SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

MANAGEMENT INVESTMENT COMPANIES

| T. Rowe Price Institutional International Funds, Inc. |

|

|

| (Exact name of registrant as specified in charter) |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

|

| (Address of principal executive offices) |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

|

| (Name and address of agent for service) |

|

|

Institutional International Funds |

September

30, 2017 |

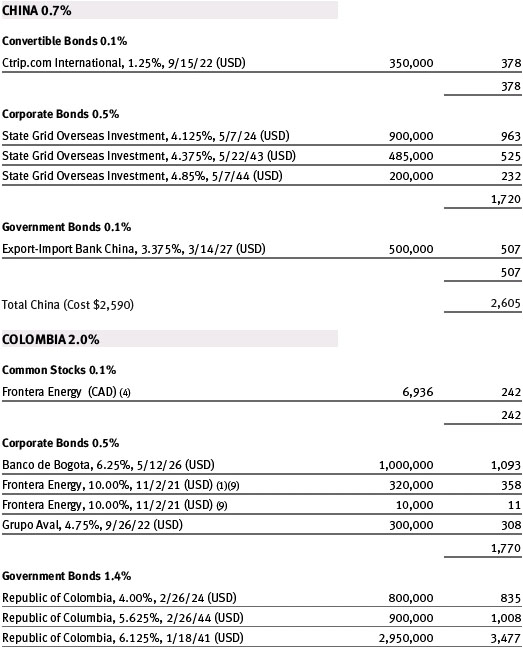

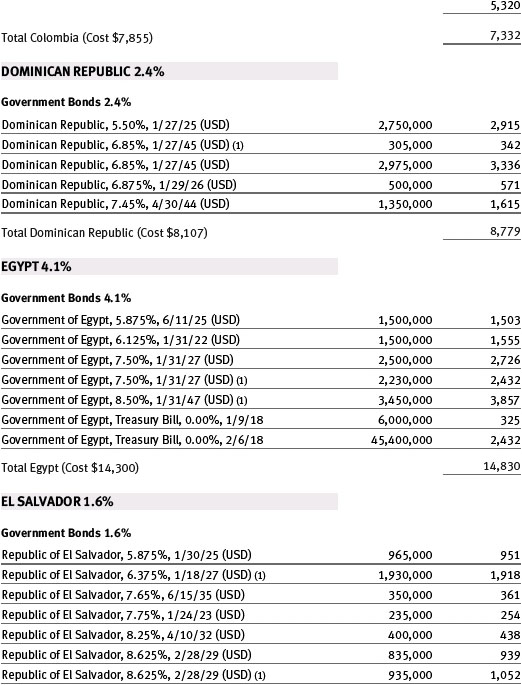

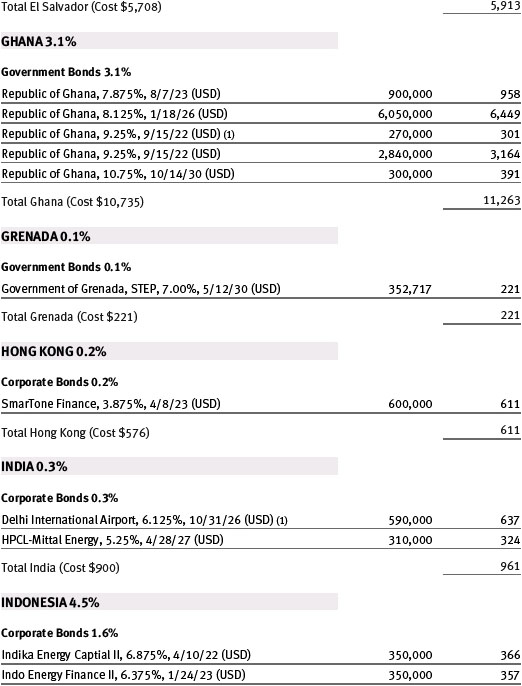

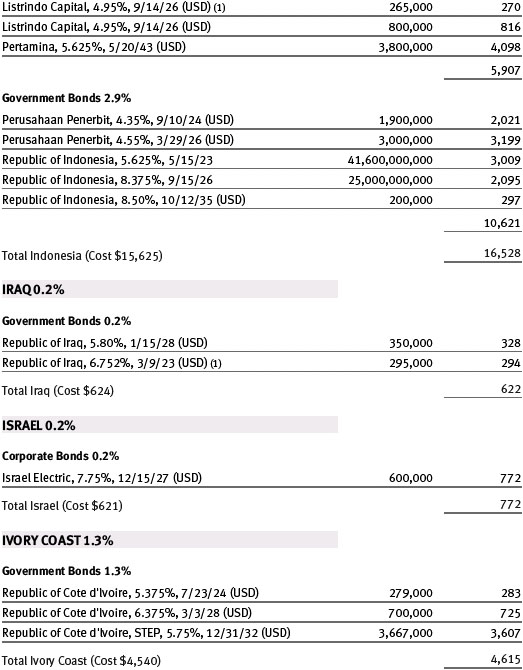

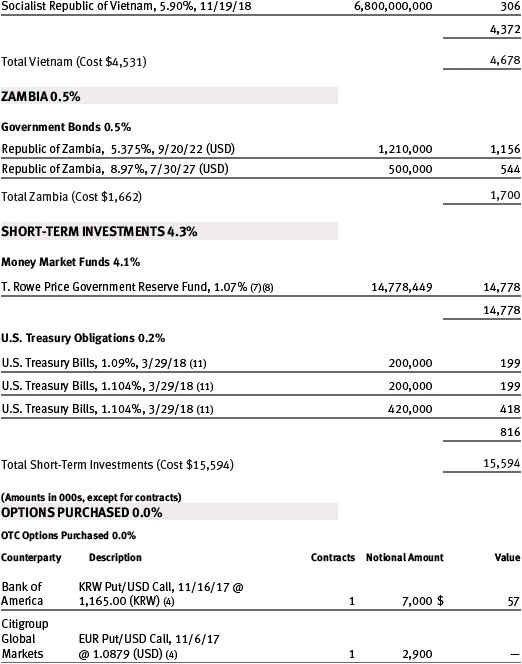

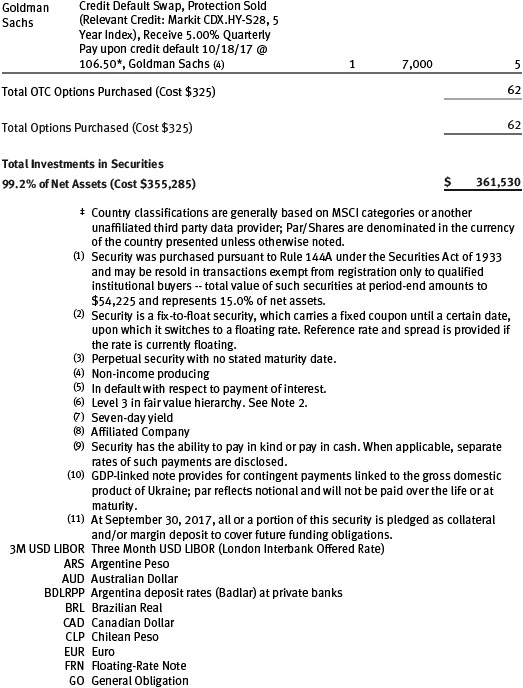

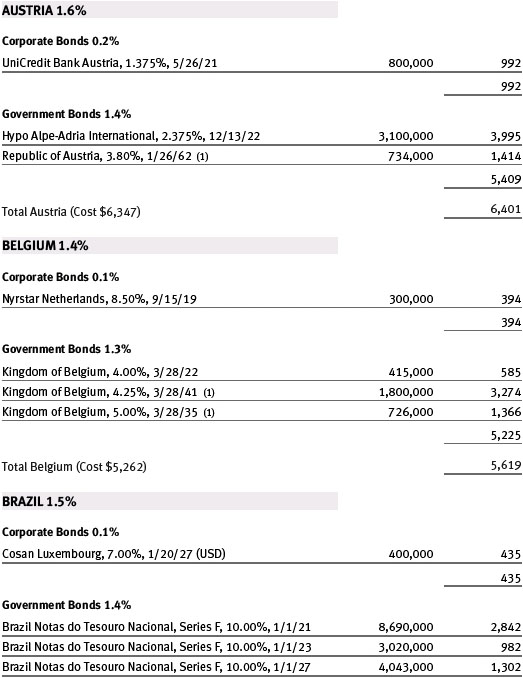

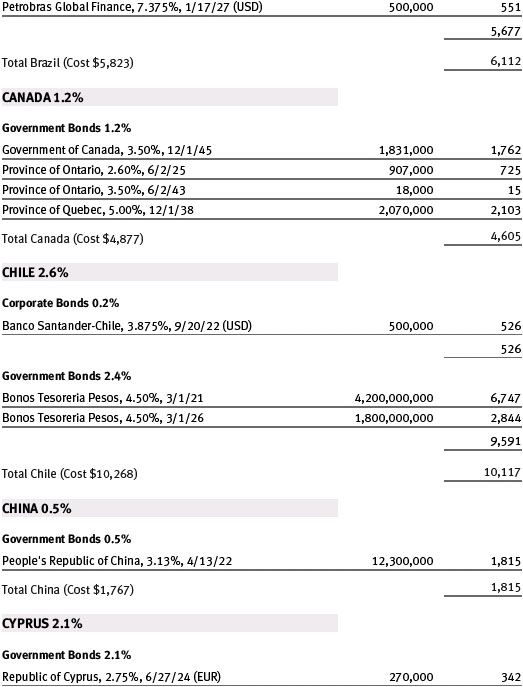

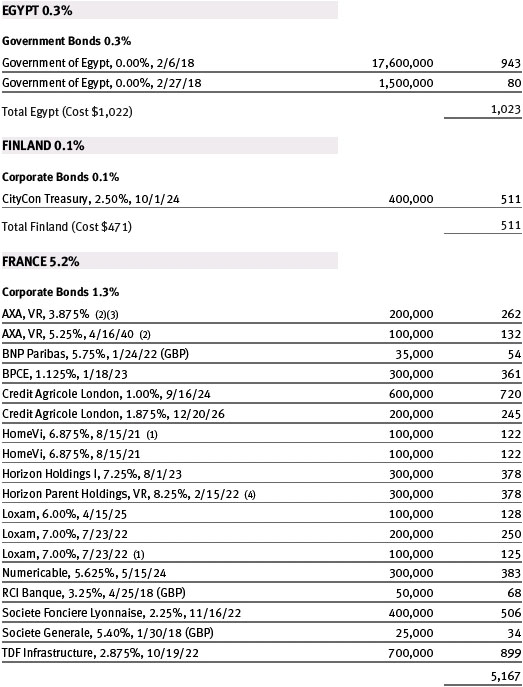

| T. Rowe Price Institutional Emerging Markets Bond Fund |

|

|

Unaudited

The accompanying notes are an integral part of this Portfolio of Investments.

T. Rowe Price Institutional Emerging

Markets Bond Fund

Unaudited

Notes To Portfolio of Investments

T. Rowe Price Institutional International Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940 (the 1940 Act). The Institutional Emerging Markets Bond Fund (the fund) is a nondiversified, open-end management investment company established by the corporation. The fund seeks to provide high income and capital appreciation.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of

Preparation

The fund is an investment

company and follows accounting and reporting guidance in the Financial

Accounting Standards Board (FASB) Accounting

Standards Codification Topic 946 (ASC 946).

The accompanying Portfolio of Investments was prepared in accordance with

accounting principles generally accepted in the United States of America (GAAP),

including, but not limited to, ASC 946. GAAP requires the use of estimates made

by management. Management believes that estimates and valuations are

appropriate; however, actual results may differ from those estimates, and the

valuations reflected in the Portfolio of Investments may differ from the values

ultimately realized upon sale or maturity.

Investment

Transactions

Investment transactions are

accounted for on the trade date.

Currency

Translation

Investments denominated in

foreign currencies are translated into U.S. dollar values each day at the

prevailing exchange rate, using the mean of the bid and asked prices of such

currencies against U.S. dollars as quoted by a major bank. Purchases and sales

of securities are translated into U.S. dollars at the prevailing exchange rate

on the date of the transaction.

New Accounting Guidance

In March 2017, the FASB issued amended

guidance to shorten the amortization period for certain callable debt

securities, held at a premium. The guidance is effective for fiscal years and

interim periods beginning after December 15, 2018. Adoption will have no effect

on the fund’s net assets or results of operations.

On August 1, 2017, the fund implemented amendments to Regulation S-X, issued by the Securities and Exchange Commission, which require standardized, enhanced disclosures, particularly related to derivatives, in investment company financial statements. Adoption had no effect on the fund’s net assets or results of operations.

NOTE 2 – VALUATION

The fund’s financial instruments are valued and its net asset value (NAV) per share is computed at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day the NYSE is open for business. However, the NAV per share may be calculated at a time other than the normal close of the NYSE if trading on the NYSE is restricted, if the NYSE closes earlier, or as may be permitted by the SEC.

Fair Value

The fund’s financial instruments are reported at fair value,

which GAAP defines as the price that would be received to sell an asset or paid

to transfer a liability in an orderly transaction between market participants at

the measurement date. The T. Rowe Price Valuation Committee (the Valuation

Committee) is an internal committee that has been delegated certain

responsibilities by the fund’s Board of Directors (the Board) to ensure that

