Annual Report and Form

20-F

2021 | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

340 ⁄399 pence each |

|

|

Ordinary Shares of 20 340 ⁄399 pence each |

| ☑ | Accelerated filer | ☐ | ||||

| Non-accelerated filer | ☐ | Emerging growth company | ||||

| US GAAP ☐ |

the International Accounting Standards Board ☑ |

Other ☐ |

| Auditor Firm Id: |

Auditor Name: |

Auditor Location: | ||

| Auditor Firm Id: |

Auditor Name: |

Auditor Location: |

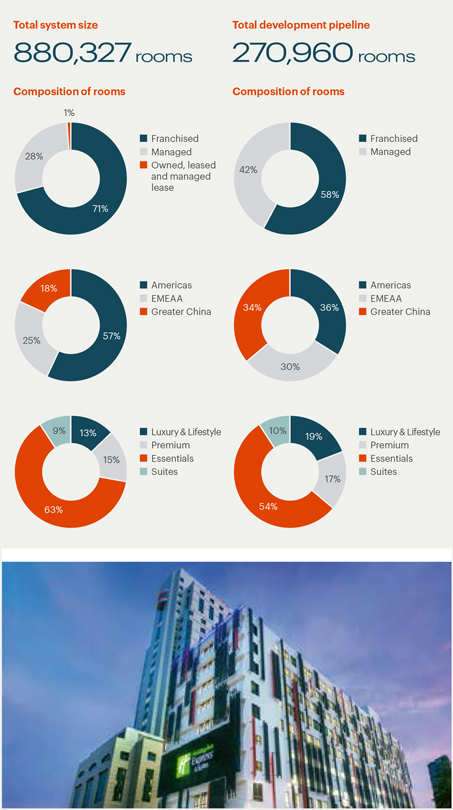

| Our presence IHG ® Hotels & Resorts is a global hospitality company, with 17 hotel brands and one of the industry’s largest loyalty programmes. We have nearly 6,000 open hotels in more than 100 countries and a further 1,800 hotels in our development pipeline. Our focus We focus on offering guests great choice, rewards and experiences, while continuously developing and investing in our people, operations, sustainability, technology and design, in order to drive demand, performance and return for our hotel owners.  Our business model We mainly franchise and manage hotels, which allows us to focus on increasing fee revenues and fee margins, with limited requirements for capital. Led by our strategic priorities, we grow our business by ensuring our brands meet consumer demand and generate strong returns for hotel owners.  | ||||||

| Our key stakeholders | ||||||

|

|

| ||||

Shareholders and investors |

Hotel owners |

Hotel guests | ||||

|

|

| ||||

Our people |

Community |

Suppliers | ||||

See pages 20 to 28, 39, 92, 101, 107, 108, 112 to 114 for information about how we have engaged with our stakeholders during 2021. See pages 20 to 28, 39, 92, 101, 107, 108, 112 to 114 for information about how we have engaged with our stakeholders during 2021. | ||||||

| 2 |

||

| 4 |

||

| 6 |

||

| 8 |

||

| 10 |

||

| 14 |

||

| 16 |

||

| 32 |

||

| 36 |

||

| 40 |

||

| 48 |

||

| 50 |

||

| 54 |

||

| 54 |

||

| 55 |

||

| 63 |

||

| 66 |

||

| 69 |

||

| 72 |

||

| 73 |

||

| 80 |

||

| 82 |

||

| 86 |

||

| 88 |

||

| 89 |

||

| 89 |

||

| 92 |

||

| 93 |

||

| 94 |

||

| 95 |

||

| 100 |

||

| 102 |

||

| 104 |

||

| 126 |

||

| 130 |

||

| 138 |

||

| 142 |

||

| 149 |

||

| 157 |

||

| 158 |

||

| 218 |

||

| 226 |

||

| 231 |

||

| 243 |

||

| 250 |

||

| 251 |

||

| 252 |

||

| 255 |

||

| 257 |

||

IHG |

1 |

| Strategic Report Chair’s statement Staying focused on long-term success |

| Final dividend 85.9 ¢ Final dividend proposed for 2021 (2020: no dividend was paid) Return of funds $ 13.6 bn Since March 2003, the Group has returned $13.6 billion of funds to shareholders by way of ordinary and special dividends, capital returns and share repurchase programmes. Since 2014: • $500 million special dividend paid 29 January 2019• $400 million special dividend paid 22 May 2017• $1.5 billion special dividend paid 23 May 2016• $500 million share buyback completed in 2014• $750 million special dividend paid 14 July 2014 |

H |

aving entered 2021 on the back of the toughest time the hospitality industry has ever known, this year has been one |

| of hope, recovery, new challenges and opportunity. IHG’s global scale means we have experienced and learned from the evolving nature of the pandemic on a daily basis, market by market, and with clarity and flexibility we have stayed focused on the strategic business needs required to deliver long-term success for all stakeholders. | ||

| profit yet to fully recover to pre-pandemic 2019 levels. A key factor in this improved performance has been a heightened commitment to support our owners, listen to their needs, and work hand in hand across teams to respond with agility and expertise to challenges ranging from restrictions impacting demand, to the need to evolve brand standards and meet staffing and supply chain pressures as demand returns.Whether operational or commercial, these actions can strengthen both short and long-term performance, and as we build owner relationships and look to accelerate net rooms growth, we continue to invest in strategic priorities that will strengthen aspects of our entire offer. These include reducing costs to build, open and operate hotels across our brands, delivering loyalty and digital enhancements that improve the guest experience and drive performance, and investing in the quality, depth and breadth of our portfolio, such as the launch of the Vignette ™ Collection brand in August.Accelerated by the pandemic, recognising that our stakeholders increasingly measure profit, growth and success in relation to how companies operate responsibly across the environmental, social and governance (ESG) agenda, the commitments set out in our Journey to Tomorrow plan create a roadmap for positive change over the next decade. During the year, important progress was made on several fronts, including investments in new training and programmes that support a diverse and inclusive culture, thoughtful guidance around a shift to hybrid working, close collaboration with charities responding to natural disasters, and the formulation of a strategy to meet an upgraded science-based carbon reduction target across our hotel estate. |

4 |

IHG |

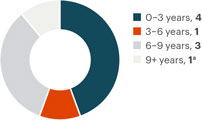

| Role of the Board To navigate an industry recovery, react to evolving trends and at the same time push to strengthen IHG on so many fronts has required great dedication from our leadership and teams. The role of the Board has been to support and constructively challenge the Executive Committee around how we prioritise, manage risk, grow and generate future value. The ESG agenda and technology landscape, including investments in our enterprise and managing cybersecurity risks, were also regularly considered in the year, alongside listening to employee sentiment via engagement sessions and feedback. Part of my role as Chair has been to encourage Board development and oversee changes that build and add new expertise and insights in recognition of the evolving nature of our business and stakeholder expectations. To this end, succession planning was also of significant focus in 2021, with both Anne Busquet and Dale Morrison retiring after tremendous service, and Richard Anderson unfortunately resigning after three months due to personal reasons. We were delighted to welcome Daniela Barone Soares as Non-Executive Director and Graham Allan was appointed as Senior Independent Non-Executive Director from 1 January 2022.In my ninth year as Chair, succession planning for my own role was also carried out, with a thorough and independent recruitment process leading to the appointment of Deanna Oppenheimer as Chair Designate from 1 June 2022, becoming Non-Executive Chair from 1 September 2022 upon my retirement. I look forward to working with Deanna on a comprehensive handover and I would like to take the opportunity to wish her the best in what I am sure will be a very successful tenure. |

