Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 1-10409

InterContinental Hotels Group PLC

(Exact name of registrant as specified in its charter)

England and Wales

(Jurisdiction of incorporation or organization)

Broadwater Park,

Denham, Buckinghamshire UB9 5HR

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| American Depositary Shares |

New York Stock Exchange | |

| Ordinary Shares of 14 194/329 pence each |

New York Stock Exchange* |

| * | Not for trading, but only in connection with the registration of American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission. |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

| Ordinary Shares of 14 194/329 pence each | 268,325,071 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: Yes þ No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934: Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days: Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer þ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) |

Indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 ¨ Item 18 þ

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act):

Yes ¨ No þ

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| US GAAP ¨ |

International Reporting Standards as issued by the International Standards Accounting Board þ |

Other ¨ |

Table of Contents

| Page | ||||||

| 1 | ||||||

| 2 | ||||||

| PART I | ||||||

| Item 1. |

Identity of Directors, Senior Management and Advisors | 4 | ||||

| Item 2. |

4 | |||||

| Item 3. |

4 | |||||

| 4 | ||||||

| 7 | ||||||

| Item 4. |

11 | |||||

| 11 | ||||||

| 14 | ||||||

| 15 | ||||||

| 38 | ||||||

| 38 | ||||||

| 39 | ||||||

| 39 | ||||||

| Item 4A. |

41 | |||||

| Item 5. |

41 | |||||

| 41 | ||||||

| 42 | ||||||

| 44 | ||||||

| 54 | ||||||

| Item 6. |

56 | |||||

| 56 | ||||||

| 61 | ||||||

| 62 | ||||||

| 65 | ||||||

| 65 | ||||||

| 66 | ||||||

| Item 7. |

67 | |||||

| 67 | ||||||

| 67 | ||||||

| Item 8. |

67 | |||||

| 67 | ||||||

| 68 | ||||||

| Item 9. |

68 | |||||

| 69 | ||||||

| 69 | ||||||

| 69 | ||||||

| 69 | ||||||

i

Table of Contents

| Page | ||||||

| Item 10. |

Additional Information | 70 | ||||

| 70 | ||||||

| 72 | ||||||

| 74 | ||||||

| 74 | ||||||

| 78 | ||||||

| Item 11. |

78 | |||||

| Item 12. |

81 | |||||

| PART II |

||||||

| Item 13. |

Defaults, Dividend Arrearages and Delinquencies | 83 | ||||

| Item 14. |

Material Modifications to the Rights of Security Holders and Use of Proceeds |

83 | ||||

| Item 15. |

83 | |||||

| Item 16. |

83 | |||||

| Item 16A. |

83 | |||||

| Item 16B. |

83 | |||||

| Item 16C. |

84 | |||||

| Item 16D. |

84 | |||||

| Item 16E. |

Purchases of Equity Securities by the Issuer and Affiliated Purchasers |

84 | ||||

| Item 16F. |

85 | |||||

| Item 16G. |

Summary of Significant Corporate Governance Differences from NYSE Listing Standards |

85 | ||||

| Item 16H. |

86 | |||||

| PART III |

||||||

| Item 17. |

Financial Statements | 86 | ||||

| Item 18. |

87 | |||||

| Item 19. |

87 | |||||

ii

Table of Contents

As used in this document, except as the context otherwise requires, the terms:

| • | “ADR” refers to an American Depositary Receipt, being a receipt evidencing title to an ADS; |

| • | “ADS” refers to an American Depositary Share, being a registered negotiable security, listed on the New York Stock Exchange, representing one InterContinental Hotels Group PLC ordinary share of 14 194/329 pence each; |

| • | “AMEA” refers to Asia, the Middle East and Africa; |

| • | “Board” refers to the Board of directors of InterContinental Hotels Group PLC or, where appropriate, the Boards of directors of InterContinental Hotels Limited or Six Continents Limited; |

| • | “Britvic” refers to Britannia Soft Drinks Limited for the period up to November 18, 2005, and thereafter, Britannia SD Holdings Limited (renamed Britvic plc on November 21, 2005) which became the holding company of the Britvic Group on November 18, 2005; |

| • | “Britvic Group” refers to Britvic and its subsidiaries; |

| • | “Company” refers to InterContinental Hotels Group PLC, InterContinental Hotels Limited or Six Continents Limited or their respective Board of directors as the context requires; |

| • | “Group” or “IHG” refers to InterContinental Hotels Group PLC and its subsidiaries or, where appropriate, InterContinental Hotels Limited or Six Continents Limited and their subsidiaries as the context requires; |

| • | “Hotels” refers to the hotels business of the Group; |

| • | “ordinary share” or “share” refers, from June 4, 2007 until October 8, 2012 to the ordinary shares of 13 29/47 pence each in the Company; and following October 9, 2012 to the ordinary shares of 14 194/329 pence each in the Company; |

| • | “Six Continents” refers to Six Continents Limited; previously Six Continents PLC and re-registered as a private limited company on June 6, 2005; |

| • | “Soft Drinks” refers to the soft drinks business of InterContinental Hotels Group PLC, which the Company had through its controlling interest in Britvic and which the Company disposed of by way of an initial public offering effective December 14, 2005; and |

| • | “VAT” refers to UK value added tax levied by HM Revenue and Customs on certain goods and services. |

The following are some of the service marks owned by Group companies: IHG®, INTERCONTINENTAL®, INTERCONTINENTAL ALLIANCE®, HUALUXE™, CROWNE PLAZA®, HOTEL INDIGO®, EVEN™, HOLIDAY INN®, HOLIDAY INN EXPRESS®, HOLIDAY INN RESORTS®, HOLIDAY INN CLUB VACATIONS®, STAYBRIDGE SUITES®, CANDLEWOOD SUITES®, PRIORITY CLUB®, HOLIDEX®, and GREEN ENGAGE®.

References in this document to the “Companies Act” mean the Companies Act 2006 of Great Britain; references in this document to the “EU” mean the European Union; references in this document to “UK” refer to the United Kingdom of Great Britain and Northern Ireland; references in this document to “US” refer to the United States of America.

The Company publishes its Consolidated Financial Statements expressed in US dollars.

In this document, references to “US dollars”, “US$”, “$” or “¢” are to United States currency, references to “euro” or “€” are to the euro, the currency of the European Economic and Monetary Union, references to “pounds sterling”, “sterling”, “£”, “pence” or “p” are to UK currency. Solely for convenience, this Annual Report on Form 20-F contains translations of certain pound sterling amounts into US dollars at specified rates. These translations should not be construed as representations that the pound sterling amounts actually represent such US dollar amounts or could be converted into US dollars at the rates indicated. The noon buying rate in The City

1

Table of Contents

of New York for cable transfers in pounds sterling as certified for customs purposes by the Federal Reserve Bank of New York on March 21, 2013 was £1.00 = $1.5180. For further information on exchange rates please refer to page F-23.

The Company’s fiscal year ends on December 31. The December 31 fiscal year end is in line with the calendar accounting year ends of the majority of comparable US and European hotel companies. IHG will continue to report on a December 31 fiscal year-end basis, as the Group believes this facilitates more meaningful comparisons with other key participants in the industry. References in this document to a particular year are to the fiscal year unless otherwise indicated. For example, references to the year ended December 31, 2012 are shown as 2012 and references to the year ended December 31, 2011 are shown as 2011, unless otherwise specified, and references to other fiscal years are shown in a similar manner.

The Company’s Consolidated Financial Statements are prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and in accordance with IFRS as adopted by the European Union (“EU”). IFRS as adopted by the EU differs in certain respects from IFRS as issued by the IASB, however, the differences have no impact on the Group’s Consolidated Financial Statements for the years presented.

