EX-T3E-1

Exhibit T3E-1

UNITED STATES BANKRUPTCY COURT

NORTHERN DISTRICT OF ILLINOIS

EASTERN DIVISION

|

|

|

|

|

| |

|

) |

|

|

| In re: |

|

) |

|

Chapter 11 |

|

|

) |

|

|

| CAESARS ENTERTAINMENT OPERATING |

|

) |

|

Case No. 15-01145 (ABG) |

| COMPANY, INC., et al.1 |

|

) |

|

|

|

|

) |

|

|

| Debtors. |

|

) |

|

(Jointly Administered) |

| |

|

) |

|

|

DISCLOSURE STATEMENT FOR THE DEBTORS’

SECOND AMENDED JOINT PLAN OF REORGANIZATION

PURSUANT TO CHAPTER 11 OF THE BANKRUPTCY CODE

|

|

THIS IS NOT A SOLICITATION OF AN ACCEPTANCE OR REJECTION OF THE PLAN WITHIN THE

MEANING OF SECTION 1125 OF THE BANKRUPTCY CODE. ACCEPTANCES OR REJECTIONS OF

THE PLAN MAY NOT BE SOLICITED UNTIL A DISCLOSURE STATEMENT HAS BEEN APPROVED

BY THE BANKRUPTCY COURT. THIS DRAFT DISCLOSURE STATEMENT HAS NOT BEEN

APPROVED BY THE BANKRUPTCY COURT |

|

|

|

| James H.M. Sprayregen, P.C. |

|

Paul M. Basta, P.C. |

| David R. Seligman, P.C. |

|

Nicole L. Greenblatt, P.C. |

| KIRKLAND & ELLIS LLP |

|

KIRKLAND & ELLIS LLP |

| KIRKLAND & ELLIS INTERNATIONAL LLP |

|

KIRKLAND & ELLIS INTERNATIONAL LLP |

| 300 North LaSalle |

|

601 Lexington Avenue |

| Chicago, Illinois 60654 |

|

New York, New York 10022 |

| Telephone: (312) 862-2000 |

|

Telephone: (212) 446-4800 |

| Facsimile: (312) 862-2200 |

|

Facsimile: (212) 446-4900 |

|

|

| Counsel to the Debtors and Debtors in Possession |

|

|

|

|

| Dated: June 28, 2016 |

|

|

| 1 |

A complete list of the Debtors and the last four digits of their federal tax identification numbers may be obtained at https://cases.primeclerk.com/CEOC. |

|

|

IMPORTANT INFORMATION FOR YOU TO READ |

THE DEADLINE TO VOTE ON THE PLAN IS

October 31, 2016, at 4:00 p.m. (prevailing Central Time).

FOR YOUR VOTE TO BE COUNTED, YOUR BALLOT MUST BE ACTUALLY RECEIVED BY PRIME

CLERK BEFORE THE VOTING DEADLINE AS DESCRIBED HEREIN

This disclosure statement (this “Disclosure Statement”) provides information regarding the Debtors’ Plan,2 which the Debtors seek to have confirmed by the Bankruptcy Court. A copy of the Plan is attached hereto as Exhibit A. Unless otherwise noted, all capitalized terms used but not otherwise

defined in this Disclosure Statement have the meanings ascribed to them in the Plan. The rules of interpretation set forth in Article I.B of the Plan govern the interpretation of this Disclosure Statement.3

The consummation and effectiveness of the Plan are subject to certain material

conditions precedent described herein and set forth in Article IX of the Plan. There is no assurance that the Bankruptcy Court will confirm the Plan or, if the Bankruptcy Court does confirm the Plan, that the conditions necessary for the Plan

to go effective will be satisfied or otherwise waived.

You are encouraged to read this Disclosure Statement (including

Article IX hereof entitled “Risk Factors”) and the Plan in their entirety before submitting your Ballot to vote on the Plan.

The Bankruptcy Court’s approval of this Disclosure Statement does not constitute a guarantee by the Bankruptcy Court of the accuracy

or completeness of the information contained herein or an endorsement by the Bankruptcy Court of the merits of the Plan.

Summaries of the Plan and statements made in this Disclosure Statement are qualified in their entirety by reference to the Plan. The

summaries of the financial information and the documents annexed to this Disclosure Statement or otherwise incorporated herein by reference are qualified in their entirety by reference to those documents. The statements contained in this Disclosure

Statement are made only as of the date of this Disclosure Statement, and there is no assurance that the statements contained herein will be correct at any time after such date. Except as otherwise provided in the Plan or in accordance with

applicable law, the Debtors are under no duty to update or supplement this Disclosure Statement.

The Debtors are providing the

information in this Disclosure Statement to Holders of Claims and Interests for purposes of soliciting votes to accept or reject the Debtors’ Second Amended Joint Plan of Reorganization Pursuant to Chapter 11 of the Bankruptcy Code. In the

event of any inconsistency between the Disclosure Statement and the Plan, the relevant provisions of the Plan will govern. Nothing in this Disclosure Statement may be relied upon or used by any entity for any other purpose. Before deciding whether

to vote for or against the Plan, each Holder entitled to vote should carefully consider all of the information in this Disclosure Statement, including the Risk Factors described in Article IX.

| 2 |

As used herein, “Plan” means the Debtors’ Second Amended Joint Plan of Reorganization Pursuant to Chapter 11 of the Bankruptcy Code, a copy of which is attached as Exhibit A

to this Disclosure Statement and incorporated herein by reference, as it may be altered, amended, modified, or supplemented from time to time in accordance with the terms of Article IX thereof, and including all exhibits thereto and the Plan

Supplement. Capitalized terms used but not otherwise defined herein have the meanings given to them in the Plan. |

| 3 |

The Debtors have proprietary rights to a number of trademarks used in this Disclosure Statement that are important to their businesses, including, without limitation, Caesars, Caesars Entertainment, Caesars Palace,

Harrah’s, Total Rewards, Horseshoe, Paris Las Vegas, Flamingo, and Bally’s. This Disclosure Statement may omit the registered trademark (®) and trademark (™) symbols for

such trademarks named herein. |

The Debtors urge each Holder of a Claim or Interest to consult with its own advisors with

respect to any legal, financial, securities, tax, or business advice in reviewing this Disclosure Statement, the Plan, and each proposed transaction contemplated by the Plan.

This Disclosure Statement contains, among other things, summaries of the Plan, certain statutory provisions, certain events in the

Debtors’ Chapter 11 Cases, and certain documents related to the Plan, attached hereto and/or incorporated by reference herein. Although the Debtors believe that these summaries are fair and accurate, they are qualified in their entirety to

the extent that they do not set forth the entire text of such documents or statutory provisions or every detail of such events. In the event of any inconsistency or discrepancy between a description in this Disclosure Statement and the terms and

provisions of the Plan or any other documents incorporated herein by reference, the Plan or such other documents will govern for all purposes. Factual information contained in this Disclosure Statement has been provided by the Debtors’

management except where otherwise specifically noted. The Debtors do not represent or warrant that the information contained herein or attached hereto is without any material inaccuracy or omission.

The Debtors have prepared this Disclosure Statement in accordance with section 1125 of the Bankruptcy Code, Bankruptcy

Rule 3016(b), and Local Bankruptcy Rule 3016-1 and is not necessarily prepared in accordance with federal or state securities laws or other similar laws.

The Debtors did not file this Disclosure Statement with the Securities and Exchange Commission (the “SEC”) or any

state authority. Neither the SEC nor any state authority has passed upon the accuracy or adequacy of this Disclosure Statement or upon the merits of the Plan. The securities to be issued on or after the effective date will not have been the subject

of a registration statement filed with the SEC under the Securities Act of 1933, as amended (the “Securities Act”) or any securities regulatory authority of any state under any state securities law (“Blue Sky Law”).

The securities to be issued will be issued pursuant to the Plan in reliance on section 4(a)(2) of the Securities Act and similar Blue Sky Law provisions, as well as, to the extent applicable, the exemption from the Securities Act and equivalent

state law registration requirements provided by section 1145(a)(1) of the Bankruptcy Code, to exempt the offer and the issuance of new securities in connection with the solicitation of the Plan from registration under the Securities Act and Blue Sky

Law.

