UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-05876

LORD ABBETT SERIES FUND, INC.

(Exact name of Registrant as specified in charter)

90 Hudson Street, Jersey City, NJ 07302

(Address of principal executive offices) (Zip code)

Brooke A. Fapohunda, Esq., Vice President & Assistant Secretary

90 Hudson Street, Jersey City, NJ 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 201-6984

Date of fiscal year end: 12/31

Date of reporting period: 12/31/2017

| Item 1: | Report(s) to Shareholders. |

LORD ABBETT

ANNUAL REPORT

Lord Abbett

Series Fund—Bond Debenture Portfolio

For the fiscal year ended December 31, 2017

Table of Contents

Lord Abbett Series Fund – Bond Debenture Portfolio

Annual

Report

For the fiscal year ended December 31, 2017

From left to right: James L.L. Tullis, Independent Chairman of the Lord Abbett Funds and Daria L. Foster, Director, President, and Chief Executive Officer of the Lord Abbett Funds.

|

Dear Shareholders: We are pleased to provide you with this overview of the performance of Lord Abbett Series Fund – Bond Debenture Portfolio for the fiscal year ended December 31, 2017. On this page, and the following pages, we discuss the major factors that influenced fiscal year performance. For additional information about the Fund, please visit our website at www.lordabbett.com, where you also can access the quarterly commentaries that provide updates on the Fund’s performance and other portfolio related updates. Thank you for investing in Lord Abbett mutual funds. We value the trust that you place in us and look forward to serving your investment needs in the years to come.

Best regards,

Daria L. Foster Director, President and Chief Executive Officer |

For the fiscal year ended December 31, 2017, the Fund returned 9.21%, reflecting performance at the net asset value (NAV) of Class VC shares, with all distributions reinvested, compared to its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index1 which returned 3.54% over the same period.

During the 12-month period the leveraged credit sectors of the U.S. fixed income market, including high yield bonds and loans, experienced positive returns, outperforming traditional government

related and investment grade securities. Despite some episodes of heightened volatility, high yield corporate spreads continued to compress during the period and returns within the high yield market were driven primarily by the lower quality segment, as CCC rated bonds meaningfully outperformed the broader market for the 12- month period.

As it has in the past, the Fund maintained a significant allocation to high yield bonds, as we remained positive on the high yield market from a fundamental

1

perspective. The Fund’s exposure to high yield bonds contributed to relative performance, as the high yield market significantly outperformed investment grade bonds, as represented by the Fund’s benchmark the Bloomberg Barclays U.S. Aggregate Bond Index.

The Fund maintained an allocation to equities throughout the period, which also contributed to relative performance, as the asset class outperformed fixed income segments of the market, including the Bloomberg Barclays U.S. Aggregate Bond Index.

The Fund’s modest allocation to government-related and securitized products detracted from performance, as these securities lagged risk assets during the period.

The Fund’s portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

1 The Bloomberg Barclays U.S. Aggregate Bond Index is an index of U.S dollar-denominated, investment-grade U.S. government and corporate securities, and mortgage pass-through securities, and asset-backed securities. Indexes are unmanaged, do not reflect the deduction of fees or expenses, and an investor cannot invest directly in an index.

Unless otherwise specified, indexes reflect total return, with all dividends reinvested. Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

Important Performance and Other Information

Performance data quoted in the following pages reflect past performance and are no guarantee of future results. Current performance may be higher or lower than the performance quoted. The investment return and principal value of an investment in the Fund will fluctuate so that shares, on any given day or when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling Lord Abbett at 888-522-2388 or referring to www.lordabbett.com.

During certain periods shown, expense waivers and reimbursements were in place. Without such expense waivers and reimbursements, the Fund’s returns would have been lower.

The annual commentary above discusses the views of the Fund’s management and various portfolio holdings of the Fund as of December 31, 2017. These views and portfolio holdings may have changed after this date. Information provided in the commentary is not a recommendation to buy or sell securities. Because the Fund’s portfolio is actively managed and may change significantly, the Fund may no longer own the securities described above or may have otherwise changed its position in the securities. For more recent information about the Fund’s portfolio holdings, please visit www.lordabbett.com.

A Note about Risk: See Notes to Financial Statements for a discussion of investment risks. For a more detailed discussion of the risks associated with the Fund, please see the Fund’s prospectus.

Mutual funds are not insured by the FDIC, are not deposits or other obligations of, or guaranteed by, banks, and are subject to investment risks including possible loss of principal amount invested.

The Fund serves as an underlying investment vehicle for variable annuity contracts and variable life insurance policies.

2

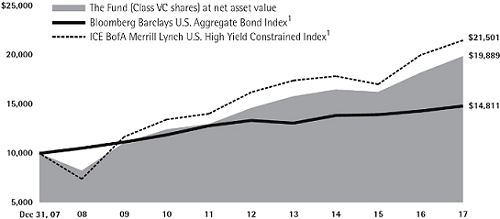

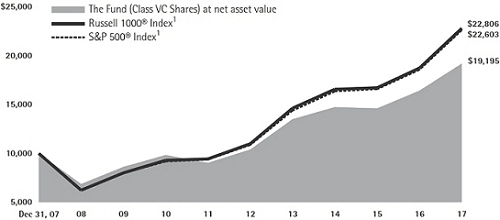

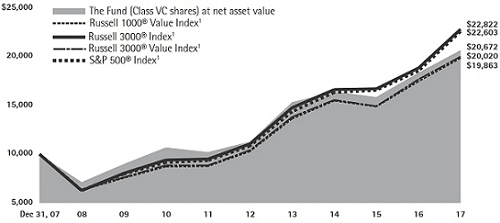

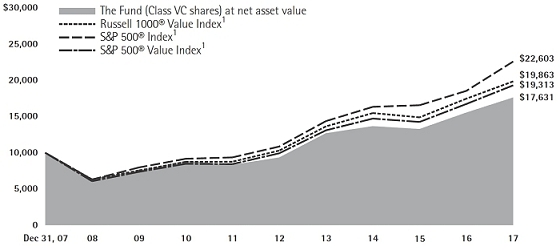

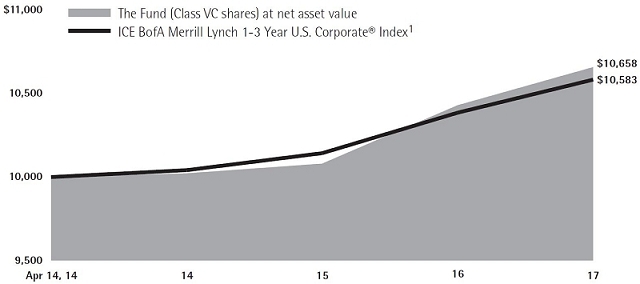

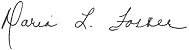

Below is a comparison of a $10,000 investment in Class VC shares with the same investment in the Bloomberg Barclays U.S. Aggregate Bond Index and the ICE BofA Merrill Lynch U.S. High Yield Constrained Index, assuming reinvestment of all dividends and distributions. The Fund’s shares are sold only to insurance company separate accounts that fund certain variable annuity and variable life contracts. This line graph comparison does not reflect the sales charges or other expenses of these contracts. If those sales charges and expenses were reflected, returns would be lower. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns for the

Periods Ended December 31, 2017

| 1 Year | 5 Years | 10 Years | ||||

| Class VC | 9.21% | 6.36% | 7.12% |

1 Performance for each unmanaged index does not reflect any fees or expenses. The performance of each index is not necessarily representative of the Fund’s performance.

3

As a shareholder of the Fund, you incur ongoing costs, including management fees; expenses related to the Fund’s services arrangements with certain insurance companies; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2017 through December 31, 2017).

The Example reflects only expenses that are deducted from the assets of the Fund. Fees and expenses, including sales charges applicable to the various insurance products that invest in the Fund, are not reflected in this Example. If such fees and expenses were reflected in the Example, the total expenses shown would be higher. Fees and expenses regarding such variable insurance products are separately described in the prospectus related to those products.

Actual Expenses

The first line of the table on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading titled “Expenses Paid During Period 7/1/17 – 12/31/17” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

4

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning Account Value |

Ending Account Value |

Expenses Paid During Period† |

|||||

| 7/1/17 | 12/31/17 | 7/1/17 – 12/31/17 |

|

||||

| Class VC | |||||||

| Actual | $1,000.00 | $1,042.40 | $4.63 | ||||

| Hypothetical (5% Return Before Expenses) | $1,000.00 | $1,020.67 | $4.58 |

| † | Net expenses are equal to the Fund’s annualized expense ratio of 0.90%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

Portfolio Holdings Presented by Sector

December 31, 2017

| Sector* | %** | |

| Asset Backed | 1.86 | % |

| Automotive | 1.84 | % |

| Banking | 8.74 | % |

| Basic Industry | 9.97 | % |

| Capital Goods | 3.53 | % |

| Consumer Goods | 3.45 | % |

| Energy | 12.10 | % |

| Financial Services | 4.09 | % |

| Foreign Government | 3.81 | % |

| Healthcare | 6.59 | % |

| Insurance | 2.38 | % |

| Leisure | 4.21 | % |

| Media | 3.36 | % |

| Municipal | 3.97 | % |

| Real Estate | 1.47 | % |

| Retail | 5.48 | % |

| Services | 3.22 | % |

| Technology | 6.90 | % |

| Telecommunications | 2.90 | % |

| Transportation | 3.14 | % |

| U.S. Government | 1.44 | % |

| Utility | 4.33 | % |

| Repurchase Agreement | 1.22 | % |

| Total | 100.00 | % |

| * | A sector may comprise several industries. | |

| ** | Represents percent of total investments. |

5

December 31, 2017

| Investments | Interest Rate | Maturity Date | Principal Amount (000) | Fair Value | ||||||||

| LONG-TERM INVESTMENTS 99.38% | ||||||||||||

| ASSET-BACKED SECURITIES 1.92% | ||||||||||||

| Automobiles 0.11% | ||||||||||||

| TCF Auto Receivables Owner Trust 2016-1A B† | 2.32% | 6/15/2022 | $ | 979 | $ | 964,024 | ||||||

| Westlake Automobile Receivables Trust 2016-3A B† | 2.07% | 12/15/2021 | 277 | 276,180 | ||||||||

| Total | 1,240,204 | |||||||||||

| Other 1.81% | ||||||||||||

| ALM XIX Ltd. 2016-19A C† | 5.709% (3 Mo. LIBOR + 4.35% | )# | 7/15/2028 | 462 | 475,152 | |||||||

| ALM XVIII Ltd. 2016-18A C† | 5.709% (3 Mo. LIBOR + 4.35% | )# | 7/15/2027 | 500 | 515,353 | |||||||

| AMMC CLO XII Ltd. 2013-12A DR† | 4.11% (3 Mo. LIBOR + 2.47% | )#(a) | 11/10/2030 | 391 | 393,625 | |||||||

| Anchorage Capital CLO 8 Ltd. 2016-8A D† | 5.578% (3 Mo. LIBOR + 4.20% | )# | 7/28/2028 | 250 | 253,845 | |||||||

| Anchorage Capital CLO 9 Ltd. 2016-9A D† | 5.359% (3 Mo. LIBOR + 4.00% | )# | 1/15/2029 | 1,150 | 1,177,136 | |||||||

| Apex Credit CLO Ltd. 2015-2A B1† | 3.753% (3 Mo. LIBOR + 2.40% | )# | 10/19/2026 | 1,500 | 1,501,565 | |||||||

| Ascentium Equipment Receivables Trust 2016-2A B† | 2.50% | 9/12/2022 | 417 | 415,210 | ||||||||

| BlueMountain CLO Ltd. 2016-1A D† | 6.163% (3 Mo. LIBOR + 4.80% | )# | 4/20/2027 | 500 | 508,882 | |||||||

| Conn Funding II LP 2017-B C† | 5.95% | 11/15/2022 | 2,250 | 2,273,600 | (b) | |||||||

| Engs Commercial Finance Trust 2016-1A A2† | 2.63% | 2/22/2022 | 832 | 828,109 | ||||||||

| Guggenheim 5180-2 CLO LP 2015-1A A2B† | 4.012% (3 Mo. LIBOR + 2.55% | )# | 11/25/2027 | 2,500 | 2,507,979 | |||||||

| Jamestown CLO VII Ltd. 2015-7A BR† | 3.017% (3 Mo. LIBOR + 1.65% | )#(a) | 7/25/2027 | 1,202 | 1,203,006 | |||||||

| KKR Financial CLO Ltd. 2013-2A C† | 5.113% (3 Mo. LIBOR + 3.75% | )# | 1/23/2026 | 500 | 501,285 | |||||||

| Marble Point CLO XI Ltd. 2017-2A A† | 2.793% (3 Mo. LIBOR + 1.18% | )#(a) | 12/18/2030 | 1,800 | 1,802,610 | |||||||

| Regatta III Funding Ltd. 2014-1A CR† | 4.659% (3 Mo. LIBOR + 3.30% | )# | 4/15/2026 | 400 | 402,931 | |||||||

| Regatta IV Funding Ltd. 2014-1A DR† | 4.667% (3 Mo. LIBOR + 3.30% | )# | 7/25/2026 | 1,300 | 1,300,761 | |||||||

| Sound Point CLO XI Ltd. 2016-1A D† | 6.013% (3 Mo. LIBOR + 4.65% | )# | 7/20/2028 | 2,000 | 2,045,240 | |||||||

| Voya CLO Ltd. 2016-2A C† | 5.607% (3 Mo. LIBOR + 4.25% | )# | 7/19/2028 | 750 | 760,662 | |||||||

| Voya CLO Ltd. 2017-4A A1† | 2.514% (3 Mo. LIBOR + 1.13% | )#(a) | 10/15/2030 | 1,059 | 1,062,121 | |||||||

| West CLO Ltd. 2014-2A BR† | 3.111% (3 Mo. LIBOR + 1.75% | )#(a) | 1/16/2027 | 459 | 459,542 | |||||||

| 6 | See Notes to Financial Statements. |

Schedule of Investments (continued)

