Table of Contents

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ Preliminary Proxy Statement |

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x Definitive Proxy Statement |

||

| ¨ Definitive Additional Materials |

||

| ¨ Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 | ||

Rand Worldwide, Inc.

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

RAND WORLDWIDE, INC.

161 WORCESTER ROAD, SUITE 401

FRAMINGHAM, MASSACHUSETTS 01701

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD

NOVEMBER 9, 2011

To the Stockholders of Rand Worldwide, Inc.:

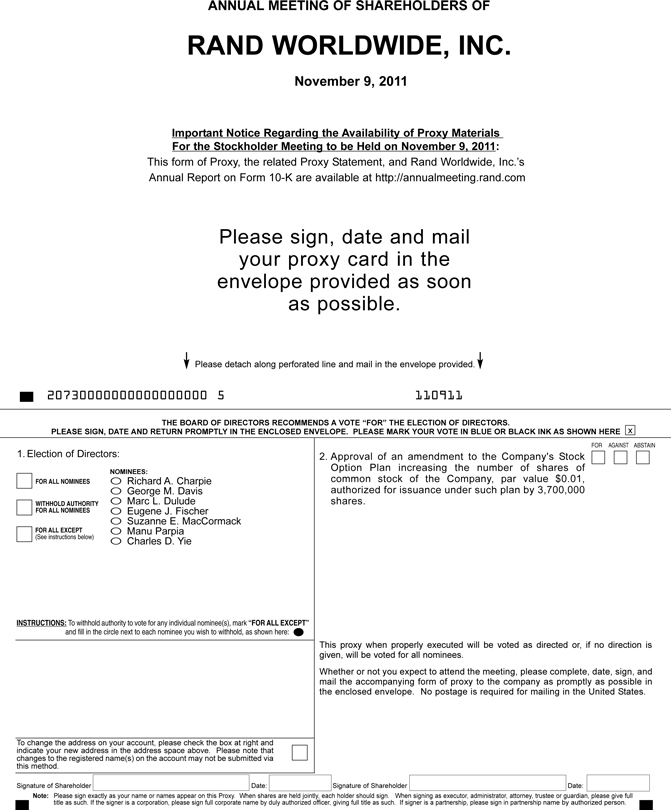

The Annual Meeting of Stockholders of Rand Worldwide, Inc. (the “Company”) will be held at the Company’s offices located at 11201 Dolefield Boulevard, Suite 112, Owings Mills, Maryland 21117 on Wednesday, November 9, 2011 at 9:00 a.m., local time, for the following purposes:

| 1. | To elect as directors the seven nominees selected by the Board of Directors and named in the enclosed proxy to serve for the ensuing year and until the election and qualification of their successors; |

| 2. | To approve an amendment to the Company’s Stock Option Plan increasing the number of shares of common stock of the Company, par value $0.01, authorized for issuance under such plan by 3,700,000 shares; and |

| 3. | To transact such other business as may properly come before the meeting or any adjournments thereof. |

The Board of Directors has fixed September 30, 2011 as the record date for the determination of stockholders entitled to notice of, and to vote at, the meeting. We ask for your support and encourage you to attend the Annual Meeting. On behalf of the Board of Directors, we urge you to sign, date, and return the accompanying proxy card as soon as possible, even if you plan to attend the Meeting. This will not prevent you from voting in person but will assure that your vote is counted if you are unable to attend the meeting. Your vote is important regardless of the number of shares that you own.

This proxy statement is accompanied by the Company’s Annual Report on Form 10-K for the year ended June 30, 2011.

| By Order of the Board of Directors, | ||||

| Marc L. Dulude | Lawrence Rychlak | |||

| Chief Executive Officer | Secretary | |||

Framingham, Massachusetts

October 5, 2011

IMPORTANT—YOUR PROXY IS ENCLOSED

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN, AND MAIL THE ACCOMPANYING FORM OF PROXY TO THE COMPANY AS PROMPTLY AS POSSIBLE IN THE ENCLOSED ENVELOPE. NO POSTAGE IS REQUIRED FOR MAILING IN THE UNITED STATES.

Important Notice Regarding the Availability of Proxy Materials

For the Stockholder Meeting to be Held on November 9, 2011:

The enclosed Proxy Statement, the enclosed form of Proxy, and Rand Worldwide, Inc.’s Annual Report

on Form 10-K are available at http://annualmeeting.rand.com.

Information on this website, other than this Proxy Statement, is not a part of this Proxy Statement.

Table of Contents

| 1 | ||||

| 2 | ||||

| 6 | ||||

| Beneficial Ownership of Voting Securities of Rand Worldwide, Inc |

10 | |||

| 11 | ||||

| 12 | ||||

| 17 | ||||

| 17 | ||||

| Approval of a Amendment to the Company’s Stock Option Plan (Proposal 2) |

17 | |||

| 24 | ||||

| 24 | ||||

| 27 | ||||

| 28 | ||||

| 28 | ||||

Table of Contents

RAND WORLDWIDE, INC.

161 WORCESTER ROAD, SUITE 401

FRAMINGHAM, MASSACHUSETTS 01701

508-663-1400

PROXY STATEMENT

The accompanying proxy is solicited by the Board of Directors of Rand Worldwide, Inc. (the “Company”) in connection with its Annual Meeting of Stockholders to be held on Wednesday, November 9, 2011 at 9:00 a.m., local time, 11201 Dolefield Boulevard, Suite 112, Owings Mills, Maryland 21117, or at any adjournments or postponements thereof, for the purposes set forth in the accompanying notice of the meeting. The cost of soliciting proxies will be borne by the Company. In addition to solicitations by mail, proxies may be solicited by officers, directors and regular employees of the Company personally or by telephone, facsimile, or e-mail. No additional remuneration will be paid to officers, directors or regular employees who solicit proxies. The Company may reimburse brokers, banks, custodians, nominees and other fiduciaries for their reasonable out-of-pocket expenses in forwarding proxy materials to their principals. The approximate date on which this proxy statement and form of proxy will be mailed to stockholders is October 6, 2011.

As used in this proxy statement, the terms “the Company”, “Rand Worldwide”, “we”, “us”, and “our” refer to Rand Worldwide, Inc. and its consolidated subsidiaries unless the context clearly requires otherwise.

As to all matters that may properly come before the meeting, including the election of directors, each record holder of common stock of the Company, par value $.01 per share (“Common Stock”), on the Record Date is entitled to one vote for each share of Common Stock held, and each record holder of the Company’s Series D and Series E Convertible Preferred Stock on the Record Date is entitled to one vote for each share of Common Stock into which shares of such Preferred Stock are convertible as of the Record Date. Shares of Common Stock and of Series D and Series E and Convertible Preferred Stock may be voted in person or by proxy.

The Board of Directors has fixed the close of business on September 30, 2011 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the meeting. On the Record Date, there were outstanding 51,922,878 shares of Common Stock, 1,089,213 shares of Series D Convertible Preferred Stock and 937 shares of Series E Convertible Preferred Stock (the shares of Series D Convertible Preferred Stock and Series E Convertible Preferred Stock are sometimes collectively referred to as the “Outstanding Preferred Shares”). As of the Record Date, the shares of Series D and Series E Convertible Preferred Stock are convertible into 2,180,244 and 1,441,539 shares of Common Stock, respectively. The terms of the Outstanding Preferred Shares entitle the holders thereof to vote together with holders of our Common Stock, as a single class, on any matter submitted to holders of our Common Stock, on an as converted basis.

Stockholders who do not plan to attend the Annual Meeting are urged to complete, date, sign and return the enclosed proxy in the enclosed envelope, to which no postage need be affixed if mailed in the United States. A prompt response is helpful and your cooperation will be appreciated.

Proxies may be revoked at any time before a vote is taken or the authority granted is otherwise exercised. Revocation may be accomplished by: (i) giving written notice to the Secretary of the Company at the Company’s address listed above; or (ii) giving written notice to the Secretary in person at the 2011 Annual Meeting. Any stockholder who attends the 2011 Annual Meeting and revokes his/her proxy may vote in person. However, attendance by a stockholder at the 2011 Annual Meeting alone will not have the effect of revoking a stockholder’s validly executed proxy.

