UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________

FORM 10-Q

____________________________________________________

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended December 29, 2018

Commission File Number: 0-18059

____________________________________________________

PTC Inc.

(Exact name of registrant as specified in its charter)

____________________________________________________

Massachusetts | 04-2866152 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

121 Seaport Boulevard, Boston, MA 02210

(Address of principal executive offices, including zip code)

(781) 370-5000

(Registrant’s telephone number, including area code)

____________________________________________________

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act:

Large accelerated filer | þ | Accelerated filer | ¨ | Non-accelerated filer | ¨ | Smaller reporting company | ¨ | ||||

(Do not check if a smaller reporting company) | |||||||||||

Emerging growth company | ¨ | ||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

There were 118,627,720 shares of our common stock outstanding on February 5, 2019.

PTC Inc.

INDEX TO FORM 10-Q

For the Quarter Ended December 29, 2018

Page Number | ||

Part I—FINANCIAL INFORMATION | ||

Item 1. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Part II—OTHER INFORMATION | ||

Item 1A. | ||

Item 6. | ||

PART I—FINANCIAL INFORMATION

ITEM 1. | UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

PTC Inc.

CONSOLIDATED BALANCE SHEETS

(in thousands, except per share data)

(unaudited)

December 29, 2018 | September 30, 2018 | ||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 276,990 | $ | 259,946 | |||

Short-term marketable securities | 25,598 | 25,836 | |||||

Accounts receivable, net of allowance for doubtful accounts of $564 and $607 at December 29, 2018 and September 30, 2018, respectively | 385,670 | 129,297 | |||||

Prepaid expenses | 63,045 | 48,997 | |||||

Other current assets | 48,682 | 169,708 | |||||

Total current assets | 799,985 | 633,784 | |||||

Property and equipment, net | 107,359 | 80,613 | |||||

Goodwill | 1,230,901 | 1,182,457 | |||||

Acquired intangible assets, net | 205,084 | 200,202 | |||||

Long-term marketable securities | 30,054 | 30,115 | |||||

Deferred tax assets | 201,149 | 165,566 | |||||

Other assets | 178,437 | 36,285 | |||||

Total assets | $ | 2,752,969 | $ | 2,329,022 | |||

LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

Current liabilities: | |||||||

Accounts payable | $ | 57,249 | $ | 53,473 | |||

Accrued expenses and other current liabilities | 83,721 | 74,388 | |||||

Accrued compensation and benefits | 74,483 | 101,784 | |||||

Accrued income taxes | 405 | 18,044 | |||||

Deferred revenue | 325,111 | 487,590 | |||||

Total current liabilities | 540,969 | 735,279 | |||||

Long-term debt | 778,484 | 643,268 | |||||

Deferred tax liabilities | 36,261 | 5,589 | |||||

Deferred revenue | 10,197 | 11,852 | |||||

Other liabilities | 65,889 | 58,445 | |||||

Total liabilities | 1,431,800 | 1,454,433 | |||||

Commitments and contingencies (Note 14) | |||||||

Stockholders’ equity: | |||||||

Preferred stock, $0.01 par value; 5,000 shares authorized; none issued | — | — | |||||

Common stock, $0.01 par value; 500,000 shares authorized; 118,657 and 117,981 shares issued and outstanding at December 29, 2018 and September 30, 2018, respectively | 1,187 | 1,180 | |||||

Additional paid-in capital | 1,553,875 | 1,558,403 | |||||

Accumulated deficit | (138,785 | ) | (599,409 | ) | |||

Accumulated other comprehensive loss | (95,108 | ) | (85,585 | ) | |||

Total stockholders’ equity | 1,321,169 | 874,589 | |||||

Total liabilities and stockholders’ equity | $ | 2,752,969 | $ | 2,329,022 | |||

The accompanying notes are an integral part of the condensed consolidated financial statements.

1

PTC Inc.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(unaudited)

Three months ended | |||||||

December 29, 2018 | December 30, 2017 | ||||||

Revenue: | |||||||

License | $ | 105,322 | $ | 119,518 | |||

Support and cloud services | 187,921 | 145,672 | |||||

Total software revenue | 293,243 | 265,190 | |||||

Professional services | 41,446 | 41,454 | |||||

Total revenue | 334,689 | 306,644 | |||||

Cost of revenue: | |||||||

Cost of license revenue | 12,563 | 12,114 | |||||

Cost of support and cloud services revenue | 31,197 | 34,502 | |||||

Total cost of software revenue | 43,760 | 46,616 | |||||

Cost of professional services revenue | 33,592 | 36,419 | |||||

Total cost of revenue | 77,352 | 83,035 | |||||

Gross margin | 257,337 | 223,609 | |||||

Operating expenses: | |||||||

Sales and marketing | 104,218 | 99,375 | |||||

Research and development | 60,782 | 63,972 | |||||

General and administrative | 37,864 | 35,020 | |||||

Amortization of acquired intangible assets | 5,936 | 7,821 | |||||

Restructuring and other charges, net | 18,493 | 105 | |||||

Total operating expenses | 227,293 | 206,293 | |||||

Operating income | 30,044 | 17,316 | |||||

Interest expense | (10,276 | ) | (10,047 | ) | |||

Other income (expense), net | 655 | (798 | ) | ||||

Income before income taxes | 20,423 | 6,471 | |||||

Benefit for income taxes | (562 | ) | (7,406 | ) | |||

Net income | $ | 20,985 | $ | 13,877 | |||

Earnings per share—Basic | $ | 0.18 | $ | 0.12 | |||

Earnings per share—Diluted | $ | 0.18 | $ | 0.12 | |||

Weighted average shares outstanding—Basic | 118,323 | 115,731 | |||||

Weighted average shares outstanding—Diluted | 119,638 | 117,656 | |||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

2

PTC Inc.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in thousands)

(unaudited)

Three months ended | |||||||

December 29, 2018 | December 30, 2017 | ||||||

Net income | $ | 20,985 | $ | 13,877 | |||

Other comprehensive income (loss), net of tax: | |||||||

Realized and unrealized hedge gain (loss) arising during the period, net of tax of $0 million and $0.1 million in the first quarter of 2019 and 2018, respectively | (2,129 | ) | (913 | ) | |||

Net hedge (gain) loss reclassified into earnings, net of tax of $0.1 million in the first quarter of 2019 and $0.1 million in the first quarter of 2018 | (549 | ) | 573 | ||||

Unrealized loss on hedging instruments | (2,678 | ) | (340 | ) | |||

Foreign currency translation adjustment, net of tax of $0 for each period | (7,569 | ) | 5,229 | ||||

Unrealized gain (loss) on marketable securities, net of tax of $0 for each period | 13 | (179 | ) | ||||

Amortization of net actuarial pension loss included in net income, net of tax of $0.2 million and $0.2 million in the first quarter of 2019 and 2018, respectively | 430 | 371 | |||||

Change in unamortized pension loss during the period related to changes in foreign currency | 281 | (263 | ) | ||||

Other comprehensive income (loss) | (9,523 | ) | 4,818 | ||||

Comprehensive income | $ | 11,462 | $ | 18,695 | |||

The accompanying notes are an integral part of the condensed consolidated financial statements.

3

PTC Inc.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Three months ended | |||||||

December 29, 2018 | December 30, 2017 | ||||||

Cash flows from operating activities: | |||||||

Net income | $ | 20,985 | $ | 13,877 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Depreciation and amortization | 20,053 | 21,046 | |||||

Stock-based compensation | 29,407 | 18,331 | |||||

Other non-cash items, net | (5 | ) | 361 | ||||

Changes in operating assets and liabilities, excluding the effects of acquisitions: | |||||||

Accounts receivable | 24,025 | 21,603 | |||||

Accounts payable and accrued expenses | (9,628 | ) | (12,885 | ) | |||

Accrued compensation and benefits | (27,504 | ) | (40,172 | ) | |||

Deferred revenue | (21,820 | ) | 22,055 | ||||

Accrued income taxes | (21,668 | ) | (14,272 | ) | |||

Other current assets and prepaid expenses | 849 | (8,575 | ) | ||||

Other noncurrent assets and liabilities | 6,520 | 4,146 | |||||

Net cash provided by operating activities | 21,214 | 25,515 | |||||

Cash flows from investing activities: | |||||||

Additions to property and equipment | (30,332 | ) | (6,377 | ) | |||

Purchase of intangible asset | — | (2,500 | ) | ||||

Purchases of short- and long-term marketable securities | (6,736 | ) | (4,248 | ) | |||

Proceeds from maturities of short- and long-term marketable securities | 7,007 | 3,740 | |||||

Acquisitions of businesses, net of cash acquired | (69,556 | ) | — | ||||

Settlement of net investment hedges | (1,595 | ) | — | ||||

Net cash used in investing activities | (101,212 | ) | (9,385 | ) | |||

Cash flows from financing activities: | |||||||

Borrowings under credit facility | 155,000 | 50,000 | |||||

Repayments of borrowings under credit facility | (20,000 | ) | (20,000 | ) | |||

Proceeds (costs) from issuance of common stock | (4,640 | ) | — | ||||

Contingent consideration | (1,575 | ) | (3,176 | ) | |||

Payments of withholding taxes in connection with stock-based awards | (33,788 | ) | (33,488 | ) | |||

Net cash provided by (used in) financing activities | 94,997 | (6,664 | ) | ||||

Effect of exchange rate changes on cash, cash equivalents and restricted cash | 2,041 | 2,598 | |||||

Net increase in cash, cash equivalents, and restricted cash | 17,040 | 12,064 | |||||

Cash, cash equivalents, and restricted cash, beginning of period | 261,093 | 281,209 | |||||

Cash, cash equivalents, and restricted cash, end of period | $ | 278,133 | $ | 293,273 | |||

The accompanying notes are an integral part of the condensed consolidated financial statements.