December 31, 2017

| Investments | Interest Rate | Maturity Date | Principal Amount (000) | Fair Value | ||||||||

| Other (continued) | ||||||||||||

| Westcott Park CLO Ltd. 2016-1A D† | 5.713% (3 Mo. LIBOR + 4.35% | )# | 7/20/2028 | $ | 850 | $ | 861,103 | |||||

| Total | 21,249,717 | |||||||||||

| Total Asset-Backed Securities (cost $22,092,665) | 22,489,921 | |||||||||||

| Shares (000) | ||||||||||||

| Common Stocks 14.62% | ||||||||||||

| Aerospace/Defense 0.30% | ||||||||||||

| Huntington Ingalls Industries, Inc. | 7 | 1,744,887 | ||||||||||

| Mercury Systems, Inc.* | 35 | 1,805,825 | ||||||||||

| Total | 3,550,712 | |||||||||||

| Air Transportation 0.20% | ||||||||||||

| Allegiant Travel Co. | 7 | 1,121,937 | ||||||||||

| Wizz Air Holdings plc†*(c) | GBP | 26 | 1,263,568 | |||||||||

| Total | 2,385,505 | |||||||||||

| Auto Loans 0.15% | ||||||||||||

| Credit Acceptance Corp.* | 5 | 1,734,823 | ||||||||||

| Auto Parts & Equipment 0.09% | ||||||||||||

| Chassix Holdings, Inc. | 59 | 1,085,419 | ||||||||||

| Automakers 0.10% | ||||||||||||

| Oshkosh Corp. | 13 | 1,199,566 | ||||||||||

| Banking 0.72% | ||||||||||||

| BOK Financial Corp. | 7 | 634,146 | ||||||||||

| Cullen/Frost Bankers, Inc. | 12 | 1,119,426 | ||||||||||

| LegacyTexas Financial Group, Inc. | 28 | 1,201,128 | ||||||||||

| Northern Trust Corp. | 12 | 1,177,303 | ||||||||||

| Sberbank of Russia PJSC ADR | 120 | 2,026,877 | ||||||||||

| SVB Financial Group* | 10 | 2,290,712 | ||||||||||

| Total | 8,449,592 | |||||||||||

| Beverages 0.79% | ||||||||||||

| Brown-Forman Corp. Class B | 36 | 2,447,673 | ||||||||||

| Constellation Brands, Inc. Class A | 5 | 1,223,307 | ||||||||||

| Monster Beverage Corp.* | 19 | 1,178,396 | ||||||||||

| Remy Cointreau SA(c) | EUR | 20 | 2,710,690 | |||||||||

| Treasury Wine Estates Ltd.(c) | AUD | 142 | 1,767,632 | |||||||||

| Total | 9,327,698 | |||||||||||

| See Notes to Financial Statements. | 7 |

Schedule of Investments (continued)

December 31, 2017

| Investments | Shares (000) | Fair Value | ||||||||||

| Brokerage 0.10% | ||||||||||||

| Cboe Global Markets, Inc. | 10 | $ | 1,200,798 | |||||||||

| Building Materials 0.21% | ||||||||||||

| Owens Corning | 27 | 2,465,923 | ||||||||||

| Chemicals 0.55% | ||||||||||||

| Potash Corp. of Saskatchewan, Inc. (Canada)(d) | 117 | 2,413,345 | ||||||||||

| Venator Materials plc (United Kingdom)*(d) | 51 | 1,128,695 | ||||||||||

| Versum Materials, Inc. | 30 | 1,149,883 | ||||||||||

| Westlake Chemical Corp. | 17 | 1,761,900 | ||||||||||

| Total | 6,453,823 | |||||||||||

| Discount Stores 0.40% | ||||||||||||

| Amazon.com, Inc.* | 1 | 1,160,114 | ||||||||||

| Dollar Tree, Inc.* | 11 | 1,178,371 | ||||||||||

| Wal-Mart Stores, Inc. | 24 | 2,370,593 | ||||||||||

| Total | 4,709,078 | |||||||||||

| Diversified Capital Goods 0.10% | ||||||||||||

| Rockwell Automation, Inc. | 6 | 1,169,461 | ||||||||||

| Electric: Integrated 0.67% | ||||||||||||

| El Paso Electric Co. | 29 | 1,596,405 | ||||||||||

| IDACORP, Inc. | 18 | 1,657,727 | ||||||||||

| NextEra Energy, Inc. | 11 | 1,734,021 | ||||||||||

| Pampa Energia SA ADR* | 25 | 1,678,636 | ||||||||||

| Public Service Enterprise Group, Inc. | 23 | 1,189,650 | ||||||||||

| Total | 7,856,439 | |||||||||||

| Electronics 0.49% | ||||||||||||

| Keyence Corp.(c) | JPY | 2 | 1,106,090 | |||||||||

| Littelfuse, Inc. | 6 | 1,117,287 | ||||||||||

| Nintendo Co., Ltd.(c) | JPY | 3 | 1,213,525 | |||||||||

| Rogers Corp.* | 7 | 1,194,322 | ||||||||||

| Trimble, Inc.* | 29 | 1,161,857 | ||||||||||

| Total | 5,793,081 | |||||||||||

| Energy: Exploration & Production 1.06% | ||||||||||||

| Carrizo Oil & Gas, Inc.* | 57 | 1,206,108 | ||||||||||

| Chaparral Energy, Inc.* | 12 | 291,648 | ||||||||||

| Chaparral Energy, Inc. Class A* | 59 | 1,386,955 | ||||||||||

| Concho Resources, Inc.* | 8 | 1,196,202 | ||||||||||

| 8 | See Notes to Financial Statements. |

Schedule of Investments (continued)

December 31, 2017

| Investments | Shares (000) | Fair Value | ||||||

| Energy: Exploration & Production (continued) | ||||||||

| Continental Resources, Inc.* | 74 | $ | 3,917,979 | |||||

| Extraction Oil & Gas, Inc.* | 58 | 831,654 | ||||||

| Jagged Peak Energy, Inc.* | 65 | 1,018,788 | ||||||

| Peabody Energy Corp. | – | (e) | 10,613 | |||||

| SM Energy Co. | 58 | 1,274,016 | ||||||

| Templar Energy LLC Class A Units | 46 | 101,682 | ||||||

| WildHorse Resource Development Corp.* | 67 | 1,232,734 | ||||||

| Total | 12,468,379 | |||||||

| Food: Wholesale 0.31% | ||||||||

| Costco Wholesale Corp. | 6 | 1,191,168 | ||||||

| Hormel Foods Corp. | 32 | 1,169,938 | ||||||

| TreeHouse Foods, Inc.* | 25 | 1,231,752 | ||||||

| Total | 3,592,858 | |||||||

| Forestry/Paper 0.10% | ||||||||

| Potlatch Corp. | 23 | 1,138,419 | ||||||

| Gaming 0.87% | ||||||||

| Aristocrat Leisure Ltd.(c) | AUD | 71 | 1,300,097 | |||||

| Caesars Entertainment Corp.* | 88 | 1,114,389 | ||||||

| Penn National Gaming, Inc.* | 80 | 2,498,599 | ||||||

| Scientific Games Corp. Class A* | 44 | 2,257,149 | ||||||

| VICI Properties, Inc.* | 29 | 597,759 | ||||||

| Wynn Resorts Ltd. | 14 | 2,423,144 | ||||||

| Total | 10,191,137 | |||||||

| Hotels 0.10% | ||||||||

| Hilton Grand Vacations, Inc.* | 29 | 1,195,575 | ||||||

| Investments & Miscellaneous Financial Services 0.71% | ||||||||

| Ameriprise Financial, Inc. | 14 | 2,344,956 | ||||||

| BlackRock, Inc. | 2 | 1,182,560 | ||||||

| Federated Investors, Inc. Class B | 34 | 1,215,680 | ||||||

| SEI Investments Co. | 16 | 1,178,576 | ||||||

| T. Rowe Price Group, Inc. | 23 | 2,379,183 | ||||||

| Total | 8,300,955 | |||||||

| Machinery 0.63% | ||||||||

| Deere & Co. | 16 | 2,459,085 | ||||||

| DMG Mori Co., Ltd.(c) | JPY | 55 | 1,130,253 | |||||

| See Notes to Financial Statements. | 9 |

Schedule of Investments (continued)

December 31, 2017

| Investments | Shares (000) | Fair Value | ||||||

| Machinery (continued) | ||||||||

| Gardner Denver Holdings, Inc.* | 37 | $ | 1,249,302 | |||||

| Komatsu Ltd.(c) | JPY | 35 | 1,270,311 | |||||

| Terex Corp. | 26 | 1,245,330 | ||||||

| Total | 7,354,281 | |||||||

| Media: Content 0.10% | ||||||||

| Netflix, Inc.* | 6 | 1,189,192 | ||||||

| Medical Products 0.05% | ||||||||

| Align Technology, Inc.* | 3 | 572,806 | ||||||

| Metals/Mining (Excluding Steel) 0.22% | ||||||||

| Sumitomo Metal Mining Co. Ltd.(c) | JPY | 57 | 2,603,785 | |||||

| Monoline Insurance 0.19% | ||||||||

| FNF Group | 29 | 1,144,984 | ||||||

| MGIC Investment Corp.* | 76 | 1,065,968 | ||||||

| Total | 2,210,952 | |||||||

| Non-Electric Utilities 0.16% | ||||||||

| Aqua America, Inc. | 48 | 1,873,860 | ||||||

| Oil Field Equipment & Services 0.15% | ||||||||

| RPC, Inc. | 70 | 1,776,097 | ||||||

| Oil Refining & Marketing 0.16% | ||||||||

| HollyFrontier Corp. | 37 | 1,896,677 | ||||||

| Pharmaceuticals 0.78% | ||||||||

| Bio-Rad Laboratories, Inc. Class A* | 5 | 1,145,616 | ||||||

| Bluebird Bio, Inc.* | 15 | 2,628,222 | ||||||

| Blueprint Medicines Corp.* | 39 | 2,933,675 | ||||||

| Juno Therapeutics, Inc.* | 27 | 1,221,828 | ||||||

| Loxo Oncology, Inc.* | 14 | 1,187,191 | ||||||

| Total | 9,116,532 | |||||||

| Printing & Publishing 0.10% | ||||||||

| S&P Global, Inc. | 7 | 1,144,975 | ||||||

| Real Estate Development & Management 0.15% | ||||||||

| CoStar Group, Inc.* | 6 | 1,779,027 | ||||||

| Real Estate Investment Trusts 0.15% | ||||||||

| Goodman Group(c) | AUD | 260 | 1,705,272 | |||||

| 10 | See Notes to Financial Statements. |

Schedule of Investments (continued)