In preparing this Disclosure Statement, the Debtors relied on financial data derived from the Debtors’ books and records

and on various assumptions regarding the Debtors’ businesses. Although the Debtors believe that such financial information fairly reflects the financial condition of the Debtors as of the date hereof and that the assumptions regarding future

events reflect reasonable business judgments, the Debtors make no representations or warranties as to the accuracy of the financial information contained in this Disclosure Statement or assumptions regarding the Debtors’ businesses and their

future results and operations. The Debtors expressly caution readers not to place undue reliance on any forward-looking statements contained herein.

This Disclosure Statement does not constitute, and should not be construed as, an admission of fact, liability, stipulation, or waiver. The

Debtors may seek to investigate, file, and prosecute Claims and may object to Claims after the Confirmation or Effective Date of the Plan irrespective of whether this Disclosure Statement identifies such Claims or objections to Claims.

The Debtors are making the statements and providing the financial information contained in this Disclosure Statement as of the date hereof,

unless otherwise specifically noted. Although the Debtors may subsequently update the information in this Disclosure Statement, the Debtors have no affirmative duty to do so, and expressly disclaim any duty to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise. Holders of Claims and Interests reviewing this Disclosure Statement should not infer that, at the time of their

review, the facts set forth herein have not changed since this Disclosure Statement was filed. Information contained herein is subject to completion, modification, or amendment. The Debtors reserve the right to file an amended or modified Plan and

related Disclosure Statement from time to time, subject to the terms of the Plan.

ii

The Debtors have not authorized any entity to give any information about or concerning the

Plan other than that contained in this Disclosure Statement. The Debtors have not authorized any representations concerning the Debtors or the value of their property other than as set forth in this Disclosure Statement.

If the Bankruptcy Court confirms the Plan and the Effective Date occurs, the terms of the Plan and the Restructuring Transactions

contemplated by the Plan will bind the Debtors, any person acquiring property under the Plan, all Holders of Claims and Interests (including those Holders of Claims and Interests that do not submit Ballots to accept or reject the Plan or that are

not entitled to vote on the Plan), and any other person or entity as may be ordered by the Bankruptcy Court in accordance with the applicable provisions of the Bankruptcy Code.

|

|

QUESTIONS AND ADDITIONAL INFORMATION |

If you would like to obtain copies of this Disclosure Statement, the Plan, or any other

solicitation materials or publicly filed documents in the Chapter 11 Cases, or if you have any questions about the solicitation and voting process or the Chapter 11 Cases generally, please contact the Debtors’ Notice and Claims

Agent, Prime Clerk LLC by (i) email at ceocballots@primeclerk.com, (ii) calling (855) 842-4123 within the United States or Canada or, outside of the United States or Canada, by calling +1 (646) 795-6969, (iii) visiting https://cases.primeclerk.com/CEOC, or (iv) writing to Prime Clerk LLC, 830 Third Avenue, 3rd Floor, New York, New York 10022.

Any Ballot received after the Voting Deadline, or otherwise not in compliance with the Solicitation Procedures set forth in the Solicitation

Procedures Order will not be counted.

iii

TABLE OF CONTENTS

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

| ARTICLE I. EXECUTIVE SUMMARY |

|

|

1 |

|

|

|

|

| A. |

|

Introduction |

|

|

1 |

|

| B. |

|

Development of the Debtors’ Proposed Plan |

|

|

2 |

|

| C. |

|

Plan Overview |

|

|

5 |

|

| D. |

|

Creditor Recoveries |

|

|

7 |

|

| E. |

|

Plan Contingencies |

|

|

12 |

|

| F. |

|

Marketing Process |

|

|

13 |

|

| G. |

|

Recommendation |

|

|

14 |

|

|

|

| ARTICLE II. BACKGROUND TO THE CHAPTER 11 CASES |

|

|

14 |

|

|

|

|

| A. |

|

The Debtors’ Businesses |

|

|

14 |

|

| B. |

|

The Debtors’ Corporate Structure, Parent, and Affiliates |

|

|

17 |

|

| C. |

|

Management of the Debtors |

|

|

20 |

|

| D. |

|

The Debtors’ Capital Structure |

|

|

24 |

|

|

|

| ARTICLE III. EVENTS LEADING TO THE CHAPTER 11 FILINGS |

|

|

27 |

|

|

|

|

| A. |

|

Economic Challenges |

|

|

27 |

|

| B. |

|

Certain Prepetition Challenged Transactions |

|

|

29 |

|

| C. |

|

Recent and Impending Property Closures |

|

|

29 |

|

| D. |

|

Litigation Regarding Challenged Transactions and CEC’s Guarantees |

|

|

29 |

|

| E. |

|

Prepetition Restructuring Negotiations and Prepetition RSA |

|

|

32 |

|

| F. |

|

Proposed Merger of CEC and CAC |

|

|

33 |

|

| G. |

|

The Debtors’ Financial Outlook and Business Strategy Going Forward |

|

|

34 |

|

|

|

| ARTICLE IV. MATERIAL EVENTS OF THE CHAPTER 11 CASES |

|

|

34 |

|

|

|

|

| A. |

|

Involuntary Chapter 11 Proceedings |

|

|

34 |

|

| B. |

|

First Day Pleadings and Certain Related Relief |

|

|

35 |

|

| C. |

|

Appointment of Official Committees |

|

|

40 |

|

| D. |

|

Special Governance Committee Investigation |

|

|

41 |

|

| E. |

|

The Examiner |

|

|

51 |

|

| F. |

|

Mesirow Financial Consulting’s Role in the SGC Investigation |

|

|

57 |

|

| G. |

|

Positions of CEC, the Sponsors, the Second Priority Noteholders Committee, and the Ad Hoc Group of 5.75% and 6.50% Notes Regarding the Challenged Transactions |

