdrawals from the Fixed Account, it could take a number of years to fully transfer or withdraw a current balance from the Fixed Account. You should keep this in mind when considering whether an allocation of Cash Value to the Fixed Account is consistent with your risk tolerance and time horizon.

Limitations on Access to Cash Value. You may withdraw cash surrender value from your Policy at any time after the first Policy anniversary. The minimum amount you may withdraw is $500. We reserve the right to limit partial withdrawals to no more than 90% of the Policy’s cash surrender value in addition to limitations on withdrawals from the Fixed Account. We may limit the number of partial withdrawals to 12 per Policy year or impose a processing charge of $25 for each partial withdrawal. Partial withdrawals may have tax consequences. You may borrow from the Cash Value of your Policy. The minimum amount you may borrow is $500. The maximum amount you may borrow is an amount equal to the Policy’s Cash Value net of the Surrender Charge, reduced by Monthly Deductions and interest charges through the next Policy anniversary, increased by interest credits through the next Policy anniversary, less any existing Policy loans.

Limitations on Transfers. We may limit transfers to four per Policy year and may. We do not currently charge for transfers, but we reserve the right to charge up to $25 per transfer, except for transfers under the Automated Investment Strategies. We have adopted procedures to limit excessive transfer activity. In addition, each Fund may restrict or refuse certain transfers among, or purchases of shares in their Portfolios as a result of certain market timing activities. You should read each Fund’s prospectus for more details.

Policy Charge and Expense Increase. We have the right to increase certain Policy charges.

Tax Law Changes. Tax laws, regulations, and interpretations have often been changed in the past and such changes continue to be proposed. To the extent that you purchase a Policy based on expected tax benefits, relative to other financial or investment products or strategies, there is no certainty that such advantages will always continue to exist.

Other Matters. The novel coronavirus COVID-19 pandemic is causing illnesses and deaths. This pandemic, other pandemics, and their related major public health issues are having a major impact on the global economy and financial markets. Governmental and non-governmental organizations may not effectively combat the spread and severity of such a pandemic, increasing its harm to the Company. Any of these events could materially adversely affect the Company’s operations, business, financial results, or financial condition.

A-17

Table of Contents

A comprehensive discussion of the risks associated with each of the Portfolios can be found in the Portfolio prospectuses, which you can obtain by calling 1-800-638-5000. There is no assurance that any of the Portfolios will achieve its stated investment objective.

A-18

Table of Contents

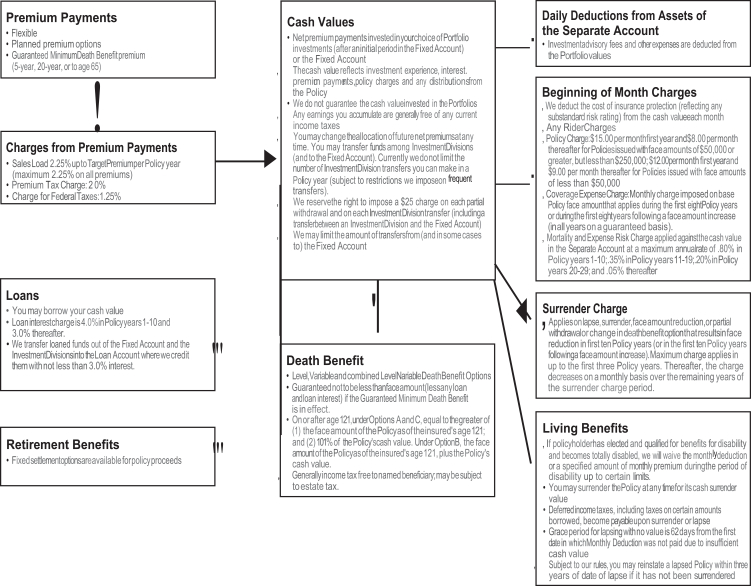

HOW THE POLICY WORKS

A-19

Table of Contents

THE COMPANY, THE SEPARATE ACCOUNT AND THE PORTFOLIOS

Metropolitan Life Insurance Company is a provider of insurance, annuities, employee benefits and asset management. We are also one of the largest institutional investors in the United States with a $____ billion general account portfolio invested primarily in fixed income securities (corporate, structured products, municipals, and government and agency) and mortgage loans, as well as real estate, real estate joint ventures, other limited partnerships and equity securities, at December 31, 2020. The Company was incorporated under the laws of New York in 1868. The Company’s office is located at 200 Park Avenue, New York, New York 10166-0188. The Company is a wholly-owned subsidiary of MetLife, Inc. We are obligated to pay all benefits under the Policies.