December 31, 2017

| Investments | Shares (000) | Fair Value | ||||||

| Restaurants 0.30% | ||||||||

| Dunkin’ Brands Group, Inc. | 19 | $ | 1,237,824 | |||||

| McDonald’s Corp. | 7 | 1,159,400 | ||||||

| Shake Shack, Inc. Class A* | 26 | 1,122,207 | ||||||

| Total | 3,519,431 | |||||||

| Software/Services 1.05% | ||||||||

| 2U, Inc.* | 18 | 1,165,051 | ||||||

| Black Knight, Inc.* | 13 | 556,952 | ||||||

| Blackbaud, Inc. | 17 | 1,620,503 | ||||||

| FleetCor Technologies, Inc.* | 9 | 1,751,690 | ||||||

| InterXion Holding NV (Netherlands)*(d) | 10 | 603,090 | ||||||

| MSCI, Inc. | 9 | 1,157,208 | ||||||

| Rheinmetall AG(c) | EUR | 5 | 619,671 | |||||

| Snap, Inc. Class A* | 36 | 531,190 | ||||||

| Tableau Software, Inc. Class A* | 16 | 1,105,539 | ||||||

| Twitter, Inc.* | 81 | 1,940,560 | ||||||

| VMware, Inc. Class A* | 10 | 1,263,978 | ||||||

| Total | 12,315,432 | |||||||

| Specialty Retail 1.21% | ||||||||

| Canada Goose Holdings, Inc. (Canada)*(d) | 43 | 1,349,190 | ||||||

| Children’s Place, Inc. (The) | 9 | 1,293,615 | ||||||

| Columbia Sportswear Co. | 17 | 1,250,712 | ||||||

| Five Below, Inc.* | 18 | 1,200,127 | ||||||

| Kering(c) | EUR | 4 | 1,796,765 | |||||

| Maisons du Monde SA†(c) | EUR | 16 | 709,264 | |||||

| Moncler SpA(c) | EUR | 56 | 1,752,640 | |||||

| Ollie’s Bargain Outlet Holdings, Inc.* | 25 | 1,307,287 | ||||||

| Polaris Industries, Inc. | 9 | 1,140,708 | ||||||

| Skechers U.S.A., Inc. Class A* | 33 | 1,244,936 | ||||||

| VF Corp. | 16 | 1,176,674 | ||||||

| Total | 14,221,918 | |||||||

| Support: Services 0.53% | ||||||||

| Ashtead Group plc(c) | GBP | 46 | 1,233,788 | |||||

| Bright Horizons Family Solutions, Inc.* | 13 | 1,200,192 | ||||||

| ManpowerGroup, Inc. | 9 | 1,172,823 | ||||||

| TopBuild Corp.* | 17 | 1,316,361 | ||||||

| Total System Services, Inc. | 16 | 1,242,425 | ||||||

| Total | 6,165,589 | |||||||

| See Notes to Financial Statements. | 11 |

Schedule of Investments (continued)

December 31, 2017

| Investments | Shares (000) | Fair Value | ||||||||||

| Technology Hardware & Equipment 0.21% | ||||||||||||

| Marvell Technology Group Ltd. | 50 | $ | 1,074,874 | |||||||||

| Tokyo Electron Ltd.(c) | JPY | 8 | 1,352,921 | |||||||||

| Total | 2,427,795 | |||||||||||

| Transportation: Infrastructure/Services 0.10% | ||||||||||||

| Landstar System, Inc. | 11 | 1,170,813 | ||||||||||

| Trucking & Delivery 0.36% | ||||||||||||

| Knight-Swift Transportation Holdings, Inc. | 27 | 1,184,812 | ||||||||||

| Old Dominion Freight Line, Inc. | 23 | 3,001,182 | ||||||||||

| Total | 4,185,994 | |||||||||||

| Total Common Stocks (cost $151,846,041) | 171,499,669 | |||||||||||

| Interest Rate | Maturity Date | Principal Amount (000) | ||||||||||

| CONVERTIBLE BONDS 0.30% | ||||||||||||

| Automakers 0.10% | ||||||||||||

| Tesla, Inc. | 1.25% | 3/1/2021 | $ | 1,035 | 1,121,681 | |||||||

| Investments & Miscellaneous Financial Services 0.10% | ||||||||||||

| Square, Inc.† | 0.375% | 3/1/2022 | 709 | 1,159,658 | ||||||||

| Software/Services 0.10% | ||||||||||||

| RealPage, Inc.† | 1.50% | 11/15/2022 | 976 | 1,212,680 | ||||||||

| Total Convertible Bonds (cost $3,582,358) | 3,494,019 | |||||||||||

| Dividend Rate | Shares (000) | |||||||||||

| CONVERTIBLE PREFERRED STOCKS 0.25% | ||||||||||||

| Personal & Household Products 0.20% | ||||||||||||

| Stanley Black & Decker, Inc. | 5.375% | 19 | 2,381,350 | |||||||||

| Software/Services 0.05% | ||||||||||||

| Mandatory Exchangeable Trust† | 5.75% | 3 | 565,167 | |||||||||

| Total Convertible Preferred Stocks (cost $2,388,060) | 2,946,517 | |||||||||||

| 12 | See Notes to Financial Statements. |

Schedule of Investments (continued)

December 31, 2017

| Investments | Interest Rate | Maturity Date | Principal Amount (000) | Fair Value | ||||||||

| FLOATING RATE LOANS(f) 3.20% | ||||||||||||

| Advertising 0.15% | ||||||||||||

| Southern Graphics, Inc. 1st Lien Initial Term Loan | – | (g) | 12/8/2022 | $ | 1,507 | $ | 1,516,992 | |||||

| Southern Graphics, Inc. Delayed Draw Term Loan | – | (g) | 12/31/2022 | 243 | 244,926 | |||||||

| Total | 1,761,918 | |||||||||||

| Building Materials 0.13% | ||||||||||||

| Zodiac Pool Solutions LLC 1st Lien Tranche B1 Term Loan | 5.693% (3 Mo. LIBOR + 4.00% | ) | 12/20/2023 | 1,514 | 1,524,153 | |||||||

| Department Stores 0.10% | ||||||||||||

| Neiman Marcus Group, Inc. Other Term Loan | 4.642% (3 Mo. LIBOR + 3.25% | ) | 10/25/2020 | 1,456 | 1,193,017 | |||||||

| Electric: Generation 0.48% | ||||||||||||

| EFS Cogen Holdings I LLC Advanced Term Loan B | 4.95% (3 Mo. LIBOR + 3.25% | ) | 6/28/2023 | 503 | 508,048 | |||||||

| Lightstone Holdco LLC Refinanced Term Loan B | 6.069% (3 Mo. LIBOR + 4.50% | ) | 1/30/2024 | 2,521 | 2,536,457 | |||||||

| Lightstone Holdco LLC Refinanced Term Loan C | 6.069% (3 Mo. LIBOR + 4.50% | ) | 1/30/2024 | 161 | 161,964 | |||||||

| Sandy Creek Energy Associates, L.P. Term Loan | 5.693% (3 Mo. LIBOR + 4.00% | ) | 11/9/2020 | 1,547 | 1,300,697 | |||||||

| Viva Alamo LLC Term Loan B | 5.819% (3 Mo. LIBOR + 4.25% | ) | 2/20/2021 | 1,182 | 1,170,487 | |||||||

| Total | 5,677,653 | |||||||||||

| Electronics 0.10% | ||||||||||||

| EXC III Holding Corp. 1st Lien Initial Term Loan | 5.161% (3 Mo. LIBOR + 7.50% | ) | 12/1/2025 | 1,141 | 1,151,874 | |||||||

| Energy: Exploration & Production 0.15% | ||||||||||||

| California Resources Corp. Initial Term Loan | – | (g) | 12/31/2022 | 589 | 587,896 | |||||||

| Chief Exploration & Development LLC 2nd Lien Term Loan | 7.959% (3 Mo. LIBOR + 6.50% | ) | 5/16/2021 | 1,179 | 1,162,299 | |||||||

| Total | 1,750,195 | |||||||||||

| Gaming 0.30% | ||||||||||||

| Cowlitz Tribal Gaming Authority Term Loan B | 12.069% (1 Mo. LIBOR + 10.50% | ) | 12/6/2021 | 2,182 | 2,449,716 | (h) | ||||||

| Stars Group, Inc. (The) 1st Lien Initial Term Loan B3 (Netherlands)(d) | 5.193% (3 Mo. LIBOR + 3.50% | ) | 8/1/2021 | 1,106 | 1,113,688 | |||||||

| Total | 3,563,404 | |||||||||||

| See Notes to Financial Statements. | 13 |

Schedule of Investments (continued)

December 31, 2017

| Investments | Interest Rate | Maturity Date | Principal Amount (000) | Fair Value | ||||||||

| Health Services 0.10% | ||||||||||||

| Genoa, a QoL Healthcare Company, LLC 1st Lien Amendment No. 1 Term Loan | 4.819% (1 Mo. LIBOR + 3.25% | ) | 10/28/2023 | $ | 1,095 | $ | 1,103,628 | |||||

| Investments & Miscellaneous Financial Services 0.07% | ||||||||||||

| VFH Parent LLC Initial Term Loan | 5.135% (3 Mo. LIBOR + 3.75% | ) | 12/30/2021 | 861 | 869,478 | |||||||

| Media: Diversified 0.11% | ||||||||||||

| UFC Holdings, LLC 2nd Lien Term Loan | 9.052% (1 Mo. LIBOR + 7.50% | ) | 8/18/2024 | 1,231 | 1,255,109 | |||||||

| Metals/Mining (Excluding Steel) 0.06% | ||||||||||||

| Oxbow Carbon LLC 2nd Lien Initial Term Loan | 10.50% (3 Mo. LIBOR + 7.50% | ) | 1/4/2024 | 650 | 652,438 | |||||||

| Personal & Household Products 0.14% | ||||||||||||

| Britax US Holdings, Inc. Initial Dollar Term Loan | 5.193% (3 Mo. LIBOR + 3.50% | ) | 10/15/2020 | 1,896 | 1,614,488 | |||||||

| Real Estate Development & Management 0.09% | ||||||||||||

| Capital Automotive L.P. 2nd Lien Initial Tranche B Term Loan | 7.57% (1 Mo. LIBOR + 6.00% | ) | 3/24/2025 | 1,051 | 1,082,920 | |||||||

| Recreation & Travel 0.24% | ||||||||||||

| Intrawest Resorts Holdings, Inc. Term Loan B1 | 4.819% (3 Mo. LIBOR + 3.25% | ) | 7/31/2024 | 2,088 | 2,106,928 | |||||||

| Kingpin Intermediate Holdings LLC 1st Lien Term Loan | 5.73% (3 Mo. LIBOR + 4.25% | ) | 6/29/2024 | 679 | 687,360 | (h) | ||||||

| Total | 2,794,288 | |||||||||||

| Software/Services 0.08% | ||||||||||||

| Misys Ltd 2nd Lien Dollar Term Loan | 8.729% (3 Mo. LIBOR + 7.25% | ) | 6/13/2025 | 965 | 970,307 | |||||||

| Specialty Retail 0.56% | ||||||||||||

| Bass Pro Group, LLC Term Loan B | – | (g) | 9/25/2024 | 1,731 | 1,728,499 | |||||||

| Container Store, Inc. Term Loan B | 8.693% (3 Mo. LIBOR + 7.00% | ) | 8/18/2021 | 899 | 873,345 | |||||||

| Forterra Finance, LLC Term Loan | – | (g) | 10/25/2023 | 1,267 | 1,188,708 | |||||||

| J.C. Penney Corp., Inc. 2016 Term Loan B | 5.729% (3 Mo. LIBOR + 0.425% | ) | 6/23/2023 | 1,295 | 1,214,005 | |||||||

| 14 | See Notes to Financial Statements. |

Schedule of Investments (continued)

December 31, 2017

| Investments | Interest Rate | Maturity Date | Principal Amount (000) | Fair Value | ||||||||

| Specialty Retail (continued) | ||||||||||||

| PetSmart, Inc. Tranche B2 Term Loan | 4.57% (1 Mo. LIBOR + 3.00% | ) | 3/11/2022 | $ | 1,965 | $ | 1,578,615 | |||||

| Total | 6,583,172 | |||||||||||

| Support: Services 0.03% | ||||||||||||

| Pike Corp. 2017 Initial Term Loan | 5.07% (3 Mo. LIBOR + 3.50% | ) | 9/20/2024 | 328 | 333,550 | |||||||

| Telecommunications: Satellite 0.05% | ||||||||||||

| Intelsat Jackson Holdings S.A. Tranche Term Loan B5 (Luxembourg)(d) | – | (g) | 1/2/2024 | 602 | 609,402 | |||||||

| Transportation: Infrastructure/Services 0.26% | ||||||||||||

| Uber Technologies, Inc. Term Loan B | 5.552% (3 Mo. LIBOR + 4.00% | ) | 7/13/2023 | 2,984 | 3,006,644 | |||||||

| Total Floating Rate Loans (cost $36,927,667) | 37,497,638 | |||||||||||

| FOREIGN BONDS(c) 0.45% | ||||||||||||

| France 0.21% | ||||||||||||

| CMA CGM SA† | 5.25% | 1/15/2025 | EUR | 657 | 787,844 | |||||||

| CMA CGM SA† | 6.50% | 7/15/2022 | EUR | 1,377 | 1,737,916 | |||||||

| Total | 2,525,760 | |||||||||||

| Netherlands 0.24% | ||||||||||||

| Hema Bondco I BV† | 6.25% (3 Mo. Euribor + 6.25% | )# | 7/15/2022 | EUR | 2,291 | 2,812,733 | ||||||

| Total Foreign Bonds (cost $4,971,412) | 5,338,493 | |||||||||||

| FOREIGN GOVERNMENT OBLIGATIONS 3.47% | ||||||||||||

| Argentina 0.89% | ||||||||||||

| City of Buenos Aires†(d) | 7.50% | 6/1/2027 | 1,275 | 1,422,262 | ||||||||

| City of Buenos Aires†(d) | 8.95% | 2/19/2021 | 1,125 | 1,251,563 | ||||||||

| Province of Santa Fe†(d) | 6.90% | 11/1/2027 | 1,521 | 1,614,009 | ||||||||

| Provincia de Mendoza†(d) | 8.375% | 5/19/2024 | 2,025 | 2,263,059 | ||||||||

| Provincia of Neuquen†(d) | 7.50% | 4/27/2025 | 540 | 579,150 | ||||||||

| Provincia of Neuquen†(d) | 8.625% | 5/12/2028 | 719 | 808,566 | ||||||||

| Republic of Argentina(d) | 7.50% | 4/22/2026 | 2,208 | 2,503,099 | ||||||||

| Total | 10,441,708 | |||||||||||

| Australia 0.33% | ||||||||||||

| Australian Government(c) | 4.25% | 4/21/2026 | AUD | 2,084 | 1,828,570 | |||||||

| Queensland Treasury Corp.†(c) | 4.00% | 6/21/2019 | AUD | 2,500 | 2,007,947 | |||||||

| Total | 3,836,517 | |||||||||||

| See Notes to Financial Statements. | 15 |

Schedule of Investments (continued)

