UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05912

MFS SPECIAL VALUE TRUST

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: October 31

Date of reporting period: April 30, 2021

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| Item 1(a): | |

|

|

1 |

|

|

2 |

|

|

4 |

|

|

4 |

|

|

5 |

|

|

21 |

|

|

22 |

|

|

23 |

|

|

24 |

|

|

26 |

|

|

36 |

|

|

37 |

|

|

37 |

|

|

37 |

|

|

37 |

|

|

back cover |

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. If none of the 3 rating agencies above assign a rating, but the security is rated by DBRS Morningstar, then the DBRS Morningstar rating is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. Not Rated includes fixed income securities and fixed income derivatives that have not been rated by any rating agency. Non-Fixed Income includes equity securities (including convertible bonds and equity derivatives) and/or commodity-linked derivatives. The fund may or may not have held all of these instruments on this date. The fund is not rated by these agencies. |

| (g) | The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and S&P Global Market Intelligence Inc. (“S&P Global Market Intelligence”). GICS is a service mark of MSCI and S&P Global Market Intelligence and has been licensed for use by MFS. MFS has applied its own internal sector/industry classification methodology for equity securities and non-equity securities that are unclassified by GICS. |

| (i) | For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts. |

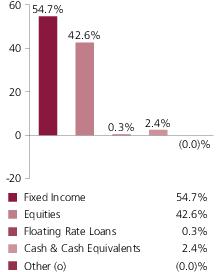

| (o) | Less than 0.1%. |

| Portfolio Manager | Primary Role | Since | Title and Five Year History |

| Ward Brown | Emerging Markets Debt Instruments Portfolio Manager | 2012 | Investment Officer of MFS; employed in the investment management area of MFS since 2005. |

| Katherine Cannan | Equity Securities Portfolio Manager | 2019 | Investment Officer of MFS; employed in the investment management area of MFS since 2013. |

| Nevin Chitkara | Equity Securities Portfolio Manager | 2012 | Investment Officer of MFS; employed in the investment management area of MFS since 1997. |

| David Cole | Below Investment Grade Debt Instruments Portfolio Manager | 2006 | Investment Officer of MFS; employed in the investment management area of MFS since 2004. |

| Matt Ryan | Emerging Markets Debt Instruments Portfolio Manager | 2012 | Investment Officer of MFS; employed in the investment management area of MFS since 1997. |

| Michael Skatrud | Below Investment Grade Debt Instruments Portfolio Manager | 2018 | Investment Officer of MFS; employed in the investment management area of MFS since 2013. |

| Issuer | Shares/Par | Value ($) | ||

| Bonds – 53.9% | ||||

| Aerospace & Defense – 1.0% | ||||

| Bombardier, Inc., 7.5%, 3/15/2025 (n) | $ | 96,000 | $ 95,820 | |

| Moog, Inc., 4.25%, 12/15/2027 (n) | 90,000 | 92,475 | ||

| TransDigm, Inc., 6.25%, 3/15/2026 (n) | 70,000 | 74,112 | ||

| TransDigm, Inc., 6.375%, 6/15/2026 | 40,000 | 41,475 | ||

| TransDigm, Inc., 5.5%, 11/15/2027 | 45,000 | 46,827 | ||

| TransDigm, Inc., 4.625%, 1/15/2029 (n) | 41,000 | 40,406 | ||

| $391,115 | ||||

| Airlines – 0.1% | ||||

| American Airlines, Inc./AAadvantage Loyalty IP Ltd., 5.5%, 4/20/2026 (n) | $ | 40,000 | $ 42,000 | |

| Automotive – 1.0% | ||||

| Dana, Inc., 5.5%, 12/15/2024 | $ | 5,000 | $ 5,102 | |

| Dana, Inc., 5.375%, 11/15/2027 | 46,000 | 48,966 | ||

| Dana, Inc., 5.625%, 6/15/2028 | 15,000 | 16,163 | ||

| Dana, Inc., 4.25%, 9/01/2030 | 25,000 | 25,250 | ||

| IAA Spinco, Inc., 5.5%, 6/15/2027 (n) | 85,000 | 89,356 | ||

| KAR Auction Services, Inc., 5.125%, 6/01/2025 (n) | 30,000 | 30,418 | ||

| Panther BR Aggregator 2 LP/Panther Finance Co., Inc., 8.5%, 5/15/2027 (n) | 80,000 | 86,400 | ||

| PM General Purchaser LLC, 9.5%, 10/01/2028 (n) | 30,000 | 33,075 | ||

| Real Hero Merger Sub 2, Inc., 6.25%, 2/01/2029 (n) | 30,000 | 31,036 | ||

| Wheel Pros, Inc., 6.5%, 5/15/2029 (n) | 30,000 | 30,041 | ||

| $395,807 | ||||

| Broadcasting – 1.4% | ||||

| Advantage Sales & Marketing, Inc., 6.5%, 11/15/2028 (n) | $ | 50,000 | $ 52,875 | |

| iHeartCommunications, Inc., 8.375%, 5/01/2027 | 55,000 | 59,015 | ||

| Netflix, Inc., 5.875%, 2/15/2025 | 90,000 | 104,063 | ||

| Netflix, Inc., 3.625%, 6/15/2025 (n) | 45,000 | 48,389 | ||

| Netflix, Inc., 5.875%, 11/15/2028 | 30,000 | 36,502 | ||

| Nexstar Broadcasting, Inc., 4.75%, 11/01/2028 (n) | 15,000 | 15,281 | ||

| Nexstar Escrow Corp., 5.625%, 7/15/2027 (n) | 75,000 | 79,219 | ||

| Scripps Escrow II, Inc., 5.875%, 7/15/2027 (n) | 50,000 | 52,611 | ||

| WMG Acquisition Corp., 3.875%, 7/15/2030 (n) | 135,000 | 136,687 | ||

| $584,642 | ||||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Brokerage & Asset Managers – 0.4% | ||||

| Aretec Escrow Issuer, Inc., 7.5%, 4/01/2029 (n) | $ | 25,000 | $ 25,617 | |

| LPL Holdings, Inc., 4.625%, 11/15/2027 (n) | 110,000 | 114,675 | ||

| LPL Holdings, Inc., 4%, 3/15/2029 (n) | 36,000 | 36,000 | ||

| $176,292 | ||||

| Building – 2.1% | ||||

| ABC Supply Co., Inc., 5.875%, 5/15/2026 (n) | $ | 60,000 | $ 61,908 | |

| ABC Supply Co., Inc., 4%, 1/15/2028 (n) | 90,000 | 91,350 | ||

| Core & Main LP, 8.625%, (8.625% cash or 9.375% PIK) 9/15/2024 (p) | 30,000 | 30,563 | ||

| Core & Main LP, 6.125%, 8/15/2025 (n) | 32,000 | 32,756 | ||

| CP Atlas Buyer, Inc., 7%, 12/01/2028 (n) | 39,000 | 40,447 | ||

| GYP Holding III Corp., 4.625%, 5/01/2029 (n) | 45,000 | 45,066 | ||

| Interface, Inc., 5.5%, 12/01/2028 (n) | 60,000 | 62,400 | ||

| LBM Acquisition LLC, 6.25%, 1/15/2029 (n) | 35,000 | 35,875 | ||

| New Enterprise Stone & Lime Co., Inc., 6.25%, 3/15/2026 (n) | 70,000 | 72,100 | ||

| New Enterprise Stone & Lime Co., Inc., 9.75%, 7/15/2028 (n) | 35,000 | 39,025 | ||

| Park River Holdings, Inc., 5.625%, 2/01/2029 (n) | 40,000 | 38,950 | ||

| Patrick Industries, Inc., 7.5%, 10/15/2027 (n) | 65,000 | 70,525 | ||

| Specialty Building Products Holdings LLC, 6.375%, 9/30/2026 (n) | 50,000 | 52,688 | ||

| SRM Escrow Issuer LLC, 6%, 11/01/2028 (n) | 50,000 | 52,992 | ||

| Standard Industries, Inc., 4.375%, 7/15/2030 (n) | 66,000 | 66,165 | ||

| Standard Industries, Inc., 3.375%, 1/15/2031 (n) | 10,000 | 9,373 | ||

| White Cap Buyer LLC, 6.875%, 10/15/2028 (n) | 40,000 | 42,450 | ||

| White Cap Parent LLC, 8.25%, (8.25% cash or 9% PIK) 3/15/2026 (p) | 20,000 | 20,750 | ||

| $865,383 | ||||

| Business Services – 0.8% | ||||

| Ascend Learning LLC, 6.875%, 8/01/2025 (n) | $ | 65,000 | $ 66,625 | |

| Austin BidCo, Inc., 7.125%, 12/15/2028 (n) | 30,000 | 30,450 | ||

| Iron Mountain, Inc., 5.25%, 3/15/2028 (n) | 25,000 | 26,225 | ||

| Iron Mountain, Inc., 5.25%, 7/15/2030 (n) | 30,000 | 31,163 | ||

| Iron Mountain, Inc., REIT, 4.875%, 9/15/2027 (n) | 55,000 | 57,200 | ||

| Switch, Ltd., 3.75%, 9/15/2028 (n) | 74,000 | 73,630 | ||

| Verscend Escrow Corp., 9.75%, 8/15/2026 (n) | 50,000 | 53,250 | ||

| $338,543 | ||||

| Cable TV – 4.1% | ||||

| CCO Holdings LLC, 4.25%, 2/01/2031 (n) | $ | 75,000 | $ 75,000 | |

| CCO Holdings LLC/CCO Holdings Capital Corp., 5.75%, 2/15/2026 (n) | 77,000 | 79,695 | ||