With the strong financial improvements delivered in 2021, including profitability rebounding and a substantial reduction in net debt, the Board is proposing a final dividend of 85.9¢ in respect of 2021, an amount equivalent to the withdrawn final payment in respect of 2019. No interim dividend was paid in respect of 2021. Going forward, dividend payments will be reflective of IHG’s prior approach to sustainably grow the ordinary dividend whilst targeting a level of leverage that maintains an investment grade credit rating, and ensuring careful consideration of our responsibilities to all stakeholders. The Board will also continue to actively assess the opportunity for any surplus capital to be additionally returned through special dividends or share buybacks. A final perspective The IHG I will depart on 31 August 2022 is much changed from the one I joined in January 2013 – not least having grown from 4,600 to almost 6,000 hotels, and from nine to 17 brands. Having first gone on a crucial journey to establish our brands in more attractive markets, the past almost five years under Keith Barr’s leadership have seen the company transform and ready for a new chapter of growth. IHG has invested in its entire enterprise, including the quality of the estate and breadth of its brand portfolio, and as an organisation it has become more sophisticated and customer-centric, with a commitment to ESG now woven into the fabric of the business. The values of integrity and transparency that I have advocated at Board level run deep through the business and its leadership, as illustrated by the care and thought with which these past two years have been handled for IHG’s different stakeholders. Keith has also set the tone from the top |

on the importance of diversity, equity and inclusion, and progress continues to be made against the changes required to be a truly successful company in this regard, with IHG recognised for a seventh year running as a ‘Best Place to Work for LGBTQ+ Equality’, with a 100% rating in the Corporate Equality Index, and being Highly Commended in the Company of the Year category at the European Diversity Awards. While the pandemic may herald some structural change for our industry, such as technology replacing certain elements of business travel, there will be opportunities too, including facilitating a global shift to flexible working. What remains unchanged though, are the industry’s long-term fundamental growth drivers, such as a growing population, rising wealth in emerging markets and increasing conversions from unbranded players. The strength of IHG’s business model, strategic investments, pipeline, leadership and passionate teams gives me great confidence in a strong future. It has been a privilege to be a part of IHG’s story for almost a decade and I would like to offer my sincere respect and gratitude to all those in our hotels, offices and reservation centres who have been a part of it. I would also like to thank our owners for choosing IHG and for their continued long-term confidence in our brands and business.  Patrick Cescau Chair |

| Chair’s statement |

IHG |

5 |

| Strategic Report Chief Executive Officer’s review Emerging as a stronger IHG |

| Key highlights in 2021 291 Hotels opened (285 in 2020) 437 Hotels signed (360 in 2020) 47% Of full-year signings were for our Holiday Inn Brand Family 42% Of our pipeline now represented by upscale and luxury brands |

I |

n the past year, the resilience of our business model and enduring importance of travel and hospitality for millions globally has shone |

| through strongly. Crucially, while demonstrating our ability to effectively manage the impact of an evolving pandemic, we have not wavered in our focus to build an even stronger IHG, by growing our brands, enhancing our guest and owner offer, supporting our people and communities, and protecting our planet. | ||

| restrictions lift. Our approach has been to stay focused on organising operations and investments around what matters most to guests and owners, and ensuring IHG can grow at pace, in the right way. For colleagues, we have improved processes and introduced new tools to both attract and retain talent in what is a competitive jobs market, and we’ve placed a greater emphasis on mental health and wellbeing. Corporate and reservation teams have been supported with shifts to hybrid working, interactive sessions have brought employees closer to our strategy, and hotel teams have received training and support needed to adapt to evolving operations and brand standards. For guests, we have used AI technology in our reservation centres to improve customer service, enhanced our award-winning Meet with Confidence programme, and offered loyalty members point expiry extensions and new promotions. We saw Reward Night bookings largely recover to pre-pandemic levels during the year and welcomed another nine million members to IHG® Rewards.Working closely with the IHG Owners Association and operators, we have strived to anticipate owners’ needs, carefully focusing on costs, and delivering training and action plans to address performance opportunities and guest feedback. Staffing and supply chain challenges have been met with new recruitment solutions and increased procurement options that have delivered key products at lower cost, despite inflationary pressures. Commercially, we have increased marketing and introduced new tools to identify and capture demand, and we continued our work with trade bodies and governments to advocate for industry support in recognition of the vital economic role hospitality plays globally. |

6 |

IHG |

| Strengthened performance Our actions, alongside our business being principally domestic focused in key markets such as the US, led to improved trading throughout 2021. On top of good essential business demand, domestic leisure bookings at times hit 2019 occupancy and rate levels in several markets, with signs of more discretionary business travel, group bookings and international trips beginning to return. Operating profit of $494m improved from a loss of $153m in 2020. Our ability to capture demand through our strong brands, enterprise and scale, coupled with careful cost control, led to operating profit from reportable segments more than doubling to $534m versus 2020, with sustainable savings successfully achieved alongside continued investment to support growth. Strong cash generation led to a reduction in net debt of almost $650m year-on-year. While a higher-than-average removals rate, linked in part to our Holiday Inn ® and Crowne Plaza® Hotel & Resorts quality review, meant our net system size declined slightly, the opening of 291 hotels, including our 3,000th for Holiday Inn Express® , represented 5.0% gross growth and underlines the long-term confidence owners have in IHG and our brands. We also added 437 hotels to our pipeline, with the almost 24,000 rooms signed in Q4 much closer to the levels seen in 2019. In total, our global pipeline of almost 1,800 hotels represents more than 30% of our current system size, with more than 40% under construction.Focus on growth Our focus in recent years has been to improve the quality of our existing hotels for guests and the returns our brands generate for owners, and in parallel increase the scale of those brands, the breadth of our portfolio, and the value of our technology and loyalty offer. In spite of a pandemic, I am proud of |

the progress against our strategic priorities in 2021 and the impact this will have on how we operate and grow with owners as the industry strengthens. Key highlights include the Holiday Inn and Crowne Plaza quality review, which has driven significant owner investment in 83 properties and the removal of 151 hotels. With excellent future growth prospects, this work is not just critical to protecting the performance and reputation of these brands, but also to our ability to reduce our future group average removals rate and help achieve our ambition of industry-leading net rooms growth. The importance of our established brands was reflected in our Holiday Inn ® Brand Family representing almost half of all signings in 2021, while the addition of new brands across more segments increases our attractiveness to owners and opens up further growth opportunities. Within Essentials, avid® hotels is now our second largest contributor to system size and outperforming peers in guest satisfaction, and voco™ hotels has already expanded to 25 countries within Premium. In Luxury & Lifestyle, progress included Six Senses® now having grown its open and pipeline estate by more than half since acquisition in 2019, and our new Vignette Collection brand already at six signings and a first opening since launch in August.As we use our IHG ® Hotels & Resorts masterbrand to showcase the breadth of our portfolio, we continue to enhance the enterprise that supports it. This includes developing our next-generation mobile app, and preparing thousands of hotels to allow guests to choose specific room characteristics and add stay enhancements when booking with us, and in parallel enable our owners to generate maximum value from their hotel’s unique features. |

Transformational work also took place in loyalty ahead of a relaunch in 2022 that will offer members more rewarding tiers and points value, provide richer benefits and exceptional choice, and attract more next-generation travellers. In the first year of our 2030 Journey to Tomorrow responsible business plan, key progress included upgrading our science-based target to help limit global warming to 1.5°C, launching our virtual IHG Skills Academy platform, corporate employees completing more than 10,000 hours of conscious inclusion training, and supporting charities responding to natural disasters. Thank you I would like to thank the Board for their guidance, and ahead of his retirement as Chair, recognise the invaluable contribution Patrick Cescau has made in his nine years with IHG. He is a hugely respected figure and on a personal note I am grateful for his counsel and support. Though he will be missed, we look forward to welcoming Deanna Oppenheimer. On behalf of the Executive Committee, I would also like to thank our owners for their partnership and commitment, and our inspiring colleagues for bringing our brands and purpose of True Hospitality for Good to life, and making IHG a stronger business. To see IHG again named a Kincentric Global Best Employer in 2021 was a proud moment and it has meant a lot to reconnect with colleagues in person this year, as well as our owners, knowing that together we look to the future with confidence.  Keith Barr Chief Executive Officer |

| Chief Executive Officer’s review |

IHG |

7 |

T |

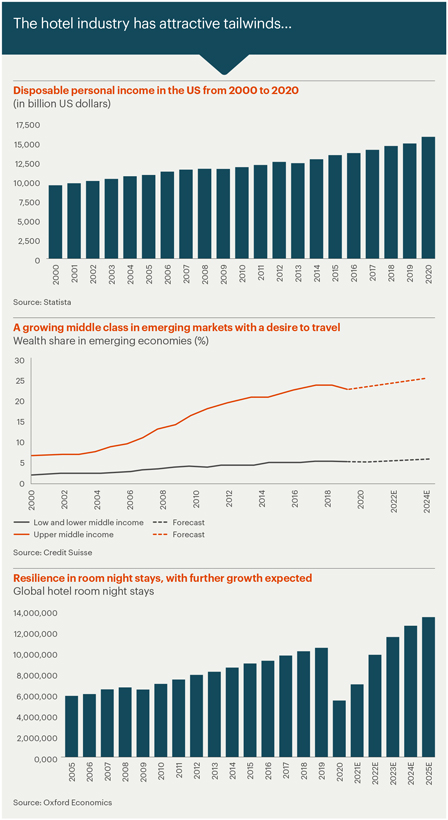

he $360 billion hotel industry has compelling structural growth drivers, underpinned by factors including consumers’ inherent desire |

to travel, population growth, and an expanding middle class in emerging markets with increasing disposable incomes. While the pandemic suppressed demand during 2020 and 2021, demand has returned rapidly in domestic markets as government restrictions have lifted and vaccination rates increased. This demand has predominantly been in markets not exposed to cross-border trips and across essential business travel, though discretionary corporate travel and group events have begun to return. | ||

