UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

|

Investment Company Act file number |

811-05883 | |||||

|

|

| |||||

|

|

Dreyfus Index Funds, Inc. |

| ||||

|

|

(Exact name of Registrant as specified in charter) |

| ||||

|

|

|

| ||||

|

|

c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 |

| ||||

|

|

(Address of principal executive offices) (Zip code) |

| ||||

|

|

|

| ||||

|

|

Bennett A. MacDougall, Esq. 200 Park Avenue New York, New York 10166 |

| ||||

|

|

(Name and address of agent for service) |

| ||||

|

| ||||||

|

Registrant's telephone number, including area code: |

(212) 922-6400 | |||||

|

|

| |||||

|

Date of fiscal year end:

|

10/31 |

| ||||

|

Date of reporting period: |

10/31/16

|

| ||||

FORM N-CSR

Item 1. Reports to Stockholders.

Dreyfus International Stock Index Fund

|

|

ANNUAL REPORT |

|

|

|

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes. |

|

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund. |

|

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

THE FUND

|

Chief Executive Officer |

|

|

With Those of Other Funds |

|

|

Public Accounting Firm |

|

FOR MORE INFORMATION

Back Cover

|

|

The Fund |

A LETTER FROM THE CHIEF EXECUTIVE OFFICER

Dear Shareholder:

We are pleased to present this annual report for Dreyfus International Stock Index Fund, covering the 12-month period from November 1, 2015 through October 31, 2016. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

Stocks and bonds generally advanced over the reporting period in the midst of heightened market volatility stemming from various global economic developments. Toward the end of 2015, investor sentiment deteriorated amid sluggish global economic growth, falling commodity prices, and the first increase in short-term U.S. interest rates in nearly a decade. These worries sparked sharp stock market declines in January 2016, but equities began to rally in February when U.S. monetary policymakers refrained from additional rate hikes, other central banks eased their monetary policies further, and commodity prices began to rebound. Stocks generally continued to climb through the summer, driving several broad measures of U.S. stock market performance to record highs in July and August before moderating as a result of uncertainty regarding U.S. elections and potential rate hikes. In the bond market, yields of high-quality sovereign bonds generally moved lower and their prices increased in response to robust investor demand for current income in a low interest rate environment.

The outcome of the U.S. presidential election and ongoing global economic headwinds suggest that uncertainty will persist in the financial markets over the foreseeable future. Some asset classes and industry groups may benefit from a changing economic and political landscape, while others probably will face challenges. Consequently, selectivity could become a more important determinant of investment success. As always, we encourage you to discuss the implications of our observations with your financial advisor.

Thank you for your continued confidence and support.

Sincerely,

Mark D. Santero

Chief Executive Officer

The Dreyfus Corporation

November 15, 2016

2

DISCUSSION OF FUND PERFORMANCE

For the period from November 1, 2015 through October 31, 2016, as provided by Thomas J. Durante, CFA, Karen Q. Wong, CFA, and Richard A. Brown, CFA, Portfolio Managers

Fund and Market Performance Overview

For the 12-month period ended October 31, 2016, Dreyfus International Stock Index Fund’s Investor shares produced a total return of -3.37%.1 This compares with a -3.23% total return for the fund’s benchmark, the Morgan Stanley Capital International Europe, Australasia, Far East Index (the “MSCI EAFE Index”), during the same period.2 Between its inception on August 31, 2016 and October 31, 2016, the fund’s Class I share produced a total return of -0.86%.

International equities ended the reporting period with moderately negative returns, on average, amid heightened market volatility.

As of August 31, 2016, existing fund shares were renamed Investor shares and Class I shares were added as a new share class of the fund.

The Fund’s Investment Approach

The fund seeks to match the performance of the MSCI EAFE Index, a broadly diversified, international index composed of approximately 1,000 companies located in developed markets outside the United States and Canada. To pursue its goal, the fund is generally fully invested in stocks included in the MSCI EAFE Index. The fund’s investments are selected to match the benchmark composition along individual name, country, and industry weighting, and other benchmark characteristics. Under these circumstances, the fund maintains approximately the same weighting for each stock as the MSCI EAFE Index does.

The fund employed futures contracts and currency forward contracts during the reporting period in its efforts to replicate the returns of the MSCI EAFE Index.

Volatility Buffeted International Equity Markets

International stocks moved lower in choppy trading during the final months of 2015 under pressure from weakening commodity prices and disappointment over recent central banking strategies in Europe. Investor sentiment turned more sharply negative in January 2016 in response to further deterioration in commodity prices, disappointing economic data in China, and worries that higher short-term rates in the United States might weigh on global economic activity.

International stocks began a dramatic recovery in mid-February when investors responded positively to encouraging European and U.S. economic data, low inflation, rebounding commodity prices, a new round of monetary easing in Europe, and indications that U.S. monetary policymakers would delay additional rate hikes. The markets endured another bout of volatility in June when the United Kingdom voted to leave the European Union. Most international equity markets quickly rebounded, and the MSCI EAFE Index recouped most, but not all, of its previous losses over the summer. However, in October, uncertainty surrounding the outcome of upcoming U.S. elections caused international stocks to lose additional ground.

3

DISCUSSION OF FUND PERFORMANCE (continued)

Investors Favored Traditionally Defensive Market Sectors

The MSCI EAFE Index’s moderately negative return for the reporting period masked heightened market volatility. The financial sector led the market’s decline when concerns intensified that negative interest rates in Europe and Japan might undermine banks’ earnings. Financial institutions in Asia struggled with exposure to a slowing and highly leveraged Chinese economy, while European banks encountered slowing loan growth and a more stringent regulatory environment. U.K.-based banks lost value amid concerns surrounding London’s role as a financial center after Britain’s exit from the European Union. In the health care sector, pharmaceutical developers in Switzerland and other markets struggled with diminishing new-product pipelines, unfavorable currency exchange rates, longer waits for regulatory approvals, pressures on drug pricing policies, and subdued demand from the emerging markets.

On the other hand, the MSCI EAFE Index achieved relatively strong results in the materials sector, where better economic conditions in China and rebounding commodity prices helped a number of basic materials producers recover from previously depressed levels. In addition, several mining companies had reduced their debt loads and cut costs during the downturn, enabling them to enhance profit margins in the industry group’s recovery. Finally, some of the larger U.K.-based metals producers benefited from the decline of the British pound in the wake of the Brexit referendum.

In the industrials sector, manufacturers in Japan and elsewhere boosted profits through the use of technology to automate their factories. Industrial production volumes in Europe improved later in the reporting period, helping electronic equipment and machinery companies in economically strong nations such as Germany and France. Among energy companies, a depreciating British pound, reduced costs, and a cautious approach to capital spending supported the stock prices of U.K.-based oil and gas producers.

Replicating the Performance of the MSCI EAFE Index

Although we do not actively manage the fund’s investments in response to macroeconomic trends, it is worth noting that aggressively accommodative monetary policies remain at work in international markets and we recently have seen signs of gradual economic improvement in some regions. As always, we intend to continue to monitor the factors considered by the fund’s investment model in light of current market conditions.

November 15, 2016

Equities are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price, yield, and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost.

2 Source: Lipper Inc. — Reflects reinvestment of net dividends and, where applicable, capital gain distributions. The Morgan Stanley Capital International Europe, Australasia, Far East (MSCI EAFE) Index is an unmanaged index composed of a sample of companies representative of the market structure of European and Pacific Basin countries. The index reflects actual investable opportunities for global investors for stocks that are free of foreign ownership limits or legal restrictions at the country level. Investors cannot invest directly in any index.

4

FUND PERFORMANCE

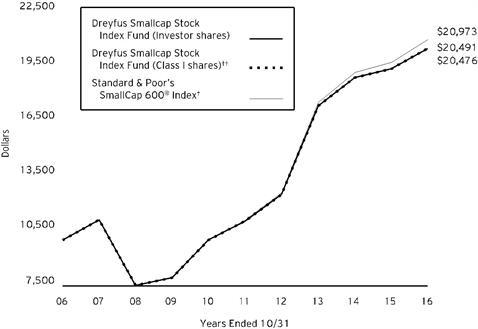

Comparison of change in value of $10,000 investment in Dreyfus International Stock Index Fund and the Morgan Stanley Capital International Europe, Australasia, Far East Index

† Source: Lipper Inc.

