Investor presentation CAESARS ENTERTAINMENT Exhibit 99.1

SAFE HARBOR STATEMENT Disclaimer Certain information in this presentation and discussed at the conference at which these materials will be presented constitutes forward-looking information within the meaning of the Private Securities Litigation Reform Act of 1995. You can identify these statements by the fact they do not relate strictly to historical or current facts and by the use of words such as “will”, “expected”, “offers”, “opportunity”, “potential”, or the negative or other variations thereof or comparable terminology. In particular, they include statements relating to, among other things, the emergence from bankruptcy of CEOC, future actions that may be taken by CEC and others with respect thereto, and the financial position and actions of CEC post-emergence. This information is based on the Company’s current expectations and actual results could vary materially depending on risks and uncertainties that may affect the Company. These risks and uncertainties include, but are not limited to, the following factors, as well as other factors described from time to time in our reports filed with the Securities and Exchange Commission (the “SEC”): CEC’s and CEOC’s ability (or inability) to meet any milestones or other considerations set forth in their restructuring support agreements, CEC’s and CEOC’s ability (or inability) to satisfy the conditions to the effectiveness of the Third Amended Joint Plan of Reorganization of CEOC and its Chapter 11 debtor subsidiaries, CEC’s ability (or inability) to secure additional liquidity to meet its ongoing obligations and its commitments to support the CEOC restructuring as necessary, CEC’s financial obligations exceeding or becoming due earlier than what is currently forecast, other risks associated with the CEOC restructuring and related litigation and industry and economic conditions, and competitive, legal, governmental and technological factors. There is no assurance that the Company's expectations will be realized. The forward-looking information in this presentation and discussed at the conference at which these materials will be presented reflects the opinion of management as of today. Please be advised that developments subsequent to the conference are likely to cause this information to become outdated with the passage of time. The Company assumes no obligation to update any forward-looking information contained in this presentation or discussed at the conference at which these materials are presented should circumstances change, except as otherwise required by securities and other applicable laws.

IMPORTANT ADDITIONAL INFORMATION Pursuant to the Amended and Restated Agreement and Plan of Merger, dated as of July 9, 2016, between Caesars Entertainment Corporation (“CEC”) and Caesars Acquisition Company (“CAC”), as subsequently amended on February 20, 2017 (as amended, the “Merger Agreement”), among other things, CAC will merge with and into CEC, with CEC as the surviving company (the “Merger”). In connection with the Merger, on March 13, 2017, CEC and CAC filed with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that includes a preliminary joint proxy statement/prospectus, as well as other relevant documents concerning the proposed transaction. The registration statement has not yet become effective. After the registration statement is declared effective by the SEC, a definitive joint proxy statement/prospectus will be mailed to stockholders of CEC and CAC. Stockholders are urged to read the registration statement and joint proxy statement/prospectus regarding the Merger and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. You will be able to obtain a free copy of such joint proxy statement/prospectus, as well as other filings containing information about CEC and CAC, at the SEC’s website (www.sec.gov), from CEC Investor Relations (investor.caesars.com) or from CAC Investor Relations (investor.caesarsacquisitioncompany.com). The information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. CEC, CAC and their respective directors, executive officers and certain other members of management and employees may be soliciting proxies from CEC and CAC stockholders in favor of the business combination transaction. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the CEC and CAC stockholders in connection with the proposed business combination transaction is set forth in the definitive proxy statement filed with the SEC on April 12, 2017 and Amendment No. 1 to the Annual Report on Form 10-K for CAC’s fiscal year ended December 31, 2016, filed on March 31, 2017, respectively. You can obtain free copies of these documents from CEC and CAC in the manner set forth above.

USE of non-gaap Measures The following non-GAAP measures will be used in the presentation and discussed at the conference at which these materials will be presented: Adjusted EBITDA and Adjusted EBITDA Margin Property EBITDA CEC + CEOC, or enterprise-wide financial measures Definitions of these non-GAAP measures, reconciliations to their nearest GAAP measures, and the reasons management believes these measures provide useful information for investors, can be found in the Appendix to this presentation, beginning on Slide 29.