financial instruments are appropriately priced at fair value in accordance with

GAAP and the 1940 Act. Subject to oversight by

the Board, the Valuation Committee develops and oversees pricing-related

policies and procedures and approves all fair value determinations.

Specifically, the Valuation Committee establishes procedures to value

securities; determines pricing techniques, sources, and persons eligible to

effect fair value pricing actions; oversees the selection, services, and

performance of pricing vendors; oversees valuation-related business continuity

practices; and provides guidance on internal controls and valuation-related

matters. The Valuation Committee reports to the Board and has representation

from legal, portfolio management and trading, operations, risk management and

the fund’s treasurer.

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting date

Level 2 – inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads)

Level 3 – unobservable inputs

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions that market participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. When multiple inputs are used to derive fair value, the financial instrument is assigned to the level within the fair value hierarchy based on the lowest-level input that is significant to the fair value of the financial instrument. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values.

Valuation Techniques

Debt securities generally are traded in

the over-the-counter (OTC) market. Securities with remaining maturities of one

year or more at the time of acquisition are valued at prices furnished by

dealers who make markets in such securities or by an independent pricing

service, which considers the yield or price of bonds of comparable quality,

coupon, maturity, and type, as well as prices quoted by dealers who make markets

in such securities. Securities with remaining maturities of less than one year

at the time of acquisition generally use amortized cost in local currency to

approximate fair value. However, if amortized cost is deemed not to reflect fair

value or the fund holds a significant amount of such securities with remaining

maturities of more than 60 days, the securities are valued at prices furnished

by dealers who make markets in such securities or by an independent pricing

service. Generally, debt securities are categorized in Level 2 of the fair value

hierarchy; however, to the extent the valuations include significant

unobservable inputs, the securities would be categorized in Level 3.

Equity securities listed or regularly traded on a securities exchange or in the OTC market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made. OTC Bulletin Board securities are valued at the mean of the closing bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the closing bid and asked prices for domestic securities and the last quoted sale or closing price for international securities.

For valuation purposes, the last quoted prices of non-U.S. equity securities may be adjusted to reflect the fair value of such securities at the close of the NYSE. If the fund determines that developments between the close of a foreign market and the close of the NYSE will affect the value of some or all of its portfolio securities, the fund will adjust the previous quoted prices to reflect what it believes to be the fair value of the securities as of the close of the NYSE. In deciding whether it is necessary to adjust quoted prices to reflect fair value, the fund reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. The fund may also fair value securities in other situations, such as when a particular foreign market is closed but the fund is open. The fund uses outside pricing services to provide it with quoted prices and information to evaluate or adjust those prices. The fund cannot predict how often it will use quoted prices and how often it will determine it necessary to adjust those prices to reflect fair value. As a means of evaluating its security valuation process, the fund routinely compares quoted prices, the next day’s opening prices in the same markets, and adjusted prices.

