WELCOME TO AMERICA’S DINER® 2015 Annual Meeting of Stockholders May 21, 2015

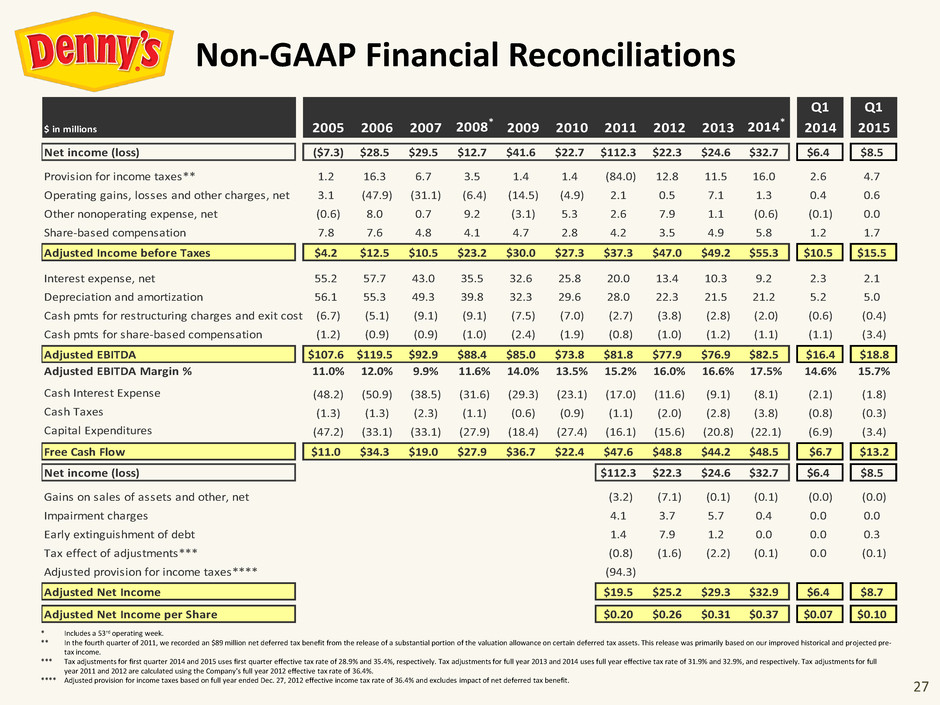

2 Denny’s Corporation urges caution in considering its current trends and any outlook on earnings disclosed in this presentation. In addition, certain matters discussed may constitute forward-looking statements. These forward-looking statements, which reflect the Company’s best judgment based on factors currently known, are intended to speak only as of the date such statements are made and involve risks, uncertainties, and other factors that may cause the actual performance of Denny’s Corporation, its subsidiaries and underlying restaurants to be materially different from the performance indicated or implied by such statements. Words such as “expects”, “anticipates”, “believes”, “intends”, “plans”, “hopes”, and variations of such words and similar expressions are intended to identify such forward-looking statements. Except as may be required by law, the Company expressly disclaims any obligation to update these forward-looking statements to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events. Factors that could cause actual performance to differ materially from the performance indicated by these forward-looking statements include, among others: the competitive pressures from within the restaurant industry; the level of success of the Company’s operating initiatives, advertising and promotional efforts; adverse publicity; changes in business strategy or development plans; terms and availability of capital; regional weather conditions; overall changes in the general economy, particularly at the retail level; political environment (including acts of war and terrorism); and other factors from time to time set forth in the Company’s SEC reports, including but not limited to the discussion in Management’s Discussion and Analysis and the risks identified in Item 1A. Risk Factors contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014 (and in the Company’s subsequent quarterly reports on Form 10-Q). The presentation includes references to the Company’s non-GAAP financials measures. The Company believes that, in addition to other financial measures, Adjusted Income Before Taxes, Adjusted EBITDA, Free Cash Flow, Adjusted Net Income and Adjusted Net Income Per Share are appropriate indicators to assist in the evaluation of its operating performance on a period-to-period basis. The Company also uses Adjusted Income, Adjusted EBITDA and Free Cash Flow internally as performance measures for planning purposes, including the preparation of annual operating budgets, and for compensation purposes, including bonuses for certain employees. Adjusted EBITDA is also used to evaluate its ability to service debt because the excluded charges do not have an impact on its prospective debt servicing capability and these adjustments are contemplated in its credit facility for the computation of its debt covenant ratios. Free Cash Flow, defined as Adjusted EBITDA less cash portion of interest expense net of interest income, capital expenditures, and cash taxes, is used to evaluate operating effectiveness and decisions regarding the allocation of resources. However, Adjusted Income, Adjusted EBITDA, Free Cash Flow, Adjusted Net Income and Adjusted Net Income Per Share should be considered as a supplement to, not a substitute for, operating income, net income or other financial performance measures prepared in accordance with U.S. generally accepted accounting principles. See Appendix for non-GAAP reconciliations. Forward Looking Statements and Non-GAAP Financial Measures

3 Drive Profit Growth for All Stakeholders Grow the Global Franchise Consistently Operate Great Restaurants Deliver a Differentiated and Relevant Brand “Become the World’s Largest, Most Admired And Beloved Family of Local Restaurants” Run Restaurants Serving Classic American Comfort Food at a Good Price Around the Clock Our Guiding Principles Guests First | Embrace Openness | Proud of Our Heritage | Hungry to Win | Power of We Brand Revitalization Plan Driving Results