IMPORTANT INFORMATION ABOUT PRESENTATION OF RESULTS On January 15, 2015, Caesars Entertainment Operating Company, Inc. filed a voluntary bankruptcy petition under Chapter 11 of the United States Bankruptcy Code, resulting in the deconsolidation of CEOC effective as of such date. As such, amounts presented in this presentation exclude the operating results of CEOC subsequent to January 15, 2015, unless otherwise stated, and analysis of our operating results in this presentation and as may be discussed on the conference call which this presentation accompanies include those components that remain in the consolidated CEC entity subsequent to the deconsolidation of CEOC. "CEC" represents CERP, CGP and associated parent company and elimination adjustments that represent the current CEC consolidated structure. Through June 30, 2016, we aggregated the operating segments within CGP into two separate reportable segments: CGP Casino Properties and CIE. On September 23, 2016, CIE sold its social and mobile games business (the “SMG Business”) for cash consideration of $4.4 billion, subject to customary purchase price adjustments, and retained only its World Series of Poker (“WSOP”) and regulated online real money gaming businesses. The SMG Business represented the majority of CIE’s operations and is being classified as a discontinued operation for all periods presented effective in the third quarter of 2016. After excluding the SMG Business from CIE’s continuing operations, CIE is no longer considered a separate reportable segment from CGP Casinos based on management’s view. Therefore, CGP Casinos and CIE have been combined for all periods presented to form the CGP segment. However, we are also providing certain supplemental information as if we had continued to consolidate CEOC throughout the first quarter of 2017. This information includes both stand-alone CEOC financials and key metrics for the first quarter of 2017, and certain financial information for CEC as if CEOC remained a consolidated entity during the quarter. This information within this presentation may be different from CEOC’s standalone results separately provided due to immaterial adjustments, rounding, and basis of presentation differences. CEC has committed to a material amount of payments to support CEOC’s restructuring, which would result in the reacquisition of CEOC’s operations if the restructuring is made on terms consistent with the current Restructuring Support Agreements to which CEC is a party (“RSAs”). In addition, compensation of management is in part determined by reference to certain of such financial information. As a result, we believe this supplemental information is useful to investors who are trying to understand the results of the entire “Caesars” enterprise, including CEOC and consistent with the management services provided across the system’s properties. As a result of the deconsolidation of CEOC, CEC generates no direct economic benefits from CEOC’s results. This supplemental information is non-GAAP. It is not preferable to GAAP results provided elsewhere in this presentation or discussed on the conference call this presentation accompanies, but is used by management as an analytical tool to assess the results of all properties owned, managed or branded by a Caesars entity, regardless of consolidation. Additionally, the results are not necessarily indicative of future performance or of the results that would be reported should the reorganization of CEOC contemplated by the RSAs be successfully completed. Supplemental materials have been posted on the Caesars Entertainment Investor Relations website at http://investor.caesars.com/financials.cfm.

ABOUT CAESARS STRONG PERFORMANCE CONTINUED VALUE CREATION agenda

~ 8,500 Live entertainment shows per year 30 Properties in North America achieving Green Key Eco-Rating ~ 1.6M Square feet of convention space and retail stores > 2.8M Square feet of casino space in North America > 600 Bars, restaurants and clubs at our U.S. properties Caesars is the Largest and most diversified GAMING & entertainment company in the u.s. Manage 47 casino properties across 13 states and 5 countries #1 or #2 share position in most markets Industry’s first loyalty program, Total Rewards #1 theater venue in U.S. #3 live entertainment promoter worldwide Strong portfolio of widely recognized brands 47 Casinos in 5 countries $8.4B 2016 total net revenue > 50M Total Rewards members > 65,000 Employees > 100M Guest visits per year > 1.7M Square feet of LEED Certified buildings > 15,700 Conventions and meetings per year > 34,000 Hotel rooms and suites in the U.S. Slot machines worldwide > 49,000 Table games worldwide > 4,000

strong portfolio of brands Digital Entertainment Across Regions Las Vegas NOTE: Nobu and Planet Hollywood are owned by other entities and licensed by Caesars.

ABOUT CAESARS STRONG PERFORMANCE CONTINUED VALUE PROPOSITION

Experienced Management Execution Management Created >$750 Million of Incremental EBITDA While CEOC Operated in Bankruptcy Note: Change in EBITDA is on an enterprise wide basis, which is defined as Continuing CEC + CEOC, from 2014 to 2016.

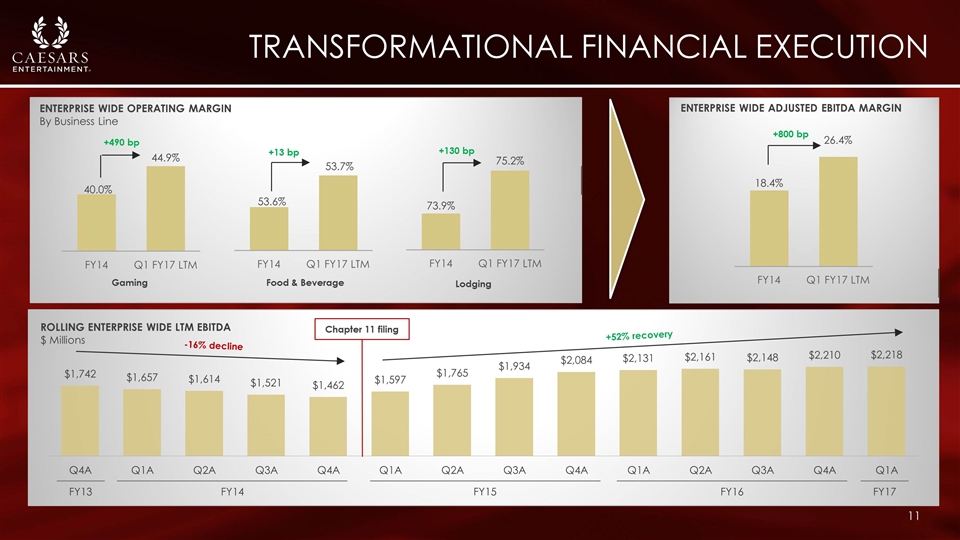

Transformational financial execution ENTERPRISE WIDE OPERATING MARGIN By Business Line Gaming Food & Beverage Lodging +490 bp +13 bp +130 bp Chapter 11 filing -16% decline +52% recovery ROLLING ENTERPRISE WIDE LTM EBITDA $ Millions FY13 FY14 FY15 FY16 ENTERPRISE WIDE ADJUSTED EBITDA MARGIN +800 bp FY17

