UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

For the Quarterly Period Ended:

COMMISSION FILE NUMBER

(Exact Name of Registrant as Specified in its Charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| (Address of principal executive offices) | (Zip Code) |

| (Registrant’s telephone number, including area code) |

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of August 30, 2023, there were

TABLE OF CONTENTS

| PART I - FINANCIAL INFORMATION | ||

| Item 1. | Unaudited Condensed Consolidated Financial Statements. | 1 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | 29 |

| Item 3. | Quantitative and Qualitative Disclosures about Market Risk. | 42 |

| Item 4. | Controls and Procedures. | 42 |

| PART II - OTHER INFORMATION | ||

| Item 1. | Legal Proceedings. | 43 |

| Item 1A. | Risk Factors. | 43 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds. | 43 |

| Item 3. | Defaults Upon Senior Securities. | 43 |

| Item 4. | Mine Safety Disclosures. | 43 |

| Item 5. | Other Information. | 43 |

| Item 6. | Exhibits. | 44 |

| SIGNATURES | 45 | |

| EXHIBIT INDEX | ||

i

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements.

TINGO GROUP, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(USD In Thousands, Except Share and Par Value Data)

| June 30, 2023 | December 31, 2022 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Trade accounts receivable, net | ||||||||

| Inventories | ||||||||

| Related party receivables | ||||||||

| Other current assets | ||||||||

| Total current assets | ||||||||

| Property and equipment, net | ||||||||

| Intangible assets, net | ||||||||

| Goodwill | ||||||||

| Right of use assets under operating lease | ||||||||

| Long-term deposit and other non-current assets | ||||||||

| Deferred tax assets | ||||||||

| Restricted cash escrow | ||||||||

| Micronet Ltd. equity method investment | ||||||||

| Total long-term assets | ||||||||

| Total assets | $ | $ | ||||||

1

TINGO GROUP, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(USD In Thousands, Except Share and Par Value Data)

| June 30, 2023 | December 31, 2022 | |||||||

| LIABILITIES, TEMPORARY EQUITY AND EQUITY | ||||||||

| Short-term loan | $ | $ | ||||||

| Trade accounts payable | ||||||||

| Deposit held on behalf of clients | ||||||||

| Related party payables | ||||||||

| Current operating lease liability | ||||||||

| Other current liabilities | ||||||||

| Total current liabilities | ||||||||

| Long-term loan | ||||||||

| Long-term operating lease liability | ||||||||

| Promissory note | ||||||||

| Deferred tax liabilities | ||||||||

| Other long-term liability | - | |||||||

| Accrued severance pay | ||||||||

| Total long-term liabilities | ||||||||

| Commitment and Contingencies (Note 11) | ||||||||

| Temporary equity | ||||||||

| Series B preferred stock subject to redemption: $ | ||||||||

| Stockholders’ Equity: | ||||||||

| Series A preferred stock: $ | ||||||||

| Common stock: $ | ||||||||

| Additional paid-in capital | ||||||||

| Accumulated other comprehensive income (loss) | ( | ) | ||||||

| Accumulated earnings (deficit) | ( | ) | ||||||

| Tingo Group, Inc. stockholders’ equity | ||||||||

| Non-controlling interest | ||||||||

| Total stockholders’ equity | ||||||||

| Total liabilities, temporary equity and stockholders’ equity | $ | $ | ||||||

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

2

TINGO GROUP, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(USD In Thousands, Except Share and Earnings Per Share Data)

| For the six months ended June 30, | For the three months ended June 30, | |||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Revenues | $ | $ | $ | $ | ||||||||||||

| Cost of revenues | ||||||||||||||||

| Gross profit | ||||||||||||||||

| Operating expenses: | ||||||||||||||||

| Research and development | ||||||||||||||||

| Selling and marketing | ||||||||||||||||

| General and administrative | ||||||||||||||||

| Amortization of intangible assets | ||||||||||||||||

| Loss from deconsolidation of subsidiaries | ||||||||||||||||

| Impairment of long-term assets and goodwill | ||||||||||||||||

| Total operating expenses | ||||||||||||||||

| Profit (loss) from operations | ( | ) | ( | ) | ||||||||||||

| Other income (loss), net | ( | ) | ( | ) | ||||||||||||

| Financial income (expenses), net | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Profit (loss) before provision for income taxes | ( | ) | ( | ) | ||||||||||||

| Income tax expenses (benefit) | ( | ) | ( | ) | ||||||||||||

| Net profit (loss) after provision for income taxes | ( | ) | ( | ) | ||||||||||||

| Loss from equity investment | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Net profit (loss) | ( | ) | ( | ) | ||||||||||||

| Net loss attributable to non-controlling interests | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Net profit (loss) attributable to Tingo Group, Inc. | $ | $ | ( | ) | $ | $ | ( | ) | ||||||||

| Profit (loss) per share attributable to Tingo Group, Inc.: | ||||||||||||||||

| Basic profit (loss) per share | $ | $ | ( | ) | $ | $ | ( | ) | ||||||||

| Diluted profit (loss) per share | $ | $ | ( | ) | $ | $ | ( | ) | ||||||||

| Weighted average common shares outstanding: | ||||||||||||||||

| Basic | ||||||||||||||||

| Diluted | ||||||||||||||||

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

3

TINGO GROUP, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(USD In Thousands)

| For the six months ended June 30, |

For the three months ended June 30, |

|||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Net profit (loss) | $ | $ | ( |

) | $ | $ | ( |

) | ||||||||

| Other comprehensive income (loss), net of tax: | ||||||||||||||||

| Currency translation adjustment | ( |

) | ( |

) | ||||||||||||

| Total comprehensive loss | ( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| Comprehensive loss attributable to non-controlling stockholders | ( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| Comprehensive loss attributable to Tingo Group, Inc. | $ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

4

TINGO GROUP, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN TEMPORARY EQUITY AND STOCKHOLDERS’ EQUITY

(USD In Thousands, Except Numbers of Shares)

| Series B preferred stock subject to redemption | Series A preferred stock | Common Stock | Additional Paid-in | Accumulated Earnings | Accumulated Other Comprehensive | Non- controlling | Total Stockholders’ | |||||||||||||||||||||||||||||||||||||

| Amount | Shares | Amount | Shares | Amount | Shares | Capital | (Deficit) | Income (Loss) | Interest | Equity | ||||||||||||||||||||||||||||||||||

| Balance, December 31, 2022 | $ | $ | | $ | $ | $ | ( | ) | $ | $ | $ | |||||||||||||||||||||||||||||||||

| Shares issued to service providers and employees | ||||||||||||||||||||||||||||||||||||||||||||

| Stock based compensation | - | |||||||||||||||||||||||||||||||||||||||||||

| Net profit (loss) | - | - | - | ( | ) | |||||||||||||||||||||||||||||||||||||||

| Repurchase of warrants | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||||||

| Exercising of warrants | ||||||||||||||||||||||||||||||||||||||||||||

| Deconsolidation of subsidiaries | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | - | - | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||||||||||||

| Balance, June 30, 2023 | $ | $ | $ | | $ | $ | $ | ( | ) | $ | $ | |||||||||||||||||||||||||||||||||

| Series B preferred stock subject to redemption | Series A preferred stock | Common Stock | Additional Paid-in | Accumulated Earnings | Accumulated Other Comprehensive | Non- controlling | Total Stockholders’ | |||||||||||||||||||||||||||||||||||||

| Amount | Shares | Amount | Shares | Amount | Shares | Capital | (Deficit) | Income (Loss) | Interest | Equity | ||||||||||||||||||||||||||||||||||

| Balance, March 31, 2023 | $ | $ | $ | $ | $ | $ | ( | ) | $ | $ | ||||||||||||||||||||||||||||||||||

| Shares issued to service providers and employees | ||||||||||||||||||||||||||||||||||||||||||||