8 |

IHG |

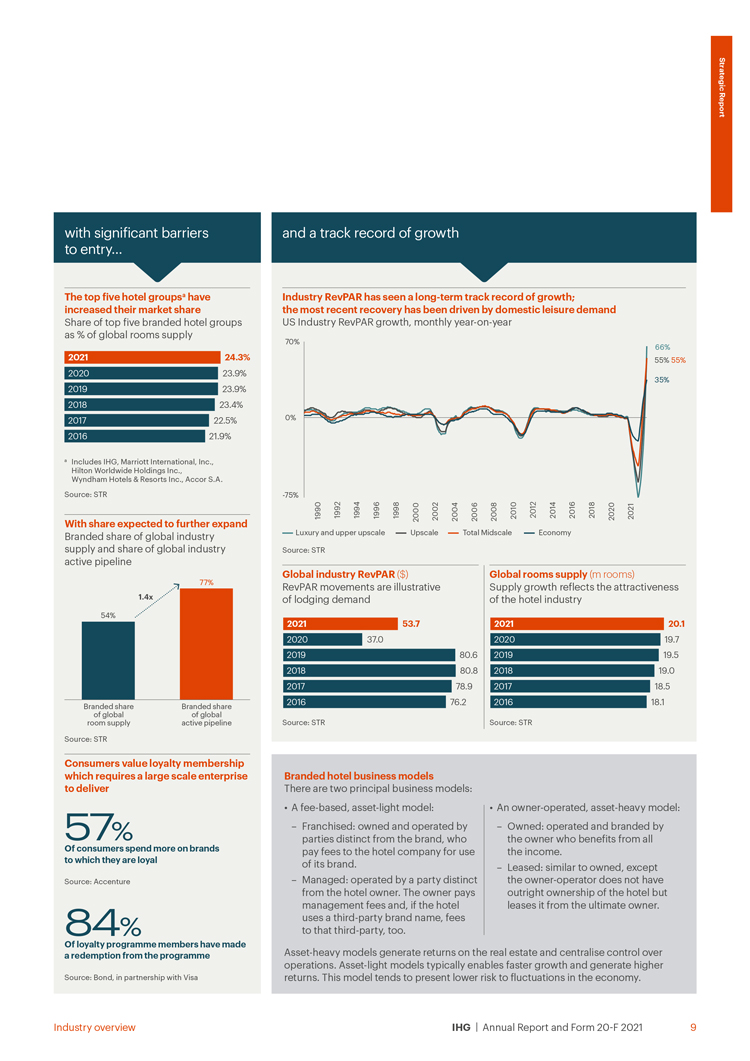

T |

he growth of our business relies on two fundamental growth drivers: revenue per available room (RevPAR) and increasing the |

number of rooms across our estate. RevPAR indicates the value guests ascribe to a given hotel, brand or market and grows when they stay more often or pay higher rates. Room supply reflects how attractive the hotel industry is as an investment from an owner’s perspective. | ||

10 |

IHG |

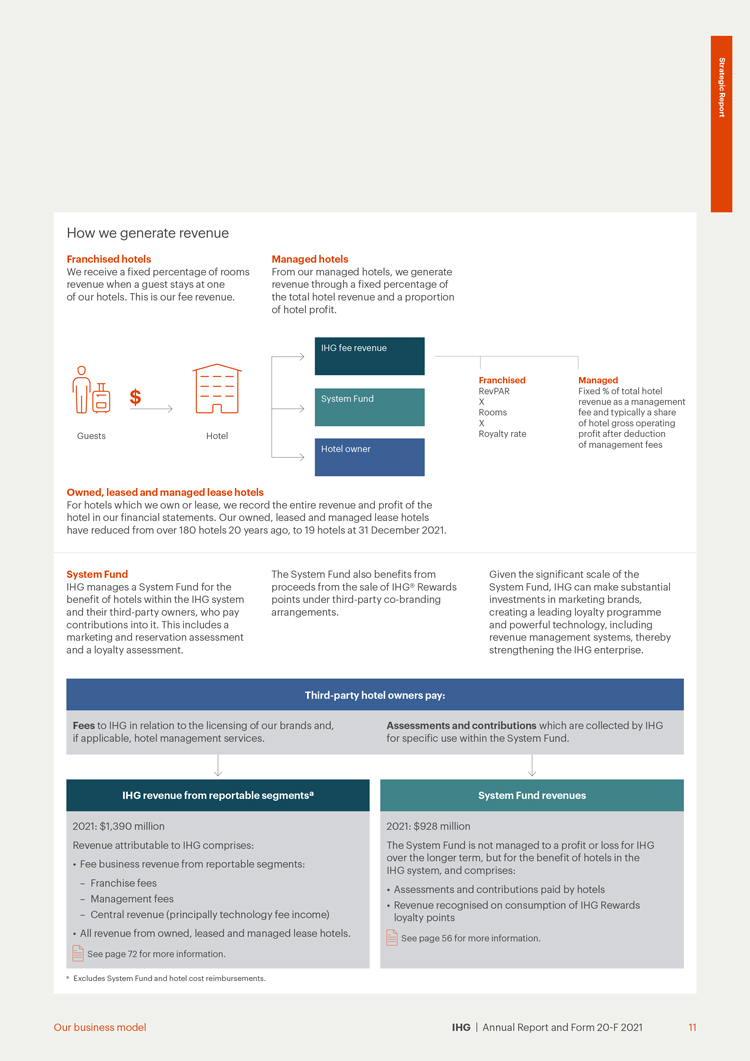

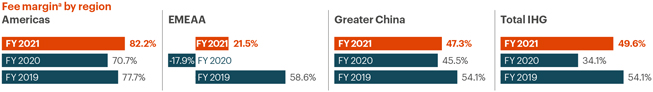

| Our asset-light business model requires a limited increase in IHG’s own operating expenditure to support our revenue growth, which delivers operating profit and fee margin growth. The benefit of operational efficiencies, along with brands and markets becoming more mature, has supported fee margin expansion on average by over 100bps a year between 2009-2019. |

For franchised hotels, the flow through of revenue to operating profit is higher than it is at managed hotels, given our well-invested scale platform where limited resources are required to support the addition of an incremental hotel. This is most evident in our Americas region, where fee margins are the highest, reflecting our scale and around 90% of our hotels operating under our franchised model. |

Across our managed hotels, the flow through of revenue to profit can be lower, given higher operating expenditure on operations teams supporting the hotel network. |

a |

Fee margin excludes owned, leased and managed lease hotels, significant liquidated damages and the results of the Group’s captive insurance company and is stated at AER. |

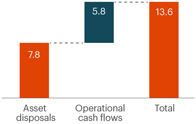

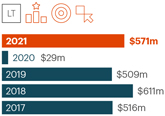

| Our asset-light business model is highly cash generative through the cycle and enables us to invest in our brands and strengthen our enterprise. We have a disciplined approach to capital allocation, which ensures that the business is appropriately invested in, whilst maintaining an efficient and conservative balance sheet. Beyond this, we look to return surplus cash to shareholders through ordinary and special dividends and share buybacks, with our objective to maintain an investment-grade credit rating. One of the measures we use to monitor this is net debt: adjusted EBITDA and we aim for a ratio of 2.5-3.0x. Liquidity through the recovery As occupancies have recovered, the strength of our cash generation became evident with adjusted free cash flow a generation of $571m in 2021. |

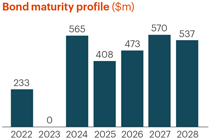

Recovering demand during 2021 and strong cost control resulted in rapid deleveraging. As such, our net debt: adjusted EBITDA ratio was 3.0x at 31 December 2021 (7.7x as at 31 December 2020). During the year, we repaid £600m of commercial paper issued under the UK Government’s Covid Corporate Financing Facility (CCFF). Following the issuance and repayment of bonds in 2020, our next bond maturity is £173m in November 2022, with no further bond maturities until October 2024. As at 31 December 2021, IHG had available liquidity of $2.7bn. Our $1.35bn syndicated and bilateral revolving credit facilities (RCF) have covenant relaxations in place for 2022 (see page 59). Our covenant leverage was 3.0x at 31 December 2021 (2020: 8.7x). |