As explained in Note 2 of the Notes to the Consolidated Financial Statements an internal reorganization during 2011 resulted in a change to the Group’s reportable segments. Comparatives have been restated to show the segmental information on a consistent basis.

In keeping with UK practice IHG believes that the reporting of profit and earnings measures before exceptional items provides additional meaningful information on underlying returns and trends to shareholders. The Group’s key performance indicators used in budgets, monthly reporting, forecasts, long-term planning and incentive plans for internal financial reporting focus primarily on profit and earnings measures before exceptional items. Throughout this document earnings per ordinary share is also calculated excluding the effect of all exceptional operating items, exceptional interest, exceptional tax and gain on disposal of assets and is referred to as adjusted earnings per ordinary share.

The Company furnishes JPMorgan Chase Bank, N.A., as Depositary, with annual reports containing Consolidated Financial Statements and an independent auditor’s opinion thereon. These Consolidated Financial Statements are prepared on the basis of IFRS. The Company also furnishes to the Depositary all notices of shareholders’ meetings and other reports and communications that are made generally available to shareholders of the Company. The Depositary makes such notices, reports and communications available for inspection by registered holders of ADRs and mails to all registered holders of ADRs voting instruction cards with specific reference to the section of the Company’s website on which such notices, reports and communications can be viewed. During 2012, the Company reported interim financial information at June 30, 2012 in accordance with the Listing Rules of the UK Listing Authority. In addition, it provided quarterly financial information at March 31, 2012 and at September 30, 2012. During fiscal 2013, the Company intends to report interim financial statements for a time period of six months. For each of the first quarter and third quarter, the Company intends to release interim management statements and publish supplementary data for rooms and revenue per available room (“RevPAR”). The Consolidated Financial Statements may be found on the Company’s website at www.ihgplc.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form 20-F contains certain forward-looking statements as defined in Section 21E of the Securities Exchange Act of 1934 with respect to the financial condition, results of operations and business of InterContinental Hotels Group and certain plans and objectives of the Board of Directors of InterContinental Hotels Group PLC with respect thereto. These forward-looking statements can be identified by the fact that they do not relate only to historical or current facts. Forward-looking statements often use words such as “anticipate”, “target”, “expect”, “estimate”, “intend”, “plan”, “goal”, “believe”, or other words of similar meaning. These statements are based on assumptions and assessments made by InterContinental Hotels Group’s management in light of their experience and their perception of historical trends, current conditions, expected future developments and other factors they believe to be appropriate.

2

Table of Contents

Such statements in the Form 20-F include, but are not limited to, statements under the following headings; (i) “Item 4. Information on the Company”; (ii) Item 5. Operating and financial review and prospects”; (iii) “Item 8. Financial information”; and (iv) “Item 11. Quantitative and qualitative disclosures about market risk”. Specific risks faced by the Company are described under “Item 3. Key information — Risk factors” commencing on page 7.

By their nature, forward-looking statements are inherently predictive, speculative and involve risk and uncertainty. There are a number of factors that could cause actual results and developments to differ materially from those expressed in, or implied by, such forward-looking statements, including, but not limited to: the risks of political and economic developments; the risk of events that adversely impact domestic or international travel; the risks of the hotel industry supply and demand cycle; the risks of dependence on a wide range of external stakeholders and business partners; the risks related to identifying, securing and retaining franchise and management agreements; the risks in relation to changing technology and systems; the risks associated with the Group’s reliance on the reputation of its brands and the protection of its intellectual property rights; the risks associated with the Group’s reliance on its proprietary reservations system and the risk of failures in the system and increased competition in reservations infrastructure; the risks related to information security and data privacy; the risks associated with safety, security and crisis management; the need to find people with the right skills and capability to manage growth and change; the risks of non-compliance with existing and changing regulations across numerous countries, territories and jurisdictions; the risk of litigation; the risks related to corporate responsibility; the risks related to the Group’s ability to borrow and satisfy debt covenants; the funding risks in relation to the defined benefits under its pension plans and the risks associated with difficulties the Group may face insuring its business.

3

Table of Contents

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

SELECTED CONSOLIDATED FINANCIAL INFORMATION

Summary

The selected consolidated financial data set forth below for the years ended December 31, 2012, 2011, 2010, 2009 and 2008 has been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and in accordance with IFRS as adopted by the European Union (“EU”), and is derived from the Consolidated Financial Statements of the Group which have been audited by its independent registered public accounting firm, Ernst & Young LLP.

IFRS as adopted by the EU differs in certain respects from IFRS as issued by the IASB. However, the differences have no impact on the Group’s Consolidated Financial Statements for the years presented. The selected consolidated financial data set forth below should be read in conjunction with, and is qualified in its entirety by reference to, the Consolidated Financial Statements and Notes thereto included elsewhere in this Annual Report.

For the years ended December 31, 2011 and 2010, the selected consolidated financial data differs from the Consolidated Financial Statements issued to UK listing authorities as explained in Note 1 of Notes to the Consolidated Financial Statements.

4

Table of Contents

Consolidated income statement data

| Year ended December 31, | ||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||

| ($ million, except earnings per ordinary share) | ||||||||||||||||||||

| Revenue* |

1,835 | 1,768 | 1,628 | 1,538 | 1,897 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating profit before exceptional operating |

614 | 559 | 444 | 363 | 549 | |||||||||||||||

| Exceptional operating items* |

(4 | ) | 57 | (7 | ) | (373 | ) | (132 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating profit/(loss)* |

610 | 616 | 437 | (10 | ) | 417 | ||||||||||||||

| Financial income |

3 | 2 | 2 | 3 | 12 | |||||||||||||||

| Financial expenses |

(57 | ) | (64 | ) | (64 | ) | (57 | ) | (113 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Profit/(loss) before tax |

556 | 554 | 375 | (64 | ) | 316 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Tax: |

||||||||||||||||||||

| On profit before exceptional items |

(153 | ) | (120 | ) | (98 | ) | (15 | ) | (101 | ) | ||||||||||

| On exceptional operating items |

1 | (4 | ) | 1 | 112 | 17 | ||||||||||||||

| Exceptional tax credit |

141 | 43 | — | 175 | 25 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (11 | ) | (81 | ) | (97 | ) | 272 | (59 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Profit after tax |

545 | 473 | 278 | 208 | 257 | |||||||||||||||

| Gain on disposal of discontinued operations, net of tax |

— | — | 2 | 6 | 5 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Profit for the year |

545 | 473 | 280 | 214 | 262 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Attributable to: |

||||||||||||||||||||

| Equity holders of the parent |

544 | 473 | 280 | 213 | 262 | |||||||||||||||

| Non-controlling interest |

1 | — | — | 1 | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Profit for the year |

545 | 473 | 280 | 214 | 262 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Earnings per ordinary share: |

||||||||||||||||||||

| Continuing operations: |

||||||||||||||||||||

| Basic |

189.5¢ | 163.7¢ | 96.5¢ | 72.6¢ | 89.5¢ | |||||||||||||||

| Diluted |

186.3¢ | 159.8¢ | 93.9¢ | 70.2¢ | 86.8¢ | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operations: |

||||||||||||||||||||

| Basic |

189.5¢ | 163.7¢ | 97.2¢ | 74.7¢ | 91.3¢ | |||||||||||||||

| Diluted |

186.3¢ | 159.8¢ | 94.6¢ | 72.2¢ | 88.5¢ | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| * | Relates to continuing operations. |