4

PTC Inc.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(in thousands)

(unaudited)

Common Stock | Additional Paid-in Capital | Accumulated Deficit | Accumulated Other Comprehensive Loss | Total Stockholders’ Equity | ||||||||||||||||||

Shares | Amount | |||||||||||||||||||||

Balance as of September 30, 2018 | 117,981 | $ | 1,180 | $ | 1,558,403 | $ | (599,409 | ) | $ | (85,585 | ) | $ | 874,589 | |||||||||

ASU 2016-16 adoption | — | — | — | 72,261 | — | 72,261 | ||||||||||||||||

ASC 606 adoption | — | — | — | 367,378 | — | 367,378 | ||||||||||||||||

Common stock issued for employee stock-based awards | 1,056 | 11 | (11 | ) | — | — | — | |||||||||||||||

Shares surrendered by employees to pay taxes related to stock-based awards | (380 | ) | (4 | ) | (33,784 | ) | — | — | (33,788 | ) | ||||||||||||

Common stock issued | — | — | (140 | ) | (140 | ) | ||||||||||||||||

Compensation expense from stock-based awards | — | — | 29,407 | — | — | 29,407 | ||||||||||||||||

Net income | — | — | — | 20,985 | — | 20,985 | ||||||||||||||||

Unrealized loss on cash flow hedges, net of tax | — | — | — | — | (385 | ) | (385 | ) | ||||||||||||||

Unrealized loss on net investment hedges, net of tax | — | — | — | — | (2,293 | ) | (2,293 | ) | ||||||||||||||

Foreign currency translation adjustment | — | — | — | — | (7,569 | ) | (7,569 | ) | ||||||||||||||

Unrealized loss on available-for-sale securities, net of tax | — | — | — | — | 13 | 13 | ||||||||||||||||

Change in pension benefits, net of tax | — | — | — | — | 711 | 711 | ||||||||||||||||

Balance as of December 29, 2018 | 118,657 | $ | 1,187 | $ | 1,553,875 | $ | (138,785 | ) | $ | (95,108 | ) | $ | 1,321,169 | |||||||||

Common Stock | Additional Paid-in Capital | Accumulated Deficit | Accumulated Other Comprehensive Loss | Total Stockholders’ Equity | ||||||||||||||||||

Shares | Amount | |||||||||||||||||||||

Balance as of September 30, 2017 | 115,333 | $ | 1,153 | $ | 1,609,030 | $ | (650,840 | ) | $ | (73,907 | ) | $ | 885,436 | |||||||||

ASU 2016-09 adoption | — | — | 681 | (556 | ) | — | 125 | |||||||||||||||

Common stock issued for employee stock-based awards | 1,317 | 13 | (13 | ) | — | — | — | |||||||||||||||

Shares surrendered by employees to pay taxes related to stock-based awards | (524 | ) | (5 | ) | (33,483 | ) | — | — | (33,488 | ) | ||||||||||||

Compensation expense from stock-based awards | — | — | 18,331 | — | — | 18,331 | ||||||||||||||||

Net income | — | — | — | 13,877 | — | 13,877 | ||||||||||||||||

Unrealized loss on cash flow hedges, net of tax | — | — | — | — | (340 | ) | (340 | ) | ||||||||||||||

Foreign currency translation adjustment | — | — | — | — | 5,229 | 5,229 | ||||||||||||||||

Unrealized loss on available-for-sale securities, net of tax | — | — | — | — | (179 | ) | (179 | ) | ||||||||||||||

Change in pension benefits, net of tax | — | — | — | — | 108 | 108 | ||||||||||||||||

Balance as of December 30, 2017 | 116,126 | $ | 1,161 | $ | 1,594,546 | $ | (637,519 | ) | $ | (69,089 | ) | $ | 889,099 | |||||||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

5

PTC Inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

1. Basis of Presentation

General

The accompanying unaudited condensed consolidated financial statements include the accounts of PTC Inc. and its wholly owned subsidiaries and have been prepared by management in accordance with accounting principles generally accepted in the United States of America and in accordance with the rules and regulations of the Securities and Exchange Commission regarding interim financial reporting. Accordingly, they do not include all the information and footnotes required by generally accepted accounting principles for complete financial statements. While we believe that the disclosures presented are adequate in order to make the information not misleading, these unaudited quarterly financial statements should be read in conjunction with our annual consolidated financial statements and related notes included in our Annual Report on Form 10-K for the fiscal year ended September 30, 2018. In the opinion of management, the accompanying unaudited condensed consolidated financial statements contain all adjustments, consisting only of those of a normal recurring nature, necessary for a fair statement of our financial position, results of operations and cash flows at the dates and for the periods indicated. The September 30, 2018 Consolidated Balance Sheet included herein is derived from our audited consolidated financial statements.

Unless otherwise indicated, all references to a year mean our fiscal year, which ends on September 30. Our fiscal quarters end on a Saturday following a thirteen-week calendar, and may result in different quarter end dates year to year. The first quarter of 2019 ended on December 29, 2018 and the first quarter of 2018 ended on December 30, 2017. The results of operations for the three months ended December 29, 2018 are not necessarily indicative of the results expected for the remainder of the fiscal year.

Changes in Presentation and Reclassifications

On October 1, 2018, we adopted ASU No. 2014-09, Revenue from Contracts with Customers: Topic 606 (ASC 606). Results for reporting periods beginning on or after October 1, 2018 are presented under ASC 606, while prior period amounts are not adjusted and continue to be reported in accordance with the guidance provided by ASC 985-605, Software-Revenue Recognition and revenues for non-software deliverables in accordance with ASC 605-25, Revenue Recognition, Multiple-Element Arrangements (ASC 605). In connection with the adoption, we changed our presentation of the statement of operations to reflect revenue and associated costs as license, support and cloud services, and professional services. For the prior year period, all components of subscription licenses (including support) are included in license revenue. Prior to our adoption of 606, revenues from subscription licenses and support thereon were not separated and were previously included in subscription revenue in our consolidated statement of operations since we did not have VSOE of fair value for support on subscription sales. In addition, revenue and costs associated with our cloud services, which are immaterial and were previously reported in subscription revenue, are classified as support and cloud services for all periods presented.

Effective at the beginning of fiscal 2019, in accordance with the adoption of ASU 2017-07, Compensation-Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost, all non-service net periodic pension costs are now presented in Other income (expense), net on the Consolidated Statement of Operations. The prior period non-service net periodic pension cost amounts have been reclassified for comparability.

Effective at the beginning of fiscal 2019, in accordance with the adoption of ASU 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash, restricted cash is now included with cash and cash equivalents in the net cash increase (decrease), beginning of period total amount and end of period total amount on the Consolidated Statements of Cash Flows. The prior period restricted cash amounts have been reclassified for comparability. As of December 29, 2018 and September 30, 2018, $1.1 million of restricted cash was included in other current assets.

Recent Accounting Pronouncements

Recently Adopted Accounting Pronouncements

Revenue Recognition

6

On October 1, 2018, we adopted ASC 606, which supersedes substantially all existing revenue recognition guidance under U.S. GAAP. We adopted ASC 606 using the modified retrospective method, under which the cumulative effect of initially applying ASC 606 was recorded as a reduction to accumulated deficit with no restatement of comparative periods.

The core principle of ASC 606 is to recognize revenue when promised goods or services are transferred to a customer in an amount that reflects the consideration that is expected to be received for those goods or services. Under the new guidance, an entity is required to evaluate revenue recognition through a five-step process: (1) identifying a contract with a customer; (2) identifying the performance obligations in the contract; (3) determining the transaction price; (4) allocating the transaction price to the performance obligations in the contract; and (5) recognizing revenue when (or as) the entity satisfies a performance obligation. The standard also requires disclosure of the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers. In applying the principles of ASC 606, more judgment and estimates are required within the revenue recognition process than is required under previous U.S. GAAP, including identifying performance obligations, estimating the amount of variable consideration to include in the transaction price, and estimating the value of each performance obligation to allocate the total transaction price to each separate performance obligation.