| CCO Holdings LLC/CCO Holdings Capital Corp., 5.875%, 5/01/2027 (n) | 105,000 | 108,380 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Cable TV – continued | ||||

| CCO Holdings LLC/CCO Holdings Capital Corp., 4.75%, 3/01/2030 (n) | $ | 165,000 | $ 172,219 | |

| CCO Holdings LLC/CCO Holdings Capital Corp., 4.5%, 8/15/2030 (n) | 50,000 | 50,869 | ||

| CSC Holdings LLC, 5.5%, 4/15/2027 (n) | 200,000 | 209,714 | ||

| DISH DBS Corp., 5.875%, 11/15/2024 | 65,000 | 70,321 | ||

| DISH DBS Corp., 7.75%, 7/01/2026 | 65,000 | 74,912 | ||

| Intelsat Jackson Holdings S.A., 5.5%, 8/01/2023 (a)(d) | 45,000 | 27,535 | ||

| Intelsat Jackson Holdings S.A., 9.75%, 7/15/2025 (a)(d)(n) | 30,000 | 18,702 | ||

| Sirius XM Holdings, Inc., 4.625%, 7/15/2024 (n) | 65,000 | 66,706 | ||

| Sirius XM Holdings, Inc., 5.5%, 7/01/2029 (n) | 125,000 | 135,078 | ||

| Telenet Finance Luxembourg S.A., 5.5%, 3/01/2028 (n) | 200,000 | 211,800 | ||

| Videotron Ltd., 5.375%, 6/15/2024 (n) | 25,000 | 27,508 | ||

| Videotron Ltd., 5.125%, 4/15/2027 (n) | 120,000 | 126,750 | ||

| Ziggo Bond Finance B.V., 5.125%, 2/28/2030 (n) | 200,000 | 204,840 | ||

| $1,660,029 | ||||

| Chemicals – 1.0% | ||||

| Axalta Coating Systems Ltd., 4.75%, 6/15/2027 (n) | $ | 150,000 | $ 157,125 | |

| Element Solutions, Inc., 3.875%, 9/01/2028 (n) | 65,000 | 64,838 | ||

| Ingevity Corp., 3.875%, 11/01/2028 (n) | 74,000 | 73,710 | ||

| Starfruit Finance Co./Starfruit U.S. Holding Co. LLC, 6.5%, 10/01/2026 (n) | EUR | 100,000 | 126,046 | |

| $421,719 | ||||

| Computer Software – 0.5% | ||||

| Camelot Finance S.A., 4.5%, 11/01/2026 (n) | $ | 95,000 | $ 98,325 | |

| PTC, Inc., 3.625%, 2/15/2025 (n) | 65,000 | 66,687 | ||

| PTC, Inc., 4%, 2/15/2028 (n) | 35,000 | 35,926 | ||

| $200,938 | ||||

| Computer Software - Systems – 0.8% | ||||

| Endurance International Group Holdings, Inc., 6%, 2/15/2029 (n) | $ | 30,000 | $ 28,725 | |

| Fair Isaac Corp., 5.25%, 5/15/2026 (n) | 130,000 | 144,300 | ||

| Fair Isaac Corp., 4%, 6/15/2028 (n) | 7,000 | 7,096 | ||

| SS&C Technologies Holdings, Inc., 5.5%, 9/30/2027 (n) | 95,000 | 100,926 | ||

| Twilio, Inc., 3.625%, 3/15/2029 | 45,000 | 45,859 | ||

| $326,906 | ||||

| Conglomerates – 2.2% | ||||

| Amsted Industries Co., 5.625%, 7/01/2027 (n) | $ | 85,000 | $ 90,100 | |

| BWX Technologies, Inc., 5.375%, 7/15/2026 (n) | 110,000 | 113,498 | ||

| BWX Technologies, Inc., 4.125%, 6/30/2028 (n) | 23,000 | 23,403 | ||

| BWX Technologies, Inc., 4.125%, 4/15/2029 (n) | 87,000 | 89,392 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Conglomerates – continued | ||||

| CFX Escrow Corp., 6.375%, 2/15/2026 (n) | $ | 52,000 | $ 55,120 | |

| EnerSys, 5%, 4/30/2023 (n) | 95,000 | 99,394 | ||

| EnerSys, 4.375%, 12/15/2027 (n) | 20,000 | 20,950 | ||

| Gates Global LLC, 6.25%, 1/15/2026 (n) | 75,000 | 78,522 | ||

| Granite Holdings U.S. Acquisition Co., 11%, 10/01/2027 (n) | 40,000 | 44,900 | ||

| Griffon Corp., 5.75%, 3/01/2028 | 75,000 | 80,062 | ||

| Stevens Holding Co., Inc., 6.125%, 10/01/2026 (n) | 65,000 | 69,875 | ||

| TriMas Corp., 4.125%, 4/15/2029 (n) | 140,000 | 139,649 | ||

| $904,865 | ||||

| Construction – 1.0% | ||||

| Empire Communities Corp., 7%, 12/15/2025 (n) | $ | 45,000 | $ 48,150 | |

| Mattamy Group Corp., 5.25%, 12/15/2027 (n) | 30,000 | 31,425 | ||

| Mattamy Group Corp., 4.625%, 3/01/2030 (n) | 55,000 | 55,550 | ||

| Shea Homes LP/Shea Homes Funding Corp., 4.75%, 2/15/2028 (n) | 65,000 | 66,137 | ||

| Taylor Morrison Communities, Inc., 5.125%, 8/01/2030 (n) | 30,000 | 33,044 | ||

| Toll Brothers Finance Corp., 4.875%, 11/15/2025 | 25,000 | 27,969 | ||

| Toll Brothers Finance Corp., 4.35%, 2/15/2028 | 50,000 | 55,000 | ||

| Weekley Homes LLC/Weekley Finance Corp., 4.875%, 9/15/2028 (n) | 74,000 | 76,405 | ||

| $393,680 | ||||

| Consumer Products – 0.7% | ||||

| Coty, Inc., 6.5%, 4/15/2026 (n) | $ | 50,000 | $ 50,312 | |

| Energizer Holdings, Inc., 4.375%, 3/31/2029 (n) | 50,000 | 49,625 | ||

| Mattel, Inc., 6.75%, 12/31/2025 (n) | 10,000 | 10,505 | ||

| Mattel, Inc., 3.375%, 4/01/2026 (n) | 46,000 | 47,620 | ||

| Mattel, Inc., 5.875%, 12/15/2027 (n) | 39,000 | 42,851 | ||

| Mattel, Inc., 5.45%, 11/01/2041 | 5,000 | 5,702 | ||

| Prestige Consumer Healthcare, Inc., 5.125%, 1/15/2028 (n) | 55,000 | 57,613 | ||

| Prestige Consumer Healthcare, Inc., 3.75%, 4/01/2031 (n) | 25,000 | 23,998 | ||

| $288,226 | ||||

| Consumer Services – 1.7% | ||||

| Allied Universal Holdco LLC, 6.625%, 7/15/2026 (n) | $ | 20,000 | $ 21,150 | |

| Allied Universal Holdco LLC, 9.75%, 7/15/2027 (n) | 50,000 | 54,875 | ||

| ANGI Group LLC, 3.875%, 8/15/2028 (n) | 65,000 | 64,594 | ||

| Arches Buyer, Inc., 6.125%, 12/01/2028 (n) | 45,000 | 46,125 | ||

| Frontdoor, Inc., 6.75%, 8/15/2026 (n) | 45,000 | 47,715 | ||

| Garda World Security Corp., 4.625%, 2/15/2027 (n) | 20,000 | 20,000 | ||

| GoDaddy, Inc., 3.5%, 3/01/2029 (n) | 38,000 | 37,005 | ||

| GW B-CR Security Corp., 9.5%, 11/01/2027 (n) | 44,000 | 48,510 | ||

| Match Group, Inc., 5%, 12/15/2027 (n) | 70,000 | 73,675 | ||

| Match Group, Inc., 4.625%, 6/01/2028 (n) | 65,000 | 67,112 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Consumer Services – continued | ||||

| Match Group, Inc., 4.125%, 8/01/2030 (n) | $ | 20,000 | $ 20,075 | |

| Realogy Group LLC, 9.375%, 4/01/2027 (n) | 70,000 | 78,225 | ||

| Realogy Group LLC, 5.75%, 1/15/2029 (n) | 20,000 | 20,750 | ||

| TriNet Group, Inc., 3.5%, 3/01/2029 (n) | 47,000 | 45,884 | ||

| WASH Multifamily Acquisition, Inc., 5.75%, 4/15/2026 (n) | 25,000 | 25,969 | ||

