UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

ANNUAL REPORT PURSUANT TO SECTIONS 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended:

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from_ to_

Commission File Number:

(Exact name of registrant as specified in its charter)

|

||

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification Number) |

(Address of principal executive offices, including zip code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol |

Name of each exchange on which registered |

Securities registered pursuant

to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

☑ |

Accelerated Filer |

☐ |

Non-accelerated Filer |

☐ |

Smaller Reporting Company |

||

|

|

|

|

|

|

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

The aggregate market value of our voting stock held by non-affiliates was approximately $

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement in connection with the 2024 Annual Meeting of Stockholders (2024 Proxy Statement) are incorporated by reference into Part III.

PTC Inc.

ANNUAL REPORT ON FORM 10-K FOR FISCAL YEAR 2023

Table of Contents

|

|

Page |

|

|

|

Item 1. |

||

Item 1A. |

||

Item 1B. |

||

Item 2. |

||

Item 3. |

||

Item 4. |

||

|

|

|

Item 5. |

||

Item 6. |

||

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

Item 7A. |

||

Item 8. |

||

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

Item 9A. |

||

Item 9B. |

||

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspection |

|

|

|

|

Item 10. |

||

Item 11. |

||

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

|

Item 14. |

||

|

|

|

Item 15. |

||

Item 16. |

||

|

|

|

|

Report of Independent Registered Public Accounting Firm (PricewaterhouseCoopers LLP, Boston, MA, PCAOB ID: |

|

|

||

|

||

|

|

|

Cautionary Note About Forward-Looking Statements

This Annual Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. In particular, statements that are not historical facts, including but not limited to, statements about our anticipated financial results, capital development and growth, as well as about the development of our products, markets and workforce, are forward-looking statements. These forward-looking statements are generally identifiable by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project” or similar expressions, whether in the negative or affirmative. Forward-looking statements are based on our current plans, expectations and assumptions and are not guarantees of future performance. Factors that may cause our actual results to differ materially from these statements include, but are not limited to, the risks and uncertainties discussed in Item 1A. “Risk Factors” and elsewhere throughout this Annual Report. Such factors, among others, could have a material adverse effect upon our business, results of operations and financial condition. We caution readers not to place undue reliance on any forward-looking statements, which only speak as of the date made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made.

Unless otherwise indicated, all references to a year reflect our fiscal year that ends on September 30.

Website References

References to our PTC.com website in this Annual Report and to our 2023 Impact Report are provided for convenience. The content on PTC.com and in our 2023 Impact Report is not incorporated by reference into this Annual Report unless expressly stated.

PART I

ITEM 1. Business

Our Business

PTC is a global software company that provides a portfolio of innovative digital solutions that work together to transform how physical products are engineered, manufactured, and serviced.

Our software portfolio includes award-winning offerings that enable companies to author product data (our computer-aided design (CAD) portfolio solutions) and to manage product data and orchestrate processes (our product lifecycle management (PLM) portfolio solutions).

Our software can be delivered on premises, in the cloud, or in a hybrid model. Our customers include some of the world's most innovative companies in the aerospace and defense, automotive, electronics and high tech, industrial machinery and equipment, life sciences, retail and consumer products industries.

We generate revenue through the sale of subscriptions, which include term-based on-premises software licenses and related support, Software-as-a-Service (SaaS), and hosting services; perpetual licenses; support for perpetual licenses; and professional services (consulting, implementation, and training).

Recent Developments

We acquired the ServiceMax® cloud-native field service management business in Q2’23, broadening our PLM solution set to encompass the service phase of the product lifecycle. We paid the first purchase payment installment of $835 million, as adjusted for working capital, indebtedness, cash, and transaction expenses, in January 2023, and the second and final installment of $650 million in October 2023. Refer to Note 6. Acquisitions and Disposition of Businesses of Notes to Consolidated Financial Statements in this Annual Report for additional discussion about the ServiceMax transaction.

1

Our Strategy

We pursue multiple strategic initiatives designed to create value for our customers, increase our Annual Run Rate (ARR) and free cash flow, and deliver long-term value for stockholders.

Subscription Business Model

Our transition from a perpetual and maintenance model to a subscription business model continues to be key to driving growth. Our subscription model offers greater benefits of scale and growth potential, drives higher customer engagement and retention, and provides better business predictability, with over 90% of our annual revenues being recurring in nature. This, in turn, enables us to make steady and sustained investments to pursue mid-to-long-term growth opportunities.

Customer Expansion

Our solutions portfolio encompasses the entire product life cycle, from design to manufacture to service, enabling companies to adopt a “digital thread” strategy to drive innovation and productivity. A digital thread manages product data and makes it accessible and useful to the right people, at the right time, and in the right context. The digital thread is particularly valuable for customers with complex products that tend to have longer life cycles. We seek to drive value for our customers by offering new and enhanced features and products that enable our customers to pursue and expand their digital thread strategies.

Our acquisition strategy targets companies with products that complement ours and that we believe will appeal to our existing customer base, allowing us to pursue cross-selling opportunities. The addition of ServiceMax in 2023 for the SLM part of our PLM portfolio further extends what was already a unique portfolio of interconnected digital thread capabilities across the full product life cycle. The addition of Codebeamer in 2022 for the ALM part of our PLM portfolio strengthened our offerings in the ALM space as software becomes integral to more and more products, especially in regulated industries where traceability is safety-critical.

PLM Expansion

PLM is at the heart of digital transformation and has become essential technology at industrial companies. No longer confined to the Engineering department, PLM data is driving decision-making across organizations, enabling them to improve how products are designed, manufactured, and serviced.

Our goal is to be the category leader in PLM and to provide our customers with best-in-class solutions to drive innovation and productivity.

SaaS Transition

We continue to invest in the transformation of our technology portfolio to include more SaaS offerings. Our acquisitions of Onshape, Arena, and ServiceMax brought cloud-native solutions to our portfolio, and we continue to work towards creating and expanding SaaS offerings for our existing products. We believe that SaaS products represent a strong value proposition for our customers, offering reduced complexity; lower costs to implement, upgrade and administer; better user collaboration and mobility; and scalability. This is a longer-term strategy as we expect that SaaS adoption in the CAD and PLM markets will be gradual at first, then accelerate significantly, given constraints such as the length and cost of conversion projects and budgeting timelines of our customers.

2

Our Principal Products and Services

Our Principal Product Groups

PLM Software Products For Product Data Management and Process Orchestration |

|

CAD Software Products For Product Data Authoring |

PLM

Our Windchill® PLM application suite manages all aspects of the product development lifecycle—from concept through service and retirement—by enabling a digital thread of product parts, materials, and configuration information. Windchill provides real-time information sharing, dynamic data visualization, and the ability to collaborate across geographically-distributed teams, enabling manufacturers to elevate their product development, manufacturing, and field service processes. With its open architecture that integrates with other enterprise systems, Windchill provides a solid foundation for a product-driven digital thread.

Our ThingWorx® platform is flexible and purpose-built for Industrial Internet of Things (IIoT). It offers a rich set of capabilities that enable enterprises to digitally transform every aspect of their business with innovative solutions that are simple to create, easy to implement, scalable to meet future needs, and designed to enable customers to accelerate time to value. Primary use cases include remote asset monitoring, remote maintenance and service, predictive maintenance and asset management, and optimized equipment effectiveness. Our ThingWorx Digital Performance Management solution enables manufacturers to identify, prioritize, and overcome their most significant production bottlenecks.