On August 17, 2010, as previously reported by the Company on a Form 8-K filed on that date, the Company, then known as Avatech Solutions, Inc., acquired all of the outstanding capital securities of a separate Delaware corporation known as Rand Worldwide, Inc. (“pre-merger Rand Worldwide”) in a reverse merger

1

Table of Contents

transaction whereby the pre-merger Rand Worldwide merged with and into the Company (the “Merger”). The Company was the legal successor in the Merger and changed its name to “Rand Worldwide, Inc.” on January 1, 2011.

Since the beginning of its last fiscal year, the Company, by virtue of the Merger, experienced a change in control. In the Merger, RWWI Holdings, LLC (“RWWI”), the sole stockholder of the pre-merger Rand Worldwide, received an aggregate of 34,232,682 shares (the “Merger Shares”) of the Company’s Common Stock in exchange for all of the outstanding shares of capital stock of the pre-merger Rand Worldwide, and the existing stockholders of the Company retained approximately 34% of the outstanding shares of Common Stock. Of the Merger Shares, 28,800,022 shares (the “Initial Shares”) are currently held by RWWI and 5,432,660 shares (the “Escrowed Shares”) are being held in escrow by the Company for the benefit of RWWI for up to 18 months from the closing date (the “Escrow Period”). RWWI may be required to surrender some or all of the Escrowed Shares to the Company in certain circumstances described below. After giving effect to the issuance of the Merger Shares, the Merger Shares represent approximately 65.9% of our outstanding shares of Common Stock.

The Merger Shares represent approximately 58.2% of the outstanding voting rights of the holders of our capital stock, after giving effect to the voting rights of the Outstanding Preferred Shares and the issuance of the Merger Shares.

If, at any time during the Escrow Period, the Company redeems or repurchases any of the Outstanding Preferred Shares, then RWWI will surrender to the Company that number of Escrowed Shares equal to 150% of the number of shares of Common Stock into which such redeemed Outstanding Preferred Shares could have been converted immediately following the closing of the Merger after giving effect to the issuance of the Initial Shares. During the Escrow Period, RWWI will have all the rights and liabilities of a stockholder with respect to the outstanding Escrowed Shares, including the right to vote such Escrowed Shares and the right to receive dividends and other distributions thereon. Upon the expiration of the Escrow Period, all Escrowed Shares that have not been surrendered to the Company during the Escrow Period will be delivered to RWWI.

As a consequence of the Merger, RWWI became a controlling stockholder of the Company. RWWI is majority-owned by funds (the “Ampersand Funds”) associated with Ampersand Capital, a private equity firm located in Wellesley, Massachusetts (“Ampersand”).

ELECTION OF DIRECTORS (Proposal 1)

At the 2011 Annual Meeting, stockholders will be asked to elect the seven directors identified below to hold office for the ensuing year until their successors are elected and qualify. Each of the nominees other than Manu Parpia is a current director of the Company who was previously elected by stockholders and is standing for re-election. The Board elected Mr. Parpia to the Board on March 31, 2011 in connection with an increase in the size of the Board. Information about the seven director nominees, including their names, ages as of the Record Date, and principal occupations and business experience for the past five years, is set forth below. The Company’s Chief Executive Officer is a director nominee.

| Name |

Age | Director Since | ||||

| Richard A. Charpie |

59 | August 2010 | ||||

| George M. Davis |

55 | July 2006 | ||||

| Marc L. Dulude |

51 | August 2010 | ||||

| Eugene J. Fischer |

65 | March 2000 | ||||

| Suzanne E. MacCormack |

54 | August 2010 | ||||

| Manu Parpia |

61 | March 2011 | ||||

| Charles D. Yie |

53 | August 2010 | ||||

RICHARD A. CHARPIE, PhD—Dr. Charpie joined the Board in connection with the August 2010 merger with Avatech Solutions, Inc., at which time he was also elected Chairman of the Board. He has nearly 30 years of

2

Table of Contents

private equity experience and is a Managing Partner of Ampersand, which is currently the largest equity owner of RWWI. Dr. Charpie joined Ampersand’s predecessor in 1980 and led its activities beginning in 1983. He has served as a director of more than 35 companies and as Chairman of more than 10 companies. He holds an M.S. degree in Physics and a Ph.D. in Economics and Finance, both from the Massachusetts Institute of Technology. Dr. Charpie serves on the boards of directors of CoreLab Partners, a clinical trial services company, Endeca Technologies, Inc., an internet search application company, and Nitinol Development Corporation. He served on the board of directors of the pre-merger Rand Worldwide immediately prior to the Merger.

GEORGE M. DAVIS—Mr. Davis joined the Board of Directors of Avatech Solutions, Inc. in July 2006 and was named Executive Vice Chairman in December 2006 and President and Chief Executive Officer in May 2007. In connection with the merger, Mr. Davis relinquished his executive roles within Avatech. Prior to joining Avatech, Mr. Davis was a co-founder of Aether Systems, Incorporated, a wireless data software and services company, and was its President and Vice Chairman of the Board from 2001 to 2004. Prior to founding Aether Systems, Mr. Davis worked for Westinghouse Electric Corporation (currently a division of Northrop Grumman) and Burroughs Corporation. He is currently a Partner in Coastal Ventures and sits on the Board of Directors of Defywire, a wireless data software company, is a member of the Directors Council of the Baltimore Museum of Art, a Steward of the Chesapeake Bay Foundation and a Trustee of Bethany College. Mr. Davis holds a Bachelor of Science degree in Economics and Business from Bethany College.

MARC L. DULUDE—Mr. Dulude became a director and Chief Executive Officer of the Company in connection with the August 2010 merger with Avatech. From April 1, 2009 through the date of the merger, Mr. Dulude was the President, Chief Executive Officer, and Chairman of the Board of the pre-merger Rand Worldwide. Prior to joining Rand Worldwide, Mr. Dulude was a General Partner with Ampersand Capital, a private equity firm he joined in 2002. Before Ampersand, Mr. Dulude spent six years at Moldflow Corporation, a product design simulation software company, where he was Chairman, President and CEO. Mr. Dulude has nearly two decades of experience as a senior information technology executive, including serving as Senior VP of Marketing at Parametric Technology Corporation (NASDAQ: PMTC), a product lifecycle management company, and in various positions at Nortel, a telecommunications company. Mr. Dulude holds a M.Eng. in Mechanical Engineering from Carleton University. Mr. Dulude is on the board of directors of Kortec, Inc., a PET packaging equipment manufacturing company.

EUGENE J. FISCHER—Mr. Fischer was a director of PlanetCAD from March 2000 until its merger with Avatech and continued to serve as a director of Avatech through the merger with Rand Worldwide. Mr. Fischer co-founded Capstone Management LLC, a venture capital firm, in July 1995, and is an executive officer in Capstone’s affiliated entities. He was previously a General Partner of Pathfinder Venture Capital Funds and Technology Funding and Vice President/Corporate Banking Group Head at Bank of America. His investment experience includes internet, software, health care service and other technology-enabled service companies. Mr. Fischer holds a Bachelor of Science degree from the University of Minnesota and a Master of Science degree from the University of California, Davis.

SUZANNE E. MACCORMACK—Ms. MacCormack joined the Board of Directors in connection with the merger and is currently a Partner with Ampersand which she joined in 2005. Prior to that, she served as Executive VP of Finance and Administration and as Chief Financial Officer at Moldflow Corporation for eight years. Ms. MacCormack holds a B.A. in Business from Stonehill College and is a C.P.A. Ms. MacCormack is on the board of directors of CoreLab Partners, and prior to the merger, was on the board of directors of Rand Worldwide.

MANU PARPIA—Mr. Parpia joined the Board of Directors in March 2011. Mr. Parpia was Chief Executive of the Electronic Business Equipment Division of Godrej & Boyce from the mid-1980s to 1999. During this period, he also founded Godrej Pacific, and served as its Managing Director from 1995 to 1999. In his activities with Godrej, he oversaw the design, development, manufacture and distribution of a variety of high-tech products. After his time at Godrej, he founded Geometric Ltd. and assumed the position of Managing Director,

3

Table of Contents

serving Geometric in that role until 2006. Today he sits on many boards including Geometric Ltd., 3d PLM Software Solutions Ltd., Virgo Engineers Ltd. and Godrej Infotech Ltd. In addition he is a Charter Member of The Indus Entrepreneurs (TiE)—Mumbai Chapter where he chairs their mentoring efforts.

