|

| ||

SUMMARY PROSPECTUS May 1, 2019 | |||

T. ROWE PRICE | |||

TREBX | Institutional Emerging Markets Bond Fund | ||

The Securities and Exchange Commission (SEC) has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense. Before you invest, you may want to review the fund’s prospectus, which contains more information about the fund and its risks. You can find the fund’s prospectus, shareholder reports, and other information about the fund online at troweprice.com/prospectus. You can also get this information at no cost by calling 1-800-638-8790, by sending an e-mail request to info@troweprice.com, or by contacting your financial intermediary. This Summary Prospectus incorporates by reference the fund’s prospectus, dated May 1, 2019, as amended or supplemented, and Statement of Additional Information, dated May 1, 2019, as amended or supplemented. Beginning on January 1, 2021, as permitted by SEC regulations, paper copies of the T. Rowe Price funds’ annual and semiannual shareholder reports will no longer be mailed, unless you specifically request them. Instead, shareholder reports will be made available on the funds’ website (troweprice.com/prospectus), and you will be notified by mail with a website link to access the reports each time a report is posted to the site. If you already elected to receive reports electronically, you will not be affected by this change and need not take any action. At any time, shareholders who invest directly in T. Rowe Price funds may generally elect to receive reports or other communications electronically by enrolling at troweprice.com/paperless or, if you are a retirement plan sponsor or invest in the funds through a financial intermediary (such as an investment advisor, broker-dealer, insurance company, or bank), by contacting your representative or your financial intermediary. You may elect to continue receiving paper copies of future shareholder reports free of charge. To do so, if you invest directly with T. Rowe Price, please call T. Rowe Price as follows: IRA, nonretirement account holders, and institutional investors, 1-800-225-5132; small business retirement accounts, 1-800-492-7670. If you are a retirement plan sponsor or invest in the T. Rowe Price funds through a financial intermediary, please contact your representative or financial intermediary, or follow additional instructions if included with this document. Your election to receive paper copies of reports will apply to all funds held in your account with your financial intermediary or, if you invest directly in the T. Rowe Price funds, with T. Rowe Price. Your election can be changed at any time in the future. | |||

| |||

SUMMARY | 1 |

Investment Objective

The fund seeks to provide high income and capital appreciation.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the fund. You may also incur brokerage commissions and other charges when buying or selling shares of the fund, which are not reflected in the table.

Fees and Expenses of the Fund

Annual fund operating

expenses | ||

Management fees | 0.70 | % |

Other expenses | — | |

Total annual fund operating expenses | 0.70 | |

Example This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods, that your investment has a 5% return each year, and that the fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

1 year | 3 years | 5 years | 10 years |

$72 | $224 | $390 | $871 |

Portfolio Turnover The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when the fund’s shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s performance. During the most recent fiscal year, the fund’s portfolio turnover rate was 41.1% of the average value of its portfolio.

Investments, Risks, and Performance

Principal Investment Strategies The fund will normally invest at least 80% (and potentially all) of its net assets (including any borrowings for investment purposes) in debt securities of emerging market governments or companies located in emerging market countries. The fund considers frontier markets to be a subset of emerging markets and any investments in frontier markets will be counted toward the fund’s 80% investment policy. The fund relies on a classification by either JP Morgan or the International Monetary Fund to determine which countries are emerging markets. The fund’s holdings may be denominated in U.S. dollars or non-U.S. dollar currencies, including emerging market currencies. The extent, if any, to which the fund attempts to cushion the impact of foreign currency fluctuations on the U.S. dollar depends on market conditions. The fund’s holdings may include the lowest-rated bonds, including those in default, and there are no overall limits on the fund’s investments that are

T. ROWE PRICE | 2 |

rated below investment-grade (BB or lower, or an equivalent rating), also known as “junk” bonds.

Although the fund expects to maintain an intermediate- to long-term weighted average maturity, there are no maturity restrictions on the overall portfolio or on individual securities. Security selection relies heavily on research, which analyzes political and economic trends as well as creditworthiness. The fund allocates investments among a variety of emerging markets (1) in order to establish a diverse portfolio; (2) based on the relative value of opportunities and associated risks within one country versus others; and (3) with a view to the liquidity of each particular market. The fund tends to favor bonds it expects will be upgraded. The fund sells holdings for a variety of reasons, such as to adjust its average maturity or credit quality, to shift assets into and out of higher-yielding securities, or to alter geographic or currency exposure.

The fund is “nondiversified,” meaning it may invest a greater portion of its assets in fewer issuers than is permissible for a “diversified” fund.

