UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05904

ELFUN GOVERNMENT MONEY MARKET FUND

(Exact name of registrant as specified in charter)

One Lincoln Street

Boston, Massachusetts 02111

(Address of principal executive offices) (Zip code)

| Copy to: | ||

| Joshua A. Weinberg, Esq. Managing Director and Managing Counsel SSGA Funds Management, Inc. One Lincoln Street Boston, Massachusetts 02111 |

Timothy W. Diggins, Esq. Ropes & Gray 800 Boylston Street Boston, Massachusetts 02110-2624 | |

| (Name and Address of Agent for Service) | ||

Registrant’s telephone number, including area code: (617) 664-7037

Date of fiscal year end: December 31

Date of reporting period: December 31, 2016

Item 1. Reports to Stockholders

Annual Report

December 31, 2016

Elfun Funds

Elfun International Equity Fund

Elfun Trusts

Elfun Diversified Fund

Elfun Tax-Exempt Income Fund

Elfun Income Fund

Elfun Government Money Market Fund

Elfun Funds

Annual Report

December 31, 2016

Table of Contents

| Page | ||||

| Notes to Performance | 1 | |||

| Manager Reviews and Schedule of Investments | ||||

| 2 | ||||

| 10 | ||||

| 16 | ||||

| 39 | ||||

| 50 | ||||

| 68 | ||||

| Notes to Schedules of Investments | 74 | |||

| Financial Statements | ||||

| 75 | ||||

| 82 | ||||

| 84 | ||||

| 86 | ||||

| 89 | ||||

| Report of Independent Registered Public Accounting Firm | 102 | |||

| Tax Information | 103 | |||

| Advisory Agreement Renewal | 104 | |||

| Special Meeting of Unitholders — Voting Results | 107 | |||

| Additional Information | ||||

| Trustees | 113 | |||

This report has been prepared for shareholders and may be distributed to others only if accompanied with a current prospectus and/or summary prospectus.

Elfun Funds

Notes to Performance — December 31, 2016 (Unaudited)

Information on the following performance pages relates to the Elfun Funds.

Total returns take into account changes in share price and assume reinvestment of all dividends and capital gains distributions, if any. Total returns shown are net of Fund expenses.

The performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Periods less than one year are not annualized. Please call toll-free (800) 242-0134 or visit the Funds’ website at http://www.ssgafunds.com/geam for the most recent month-end performance data.

A portion of the Elfun Tax-Exempt Income Fund’s income may be subject to state, federal and/or alternative minimum tax. Capital gains, if any, are subject to capital gains tax.

An investment in a Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any other government agency. An investment in a Fund is subject to risk, including possible loss of principal invested.

The S&P 500® Index, Morgan Stanley Capital International Europe, Australasia, Far East Index (MSCI EAFE® Index), MSCI® ACWI ex-U.S. Index, Bloomberg Barclays U.S. Aggregate Bond Index, the Bloomberg Barclays U.S. Municipal Bond Index, and the 90 Day U.S. T-Bill are unmanaged indices and do not reflect the actual cost of investing in the instruments that comprise each index. The results shown for the foregoing indices assume the reinvestment of net dividends or interest and do not reflect the fees, expenses or taxes.

The S&P 500® Index is an unmanaged, market capitalization-weighted index of stocks of 500 large U.S. companies, which is widely used as a measure of large-cap U.S. stock market performance.

The MSCI® EAFE® Index is a market capitalization-weighted index of equity securities of companies domiciled in various countries. The index is designed to represent the performance of developed stock markets outside the U.S. and Canada and excludes certain market segments unavailable to U.S. based investors.

The MSCI ACWI ex-U.S. Index is a market-capitalization weighted index designed to provide a broad measure of stock performance throughout the world, with the exception of U.S. based companies. The MSCI® ACWI ex-U.S. Index includes both developed and emerging markets.

The Bloomberg Barclays U.S. Aggregate Bond Index is a market value-weighted index of taxable investment-grade debt issues, including government, corporate, asset-backed and mortgage-backed securities, with maturities of one year or more. This index is designed to represent the performance of the U.S. investment-grade first-rate bond market.

The Bloomberg Barclays U.S. Municipal Bond Index is an unmanaged index comprised of investment-grade, fixed rate securities with maturities of at least eight years and less than twelve years.

The 90 Day U.S. T-Bill is an unmanaged measure/index of the performance of the most recently auctioned 90 Day U.S. Treasury bills (i.e. having a total maturity of 90 days) currently available in the marketplace.

The peer universe of underlying funds used for the peer group average annual total return calculation is based on the blend of Morningstar peer categories, as shown. Morningstar is an independent mutual fund rating service. A Fund’s performance may be compared to or ranked within a universe of mutual funds with investment objectives and policies similar but not necessarily identical to the Fund.

©2017 Morningstar, Inc. All Rights Reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damage or losses relating from any use of this information. Past performance is no guarantee of future results.

The views, expressed in this document reflect our judgment as of the publication date and are subject to change at any time without notice.

State Street Global Markets, LLC, member of FINRA & SIPC is the principal underwriter and distributor of the Elfun Funds and a wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. The Funds pay State Street Bank and Trust Company for its services as custodian and Fund Accounting agent, and pay SSGA Funds Management, Inc. for investment advisory and administrative services.

| Notes to Performance | 1 |

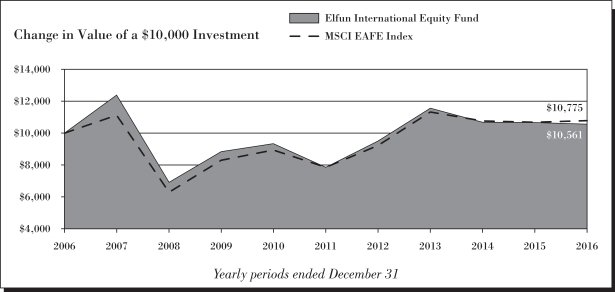

Elfun International Equity Fund

Portfolio Management Discussion and Analysis — December 31, 2016 (Unaudited)

| Q. | How did the Elfun International Equity Fund perform compared to its benchmark and Morningstar peer group for the twelve-month period ended December 31, 2016? |

| A. | For the twelve-month period ended December 31, 2016, the Elfun International Equity Fund returned -0.86%. The MSCI® EAFE Index, the Fund’s benchmark, returned 1.00% and the Fund’s Morningstar peer group of 742 Foreign Large Blend Funds returned an average of 0.67% over the same period. |

| Q. | What factors affected the Fund’s performance? |

| A. | 2016 began with equity markets falling as investors fretted over weakness in the global economy, volatility in China, currency wars, and the continuing fall in oil prices. Given the negativity of investor sentiment, it was remarkable how quickly markets rebounded from February lows, helped by a turnaround in oil and dovish rhetoric from the central banks. But the reality was that the market’s drop was always somewhat disconnected from fundamentals. For example, data out of China had been relatively stable, PMI’s and leading economic indicators were improving, and earnings growth expectations and valuations were reasonable. It was therefore not too surprising that markets mostly rose through the rest of 2016, briefly interrupted in late June when the United Kingdom voted to leave the European Union and early November on initial fears about the impact of Donald Trump’s presidential victory. 2016’s reasonable market return, however, was undermined somewhat for U.S. dollar based investors by foreign currency weakness, especially in the fourth quarter as the dollar’s strength accelerated. |

| For the year, the MSCI EAFE Index generated a 1% total return in U.S. dollars. Earnings growth during the period was not strong causing the market P/E to rise from an already elevated 21.3 at the beginning of the year to 22.9 at the end. At this valuation, the question for investors is whether the market is being overly optimistic or is it correctly pricing in healthier future earnings growth. There are some signs of earnings improvement, with, for example, Europe recently seeing the first upgrades in over a year, but this trend will need to be sustained to justify current valuations. |

| Underlying the market’s headline number was significant variance. Energy and materials, after early weakness, led throughout rest of the year, both finishing up more than 20%. For other cyclical sectors such as financials, it took longer, but starting mid-year they began to outperform, in a pronounced shift toward value stocks. Lagging this year were the defensive sectors: healthcare, utilities, telecom, and consumer staples. |