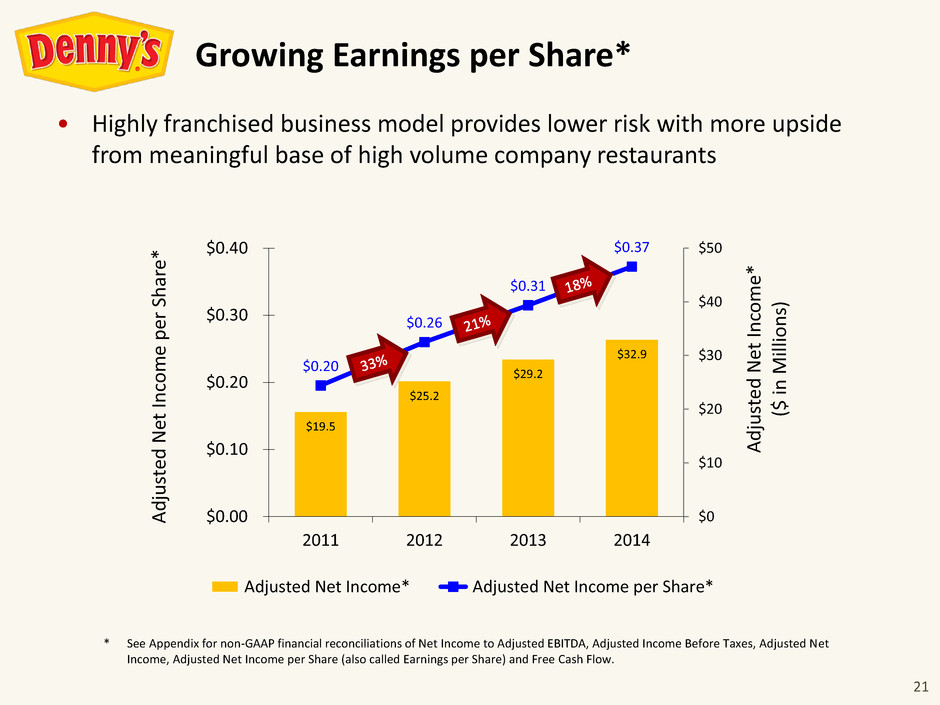

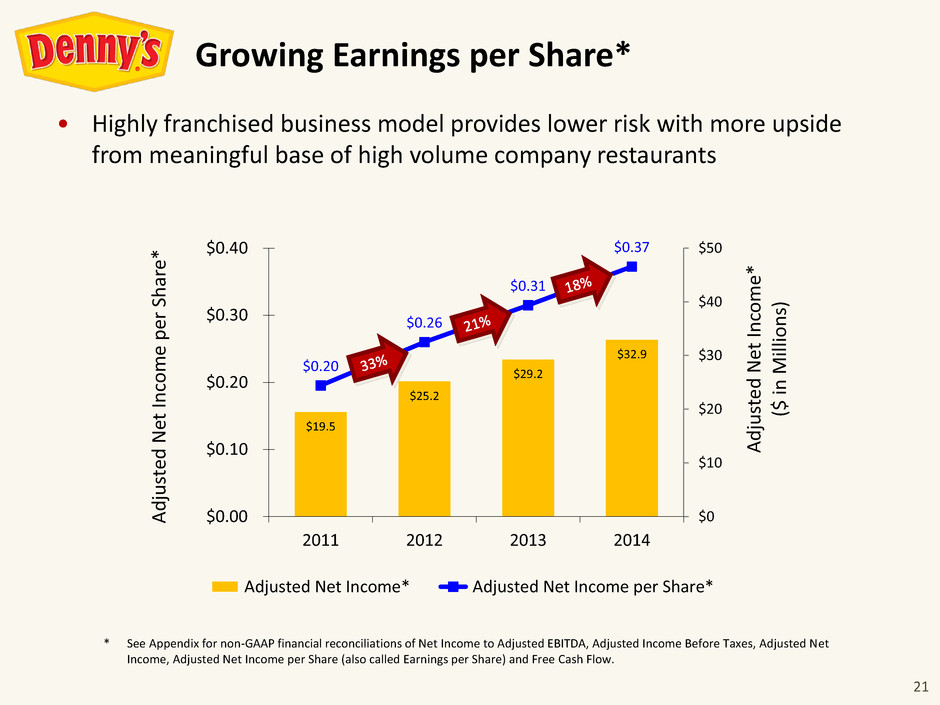

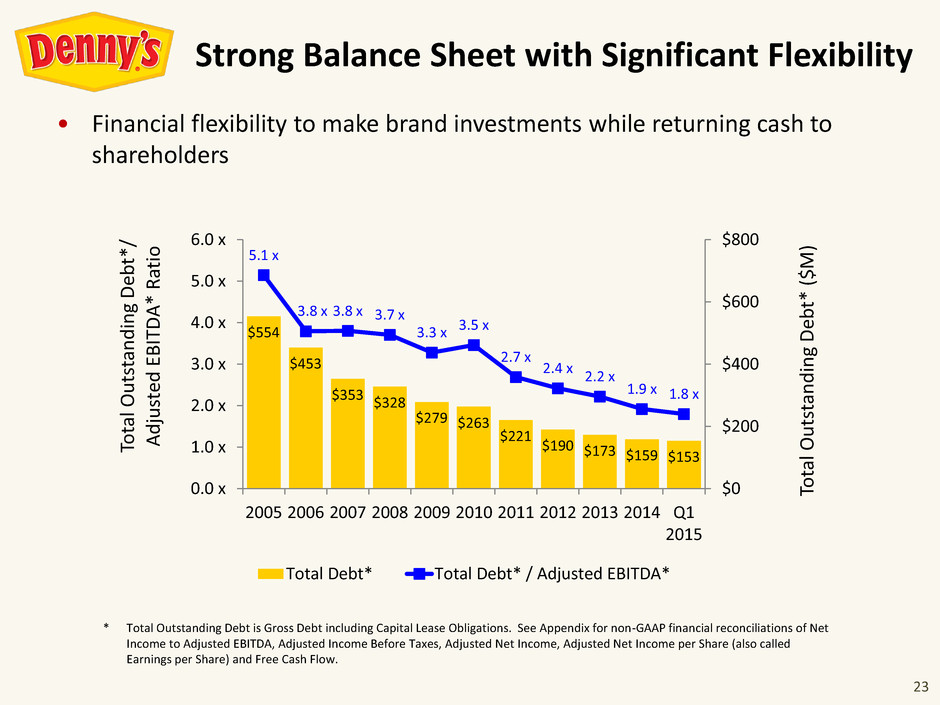

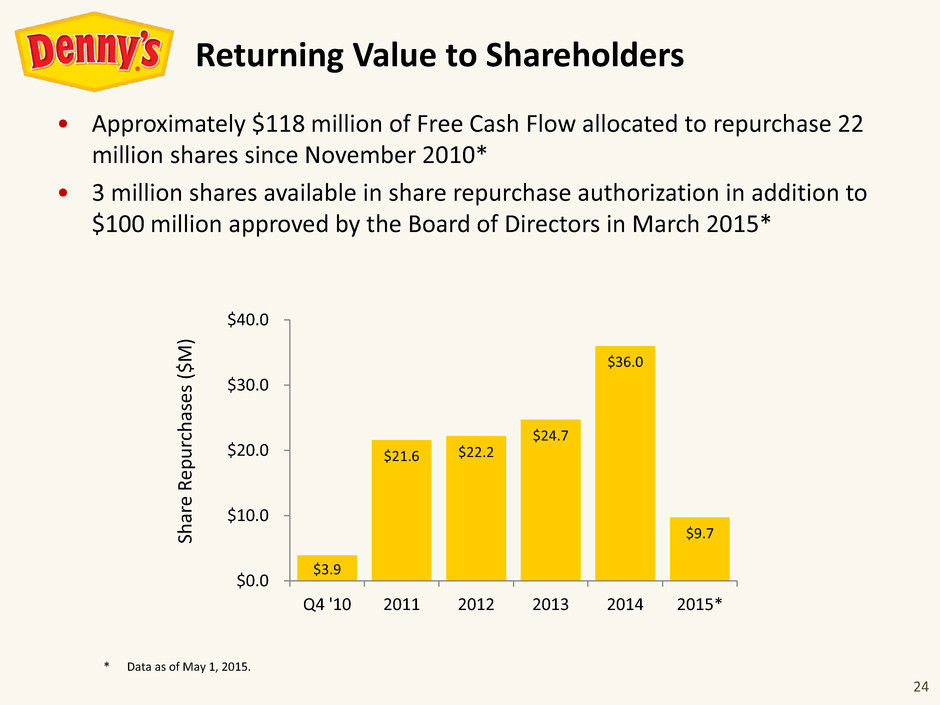

4 • Highest annual system-wide same-store sales since 2006 • Highest annual company same-store sales since 2004 • Remodeled 171 system restaurants, including 44 company restaurants • Opened 38 new restaurants in 2014 including six international and three non-traditional locations • Reopened Las Vegas Casino Royale company restaurant • Launched Denny’s Pride Review Program • Adjusted EBITDA* increased 7.3% to $82.5M • Grew Adjusted Net Income per Share* 18.3% to $0.37 • Generated $48.5M of Free Cash Flow* after capital expenditures • Allocated $36.0 million to repurchase 5.3M shares • Decreased