UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the quarterly period ended December 31, 2018

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the transition period from ____________ to ____________

Commission File Number 001-34260

CHINA GREEN AGRICULTURE, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 36-3526027 | |

| (State or other jurisdiction of | (IRS Employer | |

| incorporation or organization) | Identification No.) |

3rd floor, Borough A, Block A. No. 181, South Taibai

Road, Xi’an, Shaanxi province, PRC 710065

(Address of principal executive offices) (Zip Code)

+86-29-88266368

(Issuer’s telephone number, including area code)

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☒ | |

| Emerging growth company | ☐ | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

APPLICABLE ONLY TO CORPORATE ISSUERS:

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 39,546,945 shares of common stock, $0.001 par value, as of February 2, 2019.

TABLE OF CONTENTS

| Page | ||

| PART I | FINANCIAL INFORMATION | 1 |

| Item 1. | Financial Statements | 1 |

| Consolidated Condensed Balance Sheets As of December 31, 2018 (Unaudited) and June 30, 2018 | 1 | |

| Consolidated Condensed Statements of Income and Comprehensive Income For the Three Months Ended December 31, 2018 and 2017 (Unaudited) | 2 | |

| Consolidated Condensed Statements of Cash Flows For the Three Months Ended December 31, 2018 and 2017 (Unaudited) | 3 | |

| Notes to Consolidated Condensed Financial Statements As of December 31, 2018 (Unaudited) | 4 | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 22 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 36 |

| Item 4. | Controls and Procedures | 37 |

| PART II | OTHER INFORMATION | 38 |

| Item 6. | Exhibits | 38 |

| Signatures | 39 | |

| Exhibits/Certifications | 40 | |

i

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

December 31, 2018 | June 30, 2018 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 117,546,683 | $ | 150,805,639 | ||||

| Accounts receivable, net | 120,505,844 | 174,460,937 | ||||||

| Inventories | 115,013,591 | 53,784,814 | ||||||

| Prepaid expenses and other current assets | 3,173,718 | 2,945,247 | ||||||

| Amount due from related parties | 0 | 235,551 | ||||||

| Advances to suppliers, net | 40,777,894 | 25,194,463 | ||||||

| Total Current Assets | 397,017,730 | 407,426,651 | ||||||

| Plant, Property and Equipment, Net | 28,227,394 | 30,894,683 | ||||||

| Other Assets | 267,539 | 294,550 | ||||||

| Other Non-current Assets | 14,311,626 | 15,885,696 | ||||||

| Intangible Assets, Net | 18,710,644 | 20,317,914 | ||||||

| Goodwill | 7,863,605 | 8,166,467 | ||||||

| Total Assets | $ | 466,398,538 | $ | 482,985,960 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current Liabilities | ||||||||

| Accounts payable | $ | 13,312,634 | $ | 27,128,921 | ||||

| Customer deposits | 6,862,214 | 7,251,967 | ||||||

| Accrued expenses and other payables | 11,286,369 | 10,207,058 | ||||||

| Amount due to related parties | 3,640,504 | 3,271,619 | ||||||

| Taxes payable | 31,071,532 | 29,952,206 | ||||||

| Short term loans | 4,362,000 | 4,726,300 | ||||||

| Interest payable | 582,327 | 462,060 | ||||||

| Derivative liability | 2,248 | 66,143 | ||||||

| Total Current Liabilities | 71,119,828 | 83,066,274 | ||||||

| Long-term Liabilities | ||||||||

| Convertible notes payable | 7,302,743 | 7,371,899 | ||||||

| Total Liabilities | $ | 78,422,571 | $ | 90,438,173 | ||||

| Stockholders’ Equity | ||||||||

| Preferred Stock, $.001 par value, 20,000,000 shares authorized, zero shares issued and outstanding | - | - | ||||||

| Common stock, $.001 par value, 115,197,165 shares authorized, 39,546,945 and 38,896,945, shares issued and outstanding as of December 31, 2018 and June 30, 2018, respectively | 39,547 | 38,897 | ||||||

| Additional paid-in capital | 129,706,886 | 129,337,035 | ||||||

| Statutory reserve | 31,399,827 | 30,947,344 | ||||||

| Retained earnings | 246,887,783 | 235,822,726 | ||||||

| Accumulated other comprehensive income | (20,058,076 | ) | (3,598,215 | ) | ||||

| Total Stockholders’ Equity | 387,975,967 | 392,547,787 | ||||||

| Total Liabilities and Stockholders’ Equity | $ | 466,398,538 | $ | 482,985,960 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

1

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (LOSS)

(UNAUDITED)

Three Months Ended December 31, | Six Months Ended December 31, | |||||||||||||||

| 2018 | 2017 | 2018 | 2017 | |||||||||||||

| Sales | ||||||||||||||||

| Jinong | $ | 16,987,360 | $ | 26,211,280 | $ | 39,483,893 | $ | 52,985,040 | ||||||||

| Gufeng | 22,355,690 | 24,447,721 | 39,828,941 | 42,669,787 | ||||||||||||

| Yuxing | 2,623,493 | 1,953,748 | 5,011,039 | 3,746,391 | ||||||||||||

| VIEs - others | 10,287,920 | 10,986,576 | 25,885,396 | 26,326,758 | ||||||||||||

| Net sales | 52,254,463 | 63,599,325 | 110,209,269 | 125,727,976 | ||||||||||||

| Cost of goods sold | ||||||||||||||||

| Jinong | 8,994,882 | 13,265,827 | 20,198,054 | 26,378,583 | ||||||||||||

| Gufeng | 19,764,817 | 21,160,024 | 35,069,680 | 37,146,453 | ||||||||||||

| Yuxing | 2,166,566 | 1,536,238 | 4,213,729 | 2,928,791 | ||||||||||||

| VIEs - others | 9,083,973 | 9,135,024 | 22,013,941 | 21,828,653 | ||||||||||||

| Cost of goods sold | 40,010,238 | 45,097,113 | 81,495,404 | 88,282,480 | ||||||||||||

| Gross profit | 12,244,225 | 18,502,212 | 28,713,865 | 37,445,496 | ||||||||||||

| Operating expenses | ||||||||||||||||

| Selling expenses | 8,069,103 | 7,668,468 | 11,489,530 | 12,822,665 | ||||||||||||

| General and administrative expenses | (99,632 | ) | 902,883 | 2,209,728 | 7,817,685 | |||||||||||

| Total operating expenses | 7,969,471 | 8,571,351 | 13,699,258 | 20,640,350 | ||||||||||||

| Income from operations | 4,274,754 | 9,930,861 | 15,014,607 | 16,805,146 | ||||||||||||

| Other income (expense) | ||||||||||||||||

| Other income (expense) | (187,753 | ) | (276,836 | ) | (226,083 | ) | (284,047 | ) | ||||||||

| Discontinued VIE operation - Zhenbai | (330,966 | ) | (330,966 | ) | ||||||||||||

| Interest income | 95,957 | 130,248 | 223,341 | 218,162 | ||||||||||||

| Interest expense | (149,578 | ) | (94,587 | ) | (312,264 | ) | (274,162 | ) | ||||||||

| Total other income (expense) | (241,374 | ) | (572,141 | ) | (315,006 | ) | (671,013 | ) | ||||||||

| Income before income taxes | 4,033,380 | 9,358,720 | 14,699,601 | 16,134,133 | ||||||||||||

| Provision for income taxes | 1,527,645 | 1,530,938 | 3,182,061 | 3,253,593 | ||||||||||||

| Net income from continuing operations, net of tax | 2,505,735 | 7,827,782 | 11,517,540 | 12,880,540 | ||||||||||||

| Net income from discontinued operation, net of tax | - | (1,676 | ) | - | 40,394 | |||||||||||

| Net income, net of tax | 2,505,735 | 7,826,107 | 11,517,540 | 12,920,934 | ||||||||||||

| Other comprehensive income (loss) | ||||||||||||||||

| Foreign currency translation gain (loss) | (472,069 | ) | 8,256,738 | (16,459,861 | ) | 8,496,956 | ||||||||||

| Comprehensive income (loss) | $ | 2,033,666 | $ | 16,082,845 | $ | (4,942,321 | ) | $ | 21,417,890 | |||||||

| Basic weighted average shares outstanding | 39,546,945 | 38,551,264 | 39,546,945 | 38,551,264 | ||||||||||||

| Basic net earnings per share from continuing operations | $ | 0.06 | $ | 0.20 | 0.29 | $ | 0.33 | |||||||||

| Basic net earnings per share from discontinued operations | - | $ | 0.00 | - | $ | 0.00 | ||||||||||

| 0 | ||||||||||||||||

| Diluted weighted average shares outstanding | 39,546,945 | 38,551,264 | 39,546,945 | 38,185,277 | ||||||||||||

| Diluted net earnings per share from continuing operations | $ | 0.06 | $ | 0.20 | $ | 0.29 | $ | 0.34 | ||||||||

| Diluted net earnings per share from discontinued operations | - | $ | 0.00 | $ | - | $ | 0.00 | |||||||||

The accompanying notes are an integral part of these consolidated financial statements.

