UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number: 811-05833

| T. Rowe Price Global Funds, Inc. |

|

|

| (Exact name of registrant as specified in charter) |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

|

| (Address of principal executive offices) |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: October 31

Date of reporting period: April 30, 2022

|

Institutional Emerging Markets Equity Fund |

April 30, 2022 |

| T. ROWE PRICE Institutional Emerging Markets Equity Fund |

|

|

HIGHLIGHTS

| ■ | Emerging markets stocks fell sharply, and your fund underperformed the MSCI Emerging Markets Index Net and the Lipper Emerging Markets Funds Average for the six-month period ended April 30, 2022. |

| ■ | Our choice of securities in the financials, communication services, and consumer discretionary sectors detracted from relative performance. Our investments in Brazil and Russia also had a negative effect, though underweighting Russia partially offset the negative impact from the Ukraine crisis on Russian stocks. On the positive side, our energy sector exposure added value, as did our choice of stocks in the real estate sector. |

| ■ | Our largest relative overweight sector positions were in financials, consumer discretionary, and consumer staples. Within industrials and business services, we identified several compelling investment opportunities. |

| ■ | We believe that the prospects for economic growth across a number of emerging markets are generally encouraging and that the recovery from the pandemic is set to continue in 2022. While the Chinese economy has slowed, we are seeing the authorities stepping in to support growth. Furthermore, valuations in the emerging world seem attractive, as these markets have lagged their developed world counterparts recently. |

Log in to your account at troweprice.com for more information.

*Certain mutual fund accounts that are assessed an annual account service fee can also save money by switching to e-delivery.

Market Commentary

Dear Investor

Global stock markets produced negative returns during the first half of your fund’s fiscal year, the six-month period ended April 30, 2022, while rising bond yields weighed on returns for fixed income investors. Fears concerning new coronavirus variants, rising interest rates, and soaring inflation caused bouts of volatility throughout the period. These concerns were compounded by Russia’s invasion of Ukraine in February, sending markets around the world into correction territory.

All major global and regional equity benchmarks receded during the period. Value shares extended their recent outperformance of growth stocks as equity investors turned risk averse. Although most sectors finished in the red, energy stocks registered exceptional returns as oil prices jumped in response to Russia’s invasion and the ensuing commodity supply crunch. A strong U.S. dollar weighed on returns for U.S. investors in most international markets. Across the style spectrum, developed markets held up better than emerging markets.

In November 2021, the emergence of the omicron variant of the coronavirus prompted worries about the economic outlook and the potential that a resurgence in cases could lead to further supply chain disruptions. While omicron variant trends and restrictions eased in most regions early in 2022, China continued to pursue a “zero-COVID” policy, resulting in large-scale lockdowns and industrial production disruptions.

In February 2022, markets were caught further by surprise when Russia launched a large-scale military offensive into Ukraine. The strong sanctions on Russia that followed raised concerns about supply chains that were already stressed by the coronavirus pandemic. On March 8, the White House announced that the U.S. was cutting off all oil imports from Russia. In response, oil prices surged to their highest level in a decade.

Concerns over inflation intensified over much of the period, driven in part by events in Ukraine and China. Along with supply chain problems, the release of pent-up demand for travel, recreation, and other services also pushed prices higher. In the U.S., consumer prices rose 8.5% in March versus the year before—the highest annual reading since December 1981—driven by accelerating energy and food prices.

Elevated inflation caused global monetary policy to take a hawkish turn. In the U.S., Federal Reserve officials began tapering the central bank’s monthly purchases of Treasuries and agency mortgage-backed securities in November. In March, the Fed approved its first interest rate hike in more than three years and signaled an accelerating pace of rate increases ahead. In Europe, the Bank of England raised its key interest rate three times in a row between December and March, while the European Central Bank indicated in March that it could end its asset purchase program as soon as the third quarter of 2022.

Bond indexes were broadly negative as yields rose across the Treasury yield curve amid surging inflation and expectations of aggressive monetary tightening. (Bond yields and prices move in opposite directions.) Investment-grade corporate bonds experienced significant losses, while municipal bonds suffered through their worst quarter in more than 40 years at the start of 2022 and finished the period lower. Late in the period, multiple portions of the Treasury yield curve inverted briefly, raising fears of a looming recession.

The challenges global markets face are complex and could drive market volatility for some time. Investors will be closely monitoring the Fed’s actions as the central bank attempts to use interest rate hikes to tame inflation without stifling economic growth. Meanwhile, the ongoing geopolitical and humanitarian crisis in Ukraine continues to disrupt supply chains, increase inflationary pressures, and dampen consumer confidence.

During challenging times like these, I am heartened by our firm’s long-term focus and time-tested investment approach. I also recognize that market volatility and sector rotation historically have presented very good opportunities for active investors. I remain confident in the ability of our global research organization to uncover compelling investment ideas that can help deliver superior long-term risk-adjusted performance as market conditions normalize.

Thank you for your continued confidence in T. Rowe Price.

Sincerely,

Robert Sharps

CEO and President

Management’s Discussion of Fund Performance

INVESTMENT OBJECTIVE

The fund seeks long-term growth of capital through investments primarily in the common stocks of companies located (or with primary operations) in emerging markets.

FUND COMMENTARY

How did the fund perform in the past six months?

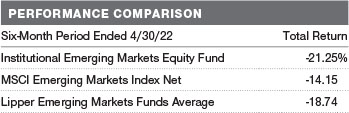

The Institutional Emerging Markets Equity Fund returned -21.25% in the six-month period ended April 30, 2022. The fund underperformed the MSCI Emerging Markets Index Net and the Lipper Emerging Markets Funds Average. (Past performance cannot guarantee future results.)