Our ServiceMax® field service management (FSM) solutions enable companies to improve asset uptime with optimized in-person and remote service, boost technician productivity with the latest mobile tools, and deliver metrics for confident decision making.

Our Arena® SaaS PLM solution enables product teams to collaborate virtually anytime and anywhere, making it easier to share the latest product and quality information with internal teams and supply chain partners and deliver innovative products to customers faster. Our Arena quality management system software connects quality and product designs into a single system to simplify regulatory compliance.

Our Codebeamer® application lifecycle management (ALM) and model-based systems engineering capabilities enable companies to accelerate the development of software-intensive products through system modeling, software configuration, and requirements, risk, and test management.

Our Servigistics® service parts management solution enables companies to effectively manage their service parts inventory, enabling them to optimize equipment availability and uptime, and increase customer satisfaction.

Our FlexPLM® solution provides retailers with a single platform for merchandising and line planning, materials management, sampling, and more.

Our Kepware® portfolio of industrial connectivity solutions helps companies connect diverse automation devices and software applications.

CAD

Our Creo® 3D CAD technology enables the digital design, testing, and modification of product models. With its design simulation, additive manufacturing, and generative design innovations, we enable our customers to be first to market with differentiated products. From initial concept to design, simulation, and analysis, Creo provides designers with innovative tools to efficiently create better products, faster.

3

Our Onshape® SaaS product development platform unites computer-aided design with data management, collaboration tools, and real-time analytics. A cloud-native multi-tenant solution that can be instantly deployed on virtually any computer or mobile device, Onshape enables teams to work together from just about anywhere. Real-time design reviews, commenting, and simultaneous editing enable a collaborative workflow where multiple design iterations can be completed in parallel and merged into the final design.

Our Vuforia® augmented reality (AR) technology enables the visualization of digital information in a physical context and the creation of AR and mixed reality experiences, enabling companies to drive results in manufacturing, service, engineering, and operations. Vuforia solutions equip frontline workers with focused and effective step-by-step instructions, procedural guidance, skill development and remote assistance that enable enterprises to improve workforce productivity, reduce errors, increase asset utilization and drive higher profitability.

Our Arbortext® dynamic publishing solution streamlines how organizations create, manage, and publish technical documentation.

Our Markets and How We Address Them

The markets we serve present different growth opportunities for us. The PLM market is undergoing expansion as PLM plays a larger role in industrial companies. Within PLM, we've extended our reach in the growing SLM and ALM spaces through our acquisitions of ServiceMax and Codebeamer. Across all our solutions, we see opportunity for further market growth with a new generation of SaaS solutions we are developing to bring to market over the next few years.

We derive most of our sales from products and services sold directly by our sales force to end-user customers. Approximately 25% of our sales of products and services are through third-party resellers. Our sales force focuses on large accounts, while our reseller channel provides a cost-effective means of covering the small- and medium-size business market. Our strategic alliance partners enable us to increase our market reach, offer broader solutions, and add compelling technology to our offerings. Our strategic services partners provide service offerings to help customers implement our product offerings and transition to SaaS.

Additional financial information about our international and domestic operations may be found in Note 3. Revenue from Contracts with Customers of Notes to Consolidated Financial Statements in this Annual Report, which information is incorporated herein by reference.

Competition

We compete with a number of companies whose offerings address one or more specific functional areas covered by our solutions. For enterprise CAD and PLM solutions, we compete with large established companies including Autodesk, Dassault Systèmes SA, and Siemens AG. In our IIoT business, we compete with large established companies such as Amazon, IBM, Oracle, SAP, Siemens AG, and Software AG as well as customers’ homegrown solutions. There are also a number of smaller companies that compete in the market for IIoT products. For our AR products, our primary competitors include Microsoft, TeamViewer SE, and Scope Technologies US Inc. For our ALM products, we compete with IBM, Jama Software, Inc. and Siemens AG. For our SLM products, we compete with enterprise software companies such as Oracle, SAP and IFS AB, and with companies that offer point solutions.

4

Proprietary Rights

Our software products and related technical know-how, along with our trademarks, including our company names, product names and logos, are proprietary. We protect our intellectual property rights in these items by relying on copyrights, trademarks, patents and common law safeguards, including trade secret protection. The nature and extent of such legal protection depends in part on the type of intellectual property right and the relevant jurisdiction. In the U.S., we are generally able to maintain our trademark registrations for as long as the trademarks are in use and to maintain our patents for up to 20 years from the earliest effective filing date. We also use license management and other anti-piracy technology measures, as well as contractual restrictions, to curtail the unauthorized use and distribution of our products.

Our proprietary rights are subject to the risks and uncertainties described under Item 1A. Risk Factors below, which is incorporated into this section by reference.

Environmental Sustainability

At PTC, we’re motivated to become an impactful contributor to the dematerialization and decarbonization of global manufacturing. While we have a climate action plan committed to reduce our company’s “footprint,” we believe far larger benefits will flow from our “handprint” stemming from our software offerings. Our software solutions enable manufacturers to design, build, and service their products more sustainably.

Footprint

In 2023, we announced our footprint reduction commitment via the Science Based Target initiative (SBTi) and submitted near-term and net-zero targets for validation by SBTi. Our submitted near-term commitment is to reduce combined Scope 1 (direct emissions from owned/controlled operations) and Scope 2 (indirect energy use) emissions by 50% and reduce Scope 3 - Category 1 (Purchased Goods and Services) 25% compared to our 2022 baseline by 2030. Our long-term net-zero commitment is to reach net-zero across all scope emissions by 2050, with absolute reductions of over 90% across Scopes 1-3, with accredited carbon removal offsets for the remaining <10% as needed.

While we await SBTi approval of our near-term and net-zero targets, we have already begun to implement programs and pursue initiatives to reduce our emissions and carbon footprint, including:

Handprint

Environmental sustainability is integral to our product offerings. With our software, manufacturers can drive sustainability improvement, including by designing with less material, enhancing product repairability and circularity, improving factory efficiency, and enabling remote service.

5

People and Culture

At PTC, we don’t just imagine a better world, we help create it. Within our work environment we seek to create an equitable and inclusive culture in which all employees can thrive. This is a key aspect of our talent strategy. Our approach is focused on promoting an agile culture, an increased sense of belonging, engaged work environments, and high-performing teams.

