Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

| Check the appropriate box: | ||||

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |||

| CAESARS ENTERTAINMENT CORPORATION | ||||

| (Name of registrant as specified in its charter) | ||||

| (Name of person(s) filing proxy statement, if other than the registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

|

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

|

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

|

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

|

| ||||

| (5) | Total fee paid: | |||

|

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

|

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

|

| ||||

| (3) | Filing Party:

| |||

|

| ||||

| (4) | Date Filed:

| |||

|

| ||||

Table of Contents

One Caesars Palace Drive

Las Vegas, Nevada 89109

March 18, 2013

Dear Fellow Stockholders:

We cordially invite you to attend our 2013 Annual Meeting of Stockholders, which will be held on Wednesday, April 24, 2013, at 12:00 p.m. in the Palermo Room at Caesars Palace, One Caesars Palace Drive, Las Vegas, Nevada.

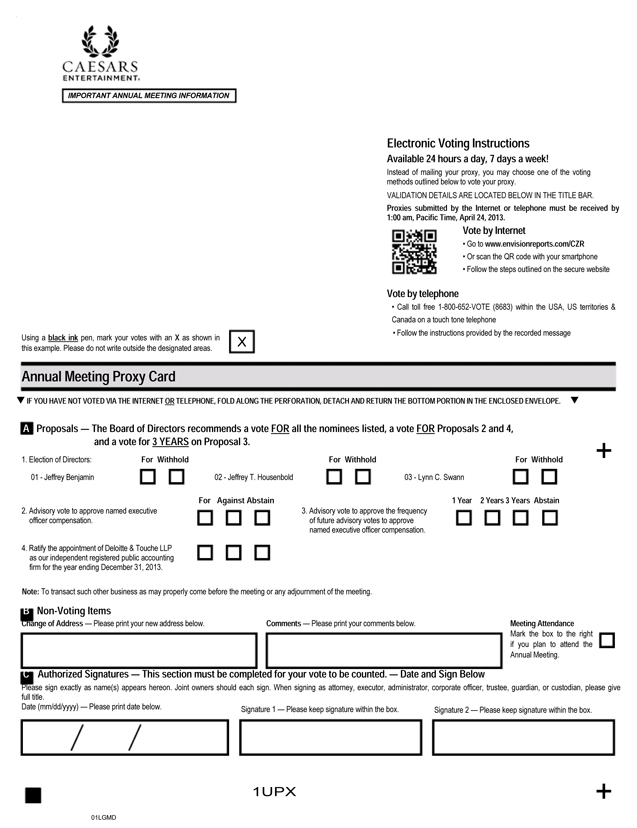

At the meeting, we will elect three directors, approve in an advisory vote the compensation of our named executive officers vote (the “say on pay”), approve in an advisory vote the frequency of say-on-pay votes, and ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2013.

Whether or not you expect to attend the meeting, please promptly complete, sign, date and return the enclosed proxy card, or grant your proxy electronically over the Internet or by telephone, so that your shares will be represented at the meeting. If you do attend, you may vote in person even if you have sent in your proxy card or voted electronically or by telephone.

We look forward to seeing you at the meeting.

| Sincerely, |

|

| Gary W. Loveman Chairman of the Board, Chief Executive Officer and President |

Table of Contents

One Caesars Palace Drive

Las Vegas, Nevada 89109

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held April 24, 2013

To the Stockholders of Caesars Entertainment Corporation:

Caesars Entertainment Corporation will hold its annual meeting of stockholders in the Palermo Room at Caesars Palace, One Caesars Palace Drive, Las Vegas, Nevada 89109 on Wednesday, April 24, 2013, at 12:00 p.m. Pacific Time, for the following purposes:

| 1. | To elect three nominees to serve as Class I directors of the Company, as recommended by the Nominating and Corporate Governance Committee of the Board of Directors, for three-year terms, with each director to serve until the 2016 annual meeting of the stockholders of the Company or until such director’s respective successor is duly elected and qualified; |

| 2. | To approve, in an advisory (non-binding) vote, the compensation of the Company’s named executive officers as described in the accompanying proxy statement (“say-on-pay”); |

| 3. | To conduct an advisory (non-binding) vote regarding the frequency of the say-on-pay votes; |

| 4. | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2013; and |

| 5. | To transact such other business as may properly come before the meeting or any adjournment of the meeting. |

Only stockholders that owned Caesars Entertainment Corporation common stock at the close of business on February 25, 2013 are entitled to notice of and may vote at this meeting or any adjournment of the meeting. A list of Caesars Entertainment Corporation stockholders of record will be available at the company’s corporate headquarters located at One Caesars Palace Drive, Las Vegas, Nevada 89109, during ordinary business hours, for 10 days prior to the annual meeting.

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, TO ENSURE THE PRESENCE OF A QUORUM, PLEASE VOTE OVER THE INTERNET OR BY TELEPHONE AS INSTRUCTED IN THESE MATERIALS OR COMPLETE, DATE, AND SIGN A PROXY CARD AS PROMPTLY AS POSSIBLE. IF YOU ATTEND THE MEETING AND WISH TO VOTE YOUR SHARES PERSONALLY, YOU MAY DO SO AT ANY TIME BEFORE THE PROXY IS EXERCISED.

By Order of the Board of Directors,

Michael D. Cohen

Senior Vice President, Deputy General

Counsel and Corporate Secretary

Las Vegas, Nevada

March 18, 2013

Table of Contents

One Caesars Palace Drive

Las Vegas, Nevada 89109

PROXY STATEMENT

Table of Contents

One Caesars Palace Drive

Las Vegas, Nevada 89109

Proxy Statement for Annual Meeting of Stockholders

to be held on April 24, 2013

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON WEDNESDAY, APRIL 24, 2013

The Company’s Proxy Statement and 2012 Annual Report to Stockholders are available on our website at www. caesars.com. Additionally, and in accordance with Securities and Exchange Commission rules, you may access our proxy materials, including the Company’s Proxy Statement and 2012 Annual Report to Stockholders at https://www.edocumentview.com/CZR.

Table of Contents

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 24, 2013

COMMONLY ASKED QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

| Q: | WHEN WAS THIS PROXY STATEMENT FIRST MAILED TO STOCKHOLDERS? |

| A: | This proxy statement was first mailed to stockholders of Caesars Entertainment Corporation (“Caesars”, “we” or the “Company”) on or about March 19, 2013. Our 2012 Annual Report to Stockholders is being mailed with this proxy statement. The annual report is not part of the proxy solicitation materials. |

| Q: | WHAT IS THE PURPOSE OF THE ANNUAL MEETING AND WHAT AM I VOTING ON? |

| A: | At the annual meeting you will be voting on four proposals: |

| 1. | The election of three directors to serve as Class I directors for three-year terms expiring in fiscal 2016. This year’s board nominees are: |

| • | Jeffrey Benjamin |

| • | Jeffrey T. Housenbold |

| • | Lynn C. Swann |

| 2. | An advisory say-on-pay resolution to approve our executive compensation. |

| 3. | An advisory proposal regarding the frequency of future say-on-pay votes. |

| 4. | A proposal to ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ended December 31, 2013. |

| Q: | WHAT ARE THE BOARD’S VOTING RECOMMENDATIONS? |

| A: | The board of directors is soliciting this proxy and recommends the following votes: |

| 1. | FOR each of the director nominees. |

| 2. | FOR the advisory say-on-pay resolution to approve our executive compensation. |

| 3. | THREE YEARS for the advisory vote on the frequency of future say-on-pay votes. |

| 4. | FOR the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ended December 31, 2013. |

| Q: | WHO MAY ATTEND THE ANNUAL MEETING? |

| A: | Stockholders of record as of the close of business on February 25, 2013, which is the “Record Date,” or their duly appointed proxies, may attend the meeting. “Street name” holders (those whose shares are held through a broker or other nominee) should bring a copy of a brokerage statement reflecting their ownership of our common stock as of the record date. Space limitations may make it necessary to limit attendance to stockholders and valid picture identification may be required. Cameras, recording devices, and other electronic devices are not permitted at the meeting. Registration will begin at 11:30 a.m., local time and the annual meeting will commence at 12:00 p.m. local time, in the Palermo Room at Caesars Palace, One Caesars Palace Drive, Las Vegas, Nevada 89109. |

| Q: | WHO IS ENTITLED TO VOTE AT THE ANNUAL MEETING? |

| A: | Only stockholders of record as of the close of business on the Record Date are entitled to receive notice of and participate in the annual meeting. Each outstanding share of common stock is entitled to one vote on each matter presented. As of the Record Date, Caesars had 125,362,197 shares of common stock |

