UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

(Exact name of Registrant as specified in its Charter)

| (State or other jurisdiction of incorporation) |

(Commission File No.) | (IRS Employer Identification Number) |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including

area code: (

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure.

Set forth below is presentation material of Great Southern Bancorp, Inc., the holding company for Great Southern Bank.

JUNE 2021

Forward - Looking Statements When used in this presentation and in other documents filed or furnished by Great Southern Bancorp, Inc. (the “Company”) with th e SEC, in the Company's press releases or other public or stockholder communications, and in oral statements made with the approval of an authorized executive officer, th e words or phrases “may,” “might,” “could,” “should,” "will likely result," "are expected to," "will continue," "is anticipated," “believe,” "estimate," "project," "inte nds " or similar expressions are intended to identify "forward - looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward - looking stateme nts also include, but are not limited to, statements regarding plans, objectives, expectations or consequences of announced transactions, known trends and statements a bou t future performance, operations, products and services of the Company. The Company’s ability to predict results or the actual effects of future plans or strat egi es is inherently uncertain, and the Company’s actual results could differ materially from those contained in the forward - looking statements. The novel coronavirus disease, or COVID - 19, pandemic is adversely affecting the Company, its customers, counterparties, employees, and third - party service providers, and the ultimate extent of the impacts on the Company’s business, financial position, results of operations, liquidity, and prospects is uncertain. Continued deterioration in general business and economic condit ion s, including further increases in unemployment rates, or turbulence in domestic or global financial markets could adversely affect the Company’s revenues and the values of its assets and liabilities, reduce the availability of funding, lead to a tightening of credit, and further increase stock price volatility. In addition, changes to statutes, regul ati ons, or regulatory policies or practices as a result of, or in response to, COVID - 19, could affect the Company in substantial and unpredictable ways. Other factors that could cause or contribute to such differences include, but are not limited to: ( i ) expected revenues, cost savings, earnings accretion, synergies and other benefits from the Company's merger and acquisition activities might not be realized within the anticipated time frames or at al l, and costs or difficulties relating to integration matters, including but not limited to customer and employee retention, might be greater than expected; (ii) changes in econom ic conditions, either nationally or in the Company's market areas; (iii) fluctuations in interest rates; (iv) the risks of lending and investing activities, including c han ges in the level and direction of loan delinquencies and write - offs and changes in estimates of the adequacy of the allowance for credit losses; (v) the possibility of other - than - tempor ary impairments of securities held in the Company's securities portfolio; (vi) the Company's ability to access cost - effective funding; (vii) fluctuations in real estate v alues and both residential and commercial real estate market conditions; (viii) the ability to adapt successfully to technological changes to meet customers' needs and development s i n the marketplace; (ix) the possibility that security measures implemented might not be sufficient to mitigate the risk of a cyber - attack or cyber theft, and that such secur ity measures might not protect against systems failures or interruptions; (x) legislative or regulatory changes that adversely affect the Company's business, including, wit hou t limitation, the Dodd - Frank Wall Street Reform and Consumer Protection Act of 2010 and its implementing regulations, the overdraft protection regulations and customers' respons es thereto and the Tax Cut and Jobs Act; (xi) changes in accounting policies and practices or accounting standards; (xii) monetary and fiscal policies of the Federal Reser ve Board and the U.S. Government and other governmental initiatives affecting the financial services industry; (xiii) results of examinations of the Company and Great S out hern Bank by their regulators, including the possibility that the regulators may, among other things, require the Company to limit its business activities, change its bus ine ss mix, increase its allowance for credit losses, write - down assets or increase its capital levels, or affect its ability to borrow funds or maintain or increase deposits, which could adversely affect its liquidity and earnings; (xiv) costs and effects of litigation, including settlements and judgments; (xv) competition; (xvi) uncertainty regarding the futur e o f LIBOR; and (xvii) natural disasters, war, terrorist activities or civil unrest and their effects on economic and business environments in which the Company operates. The Company wi shes to advise readers that the factors listed above and other risks described from time to time in documents filed or furnished by the Company with the SEC could affect th e C ompany's financial performance and could cause the Company's actual results for future periods to differ materially from any opinions or statements expressed with res pec t to future periods in any current statements. The Company does not undertake - and specifically declines any obligation - to publicly release the result of any revisions which m ay be made to any forward - looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticip ate d events. 2