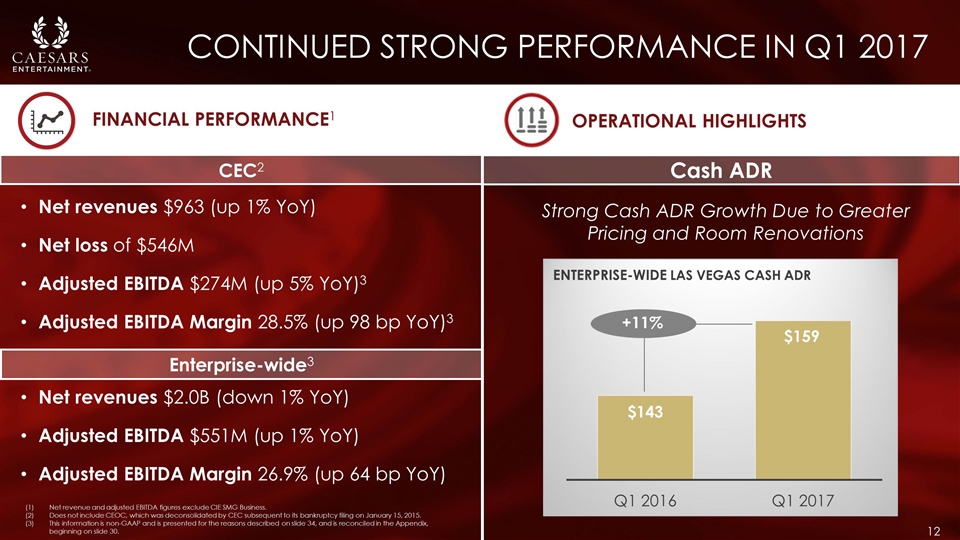

CONTINUED STRONG PERFORMANCE IN Q1 2017 FINANCIAL PERFORMANCE1 OPERATIONAL HIGHLIGHTS Net revenues $963 (up 1% YoY) Net loss of $546M Adjusted EBITDA $274M (up 5% YoY)3 Adjusted EBITDA Margin 28.5% (up 98 bp YoY)3 CEC2 Enterprise-wide3 Net revenues $2.0B (down 1% YoY) Adjusted EBITDA $551M (up 1% YoY) Adjusted EBITDA Margin 26.9% (up 64 bp YoY) Net revenue and adjusted EBITDA figures exclude CIE SMG Business. Does not include CEOC, which was deconsolidated by CEC subsequent to its bankruptcy filing on January 15, 2015. This information is non-GAAP and is presented for the reasons described on slide 34, and is reconciled in the Appendix, beginning on slide 30. Cash ADR Strong Cash ADR Growth Due to Greater Pricing and Room Renovations

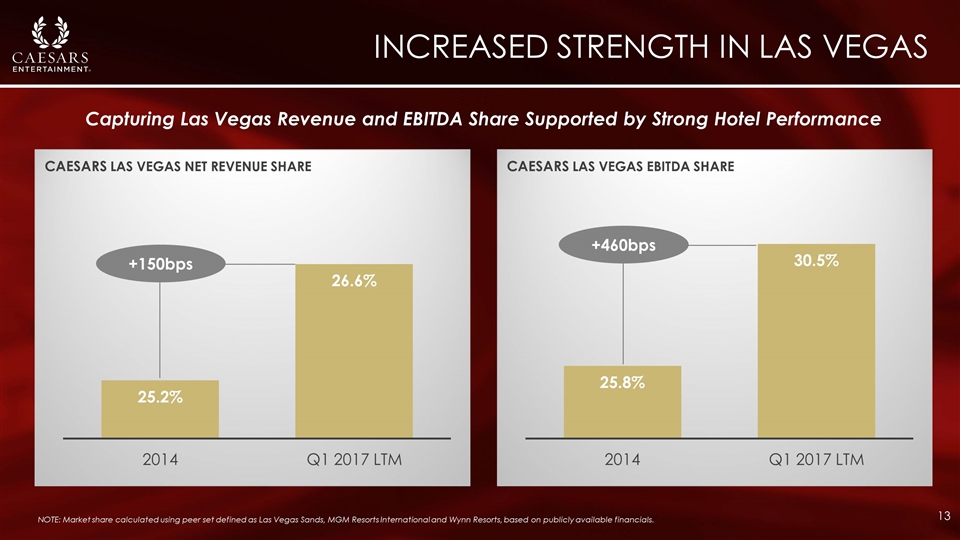

INCREASED strength IN las vegas NOTE: Market share calculated using peer set defined as Las Vegas Sands, MGM Resorts International and Wynn Resorts, based on publicly available financials. Capturing Las Vegas Revenue and EBITDA Share Supported by Strong Hotel Performance

ABOUT CAESARS STRONG PERFORMANCE CONTINUED VALUE CREATION

Driving Growth Through Investment in Customer Engagement and Hotel Room Product

Gaming innovation leadership Enhancing the customer experience with first to market gaming innovation First to offer skills-based real-money gambling machines Now featured in: NEVADA Planet Hollywood Las Vegas CALIFORNIA Harrah’s Southern California & Harrah’s Lake Tahoe