Metropolitan Life Separate Account UL is the funding vehicle for the Policies and other variable life insurance policies that we issue. Income and realized and unrealized capital gains and losses of the Separate Account are credited to the Separate Account without regard to any of our other income or capital gains or losses. Although we own the assets of the Separate Account, applicable law provides that the portion of the Separate Account assets equal to the reserves and other liabilities of the Separate Account may not be charged with liabilities that arise out of any other business we conduct. This means that the assets of the Separate Account are not available to meet the claims of our general creditors, and may only be used to support the Cash Values of the variable life insurance policies issued by the Separate Account.

We are obligated to pay the death benefit under the Policy even if that amount exceeds the Policy’s Cash Value in the Separate Account. The amount of the death benefit that exceeds the Policy’s Cash Value in the Separate Account is paid from our general account. Death benefits paid from the general account are subject to the financial strength and claims-paying ability of the Company. For other life insurance policies and annuity contracts that we issue, we pay all amounts owed under the policies and contracts from the general account. MetLife is regulated as an insurance company under state law. State law generally imposes restrictions on the amount and type of investments in the general account. However, there is no guarantee that we will be able to meet our claims-paying obligations. There are risks to purchasing any insurance product.

The investment adviser to certain of the Portfolios offered with the Policy or with other variable life insurance policies issued through the Separate Account may be regulated as a Commodity Pool Operator. While it does not concede that the Separate Account is a commodity pool, MetLife has claimed an exclusion from the definition of the term “commodity pool operator” under the Commodities Exchange Act (“CEA”), and is not subject to registration or regulation as a pool operator under the CEA.

Each Division of the Separate Account invests in a corresponding Portfolio. Each Portfolio is part of an open-end management investment company, more commonly known as a mutual fund, that serves as an investment vehicle for variable life insurance and variable annuity separate accounts of various insurance companies. The Trusts that offer the Portfolios are the American Funds Insurance Series®, Brighthouse Funds Trust I, Brighthouse Funds Trust II and the Franklin Templeton Variable Insurance Products Trust. Each of these Trusts has an investment adviser responsible for overall management of each portfolio available in the Trust. Some investment advisers have contracted with sub-advisers to make the day-to-day investment decisions for the Portfolios.

The name, type (investment objective), adviser, sub-adviser, current expenses and average annual total returns of each Portfolio are set forth in Appendix A.

A-20

Table of Contents

For more information regarding the Portfolios and their investment advisers and subadvisers, see the Portfolio prospectuses and their Statements of Additional Information, which you can obtain by calling 1-800-638-5000.

The Portfolios’ investment objectives may not be met. The investment objectives and policies of certain Portfolios are similar to the investment objectives and policies of other funds that may be managed by the same investment adviser or sub-adviser. The investment results of the Portfolios may be higher or lower than the results of these funds. There is no assurance, and no representation is made, that the investment results of any of the Portfolios will be comparable to the investment results of any other fund.