1

Table of Contents

| outstanding. Any stockholder entitled to vote may vote either in person or by duly authorized proxy. Cumulative voting is not permitted with respect to the election of directors or any other matter to be considered at the annual meeting. |

| Q: | WHO IS SOLICITING MY VOTE? |

| A: | The Company’s Board of Directors is sending you and making available this proxy statement in connection with the solicitation of proxies for use at the annual meeting. The Company pays the cost of soliciting proxies. Proxies may be solicited in person or by telephone, facsimile, electronic mail, or other electronic medium by certain of our directors, officers, and employees, without additional compensation. Forms of proxies and proxy materials may also be distributed through brokers, custodians, and other like parties to the beneficial owners of shares of our common stock, in which case we will reimburse these parties for their reasonable out-of-pocket expenses. |

| Q: | WHAT IS THE VOTE REQUIRED TO ELECT DIRECTORS? |

| A: | Directors are elected by a plurality of the votes cast in person or by proxy at the annual meeting and entitled to vote on the election of directors. “Plurality” means that the nominees receiving the greatest number of affirmative votes will be elected as directors, up to the number of directors to be chosen at the meeting. Any votes attempted to be cast “against” a candidate are not given legal effect and are not counted as votes cast in the election of directors. Therefore, any shares that are not voted, whether by withheld authority, broker non-vote or otherwise, have no effect in the election of directors except to the extent that the failure to vote for any individual results in another individual receiving a relatively larger number of votes. |

| Q: | WHAT IS THE VOTE REQUIRED TO APPROVE THE OTHER PROPOSALS? |

| A: | Advisory Say-On-Pay Resolution. The advisory say-on-pay resolution to approve our executive compensation must receive the affirmative vote of a majority of the votes cast by stockholders present in person or by proxy at the annual meeting and entitled to vote at the annual meeting. Because your vote on this proposal is advisory, it will not be binding on the Human Resources Committee (the “HRC”), the Board of Directors or the Company. However, the HRC and the Board of Directors will review the voting results and take them into consideration when making future decisions regarding executive compensation. |

Frequency of Say-On-Pay Votes. The frequency of the advisory vote on the frequency of say-on-pay votes (every one year, every two years, or every three years) receiving the affirmative vote of a majority of the votes cast by stockholders present in person or by proxy at the annual meeting and entitled to vote at the annual meeting will be the frequency that stockholders approve. In the event that no option receives a majority of the votes cast, we will consider the option that receives the most votes to be the option selected by our stockholders. Because your vote on this proposal is advisory, it will not be binding on the Company, the Board of Directors, or the HRC. Although non-binding, the Board will review and consider the voting results when making future decisions regarding the frequency of the advisory vote on executive compensation.

Ratification of Deloitte & Touche LLP. The ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ended December 31, 2013 must receive the affirmative vote of a majority of the votes cast by stockholders present in person or by proxy at the annual meeting and entitled to vote at the annual meeting.

| Q: | WILL THERE BE OTHER MATTERS TO VOTE ON AT THIS ANNUAL MEETING? |

| A: | We are not aware of any other matters that you will be asked to vote on at the annual meeting. Other matters may be voted on if they are properly brought before the annual meeting in accordance with our by-laws. If other matters are properly brought before the annual meeting, then the named proxies will vote the proxies they hold in their discretion on such matters. |

2

Table of Contents

For matters to be properly brought before the annual meeting, we must have received written notice, together with specified information, by January 15, 2013. We did not receive notice of any matters by the deadline for this year’s annual meeting.

| Q: | WHAT CONSTITUTES A QUORUM? |

| A: | The presence, in person or by proxy, of the holders of record of shares of our capital stock entitling the holders thereof to cast a majority of the votes entitled to be cast by the holders of shares of capital stock entitled to vote at the annual meeting shall constitute a quorum. There must be a quorum for business to be conducted at the meeting. Failure of a quorum to be represented at the annual meeting will necessitate an adjournment or postponement of the meeting and will subject the Company to additional expense. Votes withheld from any nominee for director, abstentions, and broker non-votes are counted as present or represented for purposes of determining the presence or absence of a quorum. |

| Q: | WHAT IF I ABSTAIN FROM VOTING? |

| A: | If you attend the meeting or send in your signed proxy card, you will still be counted for purposes of determining whether a quorum exists. If you abstain from voting on Proposal 1, 2, 3 or 4, your abstention will have no effect on the outcome of the vote on any of the proposals. |

| Q: | WILL MY SHARES BE VOTED IF I DO NOT SIGN AND RETURN MY PROXY CARD OR VOTE BY TELEPHONE OR OVER THE INTERNET? |

| A: | If you are a registered stockholder and you do not sign and return your proxy card or vote by telephone or over the Internet, your shares will not be voted at the annual meeting. Questions concerning stock certificates and registered stockholders may be directed to Computershare Trust Company, N.A., 250 Royall Street, Canton, MA 02021 or by telephone at 800-942-4282. If your shares are held in street name and you do not issue instructions to your broker, your broker may vote shares at its discretion on routine matters, but may not vote your shares on non-routine matters. Under applicable stock market rules, Proposal 4 relating to the ratification of the appointment of the independent registered public accounting firm is deemed to be a routine matter and brokers and nominees may exercise their voting discretion without receiving instructions from the beneficial owners of the shares. Proposals 1, 2 and 3 are non-routine matters and, therefore, may only be voted in accordance with instructions received from the beneficial owners of the shares. |

| Q: | WHAT IS A “BROKER NON-VOTE”? |

| A: | Under the rules, brokers and nominees may exercise their voting discretion without receiving instructions from the beneficial owner of the shares on proposals that are deemed to be routine matters. If a proposal is a non-routine matter, a broker or nominee may not vote the shares on the proposal without receiving instructions from the beneficial owner of the shares. If a broker turns in a proxy card expressly stating that the broker is not voting on a non-routine matter, such action is referred to as a “broker non-vote.” |

| Q: | WHAT IS THE EFFECT OF A BROKER NON-VOTE? |

| A: | Broker non-votes will be counted for purposes of determining the presence of a quorum but will not be counted for purposes of determining the outcome on any proposal other than Proposal 4. |

| Q: | HOW DO I VOTE IF MY SHARES ARE REGISTERED DIRECTLY IN MY NAME? |

| A: | We offer four methods for you to vote your shares at the annual meeting. While we offer four methods, we encourage you to vote through the Internet or by telephone, as they are the most cost-effective methods. We also recommend that you vote as soon as possible, even if you are planning to attend the annual meeting, so that the vote count will not be delayed. Both the Internet and the telephone provide |

3

Table of Contents

| convenient, cost-effective alternatives to returning your proxy card by mail. There is no charge to vote your shares via the Internet, though you may incur costs associated with electronic access, such as usage charges from Internet access providers. If you choose to vote your shares through the Internet or by telephone, there is no need for you to mail your proxy card. |

You may (i) vote in person at the annual meeting or (ii) authorize the persons named as proxies on the enclosed proxy card, Gary W. Loveman, Timothy R. Donovan and Michael D. Cohen, to vote your shares by returning the enclosed proxy card by mail, through the Internet or by telephone.