INCREASING CUSTOMER ENGAGEMENT Through Total rewards Growing revenue through deeper customer engagement Launching new functionality in 2017 including: Itinerary Delivery Service Coordinated Omni-channel Communication Location Based Messaging + 6.8% Total Rewards VIP Member Spending in Q1 2017 Total Rewards Dining Members earn Reward credits at 11,000+ restaurants, bars and clubs nationwide 1+ Million Total Rewards App Downloads to Date

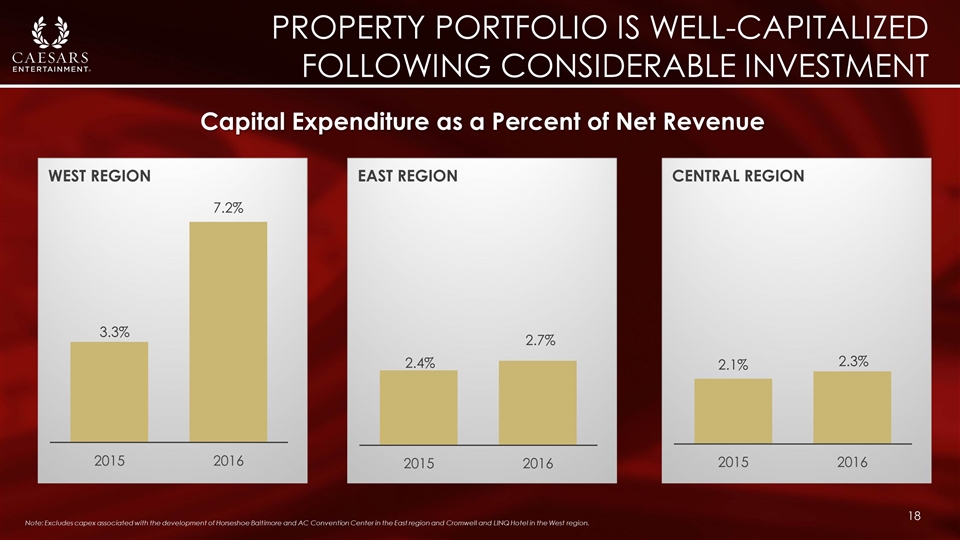

property portfolio is well-CAPITALIZED following CONSIDERABLE investment Capital Expenditure as a Percent of Net Revenue WEST REGION EAST REGION CENTRAL REGION Note: Excludes capex associated with the development of Horseshoe Baltimore and AC Convention Center in the East region and Cromwell and LINQ Hotel in the West region.

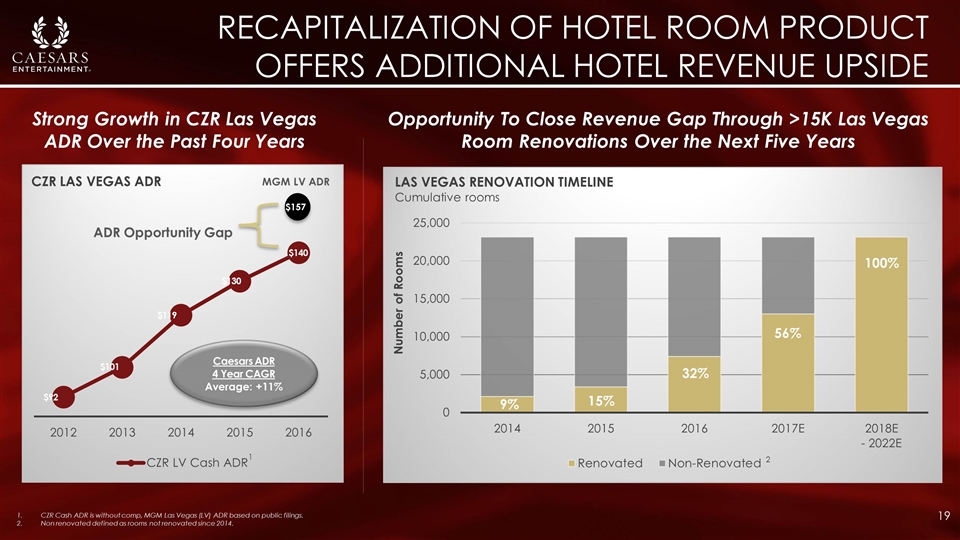

Recapitalization of hotel room product OFFERS Additional HOTEL REVENUE upside CZR Cash ADR is without comp, MGM Las Vegas (LV) ADR based on public filings. Non renovated defined as rooms not renovated since 2014. Opportunity To Close Revenue Gap Through >15K Las Vegas Room Renovations Over the Next Five Years LAS VEGAS RENOVATION TIMELINE Cumulative rooms 2 9% 15% 32% 56% 100% Strong Growth in CZR Las Vegas ADR Over the Past Four Years 1 2 MGM LV ADR Caesars ADR 4 Year CAGR Average: +11% 1