†† The total return figures presented for Class I shares of the fund reflect the performance of the fund’s Investor shares for the period prior to 8/31/16 (the inception date for Class I shares).Past performance is not predictive of future performance. The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The above graph compares a $10,000 investment made in each of the Investor and Class I shares of Dreyfus International Stock Index Fund on 10/31/06 to a $10,000 investment made in the Morgan Stanley Capital International Europe, Australasia, Far East Index (the “Index”) on that date. All dividends and capital gain distributions are reinvested. The fund’s performance shown in the line graph above takes into account all applicable fees and expenses. The Index is an unmanaged index composed of a sample of companies representative of the market structure of European and Pacific Basin countries. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

5

FUND PERFORMANCE (continued)

|

Average Annual Total Returns as of 10/31/16 | |||||

|

|

Inception Date |

1 Year |

5 Years |

10 Years | |

|

Investor Shares |

6/30/97 |

-3.37% |

4.66% |

.80% | |

|

Class I |

8/31/16 |

-3.31%† |

4.67%† |

.80%† | |

|

Morgan Stanley Capital International Europe, Australasia, Far East Index |

-3.23% |

4.99% |

1.22% | ||

† The total return performance figures presented for Class I shares of the fund reflect the performance of the fund’s Investor shares for the period prior to 8/31/16 (the inception date for Class I shares).

6

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus International Stock Index Fund from May 1, 2016 to October 31, 2016. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

|

Expenses and Value of a $1,000 Investment | |||||||

|

assuming actual returns for the six months ended October 31, 2016† | |||||||

|

Investor Shares |

Class I |

||||||

|

Expenses paid per $1,000†† |

|

$3.03 |

$.65 |

||||

|

Ending value (after expenses) |

|

$1,008.10 |

$991.40 |

||||

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

|

Expenses and Value of a $1,000 Investment | |||||||

|

assuming a hypothetical 5% annualized return for the six months ended October 31, 2016††† | |||||||

|

Investor Shares |

Class I |

||||||

|

Expenses paid per $1,000†††† |

$3.05 |

$1.98 |

|||||

|

Ending value (after expenses) |

$1,022.12 |

$1,023.18 |

|||||

† From August 31, 2016 (commencement of initial offering) to October 31, 2016 for Class I shares. The existing fund shares were redesignated as Investor shares.

†† Expenses are equal to the fund’s annualized expense ratio of .60% for Investor Shares, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the actual days in the period). Expenses are equal to the fund’s annualized expense ratio of .39% for Class I, multiplied by the average account value over the period, multiplied by 61/366 (to reflect the actual days in the period).

††† Please note that while Class I shares commenced offering on August 31, 2016, the hypothetical expenses paid during the period reflect projected activity for the full six month period for purposes of comparability. This projection assumes that annualized expense ratios were in effect during the period May 1, 2016 to October 31, 2016.

†††† Expenses are equal to the fund’s annualized expense ratio of .60% for Investor Shares and .39% for Class I, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

7

STATEMENT OF INVESTMENTS

October 31, 2016

|

Common Stocks - 98.4% |

Shares |

Value ($) |

|||

|

Australia - 7.3% |

|||||

|

AGL Energy |

28,803 |

420,242 |

|||

|

Alumina |

112,290 |

134,962 |

|||

|

Amcor |

49,738 |

556,184 |

|||

|

AMP |

126,772 |

440,710 |

|||

|

APA Group |

48,299 |

292,458 |

|||

|

Aristocrat Leisure |

23,345 |

272,416 |

|||

|

ASX |

8,145 |

292,013 |

|||

|

Aurizon Holdings |

87,215 |

323,761 |

|||

|

AusNet Services |

72,030 |

82,190 |

|||

|

Australia & New Zealand Banking Group |

122,970 |

2,605,178 |

|||

|

Bank of Queensland |

16,530 |

131,528 |

|||

|

Bendigo & Adelaide Bank |

17,767 |

150,426 |

|||

|

BHP Billiton |

135,321 |

2,374,793 |

|||

|

Boral |

29,353 |

140,671 |

|||

|

Brambles |

67,331 |

590,551 |

|||

|

Caltex Australia |

11,157 |

260,809 |

|||

|

Challenger |

24,253 |

198,514 |

|||

|

CIMIC Group |

4,044 |

91,027 |

|||

|

Coca-Cola Amatil |

25,822 |

187,392 |

|||

|

Cochlear |

2,328 |

226,605 |

|||

|

Commonwealth Bank of Australia |

72,740 |

4,060,908 |

|||

|

Computershare |

20,349 |

163,308 |

|||

|

Crown Resorts |

16,028 |

132,776 |

|||

|

CSL |

19,236 |

1,470,744 |

|||

|

Dexus Property Group |

41,439 |

281,812 |

|||

|

Domino's Pizza Enterprises |

2,506 |

122,481 |

|||

|

DUET Group |

98,706 |

178,704 |

|||

|

Flight Centre Travel Group |

2,140 |

55,137 |

|||

|

Fortescue Metals Group |

69,153 |

289,325 |

|||

|

Goodman Group |

76,560 |

395,444 |

|||

|

GPT Group |

76,962 |

272,819 |

|||

|

Harvey Norman Holdings |

21,349 |

82,013 |

|||

|

Healthscope |

74,351 |

124,995 |

|||

|

Incitec Pivot |

75,161 |

168,666 |

|||

|

Insurance Australia Group |

105,697 |

443,024 |

|||

|

James Hardie Industries-CDI |

19,090 |

285,062 |

|||

|

LendLease Group |

24,424 |

251,192 |

|||

8

|

Common Stocks - 98.4% (continued) |

Shares |

Value ($) |

|||

|

Australia - 7.3% (continued) |

|||||

|

Macquarie Group |

12,790 |

776,402 |

|||

|

Medibank Private |

120,463 |

236,421 |

|||

|

Mirvac Group |

150,475 |

239,234 |

|||

|

National Australia Bank |

111,451 |

2,373,859 |

|||

|

Newcrest Mining |

31,805 |

545,818 |

|||

|

Oil Search |

58,652 |

297,146 |

|||

|

Orica |

16,497 |

204,427 |

|||

|

Origin Energy |

73,618 |

299,606 |

|||

|

Platinum Asset Management |

9,947 |

37,758 |

|||

|

Qantas Airways |

18,369 |

42,758 |

|||

|

QBE Insurance Group |

57,997 |

440,742 |

|||

|

Ramsay Health Care |

6,139 |

342,586 |

|||

|

REA Group |

2,402 |

93,443 |

|||

|

Rio Tinto |

18,235 |

751,550 |

|||

|

Santos |

71,342 |

193,743 |

|||

|

Scentre Group |

222,359 |

712,114 |

|||

|

SEEK |

13,743 |

153,051 |

|||

|

Sonic Healthcare |

16,874 |

263,010 |

|||

|

South32 |

223,721 |

437,374 |

|||

|

Stockland |

102,579 |

344,900 |

|||

|

Suncorp Group |

54,530 |

496,527 |

|||

|

Sydney Airport |

46,218 |

220,089 |

|||

|

Tabcorp Holdings |

37,451 |

137,887 |

|||

|

Tatts Group |

59,893 |

184,976 |

|||

|

Telstra |

181,849 |

688,895 |

|||

|

TPG Telecom |

14,383 |

82,715 |

|||

|

Transurban Group |

86,518 |

683,809 |

|||

|

Treasury Wine Estates |

30,068 |

245,653 |

|||

|

Vicinity Centres |

137,818 |

300,885 |

|||

|

Vocus Communications |

20,174 |

87,628 |

|||

|

Wesfarmers |

47,361 |

1,477,487 |

|||

|

Westfield |

85,350 |

577,839 |

|||

|

Westpac Banking |

141,331 |

3,275,841 |

|||

|

Woodside Petroleum |

32,506 |

701,513 |

|||

|

Woolworths |

53,577 |

963,879 |

|||

|

37,462,405 |

|||||

|

Austria - .2% |

|||||

|

ANDRITZ |

3,152 |

164,875 |

|||

|

Erste Group Bank |

12,908 |

a |

405,399 |

||

9

STATEMENT OF INVESTMENTS (continued)

