Summary Prospectus | June 26, 2020

Schwab® Municipal Money Fund

| Ticker Symbols: | Investor Shares: SWTXX | Ultra Shares: SWOXX |

New Notice Regarding Shareholder Report Delivery

Options

Beginning on January 1, 2021,

paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from a fund or from your financial intermediary (such as a bank or broker-dealer). Instead, the reports

will be made available on a fund’s website www.schwabfunds.com/schwabfunds_prospectus, and you will be notified by mail each time a report is posted and the mailing will provide a website

link to access the report. You will continue to receive other fund regulatory documents (such as prospectuses or supplements) in paper unless you have elected to receive all fund documents electronically.

If you would like to continue to receive a

fund’s future shareholder reports in paper free of charge after January 1, 2021, you can make that request:

| • | If you invest through Charles Schwab & Co, Inc. (broker-dealer), by calling 1-866-345-5954 and using the unique identifier attached to this mailing; |

| • | If you invest through another financial intermediary (such as a bank or broker-dealer) by contacting them directly; or |

| • | If owned directly through a fund by calling 1-800-407-0256. |

If you already receive shareholder reports

and other fund documents electronically, you will not be affected by this change and you need not take any action.

Before you invest, you may want to review the fund’s

prospectus, which contains more information about the fund and its risks. You can find the fund’s prospectus, Statement of Additional Information (SAI), reports to shareholders and other information about the fund online at www.schwabfunds.com/schwabfunds_prospectus. You can also obtain this information at no cost by calling 1-866-414-6349 or by sending an email

request to orders@mysummaryprospectus.com. If you purchase or hold fund shares through a financial intermediary, the fund’s prospectus, SAI, reports to shareholders and other information

about the fund are available from your financial intermediary.

The fund’s prospectus and SAI, both dated April 28,

2020, as supplemented, include a more detailed discussion of fund investment policies and the risks associated with various fund investments. The prospectus and SAI are incorporated by reference into the summary prospectus, making them legally a

part of the summary prospectus.

Investment Objective

The fund’s goal is to seek the highest current income

that is consistent with stability of capital and liquidity, and is exempt from federal income tax.

Fund Fees and Expenses

This table describes the fees and expenses you may pay if

you buy and hold shares of the fund. This table does not reflect any brokerage fees or commissions you may incur when buying or selling fund shares.

| Shareholder Fees (fees paid directly from your investment) | ||

| Investor

Shares |

Ultra

Shares | |

| None | None | |

| Annual Fund Operating Expenses (expenses that you pay each year as a % of the value of your investment) | ||

| Management fees | 0.32 | 0.32 |

| Distribution (12b-1) fees | None | None |

| Other expenses | 0.16 | 0.01 |

| Total annual fund operating expenses | 0.48 | 0.33 |

| Less expense reduction | (0.14) | (0.14) |

| Total annual fund operating expenses after expense reduction1 | 0.34 | 0.19 |

| 1 | The investment adviser and its affiliates have agreed to limit the total annual fund operating expenses (excluding interest, taxes and certain non-routine expenses) of each share class to 0.35% for Investor Shares and 0.19% for Ultra Shares for so long as the investment adviser serves as the adviser to the fund (contractual expense limitation agreement). This contractual expense limitation agreement may only be amended or terminated with the approval of the fund’s Board of Trustees. |

Example

This example is intended to help you compare the cost of

investing in the fund with the cost of investing in other funds. The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those time periods. The example also assumes

that your investment has a 5% return each year and that the fund’s operating expenses remain the same. The figures are based on total annual fund operating expenses after any expense reduction. The example does not reflect any brokerage fees

or commissions you may incur when buying or selling fund shares. Your actual costs may be higher or lower.

| Expenses on a $10,000 Investment | ||||

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Investor Shares | $35 | $109 | $191 | $431 |

| Ultra Shares | $19 | $ 61 | $107 | $243 |

Schwab Municipal Money Fund | Summary Prospectus1

REG54672-26 00247046

Principal Investment Strategies

To pursue its goal, the fund invests in municipal money market

securities from states and municipal agencies around the country and from U.S. territories and possessions. These securities may include general obligation issues, which typically are backed by the issuer’s

ability to levy taxes; revenue bonds, which typically are backed by a stream of revenue from a given source, such as a public water system or hospital; municipal commercial paper and municipal notes; and municipal leases, which may be used to

finance construction or equipment purchases. The fund may invest more than 25% of its total assets in municipal securities financing similar projects such as those relating to education, health care, transportation, utilities, industrial development

and housing. Under normal circumstances, the fund will invest at least 80% of its net assets (including, for this purpose, any borrowings for investment purposes) in municipal money market securities the interest from which is exempt from federal

income tax.