|

|

60 |

|

| H. |

|

Value of CEC Contributions |

|

|

70 |

|

| I. |

|

The Second Lien Standing Motion |

|

|

70 |

|

| J. |

|

Development of the Proposed Restructuring and Plan |

|

|

71 |

|

| K. |

|

Marketing Process |

|

|

79 |

|

| L. |

|

Exclusivity |

|

|

81 |

|

| M. |

|

Mediation |

|

|

82 |

|

| N. |

|

The Lien Standing Challenges |

|

|

82 |

|

| O. |

|

The 1111(b) Claim Objections |

|

|

83 |

|

| P. |

|

Debtors’ Objections to Second Lien Notes Claims |

|

|

84 |

|

| Q. |

|

Claims Bar Date and the Claims Objection Process |

|

|

88 |

|

| R. |

|

Deferred Compensation Plan Issues |

|

|

89 |

|

| S. |

|

Adversary Proceedings and Contested Matters |

|

|

91 |

|

| T. |

|

Other Pending Litigation Proceedings |

|

|

99 |

|

| U. |

|

Monetizing the Former Harrah’s Tunica Property |

|

|

99 |

|

i

|

|

|

|

|

|

|

| V. |

|

Workload Bonus Program |

|

|

99 |

|

| W. |

|

Rejection and Assumption of Executory Contracts and Unexpired Leases |

|

|

100 |

|

| X. |

|

Postpetition Letter of Credit Facility |

|

|

101 |

|

| Y. |

|

Debtors’ Monthly Operating Reports |

|

|

102 |

|

|

|

| ARTICLE V. SUMMARY OF THE PLAN |

|

|

102 |

|

|

|

|

| A. |

|

Proposed Treatment of Each Class of Claims and Interests |

|

|

102 |

|

| B. |

|

Proposed Distributions to Holders of Allowed Claims and Interests |

|

|

106 |

|

| C. |

|

Timing and Calculation of Amounts to Be Distributed |

|

|

115 |

|

| D. |

|

Process for Dealing with Disputed Claims |

|

|

116 |

|

| E. |

|

The Separation Structure |

|

|

116 |

|

| F. |

|

Sources of Recovery |

|

|

117 |

|

| G. |

|

Shared Services |

|

|

127 |

|

| H. |

|

Master Lease Agreements |

|

|

127 |

|

| I. |

|

Management and Lease Support Agreements |

|

|

127 |

|

| J. |

|

Transition Services Agreement |

|

|

128 |

|

| K. |

|

Corporate Governance |

|

|

128 |

|

| L. |

|

Right of First Refusal Agreement |

|

|

129 |

|

| M. |

|

PropCo Call Right Agreement |

|

|

129 |

|

| N. |

|

The Bank Guaranty Settlement |

|

|

129 |

|

| O. |

|

Subsidiary-Guaranteed Notes Settlement |

|

|

130 |

|

| P. |

|

Unsecured Creditors Committee Settlement |

|

|

130 |

|

| Q. |

|

Adequate Protection and Operating Cash for OpCo and the REIT |

|

|

131 |

|

| R. |

|

General Settlement and Discharge of Claims, Interests, Causes of Action, and

Controversies |

|

|

132 |

|

| S. |

|

Ordinary Course of Business Through the Effective Date |

|

|

132 |

|

| T. |

|

The Debtor Release, Third-Party Release, Exculpation, and

Injunction |

|

|

132 |

|

| U. |

|

Retention of Causes of Action |

|

|

135 |

|

| V. |

|

Treatment of Executory Contracts and Unexpired Leases |

|

|

136 |

|

|

|

| ARTICLE VI. SOLICITATION AND VOTING PROCEDURES |

|

|

140 |

|

|

|

|

| A. |

|

Solicitation Packages |

|

|

140 |

|

| B. |

|

Voting Rights |

|

|

141 |

|

| C. |

|

Voting Procedures |

|

|

142 |

|

| D. |

|

Ballots and Master Ballots Not Counted |

|

|

143 |

|

|

|

| ARTICLE VII. FIRST LIEN CREDITOR ELECTIONS |

|

|

143 |

|

|

|

|

| A. |

|

PropCo Preferred Equity Put Election |

|

|

143 |

|

| B. |

|

PropCo Equity Election |

|

|

144 |

|

| C. |

|

Plan Supplement |

|

|

144 |

|

|

|

| ARTICLE VIII. CONFIRMATION OF THE PLAN |

|

|

144 |

|

|

|

|

| A. |

|

Confirmation Hearing |

|

|

144 |

|

| B. |

|

Requirements for Confirmation of the Plan |

|

|

145 |

|

| C. |

|

Acceptance by Impaired Classes |

|

|

152 |

|

| D. |

|

Confirmation without Acceptance by All Impaired Classes |

|

|

152 |

|

|

|

| ARTICLE IX. RISK FACTORS |

|

|

154 |

|

|

|

|

| A. |

|

Certain Bankruptcy Law Considerations |

|

|

154 |

|

| B. |

|

Risk Factor Regarding the NRF Claim |

|

|

156 |

|

ii

|

|

|

|

|

|

|

| C. |

|

Risk Factor Regarding the Proposed Merger Between CEC and CAC |

|

|

156 |

|

| D. |

|

Second Priority Noteholders Committee Risk Factor Regarding the CEC Consideration |

|

|

157 |

|

| E. |

|

Risk Factors Regarding Lack of Injunction of Parent Guaranty Litigation |

|

|

157 |

|

| F. |

|

Risk Factors and Considerations Regarding the Companies’ Businesses and Operations |

|

|

157 |

|

| G. |

|

Risk Factors and Considerations Regarding PropCo’s, CPLV Sub’s, and the REIT’s

Businesses and Operations |

|

|

162 |

|

| H. |

|

Risk Factors and Considerations Regarding the Companies’ Financial Condition |

|

|

163 |

|

| I. |

|

Risk Factors and Considerations Regarding the Separation of the Debtors into OpCo, PropCo, and the

REIT |

|

|

166 |

|

| J. |

|

Risk Factors and Considerations Regarding the Status of the REIT as a Real Estate Investment

Trust |

|

|

168 |

|

| K. |

|

Risk Factor Relating to Appeal and Equitable Mootness |

|

|

173 |

|

| L. |

|

Risks Relating to the New Debt |

|

|

173 |

|

| M. |

|

Risks Relating to the New Interests Under the Plan |

|

|

181 |

|

| N. |

|

Risks Relating to the New CEC Common Stock and New CEC Convertible Notes |

|

|

185 |

|

| O. |

|

Risks Related to the Marketing Process |

|

|

188 |

|

| P. |

|

Risk Factor Related to the Deferred Compensation Settlement |

|

|

188 |

|

| Q. |

|

Disclosure Statement Disclaimer |

|

|

189 |

|

| R. |

|

Liquidation Under Chapter 7 |

|

|

190 |

|

|

|

| ARTICLE X. CERTAIN SECURITIES LAW MATTERS |

|

|

190 |

|

|

|

|

| A. |

|

Issuance of Securities under the Plan Pursuant to the Plan: |

|

|

190 |

|

| B. |

|

Subsequent Transfers of Securities Issued under the Plan |

|

|

192 |

|

|

|

| ARTICLE XI. CERTAIN UNITED STATES INCOME TAX CONSEQUENCES OF THE PLAN |

|

|

193 |

|

|

|

|

| A. |

|

Introduction |

|

|

193 |

|

| B. |

|

Certain Federal Income Tax Consequences of the Plan to the Debtors |

|

|

194 |

|

| C. |

|

Certain Federal Income Tax Consequences of the Plan to U.S. Holders of Allowed Claims and

Interests |

|

|

195 |

|

| D. |

|

Certain Federal Income Tax Consequences of the Plan to Non-U.S. Holders of Allowed Claims and

Interests |

|

|

207 |

|

| E. |

|

Certain REIT Tax Considerations, Including Certain Dividend Requirements |

|

|

208 |

|

| F. |

|

Tax Aspects of REITCo’s Ownership of PropCo |

|

|

220 |

|

| G. |

|

Ownership and Disposition of the PropCo LP Interests |

|

|

221 |

|

| H. |

|

Ownership and Disposition of New CEC Common Equity and New CEC Convertible Notes |

|

|

223 |

|

| I. |

|

Ownership and Disposition of New CEC Convertible Notes and Conversion of New CEC Convertible Notes Into New CEC Common Equity |

|

|

224 |

|

| J. |

|

Constructive Distributions to Holders of New CEC Common Equity and New CEC Convertible

Notes |

|

|

226 |

|

| K. |

|

Withholding and Reporting |

|

|

226 |

|

iii

EXHIBITS

|

|

|

| EXHIBIT A |

|

Debtors’ Second Amended Joint Plan of Reorganization |

|

|

| EXHIBIT B |

|

Corporate Structure of the Debtors and Certain Non-Debtor Affiliates as of the Petition Date |

|

|

| EXHIBIT C |

|

Contribution Analysis |

|

|

| EXHIBIT D |

|

Liquidation Analysis |

|

|

| EXHIBIT E |

|

Financial Projections |

|

|

| EXHIBIT F |

|

Valuation Analysis |

|

|

| EXHIBIT G |

|

Debtors’ Consolidated Annual Financial Statements |

|

|

| EXHIBIT H |

|

Examiner Report Introduction and Executive Summary |

|

|

| EXHIBIT I |

|

Standalone Plan Analysis |

|

|

| EXHIBIT J |

|

New CEC Financial Projections |

|

|

| EXHIBIT K |

|

Second Priority Noteholders Committee Summary of Examiner Report |

|

|

| EXHIBIT L |

|

Excerpt of March 16, 2016 Hearing Transcript |

iv

ARTICLE I.