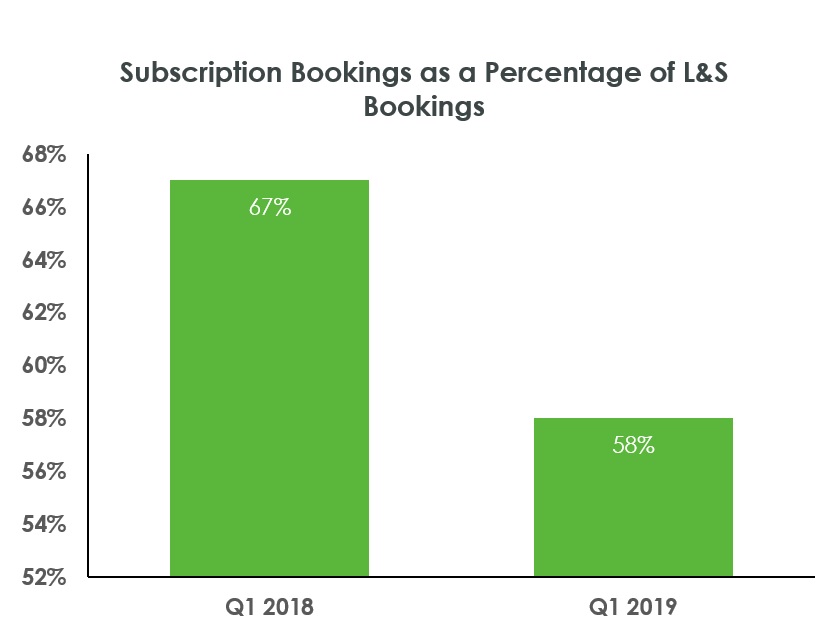

The most significant impact of ASC 606 relates to accounting for our subscription arrangements that include term-based on-premise software licenses bundled with support. Under previous GAAP (through September 30, 2018), revenue attributable to these subscription licenses was recognized ratably over the term of the arrangement because VSOE does not exist for the undelivered support element as it is not sold separately. Under the new standard, the requirement to have VSOE for undelivered elements to enable the separation of revenue for the delivered software licenses is eliminated. Accordingly, under the new standard we recognize as revenue a portion of the subscription fee upon delivery of the software license. Revenue recognition related to our perpetual licenses and related support contracts, professional services and cloud offerings is substantially unchanged, with support and cloud revenue being recorded ratably over the contract term. Due to the complexity of certain of our contracts, the actual revenue recognition treatment required under the new standard may be dependent on contract-specific terms and, therefore, may vary in some instances.

Upon implementation of the new standard in fiscal 2019, we made prospective revisions to contract terms with our customers that will result in shortening the initial, non-cancellable term of our multi-year subscriptions to one year for contract periods that begin on or after October 1, 2018. This change will result in annual contractual periods for most of our software subscriptions, the license portion of which will be recognized at the beginning of each annual contract period upon delivery of the licenses and the support portion of which will be recognized ratably over the one-year contractual period. As a result, we anticipate one year of subscription revenue will be recognized for each contract each year; however, more of the revenue will be recognized in the quarter that the contract period begins and less will be recognized in the subsequent three quarters of the contract than under ASC 605.

Under the modified retrospective method, we evaluated each contract that was ongoing on October 1, 2018 as if that contract had been accounted for under ASC 606 from contract inception. Some license revenue related to subscription arrangements that would have been recognized in future periods under current GAAP was recast under ASC 606 as if the revenue had been recognized in prior periods. Under this transition method, we did not adjust historical reported revenue amounts. Instead, the revenue that would have been recognized under this method prior to the adoption date was recorded as an adjustment to accumulated deficit and will not be recognized as revenue in future periods as previously expected. Because license revenue associated with subscription contracts is recognized up front instead of over time under ASC 606, a material portion of our deferred revenue was adjusted to accumulated deficit upon adoption.

Another significant provision under ASC 606 includes the capitalization and amortization of costs associated with obtaining a contract, such as sales commissions. Prior to October 1, 2018, we expensed commissions in the period incurred. Under ASC 606, direct and incremental costs to acquire a contract are capitalized and amortized using a systematic basis over the pattern of transfer of the goods and services to which the asset relates.

Refer to Note 2. Revenue from Contracts with Customers for further detail about the impact of the adoption of ASC 606 and further disclosures.

Income Taxes

7

In October 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2016-16, Income Taxes (Topic 740): Intra-Entity Transfers of Assets Other Than Inventory. The purpose of ASU 2016-16 is to simplify the income tax accounting of an intra-entity transfer of an asset other than inventory and to record its effect when the transfer occurs. We adopted this amendment beginning in the first quarter of 2019 using the modified retrospective method with a cumulative effect adjustment to accumulated deficit of $72.3 million, with a corresponding increase of $75.3 million to deferred tax assets, $6.0 million decrease to income tax assets and a $3.0 million decrease to income tax liabilities. The adjustment primarily relates to deductible amortization of intangible assets in Ireland. Post adoption, our effective tax rate no longer includes the benefit of this amortization.

Pension Accounting

In March 2017, the FASB issued ASU 2017-07, Compensation-Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost, which provides guidance on the capitalization, presentation and disclosure of net benefit costs related to postretirement benefit plans. We adopted the new guidance in the first quarter of 2019 on a full retrospective basis, which resulted in the retrospective reclassification of $0.2 million of non-service net periodic pension cost for the three months ended December 30, 2017 from line items within cost of revenue and operating expenses into Other income (expense), net on the Consolidated Statement of Operations.

Equity Investments

In January 2016, the FASB issued ASU 2016-01, Recognition and Measurement of Financial Assets and Financial Liabilities, which provides guidance for the recognition, measurement, presentation, and disclosure of financial assets and liabilities and requires equity securities to be measured at fair value, unless the measurement alternative method has been elected for equity investments without readily determinable fair values. Adoption of this guidance in the first quarter of fiscal 2019 did not have a material impact on our consolidated financial statements.

Restricted Cash

In November 2016, the FASB issued ASU 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash. The new guidance requires that a statement of cash flows explain the change during the period in the total of cash, cash equivalents and amounts generally described as restricted cash or restricted cash equivalents. Therefore, amounts generally described as restricted cash and restricted cash equivalents should be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period total amounts shown on the Statement of Cash Flows. Adoption of this guidance in the first quarter of fiscal 2019 did not have a material impact on our consolidated financial statements.

Pending Accounting Pronouncements

Derivative Financial Instruments

In August 2017, the FASB issued ASU No. 2017-12, "Derivatives and Hedging (Topic 815) Targeted Improvements to Accounting for Hedging Activities", which amends and simplifies existing guidance to allow companies to more accurately present the economic effects of risk management activities in the financial statements. The guidance is effective for annual reporting periods beginning after December 15, 2018 (our fiscal 2020) including interim reporting periods within those annual reporting periods and early adoption is permitted. We are currently evaluating the impact of the new guidance on our consolidated financial statements.

Leases

In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842), which will replace the existing guidance in ASC 840, Leases. The updated standard aims to increase transparency and comparability among organizations by requiring lessees to recognize lease assets and lease liabilities on the balance sheet and to disclose important information about leasing arrangements. ASU 2016-02 is effective for annual periods beginning after December 15, 2018 (our fiscal 2020) and interim periods within those annual periods. Early adoption is permitted and modified retrospective application is required. We are currently evaluating the impact of the new guidance on our consolidated financial statements.

2. Revenue from Contracts with Customers

8

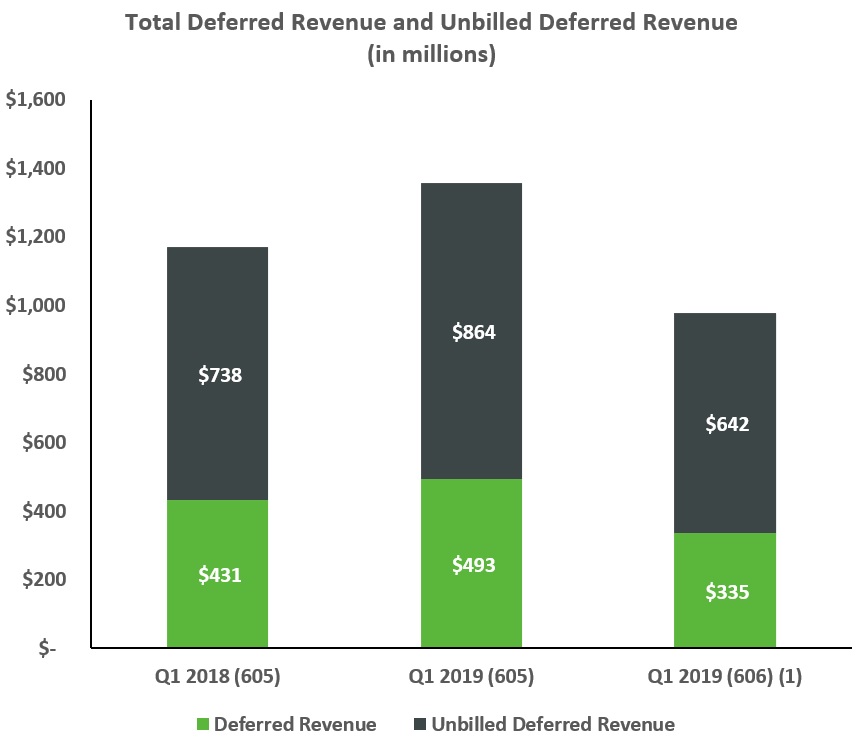

Upon adoption of ASC 606, we recorded a decrease in accumulated deficit of $431.9 million ($367.4 million, net of tax) due to the cumulative effect of the ASC 606 adoption, with the impact primarily derived from revenue related to on-premise subscription software licenses.

Nature of Products and Services

Our sources of revenue include: (1) subscription, (2) perpetual license, (3) perpetual support and (4) professional services. Revenue is derived from the licensing of computer software products and from related support contracts. We enter into contracts that include combinations of products, support and professional services, which are accounted for as separate performance obligations with differing revenue recognition patterns.