Actively traded equity securities listed on a domestic exchange generally are categorized in Level 1 of the fair value hierarchy. Non-U.S. equity securities generally are categorized in Level 2 of the fair value hierarchy despite the availability of quoted prices because, as described above, the fund evaluates and determines whether those quoted prices reflect fair value at the close of the NYSE or require adjustment. OTC Bulletin Board securities, certain preferred securities, and equity securities traded in inactive markets generally are categorized in Level 2 of the fair value hierarchy.

Investments in mutual funds are valued at the mutual fund’s closing NAV per share on the day of valuation and are categorized in Level 1 of the fair value hierarchy. Listed options, and OTC options with a listed equivalent, are valued at the mean of the closing bid and asked prices and generally are categorized in Level 2 of the fair value hierarchy. Financial futures contracts are valued at closing settlement prices and are categorized in Level 1 of the fair value hierarchy. Forward currency exchange contracts are valued using the prevailing forward exchange rate and are categorized in Level 2 of the fair value hierarchy. Swaps are valued at prices furnished by an independent pricing service or independent swap dealers and generally are categorized in Level 2 of the fair value hierarchy; however, if unobservable inputs are significant to the valuation, the swap would be categorized in Level 3.

Thinly traded financial instruments and those for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the Valuation Committee. The objective of any fair value pricing determination is to arrive at a price that could reasonably be expected from a current sale. Financial instruments fair valued by the Valuation Committee are primarily private placements, restricted securities, warrants, rights, and other securities that are not publicly traded.

Subject to oversight by the Board, the Valuation Committee regularly makes good faith judgments to establish and adjust the fair valuations of certain securities as events occur and circumstances warrant. For instance, in determining the fair value of troubled or thinly traded debt instruments, the Valuation Committee considers a variety of factors, which may include, but are not limited to, the issuer’s business prospects, its financial standing and performance, recent investment transactions in the issuer, strategic events affecting the company, market liquidity for the issuer, and general economic conditions and events. In consultation with the investment and pricing teams, the Valuation Committee will determine an appropriate valuation technique based on available information, which may include both observable and unobservable inputs. The Valuation Committee typically will afford greatest weight to actual prices in arm’s length transactions, to the extent they represent orderly transactions between market participants; transaction information can be reliably obtained; and prices are deemed representative of fair value. However, the Valuation Committee may also consider other valuation methods such as a discount or premium from market value of a similar, freely traded security of the same issuer; discounted cash flows; yield to maturity; or some combination. Fair value determinations are reviewed on a regular basis and updated as information becomes available, including actual purchase and sale transactions of the issue. Because any fair value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions, and fair value prices determined by the Valuation Committee could differ from those of other market participants. Depending on the relative significance of unobservable inputs, including the valuation technique(s) used, fair valued securities may be categorized in Level 2 or 3 of the fair value hierarchy.

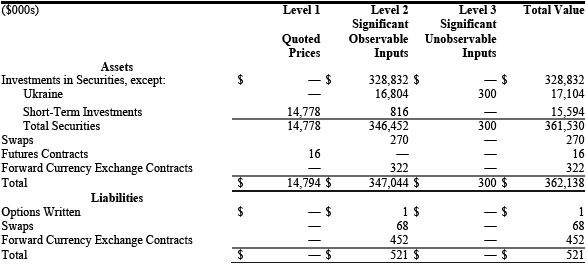

Valuation Inputs

The following table summarizes the fund’s financial

instruments, based on the inputs used to determine their fair values on

September 30, 2017:

There were no material transfers between Levels 1 and 2 during the period ended September 30, 2017.

Following is a reconciliation of the fund’s Level 3 holdings for the period ended September 30, 2017. Gain (loss) reflects both realized and change in unrealized gain/loss on Level 3 holdings during the period, if any. The change in unrealized gain/loss on Level 3 instruments held at September 30, 2017, totaled $0 for the period ended September 30, 2017.

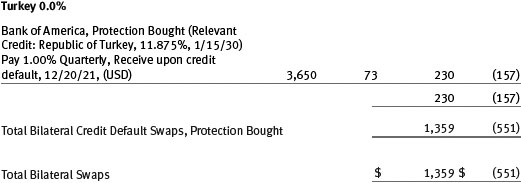

NOTE 3 - DERIVATIVE INSTRUMENTS

The fund may invest in derivative instruments. As defined by GAAP, a derivative is a financial instrument whose value is derived from an underlying security price, foreign exchange rate, interest rate, index of prices or rates, or other variable; it requires little or no initial investment and permits or requires net settlement. The fund invests in derivatives only if the expected risks and rewards are consistent with its investment objectives, policies, and overall risk profile, as described in its prospectus and Statement of Additional Information. The fund may use derivatives for a variety of purposes, such as seeking to hedge against declines in principal value, increase yield, invest in an asset with greater efficiency and at a lower cost than is possible through direct investment, or to adjust portfolio duration and credit exposure. The risks associated with the use of derivatives are different from, and potentially much greater than, the risks associated with investing directly in the instruments on which the derivatives are based. The fund at all times maintains sufficient cash reserves, liquid assets, or other SEC-permitted asset types to cover its settlement obligations under open derivative contracts. The fund values its derivatives at fair value, as described in Note 2.

Counterparty Risk and

Collateral

The fund invests in derivatives

in various markets, which expose it to differing levels of counterparty risk.

Counterparty risk on exchange-traded and centrally cleared derivative contracts,

such as futures, exchange-traded options, and centrally cleared swaps, is

minimal because the clearinghouse provides protection against counterparty

defaults. For futures and centrally cleared swaps, the fund is required to

deposit collateral in an amount specified by the clearinghouse and the clearing

firm (margin requirement) and the margin requirement must be maintained over the

life of the contract. Each clearinghouse and clearing firm, in its sole

discretion, may adjust the margin requirements applicable to the fund.

Derivatives, such as bilateral swaps, forward currency exchange contracts, and OTC options, that are transacted and settle directly with a counterparty (bilateral derivatives) expose the fund to greater counterparty risk. To mitigate this risk, the fund has entered into master netting arrangements (MNAs) with certain counterparties that permit net settlement under specified conditions and, for certain counterparties, also require the exchange of collateral to cover mark-to-market exposure. MNAs may be in the form of International Swaps and Derivatives Association master agreements (ISDAs) or foreign exchange letter agreements (FX letters).

MNAs provide the ability to offset amounts the fund owes a counterparty against amounts the counterparty owes the fund (net settlement). Both ISDAs and FX letters generally allow termination of transactions and net settlement upon the occurrence of contractually specified events, such as failure to pay or bankruptcy. In addition, ISDAs specify other events, the occurrence of which would allow one of the parties to terminate. For example, a downgrade in credit rating of a counterparty would allow the fund to terminate while a decline in the fund’s net assets of more than a specified percentage would allow the counterparty to terminate. Upon termination, all transactions with that counterparty would be liquidated and a net termination amount settled. ISDAs include collateral agreements whereas FX letters do not. Collateral requirements are determined daily based on the net aggregate unrealized gain or loss on all bilateral derivatives with a counterparty, subject to minimum transfer amounts that typically range from $100,000 to $250,000. Any additional collateral required due to changes in security values is typically transferred the same business day.

Collateral may be in the form of cash or debt securities issued by the U.S. government or related agencies; securities posted by the fund are so noted in the accompanying Portfolio of Investments. For bilateral derivatives, collateral posted or received by the fund is held in a segregated account by the fund’s custodian. As of September 30, 2017, securities valued at $432,000 had been posted by the fund to counterparties for bilateral derivatives. As of September 30, 2017, collateral pledged by counterparties to the fund for bilateral derivatives consisted of $400,000 cash. As of September 30, 2017, cash of $172,000 and securities valued at $114,000 had been posted by the fund for exchange-traded and/or centrally cleared derivatives.

