Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05912

MFS SPECIAL VALUE TRUST

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: October 31

Date of reporting period: April 30, 2020

Table of Contents

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Table of Contents

Semiannual Report

April 30, 2020

MFS® Special Value Trust

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the complete reports will be made available on the fund’s Web site, and you will be notified by mail each time a report is posted and provided with a Web site link to access the report.

If you are already signed up to receive shareholder reports by email, you will not be affected by this change and you need not take any action. You may sign up to receive shareholder reports and other communications from the fund by email by contacting your financial intermediary (such as a broker-dealer or bank) or, if you hold your shares directly with the fund, by calling 1-800-637-2304 or by logging into your Investor Center account at www.computershare.com/investor.

Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. Contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the fund, you can call 1-800-637-2304 to let the fund know that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the MFS fund complex if you invest directly.

MFV-SEM

Table of Contents

MANAGED DISTRIBUTION POLICY DISCLOSURE

The MFS Special Value Trust’s (the fund) Board of Trustees adopted a managed distribution policy. The fund seeks to pay monthly distributions based on an annual rate of 10.00% of the fund’s average monthly net asset value. The primary purpose of the managed distribution policy is to provide shareholders with a constant, but not guaranteed, fixed minimum rate of distribution each month. You should not draw any conclusions about the fund’s investment performance from the amount of the current distribution or from the terms of the fund’s managed distribution policy. The Board may amend or terminate the managed distribution policy at any time without prior notice to fund shareholders. The amendment or termination of the managed distribution policy could have an adverse effect on the market price of the fund’s shares.

With each distribution, the fund will issue a notice to shareholders and an accompanying press release which will provide detailed information regarding the amount and composition of the distribution and other related information. The amounts and sources of distributions reported in the notice to shareholders are only estimates and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. The fund will send you a Form 1099-DIV for the calendar year that will tell you how to report these distributions for federal income tax purposes. Please refer to “Tax Matters and Distributions” under Note 2 of the Notes to Financial Statements for information regarding the tax character of the fund’s distributions.

Under a managed distribution policy the fund may at times distribute more than its net investment income and net realized capital gains; therefore, a portion of your distribution may result in a return of capital. A return of capital may occur, for example, when some or all of the money that you invested in the fund is paid back to you. Any such returns of capital will decrease the fund’s total assets and, therefore, could have the effect of increasing the fund’s expense ratio. In addition, in order to make the level of distributions called for under its managed distribution policy, the fund may have to sell portfolio securities at a less than opportune time. A return of capital does not necessarily reflect the fund’s investment performance and should not be confused with ‘yield’ or ‘income’. The fund’s total return in relation to changes in net asset value is presented in the Financial Highlights.

Table of Contents

MFS® Special Value Trust

New York Stock Exchange Symbol: MFV

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Table of Contents

LETTER FROM THE EXECUTIVE CHAIR

Dear Shareholders:

Markets experienced dramatic swings in early 2020 as the coronavirus pandemic crippled the global economy for a time. Optimism over the development of vaccines

and therapeutics, along with a decline in cases in countries hit early in the outbreak, has brightened the economic and market outlook during the second quarter, though a great deal of uncertainty remains on how long the aftereffects of the lockdowns will linger.

Global central banks have taken aggressive, coordinated steps to cushion the economic and market fallout related to the virus, and governments are undertaking unprecedented levels of fiscal stimulus. As uncertainty recedes, these measures can help build a supportive environment and encourage economic recovery. In the aftermath of the crisis, there are likely to be societal changes as

households, businesses, and governments adjust to a new reality, and these alterations could change the investment landscape. For investors, occurrences such as the COVID-19 outbreak demonstrate the importance of having a deep understanding of company fundamentals, and our global research platform has been built to do just that.

Here at MFS®, we aim to help our clients navigate the growing complexity of the markets and world economies. Our long-term investment philosophy and commitment to the responsible allocation of capital allow us to tune out the noise and uncover what we believe are the best, most durable investment opportunities in the market. Through our powerful global investment platform, we combine collective expertise, thoughtful risk management, and long-term discipline to create sustainable value for investors.

Respectfully,

Robert J. Manning

Executive Chair

MFS Investment Management

June 16, 2020

The opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed.

1

Table of Contents

2

Table of Contents

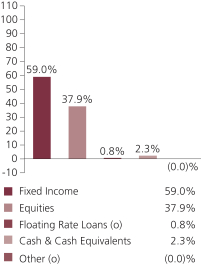

Portfolio Composition – continued

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. Not Rated includes fixed income securities and fixed income derivatives, which have not been rated by any rating agency. Non-Fixed Income includes equity securities (including convertible bonds and equity derivatives) and commodities. The fund may or may not have held all of these instruments on this date. The fund is not rated by these agencies. |

| (g) | The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and S&P Global Market Intelligence Inc. (“S&P Global Market Intelligence”). GICS is a service mark of MSCI and S&P Global Market Intelligence and has been licensed for use by MFS. |

| (i) | For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts. |

| (o) | Less than 0.1%. |

Where the fund holds convertible bonds, they are treated as part of the equity portion of the portfolio.

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. Please see the Statement of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Other includes equivalent exposure from currency derivatives and/or any offsets to derivative positions and may be negative.

Percentages are based on net assets as of April 30, 2020.

The portfolio is actively managed and current holdings may be different.

3

Table of Contents

| Portfolio Manager | Primary Role | Since | Title and Five Year History | |||

| Ward Brown | Emerging Markets Debt Instruments Portfolio Manager |

2012 | Investment Officer of MFS; employed in the investment management area of MFS since 2005. | |||

| Katherine Cannan | Equity Securities Portfolio Manager |

December 2019 |

Investment Officer of MFS; employed in the investment area of MFS since 2013. | |||

| Nevin Chitkara | Equity Securities Portfolio Manager |

2012 | Investment Officer of MFS; employed in the investment management area of MFS since 1997. | |||

| David Cole | Below Investment Grade Debt Instruments Portfolio Manager |

2006 | Investment Officer of MFS; employed in the investment management area of MFS since 2004. | |||

| Matt Ryan | Emerging Markets Debt Instruments Portfolio Manager |

2012 | Investment Officer of MFS; employed in the investment management area of MFS since 1997. | |||

| Michael Skatrud | Below Investment Grade Debt Instruments Portfolio Manager |

2018 | Investment Officer of MFS; employed in the investment management area of MFS since 2013. | |||

Note to Shareholders: Effective December 31, 2019, Katherine Cannan was added as a Portfolio Manager of the Fund.

The fund’s shares may trade at a discount or premium to net asset value. When fund shares trade at a premium, buyers pay more than the net asset value underlying fund shares, and shares purchased at a premium would receive less than the amount paid for them in the event of the fund’s concurrent liquidation.

The fund’s target annual distribution rate is calculated based on an annual rate of 10.00% of the fund’s average monthly net asset value, not a fixed share price, and the fund’s dividend amount will fluctuate with changes in the fund’s average monthly net assets.

In accordance with Section 23(c) of the Investment Company Act of 1940, the fund hereby gives notice that it may from time to time repurchase shares of the fund in the open market at the option of the Board of Trustees and on such terms as the Trustees shall determine.

4

Table of Contents

4/30/20 (unaudited)

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - 58.0% | ||||||||

| Aerospace - 1.3% | ||||||||

| Bombardier, Inc., 7.5%, 3/15/2025 (n) | $ | 116,000 | $ | 74,820 | ||||

| Bombardier, Inc., 7.875%, 4/15/2027 (n) | 60,000 | 38,850 | ||||||

| Moog, Inc., 4.25%, 12/15/2027 (n) | 120,000 | 112,500 | ||||||

| TransDigm, Inc., 6.5%, 7/15/2024 | 70,000 | 64,663 | ||||||

| TransDigm, Inc., 6.25%, 3/15/2026 (n) | 70,000 | 68,512 | ||||||

| TransDigm, Inc., 6.375%, 6/15/2026 | 45,000 | 38,511 | ||||||

| TransDigm, Inc., 5.5%, 11/15/2027 (n) | 85,000 | 71,825 | ||||||

|

|

|

|||||||

| $ | 469,681 | |||||||

| Automotive - 1.2% | ||||||||

| Adient US LLC, 7%, 5/15/2026 (n) | $ | 5,000 | $ | 4,975 | ||||

| Allison Transmission, Inc., 5%, 10/01/2024 (n) | 150,000 | 144,000 | ||||||

| Allison Transmission, Inc., 5.875%, 6/01/2029 (n) | 40,000 | 38,781 | ||||||

| Dana, Inc., 5.5%, 12/15/2024 | 5,000 | 4,652 | ||||||

| Dana, Inc., 5.375%, 11/15/2027 | 31,000 | 27,358 | ||||||

| IAA Spinco, Inc., 5.5%, 6/15/2027 (n) | 95,000 | 94,791 | ||||||

| KAR Auction Services, Inc., 5.125%, 6/01/2025 (n) | 70,000 | 59,619 | ||||||

| Panther BR Aggregator 2 LP/Panther Finance Co., Inc., 8.5%, 5/15/2027 (n) | 80,000 | 67,800 | ||||||

|

|

|

|||||||

| $ | 441,976 | |||||||

| Broadcasting - 1.6% | ||||||||

| Diamond Sports Group, LLC/Diamond Sports Finance Co., 5.375%, 8/15/2026 (n) | $ | 10,000 | $ | 7,600 | ||||