| $671,664 | ||||

| Containers – 1.2% | ||||

| Berry Global, Inc., 5.625%, 7/15/2027 (n) | $ | 30,000 | $ 31,950 | |

| Crown Americas LLC/Crown Americas Capital Corp. V, 4.25%, 9/30/2026 | 100,000 | 107,500 | ||

| Crown Americas LLC/Crown Americas Capital Corp. VI, 4.75%, 2/01/2026 | 40,000 | 41,520 | ||

| Flex Acquisition Co., Inc., 6.875%, 1/15/2025 (n) | 60,000 | 60,975 | ||

| Greif, Inc., 6.5%, 3/01/2027 (n) | 50,000 | 52,872 | ||

| Reynolds Group, 4%, 10/15/2027 (n) | 75,000 | 74,156 | ||

| Silgan Holdings, Inc., 4.75%, 3/15/2025 | 65,000 | 66,003 | ||

| Silgan Holdings, Inc., 4.125%, 2/01/2028 | 54,000 | 55,876 | ||

| $490,852 | ||||

| Electrical Equipment – 0.3% | ||||

| CommScope Technologies LLC, 6%, 6/15/2025 (n) | $ | 44,000 | $ 44,770 | |

| CommScope Technologies LLC, 5%, 3/15/2027 (n) | 60,000 | 59,441 | ||

| $104,211 | ||||

| Electronics – 1.2% | ||||

| Diebold Nixdorf, Inc., 8.5%, 4/15/2024 | $ | 15,000 | $ 15,319 | |

| Diebold Nixdorf, Inc., 9.375%, 7/15/2025 (n) | 35,000 | 38,981 | ||

| Entegris, Inc., 4.625%, 2/10/2026 (n) | 70,000 | 72,428 | ||

| Entegris, Inc., 4.375%, 4/15/2028 (n) | 30,000 | 31,538 | ||

| Entegris, Inc., 3.625%, 5/01/2029 (n) | 67,000 | 68,005 | ||

| Sensata Technologies B.V., 5.625%, 11/01/2024 (n) | 50,000 | 55,750 | ||

| Sensata Technologies B.V., 5%, 10/01/2025 (n) | 95,000 | 105,450 | ||

| Sensata Technologies, Inc., 4.375%, 2/15/2030 (n) | 30,000 | 31,365 | ||

| Synaptics, Inc., 4%, 6/15/2029 (n) | 60,000 | 60,030 | ||

| $478,866 | ||||

| Emerging Market Quasi-Sovereign – 0.8% | ||||

| Greenko Dutch B.V. (Republic of India), 3.85%, 3/29/2026 (n) | $ | 200,000 | $ 203,100 | |

| Petroleos Mexicanos, 6.49%, 1/23/2027 | 100,000 | 105,750 | ||

| $308,850 | ||||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Emerging Market Sovereign – 1.7% | ||||

| Arab Republic of Egypt, 6.588%, 2/21/2028 | $ | 200,000 | $ 208,488 | |

| Government of Ukraine, 7.75%, 9/01/2024 | 100,000 | 107,250 | ||

| Republic of Ecuador, 0%, 7/31/2030 (n) | 8,116 | 4,423 | ||

| Republic of Ecuador, 0.5%, 7/31/2030 (n) | 37,800 | 31,563 | ||

| Republic of Ecuador, 0.5%, 7/31/2035 (n) | 99,060 | 67,362 | ||

| Republic of Ecuador, 0.5%, 7/31/2040 (n) | 45,400 | 27,013 | ||

| Republic of Turkey, 5.75%, 3/22/2024 | 200,000 | 203,220 | ||

| Republic of Venezuela, 7%, 3/31/2038 (a)(d) | 203,000 | 20,808 | ||

| $670,127 | ||||

| Energy - Independent – 2.0% | ||||

| Apache Corp., 4.375%, 10/15/2028 | $ | 65,000 | $ 66,298 | |

| Apache Corp., 4.75%, 4/15/2043 | 30,000 | 29,790 | ||

| CNX Resources Corp., 6%, 1/15/2029 (n) | 40,000 | 42,692 | ||

| Encino Acquisition Partners Holdings LLC, 8.5%, 5/01/2028 (n) | 30,000 | 29,392 | ||

| EQT Corp., 5%, 1/15/2029 | 38,000 | 41,504 | ||

| Laredo Petroleum, Inc., 10.125%, 1/15/2028 | 35,000 | 36,048 | ||

| Leviathan Bond Ltd., 6.5%, 6/30/2027 (n) | 107,000 | 118,731 | ||

| Murphy Oil Corp., 6.875%, 8/15/2024 | 30,000 | 30,675 | ||

| Murphy Oil Corp., 5.875%, 12/01/2027 | 25,000 | 25,125 | ||

| Occidental Petroleum Corp., 5.875%, 9/01/2025 | 55,000 | 60,088 | ||

| Occidental Petroleum Corp., 5.5%, 12/01/2025 | 30,000 | 32,250 | ||

| Occidental Petroleum Corp., 6.45%, 9/15/2036 | 25,000 | 28,406 | ||

| Occidental Petroleum Corp., 6.6%, 3/15/2046 | 60,000 | 66,150 | ||

| Ovintiv, Inc., 6.5%, 8/15/2034 | 35,000 | 44,647 | ||

| Range Resources Corp., 9.25%, 2/01/2026 | 20,000 | 21,962 | ||

| Range Resources Corp., 8.25%, 1/15/2029 (n) | 35,000 | 37,967 | ||

| Southwestern Energy Co., 6.45%, 1/23/2025 | 34,900 | 37,692 | ||

| Southwestern Energy Co., 7.5%, 4/01/2026 | 42,900 | 45,375 | ||

| Southwestern Energy Co., 7.75%, 10/01/2027 | 10,000 | 10,749 | ||

| $805,541 | ||||

| Entertainment – 1.5% | ||||

| Boyne USA, Inc., 4.75%, 5/15/2029 (n) | $ | 70,000 | $ 71,925 | |

| Carnival Corp. PLC, 7.625%, 3/01/2026 (n) | 30,000 | 32,850 | ||

| Carnival Corp. PLC, 5.75%, 3/01/2027 (n) | 50,000 | 52,719 | ||

| Carnival Corp. PLC, 9.875%, 8/01/2027 (n) | 40,000 | 47,000 | ||

| Cedar Fair LP/Canada's Wonderland Co./Magnum Management Corp./Millennium Operations LLC, 5.5%, 5/01/2025 (n) | 20,000 | 20,952 | ||

| Cedar Fair LP/Canada's Wonderland Co./Magnum Management Corp./Millennium Operations LLC, 5.375%, 4/15/2027 | 35,000 | 36,024 | ||

| Live Nation Entertainment, Inc., 5.625%, 3/15/2026 (n) | 71,000 | 73,840 | ||

| Live Nation Entertainment, Inc., 4.75%, 10/15/2027 (n) | 20,000 | 20,181 | ||

| NCL Corp. Ltd., 3.625%, 12/15/2024 (n) | 25,000 | 23,998 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Entertainment – continued | ||||

| NCL Corp. Ltd., 10.25%, 2/01/2026 (n) | $ | 30,000 | $ 35,294 | |

| NCL Corp. Ltd., 5.875%, 3/15/2026 (n) | 25,000 | 26,125 | ||

| Royal Caribbean Cruises Ltd., 10.875%, 6/01/2023 (n) | 30,000 | 34,440 | ||

| Royal Caribbean Cruises Ltd., 5.5%, 4/01/2028 (n) | 45,000 | 47,192 | ||

| Six Flags Entertainment Corp., 4.875%, 7/31/2024 (n) | 50,000 | 50,312 | ||

| Six Flags Entertainment Corp., 7%, 7/01/2025 (n) | 25,000 | 27,009 | ||

| $599,861 | ||||

| Financial Institutions – 1.4% | ||||

| Avolon Holdings Funding Ltd., 5.125%, 10/01/2023 | $ | 45,000 | $ 48,378 | |

| Avolon Holdings Funding Ltd., 3.95%, 7/01/2024 (n) | 42,000 | 44,472 | ||

| Credit Acceptance Corp., 5.125%, 12/31/2024 (n) | 70,000 | 72,187 | ||

| Freedom Mortgage Corp., 7.625%, 5/01/2026 (n) | 45,000 | 46,912 | ||

| Global Aircraft Leasing Co. Ltd., 6.5%, (6.5% cash or 7.25% PIK) 9/15/2024 (p) | 144,266 | 144,266 | ||