While typically not sold similar to equity or fixed income securities, exchange-traded or centrally cleared derivatives may be closed out only on the exchange or clearinghouse where the contracts were traded, and OTC and bilateral derivatives may be unwound with counterparties or transactions assigned to other counterparties to allow the fund to exit the transaction. This ability is subject to the liquidity of underlying positions.

Forward Currency Exchange

Contracts

The fund uses forward currency

exchange contracts (forwards) primarily to protect its non-U.S.

dollar-denominated securities from adverse currency movements and to gain

exposure to currencies for the purposes of risk management or enhanced return. A

forward involves an obligation to purchase or sell a fixed amount of a specific

currency on a future date at a price set at the time of the contract. Although

certain forwards may be settled by exchanging only the net gain or loss on the

contract, most forwards are settled with the exchange of the underlying

currencies in accordance with the specified terms. Forwards are valued at the

unrealized gain or loss on the contract, which reflects the net amount the fund

either is entitled to receive or obligated to deliver, as measured by the

difference between the forward exchange rates at the date of entry into the

contract and the forward rates at the reporting date. Risks related to the use

of forwards include the possible failure of counterparties to meet the terms of

the agreements; that anticipated currency movements will not occur thereby

reducing the fund’s total return; and the potential for losses in excess of the

fund’s initial investment.

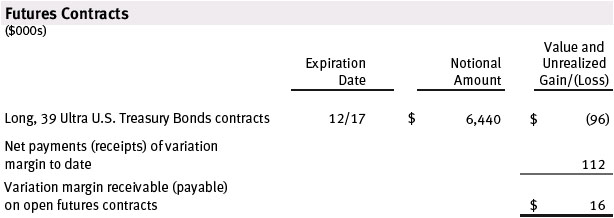

Futures Contracts

The fund may enter into futures contracts to manage exposure

to interest rate and yield curve movements, security prices, foreign currencies,

credit quality, and mortgage prepayments; as an efficient means of adjusting

exposure to all or part of a target market; to enhance income; as a cash

management tool; or to adjust portfolio duration and credit exposure. A futures

contract provides for the future sale by one party and purchase by another of a

specified amount of a specific underlying financial instrument at an agreed upon

price, date, time, and place. The fund currently invests only in exchange-traded

futures, which generally are standardized as to

maturity date, underlying financial instrument, and other contract terms.

Payments are made or received by the fund each day to settle daily fluctuations

in the value of the contract (variation margin), which reflect changes in the

value of the underlying financial instrument. Risks related to the use of

futures contracts include possible illiquidity of the futures markets, contract

prices that can be highly volatile and imperfectly correlated to movements in

hedged security values, interest rates, or

currency values; and potential losses in

excess of the fund’s initial investment.

Options

The fund may use options to manage exposure to security prices, interest

rates, foreign currencies, and credit quality; as an efficient means of

adjusting exposure to all or a part of a target market; to enhance income; as a

cash management tool; or to adjust credit exposure. In return for a premium

paid, currency options give the holder the right, but not the obligation, to buy

and sell currency at a specified exchange rate. In return for a premium paid,

options on swaps give the holder the right, but not the obligation, to enter a

specified swap contract on predefined terms. The exercise price of an option on

a credit default swap is stated in terms of a specified spread that represents

the cost of credit protection on the reference asset, including both the upfront

premium to open the position and future periodic payments. The exercise price of

an interest rate swap is stated in terms of a fixed interest rate; generally,

there is no upfront payment to open the position. Risks related to the use of

options include possible illiquidity of the options markets; trading

restrictions imposed by an exchange or counterparty; movements in the underlying

asset values and/or currency values and/or credit ratings; and, for written

options, potential losses in excess of the fund’s initial investment.

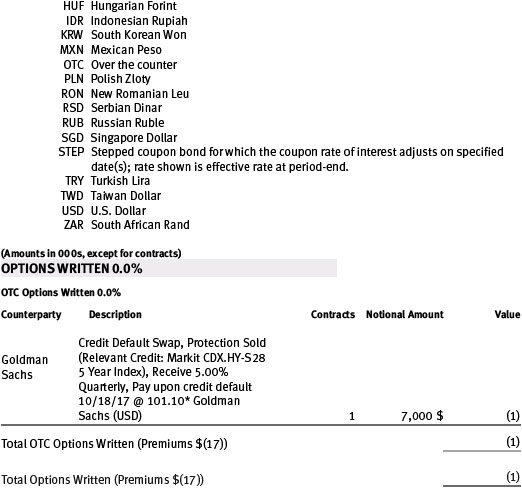

Swaps

The fund may use swaps in an effort to manage exposure to changes in

interest rates, inflation rates, and credit quality; to adjust overall exposure

to certain markets; to enhance total return or protect the value of portfolio

securities; to serve as a cash management tool; or to adjust portfolio duration

and credit

exposure. Swap agreements can be settled either directly with the counterparty

(bilateral swap) or through a central clearinghouse (centrally cleared swap).

For bilateral swaps, cash payments are made or received by the fund on a

periodic basis in accordance with contract terms. For centrally cleared swaps,

payments are made or received by the fund each day to settle the daily

fluctuation in the value of the contract (variation margin).

Credit default swaps are agreements where one party (the protection buyer) agrees to make periodic payments to another party (the protection seller) in exchange for protection against specified credit events, such as certain defaults and bankruptcies related to an underlying credit instrument, or issuer or index of such instruments. Upon occurrence of a specified credit event, the protection seller is required to pay the buyer the difference between the notional amount of the swap and the value of the underlying credit, either in the form of a net cash settlement or by paying the gross notional amount and accepting delivery of the relevant underlying credit. For credit default swaps where the underlying credit is an index, a specified credit event may affect all or individual underlying securities included in the index and will be settled based upon the relative weighting of the affected underlying security(ies) within the index. Risks related to the use of credit default swaps include the possible inability of the fund to accurately assess the current and future creditworthiness of underlying issuers, the possible failure of a counterparty to perform in accordance with the terms of the swap agreements, potential government regulation that could adversely affect the fund’s swap investments, and potential losses in excess of the fund’s initial investment.

NOTE 4 – OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Emerging and Frontier

Markets

The fund may invest, either

directly or through investments in T. Rowe Price institutional funds, in

securities of companies located in, issued by governments of, or denominated in or

linked to the currencies of emerging and frontier market countries; at

period-end, approximately 59% of the fund’s net assets were invested in emerging

markets and 35% in frontier markets. Emerging markets, and to a greater extent

frontier markets, generally have economic

structures that are less diverse and mature, and political systems that are less

stable, than developed countries. These markets may be subject to greater

political, economic, and social uncertainty and differing regulatory

environments that may potentially impact the fund’s ability to buy or sell

certain securities or repatriate proceeds to U.S. dollars. Such securities are

often subject to greater price volatility, less liquidity, and higher rates of

inflation than U.S. securities. Investing in frontier markets is significantly

riskier than investing in other countries, including emerging

markets.

Noninvestment-Grade Debt

At September 30, 2017, approximately 75%

of the fund’s net assets were invested, either directly or through its

investments in T. Rowe Price institutional funds, in noninvestment-grade debt

including “high yield” or “junk” bonds or leveraged loans. The

noninvestment-grade debt market may experience sudden and sharp price swings due

to a variety of factors, including changes in economic forecasts, stock market

activity, large sustained sales by major investors, a high-profile default, or a

change in market sentiment. These events may decrease the ability of issuers to

make principal and interest payments and adversely affect the liquidity or

value, or both, of such securities. Investments in noninvestment-grade holdings

may be considered speculative.

Restricted

Securities

The fund may invest in

securities that are subject to legal or contractual restrictions on resale.