| iHeartCommunications, Inc., 6.375%, 5/01/2026 (n) | 35,000 | 33,075 | ||||||

| iHeartCommunications, Inc., 8.375%, 5/01/2027 | 40,000 | 32,928 | ||||||

| iHeartCommunications, Inc., 5.25%, 8/15/2027 (n) | 15,000 | 13,613 | ||||||

| Lions Gate Capital Holding Co., 5.875%, 11/01/2024 | 35,000 | 32,288 | ||||||

| National CineMedia LLC, 5.875%, 4/15/2028 (n) | 50,000 | 35,500 | ||||||

| Netflix, Inc., 5.875%, 2/15/2025 | 100,000 | 110,284 | ||||||

| Netflix, Inc., 3.625%, 6/15/2025 (n) | 45,000 | 45,562 | ||||||

| Netflix, Inc., 5.875%, 11/15/2028 | 65,000 | 73,505 | ||||||

| Nexstar Escrow Corp., 5.625%, 7/15/2027 (n) | 75,000 | 71,625 | ||||||

| Terrier Media Buyer, Inc., 8.875%, 12/15/2027 (n) | 35,000 | 28,875 | ||||||

| WMG Acquisition Corp., 4.875%, 11/01/2024 (n) | 100,000 | 100,000 | ||||||

|

|

|

|||||||

| $ | 584,855 | |||||||

| Brokerage & Asset Managers - 0.3% | ||||||||

| LPL Holdings, Inc., 4.625%, 11/15/2027 (n) | $ | 130,000 | $ | 124,150 | ||||

5

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Building - 3.5% | ||||||||

| ABC Supply Co., Inc., 5.875%, 5/15/2026 (n) | $ | 80,000 | $ | 79,200 | ||||

| ABC Supply Co., Inc., 4%, 1/15/2028 (n) | 110,000 | 104,370 | ||||||

| Beacon Escrow Corp., 4.875%, 11/01/2025 (n) | 80,000 | 70,700 | ||||||

| Beacon Roofing Supply, Inc., 4.5%, 11/15/2026 (n) | 30,000 | 28,650 | ||||||

| Core & Main LP, 8.625%, (8.625% cash or 9.375% PIK) 9/15/2024 (n)(p) | 30,000 | 28,500 | ||||||

| Core & Main LP, 6.125%, 8/15/2025 (n) | 60,000 | 57,600 | ||||||

| Cornerstone Building Brands, Inc., 8%, 4/15/2026 (n) | 50,000 | 42,485 | ||||||

| HD Supply, Inc., 5.375%, 10/15/2026 (n) | 100,000 | 101,990 | ||||||

| James Hardie International Finance Ltd., 5%, 1/15/2028 (n) | 200,000 | 189,500 | ||||||

| New Enterprise Stone & Lime Co., Inc., 10.125%, 4/01/2022 (n) | 45,000 | 44,662 | ||||||

| New Enterprise Stone & Lime Co., Inc., 6.25%, 3/15/2026 (n) | 70,000 | 65,800 | ||||||

| Patrick Industries, Inc., 7.5%, 10/15/2027 (n) | 50,000 | 47,000 | ||||||

| PriSo Acquisition Corp., 9%, 5/15/2023 (n) | 69,000 | 53,668 | ||||||

| SRS Distribution, Inc., 8.25%, 7/01/2026 (n) | 30,000 | 27,549 | ||||||

| Standard Industries, Inc., 5.375%, 11/15/2024 (n) | 110,000 | 110,275 | ||||||

| Standard Industries, Inc., 6%, 10/15/2025 (n) | 100,000 | 103,000 | ||||||

| Summit Materials LLC/Summit Materials Finance Co., 6.125%, 7/15/2023 | 100,000 | 100,095 | ||||||

| U.S. Concrete, Inc., 6.375%, 6/01/2024 | 10,000 | 9,443 | ||||||

|

|

|

|||||||

| $ | 1,264,487 | |||||||

| Business Services - 1.7% | ||||||||

| Ascend Learning LLC, 6.875%, 8/01/2025 (n) | $ | 80,000 | $ | 79,200 | ||||

| CDK Global, Inc., 4.875%, 6/01/2027 | 95,000 | 94,763 | ||||||

| CDK Global, Inc., 5.25%, 5/15/2029 (n) | 25,000 | 25,500 | ||||||

| Iron Mountain, Inc., REIT, 4.875%, 9/15/2027 (n) | 50,000 | 49,000 | ||||||

| MSCI, Inc., 5.75%, 8/15/2025 (n) | 60,000 | 62,676 | ||||||

| MSCI, Inc., 4.75%, 8/01/2026 (n) | 165,000 | 172,471 | ||||||

| Refinitiv U.S. Holdings, Inc., 8.25%, 11/15/2026 (n) | 40,000 | 43,400 | ||||||

| Verscend Escrow Corp., 9.75%, 8/15/2026 (n) | 60,000 | 62,550 | ||||||

|

|

|

|||||||

| $ | 589,560 | |||||||

| Cable TV - 4.9% | ||||||||

| CCO Holdings LLC/CCO Holdings Capital Corp., 5.75%, 2/15/2026 (n) | $ | 215,000 | $ | 224,137 | ||||

| CCO Holdings LLC/CCO Holdings Capital Corp., 5.875%, 5/01/2027 (n) | 130,000 | 135,387 | ||||||

| CCO Holdings LLC/CCO Holdings Capital Corp., 4.75%, 3/01/2030 (n) | 165,000 | 167,838 | ||||||

| CSC Holdings LLC, 5.5%, 4/15/2027 (n) | 200,000 | 207,938 | ||||||

| DISH DBS Corp., 5.875%, 11/15/2024 | 30,000 | 28,855 | ||||||

| DISH DBS Corp., 7.75%, 7/01/2026 | 65,000 | 64,025 | ||||||

| Intelsat Jackson Holdings S.A., 5.5%, 8/01/2023 (a) | 60,000 | 32,100 | ||||||

| Intelsat Jackson Holdings S.A., 9.75%, 7/15/2025 (a)(n) | 50,000 | 28,250 | ||||||

| Sirius XM Holdings, Inc., 4.625%, 7/15/2024 (n) | 135,000 | 137,646 | ||||||

6

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Cable TV - continued | ||||||||

| Sirius XM Holdings, Inc., 5.5%, 7/01/2029 (n) | $ | 45,000 | $ | 47,457 | ||||

| Sirius XM Radio, Inc., 5.375%, 4/15/2025 (n) | 45,000 | 46,406 | ||||||

| Telenet Finance Luxembourg S.A., 5.5%, 3/01/2028 (n) | 200,000 | 204,000 | ||||||

| Telesat Holdings, Inc., 6.5%, 10/15/2027 (n) | 60,000 | 56,442 | ||||||

| Videotron Ltd., 5.375%, 6/15/2024 (n) | 25,000 | 26,501 | ||||||

| Videotron Ltd., 5.125%, 4/15/2027 (n) | 150,000 | 156,750 | ||||||

| Ziggo Bond Finance B.V., 5.125%, 2/28/2030 (n) | 200,000 | 197,000 | ||||||

|

|

|

|||||||

| $ | 1,760,732 | |||||||

| Chemicals - 1.0% | ||||||||

| Element Solutions, Inc., 5.875%, 12/01/2025 (n) | $ | 50,000 | $ | 49,537 | ||||

| SPCM S.A., 4.875%, 9/15/2025 (n) | 200,000 | 202,000 | ||||||

| Starfruit Finance Co./Starfruit U.S. Holding Co. LLC, 6.5%, 10/01/2026 (n) | EUR | 100,000 | 103,558 | |||||

| Tronox, Inc., 6.5%, 4/15/2026 (n) | $ | 20,000 | 18,100 | |||||

|

|

|

|||||||

| $ | 373,195 | |||||||

| Computer Software - 0.7% | ||||||||

| Camelot Finance S.A., 4.5%, 11/01/2026 (n) | $ | 60,000 | $ | 60,450 | ||||

| PTC, Inc., 3.625%, 2/15/2025 (n) | 65,000 | 63,993 | ||||||

| PTC, Inc., 4%, 2/15/2028 (n) | 10,000 | 9,800 | ||||||

| VeriSign, Inc., 5.25%, 4/01/2025 | 45,000 | 49,347 | ||||||

| VeriSign, Inc., 4.75%, 7/15/2027 | 45,000 | 47,934 | ||||||

|

|

|

|||||||

| $ | 231,524 | |||||||

| Computer Software - Systems - 1.1% | ||||||||

| Fair Isaac Corp., 5.25%, 5/15/2026 (n) | $ | 140,000 | $ | 144,550 | ||||

| Fair Isaac Corp., 4%, 6/15/2028 (n) | 22,000 | 21,813 | ||||||

| JDA Software Group, Inc., 7.375%, 10/15/2024 (n) | 70,000 | 68,775 | ||||||

| Sabre GLBL, Inc., 5.375%, 4/15/2023 (n) | 70,000 | 65,100 | ||||||

| SS&C Technologies Holdings, Inc., 5.5%, 9/30/2027 (n) | 80,000 | 82,000 | ||||||

|

|

|

|||||||

| $ | 382,238 | |||||||

| Conglomerates - 2.3% | ||||||||

| Amsted Industries Co., 5.625%, 7/01/2027 (n) | $ | 80,000 | $ | 80,088 | ||||

| BWX Technologies, Inc., 5.375%, 7/15/2026 (n) | 120,000 | 122,550 | ||||||

| CFX Escrow Corp., 6.375%, 2/15/2026 (n) | 60,000 | 61,872 | ||||||

| EnerSys, 5%, 4/30/2023 (n) | 100,000 | 99,750 | ||||||

| EnerSys, 4.375%, 12/15/2027 (n) | 20,000 | 19,300 | ||||||

| Gates Global LLC, 6.25%, 1/15/2026 (n) | 75,000 | 68,258 | ||||||

| Granite Holdings U.S. Acquisition Co., 11%, 10/01/2027 (n) | 40,000 | 34,000 | ||||||

| Griffon Corp., 5.75%, 3/01/2028 | 40,000 | 38,100 | ||||||

| MTS Systems Corp., 5.75%, 8/15/2027 (n) | 70,000 | 64,925 | ||||||

| Stevens Holding Co., Inc., 6.125%, 10/01/2026 (n) | 70,000 | 70,154 | ||||||

7

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Conglomerates - continued | ||||||||