| Nationstar Mortgage Holdings, Inc., 6%, 1/15/2027 (n) | 50,000 | 52,250 | ||

| OneMain Finance Corp., 6.875%, 3/15/2025 | 40,000 | 45,450 | ||

| OneMain Finance Corp., 8.875%, 6/01/2025 | 30,000 | 33,188 | ||

| OneMain Finance Corp., 7.125%, 3/15/2026 | 30,000 | 35,063 | ||

| Park Aerospace Holdings Ltd., 5.5%, 2/15/2024 (n) | 45,000 | 49,354 | ||

| $571,520 | ||||

| Food & Beverages – 1.9% | ||||

| Aramark Services, Inc., 6.375%, 5/01/2025 (n) | $ | 90,000 | $ 95,737 | |

| JBS USA LLC/JBS USA Finance, Inc., 6.75%, 2/15/2028 (n) | 110,000 | 121,539 | ||

| JBS USA Lux S.A./JBS USA Finance, Inc., 5.5%, 1/15/2030 (n) | 35,000 | 38,500 | ||

| Kraft Heinz Foods Co., 4.375%, 6/01/2046 | 95,000 | 101,812 | ||

| Lamb Weston Holdings, Inc., 4.625%, 11/01/2024 (n) | 100,000 | 103,750 | ||

| Lamb Weston Holdings, Inc., 4.875%, 5/15/2028 (n) | 11,000 | 12,128 | ||

| Performance Food Group Co., 5.5%, 10/15/2027 (n) | 65,000 | 68,500 | ||

| Post Holdings, Inc., 5.625%, 1/15/2028 (n) | 45,000 | 47,419 | ||

| Post Holdings, Inc., 4.625%, 4/15/2030 (n) | 45,000 | 45,450 | ||

| Primo Water Holding, Inc., 4.375%, 4/30/2029 (n) | 45,000 | 44,901 | ||

| U.S. Foods Holding Corp., 4.75%, 2/15/2029 (n) | 75,000 | 75,656 | ||

| $755,392 | ||||

| Gaming & Lodging – 2.4% | ||||

| Boyd Gaming Corp., 4.75%, 12/01/2027 | $ | 40,000 | $ 41,004 | |

| Caesars Resort Collection LLC/CRC Finco, Inc., 5.25%, 10/15/2025 (n) | 60,000 | 60,488 | ||

| CCM Merger, Inc., 6.375%, 5/01/2026 (n) | 55,000 | 57,475 | ||

| Churchill Downs, Inc., 5.5%, 4/01/2027 (n) | 45,000 | 46,713 | ||

| Colt Merger Sub, Inc., 5.75%, 7/01/2025 (n) | 45,000 | 47,375 | ||

| Colt Merger Sub, Inc., 8.125%, 7/01/2027 (n) | 50,000 | 55,559 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Gaming & Lodging – continued | ||||

| Hilton Domestic Operating Co., Inc., 3.75%, 5/01/2029 (n) | $ | 65,000 | $ 65,162 | |

| Hilton Domestic Operating Co., Inc., 3.625%, 2/15/2032 (n) | 61,000 | 59,989 | ||

| MGM Growth Properties LLC, 4.625%, 6/15/2025 (n) | 60,000 | 63,833 | ||

| MGM Growth Properties LLC, 5.75%, 2/01/2027 | 25,000 | 27,883 | ||

| MGM Growth Properties LLC, 3.875%, 2/15/2029 (n) | 42,000 | 42,522 | ||

| MGM Resorts International, 6.75%, 5/01/2025 | 60,000 | 64,350 | ||

| MGM Resorts International, 5.5%, 4/15/2027 | 45,000 | 49,106 | ||

| Scientific Games Corp., 8.25%, 3/15/2026 (n) | 35,000 | 37,712 | ||

| Scientific Games International, Inc., 7%, 5/15/2028 (n) | 40,000 | 43,000 | ||

| VICI Properties LP, REIT, 4.25%, 12/01/2026 (n) | 55,000 | 56,719 | ||

| VICI Properties LP, REIT, 3.75%, 2/15/2027 (n) | 70,000 | 70,562 | ||

| Wyndham Hotels & Resorts, Inc., 4.375%, 8/15/2028 (n) | 38,000 | 39,224 | ||

| Wynn Macau Ltd., 5.5%, 1/15/2026 (n) | 35,000 | 36,794 | ||

| Wynn Resorts Finance LLC/Wynn Resorts Capital Corp., 5.125%, 10/01/2029 (n) | 25,000 | 25,842 | ||

| $991,312 | ||||

| Industrial – 0.4% | ||||

| Howard Hughes Corp., 4.125%, 2/01/2029 (n) | $ | 84,000 | $ 83,160 | |

| Williams Scotsman International, Inc., 4.625%, 8/15/2028 (n) | 70,000 | 71,412 | ||

| $154,572 | ||||

| Insurance - Property & Casualty – 0.5% | ||||

| Acrisure LLC/Acrisure Finance, Inc., 7%, 11/15/2025 (n) | $ | 15,000 | $ 15,412 | |

| Alliant Holdings Intermediate LLC, 6.75%, 10/15/2027 (n) | 85,000 | 89,250 | ||

| AssuredPartners, Inc., 7%, 8/15/2025 (n) | 20,000 | 20,400 | ||

| AssuredPartners, Inc., 5.625%, 1/15/2029 (n) | 20,000 | 20,275 | ||

| Broadstreet Partners, Inc., 5.875%, 4/15/2029 (n) | 35,000 | 35,532 | ||

| GTCR (AP) Finance, Inc., 8%, 5/15/2027 (n) | 20,000 | 21,300 | ||

| $202,169 | ||||

| Machinery & Tools – 0.1% | ||||

| Clark Equipment Co., 5.875%, 6/01/2025 (n) | $ | 51,000 | $ 54,124 | |

| Medical & Health Technology & Services – 3.4% | ||||

| AdaptHealth LLC, 4.625%, 8/01/2029 (n) | $ | 50,000 | $ 49,721 | |

| Avantor Funding, Inc., 4.625%, 7/15/2028 (n) | 90,000 | 94,275 | ||

| BCPE Cycle Merger Sub II, Inc., 10.625%, 7/15/2027 (n) | 40,000 | 42,300 | ||

| Charles River Laboratories International, Inc., 3.75%, 3/15/2029 (n) | 85,000 | 86,488 | ||

| CHS/Community Health Systems, Inc., 6.625%, 2/15/2025 (n) | 95,000 | 100,106 | ||

| CHS/Community Health Systems, Inc., 8%, 12/15/2027 (n) | 10,000 | 11,000 | ||

| DaVita, Inc., 4.625%, 6/01/2030 (n) | 40,000 | 40,500 | ||

| DaVita, Inc., 3.75%, 2/15/2031 (n) | 45,000 | 42,750 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Medical & Health Technology & Services – continued | ||||

| Encompass Health Corp., 5.75%, 9/15/2025 | $ | 10,000 | $ 10,338 | |

| Encompass Health Corp., 4.625%, 4/01/2031 | 35,000 | 37,100 | ||

| HCA, Inc., 5.375%, 2/01/2025 | 80,000 | 89,154 | ||

| HCA, Inc., 5.875%, 2/15/2026 | 90,000 | 103,387 | ||

| HCA, Inc., 5.625%, 9/01/2028 | 20,000 | 23,325 | ||

| HCA, Inc., 5.875%, 2/01/2029 | 20,000 | 23,600 | ||

| HCA, Inc., 3.5%, 9/01/2030 | 80,000 | 82,228 | ||

| HealthSouth Corp., 5.125%, 3/15/2023 | 60,000 | 60,075 | ||

| Heartland Dental LLC, 8.5%, 5/01/2026 (n) | 45,000 | 46,688 | ||

| IQVIA Holdings, Inc., 5%, 5/15/2027 (n) | 200,000 | 209,250 | ||

| LifePoint Health, Inc., 4.375%, 2/15/2027 (n) | 25,000 | 25,000 | ||

| LifePoint Health, Inc., 5.375%, 1/15/2029 (n) | 15,000 | 15,003 | ||

| Regional Care/LifePoint Health, Inc., 9.75%, 12/01/2026 (n) | 75,000 | 81,000 | ||

| Syneos Health, Inc., 3.625%, 1/15/2029 (n) | 89,000 | 86,997 | ||

| US Acute Care Solutions LLC, 6.375%, 3/01/2026 (n) | 35,000 | 36,540 | ||

| $1,396,825 | ||||

| Medical Equipment – 0.5% | ||||

| Hill-Rom Holdings, Inc., 4.375%, 9/15/2027 (n) | $ | 85,000 | $ 87,975 | |

| Teleflex, Inc., 4.875%, 6/01/2026 | 30,000 | 30,756 | ||

| Teleflex, Inc., 4.625%, 11/15/2027 | 85,000 | 90,396 | ||

| $209,127 | ||||

| Metals & Mining – 1.8% | ||||

| Baffinland Iron Mines Corp./Baffinland Iron Mines LP, 8.75%, 7/15/2026 (n) | $ | 75,000 | $ 79,738 | |

| Big River Steel LLC/BRS Finance Corp., 6.625%, 1/31/2029 (n) | 40,000 | 43,200 | ||

| Coeur Mining, Inc., 5.125%, 2/15/2029 (n) | 45,000 | 43,637 | ||

| Compass Minerals International, Inc., 6.75%, 12/01/2027 (n) | 65,000 | 70,037 | ||