The fund may purchase certain

variable-rate demand securities issued by single state or national closed-end municipal bond funds, which, in turn, invest primarily in portfolios of tax-exempt municipal bonds. It is anticipated that the interest on the variable-rate demand

securities will be exempt from federal income tax. These securities are considered “municipal money market securities” for purposes of the fund’s 80% investment policy stated above.

Many of the fund’s securities will be subject to credit

or liquidity enhancements from U.S. and/or non-U.S. entities, which are designed to provide incremental levels of creditworthiness or liquidity. Some municipal securities have been structured to resemble variable- and floating-rate securities so

that they meet the requirements for being considered money market instruments.

In choosing securities, the fund’s manager seeks to

maximize current income within the limits of the fund’s investment objective and credit, maturity and diversification policies. Some of these policies may be stricter than the federal regulations that apply to all money market funds.

The investment adviser’s credit research department

analyzes and monitors the securities that the fund owns or is considering buying. The manager may adjust the fund’s holdings or its average maturity based on actual or anticipated changes in credit quality or market dynamics, such as interest

rates. To preserve its investors’ capital, the fund seeks to maintain a stable $1.00 share price by operating as a “retail money market fund,” as such term is defined or interpreted under the rules governing money market

funds.

During unusual market conditions, the fund may

invest in cash and taxable money market securities as a temporary defensive measure. When the fund engages in such activities, it may not achieve its investment goal.

Principal Risks

The fund is subject to risks, any of which could cause an

investor to lose money. The fund’s principal risks include:

Market Risk. Financial markets

rise and fall in response to a variety of factors, sometimes rapidly and unpredictably. Markets may be

impacted by economic, political, regulatory and other conditions, including

economic sanctions and other government actions. In addition, the occurrence of global events, such as war, terrorism, environmental disasters, natural disasters, and epidemics may also negatively affect the financial markets. These events could

reduce consumer demand or economic output; result in market closures, low or negative interest rates, travel restrictions or quarantines; and significantly adversely impact the economy. Governmental and quasi-governmental authorities and regulators

throughout the world have in the past often responded to serious economic disruptions with a variety of significant fiscal and monetary policy changes which could have an unexpected impact on financial markets and the fund’s investments. As

with any investment whose performance is tied to these markets, the value of an investment in the fund will fluctuate, which means that an investor could lose money over short or long periods.

Investment Risk. You

could lose money by investing in the fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. The fund may impose a fee upon the sale of your shares or may temporarily suspend your

ability to sell shares if the fund’s liquidity falls below required minimums because of market conditions or other factors. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other

government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time.

Retail Money Market Fund Risk.

The fund is a “retail money market fund,” as such term is defined or interpreted under the rules governing money market funds. A “retail money market fund” is a money market fund that has policies and procedures reasonably

designed to limit all beneficial owners of the fund to natural persons. The fund may involuntarily redeem any investor who is not a natural person. The fund will provide advance notice of its intent to make any such involuntary redemption. Neither

the fund nor the investment adviser will be responsible for any loss or tax liability in an investor’s account resulting from such involuntary redemption. As a “retail money market fund,” the fund is permitted to value its

securities using the amortized cost method to seek to maintain a stable $1.00 share price. However, the fund may be subject to liquidity fees and/or redemption gates on fund redemptions if the fund’s liquidity falls below required

minimums because of market conditions or other factors.

Interest Rate Risk. Interest

rates rise and fall over time. As with any investment whose yield reflects current interest rates, the fund’s yield will change over time. During periods when interest rates are low or there are negative interest rates, the fund’s yield

(and total return) also could be low or even negative. In addition, the fund may be unable to pay expenses out of fund assets or maintain a stable $1.00 share price. Also, a change in a central bank’s monetary policy or economic

conditions may result in a change in interest rates, which could have sudden and unpredictable effects on the markets. Volatility in the market may decrease liquidity in the money market securities markets, making it more difficult for the fund to

sell its money market investments at a time when the

Schwab Municipal Money Fund | Summary Prospectus2

investment adviser might wish to sell such investments. Decreased market

liquidity also may make it more difficult to value some or all of the fund’s money market securities holdings.