| TriMas Corp., 4.875%, 10/15/2025 (n) | $ | 160,000 | $ | 156,600 | ||||

|

|

|

|||||||

| $ | 815,597 | |||||||

| Construction - 0.8% | ||||||||

| Mattamy Group Corp., 5.25%, 12/15/2027 (n) | $ | 30,000 | $ | 28,125 | ||||

| Mattamy Group Corp., 4.625%, 3/01/2030 (n) | 60,000 | 53,124 | ||||||

| Shea Homes LP/Shea Homes Funding Corp., 4.75%, 2/15/2028 (n) | 55,000 | 47,506 | ||||||

| Toll Brothers Finance Corp., 4.875%, 11/15/2025 | 60,000 | 60,600 | ||||||

| Toll Brothers Finance Corp., 4.35%, 2/15/2028 | 80,000 | 78,800 | ||||||

|

|

|

|||||||

| $ | 268,155 | |||||||

| Consumer Products - 0.8% | ||||||||

| Coty, Inc., 6.5%, 4/15/2026 (n) | $ | 70,000 | $ | 58,800 | ||||

| Energizer Holdings, Inc., 6.375%, 7/15/2026 (n) | 95,000 | 98,790 | ||||||

| Mattel, Inc., 6.75%, 12/31/2025 (n) | 65,000 | 65,975 | ||||||

| Mattel, Inc., 5.875%, 12/15/2027 (n) | 39,000 | 37,955 | ||||||

| Prestige Brands, Inc., 5.125%, 1/15/2028 (n) | 35,000 | 35,403 | ||||||

|

|

|

|||||||

| $ | 296,923 | |||||||

| Consumer Services - 1.3% | ||||||||

| Allied Universal Holdco LLC, 9.75%, 7/15/2027 (n) | $ | 50,000 | $ | 50,500 | ||||

| Frontdoor, Inc., 6.75%, 8/15/2026 (n) | 65,000 | 67,438 | ||||||

| Garda World Security Corp., 4.625%, 2/15/2027 (n) | 20,000 | 19,250 | ||||||

| GW B-CR Security Corp., 9.5%, 11/01/2027 (n) | 39,000 | 39,000 | ||||||

| Match Group, Inc., 6.375%, 6/01/2024 | 105,000 | 108,741 | ||||||

| Match Group, Inc., 5%, 12/15/2027 (n) | 70,000 | 73,290 | ||||||

| Realogy Group LLC, 9.375%, 4/01/2027 (n) | 70,000 | 49,000 | ||||||

| ServiceMaster Co. LLC, 5.125%, 11/15/2024 (n) | 70,000 | 71,414 | ||||||

|

|

|

|||||||

| $ | 478,633 | |||||||

| Containers - 1.8% | ||||||||

| ARD Finance S.A., 6.5%, (6.5% cash or 7.25% PIK) 6/30/2027 (n)(p) | $ | 200,000 | $ | 185,640 | ||||

| Crown Americas LLC/Crown Americas Capital Corp. V, 4.25%, 9/30/2026 | 100,000 | 100,205 | ||||||

| Crown Americas LLC/Crown Americas Capital Corp. VI, 4.75%, 2/01/2026 | 40,000 | 41,100 | ||||||

| Flex Acquisition Co., Inc., 6.875%, 1/15/2025 (n) | 70,000 | 67,791 | ||||||

| LABL Escrow Issuer LLC, 6.75%, 7/15/2026 (n) | 10,000 | 10,333 | ||||||

| Mauser Packaging Solutions, 5.5%, 4/15/2024 (n) | 10,000 | 9,222 | ||||||

| Mauser Packaging Solutions, 7.25%, 4/15/2025 (n) | 15,000 | 11,738 | ||||||

| Reynolds Group, 5.125%, 7/15/2023 (n) | 70,000 | 70,350 | ||||||

| Reynolds Group, 7%, 7/15/2024 (n) | 25,000 | 25,092 | ||||||

| Silgan Holdings, Inc., 4.75%, 3/15/2025 | 85,000 | 86,275 | ||||||

| Silgan Holdings, Inc., 4.125%, 2/01/2028 (n) | 34,000 | 33,405 | ||||||

|

|

|

|||||||

| $ | 641,151 | |||||||

8

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Electrical Equipment - 0.3% | ||||||||

| CommScope Technologies LLC, 6%, 6/15/2025 (n) | $ | 50,000 | $ | 44,495 | ||||

| CommScope Technologies LLC, 5%, 3/15/2027 (n) | 55,000 | 47,163 | ||||||

|

|

|

|||||||

| $ | 91,658 | |||||||

| Electronics - 1.1% | ||||||||

| Entegris, Inc., 4.625%, 2/10/2026 (n) | $ | 90,000 | $ | 90,225 | ||||

| Entegris, Inc., 4.375%, 4/15/2028 (n) | 30,000 | 30,037 | ||||||

| Qorvo, Inc., 5.5%, 7/15/2026 | 65,000 | 68,250 | ||||||

| Sensata Technologies B.V., 5.625%, 11/01/2024 (n) | 60,000 | 60,900 | ||||||

| Sensata Technologies B.V., 5%, 10/01/2025 (n) | 140,000 | 139,244 | ||||||

| Sensata Technologies, Inc., 4.375%, 2/15/2030 (n) | 20,000 | 19,400 | ||||||

|

|

|

|||||||

| $ | 408,056 | |||||||

| Emerging Market Quasi-Sovereign - 0.8% | ||||||||

| Petrobras Global Finance B.V. (Federative Republic of Brazil), 5.75%, 2/01/2029 | $ | 200,000 | $ | 190,000 | ||||

| Petroleos Mexicanos, 6.49%, 1/23/2027 (n) | 100,000 | 81,490 | ||||||

|

|

|

|||||||

| $ | 271,490 | |||||||

| Emerging Market Sovereign - 1.5% | ||||||||

| Arab Republic of Egypt, 6.588%, 2/21/2028 | $ | 200,000 | $ | 183,600 | ||||

| Government of Ukraine, 7.75%, 9/01/2024 | 100,000 | 94,247 | ||||||

| Republic of Ecuador, 7.875%, 1/23/2028 (a)(n) | 200,000 | 56,752 | ||||||

| Republic of Turkey, 5.75%, 3/22/2024 | 200,000 | 192,731 | ||||||

| Republic of Venezuela, 7%, 3/31/2038 (a)(d) | 203,000 | 16,240 | ||||||

|

|

|

|||||||

| $ | 543,570 | |||||||

| Energy - Independent - 0.9% | ||||||||

| Afren PLC, 11.5%, 2/01/2016 (a)(d)(z) | $ | 195,167 | $ | 160 | ||||

| CrownRock LP/CrownRock Finance, Inc., 5.625%, 10/15/2025 (n) | 95,000 | 76,960 | ||||||

| Jagged Peak Energy LLC, 5.875%, 5/01/2026 | 45,000 | 38,250 | ||||||

| Laredo Petroleum, Inc., 10.125%, 1/15/2028 | 10,000 | 4,074 | ||||||

| Magnolia Oil & Gas Operating LLC/Magnolia Oil & Gas Finance Corp., 6%, 8/01/2026 (n) | 55,000 | 45,100 | ||||||

| Matador Resources Co., 5.875%, 9/15/2026 | 35,000 | 17,500 | ||||||

| Parsley Energy LLC/Parsley Finance Corp., 5.625%, 10/15/2027 (n) | 45,000 | 38,475 | ||||||

| PDC Energy, Inc., 5.75%, 5/15/2026 | 10,000 | 7,627 | ||||||

| SM Energy Co., 6.75%, 9/15/2026 | 20,000 | 5,450 | ||||||

| Southwestern Energy Co., 6.2%, 1/23/2025 | 24,900 | 22,037 | ||||||

| Southwestern Energy Co., 7.5%, 4/01/2026 | 17,900 | 16,065 | ||||||

| WPX Energy, Inc., 5.75%, 6/01/2026 | 55,000 | 49,847 | ||||||

|

|

|

|||||||

| $ | 321,545 | |||||||

9

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Entertainment - 0.7% | ||||||||

| Cinemark USA, Inc., 4.875%, 6/01/2023 | $ | 45,000 | $ | 37,800 | ||||

| Cinemark USA, Inc., 8.75%, 5/01/2025 (n) | 15,000 | 15,225 | ||||||

| Live Nation Entertainment, Inc., 5.625%, 3/15/2026 (n) | 110,000 | 96,800 | ||||||

| NCL Corp. Ltd., 3.625%, 12/15/2024 (n) | 15,000 | 9,637 | ||||||

| Six Flags Entertainment Corp., 4.875%, 7/31/2024 (n) | 75,000 | 66,015 | ||||||

| Six Flags Entertainment Corp., 7%, 7/01/2025 (n) | 35,000 | 36,218 | ||||||

|

|

|

|||||||

| $ | 261,695 | |||||||

| Financial Institutions - 1.5% | ||||||||

| Avolon Holdings Funding Ltd., 5.125%, 10/01/2023 | $ | 60,000 | $ | 53,683 | ||||

| Avolon Holdings Funding Ltd., 3.95%, 7/01/2024 (n) | 42,000 | 36,138 | ||||||

| Credit Acceptance Corp., 5.125%, 12/31/2024 (n) | 60,000 | 52,650 | ||||||

| Global Aircraft Leasing Co. Ltd., 6.5%, (6.5% cash or 7.25% PIK) 9/15/2024 (n)(p) | 144,000 | 87,120 | ||||||

| Nationstar Mortgage Holdings, Inc., 8.125%, 7/15/2023 (n) | 70,000 | 67,200 | ||||||

| Nationstar Mortgage Holdings, Inc., 6%, 1/15/2027 (n) | 30,000 | 25,593 | ||||||