2

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED

Six Months Ended December 31, | ||||||||

| 2018 | 2017 | |||||||

| Cash flows from operating activities | ||||||||

| Net income | $ | 11,517,540 | $ | 12,880,541 | ||||

| Income from discontinued operations, net of income taxes | ||||||||

| Income from continuing operations, net of income taxes | ||||||||

| Adjustments to reconcile net income to net cash provided by operating activities | ||||||||

| Depreciation and amortization | 2,434,189 | 3,406,443 | ||||||

| Gain (Loss) on disposal of plant, property and equipment | 4,415 | 15,318 | ||||||

| Amortization of debt discount | 204,765 | 377,450 | ||||||

| Issuance of common stock for consulting services | 370,500 | - | ||||||

| Change in fair value of derivative liability | (61,601 | ) | (114,233 | ) | ||||

| Changes in operating assets | ||||||||

| Accounts receivable | 47,607,489 | 19,963,077 | ||||||

| Amount due from related parties | 227,400 | 1,436,875 | ||||||

| Other current assets | 1,618,463 | 1,019,062 | ||||||

| Inventories | (63,386,505 | ) | (25,549,564 | ) | ||||

| Advances to suppliers | (16,560,396 | ) | 4,106,058 | |||||

| Other assets | (969,558 | ) | 974,189 | |||||

| Changes in operating liabilities | ||||||||

| Accounts payable | (12,851,196 | ) | 2,694,536 | |||||

| Customer deposits | (121,118 | ) | (226,314 | ) | ||||

| Tax payables | 1,157,226 | (554,210 | ) | |||||

| Accrued expenses and other payables | 1,227,568 | 988,125 | ||||||

| Interest payable | 137,757 | 142,283 | ||||||

| Net cash provided by (used in) continuing operating activities | (27,443,062 | ) | 21,559,636 | |||||

| Net cash provided by (used in) discontinued operating activities | 0 | (1,024,276 | ) | |||||

| Net cash provided by (used in) operating activities | (27,443,062 | ) | 20,535,360 | |||||

| Cash flows from investing activities | ||||||||

| Purchase of plant, property, and equipment | (57,195 | ) | (11,758 | ) | ||||

| Change in construction in process | 16,128 | (11,328 | ) | |||||

| Net cash used in investing activities | (41,067 | ) | (23,086 | ) | ||||

| Cash flows from financing activities | ||||||||

| Proceeds from loans | 0 | 153,300 | ||||||

| Repayment of loans | (189,508 | ) | (1,678,603 | ) | ||||

| Advance from related parties | 409,230 | 195,013 | ||||||

| Net cash provided by (used in) financing activities | 219,722 | (1,330,290 | ) | |||||

| Effect of exchange rate change on cash and cash equivalents | (5,994,548 | ) | 3,184,627 | |||||

| Net increase in cash and cash equivalents | (33,258,955 | ) | 22,366,611 | |||||

| Cash and cash equivalents, beginning balance | 150,805,639 | 123,050,548 | ||||||

| Cash and cash equivalents, ending balance | $ | 117,546,683 | $ | 145,417,159 | ||||

| Supplement disclosure of cash flow information | ||||||||

| Interest expense paid | $ | 105,733 | $ | 206,368 | ||||

| Income taxes paid | $ | 2,024,835 | $ | 3,807,803 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

3

NOTE 1 – ORGANIZATION AND DESCRIPTION OF BUSINESS

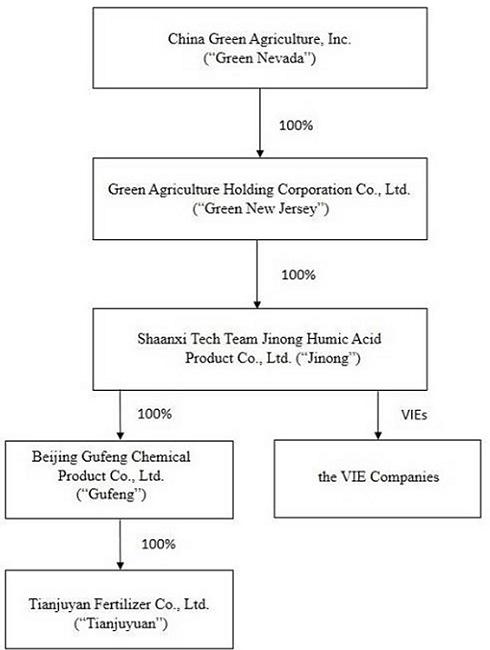

China Green Agriculture, Inc. (the “Company”, “Parent Company” or “Green Nevada”), through its subsidiaries, is engaged in the research, development, production, distribution and sale of humic acid-based compound fertilizer, compound fertilizer, blended fertilizer, organic compound fertilizer, slow-release fertilizers, highly-concentrated water-soluble fertilizers and mixed organic-inorganic compound fertilizer and the development, production and distribution of agricultural products.

Unless the context indicates otherwise, as used in this Report, the following are the references herein of all the subsidiaries of the Company (i) Green Agriculture Holding Corporation (“Green New Jersey”), a wholly-owned subsidiary of Green Nevada, incorporated in the State of New Jersey; (ii) Shaanxi TechTeam Jinong Humic Acid Product Co., Ltd. (“Jinong”), a wholly-owned subsidiary of Green New Jersey organized under the laws of the PRC; (iii) Xi’an Hu County Yuxing Agriculture Technology Development Co., Ltd. (“Yuxing”), a Variable Interest Entity (“VIE”) in the in the People’s Republic of China (the “PRC”) controlled by Jinong through a series of contractual agreements; (iv) Beijing Gufeng Chemical Products Co., Ltd., a wholly-owned subsidiary of Jinong in the PRC (“Gufeng”), and (v) Beijing Tianjuyuan Fertilizer Co., Ltd., Gufeng’s wholly-owned subsidiary in the PRC (“Tianjuyuan”).

On June 30, 2016 the Company, through its wholly-owned subsidiary Jinong, entered into strategic acquisition agreements and a series of contractual agreements with the shareholders of the following six companies that are organized under the laws of the PRC and would be deemed VIEs: Shaanxi Lishijie Agrochemical Co., Ltd. (“Lishijie”), Songyuan Jinyangguang Sannong Service Co., Ltd. (“Jinyangguang”), Shenqiu County Zhenbai Agriculture Co., Ltd. (“Zhenbai”), Weinan City Linwei District Wangtian Agricultural Materials Co., Ltd. (“Wangtian”), Aksu Xindeguo Agricultural Materials Co., Ltd. (“Xindeguo”), and Xinjiang Xinyulei Eco-agriculture Science and Technology co., Ltd. (“Xinyulei”). On January 1, 2017, the Company, through its wholly-owned subsidiary Jinong, entered into strategic acquisition agreements and a series of contractual agreements with the shareholders of the following two companies that are organized under the laws of the PRC and would be deemed VIEs, Sunwu County Xiangrong Agricultural Materials Co., Ltd. (“Xiangrong”), and Anhui Fengnong Seed Co., Ltd. (“Fengnong”).

On November 30, 2017, the Company, through its wholly-owned subsidiary Jinong, discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders of Zhenbai.

Yuxing, Lishijie, Jinyangguang, Wangtian, Xindeguo, Xinyulei, Xiangrong, and Fengnong may also collectively be referred to as the “the VIE Companies”; Lishijie, Jinyangguang, Zhenbai, Wangtian, Xindeguo, Xinyulei, Xiangrong, and Fengnong may also collectively be referred to as “the sales VIEs” or “the sales VIE companies”.

4

The Company’s corporate structure as of December 31, 2018, is set forth in the diagram below:

5

NOTE 2 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principle of consolidation

The accompanying consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries, Green New Jersey, Jinong, Gufeng, Tianjuyuan, and the VIE Companies. All significant inter-company accounts and transactions have been eliminated in consolidation.

Effective June 16, 2013, Yuxing was converted from being a wholly-owned foreign enterprise 100% owned by Jinong to a domestic enterprise 100% owned one natural person, who is not affiliated to the Company (“Yuxing’s Owner”). Effective the same day, Yuxing’s Owner entered into a series of contractual agreements with Jinong pursuant to which Yuxing became the VIE of Jinong.

VIE assessment

A VIE is an entity (1) that has total equity at risk that is not sufficient to finance its activities without additional subordinated financial support from other entities, (2) where the group of equity holders does not have the power to direct the activities of the entity that most significantly impact the entity’s economic performance, or the obligation to absorb the entity’s expected losses or the right to receive the entity’s expected residual returns, or both, or (3) where the voting rights of some investors are not proportional to their obligations to absorb the expected losses of the entity, their rights to receive the expected residual returns of the entity, or both, and substantially all of the entity’s activities either involve or are conducted on behalf of an investor that has disproportionately few voting rights. In order to determine if an entity is considered a VIE, the Company first performs a qualitative analysis, which requires certain subjective decisions regarding its assessments, including, but not limited to, the design of the entity, the variability that the entity was designed to create and pass along to its interest holders, the rights of the parties, and the purpose of the arrangement. If the Company cannot conclude after a qualitative analysis of whether an entity is a VIE, it performs a quantitative analysis. The qualitative analysis considered the design of the entity, the risks that cause variability, the purpose for which the entity was created, and the variability that the entity was designed to pass along to its variable interest holders. When the primary beneficiary could not be identified through qualitative analysis, we used internal cash flow models to compute and allocate expected losses or expected residual returns to each variable interest holder based upon the relative contractual rights and preferences of each interest holder in the VIE’s capital structure.

