SUMMARY OF GENERAL INFORMATION

THE FUND

The New Germany Fund, Inc. (the "Fund") is a diversified, actively-managed closed-end fund listed on the New York Stock Exchange with the symbol "GF." The Fund seeks long-term capital appreciation primarily through investment in middle-market German equities. It is managed and advised by wholly-owned subsidiaries of the Deutsche Bank Group.

SHAREHOLDER INFORMATION

Prices for the Fund's shares are published weekly in the New York Stock Exchange Composite Transactions section of certain newspapers. Net asset value and market price information are published each Saturday in Barron's and other newspapers in a table called "Closed End Funds." Daily information on the Fund's net asset value is available from NASDAQ (symbol XGFNX). It is also available by calling: 1-800-437-6269 (in the U.S.) or 00-800-2287-2750 (outside of the U.S.). In addition, a schedule of the Fund's largest holdings, dividend data and general shareholder information may be obtained by calling this number.

The foregoing information is also available on our web site: www.dws-investments.com.

There are three closed-end funds investing in European equities managed by wholly-owned subsidiaries of the Deutsche Bank Group:

• The European Equity Fund, Inc.—investing primarily in equity and equity-linked securities of companies domiciled in countries utilizing the euro currency (with normally at least 80% in securities of issuers in such countries).

• The New Germany Fund, Inc.—investing primarily in middle market German companies with up to 20% in other Western European companies (with no more than 10% in any single country).

• The Central Europe and Russia Fund, Inc.—investing primarily in equity and equity-linked securities of issuers domiciled in Central Europe and Russia (with normally at least 80% in securities of issuers in such countries).

Please consult your broker for advice on any of the above or call 1-800-437-6269 (in the U.S.) or 00-800-2287-2750 (outside of the U.S.) for shareholder reports.

This Fund is diversified, but primarily focuses its investments in Germany, thereby increasing its vulnerability to developments in that country.

Investing in foreign securities presents certain risks, such as currency fluctuations, political and economic changes and market risks. Any fund that concentrates in a particular segment of the market will generally be more volatile than a fund that invests more broadly.

The New Germany Fund, Inc.

Semi-Annual Report

June 30, 2011

The New Germany

Fund, Inc.

LETTER TO THE SHAREHOLDERS

The views expressed in the following discussion reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team's views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Past performance is no guarantee of future results. Current and future portfolio holdings are subject to risk.

Dear Shareholder,

For the six months ended June 30, 2011, the New Germany Fund's total return in USD was 13.80% based on net asset value and 15.14% based on market price. During the same period, the total return of the Fund's benchmark, the Midcap Market Performance Index, was 16.19%.1

For the equity market overall, the first quarter corporate reporting season, followed by Greece's approval of another austerity package, proved mostly supportive of stock prices. Renewed fears of a slowdown in China, and sovereign debt issues with rising inflation readings and consequently higher interest rates within Europe in the second quarter led to a period of increased stock market volatility. Austerity package aside, given the growing concerns of a default or restructuring of Greek bonds with a rising probability of private sector participation, equity markets stalled in the latter part of the reporting period. During the first half of the year, Moody's further downgraded Portugal's debt rating to Ba2 (junk status); S&P cut its rating outlook for Italy to "negative," claiming weak growth prospects; and Spain saw its 10-year bond yield rise to an 11-year high above 5.5%.

Macro data released in the second quarter was not supportive, with Q1 GDP growth figures in Spain (+0.3% quarter-over-quarter), Italy (+0.1%) and Portugal (-0.7%) below expectations. The European Central Bank raised key interest rates twice to 1.50% from 1.00% as annual inflation in the Eurozone rose to 2.8%, the highest level since 2008. More monetary tightening continued in China, a key demand driver for German exports. Inflation there rose to 5.5%, a 34-month high. The Central Bank hiked key rates for the fourth time since October 2010 to 6.31%, and again increased the reserve ratio requirement to a new high of 21.5%.

Not all macroeconomic news out of Europe was poor. For example, in May, the reported Eurozone Q1 year-over-year gross domestic product growth beat expectations at 0.8% vs. 0.6% expected by the market, driven particularly by Germany, which delivered 5.2% growth (the highest in decades) vs. 4.5% expected. This positive surprise trend was repeated in June, when manufacturing orders (+2.8% vs. +2.0% expected), industrial production (+0.2% vs. -0.2%) and the IFO Business Climate Index survey (114 vs. 113) all beat expectations.

German companies beat their Q1 2011 sales and earnings-per-share consensus estimates by an average 5.8% and 11.7%, respectively. The earnings revision trend in Europe moderated significantly, with average earnings revisions during Q1 at +0-1% for the DAX and +0-1.5% for the MDAX. After having previously been the star performer, the TecDAX became the worst performer, down 4.0% for the quarter, while the MDAX rose 6.0% and the DAX rose 4.8%. Exceptionally strong was the automotive sector, with BMW* and Volkswagen* delivering very strong revenue and earnings growth.

The industrials sector remains the portfolio's largest weighting. Its two main performance drivers were overweight positions in Aurubis and MTU Aero Engines Holding. Aurubis had a very strong quarter, exceeding analysts' consensus expectations as it benefited from a recovery in the copper refining market. Similarly, MTU's Q1 operating results beat market expectations on the back of its efficiency improvements program. We made two relevant adjustments to

For additional information about the Fund including performance, dividends, presentations, press releases, market updates, daily NAV and shareholder reports, please visit www.dws-investments.com

1

LETTER TO THE SHAREHOLDERS (continued)

our holdings within the sector. We took a new position in Singulus Technologies, the leading producer globally of optical disc production equipment (DVD, Blue-ray) and an emerging player in solar panel production equipment. Conversely, we sold part of our position in Kloeckner & Co, taking the stake to a slight underweight after the stock's strong performance from its trough in 2008 and lacking impetus for further steel price advances in the short term.

Our overweight in Hochtief within the construction sector was the largest performance drag. The stock came under pressure as its subsidiary, Leighton, disappointed in April and said it would sell stock worth about $800 million. Our overweight in the chemicals company Wacker Chemie also contributed negatively. While its solar silicon capabilities position it among the strategically most promising players in the solar value chain, the stock suffered from the broad-based sell-off in renewables and solar-related stocks. Within the software and technology sector, we initiated a position in Bechtle, taking advantage of the weakness in the share price. LBBW (a federal state bank) offered its 18.7% share in the company, complying with a new EU directive whereby federal state banks must sell non-core holdings.

We maintain our guardedly positive view while underlying trends such as emerging-markets growth remain constructive and inflation pressures seem to subside. Domestic demand in developed markets seems to remain on track but investors are focused more on macroeconomic developments, volatile commodity prices and structural debt problems in Europe and the U.S., which present imminent risks to global economic growth.

