UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the fiscal year ended

or

For the transition period from _________ to _____________

Commission file number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if

the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if

the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐

Indicate by check mark whether

the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required to file such report(s)), and (2) has been subject to

such filing requirements for the past 90 days.

Indicate by check mark whether

the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T

(§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit

and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Smaller reporting company | |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

has fi led a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting fi rm that prepared or

issued its audit report.

Indicate by check mark whether

the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

The aggregate market value

of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last

sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed

second fiscal quarter: $

The number of outstanding

shares of the registrant’s common stock on November 10, 2022, was

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for the 2022 Annual Meeting of Stockholders, which the registrant plans to file with the Securities and Exchange Commission are incorporated by reference in Part III of this Form 10-K to the extent described herein.

TABLE OF CONTENTS

TO ANNUAL REPORT ON FORM 10-K

FOR FISCAL YEAR ENDED June 30, 2022

i

PART I

Item 1. Business

China Green Agriculture, Inc. (‘we” or “the Company”) is primarily engaged in the research, development, production, and sale of various types of fertilizers and agricultural products in the People’s Republic of China (“PRC”) through its wholly owned Chinese subsidiaries, Jinong Shaanxi TechTeam Jinong Humic Acid Product Co., Ltd. (“Jinong”), and Beijing Gufeng Chemical Products Co., Ltd., (“Gufeng”), both of which are engaged in fertilizer production. In addition, we operate through variable interest entities (the “VIEs”), including Xi’an Hu County Yuxing Agriculture Technology Development Co., Ltd. (“Yuxing”), engaged in agricultural products production, and Tianjuyuan Fertilizer Co. Ltd. Our primary business is fertilizer products, specifically humic acid-based compound fertilizer produced through Jinong; and compound fertilizer, blended fertilizer, organic compound fertilizer, slow-release fertilizers, highly concentrated water-soluble fertilizers, and mixed organic-inorganic compound fertilizer produced through Gufeng. In addition, through Yuxing, we develop and produce agricultural products, such as top-grade fruits, vegetables, flowers and colored seedlings.

Since June 2016, the Company, through its wholly-owned subsidiary Jinong, entered into strategic acquisition agreements and a series of contractual agreements with the shareholders of the following eight companies that are organized under the laws of the PRC and are deemed as VIEs: Shaanxi Lishijie Agrochemical Co., Ltd., Songyuan Jinyangguang Sannong Service Co., Ltd., Shenqiu County Zhenbai Agriculture Co., Ltd., Weinan City Linwei District Wangtian Agricultural Materials Co., Ltd., Aksu Xindeguo Agricultural Materials Co., Ltd., and Xinjiang Xinyulei Eco-agriculture Science and Technology Co., Ltd., Sunwu County Xiangrong Agricultural Materials Co., Ltd., and Anhui Fengnong Seed Co., Ltd. (collectively hereafter referred to as “the VIE Companies.”)

As of June 30, 2022, the Company, through its wholly-owned subsidiary Jinong, has discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders of Shaanxi Lishijie Agrochemical Co., Ltd., Songyuan Jinyangguang Sannong Service Co., Ltd., Shenqiu County Zhenbai Agriculture Co., Ltd., Weinan City Linwei District Wangtian Agricultural Materials Co., Ltd., Aksu Xindeguo Agricultural Materials Co., Ltd., and Xinjiang Xinyulei Eco-agriculture Science and Technology Co., Ltd., Sunwu County Xiangrong Agricultural Materials Co., Ltd., and Anhui Fengnong Seed Co., Ltd., decreasing the number of VIE companies from eight to zero.

Fertilizer production is our core business and we generated approximately $160,657,513, $200,245,680, and $200,185,739, or 88.4%, 83.5%, and 80.3% of our total revenues for the years ended June 30, 2022, 2021 and 2020, respectively. Our total annual production capacity was 555,000 metric tons as of June 30, 2022.

As of June 30, 2022, we sold our products through a network of 1,398 regional distributors covering 22 provinces, 4 autonomous regions and 4 central government-controlled municipalities in China. We do not rely on any single distributor. Our top five distributors accounted for approximately 49.9% of our fertilizer revenues for the fiscal year ended June 30, 2022.

As of June 30, 2022, we have developed 416 different fertilizer products. We conduct our research and development activities through Yuxing, one of Jinong’s VIEs, which tests new fertilizers and grows high quality flowers, vegetables and seedlings for commercial sales.

During the fiscal years ended June 30, 2022, 2021 and 2020, our revenues from continuing and discontinued operations were $181,806,425, $239,927,726, and $249,243,496, respectively; our net income (loss) for these periods was $(98,364,332), $(119,747,617), and $(134,689,311), respectively.

1

Recent Developments

Strategic Acquisitions:

On June 30, 2016 and January 1, 2017, through Jinong, we entered (i) Strategic Acquisition Agreements (the “SAA”), and (ii) Agreements for Convertible Notes (the “ACN”), with the shareholders of the companies as identified below (the “Targets”).

June 30, 2016:

| Cash | Principal of | |||||||||

| Payment for | Notes for | |||||||||

| Acquisition | Acquisition | |||||||||

| Company Name | Business Scope | (RMB[1]) | (RMB) | |||||||

| Shaanxi

Lishijie Agrochemical Co., Ltd. |

Sales of pesticides, agricultural chemicals, chemical fertilizers, agricultural materials; Manufacture and sales of mulches. | 10,000,000 | 3,000,000 | |||||||

| Songyuan Jinyangguang Sannong Service Co., Ltd. |

Promotion and consulting services regarding agricultural technologies; Retail sales of chemical fertilizers (including compound fertilizers and organic fertilizers); Wholesale and retail sales of pesticides, agricultural machinery and accessories; Collection of agricultural information; Development of saline-alkali soil; Promotion and development of high-efficiency agriculture and related information technology solutions for agriculture, agricultural and biological engineering high technologies; E-commerce; Cultivation of freshwater fish, poultry, fruits, flowers, vegetables, and seeds; Recycling and complex utilization of straw and stalk; Technology transfer and training; Recycling of agricultural materials; Ecological industry planning. | 8,000,000 | 12,000,000 | |||||||

| Shenqiu County Zhenbai Agriculture Co., Ltd.(2) | Cultivation of crops; Storage, sales, preliminary processing and logistics distribution of agricultural by-products; Promotion and application of agricultural technologies; Purchase and sales of agricultural materials; Electronic commerce. | 3,000,000 | 12,000,000 | |||||||

| Weinan City Linwei District Wangtian Agricultural Materials Co., Ltd. | Promotion and application of new agricultural technologies; Professional prevention of plant diseases and insect pests; Sales of plant protection products, plastic mulches, material, chemical fertilizers, pesticides, agricultural medicines, micronutrient fertilizers, hormones, agricultural machinery and medicines, and gardening tools. | 6,000,000 | 12,000,000 | |||||||

| Aksu Xindeguo Agricultural Materials Co., Ltd.(3) | Wholesale and retail sales of pesticides; Sales of chemical fertilizers, packaged seeds, agricultural mulches, micronutrient fertilizers, compound fertilizers, plant growth regulators, agricultural machinery, and water economizers; Consulting services for agricultural technologies; Purchase and sales of agricultural by- products. | 10,000,000 | 12,000,000 | |||||||

| Xinjiang Xinyulei Eco-agriculture Science and Technology Co., Ltd (3) | Sales of chemical fertilizers, packaged seeds, agricultural mulches, micronutrient fertilizers, organic fertilizers, plant growth regulators, agricultural machineries, and water economizers; Purchase and sales of agricultural by-products; Cultivation of fruits and vegetables; Consulting services and training for agricultural technologies; Storage services; Sales of articles of daily use, food and oil; On-line sales of the above-mentioned products. | |||||||||

| Total | 37,000,000 | 51,000,000 | ||||||||

| (1) | The exchange rate between RMB and U.S. dollars on June 30, 2016 was RMB1=US$0.1508, according to the exchange rate published by Bank of China. |

| (2) | On November 30, 2017, the Company, through its wholly owned subsidiary Jinong, discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders of Zhenbai. In return, the shareholders of Zhenbai agreed to tender the whole payment consideration in the SAA back to the Company with early termination penalties. The convertible notes paid to Zhenbai’s shareholders, and the accrued interest had been forfeited. |

| (3) | On June 2, 2021, the Company, through its wholly owned subsidiary Jinong, discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders of Xindeguo and Xinyulei. In return, the shareholders of Xindeguo and Xinyulei and agreed to pay cash with amount of RMB1,850,000 (approximately $276,205) to the Company. |