Stable Net Asset Value Risk.

If the fund or another money market fund fails to maintain a stable net asset value (or such perception exists in the market place), the fund could experience increased redemptions, which may adversely impact the fund’s share price. The fund

is permitted, among other things, to reduce or withhold any income and/or gains generated from its portfolio to maintain a stable $1.00 share price.

Credit Risk. A decline in the

credit quality of an issuer, guarantor or liquidity provider of a portfolio investment or a counterparty could cause the fund to lose money or underperform. The fund could lose money if, due to a decline in credit quality, the issuer, guarantor or

liquidity provider of a portfolio investment or a counterparty fails to make, or is perceived as being unable or unwilling to make, timely principal or interest payments or otherwise honor its obligations. The credit quality of the fund’s

portfolio holdings can change rapidly in certain market environments and any downgrade or default on the part of a single portfolio investment could cause the fund’s share price or yield to fall.

Credit and Liquidity Enhancements Risk. The fund may invest in securities with credit or liquidity enhancements provided by a bank or other financial institution, and the existence and nature of such enhancements may be a significant factor in

the investment adviser’s decision-making process. Generally, these enhancements are employed by the issuers of the securities to reduce credit risk and provide enhanced or back-up liquidity for a purchaser, such as the fund. Adverse

developments affecting these banks and financial institutions could therefore have a negative effect on the value of the fund’s holdings. For example, a rating agency downgrade of a credit or liquidity enhancement provider may adversely

affect the value of securities held by the fund. Any decline in the value of the securities held by the fund could cause the fund’s share price or yield to fall. To the extent that a portion of the fund’s underlying investments

are enhanced by the same bank or financial institution, these risks may be increased.

Management Risk. Any

actively managed mutual fund is subject to the risk that its investment adviser will select investments or allocate assets in a manner that could cause the fund to underperform or otherwise not meet its investment objective. The fund’s

investment adviser applies its own investment techniques and risk analyses in making investment decisions for the fund, but there can be no guarantee that they will produce the desired results. The investment adviser’s maturity decisions will

also affect the fund’s yield, and potentially could affect its share price. To the extent that the investment adviser anticipates interest rate trends imprecisely, the fund’s yield at times could lag the yields of other money market

funds.

State and Regional Risk. State and regional factors could affect the fund’s performance. To the extent that the fund invests in securities from a given state or geographic region, its share price and performance could be affected by

local, state and regional factors, including erosion of the tax base and changes in the economic

climate. National governmental actions, such as the elimination of tax-exempt

status, also could affect performance. In addition, a municipality or municipal project that relies directly or indirectly on national governmental funding mechanisms may be negatively affected by the national government’s current budgetary

constraints.

Investment Concentration Risk. To the extent that the fund invests a substantial portion of its assets in municipal securities financing similar projects, the fund may be more sensitive to adverse economic, business or political developments

affecting those projects. A change that affects one project, such as proposed legislation on the financing of the project, a shortage of materials needed for the project, or a declining need for the project, would likely affect all similar projects

and the overall municipal securities market.

Taxable Determinations Risk.

Some of the fund’s income could be taxable. If certain types of investments the fund buys as tax-exempt are later ruled to be taxable, a portion of the fund’s income could become taxable. This risk, although generally considered low, is

somewhat higher for investments that have been structured as municipal money market securities than for investments in other types of municipal money market securities. Any defensive investments in taxable securities could generate taxable

income. Also, some types of municipal securities produce income that is subject to the federal alternative minimum tax (AMT).

Liquidity Risk. Liquidity

risk exists when particular investments are difficult to purchase, sell or value, especially during stressed market conditions. The market for certain investments may become illiquid due to specific adverse changes in the conditions of a

particular issuer or under adverse market or economic conditions independent of the issuer. In addition, limited dealer inventories of certain securities could potentially lead to decreased liquidity. In such cases, the fund, due to limitations

on investments in illiquid securities and the difficulty in readily purchasing and selling such securities at favorable times or prices, may decline in value, experience lower returns and/or be unable to achieve its desired level of exposure to a

certain issuer or sector. Further, transactions in illiquid securities may entail transaction costs that are higher than those for transactions in liquid securities.