Significant Opportunity for Continued Growth in Free Cash Flow Generation

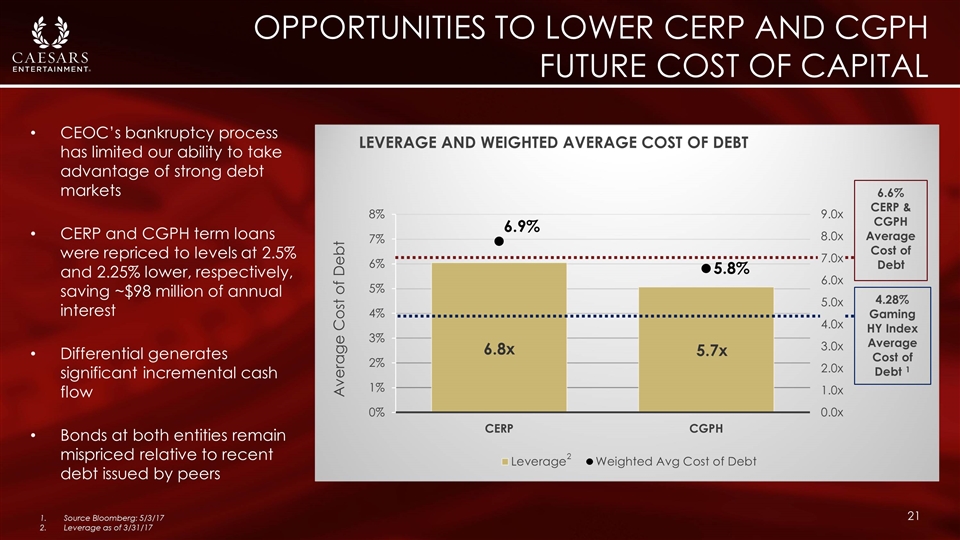

Opportunities to lower CERP and CGPH future cost of capital CEOC’s bankruptcy process has limited our ability to take advantage of strong debt markets CERP and CGPH term loans were repriced to levels at 2.5% and 2.25% lower, respectively, saving ~$98 million of annual interest Differential generates significant incremental cash flow Bonds at both entities remain mispriced relative to recent debt issued by peers LEVERAGE AND WEIGHTED AVERAGE COST OF DEBT Source Bloomberg: 5/3/17 Leverage as of 3/31/17 6.6% CERP & CGPH Average Cost of Debt 2

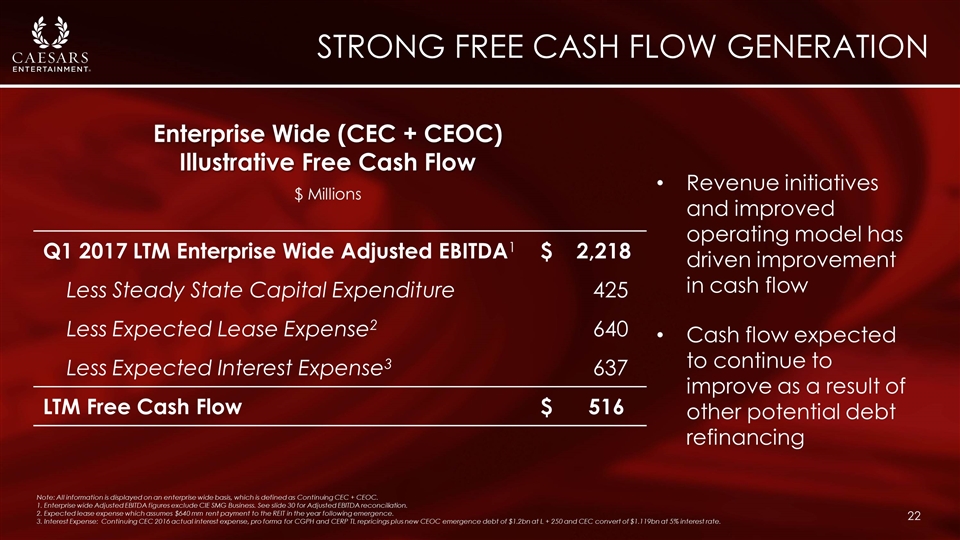

Strong FREE Cash flow generation Revenue initiatives and improved operating model has driven improvement in cash flow Cash flow expected to continue to improve as a result of other potential debt refinancing Note: All information is displayed on an enterprise wide basis, which is defined as Continuing CEC + CEOC. 1. Enterprise wide Adjusted EBITDA figures exclude CIE SMG Business. See slide 30 for Adjusted EBITDA reconciliation. 2. Expected lease expense which assumes $640 mm rent payment to the REIT in the year following emergence. 3. Interest Expense: Continuing CEC 2016 actual interest expense, pro forma for CGPH and CERP TL repricings plus new CEOC emergence debt of $1.2bn at L + 250 and CEC convert of $1.119bn at 5% interest rate. Q1 2017 LTM Enterprise Wide Adjusted EBITDA1 $ 2,218 Less Steady State Capital Expenditure 425 Less Expected Lease Expense2 640 Less Expected Interest Expense3 637 LTM Free Cash Flow $ 516 $ Millions Enterprise Wide (CEC + CEOC) Illustrative Free Cash Flow

Emergence Significantly Reduces Balance Sheet Leverage, Unlocking New Opportunities for Organic & Inorganic Growth