Total Debt Ratio below 2.0x Highlights from 2014 * See Appendix for reconciliation of Net Income to Adjusted EBITDA, Adjusted Income Before Taxes, Adjusted Net Income, Adjusted Net Income per Share (also called Earnings per Share) and Free Cash Flow.

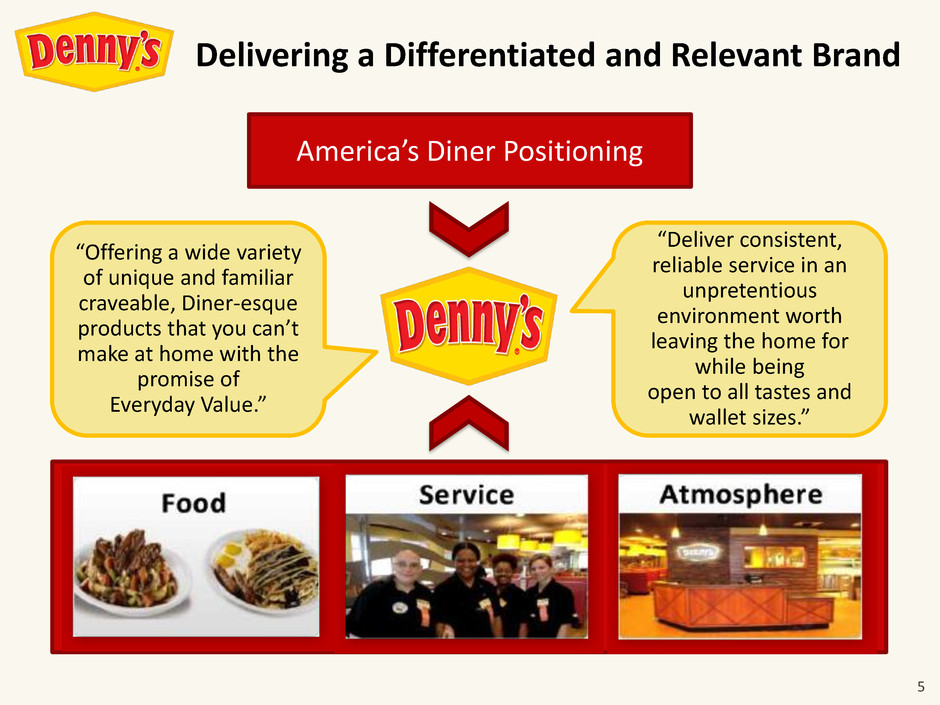

5 “Offering a wide variety of unique and familiar craveable, Diner-esque products that you can’t make at home with the promise of Everyday Value.” America’s Diner Positioning “Deliver consistent, reliable service in an unpretentious environment worth leaving the home for while being open to all tastes and wallet sizes.” Delivering a Differentiated and Relevant Brand

6 “Brand Anthem – Holiday” Commercial YouTube Video Link https://www.youtube.com/watch?v=OReMLPCOK-w