Valuations are not expensive. The DAX trades at a P/E of 11.2 x 2011 earnings and 9.8x projected 2012 earnings, and the MDAX on 15.5x and 11.9x, respectively. This is backed up by much higher expected earnings growth for the MDAX of 24 – 25% for both 2011 earnings and 2012 earnings, compared with 7% and 15%, respectively, for the DAX. Overall, these risks seem at least partially reflected in the current valuation of equity markets as they do not seem to be overly demanding. Ample liquidity and the already strongly rebounding M&A activity (as seen, for example, with Tognum, Demag Cranes and Roth & Rau, from the Midcap Market Performance Index so far this year) should be supportive factors. While we see the markets moving sideways in the near term, we maintain a growth profile in our sector positioning, with overweights in industrials and materials versus underweights2 in consumer health care and telecoms.

The Fund's discount contracted by 5.54%, ending the period at 9.00% compared to 14.54% for the same period a year earlier. Management continued the Fund's share repurchase and tender offer programs in an ongoing effort to address the discount. Please see Note 7 for details regarding the Fund's tender offer and share repurchase programs.

Sincerely,

|

|

|

|

|

|

|

| |

|

Christian Strenger

Chairman

|

|

Rainer Vermehren

Lead Portfolio Manager

|

|

W. Douglas Beck

President and Chief

Executive Officer

|

|

| |

1 The Midcap Market Performance Index is a total-return index that is composed of various mid-cap securities across all sectors of the MDAX and TecDAX. MDAX is a total-rate-of-return index of 50 mid-cap issues that rank below the DAX. DAX is a total-rate-of-return index of 30 selected German blue chip stocks traded on the Frankfurt Stock Exchange. TecDAX is a total-return index that tracks the 30 largest and most liquid issues from the various technology sectors of the Prime Segment beneath the DAX. Index returns, do not reflect any fees or expenses. It is not possible to invest directly in an index.

2 Underweight refers to a holding amount that is less than what is held in that of the benchmark.

* Not currently held in portfolio.

For additional information about the Fund including performance, dividends, presentations, press releases, market updates, daily NAV and shareholder reports, please visit www.dws-investments.com

2

FUND HISTORY AS OF JUNE 30, 2011

All performance shown is historical, assumes reinvestment of all dividend and capital gain distributions, and does not guarantee future results. Investment return and principal value fluctuate with changing market conditions so that, when sold, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please visit www.dws-investments.com for the Fund's most recent performance.

TOTAL RETURNS:

| |

|

For the

six-months ended

|

|

For the years ended December 31,

|

|

| |

|

June 30, 2011(b)

|

|

2010

|

|

2009

|

|

2008

|

|

2007

|

|

2006

|

|

|

Net Asset Value(a)

|

|

|

13.80

|

%

|

|

|

23.40

|

%

|

|

|

45.22

|

%

|

|

|

(46.75

|

)%(c)

|

|

|

25.17

|

%

|

|

|

43.94

|

%

|

|

|

Market Value(a)

|

|

|

15.14

|

%

|

|

|

32.21

|

%

|

|

|

52.07

|

%

|

|

|

(53.32

|

)%

|

|

|

25.14

|

%

|

|

|

44.13

|

%

|

|

|

Benchmark(d)

|

|

|

16.19

|

%

|

|

|

18.42

|

%

|

|

|

42.33

|

%

|

|

|

(47.86

|

)%

|

|

|

22.10

|

%

|

|

|

42.51

|

%

|

|

(a) Total return based on net asset value reflects changes in the Fund's net asset value during each period. Total return based on market value reflects changes in market value during each period. Each figure includes reinvestments of dividend and capital gains distributions, if any. These figures will differ depending upon the level of any discount from or premium to net asset value at which the Fund's shares trade during the period.

(b) Total returns shown for the six-month period are not annualized.

(c) Return includes the effect of the $0.18 per share accretion associated with the Fund's tender offer in-kind. Excluding this accretion, total return would have been 0.95% lower.

(d) Represents the Midcap Market Performance Index.*

* The Midcap Market Performance Index is a total-return index that is composed of various mid-cap securities across all sectors of the MDAX** and TecDAX***.

** MDAX is a total-rate-of-return index of 50 mid-cap issues that rank below the DAX. DAX is the total-rate-of-return index of 30 selected German blue chip stocks traded on the Frankfurt Stock Exchange.

*** TecDAX is a total-return index that tracks the 30 largest and most liquid issues from the various technology sectors of the Prime Segment beneath the DAX.

Fund performance includes reinvestment of dividends and does not reflect any fees or expenses. It is not possible to invest directly in an index.

Investments in funds involve risks, including the loss of principal.

This Fund is diversified, but primarily focuses its investments in Germany, thereby increasing its vulnerability to developments in that country. Investing in foreign securities presents certain risks, such as currency fluctuations, political and economic changes and market risks. Any fund that concentrates in a particular segment of the market will generally be more volatile than a fund that invests more broadly.

Closed-end funds, unlike open-end funds, are not continuously offered. Shares, once issued, are traded in the open market. Shares of closed-end funds frequently trade at a discount to net asset value. The price of the Fund's shares is determined by a number of factors, several of which are beyond the control of the Fund. Therefore, the Fund cannot predict whether its shares will trade at, below, or above net asset value.

The Fund has elected to be subject to the statutory calculation, notification and publication requirements of the German Investment Tax Act (Investmentsteuergesetz) (the "Act") for the fiscal year ended December 31, 2010 and intends to elect to be subject to the Act for the fiscal year ending December 31, 2011.

3

FUND HISTORY AS OF JUNE 30, 2011 (continued)

STATISTICS:

|

Net Assets

|

|

$

|

355,767,137

|

|

|

Shares Outstanding

|

|

|

17,685,351

|

|

|

Net Asset Value (NAV) Per Share

|

|

$

|

20.12

|

|

DIVIDEND AND CAPITAL GAIN DISTRIBUTIONS:

|

Record

Date

|

Payable

Date

|

|

Ordinary

Income

|

|

ST Capital

Gains

|

|

LT Capital

Gains

|

|

Total

Distribution

|

|

05/19/11

|

05/31/11

|

|

$

|

0.0400

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

0.0400

|

|

|

12/31/10

|

01/28/11*

|

|

$

|

0.0650

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

0.0650

|

|

|

04/30/10

|

05/10/10

|

|

$

|

0.0535

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

0.0535

|

|

|

12/31/09

|

01/28/10**

|

|

$

|

0.1601

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

0.1601

|

|

|

05/04/09

|

05/14/09

|

|

$

|

0.0176

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

0.0176

|

|

|

12/15/08

|

12/31/08

|

|

$

|

0.1274

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

0.1274

|

|

|

05/06/08

|

05/15/08

|

|

$

|

0.0594

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

0.0594

|

|

|

12/21/07

|

01/10/08***

|

|

$

|

0.2550

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

0.2550

|

|

|

05/03/07

|

05/15/07

|

|

$

|

0.3400

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

0.3400

|

|

|

12/21/06

|

12/28/06

|

|

$

|

0.0550

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

0.0550

|

|

|

05/05/06

|

05/15/06

|

|

$

|

0.1500

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

0.1500

|

|

|

12/22/05

|

12/30/05

|

|

$

|

0.4100

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

0.4100

|

|

|

05/19/05

|

05/27/05

|

|

$

|

0.1400

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

0.1400

|

|

|

12/22/04

|

12/31/04

|

|

$

|

0.2300

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

0.2300

|

|

|

05/06/04

|

05/14/04

|

|

$

|

0.0500

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

0.0500

|

|

|

12/22/03

|

12/31/03

|

|

$

|

0.0220

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

0.0220

|

|

|

07/24/03

|

07/30/03

|

|

$

|

0.0030

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

0.0030

|

|

OTHER INFORMATION:

|

NYSE Ticker Symbol

|

|

GF

|

|

|

NASDAQ Symbol

|

|

XGFNX

|

|

|

Dividend Reinvestment Plan

|

|

Yes

|

|

|

Voluntary Cash Purchase Program

|

|

Yes

|

|

|

Annualized Expense Ratio (6/30/11)

|

|

1.07%

|

|

Fund statistics and expense ratio are subject to change. Distributions are historical, will fluctuate and are not guaranteed.