| Navient Corp., 5.5%, 1/25/2023 | 20,000 | 18,550 | ||||||

| Navient Corp., 5%, 3/15/2027 | 20,000 | 16,840 | ||||||

| OneMain Financial Corp., 6.875%, 3/15/2025 | 60,000 | 56,742 | ||||||

| OneMain Financial Corp., 7.125%, 3/15/2026 | 30,000 | 28,275 | ||||||

| Park Aerospace Holdings Ltd., 5.5%, 2/15/2024 (n) | 75,000 | 66,033 | ||||||

| Springleaf Finance Corp., 5.375%, 11/15/2029 | 25,000 | 20,755 | ||||||

|

|

|

|||||||

| $ | 529,579 | |||||||

| Food & Beverages - 2.3% | ||||||||

| BRF S.A., 4.875%, 1/24/2030 (n) | $ | 200,000 | $ | 172,350 | ||||

| Cott Holdings, Inc., 5.5%, 4/01/2025 (n) | 80,000 | 80,400 | ||||||

| JBS USA LLC/JBS USA Finance, Inc., 6.75%, 2/15/2028 (n) | 120,000 | 128,513 | ||||||

| JBS USA Lux S.A./JBS USA Finance, Inc., 5.875%, 7/15/2024 (n) | 38,000 | 38,760 | ||||||

| JBS USA Lux S.A./JBS USA Finance, Inc., 5.5%, 1/15/2030 (n) | 35,000 | 35,437 | ||||||

| Lamb Weston Holdings, Inc., 4.625%, 11/01/2024 (n) | 110,000 | 112,145 | ||||||

| Performance Food Group Co., 5.5%, 10/15/2027 (n) | 65,000 | 61,751 | ||||||

| Pilgrim’s Pride Corp., 5.75%, 3/15/2025 (n) | 25,000 | 25,253 | ||||||

| Pilgrim’s Pride Corp., 5.875%, 9/30/2027 (n) | 65,000 | 65,777 | ||||||

| U.S. Foods Holding Corp., 5.875%, 6/15/2024 (n) | 80,000 | 76,186 | ||||||

| U.S. Foods Holding Corp., 6.25%, 4/15/2025 (n) | 25,000 | 25,469 | ||||||

|

|

|

|||||||

| $ | 822,041 | |||||||

| Gaming & Lodging - 2.3% | ||||||||

| CCM Merger, Inc., 6%, 3/15/2022 (n) | $ | 85,000 | $ | 80,325 | ||||

| GLP Capital LP/GLP Financing II, Inc., 5.375%, 11/01/2023 | 30,000 | 29,100 | ||||||

| GLP Capital LP/GLP Financing II, Inc., 5.25%, 6/01/2025 | 75,000 | 72,945 | ||||||

| Hilton Domestic Operating Co., Inc., 5.125%, 5/01/2026 | 65,000 | 64,175 | ||||||

| Hilton Worldwide Finance LLC, 4.625%, 4/01/2025 | 105,000 | 102,900 | ||||||

10

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Gaming & Lodging - continued | ||||||||

| Scientific Games Corp., 8.25%, 3/15/2026 (n) | $ | 65,000 | $ | 49,075 | ||||

| Scientific Games International, Inc., 7%, 5/15/2028 (n) | 20,000 | 14,400 | ||||||

| VICI Properties LP, REIT, 4.25%, 12/01/2026 (n) | 80,000 | 74,767 | ||||||

| VICI Properties LP, REIT, 3.75%, 2/15/2027 (n) | 70,000 | 65,100 | ||||||

| VICI Properties LP, REIT, 4.625%, 12/01/2029 (n) | 25,000 | 23,250 | ||||||

| Wyndham Hotels Group LLC, 5.375%, 4/15/2026 (n) | 135,000 | 123,525 | ||||||

| Wynn Las Vegas LLC/Wynn Las Vegas Capital Corp., 5.5%, 3/01/2025 (n) | 115,000 | 102,350 | ||||||

| Wynn Las Vegas LLC/Wynn Las Vegas Capital Corp., 5.25%, 5/15/2027 (n) | 20,000 | 17,400 | ||||||

|

|

|

|||||||

| $ | 819,312 | |||||||

| Insurance - Health - 0.4% | ||||||||

| Centene Corp., 5.375%, 6/01/2026 (n) | $ | 75,000 | $ | 79,410 | ||||

| Centene Corp., 4.25%, 12/15/2027 (n) | 45,000 | 47,081 | ||||||

|

|

|

|||||||

| $ | 126,491 | |||||||

| Insurance - Property & Casualty - 0.5% | ||||||||

| Alliant Holdings Intermediate LLC, 6.75%, 10/15/2027 (n) | $ | 60,000 | $ | 59,856 | ||||

| AmWINS Group, Inc., 7.75%, 7/01/2026 (n) | 15,000 | 15,450 | ||||||

| GTCR (AP) Finance, Inc., 8%, 5/15/2027 (n) | 15,000 | 14,025 | ||||||

| Hub International Ltd., 7%, 5/01/2026 (n) | 100,000 | 98,645 | ||||||

|

|

|

|||||||

| $ | 187,976 | |||||||

| Machinery & Tools - 0.0% | ||||||||

| United Rentals North America, Inc., 4.875%, 1/15/2028 | $ | 10,000 | $ | 10,022 | ||||

| Major Banks - 0.5% | ||||||||

| Sovcombank PJSC (SovCom Capital DAC), 8%, 4/07/2030 (n) | $ | 200,000 | $ | 194,040 | ||||

| Medical & Health Technology & Services - 4.2% | ||||||||

| Avantor, Inc., 9%, 10/01/2025 (n) | $ | 120,000 | $ | 130,140 | ||||

| BCPE Cycle Merger Sub II, Inc., 10.625%, 7/15/2027 (n) | 35,000 | 34,650 | ||||||

| CHS/Community Health Systems, Inc., 8%, 12/15/2027 (n) | 10,000 | 9,500 | ||||||

| Community Health Systems, Inc., 6.625%, 2/15/2025 (n) | 80,000 | 73,400 | ||||||

| DaVita, Inc., 5%, 5/01/2025 | 80,000 | 81,200 | ||||||

| Encompass Health Corp., 5.75%, 9/15/2025 | 40,000 | 40,600 | ||||||

| HCA, Inc., 5.375%, 2/01/2025 | 160,000 | 172,022 | ||||||

| HCA, Inc., 5.875%, 2/15/2026 | 90,000 | 100,602 | ||||||

| HCA, Inc., 5.625%, 9/01/2028 | 20,000 | 22,162 | ||||||

| HCA, Inc., 3.5%, 9/01/2030 | 60,000 | 57,351 | ||||||

| HealthSouth Corp., 5.125%, 3/15/2023 | 105,000 | 104,475 | ||||||

| Heartland Dental LLC, 8.5%, 5/01/2026 (n) | 50,000 | 43,125 | ||||||

11

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Medical & Health Technology & Services - continued | ||||||||

| IQVIA Holdings, Inc., 5%, 5/15/2027 (n) | $ | 200,000 | $ | 205,438 | ||||

| LifePoint Health, Inc., 4.375%, 2/15/2027 (n) | 25,000 | 23,500 | ||||||

| MPH Acquisition Holdings LLC, 7.125%, 6/01/2024 (n) | 55,000 | 49,017 | ||||||

| Polaris, 8.5%, (8.5% cash or 8.5% PIK) 12/01/2022 (n)(p) | 35,000 | 29,313 | ||||||

| Radiology Partners, Inc., 9.25%, 2/01/2028 (n) | 30,000 | 28,575 | ||||||

| Regional Care/LifePoint Health, Inc., 9.75%, 12/01/2026 (n) | 90,000 | 96,300 | ||||||

| Team Health Holdings, Inc., 6.375%, 2/01/2025 (n) | 20,000 | 10,996 | ||||||

| Tenet Healthcare Corp., 4.875%, 1/01/2026 (n) | 85,000 | 83,614 | ||||||

| Tenet Healthcare Corp., 5.125%, 11/01/2027 (n) | 60,000 | 59,250 | ||||||

| West Street Merger Sub, Inc., 6.375%, 9/01/2025 (n) | 45,000 | 42,188 | ||||||

|

|

|

|||||||

| $ | 1,497,418 | |||||||

| Medical Equipment - 0.6% | ||||||||

| Hill-Rom Holdings, Inc., 4.375%, 9/15/2027 (n) | $ | 85,000 | $ | 86,062 | ||||

| Hologic, Inc., 4.375%, 10/15/2025 (n) | 25,000 | 25,115 | ||||||

| Teleflex, Inc., 4.875%, 6/01/2026 | 30,000 | 30,450 | ||||||

| Teleflex, Inc., 4.625%, 11/15/2027 | 85,000 | 87,125 | ||||||

|

|

|

|||||||

| $ | 228,752 | |||||||

| Metals & Mining - 2.0% | ||||||||

| Arconic Corp., 6%, 5/15/2025 (n) | $ | 35,000 | $ | 35,394 | ||||

| Baffinland Iron Mines Corp./Baffinland Iron Mines LP, 8.75%, 7/15/2026 (n) | 45,000 | 39,600 | ||||||

| Cleveland-Cliffs, Inc., 6.75%, 3/15/2026 (n) | 30,000 | 26,175 | ||||||

| Cleveland-Cliffs, Inc., 5.875%, 6/01/2027 | 40,000 | 25,000 | ||||||

| Compass Minerals International, Inc., 6.75%, 12/01/2027 (n) | 65,000 | 64,350 | ||||||

| Freeport-McMoRan Copper & Gold, Inc., 5.4%, 11/14/2034 | 60,000 | 56,250 | ||||||

| Freeport-McMoRan, Inc., 5%, 9/01/2027 | 60,000 | 58,500 | ||||||

| Freeport-McMoRan, Inc., 5.25%, 9/01/2029 | 60,000 | 59,250 | ||||||

| Grinding Media, Inc./Moly-Cop AltaSteel Ltd., 7.375%, 12/15/2023 (n) | 50,000 | 49,345 | ||||||