CHARLES D. YIE—Mr. Yie joined the Board of Directors in connection with the merger. He is a General Partner of Ampersand, which he joined in 1985, and has been a director of more than 19 companies, including as Board Chair of four companies. Mr. Yie formerly served as a systems engineer and manufacturing specialist at Hewlett-Packard Company. He holds a B.S. degree in Electrical Engineering and a M.S. degree in Management, both from the Massachusetts Institute of Technology. Mr. Yie currently serves as the Chair of the board of directors of Kortec, Inc.

The Board of Directors unanimously recommends that you vote “FOR” the election of each nominee named above.

Interests of Director Nominees in the Election

In connection with the August 2010 merger with Avatech, the Company and each person who was serving as a director or an executive officer of Rand Worldwide immediately prior to the merger (each, a “Holder”) entered into a Stockholders’ Agreement (the “Stockholders’ Agreement”) with RWWI. Under the Stockholders’ Agreement, until the date on which RWWI ceases to hold at least 25% of the shares of Common Stock (the “Designation Period”), the parties agreed, among other things, that (i) the former Avatech Board nominate three individuals designated by RWWI to serve on our Board (each, a “Designator Nominee”) and recommend that the Avatech stockholders vote to elect such Designator Nominees as directors, (ii) the newly constituted Rand Worldwide Board will fill any vacancy that may arise upon the resignation, removal, death or disability of any of the elected Designator Nominees with a new director chosen by RWWI, and (iii) the former Avatech Board nominate for election and recommend that the Avatech stockholders vote to elect our Chief Executive Officer to serve as a director (upon such election, the “CEO Director”) until the 2010 Annual Meeting of Stockholders and that the initial CEO Director would be Mr. Dulude. Messrs. Charpie and Yie and Ms. MacCormack were designated as Designator Nominees by RWWI for purposes of this Annual Meeting.

During the Designation Period, each Holder also agreed to vote, and to cause each of his affiliates to vote, all of their voting securities held by such Holder or affiliate (i) for the election of Designator Nominees, (ii) against the removal of any elected Designator Nominee except for cause unless such removal is directed or approved by RWWI, (iii) for the removal of any elected Designator Nominee if such removal is directed or approved by RWWI, and (iv) for the election of a nominee designated to fill any vacancy created by the resignation, removal, death or disability of an elected Designator Nominee or the CEO Director. All Holders agreed to execute, and to cause their affiliates to execute, any written consents required to effectuate their obligations under the Stockholders’ Agreement.

Until the earlier of the expiration of the Designation Period and the date immediately preceding the date of our second Annual Meeting of Stockholders following the merger (the “Continuing Director Period”), the parties agreed that (i) at the 2010 Annual Meeting, our Board would nominate for election and recommend that our stockholders vote to elect two individuals, each of whom must have been serving on the Board immediately prior to the Merger (each, “Continuing Director Nominee”) to serve until the next Annual Meeting of Stockholders, and (ii) our Board will fill any vacancy that may arise upon the resignation, removal, death or disability of any elected Continuing Director with a new director who was serving our Board of Directors immediately prior to the Merger, provided that if no director who was serving on our board of directors immediately prior to the Merger is willing or able to serve, then our Board will have discretion to fill any such vacancy provided that such person is not an affiliate of RWWI or Rand Worldwide. In addition, during the Continuing Director Period, RWWI agreed to vote, and to cause each of its affiliates to vote, (a) for the election to our Board of the Continuing Director Nominees, (b) against the removal of any elected Continuing Director Nominee except for cause unless such removal is directed or approved by the remaining elected Continuing Director, if any, (c) for the removal of any

4

Table of Contents

elected Continuing Director Nominee if such removal is directed or approved by the remaining elected Continuing Director Nominee, and (d) for the election of a nominee designated by the remaining elected Continuing Director Nominee, if any, to fill any vacancy created by the resignation, removal, death or disability of an elected Continuing Director Nominee. RWWI agreed to execute, and to cause its affiliates to execute, any written consents required to effectuate their obligations under the Stockholders’ Agreement. Messrs. Davis and Fischer were designated as the Continuing Director Nominees for purposes of the 2010 Annual Meeting.

Quorum; Vote Required; Manner of Approval

A quorum for the Annual Meeting consists of a majority of the sum of (i) the shares of Common Stock outstanding on the Record Date and (ii) the shares of Common Stock into which the shares of Series D Convertible Preferred Stock and Series E Convertible Preferred Stock on the Record Date may be converted, in each case, that are present at the meeting in person or by proxy and entitled to vote. Directors are elected by a plurality of the votes cast. Accordingly, if a quorum is present, a director nominee will be elected if he or she receives the most votes cast on his or her election. Abstentions, withheld votes, and broker non-votes will be counted for the purpose of determining the presence or absence of a quorum, but will have no effect on the outcome of the vote.

All properly executed proxies received pursuant to this solicitation will be voted as directed by the stockholder on the proxy card. If no direction is given, it is the present intention of the proxies named in the accompanying form of proxy to vote the shares represented thereby for the election as directors of the six nominees listed above. If, due to unforeseen contingencies, any of the nominees designated above shall not be available for election, the proxies named in the accompanying form of proxy reserve the right to vote the shares represented thereby for such other person or persons as may be nominated for director by RWWI or the remaining new Continuing Directors, if any, so as to provide a full Board. The Company has no reason to believe that any nominee will be unable to serve if elected.

Qualifications of Director Nominees and Current Directors

The following table lists the specific experience, qualifications, other attributes and skills of each of the director nominees that led the Board of Directors to determine that such persons should serve on the Board.

| Director |

Skills/Qualifications | |

| Richard A. Charpie |

Business and Finance experience gained over 30 years of private equity experience; Managing Partner of Ampersand Capital; Numerous directorships of public and private companies; Board Chair of more than 10 companies; Ph.D. in Economics and Finance. | |

| George M. Davis |

Previously the CEO of Avatech Solutions; Senior executive positions at several large public companies; Serves on several Board of Directors; B.S. degree in Economics and Business. | |

| Marc L. Dulude |

Business experience includes several directorships and senior executive roles in both public and private companies; Eight years of private equity experience; In addition to business experience, possesses a strong technical background including a M. Eng. degree in Mechanical Engineering | |

| Eugene J. Fischer |

Over ten years experience as a Board member of Avatech; Co-founder of Capstone Management, a venture capital firm; Previous venture capital and banking experience; Holds BS and MS degrees | |

| Suzanne E. MacCormack |

Business, Accounting and Finance experience gained over 30 years of experience; Over five years experience in private equity firm; Previous senior executive experience in a public company and several positions on Boards of Directors; B.A. degree in Business and is a CPA | |

5

Table of Contents

| Director |

Skills/Qualifications | |

| Manu Parpia |

Business and Finance experience gained over 30 years of experience; Previous senior executive experience in a public company and several positions on Boards of Directors; B.S. degree in Chemical Engineering and a MBA | |

| Charles D. Yie |

Business experience includes directorships in more than 10 companies and prior senior executive experience; Significant private equity experience with Ampersand as a General Partner; B.S. degree in Electrical Engineering and M.S. degree in Management | |

The Board of Directors periodically reviews its corporate governance policies and procedures to ensure that the Company meets the highest standards of ethical conduct, reports results with accuracy and transparency, and complies with the laws, rules and regulations that govern the Company’s operations in all material respects.

Committees and Meetings of the Board of Directors

Board of Directors—During the fiscal year ended June 30, 2011, the Board of Directors held 13 meetings. During the period he or she served, no incumbent director attended fewer than 75% of the aggregate of (i) the total number of meetings of the Board held during the year and (ii) the total number of meetings held by all committees on which the director served during such year. Directors are not required to attend the Annual Meeting of Stockholders but all persons who were serving as directors at the time of the 2010 Annual Meeting of Stockholders attended that meeting.