What factors influenced the fund’s performance?

Emerging markets fell over the period and underperformed the MSCI World Index. The key global event of the last six months was Russia’s invasion of Ukraine and the resulting heightened geopolitical tensions and retaliatory sanctions, which raised concerns about global economic growth and led to a sharp sell-off in emerging market equities. The price of oil and other key commodities rose, adding to concerns about global inflation and the possible implications for key central banks’ monetary policies. Central banks in several emerging market countries raised interest rates in a bid to combat inflationary pressures. In other developments, Chinese equities saw significant volatility in the latter part of the period,sparked by news flow related to the potential for delisting by the U.S. Securities and Exchange Commission of Chinese American Depository Receipts by 2024. Worries about the country’s property sector and the domestic economic growth outlook, given the newest COVID-19 wave, were also negative for sentiment.

In terms of relative performance, our choice of securities in the financials, communication services, and consumer discretionary sectors detracted. Our choice of investments in Brazil and Russia also had a negative effect, although underweighting Russia helped reduce the impact to the portfolio from the Russian sell-off. On the positive side, our energy sector exposure added value, as did our choice of stocks in the real estate sector.

Our choice of securities in communication services detracted. This sector underperformed against a background of volatility in technology-related names, as expectations for higher U.S. interest rates provided a headwind. Sea Limited, an internet platform company operating in Southeast Asia, reported weaker-than-expected results, while 2022 guidance for its online games business surprised negatively. We continue to like the name for its growth potential; while we believe the gaming business may become less important for the stock, in our view, the e-commerce and fintech operations are executing ahead of expectations. (Please refer to the portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

Stock selection in Brazil held back returns. Fintech name StoneCo saw its share price fall sharply on results that disappointed investors; earnings were adversely affected by higher-than-expected operational and financial expenses. We eliminated our position to reflect our reduced level of conviction. Investment platform XP also underperformed; the company released quarterly operating data with assets under custody lower than both our and consensus expectations, reflecting the impact of weaker markets. Later in the period, the company unveiled numbers that showed revenues and profitability that were ahead of our expectations.

Stock choices in Russia had a negative impact, although our underweight added value. The Russian market fell sharply following the country’s late-February invasion of Ukraine. The domestic equity market remains closed to foreign investors. MSCI announced that it would remove Russian securities from its MSCI indexes, including the MSCI Emerging Markets Index, as of the close of March 9, 2022, at a price that was effectively zero.

Stock selection in the real estate space added value. While the real estate sector declined, it outperformed the MSCI Emerging Markets Index. We have identified some investment opportunities in this space; the portfolio has a position in China Overseas Land & Investment, a residential property developer, which saw its share price significantly outperform. In our view, the company has a good balance sheet and offers reasonable growth potential.

How is the fund positioned?

Information technology (IT) is one of the largest sectors in emerging markets, and we have a sizable exposure in absolute terms. Our highly detailed research is helping us to find considerable investment potential in this space, as we look to benefit from increased technological innovation across the emerging world. We made changes to some of the portfolio’s positions during the period. We sold some of our large position in Taiwan Semiconductor Manufacturing Company (TSMC), a multinational semiconductor contract manufacturing and design company, in order to manage the balance between risk and potential reward. TSMC remains one of our largest absolute holdings and, in our view, is one of the most strategic assets in the semiconductor industry. We sold shares in South Korea’s Samsung Electronics, the world’s largest memory chipmaker, as we believe we are near the peak of the current memory upcycle, and we expect demand to decelerate throughout 2022.

Industrials and business services is one of the more diverse sectors in emerging markets, and the portfolio has a sizable absolute position here. We have identified several good investment opportunities in the space. Shenzhen Inovance Technology is China’s largest and, in our view, highest-quality elevator controller supplier. We see this company as a long-term structural winner, as we expect Chinese automation demand to grow alongside a shrinking working-age population, and we believe Inovance is well placed to gain market share through relatively strong execution.

The portfolio has a long-standing underweight to the energy space; we generally do not see many firms in this sector with the kind of long-term growth characteristics that we favor. However, we identified what we believe to be a compelling investment opportunity in India. We purchased shares in Reliance Industries, an industrial conglomerate, as it has been reinvesting its cash flow into digital and retail, new business verticals that, in our view, have the potential to achieve high growth and are light in terms of capital expenditure.

What is portfolio management’s outlook?

We believe that the prospects for economic growth across a number of emerging markets are generally encouraging and that the recovery from the pandemic is set to continue in 2022. While the Chinese economy has slowed, we are seeing the authorities stepping in to support growth. Furthermore, valuations in the emerging world seem attractive, as these markets have lagged their developed world counterparts recently. Emerging markets’ central banks have generally been more disciplined with their monetary policies, with the use of tools such as inflation targeting. Importantly, earnings, which came under significant pressure during the pandemic, should recover as we head toward the end of this year. Broadly speaking, corporate balance sheets are relatively strong, expenses have been cut, and capital spending plans have been delayed or canceled. As free cash flow rebounds, we believe many companies may begin to return some of that cash to shareholders in the form of higher dividends.

The views expressed reflect the opinions of T. Rowe Price as of the date of this report and are subject to change based on changes in market, economic, or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

RISKS OF INVESTING IN THE FUND

Emerging market countries tend to have economic structures that are less diverse and mature, and political systems that are less stable, than those of developed countries. In addition to the risks associated with investing outside the U.S., emerging markets are more susceptible to governmental interference, political and economic uncertainty, local taxes and restrictions on the fund’s investments, less efficient trading markets with lower overall liquidity, and more volatile currency exchange rates. Investments outside the U.S. are also subject to settlement practices and regulatory and financial reporting standards that differ from those of the U.S.