Use of estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the amount of revenues and expenses during the reporting periods. Management makes these estimates using the best information available at the time the estimates are made. However, actual results could differ materially from those results.

Cash and cash equivalents and concentration of cash

For statement of cash flows purposes, the Company considers all cash on hand and in banks, certificates of deposit with state-owned banks in the Peoples Republic of China (“PRC”) and banks in the United States, and other highly-liquid investments with maturities of three months or less, when purchased, to be cash and cash equivalents. The Company maintains large sums of cash in three major banks in China. The aggregate cash in such accounts and on hand as of December 31 and June 30, 2018, were $117,546,683 and $150,805,639, respectively. The Company had $117,296,696 and $150,785,737 in cash in banks in China and had $249,987 and $19,902 in cash in two banks in the United States as of December 31 and June 30, 2018, respectively. Cash overdrafts as of a balance sheet date will be reflected as liabilities in the balance sheet. The Company has not experienced any losses in such accounts and believes it is not exposed to any significant risks on its cash in bank accounts.

Accounts receivable

The Company’s policy is to maintain reserves for potential credit losses on accounts receivable. Management regularly reviews the composition of accounts receivable and analyzes customer creditworthiness, current economic trends and changes in customer payment patterns to evaluate the adequacy of these reserves at each year-end. Accounts considered uncollectible are written off through a charge to the valuation allowance. As of December 31, 2018, and June 30, 2018, the Company had accounts receivable of $120,505,844 and $174,460,937, net of allowance for doubtful accounts of $17,699,871 and $24,551,796, respectively.

6

Inventories

Inventory is valued at the lower of cost (determined on a weighted average basis) or market. Inventories consist of raw materials, work in process, finished goods and packaging materials. The Company reviews its inventories regularly for possible obsolete goods and establishes reserves when determined necessary. On December 31, 2018 and 2017, the Company had no reserve for obsolete goods.

Intangible Assets

The Company records intangible assets acquired individually or as part of a group at fair value. Intangible assets with definitive lives are amortized over the useful life of the intangible asset, which is the period over which the asset is expected to contribute directly or indirectly to the entity’s future cash flows. The Company evaluates intangible assets for impairment at least annually and more often whenever events or changes in circumstances indicate that the carrying value may not be recoverable. Whenever any such impairment exists, an impairment loss will be recognized for the amount by which the carrying value exceeds the fair value. The Company has not recorded an impairment of intangible assets as of December 31, 2018 and 2017 respectively.

Customer deposits

Payments received before all the relevant criteria for revenue recognition are satisfied are recorded as customer deposits. When all revenue recognition criteria are met, the customer deposits are recognized as revenue. As of December 31, 2018, and June 30, 2018, the Company had customer deposits of $6,862,214 and $7,251,967, respectively.

Earnings per share

Basic earnings per share are computed based on the weighted average number of shares of common stock outstanding during the period. Diluted earnings per share are computed based on the weighted average number of shares of common stock plus the effect of dilutive potential common shares outstanding during the period using the treasury stock method. Dilutive potential common shares include outstanding stock options and stock awards.

The components of basic and diluted earnings per share consist of the following:

| Three Months Ended | ||||||||

| December 31, | ||||||||

| 2018 | 2017 | |||||||

| Net Income from continuing operations for Basic Earnings Per Share | 2,505,735 | 7,827,782 | ||||||

| Net Income from discontinued operations for Basic Earnings Per Share | $ | 0 | $ | (1,676 | ) | |||

| Basic Weighted Average Number of Shares | 39,546,945 | 38,511,264 | ||||||

| Basic net earnings per share from continuing operations | 0.06 | 0.20 | ||||||

| Basic net earnings per share from discontinued operations | $ | 0.00 | $ | 0.00 | ||||

| Net Income from continuing operations for Diluted Earnings Per Share | 2,505,735 | 7,827,782 | ||||||

| Net Income from discontinued operations for Diluted Earnings Per Share | $ | 0 | $ | (1,676 | ) | |||

| Diluted Weighted Average Number of Shares | 39,546,945 | 38,551,264 | ||||||

| Diluted net earnings per share from continuing operations | 0.06 | 0.20 | ||||||

| Diluted net earnings per share from discontinued operations | $ | 0.00 | $ | 0.00 | ||||

| Six Months Ended | ||||||||

| December 31, | ||||||||

| 2018 | 2017 | |||||||

| Net Income from continuing operations for Basic Earnings Per Share | 11,517,540 | 12,880,540 | ||||||

| Net Income from discontinued operation for Basic Earnings Per Share | $ | 0 | $ | 40,394 | ||||

| Basic Weighted Average Number of Shares | 39,546,945 | 38,551,264 | ||||||

| Basic net earnings per share from continuing operations | 0.29 | 0.33 | ||||||

| Basic net earnings per share from discontinued operations | $ | 0 | $ | 0.00 | ||||

| Net Income from continuing operations for Diluted Earnings Per Share | 11,517,540 | 12,880,540 | ||||||

| Net Income from discontinued operations for Diluted Earnings Per Share | $ | 0 | $ | 40,394 | ||||

| Diluted Weighted Average Number of Shares | 39,546,945 | 38,551,264 | ||||||

| Diluted net earnings per share from continuing operations | 0.29 | 0.34 | ||||||

| Diluted net earnings per share from discontinued operations | $ | 0 | $ | 0 | ||||

7

Recent accounting pronouncements

Revenue Recognition: In May 2014, the FASB issued Accounting Standards Update No. 2014-09, Revenue from Contracts with Customers: Topic 606 (ASU 2014-09), to supersede nearly all existing revenue recognition guidance under U.S. GAAP. The core principle of ASU 2014-09 is to recognize revenues when promised goods or services are transferred to customers in an amount that reflects the consideration that is expected to be received for those goods or services. ASU 2014-09 defines a five-step process to achieve this core principle and, in doing so, it is possible more judgment and estimates may be required within the revenue recognition process that is required under existing U.S. GAAP, including identifying performance obligations in the contract, estimating the amount of variable consideration to include in the transaction price and allocating the transaction price to each separate performance obligation. ASU 2014-09 is effective for us in our first quarter of fiscal 2018 using either of two methods: (i) retrospective to each prior reporting period presented with the option to elect certain practical expedients as defined within ASU 2014-09 (full retrospective method); or (ii) retrospective with the cumulative effect of initially applying ASU 2014-09 recognized at the date of initial application and providing certain additional disclosures as defined per ASU 2014-09 (modified retrospective method). We are currently assessing the impact on our consolidated financial statements and have not yet selected a transition approach.

Disclosure of Going Concern Uncertainties: In August 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update No. 2014-15, Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern (ASU 2014-15), to provide guidance on management’s responsibility in evaluating whether there is substantial doubt about a company’s ability to continue as a going concern and to provide related footnote disclosures. ASU 2014-15 is effective for us in our fourth quarter of fiscal 2017 with early adoption permitted. We do not believe the impact of our pending adoption of ASU 2014-15 on the Company’s financial statements will be material.

Financial instrument: In January 2016, the FASB issued ASU No. 2016-01, “Financial Instruments - Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities” (“ASU 2016-01”). The standard addresses certain aspects of recognition, measurement, presentation, and disclosure of financial instruments. ASU 2016-01 is effective for fiscal years, and interim periods within those years, beginning after December 15, 2017, and early adoption is not permitted. Accordingly, the standard is effective for us on September 1, 2018. We are currently evaluating the impact that the standard will have on our consolidated financial statements.

Leases: In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842) (“ASU 2016-2”), which provides guidance on lease amendments to the FASB Accounting Standard Codification. This ASU will be effective for us beginning on May 1, 2019. We are currently in the process of evaluating the impact of the adoption of ASU 2016-2 on our consolidated financial statements.

Stock-based Compensation: In March 2016, the FASB issued ASU 2016-09, Compensation—Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting (ASU 2016-09). ASU 2016-09 changes how companies account for certain aspects of stock-based awards to employees, including the accounting for income taxes, forfeitures, and statutory tax withholding requirements, as well as classification in the statement of cash flows. ASU 2016-09 is effective for us in the first quarter of 2018, and earlier adoption is permitted. We are still evaluating the effect that this guidance will have on our consolidated financial statements and related disclosures.