Audit Committee—The Company’s Board maintains a separately-designated standing Audit Committee that is appointed by the Board to oversee the Company’s accounting, financial reporting and internal control functions and the audit of the Company’s financial statements, consisting of Suzanne E. MacCormack (Chair) and George M. Davis. The Audit Committee’s responsibilities include, among others, direct responsibility for hiring, firing, overseeing the work of and determining the compensation for the Company’s independent registered public accounting firm, which reports directly to the Audit Committee. Ms. MacCormack satisfies the SEC’s definition of “audit committee financial expert” as set forth in applicable rules of the Securities and Exchange Commission (the “SEC”). The Audit Committee has adopted a written charter, which is available on the Company’s Internet website at www.rand.com. During the fiscal year ended June 30, 2011, the Audit Committee met six times.

Nominating Committee—The full Board of Directors acts as a nominating committee for the annual selection of nominees for election as directors (see “Director Recommendations and Nominations” below). The Board met in this capacity one time during fiscal year 2011. The Board believes that the interests of the Company’s stockholders are served by relegating the nominations process to the full Board and all but two of its members are independent directors.

Compensation Committee—Following the merger, Messrs. Yie, (Chair), Fischer and Parpia were appointed to serve as the members of the Compensation Committee. The Compensation Committee is charged with reviewing and determining the compensation of the Chief Executive Officer and the other members of the senior management of the Company, subject to approval from the full Board. On an annual basis, the Chief Executive Officer evaluates the compensation of the senior management team based on their performance and peer comparisons and makes recommendations to the Compensation Committee as to the compensation level for those positions for the coming year. During the fiscal year ended June 30, 2011, the Compensation Committee met two times and did not operate under a written charter.

6

Table of Contents

Director Independence

The Board has determined that each of Messrs. Charpie, Fischer, Parpia and Yie and Ms. MacCormack is an “independent director” as defined by Rule 5605(a)(2) of The NASDAQ Stock Market Rules (the “NASDAQ Rules”), that each member of the Compensation Committee is an “independent director” as defined by NASDAQ Rule 5605(a)(2), and that Suzanne E. MacCormack, the Audit Committee financial expert, satisfies the audit committee independence standards of NASDAQ Rule 5605(c)(2). Mr. Dulude is not independent because he is the current CEO of the Company, and Mr. Davis is not independent because he is the former CEO of the Company.

With respect to the composition of the Board of Directors and its committees prior to the Merger, the Board of Directors determined that each of Garnett Y. Clark, Jr., George W. Cox, Eugene J. Fischer, Aris Melissaratos, Robert J. Post, David C. Reymann and Thom Waye was an “independent director” as that term is defined by NASDAQ Rule 5605(a)(2), that each member of the Compensation Committee was an “independent director” as defined by NASDAQ Rule 5605(a)(2), and that each member of the Audit Committee satisfied the audit committee independence standards of NASDAQ Rule 5605(c)(2).

In making these independence determinations, in addition to the transactions described below under “Certain Relationships and Related Transactions”, the Board considered the effect of the merger on director independence.

Board Leadership and Role in Risk Oversight

The Board believes that effective board leadership structure can depend on the experience, skills, and personal interaction between persons in leadership roles and the needs of the Company at any point in time. The positions of Chairman of the Board and Chief Executive Officer are held by two different people based on the Board’s recognition of the differences between the two responsibilities. Our Chief Executive Officer is responsible for setting our strategic direction and for day-to-day leadership and performance of the Company. Our Chairman of the Board provides input to the Chief Executive Officer, sets the agenda for board meetings, and presides over meetings of the full Board.

The Board fulfills a significant role in the oversight of risk in the Company, both through the actions of the Board as a whole and those of its Compensation and Audit Committees. The Board is responsible for oversight of our risk management practices, while management is responsible for the day-to-day risk management processes. The Board believes that this division of responsibilities is the most effective approach for addressing the risks facing the Company, and the Company’s Board leadership structure supports this approach. The Board receives periodic reports from management regarding the most significant risks facing our Company. The Board meets at least every quarter to review the operations of the Company, its financial results and any items of strategic importance or significant risk. The Audit Committee meets regularly with the Company’s independent registered public accounting firm to receive reports on the results of the audited financial statements and to review and approve all major regulatory filings. The Compensation Committee establishes and oversees the Company’s executive compensation programs and periodically reviews these programs to determine whether they present any significant risks to the value of the Company.

Compensation of Directors

The full Board is responsible for establishing compensation policies and setting directors compensation and intends to continue in effect the Compensation Committee’s policy. The following table provides information about the compensation paid to or earned by the Company’s directors during fiscal year 2011 who are not Named Executive Officers (as defined below). Information regarding directors who are also Named Executive Officers is presented in the Summary Compensation Table that is provided later in this report. Information with respect to Messrs. Charpie and Yie and Ms. MacCormack is not included because they received no compensation, in any form, from the Company during fiscal year 2011.

7

Table of Contents

DIRECTOR COMPENSATION

| Name |

Fees Earned or Paid in Cash ($) |

Stock

Awards ($)(3) |

Option Awards ($)(3, 4) |

All

Other Compensation ($)(5) |

Total ($) |

|||||||||||||||

| George M. Davis |

14,800 | 0 | 2,304 | 0 | 17,104 | |||||||||||||||

| Eugene J. Fischer |

13,400 | 0 | 2,304 | 3,105 | 20,209 | |||||||||||||||

| Manu Parpia1 |

3,500 | 0 | 10,368 | 2,644 | 16,512 | |||||||||||||||

| Garnett Y. Clark, Jr.2 |

7,200 | 0 | 0 | 0 | 7,200 | |||||||||||||||

| George W. Cox2 |

7,200 | 0 | 0 | 0 | 7,200 | |||||||||||||||

| Aris Melissaratos2 |

0 | 8,640 | 0 | 0 | 8,640 | |||||||||||||||

| Robert J. Post2 |

0 | 8,640 | 0 | 0 | 8,640 | |||||||||||||||

| David C. Reymann2 |

7,200 | 0 | 0 | 0 | 7,200 | |||||||||||||||

| Thom Waye2 |

0 | 8,640 | 0 | 0 | 8,640 | |||||||||||||||

| (1) | Mr. Parpia joined the Board on March 31, 2011. |

| (2) | Messrs. Clark, Cox, Melissaratos, Post, Reymann and Waye served as directors until the closing date of the Merger, and the amounts shown above represent compensation paid for services performed between July 1, 2010 and August 17, 2010. |

| (3) | The value of each equity award reflects the aggregate grant date fair value of that award computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standard Codification (“ASC”) Topic 718, “Accounting for Stock Compensation”. See Note 1 to the consolidated audited financial statements contained in the Company’s Annual Report on Form 10-K for the year ended June 30, 2011 regarding the assumptions underlying the valuation of equity awards. |

| (4) | At June 30, 2011, outstanding stock options held by Mr. Davis, Mr. Fischer and Mr. Parpia were options to purchase 6,000, 70,800 shares and 22,200 shares, respectively. |

| (5) | Amount represents travel reimbursements to Directors to attend Board and other Company meetings. |

During the fiscal year ended June 30, 2011, those directors who were employed by the Company received no compensation for serving as a director. Directors are eligible to participate in the Company’s 2002 Stock Option Plan. In April 2009, the Board of Directors approved a reduction of all aspects of Board compensation of 10% in response to a 10% reduction in the base compensation of all Company employees. In May 2011, the Board voted to reinstate the Board compensation plan to the levels prior to the April 2009 reduction (the “Board Compensation Plan”). Under the provisions of the current Board Compensation Plan, non-employee members of the Board of Directors receive an annual salary of $10,000, payable in quarterly installments, as well as $1,000 for each meeting attended. The Chair of the Compensation Committee receives an additional $2,500 per year, paid in quarterly installments, for performing his duties and the Audit Committee Chair receives an additional annual salary of $24,000, also paid in quarterly installments. Non-employee members of the Board receive an additional $500 for each committee meeting which lasts more than 30 minutes. Directors may elect to receive $1.20 worth of stock in lieu of each dollar of cash compensation. Each non-employee director also receives an initial grant of an option to purchase 18,000 shares of Common Stock upon joining the Board, one-third of which vests immediately and the remainder vests in equal installments on the first and second anniversary of the grant date. At the end of each fiscal year, non-employee directors are granted immediately vested options to purchase 6,000 shares of stock. The exercise price of all non-employee director stock options and the value of stock granted in lieu of cash compensation is the closing price of a share of the Common Stock on the last business day before the options are granted or shares of stock are issued.