|

Common Stocks - 98.4% (continued) |

Shares |

Value ($) |

|||

|

Austria - .2% (continued) |

|||||

|

OMV |

6,042 |

188,864 |

|||

|

Raiffeisen Bank International |

4,550 |

a |

74,572 |

||

|

Voestalpine |

4,531 |

160,310 |

|||

|

994,020 |

|||||

|

Belgium - 1.3% |

|||||

|

Ageas |

7,979 |

291,455 |

|||

|

Anheuser-Busch InBev |

34,112 |

3,915,044 |

|||

|

Colruyt |

3,021 |

162,384 |

|||

|

Groupe Bruxelles Lambert |

3,568 |

306,920 |

|||

|

KBC Group |

10,653 |

a |

649,155 |

||

|

Proximus |

6,406 |

183,400 |

|||

|

Solvay |

3,202 |

367,494 |

|||

|

Telenet Group Holding |

2,038 |

a |

109,098 |

||

|

UCB |

5,409 |

366,300 |

|||

|

Umicore |

3,912 |

237,868 |

|||

|

6,589,118 |

|||||

|

China - .0% |

|||||

|

Yangzijiang Shipbuilding Holdings |

91,000 |

48,730 |

|||

|

Denmark - 1.7% |

|||||

|

AP Moller - Maersk, Cl. A |

154 |

225,348 |

|||

|

AP Moller - Maersk, Cl. B |

273 |

419,021 |

|||

|

Carlsberg, Cl. B |

4,628 |

417,325 |

|||

|

Charles Hansen Holding |

4,223 |

252,914 |

|||

|

Coloplast, Cl. B |

5,074 |

354,052 |

|||

|

Danske Bank |

28,776 |

888,447 |

|||

|

DSV |

8,030 |

389,187 |

|||

|

Genmab |

2,344 |

a |

386,758 |

||

|

ISS |

6,985 |

274,625 |

|||

|

Novo Nordisk, Cl. B |

81,013 |

2,898,189 |

|||

|

Novozymes, Cl. B |

9,930 |

368,869 |

|||

|

Pandora |

4,803 |

625,202 |

|||

|

TDC |

33,595 |

a |

185,383 |

||

|

Tryg |

5,250 |

102,586 |

|||

|

Vestas Wind Systems |

9,531 |

764,500 |

|||

|

William Demant Holding |

4,877 |

a |

90,835 |

||

|

8,643,241 |

|||||

|

Finland - .9% |

|||||

|

Elisa |

6,146 |

207,127 |

|||

|

Fortum |

19,209 |

320,308 |

|||

10

|

Common Stocks - 98.4% (continued) |

Shares |

Value ($) |

|||

|

Finland - .9% (continued) |

|||||

|

Kone, Cl. B |

14,331 |

659,640 |

|||

|

Metso |

5,095 |

133,674 |

|||

|

Neste |

5,198 |

224,422 |

|||

|

Nokia |

245,689 |

1,097,165 |

|||

|

Nokian Renkaat |

4,816 |

161,617 |

|||

|

Orion, Cl. B |

4,426 |

188,468 |

|||

|

Sampo, Cl. A |

18,681 |

856,584 |

|||

|

Stora Enso, Cl. R |

23,000 |

217,515 |

|||

|

UPM-Kymmene |

23,011 |

535,521 |

|||

|

Wartsila |

6,319 |

273,307 |

|||

|

4,875,348 |

|||||

|

France - 9.7% |

|||||

|

Accor |

7,307 |

277,417 |

|||

|

Aeroports de Paris |

1,220 |

123,225 |

|||

|

Air Liquide |

16,441 |

1,672,706 |

|||

|

Airbus Group |

24,948 |

1,482,995 |

|||

|

Alstom |

6,914 |

a |

185,724 |

||

|

Altice, Cl. A |

15,686 |

a |

289,286 |

||

|

Altice, Cl. B |

3,963 |

a |

73,761 |

||

|

Arkema |

2,875 |

272,619 |

|||

|

Atos |

3,789 |

393,562 |

|||

|

AXA |

81,756 |

1,842,977 |

|||

|

BNP Paribas |

44,640 |

2,589,360 |

|||

|

Bollore |

38,356 |

126,316 |

|||

|

Bouygues |

8,879 |

289,534 |

|||

|

Bureau Veritas |

11,374 |

214,882 |

|||

|

Capgemini |

7,030 |

582,496 |

|||

|

Carrefour |

23,940 |

627,967 |

|||

|

Casino Guichard Perrachon |

2,511 |

124,950 |

|||

|

Christian Dior |

2,378 |

458,789 |

|||

|

Cie de St-Gobain |

20,718 |

919,852 |

|||

|

Cie Generale des Etablissements Michelin |

7,745 |

838,563 |

|||

|

CNP Assurances |

6,982 |

120,985 |

|||

|

Credit Agricole |

45,463 |

490,688 |

|||

|

Danone |

24,840 |

1,720,080 |

|||

|

Dassault Systemes |

5,580 |

441,892 |

|||

|

Edenred |

8,572 |

198,597 |

|||

|

Eiffage |

2,339 |

173,162 |

|||

|

Electricite de France |

10,350 |

116,004 |

|||

11

STATEMENT OF INVESTMENTS (continued)