6

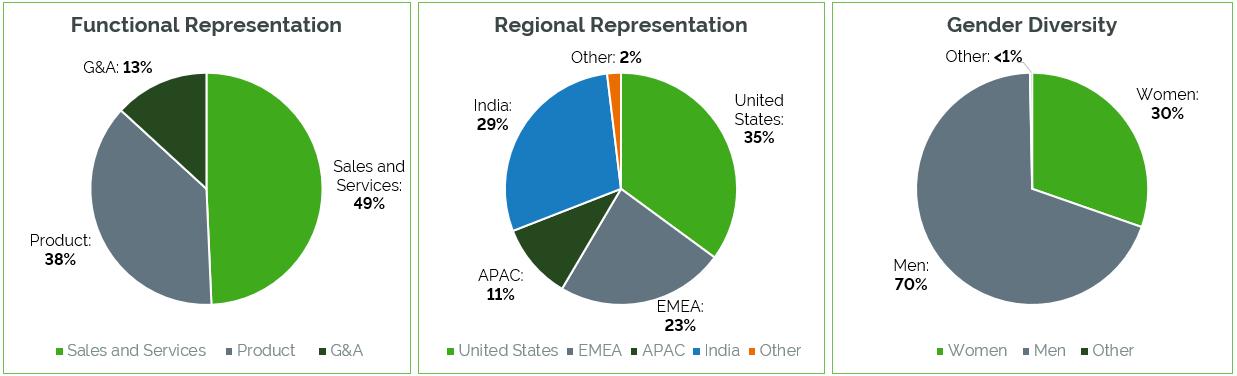

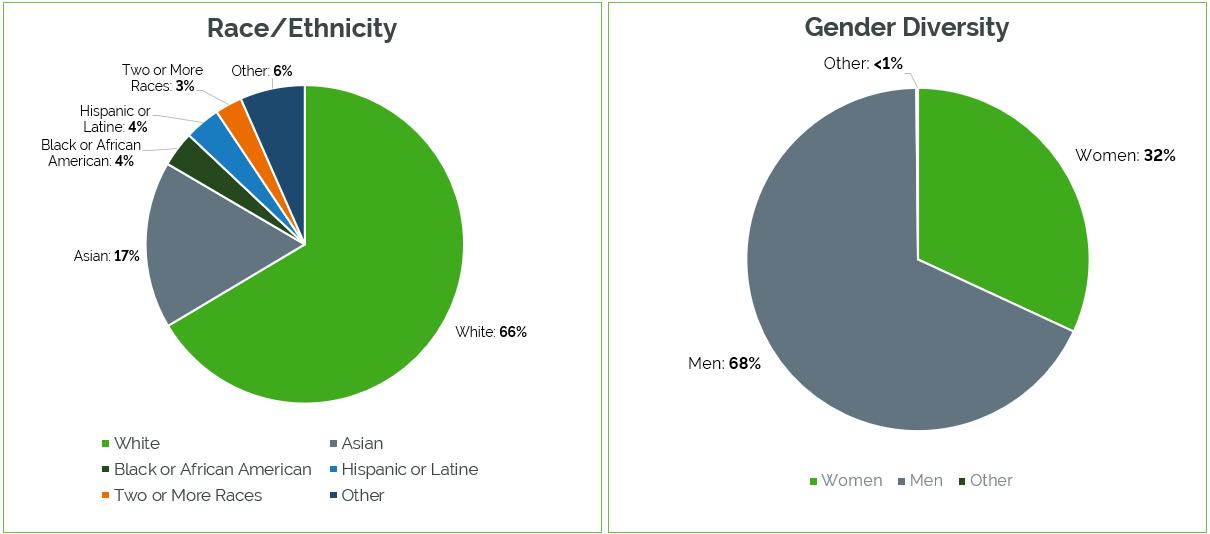

PTC at-a-Glance

As of September 30, 2023, PTC had 7,231 full-time employees. Our employee population is geographically diverse and serves a geographically diverse customer and partner network.

Worldwide Employee Representation

United States Employee Representation

7

Compensation and Benefits

PTC provides a comprehensive and competitive compensation and benefits package designed to attract, retain, motivate, and engage talent around the world.

We provide employees with competitive compensation packages, including base salaries, and, for eligible roles, incentive and equity compensation. Employees also have the opportunity to purchase PTC stock at a discount through our Employee Stock Purchase Plan.

Our benefits offerings are designed to meet the needs of our employees and their families around the world. Specific offerings differ country by country due to cultural norms, market dynamics, and legal requirements, but we provide a wide variety of core health and financial programs such as healthcare, life and disability insurance, employee assistance plans, retirement savings and pension benefit plans, and generous paid family leave and vacation time.

Talent Development & Employee Engagement

As we focus on enhancing the employee experience, we are increasing our efforts to invest in our people and create meaningful opportunities to learn, grow, develop, and advance their careers. We have specific development programs and coaching programs, as well as numerous other self-led learning paths. The variety of options means that employees have the ability to focus on the development path most meaningful to them.

Diversity, Equity, and Inclusion (DEI)

Commitment to our values and diversity in our workforce is supported by various ongoing efforts. We mitigate bias by coaching managers and leaders in fostering psychologically safe environments. We also review and revise our processes based on feedback and engagement scores from employee pulse surveys. We embed equitable practices into the planning and execution of how we attract, select, develop, and retain talent. Meanwhile, our DEI ambassadors are aligned with functions across the business to amplify and enhance our efforts in these areas. Finally, to cultivate a community of belonging, our 12 Employee Resource Groups foster an inclusive culture and facilitate safe spaces for employees to navigate social issues and challenges.

Additional Information About Our Employee Initiatives

You can find more information about our employee initiatives in our 2023 Impact Report, which we expect to release in December 2023.

Available Information

We make available free of charge on our website at www.ptc.com the following reports as soon as reasonably practicable after electronically filing them with, or furnishing them to, the SEC: our Annual Reports on Form 10-K; our Quarterly Reports on Form 10-Q; our Current Reports on Form 8-K; and amendments to those reports filed or furnished pursuant to Sections 13(a) or 15(d) of the Securities Exchange Act of 1934. Our Proxy Statements for our Annual Meetings and Section 16 trading reports on SEC Forms 3, 4 and 5 also are available on our website.

Corporate Information

PTC was incorporated in Massachusetts in 1985 and is headquartered in Boston, Massachusetts.

8

ITEM 1A. Risk Factors

The following are important factors we have identified that could affect an investment in our securities. You should consider them carefully when evaluating an investment in PTC securities, because these factors could cause actual results to differ materially from historical results or any forward-looking statements. The risks described below are not the only risks we face. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially adversely affect our business, financial condition, operating results, and prospects.

I. Risks Related to Our Business Operations and Industry

We face significant competition, which could adversely affect our business, financial condition, operating results, and prospects if we are unable to successfully compete.

The markets for our products and solutions are rapidly changing and characterized by intense competition, disruptive technology developments, evolving distribution models and increasingly lower barriers to entry. If we are unable to provide products and solutions that address customers’ needs as well as our competitors’ products and solutions do, or to align our pricing, licensing and delivery models with customer preferences, we could lose customers and/or fail to attract new customers, which could adversely affect our business, financial condition, operating results, and prospects.

For example, customer demand for SaaS solutions is increasing. While our Arena, ServiceMax, and Onshape solutions are cloud-native SaaS solutions, and we have introduced our Windchill+, Creo+, and Kepware+ SaaS solutions, customers may not adopt them as we expect. If we are unable to compete successfully with competitors offering SaaS solutions, we could lose customers and/or fail to attract new customers, which could adversely affect our business, financial condition, operating results, and prospects.

Our current and potential competitors range from large and well-established companies to emerging start-ups. Some of our competitors and potential competitors have greater name recognition in the markets we serve and greater financial, technical, sales and marketing, and other resources, which could limit our ability to gain customer recognition and confidence in our products and solutions and successfully sell our products and solutions, which could adversely affect our ability to grow our business.

A breach of security in our products or computer systems, or those of our third-party service providers, could compromise the integrity of our products, cause loss of data, harm our reputation, create additional liability and adversely affect our business, financial condition, operating results, and prospects.