5

Table of Contents

Consolidated statement of financial position data

| At December 31, | ||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||

| ($ million, except number of shares) | ||||||||||||||||||||

| Goodwill and intangible assets |

447 | 400 | 358 | 356 | 445 | |||||||||||||||

| Property, plant and equipment |

1,056 | 1,362 | 1,690 | 1,836 | 1,684 | |||||||||||||||

| Investments and other financial assets |

239 | 243 | 178 | 175 | 195 | |||||||||||||||

| Retirement benefit assets |

99 | 21 | 5 | 12 | 40 | |||||||||||||||

| Non-current tax receivable |

24 | 41 | — | — | — | |||||||||||||||

| Deferred tax assets |

204 | 106 | 88 | 95 | — | |||||||||||||||

| Current assets |

660 | 578 | 466 | 419 | 544 | |||||||||||||||

| Non-current assets classified as held for sale |

534 | 217 | — | — | 210 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

3,263 | 2,968 | 2,785 | 2,893 | 3,118 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Current liabilities |

780 | 860 | 943 | 1,040 | 1,141 | |||||||||||||||

| Long-term debt |

1,242 | 670 | 776 | 1,016 | 1,334 | |||||||||||||||

| Net assets |

317 | 555 | 278 | 156 | 1 | |||||||||||||||

| Equity share capital |

179 | 162 | 155 | 142 | 118 | |||||||||||||||

| IHG shareholders’ equity |

308 | 547 | 271 | 149 | (6 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Number of shares in issue at period end (millions) |

268 | 290 | 289 | 287 | 286 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Dividends

InterContinental Hotels Group PLC paid an interim dividend of 21.0 cents per ADS (equivalent to 13.5 pence per share at the closing exchange rate on August 3, 2012) on September 28, 2012. A special dividend of $1.72 per ADS (equivalent to 108.4 pence per share at the closing exchange rate on September 11, 2012) was paid on October 22, 2012. The Board has proposed a final dividend of 43.0 cents per ADS (equivalent to 27.7 pence per share at the closing exchange rate on February 15, 2013), payable on May 31, 2013, if approved by shareholders at the Annual General Meeting to be held on May 24, 2013, bringing the total IHG dividend, excluding the special dividend, for the year ended December 31, 2012 to 64.0 cents per ADS (equivalent to 41.2 pence per share).

The table below sets forth the amounts of interim, final and total dividends on each ordinary share in respect of each fiscal year indicated. Below are also details of the special dividend paid in 2012. In respect of the interim and final dividends for each of 2008, 2009, 2010, 2011 and 2012 such amounts are translated from US dollars into sterling at the prevailing exchange rate immediately prior to their announcement.

Ordinary dividend

| Pence per ordinary share | Cents per ADS | |||||||||||||||||||||||

| Interim | Final | Total | Interim | Final | Total | |||||||||||||||||||

| Year ended December 31, |

||||||||||||||||||||||||

| 2008* |

6.40 | 20.20 | 26.60 | 12.2 | 29.2 | 41.4 | ||||||||||||||||||

| 2009 |

7.30 | 18.70 | 26.00 | 12.2 | 29.2 | 41.4 | ||||||||||||||||||

| 2010 |

8.00 | 22.00 | 30.00 | 12.8 | 35.2 | 48.0 | ||||||||||||||||||

| 2011 |

9.80 | 24.70 | 34.50 | 16.0 | 39.0 | 55.0 | ||||||||||||||||||

| 2012 |

13.50 | 27.70 | 41.20 | 21.0 | 43.0 | 64.0 | ||||||||||||||||||

| * | IHG changed the reporting currency of its Group Consolidated Financial Statements from sterling to US dollars effective from the interim results as at June 30, 2008. Starting with the interim dividend for 2008, all dividends have first been determined in US dollars and converted into sterling immediately before announcement. |

Special dividend

| Pence per ordinary share | Cents per ADS | |||||||

| Year ended December 31, |

||||||||

| 2012 |

108.40 | 172.00 | ||||||

6

Table of Contents

This section describes the principal risks that could materially affect the Group’s business. The factors below should be considered in connection with any financial and forward-looking information in this Form 20-F and the cautionary note regarding forward-looking statements contained on pages 2 and 3.

The risks below are not the only ones that the Group faces. Some risks are not yet known to the Group and some that the Group does not currently believe to be material could later turn out to be material. All of these risks could materially affect the Group’s business operations, cash flow, financial condition, turnover, profits, liquidity and/or capital reserves.

The Group is exposed to the risks of political and economic developments

The Group is exposed to political, economic and financial market developments such as recession, inflation, availability of credit and currency fluctuations that could lower revenues and reduce income. The current outlook for 2013 may worsen due to escalating impacts of the US “fiscal cliff”, change in leadership in China, uncertainty in the Eurozone and ongoing unrest in the Middle East. In addition to trading conditions, the economic outlook also affects the availability of capital to current and potential owners which could impact existing operations and health of the pipeline. A recession reduces leisure and business travel to and from affected countries and adversely affects room rates and/or occupancy levels and other income-generating activities.

This may result in deterioration of results of operations and potentially reduce the value of properties in affected economies. The owners or potential owners of hotels franchised or managed by the Group face similar risks which could adversely impact the Group’s ability to retain and secure franchise or management agreements. More specifically, the Group is highly exposed to the US market and, accordingly, is particularly susceptible to adverse changes in the US economy as well as the US dollar.

The Group is exposed to the risk of events that adversely impact domestic or international travel

The room rates and occupancy levels of the Group could be adversely impacted by events that reduce domestic or international travel, such as actual or threatened acts of terrorism or war, political or civil unrest, epidemics, travel-related accidents, travel-related industrial action, increased transportation and fuel costs and natural disasters, resulting in reduced worldwide travel or other local factors impacting individual hotels. A decrease in the demand for hotel rooms as a result of such events may have an adverse impact on the Group’s operations and financial results. In addition, inadequate contingency planning or recovery capability in relation to a major incident or crisis may prevent operational continuity and consequently impact the value of the brands and/or the reputation of the Group.

The Group is exposed to the risks of the hotel industry supply and demand cycle

The future operating results of the Group could be adversely affected by industry overcapacity (by number of rooms) and weak demand due, in part, to the cyclical nature of the hotel industry, or other differences between planning assumptions and actual operating conditions. Reductions in room rates and occupancy levels would adversely impact the results of Group operations.

The Group is dependent upon a wide range of external stakeholders and business partners

The Group is dependent upon the performance, behaviors and reputation of a wide range of business partners and external stakeholders including, but not limited to, owners, contractors, lenders, suppliers, vendors, joint venture partners, agents, third-party intermediaries and other business partners. Further, the number and complexity of interdependencies with stakeholders is evolving. Breakdown in relationships, poor vendor performance, stakeholder behaviors or adverse reputations could impact on the Group’s performance and competitiveness, guest experiences or the reputation of the Group or its brands.

7

Table of Contents

The Group is exposed to a variety of risks related to identifying, securing and retaining franchise and management agreements

The Group’s growth strategy depends on its success in identifying, securing and retaining franchise and management agreements. This is an inherent risk for the hotel industry and franchise business model. Competition with other hotel companies may generally reduce the number of suitable franchise, management and investment opportunities offered to the Group and increase the bargaining position of property owners seeking to become a franchisee or engage a manager. The terms of new franchise or management agreements may not be as favorable as current arrangements; and the Group may not be able to renew existing arrangements on similarly favorable terms, or at all.