| • | By internet: Go to www.envisionreports.com/CZR. Have your proxy card available when you access the website. You will need the control number from your proxy card to vote. |

| • | By telephone: Call 800-652-8683 toll-free (in the United States, U.S. territories and Canada), on a touch-tone telephone. Have your proxy card available when you call. You will need the control number from your proxy card to vote. |

| • | By mail: Complete, sign and date the proxy card, and return it in the postage paid envelope provided with the proxy material. |

| Q: | HOW DO I VOTE MY SHARES IF THEY ARE HELD IN THE NAME OF MY BROKER (STREET NAME)? |

| A: | If your shares are held in street name, you will receive a form from your broker or nominee seeking instruction as to how your shares should be voted. You should contact your broker or other nominee with questions about how to provide or revoke your instructions. |

| Q: | WHO WILL COUNT THE VOTE? |

| A: | Computershare Trust Company, N.A., our transfer agent, will use an automated system to tabulate the votes. Its representative(s) will also serve as the inspector(s) of election. |

| Q: | CAN I CHANGE MY VOTE AFTER I RETURN OR SUBMIT MY PROXY? |

| A: | Yes. Even after you have submitted your proxy, you can revoke your proxy or change your vote at any time before the proxy is exercised by appointing a new proxy or by providing written notice to the Corporate Secretary or acting secretary of the meeting and by voting in person at the meeting. Presence at the annual meeting of a stockholder who has appointed a proxy does not in itself revoke a proxy. |

| Q: | MAY I VOTE AT THE ANNUAL MEETING? |

| A: | If you complete a proxy card, or vote through the Internet or by telephone, then you may still vote in person at the annual meeting. To vote at the meeting, please give written notice that you would like to revoke your original proxy to the Corporate Secretary or acting secretary of the meeting. |

If a broker, bank or other nominee holds your shares and you wish to vote in person at the annual meeting you must obtain a proxy issued in your name from the broker, bank or other nominee; otherwise you will not be permitted to vote in person at the annual meeting.

| Q: | WHERE CAN I FIND THE VOTING RESULTS OF THE ANNUAL MEETING? |

| A: | We intend to announce preliminary voting results at the annual meeting and publish final results in a Current Report on Form 8-K that will be filed with the SEC following the annual meeting. All reports we file with the SEC are available when filed. Please see the question “Where to Find Additional Information” below. |

4

Table of Contents

| Q: | WHEN ARE STOCKHOLDER PROPOSALS AND STOCKHOLDER NOMINATIONS DUE FOR THE 2014 ANNUAL MEETING? |

| A: | Under Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Corporate Secretary must receive a stockholder proposal no later than November 18, 2013 in order for the proposal to be considered for inclusion in our proxy materials for the 2014 annual meeting. To otherwise bring a proposal or nomination before the 2014 annual meeting, you must comply with our by-laws. Currently, our by-laws require written notice to the Corporate Secretary between December 25, 2013 and January 24, 2014. The purpose of this requirement is to assure adequate notice of, and information regarding, any such matter as to which stockholder action may be sought. If we receive your notice before December 25, 2013 or after January 24, 2014, then your proposal or nomination will be untimely. In addition, your proposal or nomination must comply with the procedural provisions of our by-laws. If you do not comply with these procedural provisions, your proposal or nomination can be excluded. Should the board nevertheless choose to present your proposal, the named proxies will be able to vote on the proposal using their best judgment. |

| Q: | HOW MANY COPIES SHOULD I RECEIVE IF I SHARE AN ADDRESS WITH ANOTHER STOCKHOLDER? |

| A: | The SEC has adopted rules that permit companies and intermediaries, such as brokers, to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, commonly referred to as “householding,” potentially provides extra convenience for stockholders and cost savings for companies. The Company and some brokers may be householding our proxy materials by delivering a single proxy statement and annual report to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker or us that they or we will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If any time you no longer wish to participate in householding and would prefer to receive a separate proxy statement and annual report, or if you are receiving multiple copies of the proxy statement and annual report and wish to receive only one, please notify your broker if your shares are held in a brokerage account or us if you are a stockholder of record. You can notify us by sending a written request to our Corporate Secretary at Caesars Entertainment Corporation, One Caesars Palace Drive, Las Vegas, Nevada 89109, or by calling the Corporate Secretary at (702) 407-6000. In addition, we will promptly deliver, upon written or oral request to the address or telephone number above, a separate copy of the annual report and proxy statement to a stockholder at a shared address to which a single copy of the documents was delivered. |

| Q: | HOW DOES CAESARS RECENT INITIAL PUBLIC OFFERING AFFECT THIS PROXY STATEMENT? |

| A: | Caesars completed its initial public offering (“IPO”) on February 8, 2012 and its common stock began trading on the NASDAQ Global Select Market (“NASDAQ”) on that same day. As a result of the IPO, Caesars is holding its first annual meeting of stockholders as a public company. This is therefore the first proxy statement that we are sending to our stockholders for an annual meeting. To the extent that this proxy statement describes actions or information prior to February 8, 2012, they occurred prior to our becoming a public company, and therefore at a time when various SEC and NASDAQ rules did not yet apply to us. |

5

Table of Contents

On January 28, 2008, Caesars was acquired by affiliates of Apollo Global Management, LLC (together with such affiliates, “Apollo”) and affiliates of TPG Capital, LP (together with such affiliates, “TPG” and, together with Apollo, the “Sponsors”) in an all-cash transaction, hereinafter referred to as the “Acquisition,” valued at approximately $30.7 billion, including the assumption of $12.4 billion of debt, and the incurrence of approximately $1.0 billion of acquisition costs. Subsequent to the Acquisition, our stock was no longer publicly traded.

In February 2012, the Company offered 1.8 million shares of its common stock in a public offering (the “Public Offering”) at $9.00 per share. The Company received net proceeds of approximately $15.2 million after taking into account expenses and underwriting commissions and giving effect to the exercise of the underwriters’ overallotment option. Under this option, the Company granted to the underwriters, and the underwriters subsequently exercised, a 30-day option to purchase 271,697 additional shares of its common stock at the initial price less underwriting discounts and commissions. The Company used the net proceeds from the Public Offering for general corporate purposes. As the result of the Public Offering, our common stock trades on NASDAQ under the symbol “CZR.” In connection with the Public Offering, the Company effected a 1.742-for-one split of its common stock. Unless otherwise stated, all applicable share and per-share data presented herein have been retroactively adjusted to give effect to this stock split.

6

Table of Contents

Director Independence. Hamlet Holdings LLC (“Hamlet Holdings”), the members of which are comprised of an equal number of individuals affiliated with each of the Sponsors, beneficially owns approximately 69.9% of our common stock pursuant to an irrevocable proxy providing Hamlet Holdings with sole voting and sole dispositive power over those shares, and, as a result, the Sponsors have the power to elect all of our directors. As a result, we are a “controlled company” under NASDAQ corporate governance standards, and we have elected not to comply with the NASDAQ corporate governance requirement that a majority of our Board and human resources (i.e., compensation) and nominating and corporate governance committees consist of independent directors. See “Certain Relationships and Related Person Transactions.”

Our Board of Directors affirmatively determines the independence of each director and director nominee in accordance with guidelines it has adopted, which include all elements of independence set forth in the applicable rules of listing standards of NASDAQ. These guidelines are contained in our Corporate Governance Guidelines which are posted on the Corporate Governance page of our web site located at http://investor.caesars.com.

As of the date of this proxy statement, our Board of Directors consisted of 11 members: Jeffrey Benjamin, David Bonderman, Kelvin L. Davis, Jeffrey T. Housenbold, Gary W. Loveman, Karl Peterson, Eric Press, Marc Rowan, Lynn C. Swann, Christopher J. Williams, and David B. Sambur. Mr. Loveman’s employment agreement provides that the Company shall use its best efforts to cause our Board of Directors to appoint Mr. Loveman as a member of the Board of Directors or cause Mr. Loveman to be nominated for election to the Board of Directors by the Company’s stockholders. Based upon the listing standards of the NASDAQ, we do not believe that Messrs. Benjamin, Bonderman, Davis, Loveman, Peterson, Press, Rowan, or Sambur would be considered independent because of their relationships with certain affiliates of the Sponsors and other relationships with us. Our Board of Directors has affirmatively determined that Messrs. Williams, Housenbold, and Swann are independent from our management under the NASDAQ listing standards. The Board has also affirmatively determined that Messrs. Williams, Housenbold and Swann, the members of our Audit Committee, meet the independence requirements of Rule 10A-3 of the Exchange Act.