| Freeport-McMoRan, Inc., 5%, 9/01/2027 | 60,000 | 63,668 | ||

| Freeport-McMoRan, Inc., 4.375%, 8/01/2028 | 35,000 | 37,319 | ||

| Freeport-McMoRan, Inc., 5.25%, 9/01/2029 | 55,000 | 60,913 | ||

| GrafTech Finance, Inc., 4.625%, 12/15/2028 (n) | 49,000 | 50,379 | ||

| Grinding Media, Inc./Moly-Cop AltaSteel Ltd., 7.375%, 12/15/2023 (n) | 65,000 | 66,118 | ||

| Kaiser Aluminum Corp., 4.625%, 3/01/2028 (n) | 83,000 | 85,282 | ||

| Novelis Corp., 5.875%, 9/30/2026 (n) | 95,000 | 99,103 | ||

| Novelis Corp., 4.75%, 1/30/2030 (n) | 20,000 | 20,800 | ||

| $720,194 | ||||

| Midstream – 2.4% | ||||

| Cheniere Energy Partners LP, 4.5%, 10/01/2029 | $ | 27,000 | $ 28,181 | |

| Cheniere Energy, Inc., 4%, 3/01/2031 (n) | 55,000 | 55,962 | ||

| EnLink Midstream Partners LP, 4.85%, 7/15/2026 | 40,000 | 40,400 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Midstream – continued | ||||

| EnLink Midstream Partners LP, 5.625%, 1/15/2028 (n) | $ | 44,000 | $ 45,485 | |

| EQM Midstream Partners LP, 6%, 7/01/2025 (n) | 15,000 | 16,387 | ||

| EQM Midstream Partners LP, 6.5%, 7/01/2027 (n) | 15,000 | 16,564 | ||

| EQM Midstream Partners LP, 5.5%, 7/15/2028 | 120,000 | 127,464 | ||

| EQM Midstream Partners LP, 4.5%, 1/15/2029 (n) | 30,000 | 29,775 | ||

| Genesis Energy LP/Genesis Energy Finance Corp., 5.625%, 6/15/2024 | 15,000 | 15,000 | ||

| Genesis Energy LP/Genesis Energy Finance Corp., 6.25%, 5/15/2026 | 53,900 | 52,782 | ||

| Genesis Energy LP/Genesis Energy Finance Corp., 8%, 1/15/2027 | 5,000 | 5,151 | ||

| Northriver Midstream Finance LP, 5.625%, 2/15/2026 (n) | 75,000 | 77,344 | ||

| NuStar Logistics, LP, 5.75%, 10/01/2025 | 48,000 | 51,660 | ||

| Peru LNG, 5.375%, 3/22/2030 | 200,000 | 167,502 | ||

| Targa Resources Partners LP/Targa Resources Finance Corp., 5.375%, 2/01/2027 | 35,000 | 36,336 | ||

| Targa Resources Partners LP/Targa Resources Finance Corp., 6.875%, 1/15/2029 | 80,000 | 89,800 | ||

| Targa Resources Partners LP/Targa Resources Finance Corp., 4.875%, 2/01/2031 (n) | 30,000 | 31,304 | ||

| Western Midstream Operating LP, 5.3%, 2/01/2030 | 45,000 | 49,106 | ||

| Western Midstream Operation LP, 4.65%, 7/01/2026 | 35,000 | 37,472 | ||

| Western Midstream Operation LP, 5.5%, 8/15/2048 | 15,000 | 15,300 | ||

| $988,975 | ||||

| Municipals – 0.3% | ||||

| Puerto Rico Industrial, Tourist, Educational, Medical & Environmental Control Facilities Financing Authority Rev. (Cogeneration Facilities - AES Puerto Rico Project), 9.12%, 6/01/2022 | $ | 100,000 | $ 102,500 | |

| Network & Telecom – 0.1% | ||||

| Front Range BidCo, Inc., 6.125%, 3/01/2028 (n) | $ | 60,000 | $ 61,725 | |

| Oil Services – 0.6% | ||||

| Ensign Drilling, Inc., 9.25%, 4/15/2024 (n) | $ | 15,000 | $ 12,075 | |

| MV24 Capital B.V., 6.748%, 6/01/2034 (n) | 189,264 | 200,453 | ||

| Solaris Midstream Holding LLC, 7.625%, 4/01/2026 (n) | 20,000 | 20,946 | ||

| $233,474 | ||||

| Oils – 0.2% | ||||

| PBF Holding Co. LLC/PBF Finance Corp., 7.25%, 6/15/2025 | $ | 45,000 | $ 38,363 | |

| PBF Holding Co. LLC/PBF Finance Corp., 6%, 2/15/2028 | 40,000 | 30,183 | ||

| $68,546 | ||||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Other Banks & Diversified Financials – 0.5% | ||||

| BBVA Bancomer S.A./Texas, 5.875%, 9/13/2034 (n) | $ | 200,000 | $ 218,500 | |

| Personal Computers & Peripherals – 0.3% | ||||

| NCR Corp., 5%, 10/01/2028 (n) | $ | 65,000 | $ 66,950 | |

| NCR Corp., 5.125%, 4/15/2029 (n) | 35,000 | 36,006 | ||

| $102,956 | ||||

| Pharmaceuticals – 1.7% | ||||

| Bausch Health Companies, Inc., 6.125%, 4/15/2025 (n) | $ | 150,000 | $ 153,154 | |

| Bausch Health Companies, Inc., 5%, 1/30/2028 (n) | 105,000 | 106,575 | ||

| Bausch Health Companies, Inc., 5%, 2/15/2029 (n) | 30,000 | 30,046 | ||

| Catalent, Inc., 3.125%, 2/15/2029 (n) | 19,000 | 18,383 | ||

| Emergent BioSolutions, Inc., 3.875%, 8/15/2028 (n) | 65,000 | 60,938 | ||

| Endo Luxembourg Finance Co I S.à r.l., 6.125%, 4/01/2029 (n) | 30,000 | 29,700 | ||

| Jaguar Holding Co. II/Pharmaceutical Development LLC, 5%, 6/15/2028 (n) | 61,000 | 66,520 | ||

| Organon Finance 1 LLC, 4.125%, 4/30/2028 (n) | 200,000 | 204,898 | ||

| Par Pharmaceutical, Inc., 7.5%, 4/01/2027 (n) | 35,000 | 36,838 | ||

| $707,052 | ||||

| Pollution Control – 0.4% | ||||

| GFL Environmental, Inc., 3.75%, 8/01/2025 (n) | $ | 20,000 | $ 20,350 | |

| GFL Environmental, Inc., 8.5%, 5/01/2027 (n) | 20,000 | 21,900 | ||

| GFL Environmental, Inc., 4%, 8/01/2028 (n) | 35,000 | 33,493 | ||

| GFL Environmental, Inc., 3.5%, 9/01/2028 (n) | 40,000 | 38,510 | ||

| Stericycle, Inc., 3.875%, 1/15/2029 (n) | 55,000 | 54,862 | ||

| $169,115 | ||||

| Precious Metals & Minerals – 0.2% | ||||

| IAMGOLD Corp., 5.75%, 10/15/2028 (n) | $ | 50,000 | $ 52,000 | |

| Taseko Mines Ltd., 7%, 2/15/2026 (n) | 30,000 | 31,200 | ||

| $83,200 | ||||

| Printing & Publishing – 0.5% | ||||

| Cimpress N.V., 7%, 6/15/2026 (n) | $ | 150,000 | $ 157,875 | |

| News Corp., 3.875%, 5/15/2029 (n) | 45,000 | 45,887 | ||

| $203,762 | ||||

| Railroad & Shipping – 0.2% | ||||

| Watco Cos. LLC/Watco Finance Corp., 6.5%, 6/15/2027 (n) | $ | 58,000 | $ 61,770 | |