Great Southern Bancorp, Inc. x Focused on long - term growth and profitability with a 98 - year history x Exceptional credit quality x Well capitalized, diversified loan portfolio and strong core deposit base x Strong core operating earnings power x Diverse retail banking franchise x Experienced management team working through economic cycles x High percentage of insider ownership of 24% aligns interests with stakeholders 3 A Long - term View

4 $0.34 $0.00 $0.05 $0.10 $0.15 $0.20 $0.25 $0.30 $0.35 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Q1 Q2 Q3 Q4 Regular Quarterly Cash Dividends Declared on Common Stock A Long - term View Special Cash Dividends Declared on Common Stock January 2019 – $0.75 per common share January 2020 – $1.00 per common share

5 Recent Accolades

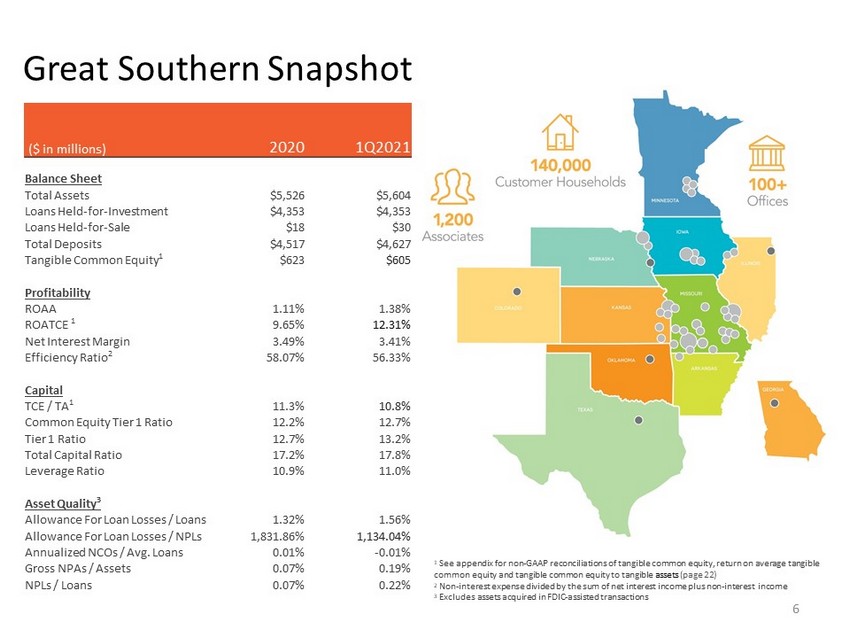

Great Southern Snapshot ($ in millions) 2020 1Q2021 Balance Sheet Total Assets $5,526 $5,604 Loans Held - for - Investment $4,353 $4,353 Loans Held - for - Sale $18 $30 Total Deposits $4,517 $4,627 Tangible Common Equity 1 $623 $605 Profitability ROAA 1.11% 1.38% ROATCE 1 9.65% 12.31% Net Interest Margin 3.49% 3.41% Efficiency Ratio 2 58.07% 56.33% Capital TCE / TA 1 11.3% 10.8% Common Equity Tier 1 Ratio 12.2% 12.7% Tier 1 Ratio 12.7% 13.2% Total Capital Ratio 17.2% 17.8% Leverage Ratio 10.9% 11.0% Asset Quality 3 Allowance For Loan Losses / Loans 1.32% 1.56% Allowance For Loan Losses / NPLs 1,831.86% 1,134.04% Annualized NCOs / Avg. Loans 0.01% - 0.01% Gross NPAs / Assets 0.07% 0.19% NPLs / Loans 0.07% 0.22% 1 See appendix for non - GAAP reconciliations of tangible common equity, return on average tangible common equity and tangible common equity to tangible assets (page 22) 2 Non - interest expense divided by the sum of net interest income plus non - interest income 3 Excludes assets acquired in FDIC - assisted transactions 6