| Stock based compensation | - | |||||||||||||||||||||||||||||||||||||||||||

| Net profit (loss) | - | - | - | ( | ) | |||||||||||||||||||||||||||||||||||||||

| Warrants repurchase agreements | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||||||

| Exercising of warrants | ||||||||||||||||||||||||||||||||||||||||||||

| Deconsolidation of subsidiaries | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | - | - | - | ( | ) | ( | ) | |||||||||||||||||||||||||||||||||||||

| Balance, June 30, 2023 | $ | $ | $ | $ | $ | $ | ( | ) | $ | $ | ||||||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-in | Accumulated | Accumulated Other Comprehensive | Non- controlling | Total Stockholders’ | |||||||||||||||||||||||

| Amount | Shares | Capital | Deficit | Income (Loss) | Interest | Equity | ||||||||||||||||||||||

| Balance, December 31, 2021 | $ | $ | $ | ( | ) | $ | ( | ) | $ | $ | ||||||||||||||||||

| Shares issued to service providers and employees | ||||||||||||||||||||||||||||

| Stock based compensation | - | |||||||||||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||

| Other comprehensive income (loss) | - | - | ||||||||||||||||||||||||||

| Balance, June 30, 2022 | $ | $ | $ | ( | ) | $ | $ | $ | ||||||||||||||||||||

| Common Stock | Additional Paid-in | Accumulated | Accumulated Other Comprehensive | Non- controlling | Total Stockholders’ | |||||||||||||||||||||||

| Amount | Shares | Capital | Deficit | Income (Loss) | Interest | Equity | ||||||||||||||||||||||

| Balance, March 31, 2022 | $ | $ | $ | ( | ) | $ | ( | ) | $ | $ | ||||||||||||||||||

| Shares issued to service providers and employees | ||||||||||||||||||||||||||||

| Stock based compensation | - | |||||||||||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||

| Other comprehensive income (loss) | - | - | ||||||||||||||||||||||||||

| Balance, June 30, 2022 | $ | $ | $ | ( | ) | $ | $ | $ | ||||||||||||||||||||

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements

5

TINGO GROUP, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(USD In Thousands)

| For the six months ended June 30, | ||||||||

| 2023 | 2022 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net profit (loss) | $ | $ | ( | ) | ||||

| Adjustments to reconcile net profit (loss) to net cash provided by (used in) operating activities: | ||||||||

| Impairment of long-term assets | ||||||||

| Impairment of goodwill | ||||||||

| Loss from deconsolidation of subsidiaries | ||||||||

| Loss from equity investment | ||||||||

| Depreciation and amortization | ||||||||

| Provision for doubtful accounts | ||||||||

| Issuance of shares for service providers and employees | ||||||||

| Stock-based compensation | ||||||||

| Changes in assets and liabilities: | ||||||||

| Deferred taxes, net | ( | ) | ( | ) | ||||

| Long-term deposit and other non-current assets | ||||||||

| Right of use assets | ||||||||

| Lease liabilities | ( | ) | ( | ) | ||||

| Due to related party | ( | ) | ||||||

| Promissory note | ||||||||

| Trade accounts receivable, net | ( | ) | ||||||

| Inventories | ( | ) | ||||||

| Other current assets | ( | ) | ||||||

| Trade accounts payable | ( | ) | ( | ) | ||||

| Deposit held on behalf of client | ( | ) | ( | ) | ||||

| Other current liabilities | ( | ) | ||||||

| Net cash provided by (used in) operating activities | ( | ) | ||||||

6

TINGO GROUP, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(USD In Thousands)

| For the six months ended June 30, | ||||||||

| 2023 | 2022 | |||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Advances and purchases of property and equipment | ( | ) | ( | ) | ||||

| Acquisition of Tingo Foods (Appendix A) | ||||||||

| Receipt of loan from related party (Micronet) | ||||||||

| Loan to Tingo pursuant to the merger agreement | ( | ) | ||||||

| Net cash used in investing activities | ( | ) | ( | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Repayment of short-term loan | ( | ) | ( | ) | ||||

| Repayment of loan from related party | ( | ) | ||||||

| Repurchase of warrants | ( | ) | ||||||

| Proceeds from Common shares issued for warrant exercises | ||||||||

| Net cash used in financing activities | ( | ) | ( | ) | ||||

| TRANSLATION ADJUSTMENT ON CASH AND CASH EQUIVALENTS AND RESTRICTED CASH | ( | ) | ||||||

| NET CHANGE IN CASH AND CASH EQUIVALENTS AND RESTRICTED CASH | ( | ) | ( | ) | ||||

| Cash and cash equivalents and restricted cash at beginning of the period | ||||||||

| Cash and cash equivalents and restricted cash at end of the period | $ | $ | ||||||

| Supplemental disclosure of cash flow information: | ||||||||

| Amount paid during the period for: | ||||||||

| Interest | $ | $ | ||||||

| Taxes | $ | $ | ||||||

The following table provides a reconciliation of cash and cash equivalent and restricted cash reported within the statement of financial position that sum to the total of the same amounts shown in the statement of cash flows:

| Cash and cash equivalents at end of the period | $ | $ | ||||||

| Restricted cash at end of the period | ||||||||

| Cash and cash equivalents and restricted cash at end of the period | $ | $ |

Supplemental non-cash investing and financing activities

Appendix A: Acquisition of Tingo Foods

| February 9, 2023 | ||||

| Net working capital | $ | |||

| Property and equipment | ( | ) | ||

| Intangible assets | ( | ) | ||

| Goodwill | ( | ) | ||

| Deferred tax liabilities | ||||

| Promissory note | ||||

| Net cash provided by acquisition | $ | |||

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements

7

TINGO GROUP, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, except Share and Par Value Data)

NOTE 1 — DESCRIPTION OF BUSINESS

Overview

Tingo Group, Inc. (“Tingo Group”, the “Company”, “we”, “us”, “our”) was formed as a Delaware corporation on January 31, 2002 under the name Lapis Technologies, Inc. On March 14, 2013, we changed our corporate name to Micronet Enertec Technologies, Inc. On July 13, 2018, following the sale of our former subsidiary, Enertec Systems Ltd., we changed our name to MICT, Inc. On February 27, 2023, following the merger transaction with Tingo Mobile Limited (“Tingo Mobile”), we changed our name to Tingo Group, Inc. Our shares have been listed for trading on The Nasdaq Capital Market (“Nasdaq”) since April 29, 2013 and trade under the symbol “TIO”.

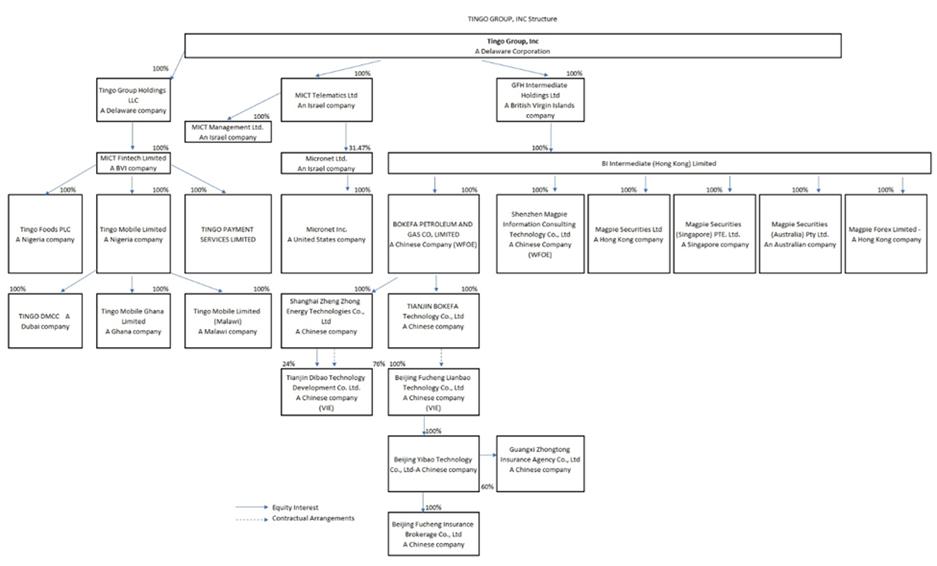

The Company is a holding company conducting financial technology business, agri-fintech and food business through its subsidiaries and entities, both wholly-owned and controlled through various variable interest entity (“VIE entities”, together with the Company, the “Group”) arrangements (“VIE”), which are located mainly in Africa, Southeast Asia and the Middle East. The Group’s business has changed materially since December 1, 2022, following the completion of two material acquisitions of Tingo Mobile and Tingo Foods PLC (“Tingo Foods”), the details of which are described below under “Acquisition of Tingo Mobile” and “Acquisition of Tingo Foods”, respectively.