December 31, 2017

| Investments | Interest Rate | Maturity Date | Principal Amount (000) | Fair Value | ||||||||

| Bahamas 0.29% | ||||||||||||

| Commonwealth of Bahamas†(d) | 5.75% | 1/16/2024 | $ | 1,100 | $ | 1,150,930 | ||||||

| Commonwealth of Bahamas†(d) | 6.00% | 11/21/2028 | 2,200 | 2,299,000 | ||||||||

| Total | 3,449,930 | |||||||||||

| Bermuda 0.23% | ||||||||||||

| Government of Bermuda† | 4.138% | 1/3/2023 | 1,350 | 1,422,387 | ||||||||

| Government of Bermuda† | 4.854% | 2/6/2024 | 1,175 | 1,277,965 | ||||||||

| Total | 2,700,352 | |||||||||||

| Canada 0.21% | ||||||||||||

| Province of British Columbia Canada(c) | 2.85% | 6/18/2025 | CAD | 3,000 | 2,453,007 | |||||||

| Cayman Islands 0.04% | ||||||||||||

| Cayman Islands Government† | 5.95% | 11/24/2019 | $ | 425 | 459,045 | |||||||

| Ghana 0.14% | ||||||||||||

| Republic of Ghana†(d) | 7.875% | 8/7/2023 | 1,541 | 1,697,396 | ||||||||

| Greece 0.16% | ||||||||||||

| Hellenic Republic†(c) | 4.375% | 8/1/2022 | EUR | 1,500 | 1,869,605 | |||||||

| Honduras 0.21% | ||||||||||||

| Honduras Government†(d) | 6.25% | 1/19/2027 | $ | 2,300 | 2,465,830 | |||||||

| Jamaica 0.35% | ||||||||||||

| Government of Jamaica(d) | 6.75% | 4/28/2028 | 2,373 | 2,696,321 | ||||||||

| Government of Jamaica(d) | 8.00% | 3/15/2039 | 1,110 | 1,364,701 | ||||||||

| Total | 4,061,022 | |||||||||||

| Nigeria 0.08% | ||||||||||||

| Republic of Nigeria†(d) | 6.50% | 11/28/2027 | 857 | 895,807 | ||||||||

| Senegal 0.15% | ||||||||||||

| Republic of Senegal†(d) | 6.25% | 5/23/2033 | 1,661 | 1,758,095 | ||||||||

| Sri Lanka 0.20% | ||||||||||||

| Republic of Sri Lanka†(d) | 6.20% | 5/11/2027 | 2,209 | 2,336,501 | ||||||||

| United Arab Emirates 0.10% | ||||||||||||

| Abu Dhabi Government International†(d) | 3.125% | 5/3/2026 | 1,255 | 1,241,282 | ||||||||

| Uruguay 0.09% | ||||||||||||

| Republic of Uruguay†(c) | 8.50% | 3/15/2028 | UYU | 30,282 | 1,057,655 | |||||||

| Total Foreign Government Obligations (cost $38,491,810) | 40,723,752 | |||||||||||

| 16 | See Notes to Financial Statements. |

Schedule of Investments (continued)

December 31, 2017

| Investments | Interest Rate | Maturity Date | Principal Amount (000) | Fair Value | ||||||||

| GOVERNMENT SPONSORED ENTERPRISES PASS-THROUGH 1.45% | ||||||||||||

| Federal National Mortgage Assoc.(i) (cost $17,124,134) | 3.50% | TBA | $ | 16,600 | $ | 17,054,477 | ||||||

| HIGH YIELD CORPORATE BONDS 69.02% | ||||||||||||

| Advertising 0.19% | ||||||||||||

| Clear Channel Worldwide Holdings, Inc. | 6.50% | 11/15/2022 | 1,579 | 1,612,554 | ||||||||

| Lamar Media Corp. | 5.75% | 2/1/2026 | 566 | 606,327 | ||||||||

| Total | 2,218,881 | |||||||||||

| Aerospace/Defense 0.78% | ||||||||||||

| Bombardier, Inc. (Canada)†(d) | 7.50% | 12/1/2024 | 1,068 | 1,086,690 | ||||||||

| Bombardier, Inc. (Canada)†(d) | 8.75% | 12/1/2021 | 1,010 | 1,116,050 | ||||||||

| Bombardier, Inc.(Canada)†(d) | 7.50% | 3/15/2025 | 4,079 | 4,129,988 | ||||||||

| Huntington Ingalls Industries, Inc.† | 3.483% | 12/1/2027 | 1,711 | 1,708,861 | ||||||||

| Huntington Ingalls Industries, Inc.† | 5.00% | 11/15/2025 | 1,048 | 1,123,980 | ||||||||

| Total | 9,165,569 | |||||||||||

| Air Transportation 0.56% | ||||||||||||

| Air Canada (Canada)†(d) | 7.75% | 4/15/2021 | 1,140 | 1,305,300 | ||||||||

| Air Canada 2015-2 Class A Pass-Through Trust (Canada)†(d) | 4.125% | 6/15/2029 | 818 | 859,111 | ||||||||

| American Airlines 2013-2 Class B Pass-Through Trust† | 5.60% | 1/15/2022 | 647 | 670,626 | ||||||||

| Azul Investments LLP† | 5.875% | 10/26/2024 | 3,049 | 3,037,566 | ||||||||

| Latam Finance Ltd.† | 6.875% | 4/11/2024 | 656 | 685,520 | ||||||||

| Total | 6,558,123 | |||||||||||

| Auto Parts & Equipment 0.72% | ||||||||||||

| Allison Transmission, Inc.† | 5.00% | 10/1/2024 | 1,250 | 1,292,188 | ||||||||

| American Axle & Manufacturing, Inc.† | 6.25% | 4/1/2025 | 2,056 | 2,169,080 | ||||||||

| American Axle & Manufacturing, Inc.† | 6.50% | 4/1/2027 | 2,296 | 2,436,630 | ||||||||

| Gates Global LLC/Gates Global Co.† | 6.00% | 7/15/2022 | 1,617 | 1,661,467 | ||||||||

| International Automotive Components Group SA (Luxembourg)†(d) | 9.125% | 6/1/2018 | 257 | 254,591 | ||||||||

| TI Group Automotive Systems LLC (United Kingdom)†(d) | 8.75% | 7/15/2023 | 584 | 629,260 | ||||||||

| Total | 8,443,216 | |||||||||||

| Automakers 0.70% | ||||||||||||

| BMW US Capital LLC† | 2.80% | 4/11/2026 | 1,199 | 1,173,195 | ||||||||

| Tesla, Inc.† | 5.30% | 8/15/2025 | 7,365 | 7,061,194 | ||||||||

| Total | 8,234,389 | |||||||||||

| See Notes to Financial Statements. | 17 |

Schedule of Investments (continued)

December 31, 2017

| Investments | Interest Rate | Maturity Date | Principal Amount (000) | Fair Value | ||||||||

| Banking 8.13% | ||||||||||||

| ABN AMRO Bank NV (Netherlands)†(d) | 4.75% | 7/28/2025 | $ | 3,251 | $ | 3,457,438 | ||||||

| Ally Financial, Inc. | 8.00% | 11/1/2031 | 901 | 1,175,805 | ||||||||

| American Express Credit Corp. | 3.30% | 5/3/2027 | 1,891 | 1,920,659 | ||||||||

| ANZ New Zealand Int’l Ltd. (United Kingdom)†(d) | 2.125% | 7/28/2021 | 1,510 | 1,480,189 | ||||||||

| Associated Banc-Corp. | 4.25% | 1/15/2025 | 1,000 | 1,030,940 | ||||||||

| Astoria Financial Corp. | 3.50% | 6/8/2020 | 1,393 | 1,399,122 | ||||||||

| Australia & New Zealand Banking Group Ltd. (United Kingdom)†(d) | 6.75% (USD Swap + 5.17% | )# | – | (j) | 1,415 | 1,613,100 | ||||||

| Banco de Bogota SA (Colombia)†(d) | 4.375% | 8/3/2027 | 900 | 900,000 | ||||||||

| Banco de Bogota SA (Colombia)†(d) | 6.25% | 5/12/2026 | 1,000 | 1,080,800 | ||||||||

| Banco de Galicia y Buenos Aires SA (Argentina)†(d) | 8.25% (5 Yr Treasury Note CMT + 7.16% | )# | 7/19/2026 | 1,000 | 1,116,200 | |||||||

| Banco do Brasil SA† | 6.25% (10 Yr Treasury Note CMT + 4.40% | )# | – | (j) | 1,983 | 1,829,318 | ||||||

| Banco General SA (Panama)†(d) | 4.125% | 8/7/2027 | 2,275 | 2,277,685 | ||||||||

| Banco Mercantil del Norte SA (Mexico)†(d) | 7.625% (10 Yr Treasury Note CMT + 5.35% | )# | – | (j) | 1,077 | 1,183,354 | ||||||

| Banistmo SA (Panama)†(d) | 3.65% | 9/19/2022 | 1,390 | 1,376,100 | ||||||||

| Bank of America Corp. | 4.45% | 3/3/2026 | 2,201 | 2,352,798 | ||||||||

| Bank of Montreal (Canada)(d) | 3.803% (USSW5 + 1.43% | )#(k) | 12/15/2032 | 2,220 | 2,197,534 | |||||||

| BankUnited, Inc. | 4.875% | 11/17/2025 | 2,525 | 2,688,121 | ||||||||

| BNP Paribas SA (France)†(d) | 6.75% (5 Yr Swap rate + 4.92% | )# | – | (j) | 1,817 | 1,971,445 | ||||||

| Citigroup, Inc. | 4.45% | 9/29/2027 | 1,473 | 1,560,868 | ||||||||

| Citizens Financial Group, Inc. | 4.35% | 8/1/2025 | 831 | 865,539 | ||||||||

| Comerica, Inc. | 3.80% | 7/22/2026 | 1,258 | 1,278,219 | ||||||||

| Commonwealth Bank of Australia (Australia)†(d) | 4.50% | 12/9/2025 | 973 | 1,020,003 | ||||||||

| Compass Bank | 3.875% | 4/10/2025 | 2,100 | 2,109,490 | ||||||||

| Credit Suisse Group AG (Switzerland)†(d) | 7.50% (5 Yr Swap rate + 4.60% | )# | – | (j) | 1,075 | 1,230,821 | ||||||

| Fifth Third Bancorp | 8.25% | 3/1/2038 | 1,708 | 2,614,111 | ||||||||

| First Republic Bank | 4.625% | 2/13/2047 | 1,161 | 1,245,575 | ||||||||

| Goldman Sachs Group, Inc. (The) | 3.50% | 11/16/2026 | 1,520 | 1,530,081 | ||||||||

| Goldman Sachs Group, Inc. (The) | 6.75% | 10/1/2037 | 2,100 | 2,814,370 | ||||||||

| Home BancShares, Inc. | 5.625% (3 Mo. LIBOR + 3.58% | )# | 4/15/2027 | 2,396 | 2,513,404 | |||||||

| HSBC Holdings plc (United Kingdom)(d) | 4.25% | 8/18/2025 | 3,671 | 3,812,202 | ||||||||

| Intesa Sanpaolo SpA (Italy)†(d) | 5.71% | 1/15/2026 | 3,212 | 3,388,439 | ||||||||

| Intesa Sanpaolo SpA (Italy)†(d) | 7.70% (5 Yr Swap rate + 5.46% | )# | – | (j) | 2,717 | 2,954,737 | ||||||

| Itau Unibanco Holding SA† | 6.125% (BADLAR + 3.98% | )# | – | (j) | 1,186 | 1,186,709 | ||||||

| 18 | See Notes to Financial Statements. |

Schedule of Investments (continued)