|

Common Stocks - 98.4% (continued) |

Shares |

Value ($) |

|||

|

France - 9.7% (continued) |

|||||

|

Engie |

61,182 |

882,184 |

|||

|

Essilor International |

8,633 |

970,437 |

|||

|

Eurazeo |

1,825 |

105,038 |

|||

|

Eutelsat Communications |

6,845 |

143,520 |

|||

|

Fonciere Des Regions |

1,331 |

116,348 |

|||

|

Gecina |

1,800 |

262,407 |

|||

|

Groupe Eurotunnel |

19,532 |

182,916 |

|||

|

Hermes International |

1,133 |

459,071 |

|||

|

ICADE |

1,292 |

92,870 |

|||

|

Iliad |

1,127 |

236,423 |

|||

|

Imerys |

1,513 |

105,235 |

|||

|

Ingenico Group |

2,387 |

188,927 |

|||

|

JCDecaux |

3,359 |

102,711 |

|||

|

Kering |

3,255 |

721,964 |

|||

|

Klepierre |

9,411 |

384,984 |

|||

|

Lagardere |

5,470 |

139,310 |

|||

|

Legrand |

11,473 |

648,493 |

|||

|

L'Oreal |

10,665 |

1,908,917 |

|||

|

LVMH Moet Hennessy Louis Vuitton |

11,744 |

2,134,277 |

|||

|

Natixis |

41,535 |

209,966 |

|||

|

Orange |

83,425 |

1,314,176 |

|||

|

Pernod Ricard |

9,048 |

1,076,185 |

|||

|

Peugeot |

21,341 |

a |

319,664 |

||

|

Publicis Groupe |

8,137 |

558,277 |

|||

|

Remy Cointreau |

990 |

80,313 |

|||

|

Renault |

8,258 |

717,153 |

|||

|

Rexel |

12,502 |

173,404 |

|||

|

Safran |

13,098 |

900,519 |

|||

|

Sanofi |

49,102 |

3,824,884 |

|||

|

Schneider Electric |

23,523 |

1,578,787 |

|||

|

SCOR |

6,634 |

214,761 |

|||

|

SFR Group |

4,551 |

122,599 |

|||

|

Societe BIC |

1,212 |

168,040 |

|||

|

Societe Generale |

32,205 |

1,257,160 |

|||

|

Sodexo |

4,097 |

475,836 |

|||

|

Suez |

12,933 |

204,796 |

|||

|

Technip |

4,787 |

317,504 |

|||

|

Thales |

4,591 |

432,263 |

|||

|

Total |

94,170 |

4,519,581 |

|||

12

|

Common Stocks - 98.4% (continued) |

Shares |

Value ($) |

|||

|

France - 9.7% (continued) |

|||||

|

Unibail-Rodamco |

4,223 |

1,005,973 |

|||

|

Valeo |

10,112 |

582,776 |

|||

|

Veolia Environnement |

19,068 |

416,128 |

|||

|

Vinci |

21,238 |

1,538,266 |

|||

|

Vivendi |

49,547 |

1,001,872 |

|||

|

Wendel |

1,271 |

146,222 |

|||

|

Zodiac Aerospace |

8,581 |

208,838 |

|||

|

49,800,364 |

|||||

|

Germany - 8.5% |

|||||

|

adidas |

7,925 |

1,299,736 |

|||

|

Allianz |

19,269 |

3,003,675 |

|||

|

Axel Springer |

1,985 |

99,397 |

|||

|

BASF |

38,919 |

3,430,699 |

|||

|

Bayer |

35,049 |

3,473,927 |

|||

|

Bayerische Motoren Werke |

14,115 |

1,229,823 |

|||

|

Beiersdorf |

4,391 |

386,583 |

|||

|

Brenntag |

6,637 |

354,782 |

|||

|

Commerzbank |

44,804 |

304,300 |

|||

|

Continental |

4,608 |

882,953 |

|||

|

Covestro |

2,894 |

b |

171,044 |

||

|

Daimler |

40,596 |

2,892,679 |

|||

|

Deutsche Bank |

58,646 |

a |

846,905 |

||

|

Deutsche Boerse |

8,350 |

a |

649,704 |

||

|

Deutsche Lufthansa |

11,009 |

140,732 |

|||

|

Deutsche Post |

41,375 |

1,282,196 |

|||

|

Deutsche Telekom |

135,817 |

2,213,298 |

|||

|

Deutsche Wohnen-BR |

13,933 |

454,568 |

|||

|

E.ON |

83,344 |

610,430 |

|||

|

Evonik Industries |

7,030 |

219,632 |

|||

|

Fraport Frankfurt Airport Services Worldwide |

1,702 |

101,023 |

|||

|

Fresenius & Co. |

17,202 |

1,269,732 |

|||

|

Fresenius Medical Care & Co. |

9,319 |

759,167 |

|||

|

GEA Group |

7,821 |

302,426 |

|||

|

Hannover Rueck |

2,559 |

285,270 |

|||

|

HeidelbergCement |

5,833 |

551,700 |

|||

|

Henkel & Co. |

4,405 |

485,012 |

|||

|

HOCHTIEF |

849 |

115,893 |

|||

|

HUGO BOSS |

3,014 |

189,287 |

|||

|

Infineon Technologies |

48,142 |

864,331 |

|||

13

STATEMENT OF INVESTMENTS (continued)

|

Common Stocks - 98.4% (continued) |

Shares |

Value ($) |

|||

|

Germany - 8.5% (continued) |

|||||

|

Innogy |

5,265 |

b |

209,080 |

||

|

K+S |

8,440 |

170,755 |

|||

|

LANXESS |

3,947 |

252,735 |

|||

|

Linde |

7,814 |

1,289,252 |

|||

|

MAN |

1,351 |

138,163 |

|||

|

Merck |

5,356 |

550,681 |

|||

|

METRO |

7,793 |

233,461 |

|||

|

Muenchener Rueckversicherungs |

6,868 |

1,331,455 |

|||

|

OSRAM Licht |

3,716 |

210,694 |

|||

|

ProSiebenSat.1 Media |

9,548 |

411,498 |

|||

|

RWE |

19,920 |

a |

316,201 |

||

|

SAP |

41,668 |

3,670,279 |

|||

|

Siemens |

32,434 |

3,683,295 |

|||

|

Symrise |

5,305 |

364,033 |

|||

|

Telefonica Deutschland Holding |

30,497 |

118,212 |

|||

|

ThyssenKrupp |

15,523 |

359,383 |

|||

|

TUI |

21,866 |

277,544 |

|||

|

United Internet |

5,268 |

216,225 |

|||

|

Volkswagen |

1,388 |

207,221 |

|||

|

Vonovia |

19,818 |

698,019 |

|||

|

Zalando |

3,469 |

a,b |

152,286 |

||

|

43,731,376 |

|||||

|

Hong Kong - 3.4% |

|||||

|

AIA Group |

510,600 |

3,222,708 |

|||

|

ASM Pacific Technology |

10,800 |

104,232 |

|||

|

Bank of East Asia |

49,550 |

199,655 |

|||

|

BOC Hong Kong Holdings |

154,000 |

550,032 |

|||

|

Cathay Pacific Airways |

52,000 |

68,524 |

|||

|

Cheung Kong Infrastructure Holdings |

29,000 |

237,630 |

|||

|

Cheung Kong Property Holdings |

112,475 |

833,170 |

|||

|

CK Hutchison Holdings |

113,475 |

1,403,888 |

|||

|

CLP Holdings |

68,288 |

694,718 |

|||

|

First Pacific |

84,250 |

63,876 |

|||

|

Galaxy Entertainment Group |

101,277 |

415,918 |

|||

|

Hang Lung Properties |

99,000 |

218,538 |

|||

|

Hang Seng Bank |

33,000 |

596,128 |

|||

|

Henderson Land Development |

45,999 |

272,534 |

|||

|

HK Electric Investments |

106,500 |

b |

105,463 |

||

|

HKT Trust |

110,660 |

152,102 |

|||

14

|

Common Stocks - 98.4% (continued) |

Shares |

Value ($) |

|||

|

Hong Kong - 3.4% (continued) |

|||||

|

Hong Kong & China Gas |

329,582 |

645,943 |

|||

|

Hong Kong Exchanges & Clearing |

48,600 |

1,287,135 |

|||

|

Hongkong Land Holdings |

49,900 |

334,330 |

|||

|

Hysan Development |

28,000 |

129,249 |

|||

|

Jardine Matheson Holdings |

10,546 |

642,357 |

|||

|

Kerry Properties |

29,500 |

93,382 |

|||

|

Li & Fung |

259,200 |

127,669 |

|||

|

Link REIT |

93,500 |

666,690 |

|||

|

Melco Crown Entertainment, ADR |

8,076 |

135,192 |

|||

|

MTR |

64,500 |

357,199 |

|||

|

New World Development |

237,048 |

295,563 |

|||

|

Noble Group |

188,963 |

a |

22,547 |

||

|

NWS Holdings |

61,648 |

109,218 |

|||

|

PCCW |

167,000 |

99,482 |

|||

|

Power Assets Holdings |

60,000 |

564,370 |

|||

|

Shangri-La Asia |

49,000 |

53,893 |

|||

|

Sino Land |

127,730 |

217,397 |

|||

|

SJM Holdings |

78,530 |

54,375 |

|||

|

Sun Hung Kai Properties |

60,699 |

906,312 |

|||

|

Swire Pacific, Cl. A |

23,000 |

239,177 |

|||

|

Swire Properties |

48,800 |

140,318 |

|||

|

Techtronic Industries |

59,365 |

223,512 |

|||

|

WH Group |

257,000 |

b |

208,435 |

||

|

Wharf Holdings |

57,311 |

430,818 |

|||

|

Wheelock & Co. |

34,000 |

209,992 |

|||

|

Yue Yuen Industrial Holdings |

32,300 |

123,069 |

|||

|

17,456,740 |

|||||

|

Ireland - .5% |

|||||

|

Bank of Ireland |

1,228,951 |

a |

263,072 |

||

|

CRH |

34,841 |

1,134,594 |

|||

|

DCC |

3,616 |

294,993 |

|||

|

Kerry Group, Cl. A |

6,556 |

480,305 |

|||

|

Paddy Power Betfair |

3,424 |

354,447 |

|||

|

Ryanair Holdings |

3,900 |

a |

53,944 |

||

|

2,581,355 |

|||||

|

Israel - .7% |

|||||

|

Azrieli Group |

1,603 |

68,277 |

|||

|

Bank Hapoalim |

44,714 |

258,053 |

|||

|

Bank Leumi Le-Israel |

60,234 |

a |

227,351 |

||

15

STATEMENT OF INVESTMENTS (continued)