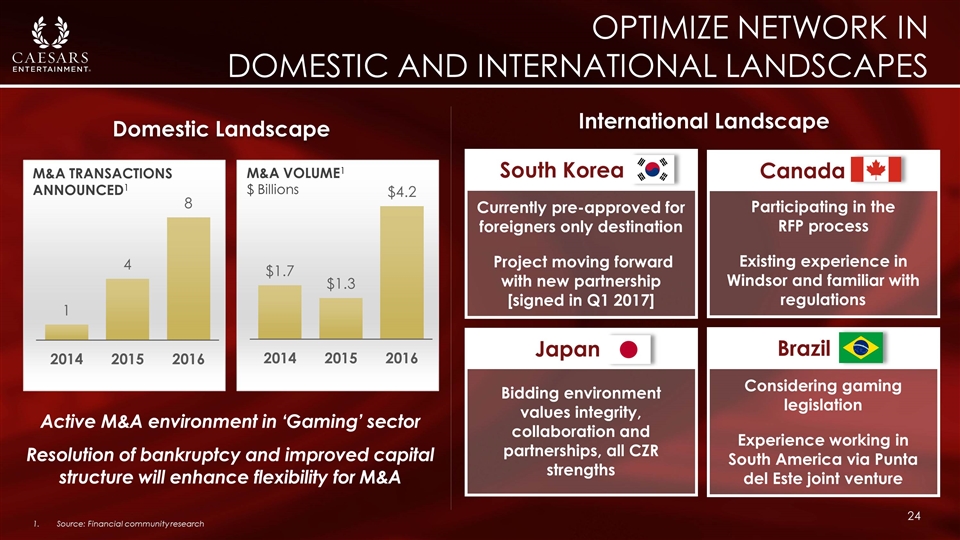

Bidding environment values integrity, collaboration and partnerships, all CZR strengths Japan Considering gaming legislation Experience working in South America via Punta del Este joint venture Brazil Currently pre-approved for foreigners only destination Project moving forward with new partnership [signed in Q1 2017] South Korea Participating in the RFP process Existing experience in Windsor and familiar with regulations Canada Active M&A environment in ‘Gaming’ sector Resolution of bankruptcy and improved capital structure will enhance flexibility for M&A Optimize Network in Domestic AND International Landscapes Source: Financial community research M&A TRANSACTIONS ANNOUNCED1 M&A VOLUME1 $ Billions Domestic Landscape International Landscape

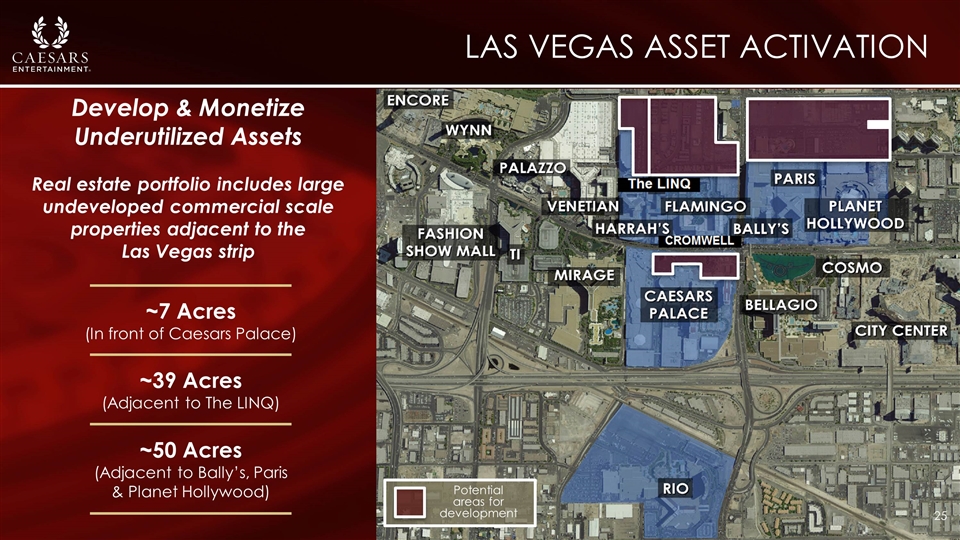

Potential areas for development Las vegas ASSET ACTIVATION ~39 Acres (Adjacent to The LINQ) ~50 Acres (Adjacent to Bally’s, Paris & Planet Hollywood) Develop & Monetize Underutilized Assets Real estate portfolio includes large undeveloped commercial scale properties adjacent to the Las Vegas strip ~7 Acres (In front of Caesars Palace)

Caesars ENTERTAINMENT Remains WELL PLACED TO CREATE Value ü ü ü ü ü Strong Free Cash Flow Profile Proven Management Execution Network Expansion Opportunities Concentrated Position in Growing Las Vegas Strongest Loyalty Program in the Gaming Industry

APPENDIX

CAESARS operating structure Post Emergence CZR New CEOC CERP CGP CES 1 100% 100% 100% PUBLIC STOCKHOLDERS Note: Simplified structure chart does not reflect the intermediate companies for each casino property 1. Caesars Enterprise Services, LLC (“CES”)

Reconciliation of non-gaap information: notes Because we deconsolidated CEOC upon its Chapter 11 filing we are also providing certain supplemental information as if we had continued to consolidate CEOC throughout the first quarter of 2017. This information includes both stand-alone CEOC financials and key metrics for the first quarter of 2017, and certain financial information for CEC as if CEOC remained a consolidated entity during the quarter. This information within this presentation may be different from CEOC’s standalone results separately provided due to immaterial adjustments, rounding, and basis of presentation differences. CEC has committed to a material amount of payments to support CEOC’s restructuring, which would result in the reacquisition of CEOC’s operations if the restructuring is made on terms consistent with the Plan of Reorganization to which CEC is a party (“RSAs”). In addition, compensation of management is in part determined by reference to certain of such financial information. As a result, we believe this supplemental information is useful to investors who are trying to understand the results of the entire “Caesars” enterprise, including CEOC and consistent with the management services provided across the system’s properties. As a result of the above, “CEC” in the following reconciliations represents GAAP results for CEC as reported for the period ended March 31, 2017 and 2016. As a result of the above, “CEC+CEOC” in the following reconciliations represents Non-GAAP results as it includes CEOC for both the 2016 and 2017 periods.