As of June 30, 2023, we operate

in

As further discussed in Note 5 the Company decided to exit its operations of one of its VIEs (as explained below). The Company is reconsidering its focus areas. As part of the reconsideration the Company considering the exit of other operations in China and subsequent to the balance sheet date decided on the cessation and abandonment of the operations of Magpie.

Since July 1, 2020, as a result of the Company’s acquisition of GFH Intermediate Holdings Ltd (“GFHI ”) (the “GFHI Acquisition”) the Group has been operating in the financial technology sector. GFHI is a financial technology company with a marketplace in China, as well as the wider southeast Asia area and other parts of the world and is currently in the process of building various platforms for business opportunities in different verticals and technology segments to capitalize on such technology and business, including the Company’s recent acquisitions of Tingo Mobile and Tingo Foods. The Company plans to increase its capabilities and its technological platforms through acquisition and licensing technologies to support its growth efforts, particularly in the agri-fintech, payment services, digital marketplace and financial services sectors.

8

TINGO GROUP, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, except Share and Par Value Data)

Acquisition of Tingo Mobile

Overview. On December 1, 2022, the Company acquired Tingo Mobile, an agri-fintech business based in Nigeria, from Tingo Inc., a Nevada corporation (“TMNA”).

Consideration Provided.

As consideration for Tingo Mobile, we issued to TMNA 25,783,675 shares of our common stock, par value $

Key Terms of Series A

Preferred Stock. On July 27, 2023, as part of the consideration paid by the Company to

TMNA at the closing of the Merger, the Company issued

Key Terms of Series B Preferred

Stock. Upon approval by Nasdaq of the change of control of the company and upon the approval of our stockholders, the Series B Preferred

Stock will convert into

On July 5, 2023, the Company entered into a forbearance agreement with the holder of the Series B Preferred Stock under the terms of which the Series B holder agreed not to redeem the Series B Preferred Stock or take any other action in connection with the Series B Preferred Stock until September 30, 2023.

Loan to TMNA. In connection

with the Merger Agreement, we also loaned $

Acquisition of Tingo Foods

On February 9, 2023, the Company

and MICT Fintech Ltd., an indirect wholly owned subsidiary of the Company organized under the laws of the British Virgin Islands (“Tingo

Group Fintech”) purchased from Dozy Mmobuosi

Tingo Foods started its operational business in September 2022, since which time its food processing activities have been conducted through arrangements with third party rice mills, cashew processing plants and other food processing companies, and the finished food products are sold to large food distributor and wholesaler companies.

As consideration for the Acquisition,

the Company agreed to pay Mr. Mmobuosi, a purchase price equal to the cost value of Tingo Foods’ stock, which will be satisfied

by the issuance of a secured promissory note (“Promissory Note”) in the amount of US$

The parties additionally agreed that Mr. Mmobuosi, as the owner of the real property on which the business of Tingo Foods is located and operates, to finance and complete construction of the building, and for the Company and Tingo Foods to fit out the building and premises, including the installation of mechanized equipment, for the specialized operations of a large food processing facility. Lastly, Mr. Mmobuosi will also provide the Company and Tingo Foods with a long-term lease with respect to the real property.

9

TINGO GROUP, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, except Share and Par Value Data)

Variable Interest Entities (VIEs)

We currently conduct our insurance broker business in China using VIEs. The Company consolidates certain VIEs for which it is the primary beneficiary. VIEs consist of certain operating entities not wholly owned by the Company.

| June 30, 2023 | December 31, 2022 | |||||||

| Current assets: | ||||||||

| Cash and cash equivalent | $ | $ | ||||||

| Trade accounts receivable, net | ||||||||

| Related party receivables | ||||||||

| Other current assets | ||||||||

| Total current assets | ||||||||

| Property and equipment, net | ||||||||

| Intangible assets, net | ||||||||

| Long-term deposit and other non-current assets | ||||||||

| Right of use assets under operating lease | ||||||||

| Restricted cash escrow | ||||||||

| Deferred tax assets | ||||||||

| Total long-term assets | ||||||||

| Total assets | $ | $ | ||||||

| Current liabilities: | ||||||||

| Short-term loan | $ | $ | ||||||

| Trade accounts payable | ||||||||

| Related party payables | ||||||||

| Current operating lease liability | ||||||||

| Other current liabilities | ||||||||

| Total current liabilities | ||||||||

| Long-term liabilities: | ||||||||

| Long-term loan | ||||||||

| Long-term operating lease liability | ||||||||

| Deferred tax liabilities | ||||||||

| Total long-term liabilities | ||||||||

| Total liabilities | $ | $ | ||||||

| For the six months Ended | For the six months Ended | For the three months Ended | For the three months Ended | |||||||||||||

| June 30, | June 30, | June 30, | June 30, | |||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Net revenues | $ | $ | $ | $ | ||||||||||||

| Profit (loss) from operations | $ | $ | ( | ) | $ | $ | ( | ) | ||||||||

| Net profit (loss) | $ | $ | ( | ) | $ | $ | ||||||||||

10

TINGO GROUP, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, except Share and Par Value Data)

NOTE 2 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Interim Financial Statements

These unaudited interim condensed consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of U.S. Securities and Exchange Commission Regulation S-X. Accordingly, they do not include all the information and footnotes required by generally accepted accounting principles for complete financial statements. In the opinion of management, all adjustments considered necessary for a fair presentation have been included (consisting only of normal recurring adjustments except as otherwise discussed). For further information, reference is made to the consolidated financial statements and footnotes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022.

Operating results for the three and six months periods ended June 30, 2023, are not necessarily indicative of the results that may be expected for the year ending December 31, 2023.

Significant Accounting Policies

The significant accounting policies followed in the preparation of these unaudited interim condensed consolidated financial statements are identical to those applied in the preparation of the latest annual financial statements, except for revenue recognition policy presented below.

Recent Accounting Standards

Management does not believe that any recently issued, but not yet effective, accounting standards, if currently adopted, would have a material effect on the Company’s condensed financial statements.

Use of estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Significant items subject to such estimates and assumptions include, but are not limited to, the initial and recurring valuation of certain assets acquired and liabilities assumed through acquisitions, goodwill and its impairment, allowance for credit losses, impairment of long-lived and intangible assets and contingencies. These estimates are made and evaluated on an on-going basis using information that is currently available as well as various other assumptions believed to be reasonable under the circumstances. Actual results could differ from those estimates.

Functional currency and Exchange Rate Income (Loss)

The functional currency of our foreign entities is their local currency. For these foreign entities, we translate their financial statements into U.S. dollars using average exchange rates for the period for statements of operations amounts and using end-of-period exchange rates for assets and liabilities. We record these translation adjustments in Accumulated other comprehensive income (loss), a separate component of stockholders’ equity, in our consolidated balance sheets. Exchange gains and losses resulting from the conversion of transaction currency to functional currency are charged or credited to other comprehensive income (loss), net of tax.

| Currency | For the six months ended June 30, 2023 average | USD 2023 | USD 2022 | |||||||||

| Naira | ||||||||||||

| RMB | ||||||||||||

11

TINGO GROUP, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, except Share and Par Value Data)

Revenue Recognition

The Company follows ASC 606 “Revenue from Contracts with Customers” and recognizes revenue when it transfers the control of promised goods or services to customers in an amount that reflects the consideration the Company expects to be entitled to in exchange for those goods or services.