|

Common Stocks - 98.4% (continued) |

Shares |

Value ($) |

|||

|

Israel - .7% (continued) |

|||||

|

Bezeq The Israeli Telecommunication Corporation |

79,342 |

144,153 |

|||

|

Check Point Software Technologies |

5,610 |

a |

474,382 |

||

|

Israel Chemicals |

24,674 |

87,857 |

|||

|

Israel Discount Bank, Cl. A |

1 |

a |

2 |

||

|

Mizrahi Tefahot Bank |

6,222 |

81,094 |

|||

|

Mobileye |

7,423 |

a |

275,987 |

||

|

NICE |

2,452 |

162,793 |

|||

|

Taro Pharmaceutical Industries |

636 |

a |

64,560 |

||

|

Teva Pharmaceutical Industries, ADR |

38,410 |

1,641,643 |

|||

|

3,486,152 |

|||||

|

Italy - 2.0% |

|||||

|

Assicurazioni Generali |

49,678 |

641,868 |

|||

|

Atlantia |

17,670 |

432,754 |

|||

|

CNH Industrial |

43,714 |

339,750 |

|||

|

Enel |

325,318 |

1,399,908 |

|||

|

Eni |

106,986 |

1,551,441 |

|||

|

EXOR |

4,701 |

199,765 |

|||

|

Ferrari |

4,926 |

259,454 |

|||

|

Fiat Chrysler Automobiles |

35,962 |

263,315 |

|||

|

Intesa Sanpaolo |

540,968 |

1,253,024 |

|||

|

Intesa Sanpaolo-RSP |

38,108 |

82,328 |

|||

|

Leonardo-Finmeccanica |

16,867 |

a |

205,526 |

||

|

Luxottica Group |

7,270 |

361,924 |

|||

|

Mediobanca |

25,082 |

183,789 |

|||

|

Poste Italiane |

21,336 |

b |

142,053 |

||

|

Prysmian |

8,493 |

211,358 |

|||

|

Saipem |

250,930 |

a |

103,297 |

||

|

Snam |

103,963 |

548,033 |

|||

|

STMicroelectronics |

26,057 |

248,485 |

|||

|

Telecom Italia |

427,134 |

a |

370,656 |

||

|

Telecom Italia-RSP |

270,919 |

a |

192,122 |

||

|

Tenaris |

20,192 |

285,496 |

|||

|

Terna Rete Elettrica Nazionale |

64,209 |

314,507 |

|||

|

UniCredit |

222,517 |

552,048 |

|||

|

Unione di Banche Italiane |

41,889 |

115,511 |

|||

|

UnipolSai |

48,164 |

91,998 |

|||

|

10,350,410 |

|||||

|

Japan - 24.5% |

|||||

|

ABC-Mart |

1,500 |

91,399 |

|||

16

|

Common Stocks - 98.4% (continued) |

Shares |

Value ($) |

|||

|

Japan - 24.5% (continued) |

|||||

|

Acom |

15,500 |

a |

71,536 |

||

|

Aeon |

28,400 |

393,489 |

|||

|

AEON Financial Service |

5,360 |

94,606 |

|||

|

AEON Mall |

4,480 |

66,643 |

|||

|

Air Water |

7,000 |

131,296 |

|||

|

Aisin Seiki |

8,100 |

356,456 |

|||

|

Ajinomoto |

23,800 |

530,263 |

|||

|

Alfresa Holdings |

7,600 |

161,030 |

|||

|

Alps Electric |

8,100 |

194,641 |

|||

|

Amada Holdings |

13,900 |

158,789 |

|||

|

ANA Holdings |

53,000 |

149,190 |

|||

|

Aozora Bank |

47,959 |

158,690 |

|||

|

Asahi Glass |

42,800 |

299,971 |

|||

|

Asahi Group Holdings |

16,000 |

572,290 |

|||

|

Asahi Kasei |

52,900 |

478,103 |

|||

|

Asics |

7,000 |

149,652 |

|||

|

Astellas Pharma |

89,995 |

1,338,297 |

|||

|

Bandai Namco Holdings |

7,750 |

232,788 |

|||

|

Bank of Kyoto |

12,000 |

88,224 |

|||

|

Benesse Holdings |

3,200 |

84,005 |

|||

|

Bridgestone |

27,300 |

1,019,162 |

|||

|

Brother Industries |

9,400 |

172,995 |

|||

|

CALBEE |

3,500 |

127,157 |

|||

|

Canon |

44,917 |

1,292,215 |

|||

|

Casio Computer |

9,300 |

130,007 |

|||

|

Central Japan Railway |

6,100 |

1,039,158 |

|||

|

Chiba Bank |

29,000 |

179,746 |

|||

|

Chubu Electric Power |

27,200 |

400,595 |

|||

|

Chugai Pharmaceutical |

9,128 |

311,607 |

|||

|

Chugoku Bank |

7,200 |

96,806 |

|||

|

Chugoku Electric Power |

12,600 |

147,543 |

|||

|

Concordia Financial Group |

50,000 |

232,288 |

|||

|

Credit Saison |

6,200 |

107,363 |

|||

|

CYBERDYNE |

4,200 |

a |

63,158 |

||

|

Dai Nippon Printing |

22,800 |

229,152 |

|||

|

Daicel |

11,800 |

155,728 |

|||

|

Dai-ichi Life Holdings |

45,800 |

673,003 |

|||

|

Daiichi Sankyo |

26,083 |

628,260 |

|||

|

Daikin Industries |

10,000 |

961,190 |

|||

17

STATEMENT OF INVESTMENTS (continued)