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Real Estate - Other – 0.4% | ||||

| InterMed Holdings Ltd., 5.875%, 10/01/2028 (n) | $ | 60,000 | $ 63,675 | |

| RHP Hotel Properties LP, 4.5%, 2/15/2029 (n) | 35,000 | 34,639 | ||

| Ryman Hospitality Properties, Inc., REIT, 4.75%, 10/15/2027 (n) | 51,000 | 52,485 | ||

| $150,799 | ||||

| Retailers – 0.4% | ||||

| L Brands, Inc., 5.25%, 2/01/2028 | $ | 110,000 | $ 120,587 | |

| L Brands, Inc., 6.625%, 10/01/2030 (n) | 25,000 | 28,812 | ||

| $149,399 | ||||

| Specialty Chemicals – 0.2% | ||||

| Univar Solutions USA, Inc., 5.125%, 12/01/2027 (n) | $ | 60,000 | $ 62,698 | |

| Specialty Stores – 0.3% | ||||

| Group 1 Automotive, Inc., 4%, 8/15/2028 (n) | $ | 69,000 | $ 68,914 | |

| Magic Mergeco, Inc., 5.25%, 5/01/2028 (n) | 20,000 | 20,250 | ||

| Magic Mergeco, Inc., 7.875%, 5/01/2029 (n) | 35,000 | 35,962 | ||

| $125,126 | ||||

| Supermarkets – 0.3% | ||||

| Albertsons Cos. LLC/Safeway, Inc., 5.75%, 3/15/2025 | $ | 7,000 | $ 7,219 | |

| Albertsons Cos. LLC/Safeway, Inc., 4.625%, 1/15/2027 (n) | 75,000 | 78,000 | ||

| Albertsons Cos. LLC/Safeway, Inc., 3.5%, 3/15/2029 (n) | 50,000 | 48,000 | ||

| $133,219 | ||||

| Telecommunications - Wireless – 2.7% | ||||

| Altice France S.A., 6%, 2/15/2028 (n) | $ | 200,000 | $ 198,460 | |

| Digicel International Finance Ltd., 8.75%, 5/25/2024 (n) | 200,000 | 209,000 | ||

| SBA Communications Corp., 4.875%, 9/01/2024 | 55,000 | 56,306 | ||

| SBA Communications Corp., 3.875%, 2/15/2027 | 55,000 | 56,247 | ||

| SBA Communications Corp., 3.125%, 2/01/2029 (n) | 70,000 | 67,058 | ||

| Sprint Capital Corp., 6.875%, 11/15/2028 | 95,000 | 119,703 | ||

| Sprint Corp., 7.125%, 6/15/2024 | 25,000 | 28,872 | ||

| Sprint Corp., 7.625%, 3/01/2026 | 120,000 | 147,150 | ||

| T-Mobile USA, Inc., 2.25%, 2/15/2026 | 35,000 | 35,222 | ||

| T-Mobile USA, Inc., 5.375%, 4/15/2027 | 110,000 | 116,462 | ||

| T-Mobile USA, Inc., 2.625%, 2/15/2029 | 68,000 | 66,240 | ||

| $1,100,720 | ||||

| Tobacco – 0.2% | ||||

| Vector Group Ltd., 10.5%, 11/01/2026 (n) | $ | 30,000 | $ 31,816 | |

| Vector Group Ltd., 5.75%, 2/01/2029 (n) | 40,000 | 40,257 | ||

| $72,073 | ||||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Transportation - Services – 0.5% | ||||

| Rumo Luxembourg S.à r.l., 5.25%, 1/10/2028 (n) | $ | 200,000 | $ 212,600 | |

| Utilities - Electric Power – 1.6% | ||||

| Adani Green Energy (UP) Ltd./Prayatna Developers Private Ltd., 6.25%, 12/10/2024 (n) | $ | 200,000 | $ 221,000 | |

| Calpine Corp., 4.5%, 2/15/2028 (n) | 40,000 | 40,428 | ||

| Calpine Corp., 5.125%, 3/15/2028 (n) | 45,000 | 45,734 | ||

| Clearway Energy Operating LLC, 4.75%, 3/15/2028 (n) | 30,000 | 31,414 | ||

| Clearway Energy Operating LLC, 3.75%, 2/15/2031 (n) | 90,000 | 88,712 | ||

| NextEra Energy Operating Co., 4.25%, 9/15/2024 (n) | 10,000 | 10,563 | ||

| NextEra Energy Operating Co., 4.5%, 9/15/2027 (n) | 35,000 | 37,783 | ||

| NextEra Energy, Inc., 4.25%, 7/15/2024 (n) | 36,000 | 38,160 | ||

| TerraForm Global Operating LLC, 6.125%, 3/01/2026 (n) | 40,000 | 41,000 | ||

| TerraForm Power Operating LLC, 5%, 1/31/2028 (n) | 80,000 | 85,800 | ||

| TerraForm Power Operating LLC, 4.75%, 1/15/2030 (n) | 15,000 | 15,619 | ||

| $656,213 | ||||

| Total Bonds (Identified Cost, $21,293,346) | $ 21,839,774 | |||

| Common Stocks – 42.6% | ||||

| Aerospace & Defense – 3.2% | ||||

| Honeywell International, Inc. | 2,979 | $ 664,436 | ||

| Northrop Grumman Corp. | 1,790 | 634,448 | ||

| $1,298,884 | ||||

| Brokerage & Asset Managers – 3.6% | ||||

| BlackRock, Inc. | 769 | $ 630,042 | ||

| NASDAQ, Inc. | 5,207 | 841,139 | ||

| $1,471,181 | ||||

| Business Services – 4.4% | ||||

| Accenture PLC, “A” | 1,693 | $ 490,919 | ||

| Equifax, Inc. | 2,723 | 624,194 | ||

| Fiserv, Inc. (a) | 5,552 | 666,906 | ||

| $1,782,019 | ||||

| Cable TV – 2.1% | ||||

| Comcast Corp., “A” | 15,239 | $ 855,670 | ||

| Construction – 1.7% | ||||

| ICA Tenedora, S.A. de C.V. | 10,542 | $ 21,099 | ||

| Sherwin-Williams Co. | 2,397 | 656,466 | ||

| $677,565 | ||||

| Issuer | Shares/Par | Value ($) | ||

| Common Stocks – continued | ||||

| Electronics – 2.0% | ||||

| Texas Instruments, Inc. | 4,457 | $ 804,533 | ||

| Food & Beverages – 1.6% | ||||

| Nestle S.A., ADR | 5,481 | $ 655,144 | ||

| Health Maintenance Organizations – 1.7% | ||||

| Cigna Corp. | 2,772 | $ 690,256 | ||

| Insurance – 4.2% | ||||

| Aon PLC | 2,384 | $ 599,433 | ||

| Chubb Ltd. | 3,344 | 573,797 | ||

| Marsh & McLennan Cos., Inc. | 3,772 | 511,860 | ||

| $1,685,090 | ||||

| Machinery & Tools – 1.9% | ||||

| Illinois Tool Works, Inc. | 3,362 | $ 774,807 | ||

| Major Banks – 2.0% | ||||

| JPMorgan Chase & Co. | 5,163 | $ 794,121 | ||

| Medical Equipment – 3.6% | ||||

| Medtronic PLC | 5,134 | $ 672,143 | ||

| Thermo Fisher Scientific, Inc. | 1,687 | 793,278 | ||

| $1,465,421 | ||||

| Oil Services – 0.1% | ||||

| LTRI Holdings LP (a)(u) | 60 | $ 16,951 | ||

| Other Banks & Diversified Financials – 3.1% | ||||

| American Express Co. | 3,282 | $ 503,295 | ||

| Citigroup, Inc. | 10,632 | 757,423 | ||

| $1,260,718 | ||||

| Pharmaceuticals – 1.7% | ||||

| Johnson & Johnson | 4,190 | $ 681,839 | ||

| Special Products & Services – 1.1% | ||||

| iShares iBoxx $ High Yield Corporate Bond ETF | 5,200 | $ 454,688 | ||

| Utilities - Electric Power – 4.6% | ||||

| Dominion Energy, Inc. | 5,030 | $ 401,897 | ||

| Duke Energy Corp. | 7,138 | 718,725 | ||

| Southern Co. | 11,235 | 743,420 | ||

| $1,864,042 | ||||

| Total Common Stocks (Identified Cost, $9,384,352) | $ 17,232,929 | |||

| Issuer | Shares/Par | Value ($) | ||

| Floating Rate Loans (r) – 0.3% | ||||

| Broadcasting – 0.0% | ||||

| Nexstar Broadcasting, Inc., Term Loan B4, 2.615%, 9/18/2026 | $ | 18,118 | $ 18,024 | |

| Cable TV – 0.1% | ||||

| CSC Holdings LLC, Term Loan B5, 2.615%, 4/15/2027 | $ | 20,737 | $ 20,600 | |

| Chemicals – 0.1% | ||||

| Axalta Coating Systems U.S. Holdings, Inc., Term Loan B3, 1.952%, 6/01/2024 | $ | 17,189 | $ 17,075 | |

| Element Solutions, Inc., Term Loan B1, 2.113%, 1/31/2026 | 20,685 | 20,577 | ||

| $37,652 | ||||

| Computer Software - Systems – 0.1% | ||||

| SS&C Technologies, Inc., Term Loan B5, 1.863%, 4/16/2025 | $ | 20,674 | $ 20,421 | |

| Pharmaceuticals – 0.0% | ||||

| Bausch Health Companies, Inc., Term Loan B, 2.863%, 11/27/2025 | $ | 18,000 | $ 17,943 | |

| Total Floating Rate Loans (Identified Cost, $115,763) | $ 114,640 | |||

| Strike

Price |

First

Exercise |

|||

| Warrants – 0.0% | ||||

| Forest & Paper Products – 0.0% | ||||

| Appvion Holdings Corp. - Tranche A (1 share for 1 warrant, Expiration 6/13/23) (a) | $27.17 | 8/24/18 | 40 | $ 0 |

| Appvion Holdings Corp. - Tranche B (1 share for 1 warrant, Expiration 6/13/23) (a) | 31.25 | 8/24/18 | 40 | 0 |