Financial Instruments - Credit Losses: In June 2016, the FASB issued ASU 2016-13, Financial Instruments - Credit Losses (Topic 326): The amendments in this Update require a financial asset (or a group of financial assets) measured at an amortized cost basis to be presented at the net amount expected to be collected. The amendments broaden the information that an entity must consider in developing its expected credit loss estimate for assets measured either collectively or individually. The use of forecasted information incorporates more timely information in the estimate of expected credit loss, which will be more decision-useful to users of the financial statements. ASU 2016-13 is effective for the Company for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years. Early adoption is allowed as of the fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. The Company is still evaluating the effect that this guidance will have on the Company’s consolidated financial statements and related disclosures.

Statement of Cash Flows: In August 2016, the FASB issued ASU 2016-15, Statement of Cash Flows (Topic 230): The amendments in this Update apply to all entities, including both business entities and not-for-profit entities that are required to present a statement of cash flows under Topic 230. The amendments in this Update provide guidance on the following eight specific cash flow issues. The amendments are an improvement to GAAP because they provide guidance for each of the eight issues, thereby reducing the current and potential future diversity in practice described above. ASU 2016-15 is effective for the Company for fiscal years beginning after December 15, 2017, including interim periods within those fiscal years. Early adoption is permitted, including adoption in an interim period. The Company is still evaluating the effect that this guidance will have on the Company’s consolidated financial statements and related disclosures.

Statement of Cash Flows: In November 2016, the FASB issued ASU No. 2016-18, Statement of Cash Flows (Topic 230): “Restricted Cash” (“ASU 2016-18”). ASU 2016-18 requires that a statement of cash flows explain the change during the period in the total of cash, cash equivalents, and amounts generally described as restricted cash or restricted cash equivalents. This update is effective in fiscal years, including interim periods, beginning after December 15, 2017, and early adoption is permitted. The adoption of this guidance will result in the inclusion of the restricted cash balances within the overall cash balance and removal of the changes in restricted cash activity, which are currently recognized in other financing activities, on the Statements of Consolidated Cash Flows. Furthermore, an additional reconciliation will be required to reconcile Cash and cash equivalents and restricted cash reported within the Consolidated Balance Sheets to sum to the total shown in the Statements of Consolidated Cash Flows. The Company anticipates adopting this new guidance effective July 1, 2018. The Company is currently evaluating this guidance and the impact it will have on the Consolidated Financial Statements and disclosures.

8

Business Combination: In January 2017, the FASB issued Accounting Standards Update No. 2017-01, Business Combinations (Topic 805): Clarifying the Definition of a Business (ASU 2017-01), which revises the definition of a business and provides new guidance in evaluating when a set of transferred assets and activities is a business. This guidance will be effective for us in the first quarter of 2018 on a prospective basis, and early adoption is permitted. We do not expect the standard to have a material impact on our consolidated financial statements.

Stock-based Compensation: In May 2017, the FASB issued ASU No. 2017-09, “Compensation—Stock compensation (Topic 718): Scope of modification accounting” (“ASU 2017-09”). The purpose of the amendment is to clarify which changes to the terms or condition of a share-based payment award require an entity to apply modification accounting. For all entities that offer share-based payment awards, ASU 2017-09 are effective for interim and annual reporting periods beginning after December 15, 2017. The Company is currently assessing the impact of ASU 2017-09 on its condensed consolidated financial statements.

Other recent accounting pronouncements issued by the FASB, including its Emerging Issues Task Force, the American Institute of Certified Public Accountants, and the Securities and Exchange Commission did not or are not believed by management to have a material impact on the Company’s present or future financial statements.

NOTE 3 – INVENTORIES

Inventories consisted of the following:

| December 31, | June 30, | |||||||

| 2018 | 2018 | |||||||

| Raw materials | $ | 39,755,211 | $ | 13,154,465 | ||||

| Supplies and packing materials | $ | 486,032 | $ | 566,254 | ||||

| Work in progress | $ | 385,082 | $ | 417,130 | ||||

| Finished goods | $ | 74,387,266 | $ | 39,646,965 | ||||

| Total | $ | 115,013,591 | $ | 53,784,814 | ||||

NOTE 4 – PROPERTY, PLANT, AND EQUIPMENT

Property, plant and equipment consisted of the following:

| December 31, | June 30, | |||||||

| 2018 | 2018 | |||||||

| Building and improvements | $ | 38,824,105 | $ | 40,319,393 | ||||

| Auto | 3,383,116 | 3,504,028 | ||||||

| Machinery and equipment | 18,098,079 | 18,765,192 | ||||||

| Agriculture assets | 740,026 | 768,528 | ||||||

| Total property, plant, and equipment | 61,045,325 | 63,357,141 | ||||||

| Less: accumulated depreciation | (32,817,931 | ) | (32,462,458 | ) | ||||

| Total | $ | 28,227,394 | $ | 30,894,683 | ||||

NOTE 5 – INTANGIBLE ASSETS

Intangible assets consisted of the following:

| December 31, | June 30, | |||||||

| 2018 | 2018 | |||||||

| Land use rights, net | $ | 9,445,315 | $ | 9,930,420 | ||||

| Technology patent, net | 3,219 | 3,570 | ||||||

| Customer relationships, net | 2,808,791 | 3,578,724 | ||||||

| Non-compete agreement | 535,539 | 659,500 | ||||||

| Trademarks | 5,917,780 | 6,145,700 | ||||||

| Total | $ | 18,710,644 | $ | 20,317,914 | ||||

LAND USE RIGHT

On September 25, 2009, Yuxing was granted land use right for approximately 88 acres (353,000 square meters or 3.8 million square feet) by the People’s Government and Land & Resources Bureau of Hu County, Xi’an, Shaanxi Province. The fair value of the related intangible asset was determined to be the respective cost of RMB73,184,895 (or $10,641,084). The intangible asset is being amortized over the grant period of 50 years using the straight-line method.

9

On August 13, 2003, Tianjuyuan was granted a certificate of Land Use Right for a parcel of land of approximately 11 acres (42,726 square meters or 459,898 square feet) at Ping Gu District, Beijing. The purchase cost was recorded at RMB1, 045,950 (or $152,081). The intangible asset is being amortized over the grant period of 50 years.

On August 16, 2001, Jinong received a land use right as a contribution from a shareholder, which was granted by the People’s Government and Land & Resources Bureau of Yangling District, Shaanxi Province. The fair value of the related intangible asset at the time of the contribution was determined to be RMB7, 285,099 (or $1,059,253). The intangible asset is being amortized over the grant period of 50 years.

The Land Use Rights consisted of the following:

| December 31, | June 30, | |||||||

| 2018 | 2018 | |||||||

| Land use rights | $ | 11,852,416 | 12,308,907 | |||||

| Less: accumulated amortization | (2,407,101 | ) | (2,378,488 | ) | ||||

| Total land use rights, net | $ | 9,445,315 | 9,930,419 | |||||

TECHNOLOGY PATENT

On August 16, 2001, Jinong was issued a technology patent related to a proprietary formula used in the production of humic acid. The fair value of the related intangible asset was determined to be the respective cost of RMB 5,875,068 (or $854,235) and is being amortized over the patent period of 10 years using the straight-line method. This technology patent has been fully amortized.

On July 2, 2010, the Company acquired Gufeng and its wholly-owned subsidiary Tianjuyuan. The fair value of the acquired technology patent was estimated to be RMB9,200,000 (or $1,337,680) and is amortized over the remaining useful life of six years using the straight-line method. As of December 31, 2018, this technology patent is fully amortized.

The technology know-how consisted of the following:

| December 31, | June 30, | |||||||

| 2018 | 2018 | |||||||

| Technology know-how | $ | 2,196,693 | $ | 2,276,335 | ||||

| Less: accumulated amortization | (2,196,693 | ) | (2,276,335 | ) | ||||

| Total technology know-how, net | $ | - | $ | - | ||||

CUSTOMER RELATIONSHIPS

On July 2, 2010, the Company acquired Gufeng and its wholly-owned subsidiary Tianjuyuan. The fair value of the acquired customer relationships was estimated to be RMB65, 000,000 (or $9,451,000) and is amortized over the remaining useful life of ten years. On June 30, 2016 and January 1, 2017, the Company acquired the sales VIE Companies. The fair value of the acquired customer relationships was estimated to be RMB16, 472,179 (or $2,395,055) and is amortized over the remaining useful life of seven to ten years.

| December 31, | June 30, | |||||||

| 2018 | 2018 | |||||||

| Customer relationships | $ | 11,592,684 | $ | 12,039,169 | ||||

| Less: accumulated amortization | (8,783,893 | ) | (8,460,445 | ) | ||||

| Total customer relationships, net | $ | 2,808,791 | $ | 3,578,724 | ||||

NON-COMPETE AGREEMENT

On July 2, 2010, the Company acquired Gufeng and its wholly-owned subsidiary Tianjuyuan. The fair value of the acquired non-compete agreement was estimated to be RMB1, 320,000 (or $191,928) and is amortized over the remaining useful life of five years using the straight-line method. On June 30, 2016 and January 1, 2017, the Company acquired the sales VIE Companies. The fair value of the acquired non-compete agreements was estimated to be RMB6, 150,683 (or $894,309) and is amortized over the remaining useful life of five years using the straight-line method.

| December 31, | June 30, | |||||||

| 2018 | 2018 | |||||||

| Non-compete agreement | $ | 1,186,964 | $ | 1,232,680 | ||||

| Less: accumulated amortization | (651,425 | ) | (573,180 | ) | ||||

| Total non-compete agreement, net | $ | 535,539 | $ | 659,500 | ||||

TRADEMARKS

On July 2, 2010, the Company acquired Gufeng and its wholly-owned subsidiary Tianjuyuan. The preliminary fair value of the acquired trademarks was estimated to be RMB40,700,000 (or $5,917,780) and is subject to an annual impairment test.