|

Common Stocks - 98.4% (continued) |

Shares |

Value ($) |

|||

|

Japan - 24.5% (continued) |

|||||

|

Daito Trust Construction |

3,000 |

502,765 |

|||

|

Daiwa House Industry |

24,300 |

668,731 |

|||

|

Daiwa House REIT Investment |

60 |

162,201 |

|||

|

Daiwa Securities Group |

72,000 |

430,956 |

|||

|

Denso |

20,300 |

883,661 |

|||

|

Dentsu |

9,400 |

469,686 |

|||

|

Don Quijote Holdings |

5,000 |

190,474 |

|||

|

East Japan Railway |

14,200 |

1,253,451 |

|||

|

Eisai |

10,700 |

683,404 |

|||

|

Electric Power Development |

6,080 |

141,869 |

|||

|

FamilyMart UNY Holdings |

3,617 |

226,946 |

|||

|

FANUC |

8,329 |

1,563,028 |

|||

|

Fast Retailing |

2,258 |

763,504 |

|||

|

Fuji Electric |

23,000 |

115,143 |

|||

|

Fuji Heavy Industries |

26,200 |

1,022,817 |

|||

|

FUJIFILM Holdings |

18,300 |

693,645 |

|||

|

Fujitsu |

79,800 |

474,143 |

|||

|

Fukuoka Financial Group |

33,000 |

143,177 |

|||

|

GungHo Online Entertainment |

19,400 |

49,208 |

|||

|

Hachijuni Bank |

16,500 |

90,154 |

|||

|

Hakuhodo DY Holdings |

9,800 |

118,026 |

|||

|

Hamamatsu Photonics |

6,400 |

194,069 |

|||

|

Hankyu Hanshin Holdings |

10,600 |

351,750 |

|||

|

Hikari Tsushin |

700 |

64,346 |

|||

|

Hino Motors |

12,100 |

132,111 |

|||

|

Hirose Electric |

1,365 |

180,664 |

|||

|

Hiroshima Bank |

20,000 |

85,821 |

|||

|

Hisamitsu Pharmaceutical |

2,400 |

128,388 |

|||

|

Hitachi |

205,900 |

1,097,924 |

|||

|

Hitachi Chemical |

4,000 |

93,830 |

|||

|

Hitachi Construction Machinery |

5,000 |

104,749 |

|||

|

Hitachi High-Technologies |

2,700 |

112,897 |

|||

|

Hitachi Metals |

10,000 |

125,107 |

|||

|

Hokuriku Electric Power |

7,700 |

87,595 |

|||

|

Honda Motor |

68,659 |

2,058,395 |

|||

|

Hoshizaki |

2,200 |

198,875 |

|||

|

Hoya |

16,900 |

706,651 |

|||

|

Hulic |

14,000 |

133,632 |

|||

|

Idemitsu Kosan |

3,600 |

83,109 |

|||

18

|

Common Stocks - 98.4% (continued) |

Shares |

Value ($) |

|||

|

Japan - 24.5% (continued) |

|||||

|

IHI |

60,000 |

158,482 |

|||

|

Iida Group Holdings |

5,800 |

112,217 |

|||

|

INPEX |

38,700 |

363,714 |

|||

|

Isetan Mitsukoshi Holdings |

15,020 |

152,105 |

|||

|

Isuzu Motors |

25,300 |

313,506 |

|||

|

ITOCHU |

62,400 |

790,487 |

|||

|

Iyo Bank |

11,000 |

67,760 |

|||

|

J Front Retailing |

10,800 |

149,019 |

|||

|

Japan Airlines |

5,200 |

153,516 |

|||

|

Japan Airport Terminal |

1,800 |

69,257 |

|||

|

Japan Exchange Group |

22,800 |

339,815 |

|||

|

Japan Post Bank |

18,100 |

213,672 |

|||

|

Japan Post Holdings |

20,100 |

256,449 |

|||

|

Japan Prime Realty Investment |

35 |

151,020 |

|||

|

Japan Real Estate Investment |

53 |

306,770 |

|||

|

Japan Retail Fund Investment |

113 |

256,343 |

|||

|

Japan Tobacco |

46,300 |

1,763,347 |

|||

|

JFE Holdings |

21,560 |

309,718 |

|||

|

JGC |

9,000 |

159,540 |

|||

|

JSR |

8,600 |

131,046 |

|||

|

JTEKT |

9,800 |

145,313 |

|||

|

JX Holdings |

91,076 |

361,195 |

|||

|

Kajima |

38,800 |

262,317 |

|||

|

Kakaku.com |

6,700 |

112,763 |

|||

|

Kamigumi |

9,400 |

80,402 |

|||

|

Kaneka |

12,000 |

99,552 |

|||

|

Kansai Electric Power |

30,599 |

a |

293,093 |

||

|

Kansai Paint |

9,100 |

196,109 |

|||

|

Kao |

21,500 |

1,108,110 |

|||

|

Kawasaki Heavy Industries |

59,000 |

172,719 |

|||

|

KDDI |

77,263 |

2,351,707 |

|||

|

Keihan Holdings |

21,000 |

141,976 |

|||

|

Keikyu |

20,000 |

201,964 |

|||

|

Keio |

25,000 |

207,400 |

|||

|

Keisei Electric Railway |

6,000 |

145,151 |

|||

|

Keyence |

1,885 |

1,385,125 |

|||

|

Kikkoman |

6,000 |

191,380 |

|||

|

Kintetsu Group Holdings |

73,354 |

296,578 |

|||

|

Kirin Holdings |

35,300 |

608,418 |

|||

19

STATEMENT OF INVESTMENTS (continued)

|

Common Stocks - 98.4% (continued) |

Shares |

Value ($) |

|||

|

Japan - 24.5% (continued) |

|||||

|

Kobe Steel |

13,300 |

a |

110,083 |

||

|

Koito Manufacturing |

4,500 |

235,148 |

|||

|

Komatsu |

38,600 |

862,399 |

|||

|

Konami Holdings |

3,900 |

154,148 |

|||

|

Konica Minolta |

19,100 |

171,385 |

|||

|

Kose |

1,300 |

118,881 |

|||

|

Kubota |

44,200 |

714,188 |

|||

|

Kuraray |

15,300 |

232,557 |

|||

|

Kurita Water Industries |

4,800 |

113,832 |

|||

|

Kyocera |

13,600 |

662,687 |

|||

|

Kyowa Hakko Kirin |

10,705 |

163,836 |

|||

|

Kyushu Electric Power |

18,400 |

167,209 |

|||

|

Kyushu Financial Group |

16,000 |

106,646 |

|||

|

Lawson |

2,700 |

205,454 |

|||

|

LIXIL Group |

10,824 |

249,054 |

|||

|

M3 |

8,100 |

247,163 |

|||

|

Mabuchi Motor |

1,900 |

110,699 |

|||

|

Makita |

4,700 |

325,822 |

|||

|

Marubeni |

71,700 |

377,883 |

|||

|

Marui Group |

9,500 |

133,618 |

|||

|

Maruichi Steel Tube |

2,000 |

64,556 |

|||

|

Mazda Motor |

23,300 |

383,816 |

|||

|

McDonald's Holdings Co. Japan |

3,000 |

86,393 |

|||

|

Mebuki Financial Group |

32,130 |

114,586 |

|||

|

Medipal Holdings |

5,800 |

99,275 |

|||

|

MEIJI Holdings |

4,942 |

493,870 |

|||

|

Minebea |

15,000 |

153,619 |

|||

|

Miraca Holdings |

2,200 |

106,570 |

|||

|

Mitsubishi |

63,598 |

1,389,368 |

|||

|

Mitsubishi Chemical Holdings |

57,180 |

376,765 |

|||

|

Mitsubishi Electric |

81,100 |

1,100,074 |

|||

|

Mitsubishi Estate |

52,000 |

1,032,116 |

|||

|

Mitsubishi Gas Chemical |

8,000 |

123,429 |

|||

|

Mitsubishi Heavy Industries |

135,700 |

581,516 |

|||

|

Mitsubishi Logistics |

4,000 |

54,315 |

|||

|

Mitsubishi Materials |

4,600 |

132,249 |

|||

|

Mitsubishi Motors |

28,600 |

159,540 |

|||

|

Mitsubishi Tanabe Pharma |

9,500 |

185,344 |

|||

|

Mitsubishi UFJ Financial Group |

537,590 |

2,791,757 |

|||

20

|

Common Stocks - 98.4% (continued) |

Shares |

Value ($) |

|||

|

Japan - 24.5% (continued) |

|||||

|

Mitsubishi UFJ Lease & Finance |

18,700 |

90,763 |

|||

|

Mitsui & Co. |

71,500 |

994,059 |

|||

|

Mitsui Chemicals |

38,000 |

187,699 |

|||

|

Mitsui Fudosan |

38,286 |

872,725 |

|||

|

Mitsui OSK Lines |

52,000 |

130,409 |

|||

|

Mixi |

1,600 |

58,968 |

|||

|

Mizuho Financial Group |

1,000,700 |

1,689,940 |

|||

|

MS&AD Insurance Group Holdings |

21,557 |

641,756 |

|||

|

Murata Manufacturing |

8,200 |

1,147,077 |

|||

|

Nabtesco |

4,700 |

140,727 |

|||

|

Nagoya Railroad |

39,000 |

206,027 |

|||

|

NEC |

114,800 |

307,608 |

|||

|

NEXON |

6,700 |

114,361 |

|||

|

NGK Insulators |

11,000 |

202,231 |

|||

|

NGK Spark Plug |

7,926 |

156,903 |

|||

|

NH Foods |

7,000 |

167,808 |

|||

|

NHK Spring |

7,000 |

66,082 |

|||

|

Nidec |

10,000 |

969,772 |

|||

|

Nikon |

15,260 |

230,930 |

|||

|

Nintendo |

4,825 |

1,170,478 |

|||

|

Nippon Building Fund |

61 |

362,382 |

|||

|

Nippon Electric Glass |

17,085 |

93,025 |

|||

|

Nippon Express |

35,000 |

173,214 |

|||

|

Nippon Paint Holdings |

6,900 |

235,549 |

|||

|

Nippon Prologis REIT |

70 |

158,396 |

|||

|

Nippon Steel & Sumitomo Metal |

34,761 |

688,955 |

|||

|

Nippon Telegraph & Telephone |

29,100 |

1,293,087 |

|||

|

Nippon Yusen |

69,800 |

143,101 |

|||

|

Nissan Motor |

105,300 |

1,072,881 |

|||

|

Nisshin Seifun Group |

8,138 |

120,126 |

|||

|

Nissin Foods Holdings |

2,600 |

150,739 |

|||

|

Nitori Holdings |

3,500 |

419,519 |

|||

|

Nitto Denko |

7,100 |

495,991 |

|||

|

NOK |

3,600 |

80,912 |

|||

|

Nomura Holdings |

154,300 |

774,663 |

|||

|

Nomura Real Estate Holdings |

5,600 |

94,891 |

|||

|

Nomura Real Estate Master Fund |

158 |

256,127 |

|||

|

Nomura Research Institute |

5,230 |

181,781 |

|||

|

NSK |

17,800 |

197,910 |

|||

21

STATEMENT OF INVESTMENTS (continued)