There can also be no assurance that the Group will be able to identify, retain or add franchisees to the Group’s system or to secure management contracts. For example, the availability of suitable sites, market saturation, planning and other local regulations or the availability and affordability of finance may all restrict the supply of suitable hotel development opportunities under franchise or management agreements. In connection with entering into franchise or management agreements, the Group may be required to make investments in, or guarantee the obligations of, third parties or guarantee minimum income to third parties. There are also risks that significant franchisees or groups of franchisees may have interests that conflict, or are not aligned, with those of the Group including, for example, the unwillingness of franchisees to support brand improvement initiatives. This could result in franchisees prematurely terminating contracts which would adversely impact overall system size and the Group’s financial performance.

The Group is exposed to inherent risks in relation to changing technology and systems

The Group is reliant upon certain technologies, systems and platforms for the running of its business, particularly those which are highly integrated with business operational processes. Some of these are dependent upon the products and services of third-party technology providers. The failure of any such third-party provider to provide products and/or perform services could materially adversely impact the Group’s business.

The Group may also have to make substantial additional investments in new technologies or systems to remain competitive. Failing to keep pace with developments in technologies or systems may put the Group at a competitive disadvantage. The technologies or systems that the Group chooses may not be commercially successful or the technology or system strategy employed may not be sufficiently aligned with the needs of the business or responsive to changes in business strategy. As a result, the Group could adversely affect guest experiences, lose customers, fail to attract new customers, incur substantial costs or face other losses.

The Group is reliant on the reputation of its brands and the protection of its intellectual property rights

Any event that materially damages the reputation of one or more of the Group’s existing or new brands and/or fails to sustain the appeal of the Group’s existing or new brands to its customers may have an adverse impact on the value of that brand and subsequent revenues from that brand or business.

In particular, where the Group is unable to enforce adherence to its safety or operating and quality standards, or the significant regulations applicable to hotel operations, pursuant to its franchise and management contracts, there may be further adverse impact upon brand reputation or customer perception and therefore the value of the Group’s brands.

In addition, the value of the Group’s brands is influenced by a number of other factors, some of which may be outside the Group’s control, including commoditization (whereby price and/or quality becomes relatively more important than brand identifications due, in part, to the increased prevalence of travel comparison websites and online travel agents), consumer preference and perception, or other factors affecting consumers’ willingness to purchase goods and services provided by the Group.

Given the importance of brand recognition to the Group’s business, the protection of its intellectual property poses a risk due to the variability and change of controls, laws and effectiveness of enforcement globally. Any widespread infringement, misappropriation or weakening of the control environment could materially harm the value of the Group’s brands and its ability to develop the business.

8

Table of Contents

The Group is reliant upon its proprietary reservations system and is exposed to the risk of failures in the system and increased competition in reservations infrastructure

The value of the Group’s brands is partly derived from the ability to drive reservations through its proprietary HolidexPlus reservations system, a central repository of the Group’s hotel room inventories linked electronically to multiple sales channels including the Group’s own websites, call centers and hotels, third party intermediaries and travel agents.

Lack of resilience and operational availability and/or the failure of a third-party technology provider could lead to prolonged service disruption and may result in significant business interruption, impact the guest booking experience and subsequently impact on revenues. Lack of investment in these systems may also result in reduced capability, stability and ability to compete. Additionally, failure to maintain an appropriate technology strategy and select the right technology partners could erode the Group’s long-term competitiveness.

The Group is exposed to the risks related to information security and data privacy

The Group is increasingly dependent upon the availability, integrity and confidentiality of information including but not limited to, guest and employee credit card, financial and personal data, business performance, financial reporting and commercial development. This information is sometimes held in different formats such as digital, paper, voice and video and could be stored in many places including facilities managed by third-party service providers.

The threats towards the Group’s information are dynamic including cyber attacks, fraudulent use, loss or misuse by employees and breaches of the Group’s vendors’ security arrangements amongst others. The legal and regulatory environment and requirements set out by the payment card industry surrounding information security and data privacy across the many jurisdictions in which the Group operates are constantly evolving. If the Group fails to appropriately protect information and ensure relevant controls are in place to enable the release of information through the appropriate channels in a timely and accurate manner, system performance, guest experiences and the reputation of the Group may be adversely affected. This can lead to revenue losses, fines, penalties and other additional costs, including legal fees.

The Group is exposed to a variety of risks associated with safety, security and crisis management

There is a constant need to protect the safety and security of our guests, employees and assets against natural and man-made threats. These include but are not limited to exceptional events such as extreme weather, civil or political unrest, violence and terrorism, serious and organized crime, fraud, employee dishonesty, cyber crime, fire and day-to-day accidents, incidents and petty crime which impact the guest or employee experience, could cause loss of life, sickness or injury and result in compensation claims, fines from regulatory bodies, litigation and impact reputation. Serious incidents or a combination of events could escalate into a crisis which if managed poorly could further expose the Group and its brands to significant adverse reputational damage.

The Group requires the right people, skills and capability to manage growth and change

In order to remain competitive, the Group must employ the right people. This includes hiring and retaining highly skilled employees with particular expertise or leadership capability. The implementation of the Group’s strategic business plans could be undermined by failure to build resilient corporate culture, failure to recruit or retain key personnel, unexpected loss of key senior employees, failures in the Group’s succession planning and incentive plans, or a failure to invest in the development of key skills.

Some of the markets in which the Group operates are experiencing economic growth and the Group must compete against other companies inside and outside the hospitality industry for suitably qualified or experienced employees. Some emerging markets may not have the required local expertise to operate a hotel and may not be able to attract the right talent. Failure to attract and retain employees may threaten the success of the Group’s operations in these markets. Additionally, unless skills are supported by a sufficient infrastructure to enable knowledge and skills to be passed on, the Group risks losing accumulated knowledge if key employees leave the Group.

9

Table of Contents

The Group is required to comply with existing and changing regulations across numerous countries, territories and jurisdictions

Governmental regulations affect countless aspects of the Group’s business ranging from corporate governance, health and safety, environmental, bribery and corruption, employment law and diversity, disability access, relationships, data privacy and information protection, financial, accounting and tax.

Regulatory changes may require significant changes in the way the business operates and may inhibit the strategy including the markets the Group operates in, brand protection, and use or transmittal of customer data. If the Group fails to comply with existing or changing regulations, the Group may be subject to fines, prosecution, loss of license to operate or reputation damage.

The Group is exposed to the risk of litigation

Certain companies in the Group are the subject of various claims and proceedings. The ultimate outcome of these matters is subject to many uncertainties, including future events and uncertainties inherent in litigation.

In addition, the Group could be at risk of litigation from many parties, including but not limited to, guests, customers, joint venture partners, suppliers, employees, regulatory authorities, franchisees and/or the owners of hotels it manages. Claims filed in the US may include requests for punitive damages as well as compensatory damages. Unfavorable outcomes of claims or proceedings could have a material impact on the Group’s results of operations, cash flow and/or financial position. Exposure to significant litigation or fines may also affect the reputation of the Group and its brands.

The Group is exposed to risks related to corporate responsibility

The reputation of the Group and the value of its brands are influenced by a wide variety of factors, including the perception of stakeholder groups such as the communities in which the Group operates. The social and environmental impacts of business are under increasing scrutiny, and the Group is exposed to the risk of damage to its reputation if it fails to demonstrate sufficiently responsible practices, ethical behavior, or fails to comply with relevant regulatory requirements.

The Group is exposed to a variety of risks associated with its financial stability and ability to borrow and satisfy debt covenants

While the strategy of the Group is to extend the hotel network through activities that do not involve significant amounts of its own capital, the Group does require capital to fund some development opportunities and to maintain and improve owned hotels. The Group is reliant upon having financial strength and access to borrowing facilities to meet these expected capital requirements. The majority of the Group’s borrowing facilities are only available if the financial covenants in the facilities are complied with. Non-compliance with covenants could result in the lenders demanding repayment of the funds advanced. If the Group’s financial performance does not meet market expectations, it may not be able to refinance existing facilities on terms considered favorable.