We have implemented and continue to implement measures intended to maintain the security and integrity of our products, source code and IT systems. The potential for a security breach or system disruption has significantly increased over time as the scope, number, intensity and sophistication of attempted cyberattacks and cyber intrusions have increased – particularly cyberattacks and intrusions designed to access and exfiltrate information and to disrupt and lock up access to systems for the purpose of demanding a ransom payment. It is impossible for us to eliminate the risk of a successful cyberattack or intrusion, and, in fact, we regularly deal with security issues and have experienced security incidents from time to time. Accordingly, there is a risk that a cyberattack or intrusion will be successful and that such event will be material.

In addition, we offer cloud services to our customers and some of our products, including our SaaS products, are hosted by third-party service providers, which expose us to additional risks as those repositories of our customers’ proprietary data may be targeted and a cyberattack or intrusion may be successful and material. Interception of data transmission, misappropriation or modification of data, corruption of data and attacks against our service providers may adversely affect our products or product and service delivery. Malicious code, viruses or vulnerabilities that are undetected by our service providers may disrupt our business operations generally and may have a disproportionate effect on those of our products that are developed and delivered in the cloud environment.

9

While we devote resources to maintaining the security and integrity of our products and systems, as well as performing due diligence of our third-party service providers, security breaches that have not had a material effect on our business or that of our customers have occurred, and we will continue to face cybersecurity threats and exposure. A significant breach of the security and/or integrity of our products or systems, or those of our third-party service providers, whether intentional or by human error by our employees or others, could disrupt our business operations or those of our customers, could prevent our products from functioning properly, could enable access to sensitive, proprietary or confidential information of our customers, or could enable access to our sensitive, proprietary or confidential information. This could require us to incur significant costs of investigation, remediation and/or payment of a ransom; harm our reputation; cause customers to stop buying our products; and cause us to face lawsuits and potential liability, any of which could have a material adverse effect on our business, financial condition, operating results, and prospects.

We increasingly rely on third-party providers of cloud infrastructure services to deliver our offerings to users on our platform, and any disruption of or interference with our use of these services could adversely affect our business, financial condition, operating results, and prospects.

Our continued growth depends in part on the ability of our existing and potential customers to use and access our cloud services or our website in order to download our software or encrypted access keys for our software within an acceptable amount of time. We use a number of third-party service providers that we do not control for key components of our infrastructure, particularly with respect to development and delivery of our cloud-based products. The use of these service providers gives us greater flexibility in efficiently delivering a more tailored, scalable customer experience, but also exposes us to additional risks and vulnerabilities. Third-party service providers operate their own platforms that we access, and we are, therefore, vulnerable to their service interruptions. We may experience interruptions, delays and outages in service and availability from time to time as a result of problems with our third-party service providers’ infrastructure. Lack of availability of this infrastructure could be due to a number of potential causes including technical failures, natural disasters, fraud or security attacks that we cannot predict or prevent. Such outages could adversely impact our business, financial condition, results of operations, and prospects.

If we are unable to renew our agreements with our cloud service providers on commercially reasonable terms, or any of our agreements are prematurely terminated, or we need to add new cloud services providers to increase capacity and uptime, we could experience interruptions, downtime, delays, and additional expenses related to transferring to and providing support for these new platforms. Any of the above circumstances or events may harm our reputation and brand, reduce the availability or usage of our platforms and impair our ability to attract new users, any of which could adversely affect our business, financial condition, results of operations, and prospects.

We may be unable to hire or retain employees with the necessary skills to operate and grow our business, which could adversely affect our ability to compete and adversely affect our business, financial condition, results of operations, and prospects.

Our success depends upon our ability to attract and retain highly skilled employees to develop our products and solutions and to operate and grow our business. Competition for such employees in our industry is intense worldwide, and particularly in the Boston, Massachusetts area where our global headquarters is located.

If we are unable to attract and retain employees with the requisite skills to develop our products and solutions, or to guide, operate and support our business, we may be unable to compete successfully, which would adversely affect our business, financial condition, results of operations, and prospects.

10

We depend on sales within the discrete manufacturing sector and our business could be adversely affected if manufacturing activity does not grow or if it contracts, or if manufacturers are adversely affected by other macroeconomic factors.

A large amount of our sales are to customers in the discrete manufacturing sector. Manufacturers worldwide continue to face uncertainty about the global macroeconomic environment due to, among other factors, the effects of earlier and ongoing supply chain disruptions, rising interest rates and inflation, volatile foreign exchange rates and the current relative strength of the U.S. Dollar, and the U.S. government’s focus on technology transactions with non-U.S. entities. Customers may delay, reduce, or forego purchases of our solutions due to these challenges and concerns, which could adversely affect our business, financial condition, results of operations, and prospects.

If we fail to successfully transform our operations to support the sale of SaaS solutions and to develop competitive SaaS solutions, our business and prospects could be adversely affected.

Transforming our business to offer and support SaaS solutions requires considerable additional investment in our organization. Whether we will be successful and will accomplish our business and financial objectives is subject to risks and uncertainties, including but not limited to: customer demand, attach and renewal rates, channel adoption, our ability to further develop and scale infrastructure, our ability to include functionality and usability in such offerings that address customer requirements, our ability and the ability of our partners to transition existing customer implementations and subscriptions to SaaS, and our costs. If we are unable to successfully establish these new offerings and navigate our business transition, our business, financial condition, results of operations, and prospects could be adversely affected.

Because our sales and operations are globally dispersed, we face additional compliance risks, and any compliance failure could adversely affect our business and prospects.

We sell and deliver software and services, and maintain support operations, in many countries whose laws and practices differ from one another and are subject to unexpected changes. Managing these geographically dispersed operations requires significant attention and resources to ensure compliance with laws of those countries and those of the U.S. governing our activities in non-U.S. countries.

Those laws include, but are not limited to, anti-corruption laws and regulations (including the U.S. Foreign Corrupt Practices Act (FCPA) and the U.K. Bribery Act 2010), data privacy laws and regulations (including the European Union's General Data Privacy Regulation), and trade and economic sanctions laws and regulations (including laws administered by the U.S. Department of the Treasury’s Office of Foreign Assets Control, the U.S. State Department, the U.S. Department of Commerce, the United Nations Security Council and other sanctions authorities). Our compliance risks are heightened due to the go-to-market approach for our business that relies heavily on a partner ecosystem, the fact that some of the countries we operate in have a higher incidence of corruption and fraudulent business practices, the fact that we sell to governments and state-owned business enterprises, and the fact that global enforcement of laws has significantly increased.

Accordingly, while we strive to maintain a comprehensive compliance program, an employee, agent or business partner may violate our policies or U.S. or other applicable laws or we may inadvertently violate such laws. Investigations of alleged violations of those laws can be expensive and disruptive. Violations of such laws can lead to civil and/or criminal prosecutions, substantial fines and other sanctions, including the revocation of our rights to continue certain operations, and also cause business loss and reputational harm, which could adversely affect our business, financial condition, results of operations, and prospects.

11

II. Risks Related to Acquisitions and Strategic Relationships

Businesses we acquire may not generate the sales and earnings we anticipate and may otherwise adversely affect our business and prospects.

We have acquired, and intend to continue to acquire, new businesses and technologies. If we fail to successfully integrate and manage the businesses and technologies we acquire, if an acquisition does not further our business strategy or return a level of sales as we expect, or if a business we acquire has unexpected legal or financial liabilities, our business, financial condition, results of operations, and prospects could be adversely affected.