Looking forward, our approach to capital allocation remains unchanged. As the business recovers, our priorities for the uses of cash are consistent: ensure the business is appropriately invested in to drive growth; target sustainable growth in the ordinary dividend; and return surplus funds to shareholders, while at the same time considering our stated aim of a leverage ratio of 2.5-3.0x, and our objective of maintaining an investment-grade credit rating. |

a |

Use of Non-GAAP measures: In addition to performance measures directly observable in the Group Financial Statements (IFRS measures), additional financial measures (described as Non-GAAP) are presented that are used internally by management as key measures to assess performance. Non-GAAP measures are either not defined under IFRS or are adjusted IFRS figures. Further explanation in relation to these measures can be found on page 73 to 77 and reconciliations to IFRS figures, where they have been adjusted, are on pages 218 to 223. |

12 |

IHG |

| Our priorities for the uses of cash are consistent with previous years and comprise three pillars: Shareholder returns (2003-19) Source of returns  |

1 Invest in the business to drive growth We look to strategically drive growth, while maintaining strict control on investments and our day-to-day |

2 Target sustainable growth in the ordinary dividend IHG has a dividend policy where we would look to grow the ordinary dividend each year, while balancing all our stakeholder interests and ensuring our long-term success. |

3 Return surplus funds to shareholders The Group has a strong track record of returning surplus cash to shareholders. Since 2003, including the ordinary dividend, the Group has returned $13.6bn. |

|

| Type |

What is it? |

Recent examples |

| |||||

Maintenance capital expenditure and key money |

Maintenance capital expenditure is devoted to the maintenance of our systems and corporate offices, along with our owned, leased and managed lease hotels. Key money is expenditure used to access strategic opportunities, particularly in high-quality and sought-after locations, when returns are financially and/or strategically attractive. |

Examples of maintenance spend include maintenance of our offices, such as reformatting in light of the pandemic. Across our owned, leased and managed lease hotels we invest in refurbishment of public spaces and guest rooms. Examples of key money include investments to secure representation for our brands in prime locations. |

| |||||

| Recyclable investments to drive the growth of our brands and our expansion in priority markets |

Recyclable investments are capital used to acquire real estate or investment through joint ventures or equity capital. This expenditure is strategic to help build brand presence. We would look to divest these investments at an appropriate time and reinvest the proceeds across the business. |

Examples of recyclable investments in prior years include our EVEN ® Hotels brand, where we used our capital to develop three hotel properties in the US to showcase the brand. These hotels have now been sold and operate under a franchise agreement. |

||||||

| System Fund capital investments for strategic investment to drive growth at hotel level |

The development of tools and systems that hotels use to drive performance. This is charged back to the System Fund over the life of the asset. |

We continue to develop our cloud-based Guest Reservation System (GRS) and IHG Concerto ™ . Other examples include redevelopment of the IHG mobile app ahead of launch in 2022. |

||||||

| |

|

|

||||||

| Dividend policy The Board consistently reviews the Group’s approach to capital allocation and seeks to maintain an efficient balance sheet and investment-grade credit rating. IHG has an excellent track record of returning funds to shareholders through ordinary and special dividends, and share buybacks. The ordinary dividend paid to shareholders increased at an 11% CAGR between 2004 and 2019. |

When reviewing dividend recommendations, the Directors take into account the long-term consequences. The Board looks to ensure that any recommendation does not harm the sustainable success of the Company and that there are sufficient distributable reserves to pay any recommended dividend. The Board assesses the Group’s ability to pay a dividend bearing in mind its responsibilities to its stakeholders and its objective of maintaining an investment-grade credit rating. |

The Board is therefore proposing a final dividend of 85.9¢ in respect of 2021, an amount equivalent to the withdrawn final payment in respect of 2019.  |

||||||

Our business model |

IHG |

13 |

W |

e know that to stay successful we need to put ourselves in the shoes of our leisure guests, business customers and owners |

managed estate, supporting both staffing levels and work-life balance. We also launched our Journey to GM talent acceleration programme to support those making the transition into General Manager roles, and strengthened how we identify and develop future talent as our estate expands. As demand increases in our hotels, we are providing our owners and teams with clear action plans, training and support for evolving brand standards and procedures to meet changing guest expectations. Rising costs due to inflation in some markets have been met with operational efficiency changes and an expanded procurement offer, with our scale and expertise helping deliver new solutions that resulted in net year-on-year Thousands of owners and operators also joined our webinars during the year on topics including virtual sales calls, evolving food and beverage, and the IHG ® Way of Clean programme. In late 2021, we collaborated with the Professional Convention Management Association to offer hotel teams a new Hybrid Events for Hotels & Venues Intro Certificate Course, to help them successfully partner with planners to host corporate and social hybrid events.We have captured demand through tailored marketing campaigns and promotions, supported by resources such as PR toolkits and new services within IHG’s Revenue Management for Hire programme, which helps hotels identify and act on revenue opportunities using business intelligence and data. |

To ensure our corporate teams are thinking like our owners, we also invited owners and General Managers (GMs) to speak at regional townhalls and share their perspectives during 2021. For our guests Cleanliness and safety standards have remained very important, underpinned by our IHG Way of Clean programme and IHG Clean Promise. The stay experience has continued to evolve, including the reintroduction of buffet breakfasts and social hours for brands in certain markets, and we offer clear guest communication on what to expect during their hotel stay at this time. During 2021, we introduced more loyalty offers for IHG Rewards members, extended the pause on points expiration and integrated select Six Senses resorts into the programme.  | |||

| in all we do. This is how we create unrivalled service and tailored experiences in our hotels, and attractive investment opportunities with strong returns for our owners. Our response to the pandemic has illustrated more than ever our desire to go the extra mile through fast, thoughtful and effective solutions, built on listening to what’s needed. Whether it’s food and beverage, cleanliness, hybrid meetings or loyalty enhancements for guests, or more efficient operations, recruitment support or procurement solutions for our owners, we’re working with a customer-centric mindset to ensure IHG and our brands stand out as a preferred choice in the market. What we achieved in 2021 Many of our hotel owners One of the big challenges of the pandemic for our industry is recruiting and retaining talent to meet returning guest demand. IHG has provided a number of tools and solutions for hotels, including new hiring resources, deeper relationships with job platforms, and targeted social media campaigns. In Australia, our myFlex initiative has given hotel colleagues the flexibility to work across any of our hotels in the country’s | ||||||

| Our strategy |

IHG |

19 |

| Such steps have deepened guest relationships, with Reward Night bookings largely recovering to pre-pandemic levels and participation rates of our higher tiered members exceeding 2019 levels. A further nine million members also joined the programme, with record enrolments on our web and mobile channels.For corporate guests, ‘Welcome Back to Business’ campaigns were launched, with our SME programme, IHG Business Edge, increasing its accounts by 44% in the year. Our Meet with Confidence programme for business customers was also expanded to include new rapid on-site testing for large events at our US hotels, while a new Points + Perks offer makes bookings even more rewarding. In November, IHG received the Stella Award gold medal for Best Hotel Chain for the exceptional meeting experience provided through the programme. Reflecting our ongoing customer-centric approach, our Guest Satisfaction Index continued to improve, achieving scores of 100 or better for each brand and outperforming peers. |

To continue improving guest satisfaction scores and drive revenue for our owners, updated guest room and public space design programmes are ongoing across many of our brands, including our Formula Blue concept at Holiday Inn Express and next-generation designs for Holiday Inn, Candlewood Suites ® and Staybridge Suites® .What’s to come Our IHG Rewards loyalty programme is critical to our business and our future growth. Our members drive around half of all room nights globally each year and spend 20% more in our hotels than non-members. They are also nine times more likely to book direct, which is more profitable to our owners.To deepen relationships with new and existing members, and drive more repeat business for our owners, we will transform our loyalty offering in 2022. In January 2022, we announced a first phase of new tiers and bonus-point earning structure that will allow our members to earn more points, more quickly than ever before. Later in the year, |

details of the full programme will commence, including new and enhanced benefits, more experiences and more redemption options, all powered by our new IHG mobile app, which goes live in 2022. As the new programme rolls out, we’re taking steps to ease the pressure and disruption on our busy hotel teams by providing training and resources, alongside carefully managing costs for owners. Helping our owners manage costs to build, open and operate is a top priority, so we continue to work closely with them on solutions to increase revenue alongside delivering more efficient and sustainable operations. Key elements to this include a continued focus on our central procurement services and reducing energy costs. As we focus on accelerating growth, we will also proactively manage our global development pipeline and help support our owners to ensure they can progress projects as quickly as possible. | ||

| Guest engagement |

||||||

|

Our ability to offer a range of differentiated and attractive brands with rich stay experiences, great value, flexibility and strong loyalty rewards are key to attracting guests to IHG branded hotels and driving commercial performance and revenue. |

|||||

What impacted them in 2021 |

Engagement |

Outcomes |

||||||||||

| • Booking, cancellation and loyalty flexibility as a result of local pandemic travel restrictions• Covid-19 related health and safety protocols• Evolving corporate meeting requirements blended with hybrid working and leisure• Quality of the guest stay and booking experience, including increased digitalisation• Location of hotels and facilities offered• Preference for hotels with trusted societal and green credentials |