The Group is exposed to funding risks in relation to the defined benefits under its pension plans

The Group is required by law to maintain a minimum funding level in relation to its ongoing obligation to provide current and future pensions for members of its UK pension plans who are entitled to defined benefits. The contributions payable by the Group must be set with a view to making prudent provision for the benefits accruing under the plans of the Group.

In particular, the trustees of the Group’s UK defined benefit plan may demand increases to the contribution rates relating to the funding of this plan, which would oblige relevant employers of the Group to contribute extra amounts. The trustees must consult the plan’s actuary and principal employer before exercising this power.

In practice, contribution rates are agreed between the Group and the trustees on actuarial advice, and are set for three-year terms. The funding implications of the last actuarial review are disclosed in the Notes to the Consolidated Financial Statements on pages F-30 to F-35.

10

Table of Contents

The Group may face difficulties insuring its business

Historically, the Group has maintained insurance at levels determined to be appropriate in light of the cost of cover and the risk profiles of the business in which it operates. However, forces beyond the Group’s control, including market forces, may limit the scope of coverage the Group can obtain and the Group’s ability to obtain coverage at reasonable rates. Other forces beyond the Group’s control, such as terrorist attacks or natural disasters may be uninsurable or simply too expensive to insure. Inadequate or insufficient insurance could expose the Group to large claims or could result in the loss of capital invested in properties, as well as the anticipated future revenue from properties, and could leave the Group responsible for guarantees, debt or other financial obligations related to such properties.

| ITEM 4. | INFORMATION ON THE COMPANY |

Group overview

The Group is an international hotel business which owns a portfolio of established and diverse hotel brands, including InterContinental Hotels & Resorts (“InterContinental”), Crowne Plaza Hotels & Resorts (“Crowne Plaza”), Holiday Inn Hotels & Resorts (including Holiday Inn Club Vacations) (“Holiday Inn”), Holiday Inn Express, Staybridge Suites, Candlewood Suites and Hotel Indigo. At December 31, 2012, the Group had 4,602 franchised, managed, owned and leased hotels and 675,982 guest rooms in nearly 100 countries and territories around the world. The Group also manages the hotel loyalty program, Priority Club Rewards (the Group announced on March 26, 2013 that it will be enhancing and renaming the Priority Club Rewards program as “IHG Rewards Club” from July 2013).

In the first quarter 2012, the Group launched two new brands. EVEN Hotels (“EVEN”) is aimed at business and leisure travelers who are looking for a wellness experience in a hotel stay at a mainstream price point. HUALUXE Hotels & Resorts (“HUALUXE”) is the first international upscale hotel brand designed specifically for Chinese guests, to take advantage of both the supply and demand side opportunities the Group sees in China.

The Group’s revenue and earnings are derived from hotel operations, which include franchise and other fees paid under franchise agreements, management and other fees paid under management contracts, where the Group operates third-parties’ hotels, and operation of the Group’s owned and leased hotels.

At March 21, 2013, InterContinental Hotels Group PLC had a market capitalization of approximately £5.3 billion, and was included in the FTSE 100, a list of the 100 largest companies by market capitalization on the London Stock Exchange.

InterContinental Hotels Group PLC is the holding company for the Group. Six Continents Limited (formerly Six Continents PLC), which was formed in 1967, is the principal subsidiary company. The Company’s corporate headquarters are in the United Kingdom, and the registered address is:

InterContinental Hotels Group PLC

Broadwater Park

Denham

Buckinghamshire UB9 5HR

Tel: +44 (0) 1895 512000

Internet address: www.ihgplc.com

InterContinental Hotels Group PLC was incorporated in Great Britain on May 21, 2004 and registered in, and operates under, the laws of England and Wales. Operations undertaken in countries other than England and Wales are subject to the laws of those countries in which they reside.

11

Table of Contents

Group history and developments

The Group, formerly known as Bass and, more recently, Six Continents, was historically a conglomerate operating as, among other things, a brewer, soft drinks manufacturer, hotelier, leisure operator, and restaurant, pub and bar owner. In the last several years, the Group has undergone a major transformation in its operations and organization, as a result of the separation (as discussed below) and a number of significant disposals during this period, which has narrowed the scope of its business.

On April 15, 2003, following shareholder and regulatory approval, Six Continents PLC (as it then was) separated into two new listed groups, InterContinental Hotels Group PLC (as it then was) comprising the Hotels and Soft Drinks businesses and Mitchells & Butlers plc comprising a retail and standard commercial property developments business.

The Group disposed of its interests in the Soft Drinks business by way of an initial public offering (“IPO”) of Britvic, a manufacturer and distributor of soft drinks in the United Kingdom, in December 2005.

Following separation, the Group has undertaken an asset disposal program realizing, by the end of 2010, proceeds of $5.6 billion from the sale of 185 hotels. Of these 185 hotels, 166 remained in the Group’s system through either franchise or management agreements. The asset disposal program has significantly reduced the capital requirements of the Group whilst largely retaining the hotels in the Group’s system.

A small number of hotels have been sold since the end of 2010 and at December 31, 2012, there were two hotels, the InterContinental New York Barclay and the InterContinental London Park Lane that were classified as held for sale. On February 19, 2013, the Company announced that the disposal process for InterContinental London Park Lane had commenced, and was continuing for InterContinental New York Barclay.

Recent acquisitions and dispositions

During 2012, the Group sold its interest in a hotel in the Europe region for a total consideration of $5 million. During 2011, the Group disposed of the Holiday Inn Burswood in Australia for $71 million, the Hotel Indigo San Diego for $55 million and two other hotels in North America for $17 million. During 2010, the Group disposed of the Holiday Inn Lexington for $5 million and the InterContinental Buckhead, Atlanta for $105 million.

The Group also divested a number of investments for total proceeds of $4 million, $15 million and $17 million in 2012, 2011 and 2010, respectively. In 2010, a loan repayment of $11 million was also received.

Capital expenditure in 2012 totaled $133 million compared with $194 million in 2011 and $95 million in 2010.

At December 31, 2012 capital committed, being contracts placed for expenditure on property, plant and equipment and intangible assets not provided for in the Consolidated Financial Statements, totaled $81 million. The Group has also committed to invest up to $60 million in two joint venture arrangements of which $37 million had been spent at December 31, 2012.

12

Table of Contents

Return of funds

Since March 2004, the Group has returned over £3.9 billion of funds to shareholders by way of special dividends, share repurchase programs and capital returns (see table below).

On August 7, 2012, the Company announced a $1 billion (£640 million) return of funds to shareholders, split between a $0.5 billion (£320 million) special dividend with share consolidation and a $0.5 billion (£320 million) share buyback program. The special dividend was paid on October 22, 2012 and as at March 21, 2013 £68.8 million of shares have been repurchased at an average price per share of 1,621 pence. Purchases are made under the existing authority from shareholders which will be presented for renewal at the Company’s Annual General Meeting to be held in 2013. Any shares repurchased may be canceled or held as treasury shares.