* Although this distribution was payable in 2011, it may have been taxable for 2010.

** Although this distribution was paid in 2010, it may have been taxable for 2009.

*** Although this distribution was paid in 2008, it may have been taxable for 2007.

4

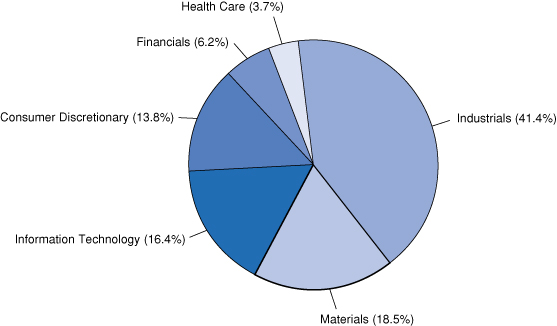

PORTFOLIO BY MARKET SECTOR AS OF JUNE 30, 2011 (As a % of Common and Preferred Stocks)

10 LARGEST EQUITY HOLDINGS AS OF JUNE 30, 2011 (As a % of Common and Preferred Stocks)

|

1.

|

|

EADS

|

|

|

6.6

|

%

|

|

|

2.

|

|

Lanxess

|

|

|

5.8

|

%

|

|

|

3.

|

|

Software

|

|

|

5.6

|

%

|

|

|

4.

|

|

GEA Group

|

|

|

4.8

|

%

|

|

|

5.

|

|

Continental

|

|

|

4.8

|

%

|

|

|

6.

|

|

Wacker Chemie

|

|

|

4.4

|

%

|

|

|

7.

|

|

Rheinmetall

|

|

|

4.4

|

%

|

|

|

8.

|

|

Hochtief

|

|

|

4.1

|

%

|

|

|

9.

|

|

MTU Aero Engines Holding

|

|

|

4.0

|

%

|

|

|

10.

|

|

Symrise

|

|

|

3.3

|

%

|

|

Portfolio by Market Sector and 10 Largest Equity Holdings are subject to change and not indicative of future portfolio composition.

For more complete details about the Fund's Schedule of Investments, see page 7.

Following the Fund's fiscal first and third quarter-ends, a complete portfolio holdings listing is filed with the SEC on Form N-Q. This form is available on the SEC's web site at www.sec.gov, and it also may be reviewed and copied at the SEC's Public Reference Room in Washington, D.C. Information on the operation of the SEC's Public Reference Room may be obtained by calling (800) SEC-0330. A complete list of the Fund's portfolio holdings and the Fund's sector breakdown compared to that of its benchmark as of the month end is posted on www.dws-investments.com on or after the last day of the following month. More frequent postings of portfolio holdings information may be made from time to time on www.dws-investments.com.

5

INTERVIEW WITH THE LEAD PORTFOLIO MANAGER — RAINER VERMEHREN

The views expressed in the following discussion reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team's views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Past performance is no guarantee of future results. Current and future portfolio holdings are subject to risk.

Question: The strength of Germany's industrial production has been key to the country's good economic standing over the past years; what can be expected for 2011?

Answer: Germany's growth engine is firing on all cylinders. Last year the German economy was already the driving force in the Eurozone and this has continued in the first half of 2011. Thanks to the global economic recovery post the crisis years of 2008/9, Germany's order intake, specifically in the mechanical engineering sector, has been very robust. Orders rose 32% year-over-year in real terms in the first quarter of 2011. The momentum came from both foreign and domestic demand (+31% and 35%, respectively). The orders boom in mechanical engineering is expected to boost German production by 15% in real terms in 2011. This is the biggest growth rate among all the other German industry sectors. This positive forecast for mechanical engineering is in line with still double-digit growth in the automotive industry (+14%) and electrical engineering (+13%). While German manufacturing as a whole will reach production levels last seen in 2008 already in 2011, the mechanical engineering sector will likely be back on the 2008 level in 2012.

Question: With Greece, Ireland and Portugal "put aside" for the short term, can you put Italy into perspective?

Answer: Italy is the third-largest government bond market in the world, at €1.8 trillion, and more than three times that of Spain. Of this, European banks hold €326bn. Since Standard and Poor's downgrade of Italy in mid-May, the Italian sovereign spread has doubled in the past six weeks prior to June 30, 2011 (from 175 bps (basis points) to 331 bps) with 10-year bond yields hitting a peak of 6.0%.2,3 This has had an effect on Italian equities of bringing them down to a valuation level where they are as cheap as those of Greece.

Question: What growth rates are markets discounting for European sectors and is this a good measure for picking stocks?

Answer: A number of growth discounter models used by investors to determine what long-term earnings-per-share growth rate the market is pricing in come to the conclusion that as of the end of June, implied growth rates favor defensive stocks over cyclicals.4 Financials, in particular, look less cheap than headline multiples. Even accounting for a better medium-term outlook for many cyclical sectors, market-implied long-term growth rates appear much more realistic for many defensives. For some investors, buying sectors on depressed expectations and selling those with excessively bullish implied growth has been a successful strategy through time, though there are no guarantees of future results. Having said that, we note that valuations are not the only drivers of sector returns. While valuations tend to be a key determinant of longer-term asset returns, using pure valuation-based strategies often leads to struggles on shorter-time horizons.

Question: How well did this year's stress test of European banks fare?

Answer: In July, the European Banking Authority (EBA) published the results of this year's so called "stress test" of European Banks. The goal of the stress test is to determine each bank's financial strength, from a regulator's point of view, given certain scenarios, in order to better anticipate weaknesses within the overall banking system. The EBA conducted two tests: (1) a 'Baseline scenario', assuming base case GDP growth and no losses on sovereign debt instruments; and, (2) an 'Adverse scenario', which also includes losses on sovereign debt exposures in the bank's trading book. Under the most severe of the two stress tests conducted, the EBA arrived at results that at first glance were perceived as being very favorable. While the vast majority of banks tested had passed the minimum requirements, eight did not: five Spanish saving banks, two Greek banks and one Austrian Bank. Looking below the surface shows that 20 banks were so close to the minimum limits that they would have fallen below the minimum threshold over the two-year horizon of the exercise had they not previously raised funds in the capital markets.

1 The Eurozone refers to a currency union among the European Union member states that have adopted the euro as their sole currency.