• Guest surveys• Nine contact centres supporting guests in seven countries, with 2,700 sales and service agents speaking 12 languages• Social media engagement• Programme of targeted stay campaigns, loyalty promotions and awareness of stay experience improvements• Board and Executive Committee reviews of guest proposition and loyalty offer as part of the Board’s consideration of strategic and operational matters• Consumer surveys focused on attitudes to being more environmentally and socially conscious when travelling, and the pandemic’s impact on appetite to travel |

• Extended points expiry for loyalty members, and increased masterbrand marketing and stay promotions, leading to uplift in brand awareness• Continuation of IHG Way of Clean programme and evolution of Meet with Confidence programme for corporate clients• Enhanced customer service support, including automation to speed up response time and direction to the right team• Guest experience enhancements, including renovations, new designs and simpler room rates• Opening of 291 hotels and launch of our 17th brand, Vignette Collection• Continued improvement in Guest Satisfaction Index, with scores of 100 or better for each brand and outperforming peers• Launch of Journey to Tomorrow 10-year responsible business plan |

||||||||||

|

See our guest love KPI on page 52 and how the Board had regard for guests as part of their consideration of strategic and operational matters on pages 90 to 91. | |

20 |

IHG |

| Why hotel owners choose to work with IHG |

|

Hotel owners choose to work with IHG because of the trust they have in our brands and our track record in delivering strong returns. | ||

| Hotel owner engagement | ||

|

IHG’s success relies on hotel owners investing in our brands. To remain attractive, we focus on the breadth of our brand portfolio and effectiveness of our loyalty programme, enterprise contribution, technology, procurement and sales offering. | |

` |

||||||||||||

What impacted them in 2021 |

Engagement |

Outcomes |

||||||||||

| • Ability to capture and drive demand to their hotels• Evolving brand standards• Labour shortages, supply chain and continued budgeting constraints caused by the pandemic• Expanded brand portfolio with launch of Vignette Collection |

• Direct meetings with CEO and regional CEOs• IHG Owners Association collaboration• Portfolio and individual hotel reviews covering operational, strategic and industry trend updates• Webinars, regular newsletters and bulletins• Hotel lifecycle and finance team support• Collaboration with governments and industry to support recovery |

• Tailored marketing and promotions, supported by new data-driven resources and services that help hotels quickly identify and act on revenue opportunities• Brand standards evolved or removed to create more efficient and effective operations• Net year-on-year • Increased training, guidance and recruitment support for hotel teams• Next-gen formats and refurbishments being applied to hotels under brands including Holiday Inn Express, Holiday Inn, Candlewood Suites and Staybridge Suites• 83 hotels committed to improvement plans as a result of the Holiday Inn and Crowne Plaza review, and 151 hotels exited the estate |

||||||||||

|

See our net rooms supply, signings, gross revenue and enterprise contribution KPIs on pages 50 and 51 and how the Board had regard for hotel owners as part of their consideration of strategic and operational matters on pages 90 to 91. | |

|

Visit www.owners.org | |

Our strategy |

IHG |

21 |

| People |

|

| Our 2030 commitments • Achieve gender balance and a doubling of under-represented groups across our leadership• Cultivate a culture of inclusion for colleagues, owners and suppliers• Support all colleagues to prioritise their own wellbeing and the wellbeing of others• Drive respect for and advance human rights |

Our people are fundamental to IHG achieving its purpose and strategic goals. IHG’s business model means that we do not employ all colleagues. We directly employ individuals in our corporate offices, reservation centres, and managed, owned, leased and managed lease hotels. However, not all individuals in managed, owned, leased and managed lease hotels are directly employed, and we do not employ any individuals in franchised hotels (nor do we control their day-to-day |

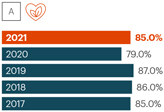

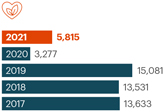

| What we achieved in 2021 People engagement We have a number of forums available for employees to share their thoughts, including employee resource groups, a designated non-executive director for workforce engagement, and our employee engagement survey, known as Colleague HeartBeat, which allows people to express their views on key aspects of working at IHG.In our 2021 survey, our overall employee engagement stood at 85%, which saw IHG again accredited as a Kincentric Global Best Employer. The survey highlighted areas that we can strengthen further, including the importance of filling job vacancies and advocating efficient and effective ways of working. Actions were taken in both these areas, including new hiring tools and a continued focus on improving processes, accountability and integration among teams. These areas will remain a priority for 2022. Attracting, developing and retaining talent To achieve our ambitions, we know we need to attract, develop and retain a diverse and talented workforce. This relies on our ability to develop an open and inclusive culture that promotes career development and equal opportunity, and recognises the importance of wellbeing in the workplace. To address the challenges in |

| attracting talent, we have developed new hiring resources and updated our policies to speed up the time it takes to process applications, worked with jobs platforms, schools and NGOs to unearth fresh talent, and run recruitment days and fairs. Our Early Careers and IHG ® Academy programmes also provide work experience, internships and graduate opportunities to those seeking a career in hospitality.We are firmly committed to investing in our employees and this year at a corporate level we embedded regular talent planning and development conversations to ensure we are building a strong pipeline for the future to deliver our ambitions. People managers have continued to hold quarterly check-ins with their teams to discuss performance and personal development, supported by an upskilling of HR partners through bespoke talent masterclasses. There is also a strong focus on reward, with our robust governance approach aimed at having fair and consistent reward and recognition practices across our employee population.In our hotels, actions in 2021 included enhancements to our learning and development programme for existing GMs, the launch of a new Journey to GM talent acceleration programme, and the implementation of a new hotel talent |

| People engagement |

||||||

|

Delivery of our purpose to provide True Hospitality for Good and the strategic priorities that drive future success relies on our people and our ability to maintain and evolve an engaged, diverse and inclusive culture where careers can grow. |

|||||

What impacted them in 2021 |

Engagement |

Outcomes |

||||||||||

| • Attractiveness of working in the hospitality industry during the pandemic• Staffing levels and ability to attract and retain talent• IHG’s strategy and approach to growth and future success• IHG’s approach to DE&I• IHG’s approach to hybrid working and wellbeing• IHG’s approach to climate change and wider environmental issues |

• Employee engagement survey• CEO and regional leadership calls with Q&A• Voice of the Employee feedback sessions• Employee communications including intranet stories, newsletters, blogs, videos, podcasts and interactive sessions on strategic priorities• ERGs representing ethnic minorities, gender, LGBTQ+, disabilities and other employees• Quarterly performance, development and wellbeing check-ins• Collaborative sessions including hackathons |

• Increased focus on recruitment and talent development at hotel and corporate levels• Continuation of employee engagement in company priorities and culture• Progress against and continued prioritisation of DE&I commitments, including conscious inclusion training and refreshed DE&I policy• Continued and increased focus on employee wellbeing, including enhanced parental leave policies in some markets and updated Global Flexible Working Guidelines• Reinstatement of bonus and annual salary increase for our corporate employees• IHG named a Kincentric Global Best Employer, with 85% employee engagement |

||||||||||

|

See our employee engagement KPI on page 53, how the Board had regard for people in their board and remuneration decisions on pages 91, 92, 107, 108, 112 and 114, Voice of the Employee disclosure on page 101, and statement on employee engagement on page 227. | |

|

Visit www.ihgplc.com/responsible-business | |

24 |

IHG |

| system in certain markets, which matches on-property talent to the most relevant opportunities across our estate. |

leave policy. We will continue to evaluate and review our policies to ensure they support people to be at their best. For hotel teams, monthly newsletters with wellbeing guidance were shared, and local initiatives were also established in some markets. Diversity, equity & inclusion (DE&I) As a global company, it’s important to us that our business reflects our people, our guests and the nationalities, cultures, ethnicities, sexual orientations, backgrounds and beliefs that they represent. This commitment is emphasised throughout our global hiring guidelines and initiatives, such as our conscious inclusion training, and is backed up by our Global Diversity, Equity, Inclusion and Equal Opportunities Policy, which was refreshed in 2021 and sets forth our commitment to promoting an inclusive environment that values and considers diverse attributes, perspectives, cultures and experiences. Recognising that we still have progress to make as a business, our Global DE&I Board and regional DE&I councils work together to monitor progress against commitments, discuss emerging trends and feedback, and identify future focus areas. Our work in this space revolves around a DE&I framework spanning three core areas: strengthening a culture of inclusion; increasing the diversity of our leadership and talent; and putting the right decision-making processes around our actions. |