| Kaiser Aluminum Corp., 4.625%, 3/01/2028 (n) | 118,000 | 109,858 | ||||||

| Northwest Acquisitions ULC/Dominion Finco, Inc., 7.125%, 11/01/2022 (a)(d)(n) | 20,000 | 2,050 | ||||||

| Novelis Corp., 5.875%, 9/30/2026 (n) | 105,000 | 102,091 | ||||||

| SunCoke Energy Partners LP/SunCoke Energy Partners Finance Corp., 7.5%, 6/15/2025 (n) | 30,000 | 22,875 | ||||||

| TMS International Corp., 7.25%, 8/15/2025 (n) | 85,000 | 63,431 | ||||||

|

|

|

|||||||

| $ | 714,169 | |||||||

| Midstream - 1.9% | ||||||||

| Cheniere Energy Partners LP, 5.25%, 10/01/2025 | $ | 180,000 | $ | 171,828 | ||||

| Cheniere Energy, Inc., 4.5%, 10/01/2029 (n) | 52,000 | 47,970 | ||||||

| EnLink Midstream Partners LP, 4.85%, 7/15/2026 | 15,000 | 9,150 | ||||||

| EQT Midstream Partners LP , 5.5%, 7/15/2028 | 65,000 | 57,850 | ||||||

12

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Midstream - continued | ||||||||

| Genesis Energy LP/Genesis Energy Finance Corp., 5.625%, 6/15/2024 | $ | 15,000 | $ | 12,675 | ||||

| Genesis Energy LP/Genesis Energy Finance Corp., 6.25%, 5/15/2026 | 58,900 | 49,181 | ||||||

| Peru LNG, 5.375%, 3/22/2030 | 200,000 | 111,300 | ||||||

| Targa Resources Partners LP/Targa Resources Finance Corp., 5.25%, 5/01/2023 | 75,000 | 70,845 | ||||||

| Targa Resources Partners LP/Targa Resources Finance Corp., 5.375%, 2/01/2027 | 95,000 | 80,750 | ||||||

| Targa Resources Partners LP/Targa Resources Finance Corp., 6.875%, 1/15/2029 | 40,000 | 36,684 | ||||||

| Western Midstream Operating LP, 4.05%, 2/01/2030 | 35,000 | 31,938 | ||||||

|

|

|

|||||||

| $ | 680,171 | |||||||

| Municipals - 0.3% | ||||||||

| Puerto Rico Industrial, Tourist, Educational, Medical & Environmental Control Facilities Financing Authority Rev. (Cogeneration Facilities - AES Puerto Rico Project), 9.12%, 6/01/2022 | $ | 100,000 | $ | 102,500 | ||||

| Network & Telecom - 0.1% | ||||||||

| Front Range BidCo, Inc., 6.125%, 3/01/2028 (n) | $ | 20,000 | $ | 18,850 | ||||

| Oil Services - 0.6% | ||||||||

| Apergy Corp., 6.375%, 5/01/2026 | $ | 45,000 | $ | 36,900 | ||||

| Diamond Offshore Drill Co., 5.7%, 10/15/2039 (a)(d) | 60,000 | 6,462 | ||||||

| Ensign Drilling, Inc., 9.25%, 4/15/2024 (n) | 40,000 | 11,608 | ||||||

| MV24 Capital B.V., 6.748%, 6/01/2034 (n) | 197,212 | 166,153 | ||||||

|

|

|

|||||||

| $ | 221,123 | |||||||

| Oils - 0.5% | ||||||||

| Parkland Fuel Corp., 6%, 4/01/2026 (n) | $ | 120,000 | $ | 115,500 | ||||

| PBF Holding Co. LLC/PBF Finance Corp., 7.25%, 6/15/2025 | 50,000 | 37,500 | ||||||

| PBF Holding Co. LLC/PBF Finance Corp., 6%, 2/15/2028 (n) | 40,000 | 28,476 | ||||||

|

|

|

|||||||

| $ | 181,476 | |||||||

| Other Banks & Diversified Financials - 0.5% | ||||||||

| BBVA Bancomer S.A./Texas, 5.875%, 9/13/2034 (n) | $ | 200,000 | $ | 175,140 | ||||

| Pharmaceuticals - 0.8% | ||||||||

| Bausch Health Companies, Inc., 5.5%, 3/01/2023 (n) | $ | 29,000 | $ | 28,710 | ||||

| Bausch Health Companies, Inc., 6.125%, 4/15/2025 (n) | 185,000 | 187,312 | ||||||

| Bausch Health Companies, Inc., 5%, 1/30/2028 (n) | 20,000 | 19,194 | ||||||

| Endo Finance LLC/Endo Finco, Inc., 5.375%, 1/15/2023 (n) | 55,000 | 41,250 | ||||||

|

|

|

|||||||

| $ | 276,466 | |||||||

13

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Pollution Control - 0.4% | ||||||||

| Covanta Holding Corp., 5.875%, 3/01/2024 | $ | 60,000 | $ | 58,950 | ||||

| Covanta Holding Corp., 6%, 1/01/2027 | 20,000 | 19,200 | ||||||

| GFL Environmental, Inc., 7%, 6/01/2026 (n) | 24,000 | 24,986 | ||||||

| GFL Environmental, Inc., 8.5%, 5/01/2027 (n) | 30,000 | 32,736 | ||||||

|

|

|

|||||||

| $ | 135,872 | |||||||

| Precious Metals & Minerals - 0.0% | ||||||||

| Teck Resources Ltd., 6.25%, 7/15/2041 | $ | 10,000 | $ | 9,425 | ||||

| Printing & Publishing - 0.7% | ||||||||

| Cimpress N.V., 7%, 6/15/2026 (n) | $ | 150,000 | $ | 108,915 | ||||

| Meredith Corp., 6.875%, 2/01/2026 | 45,000 | 38,565 | ||||||

| Nielsen Finance LLC, 5%, 4/15/2022 (n) | 86,000 | 84,719 | ||||||

|

|

|

|||||||

| $ | 232,199 | |||||||

| Real Estate - Healthcare - 0.3% | ||||||||

| MPT Operating Partnership LP/MPT Financial Co., REIT, 5.25%, 8/01/2026 | $ | 65,000 | $ | 65,650 | ||||

| MPT Operating Partnership LP/MPT Financial Co., REIT, 5%, 10/15/2027 | 55,000 | 56,100 | ||||||

|

|

|

|||||||

| $ | 121,750 | |||||||

| Real Estate - Other - 0.3% | ||||||||

| Ryman Hospitality Properties, Inc., REIT, 5%, 4/15/2023 | $ | 20,000 | $ | 18,600 | ||||

| Ryman Hospitality Properties, Inc., REIT, 4.75%, 10/15/2027 (n) | 106,000 | 92,485 | ||||||

|

|

|

|||||||

| $ | 111,085 | |||||||

| Restaurants - 0.5% | ||||||||

| Golden Nugget, Inc., 6.75%, 10/15/2024 (n) | $ | 75,000 | $ | 58,500 | ||||

| KFC Holding Co./Pizza Hut Holdings LLC/Taco Bell of America LLC, 5.25%, 6/01/2026 (n) | 105,000 | 107,363 | ||||||

|

|

|

|||||||

| $ | 165,863 | |||||||

| Retailers - 0.4% | ||||||||

| DriveTime Automotive Group, Inc., 8%, 6/01/2021 (n) | $ | 65,000 | $ | 58,175 | ||||

| L Brands, Inc., 5.25%, 2/01/2028 | 75,000 | 53,813 | ||||||

| Sally Beauty Holdings, Inc., 5.625%, 12/01/2025 | 40,000 | 32,784 | ||||||

|

|

|

|||||||

| $ | 144,772 | |||||||

| Specialty Chemicals - 0.3% | ||||||||

| Koppers, Inc., 6%, 2/15/2025 (n) | $ | 55,000 | $ | 44,688 | ||||

| Univar Solutions USA, Inc., 5.125%, 12/01/2027 (n) | 80,000 | 79,400 | ||||||

|

|

|

|||||||

| $ | 124,088 | |||||||

14

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Specialty Stores - 0.4% | ||||||||

| Penske Automotive Group Co., 5.375%, 12/01/2024 | $ | 40,000 | $ | 36,788 | ||||

| Penske Automotive Group Co., 5.5%, 5/15/2026 | 55,000 | 50,325 | ||||||

| PetSmart, Inc., 7.125%, 3/15/2023 (n) | 25,000 | 23,938 | ||||||

| PetSmart, Inc., 8.875%, 6/01/2025 (n) | 20,000 | 19,400 | ||||||

|

|

|

|||||||

| $ | 130,451 | |||||||

| Supermarkets - 0.5% | ||||||||

| Albertsons Cos. LLC/Safeway, Inc., 6.625%, 6/15/2024 | $ | 31,000 | $ | 32,046 | ||||

| Albertsons Cos. LLC/Safeway, Inc., 5.75%, 3/15/2025 | 45,000 | 46,238 | ||||||

| Albertsons Cos. LLC/Safeway, Inc., 4.625%, 1/15/2027 (n) | 85,000 | 85,850 | ||||||

| Albertsons Cos. LLC/Safeway, Inc., 5.875%, 2/15/2028 (n) | 10,000 | 10,447 | ||||||

|

|

|

|||||||

| $ | 174,581 | |||||||

| Telecommunications - Wireless - 3.5% | ||||||||

| Altice France S.A., 7.375%, 5/01/2026 (n) | $ | 200,000 | $ | 209,000 | ||||

| Altice France S.A., 6%, 2/15/2028 (n) | 200,000 | 181,960 | ||||||

| Digicel International Finance Ltd., 8.75%, 5/25/2024 (n) | 200,000 | 185,250 | ||||||