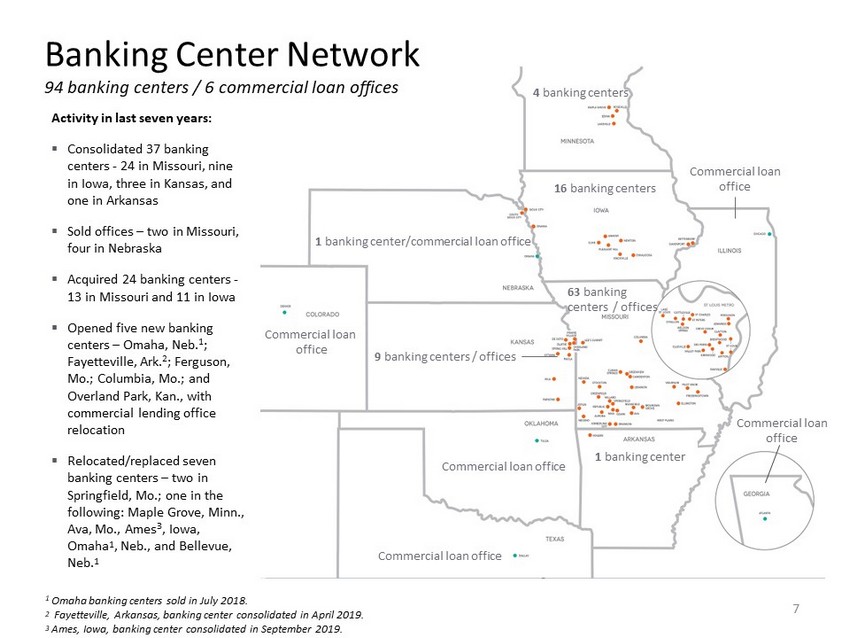

Banking Center Network 94 banking centers / 6 commercial loan offices Activity in last seven years: ▪ Consolidated 37 banking centers - 24 in Missouri, nine in Iowa, three in Kansas, and one in Arkansas ▪ Sold offices – two in Missouri, four in Nebraska ▪ Acquired 24 banking centers - 13 in Missouri and 11 in Iowa ▪ Opened five new banking centers – Omaha, Neb. 1 ; Fayetteville, Ark. 2 ; Ferguson, Mo.; Columbia, Mo.; and Overland Park, Kan., with commercial lending office relocation ▪ Relocated/replaced seven banking centers – two in Springfield, Mo.; one in the following: Maple Grove, Minn., Ava, Mo., Ames 3 , Iowa, Omaha 1 , Neb., and Bellevue, Neb. 1 9 banking centers / offices 16 banking centers 4 banking centers 63 banking centers / offices 1 banking center/commercial loan office Commercial loan office Commercial loan office 1 banking center Commercial loan office 7 1 Omaha banking centers sold in July 2018. 2 Fayetteville, Arkansas, banking center consolidated in April 2019. 3 Ames, Iowa, banking center consolidated in September 2019. Commercial loan office Commercial loan office

Operating in Stable Midwest Markets April 2021 Preliminary Unemployment Rates, Seasonally Adjusted National Unemployment Rate: 6.1% 8 Source: US Bureau of Labor Statistics, last modified May 21, 2021 State Preliminary Unemployment Rate Branch Locations Stand Alone Commercial Lending Offices Nebraska 2.8 Yes - 1 Omaha Kansas 3.5 Yes - 9 Iowa 3.8 Yes - 16 Missouri 4.1 Yes - 63 Minnesota 4.1 Yes - 4 Oklahoma 4.3 Tulsa Georgia 4.3 Atlanta Arkansas 4.4 Yes - 1 Colorado 6.4 Denver Texas 6.7 Dallas Illinois 7.1 Chicago