The Portfolios listed below are managed in a way that is intended to minimize volatility of returns (referred to as a “managed volatility strategy”):

| • | AB Global Dynamic Allocation Portfolio |

| • | AQR Global Risk Balanced Portfolio |

| • | BlackRock Global Tactical Strategies Portfolio |

| • | Invesco Balanced-Risk Allocation Portfolio |

| • | JPMorgan Global Active Allocation Portfolio |

| • | Brighthouse Balanced Plus Portfolio |

| • | MetLife Multi-Index Targeted Risk Portfolio |

| • | PanAgora Global Diversified Risk Portfolio |

| • | Schroders Global Multi-Asset Portfolio |

Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors or general market conditions. Bond prices may fluctuate because they move in the opposite direction of interest rates. Foreign investing carries additional risks such as currency and market volatility. A managed volatility strategy is designed to reduce volatility of returns to the above Portfolios from investing in stocks and bonds. This strategy seeks to reduce such volatility by “smoothing” returns, which may result in a Portfolio outperforming the general securities market during periods of flat or negative market performance, and underperforming the general securities market during periods of positive market performance.

This means that in periods of high market volatility, this managed volatility strategy could limit your participation in market gains; this may conflict with your investment objectives by limiting your ability to maximize potential growth of your Policy’s Cash Value and, in turn, the value of any guaranteed benefit that is tied to investment performance. Other Portfolios may offer the potential for higher returns.

Share Classes of the Portfolios

The Portfolios offer various classes of shares, each of which has a different level of expenses. The prospectuses for the Portfolios may provide information for share classes that are not available through the Policy. When you consult the prospectus for any Portfolio, you should be careful to refer to only the information regarding the class of shares that is available through the Policy. For the American Funds Insurance Series and the Franklin Templeton Variable Insurance Products Trust, we offer Class 2 shares only; for Brighthouse Funds Trust I, we offer Class A and Class B shares; and for Brighthouse Funds Trust II, we offer Class A shares only.

Certain Payments We Receive with Regard to the Portfolios

An investment adviser or subadviser of a Portfolio, or its affiliates, may make payments to us and/or certain of our affiliates. These payments may be used for a variety of purposes, including payment for expenses for certain administrative, marketing and support services with respect to the Policies and, in our role as intermediary, with respect to the Portfolios. We and our affiliates may profit from these payments.

A-21

Table of Contents

These payments may be derived, in whole or in part, from fees deducted from Portfolio assets. Policy Owners, through their indirect investment in the Portfolios, bear the costs of these fees (see the Portfolio prospectuses for more information). The amount of the payments we receive is based on a percentage of assets of the Portfolio attributable to the Policies and certain other variable insurance products that we and our affiliates issue. These percentages differ and some advisers or subadvisers (or other affiliates) may pay us more than others. These percentages currently range up to 0.50%. Additionally, an investment adviser or subadviser of a Portfolio or its affiliates may provide us with wholesaling services that assist in the distribution of the Policies and may pay us and/or certain of our affiliates amounts to participate in sales meetings. These amounts may be significant and may provide the adviser or subadviser (or their affiliates) with increased access to persons involved in the distribution of the Policies.

On August 4, 2017, MetLife, Inc. completed the separation of Brighthouse Financial, Inc. and its subsidiaries (“Brighthouse”) where MetLife, Inc. retained an ownership interest of 19.2% non-voting common stock outstanding of Brighthouse Financial, Inc. In June 2018, MetLife, Inc. sold Brighthouse Financial, Inc. common stock in exchange for MetLife, Inc. senior notes and Brighthouse was no longer considered a related party. At December 31, 2018, MetLife, Inc. no longer held any shares of Brighthouse Financial, Inc. for its own account; however, certain insurance company separate accounts managed by MetLife held shares of Brighthouse Financial, Inc. Brighthouse subsidiaries include Brighthouse Investment Advisers, LLC, which serves as the investment adviser for the Brighthouse Funds Trust I and Brighthouse Funds Trust II. We and Our affiliated companies have entered into agreements with Brighthouse Advisers, LLC, Brighthouse Funds Trust I and Brighthouse Funds trust II whereby We receive payments for certain administrative, marketing and support services described in the previous paragraphs. Currently, the Portfolios in Brighthouse Funds Trust I and Brighthouse Funds Trust II are only available in variable annuity contracts and variable life insurance policies issued by Metropolitan Life Insurance Company and its affiliates. As of December 31, 2020, approximately __% of Portfolio assets held in Separate Accounts of Metropolitan Life Insurance Company and its affiliates were allocated to Portfolios in Brighthouse Funds Trust I and Brighthouse Funds Trust II. Should we or Brighthouse Investment Advisers, LLC decide to terminate the agreements, we would be required to find alternative Portfolios which could have higher or lower costs to the Contract Owner. In addition, the amount of payments we receive could cease or be substantially reduced which may have a material impact on our financial statements.