| Regionally, within the MSCI EAFE regions, the Pacific Basin excluding Japan was the strongest, up 7.9%. This was followed by Japan, which has now outperformed the MSCI® EAFE Index for four years in a row. Europe and the United Kingdom lagged. But outside of the index regions, markets were stronger, with Canada, the U.S., and emerging markets all turning in double-digit returns. |

| Q. | What were the primary drivers of Fund performance? |

| A. | The Fund’s underperformance in 2016 relative to the index came largely from two distinct periods — one at the start of the year and one at the end. In the risk-off environment of the first six weeks of 2016, the Fund, which had a pro-cyclical bias, fell even more than the market. As the market recovered, the Fund mostly outperformed the MSCI® EAFE Index over the next 9 months. This lasted until post-U.S. elections when the Fund again underperformed as the market rotated strongly into value on the potential for higher rates. |

| For the full year, the energy sector, despite accounting for only about 5% of holdings, was the biggest positive contributor to Fund performance this year. As the price of oil recovered, the Fund’s oil and gas holdings and one oil-services company surged, resulting in a nearly 30% average return for the year. The Fund’s technology names, which make up a much bigger percent of holdings, also did well, up over 7% and significantly outpacing the technology sector of the index. Geographically, the Fund’s significant exposure to Continental Europe, which rose modestly, added to performance and its emerging markets holdings, up nearly 9%, also helped. |

| On the negative side, despite doing much better in the latter half of the year as the interest rate outlook improved, banks could not overcome first half weakness and were a drag on the Fund’s performance. Also detracting from performance was the Fund’s exposure to pharmaceutical companies, which were distinctly out of favor this year, although the Fund did avoid many of the worst performers in the index. The Fund’s relatively small exposure to metals & mining stocks hurt performance relative to the broader MSCI® EAFE Index, as this sector jumped more than 50% this year. |

| 2 | Elfun International Equity Fund |

Elfun International Equity Fund

Portfolio Management Discussion and Analysis, continued — December 31, 2016 (Unaudited)

| Derivatives did not have any material impact on Fund performance. |

| Q. | Were there any significant changes to the Fund during the period? |

| A. | There were no changes during the period in the portfolio management team or their approach to investing. Turnover remained relatively low in keeping with our long-term investment horizon, but did result in some changes in positioning. Regionally, the Fund’s weight in companies based in emerging market countries increased as a result of both outperformance and trading. The Fund’s overweight (relative to the MSCI® EAFE Index) in Japan decreased somewhat but remained positive. The Fund’s underweight in the Pacific region outside of Japan became larger over the past year. |

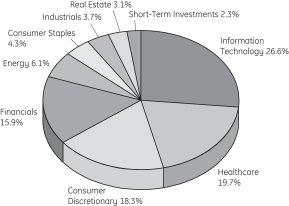

| Among sectors, Information Technology was consistently the largest overweight in 2016 although the size of that overweight fell slightly. The financials sector went from a small overweight to a moderate underweight, due in large part to reductions in Japanese banks. The consumer staples sector has been a consistent underweight, but that underweight was reduced somewhat over the last year. |

| Elfun International Equity Fund | 3 |

Elfun International Equity Fund

Understanding Your Fund’s Expenses — December 31, 2016 (Unaudited)

| 4 | Elfun International Equity Fund |

Elfun International Equity Fund

Performance Summary — December 31, 2016 (Unaudited)

| Elfun International Equity Fund | 5 |

Elfun International Equity Fund

Performance Summary, continued — December 31, 2016 (Unaudited)

| (a) | Fair Value basis is inclusive of short-term investment in State Street Institutional U.S. Government Money Market Fund Class G Shares. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

See Notes to Performance beginning on page 1 for further information, including an explanation of Morningstar peer categories.

Past performance does not predict future performance. The performance shown in the graphs and tables does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| 6 | Elfun International Equity Fund |

Elfun International Equity Fund

Schedule of Investments — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun International Equity Fund | 7 |

Elfun International Equity Fund

Schedule of Investments, continued — December 31, 2016

Other Information:

The Fund had the following long futures contracts open at December 31, 2016:

| Description | Expiration date |

Number of Contracts |

Current Notional Value |

Unrealized Depreciation |

||||||||||||

| MSCI EAFE Mini Index Futures |

March 2017 | 64 | $ | 5,361,920 | $ | (14,870 | ) | |||||||||

|

|

|

|||||||||||||||

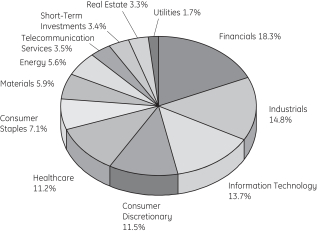

The Fund was invested in the following sectors at December 31, 2016 (unaudited):

See Notes to Schedules of Investments and Notes to Financial Statements.

| 8 | Elfun International Equity Fund |

Elfun International Equity Fund

Schedule of Investments, continued — December 31, 2016

Affiliate Table

| Number of Shares Held at 12/31/15 |

Value at 12/31/15 |

Shares Purchased |

Shares Sold |

Number of Shares Held at 12/31/16 |

Value at 12/31/16 |

Dividend/ Interest Income |

Realized Gain (Loss) |

|||||||||||||||||||||||||

| State Street Institutional U.S. Government Money Market Fund |

9,904,613 | $ | 9,904,614 | 43,649,050 | 46,571,977 | 6,981,686 | $ | 6,981,686 | $ | 14,486 | $ | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| $ | 6,981,686 | $ | 14,486 | $ | — | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun International Equity Fund | 9 |

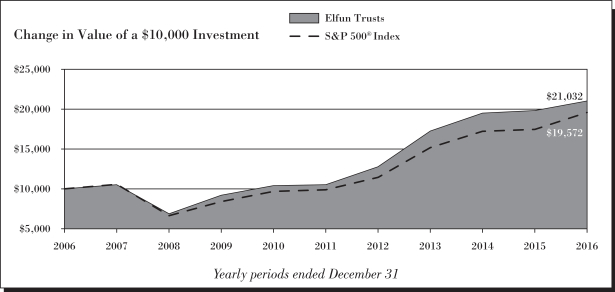

Portfolio Management Discussion and Analysis — December 31, 2016 (Unaudited)

| Q. | How did the Elfun Trusts Fund perform compared to its benchmark and Morningstar peer group for the twelve-month period ended December 31, 2016? |

| A. | For the twelve-month period ended December 31, 2016, the Elfun Trusts Fund returned 6.08%. The S&P 500® Index (the “S&P 500 Index”), the Fund’s benchmark, returned 11.96% and the Fund’s Morningstar peer group of 1,469 U.S. Large Cap Growth Funds returned an average of 3.19% over the same period. |

| Q. | What market factors affected the Fund’s performance? |

| A. | Underlying the 12% return for the S&P 500® Index last year was a wide range of performance at the sector level. The energy sector led the way with a 27% return and the healthcare sector lagged with a decline of 3%. Healthcare was the only sector with a negative return. Post the U.S. presidential election, the financial, industrial and energy sectors rebounded sharply higher. With expectations that the new administration will be more business friendly (lower taxes, stimulus, less regulatory burden, etc.) stocks moved higher across the board. The industrial, energy, and financial sectors were particularly strong post the election. |

| Q. | What were the primary drivers of Fund performance? |

| A. | The Elfun Trusts was not positioned well for the underlying trends in sector performance last year. Healthcare has long been an overweighted sector in the portfolio. It comprises about 21% of the portfolio compared to a weight of 15% in the S&P 500. Pharma and biotech sold off due to fears of a more onerous regulatory environment. We believe these fears are overblown and overly discounted in share prices. We own several pharma, biotech, and medical device companies that we believe will grow at above-average rates due to their pipelines of new products. |

| The portfolio was underweighted in the energy sector, with an energy weight of 5.5% compared with a 7% weight for the S&P 500® Index. Similarly, we are underweighted in industrials with a 4% weight compared to a 9% weight in the S&P 500® Index. With the strong performance of energy and industrials in 2016, these underweights were detractors to relative performance. We entered 2016 with the belief that the economic cycle was long in the tooth and growth would be slow. We underweighted the cyclical sectors and overweighted the growth sectors of healthcare and technology. Frankly, we were surprised by the U.S. presidential election results and were positioned for the status quo. |

| Q. | Were there any significant changes to the Fund during the period? |

| A. | Changes in the portfolio were modest last year. Turnover was 15%, in line with our long term average of 10-20%. We continue to be long term investors. The number of holding declined modestly, from 53 to 45 holdings. Sector exposure is largely the same with the two most overweighted sectors being technology and healthcare. We share the market’s new found enthusiasm for renewed growth post the election results. The portfolio remains underweighted in utilities, telecom, and consumer staples due to the slow growth and dividend yield focus of these sectors. These three sectors lagged the market post the election, and we feel they may continue to lag as interest rates trend higher. We remained focused on high quality, above-average growers trading at valuations we deem attractive. |

| 10 | Elfun Trusts |

Elfun Trusts

Understanding Your Fund’s Expenses — December 31, 2016 (Unaudited)

| Elfun Trusts | 11 |

Elfun Trusts

Performance Summary — December 31, 2016 (Unaudited)

| 12 | Elfun Trusts |

Elfun Trusts

Performance Summary, continued — December 31, 2016 (Unaudited)

| (a) | Fair Value basis is inclusive of short-term investment in State Street Institutional U.S. Government Money Market Fund Class G Shares. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

See Notes to Performance beginning on page 1 for further information, including an explanation of Morningstar peer categories.