Many Asian economies have at various times been negatively affected by inflation, currency devaluations, an overreliance on international trade and exports, political and social instability, and less developed financial systems and securities trading markets. Trade restrictions, unexpected decreases in exports, changes in government policies, or natural disasters could have a significant impact on companies doing business in Asia. The Asian region may be significantly affected by political unrest, military conflict, economic sanctions, and less demand for Asian products and services.

The Chinese government has historically exercised significant control over China’s economy and its financial markets through, among other things, its monetary policies and allocation of resources, management of currency exchange rates, preferential treatment or restrictions relating to industries deemed sensitive to national interests, and limitations on foreign ownership of Chinese securities. Although economic reforms have liberalized trade policy and reduced government control, changes in these policies or increased government intervention could adversely impact affected industries or companies.

For a more thorough discussion of risks, please see the fund’s prospectus.

BENCHMARK INFORMATION

Note: Portions of the mutual fund information contained in this report were supplied by Lipper, a Refinitiv Company, subject to the following: Copyright 2022 © Refinitiv. All rights reserved. Any copying, republication or redistribution of Lipper content is expressly prohibited without the prior written consent of Lipper. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.

Note: MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

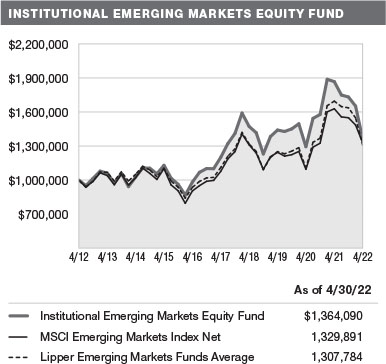

GROWTH OF $1 MILLION

This chart shows the value of a hypothetical $1 million investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which include a broad-based market index and may also include a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

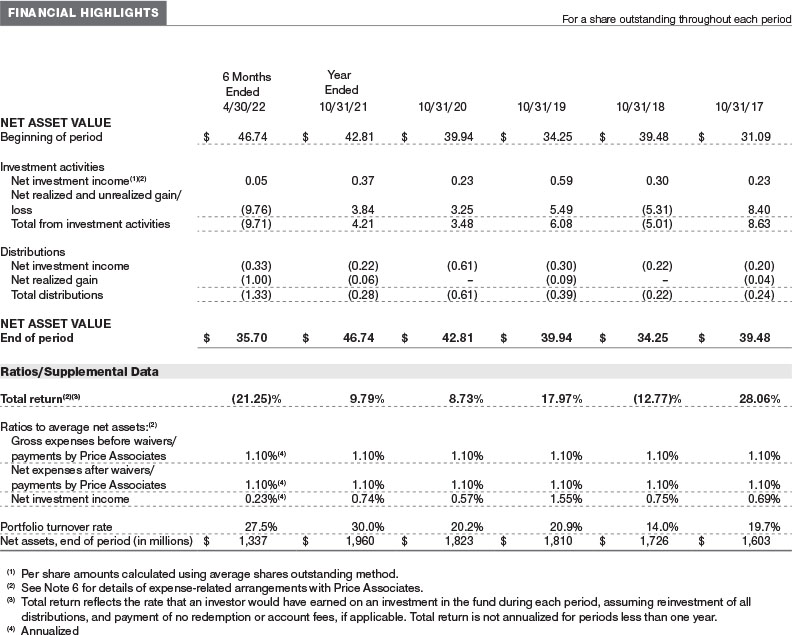

AVERAGE ANNUAL COMPOUND TOTAL RETURN

FUND EXPENSE EXAMPLE

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (Actual) provides information about actual account values and actual expenses. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (Hypothetical) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

QUARTER-END RETURNS

Unaudited

The accompanying notes are an integral part of these financial statements.