The Company’s revenues from Tingo Mobile’s comprehensive platform service are recognized upon transfer of control of promised products or services to customers in an amount that reflects the consideration the Company expects to receive in exchange for those products or services. The Company offers customers the ability to lease the phones on one-year terms, and purchase data and calls, as well as use of the NWASSA platform. As part of these contracts, the Company records revenue from the lease on a straight-line basis over the lease term. The Company also records depreciation expense on a straight-line basis over the useful life of the phones, which is estimated by management at three years.

The Company exercised judgement in determining the accounting policies related to these transactions, including the following:

| ● | Determination of whether products and services are considered distinct performance obligations that should be accounted for separately versus together, such as phone leases and purchase of data. |

| ● | Determination of stand-alone selling prices for each distinct performance obligation and for products and services that are not sold separately. |

| ● | The pattern of delivery (i.e., timing of when revenue is recognized) for each distinct performance obligation. |

| ● | Estimation of variable consideration when determining the amount of revenue to recognize (i.e., separate items on NWASSA platform) |

Tingo Foods is a diversified food processing company, which uses domestic inputs purchased from farmers across Nigeria and processes them into finished foods. Since the commencement of its operations in September 2022, the food processing activities of Tingo Foods have been conducted through arrangements with third party rice mills, cashew processing plants and other food processing companies, and the finished food products are sold to large food distributor and wholesaler companies.

In 2023, we launched our global commodities trading platform and export business (“Tingo DMCC”) from DMCC, which is regarded as the Free Trade Zone and a major global commodity trading center, to facilitate purchases and export of agricultural commodities from both its existing customer base and new customers. Tingo DMCC exports agricultural produce, including rice, wheat, millet and maize.

The Company’s revenues from Tingo Foods and Tingo DMCC are recognized when control over the finished goods transfers to its customers, which generally occurs upon shipment to, or receipt at, customers’ locations, as determined by the specific terms of the contract. These revenue arrangements generally have single performance obligations.

The arrangements are free from variable consideration and consideration payable to our customers, including applicable discounts, returns, allowances, trade promotion, unsaleable product, consumer coupon redemption and rebates. Amounts billed and due from our customers are classified as receivables and require payment on a short-term basis; therefore, the Company does not have any significant financing components.

The Company records revenues from Tingo Foods and Tingo DMCC on a gross basis because the Company controls the products before they are transferred to the customers determined on the basis that: (1) the Company is primarily responsible for fulfilling its promise to deliver the specified products to customers; (2) the Company has inventory risk before the specified products are transferred to a customers, and (3) the Company has discretion in establishing the price for the specified products.

The Company’s revenues from the insurance segment are generated from providing insurance brokerage services or insurance agency services on behalf of insurance carriers.

Our performance obligation to the insurance carrier is satisfied and commission revenue is recognized at a point in time when an insurance policy becomes effective. The Company provides customers with information regarding services and commission charge from the customers on a monthly basis. Performance obligation is satisfied at a point in time when the requested information is delivered to the customer.

In accordance with ASC 606-10-55, Revenue Recognition: Principal Agent Considerations, the Company reports revenue on a gross or net basis based on management’s assessment of whether the Company acts as a principal or agent in the transaction. To the extent the Company acts as the principal, revenue is reported on a gross basis. To the extent the Company acts as the agent, revenue is reported on a net basis. The determination of whether the Company act as a principal or an agent in a transaction is based on an evaluation of whether the Company controls the good or service prior to transfer to the customer.

12

TINGO GROUP, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, except Share and Par Value Data)

The Company reports its insurance revenue net of amounts due to the insurance companies as the Company is not the primary obligor in the relevant arrangements, the Company does not finalize the pricing, and does not bear any risk related to the insurance policies.

The Company’s revenues from the Online Stock Trading platform are generated from stock trading commission income. Commission revenue is recognized at a point in time when transfer of control occurs. Trade execution performance obligation generally occurs on the trade date because that is when the underlying financial instrument (for a purchase or for a sale) is identified, and the pricing is agreed upon.

NOTE 3 — TINGO MOBILE TRANSACTION

Tingo Mobile, Purchase Price Allocation

The table set forth below summarizes the estimates of the fair value of assets acquired and liabilities assumed and resulting goodwill. During the measurement period, which is up to one year from the acquisition date, we may adjust provisional amounts that were recognized at the acquisition date to reflect new information obtained about facts and circumstances that existed as of the acquisition date.

| Total Merger consideration (1) | $ | |||

| Total purchase consideration | $ | |||

| Less: | ||||

| Net working capital | $ | |||

| Property and equipment | ||||

| Intangible – farmer cooperative | ||||

| Intangible – trade names and trademarks | ||||

| Intangible – software | ||||

| Deferred tax liability (2) | ( | ) | ||

| $ | ||||

| Goodwill (3) | $ |

| (1) |

| (2) |

| (3) |

| For the six months ended |

For the six months ended |

For the three months ended |

For the three months ended |

|||||||||||||

| June 30, | June 30, | June 30, | June 30, | |||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Revenues | $ | $ | $ | $ | ||||||||||||

| Net profit attributable to Tingo Group, Inc | $ | $ | $ | $ | ||||||||||||

13

TINGO GROUP, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, except Share and Par Value Data)

Note 4 — Tingo Foods PLC Purchase Price Allocation

The table set forth below summarizes the estimates of the fair value of assets acquired and liabilities assumed and resulting goodwill. In addition, the following table summarizes the allocation of the preliminary purchase price as of the acquisition date. The amounts are provisional and will be adjusted during the measurement period, and additional assets or liabilities may be recognized to reflect new information obtained about facts and circumstances that existed as of the acquisition date that, if known, would have affected the amounts recognized as of that date.

| Total Merger consideration (1) | $ | |||

| Total purchase consideration | $ | |||

| Less: | ||||

| Net working capital | $ | |||

| Property and equipment | ||||

| Intangible – Customer Relationships | ||||

| Intangible – trade names and trade marks | ||||

| Deferred tax liability (2) | ( | ) | ||

| $ | ||||

| Goodwill (3) | $ |

| (1) |

|

| (2) |

| (3) |

| (USD in thousands) | For

the six months ended June 30, 2023 |

For

the three months ended June 30, 2023 |

||||||

| Revenues | $ | |||||||

| Net profit attributable to Tingo Group, Inc. | $ | |||||||

The revenues and net profit of Tingo Foods since the acquisition date

included in the unaudited condensed consolidated statements of operations for the reporting period are $

Note 5 — Exit of All Weather

On July 1, 2021, we entered into

a transaction through Tianjin Bokefa Technology Co., Ltd. (“Bokefa”), with the shareholders of All Weather Insurance Agency

Co., Ltd. (the “All Weather”), a local Chinese entity with business and operations in the insurance brokerage business. Pursuant

to the transaction, we granted loans to All Weather’s shareholders through a framework loan (the “AW Framework Loan”)

in the amount of up to RMB

During

the second quarter of 2023, the Company's management decided to focus its operations on recent acquisitions of Tingo Mobile and Tingo

Foods. That decision led to abandon our interests in All Weather. As part of the decision, the Company demanded the full repayment of

the loan granted to All Weather’s shareholders. As of the decision date, the Company is no longer consolidating All Weather. The

Company recorded a loss from deconsolidation of All Weather of $

14

TINGO GROUP, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, except Share and Par Value Data)

Note 6 — Stockholders’ Equity

A. Common Stock:

Common Stock confers upon its holders the rights to receive notice to participate and vote in general meetings of the Company, and the right to receive dividends if declared.