Performance Obligation | When Performance Obligation is Typically Satisfied |

Term-based subscriptions | |

On-premise software licenses | Point in Time: Upon the later of when the software is made available or the subscription term commences |

Support and cloud-based offerings | Over Time: Ratably over the contractual term; commencing upon the later of when the software is made available or the subscription term commences |

Perpetual software licenses | Point in Time: when the software is made available |

Support for perpetual software licenses | Over Time: Ratably over the contractual term |

Professional services | Over time: As services are provided |

Judgments and Estimates

Our contracts with customers for subscriptions typically include commitments to transfer term-based on-premise software licenses bundled with support and/or cloud services. On-premise software is determined to be a distinct performance obligation from support which is sold for the same term of the subscription. For subscription arrangements which include cloud services, we assessed whether the cloud component was highly interrelated with on-premise term software licenses. Other than a limited population of subscriptions, the cloud component is not currently deemed to be interrelated with the on-premise term software and, as a result, cloud services will be accounted for as a distinct performance obligation from the software and support components of the subscription.

Judgment is required to allocate the transaction price to each performance obligation. We use the estimated standalone selling price method to allocate the transaction price for items that are not sold separately. The estimated standalone selling price is determined using all information reasonably available to us, including market conditions and other observable inputs. The corresponding revenues are recognized as the related performance obligations are satisfied. We determined that 50% to 55% of the estimated standalone selling price for subscriptions that contain distinct license and support performance obligations are attributable to software licenses and 45% to 50%, depending upon the product offering, is attributable to support for those licenses.

Our standard multi-year, non-cancellable on-premise subscription contracts provide customers with an annual right to exchange software within the original subscription with other software. Although the exchange right is limited to software products within a similar product grouping, the exchange right is not limited to products with substantially similar features and functionality as those originally delivered. We determined that this right to exchange previously delivered software for different software represents variable consideration to be accounted for as a liability. We have identified a standard portfolio of contracts with common characteristics and applied the expected value method of determining variable consideration associated with this right. Additionally, where there are isolated situations that are outside of the standard portfolio of contracts due to contract size, longer contract duration, or other unique contractual terms, we used the most likely amount method to determine the amount of variable consideration. In both circumstances, the amount of variable consideration included in the transaction price is constrained by an amount where it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur when the uncertainty associated with the variable consideration is subsequently resolved. As of December 29, 2018, the total refund liability was $23.6 million, primarily associated with the annual right to exchange on-premise subscription software.

9

Contract Assets and Contract Liabilities

December 29, 2018 | October 1, 2018, as adjusted | ||||||

(in thousands) | |||||||

Contract asset | $ | 14,513 | $ | 26,265 | |||

Deferred revenue | $ | 335,119 | $ | 357,490 | |||

As of December 29, 2018, our contract assets are expected to be transferred to receivables within the next 12 months and therefore are included in other current assets. Approximately $12.2 million of the October 1, 2018 contract asset balance was transferred to receivables during the current period as a result of the right to payment becoming unconditional. The majority of both the contract asset balance and the amounts transferred to receivables relates to two large professional services contracts with invoicing terms based on performance milestones. Additions to contract assets of approximately $0.4 million related to revenue recognized in the period, net of period billings. There were no impairments of contract assets during the three months ended December 29, 2018.

During the three months ended December 29, 2018, $153.7 million of revenue that was included in the deferred revenue opening balance was recognized. There were additional deferrals of $131.3 million, which were primarily related to new billings.

Costs to Obtain or Fulfill a Contract

The new revenue recognition standard requires the capitalization of certain incremental costs of obtaining a contract, which impacts the period in which we record our commission expense. Prior to our adoption of the new revenue standard, we recognized commissions expense as incurred. Under the new revenue recognition standard, we are required to recognize these expenses over the period of benefit associated with these costs. This results in a deferral of certain commission expenses each period. Upon adoption, we reduced our accumulated deficit by $70.0 million and recognized an offsetting asset for deferred commission related to contracts that were not completed prior to October 1, 2018.

We recognize an asset for the incremental costs of obtaining a contract with a customer if the benefit of those costs is expected to be longer than one year. These deferred costs are amortized proportionately related to revenue over five years, which is generally longer than the term of the initial contract because of anticipated renewals as commissions for renewals are not commensurate with commissions related to our initial contracts. As of December 29, 2018, deferred costs of $19.9 million were included in other current assets and $52.5 million were included in other assets (non-current).

As the revenue recognition pattern has changed under ASC 606, the costs to fulfill contracts has also changed to match this pattern of expense recognition. As of October 1, 2018, this resulted in a $2.8 million increase in our accumulated deficit with recognition of an offsetting current liability.

Remaining Performance Obligations

Our contracts with customers include amounts allocated to performance obligations that will be satisfied at a later date. As of December 29, 2018, amounts allocated to these remaining performance obligations are $938 million, of which we expect to recognize 90% over the next 24 months with the remaining amount thereafter.

10

Disaggregation of Revenue

Three months ended | ||||||||||||

As Reported ASC 606 | ASC 605 | As Reported ASC 605 | ||||||||||

December 29, 2018 | December 29, 2018 | December 30, 2017 | ||||||||||

Revenue | ||||||||||||

(in thousands) | ||||||||||||

Subscription license | $ | 63,517 | ||||||||||

Subscription support & cloud services | 77,424 | |||||||||||

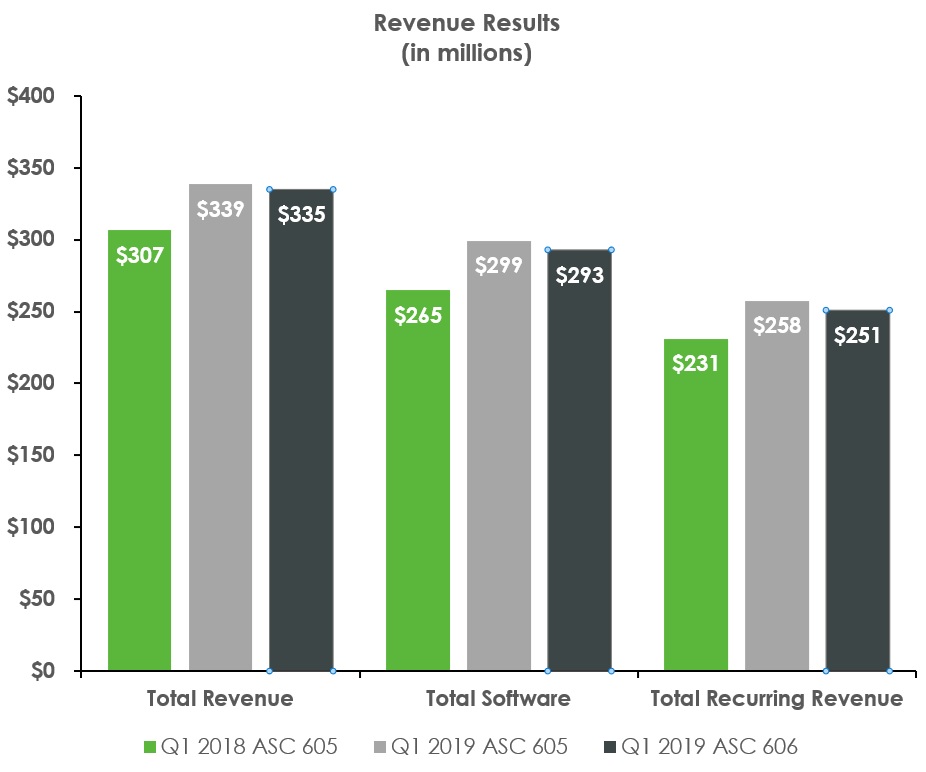

Total Subscription | 140,941 | $ | 148,413 | $ | 100,008 | |||||||

Perpetual support | 110,497 | 109,225 | 131,197 | |||||||||

Total recurring revenue | 251,438 | 257,638 | 231,205 | |||||||||

Perpetual license | 41,805 | 41,750 | 33,985 | |||||||||

Total software revenue | 293,243 | 299,388 | 265,190 | |||||||||

Professional services | 41,446 | 39,369 | 41,454 | |||||||||

Total revenue | $ | 334,689 | $ | 338,757 | $ | 306,644 | ||||||

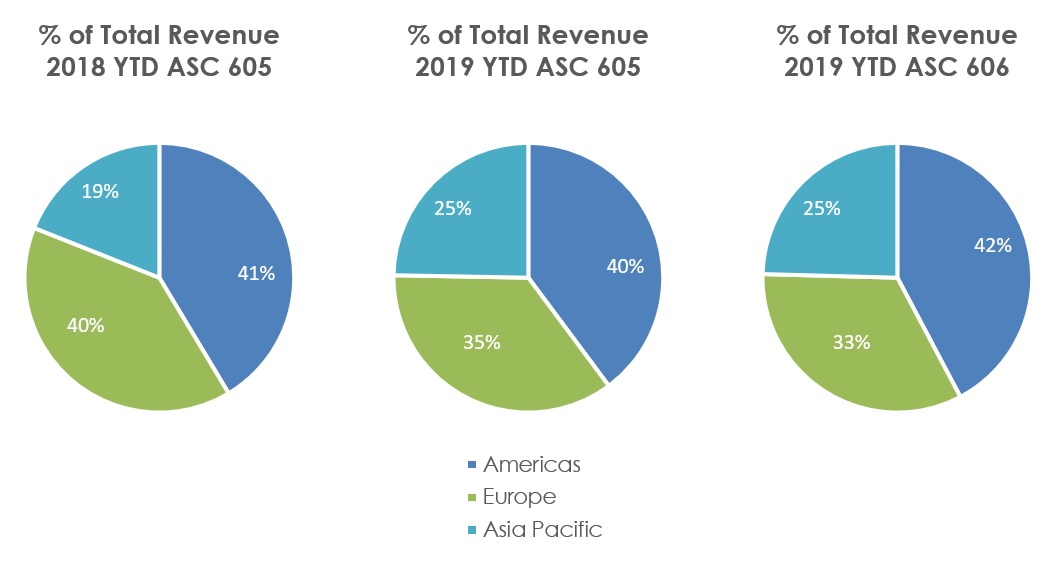

For further disaggregation of revenue by geographic region and product area see Note 11. Segment and Geographical Information.