EXECUTIVE SUMMARY

The proposed Plan achieves a complicated but tax-efficient corporate and

balance sheet restructuring that maximizes the value of the Debtors’ two primary assets: their businesses and the estate causes of action against Caesars Entertainment Corporation (“CEC”), Caesars Acquisition Company

(“CAC”), other non-Debtor affiliates, and certain third parties (the “Estate Claims”). Rather than expose the Debtors and their stakeholders to the risks of potentially

value-destructive litigation with affiliates, the Plan provides for a global settlement of the Debtors’ claims and causes of action against CEC and its affiliates by securing substantial contributions

from CEC and its affiliates to support significant near-term recoveries (in both quantum and form of consideration) to all of the Debtors’ stakeholders. Importantly, the value-maximizing REIT structure and associated creditor recoveries contemplated by the proposed Plan rely on significant cash and non-cash contributions, as well as ongoing credit support, from CEC and its

affiliates, which contributions are conditioned upon, and would not be available without, releases for CEC and its affiliates. In exchange for the releases essential to the proposed global settlement embodied in the Plan, CEC and its affiliates are

providing contributions that the Debtors estimate have a midpoint value of $4.0 billion, as more fully discussed in the contribution analysis attached hereto as Exhibit C. The Debtors, informed by the conclusions of the

investigation conducted by the independent Special Governance Committee of the Board of Directors of CEOC (the “Special Governance Committee”) and the findings of the Bankruptcy

Court-appointed Examiner’s final report, believe these contributions represent a fair and reasonable settlement is in the best interest of the Debtors and their estates, that sufficient to support the

releases included in the Plan, and will be prepared to meet their burden on these issues at confirmation.4

The Debtors have evaluated alternative transaction structures, including a standalone reorganization structure that would allow for parallel

litigation against CEC and its affiliates through the formation of a litigation trust to pursue the Estate Claims. As set forth more fully in an analysis attached hereto as Exhibit I, however, separating the Debtors from the broader

Caesars enterprise involves complicated operational challenges and is likely to result in both decreased financial performance and lower distributable value. Moreover, without the contributions from CEC and its affiliates, the Debtors would have to

provide a greater portion of recoveries in equity instead of the significant cash and debt recoveries to first lien creditors contemplated by the Plan, and the Debtors cannot force secured creditors to accept an equity recovery on account of their

collateral without their consent. Indeed, after careful analysis, the Debtors and the Special Governance Committee have determined that no alternative provides better value for the Debtors and their Estates, especially on a risk-adjusted basis,

than the proposed Plan.

The Debtors have been engaged in extensive negotiations with their stakeholders as part of an ongoing mediation

process. As a result of this process, the Unsecured Creditors Committee, certain holders of Subsidiary-Guaranteed Notes Claims, CEC, and CAC, have agreed to restructuring support agreements demonstrating their

support of the Plan, and certain holders of Prepetition Credit Agreement Claims entered into an amended restructuring support agreement reaffirming their support of the Plan. Moreover, the holders of more than 80 percent in amount of First Lien

Notes Claims are party to a restructuring support agreement with the Debtors and CEC, though that agreement is terminable because the Debtors have missed milestones under the agreement and the terms of the Plan provide different (and improved)

recoveries for the Holders of First Lien Notes Claims. Notably, because the Plan contemplates that Holders of First Lien Notes Claims receive recoveries in equity, to avoid a difficult cramdown fight, the support of such Holders will be important

for achieving confirmation of the Plan. See Bankruptcy Code § 1129(b)(2)(A).

As of the date hereof, the Ad Hoc Committee

of First Lien Noteholders, the Second Priority Noteholders Committee, BOKF, Frederick Barton Danner, and the Ad Hoc Group of 5.75% and 6.50% Notes do not support the Plan. The Ad Hoc Committee of holders of 12.75% Second Lien Notes, which

collectively hold more than the majority of the face amount of such notes, also does not support the Plan, and would encourage other holders of the 12.75% Second Lien Notes to vote against the Plan.

| 4 |

The Special Governance Committee’s investigation, including its conclusions, the claims of various creditors that the work of the Special Governance Committee is tainted and not credible (and their assertions that

the Bankruptcy Court has found it not credible), and the Debtors’ view that the work of the Special Governance Committee is valuable and credible, is described in detail in Article IV.D and Article IV.F below. |

Because the proposed Plan maximizes creditor recoveries, meaningfully reduces the Debtors’

aggregate debt (by approximately $10 billion), and best positions the Debtors’ businesses for future success, the Debtors encourage you to vote to accept the Plan.

| |

B. |

Development of the Debtors’ Proposed Plan |

CEOC is a majority-owned operating

subsidiary of CEC; the remaining Debtors are direct and indirect subsidiaries of CEOC. CEC, together with its subsidiaries (including the Debtors) and its affiliates, is the world’s most diversified casino-entertainment company (collectively,

“Caesars”). Caesars owns and operates or manages 50 casinos in five countries on three continents, with properties in the United States, Canada, the United Kingdom, South Africa, and Egypt. The Debtors, for their part, own and

operate or manage 38 gaming and resort properties in fourteen states and five countries, operating primarily under the Caesars®,

Harrahs®, and Horseshoe® brand names. The Debtors employ approximately 32,000 people.

The Debtors’ capital structure is the result of a $30.7 billion leveraged buyout—one of the largest in history (the “2008

LBO”)—that was completed just as the global economy took a precipitous downturn. The Debtors’ significant debt load following the 2008 LBO hampered their ability to confront the challenges brought on by decreased consumer

spending, increased competition in Las Vegas and local geographic markets, and system-wide revenue declines, including significant declines in the Atlantic City market. Despite implementing dozens of

cost-cutting initiatives and executing numerous capital markets transactions, the Debtors were unable to achieve an out-of-court

solution to their financial distress.

As of the Petition Date, the Debtors’ outstanding funded debt obligations totaled

approximately $18 billion (excluding accrued and unpaid interest), and comprise the following classes of claims:

| |

• |

|

Four tranches of first lien bank debt totaling approximately $5.35 billion (the “Prepetition Credit Agreement Claims”);5 |

| |

• |

|

Three series of outstanding first lien notes totaling approximately $6.35 billion (the “First Lien Notes Claims”); |

| |

• |

|

Four series of outstanding second lien notes totaling approximately $5.25 billion (the “Second Lien Notes Claims”); |

| |

• |

|

One series of subsidiary-guaranteed unsecured notes of approximately $479 million (the “Subsidiary-Guaranteed Notes Claims”); and |

| |

• |

|

Two series of senior unsecured notes totaling approximately $530 million (the “Senior Unsecured Notes Claims”). |

Additionally, certain of the Debtors’ funded debt creditors are party to various intercreditor agreements, which govern, among other

things, the payment, priority, rights, and remedies among and available to such creditors. The following table illustrates the Debtors’ outstanding funded debt as of the Petition Date, including the applicable maturities and interest rates for

each tranche of debt.

| 5 |

CEC has a contractual obligation to guarantee collection (rather than payment) of the Prepetition Credit Agreement Claims. |

2

|

|

|

|

|

|

|

|

|

|

|

|

|

| As of January 15, 2015 |

|

| CEOC Debt ($ in Millions) |

|

Maturity |

|

|

Interest Rate |

|

|

Face Value6 |

|

| Term Loan B4 |

|

|

2016 |

|

|

|

10.50 |

% |

|

$ |

376.7 |

|

| Term Loan B5 |

|

|

2017 |

|

|

|

5.95 |

% |

|

|

937.6 |

|

| Term Loan B6 |

|

|

2017 |

|

|

|

6.95 |

% |

|

|

2,298.8 |

|

| Term Loan B7 |

|

|

2017 |

|

|

|

9.75 |

% |

|

|

1,741.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Prepetition Credit Agreement |

|

|

|

|

|

|

|

|

|

|

5,354.4 |

|

| 11.25% First Lien Notes |

|

|

2017 |

|

|

|

11.25 |

% |

|

|

2,095.0 |

|

| 8.50% First Lien Notes |

|

|

2020 |

|

|

|

8.50 |

% |

|

|

1,250.0 |

|

| 9.00% First Lien Notes |

|

|

2020 |

|

|

|

9.00 |

% |

|

|

3,000.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| First Lien Notes |

|

|

|

|

|

|

|

|

|

|

6,345.0 |

|

| 12.75% Second Lien Notes |

|

|

2018 |

|

|

|

12.75 |

% |

|

|

750.0 |

|

| 10.00% Second Lien Notes due 2018 |

|

|

2018 |

|

|

|

10.00 |

% |

|

|

3,680.5 |

|

| 10.00% Second Lien Notes due 2018 |

|

|

2018 |

|

|

|

10.00 |

% |

|

|

804.1 |

|

| 10.00% Second Lien Notes due 2015 |

|

|

2015 |

|

|

|

10.00 |

% |

|

|

3.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Second Lien Notes |

|

|

|

|

|

|

|

|

|

|

5,238.3 |

|

| 10.75% Senior Subsidiary-Guaranteed Notes |

|

|

2016 |

|

|

|

10.75 |

% |

|

|

478.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subsidiary-Guaranteed Notes |