Executive Sessions. Our Corporate Governance Guidelines provide that the independent directors shall meet at least twice annually in executive session.

Stockholder Nominees. Our by-laws provide that stockholders seeking to nominate candidates for election as directors or to bring business before an annual meeting of stockholders must provide timely notice of their proposal in writing to the Secretary of the Company. Generally, to be timely, a stockholder’s notice must be delivered to or mailed and received at our principal executive offices, addressed to the secretary of the Company, no earlier than 120 days and no later than 90 days prior to the first anniversary of the date of the preceding year’s annual meeting (which anniversary date, in the case of the 2013 annual meeting, which is the first annual meeting following the closing of the Company’s initial public offering, shall be deemed to be April 15, 2012); provided, however, that if the annual meeting is advanced by more than 30 days, or delayed by more than 70 days, from the first anniversary of the preceding year’s annual meeting, to be timely the stockholder notice must be received no earlier than 120 days before such annual meeting and no later than the later of 90 days before such annual meeting or the tenth day after the day on which public disclosure of the date of such meeting is first made. In no event shall the public announcement of an adjournment or postponement of an annual meeting of stockholders commence a new time period (or extend any time period) for the giving of the stockholder notice. You should consult our by-laws for more detailed information regarding the process by which stockholders may nominate directors. Our by-laws are posted on the Corporate Governance page of our web site located at http://investor.caesars.com.

Board Committees. Our Board has six standing committees: the Audit Committee, the Human Resources Committee, the Nominating and Corporate Governance Committee, the Finance Committee, the Executive Committee and the 162(m) Plan Committee. The Board has determined that all of the members of the Audit

7

Table of Contents

Committee, one of the members of the Human Resources Committee, one of the members of the Nominating and Corporate Governance Committee and both of the members of the 162(m) Plan Committee are independent as defined in the NASDAQ listing standards and in our Corporate Governance Guidelines. The Board has adopted a written charter for each of these committees. The charters for each of these committees are available on the Corporate Governance page of our web site located at http://investor.caesars.com.

The chart below reflects the current composition of the standing committees:

| Name of Director |

Audit | Human Resources | Nominating and Corporate Governance |

Finance | Executive | 162(m) Plan | ||||||||||||||||||

| Jeffrey Benjamin |

||||||||||||||||||||||||

| David Bonderman |

||||||||||||||||||||||||

| Kelvin L. Davis |

X | X | ||||||||||||||||||||||

| Jeffrey T. Housenbold |

X | |||||||||||||||||||||||

| Gary W. Loveman * |

X | |||||||||||||||||||||||

| Karl Peterson |

X | X | ||||||||||||||||||||||

| Eric Press |

||||||||||||||||||||||||

| Marc Rowan |

X | X | X | |||||||||||||||||||||

| Lynn C. Swann |

X | X | X | X | ||||||||||||||||||||

| Christopher J. Williams |

X | X | ||||||||||||||||||||||

| David B. Sambur |

X | |||||||||||||||||||||||

| * | Indicates management director. |

Audit Committee

Our audit committee consists of Christopher J. Williams, as chairperson, Jeffrey T. Housenbold and Lynn C. Swann. Our audit committee met on 14 occasions during 2012. Our Board has determined that Mr. Williams qualifies as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K and that Messrs. Williams, Housenbold and Swann are independent as independence is defined in Rule 10A-3 of the Exchange Act and under the NASDAQ listing standards. The purpose of the audit committee is to oversee our accounting and financial reporting processes and the audits of our financial statements, provide an avenue of communication among our independent auditors, management, our internal auditors and our Board, and prepare the audit-related report required by the SEC to be included in our annual proxy statement or annual report on Form 10-K, as amended. The principal duties and responsibilities of our audit committee are to oversee and monitor the following:

| • | preparation of annual audit committee report to be included in our annual proxy statement; |

| • | our financial reporting process and internal control system; |

| • | the integrity of our financial statements; |

| • | the independence, qualifications and performance of our independent auditor; |

| • | the performance of our internal audit function; and |

| • | our compliance with legal, ethical and regulatory matters. |

The audit committee has the power to investigate any matter brought to its attention within the scope of its duties. It also has the authority to retain counsel and advisors to fulfill its responsibilities and duties.

8

Table of Contents

Human Resources Committee

See “—Executive Compensation-Compensation Discussion and Analysis-Our Human Resources Committee.”

162(m) Plan Committee

The 162(m) Plan Committee reviews and approves compensation that is intended to qualify as “performance based compensation” under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). For more information about our 162(m) Plan Committee, please see “—Executive Compensation-Compensation Discussion and Analysis-Our Human Resources Committee.”

Nominating and Corporate Governance Committee

Our Board has established a nominating and corporate governance committee whose members are Karl Peterson, David B. Sambur and Lynn C. Swann. Our nominating and corporate governance committee did not meet during 2012. The principal duties and responsibilities of the nominating and corporate governance committee are as follows:

| • | to establish criteria for board and committee membership and recommend to our Board proposed nominees for election to the Board and for membership on committees of our Board; |

| • | to make recommendations regarding proposals submitted by our stockholders; and |

| • | to make recommendations to our Board regarding board governance matters and practices. |

We have chosen the “controlled company” exception under the NASDAQ rules which exempts us from the requirement that we have a nominating and corporate governance committee composed entirely of independent directors.

Finance Committee

Our finance committee consists of Karl Peterson and Marc Rowan. The finance committee has been delegated oversight of our financial matters, primarily relating to indebtedness and financing transactions.

Executive Committee

Our executive committee consists of Gary Loveman, as chairperson, Kelvin Davis and Marc Rowan. The executive committee has all the powers of our Board in the management of our business and affairs, including without limitation, the establishment of additional committees or subcommittees of our Board and the delegation of authority to such committees and subcommittees, and may act on behalf of our Board to the fullest extent permitted under Delaware law and our organizational documents. The executive committee serves at the pleasure of our Board and may act by a majority of its members, provided that at least one member affiliated with TPG and Apollo must approve any action of the executive committee. This committee and any requirements or voting mechanics or participants may continue or be changed if Apollo and TPG no longer own a controlling interest in us.

Director Qualifications. The Board of Directors seeks to ensure the Board is composed of members whose particular experience, qualifications, attributes and skills, when taken together, will allow the Board to satisfy its oversight responsibilities effectively. In identifying candidates for membership on the Board, the Board takes into account (1) minimum individual qualifications, such as high ethical standards, integrity, mature and careful judgment, industry knowledge or experience and an ability to work collegially with the other members of the Board and (2) all other factors it considers appropriate, including alignment with our stockholders, especially investment funds affiliated with the Sponsors. While we do not have any specific diversity policies for considering Board candidates, we believe each director contributes to the Board of Directors’ overall diversity, meaning a variety of opinions, perspectives, personal and professional experiences and backgrounds.

9

Table of Contents

When considering whether the Board’s directors and nominees have the experience, qualifications, attributes and skills, taken as a whole, to enable the Board to satisfy its oversight responsibilities effectively in light of the Company’s business and structure, the Board focused primarily on the information discussed in each of the Board members’ biographical information set forth below under “Proposal 1—Election of Directors.”

Each of the Company’s directors possesses high ethical standards, acts with integrity, and exercises careful, mature judgment. Each is committed to employing their skills and abilities to aid the long-term interests of the stakeholders of the Company. In addition, our directors are knowledgeable and experienced in one or more business, governmental, or civic endeavors, which further qualifies them for service as members of the Board. Alignment with our stockholders is important in building value at the Company over time.