Certain Portfolios have adopted a Distribution Plan under Rule 12b-1 of the Investment Company Act of 1940. A Portfolio’s 12b-1 Plan, if any, is described in more detail in the Portfolio’s prospectus. (See “Fee Tables—Annual Portfolio Expenses” and “Distribution of the Policies.”) Any payments we receive pursuant to those 12b-1 Plans are paid to us or our Distributor MetLife Investors Distribution Company (MLIDC). Payments under a Portfolio’s 12b-1 Plan decrease the Portfolio’s investment return.

For more specific information on the amounts we may receive on account of your investment in the Portfolios, you may call us toll free at 1-800-638-5000.

We select the Portfolios offered through the Policy based on a number of criteria, including asset class coverage, the strength of the adviser’s or subadviser’s reputation and tenure, brand recognition, performance, and the capability and qualification of each investment firm. Another factor we consider during the selection process is whether the Portfolio’s adviser or subadviser is one of our affiliates or whether the Portfolio, its adviser, its subadviser(s), or an affiliate will make payments to us or our affiliates. For additional information on these arrangements, see “Certain Payments We Receive with Regard to the Portfolios” above. In this regard, the profit distributions we receive from our affiliated investment advisers are a component of the total revenue that we consider in configuring the features and investment choices available in the variable insurance products that we and our affiliated insurance companies issue. Since we and our affiliated insurance companies may benefit more from the allocation of assets to Portfolios advised by our affiliates than those that are not, we may be more inclined to offer Portfolios advised by our affiliates in the variable insurance products we issue. We review the Portfolios periodically and may remove a Portfolio or limit its availability to new premium payments and/or transfers of Cash Value if we determine that the Portfolio no longer meets one

A-22

Table of Contents

or more of the selection criteria, and/or if the Portfolio has not attracted significant allocations from Policy Owners. We may include Portfolios based on recommendations from selling firms. In some cases, the selling firms may receive payments from the Portfolios they recommend and may benefit accordingly from the allocation of Cash Value to such Portfolios.

We do not provide any investment advice and do not recommend or endorse any particular Portfolio. You bear the risk of any decline in the Cash Value of your Policy resulting from the performance of the Portfolios you have chosen.

We own the Portfolio shares held in the Separate Account and have the right to vote those shares at meetings of the Portfolio shareholders. However, to the extent required by Federal securities law, we will give you, as Policy Owner, the right to instruct us how to vote the shares that are attributable to your Policy.

We will determine, as of the record date, if you are entitled to give voting instructions and the number of shares to which you have a right of instruction. If we do not receive timely instructions from you, we will vote your shares for, against, or withhold from voting on, any proposition in the same proportion as the shares held in that Division for all Policies for which we have received voting instructions. The effect of this proportional voting is that a small number of Policy Owners may control the outcome of a vote. We will vote Portfolio shares held by our general account (or any unregistered separate account for which voting privileges were not extended) in the same proportion as the total of (i) shares for which voting instructions were received and (ii) shares that are voted in proportion to such voting instructions.

We may disregard voting instructions for changes in the investment policy, investment adviser or principal underwriter of a Portfolio if required by state insurance law, or if we (i) reasonably disapprove of the changes and (ii) in the case of a change in investment policy or investment adviser, make a good faith determination that the proposed change is prohibited by state authorities or inconsistent with a Division’s investment objectives. If we do disregard voting instructions, the next semi-annual report to Policy Owners will include a summary of that action and the reasons for it.