Past performance does not predict future performance. The performance shown in the graphs and tables does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Elfun Trusts | 13 |

Elfun Trusts

Schedule of Investments — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| 14 | Elfun Trusts |

Elfun Trusts

Schedule of Investments, continued — December 31, 2016

Affiliate Table

| Number of Shares Held at 12/31/15 |

Value At 12/31/15 |

Shares Purchased |

Shares Sold |

Number of Shares Held at 12/31/16 |

Value at 12/31/16 |

Dividend/ Interest Income |

Realized Gain (Loss) |

|||||||||||||||||||||||||

| State Street Corp. |

1,200,000 | $ | 79,632,000 | — | 1,200,000 | — | $ | — | $ | 357,000 | $ | 14,843,346 | ||||||||||||||||||||

| State Street Institutional U.S. Government Money Market Fund |

50,527,506 | 50,527,506 | 185,682,546 | 183,000,974 | 53,209,078 | 53,209,078 | 222,766 | — | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| $ | 53,209,078 | $ | 579,766 | $ | 14,843,346 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Trusts | 15 |

Portfolio Management Discussion and Analysis — December 31, 2016 (Unaudited)

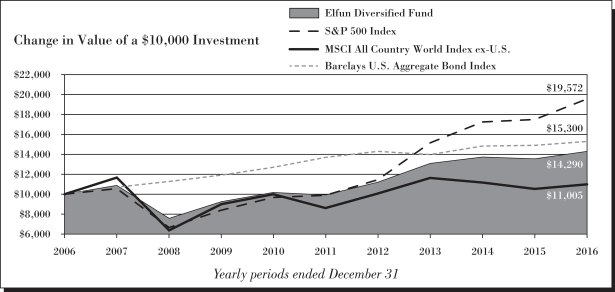

| Q. | How did the Elfun Diversified Fund perform compared to its benchmark and Morningstar peer group for the twelve-month period ended December 31, 2016? |

| A. | For the twelve-month period ended December 31, 2016, the Elfun Diversified Fund returned 5.48%. The Fund’s broad based benchmarks, the S&P 500® Index (the “S&P 500 Index”), the MSCI All Country World ex-U.S. Index, and the Bloomberg Barclays U.S. Aggregate Bond Index, returned 11.96%, 4.50% and 2.65%, respectively. The Fund’s Morningstar peer group of 823 U.S. Moderate Allocation funds returned an average of 7.37% over the same period. |

| Q. | What market factors affected the Fund’s performance? |

| A. | 2016 presented a range of challenges and opportunities for investors. After starting the year with considerable weakness in January and February, risk asset markets rebounded sharply. The growth fears that dominated those early weeks gave way to expectations for a more stable, though still subdued macro backdrop. For bond markets this led to continued declines in government bond yields, while equity markets were generally well supported by growth as well as accommodative central bank expectations. |

| As the year progressed, two main events dominated returns and the macro backdrop — the United Kingdom’s June 2016 referendum vote to withdraw from the European Union (the “Brexit vote”) and the U.S. Presidential election. In the end, both produced short-term spikes in market volatility. Following the Brexit vote, equity markets were weak for a short time before recovering. However, the weakness in British Pound and, to a lesser extent, the euro was longer lasting given the political and economic uncertainty that followed. |

| Following the U.S. presidential election, equity market weakness was confined to a few hours before giving way to a strong positive move through the end of the year driven by stronger growth expectations. Forecasts for more favorable fiscal policy courtesy of increased spending and tax cuts plus less regulation played a large role in this move, which also drove substantial outperformance of U.S. equities relative to International markets. Moreover, a sharp appreciation of the dollar through that time contributed to U.S. dollar-based outperformance. Finally, stronger growth and inflation expectations, alongside a related rise in expectations for tighter Federal Reserve policy in 2017 resulted in a sharp rise in U.S. Treasury yields in the fourth quarter. In the end, rates were not much changed for the year, but did experience a big move in the fourth quarter while U.S. equities posted a solid gain for all of 2016. |

| Q. | What were the primary drivers of Fund performance? |

| A. | For the year as a whole, the biggest positive driver of returns came from U.S. equities which rose more than 10%, with solid gains in the fourth quarter. While a smaller allocation in the overall fund, mid-cap equity markets rose more than 20% in 2016, with a gain of nearly 7% in the fourth quarter. Emerging market equities were also a strong positive contributor to overall returns. Fixed income markets produced modest gains of less than 4% in 2016. However, the fourth quarter was much to blame for the full year result, with a decline of nearly 3% in the quarter on the back of rising interest rates. Finally, international equity markets lagged the U.S. considerably for the year, leading to a slight negative return in the aggregate for the asset class. |

| Relative to our strategic benchmark, our underweight allocation to fixed income was a positive to performance given the weak returns in the asset class. Moreover, our overweight allocations to U.S. equities and to Emerging Markets were also positive contributors. Performance within fixed income was a positive contribution while the U.S. and international equity strategies were a drag on overall returns given their respective underperformance. Our overweight allocation to cash acted as a drag on performance, though only modestly given the corresponding underweight position in fixed income. |

| Within tactical overlay positions, a short U.S. equity futures position late in the year to protect against market volatility acted as a modest detractor to overall returns. Meanwhile a tactical position to U.S. high yield bonds yielded a positive contribution for the fourth quarter and for the year as a whole. |

| Q. | Were there any significant changes to the Fund during the period? |

| A. | There were no major changes to the Fund in the year. Allocation shifts within and across asset classes were consistent with historical moves. In the fourth quarter we did modestly add to our fixed income allocation in response to higher interest rates, though we remain substantially underweight. |

| 16 | Elfun Diversified Fund |

Elfun Diversified Fund

Understanding Your Fund’s Expenses — December 31, 2016 (Unaudited)

| Elfun Diversified Fund | 17 |

Elfun Diversified Fund

Performance Summary — December 31, 2016 (Unaudited)

| 18 | Elfun Diversified Fund |

Elfun Diversified Fund

Performance Summary, continued — December 31, 2016 (Unaudited)

| (a) | Fair Value basis is inclusive of short-term investment in State Street Institutional U.S. Government Money Market Fund Class G Shares. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

See Notes to Performance beginning on page 1 for further information, including an explanation of Morningstar peer categories.