Each of the directors other than Messrs. Housenbold, Williams and Swann was elected to the Board pursuant to the Stockholders’ Agreement (as defined below). Under the Stockholders’ Agreement, until we cease to be a “controlled company” within the meaning of the NASDAQ rules, each of the Sponsors have the right to nominate four directors to our Board of Directors. In addition, under the Stockholders’ Agreement, until we cease to be a “controlled company” each of the Sponsors has the right to designate four members of each committee of our Board of Directors except to the extent that such a designee is not permitted to serve on a committee under applicable law, rule, regulation or listing standards. Pursuant to the Stockholders’ Agreement, Messrs. Benjamin, Press, Rowan and Sambur were appointed to the Board as a consequence of their respective relationships with Apollo and Messrs. Bonderman, Davis and Peterson were appointed to the Board as a consequence of their respective relationships with TPG. TPG has elected not to appoint a fourth director in accordance with the terms of the Stockholders’ Agreement. Mr. Loveman was appointed to the Board pursuant to the Stockholders’ Agreement and as a consequence of his being Chief Executive Officer and President of the Company.

Criteria for Director Nomination. Our Nominating and Corporate Governance Committee identifies and recommends to the Board persons to be nominated to serve as directors of the Company. Directors are selected based on, among other things, understanding of elements relevant to the success of a large publicly traded company, understanding of the Company’s business and educational and professional background. The Nominating and Corporate Governance Committee also considers the requirements of any stockholders agreement in existence (as such may be amended from time to time), including but not limited to the Stockholders’ Agreement, which governs the composition requirements of the Company’s Board of Directors and committees. In recruiting and evaluating new director candidates, the Nominating and Corporate Governance Committee also considers such factors as industry background, financial and business experience, public company experience, other relevant education and experience, general reputation, independence and diversity. The Company endeavors to have a Board composition encompassing a broad range of skills, expertise, industry knowledge and diversity of background and experience. The Nominating and Corporate Governance Committee considers, consistent with applicable law, the Company’s certificate of incorporation and by-laws and the criteria set forth in our Corporate Governance Guidelines, and any candidates proposed by any senior executive officer, director or stockholder.

In addition, individual directors and any person nominated to serve as a director should demonstrate high ethical standards and integrity in their personal and professional dealings and be willing to act on and remain accountable for their boardroom decisions, and be in a position to devote an adequate amount of time to the effective performance of director duties.

Prior to nominating a person to serve as a director, the Nominating and Corporate Governance Committee evaluates the candidate based on the criteria described above. In addition, prior to accepting renomination, each director should evaluate himself or herself as to whether he or she satisfies the criteria described above.

Board Leadership Structure. The Board appointed the Company’s Chief Executive Officer and President as Chairman because he is the director most familiar with the Company’s business and industry, and as a result is best suited to effectively identify strategic priorities and lead the discussion and execution of strategy. The Board

10

Table of Contents

believes the combined position of Chairman and Chief Executive Officer promotes a unified direction and leadership for the Board and gives a single, clear focus for the chain of command for our organization, strategy and business plans. The Board has not designated a lead independent director.

Board’s Role in Risk Oversight. The Board exercises its role in the oversight of risk as a whole and through the Audit Committee. The Audit Committee receives regular reports from the Company’s risk management and compliance departments.

Board Meetings and Committees; Policy Regarding Director Attendance at Annual Meeting of Stockholders. During 2012, our Board of Directors held seven meetings. All directors attended at least 75% of the Board meetings and meetings of the committees of the Board on which the director served, other than Karl Peterson, who was unable to attend two of the seven meetings of the Board. Following our IPO, it is our policy that directors are encouraged to attend the Company’s annual stockholder meeting.

Policy Regarding Communication with Board of Directors. Stockholders and other interested parties may contact the Board of Directors as a group online through the Corporate Governance page of our website located at http://investor.caesars.com or as a group or to any individual director by sending a letter (signed or anonymous) to: c/o Board of Directors, Caesars Entertainment Corporation, One Caesars Palace Drive, Las Vegas, NV 89109, Attention: Corporate Secretary.

We will forward all such communications to the applicable Board member(s), except for material that is unduly hostile, threatening, illegal or similarly unsuitable. In addition, the Company’s Board has requested that certain items which are unrelated to the duties and responsibilities of the Board should be excluded, such as product complaints, suggestions, resumes and other forms of job inquires, surveys and business solicitations or advertisements. The Law Department will review the communication and concerns will be addressed through our regular procedures for addressing such matters. Depending on the nature of the concern, management also may refer it to our internal audit, legal, finance or other appropriate department. If the volume of communication becomes such that the Board adopts a process for determining which communications will be relayed to Board members, that process will appear on the Corporate Governance page of our web site located at http://investor.caesars.com.

Corporate Governance Guidelines. The Company has adopted Corporate Governance Guidelines that we believe reflect the Board’s commitment to a system of governance that enhances corporate responsibility and accountability. The Corporate Governance Guidelines contain provisions addressing the following matters, among others:

| • | board composition (i.e., size); |

| • | director qualifications; |

| • | classification of directors into three classes; |

| • | director independence; |

| • | director retirement policy and changes in a non-employee director’s primary employment; |

| • | director term limits (and the lack thereof); |

| • | director responsibilities, including director access to officers and employees; |

| • | board meetings and attendance and participation at those meetings; |

| • | executive sessions; |

| • | board committees; |

| • | director orientation and continuing education; |

| • | chief executive officer evaluation and compensation; |

| • | director compensation; |

11

Table of Contents

| • | management succession planning; |

| • | performance evaluation of the Board and its committees; and |

| • | public interactions. |

The Corporate Governance Guidelines are available on the Corporate Governance page of our web site located at http://investor.caesars.com. We intend to disclose any future amendments to the Corporate Governance Guidelines on our website.

Code of Ethics. We have a Code of Business Conduct and Ethics, which is applicable to all of our directors, officers and employees (the “Code of Ethics”). The Code of Ethics is available on the Corporate Governance page of our web site located at http://investor.caesars.com. To the extent required pursuant to applicable SEC regulations, we intend to post amendments to or waivers from our Code of Ethics (to the extent applicable to our chief executive officer, principal financial officer or principal accounting officer) at this location on our website or report the same on a Current Report on Form 8-K. Our Code of Ethics is available free of charge upon request to our Corporate Secretary, Caesars Entertainment Corporation, One Caesars Palace Drive, Las Vegas, Nevada 89109.

HUMAN RESOURCES COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The HRC is comprised of three members: Kelvin L. Davis, Marc Rowan and Lynn C. Swann. None of these individuals is a current or former officer or employee of any of our subsidiaries. During 2012, none of our executive officers served as a director or member of a compensation committee (or other committee serving an equivalent function) of any other entity whose executive officers served as a director or member of the HRC.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our directors, executive officers and greater than ten-percent stockholders to file initial reports of ownership and reports of changes in ownership of any of our securities with the SEC and us. We believe that during the 2012 fiscal year, all of our directors, executive officers and greater than ten-percent stockholders complied with the requirements of Section 16(a). This belief is based on our review of forms filed or written notice that no reports were required.

12

Table of Contents

PROPOSAL 1—ELECTION OF DIRECTORS

The current Board of Directors of Caesars consists of eleven directors. Our Board of Directors recommends that the nominees listed below be elected as members of the Board of Directors at the annual meeting.

Pursuant to our certificate of incorporation, our Board of Directors is divided into three classes. The members of each class will serve for a staggered, three-year term. Upon the expiration of the term of a class of directors, directors in that class will be elected for three-year terms at the annual meeting of stockholders in the year in which their term expires. Each of the nominees, if re-elected, will serve a three year term as a director until the annual meeting of stockholders in 2016 or until his respective successor is duly elected and qualified or until the earlier of his death, resignation or removal. If a nominee becomes unable or unwilling to accept nomination or election, the person or persons voting the proxy will vote for such other person or persons as may be designated by the Board of Directors, unless the Board of Directors chooses to reduce the number of directors serving on the Board. The Board of Directors has no reason to believe that any of the nominees will be unable or unwilling to serve as a director if re-elected.