The types of issues that we may face in integrating and operating the acquired business include:

Further, if we do not achieve the expected return on our investments, it could impair the intangible assets and goodwill that we recorded as part of an acquisition, which could require us to record a reduction to the value of those assets.

We may incur significant debt or issue a material amount of debt or equity securities to finance an acquisition, which could adversely affect our operating flexibility, business and prospects.

If we were to incur a significant amount of debt—whether by borrowing funds under our credit facility or otherwise or issuing new debt securities—to finance an acquisition, our interest expense, debt service requirements and leverage would increase significantly. The increases in these expenses and in our leverage could constrain our ability to operate as we might otherwise or to borrow additional amounts and could adversely affect our business, financial condition, results of operations, and prospects.

If we were to issue a significant amount of equity securities in connection with an acquisition, existing stockholders would be diluted and our stock price could decline.

Our inability to maintain or develop our strategic and technology relationships could adversely affect our business and prospects.

We have many strategic and technology relationships with other companies with which we work to offer complementary solutions and services, that market and sell our solutions, and that provide technologies that we embed in our solutions. We may not realize the expected benefits from these

12

relationships and such relationships may be terminated by the other party. If these companies fail to perform or if a company terminates or substantially alters the terms of the relationship, we could suffer delays in product development, reduced sales or other operational difficulties and our business, financial condition, results of operations, and prospects could be materially adversely affected.

III. Risks Related to Our Intellectual Property

We may be unable to adequately protect our proprietary rights, which could adversely affect our business and our prospects.

Our software products are proprietary. We protect our intellectual property rights in these items by relying on copyrights, trademarks, patents and common law safeguards, including trade secret protection, as well as restrictions on disclosures and transferability contained in our agreements with other parties. Despite these measures, the laws of all relevant jurisdictions may not afford adequate protection to our products and other intellectual property. In addition, we frequently encounter attempts by individuals and companies to pirate our software. If our measures to protect our intellectual property rights fail, others may be able to use those rights, which could reduce our competitiveness and adversely affect our business, financial condition, operating results, and prospects.

In addition, any legal action to protect our intellectual property rights that we may bring or be engaged in could be costly, may distract management from day-to-day operations and may lead to additional claims against us, and we may not succeed, all of which could adversely affect our business, financial condition, operating results, and prospects.

Intellectual property infringement claims could be asserted against us, which could be expensive to defend, could result in limitations on our use of the claimed intellectual property, and could adversely affect our business and prospects.

The software industry is characterized by frequent litigation regarding copyright, patent and other intellectual property rights. We have faced such lawsuits from time to time. Any such claim could result in significant expense to us and divert the efforts of our technical and management personnel. We cannot be sure that we would prevail against any such asserted claims. If we did not prevail, we could be prevented from using the claimed intellectual property or be required to enter into royalty or licensing agreements, which might not be available on terms acceptable to us. In addition to possible claims with respect to our proprietary products, some of our products contain technology developed by and licensed from third parties and we may likewise be susceptible to infringement claims with respect to these third-party technologies.

IV. Risks Related to Our Indebtedness

Our substantial indebtedness could adversely affect our business, financial condition, results of operations, and prospects, as well as our ability to meet our payment obligations under our debt.

We have a substantial amount of indebtedness. As of November 17, 2023, our total debt outstanding was approximately $2,307 million and €85 million, $1 billion of which was associated with the 3.625% Senior Notes and 4.000% Senior Notes (together, “Senior Notes”) issued in February 2020, which mature in February 2025 and 2028, respectively, and are unsecured; $807 million and €85 million of which was borrowed under our credit facility revolving line, which matures in January 2028; and $500 million of which was borrowed under our credit facility term loan, which begins amortizing in March 2024. All amounts outstanding under the credit facility and the Senior Notes will be due and payable in full on their respective maturity dates. As of November 17, 2023, we had unused commitments under our credit facility of approximately $350 million. PTC Inc. and one of our foreign subsidiaries are eligible borrowers under the credit facility and certain other foreign subsidiaries may become borrowers under our credit facility in the future, subject to certain conditions.

13

Specifically, our level of debt could:

Any of the above-listed factors could have an adverse effect on our business, financial condition, results of operations, and prospects, and our ability to meet our payment obligations under our debt agreements.

Despite our current level of indebtedness, we and our subsidiaries may still be able to incur substantially more debt and other obligations. This could further exacerbate the risks to our business, financial condition, and prospects described above.

We and our subsidiaries may be able to incur significant additional indebtedness and other obligations in the future, including secured debt. Although the credit agreement governing our credit facility contains restrictions on the incurrence of additional indebtedness, these restrictions are subject to a number of qualifications and exceptions. The additional indebtedness incurred in compliance with these restrictions could be substantial. In addition, the credit agreement and the indenture governing our Senior Notes due 2025 and 2028, will not prevent us from incurring obligations that do not constitute indebtedness. If new debt is added to our current debt levels, or we incur other obligations, the related risks that we now face could intensify.

We may not be able to generate enough cash to service all our indebtedness and may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful, and could harm our business and prospects.

Our ability to make scheduled payments on or refinance our debt obligations depends on our financial condition and operating performance, which are subject to prevailing economic and competitive conditions and to certain financial, business, legislative, regulatory and other factors, some of which are beyond our control. We may be unable to maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on our indebtedness.

14

If our cash flows and capital resources are insufficient to fund our debt service obligations, we could face substantial liquidity problems and could be forced to reduce or delay investments and capital expenditures or to dispose of material assets or operations, seek additional debt or equity capital or restructure or refinance our indebtedness. We may not be able to effect any such alternative measures, if necessary, on commercially reasonable terms or at all and, even if successful, those alternative actions may not allow us to meet our scheduled debt service obligations. Our debt agreements restrict our ability to dispose of assets and use the proceeds from those dispositions and may also restrict our ability to raise debt or equity capital to be used to repay other indebtedness when it becomes due. We may not be able to consummate those dispositions or to obtain proceeds in an amount sufficient to meet any debt service obligations then due.

Our inability to generate sufficient cash flows to satisfy our debt obligations, or to refinance our indebtedness on commercially reasonable terms or at all, would materially and adversely affect our ability to satisfy our debt obligations.

If we cannot make scheduled payments on our debt, we will be in default and the lenders under our credit facility could terminate their commitments to loan money, the lenders could foreclose against the assets securing their borrowings, the holders of our Senior Notes could declare all outstanding principal, premium, if any, and interest to be due and payable, and we could be forced into bankruptcy or liquidation. These events could result in a loss of your investment.

We are required to comply with certain financial and operating covenants under our debt agreements. Any failure to comply with those covenants could cause amounts borrowed to become immediately due and payable and/or prevent us from borrowing under the credit facility.

We are required to comply with specified financial and operating covenants under our debt agreements and to make payments under our debt, which limit our ability to operate our business as we otherwise might operate it. Our failure to comply with any of these covenants or to meet any debt payment obligations could result in an event of default which, if not cured or waived, would result in any amounts outstanding, including any accrued interest and/or unpaid fees, becoming immediately due and payable. We might not have enough working capital or liquidity to satisfy any repayment obligations if those obligations were accelerated. In addition, if we are not in compliance with the financial and operating covenants under the credit facility when we wish to borrow funds, we will be unable to borrow funds to pursue certain corporate initiatives, including strategic acquisitions, which could adversely affect our business and prospects.