Prompt sale of such securities at an acceptable price may be difficult and may

involve substantial delays and additional costs.

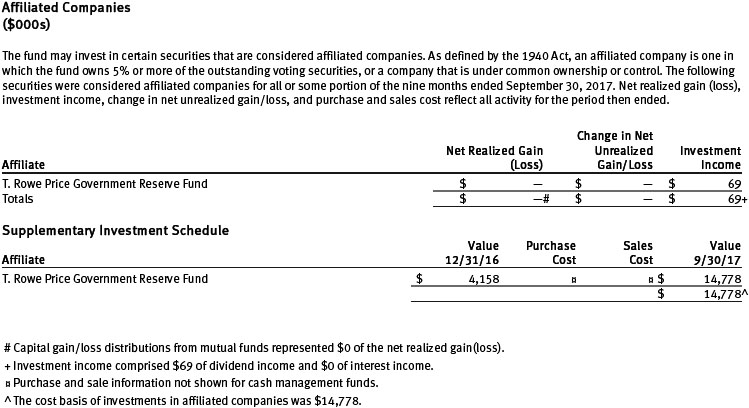

NOTE 5 - RELATED PARTY TRANSACTIONS

The fund may invest in the T. Rowe Price Government Reserve Fund, the T. Rowe Price Treasury Reserve Fund, or the T. Rowe Price Short-Term Fund (collectively, the Price Reserve Funds), open-end management investment companies managed by T. Rowe Price Associates, Inc. (Price Associates) and considered affiliates of the fund. The Price Reserve Funds are offered as short-term investment options to mutual funds, trusts, and other accounts managed by Price Associates or its affiliates and are not available for direct purchase by members of the public. The Price Reserve Funds pay no investment management fees.

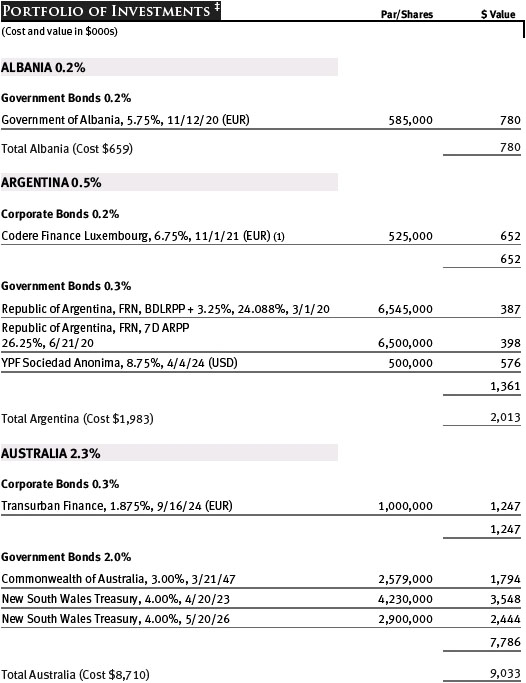

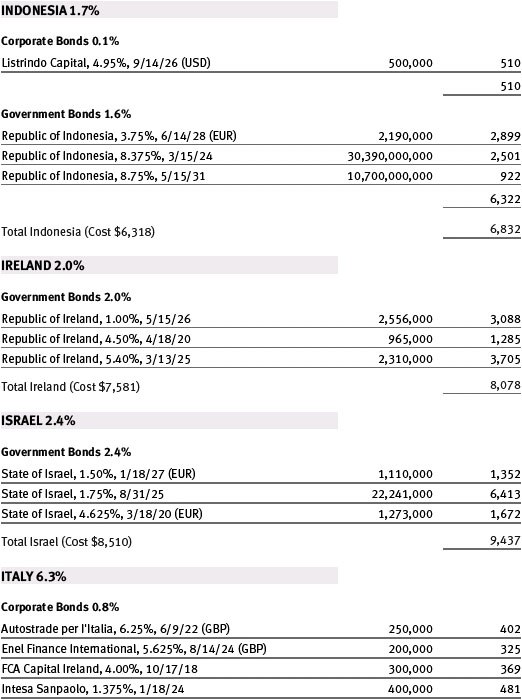

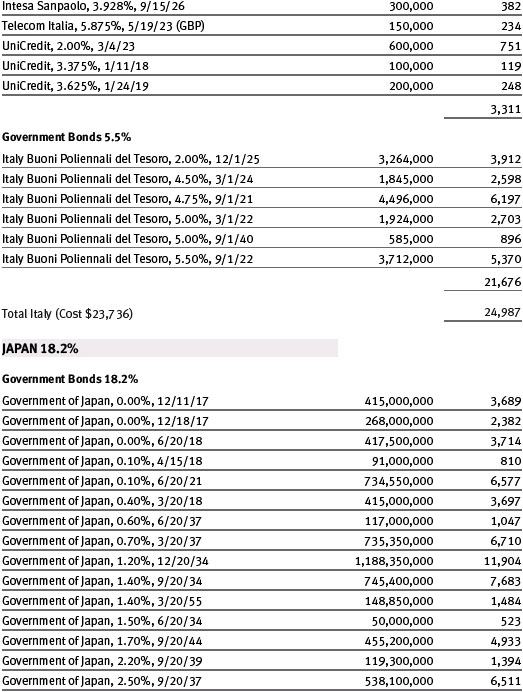

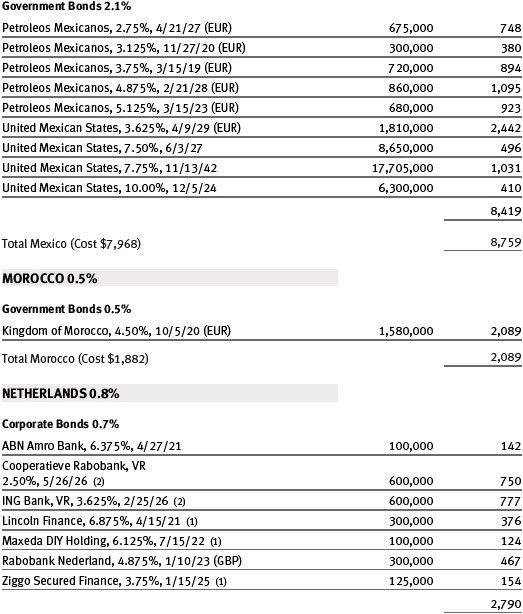

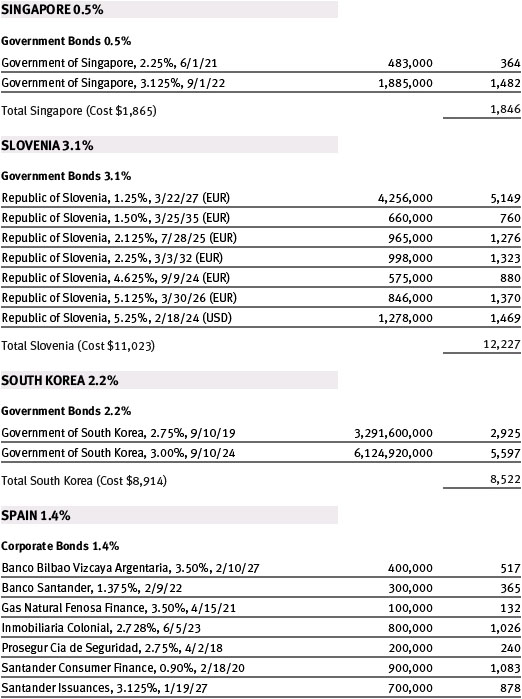

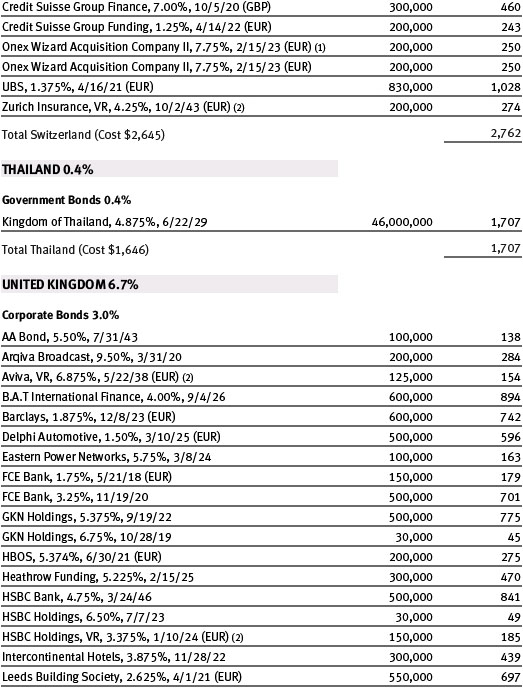

| T. Rowe Price Institutional International Bond Fund |

|

|

Unaudited

The accompanying notes are an integral part of this Portfolio of Investments.