| SBA Communications Corp., 4.875%, 9/01/2024 | 100,000 | 102,950 | ||||||

| SBA Communications Corp., 3.875%, 2/15/2027 (n) | 20,000 | 20,425 | ||||||

| Sprint Capital Corp., 6.875%, 11/15/2028 | 110,000 | 132,479 | ||||||

| Sprint Corp., 7.625%, 3/01/2026 | 175,000 | 206,867 | ||||||

| T-Mobile USA, Inc., 6.5%, 1/15/2024 | 75,000 | 76,680 | ||||||

| T-Mobile USA, Inc., 6.5%, 1/15/2026 | 25,000 | 26,406 | ||||||

| T-Mobile USA, Inc., 5.375%, 4/15/2027 | 115,000 | 121,625 | ||||||

|

|

|

|||||||

| $ | 1,263,642 | |||||||

| Tobacco - 0.1% | ||||||||

| Vector Group Ltd., 10.5%, 11/01/2026 (n) | $ | 25,000 | $ | 23,000 | ||||

| Utilities - Electric Power - 2.0% | ||||||||

| Adani Green Energy (UP) Ltd./Prayatna Developers Private Ltd., 6.25%, 12/10/2024 (n) | $ | 200,000 | $ | 194,820 | ||||

| Clearway Energy Operating LLC, 5.75%, 10/15/2025 | 160,000 | 164,784 | ||||||

| Clearway Energy Operating LLC, 4.75%, 3/15/2028 (n) | 30,000 | 30,525 | ||||||

| NextEra Energy Operating Co., 4.25%, 9/15/2024 (n) | 120,000 | 121,800 | ||||||

| NextEra Energy Operating Co., 4.5%, 9/15/2027 (n) | 35,000 | 35,919 | ||||||

| NextEra Energy, Inc., 4.25%, 7/15/2024 (n) | 46,000 | 46,819 | ||||||

| TerraForm Global Operating LLC, 6.125%, 3/01/2026 (n) | 25,000 | 24,750 | ||||||

| TerraForm Power Operating Co., 5%, 1/31/2028 (n) | 95,000 | 98,800 | ||||||

|

|

|

|||||||

| $ | 718,217 | |||||||

| Total Bonds (Identified Cost, $22,536,815) | $ | 20,761,342 | ||||||

15

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Common Stocks - 37.9% | ||||||||

| Aerospace - 2.4% | ||||||||

| Honeywell International, Inc. | 3,153 | $ | 447,410 | |||||

| Northrop Grumman Corp. | 1,210 | 400,111 | ||||||

|

|

|

|||||||

| $ | 847,521 | |||||||

| Brokerage & Asset Managers - 3.0% | ||||||||

| BlackRock, Inc. | 814 | $ | 408,660 | |||||

| NASDAQ, Inc. | 6,201 | 680,064 | ||||||

|

|

|

|||||||

| $ | 1,088,724 | |||||||

| Business Services - 3.9% | ||||||||

| Accenture PLC, “A” | 2,146 | $ | 397,418 | |||||

| Equifax, Inc. | 2,884 | 400,588 | ||||||

| Fiserv, Inc. (a) | 5,876 | 605,580 | ||||||

|

|

|

|||||||

| $ | 1,403,586 | |||||||

| Cable TV - 1.7% | ||||||||

| Comcast Corp., “A” | 16,130 | $ | 606,972 | |||||

| Chemicals - 0.7% | ||||||||

| PPG Industries, Inc. | 2,571 | $ | 233,524 | |||||

| Construction - 1.6% | ||||||||

| ICA Tenedora, S.A. de C.V. (a) | 10,542 | $ | 15,514 | |||||

| Sherwin-Williams Co. | 1,049 | 562,652 | ||||||

|

|

|

|||||||

| $ | 578,166 | |||||||

| Electronics - 1.8% | ||||||||

| Texas Instruments, Inc. | 5,671 | $ | 658,233 | |||||

| Food & Beverages - 1.3% | ||||||||

| Nestle S.A., ADR | 4,481 | $ | 470,953 | |||||

| Health Maintenance Organizations - 1.6% | ||||||||

| Cigna Corp. | 2,934 | $ | 574,419 | |||||

| Insurance - 3.3% | ||||||||

| AON PLC | 2,524 | $ | 435,819 | |||||

| Marsh & McLennan Cos., Inc. | 3,993 | 388,639 | ||||||

| Travelers Cos., Inc. | 3,337 | 337,738 | ||||||

|

|

|

|||||||

| $ | 1,162,196 | |||||||

| Machinery & Tools - 1.6% | ||||||||

| Illinois Tool Works, Inc. | 3,558 | $ | 578,175 | |||||

16

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Common Stocks - continued | ||||||||

| Major Banks - 1.6% | ||||||||

| JPMorgan Chase & Co. | 6,158 | $ | 589,690 | |||||

| Medical Equipment - 3.2% | ||||||||

| Medtronic PLC | 5,434 | $ | 530,522 | |||||

| Thermo Fisher Scientific, Inc. | 1,787 | 598,073 | ||||||

|

|

|

|||||||

| $ | 1,128,595 | |||||||

| Oil Services - 0.1% | ||||||||

| LTRI Holdings LP (a)(u) | 60 | $ | 31,764 | |||||

| Other Banks & Diversified Financials - 3.3% | ||||||||

| Citigroup, Inc. | 11,254 | $ | 546,494 | |||||

| Moody’s Corp. | 1,062 | 259,022 | ||||||

| U.S. Bancorp | 10,654 | 388,871 | ||||||

|

|

|

|||||||

| $ | 1,194,387 | |||||||

| Pharmaceuticals - 1.9% | ||||||||

| Johnson & Johnson | 4,435 | $ | 665,427 | |||||

| Special Products & Services - 1.2% | ||||||||

| iShares iBoxx $ High Yield Corporate Bond ETF | 5,200 | $ | 418,236 | |||||

| Utilities - Electric Power - 3.7% | ||||||||

| Duke Energy Corp. | 7,555 | $ | 639,606 | |||||

| Southern Co. | 11,892 | 674,633 | ||||||

|

|

|

|||||||

| $ | 1,314,239 | |||||||

| Total Common Stocks (Identified Cost, $9,172,229) | $ | 13,544,807 | ||||||

| Floating Rate Loans (r) - 0.8% | ||||||||

| Broadcasting - 0.1% | ||||||||

| Nexstar Broadcasting, Inc., Term Loan B4, 3.734%, 9/18/2026 | $ | 20,173 | $ | 18,862 | ||||

| WMG Acquisition Corp., Term Loan F, 2.528%, 11/01/2023 | 21,000 | 20,306 | ||||||

|

|

|

|||||||

| $ | 39,168 | |||||||

| Cable TV - 0.1% | ||||||||

| CSC Holdings LLC, Term Loan B5, 3.314%, 4/15/2027 | $ | 20,948 | $ | 19,900 | ||||

| Chemicals - 0.1% | ||||||||

| Axalta Coating Systems U.S. Holdings, Inc., Term Loan B3, 3.2%, 6/01/2024 |

$ | 17,392 | $ | 16,853 | ||||

| Element Solutions, Inc., Term Loan B1, 2.403%, 1/31/2026 | 20,895 | 19,922 | ||||||

|

|

|

|||||||

| $ | 36,775 | |||||||

17

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Floating Rate Loans (r) - continued | ||||||||

| Computer Software - Systems - 0.2% | ||||||||

| Sabre GLBL, Inc., Term Loan B, 2.75%, 2/22/2024 | $ | 41,786 | $ | 37,929 | ||||

| SS&C Technologies, Inc., Term Loan B5, 2.153%, 4/16/2025 | 20,893 | 20,040 | ||||||

|

|

|

|||||||

| $ | 57,969 | |||||||

| Conglomerates - 0.1% | ||||||||

| Gates Global LLC, Term Loan B2, 3.75%, 4/01/2024 | $ | 43,544 | $ | 40,061 | ||||

| Medical & Health Technology & Services - 0.1% | ||||||||

| DaVita Healthcare Partners, Inc., Term Loan B, 2.153%, 8/12/2026 | $ | 20,895 | $ | 20,275 | ||||

| Jaguar Holding Co. II, Term Loan, 2.903%, 8/18/2022 | 20,891 | 20,453 | ||||||

|

|

|

|||||||

| $ | 40,728 | |||||||

| Pharmaceuticals - 0.0% | ||||||||

| Bausch Health Companies, Inc., Term Loan B, 3.468%, 11/27/2025 | $ | 20,400 | $ | 19,562 | ||||

| Printing & Publishing - 0.1% | ||||||||

| Nielsen Finance LLC, Term Loan B4, 2.863%, 10/04/2023 | $ | 20,892 | $ | 20,109 | ||||

| Total Floating Rate Loans (Identified Cost, $289,500) | $ | 274,272 | ||||||

| Strike Price | First Exercise | |||||||||||||||

| Warrants - 0.0% | ||||||||||||||||

| Forest & Paper Products - 0.0% | ||||||||||||||||

| Appvion Holdings Corp. - Tranche A (1 share for 1 warrant, Expiration 6/13/23) (a) | $ | 27.17 | 8/24/18 | 40 | $ | 5 | ||||||||||

| Appvion Holdings Corp. - Tranche B (1 share for 1 warrant, Expiration 6/13/23) (a) | 31.25 | 8/24/18 | 40 | 0 | ||||||||||||

| Total Warrants (Identified Cost, $0) |

|

$ | 5 | |||||||||||||

| Investment Companies (h) - 2.4% | ||||||||||||||||

| Money Market Funds - 2.4% | ||||||||||||||||

| MFS Institutional Money Market Portfolio, 0.41% (v) (Identified Cost, $873,690) |

|

873,727 | $ | 873,814 | ||||||||||||

| Other Assets, Less Liabilities - 0.9% | 307,658 | |||||||||||||||

| Net Assets - 100.0% | $ | 35,761,898 | ||||||||||||||

| (a) | Non-income producing security. |

| (d) | In default. |

| (h) | An affiliated issuer, which may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate values of the fund’s investments in affiliated issuers and in unaffiliated issuers were $873,814 and $34,580,426, respectively. |