10

AMORTIZATION EXPENSE

Estimated amortization expenses of intangible assets for the next five twelve months periods ended December 31 are as follows:

| Twelve Months Ended on September 30, | Expense ($) | |||

| 2019 | 1,838,839 | |||

| 2020 | 1,306,324 | |||

| 2021 | 729,135 | |||

| 2022 | 563,663 | |||

| 2023 | 496,482 | |||

NOTE 6 – OTHER NON-CURRENT ASSETS

Other non-current assets mainly include advance payments related to leasing land for use by the Company. As of December 31, 2018, the balance of other non-current assets was $16,263,621, which was the lease fee advances for agriculture lands that the Company engaged in Shiquan County from 2018 to 2027.

In March 2017, Jinong entered into a lease agreement for approximately 3,400 mu, and 2600-hectare agriculture lands in Shiquan County, Shaanxi Province. The lease was from April 2017 and was renewable for every ten-year period up to 2066. The aggregate leasing fee was approximately RMB 13 million per annum, The Company had made 10-year advances of leasing fee per lease terms. The Company has amortized $1 million as expenses for the six months ended December 31, 2018.

Estimated amortization expenses of the lease advance payments for the next four twelve-month periods ended December 31 and thereafter are as follows:

| Twelve months ending December 31, | ||||

| 2019 | $ | 1,951,995 | ||

| 2020 | $ | 1,951,995 | ||

| 2021 | $ | 1,951,995 | ||

| 2022 | $ | 1,951,995 | ||

| 2023 and thereafter | $ | 8,455,641 | ||

NOTE 7 - ACCRUED EXPENSES AND OTHER PAYABLES

Accrued expenses and other payables consisted of the following:

| December 31, | June 30, | |||||||

| 2018 | 2018 | |||||||

| Payroll payable | $ | 25,925 | $ | 13,788 | ||||

| Welfare payable | 149,274 | 155,023 | ||||||

| Accrued expenses | 6,172,604 | 5,368,348 | ||||||

| Other payables | 4,816,624 | 4,543,261 | ||||||

| Other levy payable | 121,942 | 126,638 | ||||||

| Total | $ | 11,286,369 | $ | 10,207,058 | ||||

NOTE 8 - RELATED PARTIES TRANSACTIONS

At the end of December 2015, Yuxing entered into a sales agreement with the Company’s affiliate, 900LH.com Food Co., Ltd. (“900LH.com”, previously announced as Xi’an Gem Grain Co., Ltd) pursuant to which Yuxing is to supply various vegetables to 900LH.com for its incoming seasonal sales at the holidays and year ends (the “Sales Agreement”). The contingent contracted value of the Sales Agreement is RMB 25,500,000 (approximately $3,707,700). For the six months ended December 31, 2018 and 2017, Yuxing has sold approximately $198,115 and $181,201 products to 900LH.com.

The amount due from 900LH.com to Yuxing was $0 and $235,551 as of December 31 and June 30, 2018, respectively.

11

As of December 31, 2018, and June 30, 2018, the amount due to related parties was $3,640,504 and $3,271,619, respectively. As of December 31, 2018, and June 30, 2018, $1,017,800 and $1,057,000, respectively were amounts that Gufeng borrowed from a related party, Xi’an Techteam Science & Technology Industry (Group) Co. Ltd., a company controlled by Mr. Zhuoyu Li, Chairman and CEO of the Company, representing unsecured, non-interest-bearing loans that are due on demand. These loans are not subject to written agreements.

As of December 31, 2018, and June 30, 2018, the Company’s subsidiary, Jinong, owed 900LH.com $402,234 and $393,565, respectively.

On June 29, 2018, Jinong renewed the office lease with Kingtone Information Technology Co., Ltd. (“Kingtone Information”), of which Mr. Tao Li, former Chairman and CEO of the Company, serves as Chairman of its board of directors. Pursuant to the lease, Jinong rented 612 square meters (approximately 6,588 square feet) of office space from Kingtone Information. The lease provides for a four-year term effective as of July 1, 2018, with a monthly rent of RMB24,480 (approximately $3,559)

NOTE 9- LOAN PAYABLES

As of December 31, 2018, the short-term loan payables consisted of two loans which mature on dates ranging from May 21 through June 18, 2019, with interest rates ranging from 5.22% to 6.31%. Both loans are collateralized by Tianjuyuan’s land use right and building ownership right.

| No. | Payee | Loan period per agreement | Interest Rate | December 31, 2018 |

||||||||

| 1 | Bank of Beijing - Pinggu Branch | May 22, 2018-May 21, 2019 | 5.22 | % | 1,454,000 | |||||||

| 2 | Postal Saving Bank of China - Pinggu Branch | June 19, 2018-June 18, 2019 | 6.31 | % | 2,908,000 | |||||||

| Total | $ | 4,362,000 | ||||||||||

The interest expense from short-term loans was $312,264 and $274,162 for the six months ended December 31, 2018 and 2017, respectively.

12

NOTE 10 – CONVERTIBLE NOTES PAYABLE

Relating to the acquisition of the VIE Companies, the Company subsidiary, Jinong, issued to the VIE Companies shareholders convertible notes payable twice, in the aggregate notional amount of RMB 51,000,000 ($7,415,400) with a term of three years and an annual interest rate of 3%.

| No. | Related Acquisitions of Sales VIEs | Issuance Date | Maturity Date | Notional Interest Rate | Conversion Price | Notional

Amount (in RMB) |

|||||||||||

| 1 | Wangtian, Lishijie, Xindeguo, Xinyulei, Jinyangguang | June 30, 2016 | June 30, 2019 | 3 | % | $ | 5.00 | 39,000,000 | |||||||||

| 2 | Fengnong, Xiangrong | January 1, 2017 | December 31, 2019 | 3 | % | $ | 5.00 | 12,000,000 | |||||||||

The convertible notes take priority over the preferred stock and common stock of Jinong, and any other class or series of capital stocks Jinong issues in the future in terms of interests and payments in the event of any liquidation, dissolution or winding up of Jinong. On or after the third anniversary of the issuance date of the note, noteholders may request Jinong to process the note conversion to convert the note into shares of the Company’s common stock. The notes cannot be converted prior to the maturity date. The per share conversion price of the notes is the higher of the following: (i) $5.00 per share or (ii) 75% of the closing price of the Company’s common stock on the date the noteholder delivers the conversion notice. Due to the discontinuation of VIE agreements with Zhenbai’s shareholders, certain convertible notes issued on June 30, 2016, with a face amount of RMB 12,000,000 ($1,744,800) were tendered back to the Company. All outstanding balance of unpaid principal and accrued interest in the tendered convertible notes were forfeited.

The Company determined that the fair value of the convertible note payable was RMB 50,225,192 ($7,302,743) and RMB 48,820,525 ($7,371,899) as of December 31, 2018 and June 30, 2018, respectively. Aside from the forfeiture of the convertible notes previously issued to Zhenbai’s shareholders, the difference between the fair value of the notes and the face amount of the notes is being amortized to accretion implied interest expense over the three-year life of the notes. As of December 31, 2018, the accumulated amortization of this discount into accretion expenses was $1,126,814.

NOTE 11 – TAXES PAYABLE

Enterprise Income Tax

Effective January 1, 2008, the Enterprise Income Tax (“EIT”) law of the PRC replaced the tax laws for Domestic Enterprises (“DEs”) and Foreign Invested Enterprises (“FIEs”). The EIT rate of 25% replaced the 33% rate that was applicable to both DEs and FIEs. The two-year tax exemption and three-year 50% tax reduction tax holiday for production-oriented FIEs were eliminated. Since January 1, 2008, Jinong became subject to income tax in China at a rate of 15% as a high-tech company, because of the expiration of its tax exemption on December 31, 2007. Accordingly, it made provision for income taxes for the six-month period ended December 31, 2018 and 2017 of $ 1,356,998 and $1,845,926, respectively, which is mainly due to the operating income from Jinong. Gufeng is subject to a 25% EIT rate and thus it made provision for income taxes of $1,071,227 and $1,106,590 for the six months ended December 31, 2018 and 2017, respectively.