Information relating to the purchases of equity securities can be found in Item 16E.

| Return of funds program |

Timing |

Total return | Returned to date(i) | |||||||

| £501 million special dividend |

Paid in December 2004 | £ | 501m | £ | 501m | |||||

| First £250 million share buyback |

Completed in 2004 | £ | 250m | £ | 250m | |||||

| £996 million capital return |

Paid in July 2005 | £ | 996m | £ | 996m | |||||

| Second £250 million share buyback |

Completed in 2006 | £ | 250m | £ | 250m | |||||

| £497 million special dividend |

Paid in June 2006 | £ | 497m | £ | 497m | |||||

| Third £250 million share buyback |

Completed in 2007 | £ | 250m | £ | 250m | |||||

| £709 million special dividend |

Paid in June 2007 | £ | 709m | £ | 709m | |||||

| £150 million share buyback |

N/A(ii) |

£ | 150m | £ | 120m | |||||

| £320 million special dividend |

Paid in October 2012 | £ | 320m | £ | 320m | |||||

| £320 million share buyback |

Ongoing | £ | 320m | £ | 68.8m | |||||

|

|

|

|

|

|||||||

| Total |

£ | 4,243m | £ | 3,961.8m | ||||||

|

|

|

|

|

|||||||

| (i) | At March 21, 2013. |

| (ii) | This program was superseded by the buyback program announced on August 7, 2012. |

13

Table of Contents

Geographic segmentation

Following an internal reorganization during 2011, there was a change in the Group’s geographic segments as explained in Note 2 of the Notes to the Consolidated Financial Statements. Comparatives for 2010 were restated to show segmental information on a consistent basis.

The following table shows the Group’s revenue and operating profit before exceptional operating items and the percentage by geographical area, for the years ended December 31, 2012, 2011 and 2010.

| Year ended December 31, | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| ($ million) | ||||||||||||

| Revenue(1) |

||||||||||||

| Americas |

837 | 830 | 807 | |||||||||

| Europe |

436 | 405 | 326 | |||||||||

| AMEA |

218 | 216 | 213 | |||||||||

| Greater China |

230 | 205 | 178 | |||||||||

| Central(2) |

114 | 112 | 104 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

1,835 | 1,768 | 1,628 | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating profit before exceptional operating items(1)(3) |

||||||||||||

| Americas |

486 | 451 | 369 | |||||||||

| Europe |

115 | 104 | 78 | |||||||||

| AMEA |

88 | 84 | 82 | |||||||||

| Greater China |

81 | 67 | 54 | |||||||||

| Central |

(156 | ) | (147 | ) | (139 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total |

614 | 559 | 444 | |||||||||

|

|

|

|

|

|

|

|||||||

| Year ended December 31, | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| (%) | ||||||||||||

| Revenue |

||||||||||||

| Americas |

45.6 | 47.0 | 49.6 | |||||||||

| Europe |

23.8 | 22.9 | 20.0 | |||||||||

| AMEA |

11.9 | 12.2 | 13.1 | |||||||||

| Greater China |

12.5 | 11.6 | 10.9 | |||||||||

| Central |

6.2 | 6.3 | 6.4 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

100.0 | 100.0 | 100.0 | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating profit before exceptional operating items |

||||||||||||

| Americas |

79.2 | 80.7 | 83.1 | |||||||||

| Europe |

18.7 | 18.6 | 17.6 | |||||||||

| AMEA |

14.3 | 15.0 | 18.5 | |||||||||

| Greater China |

13.2 | 12.0 | 12.1 | |||||||||

| Central |

(25.4 | ) | (26.3 | ) | (31.3 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total |

100.0 | 100.0 | 100.0 | |||||||||

|

|

|

|

|

|

|

|||||||

| (1) | The results of operations have been translated into US dollars at the average rates of exchange for the year. In the case of sterling, the translation rate is $1 = £0.63 (2011 $1 = £0.62, 2010 $1 = £0.65). In the case of the euro, the translation rate is $1 = €0.78 (2011 $1 = €0.72, 2010 $1 = €0.76). |

| (2) | Central revenue primarily relates to technology fee income. Central operating profit includes central revenue less costs related to global functions. |

| (3) | Operating profit before exceptional operating items does not include exceptional operating items for all periods presented. Exceptional operating items (charge unless otherwise noted) by region were The Americas credit of $23 million (2011 credit of $35 million, 2010 $8 million); Europe $4 million (2011 $39 million, 2010 $5 million); AMEA $5 million (2011 credit of $26 million, 2010 credit of $6 million); Greater China $nil (2011 $nil, 2010 $nil); and Central $18 million (2011 credit of $35 million, 2010 $nil). |

14

Table of Contents

The Group is an international hotel business which owns a portfolio of established and diverse hotel brands, including InterContinental Hotels & Resorts, Crowne Plaza Hotels & Resorts, Holiday Inn Hotels & Resorts (including Holiday Inn Club Vacations), Holiday Inn Express, Staybridge Suites, Candlewood Suites and Hotel Indigo. At December 31, 2012, the Group had over 4,600 franchised, managed, owned and leased hotels and approximately 676,000 guest rooms in nearly 100 countries and territories around the world. The Group also manages the hotel loyalty program, Priority Club Rewards (the Group announced on March 26, 2013 that it will be enhancing and renaming the Priority Club Rewards program as “IHG Rewards Club” from July 2013).

In the first quarter of 2012, the Group launched two new brands. EVEN Hotels is aimed at business and leisure travelers who are looking for a wellness experience in a hotel stay at a mainstream price point. HUALUXE Hotels & Resorts is the first international upscale hotel brand designed specifically for Chinese guests, to take advantage of both the supply and demand side opportunities the Group sees in China.

Industry overview

The hotel industry performed well in 2012 despite challenging economic conditions. The economic outlook deteriorated over the course of 2012 with increased concerns over the Eurozone and weaker performance in the US and China. Global Domestic Product (“GDP”) increased by 2.3% in 2012, compared with 2.9% in 2011 and the year ended with a continued uncertain outlook across the globe.

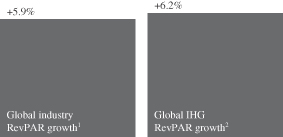

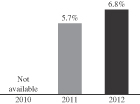

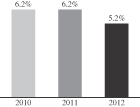

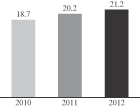

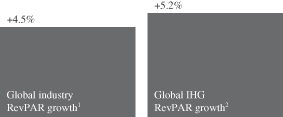

However, the hotel industry demonstrated its resilience against this challenging economic background. Globally, industry revenue per available room (“RevPAR”), a key industry indicator, increased by 4.5% compared to a 5.9% increase in 2011. The Group performed well against these market conditions, with global RevPAR growth in 2012 of 5.2%.

| RevPAR growth 2011 v 2012 |

| |

| 2011 |

2012 | |

|

|

|

1 Data sourced from Smith Travel Research.

2 Comparable hotels.

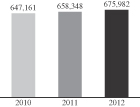

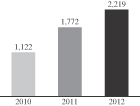

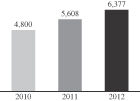

The global hotel market is estimated to include 21.5 million rooms. Smith Travel Research calculates that there are 7.3 million branded hotel rooms, with the remainder a combination of independent hotels, guesthouses and other types of lodging. The Group believes that it holds the largest share of branded rooms, currently approximately 9% of branded supply, distributed across nearly 100 countries and territories around the world. In 2012 the Group opened 33,922 new rooms worldwide (226 new hotels), resulting in an increase in the number of open Group hotel rooms to 675,982 (4,602 hotels) at December 31, 2012, up 2.7% from 2011, taking into account the removal of hotels which left the Group’s system.

The benefits of a brand, such as the greater security and performance of a global reservation system, loyalty programs and international networks, are clear to many owners and the Group is well-positioned to win the business of owners seeking to grow with a hotel brand. Additionally, the Group and other large hotel companies have the competitive advantage of a global portfolio of brands that suit the different real estate or market opportunities an owner may have.