18

Table of Contents

Portfolio of Investments (unaudited) – continued

| (n) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. At period end, the aggregate value of these securities was $14,958,080, representing 41.8% of net assets. |

| (p) | Payment-in-kind (PIK) security for which interest income may be received in additional securities and/or cash. |

| (r) | The remaining maturities of floating rate loans may be less than the stated maturities shown as a result of contractual or optional prepayments by the borrower. Such prepayments cannot be predicted with certainty. These loans may be subject to restrictions on resale. The interest rate shown represents the weighted average of the floating interest rates on settled contracts within the loan facility at period end, unless otherwise indicated. The floating interest rates on settled contracts are determined periodically by reference to a base lending rate and a spread. |

| (u) | The security was valued using significant unobservable inputs and is considered level 3 under the fair value hierarchy. For further information about the fund’s level 3 holdings, please see Note 2 in the Notes to Financial Statements. |

| (v) | Affiliated issuer that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. |

| (z) | Restricted securities are not registered under the Securities Act of 1933 and are subject to legal restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are subsequently registered. Disposal of these securities may involve time-consuming negotiations and prompt sale at an acceptable price may be difficult. The fund holds the following restricted securities: |

| Restricted Securities | Acquisition Date |

Cost | Value | |||||||

| Afren PLC, 11.5%, 2/01/2016 | 2/11/11 | $191,339 | $160 | |||||||

| % of Net assets | 0.0% | |||||||||

The following abbreviations are used in this report and are defined:

| ADR | American Depositary Receipt |

| ETF | Exchange-Traded Fund |

| REIT | Real Estate Investment Trust |

Abbreviations indicate amounts shown in currencies other than the U.S. dollar. All amounts are stated in U.S. dollars unless otherwise indicated. A list of abbreviations is shown below:

| EUR | Euro |

Derivative Contracts at 4/30/20

Forward Foreign Currency Exchange Contracts

| Currency Purchased |

Currency |

Counterparty | Settlement Date |

Unrealized Appreciation (Depreciation) |

||||||||||||

| Liability Derivatives | ||||||||||||||||

| USD | 100,930 | EUR | 92,322 | Goldman Sachs International | 5/22/2020 | $(273) | ||||||||||

|

|

|

|||||||||||||||

See Notes to Financial Statements

19

Table of Contents

Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

At 4/30/20 (unaudited)

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| Assets | ||||

| Investments in unaffiliated issuers, at value (identified cost, $31,998,544) |

$34,580,426 | |||

| Investments in affiliated issuers, at value (identified cost, $873,690) |

873,814 | |||

| Cash |

503 | |||

| Receivables for |

||||

| Investments sold |

109,059 | |||

| Interest and dividends |

340,761 | |||

| Other assets |

16,245 | |||

| Total assets |

$35,920,808 | |||

| Liabilities | ||||

| Payables for |

||||

| Distributions |

$20,588 | |||

| Forward foreign currency exchange contracts |

273 | |||

| Investments purchased |

73,666 | |||

| Payable to affiliates |

||||

| Investment adviser |

1,708 | |||

| Administrative services fee |

96 | |||

| Transfer agent and dividend disbursing costs |

743 | |||

| Payable for independent Trustees’ compensation |

648 | |||

| Accrued expenses and other liabilities |

61,188 | |||

| Total liabilities |

$158,910 | |||

| Net assets |

$35,761,898 | |||

| Net assets consist of | ||||

| Paid-in capital |

$33,000,983 | |||

| Total distributable earnings (loss) |

2,760,915 | |||

| Net assets |

$35,761,898 | |||

| Shares of beneficial interest outstanding |

7,203,820 | |||

| Net asset value per share (net assets of $35,761,898 / 7,203,820 shares of beneficial interest outstanding) |

$4.96 | |||

See Notes to Financial Statements

20

Table of Contents

Financial Statements

Six months ended 4/30/20 (unaudited)

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| Net investment income (loss) |

| |||

| Income |

||||

| Interest |

$623,278 | |||

| Dividends |

162,465 | |||

| Dividends from affiliated issuers |

8,681 | |||

| Other |

2,608 | |||

| Income on securities loaned |

559 | |||

| Foreign taxes withheld |

(1,854 | ) | ||

| Total investment income |

$795,737 | |||

| Expenses |

||||

| Management fee |

$160,106 | |||

| Transfer agent and dividend disbursing costs |

7,492 | |||

| Administrative services fee |

8,701 | |||

| Independent Trustees’ compensation |

4,363 | |||

| Stock exchange fee |

11,919 | |||

| Custodian fee |

3,048 | |||

| Shareholder communications |

22,399 | |||

| Audit and tax fees |

38,428 | |||

| Legal fees |

455 | |||

| Miscellaneous |

19,965 | |||

| Total expenses |

$276,876 | |||

| Net investment income (loss) |

$518,861 | |||

| Realized and unrealized gain (loss) |

| |||

| Realized gain (loss) (identified cost basis) |

||||

| Unaffiliated issuers |

$1,802,014 | |||

| Affiliated issuers |

(195 | ) | ||

| Futures contracts |

(14,085 | ) | ||

| Forward foreign currency exchange contracts |

777 | |||

| Foreign currency |

(37 | ) | ||

| Net realized gain (loss) |

$1,788,474 | |||

| Change in unrealized appreciation or depreciation |

||||

| Unaffiliated issuers |

$(4,888,534 | ) | ||

| Affiliated issuers |

(90 | ) | ||

| Futures contracts |

(4,084 | ) | ||

| Forward foreign currency exchange contracts |

3,219 | |||

| Translation of assets and liabilities in foreign currencies |

(2 | ) | ||

| Net unrealized gain (loss) |

$(4,889,491 | ) | ||

| Net realized and unrealized gain (loss) |

$(3,101,017 | ) | ||

| Change in net assets from operations |

$(2,582,156 | ) | ||

See Notes to Financial Statements

21

Table of Contents

Financial Statements

STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| Change in net assets | Six months ended 4/30/20 (unaudited) |

Year ended |

||||||

| From operations | ||||||||

| Net investment income (loss) |

$518,861 | $1,133,601 | ||||||

| Net realized gain (loss) |

1,788,474 | 325,084 | ||||||

| Net unrealized gain (loss) |

(4,889,491 | ) | 3,635,384 | |||||

| Change in net assets from operations |

$(2,582,156 | ) | $5,094,069 | |||||

| Distributions to shareholders |

$(1,990,888 | ) | $(1,435,228 | ) | ||||

| Tax return of capital distributions to shareholders |

$— | $(2,484,303 | ) | |||||

| Change in net assets from fund share transactions |

$77,076 | $249,179 | ||||||

| Total change in net assets |

$(4,495,968 | ) | $1,423,717 | |||||

| Net assets | ||||||||

| At beginning of period |

40,257,866 | 38,834,149 | ||||||

| At end of period |

$35,761,898 | $40,257,866 | ||||||

See Notes to Financial Statements

22

Table of Contents

Financial Statements

The financial highlights table is intended to help you understand the fund’s financial performance for the semiannual period and the past 5 fiscal years. Certain information reflects financial results for a single fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| Six months 4/30/20 |

Year ended | |||||||||||||||||||||||

| 10/31/19 | 10/31/18 | 10/31/17 | 10/31/16 | 10/31/15 | ||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

| Net asset value, beginning of period |

$5.60 | $5.43 | $6.03 | $5.91 | $6.09 | $6.78 | ||||||||||||||||||

| Income (loss) from investment operations |

|

|||||||||||||||||||||||

| Net investment income (loss) (d) |

$0.07 | $0.16 | $0.16 | $0.20 | (c) | $0.23 | $0.25 | |||||||||||||||||

| Net realized and unrealized |

(0.43 | ) | 0.56 | (0.18 | ) | 0.52 | 0.18 | (0.29 | ) | |||||||||||||||

| Total from investment operations |

$(0.36 | ) | $0.72 | $(0.02 | ) | $0.72 | $0.41 | $(0.04 | ) | |||||||||||||||

| Less distributions declared to shareholders |

|

|||||||||||||||||||||||

| From net investment income |

$(0.28 | ) | $(0.17 | ) | $(0.18 | ) | $(0.21 | ) | $(0.24 | ) | $(0.32 | ) | ||||||||||||

| From net realized gain |

— | (0.03 | ) | (0.11 | ) | — | — | — | ||||||||||||||||

| From tax return of capital |

— | (0.35 | ) | (0.29 | ) | (0.39 | ) | (0.35 | ) | (0.33 | ) | |||||||||||||

| Total distributions declared to |

$(0.28 | ) | $(0.55 | ) | $(0.58 | ) | $(0.60 | ) | $(0.59 | ) | $(0.65 | ) | ||||||||||||

| Net increase from repurchase of |

$0.00 | (w) | $— | $— | $0.00 | (w) | $— | $— | ||||||||||||||||

| Net asset value, end of period (x) |

$4.96 | $5.60 | $5.43 | $6.03 | $5.91 | $6.09 | ||||||||||||||||||

| Market value, end of period |

$4.93 | $6.48 | $5.49 | $6.66 | $5.50 | $5.53 | ||||||||||||||||||

| Total return at market value (%) (j)(r)(s)(x) |

(20.10 | )(n) | 30.24 | (8.87 | ) | 33.86 | 10.75 | (19.11 | ) | |||||||||||||||

| Total return at net asset value (%) |

(6.99 | )(n) | 13.80 | (0.44 | ) | 12.79 | (c) | 8.07 | (0.28 | ) | ||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: |

|

|||||||||||||||||||||||

| Expenses (f) |

1.43 | (a) | 1.41 | 1.39 | 1.23 | (c) | 1.42 | 1.41 | ||||||||||||||||

| Net investment income (loss) |

2.68 | (a) | 2.89 | 2.76 | 3.35 | (c) | 3.88 | 3.80 | ||||||||||||||||

| Portfolio turnover |

30 | (n) | 34 | 33 | 35 | 26 | 29 | |||||||||||||||||

| Net assets at end of period |

$35,762 | $40,258 | $38,834 | $42,842 | $41,849 | $43,126 | ||||||||||||||||||

See Notes to Financial Statements

23

Table of Contents

Financial Highlights – continued

| (a) | Annualized. |

| (c) | Amount reflects a one-time reimbursement of expenses by the custodian (or former custodian) without which net investment income and performance would be lower and expenses would be higher. |

| (d) | Per share data is based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (j) | Total return at net asset value is calculated using the net asset value of the fund, not the publicly traded price and therefore may be different than the total return at market value. |

| (n) | Not annualized. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. |

| (w) | Per share amount was less than $0.01. |

| (x) | The net asset values and total returns at net asset value have been calculated on net assets which include adjustments made in accordance with U.S. generally accepted accounting principles required at period end for financial reporting purposes. |

See Notes to Financial Statements

24

Table of Contents

(unaudited)

(1) Business and Organization

MFS Special Value Trust (the fund) is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as a diversified closed-end management investment company.

The fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investment Companies.

(2) Significant Accounting Policies

General – The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the fund’s Statement of Assets and Liabilities through the date that the financial statements were issued. The fund invests in high-yield securities rated below investment grade. Investments in below investment grade quality securities can involve a substantially greater risk of default or can already be in default, and their values can decline significantly. Below investment grade quality securities tend to be more sensitive to adverse news about the issuer, or the market or economy in general, than higher quality debt instruments. The fund invests in foreign securities. Investments in foreign securities are vulnerable to the effects of changes in the relative values of the local currency and the U.S. dollar and to the effects of changes in each country’s market, economic, industrial, political, regulatory, geopolitical, and other conditions.

In March 2020, the FASB issued Accounting Standards Update 2020-04, Reference Rate Reform (Topic 848) – Facilitation of the Effects of Reference Rate Reform on Financial Reporting (“ASU 2020-04”), which provides optional, temporary relief with respect to the financial reporting of contracts subject to certain types of modifications due to the planned discontinuation of the London Interbank Offered Rate (LIBOR) and other IBOR-based reference rates as of the end of 2021. The temporary relief provided by ASU 2020-04 is effective for certain reference rate-related contract modifications that occur during the period from March 12, 2020 through December 31, 2022. Management is evaluating the impact of ASU 2020-04 on the fund’s investments, derivatives, debt and other contracts that will undergo reference rate-related modifications as a result of the reference rate reform.

In March 2017, the FASB issued Accounting Standards Update 2017-08, Receivables –Nonrefundable Fees and Other Costs (Subtopic 310-20) – Premium Amortization on Purchased Callable Debt Securities (“ASU 2017-08”). For callable debt securities purchased at a premium that have explicit, non-contingent call features and that are callable at fixed prices on preset dates, ASU 2017-08 requires the premium to be amortized to the earliest call date. The fund adopted ASU 2017-08 as of the beginning of the reporting period on a modified retrospective basis. The adoption resulted in a

25

Table of Contents

Notes to Financial Statements (unaudited) – continued

change in accounting principle, since the fund had historically amortized such premiums to maturity for U.S. GAAP. As a result of the adoption, the fund recognized a cumulative effect adjustment that increased the beginning of period cost of investments and decreased the unrealized appreciation on investments by offsetting amounts. Adoption had no impact on the fund’s net assets or any prior period information presented in the financial statements. With respect to the fund’s results of operations, amortization of premium to first call date under ASU 2017-08 accelerates amortization with the intent of more closely aligning the recognition of income on such bonds with the economics of the instrument.

Balance Sheet Offsetting – The fund’s accounting policy with respect to balance sheet offsetting is that, absent an event of default by the counterparty or a termination of the agreement, the International Swaps and Derivatives Association (ISDA) Master Agreement, or similar agreement, does not result in an offset of reported amounts of financial assets and financial liabilities in the Statement of Assets and Liabilities across transactions between the fund and the applicable counterparty. The fund’s right to setoff may be restricted or prohibited by the bankruptcy or insolvency laws of the particular jurisdiction to which a specific master netting agreement counterparty is subject. Balance sheet offsetting disclosures, to the extent applicable to the fund, have been included in the fund’s Significant Accounting Policies note under the captions for each of the fund’s in-scope financial instruments and transactions.

Investment Valuations – Equity securities, including restricted equity securities, are generally valued at the last sale or official closing price on their primary market or exchange as provided by a third-party pricing service. Equity securities, for which there were no sales reported that day, are generally valued at the last quoted daily bid quotation on their primary market or exchange as provided by a third-party pricing service. Debt instruments and floating rate loans, including restricted debt instruments, are generally valued at an evaluated or composite bid as provided by a third-party pricing service. Short-term instruments with a maturity at issuance of 60 days or less may be valued at amortized cost, which approximates market value. Futures contracts are generally valued at last posted settlement price on their primary exchange as provided by a third-party pricing service. Futures contracts for which there were no trades that day for a particular position are generally valued at the closing bid quotation on their primary exchange as provided by a third-party pricing service. Forward foreign currency exchange contracts are generally valued at the mean of bid and asked prices for the time period interpolated from rates provided by a third-party pricing service for proximate time periods. Open-end investment companies are generally valued at net asset value per share. Securities and other assets generally valued on the basis of information from a third-party pricing service may also be valued at a broker/dealer bid quotation. In determining values, third-party pricing services can utilize both transaction data and market information such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, and other market data. The values of foreign securities and other assets and liabilities expressed in foreign currencies are converted to U.S. dollars using the mean of bid and asked prices for rates provided by a third-party pricing service.

The Board of Trustees has delegated primary responsibility for determining or causing to be determined the value of the fund’s investments (including any fair valuation) to

26

Table of Contents

Notes to Financial Statements (unaudited) – continued

the adviser pursuant to valuation policies and procedures approved by the Board. If the adviser determines that reliable market quotations are not readily available, investments are valued at fair value as determined in good faith by the adviser in accordance with such procedures under the oversight of the Board of Trustees. Under the fund’s valuation policies and procedures, market quotations are not considered to be readily available for most types of debt instruments and floating rate loans and many types of derivatives. These investments are generally valued at fair value based on information from third-party pricing services. In addition, investments may be valued at fair value if the adviser determines that an investment’s value has been materially affected by events occurring after the close of the exchange or market on which the investment is principally traded (such as foreign exchange or market) and prior to the determination of the fund’s net asset value, or after the halt of trading of a specific security where trading does not resume prior to the close of the exchange or market on which the security is principally traded. Events that occur after foreign markets close (such as developments in foreign markets and significant movements in the U.S. markets) and prior to the determination of the fund’s net asset value may be deemed to have a material effect on the value of securities traded in foreign markets. Accordingly, the fund’s foreign equity securities may often be valued at fair value. The adviser generally relies on third-party pricing services or other information (such as the correlation with price movements of similar securities in the same or other markets; the type, cost and investment characteristics of the security; the business and financial condition of the issuer; and trading and other market data) to assist in determining whether to fair value and at what value to fair value an investment. The value of an investment for purposes of calculating the fund’s net asset value can differ depending on the source and method used to determine value. When fair valuation is used, the value of an investment used to determine the fund’s net asset value may differ from quoted or published prices for the same investment. There can be no assurance that the fund could obtain the fair value assigned to an investment if it were to sell the investment at the same time at which the fund determines its net asset value per share.

Various inputs are used in determining the value of the fund’s assets or liabilities. These inputs are categorized into three broad levels. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The fund’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the investment. Level 1 includes unadjusted quoted prices in active markets for identical assets or liabilities. Level 2 includes other significant observable market-based inputs (including quoted prices for similar securities, interest rates, prepayment speed, and credit risk). Level 3 includes unobservable inputs, which may include the adviser’s own assumptions in determining the fair value of investments. Other financial instruments are derivative instruments,

27

Table of Contents

Notes to Financial Statements (unaudited) – continued

such as forward foreign currency exchange contracts. The following is a summary of the levels used as of April 30, 2020 in valuing the fund’s assets or liabilities:

| Financial Instruments | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Equity Securities: | ||||||||||||||||

| United States |

$13,026,576 | $5 | $31,764 | $13,058,345 | ||||||||||||

| Switzerland |

470,953 | — | — | 470,953 | ||||||||||||

| Mexico |

— | 15,514 | — | 15,514 | ||||||||||||

| Non-U.S. Sovereign Debt | — | 815,060 | — | 815,060 | ||||||||||||

| Municipal Bonds | — | 102,500 | — | 102,500 | ||||||||||||

| U.S. Corporate Bonds | — | 16,117,305 | — | 16,117,305 | ||||||||||||

| Foreign Bonds | — | 3,726,477 | — | 3,726,477 | ||||||||||||

| Floating Rate Loans | — | 274,272 | — | 274,272 | ||||||||||||

| Mutual Funds | 873,814 | — | — | 873,814 | ||||||||||||

| Total | $14,371,343 | $21,051,133 | $31,764 | $35,454,240 | ||||||||||||

| Other Financial Instruments | ||||||||||||||||

| Forward Foreign Currency Exchange | ||||||||||||||||

| Contracts – Liabilities | $— | $(273 | ) | $— | $(273 | ) | ||||||||||

For further information regarding security characteristics, see the Portfolio of Investments.

The following is a reconciliation of level 3 assets for which significant unobservable inputs were used to determine fair value. The table presents the activity of level 3 securities held at the beginning and the end of the period.

| Equity Securities |

||||

| Balance as of 10/31/19 | $30,347 | |||

| Change in unrealized appreciation or depreciation |

1,417 | |||

| Balance as of 4/30/20 | $31,764 | |||

The net change in unrealized appreciation or depreciation from investments held as level 3 at April 30, 2020 is $1,417. At April 30, 2020, the fund held one level 3 security.