T. Rowe Price Institutional International

Bond Fund

Unaudited

Notes To Portfolio of Investments

T. Rowe Price Institutional International Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940 (the 1940 Act). The Institutional International Bond Fund (the fund) is a nondiversified, open-end management investment company established by the corporation. The fund seeks to provide high current income and capital appreciation.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of

Preparation

The fund is an investment

company and follows accounting and reporting guidance in the Financial

Accounting Standards Board (FASB) Accounting

Standards Codification Topic 946 (ASC 946).

The accompanying Portfolio of Investments was prepared in accordance with

accounting principles generally accepted in the United States of America (GAAP),

including, but not limited to, ASC 946. GAAP requires the use of estimates made

by management. Management believes that estimates and valuations are

appropriate; however, actual results may differ from those estimates, and the

valuations reflected in the Portfolio of Investments may differ from the values

ultimately realized upon sale or maturity.

Investment

Transactions

Investment transactions are

accounted for on the trade date.

Currency

Translation

Investments denominated in

foreign currencies are translated into U.S. dollar values each day at the

prevailing exchange rate, using the mean of the bid and asked prices of such

currencies against U.S. dollars as quoted by a major bank. Purchases and sales

of securities are translated into U.S. dollars at the prevailing exchange rate

on the date of the transaction.

New Accounting Guidance

In March 2017, the FASB issued amended

guidance to shorten the amortization period for certain callable debt

securities, held at a premium. The guidance is effective for fiscal years and

interim periods beginning after December 15, 2018. Adoption will have no effect

on the fund’s net assets or results of operations.

On August 1, 2017, the fund implemented amendments to Regulation S-X, issued by the Securities and Exchange Commission, which require standardized, enhanced disclosures, particularly related to derivatives, in investment company financial statements. Adoption had no effect on the fund’s net assets or results of operations.

NOTE 2 – VALUATION

The fund’s financial instruments are valued and its net asset value (NAV) per share is computed at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day the NYSE is open for business. However, the NAV per share may be calculated at a time other than the normal close of the NYSE if trading on the NYSE is restricted, if the NYSE closes earlier, or as may be permitted by the SEC.

Fair Value

The fund’s financial instruments are reported at fair value,

which GAAP defines as the price that would be received to sell an asset or paid

to transfer a liability in an orderly transaction between market participants at

the measurement date. The T. Rowe Price Valuation Committee (the Valuation

Committee) is an internal committee that has been delegated certain

responsibilities by the fund’s Board of Directors (the Board) to ensure that financial instruments are appropriately priced at

fair value in accordance with GAAP and the 1940 Act. Subject to oversight by the

Board, the Valuation Committee develops and oversees pricing-related policies

and procedures and approves all fair value determinations. Specifically, the

Valuation Committee establishes procedures to value securities; determines

pricing techniques, sources, and persons eligible to effect fair value pricing

actions; oversees the selection, services, and performance of pricing vendors;

oversees valuation-related business continuity practices; and provides guidance

on internal controls and valuation-related matters. The Valuation Committee

reports to the Board and has representation from legal, portfolio management and

trading, operations, risk management and the fund’s treasurer.

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting date

Level 2 – inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads)

Level 3 – unobservable inputs

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions that market participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. When multiple inputs are used to derive fair value, the financial instrument is assigned to the level within the fair value hierarchy based on the lowest-level input that is significant to the fair value of the financial instrument. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values.

Valuation Techniques

Debt securities generally are traded in

the over-the-counter (OTC) market. Securities with remaining maturities of one

year or more at the time of acquisition are valued at prices furnished by

dealers who make markets in such securities or by an independent pricing

service, which considers the yield or price of bonds of comparable quality,

coupon, maturity, and type, as well as prices quoted by dealers who make markets

in such securities. Securities with remaining maturities of less than one year

at the time of acquisition generally use amortized cost in local currency to

approximate fair value. However, if amortized cost is deemed not to reflect fair

value or the fund holds a significant amount of such securities with remaining

maturities of more than 60 days, the securities are valued at prices furnished

by dealers who make markets in such securities or by an independent pricing

service. Generally, debt securities are categorized in Level 2 of the fair value

hierarchy; however, to the extent the valuations include significant

unobservable inputs, the securities would be categorized in Level 3.

Investments in mutual funds are valued at the mutual fund’s closing NAV per share on the day of valuation and are categorized in Level 1 of the fair value hierarchy. Listed options, and OTC options with a listed equivalent, are valued at the mean of the closing bid and asked prices and generally are categorized in Level 2 of the fair value hierarchy. Financial futures contracts are valued at closing settlement prices and are categorized in Level 1 of the fair value hierarchy. Forward currency exchange contracts are valued using the prevailing forward exchange rate and are categorized in Level 2 of the fair value hierarchy. Swaps are valued at prices furnished by an independent pricing service or independent swap dealers and generally are categorized in Level 2 of the fair value hierarchy; however, if unobservable inputs are significant to the valuation, the swap would be categorized in Level 3.

Thinly traded financial instruments and those for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the Valuation Committee. The objective of any fair value pricing determination is to arrive at a price that could reasonably be expected from a current sale. Financial instruments fair valued by the Valuation Committee are primarily private placements, restricted securities, warrants, rights, and other securities that are not publicly traded.

Subject to oversight by the Board, the Valuation Committee regularly makes good faith judgments to establish and adjust the fair valuations of certain securities as events occur and circumstances warrant. For instance, in determining the fair value of troubled or thinly traded debt instruments, the Valuation Committee considers a variety of factors, which may include, but are not limited to, the issuer’s business prospects, its financial standing and performance, recent investment transactions in the issuer, strategic events affecting the company, market liquidity for the issuer, and general economic conditions and events. In consultation with the investment and pricing teams, the Valuation Committee will determine an appropriate valuation technique based on available information, which may include both observable and unobservable inputs. The Valuation Committee typically will afford greatest weight to actual prices in arm’s length transactions, to the extent they represent orderly transactions between market participants; transaction information can be reliably obtained; and prices are deemed representative of fair value. However, the Valuation Committee may also consider other valuation methods such as a discount or premium from market value of a similar, freely traded security of the same issuer; discounted cash flows; yield to maturity; or some combination. Fair value determinations are reviewed on a regular basis and updated as information becomes available, including actual purchase and sale transactions of the issue. Because any fair value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions, and fair value prices determined by the Valuation Committee could differ from those of other market participants. Depending on the relative significance of unobservable inputs, including the valuation technique(s) used, fair valued securities may be categorized in Level 2 or 3 of the fair value hierarchy.

Valuation Inputs

The following table summarizes the fund’s financial

instruments, based on the inputs used to determine their fair values on

September 30, 2017:

There were no material transfers between Levels 1 and 2 during the period ended September 30, 2017.