To ensure the Group’s strategy continues to be sustainable in the changing business environment and suitable for the Group’s capabilities, the Group closely monitors markets across the globe and follows key industry and business metrics such as RevPAR, average daily rate, demand, GDP and guest satisfaction.

15

Table of Contents

The Group’s strategy

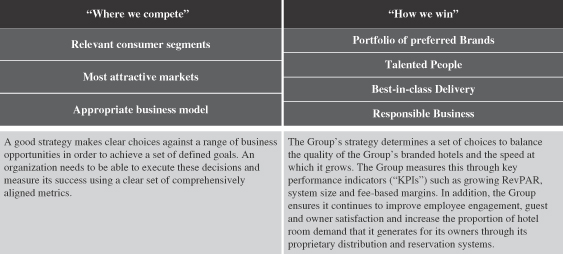

With a portfolio of preferred Brands in the most attractive markets, the Group’s talented People are focused on delivering Great Hotels Guests Love and executing a clear set of priorities to achieve its Vision of becoming one of the great companies in the world.

Delivering the elements of the Group’s strategy

“Where we compete”

Competing in relevant consumer segments

The hotel industry is usually segmented according to price point and IHG is focused on the three segments that generate over 90% of branded hotels revenue, namely midscale (broadly three star), upscale (mostly four star) and luxury (five star). However, to build preferred Brands, the Group believes it needs to advance its understanding of its guests and their needs to ensure its brands remain contemporary and relevant.

The Group has therefore completed a fundamental occasion-based needs segmentation analysis to understand why guests book hotels — looking at who they are, the occasion they are traveling for and their needs when traveling. Many guests no longer have a single purpose for their hotel stay — for example, business trips turn into family holidays, and the Group needs to meet these demands, focusing more on the needs of its guests, to deliver loyalty and brand preference. The Group used this analysis to develop the brand proposition for its two new brands, HUALUXE Hotels & Resorts and EVEN Hotels, and it continues to work on this needs-based segmentation to help inform its view of the hotel market and its brand strategies going forward.

Competing in the most attractive markets

The Group’s strategy is to build preferred Brands with scale positions in the most attractive markets globally. Concentrating growth in the largest markets means the Group and owners can operate more efficiently and benefit from enhanced revenues and reduced costs. The Group’s key markets include large developed markets such as the US, UK and Germany, as well as emerging markets like China and India.

The US is the largest market for branded hotels, with 3.38 million rooms, accounting for 69% of all US rooms available. The segment in the US with the greatest share is midscale, with 1.38 million branded hotel rooms, and the Group’s Holiday Inn brand family, comprising Holiday Inn, Holiday Inn Express, Holiday Inn Club Vacations and Holiday Inn Resort, is the largest brand in this segment.

In China, the Group sees the greatest opportunity for growth of any single country and its strategy has been to enter the market early, to develop its relationships with key local third-party owners and grow its presence rapidly. In a country with 659,000 branded hotel rooms, the Group is the largest international hotel company with

16

Table of Contents

over 61,000 rooms across its brands and more than 50,000 in the planning phase or under construction. This rapid pace of openings for the Group has been in anticipation of increasing demand for hotels, driven by a large, emerging middle class and growing domestic and international travel.

The Group is also focused on developing in other high priority markets. It seeks to develop its portfolio of brands in those markets which will be sources of strong hotel demand in the future. The Group has continued to build its position in these markets in the last year. For example, the Group increased the distribution of its core brands in India, building on its leadership position of Holiday Inn. In Russia and the Commonwealth of Independent States (“CIS”), there are opportunities for new construction and conversions as well as strong demand for branded hotels. The Group continues to adapt its business model by market, choosing partnerships and joint ventures where appropriate.

Outside the largest markets, the Group focuses on building presence in key gateway cities where its brands can generate revenue premiums from high business and leisure demand.

During 2012, the Group opened 33,922 rooms in 26 countries and territories, and signed a further 53,812 rooms into its development pipeline (hotels in planning and under construction but not yet opened) across 33 countries and territories. As part of its ongoing commitment to maintaining the quality of its brands, the Group removed 16,288 rooms during the year. As at December 31, 2012, the Group had the second largest pipeline in the industry, with 169,030 rooms in 1,053 hotels across 60 countries and territories. This represents a market share of 12% of all hotels under development, including those that are independent or unaffiliated with a brand.

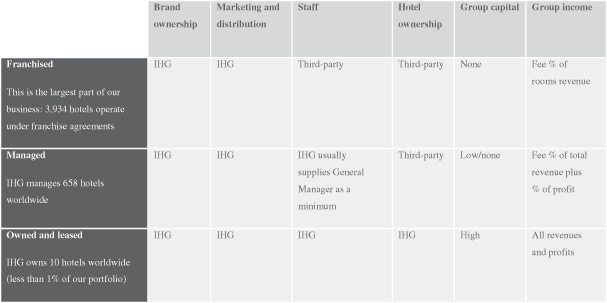

Competing with an appropriate business model

As can be seen in the diagrams above and below, the Group’s business model is focused on franchising and managing hotels, rather than owning them, enabling it to grow at an accelerated pace with limited capital investment. This allows the Group to focus on building strong, preferred Brands based on relevant consumer needs, leaving asset management and real estate to its local third-party owners with the necessary expertise. With this “asset-light” approach, the Group also benefits from the reduced volatility of fee-based income streams, as compared with the ownership of assets. It allows the Group to focus on building strong delivery systems such as its branded hotel websites and call centers, creating greater returns for owners.

A key characteristic of the franchised and managed business model is that it is highly cash generative, with a high return on capital employed. This business model enables the Group to focus on growing its fee revenues (Group revenue excluding owned and leased hotels, managed leases (being properties structured for legal reasons

17

Table of Contents

as operating leases but with the same characteristics as management contracts) and significant liquidated damages) and fee-based margins (operating profit as a percentage of revenue, excluding revenue and operating profit from owned and leased hotels, managed leases and significant liquidated damages).

As at December 31, 2012, 86% of the Group’s operating profit (before regional and central overheads and exceptional items) was derived from franchised and managed operations. In some situations, the Group supports its brands by using its capital to build or support the funding of flagship assets in high-demand locations in order to drive growth. The Group plans to recycle capital by selling these assets when the time is right and to reinvest elsewhere in the business and across its portfolio.

On November 6, 2012, the Group announced that the InterContinental London Park Lane would be the next hotel considered for sale and that discussions regarding the disposal of the InterContinental New York Barclay were progressing and would be opened to a wider group of prospective buyers. On February 19, 2013, the Company announced that the disposal process for InterContinental London Park Lane had commenced, and was continuing for InterContinental New York Barclay.

The Group continues to invest for growth, strengthening both its existing brands and launching new ones.

“How we win”

Winning with a portfolio of preferred Brands

The Group aims to build a portfolio of brands that are bigger, better, and stronger:

| • | Bigger means the Group has prioritized its growth strategy to build brand scale and leverage this scale through greater operational efficiency. |

| • | Better means a focus on continuous improvement in how the Group develops and delivers its brands to ensure guest needs are met with a consistent, high-quality experience. |

| • | Stronger means a focus on driving brand preference among guests, owners, investors and employees. |

As part of the Group’s commitment to deliver against its brand strategy, in 2012, the Group launched two unique new brands to the market, which complement its overall portfolio of brands.

Further information on the Group’s portfolio can be found on page 27.

Winning with talented People

The Group believes that its preferred Brands are brought to life by its talented and passionate People. Therefore to deliver on its brand promise, the Group must attract, retain and develop the very best talent in the industry to service its guests and bring its Brands to life.

