| T. Rowe Price Institutional International Bond Fund | ||||||||||||||||||||||||||||||

| SUMMARY T. Rowe Price Institutional International Bond Fund |

||||||||||||||||||||||||||||||

| Investment Objective | ||||||||||||||||||||||||||||||

| The fund seeks to provide current income and capital appreciation. | ||||||||||||||||||||||||||||||

| Fees and Expenses | ||||||||||||||||||||||||||||||

| This table describes the fees and expenses that you may pay if you buy and hold shares of the fund. | ||||||||||||||||||||||||||||||

| Fees and Expenses of the Fund Shareholder fees (fees paid directly from your investment) |

||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||

| Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment) |

||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||

| Example | ||||||||||||||||||||||||||||||

| This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | ||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||

| Portfolio Turnover | ||||||||||||||||||||||||||||||

| The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s performance. During the most recent fiscal year, the fund’s portfolio turnover rate was 62.5% of the average value of its portfolio. | ||||||||||||||||||||||||||||||

| Investments, Risks, and Performance Principal Investment Strategies |

||||||||||||||||||||||||||||||

| Normally, the fund will invest at least 80% of its net assets (including any borrowings for investment purposes) in foreign bonds and 50% of its net assets in foreign bonds that are rated within the three highest credit categories (i.e., A- or equivalent, or better), as determined by at least one major credit rating agency or, if unrated, deemed to be of comparable quality by T. Rowe Price. If a bond is split-rated (i.e., assigned different ratings by different credit rating agencies), the higher rating will be used. The fund may invest up to 25% of its total assets in "junk" bonds that have received a below investment-grade rating (i.e., BB or equivalent, or lower) from each of the rating agencies that has assigned a rating to the bond (or, if unrated, deemed to be below investment-grade quality by T. Rowe Price), including those in default or with the lowest rating. There is no limit on the fund's investments in investment-grade bonds of emerging markets. The fund may use credit default swaps to buy or sell credit protection on individual bond issuers or sectors of the bond markets. If the fund buys protection, it effectively takes a short position, and if the fund sells protection, it effectively takes a long position, with respect to the credit of the company or sector. Although we expect to maintain an intermediate- to long-term weighted average maturity (between 5 to 15 years) for the fund, there are no maturity restrictions on the overall portfolio or on individual securities. Through the use of futures contracts and interest rate swaps, the fund may either extend or shorten the overall maturity of the fund and take long or short positions in particular bond markets (including the U.S.). The fund's overall net short positions in bond markets will not exceed 10% of its net assets. A short position in a bond market means that the fund, for example, could sell interest rate futures with respect to bonds of a particular market and the value of the futures would exceed the value of the bonds held by the fund (or the fund could sell futures with respect to a particular bond market without owning any bonds in that market). The fund normally purchases bonds issued in foreign currencies. The fund's currency positions will vary with its outlook on the strength or weakness of the U.S. dollar compared to foreign currencies and the relative value of various foreign currencies to one another. Through the use of forward foreign exchange contracts and other currency derivatives, such as swaps, options and futures, the fund has wide flexibility to purchase and sell currencies independently of whether the fund owns bonds in those currencies and to engage in currency hedging transactions. Currency hedging into the U.S. dollar is permitted, but not required, and the fund is likely to be heavily exposed to foreign currencies. The fund's overall short positions in currencies (including the U.S. dollar) are limited to 10% of its net assets. A short position in a currency means that the fund could sell a currency in excess of its assets denominated in that currency (or the fund might sell a currency even if it doesn't own any assets denominated in the currency). The fund is "nondiversified," meaning it may invest a greater portion of its assets in fewer issuers than is permissible for a "diversified" fund. Investment decisions are based on fundamental market factors, such as yield and credit quality differences among bonds as well as supply and demand trends and currency values. The fund generally invests in securities where the combination of fixed-income returns and currency exchange rates appears attractive or, if the currency trend is unfavorable, where we believe the currency risk can be minimized through hedging. The fund sells holdings for a variety of reasons, such as to adjust the portfolio's average maturity or credit quality, to shift assets into and out of higher-yielding securities, or to alter geographic or currency exposure. |