Associates Customers Communities • Paid Time Off • Part - time associates – paid sick leave • Quarantine – full pay • Special Bonus – in April 2020 & August 2020 for all associates • Mental Health Support – enhanced Employee Assistance Program • Personal Protective Equipment – available to all onsite associates • Work from Home/Alternative Site - 28% of non - frontline associates • Employee Assistance Fund • On - site Vaccine Clinic – Springfield (most populous market) • No lay - offs/furloughs • Uninterrupted Service - normal hours through all access channels o Banking Centers o Online & Mobile Banking o ATMs/ITMs o Customer Service o Telephone Banking • Customer Hardships o Deposit account fee waivers and liberal refunds through August 31, 2020 o Loan payment relief options o CARES Act: Paycheck Protection Program • Total of All Rounds: 3,286 loans $187.4 million Average loan size: $57,000 • COVID - 19 Information o www.GreatSouthernBank.com o Email updates o Social media platforms o Fraud/scam prevention • $300 ,000 Philanthropic Initial Investment (Q1 2020) o $100,000 – food insecurity (Feeding America food banks) o $100,000 – health & human services needs (local United Way agencies) o $100,000 – local market needs o Additional contributions made throughout 2020 and 2021 • COVID - 19 Call Center – sponsorship with regional hospital • Social Media o Financial literacy resources o Fraud/scam prevention COVID - 19 Response 9

$4,551 $4,415 $4,676 $5,015 $5,526 $5,604 $3,000 $3,500 $4,000 $4,500 $5,000 $5,500 $6,000 $3,797 $3,763 $4,027 $4,194 $4,353 $4,353 $3,000 $3,500 $4,000 $4,500 $5,000 $3,677 $3,597 $3,725 $3,960 $4,517 $4,627 $3,000 $3,500 $4,000 $4,500 $5,000 Total Assets ($ in millions) Total Loans ($ in millions) Total Deposits ($ in millions) Track Record of Consistent Growth 10

11 Loan Production and Growth • Thus far in 2021, loan originations continue at a good pace in our markets. • A large portion of originations are construction loans, which are not fully funded at the time of origination. • In the final round of the Paycheck Protection Program (PPP) that began in January 2021, a total of $56.0 million of loans were originated. • Loan pay - offs continue to be a significant headwind in 2021. • In 2021 to date, PPP loan repayments totaled $90.9 million. • Net loan growth may be sporadic in different periods, due to economic and market conditions, and in 2021, may be significantly less than our historic long - term growth rate, due to repayments.