Past performance does not predict future performance. The performance shown in the graphs and tables does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Elfun Diversified Fund | 19 |

Elfun Diversified Fund

Schedule of Investments — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| 20 | Elfun Diversified Fund |

Elfun Diversified Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Diversified Fund | 21 |

Elfun Diversified Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| 22 | Elfun Diversified Fund |

Elfun Diversified Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Diversified Fund | 23 |

Elfun Diversified Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| 24 | Elfun Diversified Fund |

Elfun Diversified Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Diversified Fund | 25 |

Elfun Diversified Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| 26 | Elfun Diversified Fund |

Elfun Diversified Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Diversified Fund | 27 |

Elfun Diversified Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| 28 | Elfun Diversified Fund |

Elfun Diversified Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Diversified Fund | 29 |

Elfun Diversified Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| 30 | Elfun Diversified Fund |

Elfun Diversified Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Diversified Fund | 31 |

Elfun Diversified Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| 32 | Elfun Diversified Fund |

Elfun Diversified Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Diversified Fund | 33 |

Elfun Diversified Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| 34 | Elfun Diversified Fund |

Elfun Diversified Fund

Schedule of Investments, continued — December 31, 2016

Other Information:

The Fund has the following credit default swap contracts open at December 31, 2016:

Centrally Cleared Credit Default Swaps - Buy Protection

| Reference Entity | Counterparty | Notional Amount (000s omitted) |

Contract annual Fixed Rate |

Termination Date |

Market Value |

Unamortized Upfront Payments Received |

Unrealized Depreciation |

|||||||||||||||||||

| Markit CDX North America High Yield Index |

CME Group Inc. | $ | 2,280 | 5.00% | 12/20/21 | $ | (144,845 | ) | $ | (95,728 | ) | $ | (49,117 | ) | ||||||||||||

| Markit CDX North America Investment Grade Index |

CME Group Inc. | $ | 1,454 | 1.00% | 12/20/21 | $ | (22,475 | ) | $ | (18,399 | ) | $ | (4,076 | ) | ||||||||||||

|

|

|

|||||||||||||||||||||||||

| $ | (53,193 | ) | ||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

The Fund had the following long futures contracts open at December 31, 2016:

| Description | Expiration date |

Number of Contracts |

Current Notional Value |

Unrealized Depreciation |

||||||||||||

| MSCI EAFE Mini Index Futures |

March 2017 | 11 | $ | 921,580 | $ | (2,539 | ) | |||||||||

| S&P Mid 400 Emini Index Futures |

March 2017 | 29 | 4,811,390 | (76,903 | ) | |||||||||||

| S&P 500 Emini Index Futures |

March 2017 | 9 | 1,006,290 | (14,439 | ) | |||||||||||

| Ultra Long-Term U.S. Treasury Bond Futures |

March 2017 | 7 | 1,121,750 | (10,211 | ) | |||||||||||

| 5 Yr. U.S. Treasury Notes Futures |

March 2017 | 27 | 3,176,930 | (4,202 | ) | |||||||||||

|

|

|

|||||||||||||||

| $ | (108,294 | ) | ||||||||||||||

|

|

|

|||||||||||||||

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Diversified Fund | 35 |

Elfun Diversified Fund

Schedule of Investments, continued — December 31, 2016

The Fund had the following short futures contracts open at December 31, 2016:

| Description | Expiration date |

Number of Contracts |

Current Notional Value |

Unrealized Appreciation (Depreciation) |

||||||||||||

| S&P 500 Emini Index Futures |

March 2017 | 40 | $ | (4,472,400 | ) | $ | 31,326 | |||||||||

| U.S. Long Bond Futures |

March 2017 | 9 | (1,355,906 | ) | 3,436 | |||||||||||

| 2 Yr. U.S. Treasury Notes Futures |

March 2017 | 1 | (216,687 | ) | (455 | ) | ||||||||||

| 10 Yr. U.S. Treasury Notes Futures |

March 2017 | 22 | (2,734,188 | ) | 6,083 | |||||||||||

| Ultra 10 Yr. U.S. Treasury Futures |

March 2017 | 5 | (670,313 | ) | (834 | ) | ||||||||||

|

|

|

|||||||||||||||

| $ | 39,556 | |||||||||||||||

|

|

|

|||||||||||||||

| $ | (68,738 | ) | ||||||||||||||

|

|

|

|||||||||||||||

The Fund was invested in the following countries/territories at December 31, 2016 (unaudited):

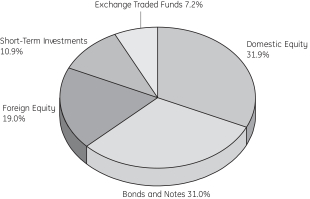

The Fund’s % share of investment in the various categories, based on Fair Value, is as follows at December 31, 2016 (unaudited):

| Industry | Domestic | Foreign | Total | |||||||||

| Exchange Traded Funds |

7.18% | 0.00% | 7.18% | |||||||||

| Diversified Banks |

2.85% | 2.08% | 4.93% | |||||||||

| Pharmaceuticals |

2.81% | 1.10% | 3.91% | |||||||||

| Integrated Oil & Gas |

1.56% | 0.59% | 2.15% | |||||||||

| Biotechnology |

1.62% | 0.38% | 2.00% | |||||||||

| Cable & Satellite |

1.72% | 0.27% | 1.99% | |||||||||

| Technology Hardware, Storage & Peripherals |

1.74% | 0.20% | 1.94% | |||||||||

| Healthcare Equipment |

0.74% | 1.17% | 1.91% | |||||||||

| Semiconductors |

0.83% | 0.74% | 1.57% | |||||||||

| Oil & Gas Exploration & Production |

1.24% | 0.26% | 1.50% | |||||||||

| Internet Software & Services |

1.39% | 0.10% | 1.49% | |||||||||

| Aerospace & Defense |

0.73% | 0.37% | 1.10% | |||||||||

| Semiconductor Equipment |

0.61% | 0.42% | 1.03% | |||||||||

| Packaged Foods & Meats |

0.45% | 0.51% | 0.96% | |||||||||

| Communications Equipment |

0.69% | 0.24% | 0.93% | |||||||||

| Industrial Machinery |

0.55% | 0.34% | 0.89% | |||||||||

| Financial Exchanges & Data |

0.82% | 0.00% | 0.82% | |||||||||

| Systems Software |

0.82% | 0.00% | 0.82% | |||||||||

See Notes to Schedules of Investments and Notes to Financial Statements.