December 31, 2017

| Investments | Interest Rate | Maturity Date | Principal Amount (000) | Fair Value | ||||||||

| Banking (continued) | ||||||||||||

| JPMorgan Chase & Co. | 3.54% (3 Mo. LIBOR + 1.38% | )# | 5/1/2028 | $ | 1,306 | $ | 1,329,845 | |||||

| JPMorgan Chase & Co. | 3.90% | 7/15/2025 | 1,150 | 1,206,460 | ||||||||

| JPMorgan Chase & Co. | 6.75% (3 Mo. LIBOR + 3.78% | )# | – | (j) | 1,688 | 1,913,770 | ||||||

| Lloyds Banking Group plc (United Kingdom)(d) | 7.50% (5 Yr Swap rate + 4.76% | )# | – | (j) | 1,519 | 1,725,964 | ||||||

| Macquarie Bank Ltd. (United Kingdom)†(d) | 6.125% (5 Yr Swap rate + 3.70% | )# | – | (j) | 1,794 | 1,868,003 | ||||||

| Macquarie Group Ltd. (Australia)†(d) | 6.00% | 1/14/2020 | 725 | 772,729 | ||||||||

| Manufacturers & Traders Trust Co. | 3.40% | 8/17/2027 | 526 | 532,622 | ||||||||

| Morgan Stanley | 3.125% | 7/27/2026 | 2,144 | 2,116,476 | ||||||||

| Morgan Stanley | 3.625% | 1/20/2027 | 2,026 | 2,075,324 | ||||||||

| Morgan Stanley | 4.00% | 7/23/2025 | 937 | 981,810 | ||||||||

| National Savings Bank (Sri Lanka)†(d) | 5.15% | 9/10/2019 | 950 | 964,155 | ||||||||

| People’s United Bank NA | 4.00% | 7/15/2024 | 1,100 | 1,112,281 | ||||||||

| Popular, Inc. | 7.00% | 7/1/2019 | 1,625 | 1,698,125 | ||||||||

| Royal Bank of Scotland Group plc (United Kingdom)(d) | 5.125% | 5/28/2024 | 584 | 620,152 | ||||||||

| Royal Bank of Scotland Group plc (United Kingdom)(d) | 6.10% | 6/10/2023 | 1,517 | 1,672,171 | ||||||||

| Royal Bank of Scotland Group plc (United Kingdom)(d) | 6.125% | 12/15/2022 | 506 | 555,140 | ||||||||

| Royal Bank of Scotland Group plc (United Kingdom)(d) | 7.50% (5 Yr Swap rate + 5.80% | )# | – | (j) | 2,235 | 2,369,100 | ||||||

| Royal Bank of Scotland Group plc (United Kingdom)(d) | 8.625% (5 Yr Swap rate + 7.60% | )# | – | (j) | 1,571 | 1,773,266 | ||||||

| SVB Financial Group | 3.50% | 1/29/2025 | 999 | 1,002,718 | ||||||||

| Toronto-Dominion Bank (The) (Canada)(d) | 3.625% (5 Yr Swap rate + 2.21% | )# | 9/15/2031 | 750 | 748,974 | |||||||

| Turkiye Garanti Bankasi AS (Turkey)†(d) | 5.25% | 9/13/2022 | 1,150 | 1,175,588 | ||||||||

| UBS AG | 7.625% | 8/17/2022 | 606 | 709,444 | ||||||||

| UBS Group AG (Switzerland)(d) | 7.00% (5 Yr Swap rate + 4.87% | )# | – | (j) | 1,000 | 1,135,000 | ||||||

| UniCredit SpA (Italy)(d) | 6.375% (5 Yr Swap rate + 5.51% | )# | 5/2/2023 | 1,149 | 1,163,752 | |||||||

| Washington Mutual Bank(l) | 6.875% | 6/15/2011 | 1,250 | 125 | (m) | |||||||

| Wells Fargo & Co. | 4.90% | 11/17/2045 | 1,759 | 1,993,800 | ||||||||

| Zenith Bank plc (Nigeria)†(d) | 7.375% | 5/30/2022 | 900 | 938,880 | ||||||||

| Total | 95,330,850 | |||||||||||

| See Notes to Financial Statements. | 19 |

Schedule of Investments (continued)

December 31, 2017

| Investments | Interest Rate | Maturity Date | Principal Amount (000) | Fair Value | ||||||||

| Beverages 0.43% | ||||||||||||

| Bacardi Ltd.† | 2.75% | 7/15/2026 | $ | 1,149 | $ | 1,105,843 | ||||||

| Brown-Forman Corp. | 4.50% | 7/15/2045 | 1,572 | 1,782,240 | ||||||||

| PepsiCo, Inc. | 3.60% | 3/1/2024 | 1,653 | 1,734,482 | ||||||||

| PepsiCo, Inc. | 4.25% | 10/22/2044 | 419 | 463,118 | ||||||||

| Total | 5,085,683 | |||||||||||

| Brokerage 0.21% | ||||||||||||

| E*TRADE Financial Corp. | 3.80% | 8/24/2027 | 1,167 | 1,165,188 | ||||||||

| Freedom Mortgage Corp.† | 8.125% | 11/15/2024 | 1,255 | 1,281,669 | ||||||||

| Total | 2,446,857 | |||||||||||

| Building & Construction 1.24% | ||||||||||||

| Ashton Woods USA LLC/Ashton Woods Finance Co.† | 6.75% | 8/1/2025 | 1,087 | 1,091,076 | ||||||||

| Ashton Woods USA LLC/Ashton Woods Finance Co.† | 6.875% | 2/15/2021 | 1,023 | 1,047,296 | ||||||||

| Beazer Homes USA, Inc. | 6.75% | 3/15/2025 | 705 | 746,419 | ||||||||

| Boral Finance Pty Ltd. (Australia)†(d) | 3.75% | 5/1/2028 | 1,306 | 1,318,021 | ||||||||

| ITR Concession Co. LLC† | 5.183% | 7/15/2035 | 785 | 831,940 | ||||||||

| Lennar Corp. | 4.75% | 11/15/2022 | 1,304 | 1,374,090 | ||||||||

| Lennar Corp. | 4.75% | 5/30/2025 | 830 | 865,275 | ||||||||

| PulteGroup, Inc. | 5.00% | 1/15/2027 | 1,959 | 2,054,501 | ||||||||

| PulteGroup, Inc. | 6.375% | 5/15/2033 | 2,250 | 2,531,250 | ||||||||

| Toll Brothers Finance Corp. | 5.625% | 1/15/2024 | 1,000 | 1,101,250 | ||||||||

| William Lyon Homes, Inc. | 5.875% | 1/31/2025 | 1,500 | 1,535,625 | ||||||||

| Total | 14,496,743 | |||||||||||

| Building Materials 1.05% | ||||||||||||

| Builders FirstSource, Inc.† | 5.625% | 9/1/2024 | 752 | 785,426 | ||||||||

| FBM Finance, Inc.† | 8.25% | 8/15/2021 | 1,003 | 1,070,703 | ||||||||

| Hillman Group, Inc. (The)† | 6.375% | 7/15/2022 | 1,311 | 1,314,278 | ||||||||

| James Hardie International Finance DAC (Ireland)†(d) | 4.75% | 1/15/2025 | 485 | 491,063 | ||||||||

| Lennox International, Inc. | 3.00% | 11/15/2023 | 1,081 | 1,068,668 | ||||||||

| Martin Marietta Materials, Inc. | 4.25% | 7/2/2024 | 1,146 | 1,206,851 | ||||||||

| Owens Corning | 4.30% | 7/15/2047 | 1,763 | 1,741,517 | ||||||||

| Standard Industries, Inc.† | 5.00% | 2/15/2027 | 1,121 | 1,149,025 | ||||||||

| Standard Industries, Inc.† | 5.375% | 11/15/2024 | 934 | 980,980 | ||||||||

| Standard Industries, Inc.† | 6.00% | 10/15/2025 | 1,786 | 1,915,485 | ||||||||

| U.S. Concrete, Inc. | 6.375% | 6/1/2024 | 552 | 594,780 | ||||||||

| Total | 12,318,776 | |||||||||||

| 20 | See Notes to Financial Statements. |

Schedule of Investments (continued)

December 31, 2017

| Investments | Interest Rate | Maturity Date | Principal Amount (000) | Fair Value | ||||||||

| Cable & Satellite Television 1.34% | ||||||||||||

| CCO Holdings LLC/CCO Holdings Capital Corp.† | 5.125% | 5/1/2027 | $ | 2,134 | $ | 2,107,325 | ||||||

| CCO Holdings LLC/CCO Holdings Capital Corp.† | 5.75% | 2/15/2026 | 1,575 | 1,639,969 | ||||||||

| CCO Holdings LLC/CCO Holdings Capital Corp.† | 5.875% | 4/1/2024 | 1,785 | 1,865,325 | ||||||||

| CSC Holdings LLC† | 10.875% | 10/15/2025 | 2,647 | 3,149,930 | ||||||||

| DISH DBS Corp. | 7.75% | 7/1/2026 | 3,658 | 3,859,190 | ||||||||

| UPCB Finance IV Ltd.† | 5.375% | 1/15/2025 | 1,929 | 1,951,955 | ||||||||

| Ziggo Secured Finance BV (Netherlands)†(d) | 5.50% | 1/15/2027 | 1,122 | 1,123,402 | ||||||||

| Total | 15,697,096 | |||||||||||

| Chemicals 1.32% | ||||||||||||

| Albemarle Corp. | 5.45% | 12/1/2044 | 1,524 | 1,803,523 | ||||||||

| CF Industries, Inc.† | 4.50% | 12/1/2026 | 1,640 | 1,712,231 | ||||||||

| Chemours Co. (The) | 5.375% | 5/15/2027 | 647 | 671,262 | ||||||||

| Chemours Co. (The) | 7.00% | 5/15/2025 | 1,380 | 1,504,200 | ||||||||

| GCP Applied Technologies, Inc.† | 9.50% | 2/1/2023 | 459 | 510,638 | ||||||||

| Halcyon Agri Corp. Ltd. (Singapore)(d) | 4.50% (H15T2Y + 8.31% | )# | – | (j) | 758 | 754,033 | ||||||

| Kraton Polymers LLC/Kraton Polymers Capital Corp.† | 10.50% | 4/15/2023 | 1,025 | 1,163,375 | ||||||||

| Olin Corp. | 5.125% | 9/15/2027 | 1,992 | 2,101,560 | ||||||||

| Sociedad Quimica y Minera de Chile SA (Chile)†(d) | 4.375% | 1/28/2025 | 1,092 | 1,138,410 | ||||||||

| TPC Group, Inc.† | 8.75% | 12/15/2020 | 1,133 | 1,138,665 | ||||||||

| Tronox Finance LLC† | 7.50% | 3/15/2022 | 1,772 | 1,856,170 | ||||||||

| Westlake Chemical Corp. | 3.60% | 8/15/2026 | 1,108 | 1,116,105 | ||||||||

| Total | 15,470,172 | |||||||||||

| Consumer/Commercial/Lease Financing 1.00% | ||||||||||||

| Nationstar Mortgage LLC/Nationstar Capital Corp. | 6.50% | 7/1/2021 | 892 | 907,053 | ||||||||

| Navient Corp. | 5.00% | 10/26/2020 | 964 | 979,665 | ||||||||

| Navient Corp. | 6.125% | 3/25/2024 | 3,319 | 3,377,082 | ||||||||

| Navient Corp. | 6.75% | 6/25/2025 | 2,669 | 2,749,070 | ||||||||

| Quicken Loans, Inc.† | 5.25% | 1/15/2028 | 3,532 | 3,495,620 | ||||||||

| TMX Finance LLC/TitleMax Finance Corp.† | 8.50% | 9/15/2018 | 189 | 173,880 | ||||||||

| Total | 11,682,370 | |||||||||||

| Department Stores 0.35% | ||||||||||||

| Kohl’s Corp. | 5.55% | 7/17/2045 | 2,288 | 2,241,109 | ||||||||

| Macy’s Retail Holdings, Inc. | 4.375% | 9/1/2023 | 1,868 | 1,886,287 | ||||||||

| Total | 4,127,396 | |||||||||||

| See Notes to Financial Statements. | 21 |

Schedule of Investments (continued)