Practical Expedients

We elected certain practical expedients with the adoption of the new revenue standard. We do not account for significant financing components if the period between revenue recognition and when the customer pays for the products or services will be one year or less. Additionally, we recognize revenue equal to the amount we have a right to invoice, when the amount corresponds directly with the value to the customer of our performance date.

Transition Disclosures

In accordance with the modified retrospective method transition requirements, we will present the financial statement line items impacted and adjusted to compare to presentation under ASC 605 for each of the interim and annual periods during the first year of adoption of ASC 606.

11

The following tables present our Balance Sheets and Statements of Operations as reported under ASC 606 for the current period with comparative periods reported under ASC 605:

As Reported ASC 606 | ASC 605 | As Reported ASC 605 | |||||||||

December 29, 2018 | December 29, 2018 | September 30, 2018 | |||||||||

ASSETS | |||||||||||

Current assets: | |||||||||||

Cash and cash equivalents | $ | 276,990 | $ | 276,990 | $ | 259,946 | |||||

Short-term marketable securities | 25,598 | 25,598 | 25,836 | ||||||||

Accounts receivable (1) | 385,670 | 138,989 | 129,297 | ||||||||

Prepaid expenses | 63,045 | 63,045 | 48,997 | ||||||||

Other current assets (2) | 48,682 | 143,104 | 169,708 | ||||||||

Total current assets | 799,985 | 647,726 | 633,784 | ||||||||

Property and equipment, net | 107,359 | 107,359 | 80,613 | ||||||||

Goodwill | 1,230,901 | 1,230,901 | 1,182,457 | ||||||||

Acquired intangible assets, net | 205,084 | 205,084 | 200,202 | ||||||||

Long-term marketable securities | 30,054 | 30,054 | 30,115 | ||||||||

Deferred tax assets (3) | 201,149 | 234,558 | 165,566 | ||||||||

Other assets (4) | 178,437 | 34,328 | 36,285 | ||||||||

Total assets | $ | 2,752,969 | $ | 2,490,010 | $ | 2,329,022 | |||||

LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||||||

Current liabilities: | |||||||||||

Accounts payable | $ | 57,249 | $ | 57,249 | $ | 53,473 | |||||

Accrued expenses and other current liabilities (5) | 83,721 | 56,897 | 74,388 | ||||||||

Accrued compensation and benefits | 74,483 | 74,483 | 101,784 | ||||||||

Accrued income taxes (3) | 405 | 4,958 | 18,044 | ||||||||

Deferred revenue (6) | 325,111 | 484,613 | 487,590 | ||||||||

Total current liabilities | 540,969 | 678,200 | 735,279 | ||||||||

Long-term debt | 778,484 | 778,484 | 643,268 | ||||||||

Deferred tax liabilities (3) | 36,261 | 5,731 | 5,589 | ||||||||

Deferred revenue (6) | 10,197 | 8,324 | 11,852 | ||||||||

Other liabilities | 65,889 | 65,889 | 58,445 | ||||||||

Total liabilities | 1,431,800 | 1,536,628 | 1,454,433 | ||||||||

Stockholders’ equity: | |||||||||||

Preferred stock | — | — | — | ||||||||

Common stock | 1,187 | 1,187 | 1,180 | ||||||||

Additional paid-in capital | 1,553,875 | 1,553,875 | 1,558,403 | ||||||||

Accumulated deficit | (138,785 | ) | (507,900 | ) | (599,409 | ) | |||||

Accumulated other comprehensive loss | (95,108 | ) | (93,780 | ) | (85,585 | ) | |||||

Total stockholders’ equity | 1,321,169 | 953,382 | 874,589 | ||||||||

Total liabilities and stockholders’ equity | $ | 2,752,969 | $ | 2,490,010 | $ | 2,329,022 | |||||

The changes in balance sheet accounts due to the adoption of 606 are due primarily to the following:

(1) | Up front license recognition under our subscription contracts and billed but uncollected support and subscription receivables that had corresponding deferred revenue, which were included in other current assets prior to our adoption of 606. |

(2) Contract assets and capitalized commission costs.

(3) | The tax effect of the accumulated deficit impact related to the acceleration of revenue and deferral of costs (primarily commissions). |

(4) The long-term portion of unbilled receivables due to the acceleration of license revenue on multi-year subscription contracts and the long-term portion of capitalized commission costs.

(5) Refund liability, primarily associated with the annual right to exchange on-premise subscription software described above in Judgments and Estimates.

(6) The decrease in deferred revenue recorded to accumulated deficit upon adoption of ASC 606 primarily related to on-premise subscription software licenses.

12

Three months ended | |||||||||||

As Reported ASC 606 | ASC 605 | As Reported ASC 605 | |||||||||

December 29, 2018 | December 29, 2018 | December 30, 2017 | |||||||||

Revenue: | |||||||||||

License (1) | $ | 105,322 | $ | 173,905 | $ | 119,518 | |||||

Support and cloud services (1) | 187,921 | 125,483 | 145,672 | ||||||||

Total software revenue | 293,243 | 299,388 | 265,190 | ||||||||

Professional services | 41,446 | 39,369 | 41,454 | ||||||||

Total revenue | 334,689 | 338,757 | 306,644 | ||||||||

Cost of revenue: | |||||||||||

Cost of license revenue | 12,563 | 12,347 | 12,114 | ||||||||

Cost of support and cloud services revenue | 31,197 | 30,630 | 34,502 | ||||||||

Total cost of software revenue | 43,760 | 42,977 | 46,616 | ||||||||

Cost of professional services revenue | 33,592 | 32,219 | 36,419 | ||||||||

Total cost of revenue (2) | 77,352 | 75,196 | 83,035 | ||||||||

Gross margin | 257,337 | 263,561 | 223,609 | ||||||||

Operating expenses: | |||||||||||

Sales and marketing (3) | 104,218 | 107,304 | 99,375 | ||||||||

Research and development | 60,782 | 60,782 | 63,972 | ||||||||

General and administrative | 37,864 | 37,864 | 35,020 | ||||||||

Amortization of acquired intangible assets | 5,936 | 5,936 | 7,821 | ||||||||

Restructuring and other charges, net | 18,493 | 18,493 | 105 | ||||||||

Total operating expenses | 227,293 | 230,379 | 206,293 | ||||||||

Operating income | 30,044 | 33,182 | 17,316 | ||||||||

Interest expense | (10,276 | ) | (10,276 | ) | (10,047 | ) | |||||

Other income (expense), net | 655 | 548 | (798 | ) | |||||||

Income before income taxes | 20,423 | 23,454 | 6,471 | ||||||||

Provision (benefit) for income taxes (4) | (562 | ) | 4,206 | (7,406 | ) | ||||||

Net income | $ | 20,985 | $ | 19,248 | $ | 13,877 | |||||

(1) | The reduction in license revenue and increase in support revenue is a result of the support component of subscription licenses which is included in license revenue under ASC 605. Additionally, license revenue decreased by approximately $65 million as a result of the revenue recorded to accumulated deficit, which would have been recognized during the quarter, partially offset by approximately $59 million of upfront license revenue recognition on new and renewal bookings. |

(2) Cost of revenue under ASC 606 is higher under ASC 606 due to the treatment of deferred professional services costs under the new accounting guidance, partially offset by the timing of revenue recognition under ASC 606 resulting in lower associated royalty costs.

(3) Sales and marketing costs are lower under ASC 606 due to the amortization of commissions costs capitalized upon adoption of ASC 606, offset by the deferral of ongoing commission expenses under the new accounting guidance.

(4) The benefit for income taxes under ASC 606 includes indirect effects of the adoption.

3. Restructuring and Other Charges

Restructuring and other charges, net includes restructuring charges (credits) and headquarters relocation charges.

Restructuring Charges (Credits)

In October 2018, we initiated a restructuring plan to realign our workforce to shift investment to support Industrial Internet of Things and Augmented Reality strategic high growth opportunities. As this is a realignment of resources rather than a cost-savings initiative, we do not expect this realignment to result in significant cost savings. The restructuring plan was completed in the first quarter of 2019 and resulted in restructuring charges of $16.3 million for termination benefits associated with approximately 240

13

employees, substantially all of which we expect will be paid in fiscal 2019. We also recorded $0.3 million of charges related to prior restructuring actions.