The following is a brief description of the background and business experience of each of our directors and nominees:

| Name |

Age (1) | Director Since |

Position(s) | |||||

| Directors whose terms will expire at the 2013 Annual Meeting |

||||||||

| Jeffrey Benjamin |

51 | 2008 | Director | |||||

| Jeffrey T. Housenbold |

43 | 2011 | Director | |||||

| Lynn C. Swann |

61 | 2008 | Director | |||||

| Directors whose terms will expire at the 2014 Annual Meeting |

||||||||

| Kelvin L. Davis |

49 | 2008 | Director | |||||

| Karl Peterson |

42 | 2008 | Director | |||||

| Eric Press |

47 | 2008 | Director | |||||

| David B. Sambur |

32 | 2010 | Director | |||||

| Directors whose terms will expire at the 2015 Annual Meeting |

||||||||

| Gary W. Loveman |

52 | 2000 | Chairman of the Board, Chief Executive Officer and President | |||||

| David Bonderman |

70 | 2008 | Director | |||||

| Marc Rowan |

50 | 2008 | Director | |||||

| Christopher J. Williams |

55 | 2008 | Director | |||||

| (1) | As of March 18, 2013. |

Nominees

Jeffrey Benjamin became a member of our board of directors in January 2008 upon consummation of the Acquisition. Mr. Benjamin has nearly 25 years of experience in the investment industry and has extensive experience serving on the boards of directors of other public and private companies, including Mandalay Resort Group, another gaming company. He has been senior advisor to Cyrus Capital Partners since June 2008 and serves as a consultant to Apollo Global Management, LLC with respect to investments in the gaming industry. He was a senior advisor to Apollo Global Management, LLC from 2002 to 2008. He holds a bachelor’s degree from Tufts University and a masters degree from the Massachusetts Institute of Technology Sloan School of Management. He has previously served on the boards of directors of Goodman Global Holdings, Inc., Dade

13

Table of Contents

Behring Holdings, Inc., Chiquita Brands International, Inc., McLeod USA, Mandalay Resort Group and Virgin Media Inc. Mr. Benjamin is Chairman of the board of directors of Spectrum Group International, Inc. and also serves on the boards of directors of Exco Resources, Inc. and Chemtura Corporation. Due to the foregoing experience and qualifications, Mr. Benjamin is nominated for election as a member of our Board.

Jeffrey T. Housenbold became a member of our board in November 2011. Mr. Housenbold has served as the President and Chief Executive Officer and a director of Shutterfly, Inc. since January 2005. Prior to joining Shutterfly, Mr. Housenbold served as Vice President of Business Development and Internet Marketing at eBay Inc., an online marketplace for the sale of goods and services, from January 2002 to January 2005. Previously, he was the Vice President & General Manager, Business-to-Consumer Group at eBay from June 2001 to January 2002, and served as Vice President, Mergers & Acquisitions at eBay from March 2001 to June 2001. Mr. Housenbold holds Bachelor of Science degrees in Economics and Business Administration from Carnegie Mellon University and a Master of Business Administration degree from the Harvard Graduate School of Business Administration. Mr. Housenbold currently serves on the Board of Directors of Digital Chocolate, a publisher of social and mobile games and the Children’s Discovery Museum of San Jose. He is a member of the Company’s Audit Committee. Due to the foregoing experience and qualifications, Mr. Housenbold is nominated for election as a member of our Board.

Lynn C. Swann became a member of our board in April 2008. Mr. Swann has served as president of Swann, Inc., a consulting firm specializing in marketing and communications since 1976 and the owner of Lynn Swann Group since 2011. The Lynn Swann Group is an affiliate of Stonehaven, LLC, which is a Member of FINRA/SIPC. Mr. Swann was also a broadcaster for the American Broadcasting Company from 1976 to 2005. He holds a bachelor’s degree from the University of Southern California. Mr. Swann also serves on the boards of directors of Hershey Entertainment Resorts Company, H. J. Heinz Company and American Homes 4 Rent. Mr. Swann also holds a Series 7 and Series 63 registration. He is member of the Company’s Audit Committee, Human Resources Committee, Nominating and Corporate Governance Committee, and the 162(m) Plan Committee. Due to the foregoing experience and qualifications, Mr. Swann is nominated for election as a member of our Board.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE DIRECTOR NOMINEES.

Class II Directors (Current Term Will Expire at the 2014 Annual Meeting)

Kelvin L. Davis became a member of our board of directors in January 2008 upon consummation of the Acquistion. Mr. Davis is a TPG Senior Partner and Head of TPG’s North American Buyouts Group, incorporating investments in all non-technology industry sectors. He also leads TPG’s Real Estate investing activities. Prior to joining TPG in 2000, Mr. Davis was President and Chief Operating Officer of Colony Capital, Inc., a private international real estate-related investment firm which is co-founded in 1991. He holds a bachelor’s degree from Stanford University and an M.B.A. from Harvard University. Mr. Davis currently serves on the boards of directors of Northwest Investments, LLC (which is an affiliate of ST Residential), Parkway Properties, Inc., Taylor Morrison, Inc., Univision Communications, Inc., and Catellus Development Corporation. He is a member of the Company’s Human Resources Committee and a member of the Executive Committee. Due to the foregoing experience and qualifications, Mr. Davis was elected as a member of our Board.

Karl Peterson became a member of our board of directors in January 2008 upon consummation of the Acquisition. Mr. Peterson is a senior partner of TPG Capital where he leads the firm’s European business. He rejoined TPG in 2004 after serving as President and Chief Executive Officer of Hotwire, Inc. Mr. Peterson led Hotwire, Inc. from inception through its sale to IAC/InterActiveCorp. Before his work at Hotwire, Inc., Mr. Peterson was a principal of TPG in San Francisco. He holds a bachelor’s degree from the University of Notre Dame and has previously served on the board of directors of Univision Communications, Inc. Mr. Peterson currently serves on the boards of directors of Norwegian Cruise Lines, Sabre Holdings Corporation, and Saxo

14

Table of Contents

Bank. Mr. Peterson is a member of the Company’s Finance Committee and a member of the Nominating and Corporate Governance Committee. Due to the foregoing experience and qualifications, Mr. Peterson was elected as a member of our Board.

Eric Press became a member of our board of directors in January 2008 upon consummation of the Acquisition. Mr. Press has been a Partner at Apollo Global Management, LLC since 2007 and has been a Partner with other Apollo entities since 1998. Mr. Press has nearly 20 years of experience in financing, analyzing, investing in and/or advising public and private companies and their board of directors. He holds a bachelor’s degree in economics from Harvard University and a law degree from Yale University. He has previously served on the board of directors of the Rodolph Sholom School, Innkeepers Trust USA, Wyndham International, Quality Distribution, Inc. AEP Industries, and WMC Finance Corp. Mr. Press also serves on the boards of directors of Prestige Cruise Holdings, Inc., Noranda Aluminum, Affinion Group Holdings, Inc., Metals USA Holdings Corp., Verso Paper Corp., WMC Residco, Inc., Apollo Commercial Real Estate Finance, Inc., and Athene Re. Due to the foregoing experience and qualifications, Mr. Press was elected as a member of our Board.

David B. Sambur became a member of our board of directors in November 2010. Mr. Sambur is a Partner of Apollo Global Management, having joined in 2004. Mr. Sambur has experience in financing, analyzing, investing in and/or advising public and private companies and their board of directors. Prior to joining Apollo, Mr. Sambur was a member of the Leveraged Finance Group of Salomon Smith Barney Inc. Mr. Sambur serves on the board of directors of Verso Paper Corp. and Momentive Performance Materials Holdings and Momentive Specialty Chemical, Inc. Mr. Sambur graduated summa cum laude and Phi Beta Kappa from Emory University with a BA in Economics. He is a member of the Company’s Nominating and Corporate Governance Committee. Due to the foregoing experience and qualifications, Mr. Sambur was elected as a member of our Board.