|

|

|

|

|

|

|

|

|

|

478.6 |

|

| 6.50% Senior Unsecured Notes |

|

|

2016 |

|

|

|

6.50 |

% |

|

|

296.7 |

|

| 5.75% Senior Unsecured Notes |

|

|

2017 |

|

|

|

5.75 |

% |

|

|

233.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Senior Unsecured Notes |

|

|

|

|

|

|

|

|

|

|

530.0 |

|

| Capitalized Lease Obligations |

|

|

to 2017 |

|

|

|

Various |

|

|

|

15.4 |

|

| Special Improvement District Bonds |

|

|

2037 |

|

|

|

5.30 |

% |

|

|

46.9 |

|

| Other Unsecured Funded Debt |

|

|

2016–2021 |

|

|

|

0–6.00 |

% |

|

|

24.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other General Borrowings |

|

|

|

|

|

|

|

|

|

|

87.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Funded Debt |

|

|

|

|

|

|

|

|

|

$ |

18,033.3 |

|

The Debtors’ significant funded debt obligations are not sustainable. Between 2009 and the Petition Date,

the Debtors’ annual interest expenses have far exceeded their annual EBITDA; in 2014 alone, the Debtors generated approximately $800 million of EBITDA compared with more than $2.2 billion of interest expense. Put simply, although the

Debtors’ businesses remain operationally strong and cash-flow positive with higher levels of EBITDA in 2015, they simply cannot service a capital structure with approximately $18 billion of funded debt. This capital structure must be materially

deleveraged to optimize the value of the Debtors’ businesses going forward.

The Debtors also have another important asset around

which to reorganize: valuable Estate Claims. Specifically, certain of the prepetition transactions executed by Caesars purportedly to assist the Debtors in meeting interest obligations, extending debt maturities, and transferring debt and capital

expenditure obligations have been the subject of investigations by the Special Governance Committee and the Bankruptcy Court-appointed Examiner.

| 6 |

These figures do not include accrued and unpaid interest as of January 15, 2015. The total Allowed Claim

amounts can be found in Article V.A. |

3

As described further herein, both the Special Governance Committee and the Examiner have determined that the Debtors’ estates have valuable claims and causes of action against CEC and its non-Debtor affiliates related to certain of these transactions—important estate assets that must be maximized through litigation or settlement as part of any restructuring. In developing the Plan, the Debtors

have focused on maximizing the value of both the Debtors’ business and litigation assets, while also recognizing the complexity of reconciling those two objectives.

On the business side, the Plan contemplates the transformation of the Debtors’ business into a real estate investment trust (or REIT)

structure that offers tax and other advantages resulting in higher valuations for REITs than comparable non-REIT companies, allowing the Debtors to deliver additional value to their stakeholders. The Debtors believe, and no party other than the

Second Priority Noteholders Committee has disputed, that maximizing the benefits of the proposed REIT structure and optimizing the form of consideration distributed to creditors (i.e., greater amounts of cash and debt and equity with a higher

overall value) is best achieved through the credit support to be provided by “New CEC” (the new CEC entity created through CEC’s merger with CAC) under the Plan. Specifically, the Plan contemplates that New CEC will make substantial

contributions to the Debtors’ reorganization, including to guarantee OpCo’s monetary obligations under the Master Lease Agreements, which underpin the REIT’s ability to support the more than $6 billion of debt contemplated in the

Plan. In addition, New CEC will also provide a guarantee, if necessary, in respect of the OpCo debt, which will assist the Debtors in syndicating such debt and support any “take-back” debt that would be issued under the Plan if the

Debtors’ first lien creditors agree to waive the OpCo debt syndication requirement. New CEC Financial Projections can be found in Exhibit J.

With respect to the Estate Claims, in parallel with the development of the Plan, the Special Governance Committee commenced a comprehensive

investigation into the Estate Claims beginning in August 2014. As described further in Article IV.D herein, the SGC Investigation evolved over time as the Special Governance Committee and its advisors obtained more documents and information to

consider. In connection with the Debtors’ entry into the Prepetition RSA, the Special Governance Committee agreed, based on the preliminary findings of its investigation at that time and subject to the satisfactory conclusion of such

investigation after receiving all of the outstanding information it had requested, that the Estate Claims had significant value and that CEC’s contributions to the then-proposed plan of reorganization—valued at no less than

$1.5 billion at the time—were sufficient to settle such claims. As discussed further below, subsequent to entering into the Prepetition RSA, based on continued negotiations among CEC, the Special Governance Committee, and the

Debtors’ senior creditors, CEC agreed to make significant additional contributions while the Special Governance Committee continued its investigation, which were reflected in prior iterations of the Plan. The Plan contemplates contributions

from CEC and its affiliates that the Debtors estimate have a midpoint value of $4.0 billion, as calculated in accordance with the contribution analysis attached hereto as Exhibit C. The Special Governance Committee believes this amount

provides for a fair and reasonable settlement that is well within the ranges of values supportive of the releases contemplated by the Plan. As described in Article IV.F, certain creditors have asserted that the Special Governance Committee’s

investigation is not credible, but the Debtors strongly disagree.

As described further in Exhibit I, the Debtors, through

the Special Governance Committee and with the assistance of financial advisor and investment banker Millstein & Co., L.P. (“Millstein”) and AlixPartners, also evaluated alternative transaction structures, including

standalone reorganization structures that would allow for parallel litigation against CEC through the formation of a litigation trust or otherwise (including a standalone REIT unsupported by CEC’s contributions). In evaluating value-maximizing alternatives, the Debtors and their senior stakeholders also recognized that, given the existing enterprise structure, any plan that separates CEOC from the broader Caesars enterprise, or that

maintains the enterprise structure while CEOC prosecutes litigation claims against its affiliates, has business and implementation risk that are substantially greater than the risks inherent in the proposed Plan. A reorganization supported by the

Debtors’ existing parent, on the other hand, has several business benefits, including (i) minimizing the risk of triggering significant tax obligations that could arise in a deconsolidated scenario, (ii) both increasing the likelihood

and accelerating the timing of the Debtors obtaining regulatory approvals for their proposed restructuring transactions, (iii) ensuring the Debtors’ continued access to enterprise shared services and experienced gaming employees, and

(iv) maintaining the benefits of the Debtors’ important Total Rewards® loyalty program and inclusion in the broader Caesars property network, which drive enhanced operating and

financial performance. For all of these reasons, the Debtors determined that maximizing the value of their business assets can best be achieved by ensuring the continued support of CEC (and its affiliates)—who are also the primary targets of

the Estate Claims.7

| 7 |

Given the existing structural and operational affiliations among CEOC and CEC, as well as the need for CEC to compensate the Debtors on account of Estate Claims, the Debtors believe that CEC is the best candidate to

provide the necessary credit support for the value-maximizing REIT structure. Nevertheless, as discussed in Article I.F and Article IV.K below, the Debtors are conducting a marketing process to, among other

things, determine whether there is any other third party whose involvement could result in better recoveries to creditors, both in form and amount. |

4

Moreover, none of the extremely valuable CEC contributions to be made pursuant to the Plan will

be available to the Debtors in the near term in the absence of either (i) a global settlement resolving both Estate Claims and certain direct claims held by third parties, including claims related to CEC’s any purported guaranty of the

Debtors’ prepetition debt (the “Third-Party Claims”), or (ii) a release of the Estate Claims and the Third-Party Claims through the Plan. For obvious reasons, the cash and credit

support contemplated by the proposed Plan simply will not work if claims against the credit parties (i.e., CEC and CAC) are not released. And not surprisingly, CEC and its affiliates have conditioned their substantial financial and credit support

for any proposed plan on securing releases of such claims. Put simply, CEC and its affiliates will not voluntarily make a multi-billion dollar contribution to the Debtors’ restructuring efforts without obtaining these releases.

The Debtors determined (subject to the market test described below) that there is no value-maximizing

alternative to the proposed Plan, under which the Debtors will settle estate litigation claims through significant contributions to these estates, including important credit support for the REIT structure.