B. Series A Preferred Stock:

As

part of the consideration paid by the Company to TMNA at the closing of the Merger on December 1, 2022, the Company issued

C. Temporary equity:

As part of the consideration

paid by the Company to TMNA at the closing of the Merger on December 1, 2022, the Company issued

On July 5, 2023, the Company entered into a forbearance agreement with the holder of the Series B Preferred Stock under the terms of which the Series B Preferred Stockholder agreed not to redeem the Series B Preferred Stock, or take any other action in connection with the Series B Preferred Stock, until September 30, 2023.

D. Stock Option Plan:

2012 Plan. Our

2012 Stock Incentive Plan (the “2012 Incentive Plan”) was initially adopted by the Company’s board of directors (the

“Board”) on November 26, 2012, and approved by our stockholders on January 7, 2013, and subsequently amended on September

30, 2014, October 26, 2015, November 15, 2017, and November 8, 2018. Under the 2012 Incentive Plan, as amended, up to

15

TINGO GROUP, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, except Share and Par Value Data)

2020

Plan. The 2020 Stock Incentive Plan (the “2020 Incentive Plan”)

provides for the issuance of up to

| Options Outstanding | Options Exercisable | |||||||||||||

| Number Outstanding on June 30, 2023 | Weighted Average Remaining Contractual Life | Number Exercisable on June 30, 2023 | Exercise Price | |||||||||||

| Years | $ | |||||||||||||

For

the | For the year ended December 31, 2022 | |||||||||||||||

| Number of Options | Weighted Average Exercise Price | Number of Options | Weighted Average Exercise Price | |||||||||||||

| Options outstanding at the beginning of period: | $ | $ | ||||||||||||||

| Changes during the period: | ||||||||||||||||

| Granted | $ | $ | ||||||||||||||

| Exercised | $ | $ | ||||||||||||||

| Forfeited | ( | ) | $ | ( | ) | $ | ||||||||||

| Options outstanding at the end of the period | $ | $ | ||||||||||||||

| Options exercisable at the end of the period | $ | $ | ||||||||||||||

| Warrants Outstanding | Average Exercise Price | Remaining Contractual Life | ||||||||||

| Balance, December 31, 2022 | $ | |||||||||||

| Granted | $ | |||||||||||

| Repurchase | ( | ) | $ | |||||||||

| Exercised | ( | ) | $ | |||||||||

| Balance, June 30, 2023 | $ | |||||||||||

The Company is required to assume a dividend yield as an input in the Black-Scholes model. The dividend yield assumption is based on the Company’s historical experience and expectation of future dividends payouts and may be subject to change in the future.

The Company uses historical volatility in accordance with FASB ASC Topic 718, “Compensation - stock compensation”. The computation of volatility uses historical volatility derived from the Company’s exchange-traded shares.

16

TINGO GROUP, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, except Share and Par Value Data)

D. Stock Option Plan - (continued):

The risk-free interest assumption is the implied yield currently available on U.S. Treasury zero-coupon bonds, issued with a remaining term equal to the expected life term of the Company’s options.

Pre-vesting rates forfeitures were zero based on pre-vesting forfeiture experience.

The

fair value of each option granted is estimated on the date of grant, using the Black-Scholes option-pricing model with the following

weighted average assumptions: dividend yield of

The Company uses the simplified method to compute the expected option term for options granted. Compensation expenses in respect of our stock option plans were recorded by the Company in line “General and administrative” expenses in the statements of operations.

On February 2, 2023, the Company entered into settlement and repurchase

agreements (the “Repurchase Agreements”) with certain holders of the outstanding warrants over its Common Stock (“Warrant

Holders”). The warrants being repurchased were originally issued by the Company between November 2020 and March 2021 pursuant to

three offerings of Common Stock and warrants. The exercise prices of the warrants were $

Pursuant to the Repurchase

Agreements, the Company paid $

E. Issuance of Shares:

On February 5, 2023, The Company

granted

On February 5, 2023, The Company

granted

On February 5, 2023, The Company

granted

On February 5, 2023, The Company granted

On February 5, 2023, the Company’s Board unanimously approved

a grant of

On March 6, 2023, The Company

granted

On May 12, 2023, The Company

granted

On May 12, 2023, The Company

granted

17

TINGO GROUP, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, except Share and Par Value Data)

E. Issuance of Shares - (continued):

On June 23, 2023, The Company

issued

Compensation expenses in respect of shares issued to service providers and employees were recorded by the Company in line “General and administrative” expenses in the statements of operations.

On July 27, 2023, the Company issued

On July 27, 2023, the Company issued 13,167,641 shares of Common Stock which are held in escrow with the Supreme Court of the State of New York pursuant to the Order. On July 19, 2023, the Company filed a motion to vacate the Order. If the motion to vacate is granted and no judgment has been entered against the Company, the Order Shares will be returned to the Company (for further information see Note 11).

On July 31, 2023, the Company

issued

On August 1, 2023, The Company

granted

NOTE 7 — SEGMENTS

ASC 280, “Segment Reporting”, establishes standards for reporting information about operating segments on a basis consistent with the Company’s internal organizational structure as well as information about geographical areas, operating segments and major customers in financial statements for detailing the Company’s operating segments.

Operating segments are based upon our internal organization structure, the manner in which our operations are managed and the availability of separate financial information. As a result of our acquisition of GFHI on July 1, 2020, and Tingo Mobile on December 1, 2022, we currently serve the marketplace, through our operating subsidiaries, as a financial technology company (Fintech Industry) targeting the African, Middle Eastern and South East Asia marketplaces as well as other areas of the world.

During the period between June 23, 2020 and May 9, 2021, we have held a controlling interest in Micronet Ltd. (“Micronet”), and we have presented our mobile resource management (“MRM”) business operated by Micronet as a separate operating segment. As of May 9, 2021, the Company’s ownership interest was diluted and, as a result, we deconsolidated Micronet.

As of June 30, 2023, the Company has five segments. This change came with the acquisition of Tingo Foods on February 9, 2023. The Company changed its reporting structure to better reflect what the chief operating decision maker (“CODM”) is reviewing to make organizational decisions and resource allocations. Following the loss of control over Micronet, MRM is no longer a separate operating segment or reportable segment since the CODM does not review discrete financial information for the business. The Company recast the information as of June 30, 2023 to align with this presentation.

The activities of each of our reportable segments from which the Company earns revenues, records equity earnings or losses and incurs expenses are described below:

| ● | Verticals and Technology segment develops insurance platform for the Chinese market and have been generating revenues from insurance products in China. |

| ● | Comprehensive Platform Service segment develops Nwassa agri-fintech marketplace platform, which enables customers in Nigeria to trade agricultural produce with customers, as well as to purchase farming inputs, to recharge airtime and data, to pay bills and utilities, to arrange insurance and to procure finance. |

18

TINGO GROUP, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, except Share and Par Value Data)

| ● | Online Stock Trading segment develops technology investment trading platform that is currently operational in Hong Kong and Singapore. |

| ● | Food Processing segment, which purchases crops and raw foods, before processing them into finished food products through arrangements with third party rice mills, cashew processing plants, and other food processing companies, to be sold to large food distributor and wholesaler companies (Tingo Foods was purchased by the Company in February 2023) |

| ● | Export and Commodity Trading, where both agricultural commodities and processed foods are exported and traded on a global basis through Tingo DMCC, which operates DMCC. |

| For the six months ended June 30, 2023 | ||||||||||||||||||||||||||||

| (USD in thousands) | Verticals and Technology (1) | Online Stock Trading (4) | Corporate and others (2) | Comprehensive Platform Service (3) | Export and Commodity Trading | Food Processing (5) | Consolidated | |||||||||||||||||||||

| Revenues from external customers | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

| Segment operating Income (loss) | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||

| Other income (loss), net | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||

| Financial income (expenses), net | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||||||||

| Consolidated profit before provision for income taxes | $ | |||||||||||||||||||||||||||

| (1) | |

| (2) |

| (3) |

| (4) |

| (5) |

| For the three months ended June 30, 2023 | ||||||||||||||||||||||||||||

| (USD in thousands) | Verticals and Technology (1) | Online Stock Trading (2) | Corporate and others (4) | Comprehensive Platform Service (3) | Export and Commodity Trading | Food Processing (5) | Consolidated | |||||||||||||||||||||

| Revenues from external customers | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