Class III Directors (Current Term Will Expire at the 2015 Annual Meeting)

Gary W. Loveman has been our Chairman of the Board since January 1, 2005, Chief Executive Officer since January 2003 and President since April 2001. He has over 15 years of experience in retail marketing and service management, and he previously served as an associate professor at the Harvard University Graduate School of Business. He holds a bachelor’s degree from Wesleyan University and a Ph.D. in Economics from the Massachusetts Institute of Technology. Mr. Loveman also serves as a director of Coach, Inc. and FedEx Corporation. Due to the foregoing experience and qualifications, Mr. Loveman was elected as a member of our Board.

David Bonderman became a member of our board of directors in January 2008 upon consummation of the Acquisition. Mr. Bonderman is a TPG Founding Partner. Prior to forming TPG in 1993, Mr. Bonderman was Chief Operating Officer of the Robert M. Bass Group, Inc. (now doing business as Keystone Group, L.P.) in Fort Worth, Texas. He holds a bachelor’s degree from the University of Washington and a law degree from Harvard University. He has previously served on the boards of directors of Gemalto N.V., Burger King Holdings, Inc., Washington Mutual, Inc., IASIS Healthcare LLC, and Univision Communications and Armstrong World Industries, Inc. Mr. Bonderman also currently serves on the boards of directors of JSC VTB Bank, Energy Future Holdings Corp., General Motors Company, CoStar Group, Inc. and Ryanair Holdings PLC, of which he is Chairman. Due to the foregoing experience and qualifications, Mr. Bonderman was elected as a member of our Board.

Marc Rowan became a member of our board of directors in January 2008 upon consumation of the Acquisition. Mr. Rowan is a founding partner of Apollo Global Management, LLC. He has more than 25 years of experience in financing, analyzing, investing in and/or advising public and private companies and their board of directors. He holds a bachelor’s degree from the University of Pennsylvania and an M.B.A. from The Wharton School. He has previously served on the boards of directors of AMC Entertainment, Inc., Culligan Water Technologies, Inc., Furniture Brands International, Mobile Satellite Ventures, National Cinemedia, Inc., National

15

Table of Contents

Financial Partners, Inc., New World Communications, Inc., Quality Distribution, Inc., Samsonite Corporation, SkyTerra Communications Inc., Unity Media SCA, The Vail Corporation, Cannondale Bicycle Corp., Riverdale Country School, Cablecom GmbH, Rare Medium, Countrywide plc and Wyndham International, Inc. Mr. Rowan also serves on the boards of directors of the general partner of AAA Guernsey Limited, Athene Re, Youth Renewal Fund, National Jewish Outreach Program, Inc., Undergraduate Executive Board of the Wharton School, Rowan Family Foundation, Wharton Private Equity Partners, New York City Police Foundation and Norwegian Cruise Lines. He is a member of the Company’s Executive Committee, the Finance Committee and the Human Resources Committee. Due to the foregoing experience and qualifications, Mr. Rowan was elected as a member of our Board.

Christopher J. Williams became a member of our board in April 2008. Mr. Williams has been Chairman of the Board and Chief Executive Officer of Williams Capital Group, L.P., an investment bank, since 1994, and Chairman of the Board and Chief Executive Officer of Williams Capital Management, LLC, an investment management firm, since 2002. He holds a bachelor’s degree from Harvard University and an M.B.A. from the Dartmouth College Tuck School of Business. Mr. Williams was a director of Caesars from November 2003 to January 2008, and was a member of the Audit Committee. Mr. Williams also serves on the boards of directors for The Partnership for New York City, the National Association of Securities Professionals, and Wal-Mart Stores, Inc. He is Chairman of the Company’s Audit Committee and is a member of the 162(m) Plan Committee. Due to the foregoing experience and qualifications, Mr. Williams was elected as a member of our Board.

16

Table of Contents

PROPOSAL 2—ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), enacted in July 2010, requires that we provide our stockholders with the opportunity to vote to approve, on a non-binding, advisory basis, the compensation of our named executive officers as disclosed in this proxy statement in accordance with the compensation disclosure rules of the SEC. As described below in the “Executive Compensation—Compensation Discussion and Analysis” section of this proxy statement, the HRC has structured our executive compensation program to achieve the following key objectives:

| • | align our rewards strategy with our business objectives, including enhancing stockholder value and customer satisfaction; |

| • | support a culture of strong performance by rewarding employees for results; |

| • | attract, retain and motivate talented and experienced executives; and |

| • | foster a shared commitment among our senior executives by aligning our and their individual goals. |

We urge stockholders to read the “Executive Compensation—Compensation Discussion and Analysis” beginning on page 24 of this proxy statement, which describes in more detail how our executive compensation policies and procedures operate and are designed to achieve our compensation objectives, as well as the Summary Compensation Table and other related compensation tables and narrative, beginning on page 50 of this proxy statement, which provide detailed information on the compensation of our named executive officers. The compensation committee and the Board of Directors believe that the policies and procedures articulated in the “Executive Compensation—Compensation Discussion and Analysis” are effective in achieving our compensation objectives and contribute to the Company’s performance.

In accordance with Section 14A of the Exchange Act, we are asking stockholders to approve the following advisory resolution at the 2013 annual meeting of stockholders:

RESOLVED, that the stockholders of the Company approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion, as set forth in the Company’s 2013 Definitive Proxy Statement on Schedule 14A.

This advisory resolution, commonly referred to as a “say-on-pay” resolution, is non-binding on the Company, the Board of Directors, and the HRC. The say-on-pay proposal is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the executive compensation policies, practices, and plans described in this proxy statement. Although non-binding, the HRC will carefully review and consider the voting results when making future decisions regarding our executive compensation program.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL OF THE ADVISORY “SAY-ON-PAY” RESOLUTION TO APPROVE OUR EXECUTIVE COMPENSATION.

17

Table of Contents

PROPOSAL 3—ADVISORY VOTE ON THE FREQUENCY OF “SAY-ON-PAY” VOTES

The Dodd-Frank Act also provides that stockholders must be given the opportunity to vote, on a non-binding, advisory basis, for their preferences as to how frequently we should seek advisory votes on the compensation of our named executive officers as disclosed in accordance with the compensation disclosure rules of the SEC. By voting with respect to this Proposal 3, stockholders may indicate whether they would prefer that we conduct advisory votes on executive compensation every one, two, or three years. Stockholders also may, if they desire, abstain from casting a vote on this proposal.

After careful consideration of the various arguments supporting each frequency level, the Board of Directors has determined that holding an advisory “say-on-pay” vote every three years on our executive compensation is the most appropriate policy for the Company at this time, and recommends that stockholders vote for advisory “say-on-pay” votes on our executive compensation to occur once every three years.

In accordance with Section 14A of the Exchange Act, we are asking stockholders to approve the following advisory resolution at the 2013 annual meeting of stockholders:

RESOLVED, that the option of once every one year, two years, or three years that receives the affirmative vote of a majority of the votes cast by stockholders present in person or by proxy at the annual meeting and entitled to vote at the annual meeting will be the frequency that stockholders approve will be determined to be the preferred frequency with which the Company is to hold a stockholder vote to approve the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion.

This vote is advisory and not binding on the Company or the Board of Directors in any way. Although non-binding, the Board will take into account the outcome of the vote when considering the frequency of future advisory votes on executive compensation. Notwithstanding the Board’s recommendation and the outcome of the stockholder vote, the Board may in the future decide to conduct advisory votes on a more or less frequent basis and may vary its practice based on factors such as discussions with stockholders and the adoption of material changes to compensation programs. Also, as a controlled company, Caesars’ controlling stockholders, the Sponsors, will be able to effectively weigh in on compensation, on stockholders’ behalf, on a continuing basis.