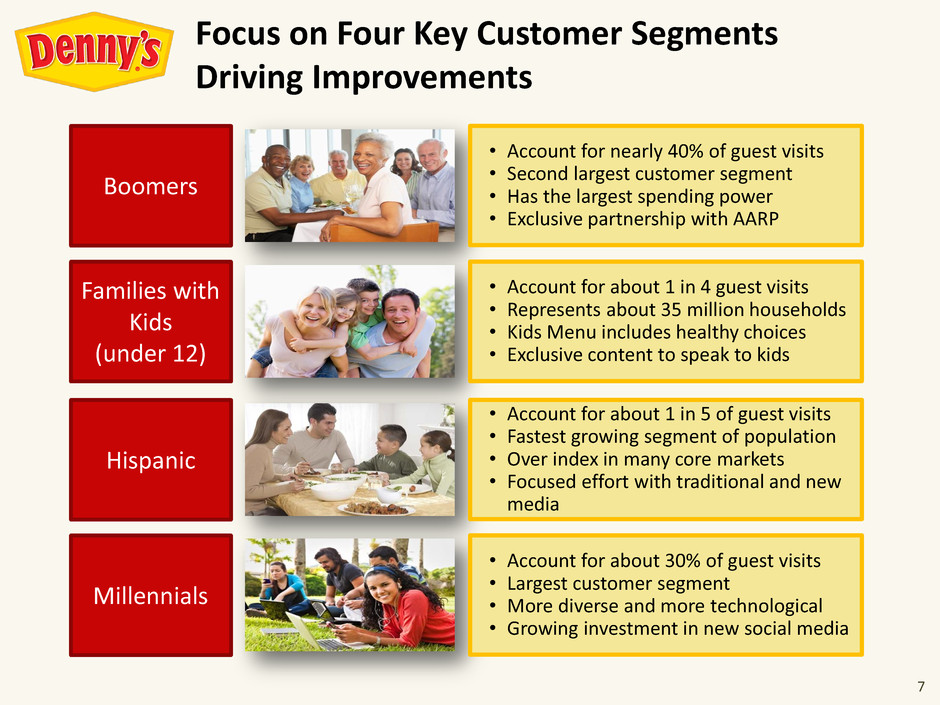

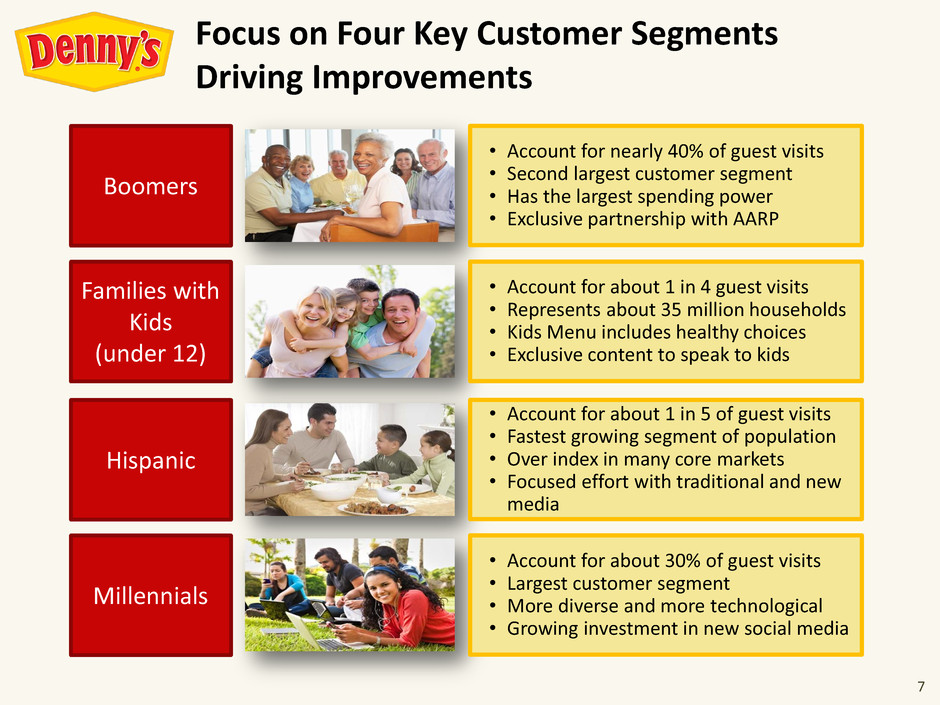

7 Hispanic Families with Kids (under 12) Boomers Millennials • Account for about 1 in 5 of guest visits • Fastest growing segment of population • Over index in many core markets • Focused effort with traditional and new media • Account for about 1 in 4 guest visits • Represents about 35 million households • Kids Menu includes healthy choices • Exclusive content to speak to kids • Account for nearly 40% of guest visits • Second largest customer segment • Has the largest spending power • Exclusive partnership with AARP • Account for about 30% of guest visits • Largest customer segment • More diverse and more technological • Growing investment in new social media Focus on Four Key Customer Segments Driving Improvements

8 “The Grand Slams – Booth vs. Counter” Video YouTube Video Link https://www.youtube.com/watch?v=nf5uFqMWpIk

9 “The Grand Slams – Slams on Grams” Video YouTube Video Link https://youtu.be/pF6tEEes-6o