Segment operating Income (loss) | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||

| Other income (loss), net | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||

| Financial income (expenses), net | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||||||||

| Consolidated profit before provision for income taxes | $ | |||||||||||||||||||||||||||

| (1) |

19

TINGO GROUP, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, except Share and Par Value Data)

| (2) | |

| (3) |

| (4) |

| (5) |

| For the six months ended June 30, 2022 | ||||||||||||||||||||||||||||

| (USD in thousands) | Verticals and Technology (1) | Online Stock Trading | Corporate and others (2) | Comprehensive Platform Service | Export and Commodity Trading | Food Processing | Consolidated | |||||||||||||||||||||

| Revenues from external customers | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

| Segment operating loss | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||

| Other income (loss), net | ( | ) | ||||||||||||||||||||||||||

| Financial income (expenses), net | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||

| Consolidated loss before provision for income taxes | $ | ( | ) | |||||||||||||||||||||||||

| (1) | |

| (2) |

For the three months ended June 30, 2022 | ||||||||||||||||||||||||||||

| (USD in thousands) | Verticals and Technology (1) | Online Stock Trading | Corporate and others (2) | Comprehensive Platform Service | Export and Commodity Trading | Food Processing | Consolidated | |||||||||||||||||||||

| Revenues from external customers | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

| Segment operating loss | ) | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||

| Other income, net | ||||||||||||||||||||||||||||

| Financial income (expenses), net | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||

| Consolidated loss before provision for income taxes | $ | ( | ) | |||||||||||||||||||||||||

| (1) | |

| (2) |

20

TINGO GROUP, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, except Share and Par Value Data)

| As of June 30, 2023 | ||||||||||||||||||||||||||||

| (USD in thousands) | Verticals and technology | Online stock trading | Comprehensive platform service (1) | Food processing (2) | Corporate and others | Export and Commodity Trading | Consolidated | |||||||||||||||||||||

| Assets related to segments | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

| Liabilities and redeemable Series B Preferred Stock related to segments | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||||

| Total equity | $ | |||||||||||||||||||||||||||

| (1) |

| Includes $ |

| (2) |

| Includes $ |

The following table summarizes the financial statements of our balance sheet accounts of the segments:

| As of December 31, 2022 | ||||||||||||||||||||

| (USD in thousands) | Verticals and technology (1) | Online stock trading (2) | Comprehensive platform service (3) | Corporate and others | Consolidated | |||||||||||||||

| Assets related to segments | $ | $ | $ | $ | $ | |||||||||||||||

| Liabilities and Series B Preferred Stock related to segments | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||

| Total equity | $ | |||||||||||||||||||

| (1) |

| Includes $ |

21

TINGO GROUP, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, except Share and Par Value Data)

| (2) |

| (3) |

| Includes $ |

NOTE 8 — TRADE ACCOUNTS RECEIVABLE, NET

For the six months ended June 30, 2023, and the fiscal year ended December 31, 2022, accounts receivable were comprised of the following:

| June 30, | December 31, | |||||||

| (USD in thousands) | 2023 | 2022 | ||||||

| Trade accounts receivable | $ | $ | ||||||

| Allowance for doubtful accounts | ( | ) | ( | ) | ||||

| $ | $ | |||||||

Movement of allowance for doubtful accounts for the six months ended June 30, 2023 and the fiscal year ended December 31, 2022 are as follows:

| (USD in thousands) | June 30, 2023 | December 31, 2022 | ||||||

| Beginning balance | $ | $ | ||||||

| Provision | ||||||||

| Recovery | ( | ) | - | |||||

| Exchange rate fluctuation | ( | ) | ( | ) | ||||

| $ | $ | |||||||

NOTE 9 — OTHER CURRENT ASSETS

| June 30, | December 31, | |||||||

| 2023 | 2022 | |||||||

| Prepaid expenses | $ | $ | ||||||

| Advance to suppliers | ||||||||

| Deposit | ||||||||

| Other receivables | ||||||||

| $ | $ | |||||||

NOTE 10 — RELATED PARTIES

| June 30, | December 31, | |||||||

| (USD in thousands) | 2023 | 2022 | ||||||

| Shareholders and other related parties of All Weather | $ | $ | ||||||

| Beijing Fucheng Lianbao Technology Co. | ||||||||

| Loan to Tingo Inc.(1) | ||||||||

| Beijing Fucheng Prospect Technology Co., Ltd. | ||||||||

| Shareholders and other related parties of Guangxi Zhongtong | ||||||||

| $ | $ | |||||||

| (1) |

22

TINGO GROUP, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, except Share and Par Value Data)

| June 30, | December 31, | |||||||

| (USD in thousands) | 2023 | 2022 | ||||||

| Beijing Century Tianyuan Business Management Co., LTD | $ | $ | ||||||

| Beijing Global Credit Financial Analysis Technology Co., LTD | ||||||||

| Beijing Internet New Network Technology Development Co. LTD | ||||||||

| Shareholders and other related parties of All Weather | ||||||||

| Shareholders of Tingo Mobile | ||||||||

| $ | $ | |||||||

NOTE 11 — COMMITMENT AND CONTINGENCIES

We

have certain fixed contractual obligations and commitments that include future estimated payments. Changes in our business needs, cancellation

provisions, and other factors may result in actual payments differing from the estimates.

| (USD in thousands) | Total | Less than 1 year |

1-3 year | 3-5 year | 5+ year | |||||||||||||||

| Contractual Obligation: | ||||||||||||||||||||

| Office leases commitment | $ | $ | $ | $ | $ | |||||||||||||||

| Short-term debt obligations Commitment | $ | $ | $ | - | $ | $ | ||||||||||||||

| Services Contract Commitment | $ | $ | $ | $ | $ | |||||||||||||||

| Total | $ | $ | $ | $ | $ | |||||||||||||||

Legal Proceedings

The Company is subject to litigation arising from time to time in the ordinary course of its business.

On April 18, 2023, Altium Growth Fund, L.P., Alto Opportunity Master

Fund, SPC – Segregated Master Portfolio B, Empery Asset Master Ltd., Empery Tax Efficient, L.P., and Empery Tax Efficient III, L.P.

(collectively “Investors”) filed a Motion for Summary Judgment in Lieu of Complaint (“Motion”) against the Company

in the Supreme Court of the State of New York, requesting that the Court order the Company to purchase certain warrants from the Investors

at the Black Scholes Value of $

On June 8, 2023, two putative class action complaints were filed in the United States District Court for the District of New Jersey against the Company, Dozy Mmobuosi, Darren Mercer, and Kevin Chen. The first complaint was filed by Christopher Arbour, individually and on behalf of a class of “persons or entities that purchased or otherwise acquired Tingo securities between March 31, 2023, and June 6, 2023.” The second was filed the same day by Mark Bloedor, individually and on behalf of a class of “all investors who purchased or otherwise acquired Common Stock between December 1, 2022, and June 6, 2023.” Both complaints are based entirely on the allegations in the Hindenburg short seller report issued on June 6, 2023, following which the Company’s stock price declined by nearly 50 percent. Relying solely on the allegations in the Hindenburg report, both complaints allege defendants violated Section 10(b) of the Securities Exchange Act of 1934, as amended (the “Securities Exchange Act”) and Rule 10b-5 promulgated thereunder, and the individual defendants violated Section 20A of the Securities Exchange Act. The Company and individual defendants deny the allegations in the complaints and intend to vigorously defend the actions. Following the publication of the Hindenburg report, the Company’s independent directors retained independent counsel to conduct an investigation of the Hindenburg allegations.