2

| (4) | On December 1, 2021, the Company, through its wholly owned subsidiary Jinong, discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders of Lishijie. In return, the shareholders of Lishijie agreed to pay cash with amount of RMB3,500,000 (approximately $522,550) to the Company. |

| (5) | On March 31, 2022, the Company, through its wholly owned subsidiary Jinong, discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders of Jinyangguang and Wangtian. In return, the shareholders of Jinyangguang and Wangtian agreed to pay cash with amount off RMB11,700,000 (approximately $1,746,810) to the Company. |

January 1, 2017:

| Cash Payment for | Principal of Notes for | |||||||||

| Acquisition | Acquisition | |||||||||

| Company Name | Business Scope | (RMB[1]) | (RMB) | |||||||

| Sunwu County Xiangrong Agricultural Materials Co., Ltd.(3) | Sales of pesticides, agricultural chemicals, chemical fertilizers, agricultural materials; Manufacture and sales of mulches. | 4,000,000 | 6,000,000 | |||||||

| Anhui Fengnong Seed Co., Ltd. | Wholesale and retail sales of pesticides; Sales of chemical fertilizers, packaged seeds, agricultural mulches, micronutrient fertilizers, compound fertilizers and plant growth regulators | 4,000,000 | 6,000,000 | |||||||

| Total | 8,000,000 | 12,000,000 | ||||||||

| (1) | The exchange rate between RMB and U.S. dollars on January 1, 2017 was RMB1=US$0.144, according to the exchange rate published by Bank of China. |

| (2) | On June 2, 2021, the Company, through its wholly owned subsidiary Jinong, discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders of Xiangrong. In return, the shareholders of Xiangrong agreed to pay cash with amount of RMB24,430,000 (approximately $3,647,399) to the Company. |

| (3) | On December 31, 2021, the Company, through its wholly owned subsidiary Jinong, discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders of Fengnong. In return, the shareholders of Fengnong agreed to pay cash with amount of RMB8,750,000(approximately $1,306,375) to the Company. |

Pursuant to the SAA and the ACN, the shareholders of the Targets, while retaining possession of the equity interests and continuing to be the legal owners of such interests, agreed to pledge and entrust all of their equity interests, including the proceeds thereof (but excluding any claims or encumbrances), and the operations and management of its business to Jinong, in exchange for an aggregate amount of RMB45,000,000 (approximately $6,718,500), to be paid by Jinong within three days following the execution of the SAA, ACN and the VIE Agreements, and convertible notes with an aggregate face value of RMB63,000,000 (approximately $9,405,900), with an annual fixed compound interest rate of 3% and a term of three years.

The SAA contains representations and warranties by both Jinong and the shareholders of the Targets, including:

Should the shareholders of the Targets fail to satisfy the conditions listed in the exhibit to the SAA, i.e., the entry into the VIE Agreements, or breach of any the representations or warranties in the SAA, other than the direct and consequential damages that may cause to Jinong, they are to pay RMB100,000 (approximately $14,930) as liquidated damages.

The shareholders of the Targets also agreed to ensure that its management and principal technology employees enter into noncompetition agreements prohibiting them from any direct or indirect operation or ownership of any business that is in competition with the Targets.

The shareholders of the Targets also represented that there are no claims or encumbrances against their interests, as defined in the SAA, and that there are no actions or other legal proceedings pending against the Targets that would have a material adverse effect on the Target’s capacity to fulfill their contractual obligations. The Targets are to have a minimum of 10% annual compound growth rate (the “Growth Rate”) within the three years after the closing of the acquisitions (the “Closing”).

Pursuant to the SAA, all the existing employees continue to be the employees of the Targets after the Closing based on their current employment terms, subject to the decisions of the new Boards of Directors of the Targets to be formed after the Closing.

Under the agreements relating to the convertible notes, each convertible note has a face value of RMB100, with a term of three years and an annual fixed compound interest rate of 3%. The convertible notes take priority over the preferred stock and common stock of Jinong, and any other class or series of capital stock Jinong issues in the future, in terms of interest and payments in the event of any liquidation, dissolution or winding up of Jinong. On or after the third anniversary of the issuance date of each note (the “Maturity Date”), noteholders may convert the notes into Common Stock of the Company. The noteholders may not convert the notes prior to the Maturity Date. If a note is converted into the Company’s common stock, the noteholder will become a holder of the Company’s common stock.

The per share conversion price of the notes is the greater of the following: (i) $5.00 per share or (ii) 75% of the closing price of the Company’s common stock on the date the noteholder delivers the conversion notice.

3

If the profits of the Targets hit certain levels of sales set by the parties, i.e., the Growth Rate, Jinong may, at its discretion, convert the notes to (i) cash, (ii) the Company’s common stock, or (iii) to a combination of cash and the Company’s common stock, in the amount of the face value of the notes with compound interest for three years.

Upon the Maturity Date of the note, the noteholder can (i) request Jinong to convert all or a part of the note; (ii) continue to hold the note until the holder elects to deliver a conversion request; however, if the holder chooses to hold the note after the Maturity Date, no interest accrues on the note after the three-year term.

In the event that the actions of the Targets or noteholders materially impair Jinong or if any of the Targets fail to achieve the Growth Rate, Jinong may request noteholders to redeem the shares they hold of the Targets for (i) an amount represented by the convertible notes including the accrued interest and the cash payment Jinong made on the Closing of the acquisition and (ii) 15% of the amount under (i) mentioned immediately prior to this item. However, the noteholder can elect to offset the payment of the interest of the note by the annual increase rate the Targets realizes, despite a lower rate.

VIE Structure with the Targets

Jinong, the Targets, and the shareholders of the Targets also entered into a series of contractual agreements for the Targets to qualify as variable interest entities or VIEs (the “VIE Agreements”). The VIE Agreements can be summarized as follows:

Entrusted Management Agreements

Pursuant to the terms of certain Entrusted Management Agreements dated June 30, 2016 and January 1, 2017, between Jinong and the shareholders of the sales VIE Companies (the “Entrusted Management Agreements”), the sales VIE Companies and their shareholders agreed to entrust the operations and management of its business to Jinong. According to the Entrusted Management Agreement, Jinong possesses the full and exclusive right to manage the sales VIE Companies’ operations, assets and personnel, has the right to control all the sales VIE Companies’ cash flows through an entrusted bank account, is entitled to the sales VIE Companies’ net profits as a management fee, is obligated to pay all the sales VIE Companies’ payables and loan payments, and bears all losses of the sales VIE Companies. The Entrusted Management Agreements will remain in effect until (i) the parties mutually agree to terminate the agreement; (ii) the dissolution of the sales VIE Companies; or (iii) Jinong acquires all the assets or equity of the sales VIE Companies (as more fully described below under “Exclusive Option Agreements”).

Exclusive Technology Supply Agreements

Pursuant to the terms of certain Exclusive Technology Supply Agreements dated June 30, 2016 and January 1, 2017, between Jinong and the sales VIE companies (the “Exclusive Technology Supply Agreements”), Jinong is the exclusive technology provider to the sales VIE companies. The sales VIE companies agreed to pay Jinong all fees payable for technology supply prior to making any payments under the Entrusted Management Agreement. The Exclusive Technology Supply Agreements shall remain in effect until (i) the parties mutually agree to terminate the agreement; (ii) the dissolution of the sales VIE companies; or (iii) Jinong acquires the sales VIE companies (as more fully described below under “Exclusive Option Agreements”).