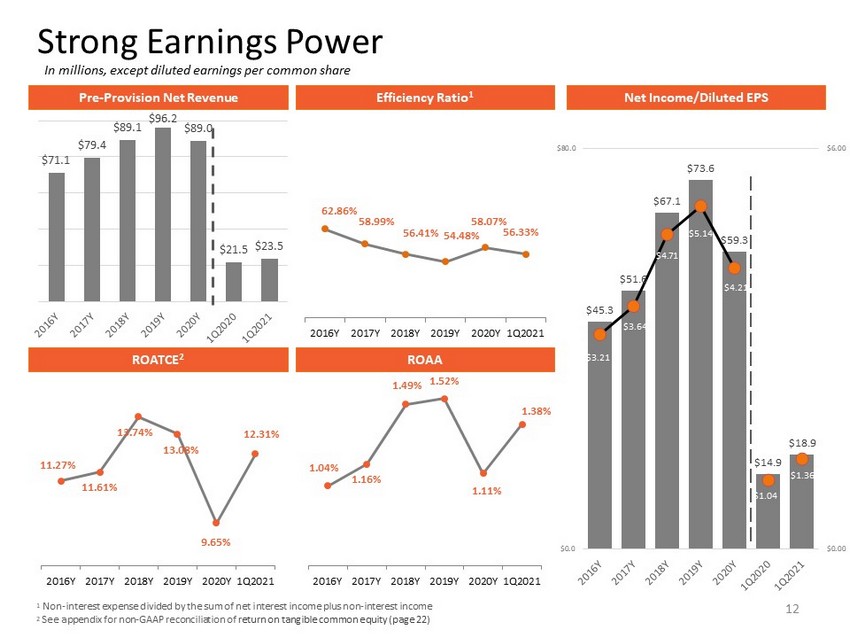

12 Strong Earnings Power Pre - Provision Net Revenue Efficiency Ratio 1 62.86% 58.99% 56.41% 54.48% 58.07% 56.33% 2016Y 2017Y 2018Y 2019Y 2020Y 1Q2021 ROATCE 2 ROAA 11.27% 11.61% 13.74% 13.08% 9.65% 12.31% 2016Y 2017Y 2018Y 2019Y 2020Y 1Q2021 1.04% 1.16% 1.49% 1.52% 1.11% 1.38% 2016Y 2017Y 2018Y 2019Y 2020Y 1Q2021 1 Non - interest expense divided by the sum of net interest income plus non - interest income 2 See appendix for non - GAAP reconciliation of return on tangible common equity (page 22) $71.1 $79.4 $89.1 $96.2 $89.0 $21.5 $23.5 Net Income/Diluted EPS $45.3 $51.6 $67.1 $73.6 $59.3 $14.9 $18.9 $3.21 $3.64 $4.71 $5.14 $4.21 $1.04 $1.36 $0.00 $6.00 $0.0 $80.0 In millions, except diluted earnings per common share

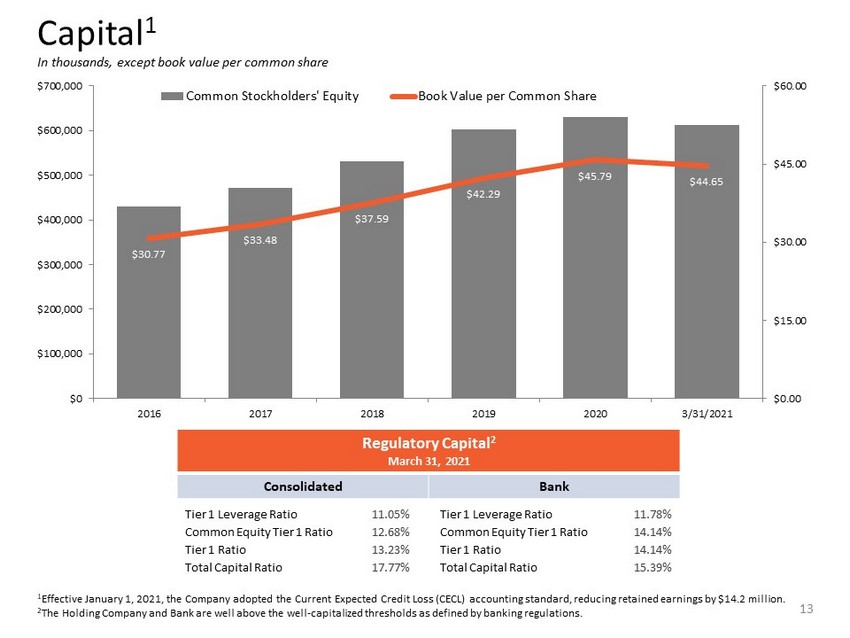

$30.77 $33.48 $37.59 $42.29 $45.79 $44.65 $0.00 $15.00 $30.00 $45.00 $60.00 $0 $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 2016 2017 2018 2019 2020 3/31/2021 Common Stockholders' Equity Book Value per Common Share 13 Capital 1 In thousands, except book value per common share Tier 1 Leverage Ratio 11.05% Common Equity Tier 1 Ratio 12.68% Tier 1 Ratio 13.23% Total Capital Ratio 17.77% Tier 1 Leverage Ratio 11.78% Common Equity Tier 1 Ratio 14.14% Tier 1 Ratio 14.14% Total Capital Ratio 15.39% 1 Effective January 1, 2021, the Company adopted the Current Expected Credit Loss (CECL) accounting standard, reducing retained ea rnings by $14.2 million. 2 The Holding Company and Bank are well above the well - capitalized thresholds as defined by banking regulations. Regulatory Capital 2 March 31, 2021 Consolidated Bank