The Group has not recognized a liability in respect of the Motion and complaints because management does not believe that the Group has incurred a probable material loss by reason of any of this matter.

23

TINGO GROUP, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, except Share and Par Value Data)

NOTE 12 — OPERATING LEASES

The

Company follows ASC No. 842, Leases. The Company has operating leases for its office facilities. The Company’s leases have remaining

terms of approximately

Lessee

The following table provides a summary of leases by balance sheet location:

| Assets/liabilities | June 30, | December 31, | ||||||

| (USD in thousands) | 2023 | 2022 | ||||||

| Assets | ||||||||

| Right-of-use assets | $ | $ | ||||||

| Liabilities | ||||||||

| Lease liabilities- current portion | $ | $ | ||||||

| Lease liabilities- long term | ||||||||

| Total Lease liabilities | $ | $ | ||||||

The operating lease expenses were as follows:

| For the six months ended June 30, | For the three months ended June 30, | |||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Operating lease cost | $ | $ | $ | $ | ||||||||||||

Maturities of operating lease liabilities were as follows:

| (USD in thousands) | Year ended December 31, |

||||

| 2023* | $ | ||||

| 2024 | |||||

| 2025 | |||||

| 2026 | |||||

| 2027 | |||||

| Thereafter | |||||

| Total lease payment | |||||

| Less: imputed interest | ( |

) | |||

| Total lease liabilities | $ | ||||

| * |

| Lease term and discount rate | June 30, 2023 | |||

| Weighted-average remaining lease term (years) – operating leases | ||||

| Weighted average discount rate – operating leases | % | |||

Lessor

The Company leases mobile phones that classified as operating leases. The following table summarizes the components of operating lease revenue recognized during the three and six months ended June 30, 2023:

| For the six months ended June 30, | For the three months ended June 30, | |||||||

| Lease revenue | 2023 | 2023 | ||||||

| Fixed contractual payments | $ | $ | ||||||

24

TINGO GROUP, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, except Share and Par Value Data)

Future fixed contractual lease payments to be received under non-cancelable operating leases in effect as of June 30, 2023, assuming no new or renegotiated leases or option extensions on lease agreements are executed, are as follows (dollars in thousands):

| Years Ending December 31, | Future lease payments due |

|||

| 2023 | $ | |||

| 2024 | ||||

| 2025 | ||||

| 2026 | ||||

| 2027 | ||||

| Thereafter | ||||

NOTE 13 — PROVISION FOR INCOME TAXES

A. Basis of Taxation

United States:

On

December 22, 2017, the U.S. Tax Cuts and Jobs Act, or the Act, was enacted, which significantly changed U.S. tax laws. The Act lowered

the tax rate of the Company. The statutory federal income tax rate was

Israel:

The

Company’s Israeli subsidiaries and associated are governed by the tax laws of the state of Israel which had a general tax rate

of

Mainland China:

The Company’s Chinese subsidiaries in China are subject to the

PRC Corporate Income Tax Law (“CIT Law”) and are taxed at the statutory income tax rate of

Hong Kong:

Our

subsidiaries incorporated in Hong Kong, such as Magpie Securities Limited, BI Intermediate Limited, are subject to Hong Kong profit tax

on their profits arising from their business operations carried out in Hong Kong.

As

of June 30, 2023, the tax loss carry forward was $

Singapore:

Our

subsidiaries incorporated in Singapore are subject to an income tax rate of

As

of June 30, 2023, the operating loss carry forward was $

Subject

to qualifying conditions, trade losses can be carried forward indefinitely while unutilized donations can be carried forward

for up to

25

TINGO GROUP, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, except Share and Par Value Data)

Australia:

Our

subsidiaries incorporated in Australia are subject to an income tax rate of

As

of June 30, 2023, the operating loss carry forward was $

Nigeria:

The Company’s Nigerian subsidiaries Tingo Mobile and Tingo Foods

is governed by the tax laws of the Federal Republic of Nigeria which had a corporate tax rate of

Dubai:

The Company operates from the Dubai

Multi Commodity Centre. Tingo DMCC is subject to a corporate tax rate of

B. Profit (Loss) Before Income Taxes

| For the six months ended June 30, | For the three months ended June 30, | |||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Domestic | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||

| Foreign | ( | ) | ( | ) | ||||||||||||

| Total | $ | $ | ( | ) | $ | $ | ( | ) | ||||||||

C. Provision for (Benefit of) Income Taxes

| For the six months ended June 30, | For the three months ended June 30, | |||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Current | ||||||||||||||||

| Domestic | $ | $ | $ | $ | ||||||||||||

| Foreign | ||||||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||

| Deferred | ||||||||||||||||

| Domestic | $ | $ | $ | $ | ||||||||||||

| Foreign | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Total | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||

| Total Income tax expenses (benefit) | $ | $ | ( | ) | $ | $ | ( | ) | ||||||||

26

TINGO GROUP, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, except Share and Par Value Data)

D. Deferred Tax Assets and Liabilities

Deferred tax reflects the net tax effects

of temporary differences between the carrying amounts of assets or liabilities for financial reporting purposes and the amounts used for

income tax purposes.

| June 30, | December 31, | |||||||

| (USD in thousands) | 2023 | 2022 | ||||||

| Deferred tax assets | ||||||||

| Provisions for employee rights and other temporary differences | $ | $ | ||||||

| Provisions for bad debt | ||||||||

| Net operating loss carry forward | ||||||||

| Valuation allowance | ( | ) | ( | ) | ||||

| Deferred tax assets, net of valuation allowance | ||||||||

| Deferred tax liabilities | ||||||||

| Recognition of intangible assets arising from business combinations | ( | ) | ( | ) | ||||

| Deferred tax assets (liabilities), net | $ | ( | ) | $ | ( | ) | ||

NOTE 14 — IMPAIRMENT OF INTANGIBLE ASSETS

During the second quarter of 2023, the Company's management decided to forsake its involvement with All Weather and as a result, the Company is no longer consolidating All Weather. We conducted forecasting and strategic reviews and integration assessments of our Verticals and Technology segment, and with performance below expectations since acquisition, we revised internal financial projections of the business to reflect updated expectations of future financial performance. These reviews and the subsequent revisions in the projections highlighted challenges for the Verticals and Technology segment as a result of performance below expectations due to the impact of modified consumer shopping behavior in the post-COVID-19 period.

Also, on July 12, 2023, the Company made a business decision to close its online stock trading business in Hong Kong and Singapore having considered the level of losses being incurred, the ongoing challenges in the market sector, and the fact that the business is no longer core to the Company’s strategy following the acquisitions of Tingo Mobile and Tingo Foods. The Company will however continue to explore opportunities to monetize the proprietary online stock trading technology and products it has developed.

Continuing losses associated with the use of a long-lived assets were considered triggering events requiring interim impairment assessments to be performed relative to the intangible assets that had been recorded as part of these acquisitions in accordance with ASC 360-10 and ASC 350-10 which require the viewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The Company's evaluation of recoverability is performed at the lowest level of assets group to which identifiable cash flows are largely independent of the cash flows of another asset group. Recoverability of the asset group (the Verticals and Technology segment and the Online Stock Trading segment) is measured by a comparison of the aggregate undiscounted future cash flows the asset group is expected to generate to the carrying amounts of the asset group. If such evaluation indicates that the carrying amount of the asset group is not recoverable, an impairment loss is calculated based on the excess of the carrying amount of the asset group over its fair value.

The intangible assets that are subject to impairment testing were recorded

as part of the intangible assets segments and included indefinite-lived and finite-lived trade name/ trademarks, licenses and finite-lived

developed technology and customer relationships. As a result of the interim impairment assessments, we recognized impairment charges for

the excess of the book value over the fair value of those intangible assets in amount of $

This testing involves estimates and significant judgments by management. We believe our estimates and assumptions used in the valuations are reasonable and appropriate to those that would be used by other market participants; however, additional adverse changes in key assumptions and actual unanticipated events and circumstances could differ substantially from those used in the valuation, and to the extent such factors result in a failure to achieve the projected cash flows used to estimate fair value, additional impairment charges could be required in the future. Therefore, although we have recorded the said impairment charges, we cannot guarantee that we will not experience asset impairments in the future.

