Credit and counterparty risk. The issuer or guarantor of a fixed-income security, the counterparty to an over-the-counter derivatives contract, or a borrower of fund securities may not make timely payments or otherwise honor its obligations. A downgrade or default affecting any of the fund’s securities could affect the fund’s performance.

Economic and market events risk. Events in the U.S. and global financial markets, including actions taken by the U.S. Federal Reserve or foreign central banks to stimulate or stabilize economic growth, may at times result in unusually high market volatility, which could negatively impact performance. Reduced liquidity in credit and fixed-income markets could adversely affect issuers worldwide. Banks and financial services companies could suffer losses if interest rates rise or economic conditions deteriorate.

Fixed-income securities risk. A rise in interest rates typically causes bond prices to fall. The longer the average maturity or duration of the bonds held by a fund, the more sensitive it will likely be to interest-rate fluctuations. An issuer may not make all interest payments or repay all or any of the principal borrowed. Changes in a security’s credit quality may adversely affect fund performance.

Hedging, derivatives, and other strategic transactions risk. Hedging, derivatives, and other strategic transactions may increase a fund’s volatility and could produce disproportionate losses, potentially more than the fund’s principal investment. Risks of these transactions are different from and possibly greater than risks of investing directly in securities and other traditional instruments. Under certain market conditions, derivatives could become harder to value or sell and may become subject to liquidity risk (i.e., the inability to enter into closing transactions). Derivatives and other strategic transactions that the fund intends to utilize include: futures contracts; inverse floating-rate securities; options on futures; and options. Futures contracts and options generally are subject to counterparty risk.

High portfolio turnover risk. Trading securities actively and frequently can increase transaction costs (thus lowering performance) and taxable distributions.

Liquidity risk. The extent (if at all) to which a security may be sold or a derivative position closed without negatively impacting its market value may be impaired by reduced market activity or participation, legal restrictions, or other economic and market impediments. Liquidity risk may be magnified in rising interest rate environments due to higher than normal redemption rates. Widespread selling of fixed-income securities to satisfy redemptions during periods of reduced demand may adversely impact the price or salability of such securities. Periods of heavy redemption could cause the fund to sell assets at a loss or depressed value, which could negatively affect performance. Redemption risk is heightened during periods of declining or illiquid markets. The secondary market for certain tax-exempt securities tends to be less well-developed or liquid than many other securities markets, which may result in increased volatility or liquidity risk.

Lower-rated and high-yield fixed-income securities risk. Lower-rated and high-yield fixed-income securities (junk bonds) are subject to greater credit quality risk, risk of default, and price volatility than higher-rated fixed-income securities, may be considered speculative, and can be difficult to resell.

Municipal bond risk. The prices of municipal bonds, including general obligation bonds, can decline if the issuer’s credit quality declines. Revenue bond prices can decline if related projects become unprofitable. An insured municipal bond is subject to the risk that the insurer may be unable to pay claims and is not insured with respect to the market value of the obligation. Municipal bond income could become taxable in the future. Investments in bonds subject to the alternative minimum tax may result in tax liability for shareholders.

Operational and cybersecurity risk. Cybersecurity breaches may allow an unauthorized party to gain access to fund assets, customer data, or proprietary information, or cause a fund or its service providers to suffer data corruption or lose operational functionality. Similar incidents affecting issuers of a fund’s securities may negatively impact performance. Operational risk may arise from human error, error by third parties, communication errors, or technology failures, among other causes.

Sector risk. When a fund focuses its investments in certain sectors of the economy, its performance may be driven largely by sector performance and could fluctuate more widely than if the fund were invested more evenly across sectors.

State/region risk. Investing heavily in any one state or region increases exposure to losses in that state or region. This risk is magnified for a fund that invests mainly in bonds from a single state. Factors that may affect performance include economic or political changes, tax base erosion, state constitutional limits on tax increases, budget deficits and other financial difficulties, and changes in credit ratings. At times, California has been more economically volatile than the United States as a whole. Puerto Rican municipal obligations, in which the fund may invest, may be subject to further devaluation due to adverse political, economic, and market conditions.

Tender option bonds risk. The fund’s participation in tender option bond transactions may increase volatility and/or reduce the fund’s returns. Tender option bond transactions create leverage. Leverage magnifies returns, both positive and negative, and risk by magnifying the volatility of returns. An investment in a tender option bond transaction typically involves greater risk than investing in the underlying municipal fixed rate bonds, including the risk of loss of principal.

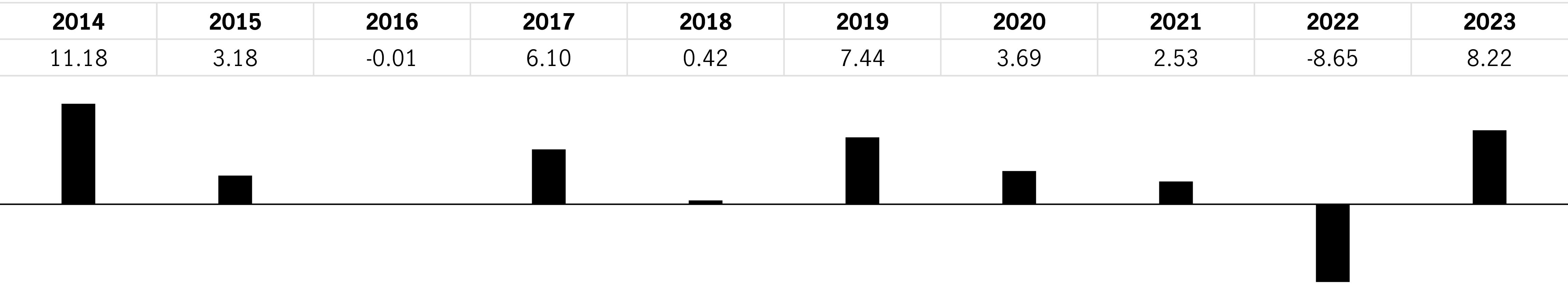

The following information illustrates the variability of the fund’s returns and provides some indication of the risks of investing in the fund by showing changes in the fund’s performance from year to year and by showing how the fund’s average annual returns compared with a broad-based securities