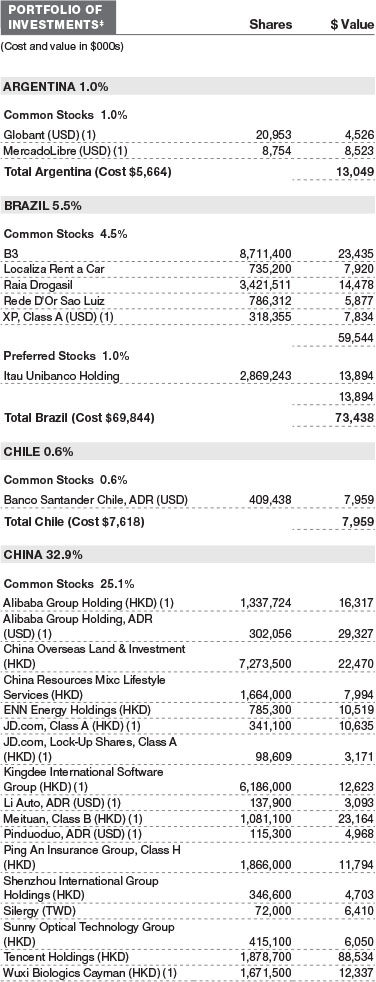

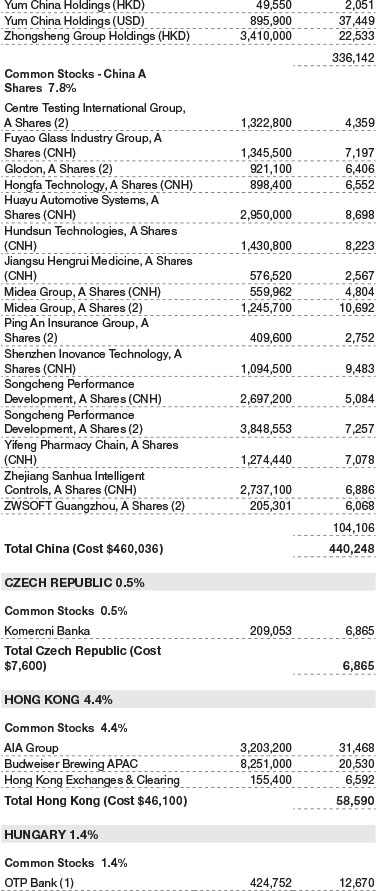

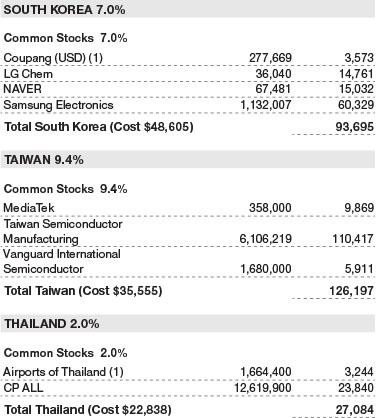

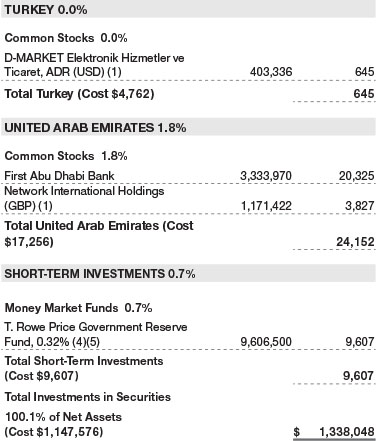

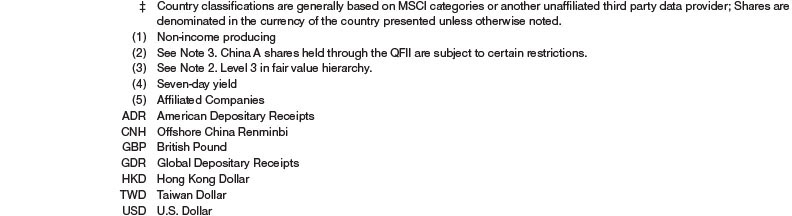

April 30, 2022 (Unaudited)

The accompanying notes are an integral part of these financial statements.

April 30, 2022 (Unaudited)

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

| NOTES TO FINANCIAL STATEMENTS |

T. Rowe Price Global Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940 (the 1940 Act). The Institutional Emerging Markets Equity Fund (the fund) is a nondiversified, open-end management investment company established by the corporation. The fund seeks long-term growth of capital through investments primarily in the common stocks of companies located (or with primary operations) in emerging markets.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 (ASC 946). The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), including, but not limited to, ASC 946. GAAP requires the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

Investment Transactions, Investment Income, and Distributions Investment transactions are accounted for on the trade date basis. Income and expenses are recorded on the accrual basis. Realized gains and losses are reported on the identified cost basis. Income tax-related interest and penalties, if incurred, are recorded as income tax expense. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Non-cash dividends, if any, are recorded at the fair market value of the asset received. Distributions to shareholders are recorded on the ex-dividend date. Income distributions, if any, are declared and paid annually. A capital gain distribution may also be declared and paid by the fund annually.

Currency Translation Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. dollars as provided by an outside pricing service. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the respective date of such transaction. The effect of changes in foreign currency exchange rates on realized and unrealized security gains and losses is not bifurcated from the portion attributable to changes in market prices.

Capital Transactions Each investor’s interest in the net assets of the fund is represented by fund shares. The fund’s net asset value (NAV) per share is computed at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day the NYSE is open for business. However, the NAV per share may be calculated at a time other than the normal close of the NYSE if trading on the NYSE is restricted, if the NYSE closes earlier, or as may be permitted by the SEC. Purchases and redemptions of fund shares are transacted at the next-computed NAV per share, after receipt of the transaction order by T. Rowe Price Associates, Inc., or its agents.

Indemnification In the normal course of business, the fund may provide indemnification in connection with its officers and directors, service providers, and/or private company investments. The fund’s maximum exposure under these arrangements is unknown; however, the risk of material loss is currently considered to be remote.

NOTE 2 - VALUATION

Fair Value The fund’s financial instruments are valued at the close of the NYSE and are reported at fair value, which GAAP defines as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The T. Rowe Price Valuation Committee (the Valuation Committee) is an internal committee that has been delegated certain responsibilities by the fund’s Board of Directors (the Board) to ensure that financial instruments are appropriately priced at fair value in accordance with GAAP and the 1940 Act. Subject to oversight by the Board, the Valuation Committee develops and oversees pricing-related policies and procedures and approves all fair value determinations. Specifically, the Valuation Committee establishes policies and procedures used in valuing financial instruments, including those which cannot be valued in accordance with normal procedures or using pricing vendors; determines pricing techniques, sources, and persons eligible to effect fair value pricing actions; evaluates the services and performance of the pricing vendors; oversees the pricing process to ensure policies and procedures are being followed; and provides guidance on internal controls and valuation-related matters. The Valuation Committee provides periodic reporting to the Board on valuation matters.

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting date

Level 2 – inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads)

Level 3 – unobservable inputs (including the fund’s own assumptions in determining fair value)

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions that market participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. When multiple inputs are used to derive fair value, the financial instrument is assigned to the level within the fair value hierarchy based on the lowest-level input that is significant to the fair value of the financial instrument. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values.

Valuation Techniques Equity securities, including exchange-traded funds, listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made. OTC Bulletin Board securities are valued at the mean of the closing bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the closing bid and asked prices for domestic securities and the last quoted sale or closing price for international securities.