10 “Dream Kitchen” Commercial YouTube Video Link https://youtu.be/1NdhZj1R2Dg

11 “Denny’s Denny’s” Video YouTube Video Link https://youtu.be/ICuc5vXcai8

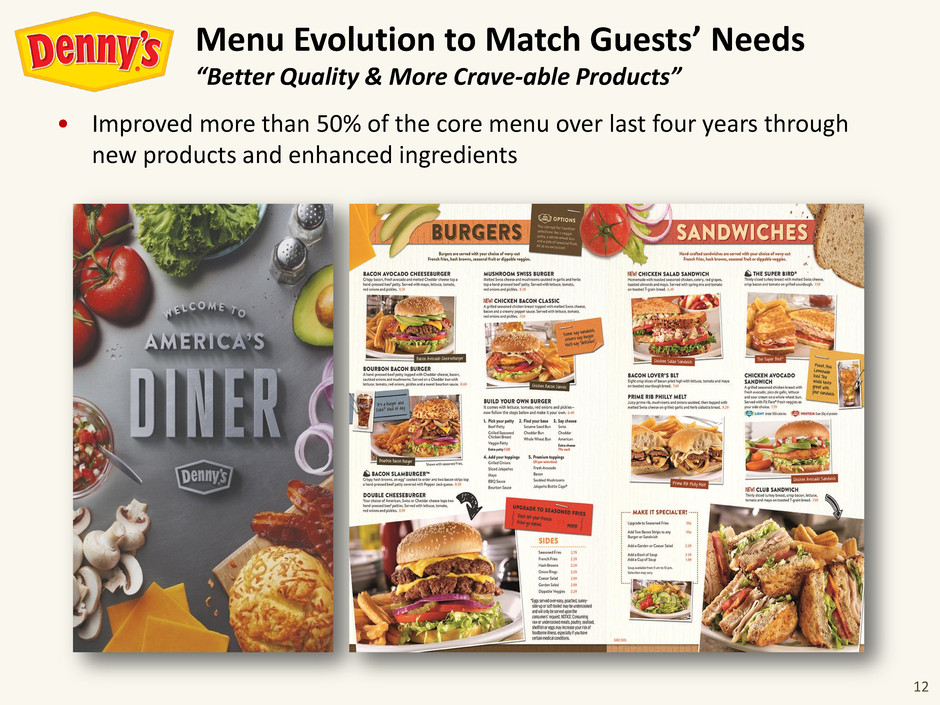

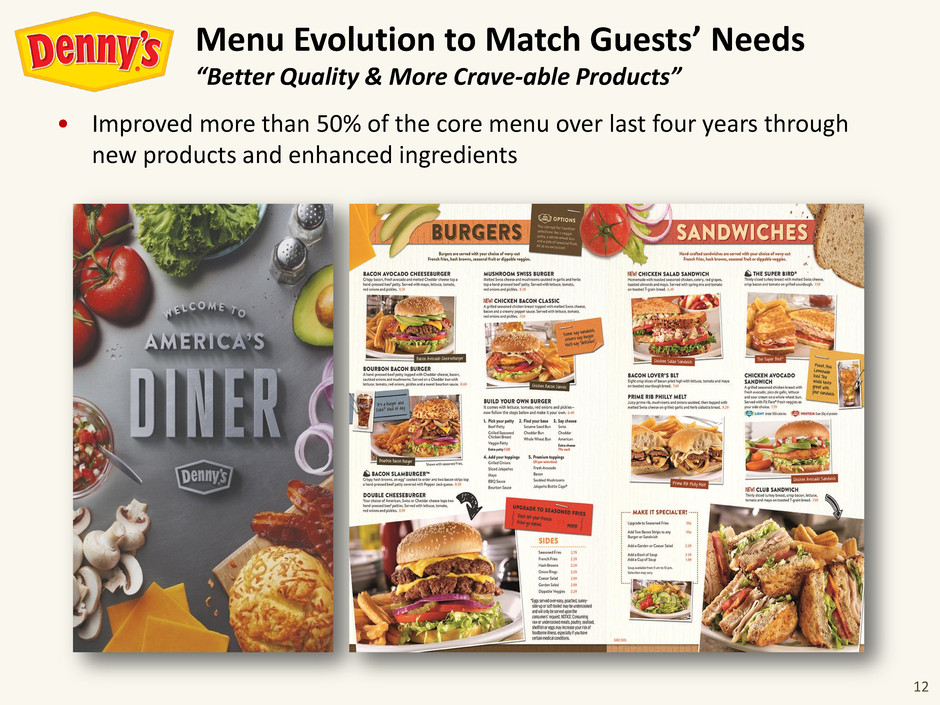

12 • Improved more than 50% of the core menu over last four years through new products and enhanced ingredients Menu Evolution to Match Guests’ Needs “Better Quality & More Crave-able Products”

13 • Provide compelling products with tiered pricing strategy while utilizing $2-4-6-8 Everyday Value Menu to help drive traffic Limited Time Only Offerings Enhance Product Differentiation to Drive Traffic

14 “Roaring Skillets” Commercial YouTube Video Link https://www.youtube.com/watch?v=jAeSh15xeuU

15 “Fire Blanket” Commercial YouTube Video Link https://youtu.be/6q5_uNSMGHU

16 • Nearly 20% of the system restaurants have the Heritage image including approximately 50% of company restaurants • Approximately 28% of system will have Heritage image by end of 2015 including around 75% of company restaurants New Remodel Program Enhancing Traffic and Scores

17 Before After Remodeled Las Vegas Casino Royale Location

18 • Investments in guest satisfaction and training tools helping to improve guest satisfaction scores • Close collaboration with franchisees executing remodels, improving speed of service and growing margins • Denny’s Pride Review Program introduced in 2014 with new team of coaches evaluating and sharing best practices Focus on Operating Great Restaurants Leading to Sustained Improvement

19 (4.2%) 0.5% 1.5% 0.5% 2.8% 1.8% 1.9% 2.4% 4.7% 7.2% (10.0%) (8.0%) (6.0%) (4.0%) (2.0%) 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 2010 2011 2012 2013 2014 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Denny's System-wide Same-Store Sales (Domestic) Denny's 2-year Same-Store Sales • Positive system-wide same-store sales in 15 of last 16 quarters • Highest annual system-wide same-store sales growth since 2006, including highest annual company same-store sales increase since 2004 * Current 2015 Annual Guidance provided with First Quarter 2015 Earnings Press Release dated May 4, 2015. 2015 Annual Guidance for Same-Store Sales* Company 3.5% to 4.5% Domestic Franchised 2.5% to 3.5% Consistently Growing Same-Store Sales