|

Common Stocks - 98.4% (continued) |

Shares |

Value ($) |

|||

|

Japan - 24.5% (continued) |

|||||

|

NTT Data |

5,500 |

284,257 |

|||

|

NTT DOCOMO |

59,100 |

1,488,067 |

|||

|

NTT Urban Development |

5,500 |

50,558 |

|||

|

Obayashi |

27,600 |

266,604 |

|||

|

Obic |

2,600 |

135,368 |

|||

|

Odakyu Electric Railway |

13,000 |

265,901 |

|||

|

Oji Holdings |

35,000 |

148,517 |

|||

|

Olympus |

12,100 |

432,679 |

|||

|

Omron |

8,200 |

315,114 |

|||

|

Ono Pharmaceutical |

17,700 |

450,137 |

|||

|

Oracle Japan |

1,600 |

87,270 |

|||

|

Oriental Land |

9,300 |

544,237 |

|||

|

ORIX |

55,300 |

878,251 |

|||

|

Osaka Gas |

77,000 |

320,644 |

|||

|

OTSUKA |

2,400 |

114,427 |

|||

|

Otsuka Holdings |

16,300 |

714,514 |

|||

|

Panasonic |

92,395 |

966,504 |

|||

|

Park24 |

3,800 |

117,584 |

|||

|

Pola Orbis Holdings |

1,000 |

83,341 |

|||

|

Rakuten |

39,400 |

455,540 |

|||

|

Recruit Holdings |

14,500 |

583,484 |

|||

|

Resona Holdings |

93,300 |

414,588 |

|||

|

Ricoh |

28,600 |

233,447 |

|||

|

Rinnai |

1,500 |

144,465 |

|||

|

Rohm |

3,800 |

200,381 |

|||

|

Ryohin Keikaku |

1,000 |

213,979 |

|||

|

Sankyo |

2,200 |

77,620 |

|||

|

Santen Pharmaceutical |

16,500 |

241,356 |

|||

|

SBI Holdings |

8,830 |

105,249 |

|||

|

Secom |

8,800 |

636,315 |

|||

|

Sega Sammy Holdings |

7,484 |

110,686 |

|||

|

Seibu Holdings |

5,900 |

102,168 |

|||

|

Seiko Epson |

12,100 |

246,108 |

|||

|

Sekisui Chemical |

17,400 |

274,597 |

|||

|

Sekisui House |

26,300 |

435,491 |

|||

|

Seven & i Holdings |

31,760 |

1,327,397 |

|||

|

Seven Bank |

26,000 |

80,080 |

|||

|

Sharp |

66,000 |

a |

113,912 |

||

|

Shikoku Electric Power |

7,000 |

65,948 |

|||

22

|

Common Stocks - 98.4% (continued) |

Shares |

Value ($) |

|||

|

Japan - 24.5% (continued) |

|||||

|

Shimadzu |

9,000 |

131,220 |

|||

|

Shimamura |

1,000 |

128,254 |

|||

|

Shimano |

3,100 |

530,905 |

|||

|

Shimizu |

22,000 |

195,938 |

|||

|

Shin-Etsu Chemical |

16,600 |

1,261,739 |

|||

|

Shinsei Bank |

78,000 |

126,442 |

|||

|

Shionogi & Co. |

12,800 |

632,005 |

|||

|

Shiseido |

16,000 |

413,159 |

|||

|

Shizuoka Bank |

23,400 |

197,919 |

|||

|

Showa Shell Sekiyu |

8,500 |

79,513 |

|||

|

SMC |

2,400 |

697,778 |

|||

|

SoftBank Group |

40,500 |

2,549,642 |

|||

|

Sohgo Security Services |

2,500 |

114,189 |

|||

|

Sompo Holdings |

14,670 |

476,177 |

|||

|

Sony |

53,080 |

1,701,172 |

|||

|

Sony Financial Holdings |

7,000 |

98,522 |

|||

|

Stanley Electric |

6,600 |

182,071 |

|||

|

Start Today |

7,200 |

126,602 |

|||

|

Sumitomo |

50,400 |

581,280 |

|||

|

Sumitomo Chemical |

64,000 |

303,919 |

|||

|

Sumitomo Dainippon Pharma |

6,900 |

119,814 |

|||

|

Sumitomo Electric Industries |

31,200 |

462,481 |

|||

|

Sumitomo Heavy Industries |

25,000 |

132,068 |

|||

|

Sumitomo Metal Mining |

21,000 |

272,237 |

|||

|

Sumitomo Mitsui Financial Group |

56,600 |

1,971,582 |

|||

|

Sumitomo Mitsui Trust Holdings |

13,764 |

465,931 |

|||

|

Sumitomo Realty & Development Co. |

15,000 |

395,204 |

|||

|

Sumitomo Rubber Industries |

7,600 |

127,403 |

|||

|

Sundrug |

1,500 |

118,289 |

|||

|

Suntory Beverage & Food |

6,000 |

262,897 |

|||

|

Suruga Bank |

7,200 |

176,104 |

|||

|

Suzuken |

3,212 |

103,371 |

|||

|

Suzuki Motor |

14,800 |

526,404 |

|||

|

Sysmex |

6,800 |

472,700 |

|||

|

T&D Holdings |

24,700 |

299,358 |

|||

|

Taiheiyo Cement |

54,000 |

154,992 |

|||

|

Taisei |

46,000 |

345,647 |

|||

|

Taisho Pharmaceutical Holdings |

1,500 |

146,610 |

|||

|

Taiyo Nippon Sanso |

6,000 |

63,221 |

|||

23

STATEMENT OF INVESTMENTS (continued)