The last quoted prices of non-U.S. equity securities may be adjusted to reflect the fair value of such securities at the close of the NYSE, if the fund determines that developments between the close of a foreign market and the close of the NYSE will affect the value of some or all of its portfolio securities. Each business day, the fund uses information from outside pricing services to evaluate and, if appropriate, decide whether it is necessary to adjust quoted prices to reflect fair value by reviewing a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. The fund uses outside pricing services to provide it with quoted prices and information to evaluate or adjust those prices. The fund cannot predict how often it will use quoted prices and how often it will determine it necessary to adjust those prices to reflect fair value.

Investments in mutual funds are valued at the mutual fund’s closing NAV per share on the day of valuation. Assets and liabilities other than financial instruments, including short-term receivables and payables, are carried at cost, or estimated realizable value, if less, which approximates fair value.

Investments for which market quotations or market-based valuations are not readily available or deemed unreliable are valued at fair value as determined in good faith by the Valuation Committee, in accordance with fair valuation policies and procedures. The objective of any fair value pricing determination is to arrive at a price that could reasonably be expected from a current sale. Financial instruments fair valued by the Valuation Committee are primarily private placements, restricted securities, warrants, rights, and other securities that are not publicly traded. Factors used in determining fair value vary by type of investment and may include market or investment specific considerations. The Valuation Committee typically will afford greatest weight to actual prices in arm’s length transactions, to the extent they represent orderly transactions between market participants, transaction information can be reliably obtained, and prices are deemed representative of fair value. However, the Valuation Committee may also consider other valuation methods such as market-based valuation multiples; a discount or premium from market value of a similar, freely traded security of the same issuer; discounted cash flows; yield to maturity; or some combination. Fair value determinations are reviewed on a regular basis and updated as information becomes available, including actual purchase and sale transactions of the investment. Because any fair value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions, and fair value prices determined by the Valuation Committee could differ from those of other market participants.

Valuation Inputs The following table summarizes the fund’s financial instruments, based on the inputs used to determine their fair values on April 30, 2022 (for further detail by category, please refer to the accompanying Portfolio of Investments):

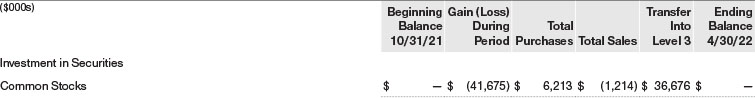

Following is a reconciliation of the fund’s Level 3 holdings for the six months ended April 30, 2022. Gain (loss) reflects both realized and change in unrealized gain/loss on Level 3 holdings during the period, if any, and is included on the accompanying Statement of Operations. The change in unrealized gain/loss on Level 3 instruments held at April 30, 2022, totaled $(39,855,000) for the six months ended April 30, 2022. During the six months ended April 30, 2022, transfers into Level 3 resulted from a lack of marketability for the securities.

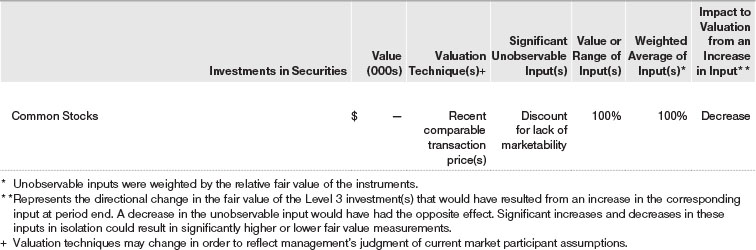

In accordance with GAAP, the following table provides quantitative information about significant unobservable inputs used to determine the fair valuations of the fund’s Level 3 assets, by class of financial instrument. Because the Valuation Committee considers a wide variety of factors and inputs, both observable and unobservable, in determining fair value, the unobservable inputs presented do not reflect all inputs significant to the fair value determination.

NOTE 3 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Emerging and Frontier Markets The fund invests, either directly or through investments in other T. Rowe Price funds, in securities of companies located in, issued by governments of, or denominated in or linked to the currencies of emerging and frontier market countries. Emerging markets, and to a greater extent frontier markets, generally have economic structures that are less diverse and mature, and political systems that are less stable, than developed countries. These markets may be subject to greater political, economic, and social uncertainty and differing regulatory environments that may potentially impact the fund’s ability to buy or sell certain securities or repatriate proceeds to U.S. dollars. Such securities are often subject to greater price volatility, less liquidity, and higher rates of inflation than U.S. securities. Investing in frontier markets is significantly riskier than investing in other countries, including emerging markets.

China A Shares The fund invests in certain Chinese equity securities (A shares) that have limited availability to investors outside of China. The fund gains access to the A share market through the Shanghai-Hong Kong Stock Connect program (Shanghai Stock Connect), through the Shenzhen-Hong Kong Stock Connect program (Shenzhen Stock Connect), or through a wholly owned subsidiary of Price Associates, which serves as the registered Qualified Foreign Institutional Investor (QFII) for all participating T. Rowe Price-sponsored products (each a participating account). Related to A shares held through the QFII, investment decisions are specific to each participating account, and each account bears the economic consequences of its holdings and transactions in A shares. Further, the fund’s ability to repatriate cash associated with its A shares held through the QFII is subject to certain restrictions and administrative processes involving the Chinese government; consequently, the fund may experience substantial delays in gaining access to its assets or incur a loss of value in the event of noncompliance with governmental requirements. A shares acquired through the QFII are valued using the onshore renminbi exchange rate (CNY), and those acquired through the Shanghai Stock Connect and the Shenzhen Stock Connect are valued using the offshore renminbi exchange rate (CNH). CNY and CNH exchange rates may differ; accordingly, A shares of the same issue purchased through different channels may not have the same U.S. dollar value. Generally, the fund is not subject to capital gains tax related to its A share investments.