V. Risks Related to Our Common Stock

Our stock price has been volatile, which may make it harder to resell shares at a favorable time and price.

Market prices for securities of software companies are generally volatile and are subject to significant fluctuations that may be unrelated or disproportionate to the operating performance of these companies. Accordingly, the trading prices and valuations of software companies’ stocks, and of ours, may not be predictable. Negative changes in the public’s perception of the prospects of software companies, or of PTC or the markets we serve, could depress our stock price regardless of our operating results.

Also, a large percentage of our common stock is held by institutional investors. Purchases and sales of our common stock by these investors could have a significant impact on the market price of our stock.

If our results of operations do not meet market or analysts’ expectations, our stock price could decline.

Our quarterly operating results fluctuate depending on many factors, including the effect of ASC 606 on revenue recognition for the on-premises software subscriptions we offer, variability in the timing of start dates for our subscription and SaaS offerings, length of contracts, and renewals, and significant unexpected expenses in a quarter. Accordingly, our quarterly results are difficult to predict and we may

15

be unable to confirm or adjust expectations with respect to our operating results for a quarter until that quarter has closed. If our quarterly operating results do not meet market or analysts’ expectations, our stock price could decline.

VI. General Risk Factors

Our international businesses present economic and operating risks, which could adversely affect our business and prospects.

We expect that our international operations will continue to expand and to account for a significant portion of our total revenue. Because we transact business in various foreign currencies, the volatility of foreign exchange rates has had and may in the future have a material adverse effect on our revenue, expenses and operating results.

Other risks inherent in our international operations include, but are not limited to, the following:

We may have exposure to additional tax liabilities and our effective tax rate may increase or fluctuate, which could increase our income tax expense, reduce our net income, and increase our tax payment obligations.

As a multinational organization, we are subject to income taxes as well as non-income based taxes in the U.S. and in various foreign jurisdictions. Significant judgment is required in determining our worldwide income tax provision and other tax liabilities. In the ordinary course of a global business, there are many intercompany transactions and calculations where the ultimate tax determination is uncertain. Our tax returns are subject to review by various taxing authorities. Although we believe that our tax estimates are reasonable, the final determination of tax audits or tax disputes could be different from what is reflected in our historical income tax provisions and accruals.

Our effective tax rate and tax payment obligations can be adversely affected by several factors, many of which are outside of our control, including:

16

ITEM 1B. Unresolved Staff Comments

None.

ITEM 2. Properties

We currently have 83 office locations used in operations in the United States and internationally, predominately as sales and/or support offices and for research and development work. Of our total of approximately 1,076,000 square feet of leased facilities used in operations, approximately 421,000 square feet are located in the U.S., including approximately 250,000 square feet at our headquarters facility located in Boston, Massachusetts, and approximately 267,000 square feet are located in India, where a significant amount of our research and development is conducted.

ITEM 3. Legal Proceedings

None.

ITEM 4. Mine Safety Disclosures

Not applicable.

PART II

ITEM 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is traded on the Nasdaq Global Select Market under the symbol "PTC."

On September 30, 2023, the close of our fiscal year, and on November 13, 2023, our common stock was held by 952 and 950 shareholders of record, respectively.

ITEM 6. [Reserved]

17

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Operating and Non-GAAP Financial Measures

Our discussion of results includes discussion of our ARR (Annual Run Rate) operating measure, non-GAAP financial measures, and disclosure of our results on a constant currency basis. ARR and our non-GAAP financial measures, including the reasons we use those measures, are described below in Results of Operations - Operating Measure and Results of Operations - Non-GAAP Financial Measures, respectively. The methodology used to calculate constant currency disclosures is described in Results of Operations - Impact of Foreign Currency Exchange on Results of Operations. You should read those sections to understand our operating measure, non-GAAP financial measures, and constant currency disclosures.

Executive Overview

ARR grew 26% (23% constant currency) to $1.98 billion as of the end of FY'23 compared to FY’22. Organic ARR, which excludes contributions from the ServiceMax business we acquired in Q2'23, grew 15% (13% constant currency) year over year to $1.81 billion. Organic ARR growth was driven by double-digit growth across all product groups and geographies.

We generated $611 million of cash from operations in FY’23 compared to $435 million in FY’22, an increase of 40%. Free cash flow of $587 million in FY'23 increased 41% from $416 million in FY'22. Our cash flow growth is attributable to strong collections driven by our solid top-line growth from our subscription business model and operational discipline. Interest payments were $41 million higher in FY'23 compared to FY'22, while restructuring payments decreased $39 million year-over-year. We ended FY’23 with cash and cash equivalents of $288 million and gross debt of $1.70 billion, with an aggregate weighted average interest rate of 5.2%.

Revenue growth of 8% (12% constant currency) in FY'23 compared to FY'22 was primarily due to the contributions from ServiceMax and Codebeamer. The timing of revenue recognition for on-premises subscription revenue can vary significantly, impacting reported revenue and growth rates. Interest expense was $75 million higher in FY'23 compared to FY'22, which adversely affected our net income and earnings per share results. The increase was driven by debt and liabilities related to the ServiceMax acquisition.

Results of Operations

The following table shows the measures that we consider the most significant indicators of our business performance. In addition to providing operating income, operating margin, diluted earnings per share and cash from operations as calculated under GAAP, we provide our ARR operating measure and non-GAAP operating income, non-GAAP operating margin, non-GAAP diluted earnings per share, and free cash flow for the reported periods. We also provide a view of our actual results on a constant currency basis. Our non-GAAP financial measures exclude the items described in Non-GAAP Financial Measures below. Investors should use our non-GAAP financial measures only in conjunction with our GAAP results.

18

For discussion of our FY'22 results and comparison to our FY'21 results, refer to Management's Discussion and Analysis of Financial Conditions and Results of Operations in our Annual Report on Form 10-K for the year ended September 30, 2022.

(Dollar amounts in millions, except per share data) |

|

Year ended September 30, |

|

|

Percent Change |

|

||||||||||

|

|

2023 |

|

|

2022 |

|

|

Actual |

|

|

Constant Currency(1) |

|

||||

ARR as of September 30 |

|

$ |

1,978.6 |

|

|

$ |

1,572.0 |

|

|

|

26 |

% |

|

|

23 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total recurring revenue(2) |