December 31, 2017

| Investments | Interest Rate | Maturity Date | Principal Amount (000) | Fair Value | ||||||||

| Discount Stores 0.79% | ||||||||||||

| Amazon.com, Inc.† | 4.25% | 8/22/2057 | $ | 2,075 | $ | 2,272,354 | ||||||

| Amazon.com, Inc. | 4.80% | 12/5/2034 | 4,062 | 4,778,610 | ||||||||

| Amazon.com, Inc. | 5.20% | 12/3/2025 | 1,950 | 2,241,559 | ||||||||

| Total | 9,292,523 | |||||||||||

| Diversified Capital Goods 0.80% | ||||||||||||

| BCD Acquisition, Inc.† | 9.625% | 9/15/2023 | 1,561 | 1,721,002 | ||||||||

| Griffon Corp. | 5.25% | 3/1/2022 | 1,163 | 1,180,445 | ||||||||

| Siemens Financieringsmaatschappij NV (Netherlands)†(d) | 3.25% | 5/27/2025 | 1,235 | 1,256,461 | ||||||||

| SPX FLOW, Inc.† | 5.625% | 8/15/2024 | 873 | 923,198 | ||||||||

| SPX FLOW, Inc.† | 5.875% | 8/15/2026 | 1,465 | 1,560,225 | ||||||||

| Valmont Industries, Inc. | 5.25% | 10/1/2054 | 2,656 | 2,756,919 | ||||||||

| Total | 9,398,250 | |||||||||||

| Electric: Distribution/Transportation 0.20% | ||||||||||||

| Oklahoma Gas & Electric Co. | 4.15% | 4/1/2047 | 960 | 1,046,191 | ||||||||

| Pennsylvania Electric Co.† | 3.25% | 3/15/2028 | 1,334 | 1,315,008 | ||||||||

| Total | 2,361,199 | |||||||||||

| Electric: Generation 1.06% | ||||||||||||

| Acwa Power Management & Investments One Ltd. (United Arab Emirates)†(d) | 5.95% | 12/15/2039 | 1,386 | 1,424,725 | ||||||||

| Calpine Corp. | 5.75% | 1/15/2025 | 1,886 | 1,798,772 | ||||||||

| Dynegy, Inc.† | 8.125% | 1/30/2026 | 1,517 | 1,663,011 | ||||||||

| Infraestructura Energetica Nova SAB de CV (Mexico)†(d) | 4.875% | 1/14/2048 | 766 | 738,233 | ||||||||

| Minejesa Capital BV (Netherlands)†(d) | 4.625% | 8/10/2030 | 2,170 | 2,223,284 | ||||||||

| NSG Holdings LLC/NSG Holdings, Inc.† | 7.75% | 12/15/2025 | 1,763 | 1,943,755 | ||||||||

| Talen Energy Supply LLC | 4.60% | 12/15/2021 | 1,287 | 1,184,040 | ||||||||

| TerraForm Power Operating LLC† | 5.00% | 1/31/2028 | 1,486 | 1,472,998 | ||||||||

| Total | 12,448,818 | |||||||||||

| Electric: Integrated 1.68% | ||||||||||||

| Aegea Finance Sarl (Brazil)†(d) | 5.75% | 10/10/2024 | 1,132 | 1,154,640 | ||||||||

| Arizona Public Service Co. | 2.95% | 9/15/2027 | 1,333 | 1,314,123 | ||||||||

| El Paso Electric Co. | 5.00% | 12/1/2044 | 1,953 | 2,161,595 | ||||||||

| Emera, Inc. (Canada)(d) | 6.75% (3 Mo. LIBOR + 5.44% | )# | 6/15/2076 | 916 | 1,035,080 | |||||||

| Enel Finance International NV (Netherlands)†(d) | 3.625% | 5/25/2027 | 2,137 | 2,126,802 | ||||||||

| Entergy Arkansas, Inc. | 4.95% | 12/15/2044 | 1,909 | 2,000,350 | ||||||||

| Entergy Mississippi, Inc. | 2.85% | 6/1/2028 | 625 | 605,752 | ||||||||

| 22 | See Notes to Financial Statements. |

Schedule of Investments (continued)

December 31, 2017

| Investments | Interest Rate | Maturity Date | Principal Amount (000) | Fair Value | ||||||||

| Electric: Integrated (continued) | ||||||||||||

| Indianapolis Power & Light Co.† | 4.05% | 5/1/2046 | $ | 2,203 | $ | 2,298,890 | ||||||

| Louisville Gas & Electric Co. | 4.375% | 10/1/2045 | 1,017 | 1,133,347 | ||||||||

| Monongahela Power Co.† | 3.55% | 5/15/2027 | 942 | 961,992 | ||||||||

| NRG Energy, Inc.† | 5.75% | 1/15/2028 | 1,059 | 1,072,237 | ||||||||

| Puget Sound Energy, Inc. | 7.02% | 12/1/2027 | 314 | 405,637 | ||||||||

| Rochester Gas & Electric Corp.† | 3.10% | 6/1/2027 | 1,113 | 1,102,749 | ||||||||

| Southern California Edison Co. | 3.90% | 3/15/2043 | 1,000 | 1,053,636 | ||||||||

| Southern California Edison Co. | 4.00% | 4/1/2047 | 1,237 | 1,330,812 | ||||||||

| Total | 19,757,642 | |||||||||||

| Electronics 1.41% | ||||||||||||

| Applied Materials, Inc. | 4.35% | 4/1/2047 | 2,370 | 2,662,923 | ||||||||

| Corning, Inc. | 4.375% | 11/15/2057 | 2,595 | 2,585,459 | ||||||||

| Nokia OYJ (Finland)(d) | 4.375% | 6/12/2027 | 928 | 919,648 | ||||||||

| NVIDIA Corp. | 3.20% | 9/16/2026 | 2,872 | 2,885,187 | ||||||||

| Qorvo, Inc. | 7.00% | 12/1/2025 | 2,479 | 2,779,579 | ||||||||

| Trimble, Inc. | 4.75% | 12/1/2024 | 3,132 | 3,384,274 | ||||||||

| Xilinx, Inc. | 2.95% | 6/1/2024 | 1,345 | 1,337,468 | ||||||||

| Total | 16,554,538 | |||||||||||

| Energy: Exploration & Production 5.44% | ||||||||||||

| Alta Mesa Holdings LP/Alta Mesa Finance Services Corp. | 7.875% | 12/15/2024 | 1,563 | 1,721,254 | ||||||||

| Anadarko Petroleum Corp. | 6.60% | 3/15/2046 | 1,740 | 2,244,384 | ||||||||

| Bill Barrett Corp. | 7.00% | 10/15/2022 | 1,042 | 1,066,748 | ||||||||

| Bill Barrett Corp. | 8.75% | 6/15/2025 | 548 | 608,280 | ||||||||

| California Resources Corp.† | 8.00% | 12/15/2022 | 1,484 | 1,229,865 | ||||||||

| Carrizo Oil & Gas, Inc. | 6.25% | 4/15/2023 | 1,916 | 1,997,430 | ||||||||

| Centennial Resource Production LLC† | 5.375% | 1/15/2026 | 1,155 | 1,179,544 | ||||||||

| CNX Resources Corp. | 8.00% | 4/1/2023 | 1,091 | 1,172,280 | ||||||||

| CNX Resources Corp. | 5.875% | 4/15/2022 | 740 | 759,425 | ||||||||

| Concho Resources, Inc. | 4.875% | 10/1/2047 | 2,658 | 2,915,919 | ||||||||

| Continental Resources, Inc. | 3.80% | 6/1/2024 | 3,564 | 3,537,270 | ||||||||

| Continental Resources, Inc. | 4.50% | 4/15/2023 | 4,919 | 5,029,677 | ||||||||

| Eclipse Resources Corp. | 8.875% | 7/15/2023 | 1,322 | 1,363,312 | ||||||||

| Endeavor Energy Resources LP/EER Finance, Inc.† | 5.50% | 1/30/2026 | 849 | 865,980 | ||||||||

| EP Energy LLC/Everest Acquisition Finance, Inc.† | 8.00% | 11/29/2024 | 1,138 | 1,180,675 | ||||||||

| EP Energy LLC/Everest Acquisition Finance, Inc.† | 8.00% | 2/15/2025 | 437 | 321,195 | ||||||||

| Gulfport Energy Corp. | 6.00% | 10/15/2024 | 259 | 260,295 | ||||||||

| Gulfport Energy Corp. | 6.375% | 5/15/2025 | 327 | 329,861 | ||||||||

| See Notes to Financial Statements. | 23 |

Schedule of Investments (continued)

December 31, 2017

| Investments | Interest Rate | Maturity Date | Principal Amount (000) | Fair Value | ||||||||

| Energy: Exploration & Production (continued) | ||||||||||||

| Gulfport Energy Corp.† | 6.375% | 1/15/2026 | $ | 658 | $ | 664,580 | ||||||

| Halcon Resources Corp.† | 6.75% | 2/15/2025 | 1,097 | 1,146,365 | ||||||||

| Hilcorp Energy I LP/Hilcorp Finance Co.† | 5.00% | 12/1/2024 | 2,553 | 2,540,235 | ||||||||

| Jonah Energy LLC/Jonah Energy Finance Corp.† | 7.25% | 10/15/2025 | 1,853 | 1,869,214 | ||||||||

| Kosmos Energy Ltd.† | 7.875% | 8/1/2021 | 1,175 | 1,207,313 | ||||||||

| MEG Energy Corp. (Canada)†(d) | 6.375% | 1/30/2023 | 1,661 | 1,420,155 | ||||||||

| MEG Energy Corp. (Canada)†(d) | 6.50% | 1/15/2025 | 1,354 | 1,342,153 | ||||||||

| MEG Energy Corp. (Canada)†(d) | 7.00% | 3/31/2024 | 3,196 | 2,712,605 | ||||||||

| Murphy Oil Corp. | 6.875% | 8/15/2024 | 517 | 553,190 | ||||||||

| Newfield Exploration Co. | 5.625% | 7/1/2024 | 3,041 | 3,284,280 | ||||||||

| Oasis Petroleum, Inc. | 6.875% | 3/15/2022 | 1,100 | 1,131,625 | ||||||||

| PT Saka Energi Indonesia (Indonesia)†(d) | 4.45% | 5/5/2024 | 948 | 964,259 | ||||||||

| Range Resources Corp. | 4.875% | 5/15/2025 | 2,379 | 2,307,630 | ||||||||

| Range Resources Corp. | 5.875% | 7/1/2022 | 726 | 744,150 | ||||||||

| Sanchez Energy Corp. | 6.125% | 1/15/2023 | 2,564 | 2,185,810 | ||||||||

| SM Energy Co. | 6.50% | 1/1/2023 | 1,867 | 1,913,675 | ||||||||

| Southwestern Energy Co. | 7.75% | 10/1/2027 | 1,714 | 1,831,837 | ||||||||

| SRC Energy, Inc.† | 6.25% | 12/1/2025 | 1,455 | 1,495,012 | ||||||||

| Texaco Capital, Inc. | 8.625% | 11/15/2031 | 1,223 | 1,881,577 | ||||||||

| Ultra Resources, Inc.† | 7.125% | 4/15/2025 | 918 | 919,148 | ||||||||

| WPX Energy, Inc. | 6.00% | 1/15/2022 | 1,242 | 1,304,100 | ||||||||

| YPF SA (Argentina)†(d) | 6.95% | 7/21/2027 | 1,361 | 1,448,104 | ||||||||

| YPF SA (Argentina)†(d) | 7.00% | 12/15/2047 | 1,180 | 1,172,330 | ||||||||

| Total | 63,822,741 | |||||||||||

| Food & Drug Retailers 0.10% | ||||||||||||

| Ingles Markets, Inc. | 5.75% | 6/15/2023 | 1,158 | 1,178,265 | ||||||||

| Food: Wholesale 1.08% | ||||||||||||

| Arcor SAIC (Argentina)†(d) | 6.00% | 7/6/2023 | 890 | 946,738 | ||||||||

| Chobani LLC/Chobani Finance Corp., Inc.† | 7.50% | 4/15/2025 | 1,312 | 1,395,640 | ||||||||

| Cosan Luxembourg SA (Luxembourg)†(d) | 7.00% | 1/20/2027 | 1,664 | 1,797,120 | ||||||||

| Kernel Holding SA (Ukraine)†(d) | 8.75% | 1/31/2022 | 1,185 | 1,308,117 | ||||||||

| Lamb Weston Holdings, Inc.† | 4.625% | 11/1/2024 | 1,299 | 1,344,465 | ||||||||

| McCormick & Co., Inc. | 4.20% | 8/15/2047 | 613 | 647,979 | ||||||||

| MHP SE (Ukraine)†(d) | 7.75% | 5/10/2024 | 1,597 | 1,734,981 | ||||||||

| Pilgrim’s Pride Corp.† | 5.875% | 9/30/2027 | 1,148 | 1,185,310 | ||||||||

| Post Holdings, Inc.† | 5.75% | 3/1/2027 | 1,235 | 1,259,700 | ||||||||

| Simmons Foods, Inc.† | 5.75% | 11/1/2024 | 1,095 | 1,086,787 | ||||||||

| Total | 12,706,837 | |||||||||||

| 24 | See Notes to Financial Statements. |

Schedule of Investments (continued)