To effectuate the

Plan, the Debtors will, among other things convert their prepetition corporate structure into two companies—OpCo and PropCo. The primary features of the credit-enhanced REIT structure contemplated by the Plan are as follows:

| |

• |

|

PropCo, as a subsidiary of a REIT entity, will directly or indirectly own substantially all of the Debtors’ real property assets and related fixtures. Caesars Palace Las Vegas will be owned by “CPLV,” a

separate subsidiary of PropCo.9 |

| |

• |

|

OpCo will, other than with respect to certain properties and operations contributed to a taxable REIT subsidiary of the REIT entity, lease the real property and fixtures pursuant to two master lease agreements

(the “MLAs”), one with PropCo and one with CPLV, and will manage the Debtors’ properties and facilities on an ongoing basis. OpCo will continue to own substantially all operations, gaming licenses, personal property, and

other related interests. |

| |

• |

|

The reorganized Debtors will remain part of the overall Caesars enterprise, and New CEC will provide guarantees of OpCo’s payments under the two MLAs and of new OpCo debt issued in connection with the Plan.

|

| 8 |

The Plan is described more fully herein and this overview of the Plan is qualified in its entirety by reference to the Plan and the more detailed overview provided in this Disclosure Statement. |

| 9 |

CPLV will be a separate entity to facilitate third-party financing. |

5

A combination of new debt, preferred shares, and common shares issued by the REIT, PropCo, OpCo,

and the CPLV Entities,10 as applicable, as well as cash, convertible debt securities and direct equity issued by New CEC,11 as applicable, will

be used to provide distributions to creditors under the Plan. The proposed corporate and capital structure as of the Effective Date is depicted in the chart below, which summarizes the projected total leverage based on projected funded debt

obligations of OpCo, PropCo, and the CPLV Entities upon consummation of the Plan.12 Before taking into account the PropCo Equity Election, the Debtors estimate that the funded debt across each of

OpCo, PropCo, and the CPLV Entities will total approximately $8,170 million to $8,287 million. The following illustrative organizational chart summarizes the organizational structure of the reorganized entities, including their new capital

structure, on the Effective Date:13

To achieve the leverage necessary to support distributions under the Plan, the Plan is conditioned upon New

CEC making significant contributions to the Debtors’ reorganization. These contributions include direct contributions to the estate to settle claims and facilitate the credit-enhanced REIT structure, as

well as direct contributions to creditors to enhance recoveries. Specifically, on behalf of itself and its non-Debtor affiliates, the Plan contemplates New CEC making the following contributions:14

| 10 |

References in this executive summary to PropCo equity (both common and preferred) refer to equity that likely will be issued by the REIT as REIT stock, provided that in certain circumstances described in detail below

and in the Plan, such equity may instead be issued by PropCo itself as PropCo LP Interests. |

| 11 |

Specifically, creditors will receive preferred shares of CEOC that will be exchanged for shares of New CEC pursuant to a merger of CEOC into a newly-formed subsidiary of New CEC (the “CEOC Merger”).

|

| 12 |

The Plan contemplates that certain debt issued by OpCo and the CPLV Entities will be syndicated to third parties for cash, which cash will be distributed to fund creditor recoveries, and that PropCo will issue new debt

directly to the Debtors’ creditors on the terms agreed in the RSAs. To the extent that the Debtors are unable to syndicate the entirety of the new OpCo debt, and subject to waivers by the Requisite Consenting Bank Lenders and/or the Requisite

Consenting Noteholders, the Plan contemplates OpCo issuing new debt directly to the Debtors’ creditors, for which debt CEC will provide a guarantee. Similarly, to the extent that the Debtors are unable to syndicate the entirety of the new CPLV

debt, the Plan contemplates the CPLV Entities issuing new debt directly to the Debtors’ creditors in an amount required to make up the shortfall, subject to certain limitations. |

| 13 |

For illustrative purposes only, the following chart reflects pro forma ownership interests under the Spin Structure. The following chart does not reflect PropCo Common LP Interests or PropCo Preferred LP Interests that

may be issued to certain Holders of Claims to the extent such Holders would own more than 9.8% of the stock issued by the REIT, subject to certain waiver provisions as discussed in greater detail below. All dollar amounts are in millions.

|

| 14 |

Importantly, CEC will fund contributions under the Plan, in part, from access to cash that it will obtain through the proposed merger with CAC. Certain of the direct and indirect subsidiaries of CAC would also be

targets of certain of the Estate Claims. |

6

| |

• |

|

$406 million in direct cash contributions to fund Plan distributions, other restructuring transactions contemplated by the Plan, and general corporate purposes, and up to an additional $6.5 million to fund

distributions to certain classes of the Debtors’ unsecured creditors; |

| |

• |

|

Committing (with no associated fee) to purchase 100% of OpCo common equity and—if the REIT structure is accomplished through the “partnership contribution structure”—5% of PropCo common equity;

|

| |

• |

|

Call rights to PropCo to purchase the Harrah’s Laughlin, Harrah’s Atlantic City and Harrah’s New Orleans properties, which have been extended for five years; |

| |

• |

|

A guarantee of OpCo’s MLA payment obligations, which underpins the value of PropCo and its ability to service the debt it will carry; |

| |

• |

|

A guarantee of OpCo debt, if necessary, to reduce the syndication risk on such debt; |

| |

• |

|

$1 billion of convertible notes issued by New CEC; |

| |

• |

|

Preemptive rights to participate in the New CEC Capital Raise; |

| |

• |

|

Up to 53.1% of New CEC Common Equity (including New CEC Common Equity convertible through the New CEC convertible notes), which will be provided upon exchange of new CEOC preferred stock in connection with the CEOC

merger; and |

| |

• |

|

A waiver by CAC of its recoveries on approximately $293 million of Senior Unsecured Notes. |

In the aggregate, the Debtors, based on an analysis by Millstein more fully explained in Exhibit C, estimate the midpoint value

of these contributions at approximately $4.0 billion if Class F votes to reject the Plan and $4.3 billion if Class F votes to accept the Plan. Because some of CEC’s contributions to the Debtors under the Plan take the form of direct credit

support, such as the guarantee of OpCo’s operating lease obligations, the Plan is explicitly conditioned upon obtaining (i) a global settlement of all claims the Debtors may have against CEC or certain of its affiliates and

(ii) comprehensive releases for CEC and its affiliates for claims or causes of action that the Debtors’ creditors may have against CEC and its affiliates, including with respect to any obligations CEC may have related to guarantees of

CEOC’s debt. The Debtors believe that the value of the contributions is sufficient to support the releases included in the Plan, including the release of Estate and Third-Party Claims, and will be prepared to meet their burden on this issue at

confirmation.

The Plan also contains a number of additional provisions not highlighted in this executive summary. Please refer to Article

V hereof for a more detailed summary of the Plan.

As discussed more fully herein and in the Plan, the Plan generally

provides for the following recoveries to be shared pro rata among the holders of claims in the various classes:15

| 15 |

As discussed in detail below and in the Plan, creditor recoveries and the applicable allocation of Plan consideration are subject to, among other things, each voting Class’s acceptance of the Plan, various put,

call, and other election rights in the Plan as well as the syndication requirements and waivers built into the Plan. For illustrative purposes only, and solely for purposes of this Article I.D, the following descriptions and summaries of recoveries

and allocation of Plan consideration assume the following (unless expressly stated otherwise): (a) the Debtors successfully syndicate $2.0 billion of CPLV Market Debt and all of the OpCo debt to third parties for cash; (b) the First

Lien Bank Lenders do not make the CPLV Mezzanine Election, and (c) each Class votes to accept the Plan. Additionally, all recovery percentages value the various components of Plan consideration at Plan value and the amount of debt is shown

before taking the PropCo Equity Election into account. Importantly, certain of the securities being issued (particularly the equity securities) could trade at prices above or below Plan value. |