The Group directly employed an average of 7,981 people worldwide in the year ended December 31, 2012, whose costs were borne by the Group. When the whole of the Group’s estate is taken into account (including staff working in the franchised and managed hotels) over 350,000 people worked globally across all the Group’s brands as at December 31, 2012.

The four pillars of the Group’s People strategy are:

| • | Developing a BrandHearted culture: The Group’s brands are brought to life by its talented and passionate People and it has focused on developing and improving its tools, to make it easy for its People to deliver the brand promise. In 2012, the Group launched a new brand framework focused on transforming its brand standards and looked at how it manages projects - all part of developing a BrandHearted culture. |

18

Table of Contents

| • | Making IHG a great place to work: The Group believes in treating people as individuals and celebrating achievements. The Group calls this “Room to be yourself” and this commitment is brought to life by four key promises. The Group continues to be recognized around the globe as an employer of choice. |

| • | Delivering world-class People Tools to our owners: By partnering with the hotel human resources community, the Group has developed a set of award-winning “People Tools” that not only help increase employee retention and guest satisfaction but also drive efficiencies and increase revenue for the Group’s owners. |

| • | Building a strong leadership team: To grow its business sustainably and responsibly, the Group needs a strong BrandHearted leadership team. Therefore, it has created a “Leadership Framework”, which clearly defines what great leadership looks like to help develop the Group’s leaders of tomorrow. |

Being the hotel company for the London 2012 Olympic and Paralympic Villages was a groundbreaking opportunity for the Group, giving its People in London 2012 the opportunity to benefit from new skills and experiences.

Winning with best-in-class Delivery

During 2012, the Group remained focused on attracting guests (room nights) to its hotels and its portfolio of brands. The Group leverages its size and scale to drive demand to its hotels, executing a multi-channel strategy that enables guests to search and book in the most appropriate mode for them, either over the phone, by computer or via an application on a mobile device. The Group maximizes the demand it delivers through these channels through advanced techniques that manage revenue per booking, drive customer loyalty and maximize owner returns. The Group’s channels and loyalty program, Priority Club Rewards, are the engine of the Group’s business.

The Group’s channels

As part of its multi-channel strategy, the Group aims to increase revenue and bookings using its direct channels. During 2012, revenue generated through the Group’s websites increased to $3.4 billion whilst its global call centers answered more than 23 million inbound contacts and drove more than $1.9 billion in revenue for its hotels.

Mobile communications are also having profound effects on the hotel industry and the Group has been quick to adapt to these new channels with significant growth in revenue generated thorough its branded mobile applications, across all major platforms, rising from $2.4 million in 2009 to more than $330 million in 2012.

The Group is also a founding member of roomkey.com, which was launched in 2012 as the first industry-owned hotel search engine, providing another innovative channel to increase guest nights to its brands.

Social media has also changed the way in which the Group communicates with guests and with its stakeholders in general. The Group’s new “Guest Ratings and Review” tool, which launched on its websites in 2012 enables guests to share their thoughts about their hotel experiences so that future guests can take this into account during the booking process.

Priority Club Rewards

Priority Club Rewards was the hotel industry’s first loyalty program and is the largest of its kind in the world with 71.4 million members at the end of 2012, an increase of 13% during the year. In 2012, it won Premier Traveler magazine’s inaugural award for Best Hotel Loyalty Program and Global Traveler magazine’s award for Best Hotel Rewards Program for the eighth consecutive year.

The Group also leverages sales and marketing expertise in order to support its multi-channel strategy. The System Fund (the “Fund”) is a $1.2 billion fund of cash assessments and contributions, collected by the Group from hotels within the Group’s system, and proceeds from the sale of Priority Club Rewards points. The System Fund is managed by the Group for the benefit of hotels in the Group’s system with the objective of driving revenues for the hotels. It is therefore used to pay for marketing, the Priority Club Rewards loyalty program and the global reservation system.

19

Table of Contents

As a result of the power of its revenue delivery systems the Group has built strong relationships with its owners. These relationships are founded on the ability to deliver high returns to owners using premium revenue generating products. The Group meets with the IHG Owners Association (the organization that represents owners of hotels operating under the Group’s brands across the world) on a regular basis to facilitate the continued development of the Group’s brands and systems.

Winning with Responsible Business practices

With over 4,600 hotels in nearly 100 countries and territories around the world, the Group’s commitment to being a Responsible Business is central to its Vision of being one of the great companies of the world. The Group understands how important it is to champion and protect the trusted reputation of the Group and its brands and this is embedded in its culture. The Group believes that being a responsible business is necessary to enable it to stay ahead of the competition and grow, creating value for all of its shareholders and stakeholders in the long term. Amongst other things, it offers the Group a huge opportunity to innovate, create employment, empower people to perform at their best and feel good about what they do, and drive value for the business. That’s why Responsible Business underpins each of the Group’s three strategic corporate priorities of preferred Brands, talented People and best-in-class Delivery, which work together to determine “How We Win” to create Great Hotels Guests Love.

Governance and leadership

The Group’s Chairman, the Board and its committees (Audit Committee, Corporate Responsibility Committee, Nomination Committee and Remuneration Committee) provide strong leadership and promote a responsible business culture by maintaining high standards in corporate governance, corporate responsibility and internal control and risk management.

Brands

Trusted brands deliver a superior and consistent brand experience and to achieve this, the Group requires a clear brand framework. Brand standards are the foundations of a clear brand framework for all the Group’s hotels and its compliance teams ensure that its hotels deliver in accordance with these. The Group’s brand safety standards assist hotels in providing a safe and secure environment for its guests and employees. The Group’s corporate responsibility programs have also been designed so that they can be implemented throughout the Group’s hotel brands and corporate offices in any region.

People

At the core of being a Responsible Business is ensuring that the actions of all of the Group’s employees working at its corporate offices and hotels maintain the Group’s trusted reputation. Operating an ethical business is vital to maintaining and protecting this trusted reputation and therefore the Group continually keeps under review its internal policies and training to promote understanding, awareness, accountability and transparency.

Delivery

Having in place an effective system of internal controls and risk management is essential to being a Responsible Business. The Group’s tools, processes and procedures ensure a business based on a solid foundation with a commitment to doing the right thing for the benefit of all its stakeholders.

20

Table of Contents

“Measuring our success”

The Group has a holistic set of carefully selected key performance indicators (“KPIs”) to monitor its success in achieving its strategy. These are organized around the elements of the Group’s strategy:

| • | “Where we compete”, focusing on relevant consumer segments, the most attractive markets and the appropriate business model; and |

| • | “How we win”, focusing on corporate priorities of preferred Brands, talented People, best-in-class Delivery and Responsible Business. |

In particular, the Group uses the following measures to monitor performance:

| • | fee revenues and fee-based margins; |

| • | global RevPAR; |

| • | system contribution — the proportion of business delivered to Group hotels by its dedicated IHG booking channels; |

| • | employee engagement; and |

| • | Responsible Business practices. |

These KPIs are used to measure the progress of the Group to deliver Great Hotels Guests Love and achieve its Vision of becoming one of the great companies of the world.

The Group’s performance against these KPIs over the 2010-2012 period is summarized below:

“Where we compete”

| Strategic priorities | KPIs |

Current status and 2012 development |

2013 priorities | |||

| Most attractive markets and appropriate business model To accelerate profitable growth of its core business in its most attractive markets where presence and scale really count using the right business model to drive its fee revenue and income streams. |

Net rooms supply

Growth in fee revenue1

Fee-based margins |

• System size grown to 675,982 rooms; • 4,602 hotels opened globally; • built scale of Hotel Indigo brand to 50 hotels globally; and • fee-based margins of 42.6%, up two percentage points on 2011, a particularly strong result. |