2 Sovereign spread refers to the difference between the yields on a sovereign government's bond versus that of a comparable bond of another country. It is often used as a measurement of the riskiness of lending to a sovereign government and the cost of borrowing for that sovereign government.

3 A basis point (bps) is one-hundredth of a percentage point (0.01%).

4 Defensive stocks are often associated with companies that provide products and services that are used in everyday life. As such, these stocks tend to be relatively unaffected by general fluctuations in the economy. Cyclical stocks are often associated with companies that provide products and services that are most often in greater demand when the markets rise and in less demand when markets fall. As such, the values of these stocks tend to be affected by fluctuations in the economy, rising prior to an economic upturn and falling prior to a downturn.

6

THE NEW GERMANY FUND, INC.

SCHEDULE OF INVESTMENTS — JUNE 30, 2011 (unaudited)

|

Shares

|

Description

|

|

Value(a)

|

|

INVESTMENTS IN GERMAN

SECURITIES – 89.6%

|

|

| |

COMMON STOCKS – 85.7%

|

| |

AEROSPACE &

DEFENSE – 3.9%

|

| |

174,084

|

|

MTU Aero Engines Holding

|

|

$

|

13,900,516

|

|

| |

AUTO COMPONENTS – 6.6%

|

| |

160,000

|

|

Continental*

|

|

|

16,804,922

|

|

| |

188,344

|

|

ElringKlinger

|

|

|

6,681,345

|

|

| |

|

|

23,486,267

|

|

| |

CHEMICALS – 13.3%

|

| |

247,760

|

|

Lanxess

|

|

|

20,329,456

|

|

| |

360,000

|

|

Symrise

|

|

|

11,471,186

|

|

| |

71,364

|

|

Wacker Chemie

|

|

|

15,425,348

|

|

| |

|

|

47,225,990

|

|

| |

COMPUTERS &

PERIPHERALS – 2.6%

|

| |

127,727

|

|

Wincor Nixdorf

|

|

|

9,227,739

|

|

| |

CONSTRUCTION &

ENGINEERING – 7.0%

|

| |

108,181

|

|

Bilfinger Berger

|

|

|

10,694,238

|

|

| |

171,567

|

|

Hochtief

|

|

|

14,326,311

|

|

| |

|

|

25,020,549

|

|

| |

ELECTRICAL EQUIPMENT – 2.3%

|

| |

60,686

|

|

SGL Carbon*†

|

|

|

3,431,084

|

|

| |

130,000

|

|

Tognum*

|

|

|

4,860,409

|

|

| |

|

|

8,291,493

|

|

| |

HEALTH CARE PROVIDERS &

SERVICES – 0.4%

|

| |

80,000

|

|

Celesio

|

|

|

1,594,670

|

|

| |

HOTELS, RESTAURANTS &

LEISURE – 0.3%

|

| |

100,000

|

|

TUI*

|

|

|

1,084,376

|

|

| |

HOUSEHOLD DURABLES – 0.3%

|

| |

118,886

|

|

Loewe*

|

|

|

973,772

|

|

| |

INDUSTRIAL

CONGLOMERATES – 4.3%

|

| |

172,583

|

|

Rheinmetall

|

|

|

15,274,318

|

|

| |

INSURANCE – 2.5%

|

| |

170,000

|

|

Hannover Rueckversicherung

|

|

|

8,863,538

|

|

| |

INTERNET SOFTWARE &

SERVICES – 2.8%

|

| |

475,966

|

|

United Internet

|

|

|

10,001,665

|

|

|

Shares

|

Description

|

|

Value(a)

|

| |

IT SERVICES – 0.3%

|

| |

20,014

|

|

Bechtle

|

|

$

|

895,091

|

|

| |

MACHINERY – 8.4%

|

| |

473,046

|

|

GEA Group

|

|

|

16,928,351

|

|

| |

240,000

|

|

Gildemeister*

|

|

|

5,043,216

|

|

| |

298,963

|

|

MAX Automation

|

|

|

2,188,704

|

|

| |

32,714

|

|

Pfeiffer Vacuum Technology

|

|

|

4,100,882

|

|

| |

255,732

|

|

Singulus Technologies*

|

|

|

1,445,865

|

|

| |

|

|

29,707,018

|

|

| |

MEDIA – 1.2%

|

| |

90,000

|

|

Axel Springer

|

|

|

4,443,910

|

|

| |

METALS & MINING – 5.0%

|

| |

160,000

|

|

Aurubis

|

|

|

10,403,047

|

|

| |

95,000

|

|

Salzgitter

|

|

|

7,242,774

|

|

| |

|

|

17,645,821

|

|

| |

PROFESSIONAL

SERVICES – 1.1%

|

| |

50,000

|

|

Bertrandt

|

|

|

3,783,717

|

|

| |

REAL ESTATE MANAGEMENT &

DEVELOPMENT – 2.2%

|

| |

202,041

|

|

Deutsche Euroshop

|

|

|

7,996,138

|

|

| |

SEMICONDUCTORS &

SEMICONDUCTOR

EQUIPMENT – 3.5%

|

| |

280,000

|

|

Aixtron†

|

|

|

9,551,204

|

|

| |

201,957

|

|

Solarworld†

|

|

|

2,725,754

|

|

| |

|

|

12,276,958

|

|

| |

SOFTWARE – 7.0%

|

| |

180,000

|

|

PSI

|

|

|

5,282,852

|

|

| |

330,000

|

|

Software

|

|

|

19,765,137

|

|

| |

|

|

25,047,989

|

|

| |

SPECIALTY RETAIL – 2.7%

|

| |

30,000

|

|

Douglas Holdings

|

|

|

1,573,722

|

|

| |

50,000

|

|

Fielmann†

|

|

|

5,568,298

|

|

| |

120,000

|

|

Tom Tailor Holding*

|

|

|

2,435,496

|

|

| |

|

|

9,577,516

|

|

| |

TEXTILES, APPAREL &

LUXURY GOODS – 0.5%

|

| |

5,647

|

|

Puma

|

|

|

1,785,875

|

|

| |

THRIFTS & MORTGAGE

FINANCE – 1.3%

|

| |

140,000

|

|

Aareal Bank*

|

|

|

4,796,912

|

|

The accompanying notes are an integral part of the financial statements.

7

THE NEW GERMANY FUND, INC.