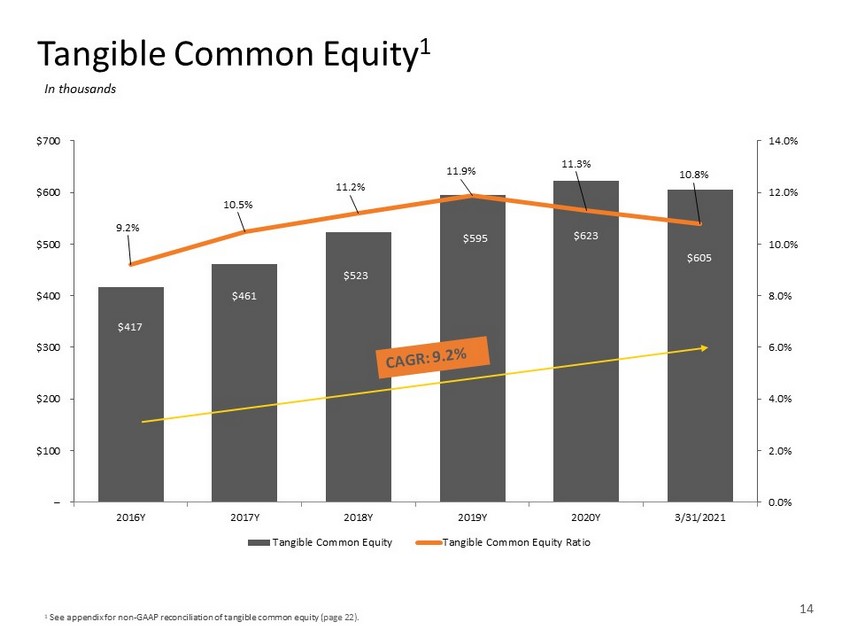

$417 $461 $523 $595 $623 $605 9.2% 10.5% 11.2% 11.9% 11.3% 10.8% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% – $100 $200 $300 $400 $500 $600 $700 2016Y 2017Y 2018Y 2019Y 2020Y 3/31/2021 Tangible Common Equity Tangible Common Equity Ratio 1 See appendix for non - GAAP reconciliation of tangible common equity ( page 22). Tangible Common Equity 1 In thousands 14

15 Stable Net Interest Margin¹ 1 See appendix for reconciliation of core net interest margin (page 21). 4.44% 4.50% 4.94% 5.19% 4.53% 4.33% 3.64% 3.62% 3.87% 3.79% 3.38% 3.36% 0.56% 0.70% 0.95% 1.28% 0.87% 0.54% 0.00% 6.00% 2016Y 2017Y 2018Y 2019Y 2020Y 1Q2021 Loan Yield Core NIM Cost of Funds