While most assets will be invested in bonds, the fund may enter into forward currency exchange contracts in keeping with the fund’s objective. Forward currency exchange contracts would primarily be used to help protect the fund’s non-U.S. dollar denominated holdings from unfavorable changes in foreign currency exchange rates, although other currency hedging techniques may be used from time to time.

Principal Risks As with any mutual fund, there is no guarantee that the fund will achieve its objective. The fund’s share price fluctuates, which means you could lose money by investing in the fund. The principal risks of investing in this fund are summarized as follows:

Active management risks The investment adviser’s judgments about the attractiveness, value, or potential appreciation of the fund’s investments may prove to be incorrect. The fund could underperform other funds with a similar benchmark or similar objectives and investment strategies if the fund’s overall investment selections or strategies fail to produce the intended results.

Fixed income markets risks Economic and other market developments can adversely affect fixed income securities markets. At times, participants in these markets may develop concerns about the ability of certain issuers of debt instruments to make timely principal and interest payments, or they may develop concerns about the ability of financial institutions that make markets in certain debt instruments to facilitate an orderly market. Those concerns could cause increased volatility and reduced liquidity in particular securities or in the overall fixed income markets and the related derivatives markets. A lack of liquidity or other adverse credit market conditions may hamper the fund’s ability to sell the debt instruments in which it invests or to find and purchase suitable debt instruments.

International investing risks Investing in the securities of non-U.S. issuers involves special risks not typically associated with investing in U.S. issuers. International securities tend to be more volatile and have lower overall liquidity than investments in U.S. securities and may lose value because of adverse local, political, social, or economic developments overseas, or due to changes in the exchange rates between foreign currencies and the U.S. dollar. In addition,

SUMMARY | 3 |

international investments are subject to settlement practices and regulatory and financial reporting standards that differ from those of the U.S.

Emerging markets risks The risks of international investing are heightened for securities of issuers in emerging market countries. Emerging market countries tend to have economic structures that are less diverse and mature, and political systems that are less stable, than those of developed countries. In addition to all of the risks of investing in international developed markets, emerging markets are more susceptible to governmental interference, local taxes being imposed on international investments, restrictions on gaining access to the fund’s investments, and less efficient trading markets with lower overall liquidity.

Frontier markets, considered by the fund to be a subset of emerging markets, generally have smaller economies and less mature capital markets than emerging markets. As a result, the risks of investing in emerging market countries are magnified in frontier market countries. Frontier markets are more susceptible to abrupt changes in currency values, have less mature markets and settlement practices, and can have lower trading volumes that could lead to greater price volatility and illiquidity.

Currency risks Because the fund may invest in securities issued in foreign currencies, the fund could experience losses based solely on the weakness of foreign currencies versus the U.S. dollar and changes in the exchange rates between such currencies and the U.S. dollar. Any attempts at currency hedging may not be successful and could cause the fund to lose money.

Credit risks An issuer of a debt instrument could suffer an adverse change in financial condition that results in a payment default (failure to make scheduled interest or principal payments), rating downgrade, or inability to meet a financial obligation.

Junk investing risks The risks of default are much greater for emerging market bonds and securities rated below investment grade (“junk” bonds). The fund is exposed to greater credit risk than other bond funds because companies and governments in emerging markets are usually not as strong financially and are more susceptible to economic downturns. Junk bonds should be considered speculative as they carry greater risks of default and erratic price swings due to real or perceived changes in the credit quality of the issuer.

Any investments in distressed or defaulted securities subject the fund to even greater credit risk than investments in other below investment-grade bonds. Investments in obligations of restructured, distressed and bankrupt issuers, including debt obligations that are already in default, generally trade significantly below par and may be considered illiquid. Defaulted securities might be repaid only after lengthy bankruptcy proceedings, during which the issuer might not make any interest or other payments, and such proceedings may result in only partial recovery of principal or no recovery at all. Recovery could involve an exchange of the defaulted obligation for other debt instruments or equity securities of the issuer or its affiliates, each of which may in turn be illiquid or speculative and be valued by the fund at significantly less than its original purchase price. In addition, investments in distressed issuers may subject the fund to liability as a lender.

T. ROWE PRICE | 4 |

Interest rate risks The prices of, and the income generated by, debt instruments held by the fund may be affected by changes in interest rates. A rise in interest rates typically causes the price of a fixed rate debt instrument to fall and its yield to rise. Conversely, a decline in interest rates typically causes the price of a fixed rate debt instrument to rise and the yield to fall. Generally, funds with longer weighted average maturities and durations carry greater interest rate risk. In recent years, the U.S. and many global markets have experienced historically low interest rates. However, interest rates have begun to rise and may continue doing so, increasing the exposure of bond investors such as the fund to the risks associated with rising interest rates.