The following table summarizes restructuring accrual activity for the three months ended December 29, 2018:

Employee severance and related benefits | Facility closures and related costs | Total | |||||||||

(in thousands) | |||||||||||

October 1, 2018 | $ | — | $ | 2,415 | $ | 2,415 | |||||

Charges to operations, net | 16,343 | 243 | 16,586 | ||||||||

Cash disbursements | (8,019 | ) | (264 | ) | (8,283 | ) | |||||

Foreign exchange impact | 32 | (59 | ) | (27 | ) | ||||||

Accrual, December 29, 2018 | $ | 8,356 | $ | 2,335 | $ | 10,691 | |||||

The following table summarizes restructuring accrual activity for the three months ended December 30, 2017:

Employee severance and related benefits | Facility closures and related costs | Total | |||||||||

(in thousands) | |||||||||||

October 1, 2017 | $ | 1,736 | $ | 4,508 | $ | 6,244 | |||||

Charges (credit) to operations, net | (212 | ) | 317 | 105 | |||||||

Cash disbursements | (198 | ) | (537 | ) | (735 | ) | |||||

Foreign exchange impact | 17 | (18 | ) | (1 | ) | ||||||

Accrual, December 30, 2017 | $ | 1,343 | $ | 4,270 | $ | 5,613 | |||||

Of the accrual for facility closures and related costs, as of December 29, 2018, $1.3 million is included in accrued expenses and other current liabilities and $1.0 million is included in other liabilities in the Consolidated Balance Sheets. The accrual for facility closures is net of assumed sublease income of $1.9 million. The accrual for employee severance and related benefits is included in accrued compensation and benefits in the Consolidated Balance Sheets.

Of the accrual for facility closures and related costs, as of December 30, 2017 $2.2 million is included in accrued expenses and other current liabilities and $2.1 million is included in other liabilities in the Consolidated Balance Sheets.

Other - Headquarters Relocation Charges

Headquarters relocation charges represent accelerated depreciation expense associated with exiting our Needham headquarters facility and relocating to our new worldwide headquarters in the Boston Seaport District, which occurred in January 2019. Because our prior headquarters lease will not expire until November 2022, we are seeking to sublease that space, but have not yet done so. As a result, we will bear overlapping rent obligations for those premises and, in the second quarter of 2019, we expect to incur a restructuring charge of approximately $24 million, based on the net present value of remaining lease commitments net of estimated sublease income. From a cash perspective, the free rent and estimated sublease income on the Seaport headquarters total approximately $30 million, as compared to the estimated cash outflows of $29 million on the prior headquarters (rent obligations and operating expenses net of estimated sublease income). Restructuring charges could increase and estimated cash outflows could increase if we are unable to sublease our prior headquarters as we expect. Additionally, we will incur other costs associated with the move which will be recorded as incurred. In the first quarter of 2019 we recorded $1.9 million of accelerated depreciation expense related to shortening the estimated useful lives of leasehold improvements related to the Needham location.

4. Stock-based Compensation

Our equity incentive plan provides for grants of nonqualified and incentive stock options, common stock, restricted stock, restricted stock units (RSUs) and stock appreciation rights to employees, directors, officers and consultants. We award RSUs as the principal equity incentive awards, including performance-based awards that are earned based on achievement of performance criteria established

14

by the Compensation Committee of our Board of Directors. Each RSU represents the contingent right to receive one share of our common stock.

We measure the cost of employee services received in exchange for RSU awards based on the fair value of RSU awards on the date of grant. That cost is recognized over the period during which an employee is required to provide service in exchange for the award. We account for forfeitures as they occur, rather than estimate expected forfeitures.

Our employee stock purchase plan (ESPP), initiated in the fourth quarter of 2016, allows eligible employees to contribute up to 10% of their base salary, up to a maximum of $25,000 per year and subject to other plan limitations, toward the purchase of our common stock at a discounted price. The purchase price of the shares on each purchase date is equal to 85% of the lower of the fair market value of our common stock on the first and last trading days of each offering period. The ESPP is qualified under Section 423 of the Internal Revenue Code. We estimate the fair value of each purchase right under the ESPP on the date of grant using the Black-Scholes option valuation model and use the straight-line attribution approach to record the expense over the six-month offering period.

Restricted stock unit activity for the three months ended December 29, 2018 | Shares | Weighted Average Grant Date Fair Value (Per Share) | ||||

(in thousands) | ||||||

Balance of outstanding restricted stock units October 1, 2018 | 3,284 | $ | 65.93 | |||

Granted (1) | 979 | $ | 81.34 | |||

Vested | (1,056 | ) | $ | 53.40 | ||

Forfeited or not earned | (266 | ) | $ | 63.60 | ||

Balance of outstanding restricted stock units December 29, 2018 | 2,941 | $ | 75.85 | |||

_________________

(1) Restricted stock granted includes 141,000 shares from prior period TSR awards that were earned upon achievement of the performance criteria and vested in November 2018.

Restricted Stock Units | |||

Grant Period | Performance-based RSUs (1) | Service-based RSUs (2) | |

(Number of Units in thousands) | |||

First three months of 2019 | 344 | 494 | |

_________________

(1) | Substantially all the performance-based RSUs were granted to our executive officers. Approximately 145,000 shares are eligible to vest based upon annual performance measures over a three-year period. RSUs not earned for a period may be earned in the third period. To the extent earned, those performance-based RSUs will vest in three substantially equal installments on November 15, 2019, November 15, 2020 and November 15, 2021, or the date the Compensation Committee determines the extent to which the applicable performance criteria have been achieved for each performance period. An additional 199,000 performance-based RSU's are eligible to vest based upon a 2019 performance measure, which RSUs will be forfeited to the extend the performance measure is not achieved. These RSUs will vest, to the extent earned, in three substantially equal installments on November 15, 2019, 2020 and 2021. |

(2) | The service-based RSUs were granted to employees, including our executive officers. Substantially all service-based RSUs will vest in three substantially equal annual installments on or about the anniversary of the date of grant. |

Compensation expense recorded for our stock-based awards was classified in our Consolidated Statements of Operations as follows:

15

Three months ended | |||||||

December 29, 2018 | December 30, 2017 | ||||||

(in thousands) | |||||||

Cost of license revenue | $ | 322 | $ | (90 | ) | ||

Cost of support and cloud services revenue | 975 | 1,311 | |||||

Cost of professional services revenue | 1,814 | 1,706 | |||||

Sales and marketing | 9,722 | 4,879 | |||||

Research and development | 4,900 | 2,960 | |||||

General and administrative | 11,674 | 7,565 | |||||

Total stock-based compensation expense | $ | 29,407 | $ | 18,331 | |||

Stock-based compensation expense in the first quarter of 2019 and 2018 includes $1.3 million and $1.1 million, respectively, related to the ESPP.

5. Earnings per Share (EPS) and Common Stock

EPS

Basic EPS is calculated by dividing net income by the weighted average number of shares outstanding during the period. Diluted EPS is calculated by dividing net income by the weighted average number of shares outstanding plus the dilutive effect, if any, of outstanding RSUs using the treasury stock method. The calculation of the dilutive effect of outstanding equity awards under the treasury stock method includes consideration of unrecognized compensation expense as additional proceeds.

Three months ended | |||||||

Calculation of Basic and Diluted EPS | December 29, 2018 | December 30, 2017 | |||||

(in thousands, except per share data) | |||||||

Net income | $ | 20,985 | $ | 13,877 | |||

Weighted average shares outstanding—Basic | 118,323 | 115,731 | |||||

Dilutive effect of restricted stock units | 1,315 | 1,925 | |||||

Weighted average shares outstanding—Diluted | 119,638 | 117,656 | |||||

Earnings per share—Basic | $ | 0.18 | $ | 0.12 | |||

Earnings per share—Diluted | $ | 0.18 | $ | 0.12 | |||

There were no antidilutive shares for the three months ended December 29, 2018 and 0.3 million of antidilutive shares for the three months ended December 30, 2017.

Common Stock Repurchases

Our Articles of Organization authorize us to issue up to 500 million shares of our common stock.

Our Board of Directors has authorized us to repurchase up to $1,500 million of our common stock in the period October 1, 2017 through September 30, 2020. We did not repurchase any shares in the first quarter of either 2019 or 2018, but resumed repurchases in the second quarter of 2019 as described in Note 15. Subsequent Events. All shares of our common stock repurchased are automatically restored to the status of authorized and unissued.

6. Acquisitions

Acquisition-related costs in the first quarter of 2019 totaled $0.4 million, compared to less than $0.1 million in the first quarter of 2018. Acquisition-related costs include direct costs of potential and completed acquisitions (e.g., investment banker fees and professional fees, including legal and valuation services) and expenses related to acquisition integration activities (e.g., professional fees and severance). In addition, subsequent adjustments to our initial estimated amount of contingent consideration associated with specific acquisitions are included within acquisition-related charges. These costs are

16

classified in general and administrative expenses in the accompanying Consolidated Statements of Operations.

Frustum

On November 19, 2018, we acquired Frustum Inc. for $69.6 million (net of cash acquired of $0.7 million). We financed the acquisition with borrowings under our credit facility. Frustum is engaged in next-generation computer-aided design, including generative design, an approach that leverages artificial intelligence to generate design options. At the time of the acquisition, Frustum had approximately 12 employees and historical annualized revenues were not material. We do not expect the acquisition to add material revenue in fiscal 2019.