We and our affiliates may change the voting procedures and vote Portfolio shares without Policy Owner instructions, if the securities laws change. We also reserve the right: (1) to add Divisions; (2) to combine Divisions; (3) to substitute shares of another registered open-end management investment company, which may have different fees and expenses, for shares of a Portfolio; (4) to substitute or close a Division to allocations of Premium payments or Cash Value or both, and to existing investments or the investment of future Premiums, or both, for any class of Policy or Policy Owner, at any time in our sole discretion; (5) to operate the Separate Account as a management investment company under the Investment Company Act of 1940 or in any other form; (6) to deregister the Separate Account under the Investment Company Act of 1940; (7) to combine it with other Separate Accounts; and (8) to transfer assets supporting the Policies from one Division to another or from the Separate Account to other Separate Accounts, or to transfer assets to our general account as permitted by applicable law. We will exercise these rights in accordance with applicable law, including approval of Policy Owners if required. We will notify you if exercise of any of these rights would result in a material change in the Separate Account or its investments.

We will not make any changes without receiving any necessary approval of the SEC and applicable state insurance departments. We will notify you of any changes.

A-23

Table of Contents

To purchase a Policy, you must submit a completed application and an initial Premium to us at our Designated Office. (See “Receipt of Communications and Payments at MetLife’s Designated Office.”) The minimum face amount for the base Policy is $50,000 unless we consent to a lower amount. For Policies acquired through a pension or profit sharing plan qualified under Section 401 of the Internal Revenue Code of 1986, the minimum face amount is $25,000.

The Policies are available for insureds age 85 or younger. We can provide you with details as to our underwriting standards when you apply for a Policy. We reserve the right to modify our minimum face amount and underwriting requirements at any time. We must receive evidence of insurability that satisfies our underwriting standards before we will issue a Policy. We reserve the right to reject an application for any reason permitted by law.

We offer other variable life insurance policies that have different death benefits, policy features, and optional programs. However, these other policies also have different charges that would affect your Division performance and Cash Values. To obtain more information about these other policies, including their eligibility requirements, contact our Designated Office or your registered representative.

It may not be in your best interest to surrender, lapse, change, or borrow from existing life insurance policies or annuity contracts in connection with the purchase of the Policy. You should compare your existing insurance and the Policy carefully. You should replace your existing insurance only when you determine that the Policy is better for you. You may have to pay a surrender charge on your existing insurance, and the Policy will impose a new surrender charge period. You should talk to your financial professional or tax adviser to make sure the exchange will be tax-free. If you surrender your existing policy for cash and then buy the Policy, you may have to pay a tax, including possibly a penalty tax, on the surrendered Policy. Because we may not issue the Policy until we have received an initial premium from your existing insurance company, the issuance of the Policy may be delayed.

A-24

Table of Contents

The Policy Owner is named in the application but may be changed from time to time. While the insured is living and the Policy is in force, the Policy Owner may exercise all the rights and options described in the Policy, subject to the terms of any beneficiary designation or assignment of the Policy. These rights include selecting and changing the beneficiary, changing the owner, changing the face amount of the Policy and assigning the Policy. At the death of the Policy Owner who is not the insured, his or her estate will become the Policy Owner unless a successor Policy Owner has been named. The Policy Owner’s rights (except for rights to payment of benefits) terminate at the death of the insured.

The beneficiary is also named in the application. You may change the beneficiary at any time before the death of the insured, unless the beneficiary designation is irrevocable. The beneficiary has no rights under the Policy until the death of the insured and must survive the insured in order to receive the death proceeds. If no named beneficiary survives the insured, we pay proceeds to the Policy Owner.

A change of Policy Owner or beneficiary is subject to all payments made and actions taken by us under the Policy before we receive a signed change form. You can contact your registered representative or our Designated Office for the procedure to follow.

You may assign (transfer) your rights in the Policy to someone else. An absolute assignment of the Policy is a change of Policy Owner and beneficiary to the assignee. A collateral assignment of the Policy does not change the Policy Owner or beneficiary, but their rights will be subject to the terms of the assignment. Assignments are subject to all payments made and actions taken by us under the Policy before we receive a signed copy of the assignment form. We are not responsible for determining whether or not an assignment is valid. Changing the Policy Owner or assigning the Policy may have tax consequences. (See “Tax Considerations” below.)