December 31, 2017

| Investments | Interest Rate | Maturity Date | Principal Amount (000) | Fair Value | ||||||||

| Foreign Sovereign 0.14% | ||||||||||||

| Instituto Costarricense de Electricidad (Costa Rica)†(d) | 6.375% | 5/15/2043 | $ | 1,801 | $ | 1,669,563 | ||||||

| Forestry/Paper 0.55% | ||||||||||||

| Klabin Finance SA (Luxembourg)†(d) | 4.875% | 9/19/2027 | 1,313 | 1,299,214 | ||||||||

| Norbord, Inc. (Canada)†(d) | 6.25% | 4/15/2023 | 1,991 | 2,182,634 | ||||||||

| Rayonier AM Products, Inc.† | 5.50% | 6/1/2024 | 1,145 | 1,146,431 | ||||||||

| Rayonier, Inc. | 3.75% | 4/1/2022 | 1,262 | 1,278,682 | ||||||||

| West Fraser Timber Co. Ltd. (Canada)†(d) | 4.35% | 10/15/2024 | 600 | 590,622 | ||||||||

| Total | 6,497,583 | |||||||||||

| Gaming 1.62% | ||||||||||||

| CRC Escrow Issuer LLC/CRC Finco, Inc.† | 5.25% | 10/15/2025 | 2,286 | 2,315,261 | ||||||||

| Eldorado Resorts, Inc. | 6.00% | 4/1/2025 | 552 | 579,600 | ||||||||

| Everi Payments, Inc.† | 7.50% | 12/15/2025 | 1,494 | 1,484,662 | ||||||||

| GLP Capital LP/GLP Financing II, Inc. | 5.375% | 4/15/2026 | 704 | 756,800 | ||||||||

| International Game Technology plc† | 6.50% | 2/15/2025 | 593 | 665,643 | ||||||||

| Jacobs Entertainment, Inc.† | 7.875% | 2/1/2024 | 1,033 | 1,107,892 | ||||||||

| MGM Growth Properties Operating Partnership LP/MGP Finance Co-Issuer, Inc. | 5.625% | 5/1/2024 | 544 | 582,080 | ||||||||

| MGM Resorts International | 6.00% | 3/15/2023 | 3,631 | 3,930,557 | ||||||||

| MGM Resorts International | 7.75% | 3/15/2022 | 416 | 475,280 | ||||||||

| Mohegan Gaming & Entertainment† | 7.875% | 10/15/2024 | 2,065 | 2,124,369 | ||||||||

| Penn National Gaming, Inc.† | 5.625% | 1/15/2027 | 1,226 | 1,275,040 | ||||||||

| River Rock Entertainment Authority(l) | 9.00% | 11/1/2018 | 431 | 104,518 | ||||||||

| Scientific Games International, Inc. | 10.00% | 12/1/2022 | 1,460 | 1,607,825 | ||||||||

| Station Casinos LLC† | 5.00% | 10/1/2025 | 1,110 | 1,118,325 | ||||||||

| Wynn Macau Ltd. (Macau)†(d) | 5.50% | 10/1/2027 | 823 | 834,316 | ||||||||

| Total | 18,962,168 | |||||||||||

| Gas Distribution 1.74% | ||||||||||||

| Andeavor Logistics LP/Tesoro Logistics Finance Corp. | 6.25% | 10/15/2022 | 398 | 422,764 | ||||||||

| Blue Racer Midstream LLC/Blue Racer Finance Corp.† | 6.125% | 11/15/2022 | 1,057 | 1,104,565 | ||||||||

| Cheniere Corpus Christi Holdings LLC | 5.125% | 6/30/2027 | 1,162 | 1,204,878 | ||||||||

| Cheniere Corpus Christi Holdings LLC | 5.875% | 3/31/2025 | 1,059 | 1,149,677 | ||||||||

| Cheniere Corpus Christi Holdings LLC | 7.00% | 6/30/2024 | 1,017 | 1,159,380 | ||||||||

| Dominion Energy Gas Holdings LLC | 3.60% | 12/15/2024 | 1,175 | 1,202,093 | ||||||||

| Energy Transfer Equity LP | 5.875% | 1/15/2024 | 347 | 366,085 | ||||||||

| Florida Gas Transmission Co. LLC† | 4.35% | 7/15/2025 | 1,895 | 2,026,737 | ||||||||

| See Notes to Financial Statements. | 25 |

Schedule of Investments (continued)

December 31, 2017

| Investments | Interest Rate | Maturity Date | Principal Amount (000) | Fair Value | ||||||||

| Gas Distribution (continued) | ||||||||||||

| IFM US Colonial Pipeline 2 LLC† | 6.45% | 5/1/2021 | $ | 1,400 | $ | 1,537,124 | ||||||

| LBC Tank Terminals Holding Netherlands BV (Belgium)†(d) | 6.875% | 5/15/2023 | 1,419 | 1,484,629 | ||||||||

| National Fuel Gas Co. | 3.95% | 9/15/2027 | 1,975 | 1,970,497 | ||||||||

| NGPL PipeCo LLC† | 4.875% | 8/15/2027 | 1,339 | 1,394,234 | ||||||||

| Rockies Express Pipeline LLC† | 5.625% | 4/15/2020 | 1,600 | 1,684,000 | ||||||||

| Rockies Express Pipeline LLC† | 6.875% | 4/15/2040 | 1,360 | 1,536,800 | ||||||||

| Southern Star Central Corp.† | 5.125% | 7/15/2022 | 1,145 | 1,190,800 | ||||||||

| Williams Cos., Inc. (The) | 3.70% | 1/15/2023 | 543 | 543,000 | ||||||||

| Williams Cos., Inc. (The) | 4.55% | 6/24/2024 | 457 | 476,422 | ||||||||

| Total | 20,453,685 | |||||||||||

| Health Facilities 1.97% | ||||||||||||

| Ascension Health | 3.945% | 11/15/2046 | 1,017 | 1,077,133 | ||||||||

| CHS/Community Health Systems, Inc. | 8.00% | 11/15/2019 | 1,203 | 1,025,557 | ||||||||

| Dignity Health | 3.812% | 11/1/2024 | 675 | 697,389 | ||||||||

| HCA, Inc. | 5.25% | 4/15/2025 | 1,612 | 1,708,720 | ||||||||

| HCA, Inc. | 5.25% | 6/15/2026 | 763 | 810,687 | ||||||||

| HCA, Inc. | 5.50% | 6/15/2047 | 1,683 | 1,683,000 | ||||||||

| HCA, Inc. | 5.875% | 3/15/2022 | 1,715 | 1,839,337 | ||||||||

| HCA, Inc. | 7.05% | 12/1/2027 | 390 | 430,950 | ||||||||

| HCA, Inc. | 7.50% | 2/15/2022 | 2,467 | 2,781,542 | ||||||||

| HCA, Inc. | 7.58% | 9/15/2025 | 552 | 634,800 | ||||||||

| HCA, Inc. | 7.69% | 6/15/2025 | 1,240 | 1,410,500 | ||||||||

| HCA, Inc. | 8.36% | 4/15/2024 | 261 | 309,938 | ||||||||

| Kindred Healthcare, Inc. | 8.75% | 1/15/2023 | 1,190 | 1,267,350 | ||||||||

| Memorial Sloan-Kettering Cancer Center | 4.20% | 7/1/2055 | 2,978 | 3,225,668 | ||||||||

| New York & Presbyterian Hospital (The) | 4.063% | 8/1/2056 | 1,770 | 1,862,635 | ||||||||

| NYU Hospitals Center | 4.368% | 7/1/2047 | 1,191 | 1,285,286 | ||||||||

| RegionalCare Hospital Partners Holdings, Inc.† | 8.25% | 5/1/2023 | 1,034 | 1,096,040 | ||||||||

| Total | 23,146,532 | |||||||||||

| Health Services 0.81% | ||||||||||||

| ASP AMC Merger Sub, Inc.† | 8.00% | 5/15/2025 | 1,405 | 1,355,825 | ||||||||

| inVentiv Group Holdings, Inc./inVentiv Health, Inc./inVentiv Health Clinical, Inc.† | 7.50% | 10/1/2024 | 596 | 646,660 | ||||||||

| Jaguar Holding Co. II/Pharmaceutical Product Development LLC† | 6.375% | 8/1/2023 | 1,109 | 1,122,863 | ||||||||

| MPH Acquisition Holdings LLC† | 7.125% | 6/1/2024 | 1,034 | 1,103,795 | ||||||||

| Polaris Intermediate Corp. PIK 8.5%† | 8.50% | 12/1/2022 | 1,603 | 1,667,120 | ||||||||

| 26 | See Notes to Financial Statements. |

Schedule of Investments (continued)

December 31, 2017

| Investments | Interest Rate | Maturity Date | Principal Amount (000) | Fair Value | ||||||||

| Health Services (continued) | ||||||||||||

| Sterigenics-Nordion Holdings LLC† | 6.50% | 5/15/2023 | $ | 1,483 | $ | 1,549,735 | ||||||

| West Street Merger Sub, Inc.† | 6.375% | 9/1/2025 | 2,006 | 2,021,045 | ||||||||

| Total | 9,467,043 | |||||||||||

| Hotels 0.30% | ||||||||||||

| ESH Hospitality, Inc.† | 5.25% | 5/1/2025 | 1,095 | 1,108,688 | ||||||||

| Hilton Domestic Operating Co., Inc. | 4.25% | 9/1/2024 | 1,254 | 1,269,675 | ||||||||

| Hilton Grand Vacations Borrower LLC/Hilton | ||||||||||||

| Grand Vacations Borrower, Inc.† | 6.125% | 12/1/2024 | 1,070 | 1,172,987 | ||||||||

| Total | 3,551,350 | |||||||||||

| Insurance Brokerage 0.30% | ||||||||||||

| Alliant Holdings Intermediate LLC/Alliant | ||||||||||||

| Holdings Co-Issuer† | 8.25% | 8/1/2023 | 1,639 | 1,725,048 | ||||||||

| Farmers Insurance Exchange† | 4.747% (3 Mo. LIBOR + 3.23% | )#(k) | 11/1/2057 | 1,750 | 1,759,275 | |||||||

| Total | 3,484,323 | |||||||||||

| Insurance-Reinsurance 0.36% | ||||||||||||

| Berkshire Hathaway, Inc. | 2.75% | 3/15/2023 | 907 | 913,436 | ||||||||

| Berkshire Hathaway, Inc. | 3.125% | 3/15/2026 | 907 | 917,988 | ||||||||

| Validus Holdings Ltd. | 8.875% | 1/26/2040 | 1,581 | 2,342,725 | ||||||||

| Total | 4,174,149 | |||||||||||

| Integrated Energy 1.26% | ||||||||||||

| Cenovus Energy, Inc. (Canada)(d) | 6.75% | 11/15/2039 | 2,678 | 3,244,944 | ||||||||

| Exxon Mobil Corp. | 3.043% | 3/1/2026 | 2,101 | 2,135,138 | ||||||||

| Hess Corp. | 4.30% | 4/1/2027 | 552 | 554,225 | ||||||||

| Hess Corp. | 5.80% | 4/1/2047 | 602 | 671,814 | ||||||||

| Petrobras Global Finance BV (Netherlands)(d) | 5.625% | 5/20/2043 | 2,500 | 2,243,475 | ||||||||

| Petrobras Global Finance BV (Netherlands)(d) | 7.375% | 1/17/2027 | 1,200 | 1,323,600 | ||||||||

| Petroleos Mexicanos (Mexico)(d) | 5.50% | 6/27/2044 | 1,275 | 1,176,137 | ||||||||

| Shell International Finance BV (Netherlands)(d) | 6.375% | 12/15/2038 | 2,473 | 3,451,922 | ||||||||

| Total | 14,801,255 | |||||||||||

| Investments & Miscellaneous Financial Services 1.54% | ||||||||||||

| Cboe Global Markets, Inc. | 3.65% | 1/12/2027 | 874 | 901,635 | ||||||||

| FMR LLC† | 5.35% | 11/15/2021 | 800 | 873,182 | ||||||||

| GrupoSura Finance SA† | 5.50% | 4/29/2026 | 1,015 | 1,102,544 | ||||||||

| Moody’s Corp.† | 3.25% | 1/15/2028 | 2,326 | 2,303,658 | ||||||||

| MSCI, Inc.† | 5.75% | 8/15/2025 | 1,338 | 1,443,368 | ||||||||

| See Notes to Financial Statements. | 27 |

Schedule of Investments (continued)