|

$ |

1,907.9 |

|

|

$ |

1,736.2 |

|

|

|

10 |

% |

|

|

13 |

% |

Perpetual license |

|

|

38.6 |

|

|

|

34.1 |

|

|

|

13 |

% |

|

|

17 |

% |

Professional services |

|

|

150.5 |

|

|

|

163.1 |

|

|

|

(8 |

)% |

|

|

(5 |

)% |

Total revenue |

|

|

2,097.1 |

|

|

|

1,933.3 |

|

|

|

8 |

% |

|

|

12 |

% |

Total cost of revenue |

|

|

441.0 |

|

|

|

386.0 |

|

|

|

14 |

% |

|

|

16 |

% |

Gross margin |

|

|

1,656.0 |

|

|

|

1,547.4 |

|

|

|

7 |

% |

|

|

11 |

% |

Operating expenses |

|

|

1,197.6 |

|

|

|

1,100.0 |

|

|

|

9 |

% |

|

|

11 |

% |

Operating income |

|

$ |

458.5 |

|

|

$ |

447.4 |

|

|

|

2 |

% |

|

|

10 |

% |

Non-GAAP operating income(1) |

|

$ |

758.9 |

|

|

$ |

732.2 |

|

|

|

4 |

% |

|

|

8 |

% |

Operating margin |

|

|

21.9 |

% |

|

|

23.1 |

% |

|

|

|

|

|

|

||

Non-GAAP operating margin(1) |

|

|

36.2 |

% |

|

|

37.9 |

% |

|

|

|

|

|

|

||

Diluted earnings per share |

|

$ |

2.06 |

|

|

$ |

2.65 |

|

|

|

|

|

|

|

||

Non-GAAP diluted earnings per share(1) |

|

$ |

4.34 |

|

|

$ |

4.58 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Cash flow from operations(3) |

|

$ |

610.9 |

|

|

$ |

435.3 |

|

|

|

|

|

|

|

||

Capital expenditure |

|

|

(23.8 |

) |

|

|

(19.5 |

) |

|

|

|

|

|

|

||

Free cash flow |

|

$ |

587.0 |

|

|

$ |

415.8 |

|

|

|

|

|

|

|

||

Impact of Foreign Currency Exchange on Results of Operations

Approximately 50% of our revenue and 35% of our expenses are transacted in currencies other than the U.S. Dollar. Because we report our results of operations in U.S. Dollars, currency translation, particularly changes in the Euro, Yen, Shekel, and Rupee relative to the U.S. Dollar, affects our reported results. Changes in foreign currency exchange rates were a headwind to reported income statement results in FY’23. However, ARR was positively impacted by improvements in currency exchange rates, particularly the Euro to U.S. Dollar exchange rate, as of September 30, 2023 compared to September 30, 2022.

The results of operations in the table above, and the tables and discussions below about revenue by line of business and product group present both actual percentage changes year over year and percentage changes on a constant currency basis. Our constant currency disclosures are calculated by multiplying the results in local currency for FY'23 and FY'22 by the exchange rates in effect on September 30, 2022. If FY'23 reported results were converted into U.S. Dollars using the rates in effect as of September 30, 2022, ARR would have been lower by $38 million, revenue would have been lower by $59 million, and expenses would have been lower by $26 million. If FY'22 reported results were converted into U.S. Dollars using the rates in effect as of September 30, 2022, ARR would have been the same, revenue would have been lower by $112 million, and expenses would have been lower by $50 million.

19

Revenue

Under ASC 606, the volume, mix, and duration of contract types (support, SaaS, on-premises subscription) starting or renewing in any given period can have a material impact on revenue in the period, and as a result can impact the comparability of reported revenue period over period. We recognize revenue for the license portion of on-premises subscription contracts up front when we deliver the licenses to the customer, typically on the start date, and we recognize revenue on the support portion of on-premises subscription contracts and stand-alone support contracts ratably over the term. We continue to convert existing perpetual support contracts to on-premises subscriptions, resulting in a shift to up-front recognition of on-premises subscription license revenue in the period converted compared to ratable recognition for a perpetual support contract. Revenue from our cloud services (primarily SaaS) contracts is recognized ratably. We expect that over time a higher portion of our revenue will be recognized ratably as we continue to expand our SaaS offerings, release additional cloud functionality into our products, and migrate customers from on-premises subscriptions to SaaS. Given the different mix, duration and volume of new and renewing contracts in any period, year-over-year or sequential revenue can vary significantly.

Revenue by Line of Business

(Dollar amounts in millions) |

|

Year ended September 30, |

|

|

Percent Change |

|

||||||||||

|

|

2023 |

|

|

2022 |

|

|

Actual |

|

|

Constant |

|

||||

License(1) |

|

$ |

747.0 |

|

|

$ |

782.7 |

|

|

|

(5 |

)% |

|

|

(1 |

)% |

Support and cloud services(2) |

|

|

1,199.5 |

|

|

|

987.6 |

|

|

|

21 |

% |

|

|

25 |

% |

Total software revenue |

|

|

1,946.6 |

|

|

|

1,770.3 |

|

|

|

10 |

% |

|

|

13 |

% |

Professional services |

|

|

150.5 |

|

|

|

163.1 |

|

|

|

(8 |

)% |

|

|

(5 |

)% |

Total revenue |

|

$ |

2,097.1 |

|

|

$ |

1,933.3 |

|

|

|

8 |

% |

|

|

12 |

% |

Software revenue in FY'23 benefited from contributions from ServiceMax, acquired early in Q2'23, and Codebeamer, acquired in Q3'22. Changes in foreign currency exchange rates were a headwind to year-over-year revenue growth.

Within software revenue, license revenue is impacted by the quantity and size of expiring and renewing multi-year on-premises subscription contracts, along with the duration of those contracts that start in the period. In FY'23, the weighted-average duration of contracts starting in the year decreased compared to FY'22 primarily due to a few high-value renewal contracts in FY'22 that had longer than typical durations. Because longer duration contracts typically have a higher total contract value, which drives the amount of upfront license revenue recognized for on-premises contracts, this year-over-year duration decrease represented a headwind to license revenue growth in FY'23.

Professional services revenue decreased in FY'23 as we continue to execute on our strategy of leveraging partners to deliver services rather than contracting to deliver services ourselves, including the Q3'22 sale of a portion of our PLM services business to ITC Infotech (which branded the business DxP Services). Changes in foreign currency exchange rates also contributed to the year-over-year revenue decline. These decreases were partially offset by ServiceMax professional services revenue.

Our expectation is that professional services revenue will continue to trend down over time as we execute on our partner strategy and deliver products that require less consulting and training services.

20

Software Revenue by Product Group

(Dollar amounts in millions) |

|

Year ended September 30, |

|

|

Percent Change |

|

||||||||||

|

|

2023 |

|

|

2022 |

|

|

Actual |

|

|

Constant |

|

||||

Product lifecycle management (PLM) |

|

$ |

1,186.0 |

|

|

$ |

980.5 |

|

|

|

21 |

% |

|

|

24 |

% |

Computer-aided design (CAD) |

|

|

760.6 |

|

|

|

789.8 |

|

|

|

(4 |

)% |

|

|

0 |

% |

Software revenue |

|

$ |

1,946.6 |

|

|

$ |

1,770.3 |

|

|

|

10 |

% |

|

|

13 |

% |

PLM software revenue growth in FY'23 benefited from contributions from ServiceMax and Codebeamer. Changes in foreign currency exchange rates were a headwind to year-over-year revenue growth. Excluding contributions from ServiceMax and Codebeamer, constant currency revenue growth was driven by Windchill and IIoT in the Americas.

PLM ARR grew 36% (34% constant currency) from Q4’22 to Q4'23, driven by ServiceMax, which contributed $171 million of ARR; Windchill; IIoT; and Codebeamer.

CAD software revenue was negatively impacted by changes in foreign currency exchange rates. Constant currency revenue growth was flat due to decreases in Creo revenue in Europe due to shorter durations of on-premises subscription contracts, offset by Creo revenue growth in the Americas and Asia Pacific.

CAD ARR grew 12% (10% constant currency) in FY'23 compared to FY'22, driven by Creo.