Dr. Charpie, Mr. Yie and Ms. MacCormack have waived the receipt of any form of compensation for serving on the Board.

Code of Ethics

The Company has adopted a Code of Business Conduct and Ethics (“Code of Ethics”) that is designed to promote the highest standards of ethical conduct by the Company’s directors, executive officers and employees,

8

Table of Contents

including its principal executive officer, principal financial officer, principal accounting officer, or controller, or persons performing similar functions. The Code of Ethics is posted on the Company’s Internet website at http://www.rand.com. In the event of an amendment to, or a waiver from, a provision of the Company’s Code of Ethics that applies to any of the Company’s principal executive officer, principal financial officer, principal accounting officer, or controller, or persons performing similar functions, the Company intends to promptly disclose such amendment or waiver on its Internet website.

Director Recommendations and Nominations

Director candidates may come to the attention of the Board of Directors from any number of sources, including current directors, executive officers or other persons. The Board does not have a formal policy under which it considers the diversity of candidates for directorship when making nominations. The Board periodically reviews its list of candidates available to fill vacancies and researches and evaluates, among other things, the talent, skills, financial and business experience and expertise of the candidate, his or her independence from the Company, and his or her general background. In addition, the Board assesses whether any vacancies are expected due to retirement or otherwise and the need for particular expertise on the Board. Historically, the Board has generally sought to choose individuals that have skills, education, experience and other attributes that will complement and/or broaden the strengths of the existing directors.

The Board will consider a candidate recommended by a stockholder and, in doing so, will apply these same methods and criteria to any such recommendation. It should be noted, however, that a stockholder recommendation is not a nomination, and there is no guarantee that a candidate recommended by a stockholder will be approved by the Board of Directors. A stockholder who desires to nominate a candidate for election may do so only in accordance with Section 5(c) of Article III of the Company’s By-Laws, a copy of which may be obtained from the Secretary of the Company or from the Company’s filings with the SEC.

Furthermore, stockholders should understand that the Board’s ability to nominate directors, whether recommended by a stockholder or otherwise, may be limited by the terms of the Stockholders’ Agreement, which are discussed in detail above in the section entitled “ELECTION OF DIRECTORS (Proposal 1)” under the heading “Interest of Director Nominees in the Election”. Specifically, the Stockholders Agreement currently limits the size of the Board to seven directors, the Board agreed to nominate certain individuals to the Board for certain periods, and RWWI and all persons who were serving as directors or executive officers of the Company at the time of the merger (and their affiliated investment funds) agreed to vote their respective shares of our voting securities for the election of certain nominees.

Communications with the Board

Any stockholder desiring to contact the Board, or any specific director(s), may send written communications to: Board of Directors (Attention: (Name(s) of director(s), as applicable)), c/o the Company’s Secretary, 161 Worcester Road, Suite 401, Framingham, Massachusetts 01701. Any proper communication so received will be processed by the Secretary. If it is unclear from the communication received whether it was intended or appropriate for the Board, the Secretary (subject to any applicable regulatory requirements) will use his judgment to determine whether such communication should be conveyed to the Board or, as appropriate, to the member(s) of the Board named in the communication.

Family Relationships

There are no family relationships among our directors and/or executive officers.

Indemnification Agreements

On the closing date of the merger, the Company entered into indemnification agreements (the “Indemnification Agreements”) with each of its directors and with Lawrence Rychlak, the Company’s President and Chief Financial Officer (each, an “Indemnitee” and collectively, the “Indemnitees”). Under the

9

Table of Contents

Indemnification Agreements, the Company agreed to indemnify each Indemnitee to the fullest extent permitted by law against any liability arising out of the Indemnitee’s performance of his or her duties to the Company. The indemnification provided by the Indemnification Agreements is in addition to the indemnification required by the Company’s bylaws and applicable law. Among other things, each Indemnification Agreement indemnifies the Indemnitee (and under certain circumstances, investment funds affiliated with the Indemnitee) against certain expenses (including reasonable attorneys’ fees) incurred by the Indemnitee in any action or proceeding, including any action by or in the right of the Company, arising out of the Indemnitee’s service to the Company or to any other entity to which the Indemnitee provides services at the Company’s request. Further, each Indemnification Agreement requires the Company to advance funds to the Indemnitee to cover any expenses the Indemnitee incurs in connection with any proceeding against the Indemnitee as to which the Indemnitee could be indemnified. Each of the director nominees is an Indemnitee.

BENEFICIAL OWNERSHIP OF VOTING SECURITIES OF RAND WORLDWIDE, INC.

The following table shows information, as of the Record Date, with respect to each person or group of persons, other than directors, director nominees, and executive officers of the Company, known by the Company to beneficially own more than 5% of the Company’s voting securities. Generally, a person “beneficially owns” voting securities if that person has or shares with others the right to vote those securities or to invest (or dispose of) those securities, or if that person has the right to acquire such voting or investment rights, within 60 days of the Record Date (such as by exercising stock options or similar rights). The percent of class owned by each such person is calculated by dividing the number of voting securities beneficially owned by each person by the total number of voting securities actually outstanding on the Record Date. To the Company’s knowledge, except as indicated in the footnotes to the following table and subject to community property laws where applicable, the persons named in this table have sole voting and investment power with respect to all voting securities shown as beneficially owned by them.

| Name and Address of Beneficial Owner |

Common Stock | Series D Convertible Preferred Stock |

Series E Convertible Preferred Stock |

|||||||||||||||||||||

| Shares Beneficially Owned |

Percent of Class |

Shares Beneficially Owned |

Percent of Class |

Shares Beneficially Owned |

Percent of Class |

|||||||||||||||||||

| RWWI Holdings LLC c/o Ampersand Capital 55 William Street, Suite 240 Wellesley, MA 02481 |

34,232,682 | 65.9 | % | — | — | — | — | |||||||||||||||||

| Peter H. Kamin One Avery Street, 17B Boston, MA 02111 |

3,638,990 | 7.0 | % | — | — | — | — | |||||||||||||||||

10

Table of Contents

The following table shows information known by the Company, as of the Record Date, with respect to the beneficial ownership of the Company’s voting securities by each of the Company’s current directors, director nominees, and Named Executive Officers, and all of the current directors, director nominees, and executive officers as a group. Generally, a person “beneficially owns” voting securities if that person has or shares with others the right to vote those securities or to invest (or dispose of) those securities, or if that person has the right to acquire such voting or investment rights, within 60 days of the Record Date (such as by exercising stock options or similar rights). The percent of class owned by each such person is calculated by dividing the number of voting securities beneficially owned by each person by the total number of voting securities actually outstanding on the Record Date. To the Company’s knowledge, except as indicated in the footnotes to the following table and subject to community property laws where applicable, the persons named in this table have sole voting and investment power with respect to all shares of the voting securities shown as beneficially owned by them.

| Common Stock | Series D Convertible Preferred Stock |

Series E Convertible Preferred Stock |

||||||||||||||||||||||

| Beneficial Owner |

Shares Beneficially Owned |

Percent of Class |

Shares Beneficially Owned |

Percent of Class |

Shares Beneficially Owned |

Percent of Class |

||||||||||||||||||

| Eugene J. Fischer1 |

1,418,208 | 2.7 | % | 500,000 | 45.9 | % | 75 | 8.0 | % | |||||||||||||||

| Lawrence Rychlak3 |

388,462 | * | — | — | 25 | 2.7 | % | |||||||||||||||||

| George M. Davis2 |

217,422 | * | — | — | — | — | ||||||||||||||||||

| Manu Parpia4 |

11,400 | * | — | — | — | — | ||||||||||||||||||

| Richard A. Charpie |

— | — | — | — | — | — | ||||||||||||||||||

| Marc L. Dulude |

— | — | — | — | — | — | ||||||||||||||||||

| Robert Heeg |

— | — | — | — | — | — | ||||||||||||||||||

| Suzanne E. MacCormack |

— | — | — | — | — | — | ||||||||||||||||||

| Charles D. Yie |

— | — | — | — | — | — | ||||||||||||||||||

| All current directors, director nominees, and executive officers as a group (a total of 9 persons): |