Redemption Risk. The fund may

experience periods of heavy redemptions that could cause the fund to liquidate its assets at inopportune times or at a loss or depressed value, particularly during periods of declining or illiquid markets. Redemptions by a few large investors in the

fund may have a significant adverse effect on the fund’s ability to maintain a stable $1.00 share price. In the event any money market fund fails to maintain a stable net asset value, other money market funds, including the fund, could face a

market-wide risk of increased redemption pressures, potentially jeopardizing the stability of their $1.00 share prices.

Money Market Fund

Risk. The fund is not designed to offer capital appreciation. In exchange for their emphasis on stability and liquidity, money market investments may offer lower long-term performance than stock or bond

investments.

Schwab

Municipal Money Fund | Summary Prospectus3

Performance

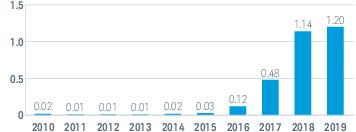

The bar chart below shows how the

fund’s Investor Shares investment results have varied from year to year, and the following table shows the fund’s Investor Shares and Ultra Shares average annual total returns for various periods. This

information provides some indication of the risks of investing in the fund. All figures assume distributions were reinvested. Keep in mind that future performance may differ from past performance. For current performance information, please see www.schwabfunds.com/schwabfunds_prospectus or call toll-free 1-877-824-5615 for the fund’s current seven-day yield.

Annual Total Returns (%) as of

12/31

Best Quarter: 0.35% Q2 2019

Worst Quarter: 0.00% Q1 2016

Worst Quarter: 0.00% Q1 2016

| Average Annual Total Returns as of 12/31/19 | |||

| 1 Year | 5 Years | 10 Years | |

| Investor Shares | 1.20% | 0.59% | 0.30% |

| Ultra Shares | 1.35% | 0.72% | 0.39% |

Investment Adviser

Charles Schwab Investment Management, Inc.

Purchase and Sale of Fund Shares

The fund is open for business each day that the New York

Stock Exchange (NYSE) is open except when the following federal holidays are observed: Columbus Day and Veterans Day. If the NYSE is closed due to weather or other extenuating circumstances on a day it would typically be open for business, or the

NYSE has an unscheduled early closing on a day it has opened for business, the fund reserves the right to treat such day as a business day and accept purchase and redemption orders and calculate its share price as of the normally scheduled close of

regular trading on the NYSE for that day.

Investments in

the fund are intended to be limited to accounts beneficially owned by natural persons. The fund has adopted policies and procedures reasonably designed to limit all beneficial owners of the fund to natural persons. The fund reserves the right to

involuntarily redeem shares in any account that are not beneficially owned by natural persons, after providing notice.

Eligible Investors (as determined by the fund and which are

limited to natural persons) may only invest in the fund through an account at Charles Schwab & Co., Inc. (Schwab) or another financial intermediary. When you place orders to purchase, exchange or redeem fund shares through Schwab or another

financial intermediary, you must follow Schwab’s or the other financial

intermediary’s transaction procedures. Shareholders who previously

purchased fund shares through the fund’s transfer agent and continue to hold such shares directly through the fund’s transfer agent may make additional purchases and place exchange and redemption orders through the fund’s transfer

agent by contacting the transfer agent by phone or in writing as noted below:

| • | by telephone at 1-800-407-0256; or |

| • | by mail to DST Asset Manager Solutions, Inc., Attn: Schwab Funds, P.O. Box 219647, Kansas City, MO 64121-9647. |

Set forth below are the investment minimums for the

fund’s share classes. The minimums may be waived for certain investors or in the fund’s sole discretion.

| Minimum

Initial Investment |

Minimum

Additional Investment | |

| Investor Shares | None | None |

| Ultra Shares | $1,000,000 | $ 1 |

Tax Information

Distributions received from the fund are typically intended

to be exempt from federal income tax, but are generally subject to state and local personal income taxes. While interest from municipal securities is generally exempt from federal income tax, some municipal securities in which the fund may invest

may produce income that is subject to the AMT. The fund may invest a portion of its assets in securities that generate income that is not exempt from federal income tax. Further, any of the fund’s defensive investments in taxable

securities also could generate taxable income.

Payments to Financial Intermediaries

If you purchase shares of the fund through a broker-dealer

or other financial intermediary (such as a bank), the fund and its related companies may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or

other financial intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

Schwab

Municipal Money Fund | Summary Prospectus4