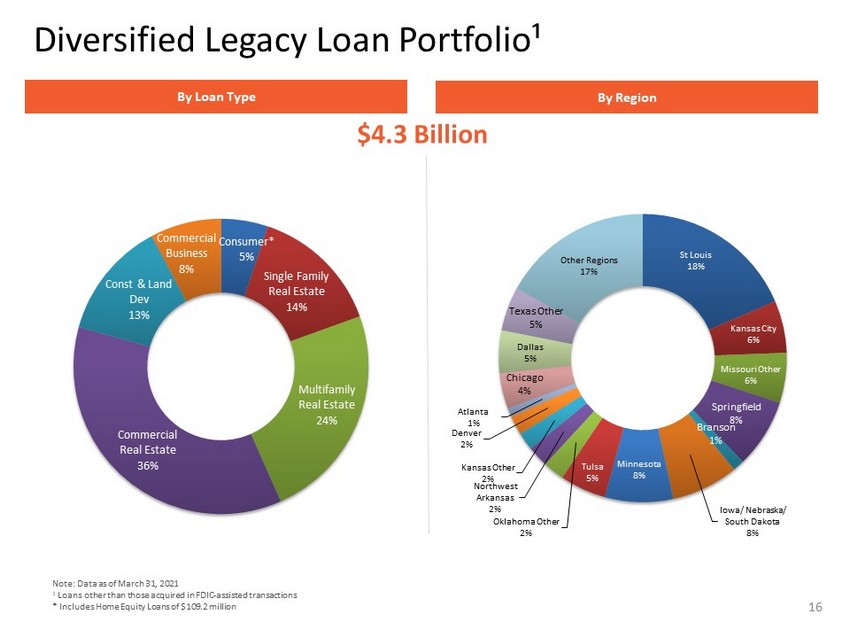

Portfolio Diversification $4.3 Billion *Includes Home Equity Loans of $110,237 16 Consumer* 5% Single Family Real Estate 14% Multifamily Real Estate 24% Commercial Real Estate 36% Const & Land Dev 13% Commercial Business 8% Note: Data as of March 31, 2021 1 Loans other than those acquired in FDIC - assisted transactions * Includes Home Equity Loans of $109.2 million Diversified Legacy Loan Portfolio¹ By Loan Type By Region St Louis 18% Kansas City 6% Missouri Other 6% Springfield 8% Branson 1% Iowa/ Nebraska/ South Dakota 8% Minnesota 8% Tulsa 5% Oklahoma Other 2% Northwest Arkansas 2% Kansas Other 2% Denver 2% Atlanta 1% Chicago 4% Dallas 5% Texas Other 5% Other Regions 17%

17 Asset Quality¹ Non - performing Assets/Assets Net Charge - offs (Recoveries)/Average Loans Allowance for Credit Losses/Loans Allowance for Credit Losses/ Non - performing Loans 1 Prior to January 1, 2021, these ratios excluded the FDIC - acquired loans. 0.86% 0.63% 0.25% 0.16% 0.07% 0.19% 2016Y 2017Y 2018Y 2019Y 2020Y 1Q2021 0.29% 0.26% 0.13% 0.10% 0.01% (0.01%) 2016Y 2017Y 2018Y 2019Y 2020Y 1Q2021 1.04% 1.01% 0.98% 1.00% 1.32% 1.56% 2016Y 2017Y 2018Y 2019Y 2020Y 1Q2021 265.60% 324.23% 609.67% 891.66% 1831.86% 1134.04% 2016Y 2017Y 2018Y 2019Y 2020Y 1Q2021

18 Favorable Deposit Mix By Type By Region Data as of March 31, 2021 Checking & Savings 73.1% CDs 23.9% Brokered CDs 2.2% CDARS Customer 0.8% Springfield MO Metro 41.8% All Other Missouri 14.1% St. Louis Metro 15.6% Kansas City Metro 4.6% All Other Kansas 3.8% Sioux City IA Metro 6.6% Des Moines Metro/Central Iowa 5.8% Quad Cities IA Metro 2.5% Northwest Arkansas 0.5% Minnesota 4.7% $4.6 Billion

19 Thank You For more information: x Visit our Web site: www.GreatSouthernBank.com x Sign up for e - mail notification to get the latest Great Southern news x Call us with questions: 417.895.5242