Gross Margin

(Dollar amounts in millions) |

|

Year ended September 30, |

|

|

|

|

||||||

|

|

2023 |

|

|

2022 |

|

|

Percent Change |

|

|||

License gross margin |

|

$ |

693.8 |

|

|

$ |

733.4 |

|

|

|

(5 |

)% |

License gross margin percentage |

|

|

93 |

% |

|

|

94 |

% |

|

|

|

|

Support and cloud services gross margin |

|

$ |

954.5 |

|

|

$ |

802.8 |

|

|

|

19 |

% |

Support and cloud services gross margin percentage |

|

|

80 |

% |

|

|

81 |

% |

|

|

|

|

Professional services gross margin |

|

$ |

7.7 |

|

|

$ |

11.1 |

|

|

|

(31 |

)% |

Professional services gross margin percentage |

|

|

5 |

% |

|

|

7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Total gross margin |

|

$ |

1,656.0 |

|

|

$ |

1,547.4 |

|

|

|

7 |

% |

Total gross margin percentage |

|

|

79 |

% |

|

|

80 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Non-GAAP gross margin(1) |

|

$ |

1,712.6 |

|

|

$ |

1,595.7 |

|

|

|

7 |

% |

Non-GAAP gross margin percentage(1) |

|

|

82 |

% |

|

|

83 |

% |

|

|

|

|

(1) Non-GAAP financial measures are reconciled to GAAP results under Non-GAAP Financial Measures below.

License gross margin decreased in FY’23 compared to FY’22 due to lower license revenue and higher royalty expense.

Support and cloud services gross margin increased in FY’23 compared to FY’22 due to higher support and cloud services revenue, partially offset by increases in cost of support and cloud services, which were driven by higher royalty expenses, compensation costs, higher intangible amortization expense due to the ServiceMax acquisition, and cloud hosting costs.

21

Professional services gross margin decreased in FY’23 compared to FY’22 due to lower professional services revenue, offset by lower professional services costs. The decrease in professional services revenue is mainly due to the sale of a portion of our PLM services business in FY'22 and continued execution on our strategy of leveraging partners to deliver services rather than contracting to deliver services ourselves.

Operating Expenses

(Dollar amounts in millions) |

|

Year ended September 30, |

|

|

|

|

||||||

|

|

2023 |

|

|

2022 |

|

|

Percent Change |

|

|||

Sales and marketing |

|

$ |

530.1 |

|

|

$ |

485.2 |

|

|

|

9 |

% |

% of total revenue |

|

|

25 |

% |

|

|

25 |

% |

|

|

|

|

Research and development |

|

|

394.4 |

|

|

|

338.8 |

|

|

|

16 |

% |

% of total revenue |

|

|

19 |

% |

|

|

18 |

% |

|

|

|

|

General and administrative |

|

|

233.5 |

|

|

|

204.7 |

|

|

|

14 |

% |

% of total revenue |

|

|

11 |

% |

|

|

11 |

% |

|

|

|

|

Amortization of acquired intangible assets |

|

|

40.0 |

|

|

|

35.0 |

|

|

|

14 |

% |

% of total revenue |

|

|

2 |

% |

|

|

2 |

% |

|

|

|

|

Restructuring and other charges (credits), net |

|

|

(0.5 |

) |

|

|

36.2 |

|

|

|

(101 |

)% |

% of total revenue |

|

|

0 |

% |

|

|

2 |

% |

|

|

|

|

Total operating expenses |

|

$ |

1,197.6 |

|

|

$ |

1,100.0 |

|

|

|

9 |

% |

Total headcount increased by 11% between FY'22 and FY'23, primarily driven by our acquisition of ServiceMax.

Operating expenses in FY'23 compared to FY'22 increased primarily due to the following:

partially offset by:

22

Interest Expense

(Dollar amounts in millions) |

|

Year ended September 30, |

|

|

|

|

||||||

|

|

2023 |

|

|

2022 |

|

|

Percent Change |

|

|||

Interest and debt premium expense |

|

$ |

(129.4 |

) |

|

$ |

(54.3 |

) |

|

|

138 |

% |

Interest expense includes interest on our revolving credit facility and term loan, our Senior Notes due 2025 and 2028, and imputed interest on the deferred payment of a portion of the ServiceMax purchase price. The increase in interest expense was driven by higher total debt and higher interest rates in FY'23 compared to FY'22, as well as $30 million of imputed interest associated with the ServiceMax deferred acquisition payment.

Other Income

(Dollar amounts in millions) |

|

Year ended September 30, |

|

|

|

|

||||||

|

|

2023 |

|

|

2022 |

|

|

Percent Change |

|

|||

Interest income |

|

$ |

5.4 |

|

|

$ |

2.5 |

|

|

|

116 |

% |

Other income (expense), net |

|

|

(1.9 |

) |

|

|

1.5 |

|

|

|

(227 |

)% |

Other income, net |

|

$ |

3.5 |

|

|

$ |

4.0 |

|

|

|

(13 |

)% |

Other income (expense), net in FY'23 was related to foreign currency exchange losses. Other income (expense), net in FY’22 included $36 million of recognized gains from the sale of assets, primarily related to the sale of a portion of our PLM services business, offset by a $35 million loss associated with an equity investment in a publicly traded company.

Income Taxes

(Dollar amounts in millions) |

|

Year ended September 30, |

|

|

|

|

||||||

|

|

2023 |

|

|

2022 |

|

|

Percent Change |

|

|||

Income before income taxes |

|

$ |

332.6 |

|

|

$ |

397.1 |

|

|

|

(16 |

)% |

Provision for income taxes |

|

|

87.0 |

|

|

|

84.0 |

|

|

|

4 |

% |

Effective income tax rate |

|

|

26 |

% |

|

|

21 |

% |

|

|

|

|

The effective tax rate for FY’23 was higher than the effective rate for FY’22, primarily due to tax expense of $21.8 million related to an uncertain tax position regarding transfer pricing in a foreign jurisdiction where we are currently under audit. Our rate was also impacted by tax expense of $6.3 million related to non-deductible imputed interest related to the deferred payment on the acquisition of ServiceMax Inc. Additionally, in FY'22, our rate included $8.1 million of tax expense arising from the basis difference on goodwill related to the sale of a portion of our PLM services business.

In the normal course of business, PTC and its subsidiaries are examined by various taxing authorities, including the IRS in the United States. We regularly assess the likelihood of additional assessments by tax authorities and provide for these matters as appropriate. We are currently under audit by tax authorities in several jurisdictions including Germany, Ireland, and Italy. Audits by tax authorities typically involve examination of the deductibility of certain permanent items, transfer pricing, limitations on net operating losses, and tax credits.

Liquidity and Capital Resources

(in millions) |

|

September 30, |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

Cash and cash equivalents |

|

$ |

288.1 |

|

|

$ |

272.2 |

|

Restricted cash |

|

|

0.7 |

|

|

|

0.7 |

|

Total |

|

$ |

288.8 |

|

|

$ |

272.9 |

|

23

(in millions) |

|

Year ended September 30, |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

Net cash provided by operating activities |

|

$ |

610.9 |

|

|

$ |

435.3 |

|

Net cash used in investing activities |

|

$ |

(866.1 |

) |

|

$ |

(201.2 |

) |

Net cash provided by (used in) financing activities |

|

$ |

268.3 |

|

|

$ |

(264.1 |