Liquidity risks The fund may not be able to meet requests to redeem shares issued by the fund without significant dilution of the remaining shareholders’ interest in the fund. In addition, the fund may not be able to sell a holding in a timely manner at a desired price. Reduced liquidity in the bond markets can result from a number of events, such as limited trading activity, reductions in bond inventory, and rapid or unexpected changes in interest rates. Markets with lower overall liquidity could lead to greater price volatility and limit the fund’s ability to sell a holding at a suitable price.

Nondiversification risks As a nondiversified fund, the fund has the ability to invest a larger percentage of its assets in the securities of a smaller number of issuers than a diversified fund. As a result, poor performance by a single issuer could adversely affect fund performance more than if the fund were invested in a larger number of issuers. The fund’s share price can be expected to fluctuate more than that of a comparable diversified fund.

Derivatives risks The fund uses forward currency exchange contracts and is therefore exposed to greater volatility and losses in comparison to investing directly in foreign bonds. Forward currency exchange contracts are also subject to the risks that anticipated currency movements will not be accurately predicted, a counterparty will fail to perform in accordance with the terms of the agreement, and the risk that potential government regulation could negatively affect the fund’s investments in such instruments.

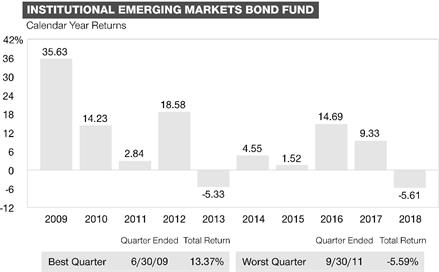

Performance The following performance information provides some indication of the risks of investing in the fund. The fund’s performance information represents only past performance (before and after taxes) and is not necessarily an indication of future results.

The following bar chart illustrates how much returns can differ from year to year by showing calendar year returns and the best and worst calendar quarter returns during those years for the fund.

SUMMARY | 5 |

The following table shows the average annual total returns for the fund, and also compares the returns with the returns of a relevant broad-based market index, as well as with the returns of one or more comparative indexes that have investment characteristics similar to those of the fund, if applicable.

In addition, the table shows hypothetical after-tax returns to demonstrate how taxes paid by a shareholder may influence returns. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as a 401(k) account or an IRA.

Average Annual Total Returns |

|

|

|

| |||||||||

|

|

| Periods ended |

| |||||||||

|

|

| December 31, 2018 |

| |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Inception |

| |

|

|

| 1 Year |

|

| 5 Years |

|

| 10 Years |

| date |

| |

| Institutional Emerging Markets Bond Fund |

|

|

|

|

|

|

|

| 11/30/2006 |

|

| |

|

| Returns before taxes | -5.61 | % |

| 4.67 | % |

| 8.43 | % |

|

|

|

|

| Returns after taxes on distributions | -7.76 |

|

| 2.06 |

|

| 5.63 |

|

|

|

|

|

| Returns after taxes on distributions |

|

|

|

|

|

|

|

|

|

|

|

|

| and sale of fund shares | -3.18 |

|

| 2.44 |

|

| 5.60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| J.P. Morgan Emerging Markets Bond Index Global Diversified (reflects no deduction for fees, expenses, or taxes) |

|

|

| |||||||||

|

| -4.26 |

|

| 4.80 |

|

| 8.20 |

|

|

|

| |

T. ROWE PRICE | 6 |

Updated performance information is available through troweprice.com.

Management

Investment Adviser T. Rowe Price Associates, Inc. (T. Rowe Price or Price Associates)

Portfolio Manager | Title | Managed | Joined |

Michael J. Conelius | Chairman of Investment Advisory Committee | 2006 | 1988 |

Purchase and Sale of Fund Shares

The fund generally requires a $1 million minimum initial investment and there is no minimum for additional purchases, although the initial investment minimum may be waived for certain types of accounts held through a retirement plan, financial advisor, or other financial intermediary.

For investors holding shares of the fund directly with T. Rowe Price, you may purchase, redeem, or exchange fund shares by mail or by telephone (1-800-638-8790).

If you hold shares through a financial intermediary or retirement plan, you must purchase, redeem, and exchange shares of the fund through your intermediary or retirement plan. You should check with your intermediary or retirement plan to determine the investment minimums that apply to your account.

Tax Information

The fund declares dividends daily and pays them on the first business day of each month. Any capital gains are declared and paid annually, usually in December. Redemptions or exchanges of fund shares and distributions by the fund, whether or not you reinvest these amounts in additional fund shares, may be taxed as ordinary income or capital gains unless you invest through a tax-deferred account (in which case you will be taxed upon withdrawal from such account).

| |

T. Rowe Price Associates, Inc. | E163-045 5/1/19 |