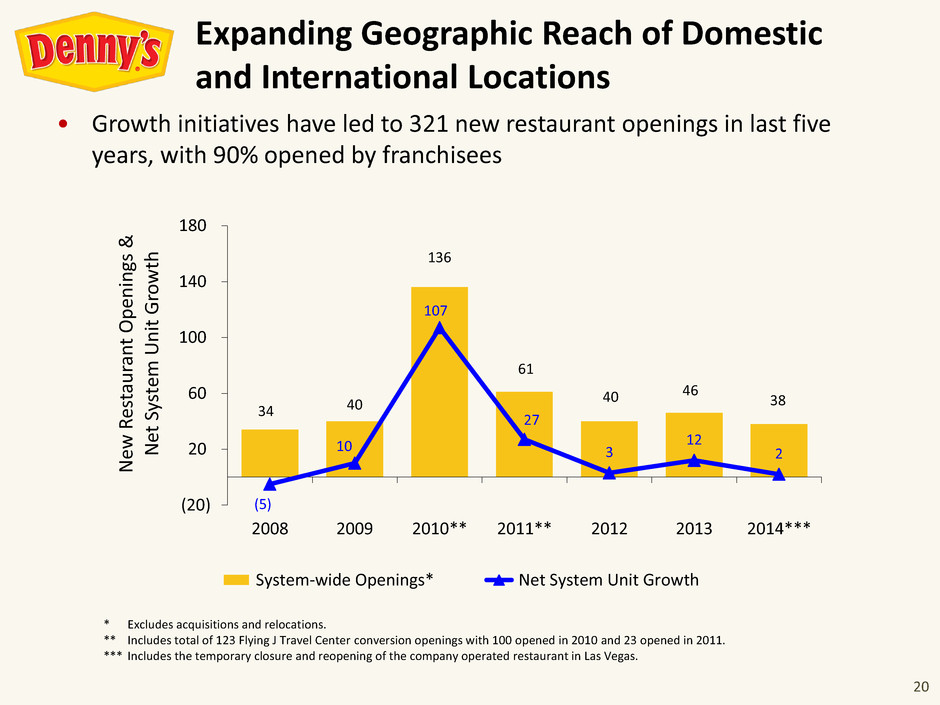

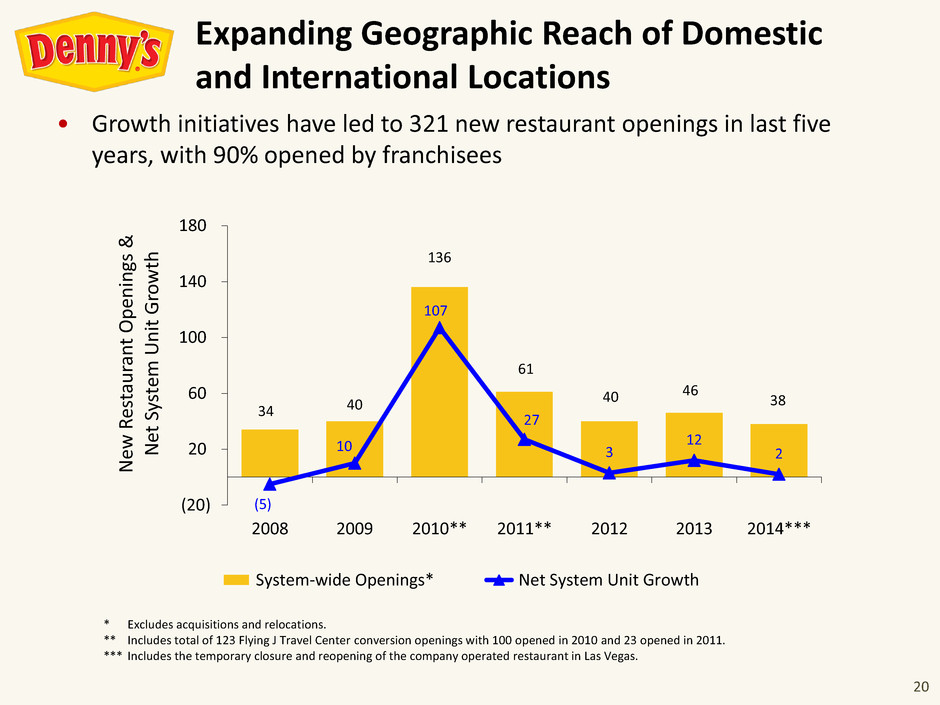

20 • Growth initiatives have led to 321 new restaurant openings in last five years, with 90% opened by franchisees 34 40 136 61 40 46 38 (5) 10 107 27 3 12 2 (20) 20 60 100 140 180 2008 2009 2010** 2011** 2012 2013 2014*** N ew R es ta u ra n t Open in gs & N et Sy st em U n it G ro wt h System-wide Openings* Net System Unit Growth * Excludes acquisitions and relocations. ** Includes total of 123 Flying J Travel Center conversion openings with 100 opened in 2010 and 23 opened in 2011. *** Includes the temporary closure and reopening of the company operated restaurant in Las Vegas. Expanding Geographic Reach of Domestic and International Locations

21 $19.5 $25.2 $29.2 $32.9 $0.20 $0.26 $0.31 $0.37 $0 $10 $20 $30 $40 $50 $0.00 $0.10 $0.20 $0.30 $0.40 2011 2012 2013 2014 Adj u st ed N et In com e* ($ in M ill ions ) Adj u st ed N et In com e pe r Sh ar e* Adjusted Net Income* Adjusted Net Income per Share* * See Appendix for non-GAAP financial reconciliations of Net Income to Adjusted EBITDA, Adjusted Income Before Taxes, Adjusted Net Income, Adjusted Net Income per Share (also called Earnings per Share) and Free Cash Flow. • Highly franchised business model provides lower risk with more upside from meaningful base of high volume company restaurants Growing Earnings per Share*

22 • Generated over $200 million in Free Cash Flow* in the last five years * See Appendix for non-GAAP financial reconciliations of Net Income to Adjusted EBITDA, Adjusted Income Before Taxes, Adjusted Net Income, Adjusted Net Income per Share and Free Cash Flow. ** Includes new construction capital expenditures for 21 Flying J conversion units. *** Current 2015 Annual Guidance provided with First Quarter 2015 Earnings Press Release dated May 4, 2015. $73.8 $81.8 $77.9 $76.9 $82.5 $22.4 $47.6 $48.8 $44.2 $48.5 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 2010** 2011 2012 2013 2014 $ in M ill ion s Adjusted EBITDA* Free Cash Flow* 2015 Annual Guidance*** Adjusted EBITDA* $85 to $87 Million Free Cash Flow* $45 to $47 Million Highly Franchised Business Model Generates Consistent Free Cash Flow*