| 36 | Elfun Diversified Fund |

Elfun Diversified Fund

Schedule of Investments, continued — December 31, 2016

| Industry | Domestic | Foreign | Total | |||||||||

| Investment Banking & Brokerage |

0.79% | 0.00% | 0.79% | |||||||||

| Soft Drinks |

0.72% | 0.00% | 0.72% | |||||||||

| Application Software |

0.42% | 0.28% | 0.70% | |||||||||

| Data Processing & Outsourced Services |

0.69% | 0.00% | 0.69% | |||||||||

| Life & Health Insurance |

0.18% | 0.50% | 0.68% | |||||||||

| Consumer Finance |

0.66% | 0.00% | 0.66% | |||||||||

| Multi-Line Insurance |

0.37% | 0.27% | 0.64% | |||||||||

| Wireless Telecommunication Services |

0.00% | 0.63% | 0.63% | |||||||||

| Electric Utilities |

0.30% | 0.31% | 0.61% | |||||||||

| Internet & Direct Marketing Retail |

0.47% | 0.13% | 0.60% | |||||||||

| Movies & Entertainment |

0.29% | 0.31% | 0.60% | |||||||||

| Auto Parts & Equipment |

0.00% | 0.59% | 0.59% | |||||||||

| Electrical Components & Equipment |

0.00% | 0.59% | 0.59% | |||||||||

| Specialized REITs |

0.58% | 0.00% | 0.58% | |||||||||

| Diversified Real Estate Activities |

0.00% | 0.57% | 0.57% | |||||||||

| Asset Management & Custody Banks |

0.48% | 0.09% | 0.57% | |||||||||

| Electronic Equipment & Instruments |

0.00% | 0.56% | 0.56% | |||||||||

| Property & Casualty Insurance |

0.00% | 0.54% | 0.54% | |||||||||

| Airlines |

0.51% | 0.00% | 0.51% | |||||||||

| Oil & Gas Equipment & Services |

0.36% | 0.14% | 0.50% | |||||||||

| Trading Companies & Distributors |

0.50% | 0.00% | 0.50% | |||||||||

| Multi-Utilities |

0.47% | 0.00% | 0.47% | |||||||||

| Building Products |

0.00% | 0.46% | 0.46% | |||||||||

| Construction Machinery & Heavy Trucks |

0.00% | 0.44% | 0.44% | |||||||||

| Specialty Chemicals |

0.04% | 0.39% | 0.43% | |||||||||

| Home Improvement Retail |

0.42% | 0.00% | 0.42% | |||||||||

| Housewares & Specialties |

0.40% | 0.00% | 0.40% | |||||||||

| Automobile Manufacturers |

0.00% | 0.38% | 0.38% | |||||||||

| Personal Products |

0.00% | 0.35% | 0.35% | |||||||||

| Research & Consulting Services |

0.31% | 0.00% | 0.31% | |||||||||

| Brewers |

0.00% | 0.30% | 0.30% | |||||||||

| Security & Alarm Services |

0.00% | 0.28% | 0.28% | |||||||||

| Construction Materials |

0.00% | 0.28% | 0.28% | |||||||||

| Diversified Metals & Mining |

0.00% | 0.27% | 0.27% | |||||||||

| Home Building |

0.00% | 0.27% | 0.27% | |||||||||

| Industrial Gases |

0.12% | 0.13% | 0.25% | |||||||||

| Apparel, Accessories & Luxury Goods |

0.25% | 0.00% | 0.25% | |||||||||

| Healthcare Services |

0.00% | 0.24% | 0.24% | |||||||||

| Leisure Products |

0.00% | 0.24% | 0.24% | |||||||||

| Advertising |

0.00% | 0.21% | 0.21% | |||||||||

| Electronic Components |

0.00% | 0.21% | 0.21% | |||||||||

| General Merchandise Stores |

0.20% | 0.00% | 0.20% | |||||||||

| Healthcare Supplies |

0.19% | 0.00% | 0.19% | |||||||||

| Automotive Retail |

0.19% | 0.00% | 0.19% | |||||||||

| Hypermarkets & Super Centers |

0.18% | 0.00% | 0.18% | |||||||||

| Industrial Conglomerates |

0.18% | 0.00% | 0.18% | |||||||||

| Agricultural Products |

0.15% | 0.00% | 0.15% | |||||||||

| Gold |

0.13% | 0.00% | 0.13% | |||||||||

| Railroads |

0.00% | 0.13% | 0.13% | |||||||||

| Independent Power Producers & Energy Traders |

0.12% | 0.00% | 0.12% | |||||||||

| Household Products |

0.00% | 0.12% | 0.12% | |||||||||

| Paper Packaging |

0.06% | 0.00% | 0.06% | |||||||||

| Drug Retail |

0.05% | 0.00% | 0.05% | |||||||||

| Diversified Support Services |

0.00% | 0.04% | 0.04% | |||||||||

|

|

|

|||||||||||

| 58.15% | ||||||||||||

|

|

|

|||||||||||

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Diversified Fund | 37 |

Elfun Diversified Fund

Schedule of Investments, continued — December 31, 2016

Affiliate Table

| Number of Shares Held at 12/31/15 |

Value at 12/31/15 |

Shares Purchased |

Shares Sold |

Number of Shares Held at 12/31/16 |

Value at 12/31/16 |

Dividend/ Interest Income |

Realized Gain (Loss) |

|||||||||||||||||||||||||

| Industrial Select Sector SPDR Fund |

16,195 | $ | 858,497 | 4,079 | 20,274 | — | $ | — | $ | 10,413 | $ | 204,970 | ||||||||||||||||||||

| SPDR Bloomberg Barclays High Yield Bond ETF |

— | — | 173,223 | — | 173,223 | 6,313,978 | 235,219 | — | ||||||||||||||||||||||||

| State Street Corp. |

15,400 | 1,021,944 | — | 15,400 | — | — | 4,888 | (151,969 | ) | |||||||||||||||||||||||

| State Street Institutional U.S. Government Money Market Fund |

28,561,801 | 28,561,801 | 76,584,182 | 82,554,544 | 22,591,439 | 22,591,439 | 65,334 | — | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| $ | 28,905,417 | $ | 315,854 | $ | 53,001 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

See Notes to Schedules of Investments and Notes to Financial Statements.

| 38 | Elfun Diversified Fund |

Portfolio Management Discussion and Analysis — December 31, 2016 (Unaudited)

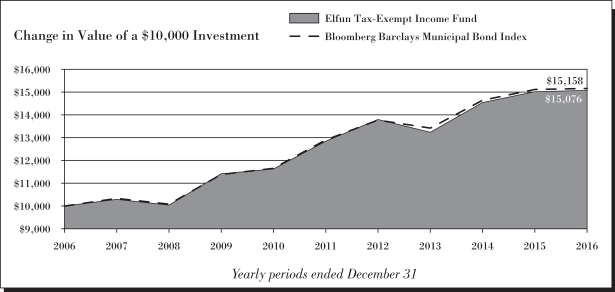

| Q. | How did the Elfun Tax-Exempt Income Fund perform compared to its benchmark and Morningstar peer group for the twelve-month period ended December 31, 2016? |

| A. | For the twelve-month period ended December 31, 2016, the Elfun Tax-Exempt Income Fund returned 0.42%. The Bloomberg Barclays U.S. Municipal Bond Index (the “Index”), the Fund’s benchmark, returned 0.25% and the Fund’s Morningstar peer group of 158 U.S. Long-term Municipal Bond funds returned an average of 0.00% over the same period. |

| Q. | What market conditions affected the Fund’s performance? |

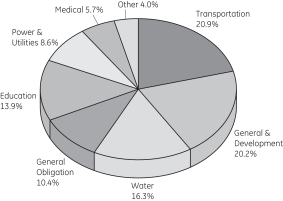

| A. | The municipal bond market was challenged throughout 2016 by divergent themes. Favorable technical factors, characterized by strong mutual fund flows and negative net supply dominated the first ten months of the year. Issuers took advantage of historic low yields to refinance outstanding debt further limiting investing opportunities and tightening spreads for willing investors. Tax-exempt interest rates fell to generational lows as municipal bonds out-performed all asset classes. A dramatic shift in post-election investor sentiment, however, led to a retracement of yields during the fourth quarter, once again reinforcing the fact that municipal bonds are fixed income instruments that can be subject to bouts of volatility. The combination of resurgence in equities as well as speculation about the potential for future tax policy change quickly reversed the trend of fund flows into tax-exempt mutual funds, leading the municipal bond market to its worst retuning quarter in over three years. Given our income oriented approach and diverse curve positioning; the Fund’s performance distinguished it from both benchmark and peers. |

| Q. | What were the primary drivers of Fund performance? |

| A. | The Fund’s performance was driven by its diversified curve positioning, emphasis on essential service revenue bonds and active risk management. The Fund benefitted early in the year from a flattening yield curve which rewarded positioning within the fifteen to twenty-five year sector. While many long term funds were rewarded for exposure to thirty year debt, our strategy to concentrate the Fund’s positioning within the intermediate sector of the yield curve allowed the Fund to participate in the massive rally through mid-year, yet limited the impact of rising rates later in the year. The Funds’ lower duration and market underweight in California and New York, the largest issuers within the Index, was a key differentiator during the market sell-off in the fourth quarter. The Fund did not have any material impact from the use of derivatives in 2016. |

| Q. | Were there any significant changes to the Fund during the period? |

| A. | The major change in the Fund impacting returns over the last twelve months was clearly the role active duration management played. The municipal market rally, which began in late 2015 and carried through October of 2016, contributed to a significant flattening of the yield curve. The Fund entered the year with risk levels one third of a year longer than the Bloomberg Barclays Municipal Bond Index and maintained an aggressive profile throughout the first three quarters of the year. In early October our belief that low absolute rates were unsustainable and did not represent a sufficient risk/reward proposition led to a reduction in duration to one third of a year less than the Index. When the market did correct post-election and tax-exempt yields rose by over 90 basis points, the Fund was well positioned to preserve capital, and outperform both its benchmark and peer group in a volatile, rising rate environment. |

| Elfun Tax-Exempt Income Fund | 39 |

Elfun Tax-Exempt Income Fund

Understanding Your Fund’s Expenses — December 31, 2016 (Unaudited)

| 40 | Elfun Tax-Exempt Income Fund |

Elfun Tax-Exempt Income Fund

Performance Summary — December 31, 2016 (Unaudited)

| Elfun Tax-Exempt Income Fund | 41 |

Elfun Tax-Exempt Income Fund

Performance Summary, continued — December 31, 2016 (Unaudited)

| (a) | Fair Value basis is inclusive of short-term investment in State Street Institutional U.S. Government Money Market Fund Class G Shares. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

See Notes to Performance beginning on page 1 for further information, including an explanation of Morningstar peer categories.