Appendix 20

Non - GAAP Reconciliation 21 This presentation contains certain financial information determined by methods other than in accordance with accounting princ ipl es generally accepted in the United States (“GAAP”). These non - GAAP financial measures include core net interest income, core net interest margin, return on average tangible common equity, tangible common equity, tangible assets and the ratio of tangible common equity to tangible assets. We calculate core net interest income and core net interest margin by subtracting the impact of adjustments regarding changes in expected cash flows related to our pools of loans we acquired through FDIC - assisted transactions from reported net interest income and net interest margin. Management believes that core net interest income and core net interest margin are useful in assessing the Company’s core performance and trends, in light of the fluctuations that can occur related to upd ate d estimates of the fair value of the loan pools we acquired in the 2009, 2011, 2012 and 2014 FDIC - assisted transactions. In calculating return on average tangible common equity, tangible common equity, tangible assets and the ratio of tangible co mmo n equity to tangible assets, we subtract average intangible assets from average common equity and intangible assets from common equity and from total assets. Management beli eve s that the presentation of these measures excluding the impact of intangible assets provides useful supplemental information that is helpful in understanding our financial condi tio n and results of operations, as they provide a method to assess management’s success in utilizing our tangible capital as well as our capital strength. Management also believes that pr oviding measures that exclude balances of intangible assets, which are subjective components of valuation, facilitates the comparison of our performance with the performance of our peers . In addition, management believes that these are standard financial measures used in the banking industry to evaluate performance. These non - GAAP financial measures are supplemental and are not a substitute for any analysis based on GAAP financial measures. B ecause not all companies use the same calculation of non - GAAP measures, this presentation may not be comparable to other similarly titled measures as calculated by other companies. Non - GAAP Reconciliation : Core Net Interest Income and Core Net Interest Margin FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 Three months ended 03/31/2021 $000 % $000 % $000 % $000 % $000 % $000 % Reported Net Interest Income/Margin $163,056 4.05 $155,156 3.74 $168,192 3.99 $180,392 3.95 $177,138 3.49 $44,089 3.41 Less: Impact of FDIC - assisted acquired loan accretion adjustments 16,393 0.41 5,014 0.12 5,134 0.12 7,431 0.16 5,574 0.11 691 0.05 Core Net Interest Income/Margin $146,663 3.64 $150,142 3.62 $163,058 3.87 $172,961 3.79 $171,564 3.38 $43,398 3.36

Non - GAAP Reconciliation (cont.) 22 Non - GAAP Reconciliation : Return on Average Tangible Common Equity, Tangible Common Equity, Tangible Assets and Ratio of Tangible Common Equity to Tangible Assets (Dollars in thousands) FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 03/31/2021 Net Income Available to Common Shareholders (a) $45,342 $51,564 $67,109 $73,612 $59,313 $18,868 Average Common Equity $414,799 $455,704 $498,508 $571,637 $622,437 $619,841 Less: Average Intangible Assets 12,592 11,713 10,046 8,681 7,532 6,812 Average Tangible Common Equity (b) $402,207 $443,991 $488,462 $562,956 $614,905 $613,029 Return on Average Tangible Common Equity (a)/(b) 11.27% 11.61% 13.74% 13.08% 9.65% 12.31% Common Equity At Period End $429,806 $471,662 $531,977 $603,066 $629,741 $611,457 Less: Intangible Assets At Period End 12,500 10,850 9,288 8,098 6,944 6,655 Tangible Common Equity At Period End (c) $417,306 $460,812 $522,689 $594,968 $622,797 $604,802 Total Assets at Period End $4,550,663 $4,414,521 $4,676,200 $5,015,072 $5,526,420 $5,603,770 Less: Intangible Assets At Period End 12,500 10,850 9,288 8,098 6,944 6,655 Tangible Assets as Period End (d) $4,538,163 $4,403,671 $4,666,912 $5,006,974 $5,519,476 $5,597,115 Tangible Common Equity to Tangible Assets (c)/(d) 9.20% 10.46% 11.20% 11.88% 11.28% 10.81% (A) Annualized year to date for the three months ended March 31, 2021 (A)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| GREAT SOUTHERN BANCORP, INC. | |||

| Date: June 22, 2021 | By: | /s/ Joseph W. Turner | |

| Joseph W. Turner, President and Chief Executive Officer | |||