Shareholder’s Voting Proxy Agreements

Pursuant to the terms of certain Shareholder’s Voting Proxy Agreements dated June 30, 2016 and January 1, 2017, among Jinong and the shareholders of the sales VIE companies (the “Shareholder’s Voting Proxy Agreements”), the shareholders of the sales VIE companies irrevocably appointed Jinong as their proxy to exercise on such shareholders’ behalf all of their voting rights as shareholders pursuant to PRC law and the Articles of Association of the sales VIE companies, including the appointment and election of directors of the sales VIE companies. Jinong agreed that it shall maintain a board of directors, the composition and appointment of which shall be approved by the Board of the Company. The Shareholder’s Voting Proxy Agreements will remain in effect until Jinong acquires all the assets or equity of the sales VIE companies.

Exclusive Option Agreements

Pursuant to the terms of certain Exclusive Option Agreements dated June 30, 2016 and January 1, 2017, among Jinong, the sales VIE companies, and the shareholders of the sales VIE companies (the “Exclusive Option Agreements”), the shareholders of the sales VIE companies granted Jinong an irrevocable and exclusive purchase option (the “Option”) to acquire the sales VIE companies’ equity interests and/or remaining assets, but only to the extent that the acquisition does not violate limitations imposed by PRC law on such transactions. The Option is exercisable at any time at Jinong’s discretion so long as such exercise and subsequent acquisition of the sales VIE companies does not violate PRC law. The consideration for the exercise of the Option is to be determined by the parties and memorialized in the future by definitive agreements setting forth the kind and value of such consideration. Jinong may transfer all rights and obligations under the Exclusive Option Agreements to any third parties without the approval of the shareholders of the sales VIE companies so long as a written notice is provided. The Exclusive Option Agreements may be terminated by mutual agreements or by 30 days written notice by Jinong.

4

Equity Pledge Agreements

Pursuant to the terms of certain Equity Pledge Agreements dated June 30, 2016 and January 1, 2017, among Jinong and the shareholders of the sales VIE companies (the “Pledge Agreements”), the shareholders of the sales VIE companies pledged all of their equity interests in the sales VIE companies to Jinong, including the proceeds thereof, to guarantee all of Jinong’s rights and benefits under the Entrusted Management Agreements, the Exclusive Technology Supply Agreements, the Shareholder’ Voting Proxy Agreements and the Exclusive Option Agreements. Prior to termination of the Pledge Agreements, the pledged equity interests cannot be transferred without Jinong’s prior written consent. The Pledge Agreements may be terminated only upon the written agreement of the parties.

Non-Compete Agreements

Pursuant to the terms of certain Non-Compete Agreements dated June 30, 2016 and January 1, 2017, among Jinong and the shareholders of the Targets (the “Non-Compete Agreements”), the shareholders of the Targets agreed that during the period beginning on the initial date of their services with Jinong, and ending five (5) years after termination of their services with Jinong, without Jinong’s prior written consent, they will not provide services or accept positions (including partners, directors, shareholders, managers, proxies or consultants) with by any profit making organizations with businesses that may compete with Jinong. They will not solicit or interfere with any of Jinong’s customers, or solicit, induce, recruit or encourage any person engaged or employed by Jinong to terminate his or her service or engagement.

Jinong acquired the Targets using the VIE arrangement based on our need to further develop our business and comply with the regulatory requirements under the PRC laws.

As our business focuses on the production of fertilizer, all our business activities intertwine with those in the agriculture industry in China. Specifically, we deal with compliance, regulation, safety, inspection, and licenses in fertilizer production, farmland use and transfer, growing and distribution of agriculture goods, agriculture basic supplies, seeds, pesticides, and trades of grains. It is an industry in which stringent regulations are implemented and strictly enforced. In addition, e-commerce, which is also under strict government regulations in the PRC, has lately become a sale and distribution channel for agricultural products. Currently, we are developing an online platform to connect the physical distribution network we either own or lease.

Compared with the regulatory environment in other jurisdictions, the regulatory environment in the PRC is unique. For example, On August 8, 2006, six PRC regulatory agencies promulgated the Regulation on Merger and Acquisition of Domestic Companies by Foreign Investors (the “M&A Rules”), which became effective on September 8, 2006. The M&A Rules require that an offshore special purpose vehicle controlled directly or indirectly by PRC companies or individuals and formed for purposes of overseas listing through acquisition of PRC domestic interests held by such PRC companies or individuals obtain the approval of the China Securities Regulatory Commission (the “CSRC”) prior to the listing and trading of such special purpose vehicle’s securities on an overseas stock exchange. On September 21, 2006, the CSRC published procedures regarding its approval of overseas listings by special purpose vehicles.

For both e-commerce and agriculture industries, PRC regulators limit the investment from foreign entities and set rules for foreign-owned entities to conduct business. We expect these limitations on foreign-owned entities will continue to exist in e-commerce and agriculture industries. VIE arrangements, however, provide feasibility for obtaining administrative approval process and avoiding industry restrictions that may be imposed on an entity that is a wholly owned subsidiary of a foreign entity. The VIE agreements reduce uncertainty and the current limitation risk. It is our understanding that the VIE agreements, as well as the control we obtained through VIE arrangement, are valid and enforceable. We believe that this legal structure does not violate the known, published, and current PRC laws. While there are substantial uncertainties regarding the interpretation and application of PRC Laws and future PRC laws and regulations, and there can be no assurance that the PRC authorities will take a view that is not contrary to or otherwise different from our belief and understanding stated above, we believe the substantial difficulty that we experienced previously to conduct business in agriculture as a foreign ownership company can be greatly reduced by the VIE arrangement. Further, as an integral part of the VIE arrangement, the underlying equity pledge agreements provide legal protection for the control we obtained. Pursuant to the equity pledge agreements, we have completed the equity pledge processes with the Targets to ensure the complete control of the interests in the Targets. The shareholders of the Targets are not entitled to transfer any shares to the third party under the exclusive option agreements. If necessary, they may transfer shares to us without consideration.

5

While the VIE arrangement provides us with the feasibility to conduct our business in the e-commerce and agriculture industries, validity and enforceability of VIE arrangement is subject to (i) any applicable bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium or similar laws affecting creditors’ rights generally, (ii) possible judicial or administrative actions or any PRC Laws affecting creditors’ rights, (iii) certain equitable, legal or statutory principles affecting the validity and enforceability of contractual rights generally under concepts of public interest, interests of the State, national security, reasonableness, good faith and fair dealing, and applicable statutes of limitation; (iv) any circumstance in connection with formulation, execution or implementation of any legal documents that would be deemed materially mistaken, clearly unconscionable, fraudulent, coercive at the conclusions thereof; and (v) judicial discretion with respect to the availability of indemnifications, remedies or defenses, the calculation of damages, the entitlement to attorney’s fees and other costs, and the waiver of immunity from jurisdiction of any court or from legal process. Validity and enforceability of VIE arrangements is also subject to risk derived from the discretion of any competent PRC legislative, administrative or judicial bodies in exercising their authority in the PRC. As a result, there can be no assurance that any of such PRC Laws will not be changed, amended or replaced in the immediate future or in the longer term with or without retrospective effect.

Our History

The Company was incorporated under the laws of the state of Kansas on February 6, 1987 under the name Videophone, Inc. The Company had no operations from December 1996 to December 2007. In October 2007, the Company was reincorporated in the state of Nevada. On December 26, 2007, the Company acquired all the issued and outstanding capital stock of Green New Jersey, through a share exchange (the “Share Exchange”). Because of the Share Exchange, the Company owns 100% of Green New Jersey. The Share Exchange occurred simultaneously with a private placement of $20,519,255 on December 26, 2007.

Green New Jersey was incorporated on January 27, 2007 under the laws of the State of New Jersey. On August 24, 2007, Green New Jersey acquired 100% of the outstanding shares of Jinong, a company incorporated in the PRC on June 19, 2000.