Value-Added Tax

Certain fertilizer products that are produced and sold in the PRC were subject to a Chinese Value-Added Tax (VAT) of 13% of the gross sales price. On April 29, 2008, the PRC State of Administration of Taxation (SAT) released Notice #56, “Exemption of VAT for Organic Fertilizer Products”, which allows certain fertilizer products to be exempt from VAT beginning June 1, 2008. The Company submitted the application for exemption in May 2009, which was granted effective September 1, 2009.

Income Taxes and Related Payables

| December 31, | June 30, | |||||||

| 2018 | 2018 | |||||||

| VAT provision | $ | (343,283 | ) | $ | (449,140 | ) | ||

| Income tax payable | 1,598,671 | 554,065 | ||||||

| Other levies | 805,609 | 836,747 | ||||||

| Total | $ | 2,060,997 | $ | 941,672 | ||||

The provision for income taxes consists of the following

| December 31, | June 30, | |||||||

| 2018 | 2018 | |||||||

| Current tax - foreign | $ | 3,182,061 | $ | 6,841,592 | ||||

| Repatriation Tax | - | 29,010,535 | ||||||

| Total | $ | 3,182,061 | $ | 35,852,127 | ||||

13

Our effective tax rates were approximately 21.6% and 20.1% for the six months ended December 31, 2018 and 2017, respectively. Substantially all the Company’s income before income taxes and related tax expense are from PRC sources. Actual income tax benefit reported in the consolidated statements of income and comprehensive income differ from the amounts computed by applying the US statutory income tax rate of 21% to income before income taxes for the three months ended December 31, 2018 and 2017 for the following reasons:

December 31, 2018

Tax Rate Reconciliation

| China | United States | |||||||||||||||||||||||

| December 31, 2018 | 15% - 25% | 21% | Total | |||||||||||||||||||||

| Pretax income (loss) | $ | 15,663,575 | (963,974 | ) | $ | 14,699,601 | ||||||||||||||||||

| Expected income tax expense (benefit) | 3,915,894 | 25.0 | % | (202,435 | ) | 21.0 | % | 3,713,459 | ||||||||||||||||

| High-tech income benefits on Jinong | (904,666 | ) | (5.8 | )% | - | - | (904,666 | ) | ||||||||||||||||

| Losses from subsidiaries in which no benefit is recognized | 170,833 | 1.1 | % | - | - | 170,833 | ||||||||||||||||||

| Change in valuation allowance on deferred tax asset from US tax benefit | - | 202,435 | (21.0 | )% | 202,435 | |||||||||||||||||||

| Actual tax expense | $ | 3,182,061 | 20.3 | % | $ | - | - | % | $ | 3,182,061 | 21.6 | % | ||||||||||||

| China | United States | |||||||||||||||||||||||

| December 31, 2017 | 15% - 25% | 34% | Total | |||||||||||||||||||||

| Pretax income (loss) | $ | 16,805,296 | $ | (630,768 | ) | $ | 16,174,528 | |||||||||||||||||

| Expected income tax expense (benefit) | 4,201,324 | 25 | % | (214,461 | ) | 34 | % | 3,986,863 | ||||||||||||||||

| High-tech income benefits on Jinong | (1,230,618 | ) | -7.3 | % | (1,230,618 | )) | ||||||||||||||||||

| Losses from subsidiaries in which no benefit is recognized | 282,887 | 1.7 | % | 282,887 | ||||||||||||||||||||

| Change in valuation allowance on deferred tax asset from US tax benefit | 0 | 214,461 | -34 | % | 214,461 | |||||||||||||||||||

| Actual tax expense | $ | 3,253,593 | 19.4 | % | $ | 0 | 0.00 | % | $ | 3,253,593 | 20.1 | % | ||||||||||||

NOTE 12 – STOCKHOLDERS’ EQUITY

Common Stock

In December 2018, the Company issued an aggregate of 650,000 shares of common stock to pay off consulting services under the 2009 Plan. The value of the stock was $370,500 and is based on the fair value of the Company’s common stock on the grant date.

There was no share issuance of common stock during the three and six months ended December 31, 2017.

As of December 31, and June 30, 2018, there were 39,546,945 and 38,896,945 shares of common stock issued and outstanding.

14

Preferred Stock

Under the Company’s Articles of Incorporation, the Board has the authority, without further action by stockholders, to designate up to 20,000,000 shares of preferred stock in one or more series and to fix the rights, preferences, privileges, qualifications and restrictions granted to or imposed upon the preferred stock, including dividend rights, conversion rights, voting rights, rights and terms of redemption, liquidation preference and sinking fund terms, any or all of which may be greater than the rights of the common stock. If the Company sells preferred stock under its registration statement on Form S-3, it will fix the rights, preferences, privileges, qualifications and restrictions of the preferred stock of each series in the certificate of designation relating to that series and will file the certificate of designation that describes the terms of the series of preferred stock the Company offers before the issuance of the related series of preferred stock.

As of December 31, 2018, the Company has 20,000,000 shares of preferred stock authorized, with a par value of $.001 per share, of which no shares are issued or outstanding.

NOTE 13 –CONCENTRATIONS

Market Concentration

All the Company’s revenue-generating operations are conducted in the PRC. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic and legal environments in the PRC, and by the general state of the PRC’s economy.

The Company’s operations in the PRC are subject to specific considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among other things, the political, economic and legal environment and foreign currency exchange. The Company’s results may be adversely affected by, among other things, changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation.

Vendor and Customer Concentration

There were three vendors from each of which the Company purchased more than 10% of its raw materials, with the total of 34.3% of its raw materials for the six months ended December 31, 2018. Total purchases from these three vendors amounted to $33,149,745 for the six-month period ended December 31, 2018.

None of the vendors accounted for over 10% of the Company’s purchase of raw materials and supplies for the six months ended December 31, 2017.

No customer accounted for over 10% of the Company’s sales for the six months ended December 31, 2018 and 2017.

15

NOTE 14 – SEGMENT REPORTING

As of December 31, 2018, the Company was organized into four main business segments based on location and product: Jinong (fertilizer production), Gufeng (fertilizer production), Yuxing (agricultural products production) and the sales VIEs. Each of the four operating segments referenced above has separate and distinct general ledgers. The chief operating decision maker (“CODM”) receives financial information, including revenue, gross margin, operating income and net income produced from the various general ledger systems to make decisions about allocating resources and assessing performance; however, the principal measure of segment profitability or loss used by the CODM is net income by segment.

| Three Months Ended | Three Months Ended | Six Months Ended | Six Months Ended | |||||||||||||

| Revenues from unaffiliated customers: | 2018 | 2017 | 2018 | 2017 | ||||||||||||

| Jinong | $ | 16,987,360 | $ | 26,211,280 | $ | 39,483,893 | $ | 52,985,040 | ||||||||

| Gufeng | 22,355,690 | 24,447,721 | 39,828,941 | 42,669,787 | ||||||||||||

| Yuxing | 2,623,493 | 1,953,748 | 5,011,039 | 3,746,391 | ||||||||||||

| Sales VIEs | 10,287,922 | 10,986,576 | 25,885,396 | 26,326,758 | ||||||||||||

| Consolidated | $ | 52,254,465 | $ | 63,599,325 | $ | 110,209,269 | $ | 125,727,976 | ||||||||

| Operating income: | ||||||||||||||||

| Jinong | $ | 2,171,448 | $ | 5,577,154 | $ | 9,099,538 | $ | 12,343,229 | ||||||||

| Gufeng | 2,493,457 | 2,549,525 | 4,102,509 | 4,655,738 | ||||||||||||

| Yuxing | (3,796,684 | ) | 222,275 | (3,603,507 | ) | 397,748 | ||||||||||

| Sales VIEs | 3,748,752 | 2,014,662 | 6,380,051 | 39,203 | ||||||||||||

| Reconciling item (1) | 0 | (2 | ) | 0 | 0 | |||||||||||

| Reconciling item (2) | (342,219 | ) | (432,753 | ) | (963,984 | ) | (630,772 | ) | ||||||||

| Consolidated | $ | 4,274,754 | $ | 9,930,861 | $ | 15,014,607 | $ | 16,805,146 | ||||||||

| Net income: | ||||||||||||||||

| Jinong | $ | 1,789,640 | $ | 4,719,159 | $ | 7,689,656 | $ | 10,460,249 | ||||||||

| Gufeng | 1,731,121 | 1,727,764 | 2,851,465 | 3,216,831 | ||||||||||||

| Yuxing | (3,796,526 | ) | 222,869 | (3,603,348 | ) | 398,491 | ||||||||||

| Sales VIEs | 3,136,310 | 1,915,799 | 5,556,339 | (239,204 | ) | |||||||||||

| Reconciling item (1) | 8 | 2 | 10 | 3 | ||||||||||||

| Reconciling item (2) | (342,218 | ) | (432,753 | ) | (963,984 | ) | (630,772 | ) | ||||||||

| Reconciling item (3) | (12,598 | ) | (325,058 | ) | (12,598 | ) | (325,058 | ) | ||||||||

| Consolidated | $ | 2,505,735 | $ | 7,827,782 | $ | 11,517,540 | $ | 12,880,540 | ||||||||