The acquisition of Frustum has been accounted for as a business combination. Assets acquired and liabilities assumed have been recorded at their estimated fair values as of the acquisition date. The fair values of intangible assets were based on valuations using a discounted cash flow model which requires the use of significant estimates and assumptions, including estimating future revenues and costs. The excess of the purchase price over the tangible assets, identifiable intangible assets and assumed liabilities was recorded as goodwill.

The purchase price allocation resulted in $53.8 million of goodwill, $17.9 million of purchased software and $2.1 million of other net liabilities. The acquired technology is being amortized over a useful life of 15 years based on the expected benefit pattern of the assets. The acquired goodwill was allocated to our software products segment and will not be deductible for income tax purposes. The resulting amount of goodwill reflects the expected value that will be created by integrating Frustum generative design technology into our CAD solutions.

7. Goodwill and Intangible Assets

We have two operating and reportable segments: (1) Software Products and (2) Professional Services. We assess goodwill for impairment at the reporting unit level. Our reporting units are determined based on the components of our operating segments that constitute a business for which discrete financial information is available and for which operating results are regularly reviewed by segment management. Our reporting units are the same as our operating segments.

As of December 29, 2018, goodwill and acquired intangible assets in the aggregate attributable to our Software Products segment was $1,405.9 million and our Professional Services segment was $30.1 million. As of September 30, 2018, goodwill and acquired intangible assets in the aggregate attributable to our Software Products segment was $1,352.4 million and our Professional Services segment was $30.2 million. Acquired intangible assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying value of the asset may not be recoverable.

We completed our annual goodwill impairment review as of June 30, 2018 based on a qualitative assessment. Our qualitative assessment included company specific (financial performance and long-range plans), industry, and macroeconomic factors, and consideration of the fair value of each reporting unit relative to its carrying value at the last valuation date. Based on our qualitative assessment, we believe it is more likely than not that the fair values of our reporting units exceed their carrying values and no further impairment testing is required.

17

Goodwill and acquired intangible assets consisted of the following:

December 29, 2018 | September 30, 2018 | ||||||||||||||||||||||

Gross Carrying Amount | Accumulated Amortization | Net Book Value | Gross Carrying Amount | Accumulated Amortization | Net Book Value | ||||||||||||||||||

(in thousands) | |||||||||||||||||||||||

Goodwill (not amortized) | $ | 1,230,901 | $ | 1,182,457 | |||||||||||||||||||

Intangible assets with finite lives (amortized) (1): | |||||||||||||||||||||||

Purchased software | $ | 379,653 | $ | 259,850 | $ | 119,803 | $ | 362,679 | $ | 254,059 | $ | 108,620 | |||||||||||

Capitalized software | 22,877 | 22,877 | — | 22,877 | 22,877 | — | |||||||||||||||||

Customer lists and relationships | 355,412 | 274,239 | 81,173 | 357,586 | 270,272 | 87,314 | |||||||||||||||||

Trademarks and trade names | 18,987 | 14,879 | 4,108 | 19,054 | 14,786 | 4,268 | |||||||||||||||||

Other | 3,981 | 3,981 | — | 4,003 | 4,003 | — | |||||||||||||||||

$ | 780,910 | $ | 575,826 | $ | 205,084 | $ | 766,199 | $ | 565,997 | $ | 200,202 | ||||||||||||

Total goodwill and acquired intangible assets | $ | 1,435,985 | $ | 1,382,659 | |||||||||||||||||||

(1) The weighted-average useful lives of purchased software, customer lists and relationships, and trademarks and trade names with a remaining net book value are 10 years, 10 years, and 11 years, respectively.

Goodwill

Changes in goodwill presented by reportable segments were as follows:

Software Products | Professional Services | Total | |||||||||

(in thousands) | |||||||||||

Balance, October 1, 2018 | $ | 1,152,720 | $ | 29,737 | $ | 1,182,457 | |||||

Frustum acquisition | 53,777 | — | 53,777 | ||||||||

Foreign currency translation adjustment | (5,199 | ) | (134 | ) | (5,333 | ) | |||||

Balance, December 29, 2018 | $ | 1,201,298 | $ | 29,603 | $ | 1,230,901 | |||||

Amortization of Intangible Assets

The aggregate amortization expense for intangible assets with finite lives was classified in our Consolidated Statements of Operations as follows:

Three months ended | |||||||

December 29, 2018 | December 30, 2017 | ||||||

(in thousands) | |||||||

Amortization of acquired intangible assets | $ | 5,936 | $ | 7,821 | |||

Cost of license revenue | 6,717 | 6,675 | |||||

Total amortization expense | $ | 12,653 | $ | 14,496 | |||

18

8. Fair Value Measurements

Fair value is defined as the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. When determining the fair value measurements for assets and liabilities required to be recorded at fair value, we consider the principal or most advantageous market in which we would transact and consider assumptions that market participants would use when pricing the asset or liability, such as inherent risk, transfer restrictions, and risk of nonperformance. GAAP prescribes a fair value hierarchy that requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. Three levels of inputs that may be used to measure fair value:

• | Level 1: quoted prices (unadjusted) in active markets for identical assets or liabilities; |

• | Level 2: inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices in active markets for similar assets or liabilities, quoted prices for identical or similar assets or liabilities in markets that are not active, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities; or |

• | Level 3: unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. |

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement.

Money market funds, time deposits and corporate notes/bonds are classified within Level 1 of the fair value hierarchy because they are valued based on quoted market prices in active markets.

Certificates of deposit, commercial paper and certain U.S. government agency securities are classified within Level 2 of the fair value hierarchy. These instruments are valued based on quoted prices in markets that are not active or based on other observable inputs consisting of market yields, reported trades and broker/dealer quotes.

The principal market in which we execute our foreign currency contracts is the institutional market in an over-the-counter environment with a relatively high level of price transparency. The market participants usually are large financial institutions. Our foreign currency contracts’ valuation inputs are based on quoted prices and quoted pricing intervals from public data sources and do not involve management judgment. These contracts are typically classified within Level 2 of the fair value hierarchy.

The fair value of our contingent consideration arrangements is determined based on our evaluation of the probability and amount of any earn-out that will be achieved based on expected future performances by the acquired entities. These arrangements are classified within Level 3 of the fair value hierarchy.

19

Our significant financial assets and liabilities measured at fair value on a recurring basis as of December 29, 2018 and September 30, 2018 were as follows:

December 29, 2018 | |||||||||||||||

Level 1 | Level 2 | Level 3 | Total | ||||||||||||

(in thousands) | |||||||||||||||

Financial assets: | |||||||||||||||

Cash equivalents | $ | 89,023 | $ | — | $ | — | $ | 89,023 | |||||||

Marketable securities | |||||||||||||||

Certificates of deposit | — | 220 | — | 220 | |||||||||||

Commercial paper | — | 1,956 | — | 1,956 | |||||||||||

Corporate notes/bonds | 52,480 | — | — | 52,480 | |||||||||||

U.S. government agency securities | — | 995 | — | 995 | |||||||||||

Forward contracts | — | 1,216 | — | 1,216 | |||||||||||

$ | 141,503 | $ | 4,387 | $ | — | $ | 145,890 | ||||||||

Financial liabilities: | |||||||||||||||

Contingent consideration related to acquisitions | $ | — | $ | — | $ | — | $ | — | |||||||

Forward contracts | — | 584 | — | 584 | |||||||||||

$ | — | $ | 584 | $ | — | $ | 584 | ||||||||

September 30, 2018 | |||||||||||||||

Level 1 | Level 2 | Level 3 | Total | ||||||||||||

(in thousands) | |||||||||||||||

Financial assets: | |||||||||||||||

Cash equivalents | $ | 93,058 | $ | — | $ | — | $ | 93,058 | |||||||

Marketable securities | |||||||||||||||

Certificates of deposit | — | 219 | — | 219 | |||||||||||

Corporate notes/bonds | 54,737 | — | — | 54,737 | |||||||||||

U.S. government agency securities | — | 995 | — | 995 | |||||||||||

Forward contracts | — | 2,889 | — | 2,889 | |||||||||||

$ | 147,795 | $ | 4,103 | $ | — | $ | 151,898 | ||||||||

Financial liabilities: | |||||||||||||||

Contingent consideration related to acquisitions | $ | — | $ | — | $ | 1,575 | $ | 1,575 | |||||||

Forward contracts | — | 3,419 | — | 3,419 | |||||||||||

$ | — | $ | 3,419 | $ | 1,575 | $ | 4,994 | ||||||||

Changes in the fair value of Level 3 contingent consideration liability associated with our acquisitions were as follows:

Contingent Consideration | |||

(in thousands) | |||

Other | |||

Balance, October 1, 2018 | $ | 1,575 | |

Payment of contingent consideration | (1,575 | ) | |

Balance, December 29, 2018 | $ | — | |

20

Contingent Consideration | |||

(in thousands) | |||

Kepware | |||

Balance, October 1, 2017 | $ | 8,400 | |

Payment of contingent consideration | (3,757 | ) | |

Balance, December 30, 2017 | $ | 4,643 | |

In the Consolidated Balance Sheet as of December 29, 2018, there is no accrued contingent consideration. In the Consolidated Balance Sheet as of December 30, 2017, there was $4.6 million of the contingent consideration liability included in accrued expenses and other current liabilities.