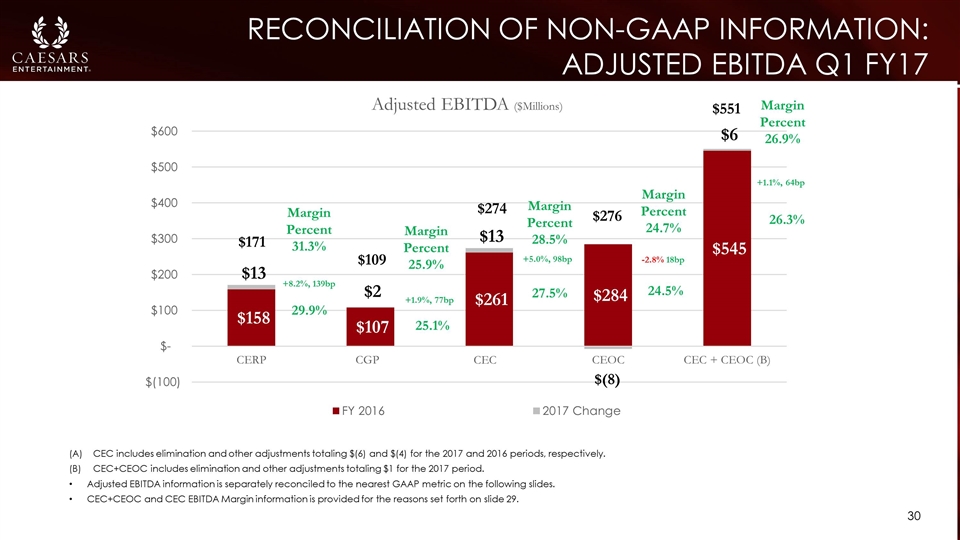

Reconciliation of non-gaap information: Adjusted ebitda Q1 FY17 CEC includes elimination and other adjustments totaling $(6) and $(4) for the 2017 and 2016 periods, respectively. CEC+CEOC includes elimination and other adjustments totaling $1 for the 2017 period. Adjusted EBITDA information is separately reconciled to the nearest GAAP metric on the following slides. CEC+CEOC and CEC EBITDA Margin information is provided for the reasons set forth on slide 29. Margin Percent 31.3% +8.2%, 139bp 29.9% Margin Percent 25.9% Margin Percent 26.9% Margin Percent 28.5% Margin Percent 24.7% $171 $109 $274 $276 $551 +1.9%, 77bp 25.1% +5.0%, 98bp 27.5% -2.8% 18bp 24.5% +1.1%, 64bp 26.3% CEC

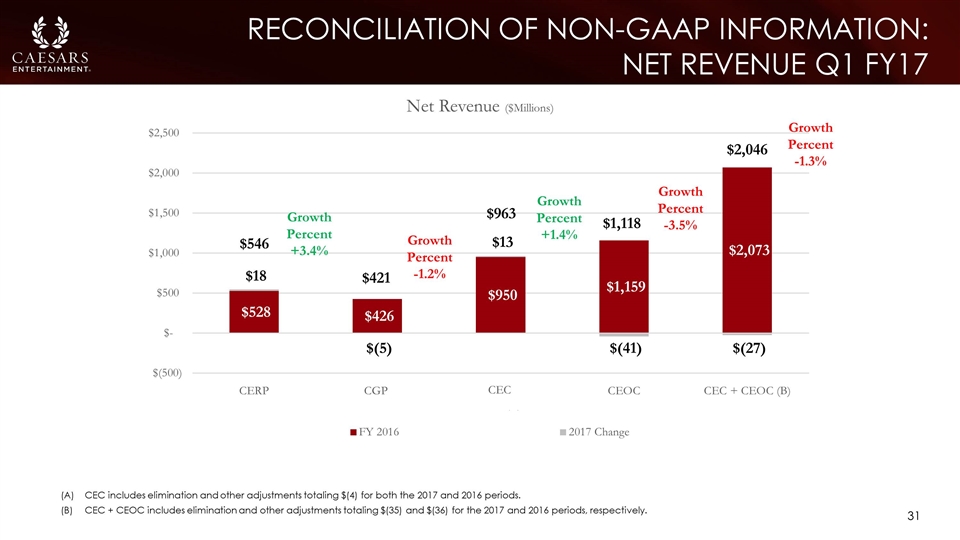

Reconciliation of non-gaap information: net revenue q1 FY17 CEC includes elimination and other adjustments totaling $(4) for both the 2017 and 2016 periods. CEC + CEOC includes elimination and other adjustments totaling $(35) and $(36) for the 2017 and 2016 periods, respectively. Growth Percent +3.4% Growth Percent -1.2% Growth Percent -1.3% Growth Percent +1.4% Growth Percent -3.5% $546 $421 $963 $1,118 $2,046 CEC