After the acquisition of Green New Jersey, the Company changed its name to China Green Agriculture, Inc., effective on February 5, 2008.

On July 23, 2009, Yuxing became a direct, wholly owned subsidiary of Jinong to facilitate the research and development of agricultural products and fertilizers. Effective June 16, 2013, Yuxing was converted into a PRC domestic enterprise wholly owned by an individual who entered into a series of contractual agreements with Jinong pursuant to which Yuxing became Jinong’s variable interest entity or VIE.

On March 9, 2009, the Company’s common stock was listed on the NYSE MKT, formerly known as NYSE Amex Equities under the trading symbol “CGA”. On December 4, 2009, the Company voluntarily ceased trading its common stock on the NYSE Amex Equities and transferred its listing to the New York Stock Exchange on December 7, 2009. The Company’s ticker symbol remains “CGA”.

On July 2, 2010, the Company, through Jinong, consummated a transaction to acquire all equity interests of Gufeng and its subsidiary Tianjuyuan. As a result, Gufeng and Tianjuyuan became wholly owned subsidiaries of Jinong and indirect subsidiaries of the Company.

On June 30, 2016, the Company, through its wholly-owned subsidiary Jinong, entered strategic acquisition agreements and a series of contractual agreements with the shareholders of the following six companies that are organized under the laws of the PRC and would be deemed as our VIEs: Shaanxi Lishijie Agrochemical Co., Ltd., Songyuan Jinyangguang Sannong Service Co., Ltd., Shenqiu County Zhenbai Agriculture Co., Ltd., Weinan City Linwei District Wangtian Agricultural Materials Co., Ltd., Aksu Xindeguo Agricultural Materials Co., Ltd., and Xinjiang Xinyulei Eco-agriculture Science and Technology Co., Ltd.

On January 1, 2017, the Company, through its wholly owned subsidiary Jinong, entered into strategic acquisition agreements and a series of contractual agreements with the shareholders of the following two companies that are organized under the laws of the PRC and would be deemed as our VIEs: Sunwu County Xiangrong Agricultural Materials Co., Ltd. and Anhui Fengnong Seed Co., Ltd.

On November 30, 2017, the Company, through its wholly owned subsidiary Jinong, discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders of Zhenbai.

On June 2, 2021, the Company, through its wholly owned subsidiary Jinong, discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders of Aksu Xindeguo Agricultural Materials Co., Ltd., Xinjiang Xinyulei Eco-agriculture Science and Technology Co., Ltd., and Sunwu County Xiangrong Agricultural Materials Co., Ltd.

On December 1, 2021, the Company, through its wholly owned subsidiary Jinong, discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders of Lishijie.

On December 31, 2021, the Company, through its wholly owned subsidiary Jinong, discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders of Fengnong.

On March 31, 2022, the Company, through its wholly owned subsidiary Jinong, discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders of Jinyangguang and Wangtian.

Our principal executive offices are located at 3rd Floor, Borough A, Block A. No. 181, South Taibai Road, Xi’an, Shaanxi Province, People’s Republic of China 710065 and our telephone number is +86-29-88266368. Our website address is www.cgagri.com. The Company routinely posts important information on its website.

6

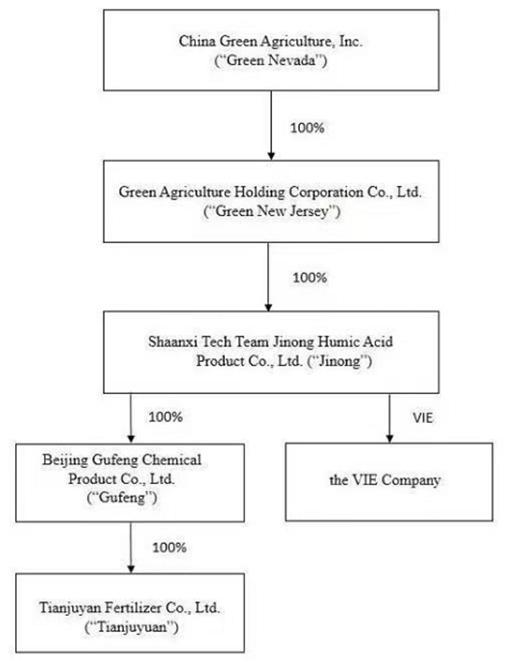

Our current corporate structure is set forth in the following diagram:

Yuxing may also collectively be referred to as “the VIE Company”.

7

Industry Analysis

Fertilizer Market in China

Influenced by the sluggish demand in domestic and international fertilizer markets, China’s fertilizer market is in a downturn during this fiscal year. In terms of production, the growth of fertilizer output remained limited during the fiscal year. Meanwhile, large inventories of fertilizer placed downward pressure on prices. Market prices of the raw material were volatile; the price of fertilizer is uncertain and can be hard to increase. In terms of domestic consumption, though grain prices increased to some extent, the domestic consumption capacity is limited; as for export, international markets are depressed continuously, resulting from the declines in export prices. During this fiscal year, the fertilizer industry was in a downward trend as profits are compressed again and the losses of enterprises are enlarged. Under the pressure of sluggish growth in the fertilizer market, industrial restructuring, merger and reorganization activity in the industry increased, reducing the number of enterprises in the market. At the same time, the production equipment and technological level was largely improved: coal-water slurry gasification technology, powdered coal pressure gasification technology, large sulfur-based compound fertilizer technology and beneficiation technology of mid-low-grade phosphate were widely used, while new fertilizer products such as slow controlled release fertilizer and microbial fertilizer have been rapidly developed and resulted in significant market expansion. In the last few years, as the growth of China’s economy has gradually slowed down and the risk of economic downturn therefore exists, the government has adopted various measures to maintain the growth and the Company needs structural adjustment and growth pattern transformation.

On the one hand, government’s support to agricultural production includes intensive agricultural investment, subsidies and minimum purchasing price increases for farm products. China has seen another bumper year of grain production, while increased fertilizer consumption remains highly uncertain. The country has achieved consecutive years of rising grain harvests since the founding of the People’s Republic of China in 1949. As the concentration of the fertilizer industry is steadily improving, the influence on market from key enterprises have increased, which appeared to help to ease the weakened market volatility. On the other hand, the current oversupply problem is difficult to relieve. Mechanisms of price reform for raw materials (such as coal, natural gas, sulfur phosphate ore, etc.) are accelerating, which caused pressure on production costs. A stricter export tariff policy is expected to last indefinitely, and the external economic situation may limit the operation and expansion of fertilizer enterprises in international markets.

The interaction of the above factors complicated the situation in fertilizer markets since 2017. The overall growth rate of this industry has continually slowed down, and the market has fluctuated violently. The transformation for China’s fertilizer industry from quantitative growth pattern to qualitative growth pattern is irreversible. The centralization of production, high-end oriented product, service-oriented marketing and market-oriented raw materials dominated the developments in the fertilizer market.

Additionally, government support for the agriculture industry in China can act as an additional boost to the fertilizer industry in China. However, we anticipate organic fertilizers will become an emerging segment in the coming years, given the additional subsidies for farming, elimination of certain land taxes, and land reform initiatives to be implemented by the PRC government to promote the growing of organic produce. We believe the demand for fertilizer will continue to grow because of increase in food demand, decrease in arable land and reduction of crop yields. The demand for fertilizers nationwide is continuously expected to increase by millions of tons of nutrient, with an expected compound annual growth rate of 7.7% from 2016 to 2022.

Organic versus Chemical Fertilizers

In general, fertilizer products are categorized into organic and chemical fertilizers. Organic fertilizers can be natural or developed artificially. Natural organic fertilizers include manure, slurry, worm castings, peat, seaweed, humic acid, brassin and guano. Artificial organic fertilizers include compost, blood meal, bone meal, humic acid, and are typically supplemented with other nutrient ingredients. Chemical fertilizers normally are composed of synthetic chemicals such as phosphate and potassium compounds. The primary difference between organic fertilizers and chemical fertilizers is in the sourcing process of ingredients, as the nutrient contents are largely the same.