Strengthening a culture of inclusion In 2021, corporate employees completed more than 10,000 hours of conscious inclusion training, promoting education and awareness, and sparking important team conversations. As part of our employee engagement survey, we also implemented an inclusion index in 2021 to track perceptions of culture and behaviour. The index showed that nine out of 10 corporate, reservation and managed hotel employees feel IHG has an inclusive culture, although perceptions were less positive among some ethnic minority groups. This is something we recognise and is reflected in our commitment to inclusion and achieving more diverse representation at all levels of our business. Central to the conversation around DE&I and our progression as a business are our Employee Resource Groups (ERGs), which continue to expand and now have 1,300 members globally. These groups represent ethnic minorities (BERG US, EMbrace EMEAA), gender (Lean In), LGBTQ+ (Out and Open, US and UK), disabilities (DAWN US and UK), and Early Careers (HYPE Greater China, US and UK) and have been instrumental in driving employee engagement and celebrating key events, including International Women’s Day, Global Inclusion & Wellbeing Week, and Pride. | ||||

|

See our GM talent acceleration programme on page 19, workplace environment on page 37 and workforce remuneration considerations on pages 107, 108, 112 and 114. | |||||

| Wellbeing In recognition of a shift to hybrid working as a result of the pandemic, we have provided employees with guidance and resources to help them adopt a balance of remote and office working that supports individuals and the delivery of IHG’s key priorities. Employee surveys have also been run to understand expectations and help inform our approach. In 2021, we updated our Global Flexible Working Guidelines with hybrid working principles, refreshed our UK Flexible Working Policy and highlighted flexible working opportunities within jobs. We’ve also taken steps to ensure a best practice approach to managing talent and performance in a hybrid environment. During the year, we provided employees with access to mental health and wellbeing guidelines and webinars, and continued Recharge days and Focus Fridays, where we try to avoid standing meetings where possible to create some undisturbed time for employees. Parental leave policies were also evaluated across a number of locations and significant enhancements were made to our UK paternity leave policy and US parental | ||||||

• |

Actively support diversity and inclusion to ensure that all our employees are valued and treated with dignity and respect. |

• |

Strive continually to provide people with a working environment that is free from racism, harassment and discrimination. |

• |

Foster an environment where our employees can work together to maintain an inclusive working environment where everyone’s unique contribution is valued. |

• |

Ensure that all decisions affecting an employee’s employment are made fairly and are based on an individual’s ability and performance. |

• |

Provide all employees with the opportunity to join our Employee Resource Groups. |

• |

Provide employees with disabilities the appropriate support where reasonable and practicable to do so and in accordance with local requirements. |

• |

Ensure our recruitment, development and reward practices, and our approach to working arrangements, are designed to attract, develop, and retain diverse talent. |

• |

Work to educate our employees about the benefits that diversity and inclusion brings to our business and support interventions that improve diversity and inclusion in our places of work. |

• |

Ensure all employees are aware of this policy and complete any relevant training in relation to diversity and inclusion. |

• |

Ensure our customers experience an inclusive welcome and stay provided by our employees. |

|

See our DE&I Policy at www.ihgplc.com/responsible-business |

|

Our strategy |

IHG |

25 |

| Increasing the diversity of our leadership talent We continue to deliver talent initiatives, such as our successful Rise programme, which is focused on increasing the number of women in GM and operations roles. During 2021, more than 100 women joined to take advantage of mentoring sessions, career development workshops, high-impact learning modules and empowering conversations designed to further careers. In the Americas, we launched Ascend, a bespoke programme to develop Black leadership talent and build strong relationships with organisations dedicated to supporting Black employees, while in the UK, we have worked with Women in Hospitality and Leisure (WiHTL) to provide opportunities for our ethnic minority talent on a dedicated talent programme. An ethnicity disclosure campaign was also carried out in the UK to further understand our population and help inform future solutions and actions to support our ethnic minority employees. IHG proudly continues to be recognised for its efforts, with CEO Keith Barr ranked first in the 2021 HERoes Advocates list, which celebrates the top 35 executives or senior leaders who actively campaign for diversity, inclusion and gender balance in the workplace. IHG also received a Highly Commended award in the Company of the Year category at the European Diversity Awards, with the efforts of several employees being acknowledged across different categories. Putting the right decision-making processes around our actions We understand that a diverse and inclusive environment creates a sense of belonging among employees and builds trust in our culture and values as a company. In 2021, we made progress on multiple fronts, including |

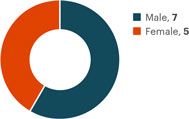

As at 31 December 2021 |

Male |

Female |

Total |

|||||||||||||

Directors |

7 |

5 |

12 |

|||||||||||||

Executive Committee |

7 |

3 |

10 |

|||||||||||||

Executive Committee direct reports |

33 |

22 |

55 |

|||||||||||||

Senior managers |

||||||||||||||||

(including subsidiary directors) |

81 |

29 |

110 |

|||||||||||||

All employees |

||||||||||||||||

(whose costs were borne by the Group or the System Fund) |

4,679 |

6,482 |

11,161 |

|||||||||||||

| We do not require employees to report ethnicity and are dependent on self-disclosure. We encourage employees to consider disclosure, which will provide stronger reporting in the future. |

| Human rights and modern slavery An integral part of our global commitment to responsible business is respecting human rights in accordance with internationally recognised standards. We understand the importance of human rights in relation to our colleagues, guests and communities and we encourage those with whom we do business – including our suppliers, owners and franchisees – to prevent, mitigate and address adverse impacts on human rights, including modern slavery. We seek to advance human rights through our business activities and by working together with others to identify challenges and effective solutions. Key focus areas in 2021 included: the development and pilot of minimum requirements relating to migrant worker risks in our hotels, including responsible recruitment and onboarding, staff living accommodation and worker voice; and a continued risk assessment of our supply chain, along with analysis of our approach to due diligence of suppliers. Findings from our 2019/20 Oman market-level labour assessment continue to be addressed and applied to other countries in the IMEA region, and we have started a similar assessment in the UK. More broadly, we have collaborated with the Sustainable Hospitality Alliance (SHA) and International Organisation for Migration (IOM) on projects focused on ethical recruitment in our industry. | ||

| IHG is a member of the United Nations Global Compact (UNGC) and is committed to alignment of IHG’s operations, culture and strategies with the UNGC’s 10 universally accepted principles in relation to human rights, environment and anti-corruption. |

|

See our Code of Conduct disclosure on pages 37 to 38, Responsible Business and Nomination Committee Reports on pages 100 to 103 and statement on disability on page 227. | |

|

See our Modern Slavery Statement at www.ihgplc.com/modernslavery | |

26 |

IHG |

| Communities |

| |

|

| Our 2030 commitments • Drive economic and social change through skills training and innovation• Support our communities when natural disasters strike• Collaborate to aid those facing food poverty |

| We rely on the communities in which we operate and are proud to use our global scale, time, skills and resources to ensure that our growth contributes positively to those around us. As we work towards our targets, it’s important we understand the impact of our investments, which makes integrity of data key to our approach. This year, we joined Business for Societal Impact (B4SI) – the global standard in managing corporate community investment – so that we can measure our input, output and impact of our projects. What we achieved in 2021 Skills training and innovation We’re passionate about our industry and inspiring individuals to explore just how rewarding a career in hospitality can be. Since 2004, our IHG Academy programme has been helping young people around the world gain valuable employment and life skills through work experience, internships and apprenticeships alongside some of the world’s best hoteliers. In the past eight years, working with local education providers and community organisations, more than 80,000 people have been trained and mentored through the IHG Academy, offering those from all backgrounds a rich variety of free programmes to help them gain a job in hospitality or other industries, as part of our promise to provide True Hospitality for Good on a global scale. To further its reach, we evolved the IHG Academy in 2021 with the launch of the IHG Skills Academy – a best-in-class |

| ||

| opportunities for thousands more people looking to build their confidence and get employment-ready. This work has been undertaken in collaboration with charities and other IHG suppliers and launched in October with more than 500 initial pieces of English content available. We continue to advance other skills-building programmes, too, including working with global NGO Junior Achievement Worldwide to give young people a headstart in the world of work, and in 2021 we hosted our Global Innovation Challenge to help high-school students learn valuable skills. We have also set up the Open Source Curriculum with the Sustainable Hospitality Alliance, which will provide free online teaching to help participants to find jobs in hospitality or other industries. In Greater China, we formed a strategic partnership with Wuxi Special Education School to provide training, internships and employment for mute and deaf children, with a number of hotels in different cities now taking part. We also welcomed 149 Future Leader Aspire participants into our Future Leaders programme. |