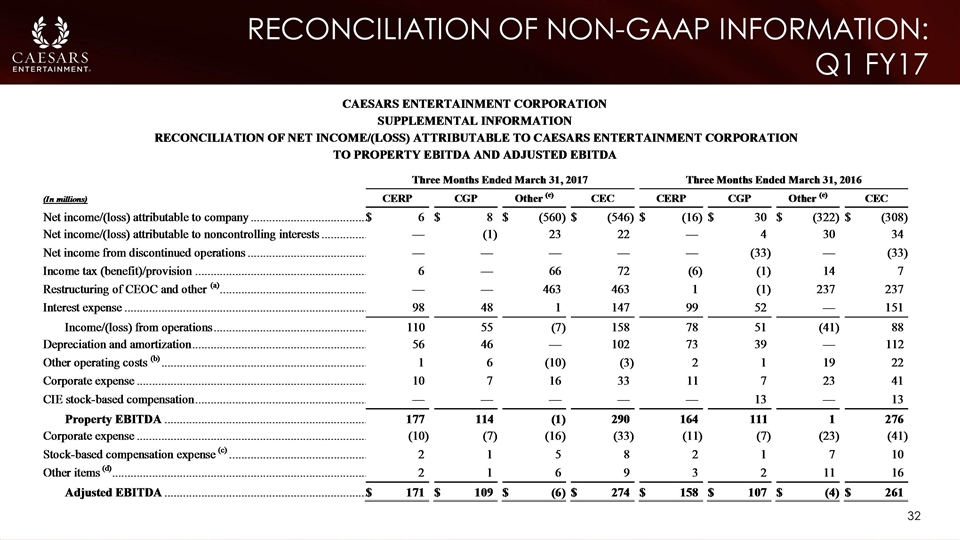

Reconciliation of non-gaap information: q1 FY17

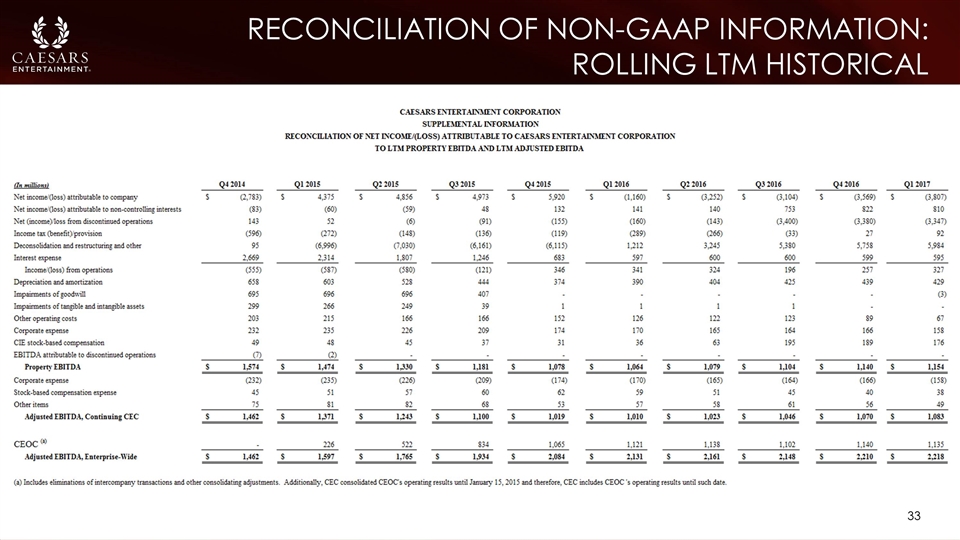

Reconciliation of non-gaap information: ROLLING LTM historical

Notes to non-gaap information Adjusted EBITDA is defined as EBITDA further adjusted to exclude certain non-cash and other items as exhibited in the above reconciliation, and is presented as a supplemental measure of the Company’s performance. Management believes that Adjusted EBITDA provides investors with additional information and allows a better understanding of the results of operational activities separate from the financial impact of decisions made for the long-term benefit of the Company. In addition, compensation of management is in part determined by reference to certain of such financial information. As a result, we believe this supplemental information is useful to investors who are trying to understand the results of the Company. Adjusted EBITDA Margin is the ratio of Adjusted EBITDA to Net Revenue and is presented for the same reasons as Adjusted EBITDA noted above. Because not all companies use identical calculations, the presentation of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies. Primarily represents CEC’s estimated costs in connection with the restructuring of CEOC. Amounts primarily represent costs incurred in connection with property openings and expansion projects at existing properties, costs associated with the development activities and reorganization activities, and/or recoveries associated with such items. Amounts represent stock-based compensation expense related to shares, stock options, and restricted stock units granted to the Company’s employees. Amounts represent add-backs and deductions from EBITDA, permitted under certain indentures. Such add-backs and deductions include litigation awards and settlements, costs associated with CEOC’s restructuring and related litigation, severance and relocation costs, sign-on and retention bonuses, permit remediation costs, and business optimization expenses. Amounts include consolidating adjustments, eliminating adjustments and other adjustments to reconcile to consolidated CEC Property EBITDA and Adjusted EBITDA.