|

Common Stocks - 98.4% (continued) |

Shares |

Value ($) |

|||

|

Japan - 24.5% (continued) |

|||||

|

Takashimaya |

12,000 |

98,064 |

|||

|

Takeda Pharmaceutical |

29,900 |

1,340,040 |

|||

|

TDK |

5,200 |

359,989 |

|||

|

Teijin |

8,000 |

155,087 |

|||

|

Terumo |

14,500 |

562,053 |

|||

|

THK |

5,500 |

116,430 |

|||

|

Tobu Railway |

41,000 |

201,735 |

|||

|

Toho |

4,700 |

141,399 |

|||

|

Toho Gas |

16,000 |

148,450 |

|||

|

Tohoku Electric Power |

19,700 |

241,389 |

|||

|

Tokio Marine Holdings |

29,100 |

1,151,291 |

|||

|

Tokyo Electric Power |

60,672 |

a |

236,046 |

||

|

Tokyo Electron |

6,500 |

588,080 |

|||

|

Tokyo Gas |

87,000 |

395,055 |

|||

|

Tokyo Tatemono |

8,500 |

108,286 |

|||

|

Tokyu |

45,820 |

343,858 |

|||

|

Tokyu Fudosan Holdings |

21,900 |

123,836 |

|||

|

TonenGeneral Sekiyu |

13,000 |

128,426 |

|||

|

Toppan Printing |

22,000 |

207,266 |

|||

|

Toray Industries |

61,000 |

569,341 |

|||

|

Toshiba |

173,000 |

a |

628,521 |

||

|

TOTO |

6,000 |

240,298 |

|||

|

Toyo Seikan Group Holdings |

7,100 |

131,344 |

|||

|

Toyo Suisan Kaisha |

4,000 |

162,296 |

|||

|

Toyoda Gosei |

2,400 |

54,948 |

|||

|

Toyota Industries |

6,900 |

316,807 |

|||

|

Toyota Motor |

112,757 |

6,536,186 |

|||

|

Toyota Tsusho |

9,000 |

213,092 |

|||

|

Trend Micro |

4,900 |

172,881 |

|||

|

Tsuruha Holdings |

1,500 |

173,357 |

|||

|

Unicharm |

16,900 |

402,638 |

|||

|

United Urban Investment |

132 |

222,664 |

|||

|

USS |

9,800 |

166,152 |

|||

|

West Japan Railway |

7,100 |

438,173 |

|||

|

Yahoo! Japan |

61,100 |

234,798 |

|||

|

Yakult Honsha |

3,700 |

172,881 |

|||

|

Yamada Denki |

28,300 |

146,533 |

|||

|

Yamaguchi Financial Group |

9,000 |

99,380 |

|||

|

Yamaha |

7,200 |

257,805 |

|||

24

|

Common Stocks - 98.4% (continued) |

Shares |

Value ($) |

|||

|

Japan - 24.5% (continued) |

|||||

|

Yamaha Motor |

11,200 |

249,375 |

|||

|

Yamato Holdings |

15,200 |

347,135 |

|||

|

Yamazaki Baking |

6,000 |

134,795 |

|||

|

Yaskawa Electric |

11,300 |

180,701 |

|||

|

Yokogawa Electric |

9,500 |

133,799 |

|||

|

Yokohama Rubber |

4,500 |

78,268 |

|||

|

126,348,362 |

|||||

|

Luxembourg - .1% |

|||||

|

RTL Group |

1,680 |

132,213 |

|||

|

SES |

14,758 |

339,404 |

|||

|

471,617 |

|||||

|

Macau - .1% |

|||||

|

MGM China Holdings |

40,000 |

66,224 |

|||

|

Sands China |

102,613 |

446,543 |

|||

|

Wynn Macau |

69,200 |

106,179 |

|||

|

618,946 |

|||||

|

Mexico - .0% |

|||||

|

Fresnillo |

9,224 |

185,160 |

|||

|

Netherlands - 3.2% |

|||||

|

ABN AMRO Group |

9,597 |

b |

221,502 |

||

|

Aegon |

73,580 |

317,276 |

|||

|

AerCap Holdings |

7,240 |

a |

297,636 |

||

|

Akzo Nobel |

10,336 |

668,076 |

|||

|

ASML Holding |

15,492 |

1,641,120 |

|||

|

Boskalis Westminster |

3,665 |

118,264 |

|||

|

Gemalto |

3,592 |

195,323 |

|||

|

Heineken |

9,635 |

793,794 |

|||

|

Heineken Holding |

4,251 |

327,172 |

|||

|

ING Groep |

163,250 |

2,149,606 |

|||

|

Koninklijke Ahold Delhaize |

54,643 |

1,247,380 |

|||

|

Koninklijke DSM |

7,833 |

503,713 |

|||

|

Koninklijke KPN |

144,649 |

471,763 |

|||

|

Koninklijke Philips |

39,691 |

1,196,460 |

|||

|

Koninklijke Vopak |

2,912 |

147,062 |

|||

|

NN Group |

13,689 |

412,496 |

|||

|

NXP Semiconductors |

12,368 |

a |

1,236,800 |

||

|

OCI |

3,786 |

a |

52,575 |

||

|

QIAGEN |

8,852 |

a |

217,668 |

||

|

Randstad Holding |

4,812 |

247,824 |

|||

25

STATEMENT OF INVESTMENTS (continued)

|

Common Stocks - 98.4% (continued) |

Shares |

Value ($) |

|||

|

Netherlands - 3.2% (continued) |

|||||

|

RELX |

41,535 |

701,027 |

|||

|

Unilever |

68,696 |

2,879,207 |

|||

|

Wolters Kluwer |

12,947 |

501,066 |

|||

|

16,544,810 |

|||||

|

New Zealand - .2% |

|||||

|

Auckland International Airport |

42,840 |

201,883 |

|||

|

Contact Energy |

31,118 |

105,699 |

|||

|

Fletcher Building |

27,941 |

207,198 |

|||

|

Mercury NZ |

29,098 |

63,464 |

|||

|

Meridian Energy |

52,186 |

95,908 |

|||

|

Ryman Healthcare |

16,781 |

106,561 |

|||

|

Spark New Zealand |

78,060 |

204,303 |

|||

|

985,016 |

|||||

|

Norway - .6% |

|||||

|

DNB |

40,666 |

588,160 |

|||

|

Gjensidige Forsikring |

8,353 |

149,725 |

|||

|

Marine Harvest |

15,623 |

a |

283,441 |

||

|

Norsk Hydro |

57,363 |

256,533 |

|||

|

Orkla |

33,180 |

313,434 |

|||

|

Schibsted, Cl. A |

3,036 |

72,792 |

|||

|

Schibsted, Cl. B |

3,578 |

80,547 |

|||

|

Statoil |

47,443 |

777,476 |

|||

|

Telenor |

31,196 |

496,502 |

|||

|

Yara International |

7,257 |

256,470 |

|||

|

3,275,080 |

|||||

|

Portugal - .2% |

|||||

|

Banco Espirito Santo |

118,053 |

a,c |

13 |

||

|

Energias de Portugal |

97,563 |

322,479 |

|||

|

Galp Energia |

20,343 |

275,796 |

|||

|

Jeronimo Martins |

10,446 |

179,690 |

|||

|

777,978 |

|||||

|

Singapore - 1.2% |

|||||

|

Ascendas Real Estate Investment Trust |

97,433 |

165,978 |

|||

|

CapitaLand |

107,500 |

238,760 |

|||

|

CapitaLand Commercial Trust |

96,000 |

108,679 |

|||

|

CapitaLand Mall Trust |

103,800 |

154,441 |

|||

|

City Developments |

17,000 |

103,741 |

|||

|

ComfortDelGro |

92,700 |

169,242 |

|||

|

DBS Group Holdings |

73,588 |

793,402 |

|||

26

|

Common Stocks - 98.4% (continued) |

Shares |

Value ($) |

|||

|

Singapore - 1.2% (continued) |

|||||

|

Genting Singapore |

251,927 |

134,904 |

|||

|

Global Logistic Properties |

119,943 |

153,027 |

|||

|

Golden Agri-Resources |

278,440 |

77,053 |

|||

|

Hutchison Port Holdings Trust |

214,800 |

95,586 |

|||

|

Jardine Cycle & Carriage |

4,113 |

124,816 |

|||

|

Keppel |

61,500 |

233,402 |

|||

|

Oversea-Chinese Banking |

131,587 |

802,054 |

|||

|

Sembcorp Industries |

43,254 |

78,658 |

|||

|

Sembcorp Marine |

38,000 |

35,371 |

|||

|

Singapore Airlines |

24,233 |

176,446 |

|||

|

Singapore Exchange |

35,000 |

178,365 |

|||

|

Singapore Press Holdings |

69,075 |

184,697 |

|||

|

Singapore Technologies Engineering |

68,000 |

152,985 |

|||

|

Singapore Telecommunications |

339,551 |

946,960 |

|||

|

StarHub |

26,918 |

65,396 |

|||

|

Suntec Real Estate Investment Trust |

99,000 |

119,547 |

|||

|

United Overseas Bank |

55,763 |

752,725 |

|||

|

UOL Group |

21,111 |

86,037 |

|||

|

Wilmar International |

80,000 |

190,332 |

|||

|

6,322,604 |

|||||

|

South Africa - .1% |

|||||

|

Mondi |

15,942 |

311,429 |

|||

|

Spain - 3.1% |

|||||

|

Abertis Infraestructuras |

27,231 |

404,302 |

|||

|

ACS Actividades de Construccion y Servicios |

8,109 |

248,624 |

|||

|

Aena |

2,854 |

b |

419,038 |

||

|

Amadeus IT Group |

18,368 |

867,033 |

|||

|

Banco Bilbao Vizcaya Argentaria |

276,721 |

1,998,211 |

|||

|

Banco de Sabadell |

228,322 |

305,532 |

|||

|

Banco Popular Espanol |

134,092 |

147,053 |

|||

|

Banco Santander |

608,433 |

2,990,235 |

|||

|

Bankia |

207,019 |

182,259 |

|||

|

Bankinter |

28,650 |

219,337 |

|||

|

CaixaBank |

128,110 |

387,726 |

|||

|

Distribuidora Internacional de Alimentacion |

28,026 |

150,044 |

|||

|

Enagas |

10,045 |

288,355 |

|||

|

Endesa |

13,393 |

284,709 |

|||

|

Ferrovial |

20,473 |

398,358 |

|||

|

Gas Natural SDG |

14,848 |

292,983 |

|||

27

STATEMENT OF INVESTMENTS (continued)

|

Common Stocks - 98.4% (continued) |

Shares |

Value ($) |

|||

|

Spain - 3.1% (continued) |

|||||

|

Grifols |

12,666 |

250,414 |

|||

|

Iberdrola |

227,914 |

1,553,453 |

|||

|

Inditex |

45,882 |

1,603,943 |

|||

|

Mapfre |

47,485 |

141,108 |

|||

|

Red Electrica |

17,696 |

369,189 |

|||

|

Repsol |

47,633 |

667,474 |

|||

|

Telefonica |

188,441 |

1,915,543 |

|||

|

Zardoya Otis |

7,181 |

60,620 |