December 31, 2017

| Investments | Interest Rate | Maturity Date | Principal Amount (000) | Fair Value | ||||||||

| Investments & Miscellaneous Financial Services (continued) | ||||||||||||

| Neuberger Berman Group LLC/Neuberger Berman Finance Corp.† | 4.50% | 3/15/2027 | $ | 1,938 | $ | 2,041,595 | ||||||

| Neuberger Berman Group LLC/Neuberger Berman Finance Corp.† | 4.875% | 4/15/2045 | 4,097 | 4,189,989 | ||||||||

| OM Asset Management plc (United Kingdom)(d) | 4.80% | 7/27/2026 | 1,571 | 1,629,031 | ||||||||

| S&P Global, Inc. | 6.55% | 11/15/2037 | 1,391 | 1,868,328 | ||||||||

| Unifin Financiera SAB de CV SOFOM ENR (Mexico)†(d) | 7.25% | 9/27/2023 | 1,100 | 1,156,155 | ||||||||

| VFH Parent LLC/Orchestra Co-Issuer, Inc.† | 6.75% | 6/15/2022 | 550 | 580,250 | ||||||||

| Total | 18,089,735 | |||||||||||

| Life Insurance 0.73% | ||||||||||||

| Lincoln National Corp. | 3.625% | 12/12/2026 | 1,176 | 1,201,957 | ||||||||

| Northwestern Mutual Life Insurance Co. (The)† | 3.85% | 9/30/2047 | 2,206 | 2,240,051 | ||||||||

| Nuveen Finance LLC† | 4.125% | 11/1/2024 | 1,453 | 1,535,382 | ||||||||

| Teachers Insurance & Annuity Association of America† | 4.27% | 5/15/2047 | 1,889 | 2,000,878 | ||||||||

| Teachers Insurance & Annuity Association of America† | 4.90% | 9/15/2044 | 1,424 | 1,631,283 | ||||||||

| Total | 8,609,551 | |||||||||||

| Machinery 0.09% | ||||||||||||

| Xylem, Inc. | 3.25% | 11/1/2026 | 1,004 | 1,000,345 | ||||||||

| Managed Care 0.91% | ||||||||||||

| Anthem, Inc. | 3.65% | 12/1/2027 | 1,434 | 1,464,245 | ||||||||

| Centene Corp. | 4.75% | 1/15/2025 | 1,797 | 1,832,940 | ||||||||

| Centene Corp. | 6.125% | 2/15/2024 | 2,044 | 2,166,640 | ||||||||

| Kaiser Foundation Hospitals | 4.15% | 5/1/2047 | 2,048 | 2,216,549 | ||||||||

| WellCare Health Plans, Inc. | 5.25% | 4/1/2025 | 2,829 | 2,991,667 | ||||||||

| Total | 10,672,041 | |||||||||||

| Media: Content 1.17% | ||||||||||||

| Activision Blizzard, Inc. | 3.40% | 9/15/2026 | 1,101 | 1,116,001 | ||||||||

| AMC Networks, Inc. | 4.75% | 8/1/2025 | 1,741 | 1,730,119 | ||||||||

| Gray Television, Inc.† | 5.125% | 10/15/2024 | 151 | 151,000 | ||||||||

| Gray Television, Inc.† | 5.875% | 7/15/2026 | 481 | 494,227 | ||||||||

| iHeartCommunications, Inc. | 9.00% | 3/1/2021 | 3,492 | 2,514,240 | ||||||||

| Netflix, Inc. | 4.375% | 11/15/2026 | 1,705 | 1,675,162 | ||||||||

| Netflix, Inc.† | 4.875% | 4/15/2028 | 1,307 | 1,282,494 | ||||||||

| Netflix, Inc. | 5.875% | 2/15/2025 | 1,661 | 1,768,965 | ||||||||

| 28 | See Notes to Financial Statements. |

Schedule of Investments (continued)

December 31, 2017

| Investments | Interest Rate | Maturity Date | Principal Amount (000) | Fair Value | ||||||||

| Media: Content (continued) | ||||||||||||

| Sirius XM Radio, Inc.† | 5.00% | 8/1/2027 | $ | 1,792 | $ | 1,805,440 | ||||||

| Sirius XM Radio, Inc.† | 6.00% | 7/15/2024 | 1,075 | 1,139,500 | ||||||||

| Total | 13,677,148 | |||||||||||

| Media: Diversified 0.25% | ||||||||||||

| 21st Century Fox America, Inc. | 4.75% | 11/15/2046 | 2,576 | 2,991,453 | ||||||||

| Medical Products 0.66% | ||||||||||||

| Boston Scientific Corp. | 7.00% | 11/15/2035 | 1,785 | 2,312,104 | ||||||||

| Fresenius Medical Care US Finance II, Inc.† | 4.75% | 10/15/2024 | 1,613 | 1,722,790 | ||||||||

| Ortho-Clinical Diagnostics, Inc./Ortho-Clinical Diagnostics SA† | 6.625% | 5/15/2022 | 2,325 | 2,348,250 | ||||||||

| Stryker Corp. | 4.625% | 3/15/2046 | 644 | 733,662 | ||||||||

| Teleflex, Inc. | 4.625% | 11/15/2027 | 641 | 648,885 | ||||||||

| Total | 7,765,691 | |||||||||||

| Metals/Mining (Excluding Steel) 4.16% | ||||||||||||

| Alcoa Nederland Holding BV (Netherlands)†(d) | 6.75% | 9/30/2024 | 2,477 | 2,712,315 | ||||||||

| Aleris International, Inc.† | 9.50% | 4/1/2021 | 1,184 | 1,255,040 | ||||||||

| Alliance Resource Operating Partners LP/Alliance Resource Finance Corp.† | 7.50% | 5/1/2025 | 1,363 | 1,453,299 | ||||||||

| Anglo American Capital plc (United Kingdom)†(d) | 4.00% | 9/11/2027 | 1,321 | 1,313,881 | ||||||||

| Anglo American Capital plc (United Kingdom)†(d) | 4.75% | 4/10/2027 | 2,386 | 2,500,297 | ||||||||

| Cleveland-Cliffs, Inc.† | 5.75% | 3/1/2025 | 2,458 | 2,353,535 | ||||||||

| Corp. Nacional del Cobre de Chile (Chile)†(d) | 4.50% | 8/1/2047 | 910 | 981,581 | ||||||||

| First Quantum Minerals Ltd. (Canada)†(d) | 7.25% | 4/1/2023 | 1,150 | 1,242,000 | ||||||||

| Freeport-McMoRan, Inc. | 3.55% | 3/1/2022 | 4,670 | 4,629,137 | ||||||||

| Freeport-McMoRan, Inc. | 3.875% | 3/15/2023 | 4,941 | 4,941,000 | ||||||||

| Glencore Funding LLC† | 4.00% | 3/27/2027 | 1,958 | 1,969,009 | ||||||||

| Grinding Media, Inc./Moly-Cop AltaSteel Ltd.† | 7.375% | 12/15/2023 | 686 | 738,273 | ||||||||

| Hudbay Minerals, Inc. (Canada)†(d) | 7.25% | 1/15/2023 | 1,039 | 1,106,535 | ||||||||

| Imperial Metals Corp. (Canada)†(d) | 7.00% | 3/15/2019 | 1,037 | 979,965 | ||||||||

| Indika Energy Capital III Pte Ltd. (Singapore)†(d) | 5.875% | 11/9/2024 | 1,182 | 1,186,401 | ||||||||

| Indo Energy Finance II BV (Netherlands)†(d) | 6.375% | 1/24/2023 | 1,408 | 1,450,467 | ||||||||

| Kinross Gold Corp. (Canada)(d) | 5.125% | 9/1/2021 | 1,175 | 1,230,812 | ||||||||

| Kinross Gold Corp. (Canada)(d) | 5.95% | 3/15/2024 | 1,322 | 1,455,852 | ||||||||

| Lundin Mining Corp. (Canada)†(d) | 7.875% | 11/1/2022 | 964 | 1,036,300 | ||||||||

| Mirabela Nickel Ltd. (Australia)(d)(l) | 1.00% | 9/10/2044 | 15 | 2 | (m) | |||||||

| New Gold, Inc. (Canada)†(d) | 6.375% | 5/15/2025 | 481 | 511,063 | ||||||||

| Novelis Corp.† | 5.875% | 9/30/2026 | 1,000 | 1,022,500 | ||||||||

| See Notes to Financial Statements. | 29 |

Schedule of Investments (continued)

December 31, 2017

| Investments | Interest Rate | Maturity Date | Principal Amount (000) | Fair Value | ||||||||

| Metals/Mining (Excluding Steel) (continued) | ||||||||||||

| Novelis Corp.† | 6.25% | 8/15/2024 | $ | 974 | $ | 1,022,700 | ||||||

| Peabody Energy Corp.† | 6.00% | 3/31/2022 | 1,099 | 1,144,334 | ||||||||

| Peabody Energy Corp.† | 6.375% | 3/31/2025 | 2,810 | 2,932,937 | ||||||||

| Peabody Energy Corp.(l) | 10.00% | 3/15/2022 | 1,310 | 131 | (m) | |||||||

| Rain CII Carbon LLC/CII Carbon Corp.† | 7.25% | 4/1/2025 | 2,127 | 2,321,089 | ||||||||

| Rain CII Carbon LLC/CII Carbon Corp.†(c) | 8.50% | 1/15/2021 | EUR | 475 | 586,855 | |||||||

| Samarco Mineracao SA (Brazil)†(d)(l) | 4.125% | 11/1/2022 | $ | 1,620 | 1,109,700 | |||||||

| Teck Resources Ltd. (Canada)†(d) | 8.50% | 6/1/2024 | 1,169 | 1,323,892 | ||||||||

| Vedanta Resources plc (India)†(d) | 6.125% | 8/9/2024 | 2,272 | 2,323,938 | ||||||||

| Total | 48,834,840 | |||||||||||

| Monoline Insurance 0.35% | ||||||||||||

| Acrisure LLC/Acrisure Finance, Inc.† | 7.00% | 11/15/2025 | 2,449 | 2,366,371 | ||||||||

| Fidelity National Financial, Inc. | 5.50% | 9/1/2022 | 406 | 448,313 | ||||||||

| MGIC Investment Corp. | 5.75% | 8/15/2023 | 1,204 | 1,319,885 | ||||||||

| Total | 4,134,569 | |||||||||||

| Multi-Line Insurance 0.15% | ||||||||||||

| American International Group, Inc. | 4.70% | 7/10/2035 | 1,576 | 1,747,084 | ||||||||

| Non-Electric Utilities 0.12% | ||||||||||||

| Brooklyn Union Gas Co. (The)† | 3.407% | 3/10/2026 | 1,368 | 1,397,343 | ||||||||

| Oil Field Equipment & Services 1.60% | ||||||||||||

| Abu Dhabi Crude Oil Pipeline LLC (United Arab Emirates)†(d) | 4.60% | 11/2/2047 | 2,329 | 2,401,828 | ||||||||

| Ensco plc (United kingdom)(d) | 4.50% | 10/1/2024 | 1,035 | 874,575 | ||||||||

| Ensco plc (United kingdom)(d) | 5.20% | 3/15/2025 | 1,368 | 1,169,640 | ||||||||

| Eterna Capital Pte Ltd. PIK 6.00% (Singapore)(d) | 6.00% | 12/11/2022 | 70 | 73,541 | (b) | |||||||

| Eterna Capital Pte Ltd. PIK 8.00% (Singapore)(d) | 8.00% | 12/11/2022 | 252 | 243,549 | (b) | |||||||

| Forum Energy Technologies, Inc. | 6.25% | 10/1/2021 | 1,300 | 1,309,750 | ||||||||

| National Oilwell Varco, Inc. | 3.95% | 12/1/2042 | 2,614 | 2,321,090 | ||||||||

| Precision Drilling Corp. (Canada)(d) | 5.25% | 11/15/2024 | 1,804 | 1,709,290 | ||||||||

| Precision Drilling Corp. (Canada)(d) | 6.50% | 12/15/2021 | 182 | 186,322 | ||||||||

| Precision Drilling Corp. (Canada)(d) | 7.75% | 12/15/2023 | 553 | 583,415 | ||||||||

| Rowan Cos., Inc. | 4.75% | 1/15/2024 | 1,114 | 985,890 | ||||||||

| Rowan Cos., Inc. | 7.375% | 6/15/2025 | 553 | 567,516 | ||||||||

| Transocean Phoenix 2 Ltd.† | 7.75% | 10/15/2024 | 921 | 1,011,619 | ||||||||

| Transocean Proteus Ltd.† | 6.25% | 12/1/2024 | 899 | 946,303 | ||||||||