7

| |

• |

|

First Lien Bank Lenders: Approximately $3,193 million of cash, $1,961 million of first lien PropCo debt, $250 million of second lien PropCo debt, and 5% of New CEC Common Equity on a fully diluted

basis (subject to reduction to 4% of New CEC Common Equity if the Holders of Second Lien Notes Claims vote to accept the Plan); provided that if this class waives the Plan’s syndication requirement with respect to the OpCo debt, certain

cash recoveries could be replaced by OpCo “take back” debt on the terms specified in the Plan. |

| |

• |

|

First Lien Noteholders: Approximately $2,037 million of cash, $431 million of first lien PropCo debt, $1,425 million of second lien PropCo debt, preferred equity in PropCo (subject to certain put and call

rights), $100 million of CPLV Mezzanine Debt, 100% of PropCo Common Equity on a fully diluted basis, and 15.8% of New CEC Common Equity (subject to reduction to 12.5% of New CEC Common Equity if the Holders of Second Lien Notes Claims vote to

accept the Plan, provided that in that scenario such Holders will receive either Cash in the amount of $20,000,000 per month and/or OpCo Series A Preferred Stock, which shall be exchanged for New CEC Common Equity of a value equal to $20,000,000 per

month (at a price per share of New CEC Common Equity using an implied equity value for New CEC of $6.5 billion), in both instances commencing on May 1, 2017, and ending on the Effective Date, which amount shall be prorated for any partial

month); provided that if this class waives the Plan’s syndication requirement with respect to the OpCo debt, certain cash recoveries could be replaced by OpCo “take back” debt on the terms specified in the Plan.

|

| |

• |

|

Non-First Lien Claimants: The Plan contemplates that the following seven groups of Non-First Lien Claims will share recoveries from the same form of consideration: (i) the Second Lien Notes Claims;

(ii) the Subsidiary-Guaranteed Notes Claims; (iii) the Senior Unsecured Notes Claims; (iv) Undisputed Unsecured Claims at the non-BIT Debtors; (v) Disputed Unsecured Claims at the non-BIT

Debtors; (vi) Insurance Covered Unsecured Claims at the non-BIT Debtors; and (vii) General Unsecured Claims at the BIT Debtors.16 These claims

have been separately classified to reflect distinct creditor rights, priorities, or proposed treatment and will thus receive varying amounts of the following (collectively, the “Non-First Lien Recovery Consideration”):

|

| |

• |

|

each applicable class’s share, as set forth in the Plan, of $1.0 billion of New CEC Convertible Notes, which shall be convertible pursuant to the terms of the New CEC Convertible Notes Indenture in the

aggregate for up to 12.2% of New CEC Common Equity on a fully diluted basis; and |

| |

• |

|

OpCo Series A Preferred Stock, which shall be exchanged for up to 24.4% of New CEC Common Equity on a fully diluted basis (after accounting for dilution by the New CEC Convertible Notes but before any New CEC Capital

Raise and assuming all Classes vote yes) pursuant to the CEOC Merger. |

| 16 |

The “BIT Debtors” are those Debtors at which, based on the Liquidation Analysis, the Debtors have

determined that Holders of General Unsecured Claims are entitled to higher recoveries than Holders of General Unsecured Claims at other Debtors. The BIT Debtors include (a) the Par Recovery Debtors, (b) Winnick Holdings, LLC,

(c) Caesars Riverboat Casino, LLC, and (d) Chester Downs Management Company, LLC. |

8

Generally, the Non-First Lien Claimants will share a Pro Rata portion of the Non-First Lien

Recovery Consideration. However, Holders of Undisputed Unsecured Claims and Disputed Unsecured Claims, if they vote as a Class to accept the Plan, will also receive Cash from the Unsecured Creditor Cash Pool (which will be comprised of up to

approximately $6.2 million contributed by New CEC) on the terms set forth in the Plan. Similarly, Holders of Insurance Covered Unsecured Claims, after accounting for insurance, will also receive Cash from the Unsecured Insurance Creditor Cash

Pool (which will be comprised of up to approximately $300,000 contributed by New CEC) on the terms set forth in the Plan. In addition, with respect to the Par Recovery Unsecured Claims, Winnick Unsecured Claims, Caesars Riverboat Casino

Unsecured Claims, and Chester Downs Management Unsecured Claims, Holders of such Claims shall receive Non-First Lien Recovery Consideration in an amount equal to 100%, 67%, 71%, and 87%, respectively, of such Holders’ Claim.17 And Subsidiary-Guaranteed Notes Claims will receive Non-First Lien Recovery Consideration in an amount equal to

approximately 85% (midpoint) of such Holders’ Claims. The Convenience Unsecured Claims will receive recoveries from the Convenience Cash Pool, which consists of $12.5 million, and will not receive any recoveries from the Non-First Lien Recovery

Consideration. Additionally, the Non-Obligor Unsecured Claims will receive payment in full in cash due to the fact that the Non Obligor Debtors are not liable for any of the Debtors’ funded debt

obligations.

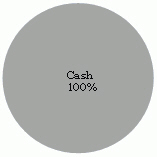

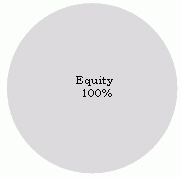

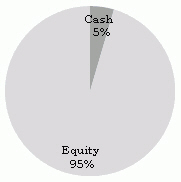

The following pie charts illustrate the approximate allocation of the various forms of Plan consideration (cash, debt, and

equity) that comprise the recovery of each class of funded debt and unsecured claims:

|

|

|

| Class A – 100% Recovery |

|

Class B – 100% Recovery |

|

|

|

| 17 |

As described more fully in Article VIII.B.2 and Exhibit D, the Debtors have carefully reviewed the result of their Liquidation Analysis and have determined that certain of the Debtor entities, including

the Non-Obligor Debtors, the Par Recovery Debtors, Winnick Holdings, LLC, Caesars Riverboat Casino, LLC, and Chester Downs Management Company, LLC are likely to achieve greater recoveries in a liquidation

scenario than those otherwise available to Holders of Non-First Lien Claims under the Plan. Recoveries for these Debtors have been adjusted accordingly under the Plan. |

9

|

|

|

| Class C – 100% Recovery |

|

Class D – Prepetition Credit Agreement Claims

18 Class F Rejects – 113% - 117% Recovery

Class F Accepts – 112% - 115% Recovery |

|

|

|

|

|

|

|

| Class E – Secured First Lien Notes Claims1

Class F Rejects – 96% - 128% Recovery

Class F Accepts – 94% - 124% Recovery |

|

Class F – Second Lien Notes Claims

Accept: 29% - 48% Recovery

Reject: 22% - 34% Recovery |

|

|

|

|

|

|

|

| Class G – Subsidiary-Guaranteed Notes Claims

61%-105% Recovery |

|

Class H – Senior Unsecured Notes Claims

Accept: 33% - 56% Recovery

Reject: 22% - 33% Recovery |

|

|

|

|

|

| 18 |

Pie chart reflects consideration split in scenario where Class F rejects the Plan |

10

|

|

|

| Class I – Undisputed General Unsecured Claims

Accept: 34% - 54% Recovery

Reject: 22% - 33% Recovery |

|

Class J – Disputed General Unsecured Claims

34% - 54% Recovery |

|

|

|

|

|

|

|

| Class K – Convenience Class Claims

46% Recovery |

|

Class L – Insurance Covered Unsecured Claims

34% - 54% Recovery |

|

|

|

|

|

|

| Classes M-P – Unsecured Claims against BIT Debtors

67% - 100% Recovery |

|

|

Importantly, the Plan is a joint plan of reorganization for all Debtors in the Chapter 11 Cases, and the Plan

takes into account the different rights and claim priorities at each Debtor in allocating recoveries as well as the various intercreditor arrangements between the Debtors’ various funded debt stakeholders. The recoveries described above are

improved recoveries based on each respective Class voting to accept the Plan. Recoveries under the Plan may be less for Holders of Claims in a particular Class if that Class does not vote to accept the Plan.

11

For a further description of the classification, exact proposed treatment, distributions, voting

rights, and projected recoveries of Claims against and Interest in the Debtors, as well as the timing and calculation of amounts to be distributed under the Plan, the sources and uses of such distributions, and the process for handling Disputed

Claims, please see Article V.D hereof and the Plan.