General Right. Generally, during the first two Policy years, or in the event of a material change in the investment policy of the Separate Account, you may convert the Policy to a fixed benefit coverage by exchanging the Policy for a fixed benefit life insurance policy agreed to by us and issued by us or an affiliate that we name, provided that you repay any Policy loans and loan interest, and the Policy has not lapsed. We make the exchange without evidence of insurability. The new policy will have the same base Policy face amount as that being exchanged. The new policy will have the same issue age, risk class and Policy Date as the variable life Policy had.

Contact our Designated Office or your registered representative for more specific information about the 24 Month Conversion Right. The exchange may result in a cost or credit to you. On the exchange, you may need to make an immediate premium payment on the new policy in order to keep it in force.

At least once each year you have the option to transfer all of your Cash Value to the Fixed Account and apply the cash surrender value to a new policy issued by us or an affiliate which provides paid-up insurance. Paid-up insurance is permanent insurance with no further premiums due. The face amount of the new Policy of paid-up insurance may be less than the face amount of the Policy.

Subject to the limits described below, you choose the amount and frequency of Premium payments. You select a Planned Premium schedule, which consists of a first-year Premium amount and an amount for subsequent Premium payments. This schedule appears in your Policy. Your Planned Premiums will not necessarily keep your Policy in force. You may skip Planned Premium payments or make additional payments. Additional payments could be subject to underwriting. No payment can be less than $50, except with our consent.

A-25

Table of Contents

You can pay Planned Premiums on an annual, semi-annual or quarterly schedule, or on a monthly schedule if payments are drawn directly from your checking account under our pre-authorized checking arrangement. We will send Premium notices for annual, semi-annual or quarterly Planned Premiums. You may make payments by check or through our pre-authorized checking arrangement. You can change your Planned Premium schedule by sending your request to us at our Designated Office. You may not make Premium payments on or after the Policy anniversary when the insured reaches age 121, except for Premiums required during the grace period.

If any payments under the Policy exceed the “7-pay limit” under Federal tax law, your Policy will become a modified endowment contract and you may have more adverse tax consequences with respect to certain distributions than would otherwise be the case if Premium payments did not exceed the “7-pay limit.” Information about your “7-pay limit” is found in your Policy illustration. If we receive a Premium payment 30 days or less before the anniversary of the 7-pay testing period that exceeds the “7-pay limit” and would cause the Policy to become a modified endowment contract, and waiting until the anniversary to apply that payment would prevent the Policy from becoming a modified endowment contract, we may retain the Premium payment in a non-interest bearing account and apply the payment to the Policy on the anniversary. If we follow this procedure, we will notify you and give you the option of having the Premium payment applied to the Policy before the anniversary. Otherwise, if you make a Premium payment that exceeds the “7-pay limit,” we will apply the payment to the Policy according to our standard procedures described below and notify you that the Policy has become a modified endowment contract. In addition, if you have selected the guideline Premium test, Federal tax law limits the amount of Premiums that you can pay under the Policy. You need our consent if, because of tax law requirements, a payment would increase the Policy’s death benefit by more than it would increase cash value. We may require evidence of insurability before accepting the payment.

We allocate net Premiums to your Policy’s Divisions as of the date we receive the payments at our Designated Office (or at our Administrative Office in Tampa, Florida), if they are received before the close of regular trading on the New York Stock Exchange. Payments received after that time, or on a day that the New York Stock Exchange is not open, will be allocated to your Policy’s Divisions on the next day that the New York Stock Exchange is open. (See “Receipt of Communications and Payments at MetLife’s Designated Office.”)

Under our current processing, we treat any payment received by us as a Premium payment unless it is clearly marked as a loan repayment.

Amount Provided for Investment under the Policy

Investment Start Date. Your initial net Premium is credited with Fixed Account interest as of the investment start date. The investment start date is the later of the Policy Date and the date we first receive a Premium payment for the Policy at our Designated Office. (See “Receipt of Communications and Payments at MetLife’s Designated Office.”)