Other Purchases and sales of portfolio securities other than short-term securities aggregated $449,972,000 and $653,584,000, respectively, for the six months ended April 30, 2022.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. The amount and character of tax-basis distributions and composition of net assets are finalized at fiscal year-end; accordingly, tax-basis balances have not been determined as of the date of this report.

At April 30, 2022, the cost of investments for federal income tax purposes was $1,168,154,000. Net unrealized gain aggregated $167,692,000 at period-end, of which $351,353,000 related to appreciated investments and $183,661,000 related to depreciated investments.

NOTE 5 - FOREIGN TAXES

The fund is subject to foreign income taxes imposed by certain countries in which it invests. Additionally, capital gains realized upon disposition of securities issued in or by certain foreign countries are subject to capital gains tax imposed by those countries. All taxes are computed in accordance with the applicable foreign tax law, and, to the extent permitted, capital losses are used to offset capital gains. Taxes attributable to income are accrued by the fund as a reduction of income. Current and deferred tax expense attributable to capital gains is reflected as a component of realized or change in unrealized gain/loss on securities in the accompanying financial statements. To the extent that the fund has country specific capital loss carryforwards, such carryforwards are applied against net unrealized gains when determining the deferred tax liability. Any deferred tax liability incurred by the fund is included in either Other liabilities or Deferred tax liability on the accompanying Statement of Assets and Liabilities.

NOTE 6 - RELATED PARTY TRANSACTIONS

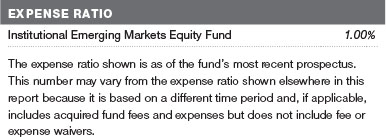

The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). Price Associates has entered into a sub-advisory agreement(s) with one or more of its wholly owned subsidiaries, to provide investment advisory services to the fund. The investment management and administrative agreement between the fund and Price Associates provides for an all-inclusive annual fee equal to 1.10% of the fund’s average daily net assets. The fee is computed daily and paid monthly. The all-inclusive fee covers investment management services and ordinary, recurring operating expenses but does not cover interest expense; expenses related to borrowing, taxes, and brokerage; or nonrecurring expenses.

Mutual funds, trusts, and other accounts managed by Price Associates or its affiliates (collectively, Price Funds and accounts) may invest in the fund. No Price fund or account may invest for the purpose of exercising management or control over the fund. At April 30, 2022, approximately 28% of the fund’s outstanding shares were held by Price Funds and accounts.

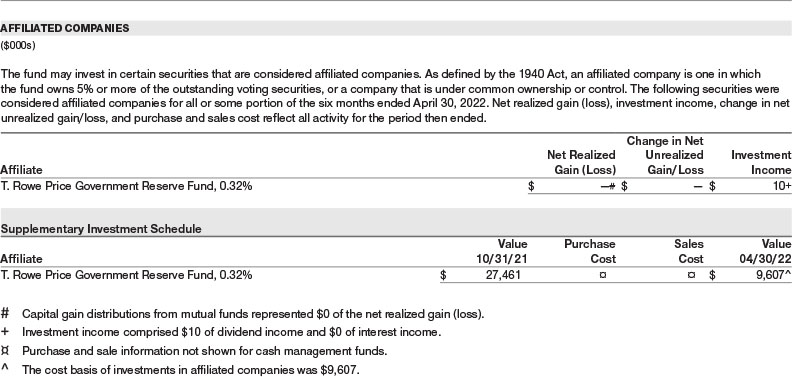

The fund may invest its cash reserves in certain open-end management investment companies managed by Price Associates and considered affiliates of the fund: the T. Rowe Price Government Reserve Fund or the T. Rowe Price Treasury Reserve Fund, organized as money market funds, or the T. Rowe Price Short-Term Fund, a short-term bond fund (collectively, the Price Reserve Funds). The Price Reserve Funds are offered as short-term investment options to mutual funds, trusts, and other accounts managed by Price Associates or its affiliates and are not available for direct purchase by members of the public. Cash collateral from securities lending, if any, is invested in the T. Rowe Price Government Reserve Fund; prior to December 13, 2021, the cash collateral from securities lending was invested in the T. Rowe Price Short-Term Fund. The Price Reserve Funds pay no investment management fees.

The fund may participate in securities purchase and sale transactions with other funds or accounts advised by Price Associates (cross trades), in accordance with procedures adopted by the fund’s Board and Securities and Exchange Commission rules, which require, among other things, that such purchase and sale cross trades be effected at the independent current market price of the security. During the six months ended April 30, 2022, the fund had no purchases or sales cross trades with other funds or accounts advised by Price Associates.

NOTE 7 - BORROWING

To provide temporary liquidity, the fund may borrow from other T. Rowe Price-sponsored mutual funds under an interfund borrowing program developed and managed by Price Associates. The program permits the borrowing and lending of cash at rates beneficial to both the borrowing and lending funds. Pursuant to program guidelines, loans totaling 10% or more of a borrowing fund’s total assets require collateralization at 102% of the value of the loan; loans of less than 10% are unsecured. During the six months ended April 30, 2022, the fund incurred $1,000 in interest expense related to outstanding borrowings on one day in the average amount of $24,300,000 and at an average annual rate of 1.67%. At April 30, 2022, there were no borrowings outstanding.