Over the past 20 years, the use of chemical fertilizers in China substantially increased, but years of use created unintended consequences for the agriculture industry—agricultural products gradually lack certain minerals, since chemical fertilizers applied fell short of natural minerals which made soil infertile.

In addition, heavy use of chemical fertilizers can create “fertilizer burn,” the over-fertilization of a single nutrient such as nitrogen, which can dry roots and suspend crop growth due to the upset of balance in compound salts and soil acidification. Another drawback caused by chemical fertilizers is that soil is easily depleted by irrigation, rainfall and flooding. In addition, the production of chemical fertilizers consumes a great deal of natural resources. For example, the production of synthetic ammonia, a common chemical fertilizer, comprises about 5% of the world’s natural gas consumption.

Organic fertilizers, on the other hand, improve the biodiversity and long-term productivity of soil. Organic nutrients increase the abundance of soil organisms by providing organic micronutrients. Unlike chemical fertilizers, organic fertilizer nutrients are diluted with better solubility. It requires less application on soil to reach the same result as of chemical fertilizers, which maintains soil fertility and avoid the runoff caused by components like soluble nitrogen and phosphorus. However, the composition of organic fertilizer is more complex and costly than chemical products. As an alternative to pure chemical fertilizer use, farmers can also use inorganic fertilizer supplemented with a small portion of organic fertilizers.

8

Since the 1980s, China has intensified the use of chemical fertilizers to increase crop yields. While the increase in crop yield slowed down in recent years, the overuse of chemical fertilizers also caused many environmental issues ranging from water pollution to soil damage. As a result, the PRC government has been promoting the use of environmentally friendly green fertilizers, such as humic acid-based organic compound fertilizers and mixed organic-inorganic compound fertilizers, because they provide crops with incremental yield by adding various nutrients essential to soil. Although being relatively new to farmers, the demand for these green fertilizers is increasing and we expect this trend to continue in the coming years. Although we expanded business among other Asian and Southeast Asian countries, the PRC remained our principal market for organic compound fertilizers and related agricultural products.

The “Green Food” Industry in the PRC

The rise of the PRC industry for food free from pollutants or harmful chemicals, or “green food,” raises the demand for organic fertilizers. “Green Food,” the certificate for agricultural products promoted by the Chinese Government, is positioned between ordinary agricultural food from common farming practice and organic food and has two levels: “AA Green Food” and “A Green Food”. The “AA Green Food” standard indicates products that are equal to those of organic agriculture. Since the market for organic agricultural products in China has huge potential, it is forecasted that the increase of organic agricultural products consumption in China will exceed that of the average organic agricultural products consumption in the world in the next few years. The market for Chinese organic agricultural products reached USD 5 billion in 2015, with an incremental 20 percent increase year over year during the following years.

With the rapid development of the organic food industry in China, an increasing number of companies have been entering into the green food sector to utilize market opportunities. In 1990, the PRC Ministry of Agriculture began to promote the production of green food. In 1992, the PRC Ministry of Agriculture established the China Green Food Development Center (CGFDC) to supervise the development and management of green food at the national and provincial levels in the PRC. In 1993, the PRC Ministry of Agriculture established regulations for green food labeling; in 1996, a trademark for green food was registered and put into use in the PRC.

Crops grown with the use of our products are qualified for the “AA Green Food” certificate. As noted above, the “AA” rating indicates that the crops contain minimal chemical residue from fertilizers. Although our products are not qualified for the “AA Green Food” certificate, they are (except for the products from Gufeng) certified as “Green Food Production Material” by the CGFDC.

According to the statistics from the CGFDC, China’s annual output of green food reached 15 million tons in 2008. However, the domestic consumption level remains relatively low, comprising approximately 3% of the market share of food commodities. The low consumption level is primarily due to: (i) small scale of production of green food; (ii) lack of consumer awareness of green food and (iii) the presence of counterfeit green food products that adversely affect consumers’ perception of green food.

As described by the CGFDC, the development strategies for China’s green food industry are as follows: first, maintain high quality standards and focus on developing key products; second, promote and facilitate the industrialization of green food; third, implement an integrated development strategy emphasizing producers, production base and farmers; fourth, accelerate the pace of development with the aid of the government; and fifth, to carry out an international development strategy aimed at promoting exports.

According to the Investment and Forecast Report on China Green Food Industry 2012-2016 by Research in China, a Chinese market research company, the green food industry is a high growth industry with significant investment potential. According to the report, leading green food producers will experience huge growth when they achieve national and provincial agricultural industrialization with the support of favorable government policies and tax incentives.

Growth Strategy

We believe that our increased production capacity and our research and development capability, along with the new sales segment, positions us to benefit from the anticipated growth of the PRC fertilizer market. We expect to expand sales and grow revenues through the following strategies:

☐ Expand Capacity and Diversify Product Offerings. Our current annual fertilizer production capacity is 555,000 metric tons and our production portfolio of fertilizers includes 416 products. In the future, we will expand our existing production lines, develop new products and acquire certain PRC fertilizer manufacturers that complement our product lines.

9

☐ Capitalize on Synergies Created by Research and Development Efforts. Regarding the construction of Yuxing’s research and development center, we have established 98 sunlight greenhouses and six “intelligent” greenhouses. We expect the Yuxing facility to help us shorten the fertilizer market cycle by providing an advanced testing field for new products which are manufactured by Jinong. In addition, by making efforts in research and development, we expect to simultaneously facilitate the production of superior agricultural products, such as flower bulbs, flowers, fruits and vegetables, which would eventually increase revenues.

☐ Develop new advanced highly efficient fertilizers. The new fertilizer products represented by slow controlled-release fertilizer, microbial fertilizer and others, are developed rapidly with high market expansion. Gufeng develops the “Tianjuyuan” controlled-release fertilizer. The objective is to provide Gufeng with fertilizer agent to improve the control release effectiveness when producing controlled-release compound fertilizers. We expect that Gufeng’s controlled-release compound fertilizer will have an advantageous position in the market.

Products

Our principal products are our own fertilizers, which consist of liquid, granular and powdered fertilizers and various kinds of compound fertilizers developed to increase crop yields. We can manufacture 416 fertilizer products from humic acid-based fertilizers to compound fertilizers. In Yuxing, we produce high quality agricultural products such as fruits, vegetables and flowers for commercial sale. In our sales segment, we sell various products such as fertilizers, pesticides, and seeds. These products are either manufactured by us or by other manufacturers.

Fertilizer Products

Fertilizer manufacturing is our core business, which accounts for approximately 88.4% of total revenues. The self-manufactured fertilizers are produced and sold through Jinong and Gufeng. We believe that Jinong utilizes one of the most advanced automated humic acid production lines in China. Humic acid is a complex with natural, organic ingredients essential to make soil fertile. Humic acid-rich material, such as peat, lignite or weathered coal generating naturally from decomposed plant or animal remains, is one of the major organic constituents for soil composition. Humic acid exhibits a high capacity for cation exchange (a chemical process in which cations of like charge are exchanged equally between a solid and a solution), which serves to chelate plant nutrient elements and release them as the plant requires. The chelation process prevents leaching of nutrients by holding them in the soil solution. Moreover, humic acids can bind soil toxins along with plant nutrients, thereby strongly stabilizing soil. The regular use of humic acid organic liquid compound fertilizer can effectively reduce the use of chemical fertilizer, insecticide, herbicide and water. This mechanism contributes to environmental protection by preventing contamination of water sources caused by runoff.

In nature, humic acid improves soil structure and aeration, nutrient absorption and water retention. It also increases soil’s buffering capacity against fluctuations in PH levels, and reduces soil crusting and erosion from wind and water as well as radical toxic pollutants. Humic acid promotes the developing of root systems, seed germination and overall plant growth. It also enhances health, resilience and overall appearance of plants. We believe there is no synthetic material currently known to match humic acid’s effectiveness and versatility.