2,035,491 | 3.8 | % | 500,000 | 45.9 | % | 100 | 10.7 | % | |||||||||||||||

| * | Less than one percent. |

| (1) | Mr. Fischer is a member of the Board of Directors. The amount shown for Mr. Fischer includes 1,000,837 and 115,385 shares of Common Stock issuable on conversion of shares of Series D and Series E Convertible Preferred Stock, respectively, held by Capstone Capital SBIC, L.P.; and 70,800 shares of Common Stock subject to options held by Capstone. Mr. Eugene Fischer is the president of the general partner Capstone and shares voting and dispositive power with respect to the shares held by Capstone with Barbra L. Santry. |

| (2) | Mr. Davis is a member of the Board of Directors and is the Company’s former Chief Executive Officer. The amount shown for Mr. Davis includes 6,000 shares of Common Stock subject to options. |

| (3) | Mr. Rychlak serves as the Company’s President and Chief Financial Officer. The amount shown for Mr. Rychlak includes 350,000 shares of Common Stock subject to options and 38,462 shares of Common Stock issuable on conversion of shares of Series E Convertible Preferred Stock. |

| (4) | Mr. Parpia is a member of the Board of Directors and the amount shown for Mr. Parpia is comprised of 11,400 shares of Common Stock subject to options. |

Set forth below is information with respect to the individuals who serve as the executive officers of the Company.

| Name |

Age | Position | ||||

| Richard A. Charpie |

59 | Chairman of the Board | ||||

| Marc L. Dulude |

51 | Chief Executive Officer | ||||

| Lawrence Rychlak |

55 | President and Chief Financial Officer | ||||

| Robert Heeg |

53 | Executive Vice President | ||||

11

Table of Contents

Richard A. Charpie—Mr. Charpie became the Chairman of the Board in connection with the Merger with Avatech. Our Bylaws provide that the Chairman is an executive officer of the Company. Information about Mr. Charpie, including his business experience during the past five years, is set forth above under the heading “Election of Directors”.

Marc L. Dulude—Mr. Dulude became Chief Executive Officer in connection with and pursuant to the terms of the Merger with Avatech. Information about Mr. Dulude, including his business experience during the past five years, is set forth above under the heading “Election of Directors”.

Lawrence Rychlak—Mr. Rychlak joined Avatech in May 2005 as Chief Financial Officer and was appointed President in October 2009. Following the Merger, Mr. Rychlak continued as the President and Chief Financial Officer of Rand Worldwide, Inc. Prior to joining the Company, he worked for Environmental Elements Corporation, where he served as interim president and Senior Vice President and Chief Financial Officer from 2001 to May 2005. Mr. Rychlak’s background also includes several senior financial positions in both for profit and not-for-profit organizations, business consulting with a regional consulting firm and eight years with an international accounting and consulting firm. He is a Certified Public Accountant and holds a Bachelor of Arts degree in Accounting and a Master’s degree in Business Administration from Loyola University in Baltimore.

Robert Heeg—Mr. Heeg joined Rand Worldwide in August 2000 as a Sales and Marketing Manager for the company’s IMAGINiT Technologies division. In August 2002, he was appointed US Country Manager of IMAGINiT Technologies and in 2004 was named Executive Vice President, and continued as Executive Vice President after the Merger. Prior to joining Rand Worldwide, Mr. Heeg served as the Vice President and General Manager of Anderson International Corp. from 1996 to 2000. He holds a Bachelor of Science degree in Electrical Engineering from Ohio University.

The following table provides detailed information about the remuneration (for services in all capacities) awarded to, earned by, or paid during the last two fiscal years to (i) the individual who served as the Company’s principal executive officer during fiscal year 2011 (the “PEO”), (ii) the Company’s two most highly compensated executive officers other than the PEO who were serving as executive officers as of June 30, 2011 and who earned more than $100,000 during fiscal year 2011, and (iii) up to two additional individuals for whom information would have been disclosed pursuant to the preceding item (ii) but for the fact that such individuals were not serving as executive officers as of June 30, 2011 (collectively, the “named executive officers”).

SUMMARY COMPENSATION TABLE

| Name and principal position |

Fiscal Year |

Salary ($) |

Bonus ($) |

Option Awards ($)1 |

Non-equity Incentive Plan Compensation ($) |

All Other Compensation ($)2 |

Total ($) |

|||||||||||||||||||||

| Marc L. Dulude Chief Executive Officer3 |

|

2011 2010 |

|

|

277,834 0 |

|

|

30,300 0 |

|

|

213,926 0 |

|

|

212,027 0 |

|

|

9,569 0 |

|

|

743,656 0 |

| |||||||

| Lawrence Rychlak President and Chief Financial Officer |

|

2011 2010 |

|

|

235,542 223,250 |

|

|

25,377 30,000 |

|

|

106,963 0 |

|

|

169,621 0 |

|

|

9,115 10,130 |

|

|

546,618 263,380 |

| |||||||

| Robert F. Heeg Executive Vice President4 |

|

2011 2010 |

|

|

232,334 0 |

|

|

24,998 0 |

|

|

106,963 0 |

|

|

169,621 0 |

|

|

9,036 0 |

|

|

542,952 0 |

| |||||||

| George M. Davis Former Chief Executive Officer5 |

|

2011 2010 |

|

|

164,584 237,500 |

|

|

0 0 |

|

|

0 0 |

|

|

0 0 |

|

|

1,583 9,450 |

|

|

166,167 246,950 |

| |||||||

12

Table of Contents

| (1) | For purposes of this table, the value of each equity award reflects the aggregate grant date fair value of that award computed in accordance with FASB ASC Topic 718, “Accounting for Stock Compensation”. See Note 1 to the consolidated audited financial statements contained in the Company’s Annual Report on Form 10-K for the year ended June 30, 2011 regarding the assumptions underlying the valuation of equity awards. |

| (2) | Amount represents employer matching contributions under the Company’s 401(k) plan. |

| (3) | Mr. Dulude was named Chief Executive Officer on August 17, 2010 upon the closing of the merger and therefore received no compensation from the Company for the fiscal year ended June 30, 2010. During that time, Mr. Dulude received $281,875 in total compensation from the pre-merger Rand Worldwide, which was comprised of $275,000 in base salary and $6,875 in other compensation. |

| (4) | Mr. Heeg was the Executive Vice President of the pre-merger Rand Worldwide and became the Executive Vice President of the Company after the Merger, and therefore received no compensation from the Company for the fiscal year ended June 30, 2010. During that time, Mr. Heeg received $236,110 in total compensation from the pre-merger Rand Worldwide, which was comprised of $230,000 in base salary and $6,110 in other compensation. |

| (5) | Mr. Davis resigned as the Company’s Chief Executive Officer on August 17, 2010 upon the closing of the merger. During the fiscal year 2010, Mr. Davis served on the Board of Directors but received no fees for such service. During fiscal year 2011, Mr. Davis was compensated in accordance with the Board of Directors Compensation Plan, as previously disclosed under the caption “Directors Compensation”. |

Executive Compensation Philosophy and Employment Arrangements with Named Executive Officers

Compensation Philosophy

The Board maintains a separate Compensation Committee that is charged with establishing executive compensation. The Committee understands and values the vital impact that executive management has in achieving success for the Company and the creation of stockholder value, and it recognizes the highly competitive environment in which the Company must compete for top-level executive management. The overall objective in establishing executive compensation is to ensure that the Company can attract, retain, motivate and reward a high caliber, high performing executive team, which is continually focused on achieving long-term stockholder value. The Committee believes that the Company’s compensation program offers a competitive compensation package to all executive employees that takes into account both individual contributions and corporate performance. The Chief Executive Officer plays a role in recommending incentive plan compensation awards to the Compensation Committee and also serves as a director and votes on compensation matters of the senior management, except for his own compensation.

The Committee seeks to accomplish its goals by paying competitive base salaries augmented with performance-based incentives, and securing these benefits and the employment of the executives through written employment agreements when appropriate. Short-term compensation includes both base salary and performance-based cash bonus opportunities, while long-term incentives are generally in the form of equity based awards, with or without performance features. Both cash bonuses and long-term incentive plans align management’s interests with stockholders by incenting earnings growth and providing significant equity interest in the Company.