NOTE 8 - OTHER MATTERS

Unpredictable events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases, and similar public health threats may significantly affect the economy and the markets and issuers in which a fund invests. Certain events may cause instability across global markets, including reduced liquidity and disruptions in trading markets, while some events may affect certain geographic regions, countries, sectors, and industries more significantly than others, and exacerbate other pre-existing political, social, and economic risks. Since 2020, a novel strain of coronavirus (COVID-19) has resulted in disruptions to global business activity and caused significant volatility and declines in global financial markets. In February 2022, Russian forces entered Ukraine and commenced an armed conflict. Economic sanctions have since been imposed on Russia and certain of its citizens, including the exclusion of Russia from the SWIFT global payments network. As a result, Russian-related stocks and debt have since suffered significant declines in value. The duration of the coronavirus outbreak and the Russian-Ukraine conflict, and their effects on the financial markets, cannot be determined with certainty. The fund’s performance could be negatively impacted if the value of a portfolio holding were harmed by these and such other events. Management is actively monitoring these events.

NOTE 9 - SUBSEQUENT EVENT

Effective May 1, 2022, Price Associates has agreed to reduce the fund’s all-inclusive annual fee from 1.10% to 1.00% of the fund’s average daily net assets.

INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS

A description of the policies and procedures used by T. Rowe Price funds to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information. You may request this document by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov.

The description of our proxy voting policies and procedures is also available on our corporate website. To access it, please visit the following Web page:

https://www.troweprice.com/corporate/en/utility/policies.html

Scroll down to the section near the bottom of the page that says, “Proxy Voting Policies.” Click on the Proxy Voting Policies link in the shaded box.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through T. Rowe Price, visit the website location shown above, and scroll down to the section near the bottom of the page that says, “Proxy Voting Records.” Click on the Proxy Voting Records link in the shaded box.

HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The fund’s reports on Form N-PORT are available electronically on the SEC’s website (sec.gov). In addition, most T. Rowe Price funds disclose their first and third fiscal quarter-end holdings on troweprice.com.

APPROVAL OF INVESTMENT MANAGEMENT AGREEMENT AND SUBADVISORY AGREEMENTS

Each year, the fund’s Board of Directors (Board) considers the continuation of the investment management agreement (Advisory Contract) between the fund and its investment adviser, T. Rowe Price Associates, Inc. (Adviser), as well as the investment subadvisory agreements (Subadvisory Contracts) that the Adviser has entered into with T. Rowe Price International Ltd and T. Rowe Price Singapore Private Ltd. (Subadvisers) on behalf of the fund. In that regard, at a meeting held on March 7–8, 2022 (Meeting), the Board, including all of the fund’s independent directors, approved the fund’s Advisory Contract and Subadvisory Contracts. At the Meeting, the Board considered the factors and reached the conclusions described below relating to the selection of the Adviser and Subadvisers and the approval of the Advisory Contract and Subadvisory Contracts. The independent directors were assisted in their evaluation of the Advisory Contract and Subadvisory Contracts by independent legal counsel from whom they received separate legal advice and with whom they met separately.

In providing information to the Board, the Adviser was guided by a detailed set of requests for information submitted by independent legal counsel on behalf of the independent directors. In considering and approving the Advisory Contract and Subadvisory Contracts, the Board considered the information it believed was relevant, including, but not limited to, the information discussed below. The Board considered not only the specific information presented in connection with the Meeting but also the knowledge gained over time through interaction with the Adviser and Subadvisers about various topics. The Board meets regularly and, at each of its meetings, covers an extensive agenda of topics and materials and considers factors that are relevant to its annual consideration of the renewal of the T. Rowe Price funds’ advisory contracts, including performance and the services and support provided to the funds and their shareholders.

Services Provided by the Adviser and Subadvisers

The Board considered the nature, quality, and extent of the services provided to the fund by the Adviser and Subadvisers. These services included, but were not limited to, directing the fund’s investments in accordance with its investment program and the overall management of the fund’s portfolio, as well as a variety of related activities such as financial, investment operations, and administrative services; compliance; maintaining the fund’s records and registrations; and shareholder communications. The Board also reviewed the background and experience of the Adviser’s and Subadvisers’ senior management teams and investment personnel involved in the management of the fund, as well as the Adviser’s compliance record. The Board concluded that it was satisfied with the nature, quality, and extent of the services provided by the Adviser and Subadvisers.

Investment Performance of the Fund

The Board took into account discussions with the Adviser and reports that it receives throughout the year relating to fund performance. In connection with the Meeting, the Board reviewed the fund’s total returns for various periods through December 31, 2021, and compared these returns with the performance of a peer group of funds with similar investment programs and a wide variety of other previously agreed-upon comparable performance measures and market data, including relative performance information as of September 30, 2021, supplied by Broadridge, which is an independent provider of mutual fund data.

On the basis of this evaluation and the Board’s ongoing review of investment results, and factoring in the relative market conditions during certain of the performance periods, the Board concluded that the fund’s performance was satisfactory.

Costs, Benefits, Profits, and Economies of Scale

The Board reviewed detailed information regarding the revenues received by the Adviser under the Advisory Contract and other direct and indirect benefits that the Adviser (and its affiliates) may have realized from its relationship with the fund. In considering soft-dollar arrangements pursuant to which research may be received from broker-dealers that execute the fund’s portfolio transactions, the Board noted that the Adviser bears the cost of research services for all client accounts that it advises, including the T. Rowe Price funds. The Board received information on the estimated costs incurred and profits realized by the Adviser from managing the T. Rowe Price funds. The Board also reviewed estimates of the profits realized from managing the fund in particular, and the Board concluded that the Adviser’s profits were reasonable in light of the services provided to the fund.