The proxy card provides stockholders with the opportunity to choose among four options (holding the vote every one, two, or three years, or abstaining). Stockholders are not voting to approve or disapprove the Board’s recommendation.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE TO CONDUCT ADVISORY “SAY-ON-PAY” VOTES EVERY THREE YEARS.

18

Table of Contents

PROPOSAL 4—RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2013. Services provided to the Company and its subsidiaries by Deloitte & Touche LLP for the year ending December 31, 2013 are described below and under “Audit Committee Report” located on page 75 of this proxy statement.

Fees and Services

The following table summarizes the aggregate fees paid or accrued by the Company to Deloitte & Touche LLP during 2012 and 2011:

| 2012 | 2011 | |||||||

| (in thousands) | ||||||||

| Audit Fees (a) |

$ | 7,545.0 | $ | 5,379.9 | ||||

| Audit-Related Fees (b) |

297.0 | 12.0 | ||||||

| Tax Fees (c) |

358.8 | 1,217.4 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 8,200.8 | $ | 6,609.3 | ||||

|

|

|

|

|

|||||

| (a) | Audit Fees—Fees for audit services billed in 2012 and 2011 consisted of: |

| • | Audit of the Company’s annual financial statements, including the audits of the various subsidiaries conducting gaming operations as required by the regulations of the respective jurisdictions; |

| • | Sarbanes-Oxley Act, Section 404 attestation services; |

| • | Reviews of the Company’s quarterly financial statements; and |

| • | Comfort letters, statutory and regulatory audits, consents, and other services related to SEC matters. |

| (b) | Audit-Related Fees—Fees for audit-related services billed in 2012 and 2011 consisted of: |

| • | Quarterly revenue and compliance audits performed at certain of our properties as required by state gaming regulations; |

| • | Internal control reviews; and |

| • | Agreed-upon procedures engagements. |

| (c) | Tax Fees—Fees for tax services paid in 2012 and 2011 consisted of tax compliance and tax planning and advice: |

| • | Fees for tax compliance services totaled $228,098 and $817,336 in 2012 and 2011, respectively. Tax compliance services are services rendered based upon facts already in existence or transactions that have already occurred to document, compute, and obtain government approval for amounts to be included in tax filings and consisted of: |

| i. | Federal, state, and local income tax return assistance |

| ii. | Requests for technical advice from taxing authorities |

| iii. | Assistance with tax audits and appeals |

| • | Fees for tax planning and advice services totaled $130,728 and $400,030 in 2012 and 2011, respectively. Tax planning and advice are services rendered with respect to proposed transactions or that alter a transaction to obtain a particular tax result. Such services consisted of: |

| i. | Tax advice related to structuring certain proposed mergers, acquisitions, and disposals |

19

Table of Contents

| ii. | Tax advice related to the alteration of employee benefit plans |

| iii. | Tax advice related to an intra-group restructuring |

| 2012 | 2011 | |||||||

| Ratio of Tax Planning and Advice Fees to Audit Fees, Audit-Related Fees, and Tax Compliance Fees | 0.02:1 | 0.06:1 | ||||||

In considering the nature of the services provided by the independent auditor, the Audit Committee determined that such services are compatible with the provision of independent audit services. The Audit Committee discussed these services with the independent auditor and Company management to determine that they are permitted under the rules and regulations concerning auditor independence promulgated by the SEC to implement the Sarbanes-Oxley Act of 2002, as well as the American Institute of Certified Public Accountants.

The services performed by Deloitte & Touche LLP in 2012 and 2011 were pre-approved in accordance with the pre-approval policy and procedures adopted by the Audit Committee at its February 26, 2003, meeting, and amended at its April 15, 2004, meeting. This policy describes the permitted audit, audit-related, tax, and other services that Deloitte & Touche may perform. Any requests for audit services must be submitted to the Audit Committee for specific pre-approval and cannot commence until such approval has been granted. Except for such services which fall under the de minimis provision of the pre-approval policy, any requests for audit-related, tax, or other services also must be submitted to the Audit Committee for specific pre-approval and cannot commence until such approval has been granted. Normally, pre-approval is provided at regularly scheduled meetings. However, the authority to grant specific pre-approval between meetings, as necessary, has been delegated to the Chairperson of the Audit Committee. The Chairperson must update the Audit Committee at the next regularly scheduled meeting of any services that were granted specific pre-approval.

In addition, although not required by the rules and regulations of the SEC, the Audit Committee generally requests a range of fees associated with each proposed service. Providing a range of fees for a service incorporates appropriate oversight and control of the independent auditor relationship, while permitting the Company to receive immediate assistance from the independent auditor when time is of the essence.

The policy contains a de minimis provision that operates to provide retroactive approval for permissible non-audit, tax, and other services under certain circumstances. The provision allows for the pre-approval requirement to be waived if all of the following criteria are met:

| 1. | The service is not an audit, review, or other attest service; |

| 2. | The estimated fees for such services to be provided under this provision do not exceed a defined amount of total fees paid to the independent auditor in a given fiscal year; |

| 3. | Such services were not recognized at the time of the engagement to be non-audit services; and |

| 4. | Such services are promptly brought to the attention of the Audit Committee and approved by the Audit Committee or its designee. |

No fees were approved under the de minimis provision in 2012 or 2011.

Representatives of Deloitte & Touche LLP will be present at the annual meeting. They will have the opportunity to make a statement if they desire to do so, and we expect that they will be available to respond to questions.

Ratification of the appointment of Deloitte & Touche LLP requires affirmative votes from the holders of a majority of the shares present in person or represented by proxy at the annual meeting and entitled to vote. If the Company’s stockholders do not ratify the appointment of Deloitte & Touche LLP, the Audit Committee will

20

Table of Contents

reconsider the appointment and may affirm the appointment or retain another independent accounting firm. Even if the appointment is ratified, the Audit Committee may in the future replace Deloitte & Touche LLP as our independent registered public accounting firm if it is determined that it is in the Company’s best interests to do so.

THE AUDIT COMMITTEE AND THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY FOR THE YEAR ENDING DECEMBER 31, 2013.

We are not aware of any matters other than those discussed in the foregoing materials contemplated for action at the annual stockholders meeting. The persons named in the proxy card will vote in accordance with the recommendation of the Board of Directors on any other matters incidental to the conduct of, or otherwise properly brought before, the annual meeting of stockholders. The proxy card contains discretionary authority for them to do so.

21

Table of Contents

Executive officers are elected annually and serve at the discretion of our Board of Directors and hold office until his or her successor is duly elected and qualified or until his or her earlier resignation or removal. There are no family relationships among any of our directors or executive officers. Gary W. Loveman serves as Chairman of the Board, Chief Executive Officer and President. His business experience is discussed above “Item 1—Election of Directors—Class III Directors (Current Term Will Expire at the 2015 Annual Meeting).” Other executive officers and their ages as of the date of this proxy statement are:

| Name |

Age | Position | ||||

| Donald A. Colvin (1) |

60 | Executive Vice President and Chief Financial Officer | ||||

| Timothy R. Donovan |

57 | Executive Vice President, General Counsel and Chief Regulatory and Compliance Officer | ||||

| Thomas M. Jenkin |

58 | President of Operations | ||||

| Janis L. Jones |

64 | Executive Vice President of Communications and Government Relations | ||||

| Gregory Miller |

51 | Senior Vice President of Domestic Development | ||||

| John W. R. Payne |

44 | President of Enterprise Shared Services | ||||

| Tariq M. Shaukat |

40 | Executive Vice President and Chief Marketing Officer | ||||

| Mary H. Thomas |

46 | Executive Vice President, Human Resources | ||||

| Steven M. Tight |

57 | President, International Development | ||||

| (1) | On May 30, 2012, Jonathan S. Halkyard resigned from his position as Executive Vice President and Chief Financial Officer of the Company. On November 15, 2012, Mr. Colvin was appointed Executive Vice President and Chief Financial Officer. |