Past performance does not predict future performance. The performance shown in the graphs and tables does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| 42 | Elfun Tax-Exempt Income Fund |

Elfun Tax-Exempt Income Fund

Schedule of Investments — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Tax-Exempt Income Fund | 43 |

Elfun Tax-Exempt Income Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| 44 | Elfun Tax-Exempt Income Fund |

Elfun Tax-Exempt Income Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Tax-Exempt Income Fund | 45 |

Elfun Tax-Exempt Income Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| 46 | Elfun Tax-Exempt Income Fund |

Elfun Tax-Exempt Income Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Tax-Exempt Income Fund | 47 |

Elfun Tax-Exempt Income Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| 48 | Elfun Tax-Exempt Income Fund |

Elfun Tax-Exempt Income Fund

Schedule of Investments, continued — December 31, 2016

Affiliate Table

| Number of Shares Held at 12/31/15 |

Value at 12/31/15 |

Shares Purchased |

Shares Sold |

Number of Shares Held at 12/31/16 |

Value at 12/31/16 |

Dividend/ Interest Income |

Realized Gain (Loss) | |||||||||||||||||||||||||||||||||

| State Street Institutional U.S. Government Money Market Fund |

39,963,872 | 39,963,873 | 476,000,147 | 465,761,380 | 50,202,639 | $ | 50,202,639 | $ | 90,074 | $ | — | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

| $ | 50,202,639 | $ | 90,074 | $ | — | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Tax-Exempt Income Fund | 49 |

Portfolio Management Discussion and Analysis — December 31, 2016 (Unaudited)

| Q. | How did the Elfun Income Fund perform compared to its benchmark for the twelve-month period ended December 31, 2016? |

| A. | For the twelve-month period ended December 31, 2016, the Elfun Income Fund returned 3.52%. The Bloomberg Barclays U.S. Aggregate Bond Index, the Fund’s benchmark, returned 2.65% and the Fund’s Morningstar peer group of 993 U.S. Intermediate-Term Funds returned an average of 3.24% over the same period. |

| Q. | What market factors affected the Fund’s performance? |

| A. | The two primary market factors that affected the Fund’s performance were the movement in interest rates and credit spreads over the period. U.S. Treasury yields fell in the first half of 2016 as the timing of a Federal Reserve rate hike was pushed out due to slow growth expectations. The U.S. Treasury 10 year note yield hit a low of 1.35% in July from 2.28% at the start of the year. Rates jumped higher after the November elections. President-elect Trump’s proposal for fiscal stimulus, tax cuts and regulatory reform increased investors’ growth outlook and increased the probability of a rate hike which was met in December when the Federal Open Market Committee raised its Fed Funds target to 0.5-0.75%. The 10-year treasury yield ended the year at 2.45%. Credit spreads spiked early in the year but then steadily tightened from mid-February of 2016 until year-end. The option-adjusted spread (“OAS”) on the Bloomberg Barclays US Credit Index peaked at +200 basis points (bps) in February and finished the year at +118 bps, down -40 bps for the year. Similarly, the OAS on the Bloomberg Barclays US High Yield Index reached +840 bps before dropping to +410 bps by year-end (down -220 bps for the year). |

| Q. | What were the primary drivers of Fund performance? |

| A. | The largest driver of the Fund’s outperformance versus its benchmark came from its relative sector allocation. Exposure to high yield (not in the benchmark) added over +65 bps as the Ba/B rated high yield market returned over +14%. The overweight in investment grade credit added roughly +25 bps due to tightening spreads. The Fund’s duration and curve positioning biased towards lower rates in the first half and a steeper curve in the second half contributed roughly +30 bps. Security selection in investment grade credit and commercial mortgage-backed securities (“CMBS”) added slightly to performance. The use of CDXHY (high yield credit swap) as a hedge against the cash positions detracted roughly -10 bps. |

| Q. | Were there any significant changes to the Fund during the period? |

| A. | The Fund’s duration positioning was biased long relative to the benchmark in the first half of the year then was reduced to neutral in the third quarter and maintained throughout the rest of the year. In general, the credit risk of the Fund was reduced during the year. The spread duration targets (excess above the index) for CMBS, investment grade and high-yield credit were cut nearly in half as credit spreads tightened during the year. |

| 50 | Elfun Income Fund |

Elfun Income Fund

Understanding Your Fund’s Expenses — December 31, 2016 (Unaudited)

| Elfun Income Fund | 51 |

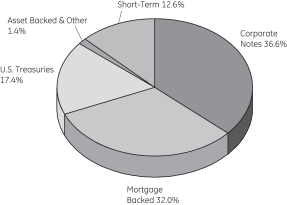

Elfun Income Fund

Performance Summary — December 31, 2016 (Unaudited)

| 52 | Elfun Income Fund |

Elfun Income Fund

Performance Summary, continued — December 31, 2016 (Unaudited)

| (a) | Fair Value basis is inclusive of short-term investment in State Street Institutional U.S. Government Money Market Fund Class G Shares. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

See Notes to Performance beginning on page 1 for further information, including an explanation of Morningstar peer categories.

Past performance does not predict future performance. The performance shown in the graphs and tables does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Elfun Income Fund | 53 |

Elfun Income Fund

Schedule of Investments — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| 54 | Elfun Income Fund |

Elfun Income Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Income Fund | 55 |

Elfun Income Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| 56 | Elfun Income Fund |

Elfun Income Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Income Fund | 57 |

Elfun Income Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| 58 | Elfun Income Fund |

Elfun Income Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Income Fund | 59 |

Elfun Income Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| 60 | Elfun Income Fund |

Elfun Income Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Income Fund | 61 |

Elfun Income Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| 62 | Elfun Income Fund |

Elfun Income Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Income Fund | 63 |

Elfun Income Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| 64 | Elfun Income Fund |

Elfun Income Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Income Fund | 65 |

Elfun Income Fund

Schedule of Investments, continued — December 31, 2016

Other Information:

The Fund has the following credit default swap contracts open at December 31, 2016:

Centrally Cleared Credit Default Swaps - Buy Protection

| Reference Entity | Counterparty | Notional Amount (000s omitted) |

Contract annual Fixed Rate |

Termination Date |

Market Value |

Unamortized Upfront Payments Received |

Unrealized Depreciation |

|||||||||||||||||||

| Markit CDX North America High Yield Index |

CME Group Inc. | $ | 9,800 | 5.00% | 12/20/21 | $ | (622,578 | ) | $ | (412,514 | ) | $ | (210,064 | ) | ||||||||||||

| Markit CDX North America Investment Grade Index |

CME Group Inc. | 6,437 | 1.00% | 12/20/21 | (99,531 | ) | (81,483 | ) | (18,048 | ) | ||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| $ | (228,112 | ) | ||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

The Fund had the following long futures contracts open at December 31, 2016:

| Description | Expiration date |

Number of Contracts |

Current Notional Value |

Unrealized Depreciation |

||||||||||||

| Ultra Long-Term U.S. Treasury Bond Futures |

March 2017 | 39 | $ | 6,249,750 | $ | (56,924 | ) | |||||||||

| 2 Yr. U.S. Treasury Notes Futures |

March 2017 | 51 | 11,051,063 | (5,665 | ) | |||||||||||

| 5 Yr. U.S. Treasury Notes Futures |

March 2017 | 7 | 823,648 | (1,488 | ) | |||||||||||

|

|

|

|||||||||||||||

| $ | (64,077 | ) | ||||||||||||||

|

|

|

|||||||||||||||

See Notes to Schedules of Investments and Notes to Financial Statements.

| 66 | Elfun Income Fund |

Elfun Income Fund

Schedule of Investments, continued — December 31, 2016

The Fund had the following short futures contracts open at December 31, 2016:

| Description | Expiration date |

Number of Contracts |

Current Notional Value |

Unrealized Appreciation (Depreciation) |

||||||||||||

| U.S. Long Bond Futures |

March 2017 | 69 | $ | (10,395,281 | ) | $ | 24,993 | |||||||||

| 10 Yr. U.S. Treasury Notes Futures |

March 2017 | 22 | (2,734,188 | ) | 6,146 | |||||||||||

| Ultra 10 Yr. U.S. Treasury Futures |

March 2017 | 18 | (2,413,125 | ) | (698 | ) | ||||||||||

|

|

|

|||||||||||||||

| $ | 30,441 | |||||||||||||||

|

|

|

|||||||||||||||

| $ | (33,636 | ) | ||||||||||||||

|

|

|

|||||||||||||||

Affiliate Table

| Number of Shares Held at 12/31/15 |

Value at 12/31/15 |

Shares Purchased |

Shares Sold |

Number of Shares Held at 12/31/16 |

Value at 12/31/16 |

Dividend/ Interest |

Realized Gain (Loss) |

|||||||||||||||||||||||||

| State Street Institutional U.S. Government Money Market Fund |

14,834,394 | 14,834,395 | 150,170,595 | 125,422,280 | 39,582,709 | $ | 39,582,709 | $ | 46,570 | $ | — | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| $ | 39,582,709 | $ | 46,570 | $ | — | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Income Fund | 67 |