| Depreciation and Amortization: | ||||||||||||||||

| Jinong | $ | 194,706 | $ | 422,383 | $ | 392,964 | $ | 1,276,126 | ||||||||

| Gufeng | 529,305 | 552,299 | 1,065,924 | 1,100,057 | ||||||||||||

| Yuxing | 299,900 | 315,282 | 604,719 | 627,801 | ||||||||||||

| Sales VIEs | 183,777 | 210,482 | 370,583 | 430,405 | ||||||||||||

| Consolidated | $ | 1,207,689 | $ | 1,500,446 | $ | 2,434,189 | $ | 3,434,389 | ||||||||

| Interest expense: | ||||||||||||||||

| Jinong | 68,317 | 71,447 | 137,758 | 142,283 | ||||||||||||

| Gufeng | 81,384 | 101,645 | 174,506 | 206,368 | ||||||||||||

| Yuxing | 0 | 0 | 0 | 0 | ||||||||||||

| Sales VIEs | (123 | ) | (78,505 | ) | 0 | (74,489 | ) | |||||||||

| Consolidated | $ | 149,578 | $ | 94,587 | $ | 312,264 | $ | 274,162 | ||||||||

| Capital Expenditure: | ||||||||||||||||

| Jinong | $ | 456 | $ | 808 | $ | 3,492 | $ | 4,149 | ||||||||

| Gufeng | 18,616 | 297 | 45,604 | 14,165 | ||||||||||||

| Yuxing | 6,850 | 4,773 | 8,099 | 4,773 | ||||||||||||

| Sales VIEs | 0 | 0 | 0 | 0 | ||||||||||||

| Consolidated | $ | 25,922 | $ | 5,878 | $ | 57,195 | $ | 23,086 | ||||||||

16

| As of | ||||||||

| December 31, | June 30, | |||||||

| 2018 | 2018 | |||||||

| Identifiable assets: | ||||||||

| Jinong | $ | 191,790,465 | $ | 226,335,489 | ||||

| Gufeng | 198,089,974 | 168,572,947 | ||||||

| Yuxing | 0 | 0 | ||||||

| Sales VIEs | 75,698,359 | 87,567,782 | ||||||

| Reconciling item (1) | 822,619 | 512,622 | ||||||

| Reconciling item (2) | (2,879 | ) | (2,879 | ) | ||||

| Consolidated | $ | 466,398,538 | $ | 482,985,960 | ||||

| (1) | Reconciling amounts refer to the unallocated assets or expenses of Green New Jersey. |

| (2) | Reconciling amounts refer to the unallocated assets or expenses of the Parent Company. |

| (3) | Reconciling amounts refer to the adjustment for net gain on derivative liability on convertible bonds. |

NOTE 15 – COMMITMENTS AND CONTINGENCIES

On June 29, 2018, Jinong renewed an office lease with Kingtone Information. Pursuant to the lease, Jinong rented 612 square meters (approximately 6,588 square feet) of office space from Kingtone Information. The lease provided for a four-year term effective as of July 1, 2018, with a monthly rent of $3,559 (approximately RMB 24,480).

In February 2004, Tianjuyuan signed a fifty-year lease with the village committee of Dong Gao Village and Zhen Nan Zhang Dai Village in the Beijing Ping Gu District, at a monthly rent of $430 (RMB 2,958).

Accordingly, the Company recorded an aggregate of $23,937 and $30,020 as rent expenses from these committed property leases for the six-month periods ended December 31, 2018 and 2017, respectively. The contingent rent expenses herein for the next five twelve-month periods ended December 31 are as follows:

| Years ending December 31, | ||||

| 2019 | $ | 47,874 | ||

| 2020 | 47,874 | |||

| 2021 | 47,874 | |||

| 2022 | 47,874 | |||

| 2023 | 47,874 | |||

NOTE 16 – VARIABLE INTEREST ENTITIES

In accordance with accounting standards regarding consolidation of variable interest entities, VIEs are generally entities that lack enough equity to finance their activities without additional financial support from other parties or whose equity holders lack adequate decision-making ability. All VIEs with which a company is involved must be evaluated to determine the primary beneficiary of the risks and rewards of the VIE. The primary beneficiary is required to consolidate the VIE for financial reporting purposes.

Green Nevada through one of its subsidiaries, Jinong, entered into a series of agreements (the “VIE Agreements”) with Yuxing for it to qualify as a VIE, effective June 16, 2013.

The Company has concluded, based on the contractual arrangements, that Yuxing is a VIE and that the Company’s wholly-owned subsidiary, Jinong, absorbs most of the risk of loss from the activities of Yuxing, thereby enabling the Company, through Jinong, to receive a majority of Yuxing expected residual returns.

On June 30, 2016 and January 1, 2017, the Company, through its wholly-owned subsidiary Jinong, entered into strategic acquisition agreements and into a series of contractual agreements to qualify as VIEs with the shareholders of the sales VIE Companies.

Jinong, the sales VIE Companies, and the shareholders of the sales VIE Companies also entered into a series of contractual agreements for the sales VIE Companies to qualify as VIEs (the “VIE Agreements”).

17

On November 30, 2017, the Company, through its wholly-owned subsidiary Jinong, exited the VIE agreements with the shareholders of Zhenbai.

As a result of these contractual arrangements with Yuxing and the sales VIE companies, the Company is entitled to substantially all the economic benefits of Yuxing and the VIE Companies. The following financial statement amounts and balances of the VIEs were included in the accompanying consolidated financial statements as of December 31 and June 30, 2018:

| December 31, | June 30, | |||||||

| 2018 | 2018 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 2,216,592 | $ | 982,312 | ||||

| Accounts receivable, net | 19,385,523 | 38,295,505 | ||||||

| Inventories | 25,072,690 | 21,133,970 | ||||||

| Other current assets | 703,112 | 988,051 | ||||||

| Related party receivable | 0 | (359,005 | ||||||

| Advances to suppliers | 4,182,891 | 848,458 | ||||||

| Total Current Assets | 51,560,808 | 61,889,291 | ||||||

| Plant, Property and Equipment, Net | 10,281,928 | 11,206,667 | ||||||

| Other assets | 218,249 | 226,654 | ||||||

| Intangible Assets, Net | 10,569,436 | 11,348,180 | ||||||

| Goodwill | 3,204,371 | 3,319,732 | ||||||

| Total Assets | $ | 75,834,792 | $ | 87,990,524 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current Liabilities | ||||||||

| Short-term loan | $ | 0 | $ | 0 | ||||

| Accounts payable | 11,903,980 | 25,584,614 | ||||||

| Customer deposits | 618,762 | 841,694 | ||||||

| Accrued expenses and other payables | 5,151,624 | 3,896,340 | ||||||

| Amount due to related parties | 41,805,103 | 43,339,286 | ||||||

| Total Current Liabilities | $ | 59,479,469 | $ | 73,661,934 | ||||

| Long-term Loan | 0 | 0 | ||||||

| Total Liabilities | $ | 59,479,469 | $ | 73,661,934 | ||||

| Stockholders’ equity | 16,355,323 | 14,328,590 | ||||||

| Total Liabilities and Stockholders’ Equity | 75,834,792 | $ | 87,990,524 | |||||

| Three Months Ended December 31, | ||||||||

| 2018 | 2017 | |||||||

| Revenue | $ | 12,911,414 | $ | 13,304,643 | ||||

| Expenses | 13,571,628 | 10,989,225 | ||||||

| Net income | $ | (660,214 | ) | $ | 2,136,994 | |||

| Six Months Ended December 31, | ||||||||

| 2018 | 2017 | |||||||

| Revenue | $ | 30,896,434 | $ | 31,077,318 | ||||

| Expenses | 28,943,442 | 25,590,542 | ||||||

| Net income | $ | 1,952,992 | $ | 199,680 | ||||

18

NOTE 17 – BUSINESS COMBINATIONS

On June 30, 2016, the Company, through its wholly-owned subsidiary Jinong, entered into strategic acquisition agreements and also into a series of contractual agreements to qualify as VIEs with the shareholders of Shaanxi Lishijie Agrochemical Co., Ltd., Songyuan Jinyangguang Sannong Service Co., Ltd., Shenqiu County Zhenbai Agriculture Co., Ltd., Weinan City Linwei District Wangtian Agricultural Materials Co., Ltd., Aksu Xindeguo Agricultural Materials Co., Ltd., and Xinjiang Xinyulei Eco-agriculture Science and Technology Co., Ltd.

Subsequently, on January 1, 2017, Jinong entered into similar strategic acquisition agreements and a series of contractual agreements to qualify as VIEs with the shareholders of Sunwu County Xiangrong Agricultural Materials Co., Ltd., and Anhui Fengnong Seed Co., Ltd.

On November 30, 2017, the Company, through its wholly-owned subsidiary Jinong, discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders of Zhenbai.