| Total Warrants (Identified Cost, $0) | $ 0 | |||

| Investment Companies (h) – 2.6% | ||||

| Money Market Funds – 2.6% | ||||

| MFS Institutional Money Market Portfolio, 0.04% (v) (Identified Cost, $1,060,119) | 1,060,155 | $ 1,060,155 | ||

| Other Assets, Less Liabilities – 0.6% | 232,519 | |||

| Net Assets – 100.0% | $40,480,017 | |||

| (a) | Non-income producing security. | |||

| (d) | In default. | |||

| (h) | An affiliated issuer, which may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate values of the fund's investments in affiliated issuers and in unaffiliated issuers were $1,060,155 and $39,187,343, respectively. | |||

| (n) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. At period end, the aggregate value of these securities was $16,529,254, representing 40.8% of net assets. |

| (p) | Payment-in-kind (PIK) security for which interest income may be received in additional securities and/or cash. | |||

| (r) | The remaining maturities of floating rate loans may be less than the stated maturities shown as a result of contractual or optional prepayments by the borrower. Such prepayments cannot be predicted with certainty. These loans may be subject to restrictions on resale. The interest rate shown represents the weighted average of the floating interest rates on settled contracts within the loan facility at period end, unless otherwise indicated. The floating interest rates on settled contracts are determined periodically by reference to a base lending rate and a spread. | |||

| (u) | The security was valued using significant unobservable inputs and is considered level 3 under the fair value hierarchy. For further information about the fund’s level 3 holdings, please see Note 2 in the Notes to Financial Statements. | |||

| (v) | Affiliated issuer that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. |

| The following abbreviations are used in this report and are defined: | |

| ADR | American Depositary Receipt |

| ETF | Exchange-Traded Fund |

| REIT | Real Estate Investment Trust |

| Abbreviations indicate amounts shown in currencies other than the U.S. dollar. All amounts are stated in U.S. dollars unless otherwise indicated. A list of abbreviations is shown below: | |

| EUR | Euro |

| Forward Foreign Currency Exchange Contracts | ||||||

| Currency

Purchased |

Currency

Sold |

Counterparty | Settlement

Date |

Unrealized

Appreciation (Depreciation) | ||

| Liability Derivatives | ||||||

| USD | 110,852 | EUR | 92,322 | JPMorgan Chase Bank N.A. | 7/16/2021 | $(309) |

| Assets | |

| Investments in unaffiliated issuers, at value (identified cost, $30,793,461) | $39,187,343 |

| Investments in affiliated issuers, at value (identified cost, $1,060,119) | 1,060,155 |

| Cash | 9,449 |

| Receivables for | |

| Investments sold | 24,710 |

| Interest and dividends | 322,376 |

| Other assets | 16,306 |

| Total assets | $40,620,339 |

| Liabilities | |

| Payables for | |

| Forward foreign currency exchange contracts | $309 |

| Investments purchased | 81,406 |

| Payable to affiliates | |

| Investment adviser | 2,108 |

| Administrative services fee | 96 |

| Transfer agent and dividend disbursing costs | 147 |

| Accrued expenses and other liabilities | 56,256 |

| Total liabilities | $140,322 |

| Net assets | $40,480,017 |

| Net assets consist of | |

| Paid-in capital | $33,143,349 |

| Total distributable earnings (loss) | 7,336,668 |

| Net assets | $40,480,017 |

| Shares of beneficial interest outstanding | 7,249,048 |

| Net asset value per share (net assets of $40,480,017 / 7,249,048 shares of beneficial interest outstanding) | $5.58 |

| Net investment income (loss) | |

| Income | |

| Interest | $580,946 |

| Dividends | 173,173 |

| Other | 652 |

| Dividends from affiliated issuers | 554 |

| Foreign taxes withheld | (2,521) |

| Total investment income | $752,804 |

| Expenses | |

| Management fee | $159,702 |

| Transfer agent and dividend disbursing costs | 6,996 |

| Administrative services fee | 8,679 |

| Independent Trustees' compensation | 2,347 |

| Stock exchange fee | 11,816 |

| Custodian fee | 2,735 |

| Shareholder communications | 20,696 |

| Audit and tax fees | 39,112 |

| Legal fees | 701 |

| Miscellaneous | 21,323 |

| Total expenses | $274,107 |

| Net investment income (loss) | $478,697 |

| Realized and unrealized gain (loss) | |

| Realized gain (loss) (identified cost basis) | |

| Unaffiliated issuers | $582,252 |

| Forward foreign currency exchange contracts | (1,713) |

| Foreign currency | (75) |

| Net realized gain (loss) | $580,464 |

| Change in unrealized appreciation or depreciation | |

| Unaffiliated issuers | $4,049,308 |

| Forward foreign currency exchange contracts | (1,294) |

| Translation of assets and liabilities in foreign currencies | 11 |

| Net unrealized gain (loss) | $4,048,025 |

| Net realized and unrealized gain (loss) | $4,628,489 |

| Change in net assets from operations | $5,107,186 |

| Six months ended | Year ended | |

| 4/30/21

(unaudited) |

10/31/20 | |

| Change in net assets | ||

| From operations | ||

| Net investment income (loss) | $478,697 | $1,053,443 |

| Net realized gain (loss) | 580,464 | 2,657,204 |

| Net unrealized gain (loss) | 4,048,025 | (3,125,641) |

| Change in net assets from operations | $5,107,186 | $585,006 |

| Distributions to shareholders | $(1,051,485) | $(3,734,845) |

| Tax return of capital distributions to shareholders | $— | $(104,397) |

| Distributions from other sources | $(903,153) | $— |

| Change in net assets from fund share transactions | $125,939 | $197,900 |

| Total change in net assets | $3,278,487 | $(3,056,336) |

| Net assets | ||

| At beginning of period | 37,201,530 | 40,257,866 |

| At end of period | $40,480,017 | $37,201,530 |

|

Six months ended |

Year ended | |||||

| 4/30/21

(unaudited) |

10/31/20 | 10/31/19 | 10/31/18 | 10/31/17 | 10/31/16 | |

| Net asset value, beginning of period | $5.15 | $5.60 | $5.43 | $6.03 | $5.91 | $6.09 |

| Income (loss) from investment operations | ||||||

| Net investment income (loss) (d) | $0.07 | $0.15 | $0.16 | $0.16 | $0.20(c) | $0.23 |

| Net realized and unrealized gain (loss) | 0.63 | (0.07) | 0.56 | (0.18) | 0.52 | 0.18 |

| Total from investment operations | $0.70 | $0.08 | $0.72 | $(0.02) | $0.72 | $0.41 |

| Less distributions declared to shareholders | ||||||

| From net investment income | $(0.15) | $(0.16) | $(0.17) | $(0.18) | $(0.21) | $(0.24) |

| From net realized gain | — | (0.36) | (0.03) | (0.11) | — | — |

| From tax return of capital | — | (0.01) | (0.35) | (0.29) | (0.39) | (0.35) |

| From other sources | (0.12) | — | — | — | — | — |

| Total distributions declared to shareholders | $(0.27) | $(0.53) | $(0.55) | $(0.58) | $(0.60) | $(0.59) |

| Net increase from repurchase of capital shares | $— | $0.00(w) | $— | $— | $0.00(w) | $— |

| Net asset value, end of period (x) | $5.58 | $5.15 | $5.60 | $5.43 | $6.03 | $5.91 |

| Market value, end of period | $6.54 | $5.25 | $6.48 | $5.49 | $6.66 | $5.50 |

| Total return at market value (%) (j)(r)(s)(x) | 30.56(n) | (10.63) | 30.24 | (8.87) | 33.86 | 10.75 |

| Total return at net asset value (%) | 13.56(n) | 1.44 | 13.80 | (0.44) | 12.79(c) | 8.07 |

| Ratios

(%) (to average net assets) and Supplemental data: | ||||||

| Expenses (f) | 1.40(a) | 1.44 | 1.41 | 1.39 | 1.23(c) | 1.42 |

| Net investment income (loss) | 2.45(a) | 2.76 | 2.89 | 2.76 | 3.35(c) | 3.88 |

| Portfolio turnover | 19(n) | 48 | 34 | 33 | 35 | 26 |

| Net assets at end of period (000 omitted) | $40,480 | $37,202 | $40,258 | $38,834 | $42,842 | $41,849 |

| (a) | Annualized. |

| (c) | Amount reflects a one-time reimbursement of expenses by the custodian (or former custodian) without which net investment income and performance would be lower and expenses would be higher. |

| (d) | Per share data is based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (j) | Total return at net asset value is calculated using the net asset value of the fund, not the publicly traded price and therefore may be different than the total return at market value. |

| (n) | Not annualized. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. |

| (w) | Per share amount was less than $0.01. |

| (x) | The net asset values and total returns at net asset value have been calculated on net assets which include adjustments made in accordance with U.S. generally accepted accounting principles required at period end for financial reporting purposes. |