Elfun Government Money Market Fund

Portfolio Management Discussion and Analysis — December 31, 2016 (Unaudited)

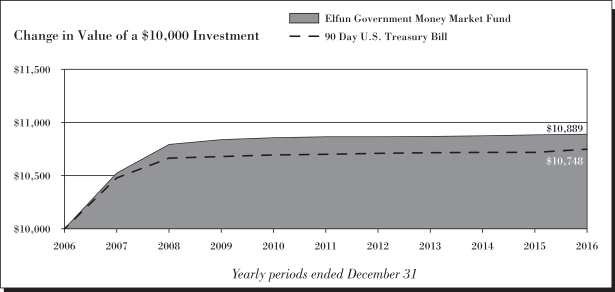

| Q. | How did the Elfun Government Money Market Fund perform compared to its benchmark for the twelve-month period ended December 31, 2016? |

| For the twelve-month period ended December 31, 2016, the Elfun Government Money Market Fund returned 0.06%. The 90-day Treasury Bill, the Fund’s benchmark, returned 0.32% over the same period. The Fund’s yield was in line with expectations. |

| Q. | What market factors affected the Fund’s performance? |

| 2016 was a historic year for the U.S. Money Market Fund Industry. The Securities and Exchange Commission’s 2a-7 Rule changes announced in 2014 that fundamentally changed the way U.S. taxable prime and tax exempt money market funds operated went into effect in 2016. The most significant rules (variable net asset value calculation of an institutional prime and institutional tax exempt funds and liquidity gates & redemption fees on all prime and tax exempt funds) went into effect on October 14, 2016. This drove $1 trillion of prime money market fund assets into U.S. government money market funds. This new demand for government fund eligible assets (government agency debt and U.S. treasury debt) caused those yield curves to flatten and spreads to tighten vs. overnight funding rates. Even with this change in the market and increased demand for government assets, the Fund performed in line with its objective of principal preservation and liquidity while generating a market rate of return. The Fund benefitted from the increase in U.S. Treasury bill supply in 2016 and indirectly from the increased capacity of the Federal Reserve’s reverse repo facility, which provided a floor for overnight rates. |

| Q. | What were the primary drivers of Fund performance? |

| The performance of this government money market fund is measured by timely access to liquidity in various market conditions. The Fund achieved this objective throughout 2016. |

| Q. | Were there any significant changes to the Fund during the period? |

| There were no significant changes to this Fund during the period. |

| 68 | Elfun Government Money Market Fund |

Elfun Government Money Market Fund

Understanding Your Fund’s Expenses — December 31, 2016 (Unaudited)

| Elfun Government Money Market Fund | 69 |

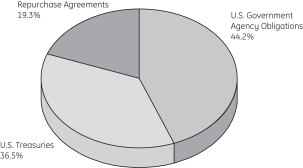

Elfun Government Money Market Fund

Performance Summary — December 31, 2016 (Unaudited)

| 70 | Elfun Government Money Market Fund |

Elfun Government Money Market Fund

Performance Summary, continued — December 31, 2016 (Unaudited)

| (a) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

See Notes to Performance beginning on page 1 for further information, including an explanation of Morningstar peer categories.

Past performance does not predict future performance. The performance shown in the graphs and tables does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

An investment in the Elfun Government Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or by any other Government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per unit, it is possible to lose money by investing in the Fund.

| Elfun Government Money Market Fund | 71 |

Elfun Government Money Market Fund

Schedule of Investments — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| 72 | Elfun Government Money Market Fund |

Elfun Government Money Market Fund

Schedule of Investments, continued — December 31, 2016

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Government Money Market Fund | 73 |

Elfun Funds

Notes to Schedules of Investments — December 31, 2016

| 74 | Notes to Schedules of Investments |

Elfun International Equity Fund

Selected data based on a share outstanding throughout the fiscal years indicated

| 12/31/16 | 12/31/15* | 12/31/14* | 12/31/13* | 12/31/12* | ||||||||||||||||

| Inception date |

1/1/88 | |||||||||||||||||||

| Net asset value, beginning of period |

$ | 19.31 | $ | 19.70 | $ | 21.93 | $ | 18.31 | $ | 15.43 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income/(loss) from investment operations: |

||||||||||||||||||||

| Net investment income |

0.41 | 0.34 | 0.58 | 0.37 | 0.35 | |||||||||||||||

| Net realized and unrealized gains/(losses) on investments |

(0.58 | ) | (0.37 | ) | (2.24 | ) | 3.62 | 2.88 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total income/(loss) from investment operations |

(0.17 | ) | (0.03 | ) | (1.66 | ) | 3.99 | 3.23 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

0.41 | 0.36 | 0.57 | 0.37 | 0.35 | |||||||||||||||

| Return of capital |

— | — | — | — | 0.00 | (b) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total distributions |

0.41 | 0.36 | 0.57 | 0.37 | 0.35 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net asset value, end of period |

$ | 18.73 | $ | 19.31 | $ | 19.70 | $ | 21.93 | $ | 18.31 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total return(a) |

(0.86 | )% | (0.18 | )% | (7.62 | )% | 21.81 | % | 20.95 | % | ||||||||||

| Ratios/Supplemental Data: |

||||||||||||||||||||

| Net assets, end of period (in thousands) |

$ | 208,044 | $ | 234,448 | $ | 254,310 | $ | 306,922 | $ | 260,728 | ||||||||||

| Ratios to average net assets: |

||||||||||||||||||||

| Net expenses |

0.37 | %(c,d) | 0.35 | % | 0.33 | %(e) | 0.31 | %(e) | 0.45 | %(e) | ||||||||||

| Gross expenses |

0.43 | %(d) | 0.35 | % | 0.33 | % | 0.31 | % | 0.45 | % | ||||||||||

| Net investment income |

2.11 | % | 1.59 | % | 2.54 | % | 1.83 | % | 1.98 | % | ||||||||||

| Portfolio turnover rate |

33 | % | 24 | % | 36 | % | 49 | % | 47 | % | ||||||||||

| (a) | Total returns are historical and assume changes in share price, reinvestment of dividends and capital gains distributions and assume no sales charge. Past performance does not guarantee future results. |

| (b) | Rounds to less than $0.005. |

| (c) | Reflects a voluntary waiver of management fees by GE Asset Management, Incorporated (“GEAM”) the Fund’s adviser and administrator prior to July 1, 2016. |

| (d) | The net and gross expense ratios include the refunded custody expense (See Note 6). Without the effect of the refunded custody expense, the net and gross ratio would have been 0.40% and 0.47%, respectively. |

| (e) | Includes contractual management fee waiver related to the Fund’s investments in the GE Institutional Money Market Fund (the “Money Market Fund”). The fee waiver agreement was terminated effective June 30, 2014 with the closure of the Money Market Fund. |

| * | Beginning with the year ended December 31, 2016, the Funds were audited by Ernst & Young LLP. The previous years were audited by another independent registered public accounting firm. |

The accompanying Notes are an integral part of these financial statements.

| Financial Highlights | 75 |

Elfun Trusts

Financial Highlights

Selected data based on a share outstanding throughout the fiscal years indicated

| 12/31/16 | 12/31/15* | 12/31/14* | 12/31/13* | 12/31/12* | ||||||||||||||||

| Inception date |

5/27/35 | |||||||||||||||||||

| Net asset value, beginning of period |

$ | 54.59 | $ | 58.02 | $ | 56.07 | $ | 44.06 | $ | 40.35 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income/(loss) from investment operations: |

|

|||||||||||||||||||

| Net investment income |

0.81 | 0.80 | 0.75 | 0.71 | 0.77 | |||||||||||||||

| Net realized and unrealized gains/(losses) on investments |

2.54 | 0.25 | 6.67 | 14.68 | 7.77 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total income from investment operations |