The VIE Agreements are as follows:

Entrusted Management Agreements

Pursuant to the terms of certain Entrusted Management Agreements dated June 30, 2016 and January 1, 2017, between Jinong and the shareholders of the sales VIE Companies (the “Entrusted Management Agreements”), the sales VIE Companies and their shareholders agreed to entrust the operations and management of its business to Jinong. According to the Entrusted Management Agreement, Jinong possesses the full and exclusive right to manage the sales VIE Companies’ operations, assets and personnel, has the right to control all the sales VIE Companies’ cash flows through an entrusted bank account, is entitled to the sales VIE Companies’ net profits as a management fee, is obligated to pay all the sales VIE Companies’ payables and loan payments, and bears all losses of the sales VIE Companies. The Entrusted Management Agreements will remain in effect until (i) the parties mutually agree to terminate the agreement; (ii) the dissolution of the sales VIE Companies; or (iii) Jinong acquires all the assets or equity of the sales VIE Companies (as more fully described below under “Exclusive Option Agreements”).

Exclusive Technology Supply Agreements

Pursuant to the terms of certain Exclusive Technology Supply Agreements dated June 30, 2016 and January 1, 2017, between Jinong and the sales VIE companies (the “Exclusive Technology Supply Agreements”), Jinong is the exclusive technology provider to the sales VIE companies. The sales VIE companies agreed to pay Jinong all fees payable for technology supply prior to making any payments under the Entrusted Management Agreement. The Exclusive Technology Supply Agreements shall remain in effect until (i) the parties mutually agree to terminate the agreement; (ii) the dissolution of the sales VIE companies; or (iii) Jinong acquires the sales VIE companies (as more fully described below under “Exclusive Option Agreements”).

Shareholder’s Voting Proxy Agreements

Pursuant to the terms of certain Shareholder’s Voting Proxy Agreements dated June 30, 2016 and January 1, 2017, among Jinong and the shareholders of the sales VIE companies (the “Shareholder’s Voting Proxy Agreements”), the shareholders of the sales VIE companies irrevocably appointed Jinong as their proxy to exercise on such shareholders’ behalf all of their voting rights as shareholders pursuant to PRC law and the Articles of Association of the sales VIE companies, including the appointment and election of directors of the sales VIE companies. Jinong agreed that it shall maintain a board of directors, the composition and appointment of which shall be approved by the Board of the Company. The Shareholder’s Voting Proxy Agreements will remain in effect until Jinong acquires all the assets or equity of the sales VIE companies.

19

Exclusive Option Agreements

Pursuant to the terms of certain Exclusive Option Agreements dated June 30, 2016 and January 1, 2017, among Jinong, the sales VIE companies, and the shareholders of the sales VIE companies (the “Exclusive Option Agreements”), the shareholders of the sales VIE companies granted Jinong an irrevocable and exclusive purchase option (the “Option”) to acquire the sales VIE companies’ equity interests and/or remaining assets, but only to the extent that the acquisition does not violate limitations imposed by PRC law on such transactions. The Option is exercisable at any time at Jinong’s discretion so long as such exercise and subsequent acquisition of the sales VIE companies does not violate PRC law. The consideration for the exercise of the Option is to be determined by the parties and memorialized in the future by definitive agreements setting forth the kind and value of such consideration. Jinong may transfer all rights and obligations under the Exclusive Option Agreements to any third parties without the approval of the shareholders of the sales VIE companies so long as written notice is provided. The Exclusive Option Agreements may be terminated by mutual agreements or by 30 days written notice by Jinong.

Equity Pledge Agreements

Pursuant to the terms of certain Equity Pledge Agreements dated June 30, 2016 and January 1, 2017, among Jinong and the shareholders of the sales VIE companies (the “Pledge Agreements”), the shareholders of the sales VIE companies pledged all of their equity interests in the sales VIE companies to Jinong, including the proceeds thereof, to guarantee all of Jinong’s rights and benefits under the Entrusted Management Agreements, the Exclusive Technology Supply Agreements, the Shareholder’ Voting Proxy Agreements and the Exclusive Option Agreements. Prior to termination of the Pledge Agreements, the pledged equity interests cannot be transferred without Jinong’s prior written consent. The Pledge Agreements may be terminated only upon the written agreement of the parties.

Non-Compete Agreements

Pursuant to the terms of certain Non-Compete Agreements dated June 30, 2016 and January 1, 2017, among Jinong and the shareholders of the sales VIE companies (the “Non-Compete Agreements”), the shareholders of the sales VIE companies agreed that during the period beginning on the initial date of their services with Jinong, and ending five (5) years after termination of their services with Jinong, without Jinong’s prior written consent, they will not provide services or accept positions including but not limited to partners, directors, shareholders, managers, proxies or consultants, provided by any profit-making organizations with businesses that may compete with Jinong. They will not solicit or interfere with any of the Jinong’s customers or solicit, induce, recruit or encourage any person engaged or employed by Jinong to terminate his or her service or engagement. If the shareholders of the sales VIE companies breach the non-compete obligations contained therein, Jinong is entitled to all loss and damages; if the damages are difficult to determine, remedies bore the shareholders of the sales VIE companies shall be no less than 50% of the salaries and other expenses Jinong provided in the past.

The Company entered into these VIE Agreements as a way for the Company to have more control over the distribution of its products. The transactions are accounted for as business combinations in accordance with ASC 805. A summary of the purchase price allocations at fair value is below:

For acquisitions made on June 30, 2016:

| Cash | $ | 708,737 | ||

| Accounts receivable | 6,422,850 | |||

| Advances to suppliers | 1,803,180 | |||

| Prepaid expenses and other current assets | 807,645 | |||

| Inventories | 7,787,043 | |||

| Machinery and equipment | 140,868 | |||

| Intangible assets | 270,900 | |||

| Other assets | 3,404,741 | |||

| Goodwill | 3,158,179 | |||

| Accounts payable | (3,962,670 | ) | ||

| Customer deposits | (3,486,150 | ) | ||

| Accrued expenses and other payables | (4,653,324 | ) | ||

| Taxes payable | (16,912 | ) | ||

| Purchase price | $ | 12,385,087 |

20

A summary of the purchase consideration paid is below:

| Cash | $ | 5,568,500 | ||

| Convertible notes | 6,671,769 | |||

| Derivative liability | 144,818 | |||

| $ | 12,385,087 |

The cash component of the purchase price for these acquisitions made on June 30, 2016 was paid in July and August 2016.

For acquisitions made on January 1, 2017:

| Working Capital | $ | 941,192 | ||

| Machinery and equipment | 222,875 | |||

| Intangible assets | 1440 | |||

| Goodwill | 684,400 | |||

| Customer Relationship | 522,028 | |||

| Non-compete Agreement | 392,852 | |||

| Purchase price | $ | 2,764,787 |

A summary of the purchase consideration paid is below:

| Cash | $ | 1,201,888 | ||

| Convertible notes | 1,559,350 | |||

| Derivative liability | 3,549 | |||

| $ | 2,764,787 |

The cash component of the purchase price for these acquisitions made on January 1, 2017 was paid during March 2017.

On November 30, 2017, the Company, through its wholly-owned subsidiary Jinong, discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders of Zhenbai. In return, the shareholders of Zhenbai agreed to tender the whole payment consideration in the SAA back to the Company with early termination penalties. The convertible notes paid to Zhenbai’s shareholders and the accrued interest has been forfeited.

For the discontinuation of Zhenbai made on November 30, 2017, the Company gave up the control of the following assets in Zhenbai:

| Working Capital | $ | 1,179,352 | ||

| Intangible assets | 896,559 | |||

| Customer Relationship | 684,727 | |||

| Non-compete Agreement | 211,833 | |||

| Goodwill | 538,488 | |||

| Total Asset | $ | 2,614,401 |

In return, the purchase consideration returned to the Company from Zhenbai’s shareholders is summarized below:

| Cash | $ | 461,330 | ||

| Interest Payable | 83,039 | |||

| Convertible notes | 1,724,683 | |||

| Derivative liability | 13,353 | |||

| Total Payback | $ | 2,282,406 | ||

| Net Loss | (331,995 | ) |

21

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our consolidated financial statements and the notes to those financial statements appearing elsewhere in this report. This discussion and analysis contain forward-looking statements that involve significant risks and uncertainties. As a result of many factors, such as the slow-down of the macro-economic environment in China and its impact on economic growth in general, the competition in the fertilizer industry and the impact of such competition on pricing, revenues and margins, the weather conditions in the areas where our customers are based, the cost of attracting and retaining highly skilled personnel, the prospects for future acquisitions, and the factors set forth elsewhere in this report, our actual results may differ materially from those anticipated in these forward-looking statements. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this report will in fact occur. You should not place undue reliance on the forward-looking statements contained in this report.

The forward-looking statements speak only as of the date on which they are made, and, except to the extent required by U.S. federal securities laws, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. Further, the information about our intentions contained in this report is a statement of our intention as of the date of this report and is based upon, among other things, the existing regulatory environment, industry conditions, market conditions and prices, and our assumptions as of such date. We may change our intentions, at any time and without notice, based upon any changes in such factors, in our assumptions or otherwise.