The pure humic acid used in our fertilizers is distilled and extracted from weathered coal by way of alkaline digestion and acid recrystallization. Our Jinong fertilizers are principally used as a foliar fertilizer (a liquid, water-soluble fertilizer applied to a plant’s foliage by a fine spray, so the plant absorbs the nutrients through its leaves), through spraying directly on soil or injecting into the irrigation systems. Benefits of using our products are to stimulate the growth and yield of plants, protecting them from drought, disease and temperature damages while improving soil structure and fertility.

Gufeng and Tianjuyuan produce compound fertilizer, blended fertilizer, organic compound fertilizer, slow-release fertilizers, highly concentrated water-soluble fertilizers, and mixed organic-inorganic compound fertilizer. Gufeng sells its products under four brands: “KEBA”, “Mei Er An”, “Huang Cheng Gen” and “SPR HOP,” which are all registered trademarks in the PRC. Tianjuyuan’s products are marketed under the brands “AGR GFJ” and “T.J.Y.” which are both PRC registered trademarks.

10

We have a multi-tiered product line of 416 fertilizer products, covering humic acid-based compound fertilizer produced through Jinong, and organic/inorganic compound fertilizer through Gufeng.

During the fiscal years ended June 30, 2022, 2021 and 2020, we recorded $160,657,513, $200,245,680, and $200,185,739, respectively, in gross revenues from sales of our fertilizer products, representing 88.4%, 83.5%, and 80.3% of our total revenues for such periods. Gufeng and Tianjuyuan manufacture a total of 336 fertilizer products. 47.7% of Gufeng’s fertilizer revenue came from humic acid compound fertilizers and 52.3% from compound fertilizer for the fiscal year ended June 30, 2022.

Agricultural Products

Our subsidiary, Yuxing, one of Jinong’s VIEs, produces top-grade fruits, vegetables, flowers and colored seedlings for commercial sale. The gross revenues from the sale of our agricultural products for the fiscal years ended June 30, 2022, 2021 and 2020, were $11,356,390, $11,038,666, and $9,227,113, respectively, representing 6.2%, 4.6%, and 3.7% of our total revenues, respectively.

Yuxing was originally established to be the research and development base for humic acid fertilizers produced by Jinong. By simulating the growing conditions and cycles of various plants, such as flowers, vegetables and seedlings, Yuxing regularly conducts experimental testing to enhance the efficacy of our new fertilizers.

Fertilizer Manufacturing Process

Our production lines employ scientifically designed production procedures and strict quality control systems to ensure high quality in our products. These production lines are fully automated and operated by a central control system with minimal manual input by technicians. The machinery and vats for the line are supplied by a local medical machinery manufacturer and the automatic control systems were developed by us. Our access management system always protects the proprietary ingredient mixes from any unauthorized use. Our computer server is connected to the electronic scales on each of the material input bins to ensure that the exact quantity of each element or ingredient is delivered correctly, thus maintaining product quality and reduce waste. Our production line producing liquid fertilizer and powered fertilizer is centrally controlled by a wireless panoramic audio and video monitoring system that allows connectivity with mobile terminals such as cell phones.

In Jinong, we operate a 6,495 square meters (69,911 square feet) facility that manufactures liquid fertilizer products and a 13,803-square meter (148,576 square feet) facility that produces liquid and highly concentrated (powdered) fertilizers. Jinong’s total annual production capacity at these facilities is 55,000 metric tons.

In Gufeng and Tianjuyuan, we operate eight manufacturing facilities located in No. 6 Mafang Logistics Park, Pinggu, Beijing. These facilities produce various kinds of fertilizers and have a total annual production capacity of 500,000 metric tons.

The manufacturing techniques utilized by Gufeng include extruder granulation, rotary drum steam granulation, urea-based spraying granulation and resin-coated sustained release, which enable Gufeng to effectively meet the production requirements of all different compound fertilizers. To ensure high quality, Gufeng and Tianjuyuan employ strict quality controls from the raw materials purchases to the products sales to end users.

We produced and sold a total of approximately 287,160 metric tons of fertilizer products during the fiscal year ended June 30, 2022.

11

Raw Materials and Suppliers

Fertilizer Products

Among the three materials utilized to produce humic acid (weathered coal, lignite and peat), we have chosen weathered coal as a key raw material because it is abundant and economical for production. We have been sourcing the humic acid from different regions including Shaanxi and Shanxi provinces, and Inner Mongolia Autonomous Region.

In addition to weathered coal, we use approximately 50 different components in our production process, including elements such as sodium, calcium, zinc, iron and potassium, all of which can be readily obtained from local markets. We utilize spectral analysis technology to select raw materials with the best quality, and we have specially trained buyers to ensure the consistency of raw materials procured.

The fertilizer products that Gufeng and Tianjuyuan manufacture incorporate over 50 different raw materials, including coal, sulfuric acid and NPK (nitrogen, phosphorus and potassium) related compounds such as amide and hydro nitrogen. Gufeng sources these supplies largely from neighboring provinces and regions, such as Hebei and Shaanxi provinces, and the Municipality of Beijing, for the economical transportation costs.

Our products are packaged in bottles, bags and boxes. Each type of packaging material, along with packaging labels, is readily available for purchase from manufacturers in Shaanxi, Beijing, Shandong and Zhejiang provinces.

Agricultural Products

The plants that generate our top-grade flowers and multi-colored seedlings are mainly planted and cultivated in research and development facilities maintained by Yuxing. We purchase seeds of green vegetables and fruits from agricultural companies, such as RijkZwaan Company, which imports the seeds from foreign markets, including Holland. We cultivate our agricultural products by applying fertilizers produced by Jinong.

Inventory

For our fertilizer products, our efficient production methods allow us to maintain appropriate inventory levels, which keep inventory costs reasonable. We purchase raw materials and packaging materials based on demands and business forecasts. Products, in various formulas and different batches, with customized volumes, are shipped to distributors and users after production in response to orders we receive.

For our agricultural products, we maintain corresponding inventory to both the anticipated demand from customers and other needs, as we often use certain agricultural products to serve our product testing base for research and development purposes.

Seasonality

The peak season to sell fertilizer products is from January through June. However, during the fiscal year ended June 30, 2022, Jinong did not experience significant seasonal variation with respect to its fertilizer sales since approximately 44.8% of its annual sales revenue occurred in the third fiscal quarter (winter) and the fourth fiscal quarter (spring). Usually, Gufeng’s sales of compound fertilizer undergoes significant seasonal variation in China. Correspondingly, during the fiscal year ended June 30, 2022, Gufeng experienced seasonal variation. 65.0% of Gufeng’s annual sales revenue occurred in the third fiscal quarter (winter) and the fourth fiscal quarter (spring).

The purchase of its raw material, basic fertilizers, is affected by the supply and demand in the fertilizer market with seasonality. Over non-peak sales season, when the raw material price is low and economical, Gufeng may choose to place larger orders for raw materials as its export business offsets the seasonality when exports are made to southern Asia, such as India, where the selling season corresponds to the non-peak season in China.

The peak selling season for our agricultural products is from October until March, namely our second fiscal quarter (fall) and the third fiscal quarter (winter). This is primarily due to the strong demand for high-end fruits and decorative flowers during the holiday seasons.

12

Marketing, Distribution and Customers

Overview

We currently market our own fertilizer products to private wholesalers and retailers of agricultural farm products in 22 provinces, 4 autonomous regions and 4 central government-controlled municipalities in China. For the fiscal year 2022, the following five PRC provinces collectively accounted for 70.2% of our fertilizer manufacturing revenue: Hebei (34.4%), Heilongjiang (12.6%), Inner Mongolia (9.4%), Liaoning (9.1%), and Shaanxi (4.7%). We believe this geographically diverse distribution helps us to become a leader in the compound fertilizer market as compared to regional competitors because we are not heavily dependent on any single geographic area for sales and are able to raise our brand and product awareness nationwide. We also manufacture our fertilizer products for export through contracted distributors in foreign countries, including India and Africa. Total revenues from exported products accounted for approximately 0.3% of our total fertilizer revenues in fiscal 2022.