SCHEDULE OF INVESTMENTS — JUNE 30, 2011 (unaudited) (continued)

|

Shares

|

Description

|

|

Value(a)

|

|

INVESTMENTS IN GERMAN

SECURITIES – 89.6% (continued)

|

|

| |

TRADING COMPANIES &

DISTRIBUTORS – 3.5%

|

| |

55,000

|

|

Brenntag

|

|

$

|

6,391,437

|

|

| |

200,000

|

|

Kloeckner & Co.

|

|

|

6,017,705

|

|

| |

|

|

12,409,142

|

|

| |

TRANSPORTATION

INFRASTRUCTURE – 2.7%

|

| |

120,000

|

|

Fraport

|

|

|

9,646,304

|

|

| |

|

|

Total Common Stocks

(cost $189,879,012)

|

|

|

304,957,284

|

|

| |

PREFERRED STOCKS – 3.9%

|

| |

HEALTH CARE EQUIPMENT &

SUPPLIES – 0.8%

|

| |

62,632

|

|

Sartorius

(cost $691,434)

|

|

|

2,878,284

|

|

| |

MACHINERY – 1.1%

|

| |

95,000

|

|

Jungheinrich

(cost $3,195,087)

|

|

|

4,007,696

|

|

| |

MEDIA – 2.0%

|

| |

245,000

|

|

ProSiebenSat.1 Media

(cost $5,665,065)*†

|

|

|

6,943,700

|

|

| |

|

|

Total Preferred Stocks

(cost $9,551,586)

|

|

|

13,829,680

|

|

| |

|

|

Total Investments in

German Securities

(cost $199,430,598)

|

|

|

318,786,964

|

|

|

INVESTMENTS IN DUTCH

COMMON STOCKS – 8.9%

|

|

| |

AEROSPACE & DEFENSE – 6.5%

|

| |

689,645

|

|

EADS

|

|

|

23,074,884

|

|

| |

LIFE SCIENCES TOOLS &

SERVICES – 2.4%

|

| |

445,887

|

|

QIAGEN*

|

|

|

8,545,440

|

|

| |

|

|

Total Investments in

Dutch Common Stocks

(cost $24,025,610)

|

|

|

31,620,324

|

|

| |

|

|

Total Investments in Common

and Preferred Stocks – 98.5%

(cost $223,456,208)

|

|

|

350,407,288

|

|

|

Shares

|

Description

|

|

Value(a)

|

|

SECURITIES LENDING

COLLATERAL – 7.8%

|

| |

27,694,569

|

|

Daily Assets Fund

Institutional, 0.13%

(cost $27,694,569)(b)(c)

|

|

$

|

27,694,569

|

|

|

CASH EQUIVALENTS – 0.2%

|

| |

668,441

|

|

Central Cash

Management Fund, 0.11%

(cost $668,441)(c)

|

|

|

668,441

|

|

| |

Total Investments – 106.5%

(cost $251,819,218)**

|

|

|

378,770,298

|

|

| |

Other Assets and Liabilities,

Net – (6.5%)

|

|

|

(23,003,161

|

)

|

| |

NET ASSETS – 100.0%

|

|

$

|

355,767,137

|

|

* Non-income producing security

** The cost for federal income tax purposes was $253,412,861. At June 30, 2011, net unrealized appreciation for all securities based on tax cost was $125,357,437. This consisted of aggregate gross unrealized appreciation for all securities in which there was an excess of value over tax cost of $130,417,753 and aggregate gross unrealized depreciation for all securities in which there was an excess of tax cost over value of $5,060,316.

† All or a portion of these securities were on loan (see Notes to Financial Statements). The value of all securities loaned at June 30, 2011 amounted to $25,846,693, which is 7.3% of net assets.

(a) Value stated in US dollars.

(b) Represents collateral held in connection with securities lending. Income earned by the Fund is net of borrower rebates.

(c) Affiliated fund managed by Deutsche Investment Management Americas Inc. The rate shown is the annualized seven-day yield at period end.

For purposes of its industry concentration policy, the Fund classifies issuers of portfolio securities at the industry sub-group level. Certain of the categories in the above Schedule of Investments consist of multiple industry sub-groups or industries.

The accompanying notes are an integral part of the financial statements.

8

THE NEW GERMANY FUND, INC.

SCHEDULE OF INVESTMENTS — JUNE 30, 2011 (unaudited) (continued)

Fair Value Measurements

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of June 30, 2011 in valuing the Fund's investments. For information on the Fund's policy regarding the valuation of investments, please refer to the Security Valuation section of Note 1 in the accompanying Notes to Financial Statements.

|

Category

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Common Stocks and/or Other Equity Investments(d)

|

|

German

|

|

$

|

318,786,964

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

318,786,964

|

|

|

Dutch

|

|

|

31,620,324

|

|

|

|

—

|

|

|

|

—

|

|

|

|

31,620,324

|

|

|

Short-Term Instruments(d)

|

|

|

28,363,010

|

|

|

|

—

|

|

|

|

—

|

|

|

|

28,363,010

|

|

|

Total

|

|

$

|

378,770,298

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

378,770,298

|

|

(d) See Schedule of Investments for additional detailed categorizations.

The accompanying notes are an integral part of the financial statements.

9

THE NEW GERMANY FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

JUNE 30, 2011 (unaudited)

|

ASSETS

|

|

Investments in non-affiliated securities, at value (cost $223,456,208) — including $25,846,693 of securities loaned

|

|

$

|

350,407,288

|

|

|

Investment in Central Cash Management Fund (cost $668,441)

|

|

|

668,441

|

|

|

Investment in Daily Assets Fund Institutional (cost $27,694,569)*

|

|

|

27,694,569

|

|

|

Total Investments, at value (cost $251,819,218)

|

|

|

378,770,298

|

|

|

Foreign currency, at value (cost $7,042,238)

|

|

|

7,130,457

|

|

|

Foreign taxes recoverable

|

|

|

72,367

|

|

|

Interest receivable

|

|

|

168,072

|

|

|

Other assets

|

|

|

20,128

|

|

|

Total assets

|

|

|

386,161,322

|

|

|

LIABILITIES

|

|

Payable upon return of securities loaned

|

|

|

27,694,569

|

|

|

Payable for investments purchased

|

|

|

2,254,560

|

|

|

Management fee payable

|

|

|

155,141

|

|

|

Investment advisory fee payable

|

|

|

73,913

|

|

|

Payable for Directors' fees and expenses

|

|

|

45,039

|

|

|

Accrued expenses and other liabilities

|

|

|

170,963

|

|

|

Total liabilities

|

|

|

30,394,185

|

|

|

NET ASSETS

|

|

$

|

355,767,137

|

|

|

Net assets consist of:

|

|

Paid-in capital, $0.001 par (Authorized 80,000,000 shares)

|

|

$

|

436,941,441

|

|

|

Cost of 17,063,990 shares held in Treasury

|

|

|

(204,524,607

|

)

|

|

Undistributed net investment income

|

|

|

3,351,089

|

|

|

Accumulated net realized loss on investments and foreign currency

|

|

|

(7,028,902

|

)

|

|

Net unrealized appreciation (depreciation) on:

|

|

Investments

|

|

|

126,951,080

|

|

|

Foreign currency

|

|

|

77,036

|

|

|

Net assets

|

|

$

|

355,767,137

|

|

|

Net assets value per share ($355,767,137 ÷ 17,685,351 shares of common stock issued and outstanding)

|

|

$

|

20.12

|

|

*Represents collateral on securities loaned.

The accompanying notes are an integral part of the financial statements.

10

THE NEW GERMANY FUND, INC.