Although, subject to the marketing process described below, the

Debtors believe that the settlement and restructuring proposed in the Plan is the best alternative for maximizing stakeholder recoveries, the Plan is subject to a number of conditions and there are certain material risks to the Debtors’ ability

to implement the Plan and consummate near-term creditor distributions, including the following:

| |

• |

|

Syndication Requirement: The Plan contains a material financing contingency in that the Debtors have agreed to syndicate OpCo and CPLV debt to third parties so that at least $3,335 million in Cash proceeds

are distributed to first lien creditors. Although requisite holders of the Debtors’ first lien debt may waive the syndication requirements with respect to certain debt and agree to accept “take back” paper on the terms specified in

the Plan, there are no guarantees that the Debtors will be able to satisfy their syndication obligations or that creditors will waive the syndication requirement. |

| |

• |

|

CEC Merger with Caesars Acquisition Company: CEC has agreed to provide substantial contributions to the Debtors’ restructuring through direct contributions to the estate, consideration in the form of cash

and securities directly to the Debtors’ creditors, and important ongoing credit support for the REIT structure. On December 22, 2014, CEC entered into a merger agreement with CAC, which merger will provide CEC with access to cash necessary

to fund its obligations to the Debtors as contemplated by the Plan. Moreover, the combined value of the merged CEC-CAC underlies the value of the CEC securities to be issued in connection with the Plan. This

merger of two public companies, however, remains subject to ongoing negotiation. In particular, the Debtors expect that independent committees of the boards of directors of CEC and CAC will review the terms of the CEC-CAC merger to ensure each

receives maximum residual value for their respective public shareholders. Put simply, the amount of New CEC Common Equity given to CEOC creditors could impact the viability of the merger. The Debtors are focused on ensuring that the Plan obtains the

greatest possible consideration from both CEC and CAC on account of the Estate and Third-Party Claims while maintaining the viability of the merger to ensure such contributions. If CEC is unable to complete

this merger for any reason, CEC will not be able to meet its funding obligations under the Plan and the feasibility of the Plan would be threatened. |

| |

• |

|

Third-Party Releases: To facilitate the substantial contributions that CEC is making in support of the Debtors’ reorganization, the Plan is predicated on, and

dependent upon, the settlement of all of the Debtors’ claims and causes of action against, among others, the CEC Released Parties,19 as well as releases of certain claims third parties may

have against, among others, the CEC Released Parties. Such releases include, among other things, any claims and causes of action related to CEC’s purported guarantees of the Debtors’ funded debt obligations, which are subject to the

pending Parent Guarantee Litigation.20 Various third parties, including certain of the parties to the Parent Guarantee Litigation, have informed the Debtors that as of the date of this Disclosure

Statement, they object to the release of their claims against CEC on account of CEC’s purported guarantees. If CEC’s guarantee obligations are reinstated in the Parent Guarantee Litigation, there is a material risk that CEC may be

unwilling or unable to make the contributions contemplated by the Plan. The Parent Guarantee Litigation also poses a material risk to the Debtors’ ability to obtain the Third-Party Releases proposed in

the Plan. As described in Article VIII.B.1, below, the Second Priority Noteholders Committee believes that the |

| 19 |

The CEC Released Parties include, among others, certain non-Debtors, the Sponsors, and associated individuals. |

| 20 |

As discussed more fully in Article IV.S.1 herein, on June 15, 2016, the Bankruptcy Court granted an

injunction staying the commencement of trials in certain of the Parent Guarantee Litigation until August 29, 2016. |

12

| |

forced, involuntary release of the guarantee claims is illegal and contrary to establish law because, among other things, Second Priority Noteholders are not being compensated in any way for the

individual rights and claims they have against CEC that would be released and eliminated under the Plan. The Ad Hoc Committee of holders of 12.75% Second Lien Notes agrees with the position of the Second Priority Noteholders Committee. Similarly,

Mr. Danner joins in these contentions as it applies to the holders of 6.50% Senior Unsecured Notes and the Ad Hoc Group of 5.75% and 6.50% Notes likewise joins these contentions for the holders of Senior Unsecured Notes.

|

| |

• |

|

Lack of First Lien Noteholder Support: The members of the Ad Hoc Committee of First Lien Noteholders represent to hold or otherwise control approximately 54 percent of the First Lien Notes. As a result, if

the First Lien Noteholders vote to reject the Plan, the Plan can only be confirmed if, among other things, it satisfies the cramdown requirements of section 1129(b) of the Bankruptcy Code with respect to the holders of Class E Secured First Lien

Notes Claims. Because, among other things, the Plan contemplates that a portion of the consideration to be provided to the Holders of Secured First Lien Notes Claims will take the form of equity securities, it will be difficult for the Debtors to

satisfy the requirements of section 1129(b) with respect to Class E because the Debtors cannot force secured creditors to accept an equity recovery on account of their collateral without their consent. Bankruptcy Code § 1129(b)(2)(A).

In addition, if Holders of Secured First Lien Notes Claims vote to reject the Plan, the Debtors may not be able to deliver the guaranty release and the waiver of the intercreditor turnover rights contemplated in the Plan. See Article V.F.9.

Accordingly, if the members of the Ad Hoc Committee of First Lien Noteholders vote to reject the Plan, the Debtors may not be able to confirm the Plan and deliver the Class treatment otherwise proposed therein. The Debtors reserve all rights with

respect to this confirmation issue. |

Although these significant contingencies reflect the fragility of the proposed

resolution for these complex cases, the Debtors believe that the Plan provides the Debtors and their creditors with the best option to maximize recoveries and enable the Debtors to exit chapter 11 and encourage you to vote to accept the Plan.

The Second Priority Noteholders Committee has requested that the Debtors include the following as an additional risk factor with regard

to the Plan:

CEC is under no obligation to make the contribution on which the Plan is premised. It can walk away from its commitment at

any time, without consequence or repercussion. CEC or its affiliate, CAC, also can call off their merger, which is a precondition to CEC’s payments under the Plan, at any time. As a result, the Debtors’ ability to consummate the Plan

depends, in part, on entities and individuals whom the Examiner found to have breached their fiduciary duties (and aided and abetted others in their breaches) to the Debtors.

The Debtors disagree with the Second Priority Noteholders Committee’s assessment of CEC’s support of the Plan. CEC’s support of

the Plan is documented in several places, in particular the recent restructuring support, settlement, and contribution agreement (the “CEC RSA”) described below in Article IV.J.4. The CEC RSA may be terminated by the parties thereto

under certain circumstances.

Although the Debtors believe that the Plan maximizes recoveries for

the Debtors’ creditors, CEC will own all of the OpCo equity distributed under the Plan. Accordingly, the Plan is likely to be considered a “new value” plan of reorganization under applicable bankruptcy law. Thus, to market test

CEC’s investment as required by applicable law—and to otherwise fulfill their obligations as estate fiduciaries by ensuring that there is no better alternative to the existing Plan—the Debtors commenced a process to market test the

Plan in November 2015. Through the marketing process, the Debtors, through Millstein, solicited proposals for a potential transaction to acquire the Debtors and their controlled non-Debtor subsidiaries. To date, the Debtors have not received any

bids for the entire company (either CEOC’s equity or a sale of all assets). The Debtors have received offers for certain assets; however, none of these offers to date have offered greater value and increased recoveries than those

13

recoveries included in the Plan. This marketing process remains ongoing and the Debtors will continue to accept bids from third parties to ensure their ability to maximize value for all

stakeholders. To the extent the marketing process results in a higher or otherwise better offer for the Debtors’ businesses, the Debtors reserve the right to amend the Plan in accordance with such offer. The Second Priority Noteholders

Committee’s position on the marketing process is described below in Article IV.K.4.

The Debtors’ Special Governance Committee has approved the

Plan—including the settlements incorporated therein—and believe the Plan is in the best interests of the Debtors’ Estates. As such, the Debtors recommend that all Holders entitled to vote accept the Plan by returning

their Ballots and Master Ballots, as applicable, so that Prime Clerk LLC, the Debtors’ notice and claims agent (“Prime Clerk”), actually receives such Ballots or Master Ballots by the Voting

Deadline. Assuming the Plan receives the requisite acceptances, the Debtors will seek the Bankruptcy Court’s approval of the Plan at the Confirmation Hearing.

ARTICLE II.

BACKGROUND

TO THE CHAPTER 11 CASES.