Our agricultural products are distributed through various channels in Shaanxi Province and other provinces. Decorative flowers are usually sold through our fertilizer distributors to end-users such as flower shops, luxury hotels and government agencies. Fruits and vegetables are sold to high-end supermarkets and upscale restaurants. Seedlings are sold primarily to departments of city planning.

A multi-tiered product strategy allows us to tailor our fertilizer products to the needs and preferences of the various geographic regions in China. Our fertilizers can be tailored to different crops grown in varying climate and soil conditions. For example, climate and rainfall conditions in Southern and Eastern China allow farmers to grow high margin crops such as fruit and seasonal vegetables. As a result, these farmers are willing to invest in expensive and specialized fertilizers. In contrast, we market low-cost fertilizers to farmers in the Northwest areas of China due to the inclement weather.

Our research and development capabilities allow us to tailor products to meet specific farming needs in considering different factors such as crops species, humidity, weather and soil conditions.

Marketing

Our marketing staff is trained to closely work with distributors and customers, including retailers and farmers, providing professional advice on customizing our products to customer needs and offering agricultural knowledge and other extensive customer support. In addition, our employees educate and communicate with distributors and customers by regularly organizing training courses on new agricultural techniques.

Compared with industry norms, we believe our product development cycle of three to nine months is relatively short. Through our regular collection of market data, including growth records of a variety of plants cultivated in different soil and climate conditions, together with feedbacks from our end-users, we can conduct nationwide market analysis, ascertain new product needs, estimate demand and customer demographics and develop new products tailored to current market needs.

Although we utilize television advertisements and mass media, most of our marketing efforts are conducted through joint activities with distributors. Our sales and marketing staff work with and train distributors and retail clients through lectures and interactive meetings. We emphasize the technological components of our products to end-users to help them understand the differences in products and how to effectively use them. Word-of-mouth advertising and sample trials of new products in new areas are also essential components of our marketing efforts. In addition, we have established nationwide telephone hotlines to answer questions and have constructed an SMS text message platform to allow real-time interaction with customers.

13

Our best-selling self-manufactured fertilizers, based on revenues for the fiscal year ended June 30, 2022, are listed below:

| Percent of | ||||||||||||||

| Volume | Revenues | Fertilizer | ||||||||||||

| Ranking | Product Names | (Tons) | (USD) | Sales | ||||||||||

| 1 | Organic/Inorganic Compound Fertilizer (humic acid) NPK46% | 102,528 | 48,749,704 | 29.5 | % | |||||||||

| 2 | Gufeng Compound Fertilizer NPK40% | 108,463 | 48,130,731 | 29.1 | % | |||||||||

| 3 | Gufeng Compound Fertilizer Other | 8,270 | 1,867,499 | 1.1 | % | |||||||||

| 4 | Gufeng Compound Fertilizer NPK51% | 2,748 | 1,243,049 | 0.8 | % | |||||||||

| 5 | Jinong Chongshifei Fertilizer (humic acid) | 676 | 1,182,603 | 0.7 | % | |||||||||

COVID-19 Update

In the fiscal year 2020, the novel coronavirus (“COVID-19”) spread rapidly across the world in the first half year of 2020 and was declared a pandemic by the World Health Organization. The COVID-19 pandemic impacted our business operations, including our employees, customers, partners, and communities. The government and private sector responses to contain its spread began to significantly affect our operating businesses in February and March and adversely affected nearly all our operations in the second quarter, although such effects may vary significantly. The duration and extent of the effects over longer terms cannot be reasonably estimated at this time. The risks and uncertainties resulting from the pandemic that may affect our future earnings, cash flows and financial condition include the closure of our various office buildings and facilities and the long-term effect on the demand for our products and services. Accordingly, significant estimates used in the preparation of our financial statements including the evaluations of bad debt expense. More information concerning the effects of COVID-19 is included in Note 22.

Fertilizer Products

The fertilizer product market in China is highly fragmented. Our primary sales strategy is to establish contractual relationships with qualified distributors throughout the country, who, in turn, will distribute our products to wholesalers and retailers, and ultimately, the farmers.

As of June 30, 2022, we sold our products through a nationwide constructed network of about 1,398 distributors covering 22 provinces, 4 autonomous regions and 4 central government-controlled municipalities in China.

The distributors sell our products to the smaller, local wholesale and retail outlets who then sell to the end-users, typically farmers. We do not grant provincial or regional exclusivity because there is currently no single distributor sufficiently dominant to warrant exclusivity. We enter into non-exclusive written distribution agreements with chosen distributors that demonstrate their ability in regional sales networks. The distribution agreements do not dictate distribution quantity because changes in weather and local market could dramatically affect sales quotas.

For the fiscal year ended June 30, 2022, sales of our self-manufactured products to our top five distributors accounted for approximately 49.9% of our revenues. As we do not depend on specific customers, we believe that the loss of single customers would not have any significant effect on our business.

Agricultural Products

We distribute our agricultural products through several networks depending on the type of product. Our top-grade flowers are mainly distributed through our fertilizer distribution network; our green vegetables and fruits are mainly distributed to a variety of wholesale markets and supermarkets in Xi’an, while our multi-colored seedlings are distributed to the seedling centers and planting companies in China with which we have had long-term cooperation.

Retail Stores and Authorized Retailers

We have successfully implemented two marketing programs in Shaanxi, Hebei, Anhui, Jiangsu and Guangzhou provinces. These marketing programs consist of: (i) establishment of Company directly owned retail stores to sell fertilizer products produced by Jinong and Gufeng through the designated sales personnel (the “Pilot Program”) and (ii) selection of qualified retailers from the Company’s distributor base to be designated as authorized retailers. With the Pilot Program, we have worked closely with our distributors, with each distributor’s outlet having an assigned territory in order not to compete with other existing distributors. We had entered into agreements with these retailers on their exhibits, and we had well-positioned standardized shelves and product displays in their retail stores. In addition, we provide the retailers with educational materials on proper product use and billboard ads with our product logo to attract target farmers.

14

Research and Development

We conduct the bulk of our research and development activities through Yuxing. Through Yuxing, we cultivate high-quality flowers, green vegetables and fruits in our own greenhouses and sell them to various end-users, including airlines, hotels and restaurants. Yuxing operates advanced research and development facilities that: (i) provide testing and an experimental data collection base for new fertilizers produced by Jinong by simulating the growing conditions and development stages of a variety of plants, such as flowers, vegetables and seedlings, and (ii) increase our capability to produce more products while shortening the new product development cycle, which allows us to release products to market quickly, thus increasing revenues and market share. In addition, our research and development capabilities allow us to develop products tailored to specific farming needs generated by different crop species, humidity, weather and soil conditions. Flowers, fruits and vegetables grown from experimental testing of Jinong’s humic acid compound fertilizers are of high quality and are sold to local supermarkets and airline companies.

The capital expenditure and other payments on Yuxing’s construction, net of accumulated depreciation, were approximately $6,988,882, $8,295,772 and $8,414,911 during the fiscal years ending of June 30, 2022, 2021 and 2020, respectively. The research and development center helps expand our output of high-quality agricultural products for commercial sale while providing an advanced testing field for new products. The facility at Yuxing enhances our capability to produce more products while shortening the development cycle, thus increasing revenues and market share. In addition to developing new humic acid-based fertilizer products, we plan to develop other agricultural derivatives such as humic-acid based organic pesticides, which can provide additional revenue sources. For the fiscal year ended June 30, 2022, we sold approximately $11,356,390 of these agricultural products.

| FY 2022 | FY 2021 | FY 2020 | ||||||||||

| Machines, Buildings and Equipment | $ | 6,926,023 | $ | 8,198,256 | $ | 8,355,336 | ||||||

| Construction in Progress | $ | 10,600 | $ | 97,516 | $ | 59,575 | ||||||

| Total | $ | 6,988,882 | $ | 8,295,772 | $ | 8,414,911 | ||||||

New Products

With our research and development capabilities, we have developed 416 products and continue to develop new products. During the fiscal year ended June 30, 2022, we developed 11 new products of liquid fertilizers.