3.35 | 1.05 | 7.42 | 15.39 | 8.54 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

0.79 | 0.80 | 0.75 | 0.72 | 0.76 | |||||||||||||||

| Net realized gains |

3.92 | 3.68 | 4.72 | 2.66 | 4.07 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total distributions |

4.71 | 4.48 | 5.47 | 3.38 | 4.83 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net asset value, end of period |

$ | 53.23 | $ | 54.59 | $ | 58.02 | $ | 56.07 | $ | 44.06 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total return(a) |

6.08 | % | 1.70 | % | 13.13 | % | 34.98 | % | 21.27 | % | ||||||||||

| Ratios/supplemental Data: |

||||||||||||||||||||

| Net assets, end of period (in thousands) |

$ | 2,331,966 | $ | 2,364,319 | $ | 2,476,637 | $ | 2,326,948 | $ | 1,820,262 | ||||||||||

| Ratios to average net assets: |

||||||||||||||||||||

| Net expenses |

0.18 | % | 0.16 | % | 0.18 | %(b) | 0.15 | %(b) | 0.19 | %(b) | ||||||||||

| Gross expenses |

0.18 | % | 0.16 | % | 0.18 | % | 0.15 | % | 0.19 | % | ||||||||||

| Net investment income |

1.43 | % | 1.32 | % | 1.26 | % | 1.36 | % | 1.60 | % | ||||||||||

| Portfolio turnover rate |

15 | % | 11 | % | 13 | % | 12 | % | 11 | % | ||||||||||

| (a) | Total returns are historical and assume changes in share price, reinvestment of dividends and capital gains distributions and assume no sales charge. Past performance does not guarantee future results. |

| (b) | Includes contractual management fee waiver related to the Fund’s investments in the GE Institutional Money Market Fund (the “Money Market Fund”). The fee waiver agreement was terminated effective June 30, 2014 with the closure of the Money Market Fund. |

| * | Beginning with the year ended December 31, 2016, the Funds were audited by Ernst & Young LLP. The previous years were audited by another independent registered public accounting firm. |

The accompanying Notes are an integral part of these financial statements.

| 76 | Financial Highlights |

Elfun Diversified Fund

Financial Highlights

Selected data based on a share outstanding throughout the fiscal years indicated

| 12/31/16 | 12/31/15* | 12/31/14* | 12/31/13* | 12/31/12* | ||||||||||||||||

| Inception date |

1/1/88 | |||||||||||||||||||

| Net asset value, beginning of period |

$ | 17.50 | $ | 18.78 | $ | 19.84 | $ | 18.30 | $ | 16.53 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income/(loss) from investment operations: |

|

|||||||||||||||||||

| Net investment income |

0.38 | 0.34 | 0.37 | 0.36 | 0.33 | |||||||||||||||

| Net realized and unrealized gains/(losses) on investments |

0.58 | (0.57 | ) | 0.62 | 2.70 | 1.78 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total income/(loss) from investment operations |

0.96 | (0.23 | ) | 0.99 | 3.06 | 2.11 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

0.36 | 0.34 | 0.37 | 0.35 | 0.34 | |||||||||||||||

| Net realized gains |

0.19 | 0.71 | 1.65 | 1.17 | — | |||||||||||||||

| Return of capital |

— | — | 0.03 | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total distributions |

0.55 | 1.05 | 2.05 | 1.52 | 0.34 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net asset value, end of period |

$ | 17.91 | $ | 17.50 | $ | 18.78 | $ | 19.84 | $ | 18.30 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total return(a) |

5.48 | % | (1.25 | )% | 4.95 | % | 16.79 | % | 12.77 | % | ||||||||||

| Ratios/supplemental Data: |

||||||||||||||||||||

| Net assets, end of period (in thousands) |

$ | 198,938 | $ | 209,688 | $ | 230,123 | $ | 235,903 | $ | 213,168 | ||||||||||

| Ratios to average net assets: |

||||||||||||||||||||

| Net expenses |

0.39 | %(b) | 0.37 | % | 0.39 | %(c) | 0.33 | %(c) | 0.46 | %(c) | ||||||||||

| Gross expenses |

0.39 | %(b) | 0.37 | % | 0.39 | % | 0.34 | % | 0.47 | % | ||||||||||

| Net investment income |

1.98 | % | 1.69 | % | 1.79 | % | 1.78 | % | 1.75 | % | ||||||||||

| Portfolio turnover rate |

116 | % | 123 | % | 176 | % | 144 | % | 173 | % | ||||||||||

| (a) | Total returns are historical and assume changes in share price, reinvestment of dividends and capital gains distributions and assume no sales charge. Past performance does not guarantee future results. |

| (b) | The net and gross expense ratios include the refunded custody expense (See Note 6). Without the effect of the refunded custody expense, the ratios would have been 0.45%. |

| (c) | Includes contractual management fee waiver related to the Fund’s investments in the GE Institutional Money Market Fund (the “Money Market Fund”). The fee waiver agreement was terminated effective June 30, 2014 with the closure of the Money Market Fund. |

| * | Beginning with the year ended December 31, 2016, the Funds were audited by Ernst & Young LLP. The previous years were audited by another independent registered public accounting firm. |

The accompanying Notes are an integral part of these financial statements.

| Financial Highlights | 77 |

Elfun Tax-Exempt Income Fund

Financial Highlights

Selected data based on a share outstanding throughout the fiscal years indicated

| 12/31/16 | 12/31/15* | 12/31/14* | 12/31/13* | 12/31/12* | ||||||||||||||||

| Inception date |

1/1/80 | |||||||||||||||||||

| Net asset value, beginning of period |

$ | 11.88 | $ | 11.97 | $ | 11.34 | $ | 12.32 | $ | 11.97 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income/(loss) from investment operations: |

||||||||||||||||||||

| Net investment income |

0.46 | 0.46 | 0.47 | 0.49 | 0.51 | |||||||||||||||

| Net realized and unrealized gains/(losses) on investments |

(0.40 | ) | (0.09 | ) | 0.63 | (0.98 | ) | 0.37 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total income/(loss) from investment operations |

0.06 | 0.37 | 1.10 | (0.49 | ) | 0.88 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

0.46 | 0.46 | 0.47 | 0.49 | 0.51 | |||||||||||||||

| Net realized gains |

— | — | — | 0.00 | (b) | 0.02 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total distributions |

0.46 | 0.46 | 0.47 | 0.49 | 0.53 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net asset value, end of period |

$ | 11.48 | $ | 11.88 | $ | 11.97 | $ | 11.34 | $ | 12.32 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total return(a) |

0.42 | % | 3.21 | % | 9.85 | % | (4.06 | )% | 7.45 | % | ||||||||||

| Ratios/Supplemental Data: |

||||||||||||||||||||

| Net assets, end of period (in thousands) |

$ | 1,495,248 | $ | 1,588,272 | $ | 1,624,266 | $ | 1,568,533 | $ | 1,785,176 | ||||||||||

| Ratios to average net assets: |

||||||||||||||||||||

| Net expenses |

0.20 | % | 0.18 | % | 0.21 | % | 0.23 | % | 0.18 | % | ||||||||||

| Gross expenses |

0.20 | % | 0.18 | % | 0.21 | % | 0.23 | % | 0.18 | % | ||||||||||

| Net investment income |

3.84 | % | 3.92 | % | 4.01 | % | 4.14 | % | 4.18 | % | ||||||||||

| Portfolio turnover rate |

31 | % | 22 | % | 34 | % | 28 | % | 28 | % | ||||||||||

| (a) | Total returns are historical and assume changes in share price, reinvestment of dividends and capital gains distributions and assume no sales charge. Past performance does not guarantee future results. |

| (b) | Rounds to less than $0.005 |

| * | Beginning with the year ended December 31, 2016, the Funds were audited by Ernst & Young LLP. The previous years were audited by another independent registered public accounting firm. |

The accompanying Notes are an integral part of these financial statements.

| 78 | Financial Highlights |

Elfun Income Fund

Financial Highlights