STATEMENT OF OPERATIONS (unaudited)

| |

|

For the

six-months ended

June 30, 2011

|

|

NET INVESTMENT INCOME

|

|

Income:

|

|

Dividends (net of foreign witholding taxes of $828,448)

|

|

$

|

5,658,678

|

|

|

Interest

|

|

|

3,205

|

|

|

Income distributions — Central Cash Management Fund

|

|

|

212

|

|

|

Securities lending, including income from Daily Assets Fund Institutional, net of borrower rebates

|

|

|

1,136,065

|

|

|

Total investment income

|

|

|

6,798,160

|

|

|

Expenses:

|

|

Management fee

|

|

|

971,285

|

|

|

Investment advisory fee

|

|

|

468,542

|

|

|

Custodian fee

|

|

|

68,262

|

|

|

Services to shareholders

|

|

|

13,763

|

|

|

Reports to shareholders

|

|

|

55,317

|

|

|

Directors' fees and expenses

|

|

|

69,591

|

|

|

Professional fees

|

|

|

113,256

|

|

|

NYSE listing fee

|

|

|

11,765

|

|

|

Insurance

|

|

|

17,265

|

|

|

Miscellaneous

|

|

|

10,891

|

|

|

Net expenses

|

|

|

1,799,937

|

|

|

Net investment income

|

|

|

4,998,223

|

|

|

REALIZED AND UNREALIZED GAIN (LOSS)

|

|

Net realized gain (loss) from:

|

|

Investments

|

|

|

4,804,805

|

|

|

Foreign currency

|

|

|

263,905

|

|

|

Net realized gain (loss)

|

|

|

5,068,710

|

|

|

Change in net unrealized appreciation (depreciation) on:

|

|

Investments

|

|

|

33,086,147

|

|

|

Foreign currency

|

|

|

(56,575

|

)

|

|

Change in net unrealized appreciation (depreciation)

|

|

|

33,029,572

|

|

|

Net gain (loss)

|

|

|

38,098,282

|

|

|

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS

|

|

$

|

43,096,505

|

|

The accompanying notes are an integral part of the financial statements.

11

THE NEW GERMANY FUND, INC.

STATEMENT OF CHANGES IN NET ASSETS

| |

|

For the

six-months ended

June 30, 2011

(unaudited)

|

|

For the

year ended

December 31, 2010

|

|

INCREASE (DECREASE) IN NET ASSETS

|

|

Operations:

|

|

Net investment income

|

|

$

|

4,998,223

|

|

|

$

|

1,452,992

|

|

|

Net realized gain (loss)

|

|

|

5,068,710

|

|

|

|

42,815,040

|

|

|

Change in net unrealized appreciation (depreciation)

|

|

|

33,029,572

|

|

|

|

15,239,144

|

|

|

Net increase in net assets resulting from operations

|

|

|

43,096,505

|

|

|

|

59,507,176

|

|

|

Distributions to shareholders from:

|

|

Net investment income

|

|

|

(710,442

|

)

|

|

|

(2,162,318

|

)

|

|

Capital share transactions:

|

|

Net proceeds from reinvestment of dividends (0 and 123,499 shares, respectively)

|

|

|

—

|

|

|

|

1,444,941

|

|

|

Cost of shares repurchased (370,431 and 802,336 shares, respectively)

|

|

|

(6,483,883

|

)

|

|

|

(10,269,965

|

)

|

|

Net decrease in net assets from capital share transactions

|

|

|

(6,483,883

|

)

|

|

|

(8,825,024

|

)

|

|

Total increase in net assets

|

|

|

35,902,180

|

|

|

|

48,519,834

|

|

|

NET ASSETS

|

|

Beginning of period

|

|

|

319,864,957

|

|

|

|

271,345,123

|

|

|

End of period (including undistributed net investment income of

$3,351,089 and distributions in excess of net investment income of $936,692,

as of June 30, 2011 and December 31, 2010, respectively)

|

|

$

|

355,767,137

|

|

|

$

|

319,864,957

|

|

The accompanying notes are an integral part of the financial statements.

12

THE NEW GERMANY FUND, INC.

FINANCIAL HIGHLIGHTS

Selected data for a share of common stock outstanding throughout each of the periods indicated:

| |

|

For the six-months

ended June 30,

|

|

For the years ended December 31,

|

| |

|

2011 (unaudited)

|

|

2010

|

|

2009

|

|

2008

|

|

2007

|

|

2006

|

|

Per share operating performance:

|

|

Net asset value:

|

|

Beginning of period

|

|

$

|

17.72

|

|

|

$

|

14.48

|

|

|

$

|

10.13

|

|

|

$

|

19.38

|

|

|

$

|

16.04

|

|

|

$

|

11.29

|

|

|

Net investment income (loss)(a)

|

|

|

.28

|

|

|

|

.08

|

|

|

|

.17

|

|

|

|

.22

|

(c)

|

|

|

.17

|

|

|

|

.04

|

|

|

Net realized and unrealized gains (loss) on

investments and foreign currency

|

|

|

2.12

|

|

|

|

3.21

|

|

|

|

4.27

|

|

|

|

(9.49

|

)

|

|

|

3.77

|

|

|

|

4.91

|

|

|

Increase (decrease) from investment operations

|

|

|

2.40

|

|

|

|

3.29

|

|

|

|

4.44

|

|

|

|

(9.27

|

)

|

|

|

3.94

|

|

|

|

4.95

|

|

|

Distributions from net investment income

|

|

|

(.04

|

)

|

|

|

(.12

|

)

|

|

|

(.18

|

)

|

|

|

(.19

|

)

|

|

|

(.60

|

)

|

|

|

(.21

|

)

|

|

Accretion resulting from tender offer

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

.18

|

|

|

|

—

|

|

|

|

—

|

|

|

Dilution in net asset value from

dividend reinvestment

|

|

|

—

|

|

|

|

(.01

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Increase resulting from share repurchases

|

|

|

.04

|

|

|

|

.08

|

|

|

|

.09

|

|

|

|

.03

|

|

|

|

—

|

|

|

|

.01

|

|

|

Net asset value:

|

|

End of period

|

|

$

|

20.12

|

|

|

$

|

17.72

|

|

|

$

|

14.48

|

|

|

$

|

10.13

|

|

|

$

|

19.38

|

|

|

$

|

16.04

|

|

|

Market value:

|

|

End of period

|

|

$

|

18.06

|

|

|

$

|

15.72

|

|

|

$

|

11.99

|

|

|

$

|

8.01

|

|

|

$

|

17.48

|

|

|

$

|

14.47

|

|

|

Total investment return for the period†

|

|

Based upon market value

|

|

|

15.14

|

%***

|

|

|

32.21

|

%

|

|

|

52.07

|

%

|

|

|

(53.32

|

)%

|

|

|

25.14

|

%

|

|

|

44.13

|

%

|

|

Based upon net asset value

|

|

|

13.80

|

%***

|

|

|

23.40

|

%(b)

|

|

|

45.22

|

%

|

|

|

(46.75

|

)%(d)(e)

|

|

|

25.17

|

%

|

|

|

43.94

|

%

|

|

Ratio to average net assets:

|

|

Total expenses

|

|

|

1.07

|

%**

|

|

|

1.15

|

%

|

|

|

1.19

|

%

|

|

|

1.25

|

%

|

|

|

1.00

|

%*

|

|

|

1.30

|

%*

|

|

Net investment income (loss)

|

|

|

1.48

|

%****

|

|

|

.53

|

%

|

|

|

1.49

|

%

|

|

|

1.40

|

%(c)

|

|

|

.90

|

%

|

|

|

.31

|

%

|

|

Portfolio turnover

|

|

|

6

|

%***

|

|

|

45

|

%

|

|

|

42

|

%

|

|

|

40

|

%

|

|

|

47

|

%

|

|

|

45

|

%

|

|

Net assets at end of period (000's omitted)

|

|

$

|

355,767

|

|

|

$

|

319,865

|

|

|

$

|

271,345

|

|

|

$

|

198,264

|

|

|

$

|

480,724

|

|

|

$

|

397,933

|

|

(a) Based on average shares outstanding during the period.