The Board also considered whether the fund benefits under the fee levels set forth in the Advisory Contract or otherwise from any economies of scale realized by the Adviser. Under the Advisory Contract, the fund pays the Adviser a single fee, or all-inclusive management fee, which is based on the fund’s average daily net assets. The all-inclusive management fee includes investment management services and provides for the Adviser to pay all of the fund’s ordinary, recurring operating expenses except for interest, taxes, portfolio transaction fees, and any nonrecurring extraordinary expenses that may arise. Under each Subadvisory Contract, the Adviser may pay the Subadviser up to 60% of the advisory fees that the Adviser receives from the fund. The Adviser has generally implemented an all-inclusive management fee structure in situations where a fixed total expense ratio is useful for purposes of providing certainty of fees and expenses for the investors in these funds and has historically sought to set the initial all-inclusive management fee rate at levels below the expense ratios of comparable funds to take into account potential future economies of scale. In addition, the assets of the fund are included in the calculation of the group fee rate, which serves as a component of the management fee for many T. Rowe Price funds and declines at certain asset levels based on the combined average net assets of most of the T. Rowe Price funds (including the fund). Although the fund does not have a group fee component to its management fee, its assets are included in the calculation because certain resources utilized to operate the fund are shared with other T. Rowe Price funds. At the Meeting, the Board approved lowering the fund’s all-inclusive management fee rate from 1.10% to 1.00% effective May 1, 2022. The Board concluded that, based on the profitability data it reviewed and consistent with this all-inclusive management fee structure, the advisory fee structure for the fund continued to be appropriate.

Fees and Expenses

The Board was provided with information regarding industry trends in management fees and expenses. Among other things, the Board reviewed data for peer groups that were compiled by Broadridge, which compared: (i) contractual management fees, actual management fees, nonmanagement expenses, and total expenses of the fund with a group of competitor funds selected by Broadridge (Expense Group) and (ii) actual management fees, nonmanagement expenses, and total expenses of the fund with a broader set of funds within the Lipper investment classification (Expense Universe). The Board considered the fund’s contractual management fee rate, actual management fee rate, and total expenses (all of which generally reflect the all-inclusive management fee rate and do not deduct the operating expenses paid by the Adviser as part of the overall management fee) in comparison with the information for the Broadridge peer groups. Broadridge generally constructed the peer groups by seeking the most comparable funds based on similar investment classifications and objectives, expense structure, asset size, and operating components and attributes and ranked funds into quintiles, with the first quintile representing the funds with the lowest relative expenses and the fifth quintile representing the funds with the highest relative expenses. The information provided to the Board at the Meeting did not reflect the reduction to the fund’s all-inclusive management fee that will become effective on May 1, 2022. The information indicated that the fund’s contractual management fee ranked in the fifth quintile (Expense Group), the fund’s actual management fee rate ranked in the fifth quintile (Expense Group and Expense Universe), and the fund’s total expenses ranked in the fourth quintile (Expense Group) and third quintile (Expense Universe).

Management provided the Board with additional information with respect to the fund’s actual management fees and total expenses ranking in the fourth and fifth quintiles and reviewed and considered the information provided relating to the fund, other funds in the peer groups, and other factors that the Board determined to be relevant, including the reduction to the fund’s all-inclusive management fee rate.

The Board also reviewed the fee schedules for other investment portfolios with similar mandates that are advised or subadvised by the Adviser and its affiliates, including separately managed accounts for institutional and individual investors; subadvised funds; and other sponsored investment portfolios, including collective investment trusts and pooled vehicles organized and offered to investors outside the United States. Management provided the Board with information about the Adviser’s responsibilities and services provided to subadvisory and other institutional account clients, including information about how the requirements and economics of the institutional business are fundamentally different from those of the proprietary mutual fund business. The Board considered information showing that the Adviser’s mutual fund business is generally more complex from a business and compliance perspective than its institutional account business and considered various relevant factors, such as the broader scope of operations and oversight, more extensive shareholder communication infrastructure, greater asset flows, heightened business risks, and differences in applicable laws and regulations associated with the Adviser’s proprietary mutual fund business. In assessing the reasonableness of the fund’s management fee rate, the Board considered the differences in the nature of the services required for the Adviser to manage its mutual fund business versus managing a discrete pool of assets as a subadviser to another institution’s mutual fund or for an institutional account and that the Adviser generally performs significant additional services and assumes greater risk in managing the fund and other T. Rowe Price funds than it does for institutional account clients, including subadvised funds.

On the basis of the information provided and the factors considered, the Board concluded that the fees paid by the fund under the Advisory Contract are reasonable.

Approval of the Advisory Contract and Subadvisory Contracts

As noted, the Board approved the continuation of the Advisory Contract and Subadvisory Contracts. No single factor was considered in isolation or to be determinative to the decision. Rather, the Board concluded, in light of a weighting and balancing of all factors considered, that it was in the best interests of the fund and its shareholders for the Board to approve the continuation of the Advisory Contract and Subadvisory Contracts (including the fees to be charged for services thereunder).

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

A code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions is filed as an exhibit to the registrant’s annual Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the registrant’s most recent fiscal half-year.

Item 3. Audit Committee Financial Expert.

Disclosure required in registrant’s annual Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Disclosure required in registrant’s annual Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

There has been no change to the procedures by which shareholders may recommend nominees to the registrant’s board of directors.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable.

Item 13. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is filed with the registrant’s annual Form N-CSR.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

T. Rowe Price Global Funds, Inc.

| By | /s/ David Oestreicher | |||

| David Oestreicher | ||||

| Principal Executive Officer | ||||

| Date | June 16, 2022 | |||

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By | /s/ David Oestreicher | |||

| David Oestreicher | ||||

| Principal Executive Officer | ||||

| Date | June 16, 2022 | |||

| By | /s/ Alan S. Dupski | |||

| Alan S. Dupski | ||||

| Principal Financial Officer | ||||

| Date | June 16, 2022 | |||