| Financial Instruments | Level 1 | Level 2 | Level 3 | Total |

| Equity Securities: | ||||

| United States | $16,539,735 | $0 | $16,951 | $16,556,686 |

| Switzerland | 655,144 | — | — | 655,144 |

| Mexico | — | 21,099 | — | 21,099 |

| Non - U.S. Sovereign Debt | — | 978,977 | — | 978,977 |

| Municipal Bonds | — | 102,500 | — | 102,500 |

| U.S. Corporate Bonds | — | 17,181,641 | — | 17,181,641 |

| Foreign Bonds | — | 3,576,656 | — | 3,576,656 |

| Floating Rate Loans | — | 114,640 | — | 114,640 |

| Mutual Funds | 1,060,155 | — | — | 1,060,155 |

| Total | $18,255,034 | $21,975,513 | $16,951 | $40,247,498 |

| Other Financial Instruments | ||||

| Forward Foreign Currency Exchange Contracts – Liabilities | $— | $(309) | $— | $(309) |

| Equity

Securities | |

| Balance as of 10/31/20 | $16,951 |

| Change in unrealized appreciation or depreciation | 0 |

| Balance as of 4/30/21 | $16,951 |

| Fair Value | |||

| Risk | Derivative Contracts | Liability Derivatives | |

| Foreign Exchange | Forward Foreign Currency Exchange Contracts | $(309) | |

| Risk | Forward

Foreign Currency Exchange Contracts |

| Foreign Exchange | $(1,713) |

| Risk | Forward

Foreign Currency Exchange Contracts |

| Foreign Exchange | $(1,294) |

| Year

ended 10/31/20 | |

| Ordinary income (including any short-term capital gains) | $1,152,035 |

| Long-term capital gains | 2,582,810 |

| Tax return of capital (b) | 104,397 |

| Total distributions | $3,839,242 |

| (b) | Distributions in excess of tax basis earnings and profits are reported in the financial statements as a tax return of capital. |

| As of 4/30/21 | |

| Cost of investments | $32,001,700 |

| Gross appreciation | 8,522,236 |

| Gross depreciation | (276,438) |

| Net unrealized appreciation (depreciation) | $ 8,245,798 |

| As of 10/31/20 | |

| Other temporary differences | (20,368) |

| Net unrealized appreciation (depreciation) | 4,204,488 |

| Six

months ended 4/30/21 |

Year

ended 10/31/20 | ||||

| Shares | Amount | Shares | Amount | ||

| Shares issued to shareholders in reinvestment of distributions | 21,968 | $125,939 | 43,842 | $239,515 | |

| Capital shares repurchased | — | — | (10,450) | (41,615) | |

| Net change | 21,968 | $125,939 | 33,392 | $197,900 | |

| Affiliated Issuers | Beginning

Value |

Purchases | Sales

Proceeds |

Realized

Gain (Loss) |

Change

in Unrealized Appreciation or Depreciation |

Ending

Value |

| MFS Institutional Money Market Portfolio | $1,148,461 | $4,984,352 | $5,072,658 | $— | $— | $1,060,155 |

| Affiliated Issuers | Dividend

Income |

Capital

Gain Distributions |

| MFS Institutional Money Market Portfolio | $554 | $— |

June 15, 2021

DIVIDEND DISBURSING AGENT

| Item 1(b): | |

A copy of the notice transmitted to the Registrant’s shareholders in reliance on Rule 30e-3 of the Investment Company Act of 1940, as amended that contains disclosure specified by paragraph (c)(3) of Rule 30e-3 is attached hereto as EX-99.30e-3Notice.

| ITEM 2. | CODE OF ETHICS. |

During the period covered by this report, the Registrant has not amended any provision in its Code of Ethics (the “Code”) that relates to an element of the Code’s definitions enumerated in paragraph (b) of Item 2 of this Form N-CSR. During the period covered by this report, the Registrant did not grant a waiver, including an implicit waiver, from any provision of the Code.

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

Not applicable for semi-annual reports.

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

Not applicable for semi-annual reports.

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

Not applicable for semi-annual reports.

| ITEM 6. | SCHEDULE OF INVESTMENTS |

A schedule of investments for MFS Special Value Trust is included as part of the report to shareholders under Item 1(a) of this Form N-CSR.

| ITEM 7. | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable for semi-annual reports.

| ITEM 8. | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

There were no changes during the period.

| ITEM 9. | PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS. |

MFS Special Value Trust

| Period |

(a) Total number of Shares Purchased |

(b) Average Price Paid per Share |

(c) Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

(d) Maximum Number (or Approximate Dollar Value) of Shares that May Yet Be Purchased under the Plans or Programs |

||||||||||||

| 11/01/20-11/30/20 |

0 | N/A | 0 | 722,312 | ||||||||||||

| 12/01/20-12/31/20 |

0 | N/A | 0 | 722,312 | ||||||||||||

| 1/01/21-1/31/21 |

0 | N/A | 0 | 722,312 | ||||||||||||

| 2/01/21-2/28/21 |

0 | N/A | 0 | 722,312 | ||||||||||||

| 3/01/21-3/31/21 |

0 | N/A | 0 | 722,312 | ||||||||||||

| 4/01/21-4/30/21 |

0 | N/A | 0 | 722,312 | ||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total |

0 | N/A | 0 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

Note: The Board approved procedures to repurchase shares and reviews the results periodically. The notification to shareholders of the program is part of the semi-annual and annual reports sent to shareholders. These annual programs begin on October 1st of each year. The programs conform to the conditions of Rule 10b-18 of the Securities Exchange Act of 1934 and limit the aggregate number of shares that may be purchased in each annual period (October 1 through the following September 30) to 10% of the Registrant’s outstanding shares as of the first day of the plan year (October 1). The aggregate number of shares available for purchase for the October 1, 2020 plan year is 722,312.

| ITEM 10. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

There were no material changes to the procedures by which shareholders may send recommendations to the Board for nominees to the Registrant’s Board since the Registrant last provided disclosure as to such procedures in response to the requirements of Item 407 (c)(2)(iv) of Regulation S-K or this Item.

| ITEM 11. | CONTROLS AND PROCEDURES. |

| (a) | Based upon their evaluation of the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as conducted within 90 days of the filing date of this Form N-CSR, the registrant’s principal financial officer and principal executive officer have concluded that those disclosure controls and procedures provide reasonable assurance that the material information required to be disclosed by the registrant on this report is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms. |

| (b) | There were no changes in the registrant’s internal controls over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the period covered by the report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

| ITEM 12. | DISCLOSURE OF SECURITIES LENDING ACTIVITIES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable for semi-annual reports.

| ITEM 13. | EXHIBITS. |

| (a) | File the exhibits listed below as part of this form. Letter or number the exhibits in the sequence indicated. |

| (1) | Any code of ethics, or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy the Item 2 requirements through filing of an exhibit. Not applicable. |

| (2) | A separate certification for each principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the Act (17 CFR 270.30a-2): Attached hereto as EX-99.302CERT. |

| (3) | Any written solicitation to purchase securities under Rule 23c-1 under the Act (17 CFR 270.23c-1) sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable. |

| (4) | Change in the registrant’s independent public accountant. Not applicable. |

| (b) | If the report is filed under Section 13(a) or 15(d) of the Exchange Act, provide the certifications required by Rule 30a-2(b) under the Act (17 CFR 270.30a-2(b)), Rule 13a-14(b) or Rule 15d-14(b) under the Exchange Act (17 CFR 240.13a-14(b) or 240.15d-14(b)) and Section 1350 of Chapter 63 of Title 18 of the United States Code (18 U.S.C. 1350) as an exhibit. A certification furnished pursuant to this paragraph will not be deemed “filed” for the purposes of Section 18 of the Exchange Act (15 U.S.C. 78r), or otherwise subject to the liability of that section. Such certification will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Exchange Act, except to the extent that the registrant specifically incorporates it by reference: Attached hereto as EX-99.906CERT. |

| (c) | Registrant’s Rule 30e-3 Notice pursuant to Item 1(b) of Form N-CSR. Attached hereto as EX-99.30e-3Notice. |

| (d) | Notices to Trust’s common shareholders in accordance with Investment Company Act Section 19(a) and Rule 19a-1. Attached hereto as EX-99.19a-1. |

Notice

A copy of the Amended and Restated Declaration of Trust of the Registrant is on file with the Secretary of State of the Commonwealth of Massachusetts and notice is hereby given that this instrument is executed on behalf of the Registrant by an officer of the Registrant as an officer and not individually and the obligations of or arising out of this instrument are not binding upon any of the Trustees or shareholders individually, but are binding only upon the assets and property of the respective constituent series of the Registrant.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Registrant MFS SPECIAL VALUE TRUST

| By (Signature and Title)* | /S/ DAVID L. DILORENZO | |

| David L. DiLorenzo, President |

Date: June 15, 2021

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title)* | /S/ DAVID L. DILORENZO | |

| David L. DiLorenzo, President (Principal Executive Officer) |

Date: June 15, 2021

| By (Signature and Title)* | /S/ JAMES O. YOST | |

| James O. Yost, Treasurer (Principal Financial Officer and Accounting Officer) |

Date: June 15, 2021

| * | Print name and title of each signing officer under his or her signature. |