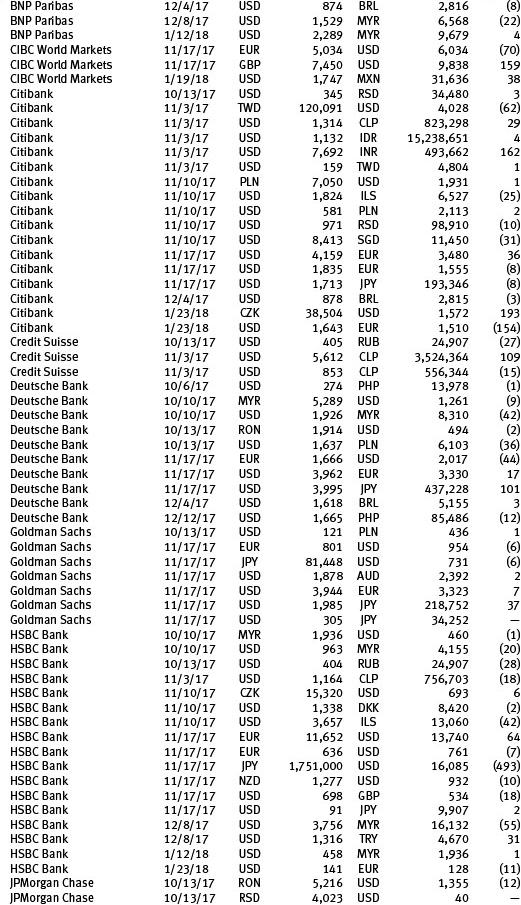

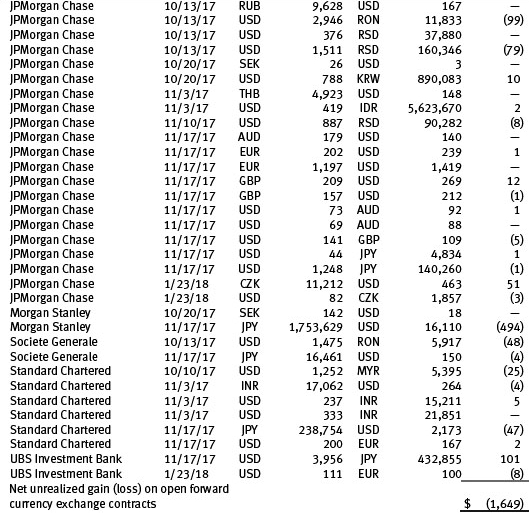

NOTE 3 - DERIVATIVE INSTRUMENTS

The fund may invest in derivative instruments. As defined by GAAP, a derivative is a financial instrument whose value is derived from an underlying security price, foreign exchange rate, interest rate, index of prices or rates, or other variable; it requires little or no initial investment and permits or requires net settlement. The fund invests in derivatives only if the expected risks and rewards are consistent with its investment objectives, policies, and overall risk profile, as described in its prospectus and Statement of Additional Information. The fund may use derivatives for a variety of purposes, such as seeking to hedge against declines in principal value, increase yield, invest in an asset with greater efficiency and at a lower cost than is possible through direct investment, or to adjust portfolio duration and credit exposure. The risks associated with the use of derivatives are different from, and potentially much greater than, the risks associated with investing directly in the instruments on which the derivatives are based. The fund at all times maintains sufficient cash reserves, liquid assets, or other SEC-permitted asset types to cover its settlement obligations under open derivative contracts. The fund values its derivatives at fair value, as described in Note 2.

Counterparty Risk and Collateral

The fund invests in derivatives in

various markets, which expose it to differing levels of counterparty risk.

Counterparty risk on exchange-traded and centrally cleared derivative contracts,

such as futures, exchange-traded options, and centrally cleared swaps, is

minimal because the clearinghouse provides protection against counterparty

defaults. For futures and centrally cleared swaps, the fund is required to

deposit collateral in an amount specified by the clearinghouse and the clearing

firm (margin requirement) and the margin requirement must be maintained over the

life of the contract. Each clearinghouse and clearing firm, in its sole

discretion, may adjust the margin requirements applicable to the fund.

Derivatives, such as bilateral swaps, forward currency exchange contracts, and OTC options, that are transacted and settle directly with a counterparty (bilateral derivatives) expose the fund to greater counterparty risk. To mitigate this risk, the fund has entered into master netting arrangements (MNAs) with certain counterparties that permit net settlement under specified conditions and, for certain counterparties, also require the exchange of collateral to cover mark-to-market exposure. MNAs may be in the form of International Swaps and Derivatives Association master agreements (ISDAs) or foreign exchange letter agreements (FX letters).

MNAs provide the ability to offset amounts the fund owes a counterparty against amounts the counterparty owes the fund (net settlement). Both ISDAs and FX letters generally allow termination of transactions and net settlement upon the occurrence of contractually specified events, such as failure to pay or bankruptcy. In addition, ISDAs specify other events, the occurrence of which would allow one of the parties to terminate. For example, a downgrade in credit rating of a counterparty would allow the fund to terminate while a decline in the fund’s net assets of more than a specified percentage would allow the counterparty to terminate. Upon termination, all transactions with that counterparty would be liquidated and a net termination amount settled. ISDAs include collateral agreements whereas FX letters do not. Collateral requirements are determined daily based on the net aggregate unrealized gain or loss on all bilateral derivatives with a counterparty, subject to minimum transfer amounts that typically range from $100,000 to $250,000. Any additional collateral required due to changes in security values is typically transferred the same business day.

Collateral may be in the form of cash or debt securities issued by the U.S. government or related agencies; securities posted by the fund are so noted in the accompanying Portfolio of Investments. For bilateral derivatives, collateral posted or received by the fund is held in a segregated account by the fund’s custodian. As of September 30, 2017, securities valued at $1,241,000 had been posted by the fund to counterparties for bilateral derivatives. As of September 30, 2017, collateral pledged by counterparties to the fund for bilateral derivatives consisted of $1,500,000 cash. As of September 30, 2017, cash of $1,208,000 had been posted by the fund for exchange-traded and/or centrally cleared derivatives.

While typically not sold similar to equity or fixed income securities, exchange-traded or centrally cleared derivatives may be closed out only on the exchange or clearinghouse where the contracts were traded, and OTC and bilateral derivatives may be unwound with counterparties or transactions assigned to other counterparties to allow the fund to exit the transaction. This ability is subject to the liquidity of underlying positions.

Forward Currency Exchange

Contracts

The fund uses forward currency

exchange contracts (forwards) primarily to protect its non-U.S.

dollar-denominated securities from adverse currency movements and to gain

exposure to currencies for the purposes of risk management or enhanced return. A

forward involves an obligation to purchase or sell a fixed amount of a specific currency on a future date at a price set at the

time of the contract. Although certain forwards may be settled by exchanging

only the net gain or loss on the contract, most forwards are settled with the

exchange of the underlying currencies in accordance with the specified terms.

Forwards are valued at the unrealized gain or loss on the contract, which

reflects the net amount the fund either is entitled to receive or obligated to

deliver, as measured by the difference between the forward exchange rates at the

date of entry into the contract and the forward rates at the reporting date.

Risks related to the use of forwards include the possible failure of

counterparties to meet the terms of the agreements; that anticipated currency

movements will not occur thereby reducing the fund’s total return; and the

potential for losses in excess of the fund’s initial investment.

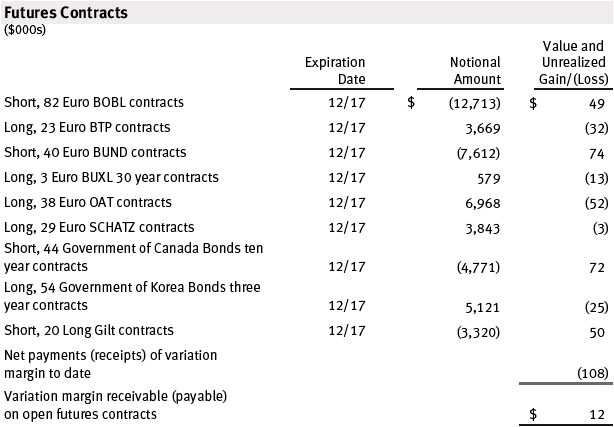

Futures Contracts

The fund may enter into futures contracts to manage exposure

to interest rate and yield curve movements, security prices, foreign currencies,

credit quality, and mortgage prepayments; as an efficient means of adjusting

exposure to all or part of a target market; to enhance income; as a cash

management tool; or to adjust portfolio duration and credit exposure. A futures

contract provides for the future sale by one party and purchase by another of a

specified amount of a specific underlying financial instrument at an agreed upon

price, date, time, and place. The fund currently invests only in exchange-traded

futures, which generally are standardized as to maturity date, underlying

financial instrument, and other contract terms. Payments are made or received by

the fund each day to settle daily fluctuations in the value of the contract

(variation margin), which reflect changes in the value of the underlying

financial instrument. Risks related to the use of futures contracts include

possible illiquidity of the futures markets, contract prices that can be highly

volatile and imperfectly correlated to movements in hedged security values,

interest rates, or currency values; and potential losses in excess of the fund’s initial

investment.