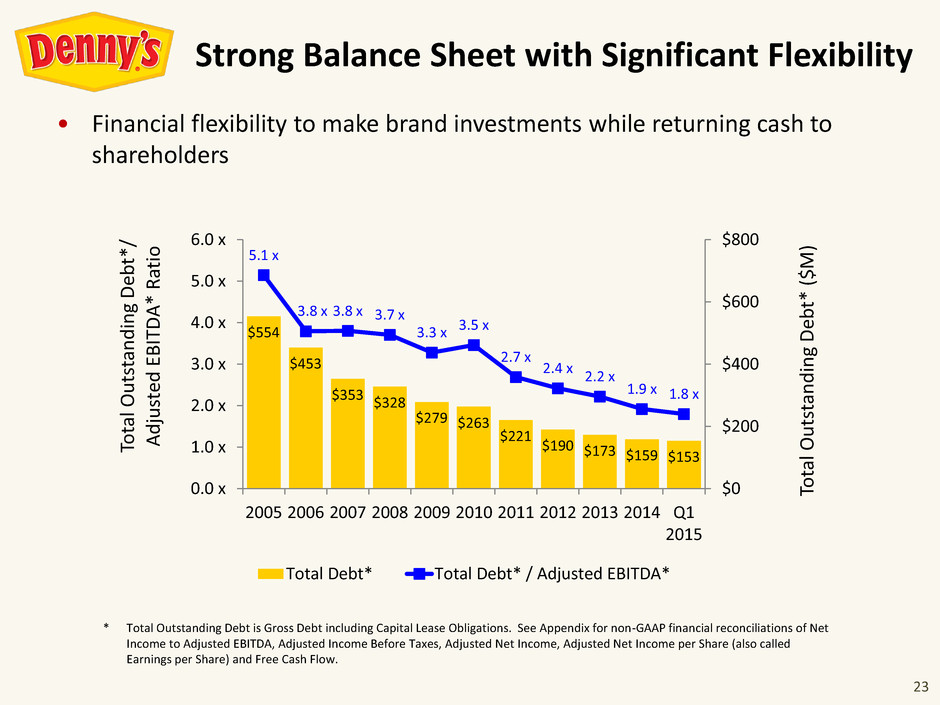

23 • Financial flexibility to make brand investments while returning cash to shareholders $554 $453 $353 $328 $279 $263 $221 $190 $173 $159 $153 5.1 x 3.8 x 3.8 x 3.7 x 3.3 x 3.5 x 2.7 x 2.4 x 2.2 x 1.9 x 1.8 x 0.0 x 1.0 x 2.0 x 3.0 x 4.0 x 5.0 x 6.0 x 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Q1 2015 $0 $200 $400 $600 $800 To ta l Ou ts ta n d in g De b t* / Adj u st ed EBIT D A* R at io To ta l Ou ts ta n d in g De b t* ( $ M ) Total Debt* Total Debt* / Adjusted EBITDA* * Total Outstanding Debt is Gross Debt including Capital Lease Obligations. See Appendix for non-GAAP financial reconciliations of Net Income to Adjusted EBITDA, Adjusted Income Before Taxes, Adjusted Net Income, Adjusted Net Income per Share (also called Earnings per Share) and Free Cash Flow. Strong Balance Sheet with Significant Flexibility

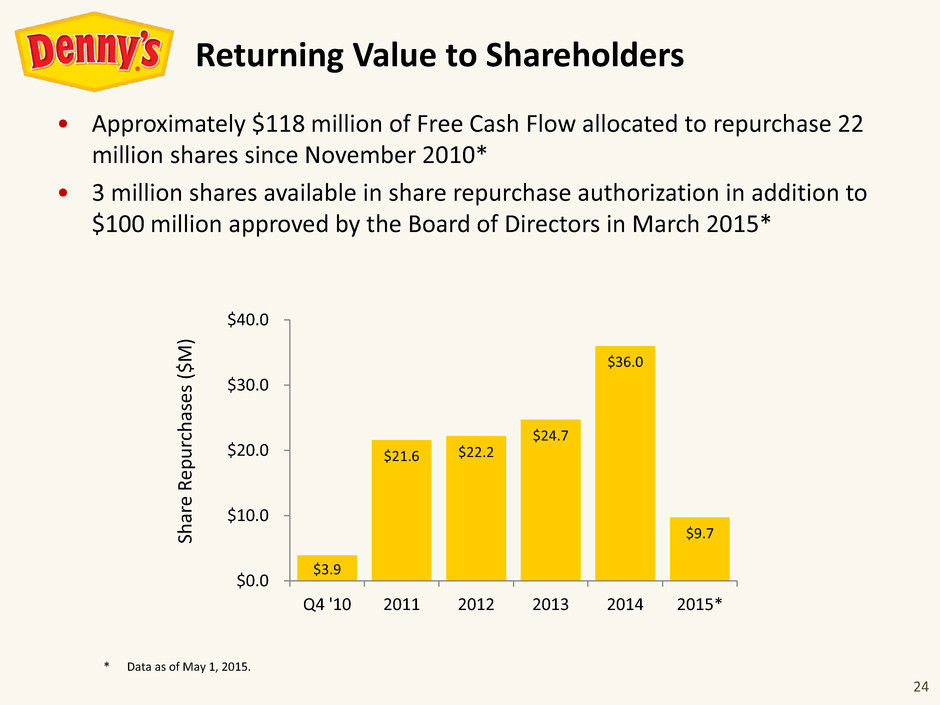

24 • Approximately $118 million of Free Cash Flow allocated to repurchase 22 million shares since November 2010* • 3 million shares available in share repurchase authorization in addition to $100 million approved by the Board of Directors in March 2015* * Data as of May 1, 2015. Returning Value to Shareholders $3.9 $21.6 $22.2 $24.7 $36.0 $9.7 Q4 '10 2011 2012 2013 2014 2015* $0.0 $10.0 $20.0 $30.0 $40.0 Sh ar e R epu rchases ( $ M )