Base salaries are set at levels intended to foster career development among executives, consistent with the long-term nature of the Company’s business objectives. In setting base salary levels, consideration is given to salary levels paid to executives holding similar positions at other comparable organizations. Annual salary adjustments are determined after considering the executive’s performance during the immediately preceding year.

Employment Arrangements with Named Executive Officers

Messrs. Dulude, Rychlak and Heeg all have employment agreements with the Company. Mr. Davis’s executive officer service prior to August 17, 2010 was performed pursuant to an employment agreement with Avatech.

13

Table of Contents

Mr. Dulude’s agreement entitles him to an annual base salary of $283,500 plus an annual bonus targeted at $125,000, based on his achievement of certain performance goals established from time to time, and subject to annual review by the Compensation Committee. The agreement also entitles Mr. Dulude to participate in any long term incentive plan that may be adopted by the Board. Mr. Dulude is also entitled to participate in the Company’s benefit programs to the same extent as, and subject to the same terms, conditions and limitations applicable to, other employees of the Company, including 401(k) plan participation, life, health, dental, accident and short term and long term disability insurance. The effective date of his agreement is January 1, 2011 and the agreement may be terminated by the Company or Mr. Dulude at any time without prior notice. If the Company terminates the agreement without “Cause” (as defined in the agreement) or in the event of Mr. Dulude’s death or disability, then Mr. Dulude is entitled to salary and benefits continuation for a period of twelve (12) months provided that Mr. Dulude (or his estate, as the case may be) executes and delivers a release and waiver of claims acceptable to the Company within twenty eight (28) days of the termination. The Company will be deemed to have terminated Mr. Dulude without “Cause” if Mr. Dulude terminates his agreement and any of the following events occur and the Company does not take action to remedy such event within 30 days of receiving notice from Mr. Dulude of such event: (i) the Company substantially reduces or diminishes Mr. Dulude’s duties and responsibilities without Cause; (ii) the Company reduces Mr. Dulude’s base salary (other than in connection with a proportional reduction of the base salaries of a majority of the executive employees of the Company); or (iii) the Company permanently relocates Mr. Dulude without his written consent to another primary office unless Mr. Dulude’s primary office following such relocation is within 50 miles of his primary office immediately before the relocation or his permanent residence immediately prior to the date of his relocation. If Mr. Dulude is terminated by the Company with Cause or if Mr. Dulude voluntarily resigns, then he is entitled only to the amount owed for work done prior to the termination or resignation. In connection with his employment agreement, Mr. Dulude executed an Employee Confidentiality, Assignment of Inventions, Non-Competition and Non-Solicitation Agreement (the “Confidentiality Agreement”) pursuant to which he agreed, among other things, not to compete with the Company or any of its affiliates, during the term of his employment or for 12 months thereafter.

On August 7, 2010, in connection with the Merger, the Company and Mr. Rychlak entered into an Amended and Restated Employment Agreement to ensure that Mr. Rychlak’s employment agreement complies with Section 409A of the Internal Revenue Code, and to modify some severance provisions. Mr. Rychlak’s employment agreement calls for an annual salary of $235,000, subject to annual review, and the right to participate in all benefit plans offered by the Company to its executive officers, including participation in the Company’s 401(k) plan, its equity compensation plans and its fringe benefit plans. In addition, the agreement provides for an annual bonus, targeted at $100,000, based on his achievement of certain performance goals established from time to time, or a discretionary bonus as determined and awarded by the Compensation Committee. Mr. Rychlak’s annual salary is currently set at $242,500. Mr. Rychlak’s employment agreement provides for severance benefits if the Company terminates him without “Cause” (as defined in the agreement), if Mr. Rychlak terminates his employment for “Good Reason” (as defined in his agreement), or if he voluntarily resigns upon a “Change in Control” (as defined in the agreement). Severance benefits include the continuation of base salary and benefits (to the extent those benefit plans permit continued participation) for (i) 24 months if the termination occurs at any time prior to June 30, 2011, (ii) a period of months equal to 12 plus the number of full months remaining before July 1, 2012 if the termination occurs on or after June 30, 2011 but before June 30, 2012, and (iii) 12 months if the termination occurs on or after June 30, 2012. Mr. Rychlak agreed in his agreement that the merger would not be deemed a Change in Control that would entitle him to voluntarily resign (other than for Good Reason) and thereafter receive severance. Under his agreement, Mr. Rychlak is prohibited from conflicts of interest and is required to maintain the confidentiality of nonpublic information regarding Rand and its customers. Additionally, Mr. Rychlak is bound by a covenant not to compete and not to interfere with other employees of Rand if his employment is terminated for any reason.

Mr. Heeg’s employment agreement, dated May 7, 2008, is with Rand IMAGINiT Technologies, Inc., a subsidiary of the Company that was acquired in the Merger, and provides for an annual salary of $220,000, subject to annual review and adjustment, and the right to participate in all benefit plans offered by the Company

14

Table of Contents

to its executive officers, including participation in the Company’s 401(k) plan, its equity compensation plans and its fringe benefit plans. In addition, the agreement provides for an annual bonus, targeted at $100,000, based on his achievement of certain performance goals established from time to time, or a discretionary bonus as determined and awarded by the Compensation Committee. Mr. Heeg’s annual salary level is currently set at $237,000. The agreement may be terminated by the Company or Mr. Heeg at any time without prior notice. If the Company terminates the agreement without “Cause” (as defined in the agreement) or in the event of Mr. Heeg’s death or disability, then Mr. Heeg or his estate is entitled to salary and benefits continuation for a period of twelve (12) months provided that Mr. Heeg executes and delivers a release and waiver of claims acceptable to the Company within twenty eight (28) days of the termination. If Mr. Heeg is terminated by the Company with Cause or if Mr. Heeg voluntarily resigns, then he is entitled only to the amount owed for work done prior to the termination or resignation. In connection with his employment agreement, Mr. Heeg executed an Employee Confidentiality, Assignment of Inventions, Non-Competition and Non-Solicitation Agreement (the “Confidentiality Agreement”) pursuant to which he agreed, among other things, not to compete with Rand Worldwide or any of its affiliates during the term of his employment or for 12 months thereafter.

Under Mr. Davis’ employment agreement, which terminated in connection with the merger, he was entitled to receive an annual base salary of $250,000, to receive and/or participate in such incentive compensation awards and programs as the Board of Directors or its Compensation Committee may from time to time grant or establish, including, without limitation, discretionary bonus programs and participation in the Company’s equity compensation programs, and to participate in the employee benefits plans and programs offered by the Company to its executives and/or its employees generally, including medical, disability and life insurance coverage and participation in the Company’s 401(k) plan. Mr. Davis’ service under his agreement terminated in connection with the merger, and the severance provisions of the agreement were triggered. Pursuant to these severance provisions, (i) all outstanding stock options held by Mr. Davis immediately vested and will remain exercisable for one year, (ii) Mr. Davis received continued base salary payments for six months, and (iii) Mr. Davis is entitled to receive continued medical insurance coverage for up to 24 months after termination. Continued medical coverage will be in the form of a waiver by the Company of payments that it otherwise would charge to Mr. Davis for continuation coverage under the federal Consolidated Omnibus Budget Reconciliation Act (“COBRA”) or, for any period during which Mr. Davis is not eligible for COBRA coverage, reimbursement by the Company of premiums (not to exceed 100% of the COBRA rate that the Company would charge to Mr. Davis under its then existing medical insurance plan) that Mr. Davis is required to pay to purchase a policy of comparable private health insurance. Mr. Davis agreed, for one year following termination, not to, directly or indirectly, (a) compete with the Company by selling comparable products or services within 50 miles of any location at which the Company or any of its affiliates sells its products or offers its services, (b) employ or retain any person who was employed or retained by the Company and/or its affiliates during the period of Mr. Davis’ employment, or (c) solicit any customers or clients of the Company and/or its affiliates.

Executive Bonuses

The Company maintains an Annual Cash Bonus Plan which is designed to pay out cash bonuses based on the achievement of pre-established levels of annual earnings before interest, taxes, depreciation and amortization (“EBITDA target”). For the year ended June 30, 2011, management exceeded the EBITDA target established shortly after the merger and Messrs. Dulude, Rychlak and Heeg were awarded cash bonuses of $212,027, $169,621 and $169,621, respectively, in accordance with the provisions of the plan.