Giving for Good month During September 2021, more than 40,000 colleagues supported community projects as part of our annual Giving for Good month, making a positive difference to more than 350,000 people. Over 260,000 volunteering hours were collectively dedicated to supporting communities, causes and charities, with colleague activities ranging from hosting free pop-up grocery stores in the US and charity walks in the UK, to planting trees in Saudi Arabia.Supporting our communities when natural disasters strike We continue to work with a range of skilled humanitarian aid organisations to support critical relief efforts and help our communities in times of need, whether that involves dealing with the impact of the pandemic or the effects of natural disasters. In 2021, we supported relief efforts around the globe through donations to charities including the International Federation of Red Cross and Red Crescent Societies following the floods in Western Europe, while also supporting its response to the pandemic in countries such as India and Brazil. | |

Our strategy |

IHG |

27 |

W |

ith hotels in thousands of communities all over the world, our business and brands touch the lives of millions of people every day. We understand that in our role as a major global hospitality |

• |

Continue the integration of climate considerations into our Group risk management framework. This allows us to consider the interactions between climate and other strategic risks, as well as implementing mitigations through business-as-usual |

• |

Continue to monitor trends in potentially material climate-related risks and opportunities, with improved data capture. This will include further embedding climate impacts into our risk assessments and long-term financial plans and Group strategy, with development of further metrics where needed. |

• |

We will take steps to align to new recommendations and disclosure requirements under the International Sustainability Standards Board (ISSB), TCFD and UK Green Finance Strategy. |

• |

Undertake a carbon price exposure assessment on how changes to carbon pricing policy could impact our business, and to inform the business cases for decarbonisation actions. |

• |

Enhance the quality of data capture on those risks that have been identified as most material and provide further quantification of the potential impacts. |

• |

Develop a Group-wide climate transition plan to coordinate decarbonisation initiatives and investments taking place across our business. This plan will align with our 1.5°C SBT commitment. |

| TCFD recommendation |

Summary of our alignment with TCFD | |||

| Governance | ||||

| a. Describe the Board’s oversight of climate-related risks and opportunities. |

The IHG Board has collective responsibility for overseeing and ensuring the management of climate-related risks and opportunities and is advised by the Responsible Business Committee on IHG’s approach in this area. See more details on page 33. | |||

| b. Describe management’s role in assessing and managing climate-related risks and opportunities. |

The Executive Committee is responsible for managing climate-related risks and opportunities. The Chief Financial Officer and Group Head of Strategy (CFO) is the overall sponsor for decarbonisation within the business, and we have formed a TCFD Steering Group of Senior Leaders from across different functions of the business who have led the work, supported by the TCFD Working Group, to ensure we assess and manage climate-related risks and opportunities, embedding the results of the climate scenario analysis into long-range business planning. See more details on page 33. | |||

| Strategy | ||||

| a. Describe the climate-related risks and opportunities the organisation has faced over the short, medium and long-term. |

With external expertise, we completed a risk and opportunity review across our value chain and identified the most material potential impacts associated with our business. See our climate-related risks table on page 34 and climate-related opportunities table on page 35. Our impacts are categorised over the following timescales: (a) short: 1-5 years to highlight immediate risks or opportunities; (b) medium: 10-15 years to align to our Group strategic planning cycles; (c) long-term: 30 years to align to TCFD requirements. | |||

| b. Describe the impact of climate-related risks and opportunities on the organisation’s businesses, strategy, and financial planning. |

Climate-related scenarios are being embedded into our long-range planning and future Board strategy discussions. Work is underway to improve data and modelling around major risks identified and TCFD findings are now considered as part of the strategic planning process. We have outlined the most material of our impacts in our climate-related risks table on page 34. See pages 29 to 31 for details of the environmental initiatives already underway and pages 149, 172 and 176 for the consideration of climate risks in the financial statements to support conclusions on going concern, deferred tax assets and goodwill respectively. | |||

| c. Describe the resilience of the organisation’s strategy, taking into consideration different climate-related scenarios, including a 2°C or lower scenario. |

We analysed the resilience of IHG’s strategy under both 2°C and 4°C climate change scenarios. The results showed that, given IHG’s asset-light business model, transition risks are more likely to have a material impact on our business, compared with physical risks. For more detail on how we are mitigating our climate-related risks to ensure business resilience, see our climate-related risks table on page 34 and see pages 29 to 31 for details of our environmental policies and initiatives. | |||

32 |

IHG |

TCFD recommendation |

Summary of our alignment with TCFD | |||

Risk management | ||||

| a. Describe the organisation’s processes for identifying and assessing climate-related risks. |

Our TCFD Steering Group has led a detailed scenario analysis of climate-related impacts across the IHG value chain. Outcomes of this risk assessment process were presented to Executive Committee members, Senior Leadership and the Board for review and used to inform our climate change action plans. The monitoring and management of the climate risks identified by our initial assessment (supported by external expertise) will now be integrated into our existing risk management processes – including scenario planning, crisis management and analysis of longer-term trends. For more information on our scenario analysis of climate-related risks, see the Climate-related risk management and strategy section on page 34. | |||

| b. Describe the organisation’s processes for managing climate-related risks. |

We have historically taken a number of steps to manage climate risk, including activities such as engaging with customers and the rest of the industry on demand for greener travel and hospitality services. For several years, we have also had carbon reduction targets at both a Group and hotel level, and in early 2020 announced a SBT to reduce greenhouse gas emissions, which we upgraded at the end of 2021. We continue to collect information to support the monitoring of these risks and develop mitigation responses as required. With oversight from our Risk and Assurance and Corporate Responsibility teams, our assessment of transition risks are continually reviewed by relevant teams across IHG. Our physical risk assessment will be reviewed every three years, or more frequently if required. See the Climate-related risk management and strategy section on page 34. | |||

| c. Describe how processes for identifying, assessing and managing climate-related risks are integrated into the organisation’s overall risk management. |

We consider climate change within the context of environmental and social megatrends as one of our principal risks. As part of our 2021 review of principal risks with the Board, we also described how climate change potentially impacts other existing principal risks and are embedding climate change resilience into existing ‘business as usual’ processes. For more information on IHG governance and management of principal risks, see pages 40 to 47. | |||

Metrics and targets | ||||

| a. Disclose the metrics used by the organisation to assess climate-related risks and opportunities in line with its strategy and risk management process. |

One of our strategic priorities is to ‘care for our people, communities and planet’ and to guide our actions and drive progress, in 2021 we launched Journey to Tomorrow, an action plan of commitments we’ve made to create positive change by 2030. As part of this action plan, we have set ourselves an ambitious SBT, aligned to 1.5°C, which is driving action across the business. More detail on our SBT is included in the strategic mitigations in our climate-related risks table page 34. Energy reduction targets are incorporated into hotel-level metrics, as well as at the Executive Committee. ESG criteria, including annual energy reduction, form part of the Annual Performance Plan (APP) structure for Executive Directors and eligible employees. This forms part of a range of KPIs and review of performance against IHG’s Global Metrics. We have continued our work this year to develop ESG metrics with a view to incorporating into our long-term incentive plan and continue to develop the quality of our environmental data in order to enable this. See more on our metrics on page 35. | |||

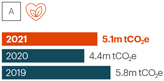

| b. Disclose scope 1, scope 2, and, if appropriate, scope 3 greenhouse gas (GHG) emissions, and the related risks. |

Our 2019-2021 scope 1, 2 and 3 emissions data and methodology can be found on pages 229 and 230. We have disclosed the categories of scope 3 emissions, which are covered by our 1.5°C aligned SBT. | |||

| c. Describe the targets used by the organisation to manage climate-related risks and opportunities and performance against targets. |