(b) Includes the effect of a gain realized on the sale of investments not meeting investment compliance policies of the Fund. Excluding this gain, total return would have been 0.52% lower.

(c) Net investment income per share and the ratio of net investment income include non-recurring dividend income amounting to $0.04 per share and 0.23% of average daily net assets, respectively.

(d) Includes the effect of a gain realized on the sale of investments not meeting investment compliance policies of the Fund. Excluding this gain, total return would have been 0.06% lower.

(e) Return includes the effect of $0.18 per share accretion associated with the Fund's tender offer in-kind. Excluding this accretion, total return would have been 0.95% lower.

† Total return based on net asset value reflects changes in the Fund's net asset value during each period. Total return based on market value reflects changes in market value during each period. Each figure includes reinvestments of dividend and capital gains distributions, if any. These figures will differ depending upon the level of any discount from or premium to net asset value at which the Fund's shares trade during the period.

* Prior to February 2007, custody credits were earned on U.S. cash balances. The ratios of total expenses after custody credits to average net assets are 1.00% and 1.30% for 2007 and 2006, respectively.

** Annualized.

*** Not Annualized.

**** Not Annualized. The ratio for the six-months ended June 30, 2011 has not been annualized since the Fund believes it would not be appropriate because the Fund's dividend income is not earned ratably throughout the fiscal year.

13

THE NEW GERMANY FUND, INC.

NOTES TO FINANCIAL STATEMENTS — JUNE 30, 2011 (unaudited)

NOTE 1. ACCOUNTING POLICIES

The New Germany Fund, Inc. (the "Fund") was incorporated in Maryland on January 16, 1990 as a non-diversified, closed-end management investment company. The Fund commenced investment operations on January 30, 1990. The Fund became a diversified fund on October 26, 2007.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Security Valuation: The Fund calculates its net asset value per share for publication at 11:30 a.m., New York time.

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Equity securities are valued at the most recent sale price or official closing price reported on the exchange (US or foreign) or over-the-counter market on which they trade prior to the time of valuation and are categorized as Level 1 securities. Securities for which no sales are reported are valued at the calculated mean between the most recent bid and asked quotations on the relevant market or, if a mean cannot be determined, at the most recent bid quotation.

Money market instruments purchased with an original or remaining maturity of sixty days or less, maturing at par, are valued at amortized cost, which approximates value, and are categorized as Level 2. Investments in open-end investment companies are valued at their net asset value each business day and are categorized as Level 1.

Securities and other assets for which market quotations are not readily available or for which the above valuation procedures are deemed not to reflect fair value are valued in a manner that is intended to reflect their fair value as determined in accordance with procedures approved by the Board and are generally categorized as Level 3. In accordance with the Fund's valuation procedures, factors used in determining value may include, but are not limited to, the type of the security; the size of the holding; the initial cost of the security; the existence of any contractual restrictions on the security's disposition; the price and extent of public trading in similar securities of the issuer or of comparable companies; quotations or evaluated prices from broker-dealers and/or the appropriate stock exchange (for exchange-traded securities); an analysis of the company's or issuer's financial statements; an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold and with respect to debt securities; the maturity, coupon, creditworthiness, currency denomination, and the movement of the market in which the security is normally traded. The value determined under these procedures may differ from published values for the same securities.

Disclosure about the classification of the fair value measurements is included in a table following the Fund's Schedule of Investments.

Securities Transactions and Investment Income: Investment transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment security transactions are reported on trade date. Interest income is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date net of foreign withholding taxes. Certain dividends from foreign securities may be recorded subsequent to the ex-dividend date as soon as the Fund is informed of such dividends. Realized gains and losses from investment transactions are recorded on an identified cost basis and may include proceeds from litigation.

14

THE NEW GERMANY FUND, INC.

NOTES TO FINANCIAL STATEMENTS — JUNE 30, 2011 (unaudited) (continued)

Securities Lending: The Fund may lend securities to certain financial institutions. The Fund retains beneficial ownership of the securities it has loaned and continues to receive interest and dividends paid by the issuer of securities and to participate in any changes in their market value. The Fund requires the borrowers of the securities to maintain collateral with the Fund consisting of either cash or liquid, unencumbered assets having a value in excess of the value of the securities loaned. When the collateral falls below specified amounts, the lending agent will use its best effort to obtain additional collateral on the next business day to meet required amounts under the security lending agreement. The Fund may invest the cash collateral into a joint trading account in an affiliated money market fund pursuant to Exemptive Orders issued by the SEC. Deutsche Investment Management Americas Inc. receives a management/administration fee (.10% annualized effective rate as of June 30, 2011) on the cash collateral invested in the affiliated money fund. The Fund receives compensation for lending its securities either in the form of fees or by earning interest on invested cash collateral net of borrower rebates and fees paid to a lending agent. Either the Fund or the borrower may terminate the loan. There may be risks of delay and costs in recovery of securities or even loss of rights in the collateral should the borrower of the securities fail financially. The Fund is subject to all investment risks associated with the reinvestment of any cash collateral received, including, but not limited to, interest rate, credit and liquidity risk associated with such investments.

Foreign Currency Translation: The books and records of the Fund are maintained in United States dollars.

Assets and liabilities denominated in foreign currency are translated into United States dollars at the 11:00 a.m. midpoint of the buying and selling spot rates quoted by the Federal Reserve Bank of New York. Purchases and sales of investment securities, income and expenses are reported at the rate of exchange prevailing on the respective dates of such transactions. The portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed but is included with net realized and unrealized gain/appreciation and loss/depreciation on investments.

At June 30, 2011, the exchange rate was EURO 1.4497 to US $1.00.

Contingencies: In the normal course of business, the Fund may enter into contracts with service providers that contain general indemnification clauses. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet been made. However, based on experience, the Fund expects the risk of loss to be remote.

Taxes: No provision has been made for United States Federal income tax because the Fund intends to meet the requirements of the United States Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders.

For United States Federal income tax purposes, the Fund has a capital loss carryforward at December 31, 2010 of approximately $12,098,000, which may be applied against any realized net taxable capital gains of each succeeding year until fully utilized or until December 31, 2017, whichever comes first.

Additionally, based on the Fund's understanding of the tax rules and rates related to income, gains and transactions for the foreign jurisdictions in which it invests, the Fund will provide for foreign taxes and, where appropriate, deferred foreign taxes.