Of the $1.6 million payments in the first three months of 2019, $1.6 million represents the fair value of the liabilities recorded at the acquisition date and is included in financing activities in the Consolidated Statements of Cash Flows. Of the $3.8 million payments in the first three months of 2018, $3.2 million represents the fair value of the liabilities recorded at the acquisition date and is included in financing activities in the Consolidated Statements of Cash Flows.

9. Marketable Securities

The amortized cost and fair value of marketable securities as of December 29, 2018 and September 30, 2018 were as follows:

December 29, 2018 | |||||||||||||||

Amortized cost | Gross unrealized gains | Gross unrealized losses | Fair value | ||||||||||||

(in thousands) | |||||||||||||||

Certificates of deposit | $ | 221 | $ | — | $ | (1 | ) | $ | 220 | ||||||

Commercial paper | 1,961 | — | (5 | ) | 1,956 | ||||||||||

Corporate notes/bonds | 52,868 | 6 | (394 | ) | 52,480 | ||||||||||

U.S. government agency securities | 1,000 | — | (5 | ) | 995 | ||||||||||

$ | 56,050 | $ | 6 | $ | (405 | ) | $ | 55,651 | |||||||

September 30, 2018 | |||||||||||||||

Amortized cost | Gross unrealized gains | Gross unrealized losses | Fair value | ||||||||||||

(in thousands) | |||||||||||||||

Certificates of deposit | $ | 220 | $ | — | $ | (1 | ) | $ | 219 | ||||||

Corporate notes/bonds | 55,140 | — | (403 | ) | 54,737 | ||||||||||

U.S. government agency securities | 1,004 | — | (9 | ) | 995 | ||||||||||

$ | 56,364 | $ | — | $ | (413 | ) | $ | 55,951 | |||||||

Our investment portfolio consists of certificates of deposit, commercial paper, corporate notes/bonds and government securities that have a maximum maturity of two years. The longer the duration of these securities, the more susceptible they are to changes in market interest rates and bond yields. All unrealized losses are due to changes in market interest rates, bond yields and/or credit ratings.

We review our investments to identify and evaluate investments that have an indication of possible impairment. We concluded that, at December 29, 2018, the unrealized losses were temporary. The following tables summarize the fair value and gross unrealized losses aggregated by category and the length of time that individual securities have been in a continuous unrealized loss position as of

December 29, 2018 and September 30, 2018.

December 29, 2018 | |||||||||||||||||||||||

Less than twelve months | Greater than twelve months | Total | |||||||||||||||||||||

Fair Value | Gross unrealized loss | Fair Value | Gross unrealized loss | Fair Value | Gross unrealized loss | ||||||||||||||||||

(in thousands) | |||||||||||||||||||||||

Certificates of deposit | $ | — | $ | — | $ | 220 | $ | (1 | ) | $ | 220 | $ | (1 | ) | |||||||||

Commercial paper | 1,956 | (5 | ) | — | — | 1,956 | (5 | ) | |||||||||||||||

Corporate notes/bonds | 22,303 | (119 | ) | 27,695 | (275 | ) | 49,998 | (394 | ) | ||||||||||||||

U.S. government agency securities | — | — | 995 | (5 | ) | 995 | (5 | ) | |||||||||||||||

$ | 24,259 | $ | (124 | ) | $ | 28,910 | $ | (281 | ) | $ | 53,169 | $ | (405 | ) | |||||||||

September 30, 2018 | |||||||||||||||||||||||

Less than twelve months | Greater than twelve months | Total | |||||||||||||||||||||

Fair Value | Gross unrealized loss | Fair Value | Gross unrealized loss | Fair Value | Gross unrealized loss | ||||||||||||||||||

(in thousands) | |||||||||||||||||||||||

Certificates of deposit | $ | 219 | $ | (1 | ) | $ | — | $ | — | $ | 219 | $ | (1 | ) | |||||||||

Corporate notes/bonds | 24,067 | (70 | ) | 30,670 | (333 | ) | 54,737 | (403 | ) | ||||||||||||||

U.S. government agency securities | — | — | 995 | (9 | ) | 995 | (9 | ) | |||||||||||||||

$ | 24,286 | $ | (71 | ) | $ | 31,665 | $ | (342 | ) | $ | 55,951 | $ | (413 | ) | |||||||||

The following table presents our available-for-sale marketable securities by contractual maturity date as of December 29, 2018 and September 30, 2018.

December 29, 2018 | September 30, 2018 | ||||||||||||||

Amortized cost | Fair value | Amortized cost | Fair value | ||||||||||||

(in thousands) | (in thousands) | ||||||||||||||

Due in one year or less | $ | 25,544 | $ | 25,430 | $ | 25,792 | $ | 25,670 | |||||||

Due after one year through three years | 30,506 | 30,221 | 30,572 | 30,281 | |||||||||||

$ | 56,050 | $ | 55,651 | $ | 56,364 | $ | 55,951 | ||||||||

10. Derivative Financial Instruments

Our earnings and cash flows are subject to fluctuations due to changes in foreign currency exchange rates. Our most significant foreign currency exposures relate to Western European countries, Japan, China, Israel, India and Canada. Our foreign currency risk management strategy is principally designed to mitigate the future potential financial impact of changes in the U.S. Dollar value of anticipated transactions and balances denominated in foreign currency, resulting from changes in foreign currency exchange rates. We enter into derivative transactions, specifically foreign currency forward contracts, to manage the exposures to foreign currency exchange risk to reduce earnings volatility. We do not enter into derivatives transactions for trading or speculative purposes.

Non-Designated Hedges

We hedge our net foreign currency monetary assets and liabilities primarily resulting from foreign currency denominated receivables and payables with foreign exchange forward contracts to reduce the risk that our earnings and cash flows will be adversely affected by changes in foreign currency exchange rates. These contracts have maturities of up to approximately three months. Generally, we do not designate these foreign currency forward contracts as hedges for accounting purposes and changes in the fair value of these instruments are recognized immediately in earnings. Because we enter into forward contracts only as an economic hedge, any gain or loss on the underlying foreign-denominated

21

balance would be offset by the loss or gain on the forward contract. Gains and losses on forward contracts and foreign denominated receivables and payables are included in interest income and other expense, net.

As of December 29, 2018 and September 30, 2018, we had outstanding forward contracts with notional amounts equivalent to the following:

Currency Hedged | December 29, 2018 | September 30, 2018 | |||||

(in thousands) | |||||||

Canadian / U.S. Dollar | 7,195 | 7,334 | |||||

Euro / U.S. Dollar | 249,703 | 297,730 | |||||

British Pound / U.S. Dollar | 7,616 | 7,074 | |||||

Israeli Sheqel / U.S. Dollar | 7,424 | 9,778 | |||||

Japanese Yen / U.S. Dollar | 27,810 | 37,456 | |||||

Swiss Franc / U.S. Dollar | 12,875 | 11,944 | |||||

Danish Kroner/ U.S. Dollar | 3,067 | 1,902 | |||||

Swedish Kronor / U.S. Dollar | 13,562 | 18,207 | |||||

Chinese Renminbi / U.S. Dollar | 8,981 | 9,010 | |||||

All other | 9,282 | 5,521 | |||||

Total | $ | 347,515 | $ | 405,956 | |||

The following table shows the effect of our non-designated hedges in the Consolidated Statements of Operations for the three months ended December 29, 2018 and December 30, 2017:

Derivatives Not Designated as Hedging Instruments | Location of Gain or (Loss) Recognized in Income | Net realized and unrealized gain or (loss) (excluding the underlying foreign currency exposure being hedged) | ||||||||

Three months ended | ||||||||||

December 29, 2018 | December 30, 2017 | |||||||||

(in thousands) | ||||||||||

Forward Contracts | Interest income and other expense, net | $ | (987 | ) | $ | 587 | ||||

In the three months ended December 29, 2018 and December 30, 2017, foreign currency losses, net were $0.2 million and $1.5 million, respectively.

Cash Flow Hedges

Our foreign exchange risk management program objective is to identify foreign exchange exposures and implement appropriate hedging strategies to minimize earnings fluctuations resulting from foreign exchange rate movements. We designate certain foreign exchange forward contracts as cash flow hedges of Euro, Yen and SEK denominated intercompany forecasted revenue transactions (supported by third party sales). All foreign exchange forward contracts are carried at fair value on the Consolidated Balance Sheets and the maximum duration of foreign exchange forward contracts is 15 months.

Cash flow hedge relationships are designated at inception, and effectiveness is assessed prospectively and retrospectively using regression analysis monthly. As the forward contracts are highly effective in offsetting changes to future cash flows on the hedged transactions, we record the effective portion of changes in these cash flow hedges in accumulated other comprehensive income and subsequently reclassify it into earnings in the period during which the hedged transactions are recognized in earnings. Changes in the fair value of foreign exchange forward contracts due to changes in time value are included in the assessment of effectiveness. Our derivatives are not subject to any credit contingent features. We manage credit risk with counterparties by trading among several counterparties and we review our counterparties’ credit at least quarterly.

22

As of December 29, 2018 and September 30, 2018, we had outstanding forward contracts designated as cash flow hedges with notional amounts equivalent to the following:

Currency Hedged | December 29, 2018 | September 30, 2018 | |||||

(in thousands) | |||||||

Euro / U.S. Dollar | $ | — | $ | 8,495 | |||

Japanese Yen / U.S. Dollar | — | 2,193 | |||||

Swedish Kronor / U.S. Dollar | — | 1,708 | |||||