WELCOME TO AMERICA’S DINER® May 21, 2015 2015 Annual Meeting of Stockholders

WELCOME TO AMERICA’S DINER® APPENDIX

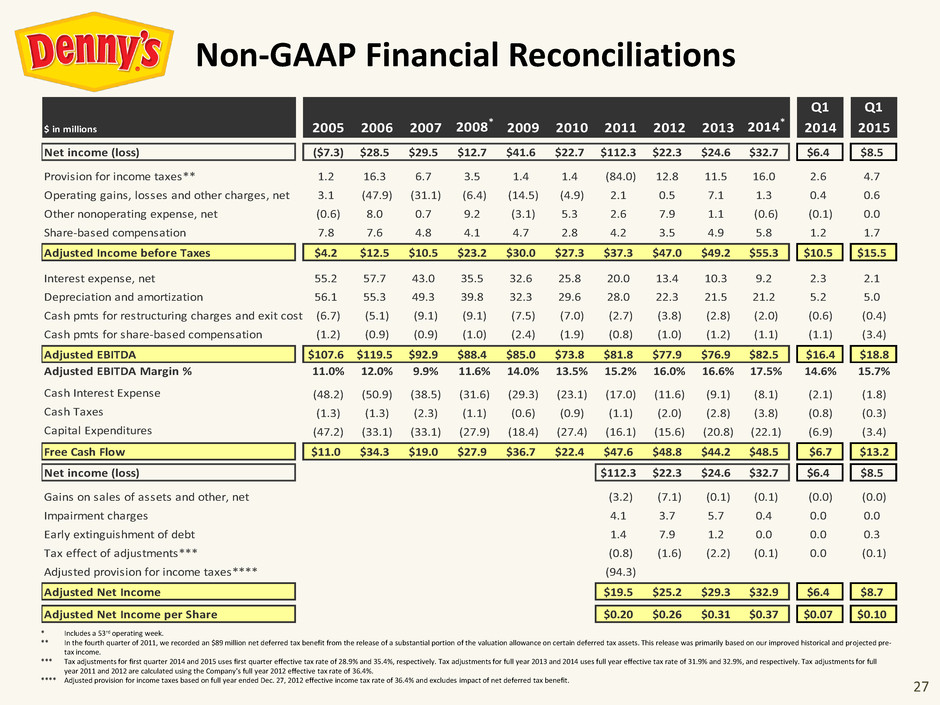

27 * Includes a 53rd operating week. ** In the fourth quarter of 2011, we recorded an $89 million net deferred tax benefit from the release of a substantial portion of the valuation allowance on certain deferred tax assets. This release was primarily based on our improved historical and projected pre- tax income. *** Tax adjustments for first quarter 2014 and 2015 uses first quarter effective tax rate of 28.9% and 35.4%, respectively. Tax adjustments for full year 2013 and 2014 uses full year effective tax rate of 31.9% and 32.9%, and respectively. Tax adjustments for full year 2011 and 2012 are calculated using the Company's full year 2012 effective tax rate of 36.4%. **** Adjusted provision for income taxes based on full year ended Dec. 27, 2012 effective income tax rate of 36.4% and excludes impact of net deferred tax benefit. Q1 Q1 $ in millions 2005 2006 2007 2008 * 2009 2010 2011 2012 2013 2014 * 2014 2015 Net income (loss) ($7.3) $28.5 $29.5 $12.7 $41.6 $22.7 $112.3 $22.3 $24.6 $32.7 $6.4 $8.5 Provision for income taxes** 1.2 16.3 6.7 3.5 1.4 1.4 (84.0) 12.8 11.5 16.0 2.6 4.7 Operating gains, losses and other charges, net 3.1 (47.9) (31.1) (6.4) (14.5) (4.9) 2.1 0.5 7.1 1.3 0.4 0.6 Other nonoperating expense, net (0.6) 8.0 0.7 9.2 (3.1) 5.3 2.6 7.9 1.1 (0.6) (0.1) 0.0 Share-based compensation 7.8 7.6 4.8 4.1 4.7 2.8 4.2 3.5 4.9 5.8 1.2 1.7 Adjusted Income before Taxes $4.2 $12.5 $10.5 $23.2 $30.0 $27.3 $37.3 $47.0 $49.2 $55.3 $10.5 $15.5 Interest expense, net 55.2 57.7 43.0 35.5 32.6 25.8 20.0 13.4 10.3 9.2 2.3 2.1 Depreciation and amortization 56.1 55.3 49.3 39.8 32.3 29.6 28.0 22.3 21.5 21.2 5.2 5.0 Cash pmts for restructuring charges and exit costs (6.7) (5.1) (9.1) (9.1) (7.5) (7.0) (2.7) (3.8) (2.8) (2.0) (0.6) (0.4) Cash pmts for share-based compensation (1.2) (0.9) (0.9) (1.0) (2.4) (1.9) (0.8) (1.0) (1.2) (1.1) (1.1) (3.4) Adjusted EBITDA $107.6 $119.5 $92.9 $88.4 $85.0 $73.8 $81.8 $77.9 $76.9 $82.5 $16.4 $18.8 Adjusted EBITDA Margin % 11.0% 12.0% 9.9% 11.6% 14.0% 13.5% 15.2% 16.0% 16.6% 17.5% 14.6% 15.7% Cash Interest Expense (48.2) (50.9) (38.5) (31.6) (29.3) (23.1) (17.0) (11.6) (9.1) (8.1) (2.1) (1.8) Cash Taxes (1.3) (1.3) (2.3) (1.1) (0.6) (0.9) (1.1) (2.0) (2.8) (3.8) (0.8) (0.3) Capital Expenditures (47.2) (33.1) (33.1) (27.9) (18.4) (27.4) (16.1) (15.6) (20.8) (22.1) (6.9) (3.4) Free Cash Flow $11.0 $34.3 $19.0 $27.9 $36.7 $22.4 $47.6 $48.8 $44.2 $48.5 $6.7 $13.2 Net income (loss) $112.3 $22.3 $24.6 $32.7 $6.4 $8.5 Gains on sales of assets and other, net (3.2) (7.1) (0.1) (0.1) (0.0) (0.0) Impairment charges 4.1 3.7 5.7 0.4 0.0 0.0 Early extinguishment of debt 1.4 7.9 1.2 0.0 0.0 0.3 Tax effect of adjustments*** (0.8) (1.6) (2.2) (0.1) 0.0 (0.1) Adjusted provision for income taxes**** (94.3) Adjusted Net Income $19.5 $25.2 $29.3 $32.9 $6.4 $8.7 Adjusted Net Income per Share $0.20 $0.26 $0.31 $0.37 $0.07 $0.10 Non-GAAP Financial Reconciliations