27

TINGO GROUP, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, except Share and Par Value Data)

NOTE 15 — GOODWILL

| For the six months ended June 30, 2023 | ||||||||||||||||||||||||

| (USD in thousands) | Verticals and Technology | Food Processing | Comprehensive Platform Service | Corporate and others | Online Stock Trading | Consolidated | ||||||||||||||||||

| Balance as of January 1, 2023 | $ | $ | $ | $ | $ | - | $ | |||||||||||||||||

| Impairment loss | ||||||||||||||||||||||||

| Acquisitions in 2023 | ||||||||||||||||||||||||

| Impairment of goodwill | ( | ) | ( | ) | ||||||||||||||||||||

| Adjustments to purchase price allocations | ||||||||||||||||||||||||

| Balance as of June 30, 2023 | $ | $ | $ | $ | $ | $ | ||||||||||||||||||

| For the year ended December 31, 2022 | ||||||||||||||||||||||||

| (USD in thousands) | Verticals and Technology | Food Processing | Comprehensive Platform Service | Corporate and others | Online Stock Trading | Consolidated | ||||||||||||||||||

| Balance as of January 1, 2022 | $ | $ | $ | $ | $ | $ | ||||||||||||||||||

| Impairment loss | ||||||||||||||||||||||||

| Acquisitions in 2022 | ||||||||||||||||||||||||

| Balance as of December 31, 2022 | $ | $ | $ | $ | $ | $ | ||||||||||||||||||

ASC 350-20 “Intangibles-Goodwill and Other” requires to test goodwill (after its allocation to the company's reporting units) for impairment at least annually, or more frequently if events or changes in circumstances indicate that goodwill may be impaired. As a result of the circumstances described in Note 14 the company decided to perform impairment test for the reporting unit to which the goodwill belongs (the Verticals and Technology segment) as of June 30, 2023.

The goodwill impairment test is performed according to the following principles:

| 1. | An initial qualitative assessment may be performed to determine whether it is more likely than not that the fair value of the reporting unit is less than it is carrying amount. |

| 2. | If the Company concludes it is more likely than not (more than 50 percent likelihood) that the fair value of the reporting unit is less than it is carrying amount, a quantitative fair value test is performed. An impairment loss is recognized to the extent that the carrying amount of a reporting unit exceeds its fair value, but not exceeding the total amount of goodwill allocated to that reporting unit. |

The Company carried out a qualitative assessment which included various factors such as macroeconomic conditions, industry and market considerations, cost factors, overall financial performance, earnings multiples, gross margin and cash flows from operating activities and other relevant factors. The circumstances mentioned above led management to believe that it is more likely than not that the fair value of the reporting unit is less than its carrying value. As a result, the fair value had to be determined as part of the quantitative assessment.

The fair value of the reporting unit was estimated in accordance with ASC 820, "Fair Value Measurements”. The Company applies assumptions that marketplace participants would consider in determining the fair value of its reporting unit. The process of evaluating the potential impairment of goodwill is subjective and requires significant judgment. Significant estimates used in the fair value methodologies include estimates of future cash flows, future short-term and long-term growth rates, and weighted average cost of capital.

As a result of this testing, we recorded an $

NOTE 16 — SUBSEQUENT EVENTS

On July 12, 2023, the Company made a business decision to close its online stock trading business in Hong Kong and Singapore having considered the level of losses being incurred, the ongoing challenges in the market sector, and the fact that the business is no longer core to the Company’s strategy following the acquisitions of Tingo Mobile and Tingo Foods. The Company will however continue to explore opportunities to monetize the proprietary online stock trading technology and products it has developed.

On July 27, 2023, the Company

issued

On July 27, 2023, the Company issued

28

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

This Quarterly Report on Form 10-Q (the “Quarterly Report”) contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other Federal securities laws and is subject to the safe-harbor created by such Act and laws. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or “continue,” the negative of such terms, or other variations thereon or comparable terminology. The statements herein and their implications are merely predictions and therefore inherently subject to known and unknown risks, uncertainties, assumptions, and other factors that may cause actual results to be materially different from those contemplated by the forward-looking statements. Such factors include, but are not limited to changes in economic conditions, government regulations, contract requirements and abilities, competitive pressures and constantly changing technology and market acceptance of our products and services and other risks and uncertainties discussed in this quarterly Form 10-Q report. Such forward-looking statements appear in this Item 2 – “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and may appear elsewhere in this Quarterly Report and include, but are not limited to, statements regarding the following:

| ● | our financing needs and strategies, and our ability to continue to raise capital in the future; |

| ● | our corporate development objectives; |

| ● | our financial position and the value of and market for our Common Stock; |

| ● | use of proceeds from any future financing, if any; and |

| ● | the sufficiency of our capital resources. |

Our business is subject to substantial risks, which increase the uncertainty inherent in the forward-looking statements contained or implied in this report. Except as required by law, we assume no obligation to update these forward-looking statements to reflect actual results or changes in factors or assumptions affecting such forward-looking statements. Further information on potential factors that could affect our business is described in our filing with the U.S. Securities and Exchange Commission (the “SEC”) and the risk factors included in Part II, Item IA below. Readers are also urged to carefully review and consider the various disclosures we have made below and in that report. The following discussion and analysis should be read in conjunction with the Unaudited Consolidated Financial Statements and related notes (the “Financial Statements”) included elsewhere in this Quarterly Report.

29

Overview

Tingo Group, Inc. is a holding company conducting financial technology business, Agri-fintech and food business through our subsidiaries and entities, both wholly owned and controlled through VIE entities, which are located mainly in Africa, Southeast Asia and the Middle East.

As of June 30, 2023, we operate in five segments and following the recent launch of a beta version of TingoPay we are adding a sixth segment: (i) verticals and technology, comprised of our operations in China where we operate our insurance brokerage business (“Verticals and Technology”); (ii) online stock trading, primarily comprised of the operation of Magpie Securities Limited (“Magpie”) through which we operate the online stock trading business, primarily out of Hong Kong and Singapore (“Online Stock Trading"); (iii) comprehensive platform service which includes the operations of Tingo Mobile Limited (“Tingo Mobile”) described below (“Comprehensive Platform Service”); (iv) food processing, where crops and raw foods are processed into finished products, through Tingo Foods PLC (“Tingo Foods”) (purchased by the Company in February 2023) (“Food Processing”); (v) export and commodity trading, where both agricultural commodities and processed foods are exported and traded on a global basis through Tingo DMCC (as defined below), which operates from the Dubai Multi Commodity Centre (the “DMCC”) (“Export and Commodity Trading”); and (vi) Consumer Super App, digital payment services and merchant services, which in partnership with Visa operates the TingoPay Super App (currently in a beta version), offering retail customers a range of services, including but not limited to online payments in their domestic or foreign currencies, as well as the ability to manage their Visa cards, pay bills, arrange insurance, arrange loans and purchase mobile telephone top-ups. TingoPay also offers businesses a range of Visa powered merchant services.

The Company recently decided to exit its operations of one of its VIEs, All Weather, which operates an insurance platform business in the Verticals and Technology segment. The Company is currently reconsidering its focus areas and subsequent to the balance sheet date made the decision to cease the operations of Magpie.

Acquisition of Tingo Mobile

Our business has changed significantly since December 1, 2022, following the completion of the acquisition of Tingo Mobile. We also consummated the significant Acquisition of Tingo Foods on February 9, 2023.

Tingo Mobile is a leading Agri-Fintech company in Africa, with a comprehensive portfolio of innovative products, including a “device as a service” smartphone and pre-loaded platform product.