Options

The fund may use options to manage exposure to security prices, interest

rates, foreign currencies, and credit quality; as an efficient means of

adjusting exposure to all or a part of a target market; to enhance income; as a

cash management tool; or to adjust credit exposure. In return for a premium

paid, currency options give the holder the right, but not the obligation, to buy

and sell currency at a specified exchange rate. Risks related to the use of

options include possible illiquidity of the options markets; trading

restrictions imposed by an exchange or counterparty; movements in the underlying

asset values and/or currency values; and, for written options, potential losses

in excess of the fund’s initial investment.

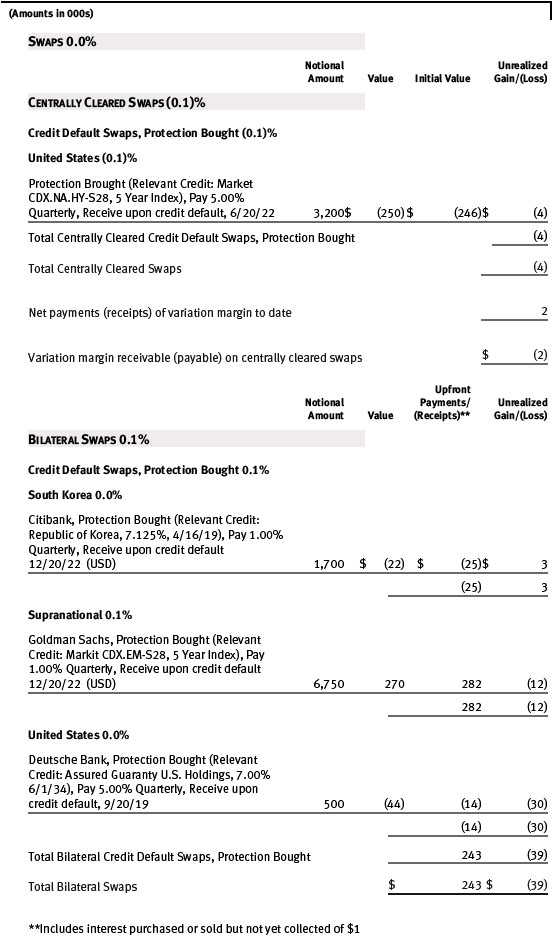

Swaps

The fund may use swaps in an effort to manage exposure to changes in

interest rates, inflation rates, and credit quality; to adjust overall exposure

to certain markets; to enhance total return or protect the value of portfolio

securities; to serve as a cash management tool; or to adjust portfolio duration

and credit

exposure. Swap agreements can be settled either directly with the counterparty

(bilateral swap) or through a central clearinghouse (centrally cleared swap).

For bilateral swaps, cash payments are made or received by the fund on a

periodic basis in accordance with contract terms. For centrally cleared swaps,

payments are made or received by the fund each day to settle the daily

fluctuation in the value of the contract (variation margin).

Interest rate swaps are agreements to exchange cash flows based on the difference between specified interest rates applied to a notional principal amount for a specified period of time. Risks related to the use of interest rate swaps include the potential for unanticipated movements in interest or currency rates, the possible failure of a counterparty to perform in accordance with the terms of the swap agreements, potential government regulation that could adversely affect the fund’s swap investments, and potential losses in excess of the fund’s initial investment.

Credit default swaps are agreements where one party (the protection buyer) agrees to make periodic payments to another party (the protection seller) in exchange for protection against specified credit events, such as certain defaults and bankruptcies related to an underlying credit instrument, or issuer or index of such instruments. Upon occurrence of a specified credit event, the protection seller is required to pay the buyer the difference between the notional amount of the swap and the value of the underlying credit, either in the form of a net cash settlement or by paying the gross notional amount and accepting delivery of the relevant underlying credit. For credit default swaps where the underlying credit is an index, a specified credit event may affect all or individual underlying securities included in the index and will be settled based upon the relative weighting of the affected underlying security(ies) within the index. Risks related to the use of credit default swaps include the possible inability of the fund to accurately assess the current and future creditworthiness of underlying issuers, the possible failure of a counterparty to perform in accordance with the terms of the swap agreements, potential government regulation that could adversely affect the fund’s swap investments, and potential losses in excess of the fund’s initial investment.

NOTE 4 – OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Emerging and Frontier

Markets

The fund may invest, either

directly or through investments in T. Rowe Price institutional funds, in

securities of companies located in, issued by governments of, or denominated in or

linked to the currencies of emerging and frontier market countries; at

period-end, approximately 26% of the fund’s net assets were invested in emerging

markets and 9% in frontier markets. Emerging markets, and to a greater extent

frontier markets, generally have economic structures that are less diverse and

mature, and political systems that are less stable, than developed countries.

These markets may be subject to greater political, economic, and social

uncertainty and differing regulatory environments that may potentially impact

the fund’s ability to buy or sell certain securities or repatriate proceeds to

U.S. dollars. Such securities are often subject to greater price volatility,

less liquidity, and higher rates of inflation than U.S. securities. Investing in

frontier markets is significantly riskier than investing in other countries,

including emerging markets.

Noninvestment-Grade Debt

At September 30, 2017, approximately 12%

of the fund’s net assets were invested, either directly or through its

investments in T. Rowe Price institutional funds, in noninvestment-grade debt

including “high yield” or “junk” bonds or leveraged loans. The

noninvestment-grade debt market may experience sudden and sharp price swings due

to a variety of factors, including changes in economic forecasts, stock market

activity, large sustained sales by major investors, a high-profile default, or a

change in market sentiment. These events may decrease the ability of issuers to

make principal and interest payments and adversely affect the liquidity or

value, or both, of such securities. Investments in noninvestment-grade holdings

may be considered speculative.

Restricted

Securities

The fund may invest in

securities that are subject to legal or contractual restrictions on resale.

Prompt sale of such securities at an acceptable price may be difficult and may

involve substantial delays and additional costs.

NOTE 5 - RELATED PARTY TRANSACTIONS

The fund may invest in the T. Rowe Price Government Reserve Fund, the T. Rowe Price Treasury Reserve Fund, or the T. Rowe Price Short-Term Fund (collectively, the Price Reserve Funds), open-end management investment companies managed by T. Rowe Price Associates, Inc. (Price Associates) and considered affiliates of the fund. The Price Reserve Funds are offered as short-term investment options to mutual funds, trusts, and other accounts managed by Price Associates or its affiliates and are not available for direct purchase by members of the public. The Price Reserve Funds pay no investment management fees.

Item 2. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-Q was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 3. Exhibits.

Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

T. Rowe Price Institutional International

Funds, Inc.

| By | /s/ Edward C. Bernard | |

| Edward C. Bernard | ||

| Principal Executive Officer | ||

| Date November 21, 2017 | ||

| By | /s/ Edward C. Bernard | |

| Edward C. Bernard | ||

| Principal Executive Officer | ||

| Date November 21, 2017 | ||

| By | /s/ Catherine D. Mathews | |

| Catherine D. Mathews | ||

| Principal Financial Officer | ||

| Date November 21, 2017 | ||