In addition to developing new fertilizer products, we also developed soilless seeding and breeding of colored-leaf plants, rare flowers and new species of fruits and vegetables.

Intellectual Property

We hold the following trademarks registered with the PRC Trademark Offices of National Industrial and Commerce Administrative Bureau (the “PRC Trademark Offices”):

| Trademark | Registration Number | Valid term | ||

| Huang Cheng Gen | No.5219720 | June 28, 2019 to June 27, 2029 | ||

| Mei Er An | No.1508004 | January 21, 2021 to January 20, 2031 | ||

| KEBA | No.10045980 | December 07, 2012 to December 06, 2022 | ||

| KEBA | No.10046405 | December 14, 2012 to December 13, 2022 | ||

| KEBA | No.10045898 | March 07, 2013 to March 06, 2023 | ||

| KEBA | No.10046344 | March 07, 2013 to March 06, 2023 | ||

| AGR GFJ | No.3320281 | May 28, 2014 to May 27, 2024 | ||

| SPR HOP | No.3320282 | May 28, 2014 to May 27, 2024 | ||

| T.J.Y | No.3320283 | May 28, 2014 to May 27, 2024 | ||

| KEBA | No.760379 | August 14, 2005 to August 13, 2025 |

A registered trademark is protected in China for a term of 10 years, and it is renewable for another 10-year term under the PRC trademark law if the renewal application is submitted to the PRC Trademark Offices within 6 months prior to the expiration of the previous term.

15

Listed below are Jinong’s four patents for a fertilizer formulation and a proprietary production line and manufacturing processes.

| Inventor’s | Date of | |||||||||

| Patent/Pending | Patent No./ | Name and | Date of | Publication and | ||||||

| Patent Application | Type of Patent | Application No. | Patent Holder | Application | Term | |||||

| Patent: | Utility Model | Application No.: | Applicant: | February 1, 2007 | November 24, | |||||

| Method and recipe of the water-soluble humic acid fertilizers | Patent | ZL200710017334.x | Jinong |

2010; 20 years | ||||||

| Patent: | Utility Model | Application No.: | Applicant: | September 22, 2011 | December 4, 2013; | |||||

| Production method of Organic Fertilizer | Patent | ZL201110282544.8 |

Jinong |

20

years | ||||||

| Patent: | Utility Model | Application No.: | Applicant: | August 15, 2013 | February 11, 2015; | |||||

| Method and recipe of the water-soluble high concentration humic acid fertilizers | Patent | ZL201310357167.9 |

Jinong |

20

years | ||||||

| Patent: | Utility Model | Application No.: | Applicant: | January 17, 2014 | April 08, 2015; | |||||

| Production method of Multifunctional liquid calcium fertilizer | Patent | NL 201410020442.2 | Jinong | 20 Years |

The PRC Patent Law was adopted by the PRC National People’s Congress in 1984 and was subsequently amended in 1992 and 2000. Under the PRC Patent Law, an invention patent is valid for a term of 20 years and a utility or design patent is valid for a term of 10 years. Both of our registered patents are utility patents. Any use of our patent without consent or a proper license from us constitutes an infringement of patent rights.

In addition to trademark and patent protection in China, we also rely on contractual confidentiality provisions to protect our brand and intellectual property rights. To safeguard these rights our research and development personnel and executive officers are subject to confidentiality agreements. They are also subject to a non-competition covenant following the termination of employment. They also agree that all work products belong to us. Moreover, we take steps to limit the number of personnel involved in the production process and, instead of disclosing fertilizer ingredients to employees, we refer to the ingredients by numbers.

Competitive Strengths

We believe our products possess the following competitive advantages which enable us to compete in the PRC fertilizer market.

Nation-wide sales network. In the highly fragmented Chinese fertilizer market, we have established our own distribution channels with private distributors that sell our products to retail stores and farmers throughout China. We have over 1,398 distributors nationwide across 22 provinces, 4 autonomous regions and 4 central government-controlled municipalities in China. Most of our competitors do not have a sales team as large as ours that specializes in the sale of compound fertilizer products. Moreover, we believe the regional strengths of Gufeng’s distribution network have expanded and will continue to expand our sales coverage to certain cities and counties as well as foreign markets.

16

Strong Research and Development. Our research and development are managed effectively. Typically, it takes only three to nine months from the decision to develop a new product to mass production, which ensures product flow and helps to maintain market share. Our strong research and development department is based on our intelligent greenhouse facilities. The advanced equipment and soil-free techniques in such facilities simulate the natural environment in different areas and control selected factors. Since most of Jinong’s experimental work is conducted in Yuxing’s greenhouse facilities, thereby speeding up development cycles, we can reduce costs without sacrificing accurate results. During the fiscal year ended June 30, 2022, we generated approximately $11,356,390 revenue from sales of Yuxing’s agricultural products, and we anticipate that this source of revenue will grow in the future. We have built 98 sunlight greenhouses and six intelligent greenhouses on an 88-acre parcel of land relating to Yuxing’s pending research and development center, which expands output of high-quality agricultural products for commercial sale while providing an advanced testing field for new products.

Gufeng and Tianjuyuan have developed seven technologies:

| (1) | Drying fan for urea-based compound fertilizer; |

| (2) | Heat balance control system for flexible compound fertilizer; |

| (3) | Automatic control system for the anti-block of compound fertilizer; |

| (4) | Water control technology for low nitrogen, low potassium and high phosphorus compound fertilizer; |

| (5) | Manufacturing technology for salt-alkaline resistance and soil improvement of compound fertilizer (The company won the third prize for “Progress in Science and Technology in Pinggu District Beijing” with this technology); |

| (6) | Manufacturing technology for compound HA fertilizer with high density (NPK ≥ 51%); and |

| (7) | Manufacturing technology for the sustained release of blending and compound fertilizer. |

While we believe our greenhouse facilities provide us with a competitive advantage over the competitors, some of them may still have better understanding in certain local markets where they have successfully marketed products over a period and have developed specifically formulated fertilizers for local plants, soil and climate conditions. To enhance our competitiveness, we will seek to diversify our fertilizers to benefit a wider range of plants and soil conditions.

Well-known Brands. We believe customers have strong brand recognition and make purchase decisions accordingly. “Jinong”, “KEBA” and “T.J.Y.” are registered trademarks and are well recognized by end users; in addition, certain large national fertilizer traders, such as Sinoagri Holding Company Limited, one of the largest domestic fertilizer traders in China, had strong brand preference for Gufeng’s fertilizer products. Gufeng sells its products under four brands, namely “KEBA”, “Mei Er An”, “Huangchenggen” and “SPR HOP”. Tianjuyuan’s products are marketed under the brands “AGR GFJ” and “T.J.Y.” The primary products sold under the Gufeng and Tianjuyuan brands include organic/inorganic compound fertilizer (humic acid) with NPK ≥ 40%, and organic /inorganic compound fertilizer (humic acid) with NPK ≥ 48%.

Automated Production Line and Process. All Jinong’s major production procedures are controlled by a centralized computer system only accessible by authorized personnel. Jinong’s production lines are fully automated to ensure that content in each product is measured exactly according to its recipe by linking the computer server with the electronic weights on each material input bin. In addition, spectral analysis is used to accurately check the composition of materials. During the fiscal year 2021, Jinong’s highly advanced production lines can manufacture a multi-tiered line of 103 fertilizer products, and we believe that Jinong’s production lines are among the few advanced lines in the Chinese industry. As mentioned above, we have patent protection for Jinong’s two proprietary production lines, one of which has medical grade production equipment with precise quality control, and the other can produce liquid, powder and granular fertilizers. We currently have an annual production capacity of 555,000 metric tons.

17

Competition