On December 22, 2010, the Regulated Investment Company Modernization Act of 2010 (the "Act") was enacted. Under the Act, net capital losses may be carried forward indefinitely, and their character is retained as short-term and/or long-term losses. Previously, net capital losses were carried forward for eight years and treated as short-term losses. As a transition rule, the Act requires that post-enactment net capital losses be used before pre-enactment net capital losses. As a result of this ordering rule, pre-enactment capital loss carryforwards may expire unused, whereas under the previous rules these losses may have been utilized. This change is effective for fiscal years beginning after the date of enactment.

15

THE NEW GERMANY FUND, INC.

NOTES TO FINANCIAL STATEMENTS — JUNE 30, 2011 (unaudited) (continued)

The Fund has reviewed the tax positions for the open tax years as of December 31, 2010 and has determined that no provision for income tax is required in the Fund's financial statements. The Fund's federal tax returns for the prior three fiscal years remain open subject to examination by the Internal Revenue Service.

Dividends and Distributions to Shareholders: The Fund records dividends and distributions to its shareholders on the ex-dividend date. Income and capital gain distributions are determined in accordance with United States Federal income tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences primarily relate to investments in foreign denominated investments, investments in foreign passive investment companies, recognition of certain foreign currency gains (losses) as ordinary income (loss) and certain securities sold at a loss. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. Accordingly, the Fund may periodically make reclassifications among certain of its capital accounts without impacting the net asset value of the Fund.

The tax character of current year distributions will be determined at the end of the current fiscal year.

NOTE 2. MANAGEMENT AND INVESTMENT ADVISORY AGREEMENTS

The Fund has a Management Agreement with Deutsche Investment Management Americas, Inc. (the "Manager"). The Fund has an Investment Advisory Agreement with Deutsche Asset Management International GmbH (the "Investment Adviser"). The Manager and the Investment Adviser are affiliated companies.

The Management Agreement provides the Manager with a fee, computed weekly and payable monthly, at the annual rates of 0.65% of the Fund's average weekly net assets up to $100 million, 0.55% of such assets in excess of $100 million and up to $500 million, and 0.50% of such assets in excess of $500 million. The Investment Advisory Agreement provides the Investment Adviser with a fee, computed weekly and payable monthly, at the annual rates of 0.35% of the Fund's average weekly net assets up to $100 million and 0.25% of such assets in excess of $100 million. Accordingly, for the six months ended June 30, 2011, the combined fee pursuant to the Management and Investment Advisory Agreements was equivalent to an annualized effective rate of 0.86% of the Fund's average daily net assets.

Pursuant to the Management Agreement, the Manager is the corporate manager and administrator of the Fund and, subject to the supervision of the Board of Directors and pursuant to recommendations made by the Fund's Investment Adviser, determines the suitable securities for investment by the Fund. The Manager also provides office facilities and certain administrative, clerical and bookkeeping services for the Fund. Pursuant to the Investment Advisory Agreement, the Investment Adviser, in accordance with the Fund's stated investment objective, policies and restrictions, makes recommendations to the Manager with respect to the Fund's investments and, upon instructions given by the Manager as to suitable securities for investment by the Fund, transmits purchase and sale orders and selects brokers and dealers to execute portfolio transactions on behalf of the Fund.

NOTE 3. TRANSACTIONS WITH AFFILIATES

DWS Investments Service Company ("DISC"), an affiliate of the Manager, is the transfer agent, dividend-paying agent and shareholder service agent of the Fund. Pursuant to a sub-transfer agency agreement between DISC and DST Systems, Inc. ("DST"), DISC has delegated certain transfer agent and dividend-paying agent paying functions to DST. DISC compensates DST out of the shareholder servicing fee it receives from the Fund. For the six months ended June 30, 2011, the amount charged to the Fund by DISC aggregated $13,763, of which $12,386 is unpaid.

Deutsche Bank AG, the German parent of the Manager and the Investment Adviser, and its affiliates may receive brokerage commissions as a result of executing agency transactions in portfolio securities on behalf of the Fund, that the Board determined were effected in compliance with the

16

THE NEW GERMANY FUND, INC.

NOTES TO FINANCIAL STATEMENTS — JUNE 30, 2011 (unaudited) (continued)

Fund's Rule 17e-1 procedures. For the six months ended June 30, 2011, Deutsche Bank AG and its affiliates did not receive brokerage commissions.

Certain officers of the Fund are also officers of either the Manager or the Investment Adviser.

The Fund pays each Director who is not an "interested person" of the Manager or Investment Adviser retainer fees plus specified amounts for attended board and committee meetings.

The Fund may invest uninvested cash balances in Central Cash Management Fund, which is managed by the Advisor. The Fund indirectly bears its proportionate share of the expenses of Central Cash Management Fund. Central Cash Management Fund does not pay the Advisor an investment management fee. Central Cash Management Fund seeks a high level of current income consistent with liquidity and the preservation of capital.

NOTE 4. PORTFOLIO SECURITIES

Purchases and sales of investment securities, excluding short-term investments, for the six months ended June 30, 2011, were $20,260,874, and $22,246,936, respectively.

NOTE 5. INVESTING IN FOREIGN MARKETS

Foreign investments may involve certain considerations and risks as a result of, among others, the possibility of political and economic developments the level of governmental supervision and regulation of foreign securities markets. In addition, certain foreign markets may be substantially smaller, less developed, less liquid and more volatile than the major markets of the United States. Any fund that concentrates in a particular segment of the market will generally be more volatile than a fund that invests more broadly.

NOTE 6. CAPITAL

During the six months ended June 30, 2011 and the year ended December 31, 2010, the Fund purchased 370,431 and 802,336 of its shares of common stock on the open market at a total cost of $6,483,883 and $10,269,965, ($17.50 and $12.80 average per share), respectively. The weighted average discount of these purchased shares comparing the purchased price to the net asset value at the time of purchase was 9.36% and 13.13%, respectively.

During the six-months ended June 30, 2011 there were no shares issued for reinvestment. During the year ended December 31, 2010, the Fund issued for dividend reinvestment 123,499 shares. The average discount of these issued shares comparing the issue price to the net asset value at the time of issuance was 16.13%.

NOTE 7. TENDER OFFER AND SHARE REPURCHASES

On July 20, 2010, the Fund announced that the Board of Directors approved a series of up to four, consecutive, semiannual tender offers each for up to 5% of the Fund's outstanding shares at a price equal to 98% of net asset value. The Fund will conduct a tender offer if its shares trade at an average discount to NAV of more than 10% during the applicable twelve-week measurement period.

The first measurement period commenced September 1, 2010 and expired on November 24, 2010. During the first measurement period the Fund's shares traded at an average discount to NAV of 9.28%. Therefore, the Fund was not required to conduct a tender offer. The second measurement period commenced on March 7, 2011 and expired on May 27, 2011. During the second measurement period the Fund's shares traded at an average discount to NAV of 9.11%. Therefore, the Fund was not required to conduct a tender offer. The third measurement period will commence on August 29, 2011 and will expire on November 18, 2011.