Our existing targets have been approved by the Science Based Targets initiative (SBTi) as 1.5°C aligned and we are also aiming for our new-build hotels to operate at very low or zero carbon by 2030. Our scope 1, 2 and 3 emissions data will provide us with an ongoing understanding of how we are progressing on our decarbonisation journey. | |||

|

See further information about Director development on page 94, and Audit, Responsible Business and Remuneration Committee Reports on pages 95 to 101, and 104 to 125. |

|

Delivering on the recommendations of TCFD |

IHG |

33 |

| Summary of risk |

Impact |

Mitigation and strategy resilience | ||||||||

| |

|

| ||||||||

| Ability to meet stakeholder expectations around IHG’s role in the energy transition Medium-term (10-15 years)Potentially material impact |

With climate change being the biggest threat facing humanity, we all have a significant and immediate role to play in curbing global carbon emissions and keeping temperature rise within 1.5°C above pre-industrial levels.Key stakeholders – including guests, investors and governments – are increasingly looking for businesses to not only set the right goals, but also demonstrate their commitment in the actions they take today. We recognise that not delivering on increased stakeholder expectations could result in a reputational risk for the Group, especially in a scenario where our peers meet or exceed our own decarbonisation plans. Continuous progress against our targets can create significant operational and commercial opportunities. We have not quantified this impact, but we are monitoring it alongside wider reputational risks. |

Being a responsible business is at the heart of IHG’s strategy and includes a strong focus on reducing the carbon footprint of operations, as well as those of our franchisees. We have upgraded our emissions reduction target to align to 1.5°C, and are progressing decarbonisation plans across the estate Our target is to reduce emissions from our managed, owned, leased and managed lease hotels by 46% by 2030, from a 2019 baseline, and to do the same with emissions from our franchised hotels, which puts us on a trajectory to achieve net-zero emissions by 2050. In 2022, we will update our transition risk assessment to align with this new target. These are challenging targets given IHG’s predominantly franchised business model and ambitious growth strategies.We are developing a Group-wide climate transition plan This will help us ensure we meet stakeholder expectations around the transition and deliver on our own ambitious targets on carbon reduction. Over the next 12 months, we will be developing a detailed climate transition plan, in line with recent supplementary guidance announced by the TCFD. This plan will coordinate a range of decarbonisation initiatives ongoing across our business and focuses on three key levers: driving energy efficiency in our existing estate; facilitating a shift to renewable energy wherever possible; and targeting 100% of new-build hotels to operate at very low or zero carbon by 2030. | ||||||||

|

See our planet section on pages 29 to 31 to learn more about our work on decarbonisation. | |||||||||

| |

|

| ||||||||

| Reduction in aviation passenger numbers expected to impact hotel demand medium to long-term (10-30 years) Potentially material impact |

Today’s aviation travel, in particular international travel, has a significant carbon footprint. Under a 2°C scenario, aviation travel could reduce significantly as travel patterns align to a low-carbon economy. This could potentially reduce the ability of guests to visit our hotels. |

Given our diverse portfolio of hotels catering to both domestic and international travellers, such a shift in travel patterns could provide both downsides and upsides to our business, if for example, more guests opt to travel domestically utilising greener transport modes such as high-speed trains in China. We are improving data collection to understand our customers’ travel patterns The impact on travel is being closely monitored post Covid-19. To enable us to calculate the potential impact of this shift in travel on our different regions and brands, we are planning changes to our guest survey to collate further data on the modes of transport used. | ||||||||

| |

|

| ||||||||

34 |

IHG |

| Summary of risk |

Impact |

Mitigation and strategy resilience | ||

| |

|

| ||

| Increased desire for ‘green hotels’ could have a material impact on IHG revenues Medium to long-term (10-30 years) Potentially material impact |

Green hotels will play an important part of our future under all scenarios. Attitudes and beliefs around climate change have changed significantly, with 60% of 9,000 adults surveyed by IHG across the US, UK, Germany, Greater China, the UAE and Australia agreeing that they want to be more environmentally and socially conscious on their travels. The changes in these attitudes and beliefs have started to now impact consumer behaviour, both for business and leisure travel, as green credentials are factoring into customers’ buying decisions. We recognise that these changing consumer behaviours offer both an opportunity and a risk for IHG, depending on how fast the green hotel market expands and how much of this new market we capture share of. Under a 2°C scenario, we do expect a significant impact over time – either a risk or opportunity depending on our ability to demonstrate our green credentials. |

We have developed a bespoke tool to help our hotels identify and prioritise energy efficiency solutions based on key building characteristics, including return on investment information and procurement support as feasible. Called the Hotel Energy Reduction Opportunities Tool (HERO Tool), it will help enhance the hotel’s environmental credentials. In the UK, all our managed lease hotels are now on renewable energy contracts, and we have started actively promoting renewable energy solutions to owners in key markets. We are improving data collection to understand consumer sentiment towards greener travel Given the potential materiality of this exposure, we are working to leverage existing consumer sentiment data in this area, such as a social monitoring platform to gather data from guests’ social posts (social media, review sites) and developing a methodology to gather, track and measure the impact of actual (rather than claimed) guest behaviour. | ||

| |

|

| ||

| Loss of franchise royalty fees following natural disasters Long term (15-30 years) Potentially minor impact |

Under both a 2°C and 4°C scenario, the frequency of natural disasters is expected to continue to increase up to 2050 and beyond. The resulting business interruption reduces the amount of franchise royalty fees we will receive from the specific hotels impacted, however this does not take into account the potential for increased demand from any ongoing recovery efforts. |

We are tracking physical climate impacts across our portfolio We have previously assessed the physical risks of climate events on our hotels, and we are now upgrading systems to track the physical impacts of climate change across our portfolio and how much additional business is driven into our hotels from recovery efforts. This will allow us to adapt to these hazards more effectively and assess the impact on our business and owners. | ||

| |

|

| ||

| Summary of opportunity |

Actions being taken | |||

Supporting hotel owners to meet new customer demand for sustainable travel |

We have committed to deliver new-build hotels that operate at very low or zero carbon by 2030We recognise our customers are increasingly expecting high standards of sustainability in their leisure and travel purchases. Our commitment to deliver new-build hotels that operate at very low or zero carbon signals our intent to further help our hotel owners meet potential future demand for green travel, and to improve our competitive position overall. This will be supported by enhanced engagement with customers and data regarding customer demand to help us deliver on customer priorities for sustainability and climate. | |||

Supporting hotel owners to decarbonise their assets could increase commercial attractiveness |

We are continuing to invest in ways to support hotels become more energy efficient and decarbonise assets While reducing emissions can require investment, we are leveraging our Green Engage system to ensure we invest in energy efficiency improvements that have the greatest potential to reduce costs over the long-term. This will be supported by our HERO tool, further details of which are available in our 2021 Responsible Business Report (see link below). | |||

Increased domestic tourism driven by changes in long-haul travel patterns |

We are improving data collection to understand our customers’ preferences on sustainability Changing travel patterns represent both a potential risk and opportunity to our business. We have a large domestic customer base, and there may be a further positive impact to this market driven by future changes to travel patterns, as some customers move to shorter-haul and less carbon intensive modes of travel. Gathering further data will help us understand this trend further and ensure we can meet the needs of any changing customer base. | |||

|

See our carbon footprint KPI on page 53. |

|

Our Responsible Business Report and ESG Databook are available at www.ihgplc.com/responsible-business |

|

Delivering on the recommendations of TCFD |

IHG |

35 |

| Our purpose of providing True Hospitality for Good is underpinned by our commitment to a culture of operating in a responsible and ethical manner. Our culture sets the tone for how we do business. |

|

| Stakeholder engagement IHG engages with its stakeholders at all levels of the business, from the Board, through the Executive Committee, Senior Leadership and corporate functions, to front-line operations. A variety of methods are used based on experience and developing best practice, including face-to-face The effectiveness of our engagement methods is measured through a range of metrics, including our KPIs (such as signings and pipeline), performance, ability to attract and retain talent, employee engagement survey results, adherence to the policies covered by our Code of Conduct and AGM results. The views and interests of other stakeholders, such as regulators and industry bodies, are also taken into consideration. They help provide a framework against which we measure ourselves, protect our reputation and develop our commercial and social awareness. | ||

|

See information on our engagement with key stakeholders, approach to the planet on pages 20 to 39, 92, 101, 107, 108, 112-114, and Section 172 statement on pages 90 and 91. | |

A |

number of linked factors impact IHG’s long-term success, including the resilience of our business model, | |

our purpose, and the effectiveness of our strategy. Underpinning all of these is our workplace culture, which is driven by our reputation as a well-governed, trusted and ethical company. | ||

36 |

IHG |