In addition, in February 2011, the Board of Directors, in recognition of management’s successful efforts relating to the merger integration of the operations of Avatech Solutions, Inc. and Rand Worldwide, Inc., awarded a Special Recognition Bonus to Messrs. Dulude, Rychlak and Heeg of $30,300, $25,377 and $24,998, respectively.

15

Table of Contents

Long-Term Incentive Compensation/Equity Based Awards

The Company believes that equity based compensation is among the most effective means of creating a long-term link between the interests of its stockholders and the performance of our organization and its executive team. Vesting schedules for equity based awards also encourage officer retention.

Executives are eligible to receive equity awards in the form of stock options and restricted stock and the value of these awards granted is based on competitive market practice, company performance, and individual performance. The Compensation Committee recommends, in its discretion, the form, number, and terms of equity based awards, and the full Board of Directors approves the awards.

In May 2011, the Compensation Committee recommended and the Board of Directors approved equity-based awards of stock options to Messrs. Dulude, Rychlak and Heeg based upon the totals of previous awards and each executive officer’s performance. The stock options expire in ten years, vest annually over a four year period and have an exercise price of $0.70 per share. These awards were as follows:

| Named Executive Officer |

Number of Options Awarded |

|||

| Marc L. Dulude |

557,100 | |||

| Lawrence Rychlak |

287,550 | |||

| Robert Heeg |

287,550 | |||

Equity Compensation

The following table sets forth certain information about options under the Company’s equity compensation plans that remain unexercised at June 30, 2011. As of that date, no other forms of equity awards were outstanding.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR END

| Name and principal position |

Number of Securities Underlying Unexercised Options (#) Exercisable1 |

Number

of Securities Underlying Unexercised Options (#) Unexercisable |

Option Exercise Price ($) |

Option Expiration Date2 |

||||||||||||

| Marc L. Dulude Chief Executive Officer |

-0- | 557,100 | 2 | $ | 0.70 | 5/10/2021 | ||||||||||

| Lawrence Rychlak President and Chief Financial Officer |

|

100,000 100,000 50,000 100,000 -0- |

|

|

-0- -0- -0- -0- 278,550 |

3 |

$ $ $ $ $ |

0.50 1.05 1.71 0.84 0.70 |

|

|

5/9/2015 10/20/2015 9/29/2016 10/29/2017 5/10/2021 |

| ||||

| Robert Heeg Executive Vice President |

-0- | 278,550 | 3 | $ | 0.70 | 5/10/2021 | ||||||||||

| George M. Davis Former Chief Executive Officer4 |

|

18,000 100,000 75,000 200,000 |

|

|

-0- -0- -0- -0- |

|

$ $ $ $ |

2.10 1.62 0.87 0.87 |

|

|

08/17/2011 08/17/2011 08/17/2011 |

| ||||

| (1) | In accordance with the terms of the stock option agreements, all outstanding equity awards held by Messrs. Rychlak and Davis as of the date of the merger became vested upon closing of the merger. |

| (2) | 139,275 shares become vested each May 10, 2012, 2013, 2014 and 2015. |

16

Table of Contents

| (3) | 69,638 shares become vested each May 10, 2012, 2013, 2014 and 2015. |

| (4) | Mr. Davis resigned his position as Chief Executive Officer on August 17, 2010 upon the closing of the merger. Pursuant to the terms of his employment agreement, the expiration dates of Mr. Davis’ outstanding options were changed to August 17, 2010 on account of the termination of his Chief Executive Officer status. These options were not exercised by Mr. Davis by August 17, 2011 and, as a result, have expired. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires directors and executive officers of the Company and each person who beneficially owns more than ten percent of the outstanding shares of Common Stock to file with the SEC an initial report of beneficial ownership on Form 3 and reports with respect to subsequent changes in beneficial ownership of such securities on Form 4 or Form 5. To the Company’s knowledge, based solely upon the review of the copies of such reports furnished to the Company, these persons timely filed all reports required by Section 16(a) during the fiscal year ended June 30, 2011, except that Mr. Parpia’s initial statement of beneficial ownership on Form 3 was filed late.

The Audit Committee has reviewed and discussed with management the audited financial statements of the Company and its subsidiaries for fiscal year ended June 30, 2011.

The Audit Committee has discussed with Stegman & Company, the Company’s independent registered public accounting firm, the matters required to be discussed by the Statement of Auditing Standards No. 114, “The Auditor’s Communication with Those Charged with Governance”. The Audit Committee has received the written disclosures and the letter from Stegman & Company required by PCAOB Rule 3526, “Communication with Audit Committees Concerning Independence”, and has discussed Stegman & Company’s independence with Stegman & Company.

Based on the foregoing review and discussions, the Audit Committee recommended to the Company’s Board of Directors that the audited financial statements for the fiscal year ended June 30, 2011 be included in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2011 for filing with the SEC.

| By: |

AUDIT COMMITTEE | |

| Suzanne E. MacCormack, Chair | ||

| George M. Davis | ||

APPROVAL OF AN AMENDMENT TO THE STOCK OPTION PLAN (Proposal 2)

At the Annual Meeting, stockholders will be asked to approve an amendment to the PlanetCad, Inc. 2002 Stock Option Plan (the “Plan”) to increase the maximum number of shares of Common Stock that may be issued under the Plan by 3,700,000 (the “Additional Shares”), from 3,100,000 to 6,800,000 (the “Plan Amendment”). The Company was previously known as “PlanetCad, Inc.” On May 10, 2011, the Board of Directors authorized the Plan Amendment, subject to stockholder approval. The Plan Amendment will become effective if and when approved by our stockholders.

Purpose of the Plan and the Plan Amendment

The Plan was approved by stockholders and adopted in 2002 and originally authorized the issuance of up to 3,100,000 shares of Common Stock upon the exercise of stock options (each, an “Option” and collectively, “Options”) to be granted under the Plan. The Plan was adopted for the purpose of attracting and retaining the services of key individuals who are essential to the Company’s long-term growth and financial success by

17

Table of Contents

providing these individuals with the right to acquire an ownership stake in the Company. Not only does the Board believe that Options constitute an important component of compensation in a competitive market for talented individuals, but it also believes that a compensation package which includes Options tends to align the interests of Plan participants with the interests of stockholders and the long-term success of the Company. In the past, the Company has relied on, and attributes its past success in part to, its ability to grant Options to key individuals, and it desires to retain this ability going forward. As of the date of this proxy statement, however, no shares remain available for issuance under the Plan. The Board authorized the Plan Amendment and directed that it be submitted to stockholders for approval to ensure that the Company can remain competitive and continue to provide key individuals with this valuable component of compensation.

The following summary of key provisions of the Plan, as amended by the Plan Amendment (the “Amended Plan”), is qualified in its entirety by reference to the Amended Plan document, which is attached to this proxy statement as Annex A and incorporated herein by reference. The Company urges stockholders to carefully read the Amended Plan document, as it is a legal document that governs the Options to be granted under the Amended Plan.

Administration

The Amended Plan contemplates that it will be administered by a committee comprised of two or more independent directors appointed by the Board of Directors (the “Committee”). If no Committee is appointed, however, then the Amended Plan will be administered by the Board, provided that a committee comprised of at least two independent directors must be appointed to grant any Option that is intended to qualify as performance-based compensation under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”).

Subject to the provisions of the Amended Plan and any outstanding Option agreements, the Committee has complete authority, in its discretion, to make the following determinations with respect to the Amended Plan and each Option: (i) the employees and directors to whom Options may be granted; (ii) the type of Option to be granted; (iii) the time at which an Option will be granted; (iv) the number of shares of the Common Stock subject to the Option; (v) the exercise price of the Option; (vi) the vesting schedule, if any, over which the Option will become exercisable; (vii) the expiration date of the Option (which may not be more than 10 years after the grant date); and (viii) the restrictions, if any, to be imposed upon transfer of shares of the Common Stock purchased upon the exercise of the Option. In addition, the Committee will have complete authority to interpret the Amended Plan, to prescribe, amend and rescind rules and regulations relating to it, to determine the terms and provisions of Option Agreements (which need not be identical), and to make all other determinations necessary or advisable for the administration of the Amended Plan.

Eligibility for Participation