||||||||||||||||||||||||||||||

| Principal Risks | ||||||||||||||||||||||||||||||

| As with any mutual fund, there is no guarantee that the fund will achieve its objective. The fund's share price fluctuates, which means you could lose money by investing in the fund. The principal risks of investing in this fund are summarized as follows: Active management risk The fund is subject to the risk that the investment adviser's judgments about the attractiveness, value, or potential appreciation of the fund's investments may prove to be incorrect. If the securities selected and strategies employed by the fund fail to produce the intended results, the fund could underperform other funds with similar objectives and investment strategies. International investing risk Investing in the securities of non-U.S. issuers involves special risks not typically associated with investing in U.S. securities. International securities tend to be more volatile and less liquid than investments in U.S. securities and may lose value because of adverse political, social, or economic developments overseas. In addition, international investments may be subject to regulatory and accounting standards that differ from those of the U.S. Emerging markets risk The risks of international investing are heightened for securities of issuers in emerging market countries. Emerging market countries tend to have economic structures that are less diverse and mature, and political systems that are less stable, than those of developed countries. In addition to all of the risks of investing in international developed markets, emerging markets are more susceptible to governmental interference, local taxes being imposed on international investments, restrictions on gaining access to sales proceeds, and less liquid and efficient trading markets. Currency risk Because the fund generally invests in securities issued in foreign currencies, the fund is subject to the risk that it could experience losses based solely on the weakness of foreign currencies versus the U.S. dollar and changes in the exchange rates between such currencies and the U.S. dollar. Hedging risk The fund's attempts at hedging and taking long and short positions in currencies may not be successful and could cause the fund to lose money or fail to get the benefit of a gain on a hedged position. If expected changes to securities prices, interest rates, currency values and exchange rates, or the creditworthiness of an issuer are not accurately predicted, the fund could be in a worse position than if it had not entered into such transactions. Credit risk This is the risk that an issuer of a debt security could suffer an adverse change in financial condition that results in a payment default, security downgrade, or inability to meet a financial obligation. The fund's overall credit risk is increased to the extent the fund invests in emerging markets bonds or bonds rated below investment-grade. Such investments carry a higher risk of default and should be considered speculative. Interest rate risk This risk refers to the chance that interest rates will increase, causing a decline in bond prices. (Bond prices and interest rates usually move in opposite directions.) Generally, securities with longer maturities and funds with longer weighted average maturities carry greater interest rate risk. Liquidity risk This is the risk that the fund may not be able to sell a holding in a timely manner at a desired price. Nondiversification risk As a nondiversified fund, the fund has the ability to invest a larger percentage of its assets in the securities of a smaller number of issuers than a diversified fund. As a result, poor performance by a single issuer could adversely affect fund performance more than if the fund were invested in a larger number of issuers. The fund's share price can be expected to fluctuate more than that of a comparable diversified fund. Derivatives risk To the extent the fund uses forward currency exchange contracts, swaps, options, or futures, it is exposed to additional volatility in comparison to investing directly in bonds and other debt securities. These instruments can be illiquid and difficult to value, may involve leverage so that small changes produce disproportionate losses for the fund, and instruments not traded on an exchange are subject to the risk that a counterparty to the transaction will fail to meet its obligations under the derivatives contract. The fund's principal use of derivatives involves the risk that anticipated changes in currency values, currency exchange rates, interest rates, or the creditworthiness of an issuer will not be accurately predicted, which could significantly harm the fund's performance, and the chance that regulatory developments could negatively affect the fund's investments in such instruments. |

||||||||||||||||||||||||||||||

| Performance | ||||||||||||||||||||||||||||||

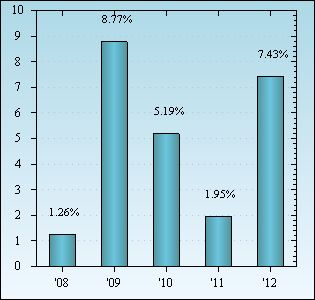

| The bar chart showing calendar year returns and the average annual total returns table indicate risk by illustrating how much returns can differ from one year to the next and how fund performance compares with that of a comparable market index. The fund’s past performance (before and after taxes) is not necessarily an indication of future performance. The fund can also experience short-term performance swings, as shown by the best and worst calendar quarter returns during the years depicted. |

||||||||||||||||||||||||||||||

| Institutional International Bond Fund Calendar Year Returns |

||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||

| In addition, the average annual total returns table shows hypothetical after-tax returns to suggest how taxes paid by a shareholder may influence returns. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as a 401(k) account or individual retirement account. | ||||||||||||||||||||||||||||||

| Average Annual Total Returns Periods ended December 31, 2012 |

||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||

| Updated performance information is available through troweprice.com or may be obtained by calling 1-800-638-8790. |